Abstract

Objectives. We estimated the effect of a simulated cap-and-trade policy to reduce added sugar in the food supply.

Methods. Using nationally representative data on added-sugar content and consumption, we constructed a mathematical model of a cap-and-trade policy and compared its health implications to those of proposals to tax sugar sweetened beverages or added sugars.

Results. Capping added-sugar emissions into the food supply by food manufacturers at a rate of 1% per year would be expected to reduce the prevalence of obesity by 1.7 percentage points (95% confidence interval [CI] = 0.9, 2.4; a 4.6% decline) and the incidence of type 2 diabetes by 21.7 cases per 100 000 people (95% CI = 12.9, 30.6; a 4.2% decline) over 20 years, averting approximately $9.7 billion in health care spending. Racial and ethnic minorities would be expected to experience the largest declines. By comparison, equivalent price penalties through excise taxes would be expected to generate smaller health benefits.

Conclusions. A cap-and-trade policy to reduce added-sugar intake may reduce obesity and type 2 diabetes to a greater extent than currently-proposed excise taxes.

High dietary intake of added sugars has been associated with an increased risk of obesity, type 2 diabetes, dental caries, fatty liver disease, and cardiovascular disease.1–7 Added-sugar intake among people in the United States exceeds dietary recommendations.8–10 Reducing added-sugar intake has been the subject of several policy proposals, including an excise tax on sugar-sweetened beverages (SSBs).11 An SSB tax may significantly reduce obesity-related morbidity and mortality if implemented at a tax rate higher than the SSB tax rates currently instituted among US states,12–14 depending on the degree to which consumers substitute SSBs with other caloric foods.15 Despite attention to SSB-oriented policies, however, over two thirds of added-sugar intake among people in the United States comes from processed food sources other than SSBs.16–18

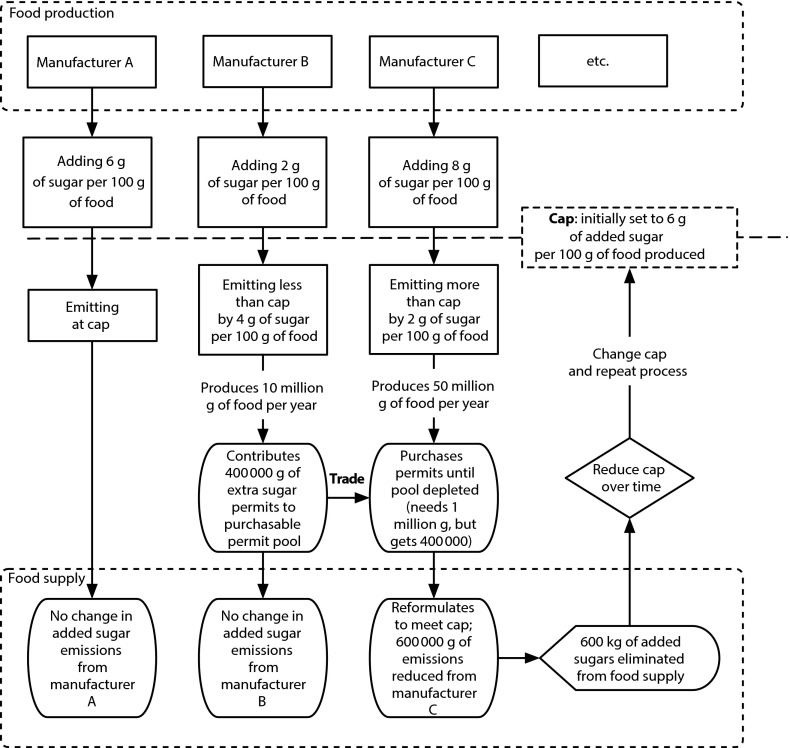

Health advocates have proposed a complementary approach to reduce added sugars: the institution of a cap-and-trade policy,19,20 similar to the “carbon trading” system implemented internationally to mitigate climate change. Reducing added sugars in the food supply through a cap-and-trade policy would work as follows (Figure 1): (1) the aggregate “added-sugar emissions” of food manufacturers into the food supply would be capped by creating tradable added-sugar permits, which manufacturers must secure and surrender in numbers equal to their added-sugar emissions into the food supply; (2) manufacturers whose added-sugar levels fall below their permitted level may sell surplus permits to other manufacturers, whereas manufacturers exceeding their permitted level must buy permits or reformulate their products to reduce added-sugar content, creating an incentive to lower added-sugar emissions into the food supply; and (3) the overall cap on sugar emissions would be lowered over time by requiring a proportion of all permits to be retired periodically, aiming toward a reduction target set by an independent scientific panel.

FIGURE 1—

Model of a cap-and-trade system to reduce added sugars in the US food supply.

