Abstract

Neuroeconomics integrates behavioral economics and cognitive neuroscience to understand the neurobiological basis for normative and maladaptive decision making. Delay discounting is a behavioral economic index of impulsivity that reflects capacity to delay gratification and has been consistently associated with nicotine dependence. This preliminary study used functional magnetic resonance imaging to examine delay discounting for money and cigarette rewards in 13 nicotine dependent adults. Significant differences between preferences for smaller immediate rewards and larger delayed rewards were evident in a number of regions of interest (ROIs), including the medial prefrontal cortex, anterior insular cortex, middle temporal gyrus, middle frontal gyrus, and cingulate gyrus. Significant differences between money and cigarette rewards were generally lateralized, with cigarette choices associated with left hemisphere activation and money choices associated with right hemisphere activation. Specific ROI differences included the posterior parietal cortex, medial and middle frontal gyrus, ventral striatum, temporoparietal cortex, and angular gyrus. Impulsivity as measured by behavioral choices was significantly associated with both individual ROIs and a combined ROI model. These findings provide initial evidence in support of applying a neuroeconomic approach to understanding nicotine dependence.

Keywords: Nicotine dependence, smoking, tobacco, behavioral economics, neuroeconomics, delay discounting, impulsivity

1. INTRODUCTION

1.1. Understanding nicotine dependence using behavioral economics and neuroeconomics

Cigarette smoking remains the single largest cause of preventable morbidity and mortality in the US and the world (Mokdad et al. 2004; World Health Organization, 2008). It is an established cause of cardiovascular disease, respiratory disease, and an array of cancers (Centers for Disease Control and Prevention 2003; 2008) and is estimated to be annually responsible for 450,000 deaths in the United States and 5,000,000 deaths worldwide (World Health Organization, 2008). Beyond disease burden, smoking also exerts a massive economic burden throughout the world (Wipfli and Samet 2009a, 2009b). Smoking is believed to be largely motivated by clinical or subclinical levels of nicotine dependence and understanding the factors that cause and maintain nicotine dependence may improve prevention and treatment (Ray et al. 2009).

Behavioral economics, a hybrid field integrating insights from psychology and economics, has been extensively applied to understand nicotine dependence and other addictive behaviors (for reviews, see Bickel and Vuchinich 2003; Vuchinich and Heather 2003). In particular, high levels of delay discounting (DD), a behavioral economic index of impulsivity, have been consistently associated with smoking (MacKillop et al., 2011; Reynolds 2006a). Specifically, delay discounting characterizes how much a person devalues a reward based on its delay in time, reflecting capacity to delay gratification. This form of impulsivity is particularly relevant to nicotine dependence and other substance use disorders because these conditions prototypically reflect persistent preferences for the transient short-term reward of the drug at the cost of much larger long-term outcomes in an array of domains. Moreover, impulsive discounting has been linked with nicotine dependence in numerous studies. Compared to non-smokers and ex-smokers, nicotine dependent individuals exhibit significantly more impulsive delay discounting (Baker et al. 2003; Bickel et al. 1999; Mitchell 1999; Reynolds 2006b; Reynolds et al. 2004) and, among smokers, greater impulsivity is associated with greater cigarette consumption and nicotine dependence (Epstein et al. 2003; Reynolds 2006b; Sweitzer et al. 2008). In addition, more impulsive delay discounting has been found to predict the onset of smoking over the course of adolescence (Audrain-McGovern et al. 2009) and is a negative prognostic factor in smoking cessation (Krishnan-Sarin et al. 2007; MacKillop and Kahler 2009; Sheffer et al. in press; Yoon et al. 2007). In most studies delay discounting is assessed using measures employing the domain-general commodity of money (i.e., a reward that can be used in a variety of different domains), but discounting can also be assessed for domain-specific commodities (i.e., a commodity that is a specific type of reward), including cigarettes. Several studies have found nicotine dependent individuals to exhibit even greater discounting for cigarette rewards (Baker et al. 2003; Bickel et al. 1999) and other drugs (Coffey et al. 2003; Madden et al. 1997; Petry 2001). This suggests that nicotine dependent individuals and individuals with other addictive disorders are both more impulsive in general and particularly so when it comes to their drug of choice.

A major step forward in behavioral economics has come from integrations of its methods with those from cognitive neuroscience, commonly termed neuroeconomics. This is particularly the case for delay discounting, which has been perhaps the most extensively studied decision-making process to date. Using functional magnetic resonance imaging (fMRI), a number of studies have revealed a profile of cortical and subcortical brain regions that appear to be responsible for discounting preferences (Ballard and Knutson 2009; Bickel et al. 2009; Kable and Glimcher 2007; McClure et al. 2004). A recent meta-analysis of fMRI discounting studies identified common regions of significant activation across diverse methodologies and samples (Carter et al. 2010), including differential activation in the medial and inferior prefrontal cortex (PFC), the anterior insular cortex (AIC), the posterior parietal cortex (PPC), posterior cingulate (PC), and subcortical limbic activation in the ventral striatum (VS). From a functional standpoint, these regions are theorized to reflect two conflicting systems, one comprising motivational brain regions that are responsible for drive, reward, and incentive value (e.g., AIC, VS) and the other comprising regions responsible for behavioral inhibition and future orientation (e.g., PFC, PPC) (Bechara 2005; Bickel et al. 2007; McClure et al. 2004). Metaphorically, the motivational regions represent the “gas pedal” and the inhibitory regions represent the “brakes,” with observed preferences being determined by the balance of the two, there is also evidence supporting a more general single system approach (Kable and Glimcher 2007; Monterosso and Luo 2010).

In spite of its promise, there have been limited applications of neuroeconomics to nicotine dependence and other substance use disorders. To date, three cross-sectional studies have examined discounting using fMRI, one studying alcohol dependent individuals and two studying stimulant dependent individuals. In the first case, Boetigger et al. (2007) found differential PFC, PPC, and hippocampal activation in comparing alcohol dependent individuals to controls. With regard to stimulant dependence, two studies examined discounting in individuals with stimulant dependence and controls (Hoffman et al. 2008; Monterosso et al. 2007). These studies used “easy” and “hard” discounting choices which were determined using pre-scan assessment. Monterosso et al. (2007) found that stimulant dependent individuals exhibited less differential PFC and PPC activation relative to controls in a contrast of “easy” and “hard” choices. This was theorized to reflect more inefficient cognitive processing. Hoffman et al. (2008) identified similar patterns, with reduced activity in stimulant dependent individuals in the dorsolateral PFC, precuneus, and VS compared to controls. No studies, to our knowledge, have applied a neuroeconomic approach to understanding nicotine dependence or examined differences in impulsivity for both domain-general rewards and addictive commodities.

1.2. Current investigation

The current study was a preliminary investigation of the differential brain activity associated with delay discounting of monetary rewards and cigarette rewards in nicotine dependent adults. Clarifying the differences in brain activity responsible for general rewards versus cigarette rewards may further inform the maladaptive decision-making that maintains nicotine dependence. Based on previous studies of delay discounting in healthy adults, we predicted that discounting would be characterized by activity in the medial and inferior PFC, AIC, PPC, PC, and VS. In addition, we predicted that, a commodity effect would be present for behavioral choices (i.e., greater impulsivity for cigarette rewards) and, for brain activity, although activity would be similarly localized to money choices, there would be significant differences in activity magnitude compared to money, reflecting the more impulsive orientation toward cigarette rewards.

2. METHOD AND MATERIALS

2.1. Participants

Fifteen participants were recruited from the community using advertisements. Inclusion criteria were: 1) 18 years-old or older; 2) daily self-reported smoking of 20+ cigarettes; 3) expired carbon monoxide (CO) of 10+ ppm; 4) Fagerström Test of Nicotine Dependence score of 6+ (Heatherton et al. 1991); 5) no interest in quitting smoking within the next year; 6) right handed. Exclusion criteria were: 1) any contraindicating conditions for MRI screening; 2) pregnancy (females only; confirmed by First Response® pregnancy test); 3) living with anyone else enrolled in the study. Two participants who completed the protocol were subsequently excluded based on missing and incorrect responses to control items in the scanner, suggesting low effort. No data from those participants were included. Participant characteristics are presented in Table 1.

