Abstract

Purpose

To determine the prevalence and predictors of the awareness of cigarette price increases following a cigarette tax increase, and assess the association of the tax increase and attempts to quit and reduce smoking among adolescents and young adults.

Design

We used a prospective cohort design.

Setting

Surveys were conducted in Minnesota before and after a $0.75 cigarette tax increase.

Subjects

We surveyed 3167 adolescents and young adults including a subsample of 781 past 30-day smokers.

Measures

Outcome measures were awareness of cigarette price increases and, among past 30-day smokers, reported changes in smoking behaviors because of the tax increase. Predictors included demographics, social factors, and prior smoking behaviors.

Analysis

We estimated the prevalence of the outcomes and their associations with the predictors using logistic regression.

Results

Among all participants, 42% noticed an increase in cigarette prices after the tax increase, including 76% of past 30-day smokers. Being a heavier smoker, living with smokers, having more smoking close friends and generally being aware of cigarette price changes prospectively predicted the awareness of the price increase after the tax increase. Among past 30-day smokers, 16.7% reported quit attempts and 24.1% reported reducing smoking because of the tax increase.

Conclusion

Because fewer than half of the participants noticed the cigarette tax increase, media campaigns to raise awareness of tax changes may increase its effectiveness.

Keywords: smoking, tax, adolescent, young adult

Indexing Key Words: Manuscript format: research, Research purpose: modeling/relationship testing, Study design: non-experimental, Outcome measure: cognitive, behavioral, Setting: state/national, Health focus: smoking control, Strategy: policy, Target population: youth, adults, Target population: Minnesota

PURPOSE

Taxation on tobacco products is one of the most effective intervention to reduce and prevent tobacco use1. Increases in cigarette taxes are particularly effective in reducing prevalence of smoking among adolescents and young adults, as they are generally more sensitive than older adults to changes in cigarette prices2–4. However, price sensitivity, and thus also the effect of tobacco taxes, may not be homogeneous across all adolescents and young adults. For example, Gruber observed racial differences in price sensitivity in high school seniors, but not in young higher school students5. Emery and colleagues found that age and smoking behaviors of adolescents also affects their price sensitivity6.

The effect of tobacco taxes among adolescents and young adults may also be affected by knowledge or perceptions of cigarette price changes, as one of the first steps in tax increases leading to changes in smoking behaviors. Individuals who are not aware of a price increase, regardless of their price sensitivity, may be unlikely to reduce their cigarette consumption or attempt to quit smoking in response. The role of perceptions of price changes has previously not been assessed.

In this study we assess effects of a $0.75 increase (from $0.48 to $1.23) in the Minnesota cigarette excise tax among older adolescents and young adults. Our primary objective is to determine the prevalence of the sample who noticed a rise in cigarette prices after the tax increase as well as the characteristics of those who noticed. Our secondary objective is to determine the prevalence and characteristics of adolescent and young adult smokers who reported attempting to quit or reducing their smoking because of the tax increase. Results from this study improve our understanding on how changes in a cigarette tax may affect smoking prevalence among adolescents and young adults.

METHODS

Design

We used data from the Minnesota Adolescent Community Cohort (MACC) Study, a prospective cohort study that began in 2000. The MACC Study was designed to examine the effect of state- and local-level tobacco prevention and control programs on youth in Minnesota, and to deepen the understanding of the transitional process from non-smoking to smoking adolescents. The survey includes over 200 questions pertaining to smoking behaviors, home and social environment, and attitudes and beliefs toward smoking. Participants were 12 to 16 years of age at baseline in 2000, and were interviewed every six months through 2007 (15 rounds of data collection with Round 7 omitted). Because the $0.75 cigarette tax increase in Minnesota occurred on August 1, 2005, we used data collected just before the tax increase (Round 9: October 2004 to March 2005) and after the tax increase (Round 11: October 2005 to March 2006). Participants ranged from 15 to 20 years of age at Round 9.

Sample

Participants in the MACC Study were selected through cluster random sampling from geo-political units (GPUs). Minnesota was divided into 129 GPUs according to existing geographic and/or political boundaries, patterns of local tobacco program activities, and number of adolescent residing in an area. Sixty GPUs were selected through stratified random sampling based on regions of the state and race/ethnicity distribution. Participants were recruited from the selected GPUs by Clearwater Research, Inc., using modified random digit dialing and a combination of probability and quota sampling methods to obtain an even distribution from ages 12 to 16. We first determined if there was at least one 12–16 year-old in a contacted household, and recruited the eligible teenager if we had not reached the quote for his or her age. If a household had multiple eligible teenagers, we randomly selected one of them into the age stratum with openings. After excluding those numbers which were non-working or disconnected, those who could not be contacted, and those who refused to participate before screening for eligibility, 6,213 eligible households were identified, and 3,636 participants in Minnesota were recruited (recruitment rate 58.5%). An additional cohort of 585 twelve year-olds was recruited through the same method during 2001–2002 (recruitment rate 63.6%). The overall baseline sample size was 4221.

