Abstract

The present study investigated the role of anticipated emotions in risky decisions of young and older adults. Young and older adults were asked to make a choice between an alternative that may have either a very positive or a very negative consequence and an alternative that was relatively safe. Meanwhile, they rated their anticipated emotions if the results turned out to be positive or negative. Older adults’ decisions were significantly influenced by anticipated positive emotions (e.g., happiness). Younger adults’ decisions were associated by anticipated negative emotions (e.g., regret). These results have implications in decision making of older adults.

Today’s American older adults may face increasing decision-making responsibilities, from retirement planning to health care, due to policy changes in Social Security and Medicare. Yet, little is known about how older adults make decisions, especially risky decisions (Mather, 2006; Sanfey & Hastie, 2000). The problem becomes more salient for older adults given their shorter future time perspectives. In other words, older adults may have a relatively shorter time frame than young adults to take risky choices and correct mistakes later.

Most of the limited research on aging and decision making focused on how cognitive decline of older adults may decrease their decision-making competence. For instance, Finucane et al. (2002) compared older and younger adults’ choices of health plan options. Older adults demonstrated greater comprehension errors and inconsistent preferences than younger adults. However, this study did not take into consideration older adults’ emotions. In real life situations, older adults’ choices are frequently influenced by their emotional experience and future consequences. Past research has demonstrated that emotions have powerful effects on our decisions (Loewenstein, Weber, Hsee, & Welch, 2001). For instance, anticipated positive emotions may either increase our tendency to take the risky choice if the results turn out to be good (e.g., feel happy for future gains) or decrease our tendency to take the risk if there is a bad consequence (e.g., feel relief by avoiding future losses). Likewise, anticipated negative emotions may either increase our tendency to take the risky choice if the results turn out to be good (e.g., feel regret if miss out on future gains) or decrease our tendency to take the risk if it has a bad consequence (e.g., feel disappointed for future losses). The present research examined the role of anticipated emotions on risky decisions for young and older adults.

AGE DIFFERENCES IN RISKY DECISIONS

Risk is typically defined as people’s preference for an option with uncertainty (e.g., winning $1000 or nothing) over a sure payoff (e.g., winning $50). Previous research found that there were no consistent age-related changes in risk-taking and risk attitudes across the adult life span (Mather, 2006; Sanfey & Hastie, 2000). This pattern of little or no age differences in risky decisions runs counter to the belief that older adults are typically more risk averse. The few experiments on age differences in risky decisions revealed mixed results. For instance, using the Iowa Gambling task, MacPherson, Phillips, and Della Sala (2002) found no age differences in choosing cards from high risk/high reward decks. In contrast, Deakin, Aitken, Robbins, and Sahakian (2004) found that aging was associated with longer deliberation time and reduced risk-taking in another computer-based gambling task. While investment research (e.g., Dulebohn, 2002) indicated that older adults became more conservative with asset allocations, medical decision making involving risk (e.g., Curley, Eraker, & Yates, 1984) revealed no age differences in young and older patients’ reactions to therapeutic uncertainty.

It is likely that different risky decision tasks required different degrees of executive function and working memory (MacPherson et al., 2002). In addition, age differences in social and emotional factors, such as goals and emotions, may contribute to the conflicting results (Mather, 2006). For example, people may use different strategies for social problem-solving and decision-making (e.g., rely on schemas and emotion-focused strategies, see Blanchard-Fields & Horhota, 2006) than for decisions involving investment (e.g., use numerical calculations, Rettinger & Hastie, 2001).

