Abstract

Objective

To predict take-up of private health insurance and Medicaid following the U.S. Supreme Court decision upholding the Affordable Care Act (ACA).

Data Sources

Data came from three large employers and a sampling of premiums from http://ehealthinsurance.com. We supplemented the employer data with information on state Medicaid eligibility and costs from the Kaiser Family Foundation. National predictions were based on the MEPS Household Component.

Study Design

We estimated a conditional logit model of health plan choice in the large group market. Using the coefficients from the choice model, we predicted take-up in the group and individual health insurance markets. Following ACA implementation, we added choices to the individual market corresponding to plans that will be available in state and federal exchanges. Depending on eligibility for premium subsidies, we reduced the out-of-pocket premiums for those choices. We simulated several possible patterns for states opting out of the Medicaid expansion, as allowed by the Supreme Court.

Principal Findings

The ACA will increase coverage substantially in the private insurance market and Medicaid. HSAs will remain desirable in both the individual and employer markets.

Conclusions

If states opt out of the Medicaid expansion, this could increase the federal cost of health reform, while reducing the number of newly covered lives.

Keywords: Insurance, health reform, microsimulation, uninsured, health savings accounts

On June 28, 2012, the Supreme Court of the United States (SCOTUS) upheld most of the provisions of the Patient Protection and Affordable Care Act and the health care provisions of the Health Care and Education Reconciliation Act (P.L. 111-148 and P.L. 111-152; henceforth referred to as the ACA).1 Starting in 2014, individuals without an offer of insurance from their employer and small businesses will be able to buy insurance on state and federal exchanges, with premium subsidies depending on their incomes. Certain employers that do not offer health insurance will be penalized, and individuals will be required to have coverage or pay a penalty.

At the same time, however, the Supreme Court ruled that states could opt out of the ACA expansion of Medicaid coverage for all individuals up to age 65 with incomes less than 133 percent of poverty. Under the ACA as enacted, but before the Supreme Court ruling, the Medicaid expansion was mandatory for states that wanted to keep their federal matching funds for any part of the Medicaid program. The Supreme Court's decision immediately raised the prospect that some states might opt out of the Medicaid expansion. The U.S. Congressional Budget Office (CBO 2012) estimated that 6 million people previously covered by the Medicaid expansion in its March 2012 baseline would not be covered; some of these would enroll in exchanges, but the number of uninsured people would rise by 4 million.

Our research has two goals. First, we predict how many people will take up private health insurance under provisions of the ACA. Second, we predict Medicaid take-up under several possible patterns for states opting out of the Medicaid expansion. Unlike the CBO, which did not make estimates for specific states but instead utilized average probabilities of opting out, we make predictions for specific states.2 We also predict enrollment in specific types of private plans (e.g., the “metallic” plans offered in health insurance exchanges).

We find the ACA will increase coverage substantially in the private health insurance market and Medicaid. However, if states opt out of the Medicaid expansion, this could increase the federal cost of health reform, while reducing the number of newly covered lives. If six states (Florida, Louisiana, Mississippi, Nebraska, South Carolina, and Texas) opt out, the number of uninsured people will increase by 7.9 million with a drop in Medicaid coverage of 4.4 million by 2021, compared with the pre-SCOTUS situation.

Our predictions are based on a microsimulation model of health plan choice that we originally developed to predict the effect of the Medicare Modernization Act of 2003 (MMA) on take-up of high-deductible health plans in the individual health insurance market (Feldman et al. 2005; Parente et al. 2005).3 We begin the study with a section that describes the model. This is followed by our simulation of the ACA effects on private health insurance and Medicaid take-up.

MicroSimulation Model

Our approach has three major components: (1) model estimation; (2) choice set assignment and prediction; and (3) policy simulation. Integral to this analysis was the use of data from three large employers working with the study investigators.

The model estimation had several steps. First, we pooled the data from the employers to estimate a conditional logit plan choice model. In the second step, we used the estimated choice model coefficients to predict health plan choices for individuals in the MEPS-HC. To complete this step, it was necessary to assign the number and types of health insurance choices that are available to each respondent in the MEPS-HC. For this purpose we turned to the smaller but more detailed MEPS Household Component–Insurance Component linked file, which contained the needed information. The third step was to generate HSA premiums and benefit designs. The final step was to apply plan choice model coefficients to the MEPS data with premium information as well as ACA provisions to estimate insurance take-up and subsidy costs. We expand on each of these steps.

Estimate Plan Choice Model

We pooled the data from the employers to estimate a conditional logit model of health plan choice similar to our earlier work (Parente, Feldman, and Christianson 2004). Conceptually, the choice model is based on utility maximization, where utility is considered to be a function of health plan attributes (such as the out-of-pocket premium) and interactions of health plan and personal attributes, formally stated as:

where i is the decision making employee choosing among j health plans on the basis of Zj health plan attributes and Xij interactions of health plan and personal attributes. The interaction terms prevent personal attributes from “differencing away” when the individual compares plans. An example is an interaction of the worker's health status with the plan's premium, which allows people of different health status to have difference choice responses to plan premiums.

A very important constraint in our modeling was that any variable used in the plan choice model from the employer data also had to be available in the MEPS-HC to permit a simulation. As a result, the health plan variables used in the choice model were the after-tax premium paid by the employee; the amount of money in the employee's health reimbursement account (HRA), if any; the difference between the employee's plan deductible and HRA; and the plan coinsurance rate. The personal attributes were whether the employee or dependent has a chronic illness; the employee's age and gender; the employee has a two-person or family contract (with single contract as the reference); and the employee's annual wage income.

Also included in the regression were alternative-specific constants (intercepts) for each health plan choice. These intercepts capture plan-specific features not represented by other identifiers of plan design. They are also included as interaction terms with age, gender, family status, and income. The intercept terms include seven choices: low-option PPO (restrictive network, high copay, 15 percent coinsurance); medium-option PPO (better network, lower copay and coinsurance); high-option PPO (open network, lowest copay, no coinsurance); health reimbursement arrangement (HRA); health savings account (HSA) with employer contribution, modeled on higher premium HRA; HSA without employer contribution, modeled on lower premium HRA; and health maintenance organization (HMO). The intercept terms for each person represent only the choices he or she has from the employer; most employees have a subset of the choices available. The low-option PPO, available to all employees, was the reference choice.

