Abstract

Telemarketing fraud is pervasive and older consumers are disproportionally targeted. Given laboratory research showing that forewarning can effectively counter influence appeals, we conducted a field experiment to test whether forewarning could protect people who had been victimized in the past. A research assistant with prior experience as a telemarketer pitched a mock scam two or four weeks after participants were warned about the same scam or an entirely different scam. Both warnings reduced unequivocal acceptance of the mock scam although outright refusals (as opposed to expressions of skepticism) were more frequent with the same scam warning than the different scam warning. The same scam warning, but not the different scam warning, lost effectiveness over time. Findings demonstrate that social psychological research can inform effective protection strategies against telemarketing fraud.

Keywords: Telemarketing fraud, prevention, forewarning, decision making, aging

Each year millions of consumers fall victim to telemarketing frauds such as lottery, investment, or identity theft scams (Anderson, 2007). Though consumers of all ages fall prey to these fraudulent appeals, a disproportionate number of telemarketing fraud victims are older adults who can ill afford the loss (FINRA, 2013). How can these vulnerable consumers be protected from such victimization? A number of initiatives have been launched to forewarn seniors about circulating telemarketing scams and educate them about strategies to resist (Aziz, Bolick, Kleinman, & Shadel, 2000; Cohen, 2006). Thus far, however, there is no solid evidence showing that such initiatives are effective in reducing vulnerable consumers’ susceptibility to fraud. To fill this gap, we conducted a field experiment that examined the effectiveness of forewarning in reducing past fraud victims’ susceptibility to a mock phone scam.

Decision-Making, Fraud Susceptibility, and Aging

Many people, including criminals, apparently believe that older adults are especially susceptible to consumer fraud and aim their solicitations accordingly (AARP, 1996). Although no conclusive evidence shows older adults are in fact more susceptible (AARP, 1999), cognitive and motivational changes associated with normal aging may increase older adults’ vulnerability because those changes alter the way individuals make decisions (Finke, Howe, & Huston, 2011; Mather, 2006; Thornton & Dumke, 2005). Consumer decisions rely heavily on “fluid” cognitive abilities such as speed of processing, working memory, and episodic memory, which decline with age starting in the early twenties and progressing throughout the adult years (Salthouse & Ferrer-Caja, 2003). When confronting telemarketers, one needs to quickly understand, evaluate, gather, and integrate relevant information. Reductions in processing capacity may reduce effective responding. Indeed there is evidence from one study that older adults who performed poorly on a decision-making task were more attracted to deceptive advertisements than higher performing peers or young adults (Denburg et al., 2007).

In addition to cognitive decline, Carstensen and colleagues have identified a “positivity effect” in older adults’ information processing (Reed & Carstensen, 2012). Relative to younger adults, older adults show increased preferences for positive over negative information in attention, memory, and decision-making. This age-related shift in preference is assumed to serve emotional goals. When making health-care choices, for example, older adults reviewed and recalled a greater proportion of positive than negative cues than young adults (Löckenhoff & Carstensen, 2007). When interacting with a fraudulent telemarketer, such neglect of negative cues can be perilous—for example in lottery scams where potential victims are told that they won a large sum of money and are to send in a fee to collect their “winnings.” Focusing on the alleged winnings (positive cue) and neglecting the associated fee (negative cue) likely increases vulnerability.

Forewarning as a Way to Improve Decision-Making

One potentially effective prevention strategy is forewarning, a strategy based on the simple assumption that warning people of an impending influence appeal enhances their vigilance and ability to resist it. A long history of laboratory research documents the effectiveness of forewarning in “inoculating” people against social influence appeals (Banas & Rains, 2010; Wood & Quinn, 2003). In one classic study, college students warned that they were going to encounter a persuasive message about changing certain college regulations responded less favorably to a subsequent message advocating the introduction of a new comprehensive examination before graduation than students who had not received such forewarning (Petty & Cacioppo, 1979). This was particularly true for participants who would supposedly be affected by the proposed requirement as opposed to those who believed that it would apply only to future students or those at another college. Subsequent replications consolidated findings that forewarning people can effectively induce resistance (Romero, Agnew, & Insko, 1996; Sagarin, Cialdini, Rice, & Serna, 2002).