Note. Manufacturers “emit” added sugars into the food supply. Under a cap-and-trade system, a cap is set and gradually lowered each year. Manufacturers emitting less than their permitted cap can sell (for profit) their extra emissions permits to other manufacturers; manufacturers emitting more than their permitted cap can purchase their needed emissions permits until the pool of available permits is exhausted. In our model, manufacturers purchase permits in random order until the pool of permits is exhausted; they must then reformulate their products to meet the cap. Those manufacturers contributing to the pool (manufacturer B in this example) profit from the sales. The cap is reduced to 20% of baseline mean emissions at a linear rate over 20 years.

A cap-and-trade policy for added sugars has not been previously evaluated, and several questions about this approach remain unresolved, including how it would affect consumption and disease and how much it might cost food manufacturers and consumers. To address such questions, we integrated large-scale data on food content and formulations, along with nationally representative data on food consumption behaviors, into a mathematical model of a cap-and-trade system for the US population. We modified modeling approaches used to simulate cap-and-trade systems for climate change to study potential implications of a cap and trade on added sugars compared with excise taxes on SSBs and added sugar. A similar exercise was, historically, the first step toward establishing the current cap-and-trade system for reducing greenhouse gas emissions,21 which passed into law in 1990 and has since reduced an estimated 3 million tons of greenhouse gases per year.22

METHODS

We used data from the US Department of Agriculture to identify the distribution of added sugars (sucrose, fructose, or glucose, including corn-derived sweeteners) per gram in foods and beverages by category.23,24 We used the US Census Bureau’s Annual Survey of Manufactures data set to identify manufacturers of different products in each food category.25 We used data from the National Health and Nutrition Examination Survey (NHANES) to identify the intake of added-sugar and non–added-sugar products within each food category among different US demographic populations26 (further details are in the Appendix, available as a supplement to the online version of this article at http://www.ajph.org). To account for secular trends in manufacturing and consumption, we used data for the period 1999 to 2010.

Cap-and-Trade Simulation

To simulate a cap-and-trade system, we developed a stochastic, discrete-time, agent-based mathematical model (Figure 1). We provide full model details in the Appendix, following international model reporting guidelines.27,28

To simulate current added-sugar emissions into the food supply, we constructed a population of food manufacturers and assigned each a baseline rate of added-sugar emissions (in kilograms of added sugar per kilograms of food produced per year). We provided initial permits to all manufacturers (year 2015) at no cost, paralleling cap-and-trade policies for greenhouse gases.29,30 The permits to each manufacturer equaled the mean baseline emissions level, so the overall cap began at the current sugar emissions rate into the food supply. We then gradually lowered the cap in each subsequent year; we simulated a 20% reduction over 20 years (at a linear rate of 1% from the starting level annually) to meet dietary recommendations and allow sufficient time to detect chronic disease effects.8–10 We varied the cap and rate of reduction in sensitivity analyses.

As the cap was lowered, each manufacturer received annual no-cost permits in the amount equal to the total capped rate divided by the number of manufacturers. Because the capped rate was expressed in kilograms of added sugar per kilogram of food produced, this method avoided discriminating against large manufacturers. Manufacturers whose added-sugar emissions were lower than their permitted emissions placed extra permits into a pool of permits for sale; those whose emissions were higher than their permitted level purchased permits from the pool in random order until the pool was exhausted. Manufacturers traded permits at an exogenously set price of $0.35 per kilogram of added sugar, the price equivalent to a penny-per-ounce SSB tax14 (to allow comparison with tax proposals). We varied permit prices in sensitivity analyses. Once the pool of tradable permits was exhausted, manufacturers were required to lower their added-sugar emissions per kilogram product to meet the permit allowance. In our conservative simulation, manufacturers make the minimum changes required to reformulate products to meet the cap, avoiding reformulation when possible.

Comparative Health Impact Estimates

We estimated the potential effects of the cap-and-trade scenario on obesity prevalence and type 2 diabetes incidence using a previously validated approach.31,32 We simulated individuals in the noninstitutionalized US population, defined by age, gender, and race/ethnicity, sampling from NHANES data to specify the distribution of kilocalories from each food category consumed by each simulated individual per day (see Appendix for disaggregated consumption statistics by demographic group). These consumption data are considered more accurate than purchasing data.33 Under the cap-and-trade system, we simulated consumers converting from their current added-sugar consumption in each food category to the product with the most similar added-sugar content in each category whenever their product of choice was reformulated to a lower-sugar version, providing a conservative estimate of the policy’s impact.

