Abstract

In this article, the effects of prescription drug coverage on use are analyzed for beneficiaries of a large retiree health benefit fund in a quasi-experiment comparing new and established enrollees. Newer enrollees show an 18-percentage point greater increase in prescription drug expenditures per capita than established enrollees during the 3-year period following enrollment. This differential is interpreted as the insurance effect of prescription coverage. The impact was greater among high-cost drugs than among low-cost drugs, and also greater among low users of prescription drugs than among high users. No clear patterns were discerned across therapeutic categories.

Introduction

Insurance coverage of health care services often results in higher levels of use. Some increases in the consumption of health care that result from benefit coverage are economically efficient and desirable outcomes (Cook and Graham, 1977; Gianfrancesco, 1978). Indeed, the principal reason for benefit coverage is to remove financial barriers that might otherwise prevent individuals from obtaining needed care. However, practical distinction between increases in use that are efficient and those that are excessive is difficult. This difficulty could influence the design of future benefit packages or result in the implementation of controls, such as higher levels of cost sharing, that inappropriately constrain use as well as reduce coverage. In theory, the relationship of insurance coverage to level of use presumably applies to the more specific case of prescription drug coverage. Therefore, an understanding of how insurance coverage of prescription drugs affects consumption of these products is important not only in considering the addition of prescription coverage where none exists but also in developing cost sharing that is effectively targeted. Several existing studies have investigated the effects of insurance coverage on prescription use.

The RAND Health Insurance Experiment (HIE) demonstrated a clear relationship between insurance coverage and prescription drug utilization. Leibowitz, Manning, and Newhouse (1985) found that individuals randomly assigned to a plan with no coinsurance or deductible generated prescription expenditures 60 percent higher than those randomly assigned to a group with practically no coverage. Most of the difference was due to a higher number of prescriptions, while a small part was due to a higher cost per prescription. The RAND HIE demonstrated that the insurance effect on prescription drugs is very similar to its effect on all ambulatory services. Unfortunately, the experiment did not examine the effect of drug coverage independent of other medical coverage. Moreover, persons 65 years of age or over were excluded from the study.

Other studies have addressed the effects of changes in drug coverage offered by State Medicaid and elderly drug benefit programs. Nelson, Reeder, and Dickson (1984) found that the implementation of a $.50 copayment per prescription in the South Carolina Medicaid program led to a decrease in the number of prescriptions per beneficiary. In a followup to this study, Reeder and Nelson (1985) found that the copayment had a differential effect among therapeutic categories of drugs, but effects were not limited to “discretionary” drugs. In a study of cost-containment measures in the New Hampshire Medicaid program, Soumerai et al. (1987) found that a limit of three covered prescriptions per month decreased utilization among users of multiple medications by 46 percent. For “marginal” or “ineffective” medications the decline was 60 percent, while for “essential” medications the decline was more moderate, though substantial, at 30 percent.

Evidence of the behavioral effects of copayments is not limited to low-income individuals or to traditional indemnity coverage. Harris et al. (1990) reported significant declines in utilization following the imposition of $1.50 and $3.00 per prescription copayments (implemented in successive years, with medical benefits held constant) among a population receiving employment-based coverage through a large health maintenance organization (HMO). This study, like the RAND HIE, included only persons 65 years of age or under.

Moeller (1989) addressed the issue of an insurance effect of drug coverage in a study using data from the National Medical Care Expenditure Survey of 1977. Employing regression analysis, Moeller found no statistically significant differences in prescription drug utilization or expenditure between insured persons with drug coverage and those without drug coverage. Among those with drug coverage, the generosity of coverage produced no significant effects on utilization or expenditures. The use of survey data, however, is generally less reliable than a quasi-experimental approach. In particular, the reliability of prescription drug survey data (Berk, Schur, and Mohr, 1990) and of cross-sectional regression (Soumerai et al., 1993) has been questioned.

Stuart et al. (1991) analyzed the prescription drug utilization of new entrants into Pennsylvania's Pharmaceutical Assistance Contract for the Elderly (PACE) Program. Almost all of these individuals were Medicare enrollees. The prescription use of annual cohorts of new enrollees was followed over time, and the utilization of each cohort increased from year to year, with strikingly similar levels of use in the first year for each cohort In a followup study employing multivariate analysis, Stuart and Coulson (1993) found similar patterns. Program effects on probability of use seemed to occur primarily within the first year of enrollment, while effects on level of use among users continued over the course of the 3-year study period. The authors ascribe these effects to “exposure” to the program, and the result is consistent with the existence of an insurance effect of prescription drug coverage. Whether manifest through a beneficiary learning curve, as suggested by Stuart and Coulson, or through the gradual response of the delivery system to induced demand, the financial impact over time in the early stages of a prescription drug benefit is an important factor in evaluating the cost of such coverage.

The present study compares the behavior of new entrants into a plan offering drug coverage with the behavior of a control group of similar individuals, already covered by the plan, over a 3-year period.

