Significance

Energy systems based on fossil fuels and uranium have brought about modernity and its specific agro-industrial metabolism. Although this achievement creates a deep lock-in effect, collateral damages such as climate change and large-scale contamination cast doubts on the sustainability of the current mode of global socioeconomic operation. This article analyzes why the incumbent energy systems are so rigid and still outcompete their more sustainable rivals. We elucidate the role of contemporary corporate law in this context and argue that the stiffness of current energy systems could be overcome by assigning unlimited responsibilities to shareholders.

Abstract

The contemporary industrial metabolism is not sustainable. Critical problems arise at both the input and the output side of the complex: Although affordable fossil fuels and mineral resources are declining, the waste products of the current production and consumption schemes (especially CO2 emissions, particulate air pollution, and radioactive residua) cause increasing environmental and social costs. Most challenges are associated with the incumbent energy economy that is unlikely to subsist. However, the crucial question is whether a swift transition to its sustainable alternative, based on renewable sources, can be achieved. The answer requires a deep analysis of the structural conditions responsible for the rigidity of the fossil-nuclear energy system. We argue that the resilience of the fossil-nuclear energy system results mainly from a dynamic lock-in pattern known in operations research as the “Success to the Successful” mode. The present way of generating, distributing, and consuming energy—the largest business on Earth—expands through a combination of factors such as the longevity of pertinent infrastructure, the information technology revolution, the growth of the global population, and even the recent financial crises: Renewable-energy industries evidently suffer more than the conventional-energy industries under recession conditions. Our study tries to elucidate the archetypical traits of the lock-in pattern and to assess the respective importance of the factors involved. In particular, we identify modern corporate law as a crucial system element that thus far has been largely ignored. Our analysis indicates that the rigidity of the existing energy economy would be reduced considerably by the assignment of unlimited liabilities to the shareholders.

“Whoever has in his hand, to him will be given and whoever has not, even the little he has, will be taken from him.”

—The Gospel of Thomas, Logos 41.*

The incumbent energy system generates a number of negative effects, many of which disturb the climate and threaten the ecosystems on which we depend. Although those effects have been known for several decades, and although sustainability is a widely held aspiration, there has been no real mitigation of the most pertinent causes: the generation and use of conventional energy sources. In fact, although the combined share of fossil and nuclear resources in the world’s total supply of primary energy has remained stable since 1973, the absolute supply of these resources has more than doubled. In parallel with this increase, shareholders' power in the realm of corporate governance has increased significantly.

This paper discusses and characterizes the structural mechanisms behind the rigidity of the contemporary energy system and considers the role of corporate law in this context. It concludes with a suggestion for a change in the structure of corporate law that may help reduce our energy system's addiction to fossil energy resources and the negative side-effects of this addiction.

Problems Caused by the Current Energy System

The generation of energy for industry and consumers has multiple negative side-effects; among others are precarious amounts of CO2 emissions; pollution of air, land, and water; nuclear waste; geopolitical conflicts; looming shortages of certain energy reserves; and rising food prices. Most of these problems have been known for five decades (2, 3). An updated integrated assessment is given by the German Advisory Council on Global Change (WBGU) in its latest report, which spells out the necessity of transformational change within the next 10–20 y (4).

Indeed, public and political awareness of the problematic impacts of fossil and nuclear energy use has grown since the 1970s. Treaties, regulations, and laws have been established to combat these impacts at national and international levels. Since the early 1990s, and accelerating in the early to mid-2000s, policies to promote energy and technology without significant negative side-effects (see the discussion of alternative energy technologies, below) have grown substantially in number (5). However, in the same period there has been no meaningful relative decline in the exploitation of conventional energy sources. In absolute terms, the world’s supply of energy from primary, conventional sources has more than doubled since 1973.

Evolution of the Energy System Since the 1970s

The negative effects of the generation and use of energy are best described by splitting the global energy system (“the energy system”) into two subsystems: a conventional system with energy sources (and associated technologies) that generate problems and an alternative system with energy sources (and technologies) that do not. These subsystems’ sources and technologies are discerned on the basis of (i) their environmental implications (e.g., air, land, or water pollution; CO2 emissions; nuclear waste generation); (ii) the finiteness of their availability; (iii) the geopolitical stress accompanying their extraction and trading; and (iv) (specifically for biofuels) their impact on the availability of crop land and food prices.

Conventional Energy System.

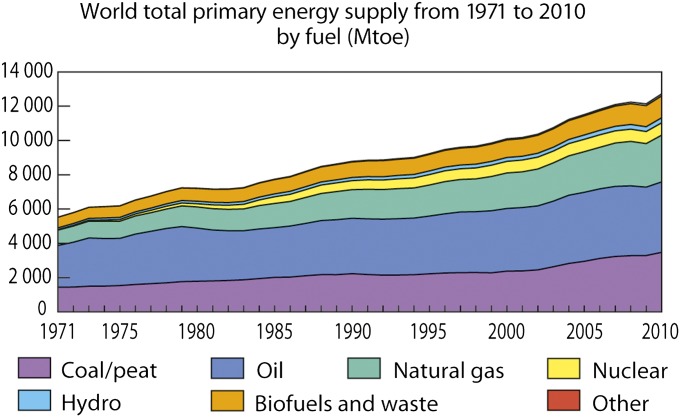

Following the above distinction, the conventional energy system comprises oil, coal, natural gas, uranium, and biofuels as energy input and, among others, coal gasification, cracking, and refining, and CO2 sequestration as technologies. Fig. 1 provides a dynamic perspective, showing that in 2010 oil (32.4%), coal (27.3%), natural gas (21.4%), and nuclear (5.7%) jointly accounted for 86.8% of the world’s total primary energy supply (“TPES”) (6). Biofuels were excluded from this list because the International Energy Agency (IEA) in its 2012 World Energy Statistics does not differentiate percentage-wise among solid biofuels and animal products, gas/liquids from biofuels, industrial waste, and municipal waste, all of which have different effects on the availability of cropland and food prices. If biofuels had been included in the calculation, the overall percentage of energy from conventional sources would be significantly higher than 86.8%.

Fig. 1.

World TPES from 1971–2010 (6). Image courtesy of Key World Energy Statistics 2012 © OECD/IEA, 2012, p 6.

According to the IEA, in 1973 conventional energy, excluding biofuels, accounted for 87.6% of world TPES. [We use the year 1973 here (instead of 1971, the first year in Fig. 1) because the IEA uses 1973 as the first year in its break-down of fuel shares of the TPES in its Key World Energy Statistics (6).] In absolute terms, global TPES (conventional and alternative combined) rose from 6,107 million tons of oil equivalent (“Mtoe”) in 1973 to 12,717 Mtoe in 2010. Thus the market share of world TPES for oil, coal, natural gas, and nuclear energy was relatively stable (with a 0.8% decrease) in this period, but the absolute total supply increased by 106.3%.

Thus, despite the negative side-effects of the conventional energy system and the widespread calls for sustainability, the conventional primary energy supply more than doubled.

Alternative Energy System.

The alternative energy system comprises solar, wind, geothermal, and hydro energy; among its associated technologies are concentrated solar technology and wind turbines. This system generates (almost) no air, land, or water pollution and no CO2 emissions; it is abundant in terms of sun, wind, geothermal heat, and water; minimal geopolitical stress is caused by its production; and it exerts no influence on world food prices. This is not to say that the alternative system will not generate serious problems in the long term, but it is safe to say that at present its energy technologies have the ability to mitigate the energy system’s current problems.