In the current study, we limited our sample to those who had completed both Round 9 (n=3467, retention rate 82.1% of the overall baseline sample) and Round 11 (n=3393, retention rate 80.3% of the overall baseline sample), resulting in a final sample of 3167. In addition, we used a subsample of individuals who reported smoking during the 30 days prior to Round 11 data collection (n = 781) to address our secondary objective (these questions were limited to past 30-day smokers since it might be difficult for individuals who had not smoked in the previous month to validly answer questions pertaining to quitting attempts and reduction in smoking).

The study was approved by the University of Minnesota Institutional Review Board. Participants have provided informed consent to participate; if they were under the age of 18, active informed consent from their parents was obtained.

Measures

Dependent Variables

Dependent variables were measured in Round 11, which was after the cigarette tax increase. The primary dependent variable was awareness of price increases, and was assessed by asking the participants, “Would you say that cigarettes have gotten more expensive, less expensive or is the price about the same compared to six months ago, or you don’t know?” Responses were collapsed into “more expensive” and “others” to differentiate participants who noticed a cigarette price increase from those who did not. Among participants who reported smoking in the past 30 days at Round 11 we measured two variables pertaining to attempts to quit smoking because of the tax increase (yes/no) and reductions in smoking because of the tax increase (yes/no).

Independent Variables

We used four categories of independent variables. The first category included the demographics: age, gender, ethnicity, parent education level and number of hours working at a paid job per week. Age was a continuous variable defined as age at Round 9. Ethnicity was collapsed from six categories to three (African American/Black, White, and other) due to the small counts in some of the original categories. Parent education level was determined by the highest education level obtained by either the mother or the father, with four response options: some graduate school or higher, college graduate, some college or associate degree, and high school graduate or under. Number of hours of working at a paid job per week at Round 11 was used as a proxy of the respondents’ income. Round 11 measurements, instead of Round 9, were chosen because current income appears to be most relevant to likelihood of purchasing cigarettes, and thus, noticing price changes. Participants who were still in school were asked to report the number of hours working at a paid job in an average week during the school year. Participants who were not in school were asked to report the number of hours working at a paid job per week. These questions originally had seven response categories, ranging from no paid job to over 40 hours. We collapsed three categories (“5 hours or less”, “6–10 hours”, and “11–20 hours”) due to low frequencies, resulting in five response categories: over 40 hours, 31 to 40 hours, 21 to 30 hours, 20 hours or less, and no paid job.

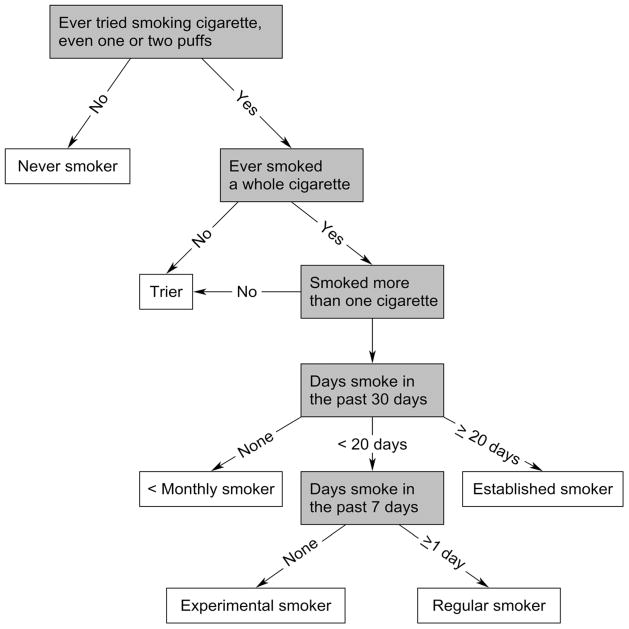

The second category of independent variables measured smoking status of the participants at Round 9. Figure 1 shows the algorithm of classifying participants into one of six stages in the order of increasing smoking intensity: never-smoker, trier, less than monthly smoker, experimental smoker, regular smoker or established smoker. The third category of independent variables assessed two environmental factors: whether the respondent lives with a smoker (yes/no), and how many of their close friends smoke (0 to 4) at Round 9. The final category pertained to general awareness of cigarette price changes at Round 9. Participants were asked about how cigarette prices had changed in the past six months. Participants who answered “don’t know” may represent individuals who do not pay attention to cigarette price changes, while participants who answered “more expensive”, “about the same”, or “less expensive” may be paying attention to cigarette price changes.

