Abstract

Numerous studies have demonstrated that animals’ tolerance for risk when foraging can be affected by changes in metabolic state. Specifically, animals on a negative energy budget increase their preferences for risk, while animals on a positive energy budget are typically risk averse. The malleability of these preferences may be evolutionarily advantageous, and important for maximizing chances of survival during brief periods of energetic stress. However, animals adapted to living in unpredictable conditions are unlikely to benefit from risk-seeking strategies and instead are expected to reduce energetic demands while maintaining risk aversion. We measured risk preferences in lemurs, a group of primates restricted to the island of Madagascar. Lemurs have evolved diverse anatomical and behavioral traits for survival in a harsh and unpredictable ecology, and these traits have been explained as forms of anatomical and behavioral risk reduction. We therefore predicted that lemurs would also be risk averse in a behavioral task that offered subjects a choice between a small certain reward, and an uncertain but potentially large reward. In Experiment 1, the average rewards associated with the constant and variable options were equal and lemurs exhibited high levels of risk aversion, replicating a phenomenon that has been demonstrated in dozens of taxa. In Experiment 2 we gradually increased the average value of the variable option relative to the constant option. Lemurs’ preferences tracked these changes and subjects became more risk seeking as the risk premium increased. However, many subjects maintained high levels of risk aversion even when the average payout of the variable option yielded double that of the constant option. These results are consistent with the notion that lemur cognition has evolved to minimize risk in an unpredictable island environment.

Risk is implicit in nearly all decisions an animal makes. Whether deciding between foraging patches, potential mates, or sleeping sites, animals are routinely faced with decisions between options that differ in the variance of their potential outcomes. How animals navigate these decisions, and the factors that influence the decision-making process has generated much theoretical and empirical work in disciplines ranging from behavioral ecology (Stephens 2008) to neuroeconomics (Platt and Huettel 2008). Several recent articles have addressed whether stable preferences for risk can be understood as adaptations to particular problems that species face in their natural environments (Watson and Platt 2008; Heilbronner et al. 2008; Gilby and Wrangham 2007; Rode and Wang 2000). For example Heilbronner and colleagues (2008) recently compared the risk preferences of chimpanzees and bonobos, two closely related species that may have evolved behavioral and cognitive differences as a result of selective pressures relevant to foraging. Compared to bonobos, chimpanzees face more variability in the distribution and availability of their food sources, rendering foraging a relatively less predictable activity. When tested in a task that allowed subjects to choose between a certain intermediate amount of food, or a gamble with a 50% chance of obtaining a larger or smaller reward, chimpanzees chose the risky option more frequently than bonobos. These results were interpreted as reflecting different species-typical foraging preferences that affected subjects’ choices in the experimental task (Heilbronner et al. 2008). Here we applied a similar rationale in exploring the preferences of lemurs, a group of primates adapted to living in the harsh and unpredictable environment of Madagascar (Wright 1999).

In a typical risky choice task, an animal is given a choice between two options, one of which yields a reward that is constant in amount, the other of which varies, but has the same average value across trials. Animals’ attitudes toward risk are inferred based on their preference for the constant or variable options. Throughout this article we use the terms “risk-seeking”, and “risk-averse” to describe these preferences (Kacelnik and Bateson 1997; Bateson and Kacelnik 1998). However, it should be noted that the economic definition of risk implies certainty of the probabilities associated with each option (Knight 1921; Luce and Raiffa 1957), a criterion that is not likely met in many animal studies of variance-sensitive choice. When faced with a risky choice, the majority of species that have been studied prefer the option that yields a constant amount of food (Kacelnik and Bateson 1996). That is, most species are risk averse when the average gains between the safe and risky options are equal.

However, these baseline levels of risk aversion frequently shift in response to changes in an animal’s metabolic state. Specifically, animals tend to become more risk prone when making choices on a negative energy budget, but more risk averse when on a positive energy budget (reviewed in Kacelnik and Bateson 1996). This phenomenon has been explained by risk-sensitive foraging theory which proposes that animals with access to a consistent food source that meets the energetic demands of survival should prefer this option to other food sources with greater variance in energetic yield (Stephens 1981). Thus the majority of species living in stable, energetically productive environments are predicted to be risk averse. However, if faced with a scenario in which the less variant food supply will not meet an animal’s expected energetic needs for survival, the animal should switch to a higher-risk food source that affords a greater chance of survival (Stephens 1981; Caraco et al. 1980; Caraco 1981). In other words, if the rate of energy gain associated with the less variant, ‘safe’ food supply falls short of that needed for survival, adopting a risk-seeking strategy offers the only chance of survival and should become the favored strategy.

Importantly, these shifts in risk preference that are associated with changes in metabolic state are thought to represent only short-term adaptations to an organism’s changing environment (Caraco 1981). Thus a small bird living in a generally stable energetic environment may survive one or two extremely cold nights by switching to a riskier food source. However long-term dependence on such a highly variable food source is sure to produce as many shortcomings as it is windfalls. Therefore the preference for risk is not thought to be a viable long-term adaptation for species living in energy-poor environments (McNamara 1996). Rather, “survivorship might be better enhanced by reducing energetic requirements (if possible) and maintaining risk-aversion, rather than adopting a long-term risk-prone strategy in a poor environment” (Caraco 1981).

