Introduction

After peaking in 1999 with roughly 7 million members, enrollment in the Medicare+Choice (M+C) Program has been dropping. As of April 2002, 5 1/2 million members remain enrolled in the program. Over this timeframe the number of M+C contracts has also dropped considerably: from more than 300 in 1998 to only 147 in 2002. While the number of insurers has dropped, this number has been affected somewhat by contract consolidations.

The majority of enrollment in the M+C Program corresponds to people who enroll on an individual basis. However, most M+C contracts also derive substantial enrollment from employer-connected offerings (e.g., persons who are eligible for Medicare and subscribe through group contracts between an employer and a M+C plan). We present data on M+C individual and employer-based enrollment patterns obtained through a data collection designed to fill in three fundamental pieces of information:

Enrollment by plan within each contract. A contract refers to a managed care organization, which may concurrently offer several distinct benefit packages, or plans.

The number of M+C enrollees enrolled through employer or union group retiree coverage.

The nature of the group benefit packages.

Survey Layout and Implementation

The survey form consisted of three main sections. The first section requested plan-level individual enrollment on October 31, 2001 and January 31, 2002. Many contracts have only one plan that is offered uniformly to its entire service area. Others have several options that may be variants for different counties in the service area or high option packages that are offered alongside standard offerings. Historically, the enrollments reported in the monthly Geographic Service Area Files produced by CMS have been at the contract level and did not capture the distribution of enrollees among the various plans in a contract. However, in June 2002 M+C organizations began reporting plan-level enrollments to CMS. The service area for each of the plans was drawn from the Medicare Compare database maintained by CMS (www.medicare.gov/download/downloaddb.asp).

The second section of the form requested employer-connected, or group, enrollment on the same two dates. CMS has not previously collected group enrollment figures and as such we requested that these data be split by county of residence.

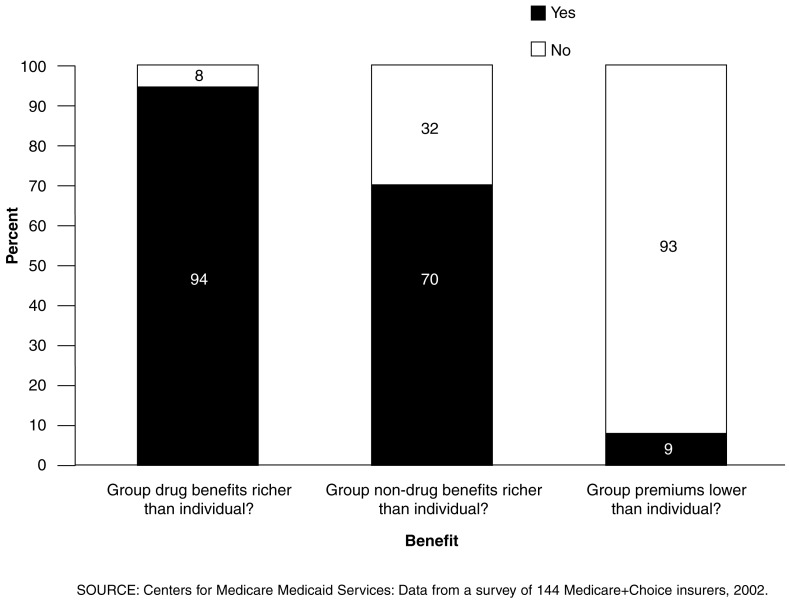

The third section determined a measure of the richness of the benefit packages offered to employer groups relative to those offered to individual enrollees. The following three questions were used for both 2001 and 2002:

Are your member premiums lower for group enrollees than for individual enrollees?

Are your drug benefits richer for group enrollees than for individual enrollees?

Are your non-drug benefits richer for group enrollees than for individual enrollees?

Comparisons in the questions previously mentioned were to be made only among a contract's own benefit packages. We specifically asked about member premiums rather than total premiums in the first question because many employers subsidize enrollee premiums. One of the ultimate objectives of creating this data set is to facilitate analysis of the decision faced by potential M+C enrollees, and we assumed that the employer-subsidized portion would not likely be a factor in this decision.

