Abstract

The reimbursement landscape for new and innovative diabetes devices in Europe is very heterogeneous and nontransparent, with each country employing different mechanisms, pathways, and requirements. This article provides an overview of how diabetes device reimbursement works in the outpatient setting in the five major European Union markets (France, Germany, Italy, Spain, and the United Kingdom; the EU-5). It will be of particular interest to manufacturers of innovative devices. Markets are first categorized as either a centralized or a regionalized reimbursement decision-making system, and implications for device reimbursement are explored. In the second part, specific requirements and success factors for wide reimbursement in the EU-5 are analyzed in detail. Gaining early acceptance by the main influencers (key opinion leaders and payers) is the first step. Equally important is the provision of convincing evidence, be this clinical, health–economic (cost-effectiveness), or a demonstration of cost savings (budget impact). In some countries, local usage data may be a requirement as well. Lastly, as payers’ willingness to pay stems directly from their perceived value of a device, a key success factor and a necessary precondition for manufacturers is to set the right price.

Keywords: clinical evidence, EU-5, France, funding, Germany, Italy, price, reimbursement, reimbursement requirements, reimbursement systems, Spain, United Kingdom

Introduction

The reimbursement landscape for new and innovative diabetes devices in Europe is heterogeneous, not very transparent, and in constant flux. Any company that seeks to obtain reimbursement for a new device will soon discover that each country has its own mechanisms and pathways, and despite the laws and official reimbursement guidelines, requirements are often vague and success factors far from obvious. This article aims to clear the confusion and provide an overview of how diabetes device reimbursement works in the EU-5: France, Germany, Italy, Spain, and the United Kingdom. We will focus on reimbursement in the outpatient setting because most diabetes devices, such as blood glucose monitoring devices, insulin pumps, and insulin needles, are designed for patients to use at home.

To do this, we first categorize the markets according to their reimbursement systems—either with central or regional reimbursement decision making—and explore the implications when applying for device reimbursement. In the second part of the article, we highlight requirements and success factors to obtain reimbursement in the EU-5, describing country specifics where necessary. The analysis is based on our experience supporting various device manufacturers with exploring reimbursement opportunities and obtaining market access since 2008.

Outpatient Reimbursement Systems and Implications

Outpatient reimbursement systems can be broadly divided into two categories according to the level at which reimbursement decisions for new and innovative diabetes devices are made. Some countries have centralized systems that take reimbursement decisions at the national level, valid for all regions in the country. Other countries have more decentralized systems in which regions enjoy a certain level of autonomy that also extends into reimbursement decision making (see Figure 1). This dichotomy has profound implications for those seeking to apply for reimbursement.

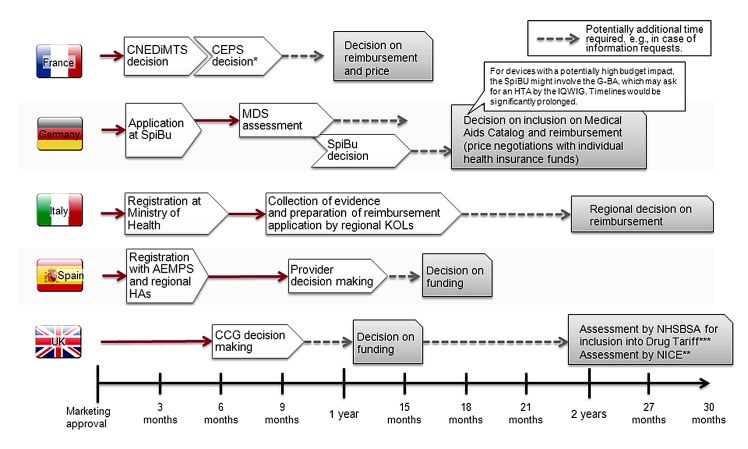

Figure 1.

