Abstract

CMS has had a continuing interest in exploring ways to incorporate frailty adjustment into the CMS Hierarchical Condition Categories (CMS-HCC) risk adjustment methodology for Medicare Advantage and other Medicare private organizations. In this article we present research results for Medicare risk adjustment of the frail elderly since the adoption of frailty adjustment for Program of All-Inclusive Care for the Elderly (PACE) organizations in 2004. In particular, we present results on the revised frailty adjuster that is being phased in for PACE organizations between 2008 and 2012.

Introduction

Several analyses have shown that diagnosis-based risk adjusters do not fully predict the expenditures of the frail elderly, where frailty is generally defined in terms of functional impairments (Pope et al., 1998, 2000; Kautter and Pope, 2001, 2004; Kautter et al., 2007). Diagnosis-based models do predict the expenditures of the frail elderly substantially better than demographic models, but some residual expenditures statistically associated with functional impairment remain unexplained. CMS has thus had a continuing interest in exploring ways to incorporate frailty adjustment into the CMS-HCC risk adjustment methodology for Medicare Advantage and other Medicare private organizations (Pope et al., 2004). The goal of frailty adjustment is to account for the costs not explained by diagnosis-based risk adjustment.

Predicting expenditures accurately for subgroups of Medicare beneficiaries is desirable. Accurate prediction for the frail elderly is especially significant because they do not comprise a uniform proportion of the enrollment of all Medicare capitated organizations, and their expenditures are considerably higher than the average beneficiary. This is a particularly important issue for organizations whose models of care focus disproportionately on the frail elderly, for example PACE organizations.1 A payment factor to account for potentially higher expenditures for the frail elderly is important in ensuring the viability of these organizations, and access for beneficiaries to the care they provide. Therefore, since 2004, CMS has applied a frailty adjustment to payments for enrollees in PACE organizations (Kautter and Pope, 2004-2005).2 CMS adopted the approach taken by many researchers and clinicians of defining frailty as functional impairment, and using counts of difficulty in performing activities of daily living (ADLs) as the core measure of functional impairment. The original frailty adjuster model was estimated using ADL information in the Medicare Current Beneficiary Survey (MCBS). The frailty adjuster is prospective, meaning that Medicare expenditures in a given year are predicted by ADL information in the prior year.

As reported here, the frailty adjustment factors have recently been updated and refined. Effective 2008, CMS is applying these new frailty factors to PACE organization payments on a 5-year phase-in schedule (Centers for Medicare & Medicaid Services, 2007a,b; 2008).3

We present research results for Medicare risk adjustment of the frail elderly since the adoption of frailty adjustment for PACE organizations in 2004 (Kautter, Ingber, and Pope, 2007). In particular, we describe the development of a frailty adjuster estimated on the Medicare Fee-For-Service Consumer Assessment of Healthcare Providers and Systems (CAHPS®) Survey. Medicare is transitioning PACE organization payments to 100 percent of the revised frailty adjuster over the 5-year period 2008-2012.

Original Frailty Adjuster

The original frailty adjuster was calibrated using 1994 to 1997 data from the MCBS for the community-residing, age 55 or over population enrolled in fee-for-service (FFS) Medicare (Kautter and Pope, 2004). The MCBS is a nationally representative sample of Medicare beneficiaries.4 We found that frailty factors are quite different for community-residing versus long-term institutionalized (nursing home) beneficiaries, and concluded that the appropriate frailty adjuster for the long-term institutionalized should be a factor of zero.5

At the time the initial frailty model was created, the MCBS data was the only comprehensive data available that allowed linkage of individual-level functional impairment data (ADLs) to Medicare claims data. Information from the MCBS was used to predict expenditures related to frailty that were unexplained by the CMS-HCC risk adjustment model. The ADLs may not relate to the incremental expenditures causally, but are strongly correlated with additional expenditures. Actual frailty scores for health organizations are calculated at the contract level (rather than the plan benefit package level)6 using these frailty factors and an estimate of the ADL limitations of enrollees reported in the Health Outcomes Survey (HOS) sent to a sample of enrollees in each organization. These frailty scores are added to the risk adjustment factors in payment. The original frailty factors calibrated on the 1994-1997 MCBS were 1.094, 0.340, 0.172, and -0.143 respectively, for, counts of ADL difficulty 5-6, 3-4, 1-2, and 0 (Kautter and Pope, 2004).