Choice Set Assignment and Prediction

We used the health plan choice model to develop two sets of plan choice predictions: one set for workers with insurance offers and a second set for individuals who do not have employer offers of coverage. The second set includes both uninsured individuals and those who take up nongroup policies. Nonoffered individuals who reported having employer group coverage through another household member are excluded from the simulations. Below we outline the analytic steps taken to develop the individuals' choice sets for the simulations.

Unlike in the employer data, in the MEPS-HC we do not observe the person's plan choice set, so we had to predict it from the linked MEPS HC-IC (as described in Feldman et al. 2005). The predictions included both the number and types of choices. For example, workers in large firms have more plan choices than those in small firms, so a worker in a large firm might have four choices: low-option PPO, medium-option PPO, high-option PPO, and HMO.

To these choices we added two additional options, conditional on the size of the establishment where the employee works. We assumed that an employer-sponsored HRA and an employer-sponsored HSA are available to all workers in establishments with more than 500 employees, but not available to other workers. For the HSA choices, we estimated the amount of money that employers and individuals contribute to their HSAs, letting the contributions vary by age and income of the policyholder. Finally, all employees with an offer of group insurance have the option of a self-financed (full cost) HSA or of turning down coverage.

Individuals who did not have health insurance offered to them at work or who were not employed faced five health plan choices regardless of income, age, or gender: high-option PPO, medium-option PPO, low-option PPO, self-financed HSA, or uninsured. A self-financed HRA is not an option for this group because only employers may contribute to an HRA.

With the sets of possible choices for workers with insurance offers and individuals without insurance offers, we used the plan choice model to predict plan choice probabilities for each MEPS-HC sample respondent.4 However, before we could predict the probabilities, we needed to develop assumptions about benefits and premiums for individual plans. To get premium estimates, we used the linked MEPS insurance data to estimate a hedonic model of premiums for group insurance plans. To predict premiums for individuals without employer offers of coverage, we used the smallest establishment size category, based on the assumption that this most closely represents an individual policy in terms of the loading charge for plan administrative costs.

The plan characteristics that we used to define the three PPOs (low, medium, and high) came from the http://eHealthinsurance.com survey of plans purchased in the individual market. Roughly speaking, we used the 25th, 50th, and 75th percentiles of coinsurance and deductibles for assigning the plan characteristics.

We also recognized that premiums in the individual market vary by a person's age. The MEPS included a table of average premiums by age cohort. We created an index using the information from this table. The index was set equal to 1.0 for the age group corresponding to the median age of adults in our sample (35–39 years). Older individuals, who had higher premiums, had index values that were greater than 1.0. Younger individuals, who had lower premiums, had index values less than 1.0. The index values ranged from .59 to 2.18 for single coverage policies and .453 to 1.65 for family coverage policies. Finally, we adjusted all premiums to current levels.

An important feature of our work was the creation of synthetic states as MEPS only shows the region where a respondent lived. We needed to identify states to gauge the state-specific impact of ACA given the differences in existing Medicaid programs among states. For this analysis, we used an approach from our prior research (Parente et al. 2011) on the impact of interstate health insurance markets. The creation of the synthetic states is a four-step process. First, we used the American Community Survey (ACS) to define the strata that would be used to generate the sample. The strata included four variables: age, income, gender, and race. Using person weights in the ACS, we tabulated the population frequencies for each of these strata by state. Second, we divided the MEPS into four regions—Northeast, Midwest, South, and West. The District of Columbia is in the South region. We then drew a random sample with replacement of 1,000 (approximately, given rounding) observations from the region containing a particular state. The frequency of observations by strata was matched to represent the population. After the random samples were drawn, the data were appended to form a national dataset. In the third step, we validated our state assignments using the CPS. In our fourth and final step, we merged several other variables into the file and selected the sample to mimic the one we have used previously in simulations (Feldman et al. 2005).

One significant issue with our simulation is that we were not able to predict whether an individual would take up insurance in the employer-offered market or be uninsured in the individual market. We faced this limitation because the employer data used to estimate the plan choice model included information only on workers who held coverage.

To address this issue, we “calibrated” the model to accurately reflect both the actual percentage of people who turn down employer offers and the actual percentage of people in the individual market who are uninsured. Calibration means setting the plan-specific intercepts for these choices at values that reproduce the known probabilities (e.g., the probability of turning down an employer offer). To obtain more accurate estimates, we performed these calibrations by four quartiles of income and then compared our results with national turn-down and uninsurance rates. We also applied the national population weights to the calibrated model to represent the entire adult population, excluding full-time students, those with public insurance, and individuals with employer-based coverage through another household member. This fairly tedious process was performed for each reestimation and/or modification in the conditional logit choice model.

Policy Simulation

Two of the most substantial advances in our microsimulation were inclusion of chronic illness in the plan choice model and generation of premiums through an iterative process using prior years' claims data to create actuarially fair estimates of premiums. Below we describe in more detail the issues we addressed in this analysis.

Health status is important in the simulations for two reasons. First, health status may be an important factor in predicting plan choice, so the addition of this variable should improve the fit of the choice model, other things equal. Second, sick (healthy) people may prefer certain plans, which would drive the premiums up (down). Specifically, if sick people are attracted to traditional plans, it could lead to a “death spiral” of increasing premiums and falling enrollment in the traditional plans. One of our goals in the simulations is to determine whether favorable selection into the HRA and HSA choices will tend to destabilize the health insurance market.

To account for health status, we used claims data for contract holders (employees) from the employers in the plan choice model. We obtained the claims data for the year prior to their possible enrollment in a high-deductible health plan. We used the diagnosis code information from these prior-year claims to calculate a set of 34 adjusted diagnosis groups (ADGs) using a methodology developed by Johns Hopkins University researchers (Weiner et al. 1991). Several of these 34 ADGs identify a diagnosis indicating the presence of a chronic condition. With this information we constructed a dummy variable indicating the presence of chronic illness and included this variable in the plan choice model interacted with plan premiums and cost sharing. Because the chronic condition indicator also is available on the MEPS-HC, this aggregate measure of health status allowed us to predict health plan choice in the MEPS database.

