Abstract

Retail clinics have rapidly become a fixture of the United States health care delivery landscape. In our analyses of trends in retail clinic utilization, we find there has been a four-fold increase in retail clinic visits between 2007 to 2009, with an estimated 5.9 million retail clinic visits in 2009. Compared with the period from 2000–2006, in the period from 2007–9 retail clinic patients are now more likely to be greater than 65 years old (18.9 percent vs. 7.8 percent) and preventive care, in particular the influenza vaccine, has become a larger component of their care (47.5 percent vs. 21.8 percent of visits). Across all retail clinic visits, 44.4 percent are on the weekend or on the weekdays when physician offices are typically closed. Retail clinics appear to be meeting a need for convenient care, in particular during times when physician offices are not open.

Retail clinics are ambulatory clinics located in stores such as pharmacies or grocery stores. Their focus is on convenience; they do not require an appointment and are open in evenings and weekends. Since their beginnings, they have been controversial; the American Medical Association, the American Academy of Family Physicians, and the American Academy of Family Practitioners have all spoken out against them. Some of the concerns about retail clinics that these organizations have voiced include their potential to disrupt patients’ relationships with their primary care physicians and to interrupt continuity of care.1–4 The concerns of the professional organizations increased1 in 2010 when some retail clinic operators began offering care for chronic illnesses such as asthma, hypertension, and diabetes.5

In an earlier paper we examined care provided in retail clinics between 2000 and 2006.6 We found that the scope of care was limited to common acute ailments, such as upper respiratory or urinary tract infections, and simple preventive care. Furthermore, the most common retail clinic patient was a young adult without a primary care physician (PCP)6. There have been notable changes in the retail clinic industry since 2006. Beyond increasing their scope of care, some retail clinic operators have developed partnerships with integrated delivery systems such as the Cleveland Clinic and Allina Health.7 This has also been a period of rapid growth. Since the beginning of 2007 to the end of 2010, the number of retail clinics increased from approximately 300 to almost 1200.8 The role of the retail clinics may change once again once the Affordable Care Act is fully implemented. It is widely expected that the implementation of this law will lead to a shortage in primary care providers, which may increase the demand for retail clinics.

There has been no detailed study of the retail clinics at a national level since our earlier paper. In this paper, we describe trends in retail clinic use, socio-demographic characteristics of patients who visit retail clinics, and reasons for which patients visit retail clinics. These empirical data about the changing role of the retail clinics in the US healthcare system provide a basis for the continuing policy debate surrounding retail clinics.

Methods

Visits to Retail Clinics

We obtained de-identified clinic data from 2007–2009 from the three largest retail clinic operators in the United States: MinuteClinic, TakeCare, and LittleClinic. Together these clinics operate 81 percent of the retail clinics in the United States.8 These data, which come from their electronic medical records and billing records, include information on the patient’s gender, age in years, method of payment for the visit, whether the patient had a PCP, and the reason for visit or diagnosis. Not all retail clinic companies could provide data on all requested data elements. We exclude visits with missing data from the relevant analyses and note when this is the case.

The primary ICD-9 diagnosis code was available for each visit. Based on this code we classify the visits into the following categories: upper respiratory infection (460, 465), sinusitis (461,473), bronchitis (490, 466), otitis media (381, 382, 388.7), otitis externa (380), pharyngitis (462, 463, 034), conjunctivitis (372), urinary tract infection (599, 595), allergies (477), immunization (V03–V06), and other preventive care such as sports physicals and screening tests (V01, V70, V72, V29–39, V73–V82). We identified visits for 4 highly prevalent chronic illnesses using the following codes: asthma (493.0–493.9, 519.11), diabetes mellitus (250.0–250.9), hypertension (401.0–405.9), and chronic obstructive pulmonary disease (COPD) (491.0–491.9, 492.0–492.9, and 496.0–496.9).

