Abstract

As preferred provider organizations (PPOs) become the dominant model of managed health care in the private sector, policymakers have increasingly viewed PPOs as an attractive option for Medicare. In part to understand how PPOs might operate under the Medicare Program, CMS launched the Medicare PPO demonstration in January 2003. In this article, we examine how PPOs have operated so far under the demonstration, including PPO availability and market entry; premiums, benefits, and beneficiary cost sharing; and enrollment, market share, enrollee characteristics, and disenrollment to date.

Introduction

As PPOs become the dominant model of managed health care in the private sector, policymakers have increasingly viewed PPOs as an attractive option for Medicare. As part of a larger effort to modernize Medicare by adopting strategies widely used in the private sector, the 2003 Medicare Prescription Drug, Improvement, and Modernization Act (MMA) introduces regional PPOs as a key component of the next generation of Medicare managed care: Medicare Advantage. Interest in PPOs for Medicare is not an entirely new concept. One goal of the Balanced Budget Act (BBA) of 1997 in establishing the Medicare+Choice (M+C) program was to expand the options and penetration of Medicare managed care, but thus far these policy goals largely have not been realized. An expanded PPO program, including both local PPOs and the MMA's regional PPOs, may be one step in accomplishing these goals of expanded choice and enrollment in Medicare Advantage.

Some policymakers favor PPOs because they offer a model of managed care that is closer to traditional fee-for-service (FFS) than the health maintenance organization (HMO) options previously available to beneficiaries. PPOs are created by contractual arrangements between a financial insurer and a network of health care providers. Unlike the traditional HMO model, PPOs offer enrollees coverage resembling indemnity insurance, using financial incentives rather than strict provider access restrictions, to channel care to network providers. Like FFS, under PPOs individuals generally have access to a wide range of providers without gatekeepers and prior approvals, including the option to use out-of-network providers. PPOs may appeal to more Medicare beneficiaries enrolled in FFS who are adverse to managed care restrictions on provider choice.

But because PPOs, like HMOs, have a provider network, PPOs have greater potential for cost control than FFS. PPOs give enrollees incentives through lower in-network cost sharing to use network providers, who are paid discounted rates and are chosen in part for their efficiency. Established PPOs may also use other managed care techniques such as physician profiling, financial and non-financial incentives, and quality monitoring programs to maintain efficient and high quality care.

Despite the nationwide application of the PPO model for Medicare managed care under the MMA legislation, to date, the Medicare Program and its beneficiaries have had limited experience with the PPO model.1 In part to understand how PPOs might operate under the Medicare Program, CMS launched the Medicare PPO demonstration, which began providing services to Medicare beneficiaries on January 1, 2003. Demonstration PPOs are local PPOs that may be offered in areas as small as a single county. The MMA further expands the PPO option under Medicare with regional PPOs, that must be offered with uniform premiums and benefits throughout at least 1 of 26 statewide or multistate areas. Regional PPOs may extend Medicare managed care options in markets where few plans currently operate. But despite these policy goals for Medicare PPOs—to offer an attractive managed care product in expanded markets—there is uncertainty how the PPO model, dominant in the commercial insurance sector, will be adapted under Medicare.

In this article, we provide insight on how Medicare PPOs operate by examining their performance so far under the local PPO demonstration. We look at:

Market Entry—Where are Medicare PPOs currently offered?

Beneficiary Benefits and Costs—What are Medicare PPO premiums, benefits, and cost sharing?

Enrollment—What are Medicare PPO enrollments to date? What are the characteristics of Medicare beneficiaries who enroll in PPOs?

Data and Methods

This article was generated from several sources of data. The Medicare Health Plan Management System (HPMS) maintained by CMS collects service area, premium, benefit, cost sharing, physician network size, and other information for most Medicare health plans2. The HPMS contains predicted beneficiary out-of-pocket costs for each plan that have been simulated by CMS and its contractor Fu Associates (2004). We analyze data from the April 2004 HPMS, which reflects March 2004 health plan benefit and premium changes resulting from increased payments to plans mandated by the MMA.3

Medicare's enrollment database records monthly health plan enrollment status and various demographic characteristics for all Medicare beneficiaries. We profile a point-in-time March 28, 2004, enrollment database sample of all Medicare beneficiaries residing in the combined PPO demonstration service areas. As contrasted with an ever enrolled sample, our currently enrolled sample excludes deaths and disenrollees. We obtained and analyzed risk scores measuring beneficiary health status that were generated using CMS' hierarchical condition categories (CMS-HCC) risk-adjustment model (Pope et al., 2004a).

Throughout this article, we use the Medicare-defined class of coordinated care plans (CCPs) as a comparison for PPOs. CCPs, almost all of which are HMOs, are plans that have a network of providers, and may be thought of as managed care plans. The term competing CCPs applies to CCPs whose service area overlaps the service area of at least one PPO plan. We compare 232 competing CCPs to the 61 PPO demonstration plans.4

In addition to our secondary data analysis, we conducted site visit interviews in spring 2003 with representatives of the insurers sponsoring the demonstration PPOs (Greenwald et al., 2004). At several points throughout the article, we draw on these discussions to help interpret our empirical findings.