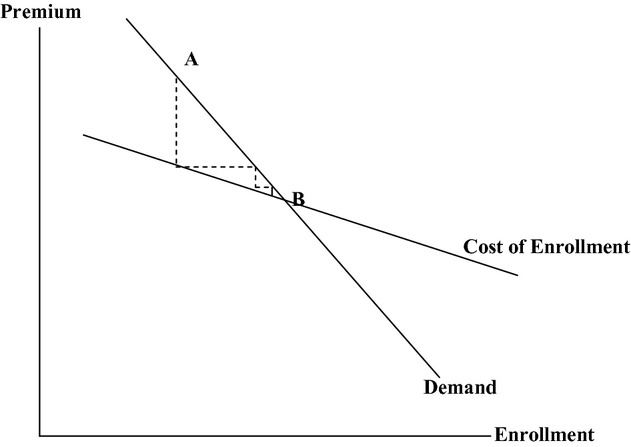

This variable also permitted us to develop a medical care cost regression to predict medical expenditure of the MEPS population enrolled in each plan type. To capture the relation between cost and health risk, we estimated a medical care cost regression for the individuals who chose each plan. We used that model to predict premiums that fed back into the choice model. We “iterated”—that is, went back and forth—between the choice model and the cost model until the market converged to a stable set of choices and premiums. Our method is illustrated in Figure 1. Starting from a premium that is too high for equilibrium (point A), the premium falls and enrollment increases until the two lines converge to a single premium and enrollment (Point B). There is no guarantee that the model will be stable as shown here. We know that the demand for enrollment is downward sloping, but the cost of enrollment also slopes downward for plans with unfavorable selection. The model will be stable if the demand curve is the steeper of the two.

Figure 1.

Model of Health Plan Demand and Cost

To implement this iterative approach, we had to construct premiums from expected medical care costs in the individual and ESI markets. Premiums obviously depend on expected costs, but they also depend on how costs are aggregated across individuals. How many individuals are in the insurance pool? Does the premium for a particular person depend on his or her experience, or on the experience of the group? In other words, how are premiums “rated” in the individual and ESI markets?

The two rating methods we used were individual experience rating (IER) for the individual health insurance market and group experience rating (GER) for the ESI market.5 The premium for each rating method was generated as follows:

Individual Market

Given that the premium for each person in the individual market is based on his or her own health care costs, we estimated how much each person would spend under each type of insurance plan (PPO, HSA, etc.). We added a loading fee of 30 percent to arrive at the premium for each choice in the individual market.6

Employer-Sponsored Market

The first step in GER is to define the “pool” that determines the premium rates. We used three pools based on establishment size—small establishments, medium-size establishments, and large establishments.7 We predicted the cost of each person in each plan. Then, we calculated the average cost across all people who work for employers in each of the three pools. For example, the average cost of the HMO for employees of small establishments may be $6,000 for a single policy and $12,000 for a family policy. The average cost of the HMO was different in medium-size and large groups. Then, we added loading fees to get predicted premiums for each pool in the ESI market.

ACA Simulation

We used the methods described above to simulate the impact of the ACA following the June 28, 2012 Supreme Court decision to allow states to opt out of the Medicaid expansion. The two primary ACA elements we modeled were as follows: (1) expansion of the private insurance market through state and federal insurance exchanges; and (2) expansion of the Medicaid program as outlined in the law for those with incomes less than 133 percent of the federal poverty level (FPL). The data used for state-specific estimates were the synthetic state assignment of MEPS-HC participants described earlier and in detail in Parente et al. (2011).

ACA at 2012 and 2014

To simulate the impact of ACA, we needed to model the choices available in the individual market exchange as well as the Medicaid expansions. For the exchanges, we mapped existing health plan choices from our previous models into the likely “metallic” plan choices that are part of ACA. We made this mapping based on our knowledge and assumptions about the existing health insurance options and the likely order of generosity of benefit design. Specifically, we assumed the following: (1) Platinum plans will be the equivalent of a high-option PPO; (2) Gold plans will map to a medium-option PPO; (3) Silver plans will map to a low-option PPO; and (4) Bronze plans will map to a high-deductible health plan (HDHP). We then needed to assign premiums for these plans in the exchange. Here, we assumed the current pricing of the high-option PPO was the reference point for 90 percent of the actuarial value requirement of the ACA for the Platinum plan. From there, we arithmetically computed the premiums for Gold, Silver, and Bronze plans that produced actuarial value ranges of 80, 70, and 60 percent, respectively. This led to premiums in the ACA that were out of sync from market conditions, particularly from the HDHPs as Bronze plans. The existing premiums for HDHPs in our simulation prior to 2014 are below the 60 percent actuarial value required in the Bronze plan. We also calibrated our premiums to reflect higher loading costs for community rating as well as to conform to the 3 : 1 modified adjusted community rating requirement using age bands common for actuarial analysis. In almost all of these calculations, there were no final rules written for ACA operation so we needed to rely on assumptions based on prior research.

To simulate the Medicaid expansion, we used Kaiser Family Foundation (2012a,b) data on benefit coverage and costs of acute-care Medicaid programs by state. This gave us the ability to cost out the Medicaid expansion in each state and then compare it with the cost of private-sector coverage expansion. We also identified the percent of FPL ceilings currently used to qualify for Medicaid in each state, so we could identify which states expanded their programs from the status quo. Finally, we used personal income, age, and gender from the MEPS to identify the population in each state that would be eligible for expanded Medicaid.

The results of our simulations are presented in Tables 1–3. In Table 1, we provide estimates of 2012 and 2014 insurance coverage across the entire under 65-year-old market affected by ACA. In 2012, we estimate the number of uninsured to be 54.8 million. Due to ACA we forecast this number will drop 38 percent to 34 million. The majority of the change will occur from expansion of the private insurance market with over 21 million newly covered enrollees. Over 17 million people will gain Medicaid coverage due to expansion of the program in all 50 states.

Table 1.

