Abstract

We analyzed national survey and linked Medicare enrollment data from 2004–2007 to examine the effects of expanded choice and benefits in Medicare Advantage on enrollment in Medicare Advantage or traditional Medicare. The availability of more plans was associated with increased Medicare Advantage enrollment when the number of options was small but decreased Medicare Advantage enrollment when the number became sufficiently high. Beneficiaries with low cognitive functioning were less responsive to the generosity of Medicare Advantage benefits in their decisions. Simplifying choice in Medicare Advantage and guiding beneficiaries to valuable options could improve enrollment decisions, strengthen value-based competition among plans, and extend the benefits of choice to seniors with impaired cognition.

Medicare’s managed care program provides beneficiaries with a choice of private health plan alternatives to traditional Medicare. Following a period of declining enrollment, the Medicare Modernization Act of 2003 initiated a series of payment increases to stimulate entry of managed care plans and expand beneficiary choice in the renamed Medicare Advantage program. These payment increases have been associated with a dramatic proliferation in the number of plans available to Medicare beneficiaries, improved benefits – including lower premiums and less cost-sharing – for Medicare Advantage enrollees, and higher rates of enrollment in Medicare Advantage.(1, 2)

In standard economic theory, more choice is better for consumers. More choice improves matching of products to consumer preferences and fosters competition based on price and quality. Empirically, however, more choice may be detrimental if there are too many or overly complex options, particularly in high-stakes decisions that involve health or money.(3, 4) Consumers may choose inferior options or make no choice at all as a result of cognitive overload, anticipated regret, or bias toward the status quo.(5–9) Therefore, providing seniors with more health plan choices could increase enrollment in Medicare Advantage or decrease enrollment if beneficiaries become overwhelmed and choose traditional Medicare by default. Moreover, elderly Medicare beneficiaries with cognitive deficits may have particular difficulty identifying the most valuable option from a complex set of Medicare Advantage and traditional Medicare alternatives.(10, 11) Impaired decision-making could thus compromise the welfare of beneficiaries and deter beneficial competition among plans, a distinct concern given the high and rising prevalence of cognitive impairment and dementia in the aging Medicare population.(12–14) The influence of cognition on enrollment decisions in Medicare, however, has not been directly examined.

Previous research suggests that the large number and complexity of plan offerings in Medicare’s prescription drug program (Part D) contributes to suboptimal choices by elderly beneficiaries, thereby limiting the gains from competition.(15–19) No prior study, however, has examined the effects of expanded choice in Medicare Advantage on enrollment decisions or whether beneficiaries with impaired cognition are less responsive to the relative generosity of Medicare Advantage options. Therefore, we used national survey data linked to Medicare enrollment files and county-level data on Medicare Advantage plans from 2004 to 2007 to assess the effects of the number of Medicare Advantage plans available to beneficiaries and the generosity of plans’ benefits on decisions to enroll in Medicare Advantage or traditional Medicare. We further examined how these effects differed by the cognitive functioning of beneficiaries.

METHODS

Study Population

We analyzed data from the Health and Retirement Study, a national longitudinal survey conducted biennially since 1992(20) and representative of the non-institutionalized U.S. population over age 55 since 1998.(21) Medicare-eligible participants who provided their Medicare identification numbers were linked to annual claims and enrollment files available through 2007. Our study cohort included participants who were alive in 2004, age 66 or older by 2007, and successfully linked to their Medicare enrollment files. We excluded adults with Medicare coverage before age 65 because few non-elderly adults with qualifying disabilities or end-stage renal disease enroll in Medicare Advantage. We also excluded counties with too few participants sampled by the Health and Retirement Study to control for county effects in adjusted analyses. Finally, we excluded enrollment decisions by participants if they had no Medicare Advantage plans from which to choose in their county in a given year.

Our study protocol was approved by the Harvard Medical School Committee on Human Studies and the Privacy Board of the Centers for Medicare & Medicaid Services.

Study Variables

We used monthly information from Medicare enrollment files to construct annual indicators of Medicare Advantage enrollment equal to 1 if the participant was continuously enrolled in Medicare Advantage or switched into Medicare Advantage during the year and equal to 0 otherwise.

We linked participants’ annual enrollment information from 2004 to 2007 to the temporally closest biennial surveys in which they participated. From surveys, we assessed sex, race, ethnicity, marital status, veteran status, employment status, educational attainment, household income, smoking status, general health status, difficulties with activities of daily living, functional limitations, chronic conditions, and cognitive functioning. We used a validated summary measure of cognitive functioning constructed from a battery of tests assessing participants’ memory and mental status.(22, 23) This measure was based on a previously developed survey instrument for assessing cognitive status(24, 25) and modeled after the Mini-Mental State Examination.(26) Summary cognition scores ranged from 0 (no cognitive tasks completed correctly) to 35 (all tasks completed correctly).

To facilitate graphical presentation of results, we divided the study cohort into those with low cognitive functioning (below median score of 22) and high cognitive functioning (median score or higher). We obtained similar results when analyzing the summary measure as a continuous predictor.

To determine the number of Medicare Advantage plans available in each county in each study year, we used the Medicare Options Compare database available from the Centers for Medicare and Medicaid Services.(27) We included in these plan counts health maintenance organizations, preferred provider organizations, point of service plans, and private fee-for-service plans. We excluded cost-based plans, demonstration plans, special needs plans, and employer-sponsored plans because these plan types were available only to small numbers of beneficiaries.

To measure the generosity of benefits offered by Medicare Advantage plans in each participant’s county, we used previously derived estimates of total out-of-pocket costs (including premiums) expected for a standardized population of Medicare beneficiaries if they were to enroll in a given plan in a given year. Specifically, all medical services used by a national sample of traditional Medicare beneficiaries were applied to the coverage rules and cost-sharing structure of each Medicare Advantage plan to determine the average monthly out-of-pocket costs expected for a beneficiary enrolling in that plan.(28) These calculations were conducted separately for thirty groups defined by health status and age. For each of these groups in each county and year, we averaged out-of-pocket cost estimates across plans (weighted by enrollment) and assigned these county-level averages to Health and Retirement Study participants according to their age, health status, year of enrollment, and county of residence (see Technical Appendix A for more details).

Expected monthly out-of-pocket costs for beneficiaries in traditional Medicare with supplemental Medigap coverage were similarly estimated based on the uniform benefits and premiums of traditional Medicare and the variable supplemental benefits and premiums of state-regulated Medigap policies.(28) We averaged these estimates across Medigap plans to obtain state-and year-specific measures of the average generosity of benefits available to study participants through traditional Medicare and Medigap coverage.

Although we could not quantify expected out-of-pocket costs for each participant across different Medicare Advantage and traditional Medicare options, these area-level measures reflected the average generosity of benefits available to participants through Medicare Advantage or traditional Medicare and thus allowed us to compare participants in counties experiencing larger or smaller changes in Medicare Advantage benefits.

Analytical Approach

To identify effects of expanded choice and benefits in Medicare Advantage on enrollment in Medicare Advantage, we exploited the variability across counties in annual changes from 2004 to 2007 in the number of Medicare Advantage plans and generosity of Medicare Advantage benefits available to Medicare beneficiaries. These within-county changes were not likely related to changes in the health-care needs or preferences of resident populations, because legislated payment increases intended to attract more plans into Medicare Advantage have varied arbitrarily across counties and time. In particular, county-specific rate updates have resulted in large increases in plan payments not reflective of contemporaneous changes in the health-care costs of prospective Medicare Advantage enrollees.(29–31) The payment increases have encouraged insurers to participate in Medicare Advantage (32) and compete for enrollees by offering more generous benefits. Since 2006, Medicare Part D has also contributed to greater choice and enhanced benefits in Medicare Advantage, as insurers have diversified plan options into those with and without prescription drug coverage, and Medicare Advantage plans with drug coverage have tended to offer more generous benefits than stand-alone Part D plans.(33) These changes related to Part D, too, may have varied across counties.