Results

Availability of Demonstration PPOs

One key question for policymakers is whether or not the PPO model is more likely to be offered by managed care organizations in a wider range of markets—including rural counties—than the more traditional HMO model. In theory, ability to access out-of-network providers and coordinate Medicare PPOs with similar widespread commercial products could make this model more feasible for plans to offer. The PPO demonstration plans we analyzed were implemented in a short timeframe, which meant they were largely limited to existing M+C contractors and areas where these plans had Medicare or commercial provider networks. Therefore, generalizability to other situations, such as Medicare Advantage regional PPOs, could be limited. Nevertheless, the service areas of demonstration PPOs, especially as compared to Medicare CCPs, gives some indication of where plan sponsors felt the PPO model would be most successful. Moreover, to reduce plan risk and promote entry, the PPO demonstration includes Medicare risk sharing outside of corridors around a plan's medical loss ratio, similar to the risk corridors specified by the MMA for the early years of regional PPO operation.

Demonstration PPOs are widely, but unevenly, available. Even given the short timeframe available for implementation, demonstration PPOs were offered in a wide range of markets. However, most (but not all) of these markets had existing Medicare managed care presence. The demonstration includes 17 parent companies operating 35 PPO contracts and 61 PPO plans. PPO service areas are located in 21 States in all 4 census regions. PPO contracts are concentrated in the Mid-Atlantic, Midwest, and Southeast States (29 of 35 contracts). Notably, no demonstration contracts are operating in California, the largest Medicare managed care market.5

The PPO demonstration provides no evidence that PPOs are more likely than other plan types to expand Medicare managed care options in rural areas. Figure 1 compares the distribution by urbanicity of counties where PPOs and CCPs are available. A higher proportion of PPO service area counties are in large metropolitan areas (51 versus 39 percent), and a lower proportion are rural (4 versus 15 percent). (Large metropolitan is metropolitan statistical areas with more than 1 million population, other metropolitan is other metropolitan statistical areas, micropolitan is micropolitan statistical areas, and rural is non-metropolitan, non-micropolitan.) That is, demonstration PPOs are relatively more likely than existing CCPs to locate in large metropolitan areas and less likely to locate in rural areas. The short timeframe for demonstration implementation may have limited PPO entry into rural counties, which largely lack existing networks. However, plans told us that the inability to negotiate favorable payment discounts with monopoly rural providers and the same Medicare network adequacy requirements in rural as urban areas are major factors hindering PPO (and CCP) entry into rural areas (Greenwald et al., 2004). Recognizing these difficulties, the MMA includes a network adequacy fund to aid regional PPO network formation in rural areas.

Figure 1. Distribution of Preferred Provider Organization (PPO) and Coordinated Care Plan (CCP) Counties, by Urbanicity: 2004.

Although PPOs have located mostly where other CCPs are offered, they have increased the choice of such plans for Medicare beneficiaries. In 21 of the 222 PPO service area counties (10 percent), PPOs are the only coordinated care option. In 72 counties (32 percent), PPOs increase beneficiaries' choice of coordinated care contracts from one to two and in 66 counties (30 percent) from two to three. Hence, in over two-thirds of their service area counties, PPOs are adding a choice to zero, one, or two other established coordinated care contracts. Although PPOs have not significantly extended managed care options to areas where they would otherwise be unavailable, they have added a managed care option to a small number of other managed care options in the majority of their service area counties.

Higher demonstration county payment rates did not increase demonstration PPO availability. As part of the PPO demonstration, in 2003, CMS offered to pay demonstration plans the higher of the regular M+C capitated county rate or 99 percent of Medicare FFS per capita expenditures. If this incentive was effective in inducing plan entry, one would expect to see greater entry in counties where the demonstration payment rate was higher than the usual M+C rate. But we found that the availability of PPOs was almost the same in counties where demonstration payment was higher than the regular M+C amount as in counties where it was not—at least one PPO is offered in about 7 percent of both types of counties. The rate of PPO entry was much higher in urban (metropolitan) counties, but was roughly the same in counties with and without the higher demonstration payment rate in both urban and rural areas.6 It may be that the extra payments were simply too small to be effective or they were viewed as transitory by plans. The MMA subsequently raised payments in 2004 for all Medicare Advantage (MA) plans to at least 100 percent of FFS per capita costs, eliminating the demonstration payment differential. Our results do not provide a basis for believing that the MMA's stabilization fund7 will be particularly successful in inducing regional PPO entry, but the particulars of that entry incentive are quite different.

PPO Premiums, Benefits, and Beneficiary Cost Sharing

Whether PPOs are a particularly attractive option for Medicare beneficiaries will depend on their benefits and costs, relative to other Medicare options. We analyzed Medicare PPO benefits and beneficiary costs relative to other Medicare managed care offerings in the same markets.

