Significance

In this report we investigate company–community conflict and its role in the regulation of sustainability performance in the extractive industries. We estimate the cost of conflict to companies and identify conflict as an important means through which environmental and social risks are translated into business costs and decision-making. The paper clarifies the relationship between the environmental and social risk experienced—and interpreted—by local communities, and the business risks experienced—and interpreted—by corporations. Findings reveal that, at least for the case of the extractive industries, these two types of risk can co-constitute each other. The central importance of corporate strategy and behavior for sustainability science is highlighted.

Keywords: regulation

Abstract

Sustainability science has grown as a field of inquiry, but has said little about the role of large-scale private sector actors in socio-ecological systems change. However, the shaping of global trends and transitions depends greatly on the private sector and its development impact. Market-based and command-and-control policy instruments have, along with corporate citizenship, been the predominant means for bringing sustainable development priorities into private sector decision-making. This research identifies conflict as a further means through which environmental and social risks are translated into business costs and decision making. Through in-depth interviews with finance, legal, and sustainability professionals in the extractive industries, and empirical case analysis of 50 projects worldwide, this research reports on the financial value at stake when conflict erupts with local communities. Over the past decade, high commodity prices have fueled the expansion of mining and hydrocarbon extraction. These developments profoundly transform environments, communities, and economies, and frequently generate social conflict. Our analysis shows that mining and hydrocarbon companies fail to factor in the full scale of the costs of conflict. For example, as a result of conflict, a major, world-class mining project with capital expenditure of between US$3 and US$5 billion was reported to suffer roughly US$20 million per week of delayed production in net present value terms. Clear analysis of the costs of conflict provides sustainability professionals with a strengthened basis to influence corporate decision making, particularly when linked to corporate values. Perverse outcomes of overemphasizing a cost analysis are also discussed.

Large-scale natural resource extraction projects (including exploration and processing activities) profoundly transform environments, communities, and economies, and often generate social conflict (2, 3). Previous studies of resource extraction and conflict have highlighted the relationship between mining and hydrocarbon resources and broader civil conflict (4, 5) and individual cases of project level conflict (6, 7). In this study, we investigate the importance of company–community conflict in the context of regulation of the sustainability performance of mining and hydrocarbon companies. We estimate the cost of social conflict to companies, determine how companies interpret this conflict, and explain how they respond to conflict. Costs were understood broadly as the negative impacts of company–community conflict on a company’s tangible and intangible assets, including value erosion. Conflict is defined as the coexistence of aspirations, interests, and world views that cannot be met simultaneously, or that actors do not perceive as being subject to simultaneous satisfaction, and is viewed in this assessment as ranging from low-level tension to escalated situations involving a complete relationship breakdown or violence (8).

There is growing appreciation that unmitigated environmental and social risks have the potential to negatively influence the financial success of large-scale developments in the extractive industries. A 2008 study of 190 projects operated by the major international oil companies showed that the time taken for projects to come on-line nearly doubled in the preceding decade, causing significant increases in costs (9), although this increase reflects project remoteness, scale, technical difficulty, and input price, as well as social conflict. A follow-up of a subset of those projects found that nontechnical risks accounted for nearly one-half of the total risks faced by these companies, and that risks related to company relationships with other social actors constituted the single largest category (10). A separate empirical study of 19 publicly traded junior gold-mining companies found two-thirds of the market capitalization of these firms was a function of the firm’s stakeholder engagement practices, whereas only one-third was a function of the value of gold in the ground (11).

In its analysis of socio-ecological systems (SESs), the sustainability science literature has said little about the large-scale private sector as an important actor within, and regulator of, SES behavior. A review of the 450 sustainability science articles published in PNAS, for example, finds just 23 referring to “corporate,” “industry,” “private sector,” or “company” in their texts. An extensive word cloud produced by a historical review of 20,000 papers related to sustainability science (12) notes just five terms implying a focus on the private sector (“corporate social,” “corporate sustainability,” “social responsibility,” “industrial ecology,” and “supply chain”), with none of these terms invoking core company decision making, culture, or calculations. However, large-scale corporate actors are obviously of central importance to the “major questions” for research in sustainability science (13), and perhaps especially the questions: “What shapes the long-term trends and transitions that provide the major directions for this century?” and “What determines the adaptability, vulnerability, and resilience of human–environment systems?” (13).

The relevance of private sector actors is particularly clear in the extractive industries where, given the evolution of technology and industrial structure in these sectors, large enterprises have become highly influential actors in SES dynamics. Dramatic events and disasters, such as the Deepwater Horizon in the Gulf of Mexico, make this clear. Such enterprises can also be critical actors in slower processes of SES change, such as those mediating the relationships among water, agriculture, livelihoods, mining, and climate change (14, 15). Companies in the extractive industries have, to greater or lesser extent, developed policies for sustainable development and used sustainability professionals to respond to the changes induced by their activities on SESs. It is therefore important to understand the drivers of company behavior to build adequate models of socio-ecological change.