Affordable Care Act Impact from 2012 to 2014 in Insurance Demand

| Individual Market | 2012 | 2014 | Difference | % Change |

|---|---|---|---|---|

| Silver or higher | 13,077,268 | 20,285,299 | 7,208,030 | 55 |

| Bronze or catastrophic | 19,539,213 | 24,721,721 | 5,182,508 | 27 |

| Medicaid | 34,855,438 | 52,012,641 | 17,157,203 | 49 |

| Uninsured | 48,854,416 | 28,542,663 | (20,311,753) | −42 |

| Group market | ||||

| HMO | 5,896,887 | 5,870,908 | (25,979) | 0 |

| HRA | 18,060,845 | 17,665,282 | (395,563) | −2 |

| HSA_funded | 2,045,882 | 3,909,279 | 1,863,397 | 91 |

| ESI 2 self-pay low PPO | 102,199 | 3,537,014 | 3,434,815 | >400 |

| PPO high | 22,395,612 | 18,486,371 | (3,909,241) | −17 |

| PPO low | 2,821,926 | 3,391,734 | 569,808 | 20 |

| PPO medium | 81,931,286 | 69,754,544 | (12,176,743) | −15 |

| ESI 2 other insurance/exchange | 19,584,084 | 30,358,810 | 10,774,725 | 55 |

| Employee refuses coverage | 5,916,908 | 5,507,608 | (409,300) | −7 |

| Total uninsured | 54,771,324 | 34,050,271 | (20,721,053) | −38 |

| Total private insurance | 205,669,993 | 226,904,491 | 21,234,498 | 10 |

| Total Medicaid | 34,855,438 | 52,012,641 | 17,157,203 | 49 |

Table 3.

Pre- and Post-Supreme Court of the United States (SCOTUS) PPACA Cost Impact (Billions) Scenario: Six States Decline to Take Expansion—FL, LA, MS, NE, SC, and TX

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Pre-SCOTUS ruling | |||||||||||

| Individual federal $$ | |||||||||||

| Insured | $0.0 | $0.0 | $219.7 | $218.9 | $220.1 | $217.5 | $211.8 | $203.0 | $194.6 | $187.0 | |

| Medicaid | $105.4 | $108.9 | $143.8 | $149.4 | $155.6 | $163.3 | $171.1 | $179.3 | $187.9 | $196.6 | |

| Uninsured | – | – | – | – | – | – | – | – | |||

| Group federal $$ | |||||||||||

| Insured | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | |

| Take Medicaid coverage | $10.7 | $13.1 | $35.6 | $41.1 | $46.3 | $51.3 | $55.8 | $60.1 | $64.0 | $67.9 | |

| Refuse coverage | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | |

| Take individual coverage | $0.0 | $0.0 | $26.9 | $25.4 | $25.2 | $25.2 | $25.5 | $25.4 | $26.0 | $26.1 | |

| Total federal $$ | |||||||||||

| Insured | $0.0 | $0.0 | $246.6 | $244.2 | $245.3 | $242.7 | $237.3 | $228.5 | $220.6 | $213.1 | |

| Medicaid | $116.1 | $122.0 | $179.4 | $190.5 | $201.9 | $214.5 | $226.9 | $239.4 | $251.9 | $264.4 | |

| Uninsured | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | |

| Total | $116.1 | $122.0 | $426.0 | $434.7 | $447.1 | $457.3 | $464.2 | $467.9 | $472.5 | $477.5 | |

| Post-SCOTUS ruling | |||||||||||

| Individual federal $$ | |||||||||||

| Insured | $0.0 | $0.0 | $236.0 | $236.0 | $237.3 | $237.4 | $237.7 | $227.6 | $214.4 | $202.1 | |

| Medicaid | $105.4 | $108.9 | $135.9 | $141.1 | $147.2 | $154.3 | $161.3 | $169.7 | $178.7 | $188.3 | |

| Uninsured | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | |

| Group federal $$ | |||||||||||

| Insured | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | |

| Take Medicaid coverage | $10.7 | $13.1 | $31.0 | $35.7 | $40.4 | $45.1 | $49.3 | $53.5 | $57.2 | $60.8 | |

| Refuse coverage | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | |

| Take individual coverage | $0.0 | $0.0 | $30.6 | $30.6 | $31.2 | $31.1 | $31.0 | $30.2 | $30.2 | $30.1 | |

| Total federal $$ | |||||||||||

| Insured | $0.0 | $0.0 | $266.7 | $266.6 | $268.5 | $268.5 | $268.7 | $257.8 | $244.6 | $232.3 | |

| Medicaid | $116.1 | $122.0 | $166.9 | $176.8 | $187.6 | $199.4 | $210.6 | $223.1 | $235.9 | $249.1 | |

| Uninsured | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | |

| Total | $116.1 | $122.0 | $433.6 | $443.5 | $456.0 | $467.9 | $479.4 | $480.9 | $480.5 | $481.3 | |

| Net impact | |||||||||||

| Insured | $0.0 | $0.0 | $20.1 | $22.4 | $23.2 | $25.8 | $31.4 | $29.3 | $24.0 | $19.2 | |

| Medicaid | $0.0 | $0.0 | $12.5 | $13.6 | −$14.3 | $15.2 | −$16.3 | $16.3 | $16.0 | $15.4 | |

| Uninsured | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | |

| Total | $0.0 | $0.0 | $7.5 | $8.8 | $8.9 | $10.6 | $15.1 | $13.0 | $8.0 | $3.8 | $75.8 |

At baseline, the iterations did not change the results of the individual market health plan choices. Enrollment in Bronze or catastrophic plans will increase by 27 percent and enrollment in Silver or more generous plans will increase by 55 percent. HSAs that qualify as Bronze plans may have too high a premium to maintain the growth they had prior to 2012. However, HSAs appear likely to continue to grow from our results.

For the group market, the iterations lead to substantial migration out of the “turned down,” “PPO high,” and “PPO medium” choices with losses of 7, 17, and 15 percent, respectively. The plans forecast to have the largest in-migration are self-funded HSAs, medium-option PPOs, and an opt-out low-option PPO where the consumer buys insurance on a qualified exchange and the employer pays a penalty. A large number of individuals (10.8 million) will find new coverage as a consequence from a switch in spousal coverage or are potentially dropped from an employer's plan and directed to a health insurance exchange.

Ten-Year Estimates of Health Reform following the 2012 Supreme Court Decision

We simulated the impact of ACA over a 10-year period from 2012 to 2021 as our baseline simulation. To test how our microsimulation could forecast policy changes, we also examined the effect of two policy changes based on the recent Supreme Court decision that states can opt out of the Medicaid expansion. This decision could greatly impact both the insurance coverage and the cost of the law. Shortly after the SCOTUS decision, 15 states were reported as not taking or very unlikely to take the Medicaid expansion in 2014 (The Hill 2012). Below we provide estimates the coverage and federal cost of ACA. These ACA estimates are compared with different possible outcomes from the SCOTUS ruling on Medicaid expansion from 2014 to 2021.