Lemurs provide an interesting case for evaluating the predictions of this hypothesis because they possess many anatomical and behavioral traits thought to have evolved for exactly this purpose: energy conservation and risk minimization (Wright 1999; Jolly 1966). Lemurs are primates who last share a common ancestor with monkeys and apes approximately 75 million years ago (Horvath 2008), and who have been geographically restricted to the island of Madagascar for over 50 million years (Yoder et al. 1996). Compared to other primate habitats, Madagascar is unusually susceptible to droughts, cyclones, periods of frost and cold, and a highly seasonal fruit supply (Wright 1999). As a consequence, most lemur habitats are considered to be relatively unpredictable and energetically stressful (Jolly 1966). Compared to monkeys and apes, lemurs have many unusual anatomical and behavioral traits, all of which are thought to be adaptations for survival in an energetically scarce and frequently unpredictable ecology. Among these traits are strict seasonal breeding, cathemerality (equal activity during both day and night), low basal metabolic rates, a low degree of frugivory (a highly variable food source) for primates of their body size, female dominance, and a lack of sexual dimorphism (reviewed in Wright 1986). Given the costs of pregnancy and lactation in lemurs, females of many lemur species are dominant to males in feeding contexts, an adaptation believed to ensure sufficient resources for motherhood in Madagascar’s energy-poor habitats (Young et al. 1990). Similarly, the typical primate pattern of males being larger than females may have been selected against through generations of large, aggressive males dying during periods of energetic stress (Wright 1999). Collectively, these features have been referred to as “bet-hedging, evolved in response to environmental unpredictability” (Richard and Dewar 1991). Given these unusual anatomical and behavioral adaptations, it is possible that lemur psychology has also evolved to minimize exposure to risk under conditions of uncertainty.

In two experiments we presented lemurs with a choice between a constant option that yielded an invariant small reward, and a variable option which yielded a larger reward than the constant option on ½ of trials, but no reward on the other half of trials. In Experiment 1 the constant and variable options had the same average reward amount across trials and thus provided a test of lemurs’ baseline preference for risk when the average rewards for choosing the constant or variable options were identical. In Experiment 2 we gradually increased the net reward associated with the variable option so that its average value became increasingly greater than that of the constant option. This procedure allowed us to assess the degree to which lemurs’ baseline risk preferences could be modulated by increasing the risk premium.

Experiment 1

Material and Methods

Subjects and Apparatus

We tested 5 male lemurs (Lemur catta, n = 2, Eulemur mongoz, n = 2, Varecia rubra, n = 1), mean ± SEM age = 12.8 ± 1.6 years, housed at the Duke Lemur Center, Duke University, Durham, NC. Subjects were housed in pairs with other animals not participating in this study (n = 3), or individually (n = 2) at the time of testing. Each of these species exhibits several of the unusual “bet-hedging” traits noted above and thus provides a diverse sample of the lemur species thought to share common adaptations for life in an unpredictable environment. All subjects with the exception of the single Varecia rubra had several months of experience in touch-screen studies unrelated to the experiments reported here. All animals had unlimited access to water and received fresh fruit, vegetables, and Purina monkey chow daily.

We tested all lemurs in their home enclosures. The equipment for stimulus presentation, data acquisition and reward delivery was housed in a custom-built, stainless steel, portable testing station (86 × 43 × 35 cm) and brought into the enclosure for the duration of each session. Stimuli were displayed on a 15-inch touch-sensitive computer monitor and a custom-built REALbasic (REAL Software, Austin, TX, U.S.A.) program presented the stimuli and recorded responses. Choice stimuli were presented in two central screen locations and the left/right location of choices was determined randomly. Lemurs were required to press a rectangular start stimulus located at the bottom center of the screen in order to initiate a trial. A clear Plexiglas panel with circular openings (diameter = 5 cm) centered on each stimulus location was mounted in front of the screen to prevent lemurs from making unnecessary contact with areas of the screen that did not contain stimuli. Subjects sat on a small plastic crate in front of the cart (33 × 43 × 35 cm) to facilitate contact with the screen. We used 190 mg fruit punch flavored TestDiet pellets (Division of Land O’Lakes Purina Feed, LLC, Richmond, IN, U.S.A.) as rewards.