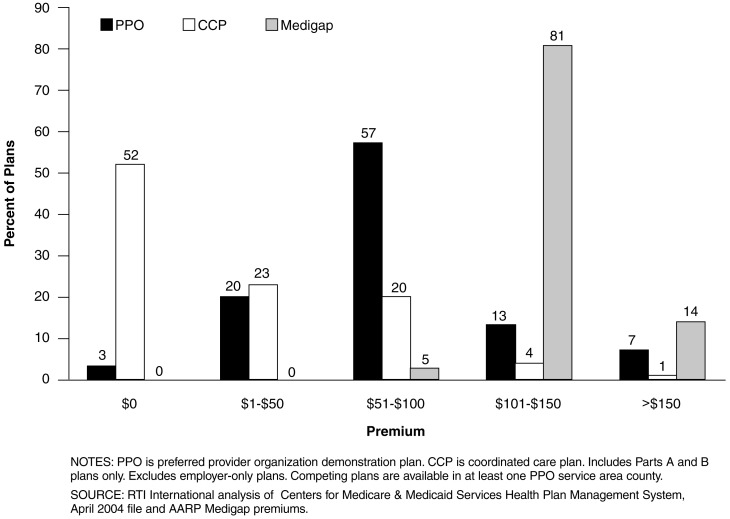

PPO monthly premiums are generally higher than competing CCP options, but lower than the most popular Medigap plan. Based on interviews with the insurers sponsoring PPOs, most indicated that they perceived the relative attractiveness of little or no monthly premium as a key factor in attracting Medicare enrollees (Greenwald et al., 2004). Figure 2 depicts the distribution of monthly premiums for PPO plans and competing CCP and Medigap F plans (excluding the Medicare Part B premium).8 PPO premiums range from $0 to $227, but over one-half are between $51 and $100. On average, PPOs charge more than twice as much as competing CCPs, $76 versus $29. About one-half of the 232 competing CCPs have no monthly premium, whereas all but 2 of the 61 PPO plans charge a monthly premium. PPOs charge about $50 less than Medigap F plans, which usually costs between $101 and $150 per month. In sum, PPOs are a midrange product, costing more than HMOs because of PPOs' out-of-network coverage, but less than Medigap.

Figure 2. PPO and Competing CCP and Medigap Plan F Monthly Premiums.

Drug coverage continues to be an important benefit to Medicare beneficiaries, and with the implementation of the Medicare Part D benefit, will become a feature of all MA plans. We were interested in finding out how drug benefits in PPOs and competing plans compare. Most PPO contracts (91 percent) offer a plan with an outpatient prescription drug benefit (Table 1). PPOs are more likely than competing CCPs to offer a drug benefit (91 versus 79 percent). However, when offered, the PPO drug benefit is less generous on average than that of competing CCPs. Only 42 percent of PPO drug benefit plans cover brand drugs, compared with 53 percent of CCP benefit plans. Only 20 percent of PPO drug benefit plans offer unlimited generics, compared with 31 percent of CCP plans, and when there is a maximum benefit, it is typically $500 in PPO plans compared with $800 in CCPs. PPOs told us it was important to have a drug benefit to attract enrollment (Greenwald et al., 2004), but may have limited it to keep their premiums down or fund their out-of-network benefit. The MMA requires all Medicare managed care contracts to offer at least one plan with a drug benefit beginning in 2006.

Table 1. Prescription Drug Benefits of Preferred Provider Organizations (PPOs) and Competing Coordinated Care Plans (CCPs)1.

| Coverage | PPO | CCP |

|---|---|---|

| Percent | ||

| Contracts with Drug Benefit | 91 | 79 |

| Plans with Drug Benefit | 82 | 70 |

| Plans with a Drug Benefit | ||

| Generic Coverage Only | 58 | 47 |

| Unlimited | 20 | 31 |

| Maximum Benefit | 38 | 16 |

| Median Annualized Maximum | $500 | $800 |

| Percent | ||

| Brand Drug Coverage | 42 | 53 |

| Unlimited | 6 | 6 |

| Brand Benefit Maximum, Unlimited Generics | 22 | 29 |

| Median Annualized Maximum | $600 | $900 |

| Percent | ||

| Brand and Generic Combination Maximum | 14 | 19 |

| Median Annualized Maximum | $1,000 | $1,000 |

Includes Parts A and B plans only. Employer-only plans are excluded. PPO is PPO demonstration plans. Competing CCP plans are defined by those offered in at least one PPO service area county.

SOURCE: RTI International analysis of Centers for Medicare & Medicaid Services Health Plan Management System, April 2004 file.

Out-of-network benefits are the major distinction between PPOs and HMOs. We wondered whether the out-of-network benefit—which raises the costs of offering PPOs—was offset by more limited benefits for other services. We found that all demonstration plans cover a core set of services out of network, including acute hospitalizations, outpatient hospital services, and primary care and specialist physicians. Other standard Medicare benefits—such as skilled nursing facility stays, home health visits, and durable medical equipment—are covered by most, but not all, demonstration plans out of network. In-network, a lower proportion of PPOs than competing CCPs provide supplemental benefits including vision, hearing, and dental benefits. The U.S. Government Accountability Office (GAO) has noted that according to demonstration PPOs' contracts, they should be required to provide all covered benefits out of network (U.S. Government Accountability Office, 2004). CMS agreed with GAO's recommendation and is working with demonstration plans to make all covered benefits available out of network. The MMA requires this.

PPOs provide less restrictive access to network physician specialists than CCPs—another key difference. This feature may be attractive to Medicare beneficiaries who value ability to gain access to specific physicians, including specialists. Seventy-two percent of competing CCPs require referrals for a specialist visit compared to only 10 percent of demonstration PPOs. But PPOs do not provide enrollees with access to a larger network of physicians. The distribution of PPO network sizes is similar to that of competing CCPs, with the median network size slightly smaller for PPOs: 1,001 to 1,500 physicians versus 1,501 to 2,000 physicians for competing CCPs. PPO and CCP network sizes may be similar because many organizations offering demonstration PPOs used the established networks of their HMO plans to create their PPO networks. Also, as PPO enrollment increases, network size may rise.