Forewarning appears to work by stimulating the formation of counterarguments (McGuire, 1961; Petty & Cacioppo, 1977) and/or inducing psychological reactance, viz. a desire to reassert one’s freedom (Brehm, 1966). According to a meta-analysis by Wood and Quinn (2003), forewarning effects tend to be stronger (1) for topics of high relative to low personal relevance, (2) when warnings are presented in more (audio or video) rather than less engaging ways (written), and (3) when participants are not distracted between warning and influence appeal, so that they can form counterarguments. This meta-analysis further revealed that warning about the specific topic and direction of a future influence appeal is equally effective as merely warning of an attempt to persuade (see also Banas & Rains, 2010). Applied to fraud prevention, this suggests that a warning about the specific telemarketing fraud to which one will be exposed will be equally effective as a more general warning or a warning about some other fraud.

Despite its potential value and relevance to fraud prevention, research on forewarning has rarely been undertaken outside the laboratory. Telemarketing fraud provided an especially appropriate target for the present real-world test for several reasons. First, most research on forewarning has been conducted with college students. Yet, targets of telemarketing fraud are typically older and more diverse than college students and may therefore differ in both their motivation and ability to form counterarguments. Second, prior work has mainly relied on hypothetical scenarios; no matter how much experimenters try to heighten the personal relevance of a persuasive argument, they rarely induce the level of involvement people have when they believe that their own money is actually at stake. Third, prior laboratory studies have typically tested resistance immediately after the forewarning or several days later. However, an effective forewarning intervention against telemarketing fraud must protect individuals across weeks and months. Scholars have suggested that forewarning effects may possibly decay after two weeks (Banas & Rains, 2010). Fourth, and most importantly, nearly all earlier studies on forewarning have focused on attitude change. Yet, the ultimate goal of forewarning against telemarketing fraud is to prevent people from behaving in ways that create financial harm for themselves and their families, not to merely make them more resistant to messages targeting their self-reported attitudes in the laboratory.

In light of the differences between standard laboratory contexts and measures and the types of contexts and responses of real-world concern to practitioners who seek to protect vulnerable consumers against fraudulent telemarketers, the test of forewarning we conducted is both timely and important. To our knowledge, this study is among the first to test forewarning in the field and with a sample of vulnerable consumers, many of which are assumed to be older. One prior AARP study (2003) tested the effectiveness of forewarning (in form of either a general warning or warning against a specific scam) across three days. Both types of warning reduced participants’ susceptibility to a mock scam they received three days later by about half. In the present study, the delay was extended to two and four weeks--an increase that takes on particular significance because of the previously noted memory declines associated with aging.

The Present Study

The present field experiment tested the effectiveness of warning a highly vulnerable group of consumers (i.e., documented past fraud victims) against telemarketing fraud. Although we were unable to obtain demographic data for a large part of the sample, based on past victim profiling studies (AARP, 2003, 2011, see below for details), it can be assumed that the sample comprised predominantly older adults. In collaboration with a Fraud Fighter Call Center operated by AARP, elderly volunteers engaged participants in one-on-one telephone conversations about fraud, which included forewarning about one specific scam currently in the marketplace. These participants, as well as a sample of control group participants who did not receive this “forewarning,” were exposed to a mock phone scam either two or four weeks later. We tested whether the forewarning is generally effective in conferring resistance to the mock scam.

We further tested the role of two moderators of forewarning effects. Since it is not feasible to warn about every telemarketing scam people might face, we investigated the extent to which warning about a specific scam might generalize to contexts where people are targeted with a different type of scam (Petty & Cacioppo, 1979). Although the AARP call center receives periodic FBI updates about current telemarketing scams, it is not feasible to issue warnings about each and every scam, especially as new scams are continually being devised. The extent to which warnings about particular scams inoculate individuals against other scams is thus an important issue. In our study, half of the experimental group was warned and response-tested with the same scam, whereas the other half was forewarned about a different scam than to which they were subsequently exposed.

A second moderator we considered was the delay interval. Specifically, we examined whether the types of warning would prove differentially effective in case of the 2-week and/or 4-week delay. Increasing the interval between warning and mock scam relative to the 3-day delay in the prior AARP (2003) study was deemed to be important to establish the practical relevance of forewarning effects, especially in light of diminished fluid cognitive capacities, coupled with a diminished tendency to attend to and remember negative-toned information, in older adults.