Design and General Procedure

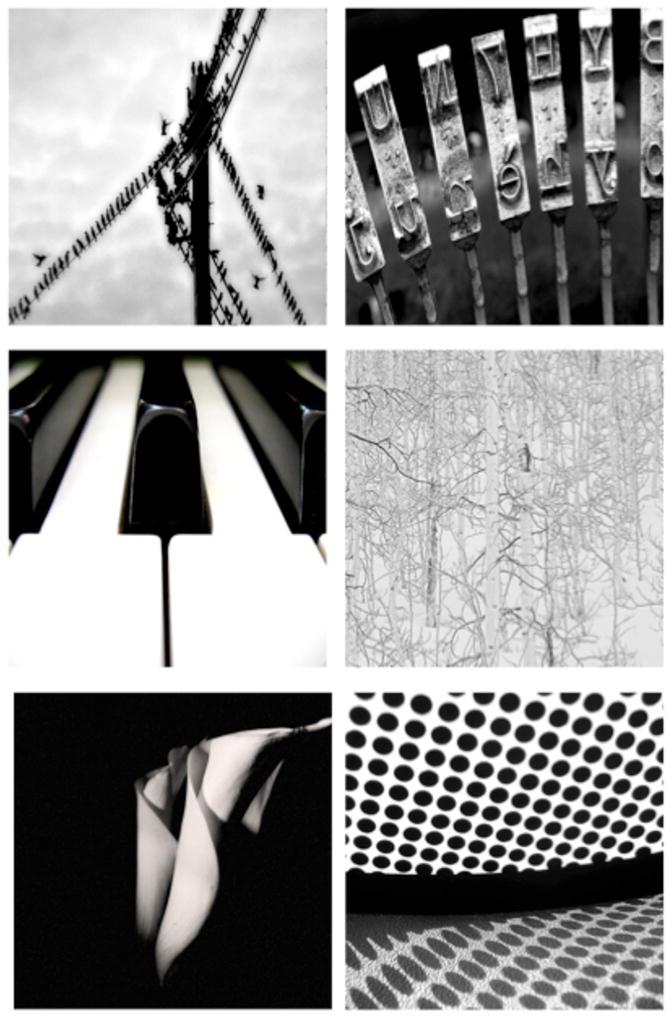

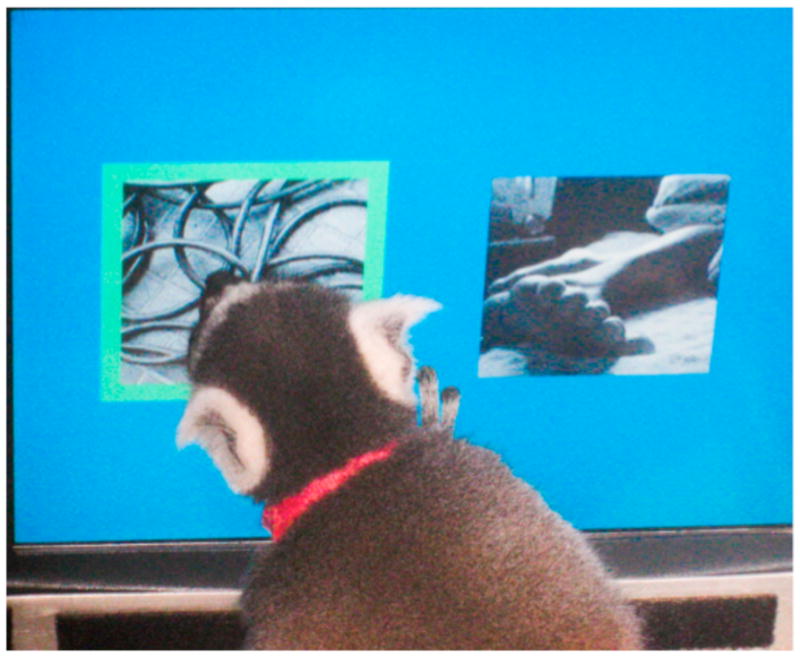

In all experiments we used high-contrast black and white images as stimuli (Figure 1). Each image was associated with a particular reward amount, or reward schedule and the image-reward associations were counterbalanced across subjects to control for extraneous image preferences. Each condition of the pretest and test used a novel pair of images. Thus lemurs were required to learn novel image-reward associations in every condition. Trials began when subjects pressed the rectangular start stimulus at the bottom of the screen. Immediately thereafter both choice stimuli were presented. When subjects pressed either stimulus a florescent border around the stimulus was illuminated, the apparatus dispensed the number of pellets associated with that choice, and a chime sounded once for every pellet being dispensed. Thus, subjects received immediate multisensory feedback regarding the outcome of their choice. An image of a subject performing the task is shown in Figure 2. With the exception of the pretest (see below), we used a 15 second inter-trial interval (ITI) throughout the experiment. In all cases the ITI began immediately following the delivery of reward on the previous trial.

Figure 1.

Examples of pairs of stimuli used in Experiment 2.

Figure 2.

A ring-tailed lemur performing the task.

Pretest – Design and Procedure

The pretest served to familiarize subjects with the task as well as to measure subjects’ abilities to discriminate the reward quantities used in the test. We tested lemurs on their ability to discriminate images that were associated with 1 pellet vs. 0 pellet, and 2 pellets vs. 1 pellet. All subjects received 5, 35-trial sessions of the 1 vs. 0 discrimination. The inter-trial interval (ITI) during this phase varied randomly between 1–3 seconds on each trial. We began the 2 vs. 1 quantity discrimination using the same ITI but subjects initially showed little preference for the larger reward. We hypothesized that because subjects were consistently receiving rewards for touching either stimulus, and there was little delay between trials, subjects had little incentive to prefer the larger reward. We therefore increased the ITI to 15 seconds in order to make trials more temporally discrete, and to impose a larger cost for choosing the stimulus associated with the smaller reward. We also added 12 forced-choice trials at the beginning of each session. On forced-choice trials only one stimulus appeared and a response resulted in the associated number of pellets (6 trials of each value). The 12 forced-choice trials were followed by 12 free-choice trials in which both stimuli were presented and subjects were required to make a choice. Subjects completed 8 sessions of the 2 vs. 1 quantity discrimination following these manipulations to the ITI and trial structure1. All analyses of the pretest were one-tailed following the a priori prediction that subjects would prefer a greater quantity of food.

Pretest - Results

As a group, lemurs chose the stimulus that yielded 1 pellet (compared to 0) more frequently than expected by chance (mean = 75% ± 11 SEM, t(4) = 2.20, p = 0.05, 1-tailed). As individuals, 4/5 lemurs exhibited an overall significant preference for the stimulus that yielded 1 pellet (binomial tests, p < 0.05, 1 -tailed). Because the procedure required subjects to first learn the arbitrary stimulus-outcome associations we also examined subjects’ preferences in the final session of the quantity discrimination. In the final session of the 1 versus 0 quantity discrimination lemurs chose the stimulus that led to the large reward on 93% (± 6 SEM) of trials, and all 5 subjects exhibited a significant preference for the large reward option (binomial tests, p < 0.05, 1-tailed). In the 2 versus 1 pellet discrimination, lemurs again preferred the stimulus associated with the larger reward. In the final 5 sessions lemurs chose the larger reward on 75% (± 8 SEM) of trials (t(4) = 3.21, p = 0.02, 1-tailed) and 4/5 lemurs showed a significant individual preference for choosing the larger reward (binomial tests, p < 0.05, one-tailed). In the final session of the 2 versus 1 quantity discrimination subjects chose the stimulus associated with the large reward on 81% (± 6 SEM) of trials. Individual data for subjects’ performance during the pretest are shown in Table S1.

Test – Design and Procedure

A new set of images were used for test sessions. Test sessions measured subjects’ sensitivity to variance when the average reward of the variable option was equal to that of the constant option. Responses to the constant option always yielded 1 pellet whereas responses to the variable option yielded 2 pellets half of the time, and 0 pellet the other half of the time. The trial-by-trial reward schedule of the variable option was counterbalanced across trials and determined pseudo-randomly by an algorithm at the beginning of each session.

Test sessions began with 12 forced-choice trials. The purpose of these trials was to ensure that subjects were equally familiarized with the probabilities of each outcome associated with the constant and variable options. The constant and variable choices were presented with equal frequency during forced-choice trials and the variable option delivered 2 pellets on half of forced-choice trials, and 0 pellet on the other half. Thus subjects obtained equal experience with each option and equal experience with each possible outcome of the variable option during these forced-choice trials. The net rewards associated with each option were therefore equal at the end of the forced-choice portion of the session. The second half of the session consisted of 12 free-choice trials between the constant and variable options. As in the pretest, the ITI was 15 seconds. All subjects completed 10 test sessions. All analyses were two-tailed to evaluate the possibilities of both risk-seeking, and risk-averse preferences.