If we also add a dynamical perspective here, then in 2010, as shown in Fig. 1, solar, wind, geothermal, heat (jointly 0.9%, shown as ”other’ in Fig. 1) and hydro energy (2.3%) made up 3.2% of the global TPES. In 1973 these resources together represented 1.9% of the world’s TPES—a growth of 1.3% over 37 y. A comparison of these numbers and those of conventional energy leads to the inescapable conclusion that, in absolute numbers, the growth in alternative energy supply is entirely overmatched by the growth in the conventional energy supply. Moreover, the IEA (7) records that, because of the financial crisis, investment in renewables-based power generation dropped relatively more than investment in other kinds of energy generation capacity in late 2008 and early 2009. Without governmental fiscal incentives, it would have decreased by almost 30%.

Explanation and Characterization of Growth and Rigidity

On the basis of IEA research spanning the last 3.5 decades, the development of global TPES suggests that there is considerable rigidity, if not stasis, in the energy market (8, 9). Because of growing energy demand, the conventional energy system has expanded its supply gradually since 1973, thereby also increasing its environmental effects. The traits of a rigid but growing market can be summed up as a relatively stable division of market shares and a substantial growth of the entire market. These traits and their underlying behavioral structures are explained below.

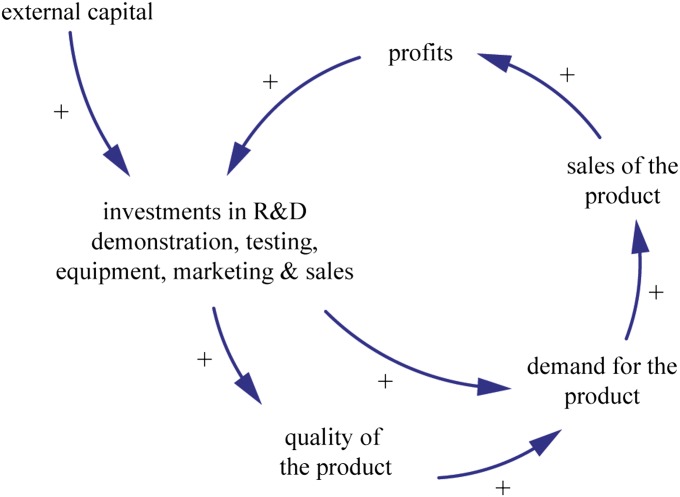

The conventional and alternative energy subsystems exhibit similar behavioral structures, because both operate by the same basic mechanisms—positive or reinforcing feedback loops, also known in economics as “increasing returns.” The basic positive feedback loop at the core of both subsystems is the following: To create appropriate technology, large investments in research and development (R&D), demonstration, testing, and equipment are needed. Generally speaking, the higher the investments, the better are the results. Thus, increased investments lead to improved R&D, superior demonstration and testing processes, better equipment, and finally, to improved production and products. The higher the quality of the product—assuming appropriate support by marketing and sales—the more products will be sold. When more products are sold, there is more feedback from the market, leading to better product quality and greater profits. Profits then can be reinvested to increase both the quality of equipment (e.g., to lower production costs) and the level of R&D, demonstration, testing, marketing, and sales. Fig. 2 depicts a causal loop diagram of this process.

Fig. 2.

Core reinforcing feedback loop in technology.

Once this wheel is turning, the company or industry operating it can increase its profits and lower its costs, leading to increasing returns (10). Companies or industries that do not manage to create or maintain this cycle for either strategic or financial reasons usually will not remain very long in the market.

Increasing returns, i.e., a state in which a process output grows more than proportionately to the increase in inputs, are particularly common in technology-driven industries (11). The very fact that technology has been profoundly involved in the generation and consumption of energy since the first Industrial Revolution explains the widespread presence of increasing returns and hence their characteristics—multiple equilibria, path dependence, lock-in (rigidity), and possible inefficiency (12)—in the energy system (13).

We now look briefly for the presence of increasing returns in the energy system by identifying their sources. Sources of increasing returns are large set-up or fixed costs, learning effects, coordination effects, and self-reinforcing expectations (12). To generate energy, capital-intensive technology is required at every stage of extraction (oil drilling rigs and platforms), processing (oil refineries, coal-fired power plants, solar cell production plants), transport (intercontinental pipelines, liquefied natural gas supertankers), and delivery (gas station networks, electricity grids), all of which have large and fixed set-up costs. The production and use of technology products and the production of energy generate feedbacks from the production process (e.g., defects in a test production line of solar cells) and from users (customer complaints about noisy wind turbines); these feedbacks can be used to improve the production process and the products themselves (learning effects). Moreover, once customers have purchased a particular technology (e.g., a car with a combustion engine) that uses a certain type of energy (e.g., gasoline or diesel), they and future customers are inclined, or even obliged, to purchase a product using the same technology and associated energy, because there already is a network (e.g., of gas stations) in place to facilitate the use of that particular technology and energy (coordination/network effects). The ensuing prevalence of a certain energy-technology complex (such as the combustion engine car and a network of gas stations) then is reinforced by the belief of consumers, producers, and investors that that type of technology and energy will become even more dominant in the transportation market (self-reinforcing expectations).

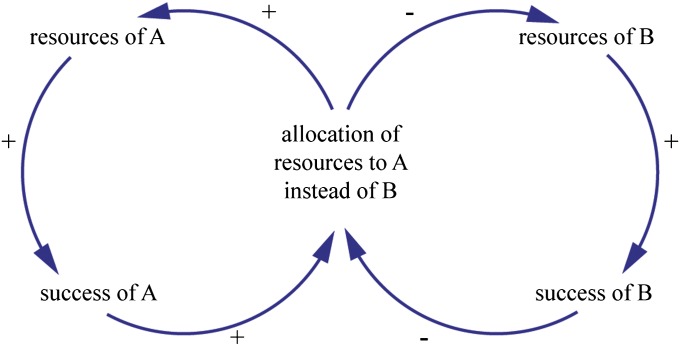

Companies and industries in both the conventional and alternative energy systems fundamentally operate the cycle portrayed in Fig. 2. However, the conventional system has been in place successfully for a longer period of time, and during that period competition for the adoption of technologies by consumers has occurred, for example, among the steam engine, the (electric car) battery, and the combustion engine. Thus, the technology and products of the conventional energy system obviously have built up hardware infrastructures, know-how, and goodwill. The alternative energy system lacks this historically accumulated position. Although both subsystems operate under increasing returns and compete for financial investment capital and the adoption of their technologies by consumers (among other things), the relationship between the conventional and the alternative energy system resembles the systems dynamics archetype of “Success to the Successful” (14). A diagram of this simple but generic and powerful systems-confrontation process is given in Fig. 3.

Fig. 3.

The “Success to the Successful” archetype.

The archetype and its behavior, described by Senge (15) and Braun (16), represent a specific mechanism of increasing returns. The mechanism underlying this archetype is one in which resources are allocated to a party in reward for (initially small) success, resulting in the creation of more success. Because these resources are not allocated to another competing party, a competitor has limited chances of success. It is evident that this mechanism may function as a powerful barrier to change. It initially has multiple equilibria (any competing party could be the first to have the resources allocated), but path dependence (success propagates success, and failure propagates failure) eventually generates lock-in and rigidity. Once a fairly consistent allocation to either A or B has been made over a sufficiently long a period, changing the allocation is virtually impossible because the system has become inflexible and unresponsive to changes in its environment. As Braun (16) notes, “[being] bogged down in this archetype can also lead to the erosion of innovation and change.”

There also is a psychological dimension to industrial lock-in: Private investors and fund managers, in particular, seem to have significant reluctance to direct financial fluxes toward emerging, highly innovative business cases, even if a superior return–risk relationship can be demonstrated for these cases. In practice, the “unfamiliarity gap” proves to be a powerful obstacle to systems transformation.