Update and Refinement of Frailty Adjuster

The source of data used to calibrate the frailty factors was changed so that the methods used to gather ADL-related data for both calibration and payment would be similar, avoiding measurement disparities that come from using different data collection methods. As previously noted, the original frailty factors were calibrated using ADL limitation information gathered from MCBS in-person surveys. CAHPS® data, which were used to update and refine the frailty factors, and HOS data, which are used to calculate frailty scores for payment, both collect ADL information via mail surveys with telephone followup.

CAHPS® Frailty Adjustment Prospective Modeling Sample

The CAHPS® survey is a self-administered mail survey with telephone followup (RTI International, 2005). The CAHPS® survey used in this work was administered to FFS Medicare beneficiaries for whom expenditure data were available. The data collection period for the 2003 CAHPS® started with the mail-out of the prenotification letter on September 10, 2003, and ended with a telephone followup on February 21, 2004.7 With 120,974 sample respondents, the response rate among eligible sample members was 69.3 percent. Among those sample respondents, 109,080 (90.2 percent) responded to all six ADL questions. Therefore, given the fact that complete information on ADLs is required for frailty adjustment modeling, the CAHPS® response rate for the purposes of frailty adjustment was 62.5 percent (69.3 percent multiplied by 90.2 percent).

To construct our CAHPS® prospective modeling sample for frailty adjustment,8 we started with the 120,974 sample respondents. Because 12 percent of the sample respondents actually responded in January/February 2004, the base and payment years of the prospective modeling sample were defined as follows:

Base year is March 2003 to February 2004.

Payment year is March 2004 to February 2005.

The nature of the prospective model is that both diagnoses used in the diagnosis-based model and ADL limitations in the frailty model come from the year prior to the year of predicted expenditures.

Table 1 shows the inclusion criteria for the CAHPS® community, age 55 or over prospective modeling sample for frailty adjustment. CAHPS® had 120,974 sample respondents, with 108,767 having complete ADL and local geographic area (Geounit)9 information. Complete ADL information is required for frailty adjustment, and complete Geounit information was required to create CAHPS® survey weights for the respondents to match characteristics of the full sample. Among the 108,767 CAHPS® sample respondents with complete ADL and Geounit information, 97,608 met all of the prospective modeling sample requirements:

Table 1. Criteria for Inclusion in Medicare FFS CAHPS® Community Age 55 or Over Frailty Adjustment Prospective Modeling Sample1.

| Criteria for Inclusion | N |

|---|---|

| Survey Respondents | 120,974 |

| ADL Information Complete2 | 109,080 |

| Geounit Information Complete3 | 120,597 |

| ADL and Geounit Information Complete | 108,767 |

| Continuous Part A & B Enrollment throughout Base Year | 103,430 |

| Continuous Part A & B Enrollment Throughout Payment Year (or Until Death) | 102,841 |

| At Least 1 Month of FFS, Aged/Disabled, Non-Hospice in Payment Year | 105,752 |

| No HMO Enrollment in Base Year | 108,159 |

| U.S. Resident in both Base and Payment Year | 107,942 |

| No ESRD in Base Year | 107,859 |

| No MSP in either Base or Payment Year | 102,609 |

| Meets All Prospective Sample Criteria | 97,608 |

| Community-Residing | 96,544 |

| Age 55 or Over | 93,538 |

| Community-Residing and Age 55 or Over | 92,490 |

| Community Age 55 or Over Frailty Adjustment Prospective Modeling Sample | 92,490 |

The base year is March 2003 to February 2004, and the payment year is March 2004 to February 2005.

Survey respondents are required to have answered all six ADL questions to be eligible for frailty modeling.

It was necessary to crosswalk survey respondents to Geounits in order to develop post-stratification weights. Geounits were strata constructed for CAHPS® sample selection and consist of one or more counties, and approximate Medicare FFS market areas. The total number used for the 2003 CAHPS® survey design was 277. Thus, they are typically smaller than States, but larger than metropolitan statistical areas.

NOTES: ADL is activity of daily living. CAHPS® is Consumer Assessment of Healthcare Providers and Systems. FFS is fee for service. ESRD is end stage renal disease. MSP is Medicare Secondary Payer. HMO is health maintenance organization.

SOURCE: RTI International analysis of 2003 Medicare FFS CAHPS® and 2003-2005 Medicare Administrative Data.