To complete this simulation, we assumed the following: (1) individuals who are not eligible for Medicaid currently and are eligible for exchange subsidies starting at 100 percent FPL will consider taking an exchange subsidy with a minimal premium required for enrollment; (2) states that do not offer an exchange will have a federal exchange available to their citizens and the federal exchange will be able to route subsidies to citizens in these states; (3) states offering Medicaid will use the same health plans they use today (e.g., the State of Washington uses private insurer Molina as a Medicaid health plan) through 2021; (4) insurance exchange premiums will grow at a higher rate than Medicaid costs because of the frequent budget constraints imposed on state Medicaid budgets to meet balanced budget requirements; (5) prior to the SCOTUS ruling, states would have auto-enrolled anyone below 134 percent of FPL in a federally financed Medicaid plan and not allowed anyone below 134 percent FPL to enroll in a state or federal exchange for private insurance coverage.

In Tables 2 and 3, we report the coverage and federal cost impacts, respectively, of ACA pre-SCOTUS to a scenario where the governors of six states have openly declared that they will not expand their Medicaid programs. These states all have Republican governors and include Florida, Louisiana, Mississippi, Nebraska, South Carolina, and Texas. We predict a 7.9 million person increase in the number of uninsured by 2021, compared with the pre-SCOTUS situation. Several million childless adults who are not disabled or aged earn sufficient income to qualify for an exchange policy in the six states choosing not to expand Medicaid. Medicaid coverage will drop by 4.4 million lives in 2014 compared with the pre-SCOTUS ruling. The number of people taking up private insurance coverage will increase by 3.2 million in 2014. The cost of private insurance displacing the Medicaid expansion will be an additional $7.5 billion in 2014 and a total of $75.8 billion from 2014 to 2021. If citizens in the states refusing to expand their Medicaid programs could accept federal subsidies for private health insurance, the federal cost will be greater and the loss of coverage larger than our baseline estimate.

Table 2.

Pre- and Post-Supreme Court of the United States (SCOTUS) PPACA Coverage Impact Scenario: Six States Decline to Take Expansion—FL, LA, MS, NE, SC, and TX

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Pre-SCOTUS ruling | ||||||||||

| Individual coverage | ||||||||||

| Insured | 32.6 | 31.3 | 45.0 | 46.9 | 47.0 | 45.3 | 43.7 | 42.0 | 40.4 | 38.9 |

| Medicaid | 31.7 | 32.1 | 41.9 | 42.6 | 43.5 | 44.9 | 46.1 | 47.4 | 48.7 | 50.0 |

| Uninsured | 48.9 | 50.9 | 28.5 | 27.1 | 27.3 | 28.8 | 30.3 | 31.9 | 33.4 | 34.9 |

| Group coverage | ||||||||||

| Insured | 152.6 | 152.4 | 144.9 | 137.7 | 131.8 | 132.2 | 132.8 | 133.8 | 135.1 | 136.8 |

| Take Medicaid coverage | 3.2 | 3.8 | 10.1 | 11.5 | 12.7 | 13.8 | 14.7 | 15.6 | 16.2 | 16.9 |

| Refuse coverage | 5.9 | 7.2 | 5.5 | 5.9 | 6.3 | 6.8 | 7.2 | 7.4 | 7.3 | 7.1 |

| Take individual coverage | 0.1 | 0.1 | 4.5 | 11.7 | 17.6 | 17.3 | 17.0 | 16.8 | 16.5 | 16.2 |

| Total coverage | ||||||||||

| Insured | 185.4 | 183.7 | 194.4 | 196.2 | 196.3 | 194.7 | 193.6 | 192.6 | 192.1 | 191.9 |

| Medicaid | 34.9 | 35.9 | 52.0 | 54.1 | 56.2 | 58.7 | 60.9 | 63.0 | 65.0 | 66.8 |

| Uninsured | 54.8 | 58.1 | 34.1 | 33.0 | 33.6 | 35.6 | 37.5 | 39.3 | 40.7 | 42.0 |

| Total | 275.0 | 277.7 | 280.5 | 283.3 | 286.1 | 289.0 | 291.9 | 294.8 | 297.8 | 300.7 |

| Post-SCOTUS ruling | ||||||||||

| Individual coverage | ||||||||||

| Insured | 32.6 | 31.3 | 46.9 | 48.1 | 47.3 | 44.7 | 42.2 | 39.3 | 36.5 | 33.9 |

| Medicaid | 31.7 | 32.1 | 38.9 | 39.6 | 40.5 | 41.7 | 42.8 | 44.2 | 45.6 | 47.1 |

| Uninsured | 48.9 | 50.9 | 29.6 | 28.9 | 29.9 | 32.6 | 35.1 | 37.9 | 40.4 | 42.7 |

| Group coverage | ||||||||||

| Insured | 152.6 | 152.4 | 145.8 | 138.6 | 132.8 | 133.2 | 133.9 | 135.0 | 136.4 | 138.1 |

| Take Medicaid coverage | 3.2 | 3.8 | 8.7 | 9.9 | 11.0 | 12.0 | 12.9 | 13.7 | 14.4 | 15.0 |

| Refuse coverage | 5.9 | 7.2 | 5.6 | 6.0 | 6.5 | 7.0 | 7.3 | 7.5 | 7.5 | 7.2 |

| Take individual coverage | 0.1 | 0.1 | 4.9 | 12.2 | 18.2 | 17.8 | 17.6 | 17.2 | 17.0 | 16.7 |

| Total coverage | ||||||||||

| Insured | 185.4 | 183.7 | 197.7 | 198.9 | 198.2 | 195.8 | 193.8 | 191.5 | 189.9 | 188.7 |

| Medicaid | 34.9 | 35.9 | 47.7 | 49.5 | 51.5 | 53.7 | 55.7 | 57.9 | 60.0 | 62.1 |

| Uninsured | 54.8 | 58.1 | 35.2 | 34.9 | 36.4 | 39.5 | 42.5 | 45.4 | 47.9 | 50.0 |