Statistical Analysis

We used logistic regression to estimate the effects of within-county changes in the number of Medicare Advantage plans available and in the generosity of plans’ benefits on contemporaneous changes in Medicare Advantage enrollment for participants with high or low cognitive functioning, while controlling for the generosity of benefits available through traditional Medicare and Medigap coverage, for national trends affecting Medicare Advantage enrollment in all counties equally, and for observed demographic, socioeconomic, and health characteristics of participants (see Technical Appendix B for more details). We also controlled for participants’ enrollment status in the preceding year. Thus, results can be interpreted as effects of expanded choice and benefits on net changes in Medicare Advantage enrollment (the net of switching from traditional Medicare to Medicare Advantage and from Medicare Advantage to traditional Medicare).

We elaborated this analysis to conduct two key comparisons. First, to test whether participants with low cognitive functioning were less likely to enroll in Medicare Advantage than those with high cognitive functioning when Medicare Advantage benefits became more generous, we allowed the effects of changes in expected out-of-pocket costs in Medicare Advantage to differ by cognition. Second, to test whether the relationship between increasing plan choice and enrollment in Medicare Advantage changed as the number of available plans increased, we allowed this relationship to differ over the following three ranges in the 2010 distribution of plans per county: minimum to 25th percentile (one to fifteen plans), 25th percentile to 75th percentile (sixteen to thirty plans), and 75th percentile to maximum (over thirty plans).

To facilitate interpretation of regression results, we calculated and plotted predicted probabilities of Medicare Advantage enrollment over a range of values for key independent variables.

Participants who were not linked to their Medicare enrollment files and others who were excluded from our study because too few Health and Retirement Study participants lived in their counties may have differed from participants included in our analysis. Therefore, we weighted analyses to improve the representativeness of estimates (see Technical Appendix C for details). This adjustment did not alter our results substantially.

Because choice sets and out-of-pocket costs likely differed for seniors who still received health benefits from their or their spouses’ current or former employers, in a sensitivity analysis we excluded participants who reported employer-sponsored coverage in surveys preceding their observed enrollment decisions. Results of this and other sensitivity analyses were not substantially different from those of our main analysis (see Technical Appendix D for details).

We adjusted all analyses for the complex survey design,(34) using robust design-based variance estimators to account for geographic clustering and repeated measures.(35)

RESULTS

From the 14,303 Health and Retirement Study participants who were alive in 2004 and age 66 or older by 2007, we excluded 1,626 (11.4%) who were enrolled in Medicare before age 65. Of the remaining 12,667 participants, 9,700 (76.5%) provided their Medicare identification numbers and were linked to their enrollment files. For this cohort, 34,555 annual enrollment decisions were observed from 2004 to 2007 in counties with at least one Medicare Advantage plan available. Our adjusted analysis focused on 23,029 (66.6%) of these enrollment decisions made by 6,947 participants living in counties with sufficient numbers of participants to estimate county fixed effects in multivariate models. Finally, we excluded 493 (2.1%) annual enrollment decisions because of missing data on other key variables and 721 (3.1%) enrollment decisions among participants who moved from the community to nursing homes after 2004. After these exclusions, our analysis included 21,815 enrollment decisions made by 6,672 participants.

In unadjusted comparisons detailed in Exhibit 1, participants enrolled in Medicare Advantage were less educated, less likely to be white, and more likely to have middle incomes and heart disease than participants enrolled in traditional Medicare, but other observed sociodemographic and health characteristics did not differ by enrollment status (see Appendix Table 1 for all comparisons). Summary cognition scores ranged from 0 to 35 (interquartile range: 18 to 25) and also did not differ by enrollment status.

Exhibit 1.

Unadjusted Comparisons of Selected Characteristics of Study Cohort by Enrollment in Traditional Medicare or Medicare Advantage

| Characteristic | Medicare Advantage Enrollees (N=5448 person years) | Traditional Medicare Enrollees (N=16,860 person years) | P value |

|---|---|---|---|

|

| |||

| Mean age, years | 76.2 | 76.4 | 0.47 |

|

| |||

| Female, % | 58.8 | 57.6 | 0.35 |

|

| |||

| Race/ethnicity, % | 0.03 | ||

| Non-Hispanic white | 80.1 | 86.2 | |

| Non-Hispanic black | 8.4 | 7.3 | |

| Hispanic | 9.0 | 4.7 | |

| Other | 2.5 | 1.9 | |

|

| |||

| Married or partnered, % | 61.4 | 59.5 | 0.28 |

|

| |||

| Education, % | 0.03 | ||

| Not a high school graduate | 25.7 | 21.7 | |

| High school graduate/GED | 35.9 | 37.2 | |

| College or more | 38.4 | 41.2 | |

|

| |||

| Annual household income, % | 0.003 | ||

| ≤ 10th percentile | 7.5 | 9.3 | |

| 10–25th percentile | 16.5 | 12.8 | |

| 25–50th percentile | 29.1 | 22.8 | |

| 50–75th percentile | 22.3 | 25.9 | |

| >75th percentile | 24.6 | 29.2 | |

|

| |||

| General health status, % | 0.97 | ||

| Excellent | 10.6 | 10.1 | |

| Very good | 28.3 | 28.9 | |

| Good | 33.5 | 33.4 | |

| Fair | 20.1 | 20.1 | |

| Poor | 7.5 | 7.4 | |

|

| |||

| Diagnosed conditions, % | |||

| Hypertension | 58.0 | 60.2 | 0.18 |

| Heart disease | 27.2 | 30.5 | 0.02 |

| Stroke | 9.9 | 9.5 | 0.71 |

| Diabetes | 19.0 | 18.5 | 0.71 |

| Chronic lung disease (except asthma) | 9.3 | 10.4 | 0.29 |

| Arthritis | 68.0 | 66.0 | 0.32 |

| Cancer (except skin) | 17.4 | 18.8 | 0.26 |

| Psychiatric, emotional, or nervous disorder | 11.9 | 13.0 | 0.38 |

|

| |||

| Cognition | |||

| Mean summary score (0–35) | 21.80 | 21.85 | 0.81 |

| Low cognition (score < median), % | 42.5 | 40.5 | 0.30 |

Source: Authors’ analysis of survey data from the Health and Retirement Study and linked Medicare enrollment data.

Notes: All estimates have been adjusted to account for the complex design of the survey, repeated observations, and exclusions related to the Medicare claims linkage and county sample sizes. GED notes general equivalency diploma. Chi-square tests were used to compare distributions of categorical variables, and t tests were used for continuous variables.

Appendix Table 1.