THE ROLE OF EMOTION IN DECISION MAKING

Traditional literature on decision making typically does not involve emotion. Rather, decisions are viewed as rational processes that involve weighting pros and cons of different options, and choices are based on calculations of maximizing benefits and minimizing losses. More recent research suggests that both experienced and anticipated emotions have powerful effects on our decisions (Fong & Wyer, 2003; Loewenstein et al., 2001; Mellers, Schwartz, & Ritov, 1999). For example, suppose that people need to make a decision whether to take the risky choice with uncertainty. People’s desire to take the risk may increase with anticipated positive emotions (e.g., happiness) if they benefited from this decision and with anticipated negative emotions (e.g., regret) if they did not take the risk and lost the opportunity to benefit. On the other hand, people’s desire to avoid the risk may increase with anticipated positive emotions (e.g., relief) if they did not take the risk and avoided a loss with anticipated negative emotions (e.g., disappointment) if they took the risk and lost. Fong and Wyer (2003) found that young adults’ decisions to take the risk were mediated by their anticipated emotions in response to alternative decision outcomes.

Age differences in emotion functions have been documented in recent studies on social cognition and aging (Blanchard-Fields & Horhota, 2006; Carstensen, Mikels, & Mather, 2006). For instance, the positivity effect was defined as the developmental pattern in which a disproportionate preference for negative materials in younger adults relative to disproportionate preference for positive information in older adults (Carstensen & Mikels, 2005). Whereas younger adults showed superior working memory for negative relative to positive emotional information, older adults exhibited superior working memory for positive relative to negative emotional stimuli (Mikels, Larkin, Reuter-Lorenz, & Carstensen, 2005). Older adults also remembered their choices more positively than young adults (Mather & Johnson, 2000). Based on the positivity effect, one may expect that anticipated positive emotions would play a larger role in older adults’ decisions, whereas anticipated negative emotions play a larger role in young adults’ decisions.

THE PRESENT STUDY

The current study used two scenarios based on Fong and Wyer (2003) to examine the role of anticipated emotions in risky decisions of young and older adults: one scenario involved investment (i.e., investment scenario) and the other involved an academic situation (i.e., academic scenario). Young and older adults were confronted with a choice between an alternative that involved uncertainty (may have either a very positive or a very negative consequence) and an alternative whose consequences were predictable. Then they were asked to rate how likely they were going to take the risky choice. Meanwhile, young and older adults were also asked to anticipate how they would feel about their choices under four different circumstances. For example, how would you feel if you take the risk and the consequence turned out to be positive? How would you feel if you take the risk and the consequence turned out to be negative? How would you feel if you did not take the risk and the consequence turned out to be positive? And how would you feel if you did not take the risk and the consequence turned out to be negative?

Based on the positivity effect (Carstensen & Mikels, 2005), it was hypothesized that older adults’ decisions to take the risk would be more likely related to their anticipated positive emotions (e.g., happiness), whereas young adults’ decisions to take the risk would be more likely affected by their anticipated negative emotions (e.g., regret).

METHOD

Participants

Thirty-six young adults (25 female, age 19 to 23, M = 19.86) from a Midwestern university and 36 community-dwelling older adults (24 female, age 62 to 87, M = 77.50) from the surrounding area participated in the experiment. Young adults received extra credits for psychology classes and older adults were compensated with $10. Young adults reported having more years of education (M = 14.03, SD = 1.28) than older adults (M = 12.50, SD = 2.27), t(70) = 3.52, p < .01. Young adults also rated themselves more healthy (M = 3.25, SD = .65) than older adults (M = 2.81, SD = .79), t(70) = 2.62, p < .05 on a self-rated health scale (1 = Poor, 2 = Fair, 3 = Good, and 4 = Excellent).

Materials

The Decision-Making Task

The decision-making task was based on Fong and Wyer (2003). Each participant received a document package. Instructions were printed on the first page:

We are interested in how people make decisions. Please read each scenario carefully at least twice, because you will not be able to go back to it in answering the questions in the following page. After you finish reading the scenario, turn over the page and make your choices by circling the appropriate numbers. We would also like you to imagine different outcomes of your decisions and rate your feelings about these future outcomes.

Two scenarios were presented: the academic scenario and the investment scenario. The academic scenario required the participants to imagine that they were taking an introductory course and tomorrow was the final exam:

Imagine that you hear a rumor that a certain topic (topic A) is likely to be covered. Because you have limited time, you must decide whether or not to study this topic. If you study for it, it will take a lot of time and you will have very little time left to study other topics that may also appear. Another option is to study other topics and ignore Topic A. If Topic A is on the exam, however, the relative weight of other topics will be substantially reduced.

