Abstract

Health plans participating in the Medicare managed care program, now called Medicare Advantage, have historically attracted healthier enrollees than the traditional fee-for-service program. Medicare Advantage plans have gained financially from this favorable risk selection because until recently Medicare payments to plans were adjusted only minimally for the clinical characteristics of enrollees, such that payments systematically exceeded costs for healthier enrollees and were systematically lower than costs for sicker enrollees. To address favorable selection in Medicare Advantage, a new risk-adjustment system adjusting plan payments for clinical diagnoses was phased in from 2004 to 2007. Also, a lock-in provision was instituted in 2006 and strengthened in 2007 to limit midyear disenrollment by Medicare Advantage enrollees, particularly those experiencing health declines whose disenrollment could benefit plans financially. To determine if these reforms were associated with intended reductions in favorable selection in Medicare Advantage, we compared self-reported utilization and health for Medicare Advantage vs. traditional Medicare beneficiaries and for those who switched into or out of Medicare Advantage vs. non-switchers both before and after these reforms were implemented. In 2001-2003, differences in utilization and health between these groups suggested favorable selection in Medicare Advantage. By 2006-2007, however, most differences were substantially narrowed, indicating reduced selection. For example, Medicare Advantage enrollees reported 17.7% lower utilization than traditional Medicare enrollees in 2001-2003 but 8.1% lower in 2006-2007. Similar risk-adjustment methods may help may help mitigate incentives for Accountable Care Organizations participating in the Medicare Shared Savings Program and plans competing in health insurance exchanges to select patients with favorable clinical risks.

Managed care plans in the Medicare Advantage program receive prospective, or capitated, payments from Medicare that are determined from spending predictions for each enrollee. Medicare Advantage plans therefore have financial incentives to enroll and retain beneficiaries whose actual medical costs are lower than their predicted costs and avoid beneficiaries whose actual costs exceed predictions. Before 2004, prediction models used by Medicare adjusted per-enrollee payments for some demographic factors but only minimally for clinical diagnoses such as diabetes or ischemic heart disease. Consequently, incentives for plans to enroll healthy and avoid chronically ill beneficiaries were large. With these incentives at work, new enrollees in Medicare managed care plans in the 1980s and 1990s were less costly prior to enrollment than demographically similar beneficiaries who remained in traditional fee-for-service Medicare.1-8 Similarly, beneficiaries who disenrolled from managed care plans into traditional Medicare were often costlier after disenrollment than other traditional Medicare beneficiaries.1,2,6-8

Because enrollment and retention of beneficiaries with favorable health risks (favorable risk selection) contributes to overpayments to Medicare Advantage plans9,10 and may weaken plan competition based on quality and costs of care, a new risk-adjustment system was mandated in the Balanced Budget Act of 1997 and phased in from 2004 to 2007. The new Centers for Medicare and Medicaid Services Hierarchical Condition Categories (CMS-HCC) model adjusts payments to Medicare Advantage plans for clinical diagnoses determined from inpatient and outpatient encounters as well as for demographic factors.11 Specifically, the model includes 70 HCC categories, each defined by a single condition or combination of conditions, and each condition defined by sets of diagnostic codes. For each Medicare Advantage enrollee in a given year, the model uses diagnostic information from the prior year to calculate a summary risk score proportional to the spending predicted by the enrollee’s conditions. This risk score is then applied to an administratively set benchmark payment rate to risk-adjust payment for the enrollee.

An enrollment lock-in was also instituted, prohibiting Medicare Advantage enrollees from disenrolling during the second half of 2006 and the last 9 months of the year starting in 2007. Medicare Advantage enrollees had been previously free to disenroll on a monthly basis, allowing plans to benefit financially from midyear disenrollment by enrollees experiencing health declines.

The HCC model will be used to risk-adjust spending targets for Accountable Care Organizations in the Medicare Shared Savings Program, and similar methods will be used to risk-adjust plan revenues in health insurance exchanges.12,13 The potential benefits of exchanges and Accountable Care Organizations could be undermined if plans and provider organizations avoid chronically ill and costly patients for whom these reforms were intended to improve coverage and care. The performance of the HCC risk-adjustment system is therefore an important determinant of success not only of the Medicare Advantage program but also of these key programs established by the Affordable Care Act. The effectiveness of risk adjustment in reducing favorable risk selection in Medicare Advantage, however, remains unclear.

How Measures to Reduce Favorable Selection Might Work

Risk-adjusting Medicare Advantage payments for clinical conditions could reduce favorable selection in Medicare Advantage through a variety of mechanisms. In response to lower payments for patients with lower predicted costs (lower HCC risk scores), Medicare Advantage plans might devote fewer resources to marketing efforts to attract beneficiaries with favorable health risks. Higher payments for patients with higher predicted costs could lead plans to reconfigure provider networks and redesign benefits in ways that attract more chronically ill beneficiaries – for example by increasing access to specialists, offering preferred provider organization (PPO) options with greater choice of physicians, providing disease management services, and aligning cost sharing and drug formularies with the needs of medically complex patients. Recognizing these enhancements, chronically ill beneficiaries might become more willing to forego unrestricted access to providers and unmanaged care in traditional Medicare in exchange for extra benefits offered by Medicare Advantage plans, such as lower premiums, less cost sharing, or additional covered services. The enrollment lock-in could additionally contribute to greater retention of Medicare Advantage enrollees in poor health, who might otherwise disenroll into traditional Medicare to have free choice of specialists and hospitals.

METHODS

To determine if the implementation of the HCC model and the enrollment lock-in were associated with reduced favorable selection in Medicare Advantage, we used nationally representative data from the Medicare Current Beneficiary Survey to conduct several “stock and flow” analyses of Medicare Advantage and traditional Medicare enrollees. We estimated changes from 2001-2003 to 2006-2007 in differences in health care utilization and health status between beneficiaries who enrolled in or disenrolled from Medicare Advantage (flow) and those who did not (stock). We similarly examined how differences in utilization and health between all Medicare Advantage and traditional Medicare enrollees changed over these years.