Table 1.

Participant characteristics (N = 13). FTND = Fagerström Test of Nicotine Dependence.

| Characteristic | #/Mean(SD)/(Median) |

|---|---|

| Sex | 7 males/6 females |

| Age | 40.15 (13.10) |

| Race | 9 White, 1 Black, 1 Native American/Pacific Islander, 2 Asian |

| Hispanic Ethnicity | 12 Non-Hispanic/1 Hispanic |

| Income | $20,000–$29,999/Annum (Median) |

| Cigarettes/Day | 22.31 (8.55) |

| FTND | 6.54 (1.20) |

| fMRI Responses | |

| Control Choices | 34 (3.28) |

| Impulsive Choices | 52 (10.46) |

| Restrained Choices | 20 (10.71) |

2.2. Assessment

2.2.1. Self-Report and Biological Indices

Eligibility for the MRI scan was assessed using an MRI safety and contraindication screening questionnaire. Demographics were assessed via a self-report questionnaire. Nicotine dependence and cigarettes/day were assessed using the psychometrically validated FTND (Heatherton et al. 1991). Expired CO was assessed using a PiCO+ Smokerlyzer (Bedfont Scientific, Ltd; Rochester, UK).

2.2.2. Delay Discounting Paradigm

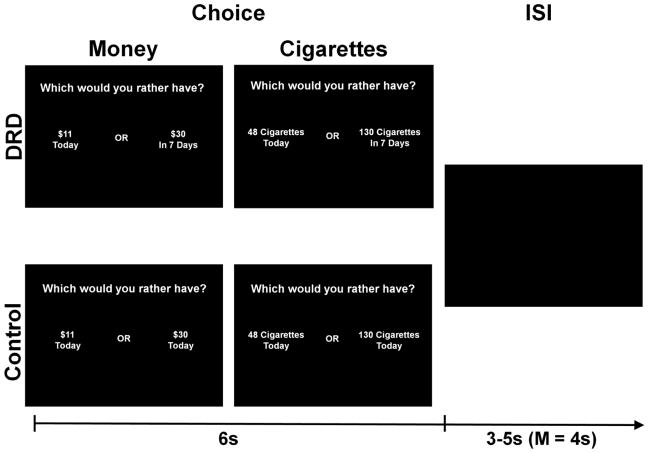

The delay discounting paradigm was based on the Monetary Choice Questionnaire (MCQ; Kirby et al. 1999), which has been previously used to study discounting in nicotine dependent adults (e.g., MacKillop and Kahler 2009). The items presented two amounts of money or cigarettes, each with an accompanying interval of time (Figure 1). The active stimuli were dichotomous choices between smaller immediate rewards (money or cigarettes) and larger delayed rewards (money or cigarettes), and are provided in Supplementary Materials. Control items were dichotomous choices between larger and smaller rewards (money or cigarettes) that were both available today. Cigarette amounts were generated by converting the monetary amounts in the MCQ by a conversion factor of $4.63/pack, the approximate national average cost of a pack of cigarettes (Boonn 2007). Participants were informed that the cigarettes in the task referred to their preferred brand. Participants’ responses were coded as “impulsive” (i.e., selecting the smaller immediate reward over the larger delayed reward), “restrained” (i.e., selecting the larger delayed reward over the smaller immediate reward), or “control” (i.e., selecting the larger immediate reward over the smaller immediate reward). Level of impulsivity exhibited during the scans as a function of choices made was quantified as the hyperbolic discounting function, k (Mazur 1987). Responses were entered with the index and middle finger of the right hand on an MRI-compatible response box placed on the participant’s hip.

Figure 1.

Delayed reward discounting paradigm. Active stimuli reflect choices between smaller immediately available money or cigarette rewards compared to larger delayed amounts of money and cigarettes, whereas control items had no delay. Notes: the cigarette amounts are the corresponding numbers based on the conversion factor used in the study itself; ISI = inter-stimulus interval; s = second.

2.2.3. Functional Neuroimaging Protocol

Imaging data were collected at the Brown University Magnetic Resonance Imaging Facility on a Siemens 3T TIM Trio scanner. Structural imaging used a high-resolution T1 scan (voxel size 1 mm3, field of view = 1922 mm, matrix = 2562, slice thickness = 1 mm). Functional imaging used echo planar imaging (EPI) of T2* scans using a single-shot gradient echo pulse sequence (TR = 2500 ms, TE = 28 ms, field of view = 1922 mm, matrix = 642, voxel size = 3 mm3, with 42 contiguous 3mm slices collected axially). Two dummy TRs, for which no data were collected, preceded the functional scans to permit the scanner to reach steady-state equilibrium.

Participants completed four delay discounting decision-making runs in an event-related design. Each imaging run comprised 27 total items, with 18 active items and 9 control item (run duration = 5:20 minutes). Each item was presented for 6000 ms for observation and response input, followed by jittered inter-stimulus interval (average duration = 4000 ms). Monetary rewards were presented during the first and third runs and cigarette rewards were presented during the second and fourth runs.

To ensure maximum relevance and salience, participants received one actual outcome from their choices. Specifically, following the scan, participants selected one poker chip from a fishbowl containing a chip for every item and received their choice for the item to which the poker chip pertained. This applied to all items, including both active and control and monetary rewards and cigarette rewards. If a participant selected the immediate reward for their outcome choice, they received that reward as they left the session; if participants received a delayed reward, they received the reward by mail or in-person, at their preference, after the prescribed number of days.

2.3. Procedure

Participants were recruited from the community using advertisements. Those appearing eligible after a telephone screen were invited for an in-person screen. There, eligible participants were given an overview of the study and those interested were enrolled and underwent informed consent. Enrolled participants were also given a more thorough orientation to the study’s procedures, including the types of choices they would be making (without disclosing stimuli) and the fact they would receive one of those choices.

At the imaging session, participants were first asked to smoke a cigarette to ensure no significant withdrawal effects and equate exposure to tobacco. Participant the completed a one-hour orientation to the procedures, including a practice scan in a demonstration MRI device. The MRI scan was then completed and the randomly-selected choice was determined, after which participants concluded the session with a debriefing interview.

In terms of compensation, participants received $15 for the in-person screen, regardless of outcome, and $30 for the MRI session, plus one of their in-scanner choices, with a maximum value of $85. For the in-scanner choices, all participants received choices resulting in immediate rewards, except one, who received a reward delayed by 14 days; 62% of the participants received monetary rewards and 38% received cigarette rewards. All procedures were approved by the Brown University Institutional Review Board.

2.4. Data Analysis

Prior to examining the fMRI data, participants’ behavioral data obtained during the scan were examined for validity, consistency of responding, consistency across runs, level of impulsive discounting exhibited and reaction time. With regard to discounting, impulsivity was operationalized as the hyperbolic discounting function, k (Mazur 1987), and derived using standard MCQ methods (Kirby et al. 1999).

Functional imaging data processing and analysis were conducted using Analysis of Functional NeuroImages software (AFNI; Cox 1996) with follow-up analyses using SPSS 16.0. Of note, technical problems resulted in data loss during one imaging run for two participants, resulting in 75% of data. Functional datasets were initially aligned to the T1 anatomical dataset, volume-registered (motion-corrected), and normalized into Talairach space using AFNI script align_epi_anat.py (Saad et al. 2009). Individual volumes from each of the four runs were registered to a base volume proximal to acquisition of the anatomical dataset (i.e., the third volume of the first delay discounting run). The data were then spatially smoothed using a 3mm FWHM Gaussian filter, excluding non-brain voxels. Raw BOLD signal was scaled to percent signal change from the mean signal intensity and all four runs were concatenated together. First level analyses of individual brain responses were characterized using separate general linear models for choice type and commodity type. For discounting decision-making in general, 3dDeconvolve (Ward, 2006) applied three task-related regressors (impulsive, restrained, and control) and six nuisance regressors to account for motion (X, Y, Z, roll, pitch, yaw); the regression model also incorporated linear and quadratic trends in the data. Of note, we did not also use a domain-general comparison of all discounting items with control items as the choice events were known to be of two opposite types (e.g., impulsive and restrained) and the primary questions of interest pertained to differences based on those types. For commodity differences, the same approach was used but with two task-related regressors (monetary choices, cigarette choices). Mixed comparisons of choice type and commodity type were not conducted because of low numbers of individual choices. In both cases, individual t-statistics per voxel were used in group-level region of interest (ROI) analyses.

