Abstract

Objectives. We report impacts on alcohol consumption following new and increased minimum alcohol prices in Saskatchewan, Canada.

Methods. We conducted autoregressive integrated moving average time series analyses of alcohol sales and price data from the Saskatchewan government alcohol monopoly for 26 periods before and 26 periods after the intervention.

Results. A 10% increase in minimum prices significantly reduced consumption of beer by 10.06%, spirits by 5.87%, wine by 4.58%, and all beverages combined by 8.43%. Consumption of coolers decreased significantly by 13.2%, cocktails by 21.3%, and liqueurs by 5.3%. There were larger effects for purely off-premise sales (e.g., liquor stores) than for primarily on-premise sales (e.g., bars, restaurants). Consumption of higher strength beer and wine declined the most. A 10% increase in minimum price was associated with a 22.0% decrease in consumption of higher strength beer (> 6.5% alcohol/volume) versus 8.17% for lower strength beers. The neighboring province of Alberta showed no change in per capita alcohol consumption before and after the intervention.

Conclusions. Minimum pricing is a promising strategy for reducing the public health burden associated with hazardous alcohol consumption. Pricing to reflect percentage alcohol content of drinks can shift consumption toward lower alcohol content beverage types.

The contribution of both individual- and population-level alcohol consumption to increased risk of a range of serious chronic diseases (e.g., cancers, liver diseases) and adverse acute events (e.g., injuries, poisonings) is well documented.1,2 In the World Health Organization Region of the Americas report, alcohol is identified as the single leading cause of the preventable loss of disability-adjusted life years.1 Globally, hazardous and harmful alcohol use has been found to be the leading contributing cause of death among young adults, involving especially, deaths from road trauma, homicide, and suicide.3 Successive comprehensive and systematic reviews of published research conclude that governments have a number of proven strategies to reduce the burden of illness from alcohol.4,5 The evidence is strongest for universal policies that control price6,7 and physical availability.8,9 In many instances, however, policies with the least evidence of effectiveness (e.g., public awareness campaigns, alcohol education in schools) attract the greatest public support whereas the most effective policy—raising the price of alcohol—is consistently less popular.10 A recent Canadian study found that provinces with higher levels of per capita alcohol consumption were more likely to oppose effective public health measures.11

We previously identified specific alcohol pricing policies that may have higher levels of public acceptability and political viability without compromising effectiveness: (1) setting prices and taxes that reflect the ethanol content of beverages, thereby encouraging consumption of lower alcohol content varieties; (2) setting minimum prices to eliminate availability of cheap alcohol often favored by young adults and other high-risk drinkers; (3) creating earmarked taxes applied to a standard drink of any alcoholic beverage to raise funds for alcohol prevention and treatment programs (e.g., “a nickel a drink” tax); and (4) indexing all price and tax rates to the cost of living.12,13 Elements of these policies have been endorsed under Canada’s National Alcohol Strategy14 and formally advocated by the Public Health Officer of British Columbia,15 and the Scottish government recently passed legislation to introduce a fixed minimum price per “unit” of ethanol.16 Some US states have previously set mandatory minimum liquor prices (e.g., Washington), but the great majority sell alcohol at substantially lower prices than in Canada.17 We have seen examples of spirits and fortified wine for sale in California liquor stores sold at approximately Can $0.25 per Canadian standard drink, less than half the price of the cheapest alcohol available in Canada.18 We evaluated the impacts on alcohol consumption and government revenue of 2 of the aforementioned policies (1 and 2) as recently implemented in a Canadian province.

On April 1, 2010, the Saskatchewan Liquor and Gaming Authority (SLGA) introduced a comprehensive set of new and increased minimum prices on alcohol. The SLGA has a monopoly on alcohol distribution and a partial monopoly on the sale of alcohol in liquor stores. Their minimum prices apply directly to liquor store retail prices and also to the prices at which the SLGA sells liquor to bar and restaurant owners; hence, they also indirectly affect on-premise retail prices, but likely to a smaller degree. Minimum prices were first introduced for spirits other than brandy and cognac in 2003, beer in 2005, wine in 2008, and higher strength coolers, brandy, and cocktails on April 1, 2010. Effective minimum prices calculated in Canadian dollars per standard Canadian drink (17.05 mL ethanol) are summarized in Table 1. As shown in the supplementary online material (Appendix A, available as a supplement to this article at http://www.ajph.org), the minimum price increase in 2010 impacted just 216 (8.5%) of the 2542 alcoholic products then sold by the SLGA, ranging from 0% of liqueurs to 17.0% of premixed cocktails.

TABLE 1—

Average Minimum Prices for Different Types of Alcoholic Beverage per Standard Drink (17.05 mL ethanol): Saskatchewan, July 2003–April 2010

| Beverage Type (Volume) and % Alcohol Content | July 2003, $ | January 2005, $ | June 2005, $ | January 2007, $ | February 2007, $ | January 2008, $ | March 2008, $ | January 2009, $ | April 2010, $ |