During the design of the data collection, we were forced to choose a balance between thoroughness and simplicity. We attempted to design a survey that would contain the minimal amount of information needed to adequately answer the questions posed by CMS while also maximizing our response rate. This strategy proved successful as we received complete responses from all, but 3 of the 147 active M+C contracts, yielding responses for 99 percent of the total number of M+C enrollees.

Group Benefit Design

Section III of the data collection elicited a comparison of the benefits and premiums offered to individual enrollees versus those offered through employer groups. Many M+C organizations design customized benefit packages at the request of employers or union groups, primarily to establish continuity between the pre-retirement and post-retirement medical benefits.

Of the 144 contracts that returned completed surveys, 107 reported some employer-group enrollment. Five of the contracts with employer groups did not complete section III of the survey. Generally, they omitted this section because there was wide variation in the design of their group benefit packages, which prohibited a clear answer to the three questions posed.

Plan Level Enrollment Data

A unique aspect of this data set is the collection of plan level enrollment data, rather than at the contract level. Because of this enrollment detail we were able to estimate average payment rates for each of the plans. We did not request breakdowns of this enrollment data by age and sex and therefore, were not able to apply the demographic adjustment factors. However, by computing weighted averages of the M+C payment rates by county level enrollment for each plan we were able to compute a proxy to the actual average payment rate.

Originally, the M+C capitation rate for a given county was equal to 95 percent of the actual fee-for-service (FFS) costs in that county. Since the Balanced Budget Act (BBA) of 1997, the payment rates for M+C have diverged from this formula with the introduction of floors, blended rates, and minimum payment increases. We used the 1999 county-specific FFS costs, released last fall by CMS' Office of the Actuary, to compute the actual FFS costs in the service area of each plan. As 1999 is the most recent year for which these data are available, we trended the values using the retrospective U.S. per capital costs for 1999 and 2002.

An explanation for the seemingly illogical disparity in benefits between the plans at each end of the payment percentage spectrum stems from the geographic areas that these plans service. The plans with payment percentages below 90 percent are generally this low because the BBA restricted payment rates to a 2-percent annual increase. These high cost areas tend to be urban areas where the managed care infrastructure is highly developed and highly competitive. As a result of this competition the benefit packages offered by these plans are comparatively richer. Conversely, the plans with very high payment percentages (as high as 150 percent in some cases) are in areas where the BBA-mandated minimum payment rate is much lower than average FFS costs. This minimum is typically paid in more rural areas where managed care has not been as successful. As a result, premiums are more common and drug coverage is less prevalent in these less competitive atmospheres.

Figure 1. Comparison of Group Versus Individual Benefit Design in Medicare+Choice Contracts: 2002.

- This shows only the responses for 2002. The responses for 2001 were nearly identical, with only one fewer contract reporting richer drug benefits and two fewer reporting richer non-drug benefits in their group offerings.

- While sample sizes are too small to allow meaningful regional analysis, it should be noted that of the 13 contracts with group enrollment in the Pacific division, only 5 offered richer non-drug benefits to their enrollees, well below the national average. However, 12 of the 13 do offer richer drug benefits to their group enrollees.

Table 1. Medicare+Choice (M+C) Penetration Rates and Enrollment for Responding M+C Organization, by Geographic Region: 2001 and 2002.

- Due to their highly competitive M+C environments, the Miami area and southern California have been included as separate regions in addition to the ten Census regions.

- It is important to note that only contracts with plans available in 2002 are included in this study. Thus, any drop in enrollment due to contracts withdrawing from the M+C Program would not be captured by this data collection.

- Among the contracts active in 2002, penetration has remained remarkably constant, with minimal variation in a few of the regions.