To estimate changes in obesity, we converted change in kilocalorie intake into a change in body weight through the validated National Institutes of Health model (see Appendix).34,35 The estimated change in kilocalorie intake accounts for how substitutions among foods change overall kilocalorie intake, not only added-sugar kilocalorie intake. We converted body weight into body mass index (defined as weight in kilograms divided by height in meters squared) using NHANES data on the distribution and secular trend in weight and height in each demographic group. To estimate the change in type 2 diabetes, we used a validated hazard function approach32 to convert the changes in body mass index and glycemic load36,37 into an estimated change in type 2 diabetes risk per year, defined by Centers for Disease Control and Prevention estimates of annual diabetes risk for each demographic group.38,39

For comparative effectiveness analyses, we simulated the impact on obesity and type 2 diabetes of 2 excise taxes: a penny-per-ounce SSB tax and a penny-per-ounce added-sugar tax. In the case of a penny-per-ounce SSB tax, we used previously calculated elasticities from the National Consumer Panel database31 to simulate how much individuals reduce consumption of SSBs and substitute with other products, estimating the net kilocalorie intake and glycemic load change from an SSB tax, then using the National Institutes of Health and hazard models to estimate obesity and type 2 diabetes rate changes. In the case of a penny-per-ounce added-sugar tax, we performed the same calculations, using the elasticities between added-sugar and non–added-sugar products to simulate substitution behavior.

In sensitivity analyses, we varied the tax rates of SSB and added-sugar taxes across a range of plausible tax levels. We also compared our baseline cap-and-trade scenario, in which consumers switched from their preferred product to the product with the closest added-sugar content within the food category when their preferred product was reformulated, with a more optimistic scenario in which consumers continue to consume their preferred food product after reformulation.

We repeated all model simulations 10 000 times to sample repeatedly from the input probability distributions of each parameter and generate 95% confidence intervals around the results. We performed data analyses and modeling in R version 3.0.2 (R Foundation for Statistical Computing, Vienna, Austria).

RESULTS

Current added sugar from food manufacturers averaged 19.8 billion kilograms per year emitted into the US food supply, about 670 000 kilograms per manufacturer annually. These sugar emissions amount to 64.2 kilograms of added sugar per person per year, or 603 kilocalories per person per day. Added-sugar content per gram was highest for sweets (an average of 28.2 g added sugar/100 g product), then for sugar-sweetened beverages (25.0 g/100 g), followed by refined grain products, including baked products (13.2 g/100 g; see Appendix for fully disaggregated statistics by food category). Approximately 67% of products in the food supply contained no added sugars.

Cap-and-Trade Simulation Outcomes

Reducing permitted added-sugar emissions by 20% over 20 years with a cap-and-trade-approach resulted in a decline in simulated added-sugar intake from 287 kilocalories per person per day without the policy to 256 kilocalories per person per day with the policy in place at the 20-year mark (a decline of 31 kcal/person/day; 95% confidence interval [CI] = 29, 33). Intake declined further, to 251 kilocalories per person per day (a decline of 36 kcal/person/day; 95% CI = 33, 39), in a sensitivity analysis in which food manufacturers passed on the cost of sugar emissions permits to consumers rather than absorbing the costs themselves. The greater decline resulted from consumers switching to lower-sugar alternatives when high-added-sugar products became more expensive. Consumers faced an average food price increase of $7.21 per year from added-sugar-product purchases (95% CI = $3.81, $10.63), or about $0.02 per person per day, as a results of the permit cost being passed to consumers.