This study addresses one potential driver of company behavior: conflicts motivated by the social and environmental risks created by, and the impacts of, corporate activities. More specifically, the study understands social conflict as a means through which populations communicate perceptions of risk and which generate costs for companies. The study refers to risk from the perspective of the entity experiencing the risk (i.e., environmental risks are risks to the environment; social risks are risks to society, social groups, or individuals; and business risks are the risks to the business). We ask about the significance of the costs associated with community conflict to companies, how far companies are prepared to respond to these costs by seeking strategies to reduce the environmental and social risk that they generate within SESs, and the conditions that can induce regulatory and strategic change within the corporate sector itself such that it reduces any negative environmental and social impacts.

Although the report addresses just one dimension of large-scale private sector activity, the purpose is to suggest the importance of paying far more attention to corporate behavior in studies of socio-ecological dynamics. Emerging research on large-scale land acquisitions, or “land grabs” (16), and the implications for land-change science (17) suggests the same need to attend to corporate actors in sustainability science. In addressing this theme, our primary purpose is to map out, explore, and identify (rather than test) particular relationships between large-scale business and SES dynamics. The intent of the research is to build SES theory in ways that treat corporate behavior as endogenous to these systems.

Through in-depth confidential interviews with corporate finance, legal, and sustainability professionals, and empirical case analysis, we investigate the extent to which recognition of the costs of conflict has the potential to change the ways in which companies address the environmental and social risks of mining and hydrocarbon development. Case studies combined desk-based analysis of secondary materials with key informant interviews to confirm or supplement the analysis. Case studies were used to characterize the types of company–community conflicts affecting mining projects, the point at which conflict took effect within the project cycle, and the types of effects that conflict appeared to have on projects. Key informant interviews were used to address how large-scale mining and hydrocarbon companies interpret these conflicts, how they respond to them, the factors determining different types of company response, and the extent to which calculations of the financial costs of conflict change the ways in which companies respond.

Results

The Triggers and Impacts of Conflict.

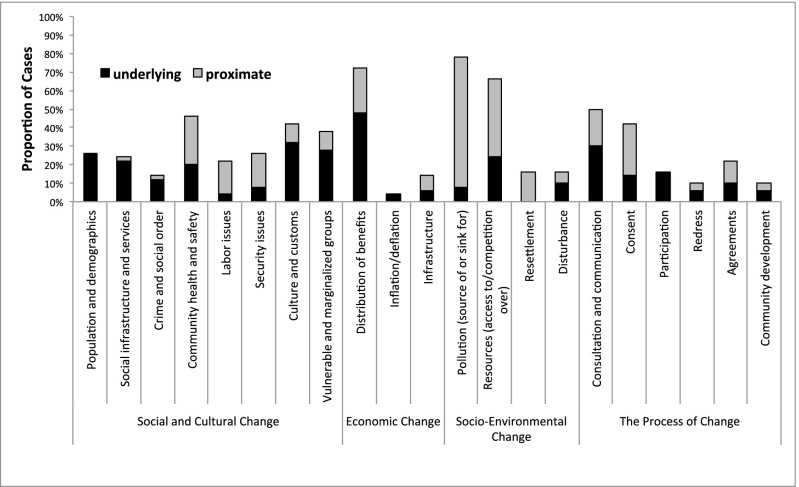

Publicly available information about cases of prolonged or escalated company–community conflict around mining operations were analyzed (n = 50) to understand the issues in dispute, the manifestations of conflict, and the project characteristics (SI Materials and Methods and Dataset S1). The case pool was selected based on the availability of secondary data in gray and published literature and the first-hand field experience of the authors. A first empirical finding is that the most common proximate issues—those that the parties to conflict presented as the central issues in dispute—were environmental issues (Fig. 1). Pollution of, competition over, and access to, natural resources were identified as the most frequent, followed by the absence of opportunities for community stakeholders to provide consent at the outset of projects, and concerns about community health and safety. The most common underlying issues—those that contributed to the state of the relationship between the parties, while not necessarily precipitating conflict—were observed to be social and economic in character. The distribution of benefits, differences in culture and custom between corporate and community actors, and the absence or quality of ongoing processes for consultation and communication, were the issues present in the highest proportion of cases.

Fig. 1.

Cases of mining company–community conflict: Issues in dispute (n = 50).