Test - Results and Discussion

Test

During test, lemurs exhibited a strong preference for the constant reward option, despite the fact that the constant and variable options yielded equal net payouts. Overall lemurs chose the constant option on 72% of trials (± 5 SEM), significantly more often than expected by chance (t(4) = 4.6, p = 0.01, 2-tailed). Because the test required subjects first to learn the arbitrary associations between each stimulus and its associated reward outcome(s), we reasoned that subjects’ preferences would be most strongly expressed in the second half of test sessions. Indeed, lemurs exhibited the strongest levels of risk aversion in the last 5 test sessions (mean = 74% choices constant ± 7 SEM) and 4 of 5 subjects showed a significant preference for the constant option during these sessions (binomial tests, p < 0.05). The subject that did not show a significant preference was not the same individual who failed to show a preference in the quantity discrimination. These results suggest that, like the majority of species tested in risky choice tasks in which the quantity of reward is manipulated, lemurs exhibit risk-aversion. This pattern is unsurprising given that the net rewards associated with choosing the constant and variable options were equal, and the majority of models of risk-sensitive foraging under these circumstances predict that animals on a positive energy budget will be risk averse (Kacelnik and Bateson 1997). Having established lemurs’ baseline preferences for risk when the rewards between the constant and variable options were equal, we next tested whether these preferences would shift in response to a changing reward structure between the constant and variable options.

Experiment 2

Experiment 1 revealed that lemurs were risk-averse when the average reward of the constant and variable options was equal. In Experiment 2 we gradually increased the average reward amount for the variable option across successive conditions in order to evaluate how lemurs’ tolerance for risk responded to changes in net rewards between the two options.

Materials and Method

Subjects and Apparatus

The subjects and apparatus were the same as in Experiment 1 with the exception that one lemur was tested on an abbreviated procedure. Specifically this subject participated in every other condition as we increased the net reward of the variable option. We therefore collected data from this subject across the same range of variable to constant reward ratios as other subjects, but at fewer intermediate measures.

Design and Procedure

The structure of test sessions was identical to Experiment 1. Over successive conditions we increased the net payout of the variable option while maintaining the value of the constant reward. Therefore, the ratio of the average reward for the variable option to the average reward for the constant option gradually increased in favor of the variable option. The possible reward outcomes and associated average payouts for each condition of Experiment 2 are shown in Table 1. In every condition, lemurs were tested in 10 sessions, each consisting of 12 forced-choice and 12 free-choice trials. However, when the mean reward for the variable option was 3.5 pellets or greater, the number of forced-choice trials was reduced to 4 in order to comply with animal’s dietary restrictions. Similarly, in the final condition of Experiment 2 (constant reward = 1, variable reward = 15 or 0) the number of free choice trials was reduced from 12 to 8. The visual stimuli for the constant and variable options were different for each phase of Experiment 2, requiring subjects to learn new stimulus-outcome associations routinely. Following the logic of Experiment 1, we analyzed subjects’ overall preferences in each condition as well as their preferences in the second half of test sessions for each condition.

Table 1.

Reward structure and subject preferences for each phase of Experiment 2.

| Variable Outcomes | Constant Outcome | Variable:Constant Reward Ratio | Group Preference | p value (all sessions) | p value (last 5 sessions) |

|---|---|---|---|---|---|

| 2/0 | 1 | 1 | Constant | 0.01 | 0.03 |

| 3/0 | 1 | 1.5 | Constant | 0.01 | 0.05 |

| 4/0 | 1 | 2 | None | 0.18 | 0.07 |

| 5/0 | 1 | 2.5 | None | 0.10 | 0.16 |

| 6/0 | 1 | 3 | None | 0.89 | 0.70 |

| 7/0 | 1 | 3.5 | None | 0.96 | 0.69 |

| 8/0 | 1 | 4 | None | 0.27 | 0.27 |

| 9/0 | 1 | 4.5 | None | 0.12 | 0.16 |

| 10/0 | 1 | 5 | None | 0.98 | 0.89 |

| 15/0 | 1 | 7.5 | None | 0.08 | 0.12 |

Statistics and Analysis

In each condition we analyzed subjects’ individual preferences for the constant or variable option using binomial tests. To assess group patterns of choice across subjects, we compared each subject’s mean percent of choices to the constant option against chance expectation (50%) in each condition. To assess changes in subjects’ risk preferences as a function of the rewards associated with the constant and variable choices, we conducted a linear regression with the predictor variable of variable to constant reward ratio, and the dependent variable of mean percent choices to the constant option. Last, to assess learning and the development of risk preferences within each condition, we conducted linear regressions with the predictor variable of session number and the dependent variable of percent choices to the constant option. The percent choices to the constant option were log 10 transformed for all regression analyses. All analyses were two-tailed to evaluate the possibilities of both risk-seeking, and risk-averse preferences.

Results and Discussion

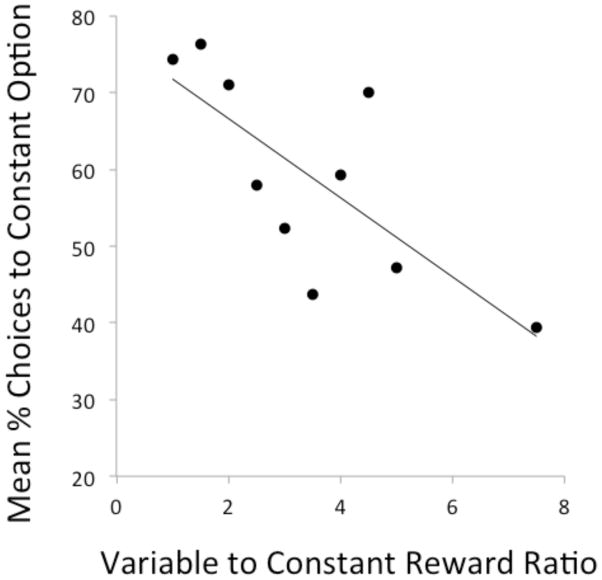

As a group lemurs exhibited increasing preference for the variable option as its net payout increased relative to the constant option (Figure 3; r2 = 0.58, F(1,8) = 10.89, p = 0.01). Thus, lemurs were sensitive to changes in the reward structures as the risk premium increased. However, lemurs maintained high levels of risk aversion even when the net gains from choosing the variable option surpassed those of the constant option. As a group, lemurs maintained a preference for the constant option even when the variable option yielded 1.5–2 times the constant option’s net payout (one sample t-tests, Table 1). As a group, subjects exhibited indifference to the two options when the ratio of the average variable reward to the constant reward ranged from 2.5:1–5:1, and exhibited a non-significant preference for the variable option when its average reward was 7.5 times that of the constant option (One-sample t-tests, Table 1).