| Spirits (750 mL) | |||||||||

| 35% to ≤ 44.9% | 1.23 | 1.25 | 1.30 | 1.29 | 1.30 | 1.37 | |||

| 45% to ≤ 54.9% | 1.03 | 1.05 | 1.09 | 1.09 | 1.09 | 1.45 | |||

| ≥ 55% | 0.66 | 0.67 | 0.70 | 0.70 | 0.70 | 1.18 | |||

| All spirits | 1.23 | 1.25 | 1.30 | 1.29 | 1.30 | 1.39 | |||

| Liqueurs (750 mL) | |||||||||

| ≤ 22.9% | 1.84 | ||||||||

| 23% to ≤ 34.9% | 1.59 | ||||||||

| All liqueurs | 1.79 | ||||||||

| Wine (750 mL) | |||||||||

| ≤ 15.9% | 1.32 | 1.41 | |||||||

| ≥ 16% | 0.82 | 1.20 | |||||||

| All wine | 1.28 | 1.39 | |||||||

| Beer (6 pack, 2.046 L) | |||||||||

| ≤ 6.5% | 1.28 | 1.32 | 1.36 | 1.40 | 1.56 | ||||

| > 6.5% to ≤ 7.5% | 1.00 | 1.03 | 1.06 | 1.10 | 1.72 | ||||

| > 7.5 to ≤ 8.5% | 0.75 | 0.77 | 0.80 | 0.82 | 1.46 | ||||

| ≥ 8.5% | 0.64 | 0.67 | 0.69 | 0.71 | 1.39 | ||||

| All beers | 1.27 | 1.32 | 1.35 | 1.40 | 1.56 | ||||

| Cocktails (1 L) | |||||||||

| ≤ 7% | 1.71 | ||||||||

| > 7% to ≤ 13.7% | 1.16 | ||||||||

| > 13.7 to ≤ 22.9% | 1.49 | ||||||||

| 23% to ≤ 34.9% | 1.44 | ||||||||

| ≥ 35% | 1.46 | ||||||||

| All cocktails | 1.50 | ||||||||

| Coolers (6 pack, 2.046 L) | |||||||||

| ≤ 5.99% | 1.48 | ||||||||

| ≥ 6% | 1.29 | ||||||||

| All coolers | 1.33 | ||||||||

Note. The effective minimum prices per standard drink introduced in April 1, 2010, were calculated in Canadian dollars for each beverage strength category after calculating a typical beverage strength within each strength category (L of beverage divided by L of ethanol) and after applying all applicable sales taxes (goods and services tax and liquor consumption tax).

The outcome of the new policy was a set of minimum prices for alcohol that, depending on beverage type and strength, ranged between $1.16 and $1.84 per standard drink and that are now among the highest of all Canadian provinces.19 Although minimum prices per standard drink were still lower for the low alcohol content beverage types after April 1, 2010 (Figure 1), the new pricing structure shifted Saskatchewan’s alcohol pricing regime significantly toward the public health ideal represented by Scotland’s forthcoming fixed minimum price for a unit of ethanol.15

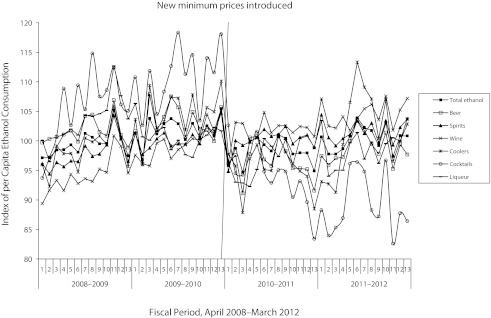

FIGURE 1—

Trends in seasonally adjusted indices of age 15 years or older per capita consumption of beers, spirits, coolers, cocktails, and liqueurs 2 years before and after the minimum price increase: Saskatchewan, Canada, April 2008–March 2012.

Note. 100 = mean per capita ethanol for each fiscal year.

In most Canadian provinces, some Nordic countries, and some US states, governments are the leading retailers of alcohol, and so minimum prices can potentially serve fiscal as well as public health goals. In countries such as the United Kingdom and in most of the United States, where alcohol retailing is managed by private businesses, most increased profits from minimum pricing will flow to private retailers. In all jurisdictions, however, raising the minimum price of alcohol also creates the opportunity for additional government revenue whether through sales taxes or simultaneous adjustments to excise taxes or government-set markups.

There is suggestive evidence that minimum alcohol pricing should have public health benefits. Meta-analyses have linked increases in overall alcohol prices to significant reductions in both alcohol consumption6,7 and related harms.20 There is evidence from the United States21 and the United Kingdom22 that the higher-risk drinkers tend to purchase the cheapest alcohol. Evidence from Sweden suggests that consumers of cheap alcohol are more price sensitive than are those who drink more expensive varieties mainly because they cannot substitute down to still cheaper beverages when prices go up.23,24 The potential impacts of setting minimum alcohol prices on health and social costs have been modeled for the United Kingdom with significant and larger effects for younger and heavier alcohol consumers.22,25 In the first empirical test of the impact of changes in minimum alcohol prices in a Canadian province, it was estimated that a 10% increase in the minimum price of any beverage resulted in a 3.4% decrease in total alcohol consumption.26

There is also a strong rationale for encouraging the consumption of lower alcohol content products as a strategy for reducing related harms. A US study demonstrated how providing unlabeled 3% alcohol strength beer at a college party resulted in similar volumes of beer being consumed but with significantly lower blood alcohol concentrations in drinkers than when unlabeled 7% beer was provided.27 A Canadian study found that young male beer drinkers were unable to reliably differentiate between low (3.7%) and high (5.6%) alcohol content beer and reported similar levels of enjoyment and subjective intoxication after consuming each type.28 The new measures introduced in Saskatchewan in April 2010 substantially reduced incentives for selecting higher alcohol content beverages by introducing proportionately larger increases in minimum price for higher alcohol content products (Table 1).

We report autoregressive integrated moving average (ARIMA) time series analyses of SLGA sales and price data for different types and strengths of alcoholic beverages to examine the size and significance of changes after the increase in minimum liquor prices in April 2010. We hypothesized that the changes implemented by the SLGA would lead to:

an overall reduction in alcohol consumption across all beverage types,

greater reductions in consumption of high versus low alcohol content varieties of each beverage type, and

greater effect sizes for off-premise sales (liquor stores) compared with sales from venues licensed to sell alcohol for on-premise consumption (bars, nightclubs, restaurants).