| 275.0 | 277.7 | 280.5 | 283.3 | 286.1 | 289.0 | 291.9 | 294.8 | 297.8 | 300.7 | |

| Net impact | ||||||||||

| Insured | 0.0 | 0.0 | 3.2 | 2.7 | 1.9 | 1.0 | 0.2 | −1.0 | −2.2 | −3.2 |

| Medicaid | 0.0 | 0.0 | −4.4 | −4.6 | −4.7 | −4.9 | −5.2 | −5.1 | −5.0 | −4.8 |

| Uninsured | 0.0 | 0.0 | 1.1 | 1.9 | 2.8 | 3.9 | 5.0 | 6.1 | 7.2 | 7.9 |

We considered an alternative scenario where only states with Medicaid benefits already at 100 percent of the FPL or above would take the expansion. The rationale for this scenario is that each of these states already is investing state revenue to support an expanded Medicaid program. As a result, the ACA offers these states financial relief from funding their expanded programs. These states include the prototype state for ACA, Massachusetts, with 133 percent FPL qualification as well as Minnesota, the state with highest FPL threshold of more than 200 percent. The coverage and cost results of this simulation are presented in Tables 4 and 5, respectively. Regarding coverage, 11.8 million fewer people are in Medicaid compared with participation by all 50 states in 2014. However, 7.5 more people are insured through private insurance. This still leaves a net reduction in uninsured in 2014 but less potential Medicaid crowd-out of the private market. By 2021, the total net difference in uninsured has grown to 11.4 million as private insurance market take-up erodes compared with 2014. With respect to cost, Table 5 shows that the net federal cost will be $7.6 billion less in 2014 due to less Medicaid expansion and $57.7 billion less by 2021 compared with fully implemented ACA. The sum of net federal savings from 2014 to 2021 will be $221.9 billion. Under this scenario, states that already made a commitment to expand Medicaid coverage would get federal financing relief and states that chose not to expand to 100 percent would get fewer federal dollars for Medicaid and more uninsured.

Table 4.

Pre- and Post-Supreme Court of the United States (SCOTUS) PPACA Coverage Impact (Millions) Only States with Medicaid Federal Poverty Level ≥100% Take the Expansion

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|---|---|---|---|---|

| Pre-SCOTUS ruling | ||||||||||

| Individual coverage | ||||||||||

| Insured | 32.6 | 31.3 | 45.0 | 46.9 | 47.0 | 45.3 | 43.7 | 42.0 | 40.4 | 38.9 |

| Medicaid | 31.7 | 32.1 | 41.9 | 42.6 | 43.5 | 44.9 | 46.1 | 47.4 | 48.7 | 50.0 |

| Uninsured | 48.9 | 50.9 | 28.5 | 27.1 | 27.3 | 28.8 | 30.3 | 31.9 | 33.4 | 34.9 |

| Group coverage | ||||||||||

| Insured | 152.6 | 152.4 | 144.9 | 137.7 | 131.8 | 132.2 | 132.8 | 133.8 | 135.1 | 136.8 |

| Take Medicaid coverage | 3.2 | 3.8 | 10.1 | 11.5 | 12.7 | 13.8 | 14.7 | 15.6 | 16.2 | 16.9 |

| Refuse coverage | 5.9 | 7.2 | 5.5 | 5.9 | 6.3 | 6.8 | 7.2 | 7.4 | 7.3 | 7.1 |

| Take individual coverage | 0.1 | 0.1 | 4.5 | 11.7 | 17.6 | 17.3 | 17.0 | 16.8 | 16.5 | 16.2 |

| Total coverage | ||||||||||

| Insured | 185.4 | 183.7 | 194.4 | 196.2 | 196.3 | 194.7 | 193.6 | 192.6 | 192.1 | 191.9 |

| Medicaid | 34.9 | 35.9 | 52.0 | 54.1 | 56.2 | 58.7 | 60.9 | 63.0 | 65.0 | 66.8 |

| Uninsured | 54.8 | 58.1 | 34.1 | 33.0 | 33.6 | 35.6 | 37.5 | 39.3 | 40.7 | 42.0 |

| Total | 275.0 | 277.7 | 280.5 | 283.3 | 286.1 | 289.0 | 291.9 | 294.8 | 297.8 | 300.7 |

| Post-SCOTUS ruling | ||||||||||

| Individual coverage | ||||||||||

| Insured | 32.6 | 31.3 | 49.5 | 50.4 | 49.2 | 46.2 | 43.2 | 39.7 | 36.4 | 33.3 |

| Medicaid | 31.7 | 32.1 | 33.4 | 34.4 | 35.8 | 37.4 | 39.0 | 41.0 | 43.1 | 45.1 |

| Uninsured | 48.9 | 50.9 | 32.6 | 31.8 | 32.8 | 35.4 | 37.9 | 40.6 | 43.1 | 45.4 |

| Group coverage | ||||||||||

| Insured | 152.6 | 152.4 | 147.2 | 140.8 | 135.8 | 137.1 | 138.6 | 140.3 | 142.3 | 144.5 |

| Take Medicaid coverage | 3.2 | 3.8 | 6.8 | 6.9 | 6.9 | 6.8 | 6.7 | 6.7 | 6.7 | 6.7 |

| Refuse coverage | 5.9 | 7.2 | 5.8 | 6.3 | 6.9 | 7.5 | 8.0 | 8.3 | 8.3 | 8.0 |

| Take individual coverage | 0.1 | 0.1 | 5.2 | 12.6 | 18.8 | 18.6 | 18.5 | 18.2 | 18.0 | 17.7 |

| Total coverage | ||||||||||

| Insured | 185.4 | 183.7 | 202.0 | 203.8 | 203.8 | 201.9 | 200.3 | 198.2 | 196.6 | 195.6 |

| Medicaid | 34.9 | 35.9 | 40.2 | 41.3 | 42.6 | 44.2 | 45.7 | 47.7 | 49.8 | 51.8 |

| Uninsured | 54.8 | 58.1 | 38.4 | 38.1 | 39.7 | 42.9 | 45.9 | 48.9 | 51.3 | 53.4 |

| 275.0 | 277.7 | 280.5 | 283.3 | 286.1 | 289.0 | 291.9 | 294.8 | 297.8 | 300.7 | |

| Net impact | ||||||||||

| Insured | 0.0 | 0.0 | 7.5 | 7.6 | 7.5 | 7.1 | 6.7 | 5.7 | 4.5 | 3.7 |

| Medicaid | 0.0 | 0.0 | −11.8 | −12.8 | −13.6 | −14.4 | −15.1 | −15.3 | −15.2 | −15.1 |

| Uninsured | 0.0 | 0.0 | 4.3 | 5.1 | 6.1 | 7.3 | 8.4 | 9.6 | 10.6 | 11.4 |

Note: States taking expansion: MN, DC, ME, NJ, WI, CT, IL, VT, RI, NY, MA, TN, DE, MD, AZ, CA, CO, and HI.