- M+C penetration remains the highest in the western regions and is still very strong in the northeast regions.

| Geographic Region | Responding Contracts1 | Medicare Population2 | M+C Penetration Rate | Individual Enrollment | Group Enrollment | |||

|---|---|---|---|---|---|---|---|---|

|

|

|

|

||||||

| 2001 | 2002 | 2001 | 2002 | 2001 | 2002 | |||

|

| ||||||||

| Percent | ||||||||

| All Regions | 144 | 40,983,514 | 18.7 | 18.4 | 4,078,372 | 4,091,239 | 936,906 | 922,315 |

| New England | 10 | 2,192,126 | 19.5 | 17.8 | 244,911 | 265,471 | 59,257 | 57,337 |

| Middle Atlantic | 26 | 6,188,727 | 24.0 | 23.8 | 700,081 | 740,679 | 220,580 | 231,185 |

| South Atlantic | 20 | 7,609,156 | 7.5 | 7.2 | 350,795 | 343,989 | 28,580 | 26,641 |

| East South Central | 8 | 2,685,491 | 8.7 | 8.8 | 97,002 | 86,989 | 9,186 | 8,420 |

| West South Central | 9 | 3,994,019 | 5.8 | 5.1 | 270,016 | 260,841 | 16,502 | 13,943 |

| East North Central | 19 | 6,597,716 | 14.2 | 12.4 | 320,906 | 308,820 | 53,293 | 43,806 |

| West North Central | 11 | 2,954,860 | 15.4 | 15.4 | 176,755 | 179,406 | 32,129 | 32,598 |

| Mountain | 15 | 2,327,610 | 13.4 | 13.0 | 348,678 | 362,085 | 54,018 | 54,252 |

| Pacific | 17 | 3,406,857 | 34.0 | 34.0 | 554,098 | 533,683 | 284,884 | 275,170 |

| Southern California | 8 | 2,201,630 | 21.0 | 21.2 | 662,321 | 653,324 | 176,434 | 175,838 |

| Miami | 11 | 825,322 | 0.6 | 0.9 | 352,809 | 355,952 | 2,043 | 3,125 |

Total does not match the sum of the regions because several contracts active in Miami or Southern California were also active in other parts of their respective regions. Enrollment in these contracts was divided accordingly (South Atlantic is exclusive of Miami and Pacific is exclusive of Southern California).

The number of Medicare beneficiaries is from the December 2001 Market Penetration File. This file is produced quarterly by the Centers for Medicare & Medicaid Services.

SOURCE: Centers for Medicare & Medicaid Services: Data from a survey of 144 M+C insurers; number of Medicare beneficiaries is from the Market Penetration File, December 2001.

Table 2. Prevalence of Group Enrollment in Medicare+Choice (M+C) Contracts, by Geographic Region: 2001 and 2002.

- Prior to this data collection, CMS has not collected any information on group enrollment. Enrollment data has been collected at the contract level, but plan-level enrollment data has not been previously available.

- Seventy-three percent of the active M+C contracts have some group enrollment.

- The level of group enrollment varies considerably among these insurers, ranging from less than 1 percent to more than 90 percent.

- In M+C plans that offer some group coverage, 20.4 percent of enrollees are enrolled through employer groups, compared with 20.6 percent in October 2001.

- The average group penetration represents an unweighted average of the levels of group penetration in each region per contract. Group penetration remained constant from 2001 to 2002.

| Geographic Region | Insurers with Group Enrollment | Level of Group Enrollment1 | Average Group Penetration Per Contract1 | ||

|---|---|---|---|---|---|

|

|

|

||||

| 2001 | 2002 | 2001 | 2002 | ||

|

| |||||

| Percent | |||||

| All Regions | 73.4 | 20.6 | 20.4 | 18.0 | 17.0 |

| New England | 100.0 | 19.5 | 17.8 | 24.9 | 19.8 |

| Middle Atlantic | 80.8 | 24.6 | 24.5 | 20.8 | 20.3 |

| South Atlantic2 | 55.0 | 9.7 | 9.4 | 17.8 | 17.0 |

| East South Central | 87.5 | 8.7 | 8.9 | 9.1 | 9.2 |

| West South Central | 66.7 | 6.3 | 5.9 | 7.5 | 6.0 |

| East North Central | 78.9 | 14.9 | 13.1 | 20.5 | 18.7 |

| West North Central | 81.8 | 15.5 | 15.5 | 15.4 | 15.3 |

| Mountain | 73.3 | 14.3 | 14.1 | 11.5 | 11.0 |

| Pacific3 | 88.2 | 34.1 | 34.2 | 24.0 | 23.8 |

| Southern California | 62.5 | 24.7 | 24.3 | 22.9 | 20.4 |

| Miami | 27.3 | 1.0 | 1.7 | 0.9 | 3.4 |

These calculations include only those contracts that offer group plans.