We compare the characteristics of these visits to those of our earlier study of retail clinic visits.6 The data for that study came from eight of twenty-four known retail clinic companies which accounted for 74 percent (326 of 441) of the clinics in operation as of 1 July 2007. The companies provided data on visits from a clinics’ inception to early 2007. Since the year of visit was not always recorded, we could not always eliminate visits in 2007. As a result, a few visits that we describe as being from 2000 to 2006 will actually have taken place in 2007. Three of the retail clinic providers in the earlier study, representing 11 percent of visits, tracked presenting symptoms (for example, burning with urination) rather than diagnosis (for example, urinary tract infection). As described in our prior work, we grouped those symptoms into diagnostic groups (e.g. rhinorrhea, fever, cough were grouped into the diagnosis group of sinusitis, upper respiratory infection, bronchitis).

Analyses

The patient visit is the unit of analysis. We examine overall visits as well as by age category (less than 18 years, 18–64, 65 and older). We transform our estimates into national estimates by dividing the total number of visits (either monthly or annual) by 0.81 (the fraction of all retail clinics in our sample).

Because of our large sample sizes (>1 million observations), we chose not to conduct statistical tests when comparing visits between the two time periods. Small differences, even if not important from a clinical or policy perspective, will be statistically significant. We note in our Exhibits when, due to missing data, analyses are based on a subset of retail clinics companies.

Results

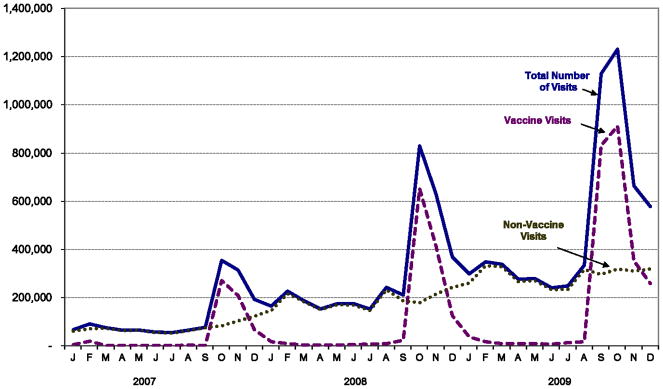

Nationally there were a total of 1.48, 3.52, and 5.97 million retail clinic visits in 2007, 2008, and 2009 respectively (average of 102 percent yearly increase over two years). As shown in Exhibit 1, there was tremendous seasonal variation in the number of visits with peaks in October and November. This seasonal variation is due primarily to visits for vaccines and to a lesser degree due to visits for acute illnesses such as upper respiratory infections.

Exhibit 1. Estimated Number of Visits per Month Nationally to Retail Clinics*.

SOURCE: Authors’ own analyses

NOTES: * We use the term estimated because we only have data from 3 retail clinic companies who run 81% of all retail clinics in the US. For this figure, we transform the trends in number of visits into national estimates by dividing the total number of visits (either monthly or annual) we observe at the three retail clinics by 0.81 (the fraction of all retail clinics in our sample).