If you study Topic A and it is on the exam, you are likely to get as high as an A for the exam.

If you study Topic A and it is not on the exam, you are likely to get as low as a D.

If you ignore Topic A and study the other topics, you will only be able to study enough to get a C regardless of whether Topic A is on the exam or not.

The investment scenario asked the participants to imagine that they had some free money and considered how to invest it.

Suppose that you have some free money and are considering whether to put all of the money into time deposit or to invest in a certain company (A). Both options will tie up your money for the same period of time (e.g., at least a year). You have to invest $5,000 in order to buy one unit of stock. The stock acquisition is open to the public but the stock will not be publicly traded in the stock market after the acquisition. If you do not buy it now, you will not be able to buy it later. So you have to make a decision quickly.

If company A does well, you could gain as much as $5,000.

If company A does poorly, you could lose as much as $5,000.

The alternative is to put all of your money in a time deposit at a large bank, where there is essentially no risk of losing your money but the return is also very small.

After participants read each scenario, they were asked to answer a series of questions. The questions concerned the likelihood that they would take the risk (i.e., studying Topic A or investing in Companying A) on a 11-point Likert scale (0 = not at all to 10 = very likely) and their anticipated feelings under four different circumstances on 11-point scales (−5 = very bad, 0 = neutral, and 5 = very good). In the following, the academic scenario is used as an example:

Imagine that you had decided to study the topic. If Topic A was on the exam, so you got a very good grade, how would you feel?

Imagine that you had decided to study the topic. If the topic was not on the exam, so you got a very poor grade, how would you feel?

Imagine that you had decided not to study the topic. If the topic was on the exam, so you missed the chance to get a very good grade, how would you feel?

Imagine that you had decided not to study the topic. If the topic was not on the exam, so you avoided getting a poor grade, how would you feel?

Design and Procedure

The current study used a 2 (age group: young vs. older adults) × 2 (decision scenario: academic vs. investment) mixed design, with the age group as a between-subject factor and the decision scenario as a within-subjects factor. Young and older adults were tested individually. Upon arriving at the laboratory, each participant filled out a demographic questionnaire, which included age, gender, years of education, and self-rated health (1 = Poor, 2 = Fair, 3 = Good, and 4 = Excellent). Then, participants completed the decision making task. Finally, they were fully debriefed and thanked for their participation.