METHODS

Multivariate time series analyses were performed to investigate the relationships between minimum prices and consumption of alcoholic beverages. The models included adjustment for household income, cost of living, sociodemographic variables, consumption of other alcoholic beverages, trends in the data, time of year, and autoregressive or moving average effects (see Equation 1 under Statistical Analysis).

Alcohol Sales Data

Sales data were provided by the SLGA in both liters of ethanol and dollar values for beer, coolers, wine, spirits, liqueurs, and premixed cocktails. Most products categorized as cocktails are spirit-based and have higher alcohol content (up to 40% alcohol by volume), whereas coolers are rarely above 7% alcohol by volume. Liqueurs are often spirit-based but almost all have an alcohol content below 35%, whereas those products categorized as spirits are almost invariably above 35% alcohol content. The data were further broken down according to on-premise or mixed on-premise and off-premise sales (clubs, restaurants, and bars—some of the latter were permitted to sell takeaway alcohol) versus purely off-premises sales (government liquor stores, rural agency and specialty wine stores) and by a total of 52 financial periods over 4 fiscal years from 2008–2009 through 2011–2012. Alcohol sales in each period were weighted accordingly for the varying number of days in each period. There were substantial and consistent seasonal trends in the per capita consumption of each beverage type across the 13 financial periods of each year (Appendix B, available as a supplement to this article at http://www.ajph.org), so data were deseasonalized by calculating an index for each of the 13 annual periods and weighting the data accordingly.29 The seasonal index was created by dividing each observation by the corresponding centered moving average. The relatively short time series precluded using differencing for this purpose.

Price Data

Applicable minimum prices during the study period were provided by the SLGA in dollars per liter of beverage by several categories of alcoholic strength and by container size. These minimum prices were converted to dollars per standard drink (17.05 mL pure ethanol) after calculating the mean alcoholic strength for each category of product defined in terms of alcohol strength and container size. A weighted average minimum price was calculated for each beverage strength category using data on average sales volumes as a function of container size for the entire study period. Minimum prices were further adjusted by the monthly Consumer Price Index for Saskatchewan30 to control for the effects of inflation and economic changes (prices were multiplied by 100 and divided by the relevant customer price index [CPI] score). Taxes and environmental surcharges were included in all estimates of minimum prices (Table 1 and Appendix C, available as a supplement to this article at http://www.ajph.org). For estimates of all products combined, the relatively small sales data for coolers, liqueurs, and cocktails (< 8% of all sales) were combined with their most similar counterparts in terms of alcohol strength, namely beer and spirits, respectively, because there were no minimum prices for these products before April 1, 2010. Although cognac and brandy are included in reported sales of spirits, they had no minimum price applied during the study period. They contributed less than 2% of spirits sales and were premium products that would not be affected by minimum prices.

Proxy measures for “mean prices” of beverages were also estimated (value divided by L of ethanol sold) and CPI-adjusted (100 in April 2008; Appendix C). Although not a precise measure of actual prices, because price is affected by shifting consumer preferences and sales volumes, it is well established that overall prices significantly predict the demand for alcohol and, hence, this proxy measure was included in the ARIMA models to better isolate unique effects for minimum prices.

Population Data

The population aged 15 years or older in Saskatchewan on July 1 for each of the 4 years of the study period was used to calculate per capita age 15 years or older alcohol consumption. The population data were estimated by Statistics Canada and further prepared by Saskatchewan Bureau of Statistics (http://www.stats.gov.sk.ca/stats/population/saskpopbyage.pdf).

Income Data

Average personal income per adult aged 15 years or older was included in the analyses. Total personal income and population size for each year was obtained from Statistics Canada,31 and then average personal income was estimated for each fiscal period assuming linear trends between each annual estimate (Appendix D, available as a supplement to this article at http://www.ajph.org).

Statistical Analysis

We used multivariate ARIMA time-series models32 to estimate the unique impacts of changes to CPI-adjusted (100 in April 2008) minimum prices for each beverage type on per capita age 15 years or older consumption of that beverage after adjusting for changes in mean price and per capita consumption of all other beverages, trend (time 1, 2, …, 52), and autoregressive or moving average effects. Separate estimates were also made for on-premise and off-premise sales. Per capita alcohol consumption variables were log transformed to remove skewness in their distributions.

All statistical analyses were conducted using SAS statistical software.33 The SAS PROC ARIMA procedure was used, specifying the P or Q parameter for the data type, thereby adjusting for autoregressive or moving-average effects. The general form of a multivariate ARIMA model for outcome variable Y (e.g., log-transformed per capita beer consumption) can be written as:

where  is the intercept,

is the intercept,  is the percentage change of beer ethanol consumption resulting from a percentage increase in minimum price of beer, and

is the percentage change of beer ethanol consumption resulting from a percentage increase in minimum price of beer, and  is the log-transformed CPI-adjusted minimum price of beer;

is the log-transformed CPI-adjusted minimum price of beer;  is the percentage change in the ethanol consumption from a percentage increase in mean price of beer, and

is the percentage change in the ethanol consumption from a percentage increase in mean price of beer, and  is the CPI-adjusted period mean price of beer;

is the CPI-adjusted period mean price of beer;  is the percentage change of beer ethanol consumption from a percentage increase in personal income, and

is the percentage change of beer ethanol consumption from a percentage increase in personal income, and  is the log-transformed CPI-adjusted dollars;

is the log-transformed CPI-adjusted dollars;  is the estimated effect of nonbeer ethanol consumption, and

is the estimated effect of nonbeer ethanol consumption, and  is the age 15 years or older per capita consumption of nonbeer beverages;

is the age 15 years or older per capita consumption of nonbeer beverages;  is the estimated effect for the trend

is the estimated effect for the trend  (i.e., time 1, 2 … , 52);