Method

Participants

Participants (N = 895) were drawn from US Postal Inspection Service lists of previous victims of mail fraud who had sent letters containing checks to post office boxes that were determined to be owned by fraud criminals. The US Postal Inspection Service recorded the names and addresses on the envelopes before returning them along with a warning about mail fraud. A commercial company matched the names to phone numbers.

It can be assumed that the sample comprised predominantly older adults. This assumption is based on prior victim profiling work. Surveys comparing verified mail fraud victims with the general population show that the mail fraud victims tend to be substantially older (AARP, 2003, 2011). In fact, the 2011 AARP survey used the same list of verified mail fraud victims provided by the US Postal Inspection Service as in the present study and reached 172 individuals; their mean age was 72 years. Thus, we can assume that the sample over-represented older people. This assumption was confirmed in a subsample of 145 participants who completed a follow-up survey (see below). Of these participants, 93% were 50 years or older, and 52% were 70 years or older.

The follow-up survey also contained questions on gender, education, marital status and subjective health. Of the 145 individuals who completed the follow-up survey, 63.4% were female, and 46% had a high-school education or less. About one-third (36.5%) of the participants were married or in a committed relationship; the remaining were single, widowed, divorced, or separated. Participants were generally in good health; 57% reported their health as good or very good compared to their peers.

Design and Procedure

Fifty-two volunteers from AARP’s Fraud Fighter Call Center in Seattle, Washington called participants with a warning about telephone fraud or a control script. Participants were randomly assigned to one of five experimental groups; four warning groups that differed in type of warning (same scam warning vs. different scam warning) and delay (2 vs. 4 weeks) and one control group. Participants in the experimental conditions were warned about a federal stimulus grant scam to which they would later be exposed, or an online pharmacy scam. The calls also included a conversational component, in which the peer counselor asked about prior experiences with scams and stressed the importance to refuse these. Participants in the control group completed a short survey about TV viewing preferences. Volunteers from AARP’s Fraud Fighter Call Center were trained on all scripts; they made blocks of phone calls rotating among the warning and control conditions.

Two or four weeks after the warning or control calls, a research assistant with prior experience as a professional telemarketer contacted participants with the mock scam. Of the 895 eligible participants whom AARP volunteers had called initially, the telemarketer reached 511 (57.1%); we ensured that these would be roughly evenly distributed across experimental conditions. During the response test the telemarketer verified that he spoke to the same person who had been assigned to receive the initial warning or control call. Calls lasted 2 minutes on average, with no differences by condition (p = .398). The two delay intervals for the control group were combined for analyses.

Three weeks after the response test, research assistants from Stanford University called these participants with a follow-up survey on demographics under the pretense of conducting a short survey on money and happiness. Of the 511 participants who received the mock scam, 278 (54.4%) were reached for the follow-up survey, of which 145 (52.1%) agreed to complete the survey, with no difference by condition (Pearson’s X2(4) = 5.41; p = .248). There was a positive association between falling for the scam and agreeing to complete the legitimate follow-up survey, X2 (1) = 5.51, p = .019.

Response Test

The Ohio Attorney General’s office provided a scam that fraudsters in the United States were using at the time of our study. Respondents were told that they qualified for a federal stimulus grant, and that the telemarketer’s company would help them apply for the grant after payment of a one-time service fee of $279. Normally, a fraudulent telemarketer would ask for the victim’s bank account number; however, due to ethical constraints, the potential victim was simply asked to accept a package with information and an invoice for the fee. By saying yes to this request, participants put themselves in harm’s way. No materials were ever mailed to the participants. A research assistant recorded call data and ensured the participants were treated comparably during the response test. Both telemarketer and the other research assistants were blinded to the experimental condition of participants by randomizing call lists. As approved by Stanford University’s institutional review board, participants were not debriefed since telemarketing occurs naturally in the marketplace and debriefing in this case likely would have caused more harm than good.