Characteristics of Study Cohort by Enrollment in Traditional Medicare or Medicare Advantage

| Characteristic | Medicare Advantage Enrollees (N=5448 person years) | Traditional Medicare Enrollees (N=16,860 person years) | P value |

|---|---|---|---|

|

| |||

| Mean age, years | 76.2 | 76.4 | 0.47 |

|

| |||

| Female, % | 58.8 | 57.6 | 0.35 |

|

| |||

| Race/ethnicity, % | 0.03 | ||

| Non-Hispanic white | 80.1 | 86.2 | |

| Non-Hispanic black | 8.4 | 7.3 | |

| Hispanic | 9.0 | 4.7 | |

| Other | 2.5 | 1.9 | |

|

| |||

| Military veteran, % | 26.1 | 27.2 | 0.39 |

|

| |||

| Married or partnered, % | 61.4 | 59.5 | 0.28 |

|

| |||

| Education, % | 0.03 | ||

| Not a high school graduate | 25.7 | 21.7 | |

| High school graduate/GED | 35.9 | 37.2 | |

| Some college | 21.4 | 20.2 | |

| College graduate | 17.0 | 21.0 | |

|

| |||

| Employment, % | 0.07 | ||

| Full-time | 5.1 | 7.1 | |

| Part-time | 2.4 | 2.5 | |

| Semiretired | 10.7 | 11.9 | |

| Retired | 71.6 | 67.8 | |

| Disabled | 0.4 | 0.7 | |

| Not in labor force | 9.8 | 10.0 | |

|

| |||

| Annual household income, % | 0.003 | ||

| ≤10th percentile | 7.5 | 9.3 | |

| 10–25th percentile | 16.5 | 12.8 | |

| 25–50th percentile | 29.1 | 22.8 | |

| 50–75th percentile | 22.3 | 25.9 | |

| >75th percentile | 24.6 | 29.2 | |

|

| |||

| Smoking status, % | |||

| Ever smoked | 56.3 | 56.2 | 0.92 |

| Current smoker | 8.6 | 9.5 | 0.23 |

|

| |||

| General health status, % | 0.97 | ||

| Excellent | 10.6 | 10.1 | |

| Very good | 28.3 | 28.9 | |

| Good | 33.5 | 33.4 | |

| Fair | 20.1 | 20.1 | |

| Poor | 7.5 | 7.4 | |

|

| |||

| Mean number of difficulties with activities of daily living (0–5)† | 0.30 | 0.30 | 0.87 |

|

| |||

| Mean number of functional limitations‡ | |||

| Mobility (0–5) | 1.17 | 1.19 | 0.70 |

| Agility (0–4) | 1.33 | 1.31 | 0.63 |

|

| |||

| Diagnosed conditions, % | |||

| Hypertension | 58.0 | 60.2 | 0.18 |

| Heart disease | 27.2 | 30.5 | 0.02 |

| Stroke | 9.9 | 9.5 | 0.71 |

| Diabetes | 19.0 | 18.5 | 0.71 |

| Chronic lung disease (except asthma) | 9.3 | 10.4 | 0.29 |

| Arthritis | 68.0 | 66.0 | 0.32 |

| Cancer (except skin) | 17.4 | 18.8 | 0.26 |

| Psychiatric, emotional, or nervous disorder | 11.9 | 13.0 | 0.38 |

|

| |||

| Cognition | |||

| Mean summary score (0–35) | 21.80 | 21.85 | 0.81 |

| Low cognition (score < median), % | 42.5 | 40.5 | 0.30 |

Source: Authors’ analysis of survey data from the Health and Retirement Study and linked Medicare enrollment data.

Notes: All estimates have been adjusted to account for the complex design of the survey, repeated observations, and exclusions related to the Medicare claims linkage and county sample sizes. GED notes general equivalency diploma. Chi-square tests were used to compare distributions of categorical variables, and t tests were used for continuous variables. Activities of daily living included bathing, dressing, eating, getting in and out of bed, and walking across a room. Functional limitations included reported difficulties with activities that required mobility (walking several blocks, walking 1 block, walking across a room, climbing several flights of stairs, and climbing 1 flight of stairs) or agility (getting up from a chair, sitting for 2 hours, pushing or pulling large objects, and stooping, kneeling, or crouching).

Exhibit 2 summarizes county-level data on the number of plans and generosity of benefits available in Medicare Advantage from 2004 to 2007. As indicated by within-county changes in U.S. counties with at least one plan, the mean number of Medicare Advantage plans increased twofold or more each year during this period. Expected monthly out-of-pocket costs for Medicare Advantage enrollees decreased within counties from 2005 to 2007 after a slight increase from 2004 to 2005, and these changes varied substantially across counties.

Exhibit 2.

Summary of County-level Data from 2004 to 2007 among All U.S. Counties with Medicare Advantage Plans Available

| Year | Number of MA Plans Available | Average Expected Monthly Out-of-Pocket Costs for MA Enrollees ($) |

|---|---|---|

|

| ||

| 2004 (1567 counties) Mean (min, max) | 2.5 (1,30) | 431 (0,529) |

|

| ||

| 2005 (2778 counties) Mean (min, max) | 3.7 (1,44) | 459 (192,615) |

| Mean within-county change since 2004 (min, max) | 2.4 (−1,21) | 11 (−229,424) |

|

| ||

| 2006 (3103 counties) Mean (min, max) | 9.8 (1,59) | 380 (208,518) |

| Mean within-county change since 2005 (min, max) | 6.6 (−1,28) | −79 (−200,86) |

|

| ||

| 2007 (3113 counties) Mean (min, max) | 20.0 (4,77) | 327 (184,417) |

| Mean within-county change since 2006 (min, max) | 10.3 (−12,34) | −53 (−164,99) |

Source: Authors’ analysis of data from the Medicare Options Compare database.

Notes: For this summary table, expected out-of-pocket cost estimates were averaged across health status and age categories based on the distributions of health status and age among study participants to yield summary weighted averages for each county (see Technical Appendix A for details on out-of-pocket cost estimates and 2006 imputations). Within-county changes in consecutive years were calculated among counties with at least 1 Medicare Advantage plan available in both years. Mean values presented in the table are the averages across all counties. Minima and maxima are provided from the counties with the lowest and highest values, respectively, to convey the range across counties in the number of plans available, benefit generosity, and year-to-year changes. Dollar estimates for years 2004–2006 have been inflated to constant 2007 dollars with use of the GDP deflator.

By 2007, more than 95 percent of study participants faced lower expected out-of-pocket costs in Medicare Advantage than in traditional Medicare with Medigap coverage, based on county-level averages. Unadjusted rates of switching into Medicare Advantage from traditional Medicare increased significantly from 2.6 percent in 2004 to 6.5 percent in 2007 (P<0.001 for test of trend), while rates of retention in Medicare Advantage tended to decrease slightly from 96.9 percent to 95.7 percent during this period (P=0.08).

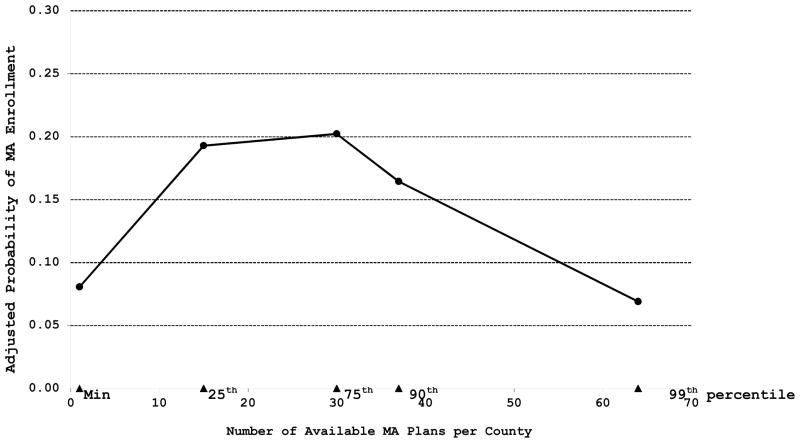

Exhibits 3 and 4 display the main results from adjusted analyses (detailed regression results available in Appendix Table 2). Within-county increases in the number of available plans up to fifteen were associated with significant increases in Medicare Advantage enrollment (P=0.004). However, increases in the number of available plans from fifteen to thirty were not associated with significant changes in enrollment (P=0.84), and increases above thirty plans were associated with significant decreases in Medicare Advantage enrollment (P<0.001).