Both a priori and ‘data-driven’ functional ROI strategies were used. This was because some aspects of the study overlapped with previous studies using discounting paradigms, but the novel focus on discounting of cigarette rewards made the possibility of unique regions of activation highly plausible. Thus, the study could both leverage established regions of activation but be able to detect novel regions. First, a priori ROIs were identified based on the recent meta-analysis of fMRI discounting studies. Specifically, we generated 5mm-radius ROIs centered on the Carter et al. (2010) coordinates for the medial prefrontal, anterior insular, posterior parietal, and inferior prefrontal cortices (all bilaterally); the left posterior cingulate and temporoparietal cortices; and the right ventral striatum. Comparisons for a priori ROI analyses were between mean t-statistics from each sphere and used only used the active stimuli because the a priori ROIs were based on previous studies comparing active stimuli. Second, functional ROIs are defined as ROIs that are identified based on their empirical levels of activation. In this case, we examined our hypotheses in regions recruited by the fMRI paradigm in our sample, using both the active and control items. Specifically, we generated a disjunction (Boolean “OR” logic) mask for choices (impulsive, restrained, or control) and a second for commodity (cigarette or money discounting choices), both in comparison to activity during rest (ISI). This strategy has been validated in previous fMRI studies on discounting studies (e.g., Ballard and Knutson 2009) and nicotine dependence (e.g., Lawrence et al. 2002; Sweet et al. 2010). Each mask includes all clusters of significant differences in activity from all conditions, which avoids bias from any one condition. Functional ROIs were defined using a family-wise error rate of p <.005 with a minimum cluster size of five adjacent voxels (voxel-wise error rate = 0.000016) (Ward, 2000). This cluster threshold further minimizes Type I error because false positive voxel activity is predicted to take place at random and not expected to aggregate in multiple adjacent voxels, whereas the opposite is true for true positive signals (Lazar 2008). Commodity effect analyses only included active items, not control items. Hypothesis testing was conducted using paired t-tests and ANOVA with mean task-associated brain response per ROI per individual as the dependent variable. Finally, associations between brain activity and behavioral performance were examined to clarify the most relevant regions. Specifically, zero-order correlations (Pearson’s r) were examined between the a priori and functionally defined regions of interest within choice type to determine overall associations. To determine specificity of association, stepwise regression was used to enter all relevant candidates into regression and retain only the most relevant regions. These analyses used a conventional p ≤ .05.

3. RESULTS

3.1. Delay Discounting Decision-making Performance

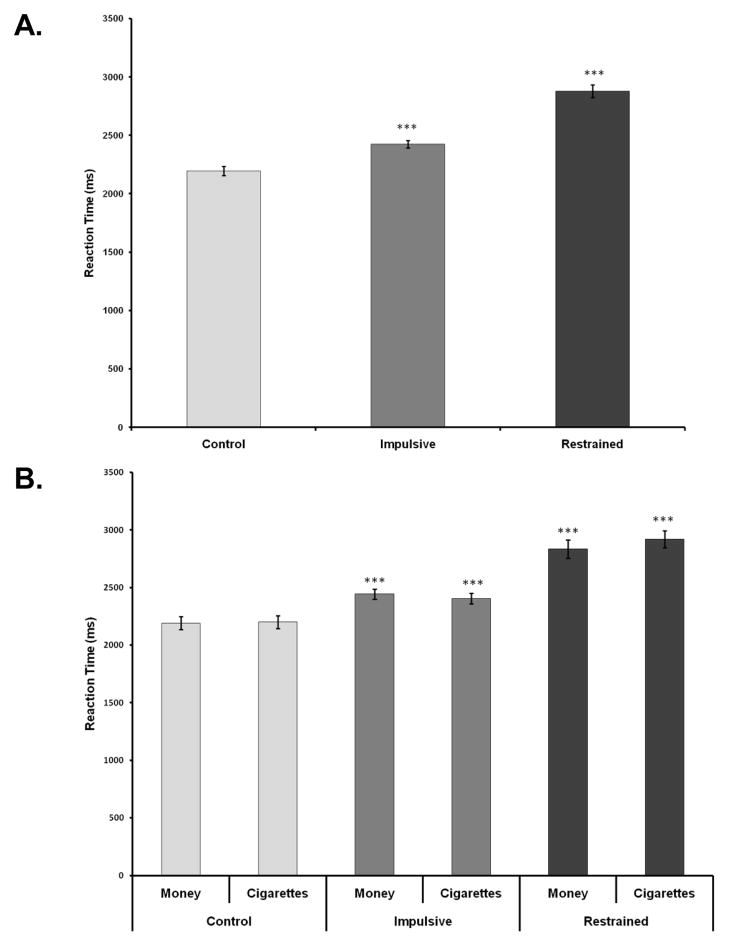

Analysis of behavioral performance suggested sufficient effort and overall valid task performance. The percentage of responses considered valid responses was high (M = 99%, range = 96–100%); valid responses were defined as a control trial in which the larger immediate reward was selected over the smaller immediate reward. In addition, responses were provided in time for 99% of items and participants’ responses were generally highly consistent, with 98% (SD = 4.57; range 90–100%) of overall choices being non-contradictory responses. Comparisons between equivalent items across runs 1/3 and 2/4 revealed no differences (ps ≥ .50), supporting the aggregation of equivalent items within the same commodity. There was no evidence of a commodity effect in comparing money and cigarette discounting (k Money = .075, k Cigarettes = .075; F [1, 12] = 1.30, p = .28); the associated discounting curves are provided in the supplementary materials. Participants provided an average of 74% impulsive choices and 26% restrained choices. Using a factorial 3 (choice type: impulsive, restrained, control) × 2 (commodity: money, cigarettes) ANOVA, there was a significant main effect of choice type (F [2, 1333] = 51.18, p <.0001, ηp2 = .08), but not of commodity type (F [1, 1333] = .15, p =.70) or an interaction effect (F [2, 1333] = .48, p = .62) (Figure 2). Participants were fastest in responding to control stimuli, intermediate for impulsive choices, and slowest for the restrained choices.

Figure 2.

Response time by decision-making choice type. Significance levels reflect left comparisons; *** p <.001.

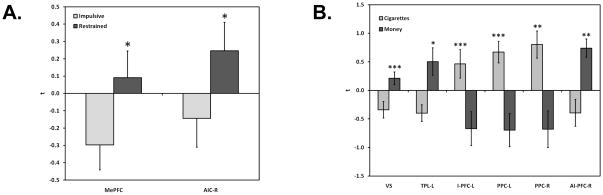

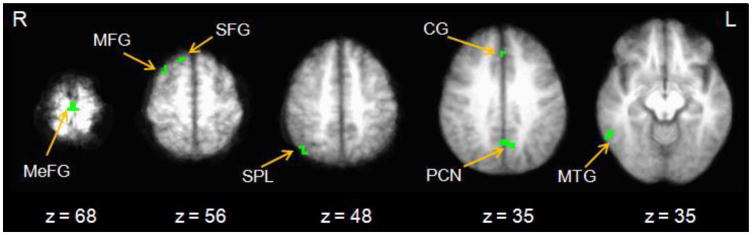

3.2. Neurocognitive Associates of Delay Discounting

Comparisons of impulsive and restrained decision making in the a priori ROIs revealed significant differences in two regions, medial PFC and AIC (Table 2). In both cases, impulsive choices were associated with lower activity in these brain regions, whereas restrained choices were associated with higher activity (Figure 3A), suggesting that recruitment of these areas plays an important role in the inhibition of a preference for an immediate reward. Seven functionally-defined ROIs were identified (Figure 4), reflecting regions associated with significantly different activity compared to rest at least in one of the three choice types (Table 3). Of these seven, significant differences between choice types were evident for five ROIs and reflected several different patterns. These patterns included regions that were specific to intertemporal choice decision making in general (e.g., medial frontal gyrus), regions that were only specific to impulsive choices (e.g., middle temporal gyrus), and regions that were only specific to restrained choices (e.g., cingulate gyrus, middle frontal gyrus, superior frontal gyrus). More simply, the different behavioral choice outcomes were associated with different profiles of brain activity.