There was considerable variability in the responses both of people who accepted and who refused the package. For example, several interested respondents refused, claiming (truthfully or as an excuse to end the call) that they couldn’t afford the fee. Also, some people agreed to accept the package but expressed a degree of skepticism that made it unclear whether they would remit the fee. Therefore, two independent raters, who were blind to condition, coded participants’ reactions to the response test into four categories (inter-rater reliability: Kappa=.88). In case of disagreement, a third rater, also blind to condition, reconciled the codes. Two of the four categories contained people who accepted the package: “unequivocal acceptance” participants readily accepted the package without reservation, whereas “skeptical acceptance” participants accepted the package while expressing skepticism. The remaining two categories contained people who refused the package: “unequivocal refusal” participants rejected the offer immediately, whereas “ambivalent refusal” participants refused it without showing explicit awareness that the call was fraudulent. We operationalized the effectiveness of forewarning as a change in response patterns across these four categories; in particular in the reduction in unequivocal acceptance and in the increase in skeptical acceptance, ambivalent refusals, or unequivocal refusals.

Results

Overall Effectiveness of Forewarning

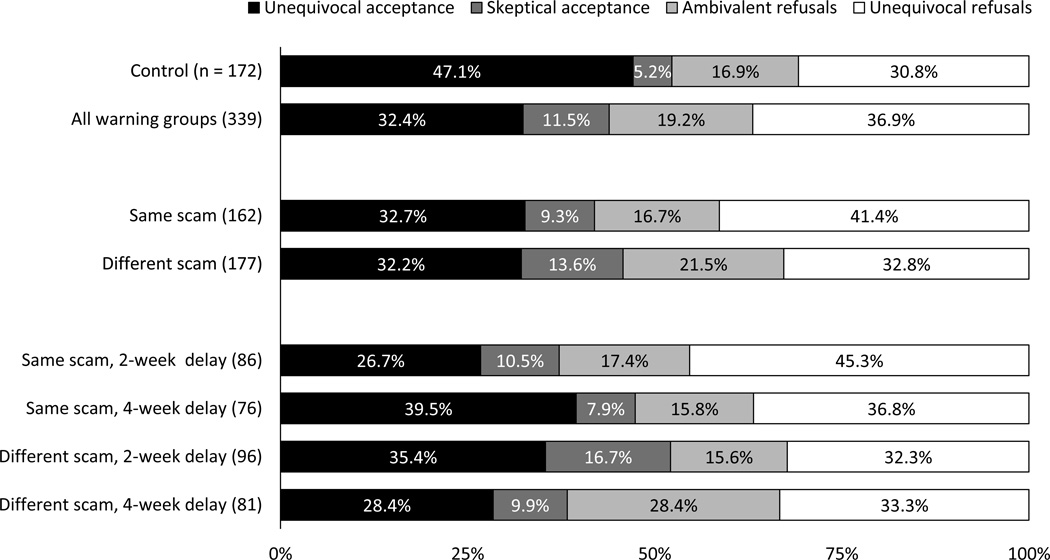

Hypotheses were tested using the sample of 511 participants who were reached for the response test; given the categorical nature of our key outcome variable chi-square tests were employed. We first examined the overall effectiveness of forewarning by comparing responses to the mock scam between the warning group (combined across type of script and delay) and the control group; the comparison yielded significant group differences, X2 (3) = 12.86, p = .005. Results are illustrated in see Figure 1 (top two rows). Follow-up chi-square tests comparing the frequency of each individual response category between groups revealed that the rate of “unequivocal acceptance” was significantly reduced in the warning group relative to the control group; X2 (1) = 10.46, p = .001, whereas the rate of “skeptical acceptance” (X2 (1) = 5.27, p = .022) was increased. The rates of “ambivalent refusal” (X2 (1) = 0.41, p = .524) and “unequivocal refusal” (X2 (1) = 1.85, p = .174) were not significantly different between warning and control groups.

Figure 1.

Responses to the mock phone scam after receiving a control versus warning call (top two rows), broken up by type of warning (middle rows), and broken up by type of warning and delays (bottom four rows). Cell sizes are given in brackets.