Continuous Medicare Parts A and B enrollment throughout base year.

Continuous Parts A and B enrollment throughout payment year (or until death).

At least 1 month of FFS, aged/disabled, non-hospice enrollment in payment year.

No Medicare Advantage (health maintenance organization or other private organization) enrollment in base year; only FFS months are used in the payment year.

U.S. resident in both base and payment year.

No end-stage renal disease in base year.

No months of Medicare as a secondary payer to other insurance in either base or payment year.

Finally, among the 97,608 CAHPS® sample respondents with complete ADL and Geounit information and meeting all of the prospective sample requirements, 92,490 are community-residing, age 55 or over. Therefore, the sample size for the CAHPS® frailty adjustment model is 92,490.

Analytic Variables

In this section we describe the creation of key analytic variables used to develop the CAHPS® frailty adjuster, including residual Medicare expenditures based on the CMS-HCC risk adjustment model, ADLs, and model weights.

Residual Medicare Expenditures

These expenditures are defined as:

We now describe the creation of actual and predicted expenditures, the two components of residual expenditures, and then provide descriptive statistics on residual expenditures. Payment year actual Medicare expenditures for each beneficiary are calculated. The methodology is as follows. First, Medicare Parts A and B expenditures (excluding hospice expenditures) are summed for each eligible month in the payment year, where eligible months are defined as community-residing, FFS, aged/disabled, non-hospice months in the payment year. Second, total expenditures are annualized by dividing them by the fraction of the payment year the beneficiary had eligible months. For example, if a person has 6 eligible months in the payment year, and generates $25,000 in total expenditures, then the annualized total expenditure for the beneficiary is $50,000.

We use the CMS-HCC community risk adjustment model to create payment year predicted expenditures (Pope et al., 2004). The CMS-HCC prospective risk adjustment model uses relatively homogeneous clinical and cost categories called HCCs, of which 70 are included in the model, to predict expenditures. The 70 HCCs are organized into hierarchies of related diseases; only the most severe manifestation of a disorder is retained in the prediction model. But multiple coexisting diseases are recognized across disease hierarchies. The CMS-HCC model utilizes diagnoses from all physician and hospital encounters.

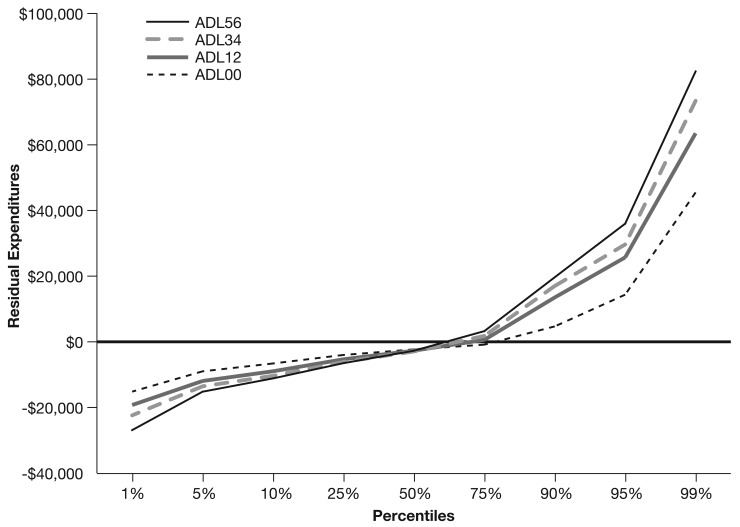

The distribution of residual expenditures for the CAHPS® community, age 55 or over frailty adjustment modeling sample is shown in Table 2. The CMS-HCC model predicts expenditures accurately for this population as a whole, which is why mean residual expenditures equal $0. However, one-half of the sample has residual expenditures less than -$2,448, and one-half have greater residual expenditures.10 Given it is well known that medical expenditure distributions tend to have high cost outliers, it is not surprising that our residual expenditure distribution is skewed. What these data show is that roughly 25 percent of the sample is underpredicted by the CMS-HCC model, and 75 percent is overpredicted. An interesting breakdown differentiates by ADL group, as shown in Figure 1. The percentage of each group that is underpredicted by the model is broadly similar, however, the magnitudes of underprediction are clearly greater for the high ADL groups.