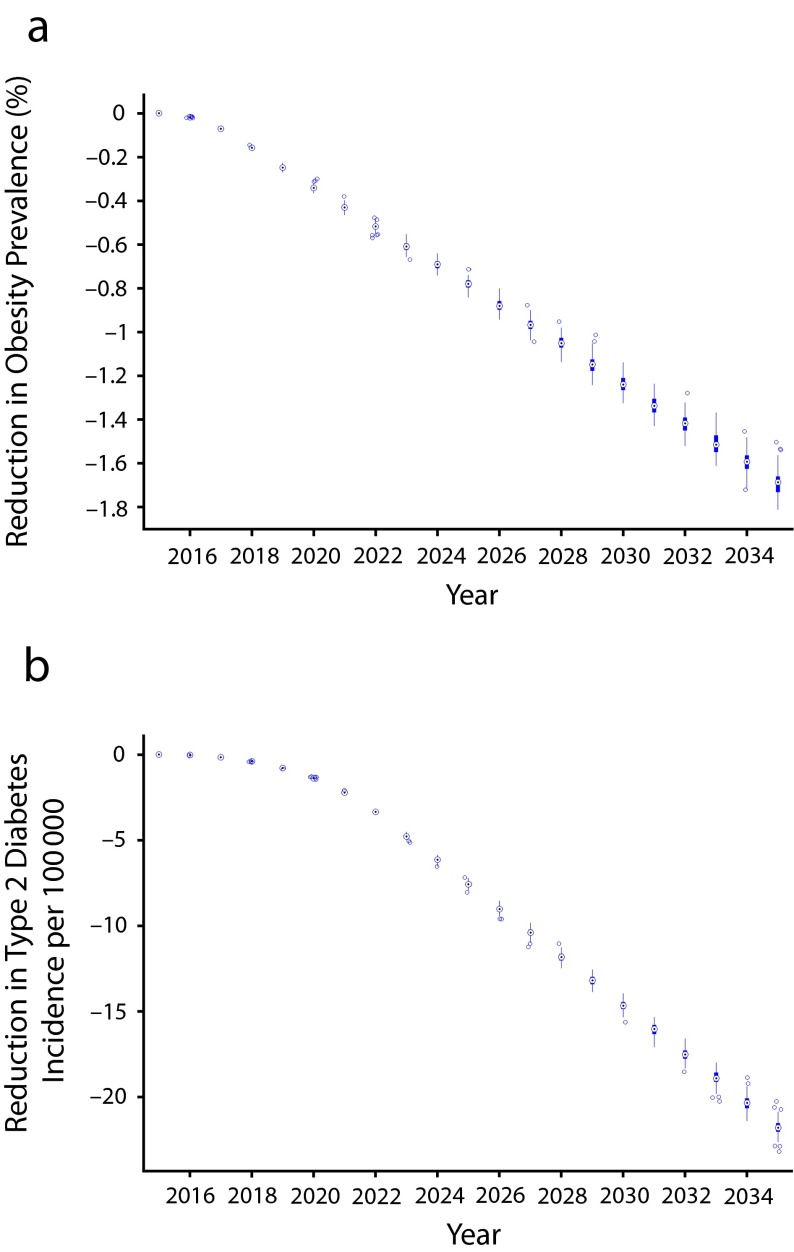

The observed reduction in added-sugar emissions had substantial health benefits, as illustrated in Figure 2 and itemized in Table 1. The reduced added-sugar emissions would be expected to lower weight among people in the United States by 3.0 pounds on average over 20 years (95% CI = 2.8, 3.2), after we accounted for both the caloric reduction from reduced added sugars and the caloric differences between the previously consumed food products and the food products that consumers switched to. Given current distributions of weight and height among the population, this reduction in body weight would correspond to a 1.7-percentage-point lower expected obesity prevalence rate than in the scenario without the cap-and-trade policy (95% CI = 0.9, 2.4), representing a 4.6% decrease. The reduced added-sugar emissions would also be expected to lower type 2 diabetes incidence by 21.7 cases per 100 000 people (95% CI = 12.9, 30.6), a 4.2% lower incidence rate. The reduced added-sugar emissions had heterogeneous effects among different demographic groups; as shown in Table 1, racial/ethnic minorities generally experienced the largest declines in obesity prevalence and type 2 diabetes incidence under the simulated policy.

FIGURE 2—

Health effects of a cap-and-trade system for added sugars on (a) obesity prevalence and (b) type 2 diabetes incidence.

Note. Reduction in obesity prevalence (% of population) and type 2 diabetes incidence (per 100 000 persons per year) over time among the US population aged 5 to 65 years under a simulated cap-and-trade policy involving a 20% cap on added sugars from current levels, achieved at a linear rate over 20 years. On each box plot, the central mark is the median result from 10 000 repeated simulations of the model, sampling from the input probability distributions of all parameters; the edges of the box plots are the 25th and 75th percentiles, the whiskers extend to the most extreme data points not considered outliers, and outliers (which are beyond the 99% confidence intervals) are plotted individually.

TABLE 1—

Comparative Effectiveness of a Cap-and-Trade System, a Sugar-Sweetened-Beverage (SSB) Tax, and an Added-Sugar Tax Over a 20-Year Planning Horizon

| Baseline Health Statistics |

Cap-and-Trade Policy |

SSB Tax |

Added-Sugar Tax |

|||||

| Demographic Characteristics | Obesity Prevalence, % (SD) | Type 2 Diabetes Incidence, per 100 000 per Year (SD) | Decline in Obesity Prevalence, % (SD) | Decline in Type 2 Diabetes Incidence, per 100 000 per Year (SD) | Decline in Obesity Prevalence, % (SD) | Decline in Type 2 Diabetes Incidence, per 100 000 per Year (SD) | Decline in Obesity Prevalence, % (SD) | Decline in Type 2 Diabetes Incidence, per 100 000 per Year (SD) |

| Age group 5 to < 18 y | ||||||||

| Male | ||||||||

| Non-Hispanic White | 7.1 (0.2) | 2.0 (0.3) | 0.6 (0.1) | 0.02 (0.01) | 0.2 (0.1) | 0.01 (0.01) | 0.8 (0.1) | 0.02 (0.00) |

| Non-Hispanic Black | 12.4 (0.3) | 9.9 (0.1) | 0.9 (0.6) | 0.10 (0.01) | 1.1 (0.1) | 0.07 (0.01) | 1.2 (0.1) | 0.10 (0.02) |

| Mexican American | 26.8 (0.4) | 6.2 (0.5) | 0.2 (0.3) | 0.06 (0.01) | 0.2 (0.1) | 0.01 (0.01) | 0.5 (0.2) | 0.02 (0.00) |

| Other | 11.8 (0.3) | 4.7 (0.1) | 1.7 (0.4) | 0.14 (0.01) | 0.5 (0.2) | 0.05 (0.01) | 0.7 (0.2) | 0.05 (0.01) |