Differences Between Warning Scripts

In a second step, we compared the effectiveness of the two warning scripts. The same scam warning and the different scam warning produced different patterns of responses to the mock scam, relative to the control group, X2 (3) = 8.76, p = .033, and X2 (3) = 12.36, p = .006, respectively (see Figure 1, middle rows). Follow-up tests comparing the frequencies for each individual response category indicated that the two types of warnings were both effective in reducing “unequivocal acceptance” responses (same scam: X2 (1) = 7.18, p = .007; different scam: X2 (1) = 8.09, p = .004). The same scam warning further increased “unequivocal refusal” responses, X2 (1) = 4.03, p = .045, whereas the different scam warning increased “skeptical acceptance” responses, X2 (1) = 7.06, p = .008. The remaining comparisons did not yield significant group differences (p ≥ .154).

Effect of Delay Interval

Unexpectedly, the effect of the delay interval differed between the two types of warnings (Figure 1, bottom four rows). Specifically, for participants who had received the same scam warning, forewarning was only effective at the 2-week delay, but not at the 4-week delay. In contrast, forewarning was effective for both delays in the different scam condition. Specifically, for the same scam participants, response patterns were significantly different from the control group at the 2-week delay, X2 (3) = 11.55, p = .009; but no longer at the 4-week delay, X2 (3) = 1.92, p = .588. The difference at the 2-week delay was driven by a decreased rate of “unequivocal acceptance” responses, X2 (1) = 9.87, p = .002; and an increased rate of “unequivocal refusal” responses, X2 (1) = 5.28, p = .022; the rates of the two intermediate response categories did not differ (p ≥ .120). A comparison of response patterns between 2-week and 4-week delay did, however, not show significant differences (p = .383).

The different scam warning, by contrast, continued to be effective over time, as indicated by different response patterns relative to the control group at both the 2-week delay, X2 (3) = 10.69, p = .014; and the 4-week delay, X2 (3) = 10.13, p = .018. At both delays, the rate of “unequivocal acceptance” responses was reduced; this difference was at trend level at the 2-week delay, X2 (1) = 3.43, p = .064; and significant at the 4-week delay, X2 (3) = 7.95, p = .005. However, in contrast to the same scam warning, there was no increase in unequivocal refusals, p ≥ .688. Instead, the reduction of unequivocal acceptance responses in the different scam warning was accompanied at the 2-week delay by an increased rate of “skeptical acceptance” responses, X2 (1) = 9.52, p = .002; and at the 4-week delay by an increased rate of “ambivalent refusals”, X2 (3) = 4.49, p = .034. A comparison of response patterns between the 2-week and 4-week delay did not show significant differences (p = .138).

In sum, the effectiveness of the different scam warning was maintained from the short to the long delay, whereas the same scam warning appeared to be effective only at the short delay. Moreover, the pattern of results suggest that whereas the same scam warning appeared to decrease vulnerability most notably by prompting direct refusals in response to the scam attempt, the different scam warning did so most notably be prompting skeptical or ambivalent responses to that attempt.

Discussion

Telemarketing fraud, which is ubiquitous and disproportionately aimed at older adults, leads to heavy financial losses for millions of consumers. Our study yielded encouraging evidence that forewarning can be an effective tool in combating this problem. Vulnerable consumers who were targeted with a mock scam after having been previously warned either about the same or about a different scam proved significantly less likely to respond in a fashion suggesting their likely potential victimization than those who had received no such warning. The current research represents an important extension of existing forewarning research that has targeted merely attitude change, often in laboratory contexts with college students and over rather short delays. In comparison to this previous work, the current study has much higher ecological validity. By using real scams and a response test conducted by a research assistant with prior experience as a professional telemarketer – whose skill is attested to by the almost 50% unequivocal acceptance responses obtained in the control condition – we closely simulated the relevant marketplace phenomenon. All participants were previous victims of mail fraud and thus the type of people who end up on fraud perpetrators’ “mooch lists” identifying “easy prey”. Inferring from earlier victim profiling research, including one study (AARP, 2011) that drew from the same list of verified mail fraud victims as the present study, and from survey responses of a subgroup of 145 participants, the total sample contained a large proportion of people of advanced age. Demonstrating the potential benefits of forewarning with this highly vulnerable population is especially encouraging.

