Abstract

Background

Mail-service pharmacies offer consumers the convenience of prescriptions filled with a 90-day supply of medication. Unlike mail-service pharmacies, retail pharmacies traditionally dispensed maintenance medication prescriptions with a 30-day supply. However, the retail landscape changed in May 2008 with Walmart's announcement of an extension of its $4 Prescription Program to include 90-day-supply prescriptions.

Objective

To evaluate recent changes in access to and use of 90-day-supply maintenance medications dispensed via retail pharmacy.

Summary

As of the first quarter of 2007, the proportion of retail-dispensed maintenance medications with a 90-day supply (compared with all maintenance prescriptions dispensed) among Medicare Part D plans, self-insured employers, and private health plans was 5.1%, 5.1%, and 5.0%, respectively. As of December 2009, this ratio had risen to 8.0% for Medicare plans and 8.1% for commercial health plans; the ratio among employers had risen more modestly to 6.1%. Of particular interest and importance, the proportion increased similarly for brand and for generic medications.

Conclusion

There has been substantial growth in 90-day prescriptions dispensed via retail pharmacy, a trend that is likely to continue as more insurance providers adopt compatible benefit designs. It is important to continue monitoring these trends and to identify opportunities to rigorously evaluate their impact on medication adherence and healthcare costs.

Nearly 96% of all employers allow employees and covered beneficiaries to fill medication prescriptions from either retail or mail-service pharmacy.1 In 2009, mail-service pharmacies dispensed approximately 238 million prescriptions, representing 6.6% of the 3.6 billion prescriptions dispensed that year.2 Mail-service pharmacies have enjoyed high levels of consumer satisfaction.3 Mail-service pharmacies offer consumers the convenience of home delivery, online ordering and renewal processes, and prescriptions filled with a 90-day supply of medication.

Unlike mail-service pharmacies, retail pharmacies traditionally dispensed maintenance medication prescriptions with a 30-day supply. However, the retail landscape changed in May 2008 with Walmart's announcement of an extension of the $4 Prescription Program to include 90-day-supply prescriptions of select maintenance medications for $10.4 Although positioned primarily as a program to lower drug costs for the uninsured for a limited number of chronic medications, the program was available to virtually all consumers. Many retail pharmacy chains followed this lead, instituting similar low-cost, 90-day-supply drug programs.

For individuals with a pharmacy insurance benefit, access to a 90-day supply of maintenance medications, either through mail or retail pharmacy, expanded as payers and pharmacy benefits managers (PBMs) began enhancing their retail pharmacy networks and pharmacy benefit designs. As a response to these initiatives, CVS Caremark, Rite Aid Health Solutions, and Walgreens Health Initiatives now offer programs that allow consumers to receive 90-day-supply prescriptions via mail or retail pharmacy. Today, even stand-alone PBMs, such as Express Scripts and Medco Health Solutions, have retail pharmacy networks that accommodate 90-day prescriptions.

KEY POINTS

-

▸

Traditionally, retail pharmacies predominantly dispensed prescription medications for the treatment of chronic disease with a 30-day-supply limit.

-

▸

However, in 2008 Walmart fundamentally changed access to retail pharmacy-dispensed 90-day-supply prescriptions by launching a program to dispense select maintenance medications in 90-day supplies for $10 via its retail pharmacy.

-

▸

This current study measured changes in paid pharmacy claims between January 2007 and December 2009, using 467 million claims purchased at retail pharmacies and adjudicated by CVS Caremark.

-

▸

Results showed that in that 3-year period, the ratio of 90-day prescription dispensing increased from 5.1% to 8.0% and from 5.0% to 8.1% among beneficiaries of select Medicare Part D and commercial health plans, respectively.

-

▸

Recent studies have shown increased medication adherence with expanded drug supply with mail-service pharmacies compared with retail pharmacies. It is therefore reasonable to assume that extended access to medications in retail pharmacy is similarly likely to improve adherence, which may have important implications on overall healthcare costs and utilization.