(i.e., time 1, 2 … , 52);  represents autoregressive or moving average effects; and

represents autoregressive or moving average effects; and  is the error term. A single dummy variable was used for analysis of the impact of minimum prices for coolers, liqueurs, and cocktails before and after these were first introduced in April 2010. A detailed specification for the main model is provided in Appendix E (available as a supplement to this article at http://www.ajph.org).

is the error term. A single dummy variable was used for analysis of the impact of minimum prices for coolers, liqueurs, and cocktails before and after these were first introduced in April 2010. A detailed specification for the main model is provided in Appendix E (available as a supplement to this article at http://www.ajph.org).

The obtained effect sizes for beer, wine, and spirits can be interpreted as the percentage change in age 15 years or older per capita ethanol consumption resulting from a 1% increase in minimum price (dollars per standard drink), mean price (dollars per standard drink), and personal income (dollars). The analyses for sales of coolers, cocktails, and liqueurs employed a categorical variable for the introduction of minimum prices, and so the models provide a direct estimate of the percentage change in per capita sales resulting from this intervention.

RESULTS

Annual per capita age 15 years or older alcohol consumption and revenues for each of the 4 study years are summarized in Appendix F (available as a supplement to this article at http://www.ajph.org). There was a 3.5% decrease in per capita alcohol consumption and a $41 million (4.3% per capita) average annual increase in the total dollar value of alcohol sales after April 1, 2010. Trends in the deseasonalized age 15 years or older per capita consumption for each beverage type are displayed in Figure 1 for the study period.

Estimated Impact of Minimum Price Increase on Alcohol Consumption

A 10% increase in minimum price of all beverages was significantly associated with an 8.43% reduction in total alcohol consumption (Table 2). There were also significant effects for the main beverage categories of beer, spirits, and wine (–10.56%, −5.87%, and −4.58%, respectively). The models for impacts on consumption of other products for which minimum prices were first introduced on April 1, 2010, estimated a significant 13.2% reduction in consumption of coolers, a 21.3% reduction in consumption of premixed cocktails, and a 5.3% reduction in consumption of liqueurs. Effects sizes were mostly larger for alcohol purchased from liquor stores as opposed to venues with predominantly on-premise sales (e.g., bars and clubs). There were no significant effects for estimates of “mean dollars per standard drink.” The difference between the impact of minimum price changes on purely off-premise versus primarily on-premise consumption was significant when tested by the addition of an interaction term to the model of overall consumption (–1.528; 95% confidence interval = −1.862, −1.194; P < .001).

TABLE 2—

Estimates of Percentage Changes in Alcoholic Beverage Sales After 1% Minimum Price Increase: Saskatchewan, Canada, April 2008–March 2012

| Variable by Alcohol Type (No. Brands Affected/Total No.) | On–Premise, % (95% CI) | Off–Premise, % (95% CI) | On–Premise and Off–Premise, % (95% CI) |

| Beer (37/415) | |||

| Minimum price | –0.889*** (–1.207, –0.571) | –1.387*** (–1.851, –0.922) | –1.056*** (–1.476, –0.635) |

| Mean $/L | 0.710* (0.162, 1.257) | 0.718 (−0.004, 1.440) | 0.639 (−0.018, 1.295) |

| Personal income | −0.153 (−0.348, 0.042) | 0.567*** (0.255, 0.879) | 0.135 (−0.126, 0.397) |

| Spirits (77/542) | |||

| Minimum price | –0.641* (–1.114, –0.168) | –0.589** (–0.943, –0.235) | –0.587** (–0.928, –0.246) |

| Mean $/L | 0.610 (−0.887, 2.108) | 0.055 (−0.336, 0.446) | 0.064 (−0.360, 0.488) |

| Personal income | −0.185 (−0.428, 0.058) | 0.267*** (0.123, 0.411) | 0.192* (0.052, 0.333) |

| Wine (79/1259) | |||

| Minimum price | −0.301 (−0.673, 0.071) | –0.511** (–0.841, –0.181) | –0.458** (–0.751, –0.165) |

| Mean $/L | 0.114 (−0.190, 0.418) | 0.038 (−0.102, 0.179) | 0.023 (−0.109, 0.155) |

| Personal income | −0.088 (−0.280, 0.104) | 0.361*** (0.193, 0.529) | 0.280*** (0.129, 0.431) |

| Coolers (14/108) | |||

| Changea | −0.057 (−0.146, 0.031) | –0.163*** (–0.245, –0.081) | –0.132** (–0.212, –0.052) |

| Mean $/L | −1.238** (−2.104, −0.371) | 0.084 (−0.359, 0.527) | −0.167 (−0.753, 0.420) |

| Personal income | −0.078 (−0.517, 0.361) | 0.075 (−0.340, 0.490) | 0.006 (−0.373, 0.384) |

| Cocktails (9/53) | |||

| Changea | −0.021 (−0.099, 0.057) | –0.287*** (–0.380, –0.194) | –0.213*** (–0.290, –0.137) |

| Mean $/L | −0.441 (−0.828, −0.054) | 0.134 (−0.302, 0.570) | 0.041 (−0.349, 0.431) |

| Personal income | 0.172 (−0.112, 0.457) | 1.130*** (0.742, 1.518) | 0.797*** (0.492, 1.103) |