Study Population

We analyzed longitudinal survey and enrollment data for elderly community-dwelling Medicare beneficiaries from the 2001-2007 Medicare Current Beneficiary Survey Cost and Use files, available for up to 3 years for each participant. We excluded certain groups of participants from our main analyses for reasons described in the appendix.14 In a sensitivity analysis, we also excluded beneficiaries dually eligible for Medicare and Medicaid because they are exempt from the enrollment lock-in. Our study was approved by the Harvard Medical School Committee on Human Studies and the CMS Privacy Board.

Study Variables

Enrollment Switches

Using monthly Medicare enrollment information starting in 2000, for each year from 2001-2007 we determined which participants switched from traditional Medicare to Medicare Advantage as of January or later in the year (new Medicare Advantage enrollees). Because enrollment information in December of the preceding year was required to determine if Medicare Advantage enrollment in January constituted a switch, we restricted analyses focused on new Medicare Advantage enrollees to participants’ second and third years in the survey. We similarly identified participants who switched from traditional Medicare to Medicare Advantage during the year or effective January of the subsequent year (Medicare Advantage disenrollees).

Self-reported Utilization and Health

In surveys, participants reported their use of medical care every 4 months by type of service: hospitalizations, emergency room visits, outpatient department visits, medical provider events, and prescription drug fills. To improve the accuracy of these self-reports, survey participants were instructed to record service use on a calendar and retain statements, receipts, prescription drug containers and other documentation related to their medical care.

We constructed a summary measure of total utilization equal to a weighted sum of annual utilization counts across service types. Service-specific weights were equal to the average additional traditional Medicare spending associated with an additional service event, as estimated by fitting a regression model predicting total traditional Medicare spending (assessed from claims) as a function of the set of self-reported utilization counts. All self-reported utilization counts significantly predicted traditional Medicare spending.

In addition to total utilization, we present analyses of annual hospitalization counts and prescription drug fills, components that reflect acute and chronic illness burden, respectively. We also analyzed annual self-reports of general health status and change in health, both as continuous variables and indicators of fair/poor or somewhat/much worse health. We describe in the appendix several methodological advantages of self-reported over administrative data for analyses of risk selection and why we would not expect reporting errors to bias our results.14

Stock and Flow Comparisons

We compared new Medicare Advantage enrollees with beneficiaries staying in traditional Medicare (traditional Medicare stayers) and with those already in Medicare Advantage (Medicare Advantage incumbents). Similarly, we compared Medicare Advantage disenrollees with traditional Medicare incumbents and with Medicare Advantage stayers. Finally, we compared all Medicare Advantage enrollees (including new enrollees) with all traditional Medicare enrollees (including Medicare Advantage disenrollees). Exhibit 1 summarizes these comparisons and comparison groups.

Exhibit 1. Comparison group definitions and sample sizes by type of comparison.

| Stock and flow comparison | Comparison group definition for a given study year |

N (person-years) |

|---|---|---|

|

| ||

| Flow into MA vs. stock | ||

| New MA enrollees vs. MA incumbents and vs. TM stayers |

Switched from TM to MA between December of previous year and January of study year or during study year |

799 |

| Already in MA as of December of previous year and remained in MA in study year |

5,875 | |

| Continuously enrolled in TM during study year | 32,746 | |

|

| ||

| Flow out of MA vs. stock | ||

| Disenrollees from MA vs. MA stayers and vs. TM incumbents |

Switched from MA to TM during study year or between December of study year and January of subsequent year |

664 |

| Enrolled in MA in study year and remained in MA in January of subsequent year |

9,819 | |

| Continuously enrolled in TM during study year | 51,970 | |

|

| ||

| All MA vs. all TM | ||

| All MA enrollees (including new enrollees) vs. all TM beneficiaries (including MA disenrollees) |

All beneficiaries continuously enrolled in MA or switched from TM to MA during study year |

10,046 |

| All beneficiaries continuously enrolled in TM or switched from MA to TM during study year |

52,407 | |

Source: Authors’ analysis of Medicare enrollment data for participants in the Medicare Current Beneficiary Survey.

Notes: MA denotes Medicare Advantage, and TM denotes traditional Medicare. As described in the Methods, we restricted analyses of new MA enrollees to participants' second and third survey years, because enrollment information from December of the preceding year was required to determine if MA enrollment in January of a given study year constituted a switch. Therefore, fewer person-years of data were analyzed in comparisons focused on new MA enrollees.

We compared differences in self-reported utilization and health between these groups over three time periods: 2001-2003, 2004-2005, and 2006-2007. We divided the phase-in of the HCC system into two periods to assess gradual changes in risk selection, as HCC risk scores received steadily increasing weight in payment calculations from 30% in 2004 to 50% in 2005 to 75% in 2006 to 100% in 2007. To provide readily interpretable results, we present differences in utilization in relative terms (reported in Exhibits as relative utilization (RU)).

We compared new Medicare Advantage enrollees with both traditional Medicare stayers and Medicare Advantage incumbents to bound estimates of risk selection. Comparisons with incumbent Medicare Advantage enrollees may have underestimated favorable risk selection, because incumbent enrollees may have remained less costly than traditional Medicare beneficiaries indefinitely, as a consequence of their initially favorable health risks. Conversely, comparisons with traditional Medicare beneficiaries may have overestimated favorable risk selection because utilization in traditional Medicare was not influenced by care management strategies employed by Medicare Advantage plans to control utilization and improve quality of care.

