Abstract

Objectives

This paper sets out to estimate the cost of illicit financial flows (IFF) in terms of the amount of time it could take to reach the fourth Millennium Development Goal (MDG) in 34 African countries.

Design

We have calculated the percentage increase in gross domestic product (GDP) if IFFs were curtailed using IFF/GDP ratios. We applied the income (GDP) elasticity of child mortality to the increase in GDP to estimate the reduction in time to reach the fourth MDG in 34 African countries.

Participants

children aged under five years.

Settings

34 countries in SSA.

Main outcome measures

Reduction in time to reach the first indicator of the fourth MDG, under-five mortality rate in the absence of IFF.

Results

We found that in the 34 SSA countries, six countries will achieve their fourth MDG target at the current rates of decline. In the absence of IFF, 16 countries would reach their fourth MDG target by 2015 and there would be large reductions for all other countries.

Conclusions

This drain on development is facilitated by financial secrecy in other jurisdictions. Rich and poor countries alike must stem the haemorrhage of IFF by taking decisive steps towards improving financial transparency.

Keywords: child mortality, millennium development goals, illicit financial flows

Background

Child mortality is higher in poor countries1 and remains very high in SSA, yet this continent loses vast quantities of money in the form of illicit financial flows (IFF).2 The Millennium Development Goals (MDGs) are eight development goals, agreed to by 189 countries in 2000. These goals provided the international community with a focus upon which to act. The fourth MDG is to reduce by two-thirds, between 1990 and 2015, the under-five mortality rate. There are three indicators which are used to monitor progress towards the fourth MDG;3 these indicators are:

4.1 Under-five mortality rate;

4.2 Infant mortality rate;

4.3 Proportion of children aged 1 year who are immunised against measles.

As each country had different rates of mortality at baseline in 1990, each were set a different target to aim towards. However, the majority of countries in the Sub-Saharan Africa (SSA) region are making insufficient progress to meet their target as indicated by their progress towards the first indicator, the under-five mortality rate.4

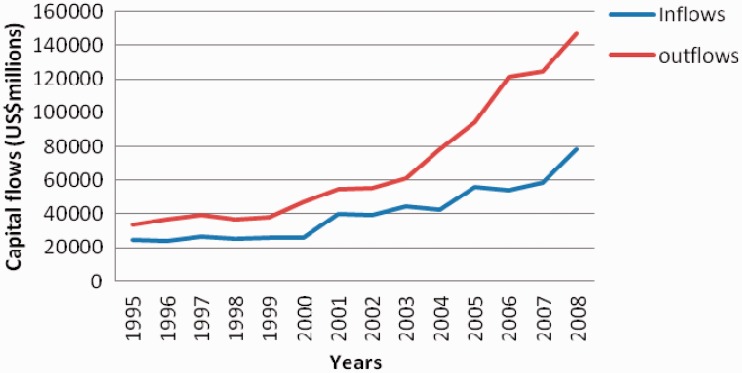

The capital coming into a country (or leaving it) may influence the child mortality rate, and therefore the fourth MDG indicators, by several pathways; see Figure 1 for a schematic representation. The most direct and arguably the most important is the impact on household income and thus the ability of the family to provide for their children. The second is that the amount of capital coming into a country will influence the amount of government revenue available to provide social goods such as healthcare, education, water and sanitation. This latter pathway may be modified either positively or negatively by factors such as control of corruption and the effectiveness of a government. The degree of corruption in a government also influences the capital coming into a country as corruption deters foreign direct investment, which in turn will affect household income. Government effectiveness is important for the provision of water and healthcare, whereas household income is more important for shelter, sanitation and education.5

Figure 1.

IFF and the pathway by which it may influence the three indicators of the fourth MDG.