Consistent with prior meta-analyses on forewarning (Banas & Rains, 2010; Wood & Quinn, 2003), the two types of warnings employed in our study were equally effective in reducing unequivocal acceptance of the scam. However, distinguishing between clear refusals, ambivalent refusals, and skeptical acceptance responses revealed some important nuances. The same scam warning had its greatest impact on the frequency of unequivocal refusals--presumably because participants recognized the fraudulent offer and followed the advice to decisively refuse it. The different scam warning had no impact on the frequency of unequivocal refusals but on the frequency of skeptical acceptance or ambivalent refusals. Because participants in this condition could not immediately identify the offer as fraudulent, they expressed doubts rather than decisively refusing the offer.

The effectiveness of forewarning apparent after 2 weeks was maintained after 4 weeks in the case of the different scam warning, although this was not as clearly the case for the same scam warning. Although the response patterns between the 2-week delay and the 4-week delay were not statistically different from each other, a comparison with the control group yielded that forewarning with the same scam warning was effective at the 2-week delay, but no longer at the 4-week delay. One explanation for this somewhat surprising finding may be failure of source memory in older adults. Skurnik and colleagues (2005) found that older adults misremembered as true strong (but not weak) marketing messages that were labeled as false. Applied to our case, participants in the same scam warning condition may keep remembering the content of the scammer’s appeal mentioned in the warning, but forget that it was fraudulent. A related factor is the tendency for older adults to remember important, general information (gist), but show poorer recall of specific, detailed information. Given decreases in fluid cognitive function, older adults may selectively focus on and remember what they consider to be the highest value information at the expense of trying to remember all the details (Castel, Farb, & Craik, 2007). Anecdotal evidence from call center volunteers suggested that many participants in the present study did not think they would be vulnerable to the online pharmacy scam since they had adequate medical coverage. Not perceiving the details of the pharmacy scam to be important, such participants may have remembered the gist rather than the specifics of the warning call. By contrast those warned about the stimulus grant scam who thought it an alluring idea, may have remembered the details of the appealing offer, at the expense of remembering the more general warnings and counsel. Future research should directly test the self-relevance of different scams, and whether perceived relevance and importance translates to behavioral differences.

Limitations and Future Directions

Results of this study need to be interpreted in light of its limitations. Ethical constraints required us to end the response test with the participants’ agreement to receive an information package with an invoice for the $279 processing fee. The proportion of respondents who would have actually authorized the relevant payment cannot be ascertained. We further have only limited knowledge of participant demographics, cognitive capacities, and their life circumstances, although we can infer these with some certainty from prior victim profiling research. Nevertheless, the lack of demographic information for a large part of this specific sample precludes the possibility to investigate the moderating influence of participant characteristics known to influence fraud susceptibility (e.g., Lichtenberg, Stickney, & Paulson, 2013) on the effectiveness of forewarning. This issue should be addressed by future research.

Further, this study utilized only two specific scams in the warning, and only one scam in the response test. Our ability to generalize to other real-world scams is thus limited. Scams differ in their persuasiveness and it may matter whether the forewarning involves a more, less, or equally compelling example. We also do not know whether describing frauds in detail during a forewarning as opposed to just mentioning the types of topics and techniques employed by the fraudsters influences the effectiveness of forewarning. Finally we did not fully script the forewarning call; the second half included a conversational component. Although this served the goal of enhancing ecological validity, it did reduce control over the conversation with individual participants, which could have been somewhat altered by the preceding warning and the participant’s response to that warning. Additionally, this procedure leaves it unclear whether the warning itself or rather the subsequent conversation is responsible for the increased resistance in the warning group as compared to the control group. At the same time, the specific warning given did make a difference for participants’ responses to the mock scam.

The current study shows that forewarning is a promising strategy for reducing fraud victimization in older adults. Future research may investigate the underlying mechanisms and how this strategy can be further refined. For example, fully recording the response test calls would provide valuable information about the degree of counter-arguing and reactance among participants. If counter-arguing will emerge as the critical factor in forewarning effectiveness, future campaigns could explicitly train older consumers to form counterarguments. Future research may further test whether forewarning may be enhanced via automated reminder calls that offer repetition of the message, or by using message framing tailored to the positivity effect in older adults’ information processing (Shamaskin, Mikels, & Reed, 2010).

