There is abundant evidence of a quantitatively large association between many measures of economic status including income and wealth and a variety of health outcomes such as mortality or morbidity. However, considerable and often heated debate remains--especially across disciplines--about the direction of causation and about why the association arises.

Although medical scientists are often convinced that the dominant if not exclusive pathway is that variation in socioeconomic status produces health disparities, they are increasingly debating among themselves about why low economic status might lead to poor health. At least for modern industrial countries,1 the old standby arguments– the less well-to-do have access to less or lower quality medical care or a stronger pattern of deleterious personal behaviors--have been rejected as insufficient. Instead, a series of intriguing competing theories have arisen that emphasize long-term impacts of early childhood or even inter-uterine environmental factors, the cumulative effects of prolonged exposures to individual stressful events, or reactions to macro-societal factors such as rising levels of income inequality. A common link is that each theory attempts to document the physiological processes through which low economic status leads to poorer health. While these scientific questions are extremely important, this research has taken place with little input from economists.

Economists are now making contributions about the alternative pathway--the impact poor health may have on economic resources. Poor health may restrict a family's capacity to earn income or to accumulate assets by limiting work or by raising medical expenses. At a minimum, this work should provide a caution against exaggerating the magnitude of causation from economic status to health outcomes. But the potential contribution runs deeper. As people age, the evolving variation in individual health outcomes may offer additional statistical information to estimate parameters of household savings and consumption behavior that so far have proven to be somewhat elusive. Thus, incorporating health uncertainty and risk into economic models should eventually enrich our understanding of basic tenets of household behavior.

The first section of this paper documents the size of the association between health and one prominent economic status measure-household wealth. Section two deals with how health influences economic status by sketching out reasons why health may alter household savings (and eventually wealth) and then providing estimates of the empirical magnitude of these effects. Section three shifts attention to the alternative pathway–the links between economic status and health--and summarizes 2major controversies and evidence surrounding these issues.

The Association Between Economic Status and Health

To show some salient aspects of the strong association between health and wealth, Table 1 lists household median wealth arrayed against the head of household’s 1984 self-reported general health status. Thus, the data cell in the first row of the first column implies that median wealth when household heads reported excellent health in 1984 was $68,300 (in 1996 dollars). Across all age groups, those in excellent health in 1984 have 74 percent more wealth than respondents in fair or poor health do. A parallel table showing income rather than wealth would display similar differentials. These differentials rival in size wealth and income differences by schooling, a subject receiving far more attention from economists. Median incomes of 1984 college graduates were $77,000 compared to $28,000 among high school dropouts--virtually the same as the income gradient from excellent to poor health.

Table 1.

Median Wealth by Self-Reported 1984 Health Status

| Age Group | 1984 | 1989 | 1994 |

|---|---|---|---|

| All Households | |||

| Excellent | 68.3 | 99.3 | 127.9 |

| Very Good | 66.3 | 81.9 | 90.9 |

| Good | 51.8 | 59.6 | 64.9 |

| Fair/Poor | 39.2 | 36.0 | 34.7 |

| 25–34 | |||

| Excellent | 28.5 | 51.5 | 84.3 |

| Very Good | 19.5 | 34.7 | 50.1 |

| Good | 10.5 | 17.2 | 28.2 |

| Fair/Poor | 0.9 | 3.1 | 10.4 |

| 35–44 | |||

| Excellent | 100.1 | 150.1 | 194.7 |

| Very Good | 81.1 | 96.3 | 117.5 |

| Good | 49.5 | 45.3 | 83.5 |

| Fair/Poor | 23.8 | 15.5 | 32.4 |

| 45–54 | |||

| Excellent | 164.2 | 198.3 | 255.8 |

| Very Good | 132.1 | 176.2 | 186.9 |

| Good | 87.8 | 76.9 | 97.1 |

| Fair/Poor | 59.7 | 61.6 | 69.4 |

Source: Calculations by author–PSID. Numbers reported in thousands of 1996 dollars.

The wealth-health gradient characterizes all age groups in Table 1. Thus, it is not only a middle- or late-life phenomena, but appears for some as their labor force activity begins and emerges for others as their economic resources and health increasingly interact over their lives. The second and third columns of Table 1 indicate that changes in wealth are also correlated with initial health. Those whose 1984 reported health was worse not only had much lower baseline wealth, but they experienced considerably smaller absolute wealth growth over the ensuing 10 years. Among those 35–44 years old in excellent health in 1984, median wealth grew by almost $100,000 while it increased by less than $10,000 for similarly aged people whose 1984 health was fair or poor.

Changes in health status over time, not shown in Table 1, are also associated with changes in wealth. Consider those in very good health in 1984 who had a median wealth of $66,300. If their health remained ‘very good’ by 1994, median wealth in 1994 was $100,000. If their 1994 health was ‘excellent’, median wealth was $121,000 while if their health declined to ‘fair’ or ‘poor’, median 1994 wealth was only $31,000.

These patterns are corroborated by other salient health outcomes.3 Between 1979 and 1989, white men with family incomes below $10,000 could expect to live 6.6 fewer years than white men in families with more than $25,000. This life-expectancy differential for black men in the same income groups was even larger--7.4 years longer life. These differences persist when data are arrayed by specific causes of death whether communicable or chronic diseases, accidents, suicides, or homicides. For example, death rates per 10,000 white men ages 25–64 with incomes below $10,000 were 32 for heart disease, 9 for lung cancer and 6 for diabetes. Among similarly aged white men with incomes over $25,000, rates were much smaller--heart disease 13, lung cancer 4, and diabetes 2.

Such differentials may not have been surprising earlier in this century when communicable diseases were the major causes of death and poor nutrition and inadequate sanitation-with obvious links to economic status- were the principal risk factors. They provide more of a challenge now when death from chronic diseases dominate and the major risk factors (smoking, high fat diet, sedentary life style) do not provide a full explanation.

These risk behaviors do exhibit higher prevalence in lower socioeconomic groups. A good example is smoking, a well-documented risk for lung cancer, respiratory and heart diseases. While cigarette smoking has declined among all groups, it remains more common among those with lower incomes or less schooling. In 1995, 40 percent of men who were not high school graduates smoked; the comparable figure for male college grads was only 14 percent. Similar patterns by socioeconomic status exist for other health risk behaviors--excessive drinking, obesity, and sedentary life-styles to name a few. But the research consensus is that health disparities by economic status are only slightly mitigated when extensive controls are included for health risk behaviors (Marmot, 1999).

Access to care also varies by economic status. But again, there is growing scepticism that differential access is the smoking gun behind the health gradient. Some of this skepticism flows from doubts that medical care has all that much to do with health outcomes. For example, more widespread availability of health insurance in Britain under the National Health Service and in the United States after the passage of Medicare apparently failed to make much of a dent on health disparities by economic status. More concretely, the RAND health insurance study, which used a careful experimental design to investigate how people reacted to different patterns of co-payments and deductibles, found that lower payments for health care do increase utilization of health care services, but result in only minor effects on most health outcomes (Newhouse, 1993).