South Atlantic is exclusive of Miami.

Pacific is exclusive of southern California.

SOURCE: Centers for Medicare & Medicaid Services (CMS): Data from a survey of 144 Medicare+Choice insurers, 2002.

Table 3. Group Enrollment in Medicare+Choice (M+C) Contract, by Level of Total Enrollment: 2001 and 2002.

- Smaller contracts are less likely to have groups, but those that do have group enrollment are likely to be more dependent on those groups.

- Only three of the six M+C organizations with less than 1,000 enrollees offer group coverage, but group enrollment for these plans represents 38 percent of total enrollment.

- In contrast, all of the eight M+C organizations with more than 100,000 enrollees offer group coverage. For these plans, group enrollment represents only 25.8 percent of total enrollment.

| Total 2002 Enrollment | Number of Insurers with Group Enrollment | Insurers with Group Enrollment | Level of Group Enrollment1 | Average Group Penetration Per Contract1 | ||

|---|---|---|---|---|---|---|

|

|

|

|||||

| 2001 | 2002 | 2001 | 2002 | |||

|

| ||||||

| Percent | ||||||

| All Contracts | 108 | 75.0 | 16.7 | 16.4 | 17.8 | 16.7 |

| Less than 1,000 | 3 | 50.0 | 63.1 | 38.0 | 33.3 | 29.4 |

| 1,000 to 5,000 | 11 | 50.0 | 17.5 | 20.1 | 23.3 | 21.6 |

| 5,001 to 25,000 | 45 | 73.8 | 14.6 | 14.8 | 12.9 | 12.6 |

| 25,001 to 100,000 | 41 | 87.2 | 17.4 | 16.8 | 19.2 | 17.7 |

| More than 100,000 | 8 | 100.0 | 25.6 | 25.8 | 24.1 | 23.3 |

These calculations include only those contracts that offer group plans.

SOURCE: Centers for Medicare & Medicaid Services: Data from a survey of 144 Medicare+Choice insurers, 2002.

Table 4. Percentage Change in Medicare+Choice (M+C) Enrollment, by Geographic Region: 2001 and 2002.

- Total enrollment in M+C plans has dropped by 10 percent from September 2001 to January 2002. This drop in enrollment reflects both non-renewals and service area reductions. Among surviving plans, the plans included in the survey, enrollment has remained stable.

- Total enrollment over this period has been nearly constant, with an increase of 0.3 percent in individual enrollment and a decrease of 1.6 percent in group enrollment.

- The Pacific and Central divisions have seen large decreases in both individual and group enrollment.

- In contrast, the mountain and northeast divisions have shown sizable enrollment gains.

- While the aggregate enrollment is relatively constant, the plan-level enrollment has varied considerably. This would seem to indicate that the smaller plans are gaining enrollment more quickly than the larger plans, and that a more competitive M+C environment could be developing.

- In the West South Central there are nine active M+C contracts in 2002. Total individual enrollment decreased by 3.4 percent in this region, driven primarily by a 15-percent drop by the largest contract. Of the eight smaller contracts, six had increases in individual enrollment.

| Geographic Region | Change in Gross Enrollment | Average Plan Enrollment Change | ||||