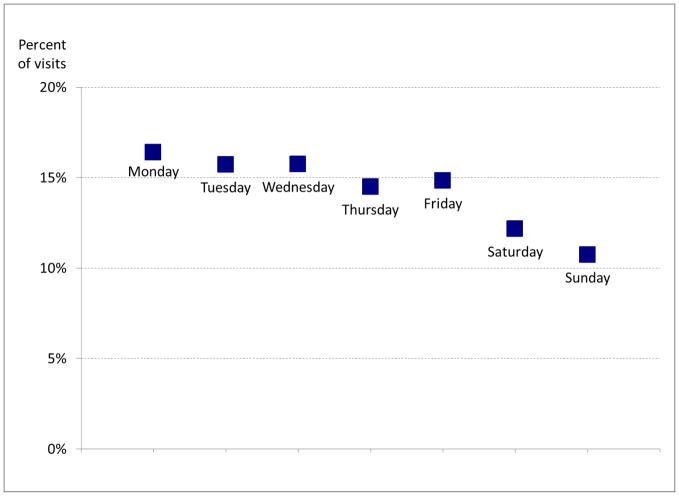

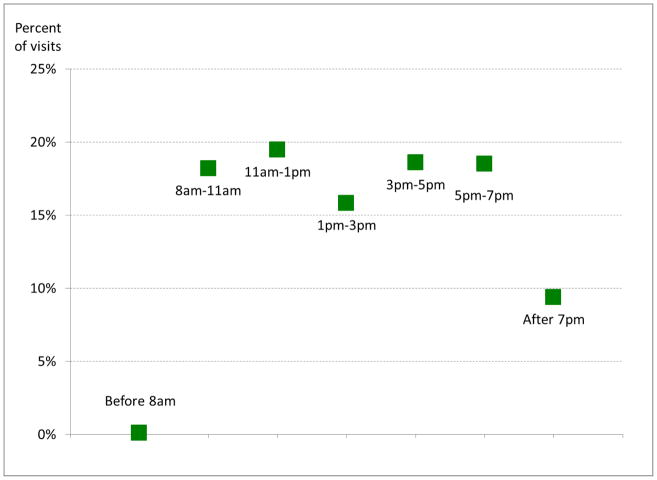

There is some variation in the distribution of visits by day of the week. The most popular day is Monday with (16.4 percent of the visits), while the least popular days are Saturday and Sunday (12.2 and 10.7 percent respectively) (Exhibit 2). Approximately a quarter (28.9 percent) of weekday visits occur before 8am or after 5pm (hours a physician office might be closed) (Exhibit 3). Overall, 44.4 percent of the retail clinics visits occurred when physicians’ offices are more likely to be closed.

Exhibit 2. Retail Clinic Visits Broken Down by Day of Week.

SOURCE: Authors’ own analyses

NOTES: Each data point represents fraction of all retail clinic visits that occur on that day. Data on day of week was not available for one of the three retail clinic companies

Exhibit 3. Weekday Retail Clinic Visits Broken Down by Time of Day.

SOURCE: The information in this exhibit is derived from the authors’ own analyses

NOTES: Each data point represents fraction of weekday retail clinic visits where patient presented during that time period. Weekdays are Monday through Friday. Data for one retail clinic company was not included because day of week was not available.

Compared with retail clinic visits from 2000–2006, the overall gender mix of patients of retail clinic visits from 2007–9 has stayed largely the same (Exhibit 4). There were, however, some notable changes in the age distribution of patients. The proportion of retail visits made by children (age less <18) has decreased from 26.8 percent (pre-2007) to 22.2 percent (2007–2009), while the proportion of visits made by those over the age of 65 increased from 7.5 percent (pre-2007) to 14.7 percent (2007–2009). Just under a third of patients who visit a retail clinic pay for the care out of pocket and only a third of patients report having a primary care physician. Neither of these percentages has notably changed over time.

Exhibit 4. Comparison of Socio-demographic Characteristics of Patients who Visit a Retail Clinic between 2000–2006 and 2007–2009.

Trends in Socio-demographic of Patients Visiting Retail Clinics^

| Visits before 2007 | Visits 2007–2009 | |

|---|---|---|

| n (millions) | 1.35 | 8.89 |

|

| ||

| % | ||

|

| ||

| Gender | ||

| Female | 62.8 | 61.1 |

| Male | 37.2 | 38.9 |

|

| ||

| Age | ||

| <2 | 0.2 | 0.3 |

| 2–5 | 6.3 | 4.5 |

| 6–17 | 20.3 | 17.4 |

| 18–44 | 43.0 | 37.6 |

| 45–64 | 22.6 | 25.5 |

| >65 | 7.5 | 14.7 |

|

| ||

| Insurance | ||

| Yes** | 67.1 | 70.5 |

| Commercial Insurance | 41.7 | |

| Medicaid | 0.1 | |

| Medicare | 7.2 | |

| Other | 0.2 | |

| No (Cash) | 32.9 | 29.5 |

|

| ||

| Patient reports having a PCP* | ||

| Yes | 38.7 | 35.5 |

| No | 61.3 | 64.5 |

SOURCE: Authors’ own analyses

NOTES:

Data on this variable not provided by one of the retail clinic companies

Data for type of insurance not available for data before 2007. From 2007–2009, one of the three retail clinic companies provided information on whether insurance was provided, but did not provide type of insurance.