The possibility of mutually reinforcing interactions have made conclusions about the relation of income, wealth and health difficult to pin down. Are healthier households wealthier ones simply because higher incomes lead to better health? Or does poor health restrict a family's ability to accumulate assets by limiting work or through rising medical expenses? Or perhaps some unobserved factor makes some people healthier and wealthier. Despite its size, the relation between better health and more wealth or larger changes in wealth depicted in Table 1 is uninformative about causality. Equally plausible stories can be told justifying either causal direction. Wealth could grow more rapidly among those who started in better health because good health enhances future earnings capacity and facilitates savings. Alternatively, additional economic resources could help protect individuals from the ravages of age so that their subsequent health is better.

These issues can be illustrated with a few concepts derived from the standard economic model of health (Grossman, 1972). This model starts with the health production function in which health at any given time is a result of a set of factors, including health in the previous time period, medical care received, the adoption of good personal health behaviors like exercise, the avoidance of unhealthy behaviors like smoking, and a vector of other personal and environmental levels factors. Family background or genetic endowments may also matter by creating temporal links between early and later life health outcomes and by making the preservation of good health easier.

A fundamental insight of an economic approach is that health is a stock where current inputs and behaviors chosen are investments producing increments to that stock. If these increments are affected by current choices, solving sequentially, today's health stock will be a function of the entire history of all current and past prices, incomes, health behaviors and initial health endowments. Since a lifetime budget constrains choices, a corollary implication is that additional current economic resources may not have a quantitatively large impact on the current stock of health, especially at older ages. Additional economic resources may increase health care utilization or induce good health behaviors, but even if behaviors were altered instantaneously, they can only directly impact on health investments and not health capital.

An important consideration is that economic resources may also be affected by the stock of health. Healthier people can work longer hours in a week and more weeks in year leading to higher earnings, or poor health may trigger the receipt of means-tested government transfer income. Health then enters the model in two ways, producing possible two way multiple feedbacks between health and income. Contemporaneous feedback exists when current health status affects current income. But eliminating current health feedbacks is only part of the problem. Prior health conditions may alter past incomes which then may affect current income. Periods of poor health in middle age by reducing earnings could have negative implications for pension and social security income during retirement. Since health status is positively correlated even across quite distant ages, a correlation of retirement income and current health may flow from past health to current retirement income.

The Effect of Health on Wealth

Life-cycle models are a natural place to begin an exploration of any role health may play in family savings decisions. But until recently, in spite of some impressive theoretical and empirical work on savings motives, health has not been an integral part of that work.4 Arithmetically, savings may fall as current health deteriorates because it reduces current period income or increases either consumption or out-of -pocket medical expenses. Since health is a stock which may be permanently altered in future years, we must also worry about potential effects on future income, consumption, and medical expenses. However, households may even adjust in more subtle ways. There may be a close trade-off between the desire to leave bequests and an individual’s health, or the length of remaining life may be altered by a poor health outcome.

The prospect of high medical expenses has been the principal way health risks have been incorporated into life-cycle models (Palumbo, 1998, Lillard and Weiss,1996). But how significant are health care costs in driving household savings behavior? Table 2 lists distributions of out-of-pocket medical expenses separately for those who experienced severe, mild, or no new chronic health conditions. Severe conditions were defined as cancer, heart condition, stroke, and diseases of the lung. All other onsets are defined as mild. The first five rows of the table rely on the Health and Retirement Survey (HRS), a random sample of households with one member born between 1931 and 1941 (51–61 years old in 1992). The second five rows uses the Asset and Health Dynamics of the Oldest Old survey (AHEAD) which sampled respondents born in 1923 or earlier (ages 70 plus in 1993). Funded by the National Institute of Aging, follow--ups of both surveys are conducted at two year intervals by the Institute of Social Research at the University of Michigan.

Table 2.

Out-of-Pocket Medical Expenditures

| Percentiles | |||||||

|---|---|---|---|---|---|---|---|

| 10th | 30th | 50th | 70th | 90th | 95th | 98th | |

| HRS (ages 51–61) Between Waves 1–3 | |||||||

| (severe new chronic) | 32 | 793 | 1,985 | 4,399 | 11,659 | 17,108 | 31,601 |

| (mild new chronic) | 49 | 434 | 1,072 | 2,255 | 6,324 | 9,489 | 18,322 |

| (no new chronic) | 22 | 358 | 868 | 1,833 | 4,774 | 7,983 | 15,452 |

| severe-with H.I. | 159 | 1,003 | 2,147 | 4,407 | 11,564 | 16,855 | 28,233 |

| Severe-without H.I. | 0 | 143 | 1,060 | 4,463 | 16,503 | 30,519 | 64,678 |

| AHEAD (ages 70+) Between Waves 1–2 | |||||||

| (severe new chronic) | 0 | 622 | 1,530 | 3,150 | 8,600 | 16,334 | 34,188 |

| (mild new chronic) | 0 | 400 | 980 | 1,910 | 5,681 | 8,894 | 14,800 |

| (no new chronic) | 0 | 255 | 800 | 1,800 | 4,839 | 8,000 | 19,008 |

The striking result is how modest out-of-pocket medical costs are for the average person and how relatively insensitive costs are to the onset of even serious illnesses. Among those in their 50s, the median costs across a four year interval due to a new severe health problem were about $2,000, only $1,100 more than for those with no new health problem. The median per-period costs are only slightly larger among those over 70; $1,530 for a severe onset, compared to $800 for people with no new health event. While typical health care costs are modest, they may be much larger. In both age groups, two percent of those with a new severe health condition spent more than $30,000 of their own funds. These small probabilities of a very expensive outcome means that attitudes toward risk and uncertainty may be central to understanding savings behavior. Indeed, some current wealth may have been accumulated to deal with today’s health problems. Since health insurance mitigates health impacts on medical expenses, Table 2 presents these distributions for the age 51–61 population from the HRS survey for those with a new severe health event by whether they have health insurance or not. In this group, the median person with a new severe illness and no health insurance actually spent less out of pocket--evidence that the lack of health insurance reduces health care utilization. Health insurance protection reveals itself instead in the tails, as the top two percent of out-of-pocket medical expenses are more than twice as high among those without health insurance.

Health events may also affect savings by reducing the amount of labor supplied. But while the earnings of the household member whose health declined may fall, other types of household income may partially compensate; for example, a spouse may work more, or early retirement or disability may be important for some households. Depending on their persistence and severity, current health events may also alter future household income, eventually reducing future social security and pension benefits. During retirement, however, new health shocks will not alter labor supply by much and income sources such as social security and pensions will remain fixed. As a result, the health of these older households are unlikely to affect their wealth accumulation through the income channel. Consistent with this notion, correlations between health and income and the social health gradient are much lower among retired households than among those who are working (Deaton and Paxton, 1998 or Smith and Kington, 1997).5

Another reason health may affect savings is that marginal utility of consumption could be a function of health status. If the marginal utility of consumption declines with poorer health, individuals will want to consume more when they are healthy than during the years when they are ill. If so, savings will rise when the prospect of poor health increases.6 A related question involves the impact of poor health on life-expectancy. In life-cycle models, mortality risks have effects similar to lower interest rates in moving consumption toward the present. The strength of this incentive to consume now will depend on other factors, such as how much future income for a surviving spouse has been annuitized (for example, through social security) or will be lost due to the death of one partner.