RESULTS

Age Differences in Risky Decisions

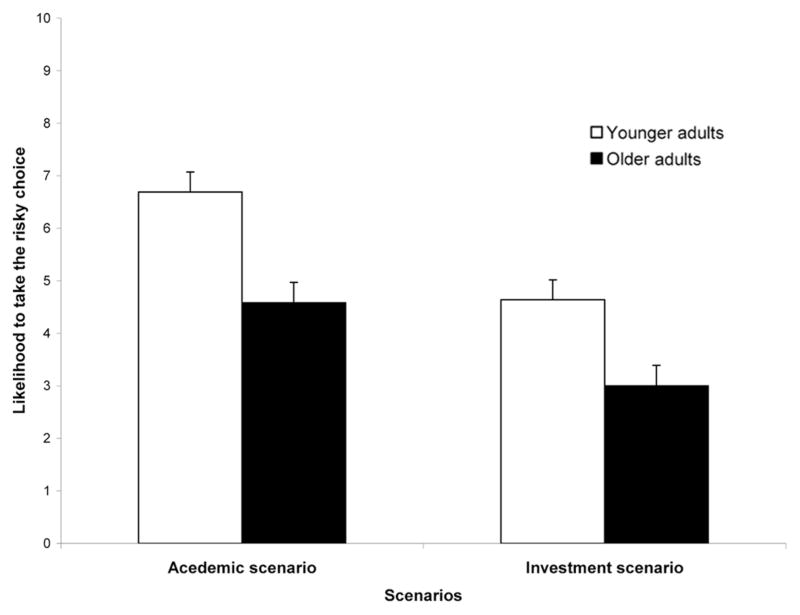

In order to examine if there were age differences in risky decisions and whether these age differences (or the lack of) differed across the two scenarios, a 2 (age group) × 2 (decision scenario) MANOVA was conducted on the likelihood to take the risky choice. Only the main effects of age group were significant in both academic and investment scenarios: F(1, 70) = 19.75, p < .001, MSE = 4.06, η2 = .22 for the academic scenario, and F(1, 70) = 10.91, p < .01, MSE = 4.43, η2 = .14 for the investment scenario. Older adults were less likely than young adults to take the risky choice in both the academic and the investment scenarios (see Figure 1). Table 1 showed means and standard deviations of risk-taking tendency for young and older adults.

Figure 1.

Age differences in the likelihood to take the risky choice.

Table 1.

Means (and standard deviations) of the likelihood of taking the risky choices

| Age group | Academic scenario | Investment scenario |

|---|---|---|

| Young adults | 6.69 (1.64) | 4.64 (1.88) |

| Older adults | 4.58 (2.33) | 3.00 (2.31) |

The Role of Anticipated Emotions in Risky Decisions of Young and Older Adults

In order to examine whether anticipated emotions affected risky decisions differently for young and older adults in the academic and the investment scenarios, four anticipated emotions under four different circumstances were regressed on the likelihood to take the risky choice. This was done separately for young and older adults. Table 2 showed regression results in both the academic and the investment scenarios.

Table 2.

Regression of anticipated emotions on risk taking of young and older adults

| Anticipated emotions | B | SEB | β | R2 |

|---|---|---|---|---|

| Academic scenario: Young adults | 0.32 | |||

| Happiness | 0.40 | 0.59 | 0.11 | |

| Regret | 0.60 | 0.16 | 0.67** | |

| Relief | 0.05 | 0.21 | 0.04 | |

| Disappointment | −0.15 | 0.14 | −0.19 | |

| Academic scenario: Older adults | 0.26 | |||

| Happiness | 0.75 | 0.26 | 0.63** | |

| Regret | 0.26 | 0.21 | 0.28 | |

| Relief | 0.09 | 0.16 | 0.10 | |

| Disappointment | 0.09 | 0.16 | 0.10 | |

| Investment scenario: Young adults | 0.09 | |||

| Happiness | 0.36 | 0.43 | 0.19 | |

| Regret | −0.04 | 0.15 | −0.05 | |

| Relief | −0.31 | 0.19 | −0.32 | |

| Disappointment | −0.04 | 0.17 | −0.04 | |

| Investment scenario: Older adults | 0.10 | |||

| Happiness | 0.52 | 0.32 | 0.34 | |

| Regret | 0.22 | 0.19 | 0.24 | |

| Relief | 0.05 | 0.13 | 0.07 | |

| Disappointment | 0.20 | 0.22 | 0.19 |

p < .01.

In the academic scenario, older adults’ likelihood to take the risky choice (i.e., studying Topic A) was significantly affected by their anticipated positive emotions (e.g., happiness) when results turned out to be positive. In contrast, young adults’ likelihood to take the risky choice were significantly influenced by anticipated negative emotions (e.g., regret) if they decided not to take the risk and consequences turned out to be positive. Consistent with our prediction, older adults’ risk-taking decisions were more likely to be influenced by their anticipated positive emotions (e.g., happiness) and young adults’ risk-taking tendencies were more likely associated with their anticipated negative emotions (e.g. regret).

In the investment scenario, however, none of the anticipated emotions had significant contributions to young and older adults’ likelihood to take the risky choice.

DISCUSSION

To our knowledge, the current study is the first to examine whether anticipated positive and negative emotions play a more or less prominent role in decision making as a function of age. It added more evidence to the limited research on age differences in risky decisions. It also contributed to the growing literature on the positivity effects of older adults in social cognition.