Table 2.

Comparisons of choice type and commodity type in the a priori regions of interest. Significant effects are in boldface.

| Region of Interest | Talairach Coordinates | Impulsive vs. Restrained Choices | Money vs. Cigarettes | ||||

|---|---|---|---|---|---|---|---|

|

| |||||||

| X | Y | Z | t (12) | p | t (12) | p | |

| Medial Prefrontal Cortex (L) | −2 | 40 | 18 | −2.37 | 0.04 | −0.05 | 0.96 |

| Ventral Striatum (R) | 14 | 10 | 0 | −1.53 | 0.15 | 3.43 | <.01 |

| Posterior Cingulate Cortex (L) | −8 | −36 | 36 | .15 | 0.88 | 0.77 | 0.45 |

| Anterior Insular Cortex (R) | 36 | 18 | −2 | −2.25 | 0.04 | −0.07 | 0.95 |

| Anterior Insular Cortex (L) | −30 | 18 | −6 | −1.69 | 0.12 | 0.58 | 0.57 |

| Temporoparietal Cortex (L) | −48 | −66 | 14 | −.69 | 0.50 | 2.66 | 0.02 |

| Posterior Parietal Cortex (L) | −28 | −60 | 44 | .20 | 0.84 | −3.53 | <.01 |

| Posterior Parietal Cortex (R) | 26 | −60 | 46 | .78 | 0.45 | −3.04 | .01 |

| Inferior Prefrontal Cortex (R) | 48 | 34 | 10 | −.12 | 0.90 | 3.27 | <.01 |

| Inferior Prefrontal Cortex (L) | −42 | 4 | 30 | −1.27 | 0.23 | −3.89 | <.01 |

Figure 3.

Significant choice type and commodity type differences in the a priori ROIs. Panel A presents significant differences based on choice type, Panel B presents significant differences based on commodity type; * p <.05, ** p <.01, *** p <.001. Abbreviations: MePFC = medial prefrontal cortex; AIC-R = anterior insular cortex (right); VS = ventral striatum; TPL-L = temporoparietal lobe (left); I-PFC-L = inferior prefrontal cortex (left); PPC-L/R = posterior parietal cortex (left)/(right); AI-PFC-R = anterior inferior prefrontal cortex (right).

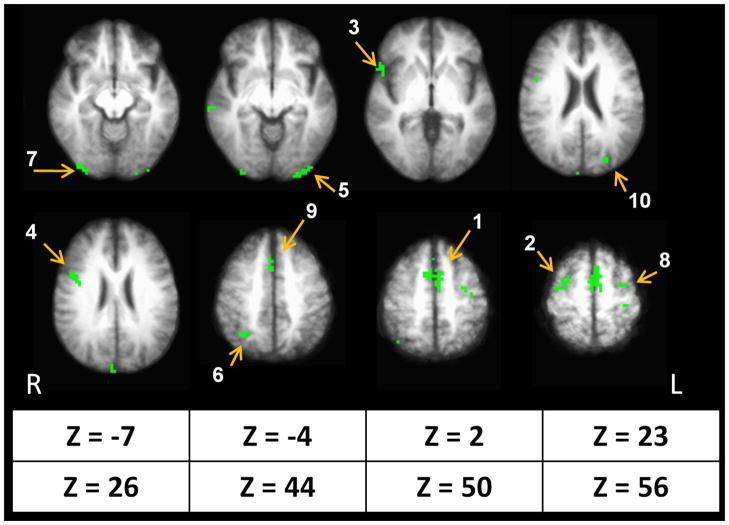

Figure 4.

Choice type disjunction mask indicating regions of significant differences in activity compared to rest (p <.005, minimum cluster size = 5 voxels). Radiological conventions are used and side of the brain is indicated by R or L (right, left). Note: MeFG = medial frontal gyrus; MFG = middle frontal gyrus; SFG = superior frontal gyrus; SPL = superior parietal lobule; CG = cingulate gyrus; PCN = precuneus; MTG = medial temporal gyrus.

Table 3.

Significant differences by choice type in functionally defined regions of interest identified using a disjunction mask. Extraction Type I error rates were familywise p <.005 + cluster size ≥5 adjacent voxels (voxelwise p <.000016). Imp = impulsive choices, Restr = restrained choices; CTL = control choices; SEM = standard error of the mean; L = left, R = right. Coordinates are in Talairach space.

| L/R | Region | Extent (mm3) | X | Y | Z | F (1,12) | Imp t (SEM) |

Restr t (SEM) |

CTL t (SEM) |

p |

|---|---|---|---|---|---|---|---|---|---|---|

| L | Medial Frontal Gyrus (MeFG) | 405 | −2 | −24 | 68 | 8.32 | 0.76 (.15)a | 0.85 (.15)a | 0.32 (.15) | <.01 |

| L | Precuneus (PCN) | 270 | −5 | −58 | 36 | 2.53 | 0.84 (.15) | 0.68 (.22) | 0.39 (.19) | 0.10 |

| R | Middle Temporal Gyrus (MTG) | 243 | 56 | −48 | −8 | 3.77 | 0.79 (.11)a | 0.40 (.22)b | 0.30 (.14) | 0.04 |

| R | Superior Parietal Lobule (SPL) | 189 | 37 | −65 | 48 | 1.20 | 0.81 (.18) | 0.59 (.15) | 0.45 (.18) | 0.32 |

| R | Cingulate Gyrus (CG) | 162 | 1 | 30 | 34 | 5.73 | 0.38 (.26) | 0.79 (.10)a,b | −0.02 (.22) | 0.01 |

| R | Superior Frontal Gyrus (SFG) | 135 | 13 | 24 | 56 | 3.73 | 0.59 (.22) | 0.89 (.14)a | 0.42 (.19) | 0.04 |

| R | Middle Frontal Gyrus (MFG) | 135 | 29 | 12 | 57 | 5.67 | 0.64 (.21) | 1.03 (.17)a,b | 0.35 (.20) | 0.01 |

Superscripts:

significantly different from CTL, p <.05;

statistical trend compared to Imp, p <.10.

3.3. Neurocognitive Associates of Choices for Cigarettes vs. Money

With regard to commodity effects, the a priori ROIs revealed significant differences in six regions (Table 2), including VS, bilateral PPC and inferior PFC, and temporal parietal cortex. Differences in activation are presented in Figure 3B and revealed three regions of significantly greater activity for money choices (VS, left temporoparietal lobe, right anterior inferior PFC) and cigarette choices (left inferior PFC, left and right PPC), respectively. Nineteen functionally defined ROIs were identified (Table 4) and, of these, cigarette choices were associated with greater activity for eleven and choices for monetary rewards were associated with greater activity for eight. Both commodities elicited activity in the inferior frontal gyrus and cuneus, albeit in different locations. Cigarette decisions were associated with greater activity in the medial frontal gyrus, middle frontal gyrus, precentral gyrus, and superior parietal lobule, whereas money decisions were associated with significantly greater activity in the angular gyrus, middle temporal gyrus, and occipital cortex

Table 4.