Background

The United Mine Workers of America (UMWA) Health and Retirement Funds (hereafter “the Funds”) provides health benefits to more than 100,000 retired and disabled miners, spouses, and dependents, Prior to a legislative restructuring of the Funds effective February 1, 1993, health benefits were provided through the 1950 and 1974 Benefit Trusts. Beneficiaries of the former 1974 Benefit Trust are younger than those of the 1950 Benefit Trust and include only individuals who are “orphaned” because their companies are no longer in existence or are otherwise no longer signatory to a labor agreement with the UMWA. About 60 percent of 1974 Benefit Trust beneficiaries are Medicare eligible. The Funds provides wrap-around coverage of inpatient hospital and ambulatory services to Medicare enrollees, while providing primary coverage of these services to non-Medicare beneficiaries. In addition, the Funds covers prescription drugs, which are generally not covered by Medicare. Funds cost sharing is modest, consisting of a $5 copayment for physician office visits, up to an annual out-of-pocket maximum of $100 per family, and a copayment of $5 per prescription up to an annual out-of-pocket limit of $50. Inpatient hospital care and related post-hospital care are covered with no deductible or copayment.

The concentrated entrance of a large number of “Nobel-class” beneficiaries into the 1974 Benefit Trust at the end of calendar year (CY) 1989 provided a unique opportunity to study the effects of benefit coverage on the use of prescription drugs, the “insurance effect.” The Nobel-class beneficiaries are a group who previously received retiree health benefits directly from their former employers, but lost these benefits when their companies became no longer signatory to a labor agreement with the UMWA and discontinued coverage. While their eligibility for the 1974 Benefit Trust was being litigated, these individuals provided for their own health benefits, independently or through a UMWA-sponsored plan. For Medicare beneficiaries in the Nobel group, the loss of coverage applied only to wrap-around benefits.

An analysis of claims for retroactive benefits, for which these beneficiaries became entitled upon eligibility, indicates the virtual absence of prescription drug coverage among Nobel beneficiaries prior to their enrollment in the 1974 Benefit Trust. This conclusion was further supported by discussions with the Funds' Field Service Office staff who were directly involved with this group. While many Funds beneficiaries live in Pennsylvania, they do not meet the combined age and income requirements for participation in the PACE drug benefit program.

Data and Methods

We analyzed patterns of prescription drug use of the original Nobel-class beneficiaries during the 3-year period following their enrollment (from January 1990 to December 1992) by comparing their drug expenditures per capita with those of a control group of other beneficiaries in the 1974 Benefit Trust during the same period. The control group includes a sample of individuals selected to exactly mirror the composition of the Nobel-class group on the basis of age, gender, State of residence, Medicare eligibility, and pension status. It contains only those beneficiaries who were already enrolled as of January 1,1990, the date by which the original Nobel-class beneficiaries were enrolled. Both groups include only those persons who remained eligible for benefits throughout the entire study period. Disabled retirees and their dependents were excluded because retroactive eligibility dates made it difficult to establish effective dates when use of covered services actually began. Of the approximately 2,400 original Nobel-class beneficiaries who were enrolled in the 1974 Benefit Trust at the end of CY 1989,1,818 formed the basis for this study. The control group included 1,841 beneficiaries. Standardized demographic characteristics, which apply to each group, are presented in Table 1.

Table 1. Nobel- and Control-Group Beneficiaries, by Gender and Age.

| Age | Total1 | Male | Female |

|---|---|---|---|

|

| |||

| Percent | |||

| Total | 100.0 | 48.7 | 51.3 |

| 25 Years or Under | 2.3 | 1.2 | 1.1 |

| 25-49 Years | 1.0 | 0.2 | 0.8 |

| 50-64 Years | 40.8 | 14.7 | 26.1 |

| 65-74 Years | 50.1 | 28.9 | 21.2 |

| 75-84 Years | 5.9 | 3.7 | 2.2 |

| 85 Years or Over | 0.0 | 0.0 | 0.0 |

Nobel n= 1,818. Control n= 1,841.

NOTES: Nobel-group beneficiaries are those whose health benefits had been discontinued and who entered the United Mine Workers of America Health and Retirement Funds in 1989. Control-group beneficiaries had continuous coverage.

SOURCE: United Mine Workers of America Health and Retirement Funds' Eligibility Data, August 1992–June 1993.

Our study groups are standardized to control for important demographic factors. However, among a population sharing a common geography (68.6 percent of beneficiaries were from Pennsylvania) and delivery system, such factors as age and gender are more likely to affect levels of use rather than rates of change. For instance, consider the experience of the Funds' 1950 Benefit Trust when compared with the 1974 Benefit Trust The 1950 Benefit Trust covered a considerably older population with a higher rate of morbidity due to age and to a concentration of black lung disease in earlier generations of miners. As Table 2 indicates, these factors produced higher levels of use in the 1950 Trust In spite of this difference, both Trust populations exhibited remarkably similar rates of growth in use and expense over a 7-year period for which complete information is available.

Table 2. Comparison of Fiscal Years (FY) 1985-92 Per Capita Prescription Drug Use and Expense Growth Rates and FY 1992 Levels Between the 1950 and 1974 Benefit Trusts1.

| Prescriptions and Charges Per Capita | Benefit Trust | Ratio | |

|---|---|---|---|

|

| |||

| 1950 | 1974 | ||

| Annual Growth Rate in Percent | |||

| Charges per Capita | 12.3 | 13.1 | — |

| Prescriptions per Capita | 4.5 | 4.5 | — |

| FY 1992 Levels | |||

| Charges per Capita | $892 | $755 | 1.18 |

| Prescriptions per Capita | 35 | 28 | 1.25 |

Prior to February 1993, these were the two health benefit trusts of the United Mine Workers of America Health and Retirement Funds.