An example of the “Success to the Successful” paradigm outside the realm of energy and technology is a neuropsychological process in the brain described by Hebb’s Law (17). The more the connections between the neurons in our brain are stimulated, the more powerful they become, thereby facilitating the capacity for repetition of the same stimulus. This stimulus takes place to the exclusion of the activation of other available connections. When the brain starts to develop, the stimulus “makes a choice” among the multiple available connections. This choice is determined by initially minute and stochastic differences among the available options. Later, this self-created heightened capacity functions like a magnet for the stimulus. As time passes, the stimulus more and more automatically takes the path it has taken before: It no longer is naturally inclined to explore alternative available connections which, not having been used, become redundant and disappear, and the old connections between the neurons ultimately die. If neurons are rarely stimulated or not stimulated at all, they lose their synapses (“synaptic pruning”). In this process the neurons that are not needed currently are returned to a so-called “uncommitted state” to support possible future development (18). In other words, the repetitive experience of certain phenomena increases the sensitivity of the brain to re-experience these same phenomena. After a certain period of time the brain can become addicted to specific observations and impressions to the exclusion of alternatives.

The behavioral mechanisms of “Success to the Successful” also surface in the energy system, for example, in the history and current configuration of the conventional energy system. The internal combustion engine currently is the dominant technology that propels cars, and its former competitors, the battery (for the electric car) and the steam engine, have practically disappeared from the market. Despite several attempts at large-scale reintroduction of the electric car (19), the market presence of this vehicle genus remains marginal, and its future is still uncertain because of rigidity in the automobile business (20, 21).

In contrast, when the automobile industry was born in the 1890s, it was a completely open-ended story. The battery, the steam engine, and the combustion motor were all candidates to become the most successful technology in the car market. There are a host of strongly varying reasons—not confined to economic or technological relevance, let alone supremacy—why the combustion engine gained the initial advantages vis-à-vis its competitors that eventually resulted in its market conquest (i.e., the collapse of the multiple-equilibria phase).

An interesting anecdote in this context is the experience of the American Stanley brothers who, in the late 1890s and early 1900s, developed steam cars that functioned just as well as, if not better than, combustion-propelled cars and that, for several years, went faster. The Stanley brothers offered a promising and highly competitive technology but made a fatal mistake by refusing to mass produce cars. In the early phase of the competition between the various car-engine options, this refusal played an important negative role in the proliferation of steam technology (21, 22).

Another enlightening example is given by Cowan and Hulten (22) regarding the introduction of small batteries for starting the automobile and for lighting and ignition, which had just been introduced to gasoline cars. As sales of these new, small batteries took off, there was a corresponding decline in the building of capacities needed for developing advanced batteries that would have enhanced the driving range of electric cars considerably. R&D strategies and investments by battery producers henceforth were focused on the mass production of small batteries that would get a car going but not keep it running.

The more money, energy, and human resources were invested in the development of combustion-based technologies by financial and industrial investors, engineers, and consumers (providing useful feedback), the more combustion-based technologies thrived (path dependence), and the less investment was available for competing technologies.

In parallel, as the sales of cars with combustion engines rose, a network of gasoline stations was created, bit by bit, to supply these cars with fuel. This process established a network effect that increased, and currently still maintains, the rigidity in the automobile market (e.g., oil companies are not switching to building hydrogen stations on a large scale, because they are waiting for manufacturers to mass produce fuel-cell cars—and vice versa).

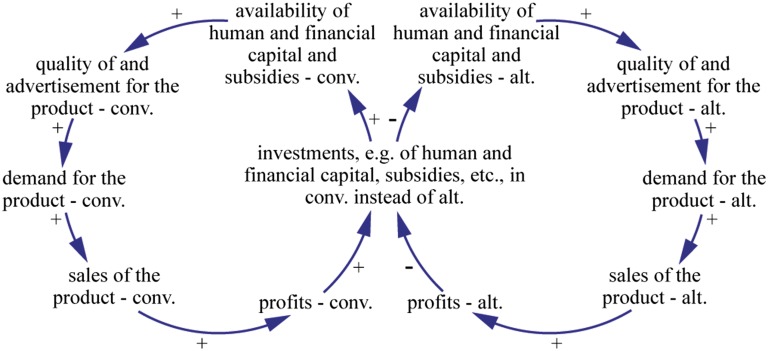

The evolution toward rigidity in evolutionary systems is certainly a prominent feature in the energy-technology market, which is the central topic of this paper. Despite the relatively high repelling power of that market, new technologies such as solar and wind energy schemes are trying to enter and to claim a substantial stake of the entire business field. In Fig. 3, actor A (a conventional energy-technology complex, e.g., oil and the combustion engine) and actor B (another conventional combination, e.g., steam and the steam turbine) have competed. A has won and claimed access to the resources needed, which were readily provided. The linkage between A and its access to resources has taken shape. Now actor C (an alternative energy-technology complex, e.g., solar and wind harvesting combined with advanced batteries for electric cars) seeks to spin up its own positive feedback loop and fights for access to the pertinent resources. This situation, adapted to the parameters of the energy-technology subsystems described earlier, is represented by Fig. 4.

Fig. 4.

“Success to the Successful” competition between conventional (conv) and alternative (alt) energy technologies.

This figure is obviously a highly stylized account of complex reality and therefore does not represent certain other important matters. For example, not all investments lead to purely positive feedback loops; they also may lead to increased organizational bureaucracy (see above). Also, when investments are made, they usually encourage the emergence of institutions with an environment conducive to technology diffusion (23). Furthermore, if the perspective is shifted from supply to demand, then the loops described above also visibly apply to technology adoptions; both loops compete for purchase, employment, and accompanying feedback by consumers.

However, for all its simplicity, Fig. 4 reflects a behavioral structure that has major implications for how the energy system can be biased in favor of alternative energy technology, if need be.

The structure of the chart indicates what happens when pension funds acquire blocks of shares in oil companies or governmental institutions decide to apportion subsidies to coal-related technology (24). Because these bodies know that a good return on their investments depends on the coal industry being successful, such investments feed into a behavioral mechanism that eventually not only locks in the technologies attracting and getting investments but also locks out those that do not. Policymakers aiming to change the status quo of the energy system therefore are faced with taking rather draconian measures, namely, not spreading their subsidies and loans over the different energy technologies—because doing so only reinforces the existing and dominating positive feedback loops—but focusing on those that solve the problems. [In the period 2007–2010, world wide, conventional energy (excluding nuclear) received $495 billion in subsidies, and alternative energy was subsidized with $61 billion, a ratio of 8.1: 1 (25).] The same process applies, mutatis mutandis, to lawmakers seeking to create regulations for overcoming the energy system's predicaments: Problem-causing technologies should be addressed only by prohibitive laws, and problem-relieving technologies should be facilitated by stimulus laws. In the last section of this paper, the link between making changes to a system that exhibits the “Success to the Successful” pattern and international corporate law will be examined further.

The rigidity of the energy system is largely the result of its major feedback loops and is comparable to the stability provided to a bicycle by its spinning wheels (preservation of angular momentum). Increasing returns are important drivers of technology industries and are key to explaining behavioral structures in the energy system, but their presence does not explain everything. For example, where is the exponential growth that increasing returns suggest? And why does the alternative energy system exist at all if the historically built up, and hence currently dominant, success of the conventional energy system works to the detriment of its alternative? These questions are important but can be considered only briefly in this paper.

Even when a positive feedback loop is available and operative in a system, genuinely exponential growth of any kind (e.g., through the adoption of either the conventional or the alternative energy system) may not happen, largely because increasing returns always eventually hit impediments—represented by negative or stabilizing loops—that reduce highly nonlinear growth to gradual development or less (2, 10). These impediments can be many. For instance, a financial crisis and saturation of the market can limit the demand for products; in the latter case initial exponential growth may be followed by stabilizing of market shares and lock-in effects. Also, rising costs caused by scarcity of energy sources or expensive and proliferating bureaucracy can limit profits and therefore reinvestment. These factors all lead eventually to decline in growth. However, as long as these negative feedback loops and other dissipative schemes do not outweigh the positive feedback loops, growth will endure, albeit perhaps not exponentially. To put these considerations in the perspective of the energy discussion above: Most of the growth in the world’s TPES today is in non-Western countries, in the emerging economies of China, India, and Brazil. In July, 2010, China became the largest energy user in the world.