Exhibit 3. Probability of Enrollment in Medicare Advantage by Number of Available Plans.

Source: Authors’ analysis of survey data from the Health and Retirement Study, linked Medicare enrollment data, and plan data from the Medicare Options Compare database.

Notes: Probabilities of enrollment in Medicare Advantage were predicted from logistic regression coefficients for a range of values in the distribution of the number of Medicare Advantage plans per county in 2010. From 2004 to 2007, within-county increases in the number of plans available to beneficiaries were associated with increased enrollment in Medicare Advantage (P=0.004) when the number of plans was below the 25th percentile in 2010 (15 plans per county). Increases between 15 and 30 plans per county, however, were not associated with significant changes in Medicare Advantage enrollment (P=0.84), and increases above 30 plans per county (over the upper quartile of plans per county in 2010) were associated with significant decreases in MA enrollment (P<0.001). P values are from tests of regression coefficients (see Appendix Table 2).

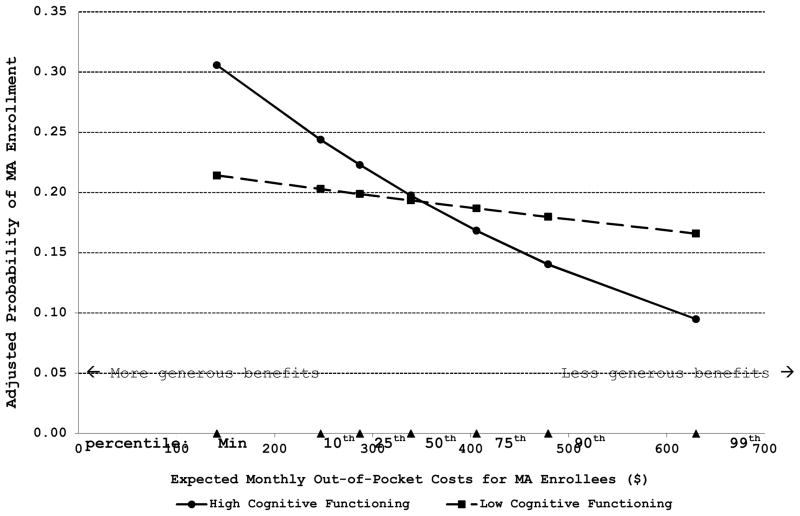

Exhibit 4. Probability of Enrollment in Medicare Advantage by Generosity of Benefits and Cognitive Functioning.

Source: Authors’ analysis of survey data from the Health and Retirement Study, linked Medicare enrollment data, and plan data from the Medicare Options Compare database.

Notes: Probabilities of enrollment in Medicare Advantage were predicted from logistic regression coefficients for a range of values in the distribution of average monthly out-of-pocket costs expected for beneficiaries if they enrolled in Medicare Advantage. From 2004 to 2007, within-county decreases in expected out-of-pocket costs in Medicare Advantage (increases in the generosity of benefits offered by plans) were associated with significant increases in enrollment in MA among beneficiaries with high cognitive functioning (P=0.02) but not among beneficiaries with low cognitive functioning (P=0.56; P=0.004 for interaction by cognition). P values are from tests of regression coefficients (see Appendix Table 2).

Appendix Table 2.

Results of Logistic Regression Model of Beneficiary Choice between Traditional Medicare and Medicare Advantage

| Variable | β(se) | P Value | Interpretation of Coefficient |

|---|---|---|---|

| Intercept | −2.42 (0.31) | <0.001 | Log odds of enrolling in MA, or logit(P(MA)), for beneficiaries with high cognitive functioning choosing between TM and 1 available MA plan and facing average MA and Medigap benefits in terms of expected out-of-pocket costs |

| Low cognition | −0.016 (0.107) | 0.88 | Difference from above in logit(P(MA)) for beneficiaries with low cognitive functioning facing the same choice and benefits |

| Number of plans available | 0.072 (0.025) | 0.004 | For all beneficiaries, logit(P(MA)) changed by 0.072 per plan as the number of available plans increased from 1 to 15 |

| Number of plans over 15 | −0.068 (0.024) | 0.005 | For all beneficiaries, logit(P(MA)) changed by 0.072−0.068 = 0.004 per plan as the number of available plans increased from 15 to 30 (P=0.84 for test of sum of coefficients = 0) |

| Number of plans over 30 | −0.040 (0.020) | 0.049 | For all beneficiaries, logit(P(MA)) changed by 0.072−0.068−0.040 = −0.036 per plan as the number of available plans increased beyond 30 (P<0.001 for test of sum of coefficients = 0) |

| Expected out-of- pocket costs in MA | −0.0029 (0.0013) | 0.02 | For beneficiaries with high cognitive functioning, logit(P(MA)) changed by −0.0029 per dollar increase in expected out-of- pocket costs in MA |

| Low cognition × Expected out-of- pocket costs in MA | 0.0023 (0.0008) | 0.004 | For beneficiaries with low cognitive functioning, logit(P(MA)) changed by −0.0029+0.0023 = −0.0006 per dollar increase in expected out-of-pocket costs in MA (P=0.56 for test of sum of coefficients = 0) |

| Expected out-of- pocket costs in TM + Medigap | 0.0022 (0.0016) | 0.17 | Change in logit(P(MA)) per dollar increase in expected out-of-pocket costs in TM plus Medigap coverage |

| Enrolled in TM in preceding year | −6.30 (0.18) | <0.001 | Difference in logit(P(MA)) associated with prior enrollment in TM relative to prior enrollment in MA |

Source: Authors’ analysis of survey data from the Health and Retirement Study, linked Medicare enrollment data, and plan data from the Medicare Options Compare database.

Notes: See Exhibits 3 and 4 for predicted probabilities derived from this model. P(MA) indicates probability of enrollment in Medicare, and TM indicates traditional Medicare. All estimates were adjusted for age, sex, race/ethnicity, education, presence of diabetes, year, and county fixed effects (regression coefficients not displayed for these covariates). All other characteristics listed in Appendix Table 1 were not significant predictors of MA enrollment and were thus removed from the model to maximize the number of counties and participants analyzed. Except for number of plans and indicators of MA enrollment and low cognitive functioning, all continuous and dichotomous variables in the model were centered about their means to facilitate interpretation of coefficients of interest as effects for the average Medicare beneficiary. Number of plans was centered about 1.

Within-county decreases in expected out-of-pocket costs for Medicare Advantage enrollees were associated with significant increases in Medicare Advantage enrollment among participants with high cognitive functioning (p=0.02) but not among participants with low cognitive functioning (P=0.56). For example, a decrease in expected monthly out-of-pocket costs from $406 (75th percentile in the distribution across counties and study years) to $287 (25th percentile) predicted an increase in Medicare Advantage enrollment from 16.8 percent to 22.3 percent for participants with high cognitive functioning but only from 18.7 percent to 19.9 percent for participants with low cognitive functioning (P=0.004 for difference by cognition).

Within-county changes in expected out-of-pocket costs for traditional Medicare beneficiaries in Medigap plans did not significantly predict enrollment in Medicare Advantage. Participants enrolled in traditional Medicare in the preceding year were much less likely to enroll in Medicare Advantage, suggesting most enrollment decisions reflected the status quo. (See Technical Appendix B and Appendix Table 2 for more details.)

DISCUSSION

In this nationally representative study, the availability of more plan options was associated with increased enrollment in Medicare Advantage when elderly Medicare beneficiaries chose from a limited number of plans (less than fifteen plans) but with unchanged or decreased enrollment in Medicare Advantage when beneficiaries chose from larger numbers of plans (fifteen to thirty and more than thirty plans, respectively). Moreover, elderly adults with low cognitive functioning responded less to the generosity of Medicare Advantage benefits than elderly adults with high cognitive functioning, suggesting many Medicare beneficiaries are unable to access or process information when making enrollment decisions in the current choice environment.