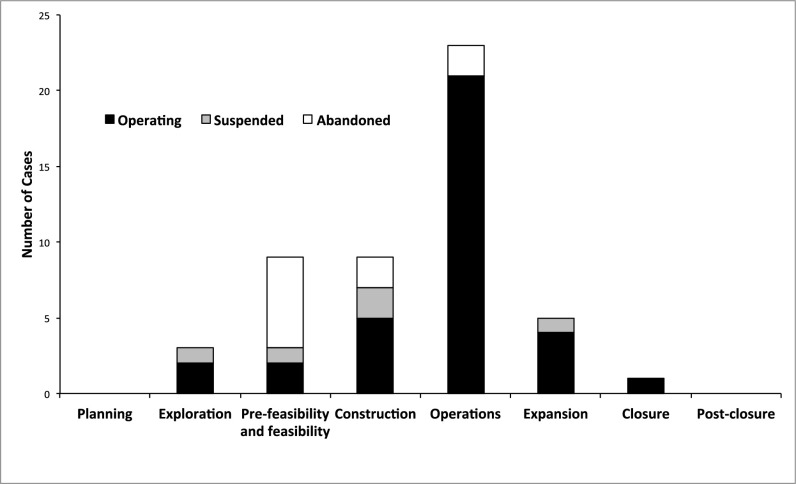

A second finding is that the feasibility and construction stages of projects are overrepresented in the proportion of conflicts that led to the suspension and abandonment of projects (Fig. 2). One explanation is that these periods can represent dramatic transitions for local communities, with major project impacts being experienced for the first time and large influxes of—often temporary—workers from other geographic locations. The feasibility and construction phases also represent time periods when local community and civil society organizations, if mobilized, have the greatest opportunity to influence whether and how projects proceed. This representation is in part because the project is smaller in scale and therefore easier to contest (18), but also because at later stages of the project cycle, capital has been sunk into an area, changes become costly to retrofit, revenues begin to be generated, and there are increased incentives for companies and governments to “defend” their projects. Civil society organizations were found to mobilize and build campaigns around major government and corporate decision points, such as final investment decisions or impact-assessment processes. The feasibility and construction stages simultaneously constitute mobilization points for project opponents and periods of vulnerability for project proponents.

Fig. 2.

Cases of mining company–community conflict: Operating stage (n = 50).

A third finding is that company–community conflict related to mining tends to escalate from campaigns and procedural actions (such as complaints or grievances lodged with governments, companies, tribunals, or courts) through to physical protest. The finding reveals that opportunities do commonly exist for dialogue to address issues before escalation. Nonetheless, a significant proportion of our cases demonstrated escalated forms of conflict. Half of the cases analyzed involved a project blockade (25 of 50) (Fig. S1) and around one-third a fatality (21 of 50), damage to private property (17 of 50), or the suspension and abandonment of the project (15 of 50).

The Factors Influencing the Translation of Social and Environmental Risks to Business Costs.

Perceived risks motivate conflict. The translation of environmental and social risk to conflict does not always occur, and cases reveal different factors that have precipitated this translation. These factors include the failure of companies to respond to expressed concerns about risk, company engineers dismissing community perceptions of risk as unfounded and “unscientific,” the presence of organizations that heighten awareness and perception of risk and present them in stark form, and the failure of government to mediate these different perceptions of risk in ways deemed impartial.

Risks to the environment, particularly to water quality and quantity, are the most frequently expressed, and these have often driven conflict that has created new costs for companies. Two large-scale examples illustrate the point, each from Peru. Plans in the North of Peru to open a new project known as Minas Conga involved the destruction and transformation of four high-altitude lagoons, two to supply water to the mine and two for deposition of mine waste. Concerns regarding this modification to the hydrological system became a primary mobilization point for protests lasting several months that ultimately led to suspension of the project. A second example, the Quellaveco project in the South of Peru involves another large international mining company, Anglo American. Several concerns about risks to water have been expressed in this project: highland farming populations have expressed concern that they would lose water resources (parts of the urban community have expressed similar concerns); and downstream, commercial agriculturalists worry about risks to irrigation water. Populations also feared the risks inherent in a permanent change to the course of the region’s primary river. The social mobilization and conflicts over the project paralyzed investment. A newly elected regional government then facilitated dialogue among the parties. After a long process, the company agreed to a fundamental redesign of the project that would reduce many of these risks by seeking water from other sources, and by committing to complete restoration of the river course postmine. These changes increased the cost of the project and led the company to postpone the final decision to proceed. Although these are individual cases, the scale of the investments involved makes them much more than isolated “anecdotes.” These examples provide clear evidence of how environmental and social risk can be translated through conflict into business risks and additional costs.

The Costs of Conflict as Interpreted by Corporations.

In depth interviews (n = 45) were held with key individuals, primarily from mining and hydrocarbon companies and in several instances at a senior corporate level, but also from industry bodies, corporate law firms, private and multilateral financial institutions, and research institutes. A typology of company costs of conflict was developed from the existing literature (19, 20) and expanded and verified with our interviewees (Table S1). These interviewees were asked to identify the costs imposed by different types of conflict at different stages of the project cycle. They were also asked to comment on the greatest and most frequent costs, and the costs most often overlooked.

The most frequent costs identified by interviewees were those arising from lost productivity as a result of delay. Multiple interviewees reported cases of a major, world-class mining project with capital expenditure of between US$3 and US$5 billion suffering roughly US$20 million per week of delayed production in net present value terms as a result of community conflict. This figure was supported by separate analysis of publicly reported financial data of a Latin American mine, at which a 9-mo delay during construction in 2010 resulted in US$750 million in additional project costs (i.e., roughly US$20 million per week). One interviewee revealed that company–community conflict in one country cost one project US$100 million per year in stoppages; in another case, community conflict that shut down a few power lines caused an entire operation to halt at a cost of US$750,000 per day. A 7-d blockage of an energy project’s supply route in a Middle Eastern country cost US$20,000 per day. Even at the exploration stage, costs can accrue. In the case of initial mineral exploration (early reconnaissance work), interviewees estimated that around US$10,000 is lost for every day of delay in lost wages and the costs of maintaining an exploration camp. For advanced exploration involving drilling and geophysical delineation, up to US$50,000 a day is lost when programs are forced into “stand-by” as a result of company–community conflict.