Exhibit 5 presents detailed information on the types of visits to retail clinics. Compared with retail clinic visits from 2006 to 2007, acute care visits make up a smaller proportion of overall visits (78.2 percent to 51.4 percent). There was a corresponding increase in the fraction of visits for preventive care visits (21.8 percent to 47.5 percent), particularly visits for vaccinations. Visits for preventive care other than vaccination also increased from 2.1 percent to 6.7 percent. Visits for chronic illnesses make up only a small share (~1 percent) of the visits between 2007–9.

Exhibit 5. Comparison of Reason for Visit for Patients who Visit a Retail Clinic between 2000.

–2006 and 2007–2009

Trends in Reasons for Retail Clinic Visits^

| Comparison of Types of Visit by Time Period | Breakdown of 2007–9 visits by Age Category | ||||

|---|---|---|---|---|---|

| All visits before 2007 | All visits 2007–2009 | Children (<18yo) | Adults (≥18–64 yo) | Adults (≥ 65 yo) | |

| n (millions) | 1.35 | 8.89 | 1.77 | 5.77 | 1.35 |

|

| |||||

| % | % | ||||

|

| |||||

| Preventive Care | 21.8 | 47.5 | 40.2 | 41.2 | 85.2 |

|

| |||||

| Vaccine | 19.7 | 40.8 | 26.9 | 35.9 | 81.8 |

| Other preventive care (e.g. sports physicals, screening for blood pressure) | 2.1 | 6.7 | 13.3 | 5.2 | 3.3 |

|

| |||||

| Acute Care | 78.2 | 51.4 | 59.6 | 57.7 | 12.9 |

|

| |||||

| Upper Respiratory Infections | 5.7 | 5.3 | 1.4 | ||

| Bronchitis | 27.4# | 18.7# | 1.7 | 5.8 | 1.3 |

| Sinusitis | 3.8 | 13.4 | 2.7 | ||

| Pharyngitis | 21.2 | 11.7 | 21.3 | 10.9 | 1.0 |

| Otitis Externa | 12.7# | 7.4# | 2.3 | 1.7 | 1.2 |

| Otitis Media* | 13.0 | 4.2 | 0.7 | ||

| Urinary Tract Infections | 3.5 | 2.5 | 0.3 | 3.8 | 0.3 |

| Conjunctivitis | 4.6 | 2.8 | 3.8 | 2.9 | 0.7 |

| Allergy | 2.1 | 2.0 | 1.5 | 2.4 | 0.7 |

| Other Acute Care | 8.9 | 6.5 | 6.2 | 7.4 | 2.9 |

|

| |||||

| Chronic Disease Care (e.g. asthma, hypertension, diabetes) | 0.1 | 1.1 | 0.2 | 1.2 | 1.9 |

SOURCE: Authors’ own analyses

NOTES:

Includes Otalgia

Based on principal diagnosis associated with visit

Pre-2007 data was based partly on reason for visit as opposed to post-visit diagnosis codes. Therefore some diagnoses with similar presentation are lumped together. Data from 2007–9 is lumped together to ease comparison across columns.

Among the visits for acute care the same set of nine conditions make up the vast majority of visits in both the 2000–2006 and 2007–2009 time periods. Both for children and for adults aged 18–64 the distribution of acute and preventive care visits is similar. However, the distribution of visits made by seniors is quite different- approximately 85 percent of their visits are for vaccinations.