| Female | ||||||||

| Non-Hispanic White | 12.5 (0.3) | 2.4 (0.4) | 1.1 (0.2) | 0.03 (0.01) | 0.7 (2.0) | 0.03 (0.01) | 0.5 (0.1) | 0.03 (0.00) |

| Non-Hispanic Black | 22.0 (0.4) | 11.7 (0.6) | 0.6 (0.2) | 0.14 (0.01) | 1.3 (0.1) | 0.12 (0.01) | 1.3 (0.2) | 0.15 (0.03) |

| Mexican American | 13.0 (0.3) | 7.3 (0.5) | 2.0 (0.2) | 0.18 (0.01) | 0.0 (0.1) | 0.01 (0.01) | 0.0 (0.1) | 0.02 (0.00) |

| Other | 23.9 (0.4) | 5.6 (0.1) | 0.2 (0.2) | 0.05 (0.01) | 0.3 (0.1) | 0.04 (0.01) | 0.8 (0.3) | 0.04 (0.00) |

| Age Group 18 to < 45 y | ||||||||

| Male | ||||||||

| Non-Hispanic White | 33.3 (0.4) | 240.9 (52.2) | 1.1 (0.1) | 13.0 (0.58) | 1.2 (0.3) | 5.66 (0.35) | 0.2 (0.2) | 4.04 (0.84) |

| Non-Hispanic Black | 25.0 (0.4) | 426.8 (56.4) | 0.4 (0.3) | 19.6 (0.54) | 0.3 (0.3) | 8.76 (0.34) | 0.3 (0.2) | 8.26 (1.71) |

| Mexican American | 34.4 (0.4) | 382.1 (56.2) | 0.5 (0.2) | 15.0 (0.45) | 1.0 (0.1) | 9.19 (0.38) | 0.4 (0.3) | 7.03 (1.46) |

| Other | 40.4 (0.4) | 350 (52.5) | 2.3 (0.7) | 22.0 (0.68) | 3.3 (0.1) | 15.4 (0.58) | 1.9 (0.2) | 9.98 (2.07) |

| Female | ||||||||

| Non-Hispanic White | 42.4 (0.4) | 220.3 (51.9) | 1.0 (0.4) | 10.3 (0.50) | 0.8 (0.2) | 3.67 (0.27) | 0.5 (0.2) | 3.98 (0.82) |

| Non-Hispanic Black | 52.3 (0.4) | 390.2 (53.9) | 4.6 (0.2) | 32.5 (0.93) | 4.6 (0.2) | 22.1 (0.73) | 3.5 (0.1) | 17.8 (3.71) |

| Mexican American | 58.1 (0.4) | 349.3 (52.9) | 3.1 (0.2) | 20.6 (0.65) | 2.2 (0.2) | 11.3 (0.45) | 1.4 (0.1) | 8.22 (1.70) |

| Other | 51.1 (0.5) | 320.0 (54.4) | 3.0 (0.3) | 20.1 (0.71) | 1.9 (0.2) | 13.0 (0.56) | 1.9 (0.2) | 10.7 (2.23) |

| Age group 45–65 y | ||||||||

| Male | ||||||||

| Non-Hispanic White | 39.1 (0.4) | 853.7 (125.0) | 2.8 (0.3) | 50.8 (1.55) | 3.7 (0.1) | 40.1 (1.32) | 3.2 (0.2) | 39.0 (8.12) |

| Non-Hispanic Black | 26.1 (0.4) | 1512.3 (123.2) | 0.2 (0.7) | 63.2 (1.07) | 0.3 (0.4) | 23.2 (0.49) | 0.1 (0.2) | 25.6 (5.33) |

| Mexican American | 22.2 (0.4) | 1353.8 (120.0) | 2.5 (0.4) | 75.5 (1.40) | 1.2 (0.1) | 42.4 (0.88) | 0.4 (0.3) | 27.1 (5.64) |

| Other | 64.1 (0.4) | 1240.0 (122.3) | 3.2 (0.4) | 86.3 (1.77) | 2.8 (0.3) | 45.2 (1.02) | 2.0 (0.2) | 39.2 (8.16) |

| Female | ||||||||

| Non-Hispanic White | 42.3 (0.4) | 791.8 (122.3) | 4.1 (0.4) | 54.4 (1.75) | 0.3 (0.2) | 11.6 (0.47) | 1.9 (0.6) | 27.4 (5.71) |

| Non-Hispanic Black | 58.0 (0.4) | 1402.6 (123.7) | 0.0 (0.5) | 53.8 (0.98) | 1.1 (0.2) | 33.8 (0.72) | 1.8 (0.3) | 41.1 (8.56) |

| Mexican American | 64.2 (0.4) | 1255.5 (123.3) | 2.0 (0.5) | 66.9 (1.36) | 0.8 (0.1) | 26.2 (0.63) | 0.9 (0.2) | 26.8 (5.59) |

| Other | 51.9 (0.5) | 1150.0 (120.0) | 1.1 (0.3) | 58.1 (1.26) | 1.5 (0.5) | 29.2 (0.73) | 2.4 (0.3) | 56.3 (11.7) |

Note. The cap-and-trade system involved a 20% reduction in capped added-sugar emissions over 20 years at a linear rate of decline. The SSB tax and added-sugar tax were both penny-per-ounce taxes, with the former applying to total ounces of sugar-sweetened beverages purchased and the latter applying to total ounces of added sugar in any food purchase. See Appendix for input parameter values used for each simulated scenario.