Statistical Analysis

To conduct stock and flow comparisons, we fitted regression models predicting utilization or health as a function of comparison groups, time periods, and interactions between the two. To control for geographic variation in utilization, we included survey primary sampling units in models (a set of metropolitan statistical areas or clusters of non-metropolitan counties consistently sampled over the study period). All analyses were adjusted for the complex survey design.14

Assessing Risk Selection Not Explained by the HCC Model

For each Medicare Advantage enrollee since 2006, the Medicare Current Beneficiary Survey has included the capitated payment to the enrollee’s plan, adjusted for the enrollee’s county of residence, demographic factors (age, gender, disability status, and Medicaid eligibility), and diagnostic information included in the HCC model. Enrollee-specific capitated payments to Medicare Advantage plans are calculated by multiplying county-specific benchmark rates by enrollees’ demographic factors and individual HCC risk scores, modified somewhat by plan bids relative to benchmark rates.15 Thus, to obtain individual risk scores for Medicare Advantage enrollees in 2006-2007 that approximated payment adjustments for demographic and diagnostic information, we divided capitation payments by county benchmark rates available from the CMS.16

For the years 2006-2007, we adjusted comparisons between new and incumbent Medicare Advantage enrollees and between Medicare Advantage disenrollees and Medicare Advantage stayers for these individual risk scores. Although we could not calculate comparable risk scores for traditional Medicare enrollees, these adjusted comparisons nevertheless addressed two important questions. First, we tested a previous study’s conclusion that Medicare Advantage plans responded to the HCC risk-adjustment model by more intensively selecting favorable risks within HCC categories.17 If this were the case, controlling for risk scores would lower estimates of relative utilization for new vs. incumbent Medicare Advantage enrollees. Second, the adjustment allowed us to quantify remaining differences in 2006-2007 between new and incumbent enrollees and between disenrollees and stayers in Medicare Advantage that were not explained by the new risk-adjustment system.

Assessing Competing Explanations for Changes in Risk Selection

As detailed in the appendix,14 several contemporaneous changes to the Medicare Advantage program from 2004 to 2007 also may have affected risk selection. Most notably, increases in benchmark payment rates during these years encouraged insurers to compete for enrollees by offering more generous benefits, lower premiums, less cost sharing, and broader provider networks. The Medicare Advantage program expanded as a result. In particular, private fee-for-service plans grew rapidly after 2005, offering similar or better coverage at a lower out-of-pocket cost (including premiums) than the combination of traditional Medicare plus supplemental Medigap insurance, on average, and with little restriction of provider choice.18 These enhanced offerings may have attracted beneficiaries with greater medical needs, or with some skew toward healthier beneficiaries if those with cognitive deficits were less able to recognize the advantages.18

To determine if changes in risk selection were related to increases in benchmark rates, we compared results for study participants living in counties where the benchmark rate increase from 2004 to 2007 was higher vs. lower than the median increase among all U.S. counties.16

Because we could not observe Medicare Advantage plan choices made by participants, we could not perform a sensitivity analysis excluding private fee-for-service enrollees. Instead, we conducted a separate supplementary analysis using 20% Medicare claims files and information on Medicare Advantage plan type from the Enrollment Database to determine if our results could be explained by growth of private fee-for-service plans. Specifically, we compared HCC risk scores and total annual non-drug medical spending in 2005 and 2006 for traditional Medicare beneficiaries who switched into private fee-for-service Medicare Advantage plans in the subsequent year (2006 or 2007) vs. those who switched into HMO or PPO plans. We adjusted these supplementary analyses for county fixed effects and applied the same inclusion criteria used in our main analyses of Medicare Current Beneficiary Survey data.

RESULTS

As described in the appendix Exhibit,14 annual rates of new enrollment in Medicare Advantage progressively rose during the study period from 0.8% in 2001-2003 to 6.3% in 2006-2007, while rates of disenrollment from Medicare Advantage progressively fell from 9.8% to 3.1%.

Exhibit 2 presents differences in self-reported utilization and health between new Medicare Advantage enrollees and traditional Medicare stayers, differences between new and incumbent Medicare Advantage enrollees, and changes in these differences over the study period. Compared with traditional Medicare stayers, new Medicare Advantage enrollees reported significantly lower total utilization and fewer hospitalizations and prescription drug fills in 2001-2003 but not in 2006-2007, as these differences were significantly and progressively narrowed or reversed. New Medicare Advantage enrollees also reported significantly better general health than traditional Medicare stayers in 2001-2003 but not in 2006-2007. Differences between new and incumbent Medicare Advantage enrollees in these utilization and health measures in 2001-2003 were similarly reduced, although some differences in 2001-2003 and reductions by 2006-2007 did not reach statistical significance.

Exhibit 2. Relative utilization (RU) and health differences for new MA enrollees vs. TM stayers and vs. incumbent MA enrollees from 2001 to 2007.