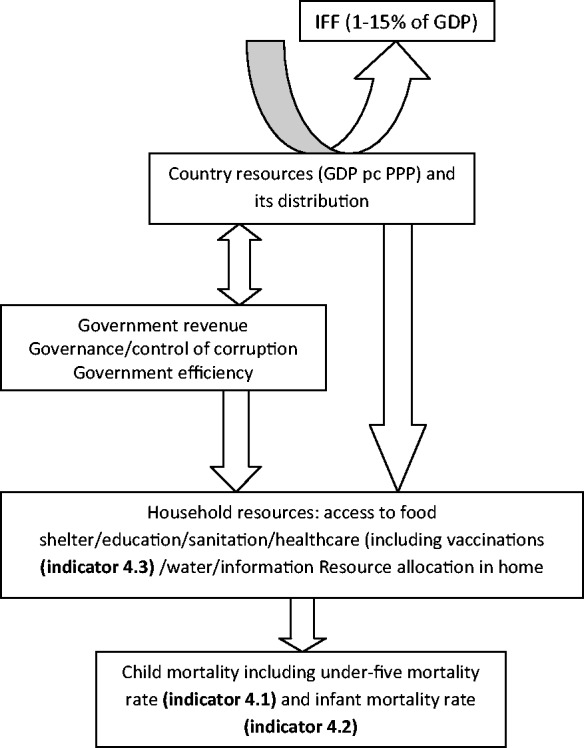

Many countries in SSA have experienced economic growth over the last decade despite a global downturn, but it remains the world’s least developed region; as a result the under-five mortality rate is still 108 per 1000 live births.6 Among the major constraints facing SSA’s development are acute shortages of capital for investment and for public expenditure,7,8 and despite its abundant natural resources and a recent boom in commodity prices, SSA still has an acute shortage of development finance.9 Although remittances and official development assistance (ODA) have increased in the new millennium, the financial gap to achieve meaningful development in SSA is wide (Figure 2). The paradox is that SSA is a ‘net creditor’ to the rest of the world,2 partially due to illicit financial flows (IFF) (Box 1). IFF is an outflow of capital from a jurisdiction through illegal means. Though documented to be a longstanding problem,10 it has been escalating in magnitude in SSA in the last 10 years, reportedly tripling between the 1990s and 2000s.2 In addition, a proliferation of tax breaks aimed at attracting foreign direct investment,11 tax evasion and avoidance by multinational companies, embezzlement of state wealth by political elites and illicit transfer of legitimately earned wealth results in lower tax revenue and thus fewer resources for government expenditure (Box 2). The scarcity of services and the burden of taxation are therefore felt by the less well off.2 The scale of IFF – which has constantly been higher in relation to foreign aid, for example – means that counter-measures should be considered as an important part of the fight against poverty.12

Figure 2.

Scale of capital flows in and out of SSA in USD for all SSA.13

While it is acknowledged that IFF has social consequences, including reduced expenditure on health, education and infrastructure,12 research has concentrated on the effects on economic growth and poverty. The aim of this paper is to provide an illustration of the human rather than the financial scale of the problem. It will always be challenging to relate upstream policies to downstream consequences. However, we need to try and do this in order to move beyond the current paradigm, where northern countries treat the symptoms of poverty with aid but do not address their policies which may contribute to it.21

Objectives

To estimate the cost of IFF in terms of the additional time required to reach MDG 4 for 34 countries in SSA.

Capital flows in and out of SSA

Capital flows in and out of SSA occur in the categories shown in Table 1.

Table 1.

Nature of capital flows and financial transfers from and to SSA.

| In | Out |

|---|---|

| Foreign direct investment* | Outward direct investment |

| Foreign portfolio investment* | Outward portfolio investment |

| Aid/grants* | |

| Loans | Debt repayments* |

| Illicit financial flows* |

*Included in Figure 1.

How multinational corporations avoid paying tax

IFF involves tax avoidance or evasion, generally using transfer price manipulation. This is the deliberate over- or under-invoicing of the prices of products (goods, services and intangibles) that are traded among the parent and affiliates of a multinational corporation, typically in order to shift profits out of high-tax jurisdictions into low-tax jurisdictions.7 This is an important conduit for IFF as it is estimated that almost 50% of global trade is between related parties. Low tax jurisdictions, often described as secrecy jurisdictions or tax havens, provide the means for companies to undertake this activity. A study by the US Congressional Research Service found that 43% of the overseas profits of US multinationals arose in just five secrecy jurisdictions, responsible for only 4% of the multinationals’ overseas workforce and 7% of their overseas investment.22 Ninety-eight percent of the largest companies on the London Stock Exchange have subsidiaries in tax havens; 82 operate in the developing world.23