SOURCE: United Mine Workers of America Health and Retirement Funds' Payment and Utilization Reports, February 17,1993.

Monthly drug expenditures and number of prescriptions for each individual were calculated from claims history data. Rates of change for the Nobel group were compared with those for the control group. The expenditures and use of each group fluctuated considerably during their ascent largely due to seasonal factors and the relatively small sizes of the populations. This made actual end-point measurements unreliable for calculating percent increases during the period. To reduce the effects of random fluctuations on this analysis, linear regression trends were estimated for both Nobel- and control-group per capita expenditures and number of prescriptions and trendline end-point values were used to calculate percent changes. Other regression forms (e.g., log and exponential) were also considered, but rejected because the sums of squared errors were significantly greater than those generated with the linear model.

The prescription drug use per capita of Nobel beneficiaries is believed to have been at or near no-insurance levels in January 1990. The use of monthly measurements of expense and utilization allow us to make this case with more confidence than would be possible using annual measurements, which are more common in the literature. The full impact of coverage on prescription drug use would have taken considerable time because it would have required visits to physicians for each of any number of conditions for which drugs might be prescribed. Attending physicians would have responded gradually to the newly acquired drug coverage of Nobel-class beneficiaries. An increase in expenditures for Nobel-class beneficiaries relative to those of the control group during the course of the period is therefore interpreted as an indication of the insurance effect on the use of these services. Insurance effects on prescription drug use cannot be attributed solely to coverage of these services. Some of the increase in use within the Nobel group could result from improved coverage of physician services. Although Nobel-class beneficiaries, for the most part, had coverage of physician services prior to enrollment in the 1974 Benefit Trust, Funds coverage may have been more generous. The increased access to physicians afforded Nobel-class beneficiaries by this coverage could have increased the number of occasions for prescribing drugs. To investigate the magnitude of this effect, rates of change in monthly physician use per capita during the first year of the study period were compared for the Nobel and control groups. Interestingly, both groups exhibited a slight decline in physician visits per capita. Visits in the control group declined by 3 percentage points more than in the Nobel group. The small difference in trend between groups, together with the downward direction of the Nobel trendline, suggests that any improvements in physician coverage for the Nobel group were not responsible for the observed trends in prescription drug use.

Insurance Effect on Prescription Drugs

Funds' beneficiaries pay a $5 copayment per prescription up to a yearly maximum of $50 per family. The price per prescription paid by beneficiaries is, therefore, $5 for the first 10 prescriptions within a year and $0 for all additional prescriptions. These amounts are generally well below the prices that beneficiaries would face in the absence of coverage. The general hypothesis is that the reduced price encourages increases in consumption.