| Measure of utilization or health | 2001-2003 | 2004-2005 | 2006-2007 |

|---|---|---|---|

|

| |||

| Total utilization | |||

| New MA enrollees vs. TM stayers | |||

| RU | 0.60*** | 0.77 | 0.93 |

| Change in RU | - | 1.29 | 1.54** |

| New MA enrollees vs. MA incumbents | |||

| RU | 0.71* | 0.87 | 1.05 |

| Change in RU | - | 1.24 | 1.49* |

|

| |||

| Hospitalizations | |||

| New MA enrollees vs. TM stayers | |||

| RU | 0.55** | 0.80 | 0.97 |

| Change in RU | - | 1.45 | 1.77** |

| New MA enrollees vs. MA incumbents | |||

| RU | 0.63* | 0.86 | 1.10 |

| Change in RU | - | 1.35 | 1.73* |

|

| |||

| Prescription drug fills | |||

| New MA enrollees vs. TM stayers | |||

| RU | 0.82** | 0.95 | 1.13*** |

| Change in RU | - | 1.16 | 1.38*** |

| New MA enrollees vs. MA incumbents | |||

| RU | 0.82** | 0.97 | 1.03 |

| Change in RU | - | 1.18 | 1.25** |

|

| |||

| General health status (1 excellent – 5 poor) | |||

| New MA enrollees vs. TM stayers | |||

| Absolute difference | −0.19** | −0.14 | −0.01 |

| Change in difference | - | 0.05 | 0.18* |

| New MA enrollees vs. MA incumbents | |||

| Absolute difference | −0.12 | −0.12 | 0.06 |

| Change in difference | - | −0.01 | 0.18 |

|

| |||

| Health fair or poor | |||

| New MA enrollees vs. TM stayers | |||

| OR | 0.68 | 1.11 | 1.05 |

| Change in OR | - | 1.62 | 1.54 |

| New MA enrollees vs. MA incumbents | |||

| OR | 0.86 | 1.17 | 1.22 |

| Change in OR | - | 1.35 | 1.42 |

|

| |||

| Health worse or much worse | |||

| New MA enrollees vs. TM stayers | |||

| OR | 0.71 | 0.92 | *0.82 |

| Change in OR | - | 1.29 | 1.16 |

| New MA enrollees vs. MA incumbents | |||

| OR | 0.84 | 1.14 | 0.97 |

| Change in OR | - | 1.36 | 1.16 |

p <0.1

p < 0.05

p < 0.01

p<0.001

Source: Authors’ analysis of survey and linked Medicare enrollment data from the Medicare Current Beneficiary Survey.

Notes: MA denotes Medicare Advantage, and TM denotes traditional Medicare. CI denotes confidence interval, and OR denotes odds ratio. Relative utilization (RU) equals utilization by new MA enrollees divided by utilization by comparison group. Change in relative utilization equals RU in 2004-2005 or 2006-2007 divided by RU in 2001-2003.

Exhibit 3 presents differences in self-reported utilization and health between Medicare Advantage disenrollees and traditional Medicare incumbents, differences between disenrollees and Medicare Advantage stayers, and changes in these differences over the study period. Relative to both comparison groups, Medicare Advantage disenrollees reported higher total utilization and more hospitalizations and prescription drug fills in 2006-2007 but not in 2001-2003. Disenrollees were also more likely to report their health was fair or poor and somewhat or much worse in 2006-2007 but not in 2001-2003. Most of these differences widened significantly over the study period. Results were similar after Medicaid recipients were excluded (data not shown).

Exhibit 3. Relative utilization (RU) and health differences for MA disenrollees vs. incumbent TM beneficiaries and vs. MA stayers from 2001 to 2007.

| Measure of utilization or health | 2001-2003 | 2004-2005 | 2006-2007 |

|---|---|---|---|

|

| |||

| Total utilization | |||

| MA disenrollees vs. TM incumbents | |||

| RU | 0.94 | 1.07 | 1.33** |

| Change in RU | - | 1.30 | 1.64*** |

| MA disenrollees vs. MA stayers | |||

| RU | 1.15 | 1.39** | 1.64*** |

| Change in RU | - | 1.21 | 1.43** |

|

| |||

| Hospitalizations | |||

| MA disenrollees vs. TM incumbents | |||

| RU | 1.00 | 1.41** | 1.80*** |

| Change in RU | - | 1.41* | 1.79*** |

| MA disenrollees vs. MA stayers | |||

| RU | 1.18 | 1.52** | 1.83*** |

| Change in RU | - | 1.29 | 1.55** |

|

| |||

| Prescription drug fills | |||

| MA disenrollees vs. TM incumbents | |||

| RU | 0.99 | 1.07 | 1.42**** |

| Change in RU | - | 1.08 | 1.43*** |

| MA disenrollees vs. MA stayers | |||

| RU | 1.06 | 1.09 | 1.26** |

| Change in RU | - | 1.03 | 1.19 |

|

| |||

| General health status (1 excellent – 5 poor) | |||

| MA disenrollees vs. TM incumbents | |||

| Absolute difference | −0.03 | 0.20* | 0.25* |

| Change in difference | - | 0.23** | 0.28* |

| MA disenrollees vs. MA stayers | |||

| Absolute difference | 0.06 | 0.29** | 0.28** |

| Change in difference | - | 0.23* | 0.22 |

|

| |||

| Health fair or poor | |||

| MA disenrollees vs. TM incumbents | |||

| OR | 0.87 | 1.43 | 1.63** |

| Change in OR | - | 1.64** | 1.87** |

| MA disenrollees vs. MA stayers | |||

| OR | 1.09 | 1.75** | 1.80** |

| Change in OR | - | 1.60* | 1.65* |

|

| |||

| Health worse or much worse | |||

| MA disenrollees vs. TM incumbents | |||

| OR | 0.95 | 1.49** | 1.57** |

| Change in OR | - | 1.57** | 1.66** |

| MA disenrollees vs. MA stayers | |||

| OR | 1.14 | 1.96*** | 1.76** |

| Change in OR | - | 1.73** | 1.55* |

p <0.1

p < 0.05

p < 0.01

p<0.001

Source: Authors’ analysis of survey and linked Medicare enrollment data from the Medicare Current Beneficiary Survey.

Notes: MA denotes Medicare Advantage, and TM denotes traditional Medicare. CI denotes confidence interval, and OR denotes odds ratio. Relative utilization (RU) equals utilization by MA disenrollees divided by utilization by comparison group. Change in relative utilization equals RU in 2004-2005 or 2006-2007 divided by RU in 2001-2003.

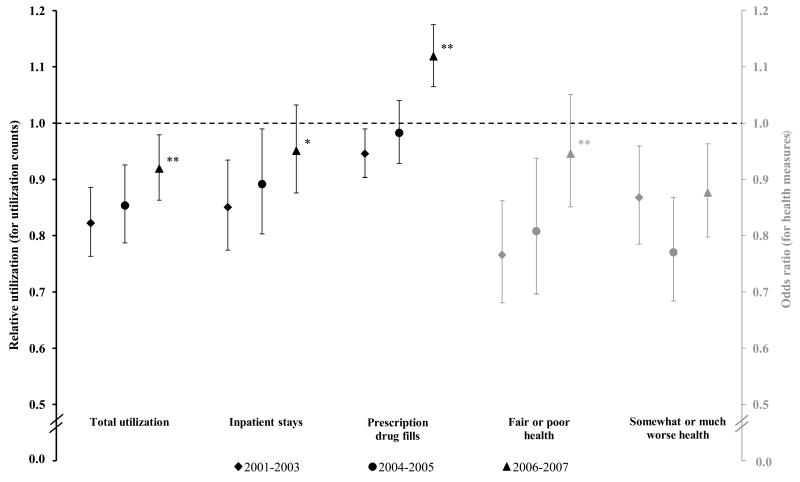

Comparisons of all Medicare Advantage enrollees with all traditional Medicare enrollees quantified the net effects of increasing enrollment rates, decreasing disenrollment rates, and changes in the relative health risks of new Medicare Advantage enrollees and Medicare Advantage disenrollees. As displayed in Exhibit 4, Medicare Advantage enrollees reported significantly lower utilization and better health than traditional Medicare enrollees across all measures in 2001-2003. Most of these differences were substantially reduced by 2006-2007, consistent with net reductions in favorable selection.