Although a higher percentage of PPOs than competing CCPs have global in-network out-of-pocket maximums, most PPOs do not have global out-of-pocket maximums. Out-of-pocket maximums can play an important role in limiting total enrollee financial risk and the out-of-pocket costs of sicker enrollees. In our analysis, we looked at both in-network and out-of-network out-of-pocket maximums for PPOs and competing CCPs. Thirty-nine percent of PPO plans have in-network out-of-pocket maximums while only 23 percent have out-of-network out-of-pocket maximums. Among PPOs that have a maximum, the in-network out-of-pocket maximum is typically about $1,800. The out-of-network out-of-pocket maximum is typically about $3,250, when it exists. A smaller percentage of competing CCPs than PPOs offer an in-network out-of-pocket maximum (30 versus 39 percent), and it is typically somewhat greater when it exists ($2,560 versus $1,800). MMA requires the new regional PPOs to have out-of-pocket maximums for in-network and for total expenditures. Some PPOs are concerned that adding catastrophic coverage (an out-of-pocket maximum) may result in adverse selection, attracting beneficiaries with high expected medical expenses (Greenwald et al., 2004).

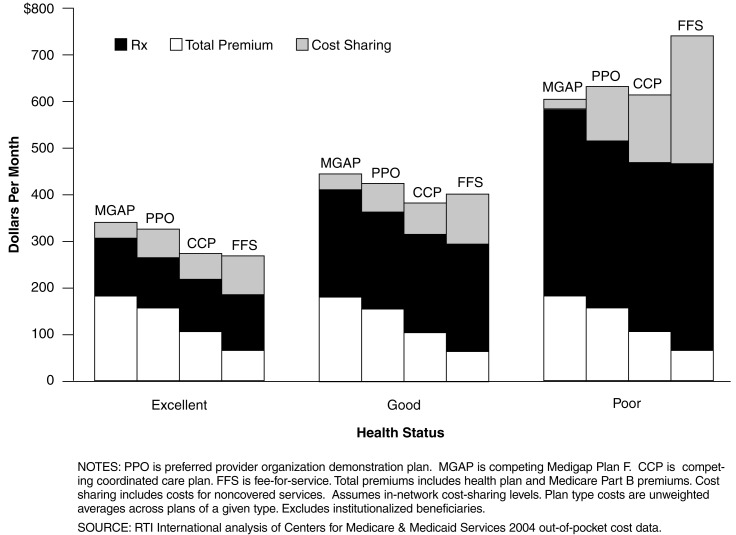

Enrollees in demonstration PPOs have higher predicted total out-of-pocket costs than enrollees in competing CCPs at all health status levels, but the difference narrows as health declines. PPOs (and CCPs) provide better protection from financial risk as health declines than FFS Medicare, but less protection than FFS supplemented with the most popular Medigap plan. Table 2 reports typical (median) cost sharing for selected services for PPOs (in network and out of network), competing CCPs, and original Medicare FFS. Figure 3 shows the implications of these cost-sharing rules for total beneficiary out-of-pocket expenses. In addition to cost sharing (which includes expenses for uncovered services), the total out-of-pocket costs shown in Figure 3 include premiums (Part B and health plan) and prescription drug expenses (assuming no drug coverage beyond what is offered by the health plan). For all types of plans, in-network cost-sharing levels are assumed to determine total out-of-pocket costs. In our analysis, we summarized total out-of-pocket costs by plan type for enrollees in excellent, good, and poor health, age 70–74.9 Plan types are demonstration PPOs, competing CCPs, original Medicare FFS, and original Medicare plus competing Medigap Plan F. Plan type costs are unweighted averages across plans of a given type; for example, an average of the 61 PPO demonstration plans.

Table 2. Cost Sharing in PPOs, Competing Coordinated Care Plans (CCPs), and Medicare Fee-for-Service (FFS)1 Typical (Median) Copayment (Dollar Amount), Coinsurance (Percent), or Deductible (Dollar Amount) for Selected Services: 2004.

| Service | PPO | CCP | FFS | |

|---|---|---|---|---|

|

| ||||

| In-Network | Out-of-Network | |||

| Primary Care Physician Visit | ||||

| Copayment | $10 | Rare | $10 | — |

| Coinsurance (Percent) | — | 20 | — | 20 |

| Specialist Physician Visit | ||||

| Copayment | $20 | Rare | $20 | — |

| Coinsurance (Percent) | — | 20 | — | 20 |

| Hospital Inpatient Stay | ||||

| Copayment Per Day2 | $100 | Rare | $175 | — |

| Copayment Per Stay3 | $250 | $750 | $250 | $876 |

| Coinsurance (Percent) | Rare | 20 | Rare | — |

| No Cost Sharing (Percent of Plans) | 13 | 0 | 19 | — |

| Hospital Outpatient | ||||

| Copayment Per Visit4 | $50 | Rare | $50–100 | — |

| Coinsurance (Percent) | 10 | 20 | 20 | 20 |

| No Cost Sharing (Percent of Plans) | 33 | 0 | 29 | — |

| Global Deductible | Rare | $250 | Rare | $110 (Part B) |

| Prescription Drugs5 | ||||

| Generic-Only Drug Tiers | $10 | — | $10 | — |

| Some or All Brand Drug Tiers | $37.50 | — | $30 | — |

Includes Parts A and B plans only. Employer-only plans are excluded. PPO is PPO demonstration plans. Competing CCP plans are defined by those offered in at least one PPO service area county. FFS is original Medicare fee-for-service.

Copayments per day are often limited to the first days of a stay, for example, the first 5 days. Copayments may vary for different days of a stay.