Moreover, the existence of the alternative energy system can be explained by the fact that, despite the presence of a “Success to the Successful” pattern (or perhaps because of it and the thus-provoked political qualms), subsidies are provided to and investments made in startup companies in the alternative energy system—even though it is not certain which of the alternative technologies will “win” and whether the technologies in question will be able to compete with their conventional counterparts. So often conspicuous niches have been created for alternative technologies and energies to experiment and thrive, albeit not ones which are truly independent of what happens in the rest of the energy system. As shown above, it was the alternative energy system that was hardest hit by the financial crisis of 2008. We can consider this situation in terms of resilience theory: Because the technologies of the alternative energy system are still in their late-reorganization and early-exploitation (α-r) phase and therefore still lack the critical mass of their conventional competitors, the alternative energy system is very prone and vulnerable to external perturbations (26).

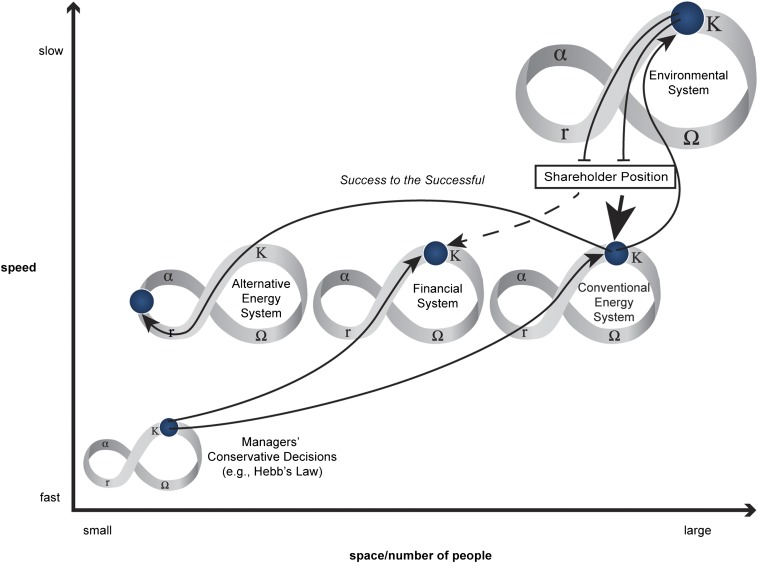

Panarchy in the Energy System

The concepts of adaptive cycles, panarchy, and resilience (26–28) provide additional insight into the dynamics of the energy system. In Fig. 5, we portray the alternative and the conventional energy systems, together with managers’ (conventional) decision-making behavior and the financial and the environmental systems, in a simple panarchical depiction, i.e., in a hierarchical representation of linked adaptive cycles. For the sake of simplicity, the environmental system represents both the climate and the earth’s ecosystems. The horizontal axis represents the size of the system while it cycles through its respective evolutionary phases. That size is expressed either as the space that the system (potentially) uses to operate, or (in social systems) as the number of people that are part of the system. The vertical axis represents the speed with which the system evolves through its respective cycle. The four phases of the adaptive cycle are the reorganization (α) phase, the exploitation (r) phase, the conservation (K) phase, and the release (Ω) phase.

Fig. 5.

Key relationships of the various systems visualized in a panarchy depiction.

In growth terms, we see that expansion of the conventional energy system and its output produced by its generation and use of energy have led to substantial interference with the environmental system (the arrow from the conventional to the environmental system in Fig. 5). As rapidly developing countries such as China and India aggressively pursue the supply and use of conventional energy, which already is severely disturbing atmosphere, oceans, and biosphere, crucial regional ecosystems—and conceivably the global ecosystem as a whole—could be pushed further in the direction of the Ω phase, with possible risks of (adverse) critical transitions (29, 30–33).

The conventional energy system, which appears to be in its characteristically rigid conservation phase (28), expands its operating space through new growth of its existing technologies in developing countries. Thus, as deeper and longer-term investments are made, the conventional energy system becomes less and less flexible, i.e., unable, to adopt energy technologies that deviate from the usual business models in the industry. For instance, in the last decade China reached a construction speed at which it added the equivalent of one (1 GW) coal-fired plant per week so that in 2012 69% of the total operating coal-fired plants was younger than 10 y (34, 35), with write-off periods of more than 30 y. These investments, in turn, increase the conventional energy system's influence on and connection with the environmental system. Because of this increasing connectivity, the feedbacks from the environmental system, such as rising planetary mean temperature and sea levels, also grow heavily and inevitably. However, these feedbacks to the conventional and the financial system are blocked (or delayed) by the lack of effective treaties responding to the problems caused by the conventional energy system, the absence of shareholder liability (the solid-dashed arrows from the environmental system to the conventional and financial system in Fig. 5), and the relegation of the problems to the realm of ‘externalities’ by economic theory.

The financial system, which, like the conventional energy system, focuses on economic efficiency, has exported a substantial portion of its problems to national states (which it evaluates, in turn, through its privately financed credit rating institutions) and appears—notwithstanding a financial crisis—to be at the peak period of its power (36). The system itself has not yet experienced a collapse, i.e. a release phase; its core processes and institutions, reflecting a high degree of connectedness, were barely affected by the financial crisis, and its accumulation of financial resources and power is still untamed (i.e., retains high potential). While the financial system operates in its conservation phase, and, like the conventional energy system, also is driven by, among other factors, conventional (path-dependent) decisions (Hebb’s law, shown in Fig. 5 by the arrows from managers’ conservative decisions to the conventional energy system and the financial energy system), it does not incur the negative consequences of its conventional energy and technology investments because the shareholder construction (with absence of liability for the shareholder) also safeguards the financial system (e.g., capital investment funds that push conventional energy companies to maintain their profitability by continuing their existing fossil focused business model).

The nascent alternative energy system now appears to be in transition between a late-reorganization phase and an early-exploitation phase: Networks of consumers and suppliers and hardware infrastructures still need to crystallize and become coherent (i.e., they now exhibit low connectedness), and efficiency is still relatively low compared with the conventional energy system. As far as the production processes and the technology itself are concerned, not enough outputs and impacts are created to disturb the conventional energy system. Even though the implementation of alternative energy technology is absolutely necessary to combat the problems mentioned above, it is clear that, if that alternative system grows, becomes more coherent, and gains critical mass, its negative influence on and disturbance of the environmental system may be bigger than now anticipated. The history of technology substitution is full of pertinent lessons: e.g., the replacement of the horse and carriage, which was responsible for massive manure on city streets, by the automobile. The environmental problems caused by the latter are now about to overwhelm entire societies.

To sum up, the conventional energy system with its supercritical mass, facilitated by the financial system, expands, increasing its influence on the environmental system. The alternative energy system, still lacking critical mass, also appears to expand but does so very slowly, hindered by the presence of the “Success to the Successful” pattern (shown by the arrow from the conventional to the alternative energy system in Fig. 5). The alternative energy system does not yet have the power to replace the conventional energy system or to disrupt the conventional energy system’s tight and damaging relationship with the environmental system (i.e., the climate and the earth’s various ecosystems).