Figure 1.

Smoking stage classification algorithm

Analyses

We first calculated frequencies of all dependent and independent variables. We then assessed possible collinearity among the independent variables using the Spearman Rank Correlation Test; none of the correlation coefficients were greater than 0.40, suggesting insignificant collinearity. Next, we conducted bivariate analyses between the independent and dependent variables using logistic regression, followed by mulitvariate analyses using generalized linear mixed models, including GPU as a random effect to adjust for the cluster sampling method. A “chunkwise” forward selection approach was used to create a final model for each dependent variable7. The four categories, or “chunks”, of independent variables were entered into models sequentially. Demographic factors were entered first followed by smoking status, environmental factors, and general awareness of cigarette price changes. Independent variables with p≥0.10 were excluded from the chunk. Variables with p<0.10 were retained in all subsequent models, regardless of their statistical significance after later chunks were added. Pairwise comparisons between categories with Bonferroni adjustment were calculated for statistically significant variables (p<0.05) with more than two response categories in the final models. All analyses were conducted with PC-SAS® version 9.1.3.

RESULTS

After the tax increase went into effect, more respondents at Round 11 than at Round 9 noticed a rise in cigarette prices. Among all respondents, 42.1% (n=1332) noticed that cigarettes became more expensive in the past six months, 3.4% (n=108) reported that cigarette prices were the same or less expensive, and 54.5% (n=1727) reported they did not know whether cigarette prices had changed. Over 76% (n=527) of the past 30-day smokers at Round 11 noticed cigarette price increases after the tax increase. About 20% of all respondents reported cigarettes became more expensive in the past six months at Round 9 (prior to the tax increase). Among past 30-day smokers at Round 11, 24.1% (n=187) reported attempting to quit and 16.7% (n=130) reported smoking less because of the tax increase.

Awareness of cigarette price increases in the full sample

Bivariate results for the full sample are shown in Table 1. Respondents in the following categories have a significantly higher odds of noticing a rise in cigarette prices after the tax change: 1) being White (versus African American or Black), 2) being older, 3) having less educated parents, 4) working more than 20 hours a week (versus those who do not have a paid job), 5) smoking before the tax increase (versus those who never smoked), 6) living with smokers, 7) having more close friends who smoke, and 8) being aware of cigarette price changes before the tax increase.

Table 1.

Awareness of cigarette price increases after a cigarette tax increase (n=3167)

| Variables | Univariate | Bivariate | Multivariate | |

|---|---|---|---|---|

|

| ||||

| N (%) | % Aware | Unadjusted OR and 95% CI† | Adjusted OR and 95% CI† | |

| Age (years) | 17.9 ± 1.7‡ | -- | 1.15 (1.10, 1.20)* | 0.96 (0.91, 1.01) |

| Gender | ||||

| Male | 1534 (48.4%) | 42.5 | 1.04 (0.90, 1.19) | § |

| Female | 1633 (51.6%) | 41.6 | Ref | |

| Ethnicity | ||||

| African American or Black | 111 (3.5%) | 31.5 | 0.62 (0.41, 0.93)* | 0.71 (0.44, 1.13) |

| Other | 261 (8.2%) | 41.0 | 0.94 (0.72, 1.21) | 0.77 (0.57, 1.06) |

| White | 2795 (88.3%) | 42.6 | Ref | Ref |

| Parent Education Level | ||||

| Some graduate school or higher | 601 (20.7%) | 36.6 | 0.60 (0.47, 0.75)* | 1.03 (0.78, 1.37) |

| College graduate | 1069 (36.8%) | 37.6 | 0.62 (0.51, 0.76)* | 1.00 (0.78, 1.28) |

| Some college or associate degree | 659 (22.7%) | 45.1 | 0.85 (0.68, 1.06) | 1.12 (0.85, 1.46) |

| High school graduate or under | 577 (19.9%) | 49.2 | Ref | Ref |

| Number of hours in paid job per week | ||||

| Over 40 hours | 159 (5.0%) | 58.5 | 2.46 (1.75, 3.45)* | 1.02 (0.67, 1.56) |

| 31 to 40 hours | 330 (10.5%) | 60.0 | 2.62 (2.03, 3.37)* | 1.33 (0.96, 1.84) |

| 21 to 30 hours | 375 (11.9%) | 50.9 | 1.81 (1.42, 2.30)* | 1.48 (1.12, 1.98)* |