Figure 3.

The average percent of choices to the constant option as a function of the mean variable-to-constant reward ratio. R2 = 0.58.

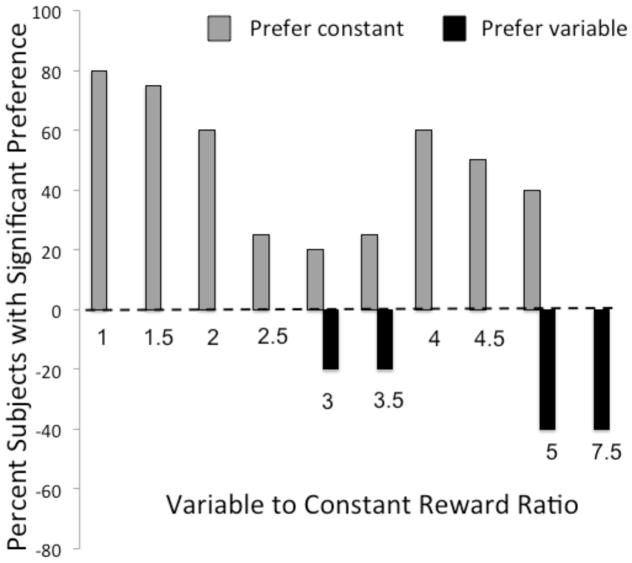

Data for individual subjects are reported in Table S2. Analysis of individuals’ preferences revealed a similar pattern (Figure 4). In the last 5 sessions of each test condition, the majority of subjects showed a significant preference (binomial tests) for the constant option when the ratio of the average variable to constant reward ranged from 1:1–2.5:1. Only when the variable-to-constant reward ratio was 7.5:1 did the number of subjects exhibiting a significant individual preference for the variable option exceed the number of subjects with a significant preference for the constant option (Figure 4). Together, these results indicate that lemurs maintain high levels of risk-aversion even when imposed with substantial costs for maintaining this strategy.

Figure 4.

The percent of subjects with a significant preference for the constant (+) or variable (−) option in each condition during Experiment 2; binomial tests, 2-tailed.

Because we increased the expected value of the variable option with each condition, the increase in expected value of the variable option was confounded with each lemur’s experience in the task. It is therefore conceivable that the overall shift in risk preferences we observed reflects a shift toward risk seeking rather than a response to the changing reward structure across conditions. To address this possibility we conducted additional analyses to assess whether subjects acquired new preferences for the constant and variable options associated with each set of new images for each condition. Specifically, for each condition we conducted linear regressions with the predictor variable of session number and the dependent variable of percent of choices to the constant option. We reasoned that for each condition in which subjects expressed risk aversion, or risk seeking, we should detect the emergence of this preference across sessions. Table 2 shows the results of this analysis. For conditions in which lemurs were generally risk averse (variable to constant reward ratios 1:1–2:1), we detected a positive relationship between the session number and the average percent of trials that subjects chose the constant option. For conditions where subjects showed risk neutrality (variable to constant reward ratios 2.5:1–4.5:1) there was no relationship between session number and the average percent of trials that subjects chose the constant option, indicating that subjects preferences hovered near indifference across sessions within these conditions. Lastly, in the conditions in which subjects were risk seeking (variable to constant reward ratios 5:1–7.5:1) we found some evidence for a negative relationship between the session number and the average percent of trials that subjects chose the constant option. The lack of a significant relationship in the final condition of Experiment 2 (variable to constant reward ratio = 7.5:1) may be due to the fact that 3 lemurs chose the constant option on 25% or less trials in their first session of this condition, although it is also possible that the lower number of trials made it more difficult for some subjects to learn the associations in this condition. Taken together, these results provide evidence that subjects learned new associations between the stimuli and their associated rewards within each condition in Experiment 2.

Table 2.

Regression analyses of the mean percent of trials that subjects chose the constant option as a function of session number within each condition.

| Variable to Constant Reward Ratio | r2 | β | p value |

|---|---|---|---|

| 1 | 0.08 | 0.01 | 0.06 |

| 1.5 | 0.10 | 0.18 | 0.05 |

| 2 | 0.08 | 0.02 | 0.05 |

| 2.5 | 0.15 | −0.01 | 0.46 |

| 3 | 0.00 | 0.01 | 0.67 |

| 3.5 | 0.09 | −0.06 | 0.07 |

| 4 | 0.03 | −0.01 | 0.27 |

| 4.5 | 0.01 | −0.01 | 0.58 |

| 5 | 0.28 | −0.07 | 0.05 |

| 7.5 | 0.03 | −0.02 | 0.21 |

General Discussion

Across two experiments, lemurs adopted risk-averse strategies when faced with a choice between a constant option and a variable option that yielded an amount that on average was equal or greater to the amount associated with the constant option. The results of Experiment 1 are consistent with those from a diverse range of other animals that adopt risk-averse strategies when the expected gains between the constant and variable options are equal (Kacelnik and Bateson 1996). The utility of this strategy has been accounted for by numerous models of decision making under uncertainty (Kacelnik and Bateson 1996; Stephens and Krebs 1986; Kahneman and Tversky 1979; McNamara and Houston 1992; Platt and Huettel 2008). In Experiment 2, lemurs demonstrated sensitivity to the increased payout associated with the variable option and increased their choices to the variable option as a function of its expected value. However, many subjects maintained significant risk-aversion, even when the expected gains from the variable option far exceeded those for the constant option.