Some households may adjust to new health events not by reducing current or future consumption, but instead by decreasing financial transfers to their heirs. Desired bequests and current health are strongly correlated. More than half of AHEAD respondents in poor health report they are certain they will not leave an inheritance larger than $10,000, while more than half of AHEAD households in excellent health are just as certain that they will leave such an inheritance (Smith, 1999). Since many low-income households may be planning to leave bequests that are close to zero, any adjustments through bequests may be more relevant for more well-to-do households.

No matter why new health events alter wealth accumulation, difficult modeling issues arise in determining how much of any health change is actually news to the respondent. Presumably, based on currently available information about their current health, people make uncertain projections about their future health states. These health trajectories contain predictable age-related components, surrounded by considerable individual level heterogeneity, all of which are updated with the realization of new and often unpleasant information about one's health.

Standard statistical identification issues arise in this application--the need for variables that affect savings only through their effect on health. Given the nature of private and public health insurance markets in the U.S., it may be more difficult than usual to obtain exogenous variation in health prices (or instruments for them). An alternative research strategy for isolating new health information lies in the onset of new chronic conditions. While to some extent people may anticipate onset, much of the actual realization and especially its timing may be unanticipated. While new onsets may provide the best chance of isolating health shocks, not all new onset is a surprise. A set of behavioral risk factors and prior health or economic conditions may make some people more susceptible than others; for example, sedentary, overweight, heavy smokers and drinkers who suffer from hypertension, and whose parents and siblings died young may be much more likely to experience a heart attack. Therefore, these and other predictors of new onsets should be included in models to increase one’s confidence that the remaining variation in new onsets is indeed ‘news’.

This attempt to isolate the 'surprise' in new health realizations mirrors similar attempts in the macro-economic literature and has many of the same advantages and limitations. In one respect, this application may have an important advantage in distinguishing between the information available to the researcher and to the decision-maker. Recent panel surveys such as the HRS and AHEAD contain extensive measurement of baseline health status as well as current and past health behaviors and detailed economic histories. It may be more likely in this application that respondents’ expectations about their future health are incorporated in these baseline measures and prior histories.

This distinction between predictable and unpredictable components may be useful for another purpose. If people anticipate that they will transit into poor health and incur health care costs or lower incomes, they will save enough prior to the onset of illness to take care of this contingency. A test of this notion involves estimating the effect of all future period predictable and unpredictable health onsets on current savings behavior. If people are also risk averse, precautionary savings would indicate that predictable onsets would increase prior wealth accumulation by more than the expected value of the needed funds to provide for the future while unpredictable components would have no effect at all.

Finally, a new health event may affect medical costs, incomes, and savings in future years as well. At the other extreme, the onset of a new health condition may induce only current period changes in medical costs and income--a one year savings effect after which savings returns to normal. Then, the wealth profile shifts down for one year, but the future path of wealth accumulation is unaffected. These possibilities suggest that lagged values of health shocks belong in the model. If there are only current period effects of health events on savings, all lagged values of health shocks will have no impact.

With this background, I describe results from empirical models estimating effects of new chronic health problems on household wealth accumulation and the pathways through which these savings effects take place. In Table 3, ordinary least squares regression models are used where the three dependent variables listed in the columns are between wave changes in total household wealth, out-of-pocket medical expenses, and total medical expenses. These changes are measured between the first and third wave of HRS and the first and second wave of AHEAD. Household wealth includes net equity in homes, other real estate, vehicles, business equity, and a rather complete list of financial assets.7 The key independent variables are the onset of chronic health problems with additional controls included for demographic factors, health risk behaviors, and pre-existing health conditions.

Table 3.

Economic Effects of New Health Onset

| Wealth | OOP Expenses |

Total Medical Expenses |

|

|---|---|---|---|

| HRS | |||

| Mild onset | −3,620 | 635 | 2,555 |

| Severe onset | −16,846 | 2,266 | 28,963 |

| AHEAD | |||

| Any onset | −10,481 | 1,026 | NA |

| HRS severe onset only | |||

| With health insurance | −17,417 | 1,912 | 26,957 |

| Without health insurance | −17,282 | 4,576 | 42,166 |

| HRS severe onset only | |||

| Below median income | −11,348 | 2,439 | 29,829 |

| Above median income | −25,371 | 2,014 | 28,085 |

| AHEAD any onset | |||

| Below median income | −4,427 | 915 | NA |

| Above median income | −17,040 | 1,101 | NA |

The first two rows of Table 3 provide estimates of mean economic impacts of mild and severe new health conditions between the first and third wave of HRS. As the word “mild” suggests, the full health costs of mild onsets are not large--$2,555--and the out-of-pocket costs to respondents are smaller still--about $635. But even these mild onsets may have lowered wealth accumulation by $3,620.

Effects are more dramatic when the health shock is severe. Now total medical costs are substantial--almost $29,000. However, individuals paid only $2,266--less than one-tenth of the total medical costs of the illness. Despite low out-of-pocket expenses, the impact of new severe health problems on savings is not trivial. The mean wealth reduction is about $17,000 or 7 percent of household wealth. Since these health problems may persist into the future, the eventual impact on wealth may be even larger for some households. When the health onset is severe, financial wealth is unable to absorb the full brunt. Instead, families dip into some of their other assets including taking new loans on their homes. With only two waves of AHEAD available, the data cannot yet distinguish between the onset of mild and severe health conditions. Thus, the evidence in Table 3 refers to the onset of all kinds of conditions. The data shows that among Americans aged 70 and over, a new health condition lowers wealth accumulation by about $10,000, half of which is a reduction in financial assets. This wealth decrement far exceeds any out-of-pocket medical expenses associated with the illness. AHEAD has no information on total health care costs, which is why the final column is labeled NA (Not Applicable).

These estimates are averages across heterogenous households. The remaining rows of Table 3 provide separate estimates by whether households have health insurance or is above or below median income. Health insurance is not synonymous with wealth insurance. The fourth and fifth rows show that HRS respondents with health insurance (and presumably lower out-of-pocket medical expenses) had roughly the same wealth decrement (about $17,000) as those individuals without any health insurance. As measured by total medical expenses incurred, those without health insurance apparently experienced more severe conditions, and spend more out-of-pocket on care. The similar average impact on wealth accumulation then implies that the magnitude of effects of the other pathways that might decrease wealth were smaller for those without health insurance. For example, those without health insurance may not have lowered their household incomes as much by when they reduced their labor supply.