In at least one instance, the cost of delay had been integrated into “construction costs” in the project budget, which included a 50% margin to cover delays arising from community conflict. Financial services companies are also beginning to factor in the prospect of delays in valuations of projects. In Australia, Credit Suisse has applied a 2.9% discount on its corporate valuation of AGL Energy (AGK) to account for the risk of regulatory approval delays following local community opposition to hydraulic fracturing at their planned Gloucester coal-seam gas project (21). An economy wide valuation of “environmental, social and governance risks” across the Australian Stock Market in 2012 by Credit Suisse identified AUS$21.4 billion in negative share-price valuation impact. The sectors with the greatest value at risk were mining and hydrocarbon (AUS$8.4 billion; and an average of 2.2% impact on the target share price) (22).

Interviewees identified the greatest costs of conflict as the opportunity costs arising from the inability to pursue projects or opportunities for expansion or for sale. In February 2006, for example, the developers of the Esquel project in Argentina were forced to write down US$379 million in assets and forgo development of US$1.33 billion in projected reserves (20). In 2003, the owners of the Tambogrande project in Peru reported an asset write-down of US$59.3 million following the abandonment of the proposed project, with reserves valued at the time at US$253 million (23, 24). In November 2011 the owners of the Minas Conga project, discussed above, suspended construction at the request of the Peruvian Government, following company–community conflict. The estimated life production of the deposit is 15–20 million ounces of gold and 4–6 billion pounds of copper, with Newmont the majority owner (51.35%) reporting capital expenditure of US$1.455 billion between 2010 and 2012 (25). Minority partner (43.65%) Compañía de Minas Buenaventura reported capital expenditure of US$498 million on Minas Conga in 2012 (26). In 2014, Anglo American confirmed that the need to redesign its Quellaveco project in the face of conflict in Southern Peru had increased the estimated cost of the project from US$3.3 billion to US$5 billion (27).

In the State of Orissa, India, the Lanjigarh bauxite mining project was abandoned following prolonged protests over Indigenous rights, land access, and environmental issues (28). The proposed 3 million ton per annum project was owned by a subsidiary of Vedanta Resources with the ore to service Vedanta’s US$1.0 billion Lanjigarh refinery (29). In 2010, the Government of India revoked environmental permits for the project in response to the community mobilization, precipitating share-price falls for Vedanta of around 10% (30). In 2013, the Indian Supreme Court ruled that the project could only proceed should the village councils in the project area indicate their support. All 12 councils rejected the proposal. The refinery has faced temporary shutdowns and has needed to source ore from other locations. The US$1.5 billion planned expansion of the refinery was also abandoned (29).

The costs cited by interviewees as the most often overlooked were those resulting from the additional staff time needed, especially at the senior management level, when conflicts arise or escalate. For one company, the working assumption is that 5% of an asset manager’s time should be spent managing stakeholder-related risk; yet, for one of its subsidiaries in an African country, it is in fact 10–15%, and in one Asia-Pacific country the figure is as high as 35–50%. In other cases, senior management estimated that assets worth 10% or less of the company’s income were demanding more than 80% of senior management time, including, in one case, the CEO’s. Interviewees understood the increased demands on personnel time resulting from company–community conflict as opportunity costs, where disproportionate time was expended that could be better used in other locations. Although not an issue raised by our interviewees, higher managerial costs associated with social conflict could potentially, however, be offset by higher profitability and lower operational costs (e.g., labor) in such locations.

Is Quantification a Useful Language?

Interviewees broadly expressed the opinion that quantification of costs related to conflict increases the extent to which senior management and the financial team will consider changing corporate behavior and project design. The interviewees confirmed that stakeholder-related business risks are generally not aggregated across all operations. A number of interviewees stated that improved understanding of the costs of conflict is essential to better communicate the value of the professional functions that are responsible for community relationships and environmental performance. Several interviewees, from different departments within mining and hydrocarbon companies, said that staff responsible for community relationships should learn the “language of costs” to better present a business case for early consideration of socio-environmental issues in project design and management. The ability to converse in technical and social-science languages was also identified as important for employees in technical, as well as environmental, community relations and management roles (see also ref. 8).

One company had undertaken a comprehensive internal review over a 2-mo period to better understand their exposure to nontechnical risks (which included risks arising from conflict with local community, delays in permitting, and local, regional, and national political issues). A corporate-level team examined one-dozen projects, including those at both the pre- and postfinancial investment decision stage. They asked project managers to identify the costs of delay and other capital expenditure impacts, based on existing timelines and budgets, and then reviewed the information. The results were scaled for a number of the company’s top projects based on cash flow models. More than US$6 billion in costs were attributed to nontechnical risks over a 2-y period, representing a double-digit percentage of the company’s annual operating profits. Even so, the review did not take into account opportunity costs or staff time. The company used this data to attract Board-level attention to the issue. Occurring at the same time as an internal restructuring process, the review led to greater support for the professionals responsible for community relations.

In contrast to the argument favoring quantification of costs, interviewees stressed the importance of avoiding a cost/benefit approach to managing stakeholder-related business risk. They saw a clear need to distinguish between (i) strategies that combine assessment of costs, internalization of the lessons of the past, and making a business case that is linked to values and ethics; and (ii) strategies only using the language of costs as a motivator of management efforts to change corporate behavior.