Exhibit 4. Differences in utilization and health between all MA and TM enrollees in 2001-03, 2004-05, and 2006-07.

Source: Authors’ analysis of survey and linked Medicare enrollment data from the Medicare Current Beneficiary Survey.

Notes: For each measure of utilization and health, differences between all participants enrolled in MA (continuously enrolled or switched into MA within calendar years) and all participants enrolled in traditional Medicare (continuously enrolled or switched into traditional Medicare within calendar years) are plotted by period (2001-2003, 2004-2005, and 2006-2007) with 95% confidence intervals. Estimates of relative utilization (RU) and odds ratios (OR) are presented for comparisons of utilization and health indicators, respectively, with traditional Medicare beneficiaries serving as the reference group. Statistically significant changes in group differences from 2001-2003 to 2006-2007 are noted at P<0.10(*) and P<0.05(**) levels.

Risk scores calculated from capitation payments for Medicare Advantage enrollees strongly predicted self-reported utilization and health. For example, mean total utilization for enrollees in the highest decile of risk scores was 330% greater than for those in the lowest decile. The percentage of Medicare Advantage enrollees reporting fair or poor health rose progressively from 6.6% in the lowest decile to 45.0% in the highest decile of risk scores (data not shown in Exhibits).

After adjustment for these risk scores, differences in utilization and health in 2006-2007 between Medicare Advantage disenrollees and Medicare Advantage stayers were consistently but not completely reduced. Adjusted relative utilization in 2006-2007 (data not shown in Exhibits) was 1.35 for total utilization (P=0.05 for test of relative utilization=1.0), 1.46 for hospitalizations (P=0.046), and 1.16 for prescription drug fills (P=0.13), and the adjusted difference in general health scores was 0.17 (P=0.18 for test of health score difference=0). Differences in utilization and health in 2006-2007 between new and incumbent Medicare Advantage enrollees were not appreciably altered by adjustment for these risk scores (e.g. adjusted relative utilization for total utilization: 1.03; P=0.81).

Exhibit 5 provides stratified results for participants living in counties with 2004-2007 payment increases above or below the median 3-year increase of 23.2%. On average, monthly payments increased by $154 up to 128% of traditional Medicare spending in high-increase counties over this period, and by $117 up to 110% of traditional Medicare spending in low-increase counties. As expected, Medicare Advantage enrollment in the study sample grew more in counties with high payment rate increases (+7.5 percentage points) than in counties with low increases (+4.2) over these years. Likewise, private fee-for-service enrollment increased more in high-increase counties (+4.6 percentage points) than in low-increase counties (+2.0). Key results from stock and flow comparisons, however, did not statistically differ by county payment rate increases. Unexpectedly, changes suggestive of reduced favorable selection into Medicare Advantage were statistically significant for low-increase counties but not high-increase counties.

Exhibit 5. Changes in relative utilization (RU) and health differences from 2001-2003 to 2006-2007, stratified by county payment rate increases.

| Stock and flow comparison |

Total utilization | Fair or poor health | ||

|---|---|---|---|---|

|

| ||||

| Change in RU from 2001-2003 to 2006-2007 (95% CI) |

Change in OR from 2001-2003 to 2006-2007 (95% CI) |

|||

|

| ||||

| High county payment rate increase from 2004 to 2007 |

Low county payment rate increase from 2004 to 2007 |

High county payment rate increase from 2004 to 2007 |

Low county payment rate increase from 2004 to 2007 |

|

|

| ||||

| All MA vs. all TM | 1.04 | 1.18*** | 1.11 | 1.30** |

|

| ||||

| New MA enrollees | ||||

| vs. TM stayers | 1.07 | 2.01** | 0.96 | 2.24** |

| vs. MA incumbents | 0.94 | 1.95** | 0.60 | 1.91* |

|

| ||||

| MA disenrollees | ||||

| vs. TM incumbents | 1.59* | 1.72** | 2.71** | 1.81* |

| vs. MA stayers | 1.45 | 1.45* | 1.99* | 1.36 |

p <0.1

p < 0.05

p < 0.01

p<0.001

Source: Authors’ analysis of survey and linked Medicare enrollment data from the Medicare Current Beneficiary Survey and county benchmark payment rates from the Medicare ratebooks.

Notes: Differences between estimates for high vs. low increase counties reached statistical significance for none of the comparisons. MA denotes Medicare Advantage, TM denotes traditional Medicare. CI denotes confidence interval, and OR denotes odds ratio.

In supplementary analyses of Medicare claims, differences in HCC scores and spending in 2005-2006 for traditional Medicare beneficiaries subsequently switching into private fee-for-service vs. HMO or PPO plans were small and opposite in direction (mean risk score difference: −0.013 or 1.3% lower for private fee-for-service enrollees; mean annual spending difference: +$52 or 0.9% higher for private fee-for-service enrollees). Thus, health risks of new private fee-for-service enrollees were similar to health risks of other new Medicare Advantage enrollees during these years, implying risk selection in private fee-for-service was similar to risk selection in other plans through 2007.

DISCUSSION

In this nationally representative study of elderly Medicare beneficiaries, differences in health care utilization and health status between new Medicare Advantage enrollees and other beneficiaries, and between all Medicare Advantage and traditional Medicare enrollees, were substantially narrowed from 2001-2003 to 2006-2007. Thus, improved risk adjustment of capitated payments and an enrollment lock-in were associated with reduced selection of beneficiaries with favorable health risks into Medicare Advantage.