Reimbursement processes and typical timelines for innovative devices. *Products asking for Amélioration du Service Médical Rendu I, II, or III in their evaluation dossier will have to submit health–economic data to the health economics committee in the health authorities, reporting to the Comité Economique des Produits de Santé. **Depending on budget impact and or/usage on local level. ***Inclusion in drug tariff is a prerequisite for broad funding but may happen only some time after launch. CNEDiMTS, Commission Nationale d’Évaluation des Dispositifs Médicaux; CEPS, Comité Economique des Produits de Santé; SpiBu, Spitzenverband Bund/GKV Spitzenverband; MDS, Medizinischer Dienstdes Spitzenverbandes Bund der Krankenkassen; IQWiG Institut für Qualität und Wirtschaftlichkeit im Gesundheitswesen; G-BA, Gemeinsamer Bundesausschuss; AEMPS, Agencia Española de Medicamentos y Productos Sanitarios; HAs, health authorities; CCG, clinical commissioning group; NHSBSA, NHS Business Service Authority.

Central Reimbursement Decision Making: France and Germany

France offers perhaps the clearest archetype of a system with centralized reimbursement decision making. Although divided into administrative regions, France maintains all decision-making authority for diabetes devices at the national level. Decisions made at this level are then binding for all the regions and the health care providers.

France keeps the decision regarding clinical effectiveness separate from the questions of price. Two authorities at the national level are central to the process of reimbursement decision making: the Commission Nationale d’Évaluation des Dispositifs Médicaux assesses the submitted clinical data, and the Comité Economique des Produits de Santé subsequently considers the expected volume and proposed price.

Germany, despite its system of health insurance funds, is also considered a country with central decision making due to the strong influence of its national agencies on reimbursement. Following a positive coverage decision at the national level (i.e., listing in the medical aids catalog Hilfsmittelverzeichnis), health insurance funds are free to negotiate the reimbursed price for new diabetes devices individually, with domino effects when smaller funds follow the reimbursed price negotiated by larger ones.

For manufacturers, the greatest advantage of the central decision-making system is that it saves time spent by authorities on the evaluation and decision making. Only one dossier needs to be presented to the national authorities, and after that, little manufacturer involvement is required. However, this can potentially also be the greatest disadvantage, because the decision is final and applies to the whole country. Therefore, should the reimbursement decision be negative, patient access is likely to be extremely limited. In addition, national authorities might ask for a health technology assessment (HTA) by the national HTA body Institut für Qualität und Wirtschaftlichkeit im Gesundheitswesen as in the case of continuous glucose monitoring (CGM), considerably prolonging timelines.

The overarching implication is, of course, that manufacturers have to prepare a very thorough application for submission to the national reimbursement authorities. As discussed in the next section, the central reimbursement authorities very often focus on clinical evidence, and solid data from well-executed randomized controlled trials (RCTs) are often a requirement for success.

Regional/Local Reimbursement Decision Making: Italy, Spain, and the United Kingdom

In some countries, regional or local authorities have much more decision-making power. Roughly speaking, there are two principal subtypes: countries where the regional authorities carry out their own assessment and make their own funding decisions, such as Italy and Spain, and countries where the assessment of a national authority may be little more than a recommendation for local units that make the final funding decisions, as seen in the United Kingdom.

Italy and Spain are the best examples of regionalized countries. The decisions of the national authorities, such as the Ministry of Health in Italy and the Agencia Española de Medicamentos y Productos Sanitarios in Spain, have very limited scope. Usually these bodies have the authority to allow and exclude a product from the market, but they rarely exercise their power for new devices.

The real hurdles come at the regional level, where the funding decisions are made—in principle, individually in each region. In most cases, the regions carry out their own assessment, which could combine the evaluation of international clinical data and local usage data. Some regions may even perform a more comprehensive and systematic assessment through a dedicated regional HTA body. For example, some regions in Spain and Italy (Veneto, Emilia Romagna) are known to carry out their own HTA evaluation, which then may or may not be considered by other regions. For innovative products with a significant budget impact, regions in Italy want to see local usage data, which have to be generated in the region in question for a period of typically 1–2 years.

In theory, this system would require the manufacturer to invest a considerable amount of time in preparing separate applications, including local usage data, for every region. In practice, manufacturers should prioritize certain regions. Domino effects are observed when the decisions of smaller regions follow the more influential ones. Achieving a “critical mass” of regions is usually necessary to gain universal access to a therapy—and this critical mass tends to consist of several larger or more influential regions. For example, in Italy, it is often recommended to start the data collection with local key opinion leaders (KOLs) in the regions of Emilia Romagna, Lombardy, Veneto, and Tuscany.