| Liqueurs (0/165) | |||

| Changea | −0.024 (−0.073, 0.026) | –0.068* (–0.127 ,–0.008) | –0.053* (–0.102, –0.003) |

| Mean $/L | −0.001 (−0.618, 0.616) | 0.118 (−0.308, 0.544) | 0.084 (−0.257, 0.424) |

| Personal income | −0.477** (−0.820, −0.135) | 0.078*** (−0.290, 0.447) | −0.093 (−0.406, 0.220) |

| Total (216/2542) | |||

| Minimum price | –0.842*** (–1.151, –0.534) | –0.918*** (–1.255, –0.582) | –0.843*** (–1.164, –0.522) |

| Mean $/L | 0.907* (0.139, 1.676) | 0.121 (−0.322, 0.564 | 0.243 (−0.261, 0.747) |

| Personal income | −0.245* (−0.449, −0.041) | 0.438*** (0.246, 0.630) | 0.189 (0.003, 0.374) |

Note. CI = confidence interval. Mean dollar value of liquor sales per liter of ethanol and personal income estimated by autoregressive integrated moving average (ARIMA) models. For each elasticity estimate was adjusted simultaneously for effects of minimum price, mean dollars per standard drink, household income, other beverage consumption, trend (time 1, 2, … , 52 [continuous variable]), season (deseasonalized), and autoregressive or moving-average effects.

The percentage changes in cooler, cocktail, and liqueur consumption from before to after April 1, 2010 can be calculated by 100*coefficient of estimate in each case.

*P < .05 **P < .01 ***P < .001. P values determined by t-test.

Sensitivity analyses were employed for the main model relating average minimum prices to total per capita age 15 years or older alcohol consumption. Strong and significantly negative elasticities were estimated when (1) mean price was excluded, (2) mean household income was excluded, and (3) a dummy variable was included as a crude control for seasonal fluctuations.

Differential Effects for High Versus Low Alcohol Content

Table 3 presents a set of estimates from 12 separate time-series models of the impact of minimum price changes on consumption of different beverages. The beverages are presented in pairs: a low alcohol content variety of each main beverage type and the higher one in each case. The high alcohol content varieties mostly had the most products affected by increases in minimum price. There were fewer significant effects for alcohol purchased from the purely or mixed on-premise outlets than there were for alcohol from purely off-premise outlets. There were larger and statistically significant effects on the overall consumption of higher strength varieties of beer, wine, and cocktails across all outlet types. Spirits and coolers evidenced a larger effect for the low alcohol content varieties. Impacts on higher strength beer (> 6.5% alcohol/volume) were particularly marked with a 22.00% reduction in total consumption for a 10% increase in minimum price (P < .001).

TABLE 3—

Estimates of Percentage Changes for Age 15 Years or Older per Capita Alcohol Consumption Associated With 1% Minimum Price Increase: Saskatchewan, Canada, April 2008–March 2012

| Beverage Type | No. Affected/Total No. | On–Premise Consumption, % (95% CI) | Off–Premise Consumption, % (95% CI) | Total Alcohol Consumption, % (95% CI) |

| Beer, %/volume | 37/415 | |||

| ≤ 6.5 | 27/394 | –0.783*** (–1.058, –0.509) | –0.883*** (–1.287, –0.478) | –0.817*** (–1.156, –0.479) |

| > 6.5 | 10/21 | –2.420* (–4.606, –0.235) | –2.514** (–4.084, –0.944) | –2.200* (–4.044, –0.356) |

| Spirits, %/volume | 77/542 | |||

| < 45 | 72/511 | –0.860** (–1.410, –0.310) | –0.710** (–1.170, –0.249) | –0.686** (–1.139, –0.233) |

| ≥ 45 | 5/31 | 0.164 (−0.186, 0.515) | 0.003 (−0.337, 0.343) | −0.074 (−0.382, 0.233) |

| Wine, %/volume | 79/1259 | |||

| < 16 | 68/1196 | −0.152 (−0.671, 0.367) | −0.316 (−0.737, 0.105) | −0.260 (−0.627, 0.107) |

| ≥ 16 | 11/63 | –0.476*** (–0.731, –0.222) | –0.554*** (–0.701, –0.408) | –0.551*** (–0.698, –0.404) |

| Coolers,a %/volume | 14/108 | |||

| < 6 | 0/56 | 0.002 (−0.158, 0.162) | –0.183*** (–0.328, –0.039) | –0.189** (–0.319, –0.059) |

| ≥ 6 | 14/52 | 0.009 (−0.117, 0.134) | –0.127** (–0.208, –0.046) | 0.004 (−0.148, 0.156) |

| Cocktails,a %/volume | 9/53 | |||

| < 35 | 0/44 | 0.049 (−0.074, 0.173) | 0.001 (−0.141, 0.142) | 0.004 (−0.148, 0.156) |

| ≥ 35 | 9/9 | –0.505* (–0.983, –0.027) | –0.530** (–0.824, –0.236) | –0.421** (–0.691, –0.152) |

| Liqueurs,a %/volume | 0/165 | |||

| < 23 | 0/124 | −0.029 (−0.063, 0.006) | –0.066** (–0.105, –0.027) | –0.053** (–0.087, –0.019) |

| ≥ 23 | 0/41 | 0.069 (−0.015, 0.154) | −0.018 (−0.125, 0.088) | 0.009 (−0.078, 0.096) |

Note. CI = confidence interval. Estimates (%) from the independent time-series analyses were each adjusted for the effects of one another as well as low or high content alcohol consumption, trend (time 1, 2, …, 52), seasonality (deseasonalized), and autoregressive or moving-average effects.