One recent study, comparing Medicare spending for traditional Medicare beneficiaries who enrolled in Medicare Advantage in the following year versus those who did not, found, like our study, that differences in HCC risk scores significantly narrowed between comparison groups after 2003. Surprisingly, however, differences in Medicare spending significantly widened when risk scores were held constant.17 This latter finding implies Medicare Advantage plans responded to new risk-adjusted payments by selecting favorable clinical risks within subgroups of beneficiaries with similar HCC risk scores to an extent equal to or greater than was achievable before 2004 across groups with different risk scores. Our findings also suggest that favorable risk selection present before 20041-8,19-21 was subsequently reduced. In contrast to this other study, however, our risk-adjusted comparisons of new vs. incumbent Medicare Advantage enrollees did not reveal favorable selection in 2006-2007 within subgroups with similar risk scores.

We also found that the implementation of the HCC risk-adjustment model and enrollment lock-in were associated with lower rates of disenrollment from Medicare Advantage, but that in more recent years those disenrolling were substantially more likely to report health declines than other beneficiaries. The disenrollment of increasingly sick and costly enrollees was not explained by the exemption of Medicaid-eligible beneficiaries from the enrollment lock-in. A potential explanation for this finding is that some Medicare Advantage enrollees experiencing sudden health declines continued to switch into traditional Medicare (outside the lock-in period in concurrent or subsequent year) to have unrestricted access to medical services and providers to address their new health needs. As disenrollment rates fell, this group may have constituted an increasing fraction of disenrollees. Withdrawal of Medicare Advantage plans from markets in 2001-2003, a period of program contraction, may have also contributed to this finding by causing involuntary disenrollment of healthier enrollees in the baseline period relative to later periods. We were not able to discern reasons for disenrollment.

Differences in utilization and health in 2006-2007 between Medicare Advantage disenrollees and Medicare Advantage stayers were only partially explained by the HCC model, suggesting that HCC-adjusted payments for these disenrollees may have been lower than their costs had they remained enrolled. Thus, disenrollment by particularly costly beneficiaries may benefit Medicare Advantage plans financially. Although our findings for disenrollees suggest more clinically detailed risk adjustment could strengthen incentives for plans to retain particularly sick enrollees, features of managed care in Medicare Advantage (e.g. restricted provider networks and utilization management) may continue to prompt their disenrollment.

Nevertheless, changes in utilization and health differences between all Medicare Advantage and traditional Medicare enrollees indicated net reductions in favorable selection by 2006-2007, despite the disenrollment of increasingly costly enrollees and their designation as traditional Medicare beneficiaries in these comparisons. Due to unmeasured differences in coverage and care management between Medicare Advantage and traditional Medicare and a lack of comparable risk scores for Medicare Advantage and traditional Medicare enrollees, we could not precisely quantify the net amount of remaining risk selection that was unexplained by the HCC model.

Limitations

Our study had several other limitations. Because the implementation of the HCC risk-adjustment system and enrollment lock-in overlapped in 2006-2007, we could not distinguish effects of these two reforms on risk selection. While the enrollment lock-in may have affected risk selection by limiting disenrollment, it did not likely attract less healthy beneficiaries into Medicare Advantage. Rather, the lock-in might have dissuaded chronically ill beneficiaries from enrolling in Medicare Advantage if they valued the option of switching to traditional Medicare in the event of a health decline.

Moreover, we could not distinguish effects of improved risk adjustment and the lock-in from potential effects of other contemporaneous changes in the Medicare Advantage program. Nonetheless, our supplementary analyses of Medicare claims described above and stratified analyses summarized in Exhibit 5 provide little empirical evidence that reductions in favorable selection into Medicare Advantage were explained by increases in benchmark payment rates, expansion of the Medicare Advantage program, or growth of private fee-for-service plans. We could not, however, entirely reject these trends as contributing factors to our findings. In particular, although reductions in favorable selection were not larger (and may have been smaller) in counties with higher payment rate increases, we could not definitively attribute results to the effects of risk adjustment because payment rates were increased in all counties concurrently with the implementation of the HCC model.

Implications for Insurance Exchanges and Accountable Care Organizations

Overall our findings are encouraging for the success of key provisions in the Affordable Care Act, as they suggest that currently available risk-adjustment methods may help mitigate incentives for Accountable Care Organizations in the Shared Savings Program and for plans competing in health insurance exchanges to select patients with favorable clinical risks. Risk selection could be less problematic for exchanges and the Shared Savings Program than it has been for the Medicare Advantage program, because exchange plans and Accountable Care Organizations will be less variable with respect to provider choice. In contrast to differences between Medicare Advantage and traditional Medicare, all exchange plans will have restricted provider networks. Traditional Medicare beneficiaries assigned to Accountable Care Organizations will continue to have unrestricted access to providers, regardless of their assignment. Therefore, if favorable risk selection into Medicare Advantage has been driven in part by stark differences in provider choice between Medicare Advantage and traditional Medicare, it may be less pronounced in these other settings. Consequently, risk-adjustment methods similar to those used in Medicare Advantage may more fully address risk selection in exchanges and the Shared Savings Program.

On the other hand, inadequate risk adjustment would likely cause greater instability in exchange markets than in Medicare Advantage because there will be no option analogous to traditional Medicare that can withstand adverse risk selection without exiting the market. Under an individual mandate, the enrollment of healthy individuals by some exchange plans would mean the enrollment of less healthy individuals by others. Inadequate risk adjustment could lead to competition among exchange plans to attract and retain healthy enrollees, and to the withdrawal of undercompensated plans. Although our findings are encouraging, it remains to be seen if a risk-adjustment system similar to the HCC model will be sufficient to prevent such wasteful competition in exchanges.