These findings are consistent with prior research on beneficiary choice in Medicare Part D(15–18) and well-described tendencies of consumers to make poor choices or refrain from making any choice at all when confronted with numerous options or complexities that overwhelm their cognitive abilities.(3–11) To make a good choice, elderly Medicare beneficiaries must often sift through dozens of Medicare Advantage options and compare these with traditional Medicare and Medigap alternatives. In contrast, most working-age adults rarely choose from more than a handful of plans pre-selected by their employers. Employers limit options to keep choices simple and to negotiate better benefits and rates for their workers.(36) Thus, our study suggests the Medicare Advantage program has facilitated an overabundance of choice for many elderly beneficiaries, posing a level of complexity far beyond that experienced by the non-elderly.

In response to efforts by the Centers for Medicare and Medicaid Services to eliminate low-enrollment and duplicative plans (plans offering no meaningful differences from others) and a new requirement that private fee-for-service plans develop provider networks, the number of Medicare Advantage plans available to beneficiaries decreased somewhat from 2009 to 2010.(1) Our findings indicate that further reductions in the number of plans would not lower enrollment in Medicare Advantage and might actually increase Medicare Advantage enrollment in the 25 percent of counties that had the most plans and accounted for over 70 percent of Medicare Advantage enrollees in 2010. Thus, choices could be simplified for beneficiaries without necessarily compromising the scale of the Medicare Advantage program.

Our findings raise particular concerns for beneficiaries with reduced cognitive functioning, a group that will grow substantially as the Medicare population ages.(12) Medicare Advantage plans currently compete for enrollees through the benefits they offer and the premiums they charge, but elderly beneficiaries with low cognitive functioning were not responsive to changes in these features, implying two problems. First, these beneficiaries may make an enrollment decision ill-suited to their needs. Second, plans can profit from this unresponsiveness by offering less generous coverage or reducing benefits but nonetheless attracting or retaining enrollees with limited cognitive abilities. Prior studies have demonstrated that elderly adults do not value larger choice sets as highly as younger adults do, that Medicare beneficiaries’ knowledge of their alternative insurance options is poor, and that educational interventions can result in more knowledge and better-informed choices.(37–42) Our findings build on these studies and suggest that national efforts to limit choice in Medicare Advantage and guide beneficiaries to the most valuable options could improve the welfare of seniors and strengthen competition among plans by rewarding value.

In particular, health insurance exchanges can improve information provided to consumers, structure choice sets, standardize benefits, and foster competition on price and quality by forcing plans to compete first for the approval of a discerning agent rather than for overwhelmed consumers.(43, 44) Under the Patient Protection and Affordable Care Act of 2010, exchanges will be created throughout the United States for individual and small group purchasers of commercial insurance. To the extent these non-elderly consumers are affected by early cognitive impairment or make suboptimal decisions when presented with numerous options, exchanges that limit the menu of plans or steer individuals toward high-value options may be most effective. Moreover, our findings would support policies to expand the role of these exchanges to serve elderly Medicare beneficiaries and Medicare Advantage plans or authorize the Medicare program to take on similar responsibilities.

Strengths of our study included a rich set of linked survey and administrative data that supported unique comparisons by cognition and a rigorous analytical approach to identify within-county changes in Medicare Advantage enrollment explained by expansions in choice and benefits that varied across counties after the Medicare Modernization Act.

Our study also had several limitations. Because enrollment files did not identify the specific Medicare Advantage plans in which beneficiaries enrolled, we could not compare the benefits of plans chosen by beneficiaries with traditional Medicare or other available plans. Consequently, we relied on a county-level measure of the average generosity of benefits available to participants through the Medicare Advantage program. Nevertheless, this measure of benefit generosity varied substantially across counties and time, as expected from increases in county-specific payment rates in Medicare Advantage during the study period. This variation allowed us to detect a significant difference between beneficiaries with high and low cognitive functioning in their responsiveness to changes in the average benefits available in their counties. Had we been able to observe and compare the specific plans individuals chose, we expect this modifying effect of cognition on enrollment decisions would have been even stronger.

By assuming beneficiaries were aware of all plans available in their counties, we likely overestimated the size of choice sets encountered by beneficiaries. Therefore, diminishing effects of increased choice on Medicare Advantage enrollment may occur at lower numbers of plans actually considered by beneficiaries than our results indicate.

We used a validated measure of cognitive functioning but one that cannot be used directly to identify adults with impaired decision making based on a cutoff score. Nevertheless, beneficiaries’ responsiveness to expanded benefits in Medicare Advantage differed significantly by the summary cognition score, when analyzed as a categorical or continuous predictor, suggesting this measure was a reliable correlate of decision-making skills. A more discerning measure of cognitive functions required for informed decision making would presumably reveal even greater differences in responsiveness to available benefits. Some participants, particularly those with severe cognitive impairments, may have been aided by family members or friends when deciding between Medicare Advantage and traditional Medicare. The involvement of proxy decision makers likely biased our results toward the null and would not alter the policy implications of our findings (see Technical Appendix D for empirical evidence of this bias).

In addition to the factors we examined, participants’ attachments to their providers, which were not assessed in surveys, may have influenced decisions to switch from traditional Medicare to Medicare Advantage plans with restricted provider networks. This omission from our analysis likely did not bias our results, however, because provider attachments in the study cohort were unlikely to change systematically over time and counties with the number of plans and generosity of benefits available in Medicare Advantage. Furthermore, much of the proliferation in choice in Medicare Advantage since 2003 has been due to the growth of private fee-for-service plans,(45) which did not restrict beneficiaries’ choice of providers during the study period. Payment rates to these plans in particular have exceeded local levels of fee-for-service spending in traditional Medicare, enabling them to attract enrollees by offering more generous benefits than traditional Medicare while preserving broad choice of providers. Thus, the growing availability of private fee-for-service plans suggests beneficiaries with low cognitive functioning were more likely to forego dominant options in favor of traditional Medicare.

Finally, we examined enrollment decisions from the beneficiary’s perspective and assessed Medicare Advantage options in terms of the expected financial burden for beneficiaries relative to traditional Medicare. We could not directly measure the value beneficiaries placed on features of Medicare Advantage plans other than benefit generosity or determine from a societal perspective whether it is better or worse for more beneficiaries to be enrolled in Medicare Advantage. Nevertheless, our findings suggest important problems in the way enrollment choices are currently presented to Medicare beneficiaries.

In conclusion, Medicare beneficiaries were less likely to enroll in Medicare Advantage when faced with numerous plan choices, and beneficiaries with low cognitive functioning were substantially less responsive to the generosity of available benefits when choosing between traditional Medicare and Medicare Advantage. Health care reforms that restructure and simplify choice in Medicare Advantage could improve beneficiaries’ enrollment decisions, lower out-of-pocket costs for beneficiaries with cognitive impairments, and help invigorate value-based competition among managed care plans in Medicare.

Acknowledgments

Supported by grants from the National Institute on Aging (P01 AG032952) and the Beeson Career Development Award Program (NIA K08 AG038354 and the American Federation for Aging Research). The content is solely the responsibility of the authors and does not necessarily represent the official views of the National Institute on Aging.