The ways to estimate IFF

Precise estimation of IFF is particularly difficult not only because of the differences as to its definition but also because IFF data are – by definition – hidden, and hence not recorded in official statistics. Researchers have had to develop proxy measures to estimate the magnitude of IFFs, but all of these measures are limited by the data available.24 The two most widely used are the World Bank residual model and Trade Mispricing model. The Residual method (World Bank, 1985) uses the difference between the recorded sources of funds and the use of funds. It captures tax evasion, theft and bribery but does not capture trade mispricing. The Trade Mispricing model which is based on the Directions of Trade Statistics has been developed to capture trade miss-invoicing. In this model, exports of goods as reported by the exporting country are compared with imports reported by the importing country after adjusting for the cost of insurance and freight.2 Several researchers combined these techniques and their variants to estimate IFF.

The magnitude of IFF in SSA

Two studies provide minimal estimates of IFF for SSA. One study estimates that SSA lost US$854 billion from 1970 to 2008 in illicit capital flows,21 with more than half of the total occurring in the period 2000–2008. The other estimates that SSA lost US$814 billion from 1970 to 2010, of which US$202 billion were lost between the year 2005 and 2010.2 The magnitude of IFF from Africa has increased from $17 billion annually in the 1990s to $50 billion per year since 2000, the latter period coinciding with increased economic growth on the continent.12

Data sources

Data on IFF were obtained from the Global Financial Integrity (GFI) database.25 Estimates of the magnitude of illicit clandestine activity are of necessity imprecise but are likely biased downwards and hence under-estimated. Data on GDP are from the World Bank,26 and under-five mortality rates are from the 2012 countdown report.4

Method

IFF/GDP ratios were obtained from GFI for 34 countries in SSA for which there were data available (see column 5 of Table 2). These ratios represent lost resources as a percentage of GDP, the corollary of which being the increase in GDP a country would have realised had IFF not occurred.

Box 1.

Definitions.

| Illicit financial flows (IFFs) are the unrecorded movement of capital out of a country in contravention of the regulations of that country.2 It occurs primarily through the economic motives of individuals and companies when the foreign rate of return on an investment is superior to the domestic risk-adjusted rate of return.8 IFF includes legitimately earned capital that become illegitimate when it has been moved across borders to evade paying tax to the country of origin. An important early study estimated that commercial tax evasion accounted for 60–65% of total capital outflows, with around one-third due to the laundering of the proceeds of crime and a small percentage due to corruption.10 Transfer price manipulation may happen between related companies or between a parent and a subsidiary company. The prices of traded goods are manipulated to maximise profit to the company and minimise the tax paid.7 Tax avoidance and aggressive tax planning are legal methods to minimise the tax due. Tax evasion is the illegal non-payment of tax, often based on hiding (corporate or personal) assets and income from authorities. Secrecy jurisdictions (a more precise term, used in preference to ‘tax havens’) are characterised not only by preferential tax treatment (typically low or zero tax rates) for non-residents and limited regulation but importantly also by a lack of transparency.14 They allow wealthy individuals, large corporations and criminals to circumvent the financial regulations and criminal laws of other jurisdictions. The financial secrecy index published by the tax justice network ranks secrecy jurisdictions according to the extent of the secrecy they offer and the scale of their contribution to global financial flows. The most important of the secrecy jurisdictions in the most recent release of the index are Switzerland, the Cayman Islands, Luxembourg, the US and Hong Kong.15 Shell companies are companies whose ownership is hidden, i.e. the name of the beneficial owner is not known. Typically, the only names that are known are nominees; a nominee may front thousands of companies. Several thousand shell companies may be registered to one address located in secrecy jurisdictions.14 GDP per capita at purchasing power parity (PPP) is the value of output produced in a country in a year divided by the country’s population, adjusted for exchange rate differentials. It is regarded as a measure of standards of living for a country’s population, suitable for international comparison – although it can be criticised for failing to take into account differences in the extent of inequality. Under-five mortality is the probability of dying before the 5th birthday, expressed as the number of deaths per 1000 live births and is considered one of the best single measures of a population’s health status.16,17 |

Box 2.