Table 2. Residual Expenditures1 Distribution for Medicare FFS CAHPS® Community Age 55 or Over Frailty Adjustment Prospective Modeling Sample2.

| Observations | 92,490 |

| Mean3 | $0 |

| Standard Error | $49 |

| Percentiles | |

| 100 Maximum | $1,618,854 |

| 99 | 56,767 |

| 95 | 20,637 |

| 90 | 9,044 |

| 75 | -437 |

| 50 Median | -2,448 |

| 25 | -4,567 |

| 10 | -7,839 |

| 5 | -10,738 |

| 1 | -18,136 |

| 0 Minimum | -53,363 |

Residual expenditures are defined as actual annualized expenditures minus expenditures predicted by the Centers for Medicare & Medicaid Services–Hierarchical Condition Categories community risk-adjustment model. They are the dependent variable in the frailty adjustment model.

Base year is March 2003 to February 2004, and payment year is March 2004 to February 2005.

The mean and standard error are both weighted by the product of the eligibility fraction and the post-stratified CAHPS® survey weights. The mean of residual expenditures is necessarily $0.

NOTES: CAHPS® is Consumer Assessment of Healthcare Providers and Systems. FFS is fee for service.

SOURCE: RTI International analysis of 2003 Medicare FFS CAHPS® and 2003-2005 Medicare Administrative Data.

Figure 1. Residual Expenditures1 Distribution for Medicare FFS CAHPS® Community Age 55 or Over Frailty Adjustment Prospective Modeling Sample,2 by Activities of Daily Living3.

1 Residual expenditures are defined as actual annualized expenditures minus expenditures predicted by the Centers for Medicare & Medicaid Services-Hierarchical Condition Categories community risk-adjustment model. They are the dependent variable in the frailty adjustment model.

2 Base year is March 2003 to February 2004, and payment year is March 2004 to February 2005. N = 92,490.

3 ADLs are activities of daily living and is measured in the base year. ADL 5-6, 3-4, 1-2, 0 are counts of difficulty in ADLs.

NOTES: CAHPS® is Consumer Assessment of Healthcare Providers and Systems. FFS is fee for service.

SOURCE: RTI International analysis of 2003 Medicare FFS CAHPS® and 2003-2005 Medicare Administrative Data.

Activities of Daily living

CAHPS® asks: “Because of a health or physical problem, do you have any difficulty doing the following activities?” The activities are: bathing, dressing, eating, getting in or out of chairs, walking, and using the toilet. We create a count scale based on the number of ADL difficulties, i.e., 5-6, 3-4, 1-2, and no difficulties (for beneficiaries responding “doesn't do the ADL,” we impute “difficulty”). Because the frailty adjuster is prospective, we use counts of ADL difficulties in the base year.

Model Weights

We start with the CAHPS® survey weights and adjust these weights to account for the fact that we are using a subset of the CAHPS® respondent sample in our frailty adjustment modeling. The procedure used to adjust the CAHPS® survey weights was to use control totals in a process called post-stratification. The primary objective of post-stratification is to dampen potential biases arising from a combination of response errors, sampling frame undercoverage, and non-response. Finally, we adjusted the CAHPS® post-stratified weights by multiplying them by the fraction of the payment year with eligible months. These were the final weights used in the frailty adjustment model.

Descriptive Analysis for CAHPS® Analytic Sample

Table 3 shows descriptive statistics for our CAHPS® analytic sample. The sample size is 92,490 Medicare beneficiaries, and the distribution for ADL groups is 6.4 percent, 8.4 percent, 23.7 percent, and 61.5 percent respectively, for, ADLs 5-6, 3-4, 1-2, and 0. The table shows that the CAHPS® frailty adjustment modeling sample is 11.1 percent age 85 or over, 57.5 percent female, 88.0 percent White persons, and 11.7 percent dually Medicare-Medicaid eligible.

Table 3. Descriptive Statistics for Medicare FFS CAHPS® Community Age 55 or Over Frailty Adjustment Modeling Sample1.

| Variable | Sample Size2 | Proportion2 |

|---|---|---|

| Age | ||

| 55-64 Years | 5,467 | 5.9 |

| 65-74 Years | 42,378 | 45.8 |

| 75-84 Years | 34,413 | 37.2 |

| 85 Years or Over | 10,233 | 11.1 |

| Sex | ||

| Female | 53,191 | 57.5 |

| Male | 39,300 | 42.5 |

| Race | ||

| White | 81,418 | 88.0 |

| Black | 6,900 | 7.5 |

| Other | 4,172 | 4.5 |

| Medicaid Status | ||

| Medicaid | 10,862 | 11.7 |

| Non-Medicaid | 81,629 | 88.3 |

| Difficulty with ADLs3 | ||

| 5-6 ADLs | 5,943 | 6.4 |

| 3-4 ADLs | 7,779 | 8.4 |

| 1-2 ADLs | 21,930 | 23.7 |

| 0 ADLs | 56,839 | 61.5 |

The base year for the CAHPS® frailty adjustment modeling sample is March 2003 to February 2004, and the payment year is March 2004 to February 2005. N = 92,490.