Recent explanations for risk-averse preferences in animals have emphasized the fact that animals likely rely on simple heuristics that have evolved to maximize success in species’ respective environments (Gigerenzer et al. 1999; Rosati and Stevens 2009; McNamara and Houston 2009). Thus, while flexible rules that maximize long-term gains may fare well in models of decision making, it is unlikely that in nature, species will evolve rules that flexibly optimize behavior in a wide range of contexts. Rather, decision rules are more likely to be closely tied to the narrow range of problems that a species typically faces, and these rules may often produce sub-optimal results when employed under complex or highly variable circumstances (McNamara and Houston 2009). Thus it is possible that lemurs’ behavior in these experiments was governed by relatively simple mechanisms that evolved to limit risky behavior. These strategies are probably effective for ensuring survival in a highly unpredictable environment, where risk-seeking behavior that yields high gains one day may lead to starvation the next. Indeed, models of normative risk preferences in these conditions suggest that access to a stable low-variance resource is far more important than a variable food source that occasionally yields large rewards (McNamara 1996).

The hypothesis that risk aversion is a useful strategy in unpredictable environments has received tentative support from comparative studies of human populations. For example, Kuznar (2001) examined risk preferences in two populations of Andean herders, one in the high sierra and the other in the Andean puna. Compared to the puna community, the high-sierra community faces more unpredictability in terms of drought and theft. When given a choice between a set number of livestock, or a lottery ticket with a set probability of winning two times as many livestock, individuals from the high-sierra community required a 90% probability of winning 100 livestock in order to forgo the certain receipt of 50 animals. In contrast, members of the puna community required a significantly lower premium to accept the same risky choice. Other studies of small-scale subsistence farmers that used procedures similar to the method we used with lemurs have revealed marked cultural differences in human risk preferences (Henrich and McElreath 2002). For example, while some cultural groups (e.g. Huinca) were indifferent between a guarantee of 790 pesos or a 50% chance of 2,000 pesos, other groups (e.g. Mapuche) required a guarantee of 1400 pesos before giving up a 50% chance of 2,000. Thus it appears that human risk preferences are likely subject to both environmental and cultural influences.

Although lemurs were risk-averse when the average reward of the variable option exceeded that of the constant option, we do not know whether this tendency is uncommon in animals. The majority of studies on risk have examined animals’ preferences in a single condition where the average reward of the constant and variable options is held constant and species are characterized as risk seeking, risk neutral, or risk averse. Because most species tested under these conditions are risk averse, we believe that procedures in which the risk premium varies between conditions may be a promising tool for systematically comparing risk preferences between species. Similar procedures have facilitated comparative studies of temporal and spatial preferences (Rosati et al. 2007; Stevens et al. 2005; Amici et al. 2008) but have not typically been used to examine risk (but see Real et al. 1982; Caraco and Lima 1985; Long et al. 2009). However, qualitative comparisons between lemurs and other taxa tested on positive energy budgets suggest that the risk premium required to offset baseline risk aversion may be unusually high in lemurs. For example, when tested on a similar task bumblebees showed a preference for the variable option when its mean reward was twice that of the constant option (Real et al. 1982), and dark-eyed juncos showed a similar preference reversal when the mean reward of the variable option was 1.5 times that of the constant option (Caraco and Lima 1985). In contrast, the majority of lemurs we tested showed significant risk aversion to these same reward ratios.

An important point to consider is that economists have historically distinguished between three categories of uncertainty under which decisions can be made (Luce and Raiffa 1957; Knight 1921). Most relevant to the current study, it has been shown that humans, and some primate species show greater aversion to ambiguity where the probability of outcomes is unknown, than to risk, where the probability of outcomes is known (Camerer and Weber 1992; Rosati and Hare 2011; Hayden et al. 2010). Here we have used the terms “risk aversion” and “risk seeking” because the inclusion of forced-choice trials within each session provided subjects with information about the probabilities of each possible outcome during the test. However, it is likely that subjects made decisions under conditions somewhere between ambiguity and risk. Recently, some authors have adopted the term “variance-sensitivity” to encompass the range of situations in which animals choose between options that differ in their expected returns (Ydenberg et al. 2007; Buchkremer and Reinhold 2010).

Another important consideration is that the experiments reported here measured risk preferences in a single foraging context and may not be representative of lemurs’ preferences under other conditions. A multitude of studies have now demonstrated that attitudes toward risk can be affected by many different factors including whether the gamble is framed as a potential gain or loss (Tversky and Kahneman 1981), whether time or reward amount is varied (Kacelnik and Bateson 1996), the delay between choices (Hayden and Platt 2007), and the total number of choices a subject makes (Samuelson 1963). Further, risk preferences may be domain specific (Weber et al. 2002) and highly variable from one context to the next (e.g. social decisions versus foraging decisions). Therefore it is likely that risk preferences in any particular task capture the emergent effects of many different task parameters, and that no single task can be used to assess a species risk preferences globally. Along these lines it is noteworthy that the variable option in our task always had a 50% chance of yielding no reward (as opposed to a small reward) which may have amplified subjects’ risk aversion. Whether the strong levels of risk aversion reported here are characteristic of lemurs risk preferences under other reward schedules or in other decision-making contexts remains an empirical question.

Given the influence of an animal’s energy budget on its risk preferences, it is important to consider the environmental conditions under which our subjects were tested. In our experiments, lemurs were housed in a zoo-like environment and were always on a positive energy budget at the time of testing. It is therefore likely that the lemurs tested in these experiments faced lower energetic demands than their wild counterparts living in Madagascar. Although an animal’s current metabolic state is clearly one important factor governing risk preferences (Caraco 1981; Kacelnik and Bateson 1996), this study was designed to assess stable species-typical preferences that have evolved across evolutionary time and which are unlikely to require immediate environmental triggers for their expression. This approach is consistent with numerous other studies of captive populations that have produced evidence of species-typical foraging preferences that are thought to reflect adaptations for the environment of evolutionary adaptedness (e.g., Heilbronner et al. 2008; Rosati et al. 2007; Stevens et al. 2005)