Kondratiev Cycles and the Adaptive Cycle

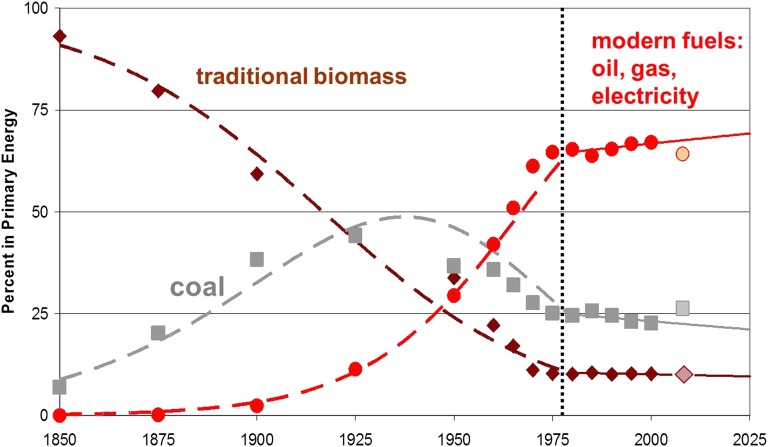

As explained above, as far as the various market shares of the important primary energy-supply sources are concerned, the development of the world energy system appears to be in a state of stagnation and rigidity. Stasis in the energy system is rare and actually did not occur in the period from the beginning of the first Industrial Revolution until the 1970s. In former times the technologies dominating the energy system would have shown the dynamics of saturation and change, leading to substitution at a fast rate (37, 38). Fig. 6 displays the conspicuous inertia of the relative market shares of the traditional biomass fuels (indicated in brown), coal (in gray), and the modern energy forms such as oil, gas, and electricity (in red) that emerges in the early 1970s.

Fig. 6.

Structural changes in world primary energy supply, 1850–2025. (Image courtesy of ref. 9).

The replacement of the dominant energy technology usually begins in the saturation phase of its diffusion process, which coincides with the upper turning point of the corresponding economic Kondratiev long-wave. This stage can be likened to the late conservation release (K–Ω) phase of the adaptive cycle (39). The dominant technology saturates the maturing energy system, the demand for its products reaches its limits, its environmental fit worsens, and eventually the associated techno-economic paradigm meets its boundaries of societal acceptance (37). As can be seen in Fig. 6, in contrast to the preceding 120 y in which coal replaced wood and then modern fuels (predominantly oil) replaced coal, there currently is no development in the energy system that suggests any collapse of the incumbents’ market shares (8, 9). The apparent slowing of the dynamics may be related to incipient critical transitions and their early warning signals, because the fundamental reduction of dynamics of change in a system (e.g., eigenvalue approaching zero) is a typical indicator of a possible upcoming catastrophic state shift (31, 40, 41); however, that interesting topic is beyond the scope of this paper.

Some previous Kondratiev cycles and the industrial revolutions associated with them disturbed the existing dominant pattern of the generation and use of energy and resulted in the replacement of the previously dominant energy technology [e.g., the steam-technology paradigm was replaced by the oil-based–technology paradigm (42)]. However, in the latest Kondratiev revolution [i.e., the technological breakthrough of information technology (IT)], no such challenging of the existing energy-technology structure appears to have occurred. Indeed, the IT revolution may have reinforced rather than disturbed the existing patterns of energy production and use. Software and computers provide the incumbent power and fuel industries with the tools to improve their technologies and make them more efficient than competing schemes. The same tools are available to the alternative energy technologies, of course, but to a lesser extent, because they cannot afford so much investment. Thus, the IT wave appears to have had a considerable smothering effect on the replacement of the dominant technology in the energy system, because the implementation ripples from that wave did not require or enforce a fundamental change in the conventional patterns of the energy business but rather reinforced them. However, once the alternative energy technologies accumulate critical mass by attracting financial capital and market penetration, that smothering effect will evaporate, because the alternative system will be able to make deep IT investments to optimize their production processes.

Although the process of energy technology substitution halted and moved into an apparent phase of stasis some decades ago, the Kondratiev dynamics of macro-socioeconomic development did not. The IT revolution eventually turned into an IT bubble that burst and hit the global financial system. The occurrence and timing of the current financial crisis period, similar to the release (Ω) phase of the adaptive cycle (26), matches the pattern of Kondratiev periodicity (23, 42). The crisis period starting around the turn of the millennium certainly is not over yet and opens opportunities to implement fundamental changes in our socioeconomic structures, because systems innovations tend to be children of crises.

The history of these technological revolutions tells us that the power of financial institutions is diminished temporarily during a deep crisis, making it much easier to pass and implement new regulations and laws in such a period (23). Although the current financial turmoil is not caused by or related directly to energy generation and consumption problems, the powerful conventional energy system is still in its detrimental conservation phase, as discussed above. Thus, this particular time and situation may be used to create new regulations that can prevent or combat full-blown crises in the environmental system, the energy system, and—beyond this paper's scope—the world food system (because the energy and food systems are intimately connected by the growing world population, among other factors). So, one rather serious crisis may help mitigate several more disastrous ones.

The analysis and the subsequent suggestion for intervention that we provide in the last section, although apparently applicable to all crises, are limited to the current financial crisis and to the explanation of the energy system's rigidity. The suggestion is intended to start a discussion about establishing a structure for self-inflicted, small, systems-level crises via permanent feedback in order (i) to shorten the often damaging late-conservation phase of the dominant subsystem (in this case, the conventional energy system) and (ii) to prevent an unsustainably delayed growth (r–K) phase of competing smaller systems (in this case, the alternative energy system). Accomplishing these goals entails an even greater benefit: an increase in the resilience of the whole system and the prevention of a release phase (collapse) on a systems-wide level from which the entire complex or some of its vital components might not recover to a life-sustaining regime [i.e.; the so-called “critical transition” (29)].

In addition to the change-impeding elements we discussed above, the role of shareholders, who naturally focus on a constant and predictable flow of short-term profits and on efficiency, makes it difficult to shift toward an energy system dominated by alternative energy, because new technologies demand investments for which returns are uncertain and initially never are more efficient than fully developed technologies. The shareholders’ role has two aspects: the shareholders’ increased power and their general lack of responsibility because of the absence of liability.

Increased Power for Shareholders

Since the early 1990s there has been a gradual shift of power in corporate governance, particularly in Europe, away from corporate boards and toward shareholders. In many countries the legal structures of corporate law protecting companies from hostile takeovers have been widely criticized (43–45), and regulations have come into effect changing corporate law to give shareholders the power to have anti-takeover measures rescinded under certain conditions (e.g., the 13th Directive 2004/25/EC on takeover bids). Regulators and companies also have been pressured to abandon the two-tier structure, common in large corporations with continental European legal roots [Rhine Capitalism; see Albert (46)], under which shareholders cannot appoint or dismiss the board, and to move to the Anglo-Saxon one-tier structure that grants shareholders those powers (47, 48).

This trend toward the abolition of anti-takeover measures was fired by the frenzy over stock trading, particularly IT-related stocks, during which profits could be generated virtually instantaneously. With the advent of the IT revolution, in many Western economies financial institutions (e.g., banks, financial investors, and stock markets) heavily involved in trading IT stock became more powerful (42). They saw anti-takeover measures as a bar to trading and an undesirable limitation of their power. Because the corporate boards of poorly performing companies could not be replaced instantly, these measures were said to reduce companies' financial value and the value of their stock.

The trend toward greater shareholder control also was fueled by scandals taking place in corporations (e.g., Enron in the United States and Ahold in the Netherlands). In both cases the company management (or its gatekeepers, such as auditors, analysts, debt-rating agencies, and attorneys) were mainly held responsible for the financial disasters (49–54). In the Enron case, in particular, the consequences were dire, because many former employees lost their pension savings. Lawmakers responded not only by making anti-takeover measures harder to implement but also by passing laws requiring greater transparency and accountability in corporate governance so that no one, including board members, could shirk their responsibilities. An example was the 2002 Sarbanes-Oxley Act in the United States, which, because it is applicable to all companies doing business with United States companies, has had a worldwide effect. Soon other countries followed suit. However, the role of shareholders and the pressure put on corporate boards by shareholders and stock markets to generate massive profits were not discussed publicly.

Thus, in the last two decades, while the problems generated by the energy system became more visible to the general public and received political and legal attention expressed through efforts to set up international treaties to combat climate change, shareholders, with their focus on short-term interests and predominantly maintaining and renewing investments in conventional energy in lieu of alternative-energy investments (9), accrued more power. We now discuss the shareholder position and provide a suggestion that may make both the shareholder position and, as a consequence, the energy system as a whole more sustainable.