Significant differences by commodity type in functionally defined regions of interest identified using a disjunction mask. Extraction Type I error rates were familywise p <.005 + cluster size ≥5 voxels (voxelwise p <.000016). Money = Money choices; Cig = cigarette choices; SEM = standard error of the mean; L = left, R = right. Coordinates are in Talairach space. Significant effects are in boldface.

| L/R | Region of Interest | mm3 | X | Y | Z | Money t (SEM) |

Cig t (SEM) |

t(12) | p |

|---|---|---|---|---|---|---|---|---|---|

| L | Medial Frontal Gyrus | 2916 | −2 | −1 | 55 | −1.15 (.31) | 1.11 (.14) | −6.10 | <.001 |

| R | Middle Frontal Gyrus | 594 | 30 | −6 | 57 | −0.83 (.27) | 1.05 (.14) | −5.61 | <.001 |

| R | Inferior Frontal Gyrus | 486 | 51 | 15 | 2 | 0.72 (.23) | −0.81 (.12) | 5.34 | <.001 |

| R | Inferior Frontal Gyrus | 459 | 43 | 4 | 27 | −0.94 (.26) | 1.19 (.16) | −6.64 | <.001 |

| L | Middle Occipital Gyrus | 405 | −33 | −90 | −3 | 1.45 (.22) | 0.05 (.29) | 3.98 | <.002 |

| R | Superior Parietal Lobule | 405 | 32 | −59 | 47 | −0.59 (.29) | 1.05 (.16) | −4.73 | <.001 |

| R | Inferior Occipital Gyrus | 378 | 32 | −88 | −7 | 1.39 (.18) | −0.25 (.20) | 6.66 | <.001 |

| L | Middle Frontal Gyrus | 378 | −30 | −7 | 53 | −0.98 (.34) | 1.11 (.15) | −4.68 | <.01 |

| R | Medial Frontal Gyrus | 297 | 3 | 19 | 46 | −0.38 (.32) | 1.05 (.20) | −3.52 | <.01 |

| L | Cuneus | 243 | −24 | −78 | 22 | −1.52 (.28) | 0.43 (.22) | −4.32 | <.01 |

| R | Middle Temporal Gyrus | 216 | 63 | −28 | −2 | 0.97 (.15) | −0.01 (.30) | 2.49 | 0.03 |

| L | Angular Gyrus | 189 | −44 | −59 | 35 | 0.84(.11) | −0.20 (.18) | 4.69 | <.01 |

| R | Cuneus | 162 | 4 | −90 | 25 | 1.27(.45) | −1.25 (.22) | 4.45 | <.01 |

| L | Middle Frontal Gyrus | 162 | −36 | 15 | 30 | −0.37(.37) | 1.05 (.18) | −2.95 | 0.01 |

| L | Superior Parietal Lobule | 162 | −27 | −55 | 41 | −0.62(.26) | 0.98 (.13) | −5.33 | <.001 |

| L | Precentral Gyrus | 162 | −34 | −278 | 59 | −0.82(.37) | 0.98 (.19) | −3.66 | <.01 |

| L | Inferior Occipital Gyrus | 135 | −25 | −90 | −9 | 1.52(.30) | 0.24 (.35) | 2.48 | 0.03 |

| R | Inferior Parietal Lobule | 135 | 62 | −41 | 30 | 0.11(.29) | −1.05 (.22) | 4.39 | <.001 |

| L | Precentral Gyrus | 135 | −38 | −16 | 51 | −1.21(.44) | 1.11 (.22) | −4.24 | <.001 |

3.4. Relationships between Brain Activity and Behavioral Performance

Of the a priori and functional ROIs that were implicated in choice-type differences, four regions were associated with behavioral impulsivity at statistically significant, high magnitude levels (rs ≥ .58, ps <.05), including the VS, medial frontal gyrus, middle temporal gyrus, and temporal parietal cortex, and several were significantly intercorrelated (Table 5). To determine specificity, stepwise regression concurrently examined all four and identified two regions that were responsible for maximum unique variance in behavioral performance. The observed level of impulsivity was largely a function of increases in medial frontal gyrus activity during restrained choices and decreases in middle temporal gyrus activity during impulsive choices (R2 = .62; Table 5).

Table 5.

Exploratory continuous analyses of brain activity in relation to the behavioral economic index of impulsivity (i.e., hyperbolic temporal discounting function, k). Panel A presents significant correlations (Pearson r) between regions of interest and level of impulsivity based on decision making performance. Panel B presents stepwise regression of a model incorporating the regions implicated in zero-order correlations, resulting in the exclusion of three. Asterisks reflect statistical significance p <.05. Final model overall R2 =.62, adjusted R2 = .54. Region coordinates are provided in Tables 2 and 3.

| A. | Region | k | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|---|

|

|

||||||

| 1. Ventral Striatuma,d | .58* | -- | ||||

| 2. Temporoparietal Cortexa,c | −.58* | −.28 | -- | |||

| 3. Medial Frontal Gyrusb,d | .63* | .80* | .18 | -- | ||

| 4. Middle Temporal Gyrusb,d | .59* | .56* | −.10 | .58* | -- | |

|

|

||||||

| B. | Region | B (SEM) | β | |||

| Medial Frontal Gyrusb,d | .06* (.02) | .54* | ||||

| Temporoparietal Cortex a,c | −.05* (.02) | −.48* | ||||

Superscripts:

a priori region of interest;

functionally defined region of interest;

activity during impulsive choices;

activity during restrained choices.

4. DISCUSSION

4.1. Neuroanatomical regions associated with delay discounting of money and cigarettes

The current investigation was a preliminary study of the differential brain activity during delay discounting decision-making for money and cigarette rewards in smokers. The results were generally consistent with our hypotheses and previous studies of discounting in healthy adults, but also revealed some unexpected and novel findings. In terms of delay discounting choices, a number of brain regions were implicated irrespective of commodity. Among the a priori ROIs, greater activity in the medial PFC and right AIC was associated with successful delay of gratification. These regions were complemented by the functionally defined ROIs, which were related to diverse aspects of the task. Specifically, there was evidence that the precuneus and superior parietal lobule were implicated in all of the types of decision making, that the medial frontal gyrus was associated with both types of intertemporal choice, that the middle temporal gyrus was specifically associated with choices for smaller immediate rewards and that the middle frontal gyrus, cingulate gyrus, and superior frontal gyrus were specifically associated with preferences for larger delayed rewards. These findings generally converge with previous neuroeconomic studies and the regions implicated largely overlap with those reported in the recent discounting ALE meta-analysis (Carter et al. 2010). These include brain areas associated with processing and evaluating incentive salience, action execution, emotional arousal, interoception, intentionality, and planning (Desmurget et al. 2009; Moratti et al. 2008; Naqvi and Bechara 2009; Rushworth et al. 2004).

In comparing decision-making for monetary rewards with cigarette rewards, several findings diverged from our predictions. Behaviorally, participants were not more impulsive for cigarette rewards compared to monetary rewards and the differences in brain activity were more substantial than expected. Significant differences were evident between commodities in both a priori and functionally-defined brain areas. This was not a categorical effect, with one reward type recruiting substantially more active regions than the other. Across the a priori and functionally-defined ROIs, close to equal numbers of regions for money and cigarette rewards exhibited significantly greater activity. In terms of specific regions, decision making for cigarette rewards most notably recruited significantly greater activity in PPC, medial and middle frontal gyrus, and precentral gyrus, whereas choices for money recruited significantly greater activity in the VS, temporoparietal cortex, and angular gyrus. More broadly, a potentially meaningful pattern in terms of differential activation comprised differences in lateralization, with the majority of regions with significantly greater activation for cigarette choices being in the left hemisphere and the majority of monetary reward regions being in the right hemisphere. This dissociation is most strikingly clear in the a priori inferior frontal gyrus ROIs, where reciprocal differences in activation and deactivation based on commodity are present.

Taken together, these findings suggest that commodity activation patterns were not differences in degree, but in kind. That is, these findings provide evidence that although domain-general activation was present, as evidenced by the regions implicated in the choice type analyses, distinct neurocognitive networks also subserved decision making for the different rewards. These results both converge and contrast with an earlier study by McClure et al. (2007), which included a between-subjects comparison of delay discounting of fruit juice and water (primary reinforcers) and money (a secondary reinforcer). Specifically, McClure et al. (2007) found areas of overlap between the commodities (e.g., supplementary motor area), but also some distinct regions of activity that appeared to be commodity-specific (e.g., posterior cingulate) (McClure et al. 2007). In the current study, the patterns of activity for overall activity attest to the presence of commonalities in activity – a core discounting choice network – but the large magnitude commodity differences suggest more meaningful differences by commodity than suggested in the earlier study, at least with regard to an addictive drug reward and a monetary reward. In addition to commodity differences, other methodological differences further reduce the comparability of the two studies and are the most probable explanation for differences in brain activation observed. Differences in hardware, software, and paradigms commonly pose a challenge to comparability across fMRI studies, but clarifying differences between domain-general and commodity-specific brain activity should nonetheless be a priority in future studies.