The United Kingdom system is based more on local units than on regions. These used to be the primary care trusts, but with the current changes to the National Health System (NHS) organization, the funding powers are being transferred to the clinical commissioning groups (CCGs). Groups of general practitioners will therefore have the main say in determining which products they will use and fund in their establishments (unless the product falls under specialized commissioning, in which case it is the commissioner who makes the final funding decisions; in the past, specialized commissioning was regional, but with the current NHS restructuring, its responsibilities are moving up to the national level).

However, to combat a too-large variation among regions and hospitals, the National Institute for Health and Care Excellence (NICE) can issue a form of official guidance on the national level. The NICE carries out HTA assessments and issues multiple types of guidance, including technology appraisals and clinical guidelines, and has launched specific guidance for medical technologies and diagnostics.1

Diabetes device manufacturers may also do well to consider the drug tariff, especially if a listing may render their device more accessible. The good news is that nonlisting does not mean automatic exclusion from usage—it just reverts to the default state where the manufacturers have to approach CCGs directly.

Nevertheless, the NICE technology appraisal remains the most authoritative and best known guidance globally. With this guidance, the NICE has the power to declare a therapy or device compulsory, in which case all CCGs are obliged to provide it to patients. However, the NICE can also issue a nonbinding guideline in which it recommends a device, usually restricted for a specific patient population. In this case, CCGs are free to make their own funding decisions, adopting the official recommendation or not. A negative recommendation from the NICE will, of course, make access very problematic.

The NICE applies its most powerful instrument, the technology appraisal, mainly for products with a significant impact on health care spending. Only a few medical technology products have undergone a technology assessment in the past five years, including insulin pump therapy (2008). Therefore, many innovative diabetes devices are not affected by technology appraisals, at least not in the first years after launch. Manufacturers will likely have to engage in dialogue with the local CCG. As in the case of regionalized countries, the influence of CCGs varies, and a manufacturer would be well advised to prioritize which of them they will approach first.

A clear consequence of regional/local reimbursement decision making is the potentially vast variations in the availability of therapies between regions, and sometimes between individual hospitals. A therapy that has become commonplace in one region may still be unavailable in another, due to the failure to reach a positive reimbursement decision. Admitting the existence of this phenomenon, the NHS has for some time now been trying to combat the “postcode lottery.” (For more information about regional variations in the United Kingdom see the NICE-conducted survey at www.rightcare.nhs.uk/index.php/nhs-atlas/. Accessed April 18, 2013).

Reimbursement Requirements and Success Factors

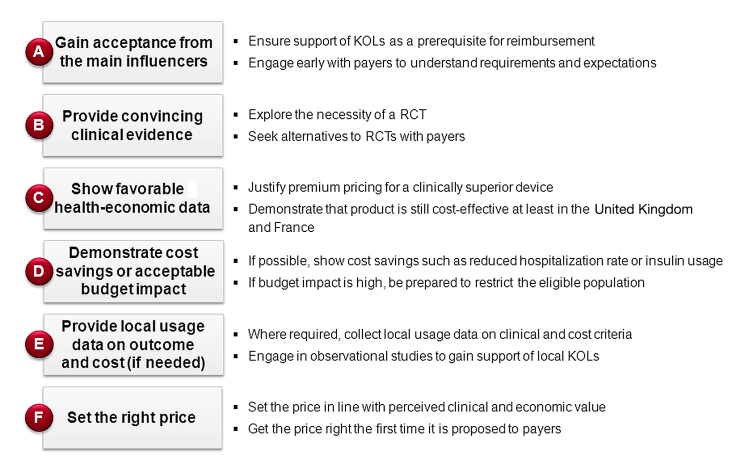

Having explored the basic dichotomy between centralized and regionalized reimbursement systems, this section explains the requirements for obtaining reimbursement in the focus countries and outlines the success factors (see Figure 2).

Figure 2.

Key requirements and success factors for reimbursement in the EU-5.

Although philosophies and practices vary by country, most requirements for reimbursement are similar in nature. They can be broadly divided into six categories: acceptance from the main influencers, convincing clinical evidence, favorable health economics, reasonable budget impact, proof of cost savings (if possible), and the right price.

Gaining Acceptance from the Main Influencers

Support from Key Opinion Leaders

The ultimate goal when applying for reimbursement for a new, innovative diabetes device is to gain payers’ acceptance. However, in a world of rapid innovation, fierce competition, and budgetary skepticism, this cannot be taken for granted. Payers themselves are held accountable for ensuring the best health care for the greatest possible number of patients. Therefore, they are most likely to listen to the advice of those who deliver that health care and come into contact with patients: the KOLs. Going above and beyond the duties of practicing general practitioners or specialists, KOLs tend to contribute to international scientific discussions, are often involved in clinical trials, and may be active in physician associations.