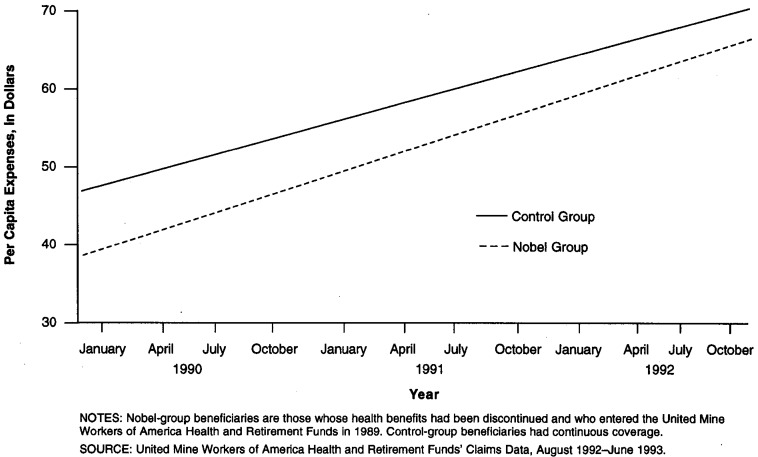

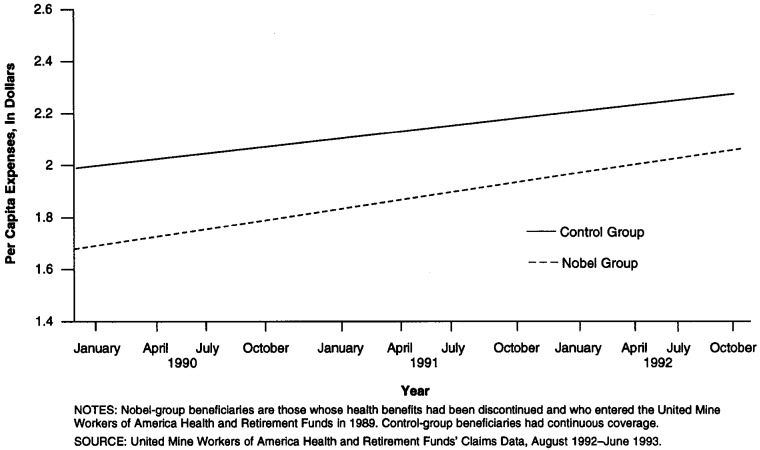

Table 3 presents the predicted prescription drug expenditures and monthly number of prescriptions per capita of Nobel- and control-group beneficiaries in January 1990 and December 1992. Figures 1 and 2 provide additional graphic detail on the trendlines and monthly measurements. Nobel trendline expenditures per capita for prescription drugs increased from $38.67 in January 1990 to $61.51 in December 1992, or 59 percent, while control-group trendline expenditures per capita increased from $46.73 to $65.81, or 41 percent Nobel trendline prescriptions per capita increased from 1.64 to 2.21, or 35 percent, while control-group trendline prescriptions per capita increased from 1.93 to 2.37, or 23 percent The estimated trends in the per capita expenses and prescriptions of each group are significant p ≥ .005. The 18-percentage point greater increase in expenditures experienced by Nobel-group beneficiaries may be interpreted as the insurance effect on prescription drug expense. The 12-percentage-point-greater increase in prescriptions experienced by Nobel-group beneficiaries may be interpreted as that portion of the insurance effect that is due to an increased number of prescriptions. Thus, about two-thirds of the effect on expense seems to arise from a greater number of prescriptions, with the remaining one-third due to a higher cost per prescription. The percent increase in the per capita expenditures of the control group may be interpreted as that part of the increase in Nobel-group per capita expenditures that is attributable to inflation and secular increases in prescription drug use, since these factors should similarly affect both groups. During the course of the study period, Nobel-group per capita expenses increased from 83 percent of the expenditures of the control group to 93 percent of such expenditures.

Table 3. Estimated Insurance Effect on Prescription Expenses and Use, by Beneficiary Group: 1990–92.

| Date and Insurance Effect | Estimated Per Capita | |||

|---|---|---|---|---|

|

| ||||

| Expenses | Prescriptions | |||

|

|

|

|||

| Nobel | Control | Nobel | Control | |

| January 1990 | $38.67 | $46.73 | 1.64 | 1.93 |

| December 1992 | 61.51 | 65.81 | 2.21 | 2.37 |

| Percent Change | 59.06 | 40.83 | 34.76 | 22.80 |

| Insurance Effect in Percent | 18.23 | — | 11.96 | — |

NOTES: Nobel-group beneficiaries are those whose health benefits had been discontinued and who entered the United Mine Workers of America Health and Retirement Funds in 1989. Control-group beneficiaries had continuous coverage.

SOURCE: United Mine Workers of America Health and Retirement Funds' Claims Data, August 1992-June 1993.

Figure 1. Per Capita Expenses for Nobel- and Control-Group Beneficiaries: 1990–92.

Figure 2. Per Capita Prescriptions for Nobel- and Control-Group Beneficiaries: 1990–92.

We also examined effects on prescription expenditures by therapeutic category. Each prescription was placed into 1 of 20 broad therapeutic categories and an insurance effect was calculated for each category according to the same algorithm previously discussed. Results are presented in Table 4 for those categories accounting for more than 1,000 Nobel-group and 1,000 control-group prescriptions during the study period. Estimated insurance effects differ greatly across therapeutic categories. Clearly, varying degrees of discretion are involved in the use of drugs in different categories. However, observed effects are not limited to those categories that would seem to be most discretionary. In this regard, these findings are consistent with those reported by Reeder and Nelson (1985) in their examination of the divergent effects of cost sharing across therapeutic categories in a Medicaid population. The trendlines exhibiting the greatest positive differential between Nobel and control groups are for anti-arthritics, cardiovascular medications, cough and cold preparations, analgesics, and skin preparations.

Table 4. Number of Prescriptions, by Nobel- and Control-Group Beneficiaries, Insurance Effect, and Cost per Day, by Therapeutic Category1.

| Generic Code | Therapeutic Category | Number of Prescriptions | Estimated Insurance Effect (Percent) | Cost per Day | |

|---|---|---|---|---|---|

|

| |||||

| Nobel | Control | ||||

| 11 | Anti-Arthritic | 5,727 | 6,113 | 38 | $1.21 |

| 41 | Cardiovascular | 12,644 | 13,737 | 28 | 1.08 |

| 50 | Cough and Cold Preparations | 2,073 | 2,426 | 28 | 1.43 |

| 02 | Analgesic | 5,483 | 5,667 | 26 | 1.19 |

| 86 | Skin Preparations | 2,501 | 2,801 | 25 | 1.87 |

| 65 | Gastrointestinal Preparations | 7,641 | 8,875 | 24 | 1.87 |

| 80 | Psychotherapeutic | 8,979 | 9,685 | 20 | 0.92 |

| 56 | Diuretics | 9,080 | 11,232 | 14 | 0.33 |

| 32 | Autonomics | 4,763 | 5,420 | 14 | 0.82 |

| 59 | Electrolyte—Caloric Preparations | 2,313 | 2,947 | 11 | 0.42 |

| 62 | EENT Preparations | 1,804 | 1,951 | 8 | 1.48 |

| 71 | Hypoglycemics | 6,311 | 6,407 | 8 | 0.97 |

| 20 | Anti-lnfectives | 5,408 | 6,039 | 7 | 2.10 |

| 17 | Anti-Histamines | 1,304 | 1,641 | 7 | 1.33 |

| 14 | Anti-Asthmatic | 5,267 | 6,505 | 5 | 1.04 |

| 38 | Cardiac | 16,597 | 19,596 | 2 | 0.89 |

| 35 | Blood | 1,704 | 1,611 | 1 | 0.99 |

| 83 | Sedative—Hypnotic | 1,531 | 1,806 | -3 | 0.54 |

| 89 | Thyroid Preparations | 2,763 | 3,385 | -8 | 0.27 |

| 68 | Hormones | 3,166 | 2,846 | -14 | 0.67 |

Generic drug categories with more than 1,000 prescriptions in both Nobel and control groups.