Conclusion

In summary, adjustment of capitated payments for clinical diagnoses and an enrollment lock-in have been associated with reduced selection of less costly and healthier beneficiaries into private plans in Medicare. Similar risk adjustment of prospective or global payments may help address risk selection arising from other payment and insurance market reforms.

Acknowledgments

Supported by grants from the Beeson Career Development Award Program (National Institute on Aging K08 AG038354 and the American Federation for Aging Research) and from the National Institute on Aging (P01 AG032952)

APPENDIX

Study Exclusions

We excluded participants in their first year of Medicare eligibility because the survey collects limited data on new beneficiaries and because Medicare does not adjust Medicare Advantage payments for new beneficiaries by the HCC model due to a lack of prior diagnostic information. We also excluded participants with end-stage renal disease and those residing in long-term care facilities because of low rates of Medicare Advantage enrollment among these groups. In a sensitivity analysis, we excluded beneficiaries dually eligible for Medicare and Medicaid because they are exempt from the enrollment lock-in and because they accounted for most of the growth in Medicare Advantage special needs plan enrollment during the study period.

Of 71,316 person-years of survey data for elderly Medicare beneficiaries from 2001 to 2007, we excluded 3,397(4.8%) for participants in their first year of Medicare eligibility, 450(0.6%) for those with end-stage renal disease, 4,861(6.8%) for those residing in long-term care facilities, and 155(0.2%) for those who both switched into and out of Medicare Advantage in the same year.

Advantages and Potential Disadvantages of Self-reported Data

Comparisons of self-reports to Medicare claims suggest Medicare Current Beneficiary Survey participants significantly underreport use of medical services in general and hospitalizations to a lesser extent.1 Self-reported utilization counts were strong predictors of Medicare spending determined from claims, however, and we would not expect reporting errors to have changed systematically over the study period by Medicare Advantage enrollment in a manner that would bias our results.

Moreover, by providing information on Medicare Advantage enrollees and consistent measures of utilization and health across Medicare Advantage and traditional Medicare, the survey data supported several comparisons not feasible in previous studies of traditional Medicare claims. In particular, because we could assess utilization and health following Medicare Advantage enrollment or preceding disenrollment, our comparisons were less subject to bias from regression to the mean than analyses of traditional Medicare claims preceding Medicare Advantage enrollment or following disenrollment.2,3 Risk differences between new Medicare Advantage enrollees and beneficiaries remaining in traditional Medicare likely overstate favorable selection when ascertained from preceding claims, as these differences are likely to diminish somewhat after Medicare Advantage enrollment due to random changes in health (assuming Medicare Advantage enrollment is a marker of good health at the time). Finally, compared with risk scores derived from traditional Medicare claims or Medicare Advantage encounter data, self-reported measures of health and utilization are less affected by incentives under the HCC system for Medicare Advantage plans to code diagnoses more intensively.

Statistical Analysis

To conduct stock and flow comparisons, we fitted regression models predicting utilization or health as a function of comparison groups, time periods, and interactions between the two. To improve model fit and provide more interpretable results in terms of relative differences in utilization (reported as relative utilization (RU)), we modeled utilization counts using generalized linear models with a log link and proportional-to-mean variance function. We used linear and logistic regression to model health scores and binary health indicators, respectively. To control for geographic variation in utilization, we included MCBS primary sampling units in models (a set of metropolitan statistical areas or clusters of non-metropolitan counties consistently sampled over the study period).

We adjusted all analyses for the complex survey design using STATA, version 11.2 (StataCorp LP, College Station, TX). We used robust design-based variance estimators to account for geographic clustering and repeated measures when calculating 2-sided P values and constructing 95% confidence intervals.

Contemporaneous Changes That May Have Affected Selection

Several contemporaneous changes to the Medicare Advantage program from 2004 to 2007 also may have affected risk selection and thus the results of stock and flow comparisons. The Medicare Modernization Act of 2003 changed the formula for setting county-specific benchmark rates, leading to substantial increases in payments to Medicare Advantage plans for all enrollees. These payment increases encouraged insurers to compete for enrollees by offering more generous benefits, lower premiums, less cost sharing, and broader provider networks. The Medicare Advantage program expanded as a result.

In particular, private fee-for-service plans grew rapidly in 2006 and 2007 as a result of the payment increases coupled with an earlier provision authorizing private fee-for-service plans to pay traditional Medicare fees to providers who accepted Medicare patients, rather than pay potentially higher fees negotiated by providers.4 Although prohibited from medical management strategies employed by health maintenance organization (HMO) and PPO plans to lower costs, the high payments and ability to impose traditional Medicare fees on providers allowed private fee-for-service plans, too, to offer similar or better coverage at a lower out-of-pocket cost (including premiums), on average, than the combination of traditional Medicare plus supplemental Medigap insurance.5 Furthermore, because private fee-for-service plans were not required to establish provider networks until 2011, they offered these advantages to beneficiaries with little restriction of provider choice.

These enhanced offerings in Medicare Advantage may have attracted beneficiaries with greater medical needs, or with some skew toward healthier beneficiaries if those with cognitive deficits were less able to recognize the advantages.5 Therefore, both improved risk adjustment and higher benchmark payment rates may have affected risk selection through changes in Medicare Advantage plan features. We explored these competing explanations in our analyses, as described in the Methods.

The implementation of the Medicare Part D prescription drug benefit in 2006 also may have affected beneficiaries’ decisions to enroll in Medicare Advantage or traditional Medicare. The effect of Part D on risk selection, however, should not have been substantial because Part D payments to prescription drug plans in both Medicare Advantage and traditional Medicare are based on the same national average bid. In other words, Part D financing supported roughly equivalent expansions in drug benefits across Medicare Advantage and traditional Medicare. Medicare Advantage plans have generally been able to offer more generous drug coverage at lower premiums than standalone drug plans in traditional Medicare primarily because of increased benchmark payment rates for Part A and B services, not Part D payments.6 Thus, our analyses exploring the contribution of payment increases to our results also indirectly addresses changes in selection mediated by greater expansions in drug coverage in Medicare Advantage relative to traditional Medicare.