Acceptance of a therapy by the KOLs is the key to payer acceptance. However cost-effective it may be, no therapy will obtain reimbursement if the KOLs are not behind it, lending their voice to support its clinical value. Key opinion leader support is sometimes even a procedural necessity: in some cases, e.g., in Italy, regions will only grant reimbursement for an innovative diabetes device in case of KOL request. Consequently, the first lesson when applying for reimbursement is that seeking and obtaining KOL acceptance is vital. To give themselves a leg up, manufacturers should start this process early in the product lifecycle—ideally as soon as the development stage. Not only may KOL input be valuable at this stage, but this will ensure that KOLs learn about the product as well as give them more time to pass this knowledge up to the payers.

As important as KOL support is, manufacturers need to be aware of potential hurdles in securing it. Once local KOLs are identified (e.g., via professional associations, conferences, introductions by foreign KOLs, or scientific articles), accessing them may prove complicated in some cases. For instance, local regulations can make interactions precarious, such as in case of hospital employees who are also government employees in Italy, Spain, or the United Kingdom. Moreover, even though the manufacturer may have confidence in its product and clinical data, it must bear in mind that the KOL reactions are somewhat less predictable.

Early Engagement with Payers

Manufacturers often find that it helps to engage with payers early in the process as well. In particular, payers can provide valuable input on the evidence required and preferred trial design, plus an indication of the value perception and suitable patient population. This allows manufacturers to plan a realistic sales volume and to construct the most effective value proposition for payers.

Even early in the product development cycle, payers will already be able to provide indications as to their willingness to reimburse. This is valuable information, because ideally, a device would be launched at a price that payers will accept. Payers in many countries see their role not as price negotiators, but as price setters—so that direct price negotiations with manufacturers will not take place. This underlines the importance of engaging with payers early and understanding their requirements, their preliminary willingness to pay, and any perceived premium ceilings.

Providing Convincing Clinical Evidence

Innovations are designed to provide better clinical outcomes. However, this comes at a higher cost. To be able to charge a premium, manufacturers have to prove the better clinical outcomes to the payers. All countries aspire to rational, evidence-based reimbursement decision making. This is why evidence is always a crucial requirement.

The first and most important consideration for a manufacturer is to produce and show the right clinical evidence. In the pharmaceuticals industry, RCTs are a key prerequisite for most drugs. Evidence is also becoming increasingly important in the medical technologies industry. We find a clear trend toward RCTs, especially when it comes to expensive therapies. Although payers are aware that device manufacturers might experience difficulty in recovering the trial costs, they still accept no alternative to RCTs in many cases. However, each company should nevertheless investigate whether prospective observational data, for example, might also be sufficient. In addition to the trial design, manufacturers also have to understand which end points payers will accept. For example, hemoglobin A1c (HbA1c) is an established surrogate marker, and absolute reduction in HbA1c and percentage of patients achieving recommended target HbA1c control are meaningful end points. However, many payers would not consider mild hypoglycemic events as meaningful.

As may be guessed from the different reimbursement systems described here, the clinical evidence requirements vary from country to country. The German system attaches great weight to methodologically rigorous, solid clinical evidence. A well-executed RCT has the best chance of success.

Although this type of trial is essential in France as well, the nuance lies in the French process, which always considers a new therapy in relation to an established comparator. Therefore, the French payers particularly appreciate head-to-head trials, where a new device is compared with a similar device or to the current standard of care.

Showing Favorable Health–Economic Data

Because of constant budgetary pressure and spiraling health care costs in practically every country, reimbursement decisions are based on more than just clinical evidence. Proof of cost-effectiveness is often required, also for innovations. As a general principle, manufacturers can show either that their product is better than the current standard of care or that they can save the system money by accomplishing the standard of care at a reduced price. The former requires clinical evidence, particularly evidence that demonstrates superiority vis-à-vis the standard of care. Moreover, the premium demanded must be in what the payers consider a reasonable range—and for this, payers often request a health–economic model, because it allows them to see whether the innovation is still cost-effective.