Source. Demographic categories and baseline statistics are from the National Health and Nutrition Examination Survey.26

The reduced added-sugar intake conferred health care cost savings in our simulations. On the basis of recent health care cost estimates for obesity,40,41 the cap-and-trade system would be expected to avert $9.7 billion in health care spending over the 20-year simulation period (95% CI = $4.5 billion, $14.9 billion), when we tabulated averted costs at a standard 3% annual discount rate. The sum of the added-sugar permits purchased by industry averaged $3.7 billion over the same simulation period (95% CI = $3.6 billion, $3.8 billion), when also tabulated at a 3% annual discount rate.

Comparative Health Impact Estimates

The reduced added-sugar intake conferred by a penny-per-ounce SSB tax was notably smaller than that from the cap-and-trade policy (Table 1). The SSB tax policy resulted in a net decline of 24 kilocalories per person per day (95% CI = 23, 26), producing a 1.4-percentage-point lower obesity prevalence rate than without the tax (95% CI = 0.8, 2.0)—3.7% lower than would otherwise be expected—and a decline in type 2 diabetes incidence of 11.5 cases per 100 000 people (95% CI = 11.0, 12.0), a 2.2% lower incidence rate.

The reduced added-sugar intake conferred by a penny-per-ounce tax on all added sugars was similar to that from a targeted SSB tax (Table 1). The added-sugar tax reduced caloric intake by 14 kilocalories per person per day (95% CI = 12, 16) compared with the scenario with no tax, producing a 1.2-percentage-point lower obesity prevalence rate (95% CI = 0.9, 1.6)—3.4% lower than otherwise would be expected at year 2035—and a decline in type 2 diabetes incidence of 11.3 cases per 100 000 people (95% CI = 10.8, 11.8; a 2.1% lower incidence rate).