What is known about this subject?

| Over the last 41 years, it is estimated that US$814 billion of IFF left 31 countries in SSA.2 IFF from oil-rich countries accounted for 72% of all IFF.2 It has been estimated that transfer price manipulation alone costs SSA $34 billion each year, which is more than the continent receives in bilateral aid.9 The detrimental impacts of IFF include reduced economic growth and retarded poverty reduction12,18,19 as well as the undermining of governance and state-citizen relationships.18 Poverty reduction in Africa would have been 4–6% higher annually than the current 2.7% annual rate of reduction in the absence of IFF, between 2000 and 2007. This would have enabled most African countries to reach MDG1 of halving poverty by 2015.2 It has been estimated that tax evasion through trade mispricing will cost 5.6 million under-five deaths in the developing world between 2000 and 2015.20 |

Table 2.

The potential reduction in the number of years required to reach MDG 4.

| Country | 2000 under-five mortality rates (per 1000) | MDG 4 target (under-five mortality rate) | Actual annual reduction in under-five mortality rates (2000–2011) | Illicit financial flows (% of GDP) | Overall potential annual reduction in under-five mortality rate in the absence of IFF | The number of years from 2000 to reach MDG at current rates of decline | The number of years from 2000 to reach MDG if ‘IFF/GDP’ curtailed |