| 20 hours or less | 1274 (40.4%) | 37.4 | 1.04 (0.88, 1.24) | 1.10 (0.89, 1.34) |

| No paid job | 1015 (32.2%) | 36.5 | Ref | Ref |

| Smoking stage at Round 9 | ||||

| Established | 335 (10.6%) | 83.3 | 15.66 (11.49, 21.33)* | 3.32 (2.23, 4.93)*|¶ |

| Regular | 190 (6.0%) | 73.2 | 8.57 (6.09, 12.05)* | 4.37 (2.23, 4.93)*| |

| Experimental | 159 (5.0%) | 66.0 | 6.11 (4.32, 8.65)* | 4.02 (2.72, 5.93)*| |

| < Monthly | 457 (14.5%) | 53.2 | 3.57 (2.87, 4.43)* | 2.56 (1.99, 2.49)*¶# |

| Trier | 445 (14.1%) | 40.1 | 2.16 (1.73, 2.69)* | 1.96 (1.54, 2.49)*# |

| Never smoker | 1570 (49.8%) | 24.2 | Ref | Ref ** |

| Living with smokers | ||||

| Yes | 1064 (33.6%) | 46.7 | 2.46 (2.12, 2.86)* | 1.45 (1.20, 1.74)* |

| No | 2098 (66.4%) | 34.7 | Ref | Ref |

| Number of close friends who smoke (0–4) | 1.1 ± 1.3‡ | -- | 1.80 (1.69, 1.91)* | 1.31 (1.12, 1.31)* |

| General awareness of cigarette price changes | ||||

| Aware | 890 (28.1%) | 76.6 | 8.21 (6.86, 9.83)* | 5.27 (4.30, 6.46)* |

| Unaware | 2277 (71.9%) | 28.6 | Ref | Ref |

p<0.05.

OR=odds ratios, CI=confidence intervals.

Means and standard deviations are provided for continuous variables.

Variables dropped in chunkwise analysis (F-test p>0.1).

Odds ratios that share the same symbol were indistinguishable in a pair-wise comparison after Bonferroni adjustment.

In the multivariate model assessing characteristics related to noticing a rise in cigarette prices following the tax increase, five variables remain statistically significant (Table 1). First, smoking stage is significantly related to perceived price increases. Compared to never smokers, the odds of recognizing a price increase is at least three times higher in the established, regular, and experimental smokers, and two times higher in less than monthly smokers and triers. The heavier smokers (established, regular, and experimental smokers) also have significantly higher odds than lighter smokers (less than monthly smokers and triers) in noticing a rise in cigarette prices. Second, respondents who are living with smokers have about one and a half times the odds of noticing a rise in cigarette price compared with those who are not living with smokers. Third, having an additional close smoking friend increases the odds of noticing a rise in cigarette prices by about one-third. Fourth, those who were generally aware of cigarette price changes before the tax increase have over five times the odds of noticing a rise in cigarette prices after the tax increase compared to those who were generally unaware of cigarette price changes at Round 9. Finally, those who worked 21 to 30 hours per week had higher odds of noticing price increases than those who did not have a paid job.

Attempting to quit or reducing smoking in past 30-day smokers

Among the 3167 adolescents and young adults, 781 (24.7%) smoked in the past month at Round 11. Bivariate results for attempting to quit smoking among past 30-day smokers at Round 11 are shown in Table 2. Those who have higher odds of reporting attempting to quit smoking because of the tax increase are those who are younger, have less educated parents, were established smokers before the tax increase, have more close friends who smoke, and were aware of cigarette price changes before the tax increase. Four variables remained significantly associated with attempting to quit in the multivariate model (Table 2). First, for every year increase in age, respondents have about fourth-fifths the odds of attempting to quit due to the tax increase. Second, those whose parents received graduate education or higher have lower odds of attempting to quit smoking because of the tax increase. Third, those who worked more than 40 hours per week are twice as likely to report attempting to quit because of tax increase than those who did not have a paid job. Fourth, the odds of attempting to quit among those who were generally aware of cigarette price changes at Round 9 are more than two times that of those who were unaware of cigarette price changes at Round 9.

Table 2.