Discussion

In our analysis of utilization trends among retail clinics, one of the most notable findings is the rapid growth in the number of retail clinic visits. We found year-over-year doubling in the number of visits, with a total of ~5.9 million visits in 2009. Based on prior estimates of $78 for a visit to the retail clinic,9 this translates into approximately $460 million dollars of health care spending in 2009. In spite of the rapid growth in retail clinics, they make up a small share of overall visits in the outpatient setting: there are 117 million visits to emergency departments and 577 million visits to physicians’ offices annually.10

The rapid growth of retail clinics makes it clear that they are meeting some patient need. We believe there are likely three basic needs they are meeting. The first is the need for convenient care. Retail clinics are located in convenient locations and patients do not need an appointment. They also provide an easy way for people to get their vaccinations. Second, they meet a need for after-hours care. Forty-four percent of the visits at a retail clinic take place when doctors’ offices are usually not open. The third is a need for a low-cost alternative source of care. Some of the growth in clinics probably reflective of the increase in the number of Americans who are more-cost sensitive, the uninsured and individuals with high-deductible health plans.11 The price transparency at retail clinics is also particularly attractive for the uninsured.12 Lastly, there is an increasing body of evidence that does not support concerns about the quality of care at retail clinics.13–18 This might lead to greater acceptance and use of retail clinics.

It will be interesting to track demand at retail clinics if the Affordable Care Act is fully enacted. The newly insured will likely seek primary care which could decrease retail clinic demand. However, if wait times for PCPs increase as they have in Massachusetts,19 this might increase demand at retail clinics. Many health care systems and private companies have begun offering online or “eVisits”.20–25 These online visits could compete with retail clinics and deter the growth of retail clinics.

We found it notable that a large fraction of patients continue to report that they do not have a PCP. We had expected that as the number of visits to retail clinics increases, new patients visiting retail clinics would be more likely to have a PCP. Patients with no or weak relationships with a PCP likely preferentially seek care at a retail clinic.

Despite the controversy over the entry of retail clinics into chronic disease management,5 we find that through 2009 less than 1 percent of visits are for chronic disease care. Because those over the age of 65 are more likely to have chronic illnesses, our finding that more patients of this age are visiting retail clinics might raise concern. However, the vast majority of the visits for those 65 and older are for the influenza vaccine. A relatively small fraction of visits to retail clinics for acute problems and other preventive services are among those 65 and older.

Our estimate is that a total of 2.4 million people receive the influenza vaccine from a retail clinic (approximately 1.9 percent of the 123.3 million patients who receive the influenza vaccine in the United States).26 Beyond these 2.4 million people, many more patients receive the influenza vaccine at a pharmacy that does not have a retail clinic. These results emphasizes the importance of alternative locations for influenza vaccine delivery.27

There are several key limitations to our analyses. First, retail clinics made chronic disease a focus in 2010, after our data was collected. Second, our estimate of the total number of clinic visits is based on the assumption that patient volume at the retail clinics in our sample (81 percent of retail clinics) is indicative of patient volume at retail clinics not in our sample. Third, we are surprised by the small fraction of patients who report having a PCP. This low fraction might be an underestimate. In prior work there have been anecdotal reports of retail clinic patients who deny having a PCP because they do not want their PCP to know they visited a retail clinic.28 Some are concerned that their PCP will become upset; others do not feel that their PCP needs to be bothered.

In summary, we find that there has been tremendous growth in the number of retail clinic visits. The scope of care continues to be focused on simple acute and preventive care and they continue to serve a population of patients who do not report having a PCP.