Cost-effectiveness aims to translate the benefits a product delivers to the patient by converting them into units that can be then compared across different therapies. There is a tradition in the United Kingdom to ask for this type of data.2 In France, a new law (published in October 2012 and taking effect in 2013)3 requires manufacturers to submit health–economic data if they want to achieve a clear price premium for their innovations. In other countries, payers may also ask manufacturers for this type of data, and payer organizations may conduct their own cost-effectiveness assessment.

Demonstrating Cost Savings or Acceptable Budget Impact

Demonstrating that a device is cost neutral or even provides cost savings is an important argument for payers and usually increases their willingness to pay, especially when brought to their attention by the manufacturer early in the reimbursement process. With the financial crises in many European countries and resulting pressure on health care budgets, it seems that cost savings/being cost neutral is becoming even more important than superior clinical outcome. This is especially true in areas where payers believe that the current standard of care is “good enough.” In diabetes, relevant arguments might be savings in hospitalization resulting from fewer hypoglycemic events or less insulin consumption in patients with high insulin usage. For manufacturers, it may be a way to obtain premium prices in the absence of clinical superiority. It can also be an effective strategy if proving clinical superiority is prohibitively expensive—for example, in the case of severe hypoglycemic events, which would require a trial with thousands of patients. To assess the cost-saving potential of a device, budget impact calculations are required. Budget impact primarily considers the cost of the new treatment (i.e., price of the device plus cost of other resources consumed that have a direct impact on payers’ budget) compared with the cost of the standard of care, multiplied by the presumed number of patients who will use it in a given year.

As a general rule, the higher the budget impact, the stricter the payers’ assessment will be. In some cases, it seems payers are prolonging the reimbursement decision due to expectedly high budget impact, for example with CGM in some European countries. However, even therapies with a significant budget impact that would cost the system more than the current standard of care may have a chance of obtaining reimbursement—but in this case, payers will most likely seek to limit the eligible patient population in an attempt to reduce the budget impact. It would of course help their case if the manufacturer demonstrated additional clinical benefits for this restricted target population.

The example of an innovative medical device called InsuPad, developed and manufactured by InsuLine Medical, used simultaneously with an insulin injection shows the positive impact of demonstrated cost savings and early payer engagement on payers’ willingness to reimburse and pay. The device heats the skin when injecting prandial insulin for better absorption due to increased local blood flow. While designing the trial, InsuLine Medical talked to payers early on to understand the end points and results they would require to grant favorable reimbursement. As a result, the pivotal trial also investigated the effect of the device use on economic parameters, because the improved absorption of insulin should lead to dose reductions. Consequently, the payers were expecting a dose reduction of at least 10%. The trial results are promising in this regard: use of the device resulted in a significant reduction of up to 30% in prandial insulin usage, providing a clear and immediate economic benefit for payers in terms of cost savings. In addition, the trial showed a reduction of hypoglycemic events of up to 45%. Although the trial was not designed to show the impact on hospitalization, payers acknowledged that the hospitalization rate will be reduced, resulting in further significant cost savings. Based on the positive trial results, payers granted both reimbursement and a premium price, taking into account the proven cost savings.

Providing Local Usage Data on Outcome and Cost Where Required

In the case of innovations with a significant budget impact, some payers may also require local usage data. This is mainly the case in Italy. It is usually an amalgam of clinical and cost data but in local conditions. Usually, payers expect usage data from a prospective observational study, not from an RCT. This type of evidence can of course only be generated in the place where the demand is made and may prolong the timeframe to reimbursement. On the other hand, payers appreciate this type of evidence because it allows them to demonstrate the direct impact of the therapy on their own patients.

It is common for manufacturers launching an innovation with a high budget impact to collect local usage data in one region in Italy for a period of 1–2 years. This requires the involvement of local KOLs who then become the therapy’s champions with the regional payers. The aforementioned domino effect between regions means that the manufacturers are unlikely to have to repeat the exercise in every region.

Setting the Right Price

Price is an integral part of the bid for reimbursement everywhere. If all other elements are in place but the price is not right, the application will fail.

The basic rule here is: price has to be in line with perceived value. Payers will be willing to grant a price premium if the new device adds value compared with current standards of care. The added value has to be credible, i.e., demonstrated by clinical evidence. Cost-effectiveness analyses and/or budget impact data help to justify the price of the new device.