NOTES: Nobel-group beneficiaries are those whose health benefits had been discontinued and who entered the United Mine Workers of America Health and Retirement Funds in 1989. Control-group beneficiaries had continuous coverage. EENT is eye, ear, nose, and throat.

SOURCE: United Mine Workers of America Health and Retirement Funds' Claims Data, August 1992–June 1993.

Effects on High- and Low-Cost Drugs

The nature of the insurance effect was further investigated by distinguishing between trends among high- and low-cost prescription drugs. Were the differences in overall trends between Nobel and control groups due to other factors, we would not expect any systematic discrepancy in trends according to cost. On the other hand, we would expect prescription coverage to have a stronger effect on more expensive prescriptions since these would become relatively more affordable. Irrespective of market price, Funds beneficiaries pay $5 (or $0) per prescription. For high-cost drugs this represents a large price reduction, while for low-cost drugs the reduction is more modest.

To test this hypothesis, all drug products were classified into two groups, high- and low-cost per day's supply. Cost per day's supply is computed by dividing the total cost of a prescription by the number of days covered. The median cost per day's supply was used to separate drug products into the high- and low-cost categories. Nobel- and control-group per capita expenditures and number of prescriptions were then compared during the 3-year period for each category. Results are presented in Table 5.

Table 5. Estimated Insurance Effect on Prescription Expenses and Use for High- and Low-Cost Drugs, by Beneficiary Group: 1990–92.

| Drug Type, Date, and Insurance Effect | Estimated Per Capita | |||

|---|---|---|---|---|

|

| ||||

| Expenses | Prescriptions | |||

|

|

|

|||

| Nobel | Control | Nobel | Control | |

| High-Cost Drugs | ||||

| January 1990 | $32.16 | $39.54 | 1.02 | 1.22 |

| December 1992 | 53.50 | 57.34 | 1.36 | 1.46 |

| Percent Change | 66.36 | 45.02 | 33.33 | 19.67 |

| Insurance Effect in Percent | 21.34 | — | 13.66 | — |

| Low-Cost Drugs | ||||

| January 1990 | $6.47 | $7.17 | 0.62 | 0.71 |

| December 1992 | 8.01 | 8.43 | 0.85 | 0.91 |

| Percent Change | 23.80 | 17.57 | 37.10 | 28.17 |

| Insurance Effect in Percent | 6.23 | — | 8.93 | — |

NOTES: Nobel-group beneficiaries are those whose health benefits had been discontinued and who entered the United Mine Workers of America Health and Retirement Funds in 1989. Control-group beneficiaries had continuous coverage.

SOURCE: United Mine Workers of America Health and Retirement Funds' Claims Data, August 1992–June 1993.

For high-cost products, trendline expenditures per capita of Nobel beneficiaries increased from $32.16 in January 1990 to $53.50 in December 1992, or by 66 percent, while trendline expenditures per capita of the control group increased from $39.54 to $57.34, or by 45 percent. Prescriptions per capita increased by 33 percent in the Nobel group and by 20 percent in the control group. The estimated trends in per capita expense are significant at p ≥ .005 for both the Nobel and control groups. The 21 percentage point excess of the Nobel-group increase over the control-group increase is interpreted as the insurance effect on high-cost drug expenditures. The effect on number of prescriptions is a more moderate 14 percent. For low-cost products, trendline expenditures per capita of Nobel-group beneficiaries increased from $6.47 in January 1990 to $8.01 in December 1992, or by 24 percent, while trendline expenditures per capita of the control group increased from $7.17 to $8.43, or by 18 percent. Trendline prescriptions per capita increased by 37 percent in the Nobel group and 28 percent in the control group. The estimated trends in prescriptions per capita are also significant at p ≥ .005 for both groups. The 6-percentage-point excess of Nobel- over the control-group increase, interpreted as the insurance effect on expenditures for low-cost drugs, is considerably smaller than that for high-cost drugs. The effect on number of prescriptions is estimated at 9 percent.

These findings suggest a stronger insurance effect on high-cost drugs, which supports the argument that the observed insurance effect is due to drug coverage. In addition, the discrepancy between effects on expense and number of prescriptions within the high-cost category also reveals a relative shift in the Nobel group toward more expensive prescriptions. The greater effect on high-cost drugs may be partially explained by substitution of more expensive for less expensive prescriptions in response to insurance coverage of these services. Although some substitution is desirable to the extent that prescription drug coverage provides financial access to more effective, albeit more expensive, therapeutic regimens, it is undesirable if the additional benefits do not warrant the costs.

Interestingly, the shift to more expensive prescriptions does not appear to be smooth along the entire range of cost. Results within the low-cost category, where the estimated effect on number of prescriptions is slightly stronger than the effect on expense, suggest a possible increase in the use of products at the low end of the cost spectrum. This may reflect a response to the Funds' ongoing efforts to increase the use of generic prescriptions. (As a major third-party payer with strong ties to a specific industry and region, the Funds has traditionally enjoyed a much stronger relationship with providers and beneficiaries than that experienced by most insurance carriers or government programs.)