Table 5.

Pre- and Post-Supreme Court of the United States (SCOTUS) PPACA Cost Impact (Billions) Only States with Medicaid Federal Poverty Level ≥100% Take the Expansion

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | ||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Pre-SCOTUS ruling | |||||||||||

| Individual federal $$ | |||||||||||

| Insured | $0.0 | $0.0 | $219.7 | $218.9 | $220.1 | $217.5 | $211.8 | $203.0 | $194.6 | $187.0 | |

| Medicaid | $105.4 | $108.9 | $143.8 | $149.4 | $155.6 | $163.3 | $171.1 | $179.3 | $187.9 | $196.6 | |

| Uninsured | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | |

| Group federal $$ | |||||||||||

| Insured | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | |

| Take Medicaid coverage | $10.7 | $13.1 | $35.6 | $41.1 | $46.3 | $51.3 | $55.8 | $60.1 | $64.0 | $67.9 | |

| Refuse coverage | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | |

| Take individual coverage | $0.0 | $0.0 | $26.9 | $25.4 | $25.2 | $25.2 | $25.5 | $25.4 | $26.0 | $26.1 | |

| Total federal $$ | |||||||||||

| Insured | $0.0 | $0.0 | $246.6 | $244.2 | $245.3 | $242.7 | $237.3 | $228.5 | $220.6 | $213.1 | |

| Medicaid | $116.1 | $122.0 | $179.4 | $190.5 | $201.9 | $214.5 | $226.9 | $239.4 | $251.9 | $264.4 | |

| Uninsured | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | |

| Total | $116.1 | $122.0 | $426.0 | $434.7 | $447.1 | $457.3 | $464.2 | $467.9 | $472.5 | $477.5 | |

| Post-SCOTUS ruling | |||||||||||

| Individual federal $$ | |||||||||||

| Insured | $0.0 | $0.0 | $247.7 | $244.7 | $242.2 | $237.5 | $231.9 | $214.4 | $194.6 | $176.6 | |

| Medicaid | $105.4 | $108.9 | $113.4 | $119.6 | $126.7 | $135.1 | $143.7 | $154.1 | $165.2 | $176.3 | |

| Uninsured | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | |

| Group federal $$ | |||||||||||

| Insured | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | |

| Take Medicaid coverage | $10.7 | $13.1 | $24.0 | $24.6 | $24.9 | $25.1 | $25.2 | $25.5 | $25.9 | $26.6 | |

| Refuse coverage | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | |

| Take individual coverage | $0.0 | $0.0 | $33.3 | $34.5 | $36.5 | $37.8 | $38.9 | $38.9 | $39.8 | $40.3 | |

| Total federal $$ | |||||||||||

| Insured | $0.0 | $0.0 | $281.0 | $279.2 | $278.7 | $275.2 | $270.8 | $253.3 | $234.4 | $216.9 | |

| Medicaid | $116.1 | $122.0 | $137.4 | $144.2 | $151.6 | $160.2 | $168.9 | $179.5 | $191.1 | $202.9 | |

| Uninsured | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | |

| Total | $116.1 | $122.0 | $418.5 | $423.4 | $430.3 | $435.4 | $439.7 | $432.9 | $425.4 | $419.9 | |

| Net impact | |||||||||||

| Insured | $0.0 | $0.0 | $34.4 | $35.0 | $33.4 | $32.5 | $33.5 | $24.8 | $13.7 | $3.9 | |

| Medicaid | $0.0 | $0.0 | −$42.0 | −$46.3 | −$50.3 | −$54.4 | −$58.0 | −$59.9 | −$60.8 | −$61.5 | |

| Uninsured | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | $0.0 | |

| Total | $0.0 | $0.0 | −$7.6 | −$11.3 | −$16.8 | −$21.9 | −$24.6 | −$35.1 | −$47.1 | −$57.7 | −$221.9 |

Note. States taking expansion: MN, DC, ME, NJ, WI, CT, IL, VT, RI, NY, MA, TN, DE, MD, AZ, CA, CO, and HI.

Caveats

While we developed an improved model for this analysis, several caveats are critical to note. The first is that we do not observe the uninsured or Medicaid in our health plan choice model. Thus, we have to add intercept terms in our prediction equations and calibrate the level of uninsured to match that reported in the markets for both the individual and ESI populations.

The second caveat is that both the employer and individual market premium data are several years old and need to be inflation adjusted for this analysis. However, we feel confident making these adjustments because the plan designs in our analysis are largely the same as when the plan choices were observed and our premium estimates are based on claims expenditures with a medical care inflation rate applied. The 2001 linked MEPS insurance component and household survey is the oldest component of the analysis, but the linked MEPS data have not been available since 2001.

The third caveat is that the estimated numbers of individuals enrolled in plans from the simulations are actually summed probabilities of a person's enrollment in different plans. For example, we do not predict that 100 actual people will join a Bronze plan. Instead, we predict that 1,000 people have (on average) a 10 percent probability of joining a Bronze plan (which sums to 100). This is what a plan choice model enables us to do. It also provides a platform to predict changes in policy, but not to the point of saying that a person will absolutely choose a particular health plan.

A fourth caveat is that we do not observe actual HSA plan choices in the employer data. Instead, we used the low-option health reimbursement arrangement (HRA) design that later became the standard benefit design template for an HSA. We are obtaining new plan choice data that includes HSAs offered by a large employer to enhance the model in the future.

Summary

Our simulation model provides a tool to gauge the national impact of federal health reform. The application of the simulation predicts significant reductions in levels of uninsured following full implementation of the ACA in 2014. Our approach employed novel characteristics that reflect an evolving insurance market with greater demand for HSAs as well as considering the influence of health status on health plan choice.