|---|---|---|---|---|---|---|---|

| Angola | 200 | 87 | 2.0 | 7 | 4.66 | 41 | 17 |

| Botswana | 96 | 17 | 10.4 | 10 | 14.20 | 16 | 11 |

| Burkina Faso | 191 | 67 | 2.0 | 3 | 3.14 | 52 | 33 |

| Burundi | 164 | 63 | 1.5 | 6 | 3.78 | 63 | 25 |

| Cameroon | 148 | 50 | 0.8 | 6 | 3.08 | 135 | 35 |

| Central African Republic | 176 | 59 | 0.5 | 5 | 2.40 | 218 | 45 |

| Chad | 190 | 67 | 1.0 | 20 | 8.60 | 104 | 12 |

| Congo, DR | 181 | 66 | 0.7 | 3 | 1.84 | 144 | 54 |

| Congo, Rep | 104 | 35 | 0.9 | 25 | 10.40 | 120 | 10 |

| Cote d'Ivoire | 148 | 51 | 1.7 | 6 | 3.98 | 62 | 26 |

| Ethiopia | 141 | 70 | 5.3 | 6 | 7.58 | 13 | 9 |

| Gabon | 88 | 31 | 2.1 | 11 | 6.28 | 49 | 16 |

| Gambia | 128 | 55 | 2.6 | 14 | 7.92 | 32 | 10 |

| Ghana | 99 | 39 | 2.2 | 2 | 2.96 | 42 | 31 |

| Guinea | 175 | 76 | 2.8 | 9 | 6.22 | 29 | 13 |

| Guinea Bissau | 177 | 80 | 1.3 | 7 | 3.96 | 61 | 20 |

| Kenya | 111 | 35 | 4.0 | 1 | 4.38 | 28 | 26 |

| Lesotho | 127 | 34 | 2.8 | 15 | 8.50 | 46 | 15 |

| Madagascar | 102 | 56 | 4.8 | 6 | 7.08 | 12 | 8 |

| Malawi | 167 | 75 | 6.2 | 10 | 10.00 | 13 | 8 |

| Mali | 213 | 83 | 1.8 | 3 | 2.94 | 52 | 32 |

| Mauritania | 116 | 43 | 0.5 | 12 | 5.06 | 198 | 19 |

| Mozambique | 177 | 83 | 4.7 | 5 | 6.60 | 16 | 11 |

| Niger | 218 | 102 | 5.0 | 3 | 6.14 | 15 | 12 |

| Nigeria | 186 | 77 | 3.8 | 12 | 8.36 | 23 | 10 |

| Rwanda | 177 | 58 | 11.1 | 5 | 13.00 | 9 | 8 |

| Senegal | 119 | 50 | 6.4 | 1 | 6.78 | 13 | 12 |

| South Africa | 78 | 19 | 4.2 | 4 | 5.72 | 33 | 24 |

| Sudan | 114 | 41 | 1.7 | 3 | 2.84 | 60 | 35 |

| Swaziland | 114 | 28 | 0.9 | 11 | 5.08 | 155 | 27 |

| Tanzania | 130 | 52 | 5.7 | 2 | 6.46 | 16 | 14 |

| Togo | 124 | 50 | 1.4 | 6 | 3.68 | 64 | 24 |

| Uganda | 144 | 62 | 4.1 | 3 | 7.52 | 20 | 16 |

| Zambia | 157 | 57 | 5.6 | 9 | 5.60 | 18 | 11 |

| Total | 146 | 56 | 3.3 | 3.31 | 29 | 16 |

A meta-analysis has found that a 1% increase in income per capita is associated with a 0.45% decline in under-five mortality rate in developing countries when no adjustment was made for other variables.27 This relationship or elasticity is slightly weaker for SSA at −0.38 (95% CI −0.43 to −0.33), and we used the estimate for SSA.28 We assumed that the relationship between the percentages of GDP lost through IFF, and therefore gained if IFF completely curtailed, would have had the same impact on child mortality as the remainder of the GDP. Using the IFF expressed as a percentage of GDP and the relationship between changes in income per capita and declines in under-five mortality rate, we calculated the potential extra annual rate of decline in under-five mortality in the absence of IFF. We used the under-five mortality rates in 20004 as the baseline rates and compared the number of years it would take to reach the MDG target for each country using the actual annual rate of reduction between 2000 and 201129 and the rate of reduction which could have been attained in the absence of IFF.

To calculate the number of years it would take to reach the MDG at the current rate of decline, we used the equation , where F (future) is the under-five mortality rate target as set for the MDG for that country, P (present) is the under-five mortality rate in 2000, r is the rate of decline in under-five mortality rate and n is the number of years. We then calculated the number of years it would take to reach the MDG target for each country using the same formula in the presence of the extra decline in under-five mortality rate which could be realized in the absence of IFF.

Results

The number of years it will, and could take to reach MDG 4 targets is given in the last two columns (Table 2). A country is taken as being able to reach its target if this figure is 15 years or less, i.e. the target reached by 2015. The results suggest that only six of these SSA countries would achieve their MDG 4 target at the current rates of decline. If IFFs were completely curtailed, this number would increase to 16 countries. Even those countries that would not achieve their targets would be able to achieve the target in a substantially shorter period in the absence of IFF.

Discussion

Statement of principal findings

If IFF had been completely curtailed from the year 2000, the first indicator of the fourth MDG could have been reached in 16 of the 34 SSA countries which we studied. This compares to six countries at the current rates of decline. Since IFFs are hidden, their magnitude is likely under-estimated and that the IFF figures are conservative; it is probable that curtailing IFF would have resulted in many more countries achieving their targets.

We assumed that illicitly removed GDP would have the same association with child mortality as official GDP. Two main channels can be envisaged as underpinning this relationship:

Higher GDP implies higher (household) incomes which in turn are associated with lower child mortality;30

Higher GDP implies higher tax revenues (both in absolute terms and proportional to GDP), and this may be associated with increased social spending, depending on factors such as government efficiency and government control of corruption.

IFF may not derive homogenously from the population, and links to general household income may be tenuous. On the other hand, a unit of IFF is more likely to be taxable than a unit of GDP (since not all GDP is taxable, while IFFs are largely motivated by the desire to escape taxation). It could also be argued that even if capital remained domestic, the same rate of income tax may not be paid for the rest of the economy, as generally corporations incur lower income tax. However, in Africa corporate income tax was on average 44% in 1990, only falling to 33% in 2005.7 On balance, assuming the same elasticity for hypothetically recovered ‘IFF GDP’ as for official GDP does not seem likely to create a predictable distortion in our mortality estimates, particularly bearing in mind that the estimates for IFFs are already very conservative.

Strengths and weakness of the study

This is the first estimate of the impact of IFF on the time taken to reach the fourth MDG for countries in SSA. We have not provided a full, causal model of the relationship between IFF and child mortality. However, the percentage of GDP lost through IFF is established and of the same order of magnitude from several sources. The relationship between GDP and child mortality has been established by a meta-analysis, and we have used an estimate of the elasticity or relationship which is specific for SSA.