TECHNICAL APPENDIX

A. Calculation of expected out-of-pocket costs for enrollees in Medicare Advantage (MA) plans

To measure the generosity of benefits offered by MA plans available in each participant’s county of residence, we used previously derived estimates of total out-of-pocket costs expected for a national sample of traditional Medicare beneficiaries in the Medicare Current Beneficiaries Survey (MCBS) if they were to enroll in a given plan in a given year. Specifically, utilization across all medical services (including prescription drugs) was assessed from MCBS survey and claims data and applied to the coverage rules and cost-sharing structure of each MA plan to determine the average monthly out-of-pocket costs expected for the sample, including premium costs.(28) These calculations were conducted separately for 30 subgroups defined by 5 health status and 6 age categories. For each of these groups in each county in each year, we averaged these out-of-pocket cost estimates across all plans available in the county, weighting each plan’s contribution to this average by the fraction of MA enrollees in the county who were enrolled under the plan’s contract. Generally, insurers contract with Medicare to offer a specific type of plan (i.e. HMO, PPO, or PFFS) in one or more counties but often offer multiple plans with different names and variable benefits under each contract. County enrollment data were available at the contract level but not the plan level for weighting purposes. We calculated these county-level averages separately for each health status by age category and assigned values to study participants according to their health status, age, year of enrollment in Medicare, and county of residence.

Expected monthly out-of-pocket costs for traditional Medicare beneficiaries enrolled in Medigap plans have been similarly estimated for the MCBS sample based on the uniform benefits and premiums of traditional Medicare and the variable supplemental benefits and premiums of Medigap plans offered in each state.(28) To obtain state-level averages of the generosity of benefits available to study participants through traditional Medicare and Medigap plans, we averaged out-of-pocket cost estimates across the most commonly selected Medigap plans for each health status by age category and assigned values to study participants according to their health status, age, year of enrollment in Medicare, and state of residence.

Calculations of expected out-of-pocket costs took into account prescription drug benefits offered by MA plans before 2006 and by MA prescription drug (MA-PD) plans after 2006 but not Part D benefits available after 2006 through stand-alone prescription drug plans (PDPs). PDPs offer the same prescription drug benefits, however, to enrollees in traditional Medicare and enrollees in MA plans without drug coverage. Therefore, changes in these benefits would not alter the relative generosity of benefits across MA and traditional Medicare options.

Expected out-of-pocket cost estimates for MA plans were available from the CMS for years 2004, 2005, and 2007, but not for 2006. Therefore, for each health status by age category, we imputed expected out-of-pocket costs for MA enrollees in each county in 2006 based on county-level out-of-pocket cost estimates in other years, national trends from 2004 to 2007, and county-level data on payment rates and number of plans that were available in all study years.(27, 46) Specifically, for each health status by age category, we fitted a linear regression model predicting average expected out-of-pocket costs for MA enrollees at the county level as a function of county benchmark payment rates, the number of plans available per county, a continuous year index ranging from 2004 to 2007, and county fixed effects, omitting data from 2006 from this model. We then used the coefficients estimated by this model and 2006 data on payment rates and number of plans to predict county-level averages for estimated out-of-pocket costs for MA enrollees in 2006.

B. Details of logistic regression model of beneficiary choice

We fitted the following logistic regression model:

where E(MAi,c,y) is the expected value of the indicator of enrollment in MA (or the predicted probability of enrollment in MA) for individual i in county c and year y; “Lowcog” is an indicator of low cognitive functioning (summary cognition score less than the median score of 22); “#plans” is the number of MA plans available in county c and year y; “#over15” is a spline term equal to “#plans”−15 if the number of plans available is greater than 15 and equal to 0 otherwise; “#over30” is a spline term equal to “#plans”−30 if the number of plans available is greater than 30 and equal to 0 otherwise; “OopMA” is the average expected monthly out-of-pocket costs for a standardized population of beneficiaries enrolling in MA in county c and year y; “OopMedigap” is the average expected out-of-pocket costs for a standardized population of beneficiaries enrolling in traditional Medicare and a Medigap plan in county c and year y; “TM” is an indicator of enrollment in traditional Medicare in the preceding year (y-1); “County” is a vector of dummy variables for counties, omitting a reference county; “Years 04–08” is a vector of dummy variables for years 2004 to 2007, omitting a reference year; and “Characteristics” is a vector of sociodemographic and health characteristics assessed from biennial surveys. Regression results are presented in the Appendix Table 2 at the end of the Technical Appendix.

We also added to this model several interaction terms not described above or presented in the Appendix Table 2. To determine if the effects of increased number of plans differed by cognitive functioning, we added interactions between cognition and spline terms. Decreases in MA enrollment associated with increases over 30 plans per county were greater but not significantly greater for participants with low cognitive functioning than for those with high cognitive functioning (P=0.13 for interaction). In a more complex model specification, we explored a 3-way interaction between cognitive functioning, number of available plans, and expected out-of-pocket costs in MA after including all 2-way interactions among these variables. The coefficient for this 3-way interaction indicated that the relationship between expected out-of-pocket costs and MA enrollment may have differed even more by cognitive functioning when the number of available plans was higher, but this difference was not statistically significant (P=0.53). Finally, an interaction between cognitive functioning and expected out-of-pocket costs for traditional Medicare beneficiaries in Medigap plans was not significant (P=0.76), suggesting within-county changes in the generosity of Medigap plans did not influence enrollment decisions for beneficiaries with either high or low cognitive functioning.

We increased the inclusion threshold for the number of observations per county until county fixed effects were estimable (≥139 observations per county). We retained in the final model only covariates and interactions that were significantly predictive of MA enrollment in order to minimize the number of observations per county required to estimate county fixed effects and thus maximize the number of counties and participants included in our analysis.

C. Weighting adjustments

We weighted all analyses to adjust for survey non-response that led to missing Medicare identification numbers and thus missing enrollment data and for the exclusion of counties that were sparsely sampled by the clustered survey design of the HRS. First, among all participants otherwise eligible for study inclusion, we fitted a logistic regression model predicting successful linkage to Medicare claims data as a function of sociodemographic characteristics and weighted this analysis by survey sampling weights. Participants with linked Medicare files were older, less educated, and more likely to be white, female, and a military veteran than participants who were not linked. From this model we derived weights equal to the inverse of the probability of linkage and combined these weights with sampling weights by taking the product of the two sets.

Among all participants with linked claims data, we then fitted a second logistic regression model predicting inclusion in our analytic sample as a function of sociodemographic and health characteristics and the Beale Urban-Rural Continuum Code for their county of residence, and weighted this analysis by the combined sampling and linkage weights. Compared to participants who were excluded because their county was too sparsely sampled by the HRS for estimation of county fixed effects, included participants were older and less educated, reported worse general health status, and were more likely to live in mid-size metropolitan areas. Included and excluded participants were equally likely to have diabetes and to be Hispanic, female, a military veteran, and enrolled in MA. From this model we derived weights equal to the inverse of the probability of inclusion and combined these with sampling and linkage weights by taking the product of the 3 sets of weights. We used these final combined weights for all analyses.

D. Sensitivity analyses

We conducted several sensitivity analyses. In our main analysis, we examined enrollment decisions made by MA enrollees as well as traditional Medicare enrollees because MA enrollees were also confronted with a new set of plan options if they wished to change plans or if their plan became unavailable (these MA enrollees must actively re-enroll during the open enrollment period if they wish to remain in MA). To focus on enrollment changes from traditional Medicare to MA, we restricted the analysis to beneficiaries enrolled in traditional Medicare in the preceding year. This restriction did not alter our results substantively.

We aggregated plan-specific expected out-of-pocket cost estimates to county-level measures using 2 alternative strategies. First, we averaged across available plans within counties, assigning each plan equal weight. Second, we used the lowest cost plan available as the county-level measure. Adjusted analyses employing these alternative variable definitions yielded results that were very similar to those we have presented.