For FFS, this refers to initial deductible per benefit period. Beyond day 60, additional cost sharing applies.

Copayments vary across outpatient services. For CCPs, the median minimum copayment is $50 and the median maximum copayment is $100.

Thirty-day supply at designated retail pharmacy.

NOTE: PPO is preferred provider organization.

SOURCE: RTI International analysis of Centers for Medicare & Medicaid Services Health Plan Management System, April 2004 file.

Figure 3. Predicted Out-of-Pocket Cost, by Plan Type for Beneficiaries Age 70-74.

As shown in Figure 3, a beneficiary can expect to have higher out-of-pocket costs in a PPO than in a competing CCP at each health status level, due to the higher PPO premium. This is true even if no out-of-network providers are patronized. But the difference between PPOs and CCPs narrows as health worsens because of lower PPO cost sharing for inpatient services. PPOs, of course, offer an out-of-network benefit that CCPs lack, which is a reason for the higher PPO premium.

PPOs (and CCPs) occupy an intermediate position between FFS and Medigap in terms of out-of-pocket costs and risk protection. PPOs are less expensive than Medigap F plans for beneficiaries in excellent and good health status, but more expensive for beneficiaries in poor health status. PPO premiums and drug costs are lower than Medigap's at each health status level, but cost sharing is higher and grows more rapidly, even if only in-network providers are used. On the other hand, PPOs are more expensive than FFS for excellent and good health statuses, but less expensive for poor health status. PPO premiums are always higher, but drug costs and cost sharing are lower and grow less rapidly as health and utilization worsens, gradually offsetting higher PPO premiums. PPOs expose enrollees to more financial risk than Medigap F plans (a difference in total out-of-pocket costs between excellent and poor health statuses of $310 versus $265 for Medigap), but less than FFS ($310 versus $472).

PPO Demonstration Enrollment

The key to the future of PPOs under Medicare is how beneficiaries respond to this option: will they be more attracted to PPOs (with their greater provider choice) than they have been, historically, to other CCPs? Insufficient enrollment in Medicare PPOs would likely discourage plans from offering this option on a wider, regional basis under the MMA. We found in general that enrollment in the demonstration PPOs has been modest, but is steadily increasing.

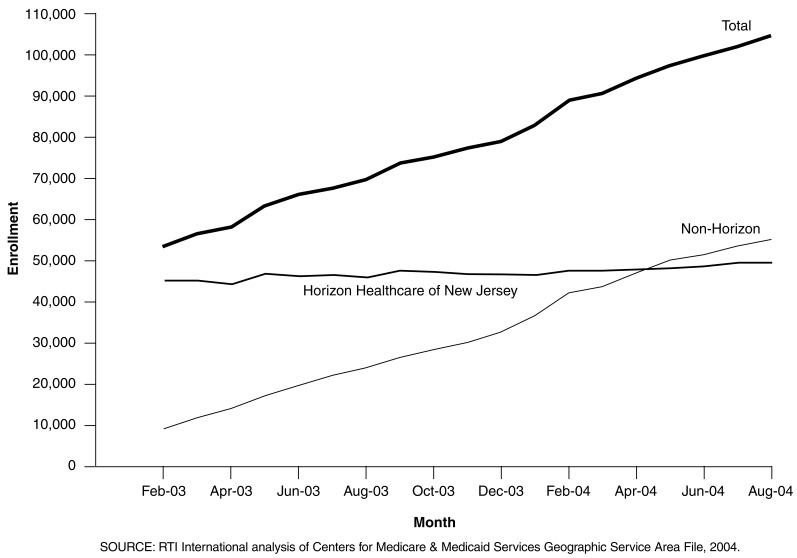

Figure 4 depicts enrollment in the PPO demonstration from its inception in January 2003 through August 2004.10 Beginning enrollment in the demonstration was about 53,000, most of which was due to the Horizon Healthcare of New Jersey contract (about 45,000 of the 53,000). Almost all of the initial Horizon enrollees transferred from a 2002 Horizon HMO product that was discontinued effective contract year 2003. For this reason, initial Horizon demonstration enrollment is more of a continuation of the earlier HMO enrollment than new enrollment attracted to a PPO product.11

Figure 4. Enrollment in the Preferred Provider Organization Demonstration: 2003-2004.

The other 30 demonstration contracts effective January 1, 2003, accounted for fewer than 9,000 enrollees initially, an average of less than 300 per contract. Enrollment in the Horizon contract grew only slightly through the first 20 months of the demonstration. Enrollment in the non-Horizon contracts grew more rapidly, in total surpassing Horizon by summer 2004. By that time, there were 34 non-Horizon demonstration contracts—two new contracts became effective September 1, 2003, and an additional two new contracts were effective January 1, 2004. By August 2004, total demonstration enrollment was nearly 105,000, with slightly more enrollees in non-Horizon than Horizon contracts. The growth in non-Horizon enrollment has been steady at about the same rate throughout the demonstration, with the exception of a noticeable upward tick in early 2004 associated with the annual open enrollment period. Lower premiums and/or enhanced benefits resulting from higher MMA-required Medicare payments to Medicare health plans—which took effect in April 2004—did not result in a noticeably higher rate of demonstration enrollment growth. As of August 2004, average enrollment per PPO demonstration contract, excluding Horizon, was 1,627 beneficiaries. Nearly one-half (15 of 34) of the demonstration contracts had small enrollments of fewer than 500 beneficiaries.