The last four rows of Table 3 include estimates for HRS and AHEAD households whose prior household income places them above or below the median income. Since total and out-of-pocket medical expenses are similar, the severity of illness is about be the same for both groups in HRS. However, families with incomes above the median suffered larger wealth losses because they had more to lose.

While Table 3 indicates that new episodes of poor health lower wealth accumulation, it doesn’t tell us much about why. To address this question, empirical models of the alternative pathways though which wealth accumulation can change–out-of--pocket and total medical expenses, changes in labor supply and household income, changes in bequest intentions, and changes in mortality expectations- were estimated. Three waves of HRS and two waves of AHEAD were used with separate models estimated for changes observed between each survey wave. Prior wave new health onsets are included in the HRS wave 3 to wave 2 models to obtain some idea about possible lags in the effects of new health events. Table 4 summarizes the main HRS results and where applicable AHEAD findings are mentioned in the text.

Table 4.

Pathways of Effects of New Health Events in HRS Survey (“t” statistics in parenthesis)

| Out-of-Pocket Medical Costs | Total Medical Costs | Change in Probability of living to 75 |

||||

|---|---|---|---|---|---|---|

| W2-W1 | W3-W2 | W2-W1 | W3-W2 | W2-W1 | W3-W2 | |

| Type of Health Onset |

||||||

| Major 1–2 | 1,608 (11.3) |

792 (3.09) |

18,299 (20.0) |

11,712 (5.31) |

−6.59 (5.66) |

−2.88 (1.96) |

| Minor 1–2 | 181 (1.76) |

308 (1.68) |

230 (0.35) |

2,191 (1.38) |

−1.75 (2.13) |

−0.207 (0.21) |

| Major 2–3 | NA | 1,699 (7.33) |

NA | 23,637 (11.8) |

NA | −5.97 (4.46) |

| Minor 2–3 NA | 677 | NA (3.67) |

4,534 | NA (2.85) |

−0.91 | (0.88) |

| Change in Weekly Hours | Probability of Staying at Work | Change in Own Earnings | ||||

|---|---|---|---|---|---|---|

| Type of Health Onset | W2-W1 | W3-W2 | W2-W1 | W3-W2 | W3-W1 | |

| Major 1–2 | −4.13 (6.09) |

0.28 (0.38) |

−0.15 (7.08) |

−0.06 (2.24) |

−2,639 (2.96) |

|

| Minor 1–2 | −1.45 (2.99) |

−0.54 (1.04) |

−0.05 (3.40) |

−0.02 (1.12) |

−1,638 (2.57) |

|

| Major 2–3 | NA | −3..92 (6.01) |

NA | −0.16 (7.67) |

NA | |

| Minor 2–3 | NA | −1.19 (2.28) |

NA | −0.04 (2.67) |

NA | |

Medical expenses--most of which are insured--contributed to but were decidedly not the leading cause of wealth depletion. The mean between wave impact of a severe health onset in HRS on out-of-pocket expenses was over $1,600 (less than a tenth of total medical costs of the illness) with much smaller medical expenses estimated for minor health onsets. Even in the medicare eligible AHEAD population, mean out-of-pocket medical expenses from a new onset run $1,026 (‘t’ = 4.79). Severe health onsets that occurred between the first and second wave of HRS resulted in higher medical expenses between the second and third HRS waves indicating that effects persist into the future. However, these effects are only half as large as the immediate within period impact on out-of-pocket medical expenses.

The labor supply effects estimated in Table 4 are large when the new health problem was severe--a per period reduction of about 4 hours per week and a 15 percentage point decline in the probability of remaining in the labor force. Moreover, when a severe health event occurred between waves 1 and 2 of HRS, there is no evidence of any return to normal weekly hours and the exit from the labor force continues into the subsequent interval. Since they are at least 70 and mostly already retired, there were no detectable labor supply effects in AHEAD.

Since work effort is affected in HRS, it is not surprising that new health onsets also reduce respondents’ earnings--about $2,600 for a severe onset. The reduction in total household income is about the same as respondents’ earnings alone, suggesting that on net all other sources of household have about a zero effect. Given that most income sources are relatively fixed, there were no statistically a significant effects of new onsets on household income in AHEAD.

Table 4 indicates that health ‘shocks’ in HRS, especially severe ones, lead to revisions in people’s expectation of how long they may live. The revisions are not all immediate, as lagged values of severe health shocks lead to additional downward revisions in life-expectancy in the next wave. Similar statistically significant impacts of health shocks on subjective probabilities of life-expectancy exist in AHEAD. Past savings collected to insure against the uncertainty about the length of life can now be spent. There is also some evidence that an onset of a major health event reduces the odds that HRS respondents will leave large inheritances to their heirs.8

These results may highlight a possible puzzle. In both HRS and AHEAD, the reduction in household wealth is larger than can be explained by the combined effects of out-of-pocket medical expenses and lower household incomes. For example, between the first and third waves of HRS, the sum of new medical expenses and changes in household income are only one-fourth the reduction in savings.

What might explain this puzzle? One set of answers is that the discrepancy may be due to measurement issues that understate medical costs or household income changes, or that overstate changes in household wealth. Out-of-pocket medical costs may seriously understate the full financial costs of an illness. There are expenditures associated with an illness of a family member -- transportation, reconfiguration of home care environments, and so on -- which people may not think of as medical costs and are often not reimbursed. Although household wealth is notoriously difficult to measure, it is not apparent why any errors should be systematically related to new health events unless estimates of wealth shift from optimistic to pessimistic with an onset of illness. Still, until a number of additional survey waves are available, measurement error in wealth labels all between wave results as tentative.

While such hypotheses should be investigated, the size of the discrepancy between changes in wealth on one side and the estimated medical costs and reductions in income on the other indicates that other adjustments are taking place. One interpretation is that the discrepancy is due to rising household consumption; Lillard and Weiss (1993) interpret this pattern to imply that the marginal utility of consumption increases in periods of poor health. This should be confirmed directly using non-medical consumption data rather than implicitly with income and savings. But one wonders how plausible rising consumption is given how ill some of these people are. Another explanation is that in anticipation of the need for long-term care and to qualify for Medicaid, people may transfer assets to their heirs or "spend down" their income by consuming at a very high rate. Yet, HRS survey evidence indicates that on average individuals may actually lower their estimates of the probability of entering a nursing home when severe health onsets begin., so this motivation for a "spend down" is uncertain. Some terminal illnesses such as lung cancer can lower the odds of entering a nursing home

The results presented here are only a first step. They are sufficient to indicate, I believe, that ignoring the potentially large impacts health status can have on wealth -- looking only at connections from wealth to health -- is surely missing a major part of the story. But the data descriptive models used here do not attempt to recover behavioral parameters, nor to test hypotheses about precautionary savings motives in anticipation of future health events. Moreover, relying only on type of chronic condition to distinguish among health events is certainly too simplistic. Distinctions which simultaneously incorporate other dimensions of health, including changes in the ability to function would be desirable. As future survey waves become available, it will be possible to investigate these questions further.