Lack of Liability and Changing the Rules of the Game

As discussed above, the present lingering financial-economic crisis probably is a time at which reform measures to create a genuinely sustainable business environment may stand a chance of being implemented. If so, then, in addition to international treaty initiatives to curb environmental problems such as CO2 emissions, the introduction of an appropriate and powerful endogenous mechanism is advisable in both the energy system and the financial system. The mechanism we suggest would cause the actors and institutions playing a key role in energy-technology investments and the governments that subsidize public authorities (such as utilities) to counteract the detrimental consequences of both unlimited nonlinear growth and rigidity and to move away from that destructive path. The lack of such a mechanism has been a core problem since the first Industrial Revolution. For an explanation of this deficiency and of how to remove it, we need to consider the backbone of corporate law, i.e., the structure and the origin of the corporation.

The basic structure of a corporation or company, private or public, involves the setting up of a legal vehicle with legal personality, through and on behalf of which the directors (and sometimes other employees) can act. The directors normally cannot be held personally liable for their actions or omissions on behalf of the company.

Moving a step further into corporate law, we observe that a company is owned by its shareholders. If the shareholders have established the company, they normally must pay a fixed amount of capital (set by national regulation) that eventually must be provided in full. The purpose of this capital is to serve as minimal insurance for the company creditors. If shareholders have not established the company themselves, they generally must pay a portion of the value of the company to acquire share ownership. Thus, the shareholders have a limited liability: Their financial risk extends only to the amount they paid for their shares if the company ceases operating. Like the company directors, shareholders normally cannot be held personally liable for the actions taken or omitted by the company.[In rare and very specific cases, the shareholders (or the directors) of the company can be held liable (e.g., if a company was established for fraudulent purposes); in such cases one speaks of “lifting” or “piercing the corporate veil. This liability occurs particularly in the case of small companies (55).]

As company owners, shareholders can appoint, or influence the appointment of, the directors (now usually called “chief executive officers,” CEOs), who, following agency theory, are agents of those shareholders and are obliged to observe their fiduciary duties, taking care of the interests of the shareholders. The shareholders also must be consulted if the directors plan to change the structure or strategy of the company in any significant way. Through voting power the shareholders thus have significant influence on the company’s actions. Thus shareholders take financial risks by paying for shares and in return get power in the form of rights conveying influence—a balanced and legally objective system.

Or so the general legal-economic story goes. However, lacking from this narrative is the fact that shareholders not only risk losing their investment but also “risk” increasing the value of that investment. These risks are then in economic balance. As we saw above, however, such an equilibrium state does not exist in the corporate legal realm: The jurisdictional counterweight of shareholder’s rights, i.e., shareholder’s obligations and liabilities (apart from the obligation to pay for acquiring share ownership and specific cases in which the corporate veil is lifted) generally does not exist. In other words, what often is considered a well-balanced legal-financial construction has an asymmetric and unbalanced foundation.

The specific legal-financial framework thus grants sweeping power to the shareholders, who invest in, influence, and determine (through the pressure of the demand for immediate profits) the course of the company but actively blocks feedback to the stockholders from any system that is or may be affected by the company’s decisions and actions. In other words: the positive investment-feedback loop is facilitated, and potentially stabilizing feedback loops that could confine unsustainable runaway dynamics are blocked.

In this context, it is instructive to look at the origin of the first public corporation ever established (in 1602), the Vereenigde Oostindische Compagnie (VOC, in English, the Dutch East India Company). Its owners neither wished nor expected to be confronted with the legal consequences of the actions and omissions of the economic entity in which they invested. In fact, they were not supposed to bear these consequences—these were colonial times. In an era when Europeans were discovering the existence of entire continents, the world appeared to have an endlessly receding horizon, and the indigenous people of the colonies were not necessarily considered important, let alone equal. In other words, when the shareholder company structure was formed, there was little reason to take into account a rationale for stabilizing feedback mechanisms.

The parallels between the VOC period and current times cannot be overlooked. Then and now, companies serve as legal vehicles for generating immediate profits for shareholders and allowing investors to reap the benefits of expansion (precious spices such as pepper, nutmeg, and cloves from colonies in the past; oil, coal, gas, and uranium from friendly powers at present) without being confronted with the consequences of such harvesting dynamics. This historical perspective alone should suffice for reconsidering, at least, the assumption that the international financial make-up, with the structure of the shareholder company as its backbone, is the perfect example of an “unquestionable” system (56). It shows the expansion through time of a legal structure, which came into being under very specific (colonialism) and still open circumstances (i.e., the shareholder construction was still new and adjustable, without path dependence). What was logical and useful then is not necessarily logical and useful now, and adjustability has been replaced by rigidity.

In the wider legal universe, ownership of any kind generally encompasses not only entitlements but also liabilities: There are property duties as well as property rights. A simple example is house ownership: the owner is obliged to maintain his/her building so that it does not cause damage to others (e.g., a chimney falling on a passer-by would constitute liability and enforce compensational payments). However, as some argue, although a house has no will of its own and is normally under the control of its owner or tenant, the situation is different for companies. Even though the shareholders own the company and influence decisions concerning it, the directors or managers are assumed to make judicious and independent decisions on its behalf. Following this line of reasoning, however, the broader legal system provides a helpful analogical remedy. In the case of the house owner, even if the building is let to a third person (i.e., the house is not under direct control of the owner), the proprietor normally remains liable for damages such as those caused by the collapsing chimney. If one owns an entity, one normally is responsible for the consequences of events resulting from that ownership, however remote or incomplete the control.

In contrast, if a modern company pollutes the environment, the shareholder has no direct legal obligations and is not even obliged to prevent the company’s management from polluting or to mitigate the damage or to stop polluting completely. As a result of the absence of shareholders’ obligations, for a shareholder the only economic consequences related to the operation of the company are a chance of profit and a risk of loss expressed in the financial value of shares and the amount of dividend the company distributes.

For legal and logical consistency, and because the shareholders strongly influence, if not fully determine, the strategy and the operation of the business based on their rights, it seems expedient to oblige investors to exert their power in such a way that the company does not cause damage to third parties or public goods. Should these obligations not be met, liability should ensue automatically. In other words a legal negative feedback loop establishing shareholder liability should balance the shareholders’ zest for unrestricted expansion (Fig. 5).

If such unlimited liability were established under general prevailing norms of tort law, there are no grounds for assuming that shareholder investment would be discouraged (excluding firms that impose net costs on society) or for supposing that such liability would create insurmountable obstacles to judicial administration (57).

As discussed above, shareholders' power has increased in the last decades as a result of various regulatory changes. Also, with the help of novel IT facilities, the financial markets and shareholders now move trillions of dollars and Euros for investment and disinvestment around the globe daily, just by clicking electronic mice (58, 59). In essence, although the shareholders have become almost omnipotent, their responsibility for the actions of the company they own has not caught up.

If we attempt to place this situation in a perspective unifying the concepts of self-organization (cybernetics) theory (60, 61), the adaptive cycle (26), panarchical dimensions (27), and process ecology (62), we observe the following. If a system has reached maturity (conservation or K phase) after an evolutionary competitive battle that required emphasis on efficiency and the removal of redundancy, it exhibits the propensity to become rigid and powerless to respond to the changes in and needs of its environment, entailing the risk that the system, its environment, or both, will collapse. Information flowing between the system and its environment generally allow each to accommodate to the other, increasing the resilience of the conglomerate of systems (i.e., the whole system under consideration). In the conventional energy system, corporate law, through the exclusion of liability, precludes the feeding back of information from the environment to company shareholders. Thus, this subsystem is prevented from adapting to environmental signals. The in-built tragedy of systems in their conservation phase follows rigorously from their dominance, which implies both rigidity and destructiveness to their context and thus, finally, to themselves. That tragedy can be defused only by allowing moderating feedbacks between the system and its context in the spirit of coexistence. Younger subsystems normally are much smaller and more adaptive and therefore less destructive toward their environment. Genuine shareholder liability would solve this dilemma even for a mature corporation: If the company does not cause major damage, its shareholders will have nothing to fear—and vice versa.