We found that older adults were less likely than young adults to take the risky choice in both academic and investment scenarios. This pattern of results on age differences in risky decisions is consistent with the beliefs that older adults tend to be more risk averse. However, as Mather (2006) pointed out, it was not entirely clear whether these age differences were due to other factors confounded with age. For instance, young and older adults may differ in their academic goals and beliefs of rumors in the academic scenario. For young adults, receiving a “C” may be regarded as a failure instead of a relatively safe choice. Thus, they may be more likely than older adults to trust the rumor and take the risky choice. On the other hand, older adults may view test grades as less important in academic learning experience, and rumor should not be trusted. Similarly, in the investment scenario, young and older adults may differ in wealth and the time horizon of the investment goals (Mather, 2006). Five thousand dollars may weight differently for young and older adults in investment, but the time left to make it up in case of loss was definitely shorter for older adults. It is worthy noting that although the likelihood to take the risky choice was below the midpoint of 5 (scale ranged 0 to 10) for both age groups (M = 4.64 and M = 3.00 for young and older adults in the investment scenario, respectively), older adults were farther away from the midpoint.

You may also wonder if older adults’ risk-taking was indeed more likely to be influenced by positive emotions (e.g., happiness). Why weren’t they more likely than young adults to take the risky choices? First of all, as we pointed out earlier in the manuscript, positive emotions can either increase or decrease risk-taking tendencies depending on the anticipated results of risk taking. If anticipated results turned out to be good, anticipated positive emotions (e.g., happiness) would increase risk-taking tendency. On the other hand, if results turned out to be bad, anticipated positive emotions (e.g., relief) would decrease risk-taking tendency. Our findings of a positive relationship between older adults’ risk-taking tendency and anticipated positive emotions (e.g., happiness) may simply suggest that older adults were more likely to think about good outcomes when they made risky decisions in the academic scenario. Furthermore, the anticipated negative emotion (e.g., regret) if not taking the risk and the consequence turning out to be positive was associated with young adults’ risky decisions in the academic scenario. This pattern of results seemed to suggest that older adults paid more attention to positive feelings associated with gains (e.g., happiness) when making risky decisions. Young adults were more concerned with the negative feelings associated with missing out on the opportunity (e.g., regret).

In addition to goals and outcome evaluations, there are a lot of other variables that could affect individuals’ risky decisions (e.g., risk perception). Anticipated emotions are only one among the factors (Loewenstein et al., 2001). The role of anticipated emotions did not seem to play an important role in young and older adults’ risky decisions in the investment scenario. We suspect that factors other than anticipated emotions may be more important in the investment scenario. For instance, the risk stake of gaining or losing up to $5,000 may have been too high for both young and older adults. Hence, a relatively safe alternative was preferred regardless of anticipated emotions under different circumstances.

Although results of our study had important contributions to our understanding of the role of emotions in risky decisions of young and older adults, it is far from conclusive. The risk scenarios were not systematically manipulated, so the probability of the risk was not clear for young and older participants. The two content domains with differential familiarity to young and older adults may have introduced additional factors confounded with age. Finally, the sample size may be too small to detect significance of regression analysis. More research is needed in this area to answer the questions of whether there are truly age differences in risk-taking and what role anticipated emotions play in young and older adults’ decision making.

In spite of the limitations, the findings of the current study have important implications in older adults’ everyday decision making. For instance, in January 2006, the new Medicare Modernization Act (Part D) offered more than 50 insurance plans to older adults for prescription drug coverage (Kaiser Family Foundation, 2007). These insurance plans also varied greatly in terms of benefit design, drug coverage, and out-of-pocket cost. These medical decisions not only placed enormously cognitive burdens on older adults but also likely took great emotional tolls. Older adults’ tendency to pay more attention to positive information (Carstensen et al., 2006) and anticipate positive emotions associated with good outcomes may prompt them to ignore negative information and negative emotions associated with bad outcomes in other dimensions. Professional consultants should advise older adults on the balance of positive versus negative information and emotions associated with it in order to help them make good decisions.