The Effect of Economic Status on Health

Strong feedbacks from health to economic resources are not evidence that there are not equally powerful impacts of economic status on health. While this pathway has a more distinguished research tradition, current research is in some disarray as the traditional culprits--poor health behaviors and access to care--are put aside in search of fuller explanations. While no consensus has been reached, the upside of disarray is a period of intellectual vibrancy which if successful may fundamentally change our knowledge of how the biology of the human body and the economic environment in which we live interact.

To assess the nature of the relation between health and income and wealth, Table 5 lists results from a typical model. Since the outcome is self-reported general health status (ranked from excellent to poor), ordered probit models are used in estimation. While the models include a long list of standard covariates, only the income and wealth coefficients are highlighted. There are a few essential points. First, in linear form, both total household income and wealth have statistically significant positive effects on self-reported health status. This relation is only reduced by a third when controls are added for health risk behaviors such as smoking, excessive drinking, exercise and Body Mass Index (BMI) (for obesity).

Table 5.

Ordered Probit Models of Self-Reported Health Status In HRS

| Total incomea | .0034 | (11.3) | ||||||

| Income 1st tercile | .0153 | (7.46) | ||||||

| Income 2nd tercile | .0046 | (3.41) | ||||||

| Income 3rd tercile | .0009 | (2.64) | ||||||

| Total wealtha | .0003 | (8.83) | ||||||

| Wealth 1st tercile | .0059 | (7.42) | ||||||

| Wealth 2nd tercile | .0009 | (3.07) | ||||||

| Wealth 3rd tercile | .0001 | (2.73) | ||||||

| Weekly Wages | .0467 | (4.39) | .0061 | (0.66) | ||||

| Retirement Income | −.0050 | (3.42) | .0108 | (0.40) | ||||

| Welfare Income | −.0355 | (5.34) | −.0184 | (1.96) | ||||

| Weekly Wages = 0 | −.3663 | (13.5) | ||||||

| Retirement Income = 0 | .2915 | (8.01) | ||||||

| Welfare Income = 0 | .0756 | (1.51) |

Models include controls for race, Hispanic, sex, age, marital status, years of schooling (0–11, 12–15, 16 or more) of respondent and spouse. See Smith and Kington (1997). Coefficients are in 000 of dollars.

Second, the relation is decidedly non-linear in this ordinal health index with effects decaying across the income or wealth distribution--strongest among the poor, and weakest among the affluent. This decay is seen in the third column of Table 5 which estimates splined linear effects that are allowed to break at the 33rd and 66th percentiles. The importance of non-linearity will come up below. Third, as for wealth, there are significant feedbacks from health to income. The third column shows that the positive relation with good health characterizes only wage income while retirement (pension or social security) or safety net income are negatively correlated with good health. The reason is evident from the fourth column which includes dummy variables for the receipt of any income of each type. Especially during their fifties, individuals receiving income from pensions, social security or safety net programs are more likely to be in poorer health suggesting that the main causation flows from health to income. But even the strong positive wage effect disappears when a dummy is added for the receipt of wage income. The main pathway involving no wage income is no doubt poor health reducing labor supply. Since feedbacks from health to income or wealth may maximize among older workers, the influence economic resources has on health may peak at much younger ages. In the rest of this section, I highlight the major findings and controversies representing the main competing views.

The Two Whitehall Studies

Hands down, the most influential investigations of the social health gradient are the two “Whitehall” studies of British civil servants conducted almost 20 years apart. The original 1967 project documented for men a steep inverse relationship between employment grade and poor health outcomes, including mortality from many diseases. Beyond its extensive catalogue of the diverse medical outcomes associated with employment grade, the Whitehall I study was justly influential because its sample was mostly office workers with stable employment who would not be considered poor in any absolute sense. It came as a surprise to many that the association from socioeconomic status, as represented by employment grade, to health would be so steep in a population where the truly poor were not represented. The second reason for Whitehall I’s subsequent influence stemmed from its substantive conclusion that not much of the health gradient could be explained by poor health behaviors or access to medical care.9

The 1985–1988 Whitehall II examined a large new cohort of British civil servants; about 10,000 male and female civil servants aged 35–55 (Marmot et al., 1991). Follow-up studies have also been collected (Marmot, 1999). An extensive questionnaire was administered exploring each individual’s current and past health outcomes, diets, health behaviors, work histories, networks of social support, characteristics of the work environment, and psycho-social factors related to stress. In addition, biomedical data was collected, including blood pressure, blood (for cholesterol), electrocardiography, and fibrinogen. Fibrin controls blood clotting so that permanently high levels of fibrinogen increases the risks of cardiovascular disease levels by blocking the blood vessels. Besides attempting to document the character of the health gradient twenty years later, Whitehall II set out to find new explanations.

In terms of policy and scientific clout, Whitehall II is living up to the standard of its predecessor. The most salient finding is that the 20 year interval since Whitehall I has seen no diminution (in some cases even a widening) of the gradient in prevalence and incidence of many diseases and other health outcomes. In the twenty-five year follow-up of Whitehall 1 men ages 40–64, there was a four-fold higher relative risk of death from all causes of mortality from the lowest to highest grade (Marmot, 1999). The gradient apparently cuts across major causes of death--heart respiratory, and cancers (whether smoking related or not). This persistence of the health gradient when absolute income levels were rising in Britain and when there was a determined effort there to equalize access of all to health care is the primary intellectual challenge laid down by Whitehall I and II.

That challenge has spawned considerable research both within the Whitehall group and by many others for new ways of thinking about the way micro and macro social and economic environments alter human biological functioning. Within the Whitehall study, the principal maintained hypothesis appears to be that psycho-social factors, such as work related stress and social support networks, have major roles to play in the social gradient in health both directly and indirectly by encouraging poor health behaviors.10

Job related characteristics that appear to matter include monotonous work over which a worker has little control. Low job control was found to contribute independently to the development of coronary hearth disease among both male and female civil servants. The physiological connection came from tests showing that fibrinogen levels were higher among workers with low control over their job. The importance of this result goes beyond the narrow finding by providing evidence that psycho-social stress may matter both on the job and elsewhere.

While Whitehall’s ultimate influence cannot be understated, it may not be the ideal study to test the hypotheses it has generated. If job attributes are central, we might prefer more variation in work environment than can be obtained in a sample from a single employer. Since workers were not observed before becoming civil servants, there also exists a question of prior self-selection by health status into grades. Before economists sign on to these findings, variables that instrument for health status prior to Whitehall employment would have be part of the analytical approach. Although most of the job-related hypotheses imply interactions with job tenure, such tests have not been the common approach in these studies. Finally, job-related attributes are unlikely to be the only factors that matter, and study design strategies ignoring family and environmental attributes and stressors are certainly incomplete. If spouses of Whitehall employees exhibit the same health gradient with their spouses’ grade of employment, the psycho-social stress mechanisms emphasized by the Whitehall group may be off the mark.