Importantly, our testing procedures required lemurs to learn new stimulus-reward contingencies at each phase of Experiment 2. As a consequence, learned preferences for any given stimulus (and its associated reward schedule) could not carry over into subsequent phases of the experiment. Further, the forced-choice trials at the beginning of each test session ensured that subjects accrued equal experience with the constant and variable options before having to choose between them. Therefore lemurs’ preferences for risk at each phase of the experiment were formed independently of extraneous biases induced by perseveration on a single stimulus, or failure to acquire adequate experience with one or both the choices. However, it is possible that subjects maintained high levels of risk aversion throughout the experiment by perseverating on a single strategy. Specifically, it is possible that lemurs initially learned a rule either to avoid any stimulus with a variable reinforcement schedule, or to preferentially choose a stimulus that yielded a constant reward. By employing this heuristic lemurs may have been biased to continue their avoidance of variable choices, even when they faced a cost in net gains for doing so. Future experiments could explore the possible effects of such strategic inertia by varying whether subjects participated in a procedure that progressively increased or decreased the average payout associated with the variable option. If subjects choices in the earlier phases of the procedure bias their choices in subsequent phases, these carryover effects should have opposite effects depending on whether the reward associated with the variable option is increased or decreased across the experiment. The task demands of mapping new stimulus-reward contingencies may also explain some of the non-linear variance between conditions in Experiment 2 (as well as subjects’ imperfect performance in the quantity discrimination pretest). Although each group of stimuli was hand picked to maximize discriminability to the human eye (Figure 1), it is possible that certain pairs of stimuli were less discriminable than others introducing an additional source of variance influencing subjects’ choices.

The experiments reported here demonstrate that lemurs, like most taxa tested thus far, are risk-averse when choosing between two options with the same mean reward but different variances. Our results further show that lemurs maintain risk-averse preferences even in the face of substantial costs for employing this strategy. These strong levels of risk aversion are consistent with other behavioral and anatomical adaptations common to the lemurs of Madagascar and may be part of a suite of traits that have evolved for living in a highly unpredictable and energetically-stressful environment. However, the current study cannot directly test the prediction that evolution in an unpredictable environment has selected for risk aversion in lemurs. Therefore, future studies of other species will be important for understanding the phylogenetic distribution, and ecological correlates of risk preferences in animals, and will ultimately allow us to infer the selective pressures that shape species-typical risk preferences.

Supplementary Material

Acknowledgments

We thank the Duke Lemur Center and the many Duke University undergraduates who assisted with this research. We also thank Michael Platt, Benjamin Hayden, Sarah Heilbronner, Alexandra Rosati, and all members of the Brannon laboratory for their helpful discussion of these data. We thank Jeff Stevens and two anonymous reviewers for their helpful comments on previous versions of this manuscript. This work was supported by a National Science Foundation CAREER award (no. 0448250), National Institute of Child Health and Human Development Grant R01 (HD49912) and a John Merck Fund fellowship to E.M.B.

Footnotes

One subject completed an extended version of this quantity discrimination that did not incorporate forced-choice trials.

References

- Amici F, Aureli F, Call J. Fission-fusion dynamics, behavioral flexibility, and inhibitory control in primates. Current Biology. 2008;18(18):1415–1419. doi: 10.1016/j.cub.2008.08.020. [DOI] [PubMed] [Google Scholar]

- Bateson M, Kacelnik A. Risk-sensitive foraging: Decision making in variable environments. In: Dukas R, editor. Cognitive ecology: The evolutionary ecology of information processing and decision making. University of Chicago Press; Chicago: 1998. pp. 297–341. [Google Scholar]

- Buchkremer EM, Reinhold K. The emergence of variance-sensitivity with successful decision rules. Behav Ecol. 2010;21(3):576–583. doi: 10.1093/beheco/arq026. [DOI] [Google Scholar]

- Camerer C, Weber M. Recent developments in modeling preferences - uncertainty and ambiguity. Journal of Risk and Uncertainty. 1992;5 (4):325–370. [Google Scholar]

- Caraco T. Energy budgets, risk and foraging preferences in dark-eyed juncos (junco-hyemalis) Behavioral Ecology and Sociobiology. 1981;8 (3):213–217. [Google Scholar]

- Caraco T, Lima SL. Foraging juncos - interaction of reward mean and variability. Animal Behaviour. 1985;33:216–224. [Google Scholar]

- Caraco T, Martindale S, Whittam TS. An empirical demonstration of risk- sensitive foraging preferences. Animal Behaviour. 1980;28:820–830. [Google Scholar]

- Gigerenzer G, Todd PM ABC Research Group. Simple heuristics that make us smart. Oxford University Press; New York; Oxford: 1999. [Google Scholar]

- Gilby IC, Wrangham RW. Risk-prone hunting by chimpanzees (Pan troglodytes schweinfurthii) increases during periods of high diet quality. Behavioral Ecology and Sociobiology. 2007;61(11):1771–1779. doi: 10.1007/s00265-007-0410-6. [DOI] [Google Scholar]

- Hayden BY, Heilbronner SR, Platt ML. Ambiguity aversion in rhesus macaques. Front Neurosci. 2010:4. doi: 10.3389/fnins.2010.00166. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Hayden BY, Platt ML. Temporal discounting predicts risk sensitivity in rhesus Macaques. Current Biology. 2007;17(1):49–53. doi: 10.1016/j.cub.2006.10.055. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Heilbronner SR, Rosati AG, Stevens JR, Hare B, Hauser MD. A fruit in the hand or two in the bush? Divergent risk preferences in chimpanzees and bonobos. Biology Letters. 2008;4(3):246–249. doi: 10.1098/rsbl.2008.0081. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Henrich J, McElreath R. Are peasants risk-averse decision makers? Current Anthropology. 2002;43 (1):172–181. [Google Scholar]

- Horvath J, Weisrock D, Embry SL, Fiorentino, Balhoff JPI, Kappeler P, Wray GA, Willard H, Yoder AD. The development and application of a phylogenomic toolkit: resolving the evolutionary history of Madagascar’s lemurs. Genome Research. 2008 doi: 10.1101/gr.7265208. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Jolly A. Lemur behavior; a Madagascar field study. University of Chicago Press; Chicago: 1966. [Google Scholar]