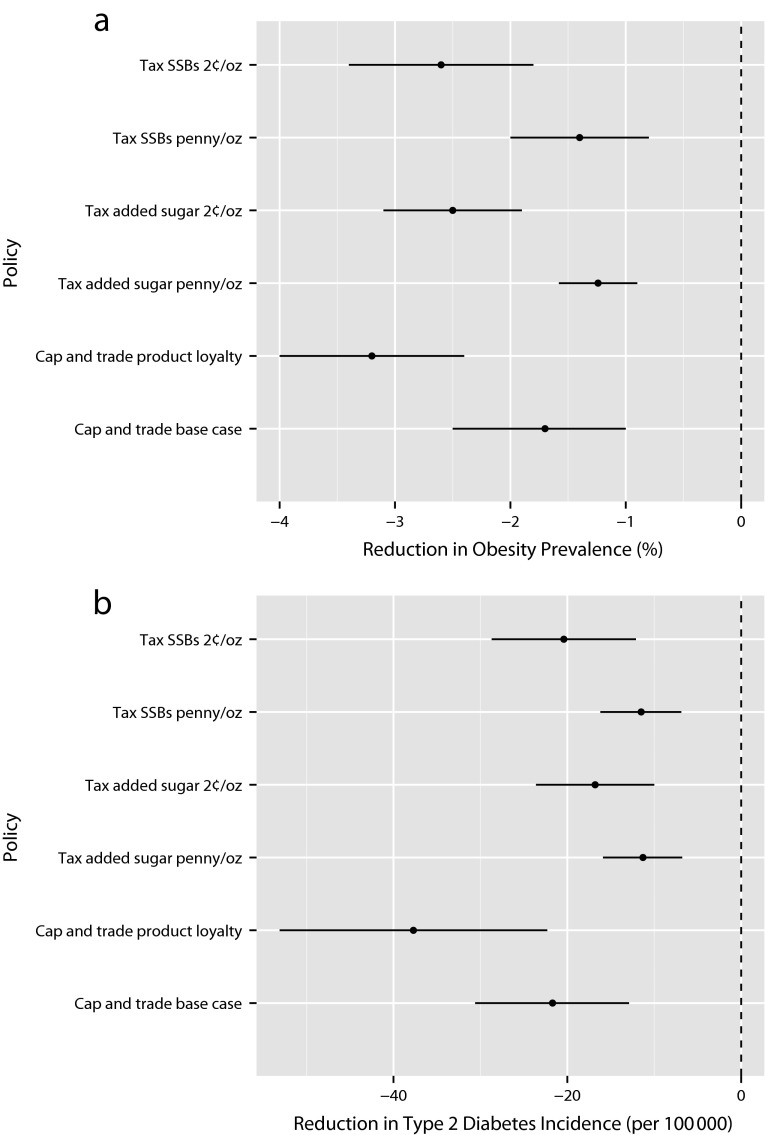

In our sensitivity analyses comparing the 3 policies under a range of scenarios, we observed that cap and trade would be almost twice as effective in reducing obesity and type 2 diabetes under an optimistic scenario in which consumers continued consuming their preferred food product after its reformulation (rather than switching to another product with the nearest added-sugar content when their preferred product was reformulated). In this optimistic scenario, obesity prevalence was reduced by 3.2 percentage points (95% CI = 2.4, 4.0) and type 2 diabetes incidence by 37.7 per 100 000 (95% CI = 22.4, 53.1), as shown in Figure 3. We also observed that a doubling of tax rates (to 2 cents per ounce) for both SSBs and added sugars was of lower efficacy than the cap-and-trade policy (Figure 3) in reducing type 2 diabetes, because of the substitution of other high-glycemic-load products for the taxed products. Further sensitivity analyses are provided in the Appendix.

FIGURE 3—

Sensitivity analyses comparing the effect of 3 added-sugar-reduction policies over a 20-year policy-planning horizon on (a) obesity prevalence and (b) type 2 diabetes incidence.

Note. SSB = sugar-sweetened beverage. In our “base case” simulation of a cap-and-trade policy, we conservatively simulated consumers as switching from their preferred product to the product with the closest added-sugar content within the food category when their preferred product was reformulated to meet the added sugar cap. We compared this scenario to a less pessimistic “product loyalty” simulation in which consumers continue to consume their preferred food product after reformulation of the product to a lower-sugar version. We compared these cap-and-trade policy scenarios with both the sugar-SSB and added-sugar tax policies, varying the level of the tax from a penny per ounce to 2 cents per ounce. Further sensitivity analyses, including details of policy effects among different demographic groups given differences in obesity and type 2 diabetes rates and consumption behaviors, are provided in the Appendix (available as a supplement to the online version of this article at http://www.ajph.org). In each comparative effectiveness analysis, the policy outcomes are compared with the counterfactual case in which the policy is not introduced, accounting for secular trends in consumption and disease risk in the population over a 20-year policy-planning horizon.

DISCUSSION

We conducted the first simulation of a cap-and-trade approach to reduce added sugars in the US food supply and compared it with 2 other policy proposals aimed at reducing added-sugar intake. We observed that reduced added sugar in the food supply would likely have substantial health benefits, as well as conferring associated health care cost savings. In our simulations, a gradual 20% cap on added-sugar emissions into the food supply applied over 20 years would be expected to reduce obesity prevalence by 1.7 percentage points and type 2 diabetes by 4.2 percentage points, using a model that conservatively simulated the smallest-possible changes in manufacturer and consumer behavior in response to permits and reformulations. These impacts would make cap and trade more effective than other currently available obesity reduction tools evaluated to date.42,43 Racial and ethnic minorities would be expected to experience the largest declines in obesity prevalence and type 2 diabetes incidence given their current consumption behaviors and health profiles, suggesting that the policy may mitigate health disparities between racial/ethnic groups.26,42

In our model, the cap-and-trade approach had a slightly but not significantly larger effect on obesity and type 2 diabetes than an equivalently priced SSB tax or an added sugar tax. Our simulations of effect size from a penny-per-ounce SSB tax were consistent with previous assessments.14,44,45 Cap and trade produced larger health impacts than an SSB tax because there was less impact of consumer substitution on net caloric intake. The cap-and-trade policy was also found to be more effective than a general added-sugar tax because the general tax produced only small price increases that resulted in smaller reductions in added sugar consumption than did the product reformulations observed under a cap-and-trade system.

We chose to apply the cap-and-trade policy specifically to added sugars rather than other food components for a number of reasons. Added sugars appear to elevate the risk of type 2 diabetes in a dose-dependent manner in large prospective cohort studies, as glycemic load contributes to insulin resistance and type 2 diabetes.36,37 Furthermore, there is no evidence to suggest that low consumption of added sugars is harmful, given the prevalent availability of natural sugars in foods. Although some consumers may manually add sugar back to reformulated food products, such behavior is unlikely to match the 22 teaspoons of added sugars consumed by adults, and 34 teaspoons consumed by adolescents, through processed foods each day in the United States.9