Notes

- 1.American Academy of Family Physicians. AAFP policy on retail clinics [Internet] American Academy of Family Physicians; 2010. [Cited 2012 March 30]. Available from: http://www.aafp.org/online/en/home/policy/policies/r/retailhealth.html. [Google Scholar]

- 2.Japsen B. AMA takes on retail clinics [Internet] Chicago: Chicago Tribune; 2007. Jun 25, [Cited 29 March 2012]. Available from: http://articles.chicagotribune.com/2007-06-25/business/0706240383_1_retail-clinics-ama-doctors-groups. [Google Scholar]

- 3.AAP principles concerning retail-based clinics. Pediatrics 2006 - Reaffirmed January. 2011 Dec;118(6):2561–2. doi: 10.1542/peds.2006-2681. [DOI] [PubMed] [Google Scholar]

- 4.American Medical Association. AMA calls for investigation of store-based health clinics [Internet] Chicago: American Medical Association; 2007. Jun 25, [Cited 2012 March 29]. Available from: http://www.ama-assn.org/ama/pub/category/print/17723.html. [Google Scholar]

- 5.Frieden J. Retail clinics branch into chronic disease treatment [Internet] ABC News; Mar 25, 2012. [Cited 30 March 2012]. Available from: http://abcnews.go.com/Health/HealthCare/retail-clinics-branch-chronic-disease-treatment/story?id=10152224. [Google Scholar]

- 6.Mehrotra A, Wang MC, Lave JR, Adams JL, McGlynn EA. Retail clinics, primary care physicians, and emergency departments: A comparison of patients’ visits. Health Aff (Millwood) 2008 Sep-Oct;27(5):1272–82. doi: 10.1377/hlthaff.27.5.1272. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.American Medical News. Cleveland clinic strikes deal with minuteclinic [Internet] American Medical Association; 2009. Feb 23, [Cited 2012 March 29]. Available from: http://www.ama-assn.org/amednews/2009/02/23/bibf0223.htm. [Google Scholar]

- 8.Charland T. Preparing for new growth: 2010 retail clinic market year in review Merchant Medicine News. 2011. Jan 6, [Google Scholar]

- 9.Rudavsky R, Pollack CE, Mehrotra A. The geographic distribution, ownership, prices, and scope of practice at retail clinics. Ann Intern Med. 2009 Sep 1;151(5):315–20. doi: 10.7326/0003-4819-151-5-200909010-00005. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 10.Schappert S, Rechtsteiner E. Ambulatory medical care utilization estimates for 2007. National Center for Health Statistics Vital Health Stat. 2011;13(169) [PubMed] [Google Scholar]

- 11.Centers for Disease Control and Prevention. Final estimates for 2009–10 seasonal influenza and influenza a (h1n1) 2009 monovalent vaccination coverage–united states, august 2009 through May, 2010 [Internet] Atlanta, GA: Centers for Disease Control and Prevention; [Cited 2012 March 30]. Available from: http://www.cdc.gov/flu/professionals/vaccination/coverage_0910estimates.htm. [Google Scholar]

- 12.Wang MC, Ryan G, McGlynn EA, Mehrotra A. Why do patients seek care at retail clinics, and what alternatives did they consider? Am J Med Qual. 2010 Mar-Apr;25(2):128–34. doi: 10.1177/1062860609353201. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 13.Mehrotra A, Liu H, Adams JL, Wang MC, Lave JR, Thygeson NM, et al. Comparing costs and quality of care at retail clinics with that of other medical settings for 3 common illnesses. Ann Intern Med. 2009 Sep 1;151(5):321–8. doi: 10.7326/0003-4819-151-5-200909010-00006. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 14.Jacoby R, Crawford AG, Chaudhari P, Goldfarb NI. Quality of care for 2 common pediatric conditions treated by convenient care providers. Am J Med Qual. 2010 Sep 22; doi: 10.1177/1062860610375106. [DOI] [PubMed] [Google Scholar]

- 15.Rohrer JE, Angstman KB, Furst JW. Impact of retail walk-in care on early return visits by adult primary care patients: Evaluation via triangulation. Qual Manag Health Care. 2009 Jan-Mar;18(1):19–24. doi: 10.1097/01.QMH.0000344590.61971.97. [DOI] [PubMed] [Google Scholar]