Our simulation model predicted nontrivial impacts of the recent Supreme Court decision on federal cost and the level of uninsured, depending on whether a state decides to accept or decline the Medicaid expansion. Generally, the number of uninsured will rise and uninsured and federal costs will fall as more states opt out. The one exception is our six-state model where the consequence of a small population of uninsured entering private exchanges as opposed to a Medicaid expansion has greater federal cost as well as more uninsured. However, when we consider the effect of all states providing more than 100 percent of the FPL for Medicaid accepting expansion and thus defraying some of the states' own outlays, we predict a sizable reduction in the number of covered lives resulting from the ACA as well as a substantially lower federal cost.

At best, full implementation of the ACA will reduce the number of uninsured by more than 20 million. If achieved in 2014, this would be the largest coverage expansion in recent U.S. history.

Acknowledgments

Joint Acknowledgment/Disclosure Statement: This research was funded by the U.S. Department of Health and Human Services (Contract HHS-P23320054301ER) with additional support for the Agency for Health Research and Quality (Contract HHS-N263200500063293) and the Center for Health and Economy, Washington, DC.

Disclosures: None.

Disclaimers: None.

Notes

National Federation of Independent Business v. Sebelius, 132 S. Ct. 2566 (2012).

Families USA (2012) recently released a 50-state estimate of the impact of ACA. However, this report did not create a separate estimate for the impact of the Medicaid expansion.

High-deductible health plans feature a large deductible coupled with a health savings account (HSA) owned by the individual that can be used to pay for eligible medical expenses. The MMA made it possible for contributions to the HSA to be made on a tax-preferred basis. That is, contributions less than the size of the deductible are exempt from federal income taxes. If the contribution is made by an employer, it is exempt from Social Security taxes as well.

Regression coefficients for our plan choice model are available in Parente et al. (2007). We converted HMO copays to actuarially equivalent coinsurance rates to predict the probability of HMO enrollment.

Pauly and Herring (1999) have suggested that individual policies contain some degree of group experience rating and vice versa. According to Pauly and Herring, premiums in the individual market do not rise one-for-one with predictable expenses, and premiums in the group market have a positive association with predicted individual medical expenditures, contrary to the GER hypothesis. Notwithstanding these findings, we decided to use IER and GER as our rating assumptions because these methods are more tractable and because it is not clear how to combine them to form “mixed” ratings systems as suggested by Pauly and Herring.

See Pauly, Percy, and Herring (1999) for data on loading fees in the individual health insurance market.

The MEPS uses “establishment size” rather than employer size. The three size classes are less than 50 employees, 50–200, and more than 200. We assume the loading factors for these classes are 20, 15, and 10 percent, respectively.

SUPPORTING INFORMATION

Additional supporting information may be found in the online version of this article:

Appendix SA1: Author Matrix.

References

- Families USA. 2012. October, “ObamaCare versus RomneyCare versus RomneyCandidateCare: A National and State-by-State Analysis” [accessed on November 19, 2012]. Available at http://www.familiesusac4.org/2012-health-care-comparison.pdfStuart Altman, Jonathan Gruber, and John McDonough are credited with significant roles in creating the report.

- Feldman R, Parente ST, Abraham J, Christianson JB, Taylor R. “Health Savings Accounts: Early Evidence of National Take-up from the 2003 Medicare Modernization Act and Future Policy Proposals”. Health Affairs. 2005;24(6):1582–91. doi: 10.1377/hlthaff.24.6.1582. [DOI] [PubMed] [Google Scholar]

- Kaiser Family Foundation. 2012a. Employer Health Benefits 2011 Annual Survey [accessed on November 19, 2012]. Available at http://ehbs.kff.org/pdf/2011/8225.pdf.

- Kaiser Family Foundation. Where Are States Today? Medicaid and CHIP Eligibility Levels for Children and Non-Disabled Adults. 2012b. [accessed on November 19, 2012]. Available at http://www.kff.org/medicaid/upload/7993-02.pdf.

- Parente ST, Feldman R, Christianson JB. “Employee Choice of Consumer-Driven Health Insurance in a Multiplan, Multiproduct Setting”. Health Services Research. 2004;39(4, Part II):1091–111. doi: 10.1111/j.1475-6773.2004.00275.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Parente ST, Feldman R, Christianson JB, Abraham J. 2005. “Health Savings Accounts: Early Estimations on National Take-up from 2003 MMA and Future Policy Proposals.” Final Report on Contract HHSP233200400573P: Analytic Support in Assessing the Impact of Health Savings Accounts on Health Insurance Coverage and Costs.

- Parente ST, Feldman R, Abraham J, Christianson JB. 2007. “Continuation of Research on Consumer Directed Health Plans: HSA Simulation Model Refinement.” Final Technical Report for DHHS Contract HHSP23320054301ER.

- Parente ST, Feldman R, Abraham J, Xu Y. “Consumer Response to a National Marketplace for Individual Health Insurance”. Journal of Risk and Insurance. 2011;78(2):389–411. [Google Scholar]

- Pauly M, Herring B. Pooling Health Insurance Risks. Washington, DC: The AEI Press; 1999. [Google Scholar]

- Pauly M, Percy A, Herring B. “Individual versus Job-Based Health Insurance: Weighing the Pros and Cons”. Health Affairs. 1999;18(6):28–44. doi: 10.1377/hlthaff.18.6.28. [DOI] [PubMed] [Google Scholar]

- The Hill. 2012. “Fifteen Governors Reject or Leaning against Expanded Medicaid Program” [accessed on November 19, 2012]. Available at http://thehill.com/blogs/healthwatch/health-reform-implementation/236033-fifteen-governors-reject-or-leaning-against-expanded-medicaid-program July 7, 2012.

- U.S. Congressional Budget Office. 2012. July 23, “Estimates for the Insurance Coverage Provisions of the Affordable Care Act Updated for the Recent Supreme Court Decision” [accessed on November 19, 2012]. Available at http://www.cbo.gov/publication/43472.

- Weiner J, Starfield B, Steinwachs D, Mumford L. “Development and Application of a Population Oriented Measure of Ambulatory Care Case-Mix”. Medical Care. 1991;29:452–72. doi: 10.1097/00005650-199105000-00006. [DOI] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.