We fitted a model using number of MA contracts per county instead of number of available plans per county and specified spline terms to allow the effect of increasing number of contracts to change above the 25th percentile (6 contracts) and the 75th percentile (10 contracts) of the distribution of number of contracts per county in 2010. Effects on MA enrollment were proportionately larger when estimated on a per contract basis but substantively very similar to effects estimated on a per plan basis and presented in the Appendix Table 2. We also fitted a model that included all characteristics listed in Appendix Table 1, which required counties with fewer than 225 observations to be excluded for county fixed effects to be estimated. Point estimates were similar to those reported in the Appendix Table 2, and key spline and interaction terms remained statistically significant.

Instead of including expected out-of-pocket costs in MA and in traditional Medicare with Medigap coverage as separate terms in the model, we calculated the difference between these variables for each county in each year and specified an alternative model with these differences and an interaction between cognition and these differences as predictors. Estimates were similar to those we have reported in the Appendix Table 2 for variables “Expected out-of-pocket costs in MA” and “Low cognition × Expected out-of-pocket costs in MA.”

We excluded participants who were not enrolled in Medicare Part B in addition to Part A, and in a separate sensitivity analysis we excluded annual enrollment observations that were not linked to survey data within 2 years of the claims year. Results were not significantly altered by these exclusions. We also excluded observations from 2006, the year for which we imputed expected out-of-pocket costs. To distinguish effects of increased plan payment rates from potential effects of the Part D drug benefit on MA enrollment, we restricted the analysis to the 2006–2007 period after the implementation of Medicare Part D. Due to the reduced sample size in these analyses of restricted time periods, standard errors for many coefficients were larger, but coefficients for key spline and interaction terms remained statistically significant.

Finally, we identified participants who had proxies respond to surveys because of cognitive impairments that limited their ability to complete interviews. Some of these participants were excluded from our main analysis because they had missing cognition scores due to non-response to cognition items in all surveys we analyzed before and during the study period. We added these participants to the study cohort for the following analysis. We categorized participants with proxy survey respondents due to cognitive impairments as having low cognitive functioning, and we assumed these participants were particularly likely to have help from others in making health insurance decisions, too. We compared the responsiveness of this group to increases in MA benefit generosity to the responsiveness of participants with high cognitive functioning by adding to our model a main effect for this group and an interaction with “OopMA”. In contrast to our findings for participants with low cognitive functioning detailed in Appendix Table 2 (β6 = +0.0023 for interaction with “OopMA”; P=0.004), cognitively impaired participants with survey proxies were equally responsive to changes in expected out-of-pocket costs in MA as participants with high cognitive functioning (β=+0.0004 for interaction with “OopMA”; P=0.84). These results suggest the involvement of proxy decision makers improved the responsiveness of cognitively impaired beneficiaries to the generosity of benefits available in MA. Because some participants with low cognitive functioning but without proxy survey respondents may have also been aided by family or friends in their enrollment decisions, our main analysis likely underestimated the modifying effect of cognition on responsiveness to benefit generosity in the absence of such aid.

ENDNOTES

- 1.Medicare Payment Advisory Commission. Report to the Congress: Medicare Payment Policy. Washington, D.C.: MedPAC; 2010. [cited 2011 January 13]; Available from: http://www.medpac.gov/documents/Mar10_EntireReport.pdf. [Google Scholar]

- 2.Gold M. The growth of private plans in Medicare, 2006. The Kaiser Family Foundation; Washington, D.C.: 2006. Report No.: 7473. [Google Scholar]

- 3.Botti S, Iyengar SS. The dark side of choice: when choice impairs social welfare. J Public Policy Mark. 2006;25(1):24–38. [Google Scholar]

- 4.Kunreuther H, Meyer R, Zeckhauser R, Slovic P, Schwartz B, Schade C, et al. High stakes decision making: normative, descriptive and prescriptive considerations. Marketing Letters. 2002;13(3):259–68. [Google Scholar]

- 5.Anderson CJ. The psychology of doing nothing: forms of decision avoidance result from reason and emotion. Psychol Bull. 2003;129(1):139–67. doi: 10.1037/0033-2909.129.1.139. [DOI] [PubMed] [Google Scholar]

- 6.Dhar R. Consumer preference for a no-choice option. J Consum Res. 1997;24:215–31. [Google Scholar]

- 7.Gilovich T, Medvec VH. The experience of regret: what, when, and why. Psychol Rev. 1995 Apr;102(2):379–95. doi: 10.1037/0033-295x.102.2.379. [DOI] [PubMed] [Google Scholar]

- 8.Iyengar SS, Lepper MR. When choice is demotivating: can one desire too much of a good thing? J Pers Soc Psychol. 2000;79(6):995–1006. doi: 10.1037//0022-3514.79.6.995. [DOI] [PubMed] [Google Scholar]

- 9.Samuelson W, Zeckhauser R. Status quo bias in decision making. J Risk Ins. 1988;1:7–59. [Google Scholar]

- 10.Finucane ML, Slovic P, Hibbard JH, Peters E, Mertz CK, MacGregor DG. Aging and decision-making competence: an analysis of comprehension and consistency skills in older versus younger adults considering health plan options. J Behav Dec Making. 2002;15:141–64. [Google Scholar]

- 11.Hibbard JH, Slovic P, Peters E, Finucane ML, Tusler M. Is the informed-choice policy approach appropriate for Medicare beneficiaries? Health Aff (Millwood) 2001;20(3):199–203. doi: 10.1377/hlthaff.20.3.199. [DOI] [PubMed] [Google Scholar]

- 12.2009 Alzheimer’s disease facts and figures. Alzheimers Dement. 2009;5(3):234–70. doi: 10.1016/j.jalz.2009.03.001. [DOI] [PubMed] [Google Scholar]

- 13.Plassman BL, Langa KM, Fisher GG, Heeringa SG, Weir DR, Ofstedal MB, et al. Prevalence of cognitive impairment without dementia in the United States. Ann Intern Med. 2008;148(6):427–34. doi: 10.7326/0003-4819-148-6-200803180-00005. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 14.Plassman BL, Langa KM, Fisher GG, Heeringa SG, Weir DR, Ofstedal MB, et al. Prevalence of dementia in the United States: the aging, demographics, and memory study. Neuroepidemiology. 2007;29(1–2):125–32. doi: 10.1159/000109998. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.Abaluck JT, Gruber J. Choice inconsistencies among the elderly: evidence from plan choice in the Medicare Part D program. National Bureau of Economic Research; Cambridge, MA: 2009. Report No.: 14759. [Google Scholar]

- 16.Hanoch Y, Rice T, Cummings J, Wood S. How much choice is too much? The case of the Medicare prescription drug benefit. Health Serv Res. 2009;44(4):1157–68. doi: 10.1111/j.1475-6773.2009.00981.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 17.Winter J, Balza R, Caro F, Heiss F, Jun BH, Matzkin R, et al. Medicare prescription drug coverage: consumer information and preferences. Proc Natl Acad Sci U S A. 2006;103(20):7929–34. doi: 10.1073/pnas.0601837103. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18.Kling JR, Mullainathan S, Shafir E, Vermeulen L, Wrobel MV. Misperception in choosing Medicare drug plans. Unpublished paper. 2009 [cited 2011 January 13]; Available from: http://web.gc.cuny.edu/economics/SeminarPapers/Fall%202010/Kling.pdf.