-

▸

Studies are needed to investigate the impact of 90-day prescription supply at retail pharmacies on medication adherence.

According to the 2010–2011 Prescription Drug Benefit Cost and Plan Design report, 96.3% of employers offer access to mail-service pharmacy for maintenance medications (routinely dispensed with 90-day supplies) but 58.3% also use retail pharmacies to dispense maintenance supplies of medications.1

The availability of prescriptions with an expanded-day supply in retail pharmacies may have important implications for medication adherence. Recent evaluations of mail-service pharmacy have documented improved medication adherence compared with prescriptions dispensed with 30-day supplies via retail pharmacy, in large part because of the availability of extended-day supply dispensed with each prescription.5,6 Yet despite the recent expansion of 90-day prescription drug access at retail pharmacies, little has been documented in peer-reviewed literature about the use of these programs by consumers. Understanding this trend has important implications for payers and patients.

Methods

To document recent medication trends, we measured changes in paid pharmacy claims purchased at retail pharmacies and adjudicated by CVS Caremark during the 3-year period from 2007 through 2009. To be eligible, a payer had to fulfill the following criteria:

Provide covered beneficiaries with pharmacy insurance benefits administered by CVS Caremark continuously from January 1, 2007, through December 31, 2009

Not mandate maintenance medications to be dispensed by a mail-service pharmacy

Have no more than ±15% change in average membership between calendar years 2008 and 2009.

During the study period (2007–2009), the use of 90-day-supply prescriptions among Medicaid beneficiaries was negligible and thus excluded. Eligible paid pharmacy claims were (1) submitted by a retail pharmacy, (2) designated as a maintenance medication by either Medi-Span or First DataBank, and (3) adjudicated and paid during the 3-year study period.

In January 2009, CVS Caremark launched Maintenance Choice—a pharmacy benefit design which, in general, provides members with the choice of receiving their 90-day prescriptions through CVS Caremark mail-service pharmacy or at a CVS/pharmacy retail location for the same out-of-pocket (ie, copayment) cost as a mail prescription. Because the CVS Caremark PBM data overrepresents this Maintenance Choice pharmacy benefit, we stratified the results by retail pharmacy—CVS/pharmacy versus all other retail pharmacies.

The overall trend in dispensing 90-day prescriptions was tested for statistical significance using the Cochran-Armitage test for trend, testing the frequency of 90-day–supply prescriptions monthly over the study period.

Results

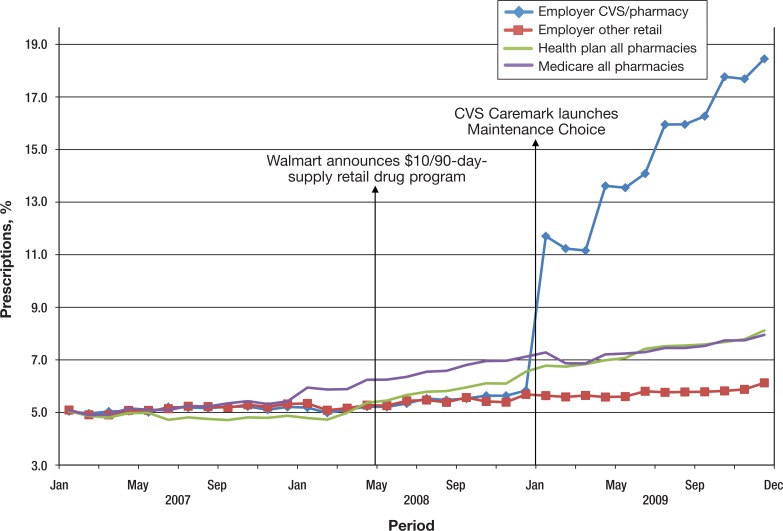

In total, we included 467 million claims adjudicated for 27 million members covered by 1115 insurers. Figure 1 (page 97) displays the percent of maintenance prescriptions dispensed with a 90-day supply (thereafter, 90-day ratio) from January 2007 through December 2009. As of the first quarter of 2007, the 90-day ratio was 5.1%, 5.1%, and 5.0% for Medicare Part D plans, self-insured employers, and private health plans, respectively. As of December 2009, the 90-day ratio had risen to 8.0% for Medicare and 8.1% for health plans; the ratio among employers had risen more modestly to 6.1%.