An exploratory objective was to simultaneously consider the various regions implicated and determine unique associations between brain activity and impulsive behavior. In terms of neural activity, although a number of regions were individually correlated with behavioral performance, two regions in particular were substantially and uniquely associated with level of impulsivity, the medial frontal gyrus and temporoparietal cortex, and the relative balance between the two predicted over half the variation in behavioral performance. Specifically, medial frontal gyrus activity was positively associated with discounting, whereas temporoparietal cortex activity was negatively associated with discounting. This opposing directionality is broadly consistent with the competing systems hypothesis, in which motivational drive and regulatory inhibition jointly determine the behavioral outcome (Bickel et al. 2007; McClure et al. 2004).

4.2. Considerations and limitations

As a preliminary study in this area, it is important to note that there are also a number of interpretive considerations and limitations. For example, decision making for monetary rewards was associated with significantly higher activity in the VS compared to cigarette rewards, which was surprising, as the VS is believed to play an important role in processing incentive salience (Voorn et al. 2004) and would be expected to be more sensitive to a consumable drug reward. However, it is also possible that monetary rewards may in fact have been more salient to the participants because they were of relatively low income and, having just smoked a cigarette, were satiated in terms of nicotine. This hypothesis is testable in future studies manipulating commodity deprivation. Another consideration is that money and cigarettes may have some identification overlap (e.g., money is directly exchanged for cigarettes) and clarifying brain activity differences in commodity-based decision making may benefit from using multiple commodities (e.g., money, food, water, cigarettes) or cross-commodity decision-making (drug today versus money in the future; e.g., Bickel et al., in press). Studies using designs such as these would have the potential for substantially clarifying commodity-specific and non-specific brain activity. Likewise, differences in lateralization were also not predicted, but, the fact that choices for cigarette rewards were largely subserved by the left hemisphere, which is associated with more hedonic and affectively-informed decision making (Demaree et al. 2005; Hecht 2010), may reflect less deliberate consideration of exact numbers of cigarettes and more consideration of the subjective appeal of smoking. This is necessarily conjecture, but represents an empirical question for future research. Finally, the absence of a behavioral commodity effect was unexpected, however, previous studies have translated dollars into packs of cigarettes (e.g., Baker et al. 2003), not individual cigarettes, which may explain the difference. Delay discounting is typically subject to robust magnitude effects – greater impulsivity for smaller rewards and vice versa (e.g., MacKillop et al. 2010). As such, the two different conversions result in much larger numeric values or much lower numeric values in the task. In the case of a conversion to individual cigarettes, the magnitude effect of a large numeric value may have cancelled out the commodity effect behaviorally, although the fMRI nonetheless revealed a distinct profile of activation. This commodity and magnitude effect interaction is speculative, but it is a plausible explanation for this divergence from previous studies.

In terms of limitations, the sample size was self-evidently sufficient to detect an array of significant differences, but a larger sample would be expected to bring these effects into sharper relief for the regions implicated and identify several additional ones. For example, in the general discounting behavior analyses, the VS, left AIC, and precuneus exhibited differences in magnitude that would be expected to be statistically significant in an only modestly larger sample. Moreover, the presence of notable differences in the commodity-based difference requires caution be applied to the general decision-making findings. Some of these differences may have effectively cancelled each other out, meaning that the observed common regions effectively met a higher threshold of being present in spite of commodity differences. The relatively small number of items per category meant that further fractionation of the stimuli was not viable and future studies will be necessary to more comprehensively characterize regions responsible for domain-general and commodity-specific aspects of discounting. Given the high overall levels of discounting observed, this also suggests that the items used in this study, which came from the Monetary Choice Questionnaire (Kirby et al., 1999), may not be optimally sensitive for characterizing variation in discounting in in neuroimaging research. Rather, stimuli from a more traditional delay discounting task that include a broader array of amounts and delays might be necessary to provide a high-resolution characterization (e.g., Bickel et al., 2009). Another methodological point that is relevant is that the order of stimuli was counterbalanced in general (i.e., money-cigarettes-money-cigarettes), but not by participant, so it is possible that order had an effect on the findings. Finally, it should be noted that the protocol did not comprehensively assess concurrent drug use and psychiatric symptoms among the participants, which could have influences on brain activity or behavior and could not be evaluated.

4.3. Applications

Recognizing the preceding considerations, the current study nonetheless provides proof-of-concept that a neuroeconomic approach has promise for studying nicotine dependence. As such, there are several clear directions for the future. Although this study provides initial evidence of the neurocognitive substrates underlying discounting and notable commodity differences, more comprehensive studies will be essential for fully characterizing discounting in smokers, both for monetary and cigarette rewards, and in comparison to non-smokers or occasional smokers. However, an important factor is that smokers and non-smokers differ significantly in terms of both vascular and brain health (e.g., Paul et al., 2008), which could affect BOLD response and should be controlled for to the extent possible. Given the sample size, the current study could not examine differences between males and females, but, as sex differences have been implicated in the relationship between discounting and smoking (Jones et al., 2009), that is another direction for future work. Similarly, the role of withdrawal (and by association, craving), which has previously been shown to significantly increase discounting (e.g., Field et al., 2006), is another promising target for future studies. Finally, impulsive discounting is a risk factor for smoking cessation treatment failure (Krishnan-Sarin et al. 2007; MacKillop and Kahler 2009; Sheffer et al., in press; Yoon et al. 2007) and the current study suggests a neuroeconomic approach may clarify the brain regions responsible for treatment outcome.

4.4. Conclusions

The current study applied a neuroeconomic approach to understand impulsive delay discounting in individuals with nicotine dependence. The brain regions associated with discounting converged with a number of previous studies and, in some cases, were closely associated with behavioral performance, but the study also revealed a qualitatively different pattern of brain activity for discounting of cigarette rewards. Although a number of considerations and limitations apply, these findings suggest the high promise of applying a neuroeconomic approach to understand the etiology, maintenance, and treatment of nicotine dependence.

Supplementary Material

Figure 5.

Commodity type disjunction mask indicating regions of significant differences in activity compared to rest (p <.005, minimum cluster size = 5 voxels). The ten largest regions of interest (ROIs) are illustrated with numbers in descending order of magnitude; the numbers correspond to the ROIs in Table 4, where neuroanatomical labels and specific coordinates are provided.

Acknowledgments

This research was partially supported by grants and resources from the Russell Sage Foundation (JM, LS, SD), the National Institutes of Health (K23 AA016936 [JM], P30 DA027827 [JM], R21 DA027331 [SPD], R24 GM61374 [SPD]), the National Science Foundation (0521432), Butler Hospital, the John and Mary Franklin Foundation [MTA], the Brown University Magnetic Resonance Imaging Facility, and the Brown University Center for Alcohol and Addiction Studies.