- 16.Rohrer JE, Angstman KB, Garrison G. Early return visits by primary care patients: A retail nurse practitioner clinic versus standard medical office care. Popul Health Manag. 2012 Mar 12; doi: 10.1089/pop.2011.0058. [DOI] [PubMed] [Google Scholar]

- 17.Rohrer JE, Garrison GM, Angstman KB. Early return visits by pediatric primary care patients with otitis media: A retail nurse practitioner clinic versus standard medical office care. Qual Manag Health Care. 2012 Jan-Mar;21(1):44–7. doi: 10.1097/QMH.0b013e3182418157. [DOI] [PubMed] [Google Scholar]

- 18.Rohrer JE, Yapuncich KM, Adamson SC, Angstman KB. Do retail clinics increase early return visits for pediatric patients? J Am Board Fam Med. 2008 Sep 1;21(5):475–6. doi: 10.3122/jabfm.2008.05.080072. [DOI] [PubMed] [Google Scholar]

- 19.Bodenheimer T, Pham HH. Primary care: Current problems and proposed solutions. Health Aff (Millwood) 2010 May;29(5):799–805. doi: 10.1377/hlthaff.2010.0026. [DOI] [PubMed] [Google Scholar]

- 20.Rohrer JE, Angstman KB, Adamson SC, Bernard ME, Bachman JW, Morgan ME. Impact of online primary care visits on standard costs: A pilot study. Popul Health Manag. 2010 Apr;13(2):59–63. doi: 10.1089/pop.2009.0018. [DOI] [PubMed] [Google Scholar]

- 21.Allina Health System. E-visits: Connect with a clinician online [Internet] 2012 [Cited 2012 March 29]. Available from: http://www.allina.com/ahs/medicalservices.nsf/page/evisits_MyChart.

- 22.Bell A. What’s next? Medicine catching up with practical uses of technology. [Internet] Press and Guide. 2012 Mar 14; [Cited 2012 March 29]. Available from: http://www.pressandguide.com/articles/2012/03/14/news/doc4f6104e396847656235090.txt.

- 23.Berry E. Health plans look to save on each patient visit. [Internet] American Medical News. 2011 Dec 26; [Cited 2012 March 29]. Available from: http://www.ama-assn.org/amednews/2011/12/26/bisc1226.htm.

- 24.Bershow B. The doctor is in (your inbox) [Internet] Minneapolis, MN: Minnesota Medical Association; 2009. Jun, [Cited 2012 March 29]. Available from: http://www.minnesotamedicine.com/PastIssues/PastIssues2009/January2009/PulseInboxJanuary2009.aspx. [Google Scholar]

- 25.Saurage-Altenloh S. Online doctor consultations: Is medicine going remote? [Internet] Houston, TX: Chron.com; Mar 6, 2012. [Cited 2012 March 29]. Available from: http://blog.chron.com/factistics/2012/03/online-doctor-consultations-is-medicine-going-remote/ [Google Scholar]

- 26.Centers for Disease Control and Prevention. Final estimates for 2009–10 seasonal influenza and influenza a (h1n1) 2009 monovalent vaccination coverage–united states, august 2009 through may, 2010 [Internet] Atlanta, GA: Centers for Disease Control and Prevention; [Cited 2012 March 30]. Available from: http://www.cdc.gov/flu/professionals/vaccination/coverage_0910estimates.htm. [Google Scholar]

- 27.Lee BY, Mehrotra A, Burns RM, Harris KM. Alternative vaccination locations: Who uses them and can they increase flu vaccination rates? Vaccine. 2009 Jul 9;27(32):4252–6. doi: 10.1016/j.vaccine.2009.04.055. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 28.Weinick RM, Pollack C, Mehrotra A. Policy implications of the use of retail clinics. Santa Monica, CA: RAND; 2010. [PMC free article] [PubMed] [Google Scholar]