Conflict and the Regulation of Company Behavior.

There was variation among corporate approaches to conflict avoidance and resolution. Several interviewees were strongly of the view that the triggers for and underlying causes of company–community conflict, and its costs, are predictable, and that approaches, procedures, and standards are available to companies to avoid conflict and develop constructive relationships with community actors. Examples of practices cited by interviewees include: (i) meaningful engagement, consultation, and consent processes with affected communities; (ii) processes for keeping track of and responding to complaints, grievances, and company commitments; (iii) root cause analysis to understand conflicts and delve beyond the presenting issues, which can mask other issues of significance to the parties to conflict; and (iv) processes for identifying and responding to the risks and impacts of projects, such as environmental and social impact assessment. Two of the companies interviewed were in the process of instituting standardized procedures for tracking complaints and social incidents throughout all of their operations, aimed at addressing issues before they escalate.

Discussion: Factors Influencing the Translation of Risks to Costs to Changes in Company Behavior

Boundary Actors and Corporate Behavior in SESs.

Our results indicate that knowledge of the costs of company–community conflict, and skills in quantification, can support sustainability professionals within companies (both those that are environment- and community-focused) develop a business case for environmental and social risk management, and can provide a strengthened basis from which to influence corporate decision-making. Interviewees revealed a range of corporate behaviors. Some companies already had procedures for integrating stakeholder-related concerns into corporate decision making; others do not adequately consider these issues (according to those inside the company); and some see stakeholder-related concerns as optional “add-ons” to broader regulatory processes for operating projects (e.g., health and safety risk management).

The processes associated with translating the cost of conflict into a pragmatic business case that would change corporate strategy are not straightforward. Translation requires individuals within organizations who can work across functional, organizational, and conceptual boundaries (31), and who can work in more than one “language” and interpret how social and environmental risk is translating into costs for business. The need for internal “translators” suggests that corporate decision-makers do not currently have the necessary models to internalize externalities and translate social risk inward. Those people and processes bridging the divide between financial quantification and social conflict represent the boundary phenomena (32–34) that will enable alternative conceptions of risk in the extractive industries.

The Role of Corporate Culture and Policy.

Such agents and processes of translation do not exist accidentally: they prosper within organizations when corporate cultures enable diverse voices, perspectives, and ways of characterizing problems. Although the evolution of supportive corporate cultures was not the subject of our inquiry, research reveals that in the mining industry, boundary workers are more often constrained by corporate cultures and the broader institutional environment than they are integrated into corporate decision making (35). Where social, ecological, technical, and financial knowledge connect within companies, certain organizational conditions are evident. When sustainability practitioners are elevated to a position of authority equivalent to other functions, their influence often increases (8). Cross-functional internal decision-making forums, such as committees with membership across organizational units that are responsible for addressing community grievances, provide opportunities for diverse internal perspectives to be heard and acted upon.

In some corporate cultures, sustainability practitioners are involved in key decisions from the outset of operations, when there is greatest potential to avert or avoid conflict. In these instances, the potential costs of company–community conflict are integrated into early engagement and planning. In other instances, sustainability professionals are included only when conflict has erupted, or a crisis has escalated. Sustainability professionals report that they are more able to calculate costs of conflict and secure immediate resources in a crisis scenario. They also report that operations tend to suffer from what researchers have called “postcrisis recognition regression,” where the effectiveness of sustainability professionals as boundary agents is temporary, and occurs only for the duration of the crisis (35).

Whether operating under crisis conditions or in a stable operating environment, new calculative processes for costing conflict may not induce corporate responses that reduce social and environmental risks. It may be the case, for example, that a corporate culture supports boundary spanners to account for the cost of conflict, but not to catalyze change. Outcomes may be limited to improved accounting, where companies become adept at “building in” the cost of conflict into business models, rather than mobilizing resources to understand conflict dynamics and address root causes. Moreover, the responsiveness of companies may vary depending on the commodity price cycle and the availability of resources to devote to the sustainability and community relations functions of the business. The perverse effects of “costing conflict” in organizations that have not embedded sustainability as a value within corporate culture may not achieve improved sustainability outcomes. Nonetheless, calculating the cost of conflict does offer sustainability professionals a powerful lever to exercise influence within companies.

The Role of Government Regulation.

Variation in the approaches adopted by different companies highlights the importance of sound policy and regulation that addresses the full spectrum of sustainable development issues. Our findings indicate that a policy environment that encourages effective predictive assessment and management of environmental and social impacts, greater community involvement in dialogue and decision making during the early stages of projects (including addressing community held expectations for consent); the formalization of such dialogue into agreements between companies and their employees, Indigenous peoples, and communities; and the implementation of conflict resolution and grievance handling approaches, is particularly important in ensuring that environmental and social risks are managed and conflict is regulated in constructive ways.

Some governments have recently strengthened the environmental and social requirements of companies in extractive industries. Of particular note is the approach being taken by the Superintendence of Banks, Insurers and Private Pension Funds (SBS) in Peru to create incentives for better management of social conflict by companies, particularly in the mining, energy, and forestry sectors (36). Social conflict, resulting in part from local communities’ concerns about the impacts such projects may have on their livelihoods, welfare, and human rights, is seen as having implications for the credit risk of individual Peruvian banks, the stability of the Peruvian financial system, and the reputation of Peru as an investment location. The SBS is considering how regulatory measures directed at the banking sector might encourage improved corporate policies, processes, and practices for engagement and consultation with local communities. This process includes consideration of how to evaluate the quality of company–community relationships, and the processes that support them.