The ‘Long Reach’ of Early Childhood

An alternative view on how economic status affects health emphasizes the negative impacts of even short exposures to bad times-- especially if they take place during critical periods of the human body’s development. How could short exposures matter all that much if health is a stock? In thinking about why and when brief episodes might matter, attention shifts from the age groups examined thus far to the childhood years and then right back to the womb. The most important work is being conducted by David Barker and his associates who are investigating the lasting impacts of fetal environment.

The health of an embryo generally depends on a steady supply of nutrients and oxygen, as well as the size of uterus. A critical period of intra-uterine life occurs when cells are dividing rapidly. A reaction to lack of nutrients or oxygen is to slow rates of cell division thereby reducing the number of cells. This may permanently change the development of some organs thereby ‘programming ‘ the body to the onset of later life diseases such as coronary heart disease, strokes, diabetes, and hypertension (Barker, 1997).

When nutrients and oxygen are in short supply, the embryo is not an equal opportunity supplier but instead favors organs more critical to its early life development and survival--in Barker’s language sustaining the brain while starving the trunk. The end result is not only undernourished babies born with low birth weight, but just as important, disproportionate growth in different parts of the body. Compared to normal babies, undernourished children are short in relation to the size of the head. Even within normal birth weights, short bodies relative to head size may have less developed livers leading to persistent problems of cholesterol metabolism and blood coagulation (Barker, 1997). These conditions 50 or 60 years later produce higher risks of coronary heart disease. Similarly, intra-uterine changes in vascular structure (the loss of elasticity in vessel walls) place individuals at higher risks of hypertension.

The notion of fetal ‘programming’ is supported by many animal experiments and epidemiological studies tracing late life onsets of coronary disease and diabetes to such early markers as birth weight. Even controlling for current weight, both at age 10 and age 36, systolic blood pressure rates were inversely related to birth weight (Barker et al., 1989). Data from some natural experiments also lend some support. Ravelli et al (1998) studied people born in Amsterdam who were exposed prenatally to famine conditions in 1944–1945. When compared to those conceived a year before or after the famine, prenatal exposure to famine, especially during late gestation, was linked to decrease glucose tolerance in adults producing higher risks of diabetes.

The most compelling study examining the sequence of early life forces impinging on adult health is the British 1946 national birth cohort study consisting of births during in a single week in March 1946 (Wadsworth and Kuh, 1997). The 5,362 original ‘respondents’ were visited eight weeks after birth and have been followed up 22 times with the last two major interviews at ages 43 and 51. Data were collected on mental and physical health, health behaviors, utilization, and diet obtained from interviews with mothers and respondents, nurses visits, and physician exams. A battery of school tests of cognitive and intellectual development were performed and data on occupation, income, home and family circumstances were collected during adult year interviews.

The cumulative evidence from a 50 year study is impossible to synthesize in a few sentences. But events in early childhood are independent predictors of cardiovascular, respiratory, and neurological health at mid-adulthood. For example, poor conditions at home during early life predict high systolic blood pressure at age 43 and reduced peak expiratory flow rate at age 36 and development of schizophrenia by age 43 was related to difficulties in infancy in walking and talking. Part of transmission is related directly to diseases in early childhood. Lower respiratory illness in the first two years of life was a significant risk for adult chronic obstructive pulmonary disease and more than half of those physically disabled by age 43 had a serious childhood illness. Another transmission path was the adoption of health behaviors either through more schooling (reduction in smoking) or as a coping mechanism for stress. Those whose parents had divorced by age 15 reported higher levels of male alcohol consumption and female smoking.

Nor are these effects confined to one generation. The kids of the 1946 cohort are now themselves the subject of inquiry and evidence about inter-generational transmission is being obtained. For example, among the offspring generation at age two, the risk of bronchitis was greatest among those whose parents had an early childhood respiratory disease or who had smoked as adults. (Wadsworth and Kuh, 1997)

A growing number of impressive studies demonstrate that health at middle and older ages reflects health at earlier life and may be correlated across and within generations. The extent to which this correlation reflects shared genetic endowments or the cumulative common social and economic endowments remains unresolved. Whatever its cause, the correlation implies temporal persistence in health from early childhood to old age, which must be factored into our models of health outcomes especially at older ages. Economists have research tools that are well suited to model such complex feedback mechanisms and to isolate within-period innovations in the stock of health.

Since subsequent events may re-enforce or counteract effects of in-utero environments, fetal ‘programming’ is an unfortunate term if it implies inevitability or the lack of malleability. While people debate whether life begins at conception, it doesn’t end at birth. This research also suggests that either direct provision of health care early in life or improvements in household living standards for families with younger children may have a high long-run return on lifetime health. This return may be especially high compared to our current major public investments in health and income maintenance-- which take place through Medicare and social security during the post-retirement years.

Allostatic Load

The third perspective sees the principal impacts as flowing not from brief episodes but instead from the accumulation of advantage and disadvantage through the life course. The cumulative, repeated wear and tear on the body over time arises from being bombarded by episodes of high and repeated stress. Since these episodes occur at different frequencies across socioeconomic groups, this accumulation contributes to the social health gradient. Besides identifying the salient types and sequences of events, a central theme of this research has involved isolating the physiological mechanisms at work.

A basic concept in this approach is allostatic load. Instead of seeing the ‘optimal’ functioning of physiological systems as fixed, healthy systems are designed to alter their functioning to adapt to different environmental demands and stimuli (see Seeman et al., 1997). When a person is confronted with an external threat and its accompanying stress, epinephrin (adrenalin) levels may be elevated, allowing the body to perform at higher levels. Elevated adrenalin may provide simultaneous challenges for blood pressure, heart rate, and the immune system. Such fluctuations may be ideal for short run responses, but frequent and cumulative episodes may be quite harmful and ultimately lead to disease. Allostatic load is the cumulative toll on the body from elevated use of physiologic systems either through frequent sudden shifts or by more prolonged activity. After repeated cumulative stress bombardment, it becomes too difficult for the body to return to its normal state. The body may then permanently function at higher levels of elevations instead of simply during periods of necessary short run response, eventually raising risks of high blood pressure, diabetes, or high cholesterol.

While allostatic load is appealing in providing a physiologic rationale for why lives arrayed by economic status lead to different health outcomes, work is just beginning on identifying the set of episodes and events that produce this load. After all, stress is a constant feature of life and there are multiple reasons in a day, week or year why we experience its symptoms. The empirical challenge is to reduce this complexity to a relatively few salient family and job life events that are the principal markers of excessive toll. Economists may have a lot to offer in that search. Our concepts and measurement of permanent and transitory changes in incomes and unemployment may be a good place to start in codifying a lifetimes worth of income data. Similarly, existing research findings on the economic consequences of job loss, marital disruption, or death of a close family member should help focus the search.