In order to further explore the effect of prescription coverage according to cost, we took a closer look at the therapeutic categories exhibiting a greater-than-average insurance effect. These categories were divided into specific drug classes. Within each therapeutic category, cost per day and the growth differential in per capita expense were calculated separately for each specific drug class with 400 or more Nobel-group and 400 or more control-group prescriptions during the study period. This analysis is presented in Table 6. Because of smaller numbers, results vary even more widely among specific drug classes than among the therapeutic categories. At the level of disaggregation represented by specific drug classes, differences between the Nobel and control groups in the growth of per capita expenditure are likely to be strongly influenced by differences between the groups in the incidence of underlying medical conditions. For this reason, it is difficult to interpret these growth differentials as insurance effects, thereby limiting the ability to establish a clear relationship between the costliness of a drug and the magnitude of its insurance effect. In four of the seven therapeutic categories studied, the specific drug class with the largest growth differential was also the most expensive per day. In two therapeutic categories, the results went the opposite direction, and one category, analgesics, displayed a mixed pattern. Although the added detail may be of interest to some readers, the small numbers and erratic results make it difficult to draw any additional conclusions from these results.

Table 6. Number of Prescriptions, by Nobel- and Control-Group Beneficiaries, Growth Differential, and Cost per Day, by Specific Drug Classes Within Therapeutic Categories1.

| Therapeutic Category | Drug Class | Number of Prescriptions | Growth Differential (Percent) | Cost per Day | |

|---|---|---|---|---|---|

|

| |||||

| Nobel | Control | ||||

| Anti-Arthritic | Purine Inhibitors | 1,122 | 1,116 | -25 | $0.26 |

| Anti-Inflammatory Agents | 4,237 | 4,684 | 40 | 1.55 | |

| Cardiovascular | Aldosterone Antagonists | 403 | 431 | 50 | 0.42 |

| Hypotensives, Sympatholytic | 2,420 | 2,501 | 33 | 0.67 | |

| Hypotensives, Vasodilators | 1,633 | 1,671 | 15 | 0.83 | |

| Hypotensives, Angiotensin | 4,786 | 5,327 | 15 | 1.03 | |

| Hypotensives, Miscellaneous | 501 | 518 | -27 | 1.01 | |

| Lipotropics | 2,268 | 3,098 | 72 | 1.86 | |

| Gastrointestinal Preparations | Anti-Emetics | 457 | 695 | -9 | 0.63 |

| Bile Salt Inhibitors | 476 | 480 | -59 | 1.64 | |

| Anti-Ulcer Preparations | 794 | 912 | -17 | 2.15 | |

| Histamine H2 Inhibitors | 4,084 | 5,121 | 31 | 2.21 | |

| Skin Preparations | Topical Anti-Inflammatory Preparations | 1,385 | 1,472 | 23 | 1.88 |

| Topical Anti-Fungals | 714 | 730 | 25 | 1.93 | |

| Analgesics | Anti-Pyretic/Non-Salicylate | 417 | 729 | 44 | 0.63 |

| Non-Narcotic | 2,000 | 2,144 | 79 | 1.17 | |

| Narcotic | 2,206 | 2,236 | -13 | 1.27 | |

| Salicylate | 791 | 536 | 22 | 1.49 | |

| Cough and Cold Preparations | Expectorants | 560 | 782 | 86 | 1.30 |

| Cold and Cold Preparations | 1,135 | 1,231 | -16 | 1.41 | |

| Psychotherapeutic | Phenothiazines | 596 | 564 | 92 | 0.85 |

| Anti-Depressants | 2,282 | 2,678 | 46 | 0.92 | |

| Anti-Anxiety Drugs | 5,610 | 5,830 | 8 | 0.96 | |

Generic drug categories with more than 1,000 prescriptions in both Nobel and control groups.

NOTES: Nobel-group beneficiaries are those whose health benefits had been discontinued and who entered the United Mine Workers of America Health and Retirement Funds in 1989. Control-group beneficiaries had continuous coverage.

SOURCE: United Mine Workers of America Health and Retirement Funds' Claims Data, August 1992–June 1993.

High and Low User Effects

The insurance effect on prescription use was also investigated separately for high and low users of these services. A finding of divergent insurance effects among high and low users within the Nobel group is consistent with expected economic behavior under insurance. Low users presumably have a lesser need for prescription drugs and, in the absence of insurance, might often find the benefits of such drugs to be outweighed by the out-of-pocket costs that they must incur. Insurance may sharply reduce the price faced by beneficiaries, rationalizing the use of these services by low users even though their benefits may be relatively moderate. In contrast, high users presumably have a greater need for prescription drugs and, even in the absence of insurance, would find the benefits of such drugs sufficient to warrant the costs that they must incur. Therefore, the reduction in price under insurance would have a more moderate effect on the consumption of prescription drugs by high users. These arguments suggest that the demand of low users for prescription drugs may be more price-sensitive than that of high users.