Conclusion

Forewarning can effectively reduce fraud susceptibility in vulnerable consumers. Assuming that all persons responding in a “clearly vulnerable” manner in our study would have actually sent the requested $279, the telemarketer “earned” an average of $91 per call when consumers were warned against fraud. Without the warning calls, the average earning per call was $131. Given that literally millions of calls are made by fraudsters every year, the forewarning effect is highly significant. Further improving the effectiveness of warning messages through carefully designed field research could do much to protect vulnerable consumers.

Acknowledgments

The study was supported by National Institute on Aging grant R37AG008816 to L.L.C., a fellowship from the German Research Foundation (DFG) to S.S., and a grant from AARP to the Stanford Center on Longevity. We gratefully acknowledge the many highly committed AARP Fraud Fighter Call Center volunteers who conducted the “forewarning” calls in our study.

Appendix

Scripts Used During Warning Calls

Hello, my name is ___________ and I’m calling from the Fraud Fighter Call Center in XXXX with a quick public service message about a scam that is going around. [Same scam warning] If you receive a call from someone who claims that you are eligible for free money from the government as part of the economic stimulus package, be careful. This scam is happening all over the country. These folks are con artists who are after your money and your personal information. The caller will next tell you that you are eligible but first you need to pay an upfront fee. [Different scam warning] If you ever get a call from someone who claims to represent a discount online prescription program and the caller then tells you that, by signing on to their program and paying an upfront fee, you can save more than 50% on your drugs, guaranteed, be careful. You will then be asked to share a credit card number, or bank account number or send money in advance; you need to know that this is a scam and you are being targeted for fraud. The people making these calls are con artists who are after your money and personal information.

We suggest that if you receive a call like this, you should advise the caller you do not conduct business over the telephone or, better yet, simply hang up.

At this point you can initiate a conversation by asking,

“Have you ever had a call like this? Have you ever had any calls or mailers on any other type of scam?”….Take it where it leads

Be sure to stress that it is best to refuse ANYONE who calls with ANY offer where you are asked to share your personal or financial information.

At some point, ask the following question:

If you would like, I can give you the number of the fraud fighter call center…they have experts who can help you with any type of consumer fraud or consumer protection questions you or your friends may have….it’s free.

X (XXX) XXX-XXXX.

Thank you for listening to our message and again - be sure to hang up on fraudulent telemarketers.

References

- AARP. Telemarketing fraud victimization of older americans: An AARP survey. Washington, DC: AARP Foundation; 1996. Retrieved from http://longevity.stanford.edu/Fraud/Docs/AARP,%202006%20Fraud%20Victimizaiton.pdf. [Google Scholar]

- AARP. Consumer behavior, experiences and attitudes: A comparison by age groups. New Jersey: Princeton Survey Research; 1999. [Google Scholar]

- AARP. Off the hook: Reducing participation in telemarketing fraud. Washington, DC: AARP Foundation; 2003. Retrieved from http://assets.aarp.org/rgcenter/consume/d17812_fraud.pdf. [Google Scholar]

- AARP. AARP Foundation national fraud victim study. Washington, DC: AARP Foundation; 2011. Retrieved from http://assets.aarp.org/rgcenter/econ/fraud-victims-11.pdf. [Google Scholar]

- Anderson KB. Consumer fraud in the United States: The second FTC survey. Washington, DC: Federal Trade Commission; 2007. Retrieved from http://www.ftc.gov/opa/2007/10/fraud.pdf. [Google Scholar]

- Aziz SJ, Bolick DC, Kleinman M, Shadel DP. The national telemarketing victim call center: Combating telemarketing fraud in the United States. Journal of Elder Abuse & Neglect. 2000;12(2):93–98. [Google Scholar]

- Banas JA, Rains SA. A meta-analysis of research on inoculation theory. Communication Monographs. 2010;77:281–311. [Google Scholar]

- Brehm JW. A theory of psychological reactance. Oxford England: Academic Press; 1966. [Google Scholar]

- Castel AD, Farb NAS, Craik FIM. Memory for general and specific value information in younger and older adults: Measuring the limits of strategic control. Memory & Cognition. 2007;35:689–700. doi: 10.3758/bf03193307. [DOI] [PubMed] [Google Scholar]