Income Inequality

The most provocative explanation for the social health gradient is that it reflects not a distribution of individual attributes or behaviors, but instead is a consequence of how societies are structured both economically and socially (Wilkinson, 1996). The degree of societal level income inequality is seen to have a direct bearing on its average health. The rationale has many variants, but a common theme is that inequality in relative rank raises levels of psycho-social stress which negatively affects endocrine and immunological processes. At least in industrial countries, it is not material deprivation that matters, but the stress associated with being at the bottom end of an unequal social pecking order. Besides income inequality, the most often mentioned health enhancing trait is social cohesion. Societies placing a strong value on caring for one another and less on individualism are hypothesized to be healthier ones.

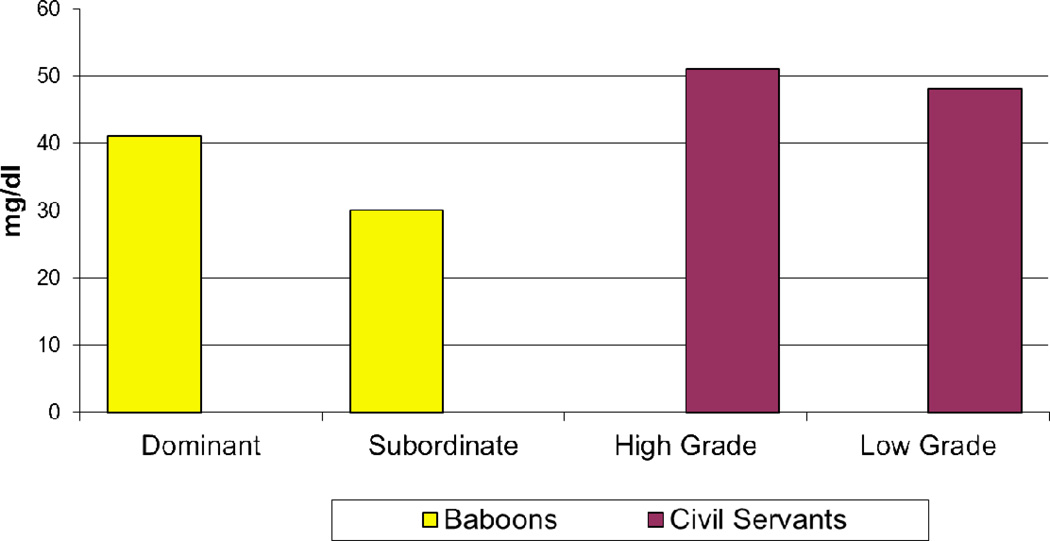

The evidence often begins with monkeys; a popular supporting citation is Sapolsky's 1993 study of adult male baboons. Social animals such as baboons form into groups with well-defined hierarchies, and indicators of health within the group reveal a social gradient. Sapolsky’s study indicates that low ranking male baboons have higher levels of glucocorticoids, which are steroid hormones released during stress, apparently in reaction to the chronic stress they experience by their low status. This relation is argued not to be only genetic sorting as Sapolsky reports similar findings in situations where wild or captive baboons are introduced into the group with an accompanying change in their social status. Figure 1, based on Marmot (1999), shows that HDL cholesterol- the so-called good cholesterol since it scavenges excess cholesterol- was less in low status than high status baboons with a similar if less pronounced statistically significant differential by employment grade for British civil servants. While this civil service differential in HDL cholesterol would not be clinically significant for an individual, group differences of this magnitude can be predictive of later onset of coronary heart disease.

Figure 1.

HDL Cholesterol in Male Baboons and British Male Civil Servants

When we leave the animal kingdom, much of the evidence reduces to non-linear patterns between health outcomes and economic resource measures similar to those depicted in Table 5. International comparisons also played a central role. Across industrialized countries, average mortality is not related to average income differences between countries-- but rather to income inequality within countries. Even among countries with similar average incomes, on one end lies equalitarian Sweden and Norway with mean life expectancies two to three years higher than the far more unequal outcomes in the United States, United Kingdom, and West Germany (Wilkinson, 1996).

Unfortunately, most adherents and critics seem driven more by ideology than science so that there is a rush to judgement on both sides. A good place to begin places opinions on social reform off to one side. A stable and steep health gradient--even if attributable to psycho-social stress from social ranking-- does not mean that it explains inequality in health. ‘Big’ regression coefficients do not imply importance in the sense of explaining variance. Even if the social health gradient was magically eliminated, dispersion in health outcomes in the population would remain very much the same. The vast majority of variation in individual health is within not between socioeconomic groups.

With all that said, this hypothesis may help us understand what underlies the social health gradient and it may complement evidence from other settings psycho-social stress matters. Current evidence is inconclusive due to a failure to control for a strong individual level non-linearity between all types of health outcomes and economic resources. This concave function-income effects larger for the poor than the rich- necessarily implies a negative relation between means and variances. The international comparisons mentioned above may simply reflect this functional form. The argument that aggregate inequality matters in linking psycho-social stress to health goes further. It claims that health of those at the bottom (even holding their own incomes or wealth constant) will deteriorate if resources of those at the top are increased. This is a more subtle but profound hypothesis that merits rigorous scientific testing. A good data source for economists to begin our testing is the Panel Survey of Income Dynamics (PSID) collected for thirty years during a time when income inequality was rising rapidly in the U.S. A first cut at this evidence, presented in Table 6, is not especially favorable. In spite of rapidly rising income and wealth inequality between 1984 and 1994, self-reported health status in the lowest twenty percent of each distribution actually improved. Although the initial evidence is not favorable, a final verdict awaits more exacting tests that control for other relevant factors especially those that may produce secular improvements in health at all segments of the distribution.

Table 6.

Aggregate Inequality and Self-Reported Health Status

|

Income 80–90 / 0–20 percentile |

% of bottom 20% in fair or poor health |

Wealth 80–90 percentile/Median |

% of bottom 20% in fair or poor health |

|

|---|---|---|---|---|

| 1984 | 8.11 | 41.9 | 3.90 | 35.3 |

| 1994 | 9.20 | 37.8 | 4.32 | 34.3 |

Source: Calculations by author using PSID

A tricky but necessary step in specifying more precise tests is precision about the appropriate reference group. Is it one’s neighbors, age group, state, or the nation as a whole? If the nation, as some proponents believe, evidence thought to support the societal rank--psycho-social stress link actually contradicts it. Within state income inequality is strongly correlated with state mortality rates which on psycho-social ground alone should not happen if the nation is the reference group. Similarly, thought has to be given to what reasonable lag structures might be. Instantaneous co-movements between death rates and rising inequality would be as much a caution flag as a support pillar for this theory.

Conclusions

The causality debate surrounding the social health gradient is not a boxing match in which a knockout blow will eventually be delivered. In middle and at older ages, there are pronounced effects of new health events on household income and wealth, but it is an open question how much earlier in the life-cycle such a sweeping statement is true. While economic resources also appear to impact health outcomes, this may be most acute during childhood and early adulthood when health levels and trajectories are being established. Innovative methods that help isolate economic and health shocks would be informative on this vexing issue of causality. Economists have already used ‘natural experiments’ such as lotteries to isolate wealth effects. On the health side, clinical trials—which often contain tens of thousands of observations—have focused on the efficacy of treatment and on health outcomes. These trials could be expanded to include more economic content so that the impacts of health on economic status can be measured. These issues are important and economists should participate in the verdict that will eventually be rendered.