References

- Audrain-McGovern J, Rodriguez D, Epstein LH, Cuevas J, Rodgers K, Wileyto EP. Does delay discounting play an etiological role in smoking or is it a consequence of smoking? Drug and Alcohol Dependence. 2009;103:99–106. doi: 10.1016/j.drugalcdep.2008.12.019. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Baker F, Johnson MW, Bickel WK. Delay discounting in current and never-before cigarette smokers: similarities and differences across commodity, sign, and magnitude. Journal of Abnormal Psychology. 2003;112:382–92. doi: 10.1037/0021-843x.112.3.382. [DOI] [PubMed] [Google Scholar]

- Ballard K, Knutson B. Dissociable neural representations of future reward magnitude and delay during temporal discounting. NeuroImage. 2009;45:143–50. doi: 10.1016/j.neuroimage.2008.11.004. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Bechara A. Decision making, impulse control and loss of willpower to resist drugs: a neurocognitive perspective. Nat Neurosci. 2005 Nov;8(11):1458–63. doi: 10.1038/nn1584. [DOI] [PubMed] [Google Scholar]

- Bickel WK, Landes RD, Christensen DR, Jackson L, Jones BA, Kurth-Nelson Z, Redish AD. Single- and cross-commodity discounting among cocaine addicts: the commodity and its temporal location determine discounting rate. Psychopharmacology (Berl) doi: 10.1007/s00213-011-2272-x. (in press) [DOI] [PMC free article] [PubMed] [Google Scholar]

- Bickel WK, Miller ML, Yi R, Kowal BP, Lindquist DM, Pitcock JA. Behavioral and neuroeconomics of drug addiction: competing neural systems and temporal discounting processes. Drug and Alcohol Dependence. 2007;90(Suppl 1):S85–91. doi: 10.1016/j.drugalcdep.2006.09.016. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Bickel WK, Odum AL, Madden GJ. Impulsivity and cigarette smoking: delay discounting in current, never, and ex-smokers. Psychopharmacology (Berl) 1999;146:447–54. doi: 10.1007/pl00005490. [DOI] [PubMed] [Google Scholar]

- Bickel WK, Pitcock JA, Yi R, Angtuaco EJ. Congruence of BOLD response across intertemporal choice conditions: fictive and real money gains and losses. Journal of Neuroscience. 2009;29:8839–46. doi: 10.1523/JNEUROSCI.5319-08.2009. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Bickel WK, Vuchinich RE. Reframing health behavior change with behavioral economics. Lawrence Erlbaum Associates; Mahwah, NJ: 2003. [Google Scholar]

- Boettiger CA, Mitchell JM, Tavares VC, Robertson M, Joslyn G, D’Esposito M, Fields HL. Immediate reward bias in humans: fronto-parietal networks and a role for the catechol-O-methyltransferase 158(Val/Val) genotype. Journal of Neuroscience. 2007;27:14383–91. doi: 10.1523/JNEUROSCI.2551-07.2007. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Boonn A. State Cigarette Prices, Taxes, and Costs per Pack. Campaign for Tobacco-free Kids; Washington, DC: 2007. [Google Scholar]

- Centers for Disease Control and Prevention . Cigarette Smoking-Attributable Morbidity --- United States, 2000. Morbidity and Mortality Weekly Review. 2003;52:842–844. [PubMed] [Google Scholar]

- Centers for Disease Control and Prevention. Smoking-Attributable Mortality, Years of Potential Life Lost, and Productivity Losses --- United States, 2000--2004. Morbidity and Mortality Weekly Review. 2008;57:1226–1228. [PubMed] [Google Scholar]

- Carter RM, Meyer JR, Huettel SA. Functional neuroimaging of intertemporal choice models: A review. Journal of Neuroscience Psychology and Economics. 2010:27–45. [Google Scholar]

- Coffey SF, Gudleski GD, Saladin ME, Brady KT. Impulsivity and rapid discounting of delayed hypothetical rewards in cocaine-dependent individuals. Experimental and Clinical Psychopharmacology. 2003;11:18–25. doi: 10.1037//1064-1297.11.1.18. [DOI] [PubMed] [Google Scholar]

- Cox RW. AFNI: software for analysis and visualization of functional magnetic resonance neuroimages. Computers in Biomedical Research. 1996;29:162–73. doi: 10.1006/cbmr.1996.0014. [DOI] [PubMed] [Google Scholar]

- Demaree HA, Everhart DE, Youngstrom EA, Harrison DW. Brain lateralization of emotional processing: historical roots and a future incorporating “dominance”. Behavioral and Cognitive Neuroscience Review. 2005;4:3–20. doi: 10.1177/1534582305276837. [DOI] [PubMed] [Google Scholar]

- Desmurget M, Reilly KT, Richard N, Szathmari A, Mottolese C, Sirigu A. Movement intention after parietal cortex stimulation in humans. Science. 2009;324:811–3. doi: 10.1126/science.1169896. [DOI] [PubMed] [Google Scholar]

- Epstein LH, Richards JB, Saad FG, Paluch RA, Roemmich JN, Lerman C. Comparison between two measures of delay discounting in smokers. Experimental and Clinical Psychopharmacology. 2003;11:131–8. doi: 10.1037/1064-1297.11.2.131. [DOI] [PubMed] [Google Scholar]

- Field M, Santarcangelo M, Sumnall H, Goudie A, Cole J. Delay discounting and the behavioural economics of cigarette purchases in smokers: the effects of nicotine deprivation. Psychopharmacology (Berl) 2006;186:255–63. doi: 10.1007/s00213-006-0385-4. [DOI] [PubMed] [Google Scholar]

- Heatherton TF, Kozlowski LT, Frecker RC, Fagerstrom KO. The Fagerstrom Test for Nicotine Dependence: a revision of the Fagerstrom Tolerance Questionnaire. British Journal on Addiction. 1991;86:1119–27. doi: 10.1111/j.1360-0443.1991.tb01879.x. [DOI] [PubMed] [Google Scholar]

- Hecht D. Depression and the hyperactive right-hemisphere. Neurosci Res. 2010;68:77–87. doi: 10.1016/j.neures.2010.06.013. [DOI] [PubMed] [Google Scholar]

- Hoffman WF, Schwartz DL, Huckans MS, McFarland BH, Meiri G, Stevens AA, Mitchell SH. Cortical activation during delay discounting in abstinent methamphetamine dependent individuals. Psychopharmacology (Berl) 2008 Dec;201(2):183–93. doi: 10.1007/s00213-008-1261-1. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Jones BA, Landes RD, Yi R, Bickel WK. Temporal horizon: modulation by smoking status and gender. Drug Alcohol Depend. 2009;104(Suppl 1):S87–93. doi: 10.1016/j.drugalcdep.2009.04.001. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Kable JW, Glimcher PW. The neural correlates of subjective value during intertemporal choice. Nature Neuroscience. 2007;10:1625–33. doi: 10.1038/nn2007. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Kirby KN, Petry NM, Bickel WK. Heroin addicts have higher discount rates for delayed rewards than non-drug-using controls. Journal of Experimental Psychology: General. 1999;128:78–87. doi: 10.1037//0096-3445.128.1.78. [DOI] [PubMed] [Google Scholar]

- Krishnan-Sarin S, Reynolds B, Duhig AM, Smith A, Liss T, McFetridge A, Cavallo DA, Carroll KM, Potenza MN. Behavioral impulsivity predicts treatment outcome in a smoking cessation program for adolescent smokers. Drug and Alcohol Dependence. 2007;88:79–82. doi: 10.1016/j.drugalcdep.2006.09.006. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Lawrence NS, Ross TJ, Stein EA. Cognitive mechanisms of nicotine on visual attention. Neuron. 2002;36:539–48. doi: 10.1016/s0896-6273(02)01004-8. [DOI] [PubMed] [Google Scholar]

- Lazar NA. The Statistical Analysis of Functional MRI Data. Springer, Springer; 2008. [Google Scholar]

- MacKillop J, Amlung MT, Few LR, Ray LA, Sweet LH, Munafò MR. Delayed reward discounting and addictive behavior: a meta-analysis. Psychopharmacology (Berl) 2011;216:305–21. doi: 10.1007/s00213-011-2229-0. [DOI] [PMC free article] [PubMed] [Google Scholar]

- MacKillop J, Kahler CW. Delayed reward discounting predicts treatment response for heavy drinkers receiving smoking cessation treatment. Drug and Alcohol Dependence. 2009;104:197–203. doi: 10.1016/j.drugalcdep.2009.04.020. [DOI] [PMC free article] [PubMed] [Google Scholar]

- MacKillop J, Miranda R, Jr, Monti PM, Ray LA, Murphy JG, Rohsenow DJ, McGeary JE, Swift RM, Tidey JW, Gwaltney CJ. Alcohol demand, delayed reward discounting, and craving in relation to drinking and alcohol use disorders. Journal of Abnormal Psychology. 2010;119:106–14. doi: 10.1037/a0017513. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Madden GJ, Petry NM, Badger GJ, Bickel WK. Impulsive and self-control choices in opioid-dependent patients and non-drug-using control participants: drug and monetary rewards. Experimental and Clinical Psychopharmacology. 1997;5:256–62. doi: 10.1037//1064-1297.5.3.256. [DOI] [PubMed] [Google Scholar]