Unfortunately, manufacturers have very little margin of error in this matter, because payers rarely negotiate on price. That means the pricing has to be right from the start. If payers think the price is too high, the therapy may not obtain broad reimbursement, may not receive reimbursement until many years later, or may be severely restricted and never really “take off.” And if the product is underpriced, it will never exploit its full potential.

Continuous glucose monitoring devices are a good illustration of the need to get pricing right the first time (in addition to clinical evidence). Continuous glucose monitoring was an important innovation when it was first introduced to the market. Instead of obtaining intermittent glucose measurements after pricking their fingertip every time, patients are able to obtain an almost real-time, continuous reading of their glucose levels. But at launch, payers did not find the proposed price very palatable, especially because the few studies investigating the benefit of CGM were short and small and did not convince payers of CGM’s superiority to blood glucose monitoring.4 As a result, payers were unwilling to pay the premiums expected by the manufacturers and denied broad coverage. Today, some eight years after CGM’s introduction and despite the availability of more favorable clinical evidence, payers in the EU-5 still do not grant broad reimbursement for CGM, with price remaining a key reason. It is reimbursed mainly on a case-by-case basis, requiring approval based on thorough clinical assessment. Approval is limited to specific patient subgroups, such as children with type 1 diabetes with persistent hypoglycemia unawareness.5 Only in a few other European countries, such as Sweden and the Netherlands, have payers assessed CGM to be clinically effective and cost-effective and have granted national reimbursement for specific indications.

Conclusion

Although significant differences are found among countries and even regions, we can also identify a number of similarities in the reimbursement processes. Fortunately for manufacturers, these similarities concern the vital elements of any reimbursement process. They can be summarized as follows:

There can be no reimbursement without KOL support in any country. Early payer engagement is extremely valuable when seeking reimbursement for an innovation.

Convincing clinical evidence is the other prerequisite for obtaining reimbursement. Payers demand solid evidence from well-executed trials even for medical devices.

There is a growing need to show cost-effectiveness data.

Proven cost savings are a very powerful argument in Europe, especially if payers can realize those savings immediately.

Even with the required evidence and KOL support in place, setting the right price can make the difference between sinking and swimming when it comes to reimbursement decisions.

Payers’ willingness to pay stems directly from their perception of the clinical and economic value of a device. If they think the price is too high, they often will not negotiate; they will simply refuse to reimburse the product. Manufacturers must therefore carefully consider the combination of clinical and economic evidence they are able to deliver, the eligible patient population, and the proposed price.

Glossary

- (CCG)

clinical commissioning group

- (CGM)

continuous glucose monitoring

- (HbA1c)

hemoglobin A1c

- (HTA)

health technology assessment

- (KOL)

key opinion leader

- (NHS)

National Health System

- (NICE)

National Institute for Health and Care Excellence

- (RCT)

randomized controlled trial

Disclosure:

Elmar Schäfer is Managing Director of InsuLine Medical GmbH, Mannheim, Germany.

References:

- 1.National Institute for Health and Care Excellence Medical Technologies Evaluation Programme. www.nice.org.uk/aboutnice/whatwedo/aboutmedicaltechnologies/medicaltechnologiesprogramme.jsp . Accessed April 18, 2013.

- 2.National Institute for Health and Care Excellence Measuring effectiveness and cost effectiveness: the QALY. www.nice.org.uk/newsroom/features/measuringeffectivenessandcosteffectivenesstheqaly.jsp . Accessed April 18, 2013.

- 3.Décret n° 2012–1116 du 2 Octobre 2012 Relatif aux Missions Médico-Économiques de la Haute Autorité de Santé. NOR: AFSS1208661D www.legifrance.gouv.fr/affichTexte.do?cidTexte=JORFTEXT000026453514&dateTexte=&categorieLien=id . Accessed April 18, 2013.

- 4.Bartelme A, Bridger P. The role of reimbursement in the adoption of continuous glucose monitors. J Diabetes Sci Technol. 2009;3(4):992–995. doi: 10.1177/193229680900300449. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.National Institute for Clinical Excellence Type 1 diabetes: diagnosis and management of type 1 diabetes in children, young people and adults. Clinical guideline 15. www.nice.org.uk/nicemedia/pdf/CG015NICEguideline.pdf . Accessed April 18, 2013. [Google Scholar]