Acknowledgments

This research owes a debt to David Barker, Angus Deaton, Daniel Hill, Michael Marmot, John Peabody, Richard Suzman, and Michael Wadsworth. None should be implicated in the outcome. Expert programming assistance was provided by Iva Maclennan, Joe Lupton, and David Rumpel. Very constructive comments were given by the editors; Brad de Long, Alan Kreuger, and Timothy Taylor. This research was supported by grants from the National Institute of Aging.

Footnotes

Other issues (malnutrition) arise for less developed countries and are beyond this essay’s scope.

While a single index of a multi-dimensional outcome, self-reported general health status has been shown to be highly correlated with subsequent morbidity and mortality (Ware et al. 1978).

The data in the next three paragraphs can be found National Center for Health Statistics 1998.

Exceptions are Hubbard, Skinner and Zeldes (1994), Palumbo (1998) and Lillard and Weiss (1996).

Mortality may provide an alternative explanation for this decay with age. Mortality is also related to economic status and at older ages only the more robust among lower economic groups may be survivors.

Lillard and Weiss (1993) find that the marginal utility of consumption falls with good health, Viscusi and Evans (1990) claims the opposite and Phelan and Rust (1991) report no significant effect.

Financial assets include IRA or Keogh; stocks or mutual funds; checking, savings, or money market funds; CD's, government savings bonds, or treasury bills; other bonds; trusts and estates; other assets and other debt.

HRS included subjective probability questions about planned bequests. Each respondent was asked to rank on a scale of 0 to 100 the chances that they would leave a financial inheritance that would exceed $10,000 or $100,000. Between wave changes in these probabilities were used.

My own view is that the recent literature may have too quickly dismissed more traditional factors including the explicit and implicit ways the more well-to-do obtain access to better quality health care.

While often ignored in favor of the new, Whitehall II documents the critical role of family background and health behaviors. 51% of men in the lowest grade had a father who was a manual worker and mean male height varied from173 to 178 cm from lowest to highest grade. Similarly, the male smoking gradient was 34% to 8%.

References

- Barker David JP. Maternal Nutrition, Fetal Nutrition and Diseases in Later Life. Nutrition. 1997;13(9):807–813. doi: 10.1016/s0899-9007(97)00193-7. [DOI] [PubMed] [Google Scholar]

- Barker David JP, Osmond C, Golding J, Kuh D, Wadsworth MEJ. Growth in Utero, Blood Pressure in Childhood and Adult Life, and Mortality from Cardiovascular Disease. British Medical Journal. 1989 Mar;298:564–567. doi: 10.1136/bmj.298.6673.564. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Deaton Angus, Paxton Cristina. Aging and Inequality in Health and Income. American Economic Review. 1998 May;Vol.88(no 2):248–253. [Google Scholar]

- Grossman Michael. The Demand for Health—A Theoretical and Empirical Investigation. New York: National Bureau of Economic Research; 1972. [Google Scholar]

- Hubbard R Glenn, Skinner Jonathan, Zeldes Stephen P. Precautionary Savings and Social Insurance. Journal of Political Economy. 1995;103(2):360–399. [Google Scholar]

- Lillard Lee, Weiss Yoram. Uncertain Health and Survival: Effect on End-of-Life Consumption. Journal of Business and Economic Statistics. 1996;15(2) [Google Scholar]

- Marmot Michael G, Smith George Davey, Stansfeld Stephen, Patel Chandra, North Fiona, Head J, White Ian, Brunner Eric, Feeny Amanda. Health Inequalities among British Civil Servants: The Whitehall II Study. Lancet. 1991 Jun 8;:1387–1393. doi: 10.1016/0140-6736(91)93068-k. [DOI] [PubMed] [Google Scholar]

- Marmot Michael. Social Epidemiology. Lisa Berkman and Ichiro: Kawachi Oxford University Press Oxford; 1999. Multi-Level Approaches to Understanding Social Determinants. [Google Scholar]

- National Center for Health Statistics. Health, United States, 1998 with Socioeconomic Status and Health Chart book. Maryland: 1998. [Google Scholar]

- Newhouse Joseph. Free for All. Cambridge, MA: Harvard University Press; 1993. [Google Scholar]

- Palumbo Michael G. Uncertain Medical Expenses and Precautionary Saving Near the End of the Life Cycle. 1998 Mar; unpublished manuscript. [Google Scholar]

- Phelan C, Rust John. U.S Social Security Policy: A Dynamic Analysis of Incentives and Self-Selection. Econometrica. 65 [Google Scholar]

- Ravelli ACJ, van der Meulen JHP, Michels RPJ, Osmond C, Barket DJP, Hales CN, Bleker OP. Glucose tolerance in adults after prenatal exposure to famine. Lancet. 1998 Jan 17;vol351:173–176. doi: 10.1016/s0140-6736(97)07244-9. [DOI] [PubMed] [Google Scholar]

- Seeman Teresa, Singer Burt, Rowe John, Horwitz Ralph, McEwen Bruce. Price of Adaption-Allostatic Load and its Health Consequences. Archives of Internal Medicine. 1997 Oct 27;157 [PubMed] [Google Scholar]

- Sapolsky Robert. Endocrinology Afresco: Psychoendocrine Studies of Wild Baboons. Recent Progress in Hormone Research. 1993;48:437–468. doi: 10.1016/b978-0-12-571148-7.50020-8. [DOI] [PubMed] [Google Scholar]

- Smith James P. Inheritances and Bequests. In: Smith James, Willis Robert., editors. Health and Wealth: Theory and Measurement. University of Michigan Press; 1999. forthcoming. [Google Scholar]

- Smith James P, Kington Raynard. Race, Socioeconomic Status and Health in Late Life. In: Martin Linda, Soldo Beth., editors. Racial and Ethnic Differences in the Health of Older Americans. Washington, DC: National Academy Press; 1997. pp. 106–162. [Google Scholar]

- Viscusi W Kip, Evans William N. Utility Functions that Depend on Health Status: Estimates and Economic Implications. American Economic Review. 1978 Sep;68(4):547–560. [Google Scholar]

- Wadsworth MEJ, Kuh DJL. Childhood Influences on Adult Health: A Review of Recent Work from the British 1946 National Birth Cohort Study, the MRC National Survey of Health and Development. Pediatric and Perinatal Epidemiology. 1997;11:2–20. doi: 10.1046/j.1365-3016.1997.d01-7.x. [DOI] [PubMed] [Google Scholar]

- Ware John, Davies-Avery Allyson, Donald Cathy. Santa Monica California: R-1987/5 HEW, RAND; 1978. General Health Perceptions. [Google Scholar]

- Wilkenson Richard G. Unhealthy Societies: The Afflictions of Inequality. London: Routledge; 1996. [Google Scholar]