As of March 2004, demonstration PPOs' share of all beneficiaries in their combined service areas was 1 percent, and their share of total Medicare health plan enrollment was 5 percent. Since enrollment in demonstration PPOs continues to increase, and the MMA's regional PPOs will broaden PPOs' availability, the long-run potential for PPO enrollment is unclear. However, based on the demonstration experience, it seems unlikely that regional PPOs will initially capture a large share of the market.

Forty-two percent of PPO enrollees were previously enrolled in FFS Medicare, 43 percent in another Medicare health plan, and 15 percent were recent enrollees in the Medicare Program. These proportions are similar to competing CCPs. Aside from tracking overall enrollment trends, we were interested in learning whether Medicare PPO enrollees came from FFS—suggesting that PPOs may in fact be a more attractive managed care option to beneficiaries historically wary of leaving FFS. Or, were PPO enrollees primarily switchers from other CCPs? Table 3 presents the prior enrollment status of March 2004 enrollees in PPOs and recent enrollees in competing CCPs in demonstration service areas. Enrollees in the Horizon PPO demonstration who were previously enrolled in the Horizon HMO are excluded from these data. There was some expectation that PPOs would be more attractive to FFS beneficiaries than other CCPs (mostly HMOs) because of PPOs' greater freedom of provider choice. But PPOs drew about the same proportion of their enrollees from FFS as CCPs. Also, compared with CCPs, PPOs drew a somewhat lower proportion of their enrollees from recent Medicare enrollees (beneficiaries new to the Medicare Program during the demonstration period), which is not consistent with the hypothesis that PPOs are especially attractive to Medicare “age ins”—those joining the program when they become eligible at age 65.

Table 3. Prior Enrollment Status of PPO and Recent CCP Enrollees1,2.

| Prior Enrollment | Current Enrollment | |

|---|---|---|

|

| ||

| PPO | CCP | |

|

| ||

| Percent | ||

| Recent Medicare Enrollee3 | 14.8 | 23.2 |

| Fee-for-Service Medicare | 41.9 | 39.6 |

| Medicare Health Plan | 43.4 | 37.3 |

| Unaffiliated4 | 27.8 | — |

| Affiliated5 | 15.5 | — |

Includes beneficiaries with Parts A and B coverage as of March 2004, residing in the open enrollment service area counties of any PPO demonstration contract.

Includes beneficiaries who enrolled in their current plan January 1, 2003 or after. Excludes Horizon PPO demonstration enrollees previously enrolled in the Horizon Health Care of New Jersey health maintenance organization.

Beneficiaries who newly enrolled in the Medicare Program January 2003 or after.

Prior plan has a different parent company than the current plan.

Prior plan has the same parent company as the current plan.

NOTES: PPO is preferred provider organization. CCP is coordinated care plan.

SOURCE: RTI analysis of the Centers for Medicare & Medicaid Services Medicare Enrollment Database: March 28, 2004.

Among PPO enrollees previously in Medicare health plans, about two-thirds (64 percent) were previously enrolled in unaffiliated plans and about one-third (36 percent) were previously enrolled in affiliated plans. An affiliated plan is a plan (typically an HMO) offered in the same market area by the same parent company that is sponsoring the demonstration PPO, for example, a United Healthcare Medicare HMO offered in the same service area as the United demonstration PPO. Thus, the demonstration PPOs are not simply siphoning affiliated HMO enrollment—only about 15 percent of total PPO enrollment came from this source.12

The demographic and health status characteristics of PPO enrollees are similar to those of recent enrollees in competing CCPs, except that PPOs enroll fewer Black persons and other minorities and fewer Medicaid recipients. Like other CCPs, PPOs are experiencing favorable selection relative to Medicare FFS. Because of the out-of-network benefits and ready access to specialists, one potential policy concern is that PPOs may attract sicker beneficiaries. Were this adverse selection to occur among PPOs, risk-adjusted payments might only partially account for this bias, making PPOs difficult to maintain financially. We found, however, that the characteristics of PPO and CCP enrollees were similar. Table 4 presents demographic and health status characteristics of PPO and competing CCP enrollees in demonstration service areas as of March 2004. The age distribution of PPO enrollees is generally similar to recent enrollees of competing CCPs. PPOs seem to be slightly more popular among the midrange elderly, age 70-84. The share of enrollees under age 65, most of whom are entitled by disability, was nearly the same among PPO enrollees and recent enrollees of CCPs. This is not consistent with the hypothesis that PPOs are especially attractive to disabled beneficiaries who may have difficulty obtaining Medigap supplemental coverage but want to avoid the provider access restrictions of HMOs. A smaller share of PPO enrollees than recent enrollees of competing CCPs were Black persons and other minorities, and were on Medicaid. This may be related to higher monthly premiums for PPOs and lower incomes of those who chose not to enroll.

Table 4. Demographic and Health Status Characteristics of PPO and Recent1 CCP Enrollees2: March 2004.

| PPO | CCP | |

|---|---|---|

|

| ||

| Percent | ||

| Age | ||

| < 65 Years | 11.7 | 12.7 |

| 65-69 Years | 31.8 | 38.6 |

| 70-74 Years | 23.7 | 18.8 |

| 75-84 Years | 26.7 | 23.6 |

| 85 Years or Over | 6.2 | 6.3 |

| Race | ||

| White | 90.9 | 81.9 |

| Black | 6.4 | 13.3 |

| Other/Unknown | 2.7 | 4.8 |

| Medicaid Status | ||

| Not Enrolled | 97.7 | 91.8 |

| Enrolled | 2.3 | 8.2 |

| Health Status Risk Score3 | ||

| All Enrollees4 (Fee-for-Service = 1.11) |

0.95 | 0.96 |

| All Recent Enrollees5 | 0.93 | 0.88 |

| Recent Medicare Enrollees6 | 0.58 | 0.56 |

| Switchers7 | 0.99 | 0.98 |

Beneficiaries enrolling in their current CCP on or after January 1, 2003.