Sample sizes and proportions calculated using survey weights.

ADLs are activities of daily living and are measured in the base year.

NOTES: CAHPS® is Consumer Assessment of Healthcare Providers and Systems. FFS is fee for service.

SOURCE: RTI International Analysis of 2003 Medicare FFS CAHPS® and 2003-2005 Medicare Administrative Data.

Frailty Factors Recalibrated on CAHPS®

We recalibrate a frailty adjustment model on the CAHPS® similar to the original MCBS model. For the community-residing, age 55 or over Medicare population, residual expenditures are regressed on counts of ADL difficulties (Table 4). Among beneficiaries with 5-6, 3-4, and 1-2 ADL difficulties, the CMS-HCC model underpredicts Medicare expenditures, respectively, by an average of $2,039, $1,164, and $602, and for no ADL difficulties, overpredicts by $628. Each of these regression coefficient estimates is statistically significantly different from zero at the 1 percent level. By dividing the dollar values of the coefficients by the national mean spending, relative factors are produced. There is a noticeable difference in the frailty factor for the ADL 5-6 group between the original model and the model recalibrated on the CAHPS®. The frailty factor from the original model is 1.094, whereas it is 0.316 from the CAHPS®-based model, a 71-percent reduction.

Table 4. Medicare FFS CAHPS® Community Age 55 or Over Frailty Adjustment Model1,2.

| Independent Variable3 | Sample Size4 | Coefficient Estimate5 | T-Ratio | Frailty Factor6 |

|---|---|---|---|---|

| ADL5-6 | 5,943 | $2,039 | 10.69 | 0.316 |

| ADL3-4 | 7,779 | 1,164 | 7.09 | 0.18 |

| ADL1-2 | 21,930 | 602 | 6.09 | 0.093 |

| ADL0 | 56,839 | -628 | -10.05 | -0.097 |

Dependent variable is residual expenditures, which are equal to annualized actual expenditures minus expenditures predicted by the Centers for Medicare & Medicaid Services-Hierarchical Condition Categories community model.

Regression is weighted by the product of the CAHPS® survey weight and the fraction of the prediction year enrolled in Medicare and community-residing.

ADLs are activities of daily living and is measured in the base year.

Observations weighted by CAHPS® survey weights. Because of rounding, listed sample sizes don't sum to 92,490.

All coefficient estimates are significant at the 1 percent level.

Frailty factor equals coefficient estimate divided by mean FFS expenditures. It is additive to the CMS-HCC risk score.

NOTES: CAHPS® is Consumer Assessment of Healthcare Providers and Systems. FFS is fee for service.

SOURCE: RTI International analysis of 2003 Medicare FFS CAHPS® and 2003-2005 Medicare Administrative Data.