The percentage changes in cooler, cocktail, and liqueur consumption from before to after April 1, 2010 can be calculated by 100*coefficient of estimate in each case.

*P < .05 **P < .01 ***P < .001. P values determined by t-test.

DISCUSSION

There were statistically significant reductions in per capita age 15 years or older alcohol consumption related to increases in Saskatchewan minimum alcohol prices and their adjustment by alcoholic strength. The impact of the minimum price varied in relation to sales from different types of licensed premises, different beverage types, and different strengths of particular beverages. Results were consistent with the principle that increasing the price of ethanol reduces its consumption. For example, effect sizes were absent or weak when very few or no products in a particular beverage category were affected by new minimum prices. Because minimum prices set by the SLGA precisely determine the minimum prices from the government monopoly liquor stores, but only indirectly influence prices in bars, restaurants, and clubs, the observed larger effects for sales from purely off-premise than mostly on-premise venues were as predicted. In 2011–2012, off-premise sales accounted for at least 63% of total consumption by the liters of ethanol in Saskatchewan (Appendix F). The most substantial change in consumption was for higher alcohol content varieties of beer (especially), wine, and cocktails, which also had the most increases in minimum price. This finding is important for public health goals because these higher strength products have been associated with high-risk patterns of alcohol consumption.12 The absence of an effect for higher strength spirits and coolers is very likely a result of substitution effects involving drinkers switching from higher strength beer to these other higher strength products, which were substantially cheaper per standard drink after April 2010 (Appendix C). Such between-beverage substitution and differences in effect sizes between on-premise and off-premise sales are consistent with theory developed by Gruenewald et al.23,24 Finally, the reduction in consumption was associated with an increase in the dollar value of alcohol sales which will have contributed to an overall increase in government revenue.

The overall effect size or “elasticity” for minimum prices estimated here in terms of total alcohol consumption (–0.84) is larger than an earlier estimate for the Canadian province of British Columbia of −0.34.26 This may result from minimum prices in Saskatchewan being increased across virtually all beverage types, whereas in British Columbia only the minimum price of spirits was increased with any regularity.21 Given that the main minimum price increase only affected 8.5% of all available alcoholic beverages in Saskatchewan, this is a significant finding. Its public health significance is underscored by evidence from other studies that cheaper alcohol is preferred by younger and heavier drinkers, both of whom are more likely to experience alcohol-related harms.21,22 Furthermore, there is strong evidence that significant reductions in rates of alcohol-related illnesses, injuries, and social problems almost always flow from reductions in per capita alcohol consumption,34,35 as well as more generally from increased prices in US,36,37 Canadian, and other contexts.35

The level of minimum prices introduced in Saskatchewan in 2010 is on average higher than in other Canadian provinces,26 and, furthermore, the practice of adjusting prices based on alcohol content comes close to creating the public health ideal of a fixed minimum price for a standard drink (i.e., a standard dose of ethanol).5,12 Despite this, most low alcohol content varieties still had slightly higher minimum prices per standard drink than their high alcohol content counterparts even after April 1, 2010. This is because they are still calculated at a fixed rate per liter of beverage (as opposed to ethanol) within wide bands of alcoholic strength (e.g., > 8.5% alcohol/volume). Further improvements to the pricing structure would involve setting minima according to more precise calculations of ethanol concentration (e.g., at 1% increments) for the full range of beverage strengths.

Limitations of our study include the lack of a control jurisdiction, a relatively short time series, and only a crude measure of mean price. We note, however, that mean price added little influence on the model estimates we have reported here. Although we were unable to access detailed data from a control jurisdiction, the neighboring province of Alberta—which has no minimum liquor store prices—had no change in annual per capita alcohol consumption from before to after the major change in Saskatchewan in April 2010.38 Finally, there were adjustments to mark-ups of some alcoholic drinks (e.g., a $0.16/L increase for beer introduced in April 2010) that accompanied the changes in minimum prices, which could have influenced results. However, we adjusted for this confounding at least in part by the inclusion of our estimate of mean overall beverage prices in the models and a relatively small effect on prices. We also note that our design incorporates internal controls by virtue of being able to compare outcomes for beverages which were not affected by minimum price increases with those that were, and also by contrasting off-premise with mostly on-premise sales data. No estimate could be made for the influence of cross-border sales, although it is not likely to be large because the majority of Saskatchewans live in urban areas at least 100 kilometers from the US or provincial borders. Our measure of average household income may not have been sufficiently precise to pick up significant associations at this aggregate level of analysis.

In conclusion, the substantial increase in minimum prices and their adjustment to reflect the alcoholic content implemented in Saskatchewan in April 2010 significantly reduced alcohol consumption while at the same time increasing government revenue. The impact was greater for beverages most affected by minimum price increases and for alcohol purchased from liquor stores and was accompanied by a shift in consumer preferences toward lower alcohol content beer, wine, and cocktails. Evidence from international experiences with the reduction of per capita alcohol consumption suggests that substantial public health, safety, and order benefits will likely flow from these policies in terms of reductions in alcohol-related harms and associated economic costs.34 Further research is under way to confirm and quantify whether these likely public health benefits apply in this specific Canadian case study. We also recommend further research into potential adverse impacts on low income problem drinkers from the application of such policies.39 Finally, we recommend careful consideration of minimum pricing as part of any comprehensive strategy to reduce alcohol-related harm.40

Acknowledgments

This research was funded by the Canadian Institutes for Health Research (grant 102627 “Does minimum pricing reduce the burden of injury and illness attributable to alcohol?”; T. Stockwell, principal investigator). T. Stockwell and S. Macdonald’s salaries were paid by the University of Victoria. N. Giesbrecht’s contribution was supported by funding from the Ontario Ministry of Health and Long Term Care to the Centre for Addiction and Mental Health for the salary of scientists and infrastructure. G. Thomas is employed as a Senior Policy Analyst at the Canadian Centre on Substance Abuse, Ottawa, and also works as a consultant on alcohol and substance use projects for various government and nongovernment agencies.