Figure 1. Percent of Maintenance Prescriptions Filled as 90-Day Supply in Retail Pharmacies by Market Segment and Pharmacy.

Among the network of CVS/pharmacy retail stores, the 90-day ratio increased by 13.4 percentage points among employers, with substantial increases subsequent to the launch of Maintenance Choice.

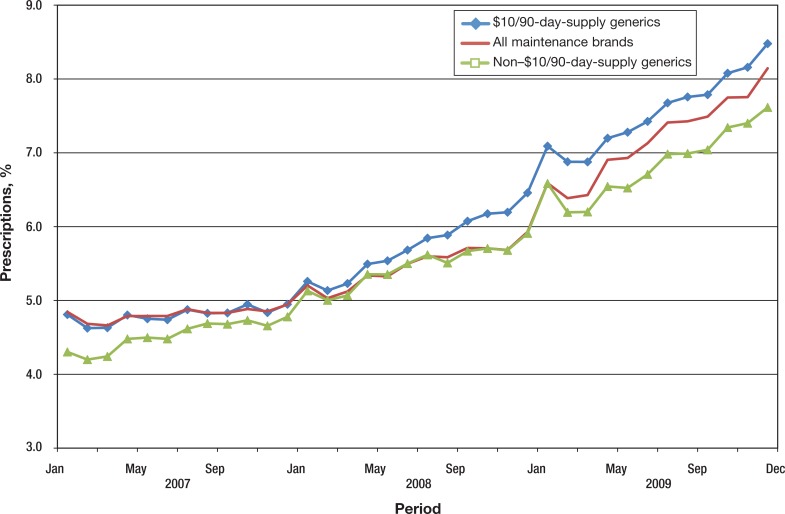

Of particular interest, the 90-day ratio increased similarly for brand and generic medications, with the ratio increasing by 3.3 percentage points for brand-name and for generic drugs. Comparable increases were noted for generic drugs that were included on and omitted from the $10/90 generic drug program lists (Figure 2, page 98). The increase in dispensed 90-day prescriptions at retail pharmacies during this period was significant (P <.001).

Figure 2. Percent of Retail Prescriptions Filled as 90-Day Supply by Brand and Generic Status.

Discussion

The growth in the 90-day ratio reveals a preference by consumers and further supports the growing body of evidence in support of offering consumers access to extended-day supplies of prescriptions at mail and retail pharmacies. Consumers cite high levels of overall satisfaction with retail and mail pharmacy services3,7,8 and value choice in pharmacy and prescription drug access.9 According to recent market research conducted by Walgreens, nearly 4 of 5 patients stated a preference for receiving their 90-day prescription at a retail pharmacy rather than by mail.10

Furthermore, in a recent study of consumer pharmacy preference, Liberman and colleagues showed that among commercially insured patients who transitioned from mandatory mail benefit to the Maintenance Choice benefit, 66.3% of those initiating therapy without a recent mail pharmacy prescription and 23.7% of current mail-service pharmacy users selected a retail pharmacy for subsequent 90-day-supply prescriptions.11 This benefit design, however, in general charges the consumer with the same copayment, regardless of the pharmacy channel selected. Not all pharmacy programs apply identical copayments for mail or retail pharmacy dispensed as 90-day prescriptions, and this will likely alter consumer preference and program uptake.

The growth in 90-day prescriptions at retail pharmacies has implications for medication adherence. In a recent study of 13,922 patients from the Kaiser Permanente Northern California diabetes registry, Duru and colleagues reported that mail-order pharmacy users had better adherence to antiglycemic, antihypertensive, and dyslipidemic medications.6 In a study of oral antidiabetic medication use, Devine and colleagues used propensity scores to match 14,600 cases to 43,800 controls selected from the MarketScan database.5 After adjustment, mail-service pharmacy users realized significantly higher adherence rates. In addition, the improved adherence was associated with lower total and diabetes-related medical costs over time.