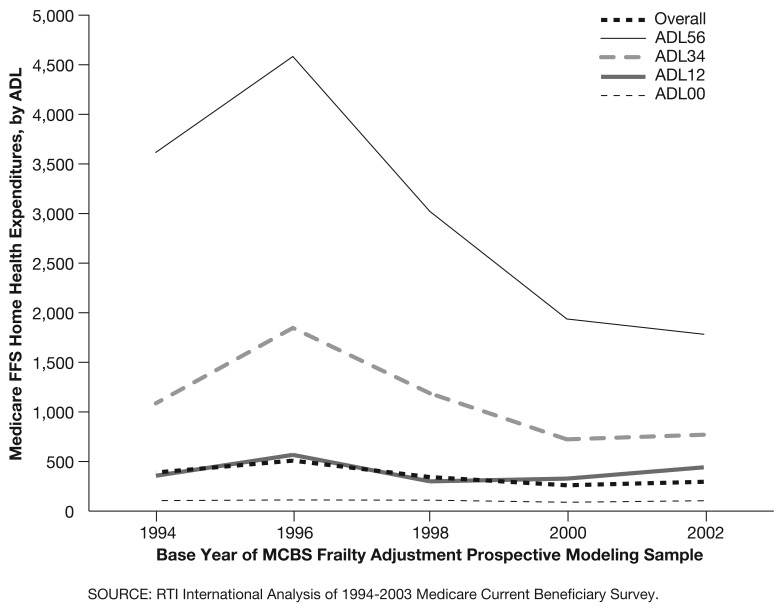

One likely reason for the change in the frailty factor for the ADL 5-6 group is the impact of changes to the Medicare FFS home health payment system that were mandated by the 1997 Balanced Budget Act (BBA). As a result of these changes, there was a significant decline in per capita home health expenditures for FFS beneficiaries, dropping from a high of $506 in 1997 to a low of $193 in 2000, a decline of 62 percent (Centers for Medicare & Medicaid Services, 2006), roughly similar to the reduction in the frailty factor for ADL 5-6 (71 percent). Although the home health reductions that occurred post-BBA were large for all types of Medicare beneficiaries, some subgroups did experience differential effects. Larger reductions were found for those beneficiaries more prone to have chronic conditions and those with high home health use pre-BBA (McCall et al., 2003), characteristics typical of the functionally impaired.

To illustrate, Figure 2 tracks Medicare FFS per capita home health expenditures by ADL group between 1994 and 2002. As is evident in the figure, there is a significant drop in home health expenditures for the high ADL group during the late 1990s. Given the frailty adjustment model predicts residual expenditures (actual expenditures minus CMS-HCC predicted expenditures), to the extent that high ADL beneficiaries' actual expenditures were decreased by the change in the home health payment system, this would have lowered their residual expenditures, and hence their frailty factor.

Figure 2. Medicare Fee-for-Service Home Health Expenditures, by Activities of Daily Living (ADLs), 1994-2002.

We also refined the frailty adjustment model to compute two sets of frailty factors: (1) for those Medicare beneficiaries who are dually eligible for Medicaid, and (2) for those who are not (Table 5). Each of the regression coefficients is statistically significantly different from zero at the 1 percent level, except for Medicaid ADL 1-2, which is insignificant. The equality of regression coefficient estimates for Medicaid and non-Medicaid is rejected at the 1 percent level of significance. The frailty factor for Medicaid beneficiaries with 5-6 ADLs is only approximately one-half that for non-Medicaid beneficiaries with 5-6 ADLs (0.188 versus 0.377). On the other side of the spectrum, the frailty factor for Medicaid beneficiaries with no functional impairments is approximately two times (in absolute value) that for non-Medicaid beneficiaries with no functional impairments (-0.183 versus -0.089).

Table 5. Medicare FFS CAHPS® Community Age 55 or Over Frailty Adjustment Model1,2.

| Independent Variable3,4 | Sample Size5 | Coefficient Estimate6 | T-Ratio | Frailty Factor7 |

|---|---|---|---|---|

| ADL56/Medicaid | 1,573 | $1,213 | 3.61 | 0.188 |

| ADL34/Medicaid | 1,825 | 854 | 2.82 | 0.132 |

| ADL12/Medicaid | 3,404 | 154 | 0.69 | 0.024 |

| ADL00/Medicaid | 4,061 | -1,178 | -5.64 | -0.183 |

| ADL56/Non-Medicaid | 4,370 | 2,431 | 10.49 | 0.377 |

| ADL34/Non-Medicaid | 5,954 | 1,293 | 6.62 | 0.200 |

| ADL12/Non-Medicaid | 18,526 | 712 | 6.45 | 0.110 |

| ADL00/Non-Medicaid | 52,778 | -574 | -8.76 | -0.089 |

Dependent variable is residual expenditures, which are equal to annualized actual expenditures minus expenditures predicted by the Centers for Medicare & Medicaid Services-Hierarchical Condition Categories community model.

Regression is weighted by the product of the CAHPS® survey weight and the fraction of the prediction year enrolled in Medicare and community-residing.

ADLs are activities of daily living. ADLs are measured in the base year.

Medicaid status measured in the base year.

Observations weighted by CAHPS® survey weights. Because of rounding, listed sample sizes don't sum to 92,490.

All coefficient estimates are significant at the 1 percent level, except for ADL 12/Medicaid, which is insignificant. F-test results on the equality of regression coefficient estimates for Medicaid and non-Medicaid are as follows: F-Value = 5.76; P-Value = 0.000.