We are indebted to staff at the Saskatchewan Liquor and Gaming Authority for access to key data on alcohol sales and pricing, advice on interpretation of study results, and comments on successive drafts.

Human Participant Protection

Institutional ethics review board approval was received. All the analyses presented here are of aggregate official government data sets with no breakdown or analysis by individual characteristics.

References

- 1. The global burden of disease: 2004 update. Geneva, Switzerland: World Health Organization. Available at: http://www.who.int/healthinfo/global_burden_disease/GBD_report_2004update_full.pdf. Accessed September 30, 2011; 2008.

- 2.Rehm J, Samokhvalov AV, Neuman MGet al. The association between alcohol use, alcohol use disorders and tuberculosis (TB). A systematic review. BMC Public Health. 2009;9:450. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3.Rehm J, Mathers C, Popova S, Thavorncharoensap M, Teerawattananon Y, Patra J. Global burden of disease and injury and economic cost attributable to alcohol use and alcohol-use disorders. Lancet. 2009;373(9682):2223–2233 [DOI] [PubMed] [Google Scholar]

- 4.Anderson P, Chisholm D, Fuhr DC. Alcohol and Global Health 2 Effectiveness and cost-effectiveness of policies and programmes to reduce the harm caused by alcohol. Lancet. 2009;373(9682):2234–2246 [DOI] [PubMed] [Google Scholar]

- 5.Scottish Government. Changing Scotland ’s Relationship with Alcohol: A Framework for Action. Edinburgh, UK: Scottish Government, Edinburgh. Available at: http://www.scotland.gov.uk/Resource/Doc/262905/0078610.pdf. Accessed March 21, 2011.

- 6.Wagenaar AC, Salois MJ, Komro KA. Effects of beverage alcohol price and tax levels on drinking: a meta-analysis of 1003 estimates from 112 studies. Addiction. 2009;104(2):179–190 [DOI] [PubMed] [Google Scholar]

- 7.Gallet CA. The demand for alcohol: a meta-analysis of elasticities. Aust J Agric Resour Econ. 2007;51(2):121–135 [Google Scholar]

- 8.Stockwell T, Zhao JH, Macdonald Set al. Impact on alcohol-related mortality of a rapid rise in the density of private liquor outlets in British Columbia: a local area multi-level analysis. Addiction. 2011;106(4):768–776 [DOI] [PubMed] [Google Scholar]

- 9.Stockwell T, Chikritzhs T. Do Relaxed Trading Hours for Bars and Clubs Mean More Relaxed Drinking? A Review of International Research on the Impacts of Changes to Permitted Hours of Drinking. Crime Prev Community Saf. 2009;11(3):153–170 [Google Scholar]

- 10.Giesbrecht N, Greenfield TK. Public opinions on alcohol policy issues: a comparison of American and Canadian surveys. Addiction. 1999;94(4):521–531 [DOI] [PubMed] [Google Scholar]

- 11.Macdonald S, Stockwell T, Luo J. The relationship between alcohol problems, perceived risks and attitudes toward alcohol policy in Canada. Drug Alcohol Rv. 2011;30(6):652–658 [DOI] [PubMed] [Google Scholar]

- 12.Stockwell T, Leng J, Sturge J. Alcohol pricing and public health in Canada: issues and opportunities. Victoria, BC: Centre for Addictions Research of BC. Available at: http://www.carbc.ca/Portals/0/PropertyAgent/2111/Files/6/AlcPricingFeb06.pdf. Accessed July 30, 2011.

- 13.Thomas G, Stockwell T, Reist D. Alcohol Pricing, Public Health and the HST: Proposed Incentives for BC Drinkers to Make Healthy Choices. Victoria, BC: CARBC at the University of Victoria; Available at: http://www.vicpd.ca/uploads/bod/monitoring/2010/Jan%202010%20Alcohol%20Pricing%20HST.pdf. Accessed December 16, 2011 [Google Scholar]

- 14. National Alcohol Strategy Working Group. Reducing alcohol-related harm in Canada: toward a culture moderation - synopsis of a proposed national alcohol strategy. Ottawa, ON: Canadian Centre on Substance Abuse. Available at: http://www.nationalframework-cadrenational.ca/uploads/files/FINAL_NAS_EN_April3_07.pdf. Accessed January 10, 2012.

- 15.Kendall P. Public health approach to alcohol policy: an updated report from the Provincial Health Officer. Victoria: Ministry of Healthy Living and Sport. Available at: http://www.health.gov.bc.ca/library/publications/year/2008/alcoholpolicyreview.pdf. Accessed March 13, 2011.