Includes beneficiaries with Parts A and B coverage as of March 2004, residing in any PPO demonstration open-enrollment service area county.

Centers for Medicare & Medicaid Services hierarchical condition categories risk score.

Includes all current enrollees, experienced as well as recent.

Beneficiaries enrolling in their plan January 2003 or after. For PPOs, excludes Horizon enrollees previously enrolled in the Horizon Health Care of New Jersey health maintenance organization.

Beneficiaries who newly enrolled in the Medicare Program January 2003 or after.

Beneficiaries who switched into their current Medicare plan (including from one health plan contract to another) since January 2003.

NOTES: PPO is preferred provider organization. CCP is coordinated care plan.

SOURCE: RTI analysis of Centers for Medicare & Medicaid Services enrollment and risk score data, 2004.

The average health status of PPO and competing CCP enrollees was virtually the same (0.95 risk score for PPOs versus 0.96 for CCPs).13 PPOs were not drawing sicker beneficiaries than CCPs, despite the potential attractiveness of their out-of-network benefit to beneficiaries using many health services. But Medicare health plan enrollees—both PPO and CCP—are healthier on average than enrollees in Medicare FFS within the PPO service area, who have a mean risk score of 1.11. Beneficiaries switching into PPOs or CCPs from FFS or other health plans have almost identical mean risk scores, as do new Medicare beneficiaries enrolling in PPOs or CCPs. Because new beneficiaries, who have much lower average risk scores, comprised a larger proportion of recent CCP than PPO enrollment, overall, recent enrollees in CCPs were slightly healthier. In sum, the average health status of PPO and CCP enrollees was very similar, and both plans were experiencing favorable selection relative to Medicare FFS. PPOs, of course, are startup plans, and it is possible that the average health status of their enrollees will decline over time as the tenure of their enrollees increases.

The voluntary disenrollment rate among all PPO demonstration enrollees is similar to the rate among competing CCP enrollees. However, excluding continuing enrollees in the Horizon demonstration plan, PPO disenrollment is modestly higher than disenrollment among recent enrollees in competing CCPs. We were also interested in learning whether PPO enrollees, once in this new type of plan, remained for a length of time, or whether they voluntarily disenrolled relatively quickly—suggesting that they either did not fully understand the PPO option and/or were somehow dissatisfied. Among all PPO enrollees in plans effective January 2003, the 18-month (January 2003-June 2004) voluntary disenrollment rate was 12.3 percent, slightly lower than the 13.1 percent rate among all competing CCP enrollees over the same period. But when enrollees continuing from the Horizon HMO to the Horizon PPO demonstration contract are excluded, the PPO disenrollment rate rises to 15.0 percent. The comparable voluntary disenrollment rate for CCPs, restricted to CCP enrollees with enrollment spells beginning during the demonstration period, remains at 13.1 percent. This is weak evidence of a higher voluntary disenrollment rate in PPOs than competing CCPs, which could indicate slightly greater dissatisfaction among PPO than recent CCP enrollees. We heard some reports in our case study interviews that the newness of Medicare PPOs has created misunderstanding and unfulfilled expectations among some beneficiaries, and of early operational difficulties with providers, such as some providers refusing to accept PPO out-of-network coverage (Greenwald et al., 2004).

Conclusions

The analysis reported here, together with our site visit interviews with plans conducted early in the project (Greenwald et al., 2004), provides some insights into how PPOs operate under Medicare and what the future of regional PPOs may be once these new plans are implemented in 2006. Particularly considering the tight timeframe for its implementation, the PPO demonstration has succeeded in making a new managed care option available to a significant proportion of Medicare beneficiaries. In our site visits, we found that most PPOs chose to offer products in urban or near urban areas where other managed care options already exist—and not in rural or previously unserved areas—in part because of the difficulties and costs they faced in developing sufficient provider networks in rural areas.

Lower PPO premiums relative to Medigap and CCPs could stimulate PPO enrollment, but PPOs face constraints in their ability to lower premiums. Early in the demonstration, PPOs reported that the monthly premium for their products would be an important factor in attracting Medicare beneficiaries to this relatively new option. We found that the premiums offered by the demonstration PPOs tend to be more costly than competing CCPs, but less costly than popular Medigap options. Also, Medigap premiums may increase as beneficiaries age, and Medigap applicants are often subject to medical underwriting or screening. Therefore, PPOs may represent a useful midpriced option for some beneficiaries, especially older or sicker beneficiaries with limited or costly Medigap access, and beneficiaries wishing to avoid the restrictions of HMOs. But with their current enrollments, the discounts PPOs can obtain from providers in return for in-network designation are limited. This constrains PPOs' ability to lower premiums, which would stimulate further enrollment growth. Also, plans reported that PPOs are more loosely managed than HMOs, which limits cost savings—and premium reductions—from utilization management activities.