Implications for policy-makers and future research

Most countries in SSA have experienced strong economic growth over the last decade, and tax revenues represent an increasing share of GDP of around 20% in Africa as a whole.31 However, around half of SSA countries still mobilise less than the 20% considered necessary to reach the MDGs.11 Taxation provides governments with the funds needed to provide public services.11 Governments raise 10 times more income through taxes than they receive in aid23 and aid may even discourage recipients from developing their domestic tax regime.11 Aid which could support the development of a partner country’s tax base only attracts 0.01% of ODA each year.11

A considerable number of African countries have large supplies of natural resources, and there has been a boom in the price of primary commodities over the last decade.9 This could represent an opportunity for child survival if these resources are carefully stewarded. However, countries which are oil exporters have a higher IFF as a proportion of GDP than countries which do not export oil12 and countries which trade commodities (particularly through Switzerland) are exposed to illicit outflows through price distortions.32

The UN high-level panel on the post-2015 development framework has recommended a global target to ‘reduce illicit flows and tax evasion and increase stolen-asset recovery’,33 which is a welcome recognition of the importance of the issue for development. What is lacking so far is a specific target for reduction and a plan of action to achieve this. Both the G8 and G20 have relevant agenda in this area and should prioritise the automatic exchange of tax information between countries, including the identification of companies, trusts and bank accounts owned by residents of other countries; and a requirement that multinational groups publish a combined report on their global activities, including a country-by-country breakdown.34

We hope this may galvanise policy-makers to address the issue of illicit flows with greater urgency, including through greater international financial transparency. Future research could usefully estimate the pathways through which economic determinants of child mortality operate and more accurately model the impact of IFF on child mortality.

Declarations

Competing interests

None declared

Funding

John Dowling paid for research assistance but had no input into the study, analysis or results.

Ethical approval

Not required because secondary data was used.

Guarantor

BOH

Contributorship

Concept: BOH; analysis: BOH and IM; first draft: all authors; final draft: all authors.

Acknowledgements

The authors would like to thank David Woodward for his valuable comments on an earlier version of this manuscript.

Provenance

Not commissioned; peer-reviewed by Bruce Currey.

References

- 1. Pritchett L, Summers LH, 1996. Wealthier is Healthier. Journal of Human Resources, 31: 841–68.

- 2.Boyce JK, Ndikumana L. Capital flight from Sub-Saharan African countries: updated estimates, 1970–2010, Amherst, MA: Political Economy Research Institute, 2012, 2012 [Google Scholar]

- 3. unstats|Millennium Indicators. See http://mdgs.un.org/unsd/mdg/host.aspx?Content=indicators/officiallist.htm (last checked 13 November 2013)

- 4. Countdown 2015. Building a Future for Women and Children: The 2012 Report. See http://www.countdown2015mnch.org/reports-and-articles/2012-report (last checked 13 November 2013)

- 5. Halleröd B, Rothstein B, Daoud A and Nandy S. Bad governance and poor children: a comparative analysis of government efficiency and severe child deprivation in 68 low- and middle-income countries. World Dev 2013;48:19–31. See http://linkinghub.elsevier.com/retrieve/pii/S0305750X13000831 (last checked 13 November 2013)

- 6. Data|The World Bank. See http://data.worldbank.org/ (last checked 13 November 2013).

- 7. The World Bank. Draining development. In: Reuter P (ed.) Draining Development? Controlling Flows of Illicit Funds from Developing Countries, Washington, DC: The World Bank, 2012.

- 8.Ndikumana L, Boyce J. Public debts and private assets: explaining capital flight from Sub-Saharan African countries. World Dev 2003; 31: 107–30 [Google Scholar]

- 9.Africa Progress Panel. Equity in Extractives: Stewarding Africa's natural resources for all, Africa Progress Report: Geneva, 2013. See http://www.africaprogresspanel.org/publications/policy-papers/africa-progress-report-2013/ (last checked 22 November 2013) [Google Scholar]

- 10. Baker R. Capitalism’s Achilles Heel. Dirty Money and How to Renew the Free-Market System. Hoboken, NJ: John Wiley and Sons, 2005: 438. See http://www.e-reading.biz/bookreader.php/135381/Baker_Capitalisms_Achilles_heel.pdf (last checked 22 November 2013)

- 11. IMF, OECD, UN, The World Bank. Supporting the Development of More Effective Tax Systems. A report to the G-20 development working group by THE IMF, OECD, UN and World Bank, 2011. See http://www.oecd.org/ctp/48993634.pdf (last checked 22 November 2013)

- 12. Minter W, Scarnecchia T, Ndikumana L and Boyce J (eds). Africa’s Capital Losses: What Can Be Done? Bulletin 87. Concerned African Scholars, 2012.