Reported attempts to quit smoking after the tax increase among past 30-day smokers at Round 11 (n=781)

| Variables | Univariate | Bivariate | Multivariate | |

|---|---|---|---|---|

|

| ||||

| N (%) | % attempted to quit | Unadjusted OR and 95% CI† | Adjusted OR and 95% CI† | |

| Age (years) | 18.4 ± 1.6‡ | -- | 0.87 (0.77, 0.98) * | 0.77 (0.67, 0.89)* |

| Gender | ||||

| Male | 396 (50.7%) | 16.5 | 0.97 (0.67, 1.41) | § |

| Female | 385 (49.3%) | 16.9 | Ref | |

| Ethnicity | ||||

| African American or Black | 12 (1.5%) | 16.7 | 1.04 (0.23, 4.81) | § |

| Other | 73 (9.4%) | 21.9 | 1.50 (0.81, 2.63) | |

| White | 696 (89.1%) | 16.1 | Ref | |

| Parent Education Level | ||||

| Some graduate school or higher | 117 (17.0%) | 7.7 | 0.35 (0.16, 0.76) * | 0.43 (0.18, 0.98)* |

| College graduate | 228 (33.1%) | 14.5 | 0.71 (0.42, 1.20) | 0.88 (0.51, 1.52) |

| Some college or associate degree | 168 (24.4%) | 22.2 | 1.19 (0.71, 2.01) | 1.33 (0.77, 2.30) |

| High school graduate or under | 176 (25.5%) | 19.3 | Ref | Ref |

| Number of hours in paid job per week | ||||

| Over 40 hours | 73 (9.4%) | 24.7 | 1.86 (0.96, 3.58) | 2.16 (1.05, 4.44)* |

| 31 to 40 hours | 131 (16.9%) | 21.4 | 1.54 (0.87, 2.72) | 1.69 (0.90, 3.19) |

| 21 to 30 hours | 109 (14.1%) | 15.6 | 1.05 (0.55, 2.00) | 1.17 (0.59, 2.32) |

| 20 hours or less | 261 (33.6%) | 13.8 | 0.91 (0.54, 1.53) | 1.01 (0.58, 1.76) |

| No paid job | 202 (26.0%) | 15.0 | Ref | Ref |

| Smoking stage at Round 9 | ||||

| Established | 313 (40.2%) | 19.2 | 7.62 (1.02, 56.83) * | 4.22 (0.54, 36.35) |

| Regular | 153 (19.6%) | 16.5 | 6.30 (0.82, 48.22) | 4.72 (0.58, 38.43) |

| Experimental | 92 (11.8%) | 19.6 | 7.78 (1.00, 60.78) | 8.31 (1.00, 69.05) |

| < Monthly | 126 (16.2%) | 10.3 | 3.68 (0.46, 29.20) | 3.78 (0.45, 31.47) |

| Trier | 62 (8.0%) | 17.7 | 6.90 (0.85, 56.00) | 6.92 (0.81, 58.80) |

| Never smoker | 33 (4.2%) | 3.0 | Ref | Ref |

| Living with smokers | ||||

| Yes | 394 (50.1%) | 17.1 | 1.05 (0.72, 1.53) | § |

| No | 385 (49.4%) | 16.4 | Ref | |

| Number of close friends who smoke (0–4) | 2.2 ± 1.4‡ | -- | 1.21 (1.06, 1.38) * | 1.11 (0.93, 1.32) |

| General awareness of cigarette price changes | ||||

| Aware | 432 (55.3%) | 21.6 | 2.31 (1.53, 3.49) * | 2.35 (1.43, 3.86)* |

| Unaware | 349 (44.7%) | 10.6 | Ref | Ref |

p<0.05.

OR=odds ratios, CI=confidence intervals.

Means and standard deviations are provided for continuous variables.

Variables dropped in chunkwise analysis (F-test p>0.1).

Table 3 shows the results for reducing smoking because of the tax increase among past 30-day smokers at Round 11. In the bivariate analyses, those who have higher odds of reporting reducing their smoking because of the tax increase are those who have less educated parents, do not have a paid job, were established or regular smokers before the tax increase, have more close friends who smoke, and are generally aware of cigarette price changes. In the multivariate model, parent education and the number of hours working for a paid job remained statistically significant (Table 3). Past 30-day smokers with more educated parents have lower odds of reporting reducing smoking, and those who worked 30 hours or less a week have lower odds of reporting reduced smoking because of the tax increase than those who did not have a paid job.

Table 3.