Contributor Information

J. Michael McWilliams, Department of Health Care Policy, Harvard Medical School, Boston, MA; Division of General Internal Medicine and Primary Care, Department of Medicine, Brigham and Women’s Hospital and Harvard Medical School, Boston, MA.

John Hsu, Department of Health Care Policy, Harvard Medical School, Boston, MA; Mongan Institute for Health Policy, Massachusetts General Hospital and Harvard Medical School, Boston, MA.

Joseph P. Newhouse, Department of Health Care Policy, Harvard Medical School, Boston, MA; Department of Health Policy and Management, Harvard School of Public Health, Boston, MA; Harvard Kennedy School of Government, Cambridge, MA.

ENDNOTES

- 1.Call KT, Dowd B, Feldman R, Maciejewski M. Selection experiences in Medicare HMOs: pre-enrollment expenditures. Health Care Financ Rev. 1999;20(4):197–209. [PMC free article] [PubMed] [Google Scholar]

- 2.Cox DF, Hogan C. Biased selection and Medicare HMOs: analysis of the 1989-1994 experience. Med Care Res Rev. 1997;54(3):259–85. doi: 10.1177/107755879705400301. [DOI] [PubMed] [Google Scholar]

- 3.Eggers P. Risk differential between Medicare beneficiaries enrolled and not enrolled in an HMO. Health Care Financ Rev. 1980;1(3):91–9. [PMC free article] [PubMed] [Google Scholar]

- 4.Eggers PW, Prihoda R. Pre-enrollment reimbursement patterns of Medicare beneficiaries enrolled in “at-risk” HMOs. Health Care Financ Rev. 1982;4(1):55–73. [PMC free article] [PubMed] [Google Scholar]

- 5.Hill JW, Brown RS. Biased selection in the TEFRA HMO/CMP program. Mathematica Policy Research; Princeton, NJ: 1990. Report No.: PR90-35. [Google Scholar]

- 6.Morgan RO, Virnig BA, DeVito CA, Persily NA. The Medicare-HMO revolving door--the healthy go in and the sick go out. N Engl J Med. 1997;337(3):169–75. doi: 10.1056/NEJM199707173370306. [DOI] [PubMed] [Google Scholar]

- 7.Physician Payment Review Commission . Annual Report to Congress, 1996. Washington, DC: 1996. [Google Scholar]

- 8.Medicare Payment Advisory Commission . Report to the Congress: Improving Risk Adjustment in Medicare. Washington, DC: 2000. [Google Scholar]

- 9.Medicare Payment Advisory Commission . Report to the Congress: Medicare Payment Policy. Washington, DC: 2010. [cited 2011 December 5]; Available from: http://www.medpac.gov/documents/Mar10_EntireReport.pdf. [DOI] [PubMed] [Google Scholar]

- 10.Brown RS, Clement DG, Hill JW, Retchin SM, Bergeron JW. Do health maintenance organizations work for Medicare? Health Care Financ Rev. 1993;15(1):7–23. [PMC free article] [PubMed] [Google Scholar]

- 11.Pope GC, Kautter J, Ellis RP, Ash AS, Ayanian JZ, Lezzoni LI, et al. Risk adjustment of Medicare capitation payments using the CMS-HCC model. Health Care Financ Rev. 2004;25:119–41. [PMC free article] [PubMed] [Google Scholar]

- 12.Department of Health and Human Services . Final rule. U.S. Government Printing Office; 2012. Patient Protection and Affordable Care Act; standards related to reinsurance, risk corridors and risk adjustment. [cited 2012 April 3]; Available from: http://www.gpo.gov/fdsys/pkg/FR-2012-03-23/pdf/2012-6594.pdf. [PubMed] [Google Scholar]

- 13.Department of Health and Human Services and Centers for Medicare and Medicaid Services . Final rule. U.S. Government Printing Office; 2011. Medicare program; Medicare Shared Savings Program: accountable care organizations. [cited 2012 October 1]; Available from: http://www.gpo.gov/fdsys/pkg/FR-2011-11-02/pdf/2011-27461.pdf. [Google Scholar]

- 14.Please see online appendix for more details.

- 15.Centers for Medicare and Medicaid Services . 2008 risk adjustment data technical assistance for Medicare Advantage organizations participant guide. 2008. [cited 2011 December 5]; Available from: http://www.scanhealthplan.com/documents/hcc/2008%20RAPS%20Participant%20Guide.pdf. [Google Scholar]

- 16.Medicare Advantage ratebooks . Centers for Medicare and Medicaid Services. Apr 3, 2012. Available from: https://www.cms.gov/medicareadvtgspecratestats/rsd/list.asp. [Google Scholar]

- 17.Brown J, Duggan M, Kuziemko I, Woolston W. Evidence from the Medicare Advantage program. : National Bureau of Economic Research; Cambridge, MA: 2011. How does risk selection respond to risk adjustment? Report No.: 16977. [DOI] [PubMed] [Google Scholar]

- 18.McWilliams JM, Afendulis CC, McGuire TG, Landon BE. Complex Medicare Advantage choices may overwhelm seniors--especially those with impaired decision making. Health Aff (Millwood) 2011;30(9):1786–94. doi: 10.1377/hlthaff.2011.0132. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 19.Brown RS, Bergeron JW, Clement DG, Hill JW, Retchin SM. The Medicare risk program for HMOs - final summary report on findings from the evaluation. Mathematica Policy Research; Princeton, NJ: 1993. Report No.: Contract No. 500-88-006. [Google Scholar]

- 20.Hellinger FJ, Wong HS. Selection bias in HMOs: a review of the evidence. Med Care Res Rev. 2000;57(4):405–39. doi: 10.1177/107755870005700402. [DOI] [PubMed] [Google Scholar]

- 21.Mello MM, Stearns SC, Norton EC, Ricketts TC. Understanding Biased Selection in Medicare HMOs. Health Serv Res. 2003;38(3):961–92. doi: 10.1111/1475-6773.00156. [DOI] [PMC free article] [PubMed] [Google Scholar]