- Cohen CA. Consumer fraud and the elderly: A review of Canadian challenges and initiatives. Journal of Gerontological Social Work. 2006;46(3–4):137–144. doi: 10.1300/J083v46n03_08. [DOI] [PubMed] [Google Scholar]

- Denburg NL, Cole CA, Hernandez M, Yamada TH, Tranel D, Bechara A, Wallace RB. The orbitofrontal cortex, real-world decision making, and normal aging. Annals of the New York Academy of Sciences. 2007;1121:480–498. doi: 10.1196/annals.1401.031. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Finke MS, Howe JS, Huston SJ. Old age and the decline in financial literacy. 2011 Social Science Research Network: Retrieved at http://dx.doi.org/10.2139/ssrn.1948627. [Google Scholar]

- FINRA Investor Education Foundation. Financial fraud and fraud susceptibility in the United States: Research report from a 2012 national survey. 2013 Retrieved from http://www.finrafoundation.org/web/groups/sai/@sai/documents/sai_original_content/p337731.pdf. [Google Scholar]

- Lichtenberg PA, Stickney L, Paulson D. Is psychological vulnerability related to the experience of fraud in older adults? United Kingdom: Taylor & Francis; 2013. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Löckenhoff CE, Carstensen LL. Aging, emotion, and health-related decision strategies: Motivational manipulations can reduce age differences. Psychology and Aging. 2007;22:134–146. doi: 10.1037/0882-7974.22.1.134. [DOI] [PubMed] [Google Scholar]

- Mather M. A review of decision-making processes: Weighing the risks and benefits of aging. In: Carstensen LL, Hartel CR, editors. When I'm 64. Washington, DC US: National Academies Press; 2006. pp. 145–173. [Google Scholar]

- McGuire WJ. Resistance to persuasion conferred by active and passive prior refutation of the same and alternative counterarguments. The Journal of Abnormal and Social Psychology. 1961;63:326–332. [Google Scholar]

- Petty RE, Cacioppo JT. Forewarning, cognitive responding, and resistance to persuasion. Journal of Personality and Social Psychology. 1977;35:645–655. [Google Scholar]

- Petty RE, Cacioppo JT. Effects of forewarning of persuasive intent and involvement on cognitive responses and persuasion. Personality and Social Psychology Bulletin. 1979;5:173–176. [Google Scholar]

- Reed AE, Carstensen LL. The theory behind the age-related positivity effect. Frontiers in Psychology. 2012;3:339. doi: 10.3389/fpsyg.2012.00339. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Romero AA, Agnew CR, Insko CA. The cognitive mediation hypothesis revisited: An empirical response to methodological and theoretical criticism. Personality and Social Psychology Bulletin. 1996;22:651–665. [Google Scholar]

- Sagarin BJ, Cialdini RB, Rice WE, Serna SB. Dispelling the illusion of invulnerability: The motivations and mechanisms of resistance to persuasion. Journal of Personality and Social Psychology. 2002;83(3):526–541. doi: 10.1037//0022-3514.83.3.526. [DOI] [PubMed] [Google Scholar]

- Salthouse TA, Ferrer-Caja E. What needs to be explained to account for age-related effects on multiple cognitive variables? Psychology and Aging. 2003;18:91–110. doi: 10.1037/0882-7974.18.1.91. [DOI] [PubMed] [Google Scholar]

- Shamaskin AM, Mikels JA, Reed AE. Getting the message across: Age differences in the positive and negative framing of health care messages. Psychology and Aging. 2010;25:746–751. doi: 10.1037/a0018431. [DOI] [PubMed] [Google Scholar]

- Skurnik I, Yoon C, Park DC, Schwarz N. How warnings about false claims become recommendations. Journal of Consumer Research. 2005;31:713–724. [Google Scholar]

- Thornton WJ, Dumke HA. Age differences in everyday problem-solving and decision-making effectiveness: A meta-analytic review. Psychology and Aging. 2005;20:85–99. doi: 10.1037/0882-7974.20.1.85. [DOI] [PubMed] [Google Scholar]

- Wood W, Quinn JM. Forewarned and forearmed? two meta-analysis syntheses of forewarnings of influence appeals. Psychological Bulletin. 2003;129:119–138. doi: 10.1037/0033-2909.129.1.119. [DOI] [PubMed] [Google Scholar]