Also in Peru, as well as in other jurisdictions—notably parts of Australia and Canada—administrations have sought to reduce so-called “green-tape” to accelerate government approval processes and decrease business costs (37). Our findings suggest that any reduction of appropriate oversight of social and environmental performance has the potential to lead to substantial costs for the industry in the medium- to long-term through heightened risk of company–community conflict.

Timing in the Project Cycle.

When conflict occurs within the project cycle it has a significant influence on how companies respond to it. Conflict early in the cycle is more likely to lead companies to withdraw from an investment (which may imply reduced social and environmental impact, or may also mean the transfer of impacts to another location) and to consider fundamental redesign of the project. When conflict occurs later in the project cycle, companies are more likely to adapt the design or add on social responsibility activities, the latter of which provides impact compensation rather than impact reduction.

Conflict as a Regulator of Industrializing SESs.

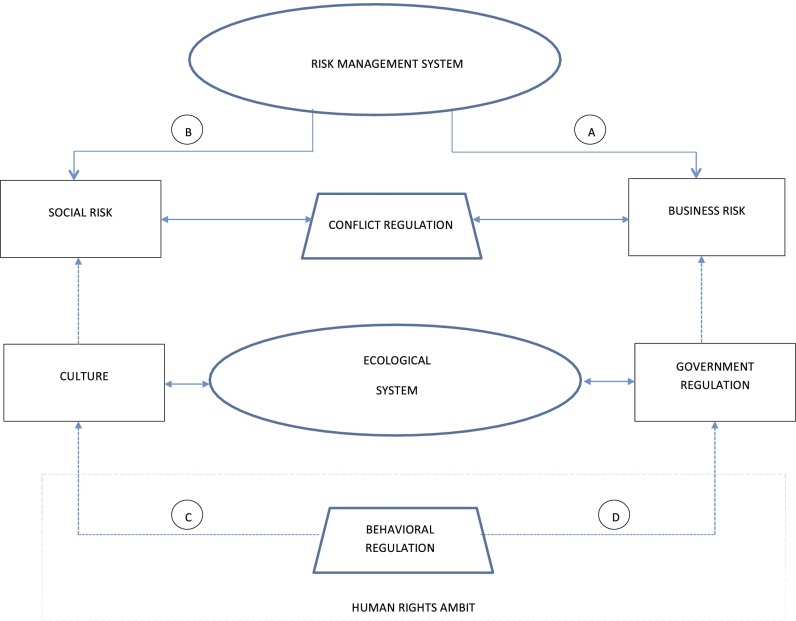

In any large-scale industrial development that might challenge the sustainability of SESs, there are essentially two pathways for risk quantification that are often decoupled from each other by corporate decision-makers (Fig. 3). Pathway A in Fig. 3 reflects the business risk that is often calculated by for-profit entities and is a reflection of their economic and financial interests. Pathway B reflects the social risk, which is borne by a community that is subject to such large-scale development and may not be directly incorporated by pathway A. Social conflict is often a result of this disconnect and is reflective of socio-ecological stresses borne by the community.

Fig. 3.

Conflict as a regulator of industrializing SESs.

Although social conflict and the calculation of business risk can each regulate corporate behavior and thus the ways in which companies intervene in SESs, it has been the latter behavior that has typically been assumed to be the most important source of regulation. Our results reveal, however, that companies are increasingly willing to reduce social and environmental risks that are expressed through social conflict once they understand the financial implications and the connection to business risk. This connection is particularly the case when cost arguments are directly linked to corporate citizenship and values. Company behavior can also be regulated by more general societal norms, what we have termed “behavioral regulation.” Behavioral regulation is often expressed through culture (pathway C in Fig. 3) and internationally agreed values, principles, and standards (e.g., ref. 38), or as government regulation (pathway D in Fig. 3). Existing literature (39) does suggest, however, that government regulations frequently fail, at the very least when environmental agencies are charged with enforcement. Government regulation as well as global codes of conduct remain important, particularly so in circumstances where constructive conflict and the public expression of risk and grievance are not possible because of a range of reasons from social protocols, or repression of social movements in authoritarian states. The convergence of behavioral regulation through cultural and political means and risk management through cost metrics is likely to achieve more sustainable outcomes for ecological systems impacted by resource extraction projects.

Conclusions

The transformations driven by the activities of large-scale mining and hydrocarbon operations are on such a scale that the conflicts discussed in this report exceed disputes over access to and control of resources. Instead, they are conflicts over threats to—as well as modes of enhancing—broader SES sustainability. Indeed, citizen and corporate actors involved in these processes increasingly frame them as challenges of sustainability: not only because such a framing may improve either the resonance of their discourse of protest or their corporate image, but also because they increasingly view the issues at stake as being of critical importance to their own survival (as communities and as corporations).