- 19.Tanius BE, Wood S, Hanoch Y, Rice T. Aging and choice: applications to Medicare Part D. Judgment and Decision Making. 2009;4(1):92–101. [Google Scholar]

- 20.1992–2008 public use datasets, 1992–2006 restricted geographic identifiers, and 1991–2007 restricted linked Medicare claims files. Produced and distributed by the University of Michigan with funding from the National Institute on Aging (grant number NIA U01AG009740); Ann Arbor, MI: Health and Retirement Study. [Google Scholar]

- 21.Health and Retirement Study. Sample Sizes and Response Rates (2002 and beyond) [cited 2011 April 8]; Available from: http://hrsonline.isr.umich.edu/sitedocs/sampleresponse.pdf.

- 22.Ofstedal MB, Fisher GG, Herzog AR. HRS Documentation Report DR-006. Ann Arbor, MI: Survey Research Center, University of Michigan; 2005. Documentation of Cognitive Functioning Measures in the Health and Retirement Study. [cited 2011 January 13]; Available from: http://hrsonline.isr.umich.edu/sitedocs/userg/dr-006.pdf. [Google Scholar]

- 23.Fisher GG, Hassan H, Rodgers WL, Weir DR. Health and Retirement Study Imputation of Cognitive Functioning Measures: 1992–2006. Ann Arbor, MI: Survey Research Center, University of Michigan; 2009. [cited 2011 January 13]; Available from: http://hrsonline.isr.umich.edu/modules/meta/xyear/cogimp/desc/CO.GIMPdd.pdf. [Google Scholar]

- 24.Brandt J, Spencer M, Folstein M. The telephone interview for cognitive status. Neuropsy Neuropsy Be. 1988;1:111–7. [Google Scholar]

- 25.Breitner JC, Welsh KA, Gau BA, McDonald WM, Steffens DC, Saunders AM, et al. Alzheimer’s disease in the National Academy of Sciences-National Research Council Registry of Aging Twin Veterans. III. Detection of cases, longitudinal results, and observations on twin concordance. Arch Neurol. 1995;52(8):763–71. doi: 10.1001/archneur.1995.00540320035011. [DOI] [PubMed] [Google Scholar]

- 26.Folstein MF, Folstein SE, McHugh PR. “Mini-mental state”. A practical method for grading the cognitive state of patients for the clinician. J Psychiatr Res. 1975;12(3):189–98. doi: 10.1016/0022-3956(75)90026-6. [DOI] [PubMed] [Google Scholar]

- 27.Medicare Options Compare. [cited 2011 January 13]; Available from: http://www.medicare.gov/MPPF/Include/DataSection/Questions/Welcome.asp.

- 28.CY. 2009 Medicare Options Compare Cohort Selection and Out-of-pocket Cost Estimates Methodology. Center for Medicare & Medicaid Services; 2008. [cited 2011 January 13]; Available from: http://www1.cms.gov/ResearchGenInfo/downloads/Research_Calculation.pdf. [Google Scholar]

- 29.Medicare Payment Advisory Commission. Report to the Congress: Medicare Payment Policy. Washington, D.C.: MedPAC; 2009. [cited 2011 January 13]; Available from: http://www.medpac.gov/documents/Mar09_EntireReport.pdf. [Google Scholar]

- 30.Chaikind HR, Morgan PC, Chaikind HR, Morgan PC. Congressional Research Service Report for Congress. Medicare Advantage Payments. The Library of Congress. 2004 [cited 2011 January 13]; Available from: http://www.law.umaryland.edu/marshall/crsreports/crsdocuments/RL32618.pdf.

- 31.Chernew M, Decicca P, Town R. Managed care and medical expenditures of Medicare beneficiaries. J Health Econ. 2008;27:1451–61. doi: 10.1016/j.jhealeco.2008.07.014. [DOI] [PubMed] [Google Scholar]

- 32.Frakt AB, Pizer SD, Feldman R. Payment reduction and Medicare private fee-for-service plans. Health Care Financ Rev. 2009;30(3):15–24. [PMC free article] [PubMed] [Google Scholar]

- 33.Bach PB, McClellan MB. The first months of the prescription-drug benefit--a CMS update. N Engl J Med. 2006;354(22):2312–4. doi: 10.1056/NEJMp068108. [DOI] [PubMed] [Google Scholar]

- 34.Heeringa SG, Connor JH. Technical description of the Health and Retirement Survey sample design. Ann Arbor: University of Michigan; 1995. [cited 2011 April 8]; Available from: http://hrsonline.isr.umich.edu/docs/userg/HRSSAMP.pdf. [Google Scholar]

- 35.Lohr SL. Sampling: Design and Analysis. Pacific Grove, CA: Duxbury Press, Brooks/Cole Publishing Company; 1999. [Google Scholar]

- 36.Glazer J, McGuire TG. Private employers don’t need formal risk adjustment. Inquiry. 2001;38(3):260–9. doi: 10.5034/inquiryjrnl_38.3.260. [DOI] [PubMed] [Google Scholar]

- 37.Harris-Kojetin LD, Uhrig JD, Williams P, Bann C, Frentzel EM, McCormack L, et al. The “choose with care system”-development of education materials to support informed Medicare health plan choices. J Health Commun. 2007 Mar;12(2):133–56. doi: 10.1080/10810730601150098. [DOI] [PubMed] [Google Scholar]

- 38.McCormack LA, Garfinkel SA, Hibbard JH, Keller SD, Kilpatrick KE, Kosiak B. Health insurance knowledge among Medicare beneficiaries. Health Serv Res. 2002 Feb;37(1):43–63. [PubMed] [Google Scholar]

- 39.McCormack LA, Uhrig JD. How does beneficiary knowledge of the Medicare program vary by type of insurance? Med Care. 2003 Aug;41(8):972–8. doi: 10.1097/00005650-200308000-00010. [DOI] [PubMed] [Google Scholar]

- 40.Mikels JA, Reed AE, Simon KI. Older adults place lower value on choice relative to young adults. J Gerontol B Psychol Sci Soc Sci. 2009 Jun;64(4):443–6. doi: 10.1093/geronb/gbp021. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 41.Uhrig JD, Bann CM, McCormack LA, Rudolph N. Beneficiary knowledge of original Medicare and Medicare managed care. Med Care. 2006 Nov;44(11):1020–9. doi: 10.1097/01.mlr.0000228019.47200.f2. [DOI] [PubMed] [Google Scholar]

- 42.Uhrig JD, Harris-Kojetin L, Bann C, Kuo TM. Do content and format affect older consumers’ use of comparative information in a Medicare health plan choice? Results from a controlled experiment. Med Care Res Rev. 2006 Dec;63(6):701–18. doi: 10.1177/1077558706293636. [DOI] [PubMed] [Google Scholar]

- 43.Frank RG, Zeckhauser RJ. Health insurance exchanges--making the markets work. N Engl J Med. 2009;361(12):1135–7. doi: 10.1056/NEJMp0906246. [DOI] [PubMed] [Google Scholar]

- 44.Kingsdale J. Health Insurance Exchanges -- Key Link in a Better-Value Chain. N Engl J Med. 2010;362(23):2147–50. doi: 10.1056/NEJMp1004758. [DOI] [PubMed] [Google Scholar]

- 45.Gold M. Medicare Advantage in 2006–2007: what Congress intended? Health Aff (Millwood) 2007;26(4):w445–55. doi: 10.1377/hlthaff.26.4.w445. [DOI] [PubMed] [Google Scholar]

- 46.Medicare Advantage Ratebooks. Accessed at http://www3.cms.gov/MedicareAdvtgSpecRateStats/RSD/list.asp on 28 September, 2010. Available from: http://www3.cms.gov/MedicareAdvtgSpecRateStats/RSD/list.asp.

- 46.Medicare Advantage Ratebooks. [cited 2011 January 13]; Available from: http://www3.cms.gov/MedicareAdvtgSpecRateStats/RSD/list.asp.