Reported reduction in smoking after the tax increase among past 30-day smokers at Round 11 (n=781)

| Variables | Univariate | Bivariate | Multivariate | |

|---|---|---|---|---|

|

| ||||

| N (%) | % reduced smoking | Unadjusted OR and 95% CI† | Adjusted OR and 95% CI† | |

| Age (years) | 18.4 ± 1.6‡ | -- | 0.95 (0.85, 1.05) | § |

| Gender | ||||

| Male | 396 (50.7%) | 26.5 | 1.31 (0.94, 1.82) | § |

| Female | 385 (49.3%) | 21.7 | Ref | |

| Ethnicity | ||||

| African American or Black | 12 (1.5%) | 41.7 | 2.39 (0.75, 7.63) | § |

| Other | 73 (9.4%) | 31.9 | 1.57 (0.93, 2.66) | |

| White | 696 (89.1%) | 23.0 | Ref | |

| Parent Education Level | ||||

| Some graduate school or higher | 117 (17.0%) | 16.4 | 0.43 (0.24, 0.77)* | 0.46 (0.25, 0.84)* |

| College graduate | 228 (33.1%) | 20.3 | 0.56 (0.36, 0.88)* | 0.61 (0.38, 0.98)* |

| Some college or associate degree | 168 (24.4%) | 25.3 | 0.75 (0.46, 1.20) | 0.76 (0.47, 1.23) |

| High school graduate or under | 176 (25.5%) | 31.3 | Ref | Ref |

| Number of hours in paid job per week | ||||

| Over 40 hours | 73 (9.4%) | 31.0 | 0.90 (0.50, 1.61) | 0.78 (0.42, 1.42) |

| 31 to 40 hours | 131 (16.9%) | 25.2 | 0.67 (0.41, 1.10) | 0.76 (0.37, 1.03) |

| 21 to 30 hours | 109 (14.1%) | 22.2 | 0.57 (0.33, 0.98)* | 0.55 (0.31, 0.95)* |

| 20 hours or less | 261 (33.6%) | 15.4 | 0.37 (0.23, 0.57)* | 0.38 (0.24, 0.59)* |

| No paid job | 202 (26.0%) | 33.3 | Ref | Ref |

| Smoking stage at Round 9 | ||||

| Established | 313 (40.2%) | 27.4 | 3.76 (1.12, 12.69)* | 2.45 (0.70, 8.60) |

| Regular | 153 (19.6%) | 29.1 | 4.11 (1.19, 14.16)* | 3.20 (0.91, 11.28) |

| Experimental | 92 (11.8%) | 23.9 | 3.14 (0.87, 11.29) | 2.49 (0.68, 9.18) |

| < Monthly | 126 (16.2%) | 15.9 | 1.89 (0.53, 6.78) | 1.56 (0.43, 5.72) |

| Trier | 62 (8.0%) | 21.3 | 2.71 (0.72, 10.29) | 2.21 (0.57, 8.60) |

| Never smoker | 33 (4.2%) | 9.1 | Ref | Ref |

| Living with smokers | ||||

| Yes | 394 (50.1%) | 23.6 | 0.94 (0.67, 1.30) | § |

| No | 385 (49.4%) | 24.8 | Ref | |

| Number of close friends who smoke (0–4) | 2.2 ± 1.4‡ | -- | 1.17 (1.02, 1.33)* | § |

| General awareness of cigarette price changes | ||||

| Aware | 432 (55.3%) | 27.7 | 1.57 (1.12, 2.20)* | § |

| Unaware | 349 (44.7%) | 19.7 | Ref | |

p<0.05.

OR=odds ratios, CI=confidence intervals.

Means and standard deviations are provided for continuous variables.

Variables dropped in chunkwise analysis (F-test p>0.1).

DISCUSSION

Following the $0.75 per pack cigarette tax increase in Minnesota, approximately 40% of surveyed adolescents and young adults said they noticed a rise in cigarette prices. Given that 20% of this population also indicated that the price of cigarettes had risen prior to tax increase, it is possible that prices also could have increased from marketing strategies used by the tobacco industry. On the other hand, not all the smokers noticed a rise in cigarette prices after the tax increase. If knowledge of a rise in prices is one of the first steps in changing an individual’s smoking behaviors, campaigns to raise awareness of a tax increase could increase the effectiveness of that increase. Such campaigns may subsequently help prevent adolescents and young adults from initiating smoking as they realize smoking cigarettes is increasingly expensive.

As would be expected, contact with smokers is associated with increased likelihood of perceiving a price increase following the change in the cigarette tax. A possible explanation for these findings is that because these individuals socialize/live with smokers, they may be more likely to participate in or hear discussions about the cigarette tax increase than those who do not have contact with smokers. Such discussions are likely to lead to noticing an increase in cigarette prices after the tax increase regardless of their smoking status.

We also found that heavier smokers are more likely to notice the cigarette price increase than lighter smokers, potentially due to the different sources used to obtain cigarettes. Adolescents and young adults who are heavier smokers may directly observe an increase in price since they are more likely to purchase cigarettes; in contrast, lighter smokers are more likely to observe a rise in prices indirectly, since they more often may obtain cigarettes from social sources8. As the price of cigarettes goes up, adolescents and young adults may notice a cigarette price increase through the potentially increasing reluctance of their friends to give out cigarettes. However we could not assess this hypothesis since we did not collect information on sources of cigarettes for individuals age 18 and older.