Long-term trends in SESs will depend considerably on the extent to which the private sector internalizes the environmental and social consequences of development into business decision making. Social conflict is one medium whereby environmental and social risks can translate into costs for businesses. An improved understanding of the relationship between environmental and social risk and project success has the potential to enhance the sustainability outcomes of large-scale development in the extractive industries. Sustainability science will benefit from greater understanding of the relative burdens of risks on companies and communities. To date, there has been minimal focus on how the risks borne by communities in the form of social risk interface with business risk, and associated costs and financial liabilities. We have therefore focused on how large-scale corporate actors intervene in SESs, how they monitor these interventions, how they learn from and with other populations living within these systems, and how their internal organizational forms and cultures affect such learning processes.

Materials and Methods

Our findings are derived from three primary data sources: in depth, confidential interviews (n = 45); case analysis of company-community conflict around mining operations (n = 50); and a national key informant survey (n = 97) and detailed field study (n =39) of mining company and government responses to conflict in Peru. Detailed explanation of methods is available in SI Materials and Methods. See Figs. S2–S4 for cases by geographic location, mining company type, and primary commodity.

Supplementary Material

Acknowledgments

We thank Caroline Rees, Warwick Browne, Ming Lei, Olivier Salas, Jack Nichols, Kristen Roy, Daniel Tuazon, Ashlee Schleger, Rebekah Ramsay, Magaly Garcia-Vásquez, David Plumb, Sanford Lewis, and Anahí Chaparro for assisting with case research, interviews, analysis, and presentation of data; Gillian Cornish for assisting with literature review; and David Brereton, John Owen, Peter Erskine, John Sherman, Robert Eccles, and Ron Nielsen for providing feedback. This work was supported in part by a Ford Foundation research grant (to A.J.B. and M.S.) and grants from the University of Queensland (D.K. and A.J.B.) and University of Queensland Foundation (D.M.F.). In-kind site-level transport and logistical support was provided for field research by some companies.

Footnotes

Conflict of interest statement: D.M.F., S.H.A., and D.K. have undertaken funded research and consulting on behalf of mining and hydrocarbon companies as well as for governments and civil society organizations; however, external funding was not received for this research.

An earlier version of this research, with a more limited dataset, was presented at the First International Seminar on Social Responsibility in Mining, October 19–21, 2011, Santiago, Chile. A working paper with an expanded discussion of interview findings was published by the Corporate Social Responsibility Initiative of the Harvard Kennedy School (1).

This article contains supporting information online at www.pnas.org/lookup/suppl/doi:10.1073/pnas.1405135111/-/DCSupplemental.

References

- 1.Davis R, Franks DM. (2014) Costs of Company-Community Conflict in the Extractive Sector. Corporate Social Responsibility Initiative Report (John F. Kennedy School of Government, Harvard University, Cambridge, MA) [Google Scholar]

- 2.Hilson G. An overview of land use conflicts in mining communities. Land Use Policy. 2002;19(1):65–73. [Google Scholar]

- 3.Bridge G. Contested terrain: Mining and the environment. Annu Rev Environ Resour. 2004;29:205–259. [Google Scholar]

- 4.Ross M. A closer look at oil, diamonds and civil war. Annu Rev Polit Sci. 2006;9:265–300. [Google Scholar]

- 5.Bernauer T, Böhmelt T, Koubi V. Environmental changes and violent conflict. Environ Res Lett. 2012;7:015601. [Google Scholar]

- 6.Muradian R, Martinez-Alier J, Correa H. International capital versus local population: The environmental conflict of the Tambogrande Mining Project, Peru. Soc Nat Resour. 2003;16(9):775–792. [Google Scholar]

- 7.Hilson G, Yakovleva N. Strained relations: A critical analysis of the mining conflict in Prestea, Ghana. Polit Geogr. 2007;26(1):98–119. [Google Scholar]

- 8.Rees C, Kemp D, Davis R. 2012. Conflict Management and Corporate Culture in the Extractive Industries: A Study in Peru. Corporate Social Responsibility Initiative Report 50 (John F. Kennedy School of Government, Harvard University, Cambridge, MA)

- 9.Goldman Sachs . 190 Projects to Change the World. Goldman Sachs Group; 2008. [Google Scholar]

- 10.Ruggie JG. 2010. Business and human rights: Further steps towards the operationalisation of the “protect, respect and remedy” framework. United Nations Human Rights Council. 14th Session. April (Office of the High Commissioner for Human Rights, New York and Geneva)

- 11.Henisz W, Dorobantu S, Nartey N. Spinning gold: The financial returns of stakeholder engagement. Strateg Manage J. 2013 10.1002/smj. [Google Scholar]

- 12.Bettencourt LMA, Kaur J. Evolution and structure of sustainability science. Proc Natl Acad Sci USA. 2011;108(49):19540–19545. doi: 10.1073/pnas.1102712108. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 13.Kates RW. What kind of a science is sustainability science? Proc Natl Acad Sci USA. 2011;108(49):19449–19450. doi: 10.1073/pnas.1116097108. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 14.Bury J, et al. New geographies of water and climate change in Peru: Coupled natural and social transformations in the Santa River Watershed. Ann Assoc Am Geogr. 2013;103(2):363–374. [Google Scholar]

- 15.Sharma V, Franks DM. In-situ adaptation to climatic change: Mineral industry responses to extreme flooding events in Queensland, Australia. Soc Nat Resour. 2013;26(11):1252–1267. [Google Scholar]