|---|---|---|---|---|---|---|

|

|

|

|||||

| Individual | Group | Total | Individual | Group | Total | |

|

| ||||||

| Percent | ||||||

| All Regions | 0.3 | -1.6 | 0.0 | 17.5 | -3.2 | 14.2 |

| New England | 8.4 | -3.2 | 6.1 | 54.2 | -5.0 | 22.4 |

| Middle Atlantic | 5.8 | 4.8 | 5.6 | 13.3 | -3.0 | 12.1 |

| South Atlantic1 | -1.9 | -6.8 | -2.3 | 35.1 | -20.3 | 33.2 |

| East South Central | -10.3 | -8.3 | -10.2 | -12.7 | 67.8 | -12.6 |

| West South Central | -3.4 | -15.5 | -4.1 | 73.2 | -35.5 | 72.6 |

| East North Central | -3.8 | -17.8 | -5.8 | -1.7 | -7.4 | -5.5 |

| West North Central | 1.5 | 1.5 | 1.5 | 7.3 | 3.8 | 7.2 |

| Mountain | 3.8 | 0.4 | 3.4 | 10.1 | -4.0 | 9.6 |

| Pacific2 | -3.7 | -3.4 | -3.6 | -6.8 | -5.9 | -7.3 |

| Southern California | -1.4 | -0.3 | -1.1 | 10.0 | -2.0 | 7.2 |

| Miami | 0.9 | 53.0 | 1.2 | 34.7 | -33.6 | 35.0 |

South Atlantic is exclusive of Miami.

Pacific is exclusive of southern California.

SOURCE: Centers for Medicare & Medicaid Services: Data from a survey of 144 Medicare+Choice insurers, 2002.

Table 5. Relationship of Payment Rates to Actual Fee-for-Service (FFS) Costs in the Medicare+Choice (M+C) Program: 2001 and 2002.

- Despite the general drop in payment rates due to the 1997 BBA, nearly one-third of the plans still have average payment rates exceeding 95 percent.

- Enrollment does not include group enrollment because specifics concerning the benefit packages for these plans are not known.

- From 2001 to 2002 the largest increase in enrollment came from the plans with the lowest relative payment rate. For the 87 plans that appear to be paid less than 85 percent of the FFS costs in their area, there was a 12.3-percent increase in enrollment.

- There was also moderate enrollment growth among the 52 plans with a payment percent exceeding 105 percent, at 4.1 percent.

- In the four categories where the payment rate is below 100 percent, more than 70 percent of the plans offer drug coverage. In contrast, of the plans whose payment rate is more than 105 percent, only one-half offer drug coverage.

- The same trend is evident with a monthly premium in excess of the Part B premium that is collected by all M+C plans, where the two categories most likely to not charge premium both have payment rates below 90 percent.

| Payment Percentage | Average Payment Rate in Interval | Number of Plans | Enrollment | Change in Enrollment | Drug Coverage | $0 Premium | |

|---|---|---|---|---|---|---|---|

|

| |||||||

| 2001 | 2002 | ||||||

|

| |||||||

| Percent | |||||||

| Total | $600.77 | 385 | 3,849,769 | 3,972,234 | 3.2 | 69.9 | 35.1 |

| Less than 85 | 629.35 | 87 | 988,581 | 1,110,491 | 12.3 | 74.7 | 41.4 |

| 85 to 90 | 668.65 | 95 | 1,051,786 | 1,062,114 | 1.0 | 74.7 | 47.4 |

| 91 to 95 | 573.00 | 50 | 541,410 | 510,926 | -5.6 | 82.0 | 18.0 |

| 96 to 100 | 565.88 | 55 | 525,058 | 528,187 | 0.6 | 70.9 | 38.2 |

| 101 to 105 | 552.92 | 46 | 401,690 | 405,309 | 0.9 | 58.7 | 30.4 |

| More than 105 | 534.84 | 52 | 341,244 | 355,207 | 4.1 | 50.0 | 19.2 |

SOURCE: Centers for Medicare & Medicaid Services: Data from a survey of 144 Medicare+Choice insurers; payment rates calculated from Medicare+Choice county payment rates, 2002.

Footnotes

The authors are with Actuarial Research Corporation. The research in this article was funding by HCFA under Contract Number 500-00-0016. The views expressed in this article are those of the authors and do not necessarily reflect the views of Actuarial Research Corporation or the Centers for Medicare & Medicaid Services (CMS).

Reprint Requests: Geoffrey Hileman, Actuarial Research Corporation, 5513 Twin Knolls Road, Suite 213, Columbia, MD 21045. E-mail: grh@aresearch.com