- Kacelnik A, Bateson M. Risky theories - The effects of variance on foraging decisions. Am Zool. 1996;36 (4):402–434. [Google Scholar]

- Kacelnik A, Bateson M. Risk-sensitivity: crossroads for theories of decision- making. Trends in Cognitive Sciences. 1997;1 (8):304–309. doi: 10.1016/S1364-6613(97)01093-0. [DOI] [PubMed] [Google Scholar]

- Kahneman D, Tversky A. Prospect theory - analysis of decision under risk. Econometrica. 1979;47 (2):263–291. [Google Scholar]

- Knight FH. Risk, uncertainty and profit. Hart, Schaffner & Marx prize essays, XXXI. Houghton Mifflin Company; Boston: 1921. [Google Scholar]

- Kuznar LA. Risk sensitivity and value among Andean pastoralists: Measures, models, and empirical tests. Current Anthropology. 2001;42 (3):432–440. [Google Scholar]

- Long AB, Kuhn CM, Platt ML. Serotonin shapes risky decision making in monkeys. Social Cognitive and Affective Neuroscience. 2009;4(4):346–356. doi: 10.1093/scan/nsp020. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Luce RD, Raiffa H. Games and decisions : introduction and critical survey. Wiley; New York: 1957. [Google Scholar]

- McNamara JM. Risk-prone behaviour under rules which have evolved in a changing environment. Am Zool. 1996;36 (4):484–495. [Google Scholar]

- McNamara JM, Houston AI. Risk-sensitive foraging - a review of the theory. Bull Math Biol. 1992;54 (2–3):355–378. [Google Scholar]

- McNamara JM, Houston AI. Integrating function and mechanism. Trends Ecol Evol. 2009;24(12):670–675. doi: 10.1016/j.tree.2009.05.011. [DOI] [PubMed] [Google Scholar]

- Platt ML, Huettel SA. Risky business: the neuroeconomics of decision making under uncertainty. Nat Neurosci. 2008;11(4):398–403. doi: 10.1038/nn2062. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Real L, Ott J, Silverfine E. On the tradeoff between the mean and the variance in foraging - effect of spatial-distribution and color preference. Ecology. 1982;63 (6):1617–1623. [Google Scholar]

- Richard AF, Dewar RE. Lemur ecology. Annual Review of Ecology and Systematics. 1991;22:145–175. [Google Scholar]

- Rode C, Wang X. Risk-sensitive decision making examined within an evolutionary framework. Am Behav Sci. 2000;43 (6):926–939. [Google Scholar]

- Rosati AG, Hare B. Chimpanzees and bonobos distinguish between risk and ambiguity. Biology Letters. 2011;7(1):15–18. doi: 10.1098/rsbl.2010.0927. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Rosati AG, Stevens JR. Rational decisions: the adaptive nature of context- dependence choice. In: Watanabe S, Blaisdell AP, Huber L, Young A, editors. Rational Animals, Irrational Humans. Keio University Press; Tokyo: 2009. pp. 101–117. [Google Scholar]

- Rosati AG, Stevens JR, Hare B, Hauser MD. The evolutionary origins of human patience: Temporal preferences in chimpanzees, bonobos, and human adults. Current Biology. 2007;17 (19):1663–1668. doi: 10.1016/j.cub.2007.08.033. [DOI] [PubMed] [Google Scholar]

- Samuelson PA. Risk and uncertainty - a fallacy of large numbers. Scientia. 1963;98 (612):108–113. [Google Scholar]

- Stephens DW. The logic of risk-sensitive foraging preferences. Animal Behaviour. 1981;29:628–629. [Google Scholar]

- Stephens DW. Decision ecology: Foraging and the ecology of animal decision making. Cognitive Affective & Behavioral Neuroscience. 2008;8(4):475–484. doi: 10.3758/cabn.8.4.475. [DOI] [PubMed] [Google Scholar]

- Stephens DW, Krebs JR. Foraging theory. Monographs in behavior and ecology. Princeton University Press; Princeton, N.J: 1986. [Google Scholar]

- Stevens JR, Hallinan EV, Hauser MD. The ecology and evolution of patience in two New World monkeys. Biology Letters. 2005;1(2):223–226. doi: 10.1098/rsbl.2004.0285. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Tversky A, Kahneman D. The framing of decisions and the psychology of choice. Science. 1981;211 (4481):453–458. doi: 10.1126/science.7455683. [DOI] [PubMed] [Google Scholar]

- Watson KK, Platt ML. Neuroethology of reward and decision making. Philos Trans R Soc B-Biol Sci. 2008;363(1511):3825–3835. doi: 10.1098/rstb.2008.0159. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Weber EU, Blais AR, Betz NE. A domain-specific risk-attitude scale: Measuring risk perceptions and risk behaviors. Journal of Behavioral Decision Making. 2002;15(4):263–290. doi: 10.1002/bdm.414. [DOI] [Google Scholar]

- Wright PC. Diet, Ranging Behavior and Activity Pattern of the Gentle Lemur (Hapalemur griseus) in Madagascar. American journal of physical anthropology. 1986;69 (2):283–283. [Google Scholar]

- Wright PC. Yearbook of Physical Anthropology. Vol. 42. Wiley-Liss, Inc; New York: 1999. Lemur traits and Madagascar ecology: Coping with an island environment; pp. 31–72. [DOI] [PubMed] [Google Scholar]

- Ydenberg RC, Brown JS, Stephens DW. Foraging: an overview. In: Brown JS, Stephens DW, Ydenberg RC, editors. Foraging : behavior and ecology. University of Chicago Press; Chicago: 2007. pp. 1–28. [Google Scholar]

- Yoder AD, Cartmill M, Ruvolo M, Smith K, Vilgalys R. Ancient single origin for Malagasy primates. Proceedings of the National Academy of Sciences. 1996;93 (10):5122–5126. doi: 10.1073/pnas.93.10.5122. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Young AL, Richard AF, Aiello LC. Female dominance and maternal investment in strepsirhine primates. American Naturalist. 1990;135 (4):473–488. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.