- 16.Rulli MC, Saviori A, D’Odorico P. Global land and water grabbing. Proc Natl Acad Sci USA. 2013;110(3):892–897. doi: 10.1073/pnas.1213163110. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 17.Turner BL, Lambin EF, Reenberg A. The emergence of land change science for global environmental change and sustainability. Proc Natl Acad Sci USA. 2007;104(52):20666–20671. doi: 10.1073/pnas.0704119104. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18.Bebbington A, et al. Mining and social movements: Struggles over livelihood and rural territorial development in the Andes. World Dev. 2008;36(12):2888–2905. [Google Scholar]

- 19. International Alert, Engineers Against Poverty (2006) Conflict-Sensitive Business Practice: Engineering Contractors and their Clients (International Alert, Engineers Against Poverty, London)

- 20.Herz S, La Vina A, Sohn J. Development Without Conflict: The Business Case for Community Consent. Washington: World Resources Institute; 2007. [Google Scholar]

- 21.Credit Suisse . AGL Energy: Delays at Gloucester. 26 February. Sydney: Asia Pacific; 2014. [Google Scholar]

- 22.Credit Suisse 2012. Australian ESG/SRI. Available at www.credit-suisse.com/conferences/aic/2012/doc/web/20120731_esg_sri.pdf. Accessed December 20, 2013.

- 23.Manhattan Minerals (2003) Securities and Exchange Commission Form 6-K (Vancouver)

- 24.Manhattan Minerals (2004) Securities and Exchange Commission Form 6-K (Vancouver)

- 25.Newmont 2012. Annual Report Available at http://newmont.q4web.com/files/2012%20Annual%20Report_v001_e75k8c.pdf Accessed December 20, 2013.

- 26.Compañía de Minas Buenaventura 2012. Memoria Anual 2012 [Annual Report 2012] (Compañía de Minas Buenaventura, Lima, Peru)

- 27.Pinedo C. Anglo American ratifica que en el 2015 desarrollará el proyecto Quellaveco. [Anglo American reaffirms development of Quellaveco in 2015] La República. 2014. 19 February, Available at: www.larepublica.pe/19-02-2014/anglo-american-ratifica-que-el-2015-desarrollara-el-proyecto-minero-quellaveco. Accessed April 1, 2014.

- 28.Saxena NC, Parasuraman S, Kant P, Baviskar A. 2010. Report Of The Four Member Committee For Investigation Into The Proposal Submitted By The Orissa Mining Company For Bauxite Mining In Niyamgiri, Submitted to the Ministry of Environment & Forests, Government of India, New Delhi. Available at http://envfor.nic.in/sites/default/files/Saxena_Vedanta-1.pdf. Accessed 20 December 20, 2013.

- 29.Vedanta Resources 2011. Annual Report 2011 (Vedanta, London)

- 30.Dudley C. Pension group slams Vedanta for ESG inaction. Environmental Finance. 2010 September. Available at www.environmental-finance.com/content/news/pension-group-slams-vedanta-for-esg-inaction.html. Accessed 20 December, 2013. [Google Scholar]

- 31.Cash DW, Clark WC, Alcock NM, Dickson N, Jäger J. 2002. Salience, credibility, legitimacy and boundaries: Linking research, assessment and decision making. RWP 02-046, (John F. Kennedy School of Government, Harvard University, Faculty Working Paper Series, Cambridge, MA)

- 32.McGreavy B, Hutchins K, Smith H, Lindenfeld L, Silka L. Addressing the complexities of boundary work in Sustainability Science through communication. Sustainability. 2013;5(10):4195–4221. [Google Scholar]

- 33.Bebbington AJ, Bury JT. Institutional challenges for mining and sustainability in Peru. Proc Natl Acad Sci USA. 2009;106(41):17296–17301. doi: 10.1073/pnas.0906057106. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 34.Cash DW, et al. Knowledge systems for sustainable development. Proc Natl Acad Sci USA. 2003;100(14):8086–8091. doi: 10.1073/pnas.1231332100. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 35.Kemp D, Owen JR. Community relations in mining: Core to business but not ‘core business’. Resour Policy. 2013;38(4):523–531. [Google Scholar]

- 36.Quispe Chumpitaz M. En un año se regulará riesgo crediticio socio ambiental [Socio-environmental credit risk to be regulated within one year] La República. 2014. 27 January, Available at www.larepublica.pe/27-01-2014/en-un-ano-se-regulara-riesgo-crediticio-socio-ambiental, Accessed April 1, 2014.

- 37.Franks DM, Vanclay F. Social impact management plans: Innovations in corporate and public policy. Environ Impact Assess Rev. 2013;43:40–48. [Google Scholar]

- 38.Ruggie JG. 2011. Guiding Principles on Business and Human Rights: Implementing the United Nations “Protect, Respect and Remedy” Framework. United Nations Human Rights Council. 17th Session. March. (Office of the High Commissioner for Human Rights, New York and Geneva)

- 39.Van Rooij B. Greening industry without enforcement? An assessment of the World Bank’s Pollution Regulation Model for Developing Countries. Law Policy. 2010;32(1):127–152. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.