Our secondary objective was to investigate how the tax increase affected smoking behaviors of the past 30-day smokers and determine characteristics related to such behavioral changes. Nearly 17% of the past 30-day smokers in Round 11 reported that they had tried to quit smoking, and 24% reported they had reduced smoking because of the tax increase. This is an encouraging finding because it usually takes several attempts to successfully quit smoking9, and the more times a person attempts to quit smoking, the more likely he or she will be successful. Furthermore, smoking has a dose response association with various diseases10, and therefore a reduction in smoking could lead to reductions in health problems. These findings may have actually underestimated the prevalence of overall smoking reductions and quit attempts resulting from the tax increase given that the subsample used for these analyses only included those who had smoked in the 30 days prior to Round 11 data collection. It is possible that some individuals may have already successfully quit smoking or reduced their smoking to less than monthly between Rounds 9 and 11 and therefore were not asked about smoking reductions or quit attempts resulting from the tax increase. In fact, 16.7% (n=115) of the past 30-day smokers in Round 9 had quit or reduced their smoking to less than monthly. If these individuals had been asked why they quit or reduced smoking, at least some might have attributed those to the tax change.

Characteristics associated with attempting to quit versus reducing smoking because of the tax increase appear to be different. The odds of attempting to quit smoking decreases with age, or with more educated parents, but increases with working over 40 hours a week or being generally aware of cigarette price changes. The odds of reducing smoking only decreases among those have more educated parents, or have a paid job but work 30 hours or less. The finding of adolescents and young adults who were generally aware of cigarette price changes had higher odds of attempting to quit supports our hypothesis that noticing a rise in cigarette prices after a tax change is one of the first steps in modifying individual’s smoking behaviors. Those who are generally more aware of cigarette price changes have higher odds of noticing a rise in cigarette prices after a tax increase, which may contribute to the higher odds of attempting to quit. The association between noticing the actual tax increase and reducing smoking was not directly observed in our study. Future studies should try to directly compare those who attempted to quit versus those who reduced smoking because of a tax increase to better understand the differences in their characteristics.

In addition, parent education and numbers of hours working in a paid job are predictive of attempting to quit and reducing smoking after the tax increase. Participants who had more educated parents were less likely to attempt to quit or reduce smoking after the tax increase, as were those who worked 30 hours or less compared with participants with no paid job. In contrast, participants who worked over 40 hours per week were more likely to attempt to quit smoking after the tax increase. Further understanding of the mechanism through which parent education and employment status influence adolescents’ and young adults’ responses to a cigarette tax increase could inform future interventions to effectively target those who are less responsive to such a tax increase.

One limitation of this study is that a cigarette excise tax increase does not always lead to higher cigarette prices. Internal documents from the tobacco companies show that they have used strategies such as coupons and multipack discounts, either through direct mail or at point-of-purchase, to target price-sensitive smokers to offset the short-term effect of cigarette excise tax increases11. However we do not know how much the respondents actually paid for cigarettes before and after the tax increase, and that information is difficult to obtain reliably.

Another limitation of this study is that the results may not generalize to all U.S. adolescents and young adults because the sample for the study is drawn from one state. However, the mechanisms that determine smoking behaviors in adolescents and young adults are not likely to vary significantly by state. We did not directly assess exposure to media coverage of the cigarette tax increase, peer communication about the cigarette tax increase, or sources of cigarettes; therefore, we could not distinguish whether the perception of cigarette price increase after the tax increase is due to noticing the increase while purchasing cigarettes, media coverage, through talking with friends about the tax increase, or through some other means.

Despite these limitations, the current study possesses the strengths from utilizing data from the MACC Study, a community-based prospective cohort study designed to study the effects of tobacco control policies. One of these strengths is that the sample used in the MACC Study was selected to be representative of adolescents in Minnesota. Estimate of past 30-day smoking prevalence is very similar to prevalence estimated from other survey.12 Another strength is that because the surveys were conducted every six months, we were also able to examine the changes in price perception in adolescents and young adults shortly after the excise tax increase.

SO WHAT?

This is the first study that we are aware of assessing noticing cigarette price changes related to a cigarette tax increase among adolescents and young adults. Results showed that many, but not most, adolescents and young adults noticed a cigarette price increase after the cigarette tax increase went into effect, and many reported changing their smoking behavior because of the tax increase. Further studies should evaluate the mechanisms of how adolescents and young adults find out about cigarette tax increases, whether campaigns to raise awareness of tax changes could increase effectiveness of excise taxes in reducing smoking rates within these populations, and the differences between smokers who attempted to quit and smokers who reduced smoking because of the tax increase.