Let us emphasize that successful systems (companies or entire industries) do not necessarily behave in ways that are damaging to their environment. However, as they continually grow, their adaptive capacities generally decrease, and the damage they may inflict on their environment escalates. This propensity implies that introducing shareholder liability may discourage investment in certain companies or industries at an earlier point in their evolution than at present, i.e., as soon as damaging effects become foreseeable or even observable. Today, the underlying structural mismatch between corporations and their environment often becomes visible only when companies run out of economic reasons for existence, i.e., when the endgame is played.

The mismatch in question is especially conspicuous in the energy system and its specific relationship between the shareholders' legal position and the production of negative side-effects (e.g., through deep-sea or polar drilling for oil). The relationship is damage-sustaining in that (i) it conserves capital flows and vested interests in industries that are proven to be damaging and (ii) liability is expressly excluded. It also is damage-increasing by facilitating additional/new capital flows into unsustainable industries. Or, to put it in systems dynamics terms, shareholder power and production of negative side-effects by the energy system are positively related. This relationship has its origin in the seemingly neutral and objective system of corporate law applied worldwide. To reduce the problems inherent in the energy system, reconfiguring this relationship is essential.

As long as no negative feedback is allowed to reach and affect shareholders, they will neither reallocate their investments nor move the management of the company that they own away from the drive for constant and immediate profits and to alternative purposes. For example, shortly after the nuclear disaster at the Fukushima Daiichi plant of Tokyo Electric Power Company Inc., several governments and investors announced that they would continue to fund the development of atomic energy [see, for example, Japan’s expression of commitment to nuclear power (63)]. Note also that on April 20, 2011, 1 y after the explosion at the Deepwater Horizon platform in the Gulf of Mexico, the New York Stock Exchange value of British Petroleum reached again $45.91 per share, a recovery of more than 69% after its low of $27.07 per share on June 25, 2010 (64). Accidental developments evidently do not have system-transforming power by themselves.

However, if shareholders had clear-cut liabilities and had to consider these responsibilities in all their activities, would there still be massive investments in CO2-producing and polluting coal-fired power plants or, indeed, in any technologies that clearly create extensive damage? By restoring the balance of rights and obligations in the currently asymmetrical legal framework for corporations, the “Success to the Successful” pattern can be disturbed creatively, and shareholders will have good reasons to reallocate their investments to more sustainable ventures.

Given the central position of corporate law in the financial system and the energy system, policymakers who strive to break away from destructive energy business-as-usual practices might find it worthwhile to address the fundamental asymmetries noted in this paper. Modification of the corporate law system—in addition to the creation of laws prohibiting damaging energy production and consumption—appears to be unavoidable.

Footnotes

Conflict of interest statement: The research conducted by A.T.C.J.D. for this article was partly funded by Shell Research Foundation and Nuon Energy. The views expressed in this article do not necessarily reflect the views of Shell Research Foundation and Nuon Energy.

See Commentary on page 2436 in issue 7 of volume 110.

*The essential difference with the commonly used Matthew effect (i.e., “the rich get richer and the poor get poorer”) lies in the wording “in his hand.” Quispel (1) explains that at the time of writing of the Gospel of Thomas the phrase “to have in your hand” had a particular meaning in Coptic: that one was willing to give away, to let go of what one possessed. The Matthew effect represents unlimited, runaway growth or decline, whereas the statement from the Gospel of Thomas incorporates stabilizing behavior, which, if not used, will be succeeded by runaway decline.

References

- 1.Quispel G. Het Evangelie van Thomas. Amsterdam: In de Pelikaan; 2005. p. 380. [Google Scholar]

- 2.Meadows DH, Meadows DL, Randers J, Behrens WW. The Limits to Growth. New York, NY: Universe Books; 1972. [Google Scholar]

- 3.Williams J, editor. Carbon Dioxide, Climate and Society; Proceedings of a IIASA Workshop, February 21–24, 1978. Oxford, UK: Pergamon; 1978. [Google Scholar]

- 4.German Advisory Council on Global Change (WGBU) Flagship Report. Berlin: WBGU; 2011. World in transition. A social contract for sustainability. [Google Scholar]

- 5.Mitchell C, et al. Policy, financing and implementation. In: Edenhofer O, et al., editors. IPCC Special Report on Renewable Energy Sources and Climate Change Mitigation. Cambridge, UK: Intergovernmental Panel on Climate Change; 2011. [Google Scholar]

- 6.International Energy Agency . Key World Energy Statistics 2012. Paris: IEA; 2012. [Google Scholar]

- 7.International Energy Agency . World Energy Outlook 2009 Fact Sheet. Paris: IEA; 2009. [Google Scholar]

- 8.Smil V. Energy Transitions: History, Requirements, Prospects. Santa Barbara, CA: Praeger; 2010. p. 178. [Google Scholar]

- 9.Grübler A, et al. Policies for the Energy Technology Innovation System (ETIS) 2012. Global Energy Assessment - Toward a Sustainable Future, ed International Institute for Applied Systems Analysis (IIASA, Cambridge, UK). Chap 24.

- 10.Sterman J. Business Dynamics: Systems Thinking and Modeling for a Complex World. Boston: Irwin/McGraw-Hill; 2000. p. xxvi. 982. [Google Scholar]

- 11.Arthur WB. Increasing returns and the new world of business. Harv Bus Rev. 1996;74(4):100–109. [PubMed] [Google Scholar]

- 12.Arthur WB. In: Self-Reinforcing Mechanisms in Economics. The Economy as an Evolving, Complex System, Studies in the Science of Complexity. Anderson P, Arrow K, Pines D, editors. Reading, MA: Addison Wesley; 1988. pp. 9–31. [Google Scholar]

- 13.Unruh G. Understanding carbon lock-in. Energy Policy. 2000;28(12):817–830. [Google Scholar]

- 14.Dangerman ATCJ, Grössler A. No way out?–Analysing policy options to alleviate or derail success-to-the-successful in the energy system. In: Lyneis JM, Richardson GP, editors. Systems Dynamics Conference 2011. Red Hook, NY: Curran Associates; 2011. pp. 750–766. [Google Scholar]

- 15.Senge PM. 1990. The Fifth Discipline: The Art and Practice of the Learning Organization (Doubleday/Currency, New York) 1st Ed, pp viii, 424.

- 16.Braun W. The system archetypes. The Systems Modeling Workbook. 2002. Available at http://wwwu.uni-klu.ac.at/gossimit/pap/sd/wb_sysarch.pdf.

- 17.Hebb DO. The Organization of Behavior: A Neuropsychological Theory. New York: John Wiley & Sons; 1949. [Google Scholar]

- 18.Webb SJ, Monk CS, Nelson CA. Mechanisms of postnatal neurobiological development: implications for human development. Dev Neuropsychol. 2001;19(2):147–171. doi: 10.1207/S15326942DN1902_2. [DOI] [PubMed] [Google Scholar]

- 19.Pogue D. (March 19, 2009) Electric cars for all! (no, really this time). The New York Times. Available at http://www.nytimes.com/2009/03/19/technology/personaltech/19pogue-email.html?8cir=&emc=cira1&pagewanted=print.