Frailty factor equals coefficient estimate divided by mean FFS expenditures. It is additive to the CMS-HCC risk score.

NOTES: CAHPS® is Consumer Assessment of Healthcare Providers and Systems. FFS is fee for service.

SOURCE: RTI International Analysis of 2003 Medicare FFS CAHPS® and 2003-2005 Medicare Administrative Data.

Frailty factors steadily rise with counts of ADLs, both for Medicaid (-0.183 to 0.024 to 0.132 to 0.188) and for non-Medicaid (-0.089 to 0.110 to 0.200 to 0.377), which was not the case for the original MCBS frailty adjuster (Kautter and Pope, 2004). One explanation for this is the much larger sample size of the CAHPS® compared with the MCBS, which other things equal, will produce more stable frailty factors.

One reason for the difference in the magnitude of the coefficients for Medicaid and non-Medicaid beneficiaries is that the CMS-HCC risk adjuster model incorporates an adjustment for Medicaid status. Thus CMS-HCC model predictions are higher for Medicaid beneficiaries than otherwise similar non-Medicaid beneficiaries. The residuals left to be explained by frailty adjustment are reduced on average.

Although the sample size of the MCBS that we used to develop the original frailty model did not allow us to reliably estimate separate models for Medicaid and non-Medicaid beneficiaries, we can do so for the recalibrated model because the CAHPS® sample is much larger. Using the model estimated by Medicaid status produces the appropriate factors for each population.11

Discussion

In this article we presented our continuing frailty adjustment research and development since the adoption of frailty adjustment for PACE organizations in 2004. We described the development of a frailty adjustment model calibrated on CAHPS®. CMS (2007a,b: 2008) is transitioning PACE organization payments to 100 percent of the revised frailty factors over the 5-year period 2008-2012.

Although CMS (2007a,b; 2008) is continuing to apply frailty adjustment to PACE payments, the following methodological concerns have led CMS to conclude that the application of frailty adjustment programwide in 2008 would not improve payment accuracy. First, HOS survey data currently used to determine frailty scores for payment is sampled only at the contract level and, therefore, does not allow CMS to calculate accurate frailty scores at the plan benefit package level. Because bids and plan benefit designs are determined for the plan benefit package level, applying a contract-level frailty score would lead to inconsistent payments across organizations and beneficiaries. Second, if frailty were applied programwide, Medicare Advantage organizations would need to project a frailty score in their plan bids. However, when CMS pays organizations, they use frailty scores calculated after the bid has been submitted. Due to the changing nature of the marketplace and the different enrollment profiles of plans from year to year, this creates a risk that the level of frailty assumed by a plan in its bid would not reflect its actual frailty score in the payment year. PACE plans do not bid on Part C benefits, and would not be affected by this issue.

CMS nevertheless has a continuing interest in exploring ways to incorporate frailty adjustment into the CMS-HCC risk-adjustment methodology for Medicare Advantage organizations. CMS will continue to explore ways to incorporate factors into the CMS-HCC risk adjustment model that will predict costs associated with the frailty of individual beneficiaries. Making frailty-adjusted payments regardless of Medicare Advantage organization type would encourage all organizations to enroll frail beneficiaries, to innovate in their care (Medicare Payment Advisory Commission, 1999), and to care for them in the community rather than in long-term care institutions. There are however several concerns regarding expanding the application of frailty adjustment besides the operational factors previously mentioned. Among the issues that will need to be addressed before frailty adjustment can be expanded are (1) size of calibration sample and stability of frailty factors, (2) possible need for restandardization of the Medicare capitation payment county ratebook for frailty, and (3) inherent limitations in survey-based approaches to frailty adjustment (e.g., non-response bias), and whether non-survey-based approaches are preferred.

Footnotes

The authors are with RTI International. The research in this article was supported by the Centers for Medicare & Medicaid Services (CMS) under Contract Number 500-02-0033 (TO1). The statements expressed in this article are those of the authors and do not necessarily reflect the view or policies of RTI International or CMS.

PACE enrollees must be at least age 55, live in a plan service area, and be certified as eligible for nursing home care by the appropriate State agency.

CMS also applied the frailty adjustment to certain demonstration organizations, including: Social Health Maintenance Organizations; Minnesota Senior Health Options/Minnesota Disability Health Options; Wisconsin Partnership Program; and Massachusetts Senior Care Options.