- 16. The Scottish Parliament. Alcohol (Minimum Pricing) Scotland Act 2012. Available at: http://www.legislation.gov.uk/asp/2012/4/contents/enacted. Accessed October 10, 2012. [Google Scholar]

- 17.Kerr W, Patterson D, Greenfield T: Spirits tax rates for the Control States: 2008 estimates based on retail price impact relative to open state pricing. Report prepared for the National Alcoholic Beverage Control Association (NABCA), VA, USA. Emeryville, CA: Alcohol Research Group, Public Health Institute; 2012

- 18.Stockwell T, Vallance K, Martin Get al. The price of getting high, stoned and drunk in BC: a comparison of minimum prices for alcohol and other psychoactive substances. : CARBC Statistical Bulletin #7. Victoria, British Columbia: University of Victoria; Available at: http://www.carbc.ca/Portals/0/PropertyAgent/2111/Files/385/CARBC_Bulletin7.pdf. Accessed May 9, 2011 [Google Scholar]

- 19.Thomas G. Price Policies to Reduce Alcohol-Related Harms in Canada: Current Context and Recommendations for Targeted Policies. Ottawa, Ontario: Canadian Centre on Substance Abuse; 2012 [Google Scholar]

- 20.Wagenaar AC, Tobler AL, Komro KA. Effects of alcohol tax and price policies on morbidity and mortality: a systematic review. Am J Public Health. 2010;100(11):2270–2278 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 21.Kerr WC, Greenfield TK. Distribution of alcohol consumption and expenditures and the impact of improved measurement on coverage of alcohol sales in the 2000 National Alcohol Survey. Alcohol Clin Exp Res. 2007;31(10):1714–1722 [DOI] [PubMed] [Google Scholar]

- 22.Meier PS, Purshouse R, Brennan A. Policy options for alcohol price regulation: the importance of modelling population heterogeneity. Addiction. 2010;105(3):383–393 [DOI] [PubMed] [Google Scholar]

- 23.Gruenewald PJ, Ponicki WR, Holder HD, Romelsjo A. Alcohol prices, beverage quality, and the demand for alcohol: quality substitutions and price elasticities. Alcohol Clin Exp Res. 2006;30(1):96–105 [DOI] [PubMed] [Google Scholar]

- 24.Treno AJ, Nephew TM, Ponicki WR, Gruenewald PJ. Alcohol beverage price spectra: opportunities for substitution. Alcohol Clin Exp Res. 1993;17(3):675–680 [DOI] [PubMed] [Google Scholar]

- 25.Purshouse RC, Meier PS, Brennan A, Taylor KB, Rafia R. Estimated effect of alcohol pricing policies on health and health economic outcomes in England: an epidemiological model. Lancet. 2010;375(9723):1355–1364 [DOI] [PubMed] [Google Scholar]

- 26.Stockwell T, Auld C, Zhao J, Martin G. Does minimum pricing reduce alcohol consumption? The experience of a Canadian province. Addiction. 2012;107(5):912–920 [DOI] [PubMed] [Google Scholar]

- 27.Geller ES, Kalsher MJ, Clarke SW. Beer versus mixed-drink consumption at fraternity parties: a time and place for low-alcohol alternatives. J Stud Alcohol. 1991;52(3):197–204 [DOI] [PubMed] [Google Scholar]

- 28.Segal DS, Stockwell T. Low alcohol alternatives: a promising strategy for reducing alcohol related harm. Int J Drug Policy. 2009;20(2):183–187 [DOI] [PubMed] [Google Scholar]

- 29.Anderson D, Sweeney D, Williams T. Statistics for Business and Economics. Minneapolis, MN: West Publishing Company; 1996 [Google Scholar]

- 30. Statistics Canada. Your guide to the consumer price index. Available at: http://www.eco.gov.yk.ca/pdf/cpi_guide.pdf. Accessed December 16, 2011.

- 31. Statistics Canada. Provincial and territorial economic accounts: data tables. Available at: http://www.statcan.gc.ca/pub/13-018-x/2011001/t/tab1847-eng.htm. Accessed January 11, 2012.

- 32.McDowall D, McCleary R, Meidinger EE, Hay JRA. Interrupted Time Series Analysis. London, UK: Sage Publications; 1976 [Google Scholar]

- 33.SAS Institute SAS/STAT 9.2 User’s Guide. Cary, NC: SAS Instatitute Inc.; 2008 [Google Scholar]

- 34.Babor T, Caetano R, Casswell Set al. Alcohol: No Ordinary Commodity - Research and Public Policy. Oxford, UK: Oxford University Press; 2003 [Google Scholar]

- 35.Babor T, Caetano R, Casswell Set al. Alcohol: No Ordinary Commodity – Research and Public Policy. Oxford, UK: Oxford University Press; 2010 [Google Scholar]

- 36.Chaloupka FJ. The effects of price on alcohol use, abuse, and their consequences. : Reducing Underage Drinking: A Collective Responsibility. Washington, DC: The National Academies Press; 2004 [PubMed] [Google Scholar]

- 37.Cook PJ. Paying the Tab: The Economics of Alcohol Policy. Princeton, NJ: Princeton University Press; 2007 [Google Scholar]

- 38. Statistics Canada. Table 183–00193—Volume of sales of alcoholic beverages in litres of absolute alcohol and per capita 15 years and over, fiscal years ended March 31, annual (data in thousands). Available at: http://cansim2.statcan.gc.ca/cgi-win/cnsmcgi.exe?Lang=E&Accessible=1&ArrayId=T1336&ResultTemplate=CII\SNA___&RootDir=CII/&Interactive=1&OutFmt=HTML2D&Array_Retr=1&Dim=-#HERE. Accessed May 30, 2011.

- 39.Stockwell T, Williams NS, Pauly B. Working and waiting: coping responses of homeless problem drinkers when they cannot afford alcohol. Drug Alcohol Rev. 2012; in press [DOI] [PubMed] [Google Scholar]

- 40.Giesbrecht N, Stockwell T, Kendall P, Strang R, Thomas G. Alcohol in Canada: reducing the toll through focused interventions and public health policies. CMAJ. 2011;183(4):450–455 [DOI] [PMC free article] [PubMed] [Google Scholar]