- Mazur JE. An adjusting procedure for studying delayed reinforcement. In: Commons ML, Mazur JE, Nevin JA, Rachlin H, editors. The Effect of Delay and of Intervening Event on Reinforcement Value. Quantitative Analyses of Behavior. Lawrence Erlbaum Associates Inc; Hillsdale, NJ: 1987. pp. 55–73. [Google Scholar]

- McClure SM, Ericson KM, Laibson DI, Loewenstein G, Cohen JD. Time discounting for primary rewards. Journal of Neuroscience. 2007;27:5796–804. doi: 10.1523/JNEUROSCI.4246-06.2007. [DOI] [PMC free article] [PubMed] [Google Scholar]

- McClure SM, Laibson DI, Loewenstein G, Cohen JD. Separate neural systems value immediate and delayed monetary rewards. Science. 2004;306:503–7. doi: 10.1126/science.1100907. [DOI] [PubMed] [Google Scholar]

- Mitchell SH. Measures of impulsivity in cigarette smokers and non-smokers. Psychopharmacology (Berl) 1999;146:455–64. doi: 10.1007/pl00005491. [DOI] [PubMed] [Google Scholar]

- Mokdad AH, Marks JS, Stroup DF, Gerberding JL. Actual causes of death in the United States, 2000. JAMA. 2004;291:1238–45. doi: 10.1001/jama.291.10.1238. [DOI] [PubMed] [Google Scholar]

- Monterosso JR, Ainslie G, Xu J, Cordova X, Domier CP, London ED. Frontoparietal cortical activity of methamphetamine-dependent and comparison subjects performing a delay discounting task. Hum Brain Mapp. 2007 May;28(5):383–93. doi: 10.1002/hbm.20281. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Monterosso JR, Luo S. An argument against dual valuation system competition: cognitive capacities supporting future orientation mediate rather than compete with visceral motivations. Journal of Neuroscience, Psychology and Economics. 2010;3:1–14. doi: 10.1037/a0016827. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Moratti S, Rubio G, Campo P, Keil A, Ortiz T. Hypofunction of right temporoparietal cortex during emotional arousal in depression. Archives of General Psychiatry. 2008;65:532–41. doi: 10.1001/archpsyc.65.5.532. [DOI] [PubMed] [Google Scholar]

- Naqvi NH, Bechara A. The hidden island of addiction: the insula. Trends in Neuroscience. 2009;32:56–67. doi: 10.1016/j.tins.2008.09.009. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Paul RH, Grieve SM, Niaura R, David SP, Laidlaw DH, Cohen R, Sweet L, Taylor G, Clark RC, Pogun S, Gordon E. Chronic cigarette smoking and the microstructural integrity of white matter in healthy adults: a diffusion tensor imaging study. Nicotine Tob Res. 2008;10:137–47. doi: 10.1080/14622200701767829. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Petry NM. Delay discounting of money and alcohol in actively using alcoholics, currently abstinent alcoholics, and controls. Psychopharmacology (Berl) 2001;154:243–50. doi: 10.1007/s002130000638. [DOI] [PubMed] [Google Scholar]

- Ray R, Schnoll RA, Lerman C. Nicotine dependence: biology, behavior, and treatment. Annu Rev Med. 2009;60:247–60. doi: 10.1146/annurev.med.60.041707.160511. [DOI] [PubMed] [Google Scholar]

- Reynolds B. A review of delay-discounting research with humans: relations to drug use and gambling. Behav Pharmacol. 2006a;17:651–67. doi: 10.1097/FBP.0b013e3280115f99. [DOI] [PubMed] [Google Scholar]

- Reynolds B. The Experiential Discounting Task is sensitive to cigarette-smoking status and correlates with a measure of delay discounting. Behavioural Pharmacology. 2006b;17:133–42. doi: 10.1097/01.fbp.0000190684.77360.c0. [DOI] [PubMed] [Google Scholar]

- Reynolds B, Richards JB, Horn K, Karraker K. Delay discounting and probability discounting as related to cigarette smoking status in adults. Behavioural Processes. 2004;65:35–42. doi: 10.1016/s0376-6357(03)00109-8. [DOI] [PubMed] [Google Scholar]

- Rushworth MF, Walton ME, Kennerley SW, Bannerman DM. Action sets and decisions in the medial frontal cortex. Trends Cogn Sci. 2004;8:410–7. doi: 10.1016/j.tics.2004.07.009. [DOI] [PubMed] [Google Scholar]

- Saad ZS, Glen DR, Chen G, Beauchamp MS, Desai R, Cox RW. A new method for improving functional-to-structural MRI alignment using local Pearson correlation. Neuroimage. 2009;44:839–48. doi: 10.1016/j.neuroimage.2008.09.037. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Schluter ND, Krams M, Rushworth MF, Passingham RE. Cerebral dominance for action in the human brain: the selection of actions. Neuropsychologia. 2001;39:105–13. doi: 10.1016/s0028-3932(00)00105-6. [DOI] [PubMed] [Google Scholar]

- Sheffer S, MacKillop J, McGeary J, Landes R, Carter L, Yi R, Jones B, Christensen C, Stitzer M, Jackson L, Bickel WK. Delay discounting, locus of control, and cognitive impulsivity independently predict tobacco dependence treatment outcomes in a highly dependent, lower socioeconomic group of smokers. American Journal on Addictions. doi: 10.1111/j.1521-0391.2012.00224.x. (in press) [DOI] [PMC free article] [PubMed] [Google Scholar]

- Sweet LH, Mulligan RC, Finnerty CE, Jerskey BA, David SP, Cohen RA, Niaura RS. Effects of nicotine withdrawal on verbal working memory and associated brain response. Psychiatry Res. 2010;183:69–74. doi: 10.1016/j.pscychresns.2010.04.014. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Sweitzer MM, Donny EC, Dierker LC, Flory JD, Manuck SB. Delay discounting and smoking: association with the Fagerstrom Test for Nicotine Dependence but not cigarettes smoked per day. Nicotine Tob Res. 2008;10:1571–5. doi: 10.1080/14622200802323274. [DOI] [PubMed] [Google Scholar]

- Voorn P, Vanderschuren LJ, Groenewegen HJ, Robbins TW, Pennartz CM. Putting a spin on the dorsal-ventral divide of the striatum. Trends Neurosci. 2004;27:468–74. doi: 10.1016/j.tins.2004.06.006. [DOI] [PubMed] [Google Scholar]

- Vuchinich RE, Heather N. Choice, behavioural economics and addiction. Pergamon/Elsevier Science; Amsterdam, The Netherlands: 2003. p. 438. [Google Scholar]

- Ward BD. Simultaneous inference for FMRI data. Biophysics Research Insitute, Medical College of Wisconsin; Milwaukee Wisconsin: 2000. [Google Scholar]

- Wipfli H, Samet JM. Global economic and health benefits of tobacco control: part 1. Clinical Pharmacology and Therapeutics. 2009a;86:263–71. doi: 10.1038/clpt.2009.93. [DOI] [PubMed] [Google Scholar]

- Wipfli H, Samet JM. Global economic and health benefits of tobacco control: part 2. Clinical Pharmacology and Therapeutics. 2009b;86:272–80. doi: 10.1038/clpt.2009.94. [DOI] [PubMed] [Google Scholar]

- World Health Organization. World Health Organization Statistics Report - 2008. World Health Organization Press; Geneva, Switzerland: 2008. [Google Scholar]

- Yoon JH, Higgins ST, Heil SH, Sugarbaker RJ, Thomas CS, Badger GJ. Delay discounting predicts postpartum relapse to cigarette smoking among pregnant women. Experimental and Clinical Psychopharmacology. 2007;15:176–86. doi: 10.1037/1064-1297.15.2.186. [DOI] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.