- 13. Kar D and Cartwright-Smith D. Illicit Financial Flows from Africa: Hidden Resources for Development. Global Financial Integrity Working Paper. See www.gfip.org (last checked 13 November 2013)

- 14.Cobham A. Tax havens and illicit flows. In: Reuter P. (eds). Draining Development: Controlling Flows of Illicit Funds from Developing Countries, Washington, DC: World Bank, 2012, pp. 337–72 [Google Scholar]

- 15. Tax Justice Network. Financial Secrecy Index, 2013. See http://www.financialsecrecyindex.com/ (last checked 24 November 2013)

- 16. Amouzou A and Hill K. Child mortality and socioeconomic status in Sub-Saharan Africa. African Population Studies 2004; 19: 1–11.

- 17.Filmer D, Pritchett L. The impact of public spending on health: does money matter? Soc Sci Med 1999; 49: 1309–23 [DOI] [PubMed] [Google Scholar]

- 18.Epstein G. 1. Introduction. In: Epstein G. Capital Flight and Capital Controls in Developing Countries: an Introduction, Cheltenham, UK: Edward Elgar, 2005, pp. 3–14 [Google Scholar]

- 19.Ajayi S. An Economic Analysis of Capital Flight from Nigeria, Policy Research Working Paper. Washington, DC: World Bank Publications, 1992 [Google Scholar]

- 20. Cobham A, Hogg A, Melby J, Kwatra A, Wilson S and Baird R. Death and Taxes: The True Toll of Tax Dodging. London: Christian Aid, 2008.

- 21. Barder O, Clark J, Reynolds L and Roodman D. Europe beyond aid: assessing European countries individual and collective commitment to development. J Int Dev 2013; 25: 832–53.

- 22.Keightley MP. An Analysis of Where American Companies Report Profits: Indications of Profit Shifting, Report for Congress. Washington, DC: Congressional Research Service, 2013 [Google Scholar]

- 23.Actionaid. Collateral Damage: How Government Plans to Water Down UK Anti-Tax Haven Rules Could Cost Developing Countries – and the UK – Billions, London: Actionaid, 2012 [Google Scholar]

- 24. Kar D and Freitas S. Illicit Financial Flows from Developing Countries Over the Decade Ending 2009 by Global Financial Integrity, 2011. See http://www.gfintegrity.org/ (last checked 13 November 2013)

- 25. Global Financial Integrity. See http://www.gfintegrity.org/index.php?option=com_frontpage&Itemid=80 (last checked 13 November 2013)

- 26. World Development Indicators|Data. See http://data.worldbank.org/data-catalog/world-development-indicators (last checked 13 November 2013)

- 27. O’Hare B, Makuta I, Chiwaula L and Bar-Zeev N. Income and child mortality in SSA: a systematic review and meta analysis. J R Soc Med 2013;106. [DOI] [PMC free article] [PubMed]

- 28. Hague S, Gottschalk R and Martins P. Pro-poor growth: the evidence beyond income. IDS ESRC Dev Econ Conf 2008; 14.

- 29. Childinfo.org. See http://www.childinfo.org/index.html (last checked 13 November 2013)

- 30. Van Malderen C, Van Oyen H and Speybroeck N. Contributing determinants of overall and wealth-related inequality in under-5 mortality in 13 African countries. J Epidemiol Community Heal 2013; 67: 667–76. [DOI] [PubMed]

- 31. African Economic Outlook – Measuring the pulse of Africa. See http://www.africaneconomicoutlook.org/en/ (last checked 13 November 2013).

- 32. Cobham A, Jansky P and Prats A. Swiss-Ploitation? The Swiss Role in Commodity Trade. Christian Aid Occasional Paper, 2013, 10. http://www.christianaid.org.uk/images/caw-swissploitation-may-2013.pdf (last accessed 21 November 2013)

- 33. Economies Through Sustainable Development A New Global Partnership: The Report of the High-Level Panel of Eminent Persons. See http://www.un.org/sg/management/pdf/HLP_P2015_Report.pdf (last checked 13 November 2013)

- 34. Cobham A and Barder O. The Fermanagh Declaration on tax, trade and transparency. 2013:1–4. See http://international.cgdev.org/sites/default/files/FermanaghDeclaration.pdf (last checked 13 November 2013)