In addition, CMS will phase-out frailty adjustment payments for certain demonstration organizations.

Since Medicare expenditure data is not available for Medicare Advantage enrollees, the frailty adjuster must be calibrated using data for FFS beneficiaries.

We also concluded that the appropriate frailty factors for the young disabled Medicare population age 0 to 54 was also a factor of zero.

Refers to a contract between a Medicare Advantage organization (typically an insurer) and CMS to enroll Medicare beneficiaries and provide them services in a defined geographic area. Plan refers to a specific benefit package offered by a Medicare Advantage organization in specific counties.

Proxies are permitted to respond to the survey, but analysis has shown that for CAHPS® the effect is small.

As mentioned, the frailty adjuster is prospective, meaning that Medicare expenditures in a given year are predicted by ADL information in the prior year.

Geounits were strata constructed for CAHPS® sample selection and consist of one or more counties, and approximate Medicare FFS market areas. The total number used for the 2003 CAHPS® survey design was 277. Thus, they are typically smaller than States, but larger than metropolitan statistical areas.

Statistical models predicting expenditures will always have errors of prediction, both over and under. This research is intended to reduce the effects of underpredicting for a group of enrollees concentrated in particular organizations.

The CAHPS® frailty model has been recently recalibrated using the 2004-2005 calibration of the CMS-HCC community risk adjustment model to create payment year predicted expenditures. This produced slightly changed frailty factors (Centers for Medicare & Medicaid Services, 2008). The newly revised frailty factors will be implemented beginning in Medicare payment year 2009.

Reprint Requests: John Kautter, Ph.D., RTI International, 1440 Main Street, Suite 310, Waltham, MA 02451. E-mail: jkautter@rti.org.

References

- Centers for Medicare & Medicaid Services. Advance Notice of Methodological Changes for Calendar Year 2009 for Medicare Advantage (MA) Capitation Rates. 2008.

- Centers for Medicare & Medicaid Services. Advance Notice of Methodological Changes for Calendar Year 2008 for Medicare Advantage (MA) Capitation Rates. 2007a.

- Centers for Medicare & Medicaid Services. Announcement of Calendar Year (CY) 2008 Medicare Advantage Capitation Rates and Payment Policies. 2007b.

- Centers for Medicare & Medicaid Services. Health Care Financing Review, Medicare and Medicaid Statistical Supplement, 2006. 2006 Dec; Publication Number 03477. Internet address: http://www.cms.hhs.gov/review/default.asp (Accessed 2008.)

- Kautter J, Ingber M, Pope GC. Frailty Adjustment of Medicare Capitation Payments. RTI International; Oct, 2007. Final Report to CMS. [Google Scholar]

- Kautter J, Pope GC. CMS Frailty Adjustment Model. Health Care Financing Review. 2005;26(2):1–19. [PMC free article] [PubMed] [Google Scholar]

- Kautter J, Pope GC. Predictive Accuracy of Diagnostic Cost Group (DCG) Risk Adjustment Models. RTI International; 2001. Final Report to the Centers for Medicare and Medicaid Services. [Google Scholar]

- McCall N, Petersons A, Moore S, et al. Utilization of Home Health Services before and after the Balanced Budget Act of 1997: What Were the Initial Effects? Health Services Research. 2003 Feb;38(1 Pt. 1):85–106. doi: 10.1111/1475-6773.00106. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Medicare Payment Advisory Commission. Selected Medicare Issues. 1999. Report to Congress.

- Pope GC, Kautter J, Ellis RP. Risk Adjustment of Medicare Capitation Payments Using the CMS-HCC Model. Health Care Financing Review. 2004 Summer;25(4):119–141. [PMC free article] [PubMed] [Google Scholar]

- Pope GC, Ellis RP, Ash AS. Principal Inpatient Diagnostic Cost Group Model for Medicare Risk Adjustment. Health Care Financing Review. 2000 Spring;21(3):93–118. [PMC free article] [PubMed] [Google Scholar]

- Pope GC, Adamache KA, Walsh EG, et al. Evaluating Alternative Risk Adjusters for Medicare. Health Care Financing Review. 1998 Winter;20(2):109–125. [PMC free article] [PubMed] [Google Scholar]

- RTI International. Implementation of Medicare CAHPS® Fee-For-Service Survey. Report for the 2003 Survey. 2005.