Although we are unaware of any research that demonstrates improved adherence with 90-day medication access at retail pharmacy, it is reasonable to assume that access to a 90-day supply of medication, regardless of point of access (retail or mail), would be associated with an improvement in adherence and improved control of many chronic conditions. If so, the recent studies of mail-service pharmacy by Devine and colleagues and Duru and colleagues provide compelling, supporting evidence for that likely improvement in adherence.5,6

Limitations

This analysis was limited to prescriptions managed through insurance benefits of a major PBM. As such, it is potentially not representative of the consumer behavior related to prescriptions purchased without the use of such insurance (ie, cash purchases) nor those related to some government programs that provide beneficiaries copay assistance (ie, Medicaid).

Furthermore, because of the increasing availability of cash-only programs, it is possible that the actual access to, and use of, 90-day prescription supplies are higher than our estimates.

Conclusion

Optimizing access to essential medications while managing pharmacy expenditures is a key function of PBMs.12 Benefit managers must weigh the potential value of increased convenience against the potential costs of providing access through different distribution channels. Nonetheless, the growth in 90-day prescriptions at retail pharmacy is likely to continue as more insurance providers adopt compatible benefit designs.

Preliminary research indicates the potential benefits to the consumer by providing greater convenience and satisfaction, and overall health benefits resulting from improved medication adherence. It is important to continue monitoring these trends and to identify opportunities to rigorously evaluate their impact on healthcare costs and utilization.

Stakeholder Perspective

When More Is Almost Always Better

POLICYMAKERS/PAYERS: The current relationship between mail order versus retail dispensing and 30-day versus 90-day prescriptions seems artificial. That 90-day prescriptions come by mail and 30-day prescriptions come from retail pharmacies is likely to be a side effect of the marketplace and of competition among pharmacy benefit managers (PBMs), insurers, and pharmacies rather than a rational, patient-centered approach to offering prescriptions.

An alternative is seen in the Veterans Affairs (VA) Healthcare System, where I practice. At the VA system, the 90-day prescriptions for chronic medications (ie, noncontrolled substances) is the standard, and these typically come by mail, but some patients elect to receive a partial fill at the window during the visit. The 30-day prescriptions that are set to be dispensed at the window but are never picked up are subsequently mailed directly to the patient. This synergy between retail and mail-order prescriptions creates rates of abandonment of prescriptions of almost zero, unlike outside the VA system.1

In the private sector, more options for where to fill a prescription (and thus more competition) would likely lower costs. Each of the players in the equation, however, faces financial risks if costs are lowered. Pharmacies that fill 90-day prescriptions are likely to receive fewer dispensing fees and lowered foot traffic through their pharmacies. These pharmacies could also, however, increase their market share if patients buy prescriptions at retail pharmacies instead of by mail. The mail-order operations run by PBMs face risks of dropping market share if patients can obtain 90-day prescription fills at retail pharmacies, although centralized mail-order pharmacies can achieve economies of scale and drive generic dispensing, making it difficult for retail pharmacies to compete. Employers are likely to benefit on several levels, from a more satisfied and potentially more adherent (and thus healthier) workforce, to more choice in pharmacy benefits.

PATIENTS: From the patient's perspective, it is difficult to argue against the availability of 90-day supplies of prescriptions at retail pharmacies. The proposition of offering more choices to patients for where and how to fill their prescriptions seems, on the surface, easily justified. As the present article by Dr Liberman and Ms Girdish describes, there is some evidence of greater satisfaction and improved adherence with 90-day versus 30-day supplies.

Although the evidence is by no means definitive, the conclusions make intuitive sense—I have yet to meet a patient using ongoing, stable medications in my own practice who complains about having to come back in 3 months for a prescription rather than in 1 month. I do hear, however, patients who complain about having to coordinate receiving their prescriptions from multiple sources, whether they get their generics from low-cost retail pharmacies, their chronic disease medications in the mail, and their acute-need medication for their child (eg, antibiotic) from the pharmacy nearest to their workplace.