Contributor Information

T.C. Kelvin Choi, Email: choix137@umn.edu, Division of Epidemiology and Community Health, School of Public Health, University of Minnesota, Mailing address: 1300 Second Street South Suite 300, Minneapolis, MN 55454, Work telephone number: 612-626-3988, Work fax number: 612-624-0315

Traci L. Toomey, Email: toome001@umn.edu, Division of Epidemiology and Community Health, School of Public Health, University of Minnesota, Mailing address: 1300 Second Street South Suite 300, Minneapolis, MN 55454, Work telephone number: 612-626-9070, Work fax number: 612-624-0315

Vincent Chen, Email: chin-hsing.chen@uth.tmc.edu, School of Public Health, University of Texas Health Science Center at Houston, Mailing address: P.O. Box 20036, Work telephone number: 713-900-9766

Jean L. Forster, Email: forst001@umn.edu, Division of Epidemiology and Community Health, School of Public Health, University of Minnesota, Mailing address: 1300 Second Street South Suite 300, Minneapolis, MN 55454, Work telephone number: 612-626-8864, Work fax number: 612-624-0315

References

- 1.Shibuya K, Ciecierski C, Guindon E, Bettcher DW, Evans DB, Murray CJ. WHO Framework Convention on Tobacco Control: development of an evidence based global public health treaty. BMJ. 2003 Jul 19;327(7407):154–157. doi: 10.1136/bmj.327.7407.154. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 2.Ding A. Youth are more sensitive to price changes in cigarettes than adults. Yale J Biol Med. 2003 May 1;76(3):115–124. [PMC free article] [PubMed] [Google Scholar]

- 3.Chaloupka FJ, Wechsler H. Price, tobacco control policies and smoking among young adults. J Health Econ. 1997 Jun;16(3):359–373. doi: 10.1016/s0167-6296(96)00530-9. [DOI] [PubMed] [Google Scholar]

- 4.Sloan FA, Trogdon JG. The impact of the Master Settlement Agreement on cigarette consumption. J Policy Anal Manage. 2004 Aug;23(4):843–855. doi: 10.1002/pam.20050. [DOI] [PubMed] [Google Scholar]

- 5.Gruber J. Youth smoking in the US: prices and policies. Vol. 2000 Cambridge: National Bureau of Economic Research; Jan, 2000. [Google Scholar]

- 6.Emery S, White MM, Pierce JP. Does cigarette price influence adolescent experimentation? J Health Econ. 2001 Mar;20(2):261–270. doi: 10.1016/s0167-6296(00)00081-3. [DOI] [PubMed] [Google Scholar]

- 7.Kleinbaum DG, Kupper LL, Muller KE. Applied regression analysis and other multivariable methods. 2. Boston, Mass: PWS-Kent Pub. Co; 1988. [Google Scholar]

- 8.Harrison PA, Fulkerson JA, Park E. The relative importance of social versus commercial sources in youth access to tobacco, alcohol, and other drugs. Prev Med. 2000 Jul;31(1):39–48. doi: 10.1006/pmed.2000.0691. [DOI] [PubMed] [Google Scholar]

- 9.United States Public Health Service Office of the Surgeon General. Women and Smoking: A Report of the Surgeon General. Rockville, Maryland: U.S. Department of Health and Health Services, Public Health Service, Centers for Disease Control, Center for Chronic Disease Prevention and Health Promotion, Office on Smoking and Health; 2001. [Google Scholar]

- 10.United States Public Health Service Office of the Surgeon General, National Center for Chronic Disease Prevention and Health Promotion (U.S.) The health consequences of smoking a report of the Surgeon General. U.S. Public Health Service, National Center for Chronic Disease Prevention and Health Promotion; Available at: http://purl.access.gpo.gov/GPO/LPS49585 Scroll down to report. [Google Scholar]

- 11.Chaloupka FJ, Cummings KM, Morley CP, Horan JK. Tax, price and cigarette smoking: evidence from the tobacco documents and implications for tobacco company marketing strategies. Tob Control. 2002 Mar;11( Suppl 1):I62–72. doi: 10.1136/tc.11.suppl_1.i62. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 12.Minnesota Department of Health Center for Health Statistics. Changes in Tobacco Use by Minnesota Youth, 2000–2005: Results from the Minnesota Youth Tobacco Survey. St. Paul, MN: Minnesota Department of Health Commissioner’s Office; 2005. [Google Scholar]