References

- Blanchard-Fields F. Everyday problem solving and emotion: An adult developmental perspective. Current Directions in Psychological Science. 2006;16:26–31. [Google Scholar]

- Blanchard-Fields F, Horhota M. How can the study of aging inform research on social cognition? Social Cognition. 2006;24:207–217. [Google Scholar]

- Carstensen LL, Mikels JA. At the intersection of emotion and cognition: Aging and the positivity effect. Current Directions in Psychological Science. 2005;14:117–121. [Google Scholar]

- Carstensen LL, Mikels JA, Mather M. Aging and the intersection of cognition, motivation, and emotion. In: Birren JE, Schaire KW, editors. Handbook of the psychology of aging. 6. Amsterdam: Elsevier; 2006. pp. 343–362. [Google Scholar]

- Curley SP, Eraker SA, Yates JF. An investigation of patients’ reactions to therapeutic uncertainty. Medical Decision Making. 1984;4:501–511. [Google Scholar]

- Deakin J, Aitken M, Robbins T, Sahakian BJ. Risk taking during decision-making in normal volunteers changes with age. Journal of the International Neuropsychological Society. 2004;10:590–598. doi: 10.1017/S1355617704104104. [DOI] [PubMed] [Google Scholar]

- Dulebohn JH. An investigation of the determinants of investment risk behavior in employer-sponsored retirement plans. Journal of Management. 2002;28:3–26. [Google Scholar]

- Finucane ML, Slovic P, Hibbard JH, Peters E, Mertz CK, MacGregor DG. Aging and decision-making competence: An analysis of comprehension and consistency skills in older versus younger adults considering health-plan options. Journal of Behavioral Decision Making. 2002;15:141–164. [Google Scholar]

- Fong CPS, Wyer RS. Cultural, social, and emotional determinants of decisions under uncertainty. Organizational Behavior and Human Decision Processes. 2003;90:304–322. [Google Scholar]

- Kaiser Family Foundation. The Medicare prescription drug benefit: Fact sheet. 2007 Retrieved March 18, 2008, from http://www.kff.org/medicare/upload/7044_06.pdf.

- Loewenstein GF, Weber EU, Hsee CK, Welch N. Risk as feelings. Psychological Bulletin. 2001;127:267–286. doi: 10.1037/0033-2909.127.2.267. [DOI] [PubMed] [Google Scholar]

- MacPherson SE, Philips LH, Della Sala S. Age, executive function, and social decision making: A dorsolateral prefrontal theory of cognitive aging. Psychology and Aging. 2002;17:598–609. [PubMed] [Google Scholar]

- Mather M, Johnson MK. Choice-supportive source monitoring: Do our decisions seem better to us as we age? Psychology and Aging. 2000;15:596–606. doi: 10.1037//0882-7974.15.4.596. [DOI] [PubMed] [Google Scholar]

- Mather M. When I’m 64. Washington, DC: The National Academies Press; 2006. A review of decision-making processes: Weighting the risks and benefits of aging. In National Research Council. [Google Scholar]

- Mellers B, Schwartz A, Ritov I. Emotion-based choice. Journal of Experimental Psychology: General. 1999;128:332–345. [Google Scholar]

- Mikels JA, Larkin GR, Reuter-Lorenz PA, Carstensen LL. Divergent trajectories in the aging mind: Changes in working memory for affective versus visual information with age. Psychology and Aging. 2005;20:542–553. doi: 10.1037/0882-7974.20.4.542. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Rettinger DA, Hastie R. Content effects on decision making. Organizational Behavior and Human Decision Processes. 2001;85:336–359. doi: 10.1006/obhd.2000.2948. [DOI] [PubMed] [Google Scholar]

- Sanfey AG, Hastie R. Judgment and decision making across the adult life span: A tutorial review of psychological research. In: Park DC, Schwarz N, editors. Cognitive aging: A primer. Philadelphia: Psychology Press; 2000. pp. 253–273. [Google Scholar]