The availability of 90-day supplies of medications from retail pharmacies may offer patients the option of receiving their long-term medications at the same location (and from the same pharmacists) where they pick up their short-term medications or over-the-counter products—more choice, better adherence, lower costs.

Walid F. Gellad, MD, MPH

Staff Physician, VA Pittsburgh Healthcare System, Assistant Professor of Medicine, University of Pittsburgh, Adjunct Scientist, RAND Health

- 1.Shrank WH, Choudhry NK, Fischer MA, et al. The epidemiology of prescriptions abandoned at the pharmacy. Ann Intern Med. 2010; 153: 633–640 [DOI] [PubMed] [Google Scholar]

Biography

Joshua N. Liberman

Author Disclosure Statement

Dr Liberman has reported no conflicts of interest. Ms Girdish owns stock in CVS Caremark. CVS Caremark provided support for this study.

Contributor Information

Joshua N. Liberman, Vice President, Strategic Research, CVS Caremark, Hunt Valley, MD, at the time of this research.

Charmaine Girdish, Senior Analyst, Strategic Research, CVS Caremark, Scottsdale, AZ.

References

- 1.Pharmacy Benefits Management Institute. Prescription Drug Benefit Cost and Plan Design Online Report, 2010–2011 Edition. www.pbmi.com/BenefitDesign.asp Accessed December 9, 2010.

- 2.National Association of Chain Drug Stores. Industry facts-at-a-glance. www.nacds.org/wmspage.cfm?parm1=6536#pharmpricing Accessed September 9, 2010.

- 3.Birtcher KK, Shepherd MD. Users’ perceptions of mail-service pharmacy. Am Pharm. 1992; NS31:35–41 [DOI] [PubMed] [Google Scholar]

- 4.Walmart. Walmart launches phase three of $4 Prescription Program. May 5, 2008. http://walmartstores.com/pressroom/news/8248.aspx Accessed September 9, 2010.

- 5.Devine S, Vlahiotis A, Sundar H. A comparison of diabetes medication adherence and healthcare costs in patients using mail order pharmacy and retail pharmacy. J Med Econ. 2010; 13: 203–211 [DOI] [PubMed] [Google Scholar]

- 6.Duru OK, Schmittdiel JA, Dyer WT, et al. Mail-order pharmacy use and adherence to diabetes-related medications. Am J Manag Care. 2010; 16: 33–40 [PMC free article] [PubMed] [Google Scholar]

- 7.Power J.D. and Associates. 2009National Pharmacy Study. www.jdpower.com/healthcare/articles/2009-National-Pharmacy-Study/ Accessed February 25, 2011.

- 8.90-day Rx solution. More health plans implement mandatory mail-order pharmacy programs, yielding greater savings and adherence rates. Drug Benefit News. 2010; 11: 1–2 www.silverlink.com/assets/pdfs/silverlinknews/dbn030510.pdf Accessed March 11, 2011. [Google Scholar]

- 9.Desselle SP. Determinants of satisfaction with prescription drug plans. Am J Health Syst Pharm. 2001; 58: 1110–1119 [DOI] [PubMed] [Google Scholar]

- 10.Business Wire. Walgreens to promote 90-day prescriptions at community pharmacies in Minneapolis. August 3, 2010. www.businesswire.com/news/home/20100803006228/en/Walgreens-Promote-90-Day-Prescriptions-Community-Pharmacies-Minneapolis Accessed August 26, 2010.

- 11.Liberman JN, Wang Y, Hutchins DS, et al. Revealed preference for retail and mail-service pharmacy. J Am Pharm Assoc. 2011; 51: 50–57 [DOI] [PubMed] [Google Scholar]

- 12.Shrank WH, Porter ME, Jain SH, Choudhry NK. A blueprint for pharmacy benefit managers to increase value. Am J Manag Care. 2009; 15: 87–93 [PMC free article] [PubMed] [Google Scholar]