To test this hypothesis, the median per capita expenditure was applied to individual expenditures over the 3-year period to separate Nobel-group high and low users into two groups of equal size. The same separation was performed on the control group, and comparisons of Nobel-group with control-group per capita expenditures and prescriptions were then made for high and low users. An important methodological concern emerged when considering whether to include non-users in this analysis. Although the inclusion of non-users does not affect the calculation of growth rates and insurance effects in the preceding analyses (only absolute levels are affected), this is not true when comparing high and low users. The inclusion of non-users among low users alters the demarcation between low users and high users, affecting the growth rates calculated for each group. Conceptually, there are arguments both in favor of and against including non-users. Non-users should be included among low users to the extent that they are comprised of individuals who had a need for medication but were not induced by benefit coverage to shift from over-the-counter to prescription drugs. Alternatively, non-users should be excluded from among low users to the extent that they are comprised of individuals who truly had no need for medication and therefore were not susceptible to insurance effects. Given that over-the-counter drugs are not covered by the Funds, the latter scenario would seem to occur most often among the non-users. For this reason and because growth rates are affected, we chose to exclude non-users. These account for exactly 9 percent of both the Nobel and control groups over the 3-year study period.

Results are reported in Table 7. For high users, Nobel trendline expenditures per capita increased from $76.38 in January 1990 to $119.26 in December 1992, or by 56 percent, while control-group trendline expenditures per capita increased from $90.57 to $125.62, or by 39 percent. Trendline prescriptions for high users increased by 30 percent in the Nobel group and 20 percent in the control group. The estimated trends in per capita levels for each population are significant at p ≥ .005. The 17-percentage point difference between the Nobel-group increase and the control-group increase in per capita expense is interpreted as the insurance effect on the prescription drug expenditures of high users. The effect on number of prescriptions is estimated to be 10 percent.

Table 7. Estimated Insurance Effect on Prescription Expenses and Use for High and Low Users, by Beneficiary Group: 1990–92.

| Drug Type, Date, and Insurance Effect | Estimated Per Capita | |||

|---|---|---|---|---|

|

| ||||

| Expenses | Prescriptions | |||

|

|

|

|||

| Nobel | Control | Nobel | Control | |

| High Users | ||||

| January 1990 | $76.38 | $90.57 | 3.11 | 3.52 |

| December 1992 | 119.26 | 125.62 | 4.05 | 4.25 |

| Percent Change | 56.14 | 38.70 | 30.23 | 20.17 |

| Insurance Effect In Percent | 17.44 | — | 10.05 | — |

| Low Users | ||||

| January 1990 | $8.62 | $12.22 | 0.51 | 0.72 |

| December 1992 | 15.95 | 19.06 | 0.78 | 0.98 |

| Percent Change | 85.03 | 55.97 | 52.94 | 36.11 |

| Insurance Effect in Percent | 29.06 | — | 16.83 | — |

NOTES: Nobel-group beneficiaries are those whose health benefits had been discontinued and who entered the United Mine Workers of America Health and Retirement Funds in 1989. Control-group beneficiaries had continuous coverage.

SOURCE: United Mine Workers of America Health and Retirement Funds' Claims Data, August 1992–June 1993.

Although the estimated insurance effects on the per capita expenses and prescriptions of high users differ little from those estimated for all beneficiaries, low users appear to be more sensitive to these effects. For low users, Nobel trendline expenditures per capita increased from $8.62 in January 1990 to $15.95 in December 1992, or by 85 percent, while control-group trendline expenditures per capita increased from $12.22 to $19.06, or by 56 percent Nobel trendline prescriptions increased by 53 percent and control-group trendline prescriptions increased by 36 percent. The estimated trends in per capita levels for each population are significant at p ≥ .005. These results imply an insurance effect of 29 percentage points on expenses and 17 percentage points on number of prescriptions among low users. (A similar analysis was performed including non-users among low users. While the magnitude of difference between high and low users is sensitive to this choice of method, it too produces a larger estimated insurance effect for low users.)

Conclusions

Results from this study of an aging population support the arguments of those who ascribe a significant insurance effect to prescription drug coverage, and suggest that such findings are relevant to the Medicare population. After a 3-year period following the initiation of coverage, newly enrolled Funds' beneficiaries increased their use of these products by 18 percentage points more than other beneficiaries who had already been enrolled. This suggests that in the early stages of a prescription drug benefit in a population such as that insured by the Funds, overall consumption of prescription drugs (measured in number, size, and costliness of prescriptions) will increase by about 18 percentage points over any increase that might have occurred in the absence of coverage. The size of the observed effect is notable because of the characteristics of the Funds' beneficiary population. As a group, Funds beneficiaries are older and have higher rates of morbidity than the general population. These factors may imply a more intense need for prescription drugs, making their demand for these products less price- and insurance-sensitive.

We examined varying sensitivities to insurance according to drug cost per day and therapeutic category. Findings indicate an insurance effect on expenditures for high cost drugs of 21 percent, while the effect on low cost drugs was a more modest 6 percent. These results may follow from the typical design of prescription drug coverage, which reduces the purchase price of high-cost drugs by more than that of low-cost drugs. In any event, the differential impact on high- and low-cost drugs supports the argument that the observed insurance effect is due to the drug coverage itself rather than an improvement in medical coverage.