- 20.Andersen PH, Mathews JA, Rask M. Integrating private transport into renewable energy policy: the strategy of creating intelligent recharging grids for electric vehicles. Energy Policy. 2009;37(7):2481–2486. [Google Scholar]

- 21.Hård M, Jamison A. Alternative CARS: The contrasting stories of steam and diesel automotive engines. Technol Soc. 1997;19(2):145–160. [Google Scholar]

- 22.Cowan R, Hulten S. Escaping lock-in: The case of the electric vehicle. Technol Forecast Soc Change. 1996;53(1):61–80. [Google Scholar]

- 23.Perez C. The financial crisis and the future of innovation: A view of technical change with the aid of history. Technology Governance and Economic Dynamics. 2010;28:42. [Google Scholar]

- 24.Storchmann K. The rise and fall of German hard coal subsidies. Energy Policy. 2005;33(11):1469–1492. [Google Scholar]

- 25.International Energy Agency . World Energy Outlook 2011. Paris: IEA; 2011. [Google Scholar]

- 26.Holling CS, Gunderson LH. Resilience and adaptive cycles. In: Gunderson LH, Holling CS, editors. Panarchy: Understanding Transformations in Human and Natural Systems. Washington, DC: Island; 2002. pp. 25–62. [Google Scholar]

- 27.Holling CS, Gunderson LH, Peterson GD. Sustainability and panarchies. In: Gunderson LH, Holling CS, editors. Panarchy: Understanding Transformations in Human Natural Systems. Washington: Island; 2002. pp. 63–102. [Google Scholar]

- 28.Walker BH, Salt DA. Resilience Thinking: Sustaining Ecosystems and People in a Changing World. Washington, DC: Island; 2006. [Google Scholar]

- 29.Scheffer M. Critical Transitions in Nature and Society. Princeton, NJ: Princeton Univ Press; 2009. [Google Scholar]

- 30.Intergovernmental Panel on Climate Change . Climate change 2007: Impacts, adaptation and vulnerability: contribution of Working Group II to the Fourth Assessment Report of the Intergovernmental Panel on Climate Change. In: Parry ML, Canziani OF, Palutikof JP, van der Linden PJ, Hanson CE, editors. Climate Change 2007. Cambridge, UK: IPCC; 2007. [Google Scholar]

- 31.Lenton TM, et al. Tipping elements in the Earth’s climate system. Proc Natl Acad Sci USA. 2008;105(6):1786–1793. doi: 10.1073/pnas.0705414105. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 32.Barnosky AD, et al. Approaching a state shift in Earth’s biosphere. Nature. 2012;486(7401):52–58. doi: 10.1038/nature11018. [DOI] [PubMed] [Google Scholar]

- 33.Rockström J, et al. A safe operating space for humanity. Nature. 2009;461(7263):472–475. doi: 10.1038/461472a. [DOI] [PubMed] [Google Scholar]

- 34.Ansolabehere S, et al. The Future of Coal: An Interdisciplinary MIT Study. Cambridge, MA: Massachusetts Institute of Technology; 2007. [Google Scholar]

- 35.International Energy Agency . CCS Retrofit: Analysis of the Globally Installed Coal-Fired Power Plant Fleet. France: IEA, Paris; 2012. [Google Scholar]

- 36.Dore R. Financialization of the global economy. Ind Corp Change. 2008;17(6):1097–1112. [Google Scholar]

- 37.Grübler A, Nakicenovic N. 1991. Long Waves, Technology Diffusion, and Substitution (International Institute for Applied Systems Analysis, Laxenburg, Austria), pp. 313–342.

- 38.Grübler A. 2008. Energy transitions. Encyclopedia of Earth, ed Cleveland C (Environmental Information Coalition, National Council for Science and the Environment, Washington, DC)

- 39.Allison HE, Hobbs RJ. 2004. Resilience, adaptive capacity, and the “lock-in trap” of the Western Australian agricultural region. Ecology and Society 9(1):3.

- 40.Scheffer M, et al. Early-warning signals for critical transitions. Nature. 2009;461(7260):53–59. doi: 10.1038/nature08227. [DOI] [PubMed] [Google Scholar]

- 41.Lenton TM. Early warning of climate tipping points. Nature Climate Change. 2011;1(4):201–209. [Google Scholar]

- 42.Perez C. Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages. Cheltenham, UK: Edward Elgar Publishing; 2002. p. xix. 198. [Google Scholar]

- 43.DeAngelo H, Rice EM. Antitakeover charter amendments and stockholder wealth. J Financ Econ. 1983;11(1-4):329–360. [Google Scholar]

- 44.Jarrell GA, Poulsen AB. Shark repellents and stock prices: The effects of antitakeover amendments since 1980. J Financ Econ. 1987;19(1):127–168. [Google Scholar]

- 45.Ryngaert M. The effect of poison pill securities on shareholder wealth. J Financ Econ. 1988;20:377–417. [Google Scholar]

- 46.Albert M. Capitalism Against Capitalism. London: Whurr; 1993. [Google Scholar]

- 47.Asser C, Maeijer JMM, Van Solinge G, Nieuwe Weme MP. 2009. Rechtspersonenrecht: De Naamloze en Besloten Vennootschap (Kluwer, Deventer, The Netherlands) 3rd Ed, p. 1155.

- 48.Mantel LM, Overkleeft FGK. De Toelaatbaarheid van Beschermingsconstructies bij Beursvennootschappen. Vennootschap & Onderneming. 2009;19(10):195–202. [Google Scholar]

- 49.O'Connor MA. The Enron Board: The perils of groupthink. Univ Cincinnati Law Rev. 2003;71:1233–1471. [Google Scholar]

- 50.De Jong A, DeJong DV, Mertens G, Roosenboom P. Belgium: European Corporate Governance Institute, Brussels; 2005. Royal Ahold: A failure of corporate governance. Available at https://papers.ssrn.com/sol3/Delivery.cfm/SSRN_ID663504_code254274.pdf?abstractid=663504&mirid=1. [Google Scholar]

- 51.Smit J. Het Drama Ahold. Amsterdam, The Netherlands: Balans; 2004. [Google Scholar]

- 52.Gordon JN. What Enron means for the management and control of the modern business corporation: Some initial reflections. Univ Chic Law Rev. 2002;69:1233. [Google Scholar]

- 53.Coffee JC., Jr What caused Enron—a capsule social and economic history of the 1990s. Cornell Law Rev. 2003;89:269–309. [Google Scholar]

- 54.Coffee JC., Jr Understanding Enron: It's about the gatekeepers, Stupid. Business Law. 2001;57:1403–1420. [Google Scholar]

- 55.Boyd CL, Hoffman DA. Disputing limited liability. Northwest Univ Law Rev. 2010;104(3):853–916. [Google Scholar]

- 56.Blankenburg S, Plesch D, Wilkinson F. Limited liability and the modern corporation in theory and in practice. Camb J Econ. 2010;34(5):821. [Google Scholar]

- 57.Hansmann H, Kraakman R. Toward unlimited shareholder liability for corporate torts. Yale Law J. 1991;100(7):1879–1934. [Google Scholar]

- 58.Capra F. The Hidden Connections. London: HarperCollins; 2002. [Google Scholar]

- 59.Castells M. Information Technology and Global Capitalism. In: Hutton W, Giddens A, editors. Global Capitalism. New York: The New Press; 2000. pp. 52–74. [Google Scholar]

- 60.Ashby WR. Requisite variety and its implications for the control of complex systems. Cybernetica. 1958;1(2):83–99. [Google Scholar]

- 61.Heylighen F. 2001. The science of self-organization and adaptively. The Encyclopedia of Life Support Systems 5(3):253–280.

- 62.Ulanowicz RE. A Third Window: Natural Life Beyond Newton and Darwin. West Conshohocken, PA: Templeton; 2009. p. 196. [Google Scholar]

- 63.Kubota Y. (May 8, 2011) Japan “committed to nuclear power” despite shutdown. Reuters Edition: UK. Available at http://uk.reuters.com/article/2011/05/08/uk-japan-nuclear-idUKTRE74610X20110508.

- 64.Bloomberg LP. 2011. Interactive stock chart for BP PLC (BP), in Market Data (Bloomberg LP, New York, NY)