Some plans reported that one factor limiting PPO enrollment gains versus Medigap is that age-rated Medigap policies charge relatively lower premiums for younger beneficiaries, a natural target for PPO enrollment. PPOs, and other Medicare health plans, must charge the same premiums for all beneficiaries. Another factor is the aversion of many beneficiaries to financial risk and out-of-pocket costs, which are minimized by popular Medigap options. Beneficiaries enrolling in PPOs, plans reported, are those who are willing to accept some out-of-pocket costs, financial risk, and care management, but who do not want the provider access restrictions of HMOs. Beneficiaries who are very price sensitive (e.g., lower-income beneficiaries) choose HMOs for their lower premiums. This will likely continue to be an issue for regional PPOs under the MMA.

PPOs also reported that Medicare beneficiaries tend to react slowly to new options and potential changes, and that increasing enrollment in PPOs will require considerable efforts in marketing and education. This finding suggests that, as in this demonstration, enrollment in regional PPOs may take some time to reach their full potential. Nevertheless, plans participating in the demonstration felt that PPOs were a viable long-term investment, whose enrollment would steadily build over time.

Acknowledgments

The authors wish to thank CMS project officer Victor McVicker for his helpful comments, Aleksandra Petrovic and Helen Margulis for computer programming support, and Jeff Novey and Norma DiVito for their editorial and document preparation assistance. We would also like to thank Shula Bernard, Wayne Anderson, and Nathan West for their help.

Footnotes

The authors are with RTI International. The research in this article was supported by the Centers for Medicare & Medicaid Services (CMS) under Contract Number 500-00-0024 (TO5). The statements expressed in this article are those of the authors and do not necessarily reflect the views or policies of RTI International or the Centers for Medicare & Medicaid Services (CMS).

By 2003, there were about 3,000 Medicare beneficiaries enrolled in a total of six M+C PPO plans (U.S. Government Accountability Office, 2004).

Medicare health plan refers to a private plan that replaces original Medicare FFS, contract refers to a contract between Medicare and a managed care organization, and plan indicates a set of benefits offered by a contracting organization in a specific area. Plan is also sometimes used generically to mean a managed care organization.

Certain HPMS data—simulated beneficiary out-of-pocket costs and physician network size—do not reflect the March 2004 changes.

PPO and comparison plans that are open to retirees of particular employers only are excluded from our analyses.

PacifiCare had planned a demonstration PPO in Southern California, but withdrew it after encountering difficulties establishing a provider network.

In multivariate work not reported in this article, we also found that the demonstration financial incentive had no effect on PPO entry, controlling for a large number of other factors potentially affecting entry (Pope et al., 2004b).

The stabilization fund provides financial incentives (higher payment rates) for MA regional PPO plans to enter and stay in otherwise underserved regions, or for having a nationwide plan.

Medigap Plan F was selected for comparison because it is the most popular of the standardized Medigap plans, with 37 percent of enrollment in these plans (Medicare Payment Advisory Committee, 2003). Medigap Plan F covers most Medicare cost sharing, but has no prescription drug benefit.

In general, relative costs by health plan and health status do not appear very sensitive to the age range chosen. However, to the extent that Medigap premiums are age-rated, Medigap costs may be higher for older beneficiaries and lower for younger beneficiaries.

The CMS geographic service area file data do not fully reflect initial PPO enrollment until February 2003, so Figure 4 begins in February 2003 rather than January.

Horizon does not describe their demonstration product as a PPO, but rather as a point-of-service plan, or an HMO with an out-of-network benefit option.

If beneficiaries who transferred from Horizon's HMO to its PPO demonstration contract were included as enrollees from an affiliated HMO, the proportion of demonstration enrollees drawn from an affiliated health plan would be much greater.

Risk scores indicate predicted future Medicare expenditures relative to the national average of 1.00.

Reprint Requests: Gregory C. Pope, M.S., RTI International, 411 Waverley Oaks Road, Suite 330, Waltham, MA 02452. E-mail: gpope@rti.org

References

- Fu Associates. 2004 Medicare Personal Plan Finder Cohort Selection and Out of Pocket Cost Estimates Development Process Requirements. 2004 Internet address: http://www.cms.hhs.gov/health-plans/2004_OOPC_Specs.pdf. (Accessed 2005.)

- Greenwald L, Pope G, Anderson W, et al. Medicare Preferred Provider Organization (PPO) Case Study and Implementation Report. Jan, 2004. RTI Final Report to the Centers for Medicare & Medicaid Services. [Google Scholar]

- Medicare Payment Advisory Commission. Report to the Congress: Medicare Payment Policy. Washington DC.: Mar, 2003. [Google Scholar]

- Pope G, Kautter J, Ellis R, et al. Risk Adjustment of Medicare Capitation Payments Using the CMS-HCC Model. Health Care Financing Review. 2004a Summer;25(4):119–141. [PMC free article] [PubMed] [Google Scholar]

- Pope G, Olmsted E, Kautter J, et al. The Medicare Preferred Provider Organization Demonstration: Plan Offerings and Enrollment. RTI International; Waltham, MA.: Oct, 2004b. Report to Centers for Medicare & Medicaid Services. [PMC free article] [PubMed] [Google Scholar]

- U.S. Government Accountability Office. Medicare Demonstration PPOs: Financial and Other Advantages for Plans, Few Advantages for Beneficiaries. U.S. Government Printing Office; Washington, DC.: 2004. Report to the Ranking Minority Member, Committee on Finance, U.S. Senate. GAO-04-960. [Google Scholar]