A primary concern is the substitution of high- for low-cost prescription drugs that may result from insurance coverage. This substitution, if widespread, would offer the potential for cost savings through implementation of a drug formulary. Indeed, it is the purpose of such formularies to discourage the substitution of high- for low-cost products, particularly where such actions are not justified by medical reasons. This is accomplished by paying only for the lowest cost drug product within each specific drug class. Under some formulary programs, a higher cost drug may be covered when explicitly required by the prescribing physician. Any formulary must be carefully designed with an eye toward its clinical and financial implications. Such possible repercussions have been the subject of wide discussion (Soumerai and Ross-Degnan, 1990; Soumerai et al., 1993). It is noteworthy that the Funds has implemented a drug formulary since this study was undertaken.

We also investigated varying sensitivities to insurance of high and low prescription users. Results suggest that low users may be more sensitive to prescription drug coverage than high users. This is consistent with the notion that low users have a more discretionary and, therefore, price-sensitive demand for prescription drugs relative to high users. Our findings suggest that policymakers should consider the divergent behavioral responses of varied groups of beneficiaries when estimating or evaluating the effects of benefit changes and cost-sharing measures. For example, an up-front deductible could impose a significant barrier to the initiation of drug regimens of marginal therapeutic value, making it more effective than copayments in constraining discretionary use among beneficiaries with moderate needs. Whether the out-of-pocket expense is in the form of an up-front deductible or copayments should have less effect on the behavior of beneficiaries with more intense needs. It is cautioned, however, that although the annual out-of-pocket amount may be the same with either an up-front deductible or copayments with a maximum, the concentrated out-of-pocket payment represented by a deductible may be especially burdensome to beneficiaries living on limited monthly budgets. Regardless of its efficiency, such concentrated cost sharing may be inappropriate among elderly or low-income populations. Policymakers must consider differential impacts in addition to aggregate results when deliberating the structure of cost sharing measures.

Footnotes

The authors are with the Department of Research and Systems, United Mine Workers of America (UMWA) Health and Retirement Funds. The opinions expressed in this article are those of the authors and do not necessarily reflect the policies of the UMWA Health and Retirement Funds or the Health Care Financing Administration.

Reprint Requests: Frank Gianfrancesco, Ph.D., Assistant Director for Research, UMWA Health and Retirement Funds, 4455 Connecticut Avenue, NW., Washington DC 20008.

References

- Berk M, Schur C, Mohr P. Using Survey Data to Estimate Prescription Drug Costs. Health Affairs. 1990 Fall;9(3):146–157. doi: 10.1377/hlthaff.9.3.146. [DOI] [PubMed] [Google Scholar]

- Cook C, Graham D. The Demand for Insurance and Protection. Quarterly Journal of Economics. 1977 Feb;92(1):231–241. [Google Scholar]

- Gianfrancesco F. Insurance and Medical Care Expenditure: An Analysis of the Optimal Relationship. Eastern Economic Journal. 1978 Jul-Oct;3(3):225–234. [Google Scholar]

- Harris B, Stergachis A, Ried LD. The Effect of Drug Co-Payments on Utilization and Cost of Pharmaceuticals in a Health Maintenance Organization. Medical Care. 1990 Oct;28(10):907–917. doi: 10.1097/00005650-199010000-00005. [DOI] [PubMed] [Google Scholar]

- Leibowitz A, Manning W, Newhouse J. The Demand for Prescription Drugs as a Function of Cost-Sharing. Social Science and Medicine. 1985;21(10):1063–1069. doi: 10.1016/0277-9536(85)90161-3. [DOI] [PubMed] [Google Scholar]

- Moeller J. Impact of Health Insurance on Annual Expenditures for Prescribed Medicines. Paper presented at Annual Meeting of the American Public Health Association; October 1989. [Google Scholar]

- Nelson A, Reeder CE, Dickson WM. The Effect of a Medicaid Drug Copayment Program on the Utilization and Cost of Prescription Services. Medical Care. 1984 Aug;22(8):724–735. doi: 10.1097/00005650-198408000-00004. [DOI] [PubMed] [Google Scholar]

- Reeder CE, Nelson A. The Differential Impact of Copayment on Drug Use in a Medicaid Population. Inquiry. 1985 Winter;22:396–403. [PubMed] [Google Scholar]

- Soumerai S, Ross-Degnan D. Experience of State Drug Benefit Programs. Health Affairs. 1990 Fall;9(3):36–54. doi: 10.1377/hlthaff.9.3.36. [DOI] [PubMed] [Google Scholar]

- Soumerai S, Avorn J, Ross-Degnan D, et al. Payment Restrictions for Prescription Drugs under Medicaid — Effects on Therapy, Cost, and Equity. New England Journal of Medicine. 1987 Aug 27;317(9):550–556. doi: 10.1056/NEJM198708273170906. [DOI] [PubMed] [Google Scholar]

- Soumerai S, Ross-Degnan D, Fortess E, et al. A Critical Analysis of Studies of State Drug Reimbursement Policies: Research in Need of Discipline. Milbank Quarterly. 1993;71(2):217–252. [PubMed] [Google Scholar]

- Stuart B, Coulson NE. Dynamic Aspects of Prescription Drug Use in an Elderly Population. Health Services Research. 1993 Jun;28(2):237–264. [PMC free article] [PubMed] [Google Scholar]

- Stuart B, Ahern F, Rabatin V, et al. Patterns of Outpatient Prescription Drug Use Among Pennsylvania Elderly. Health Care Financing Review. 1991 Spring;12(3):61–72. [PMC free article] [PubMed] [Google Scholar]