A cap-and-trade approach to reducing added sugar faces several challenges that cannot be addressed by this first-stage research. First, recommendations for added-sugar consumption vary; here, we simulated a reduction in added-sugar consumption to correspond to the average sugar intake recommended by commonly cited expert groups.8–10 The average added-sugar consumption among people in the United States has declined on its own during the past decade,16 a trend that we built into our models; however, whether this will continue into the future without regulatory action is unclear. The current model also does not factor in the political feasibility or administrative complexity of a cap-and-trade system, which will likely face food industry opposition; our results should not impede policymakers and health advocates from pursuing more proximal strategies for improving nutrition, especially as multiple simultaneous strategies are probably required to address obesity in the United States.42 Incentivizing manufacturers to decrease their use of added sugars raises the potential for increasing the use of nonnutritive sweeteners, a phenomenon already occurring in the context of the increasing unpopularity of added sugars.46 Despite safety reassurances by scientific groups,47,48 further research to ensure the safety of long-term nonnutritive sweeteners may be warranted, particularly given preliminary research suggesting that nonnutritive sweeteners may in fact also induce glucose intolerance, posing a risk of type 2 diabetes.49 Unintended consequences could also occur if sodium or fats are substituted for added sugars to increase palatability, or if food manufacturers ship surplus foods overseas; hence, bundling regulatory strategies into universal standards rather than focusing on single ingredients alone may be sensible. As a complement to a cap-and-trade approach, further studies can also address the role of altering subsidies to the corn and sucrose industries.

Despite these topics for future research, our study constitutes a first step toward better understanding a cap-and-trade strategy to reduce added-sugar intake among people in the United States. Our research demonstrates that there are key areas for further investigation before such a proposal is considered; however, the approach appears potentially effective even under a very gradual emissions-reduction target that would confer the same or fewer expenditures onto the US consumer population than currently proposed fiscal strategies. The continuing consideration of a cap-and-trade approach to reduce added sugar in our food supply could therefore substantially improve the health of the population, addressing some of the negative externalities currently characteristic of industrial food production.

Acknowledgments

This study was funded by the Department of Medicine, Stanford University.

Human Participant Protection

No protocol approval was needed because only publicly available data were used.

References

- 1.Basu S, Yoffe P, Hills N, Lustig RH. The relationship of sugar to population-level diabetes prevalence: an econometric analysis of repeated cross-sectional data. PLoS ONE. 2013;8(2):e57873. doi: 10.1371/journal.pone.0057873. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 2.Te Morenga L, Mallard S, Mann J. Dietary sugars and body weight: systematic review and meta-analyses of randomised controlled trials and cohort studies. BMJ. 2012;346:e7492. doi: 10.1136/bmj.e7492. [DOI] [PubMed] [Google Scholar]

- 3.Malik VS, Popkin BM, Bray GA, Després J-P, Willett WC, Hu FB. Sugar-sweetened beverages and risk of metabolic syndrome and type 2 diabetes: a meta-analysis. Diabetes Care. 2010;33(11):2477–2483. doi: 10.2337/dc10-1079. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 4.de Ruyter JC, Olthof MR, Seidell JC, Katan MB. A trial of sugar-free or sugar-sweetened beverages and body weight in children. N Engl J Med. 2012;367(15):1397–1406. doi: 10.1056/NEJMoa1203034. [DOI] [PubMed] [Google Scholar]

- 5.Welsh JA, Sharma A, Cunningham SA, Vos MB. Consumption of added sugars and indicators of cardiovascular disease risk among US adolescents. Circulation. 2011;123(3):249–257. doi: 10.1161/CIRCULATIONAHA.110.972166. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6.Welsh JA, Sharma A, Abramson JL, Vaccarino V, Gillespie C, Vos MB. Caloric sweetener consumption and dyslipidemia among US adults. JAMA. 2010;303(15):1490–1497. doi: 10.1001/jama.2010.449. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.Yang Q, Zhang Z, Gregg EW, Flanders W, Merritt R, Hu FB. Added sugar intake and cardiovascular diseases mortality among us adults. JAMA Intern Med. 2014;174(4):516–524. doi: 10.1001/jamainternmed.2013.13563. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8.Nishida C, Uauy R, Kumanyika S, Shetty P. The joint WHO/FAO expert consultation on diet, nutrition and the prevention of chronic diseases: process, product and policy implications. Public Health Nutr. 2004;7(1A):245–250. doi: 10.1079/phn2003592. [DOI] [PubMed] [Google Scholar]

- 9.Johnson RK, Appel LJ, Brands M et al. Dietary sugars intake and cardiovascular health: a scientific statement from the American Heart Association. Circulation. 2009;120(11):1011–1020. doi: 10.1161/CIRCULATIONAHA.109.192627. [DOI] [PubMed] [Google Scholar]

- 10.2010 Dietary Guidelines for Americans. 7th ed. Washington, DC: US Dept of Agriculture; 2013. [Google Scholar]

- 11.Brownell KD, Farley T, Willett WC et al. The public health and economic benefits of taxing sugar-sweetened beverages. N Engl J Med. 2009;361(16):1599–1605. doi: 10.1056/NEJMhpr0905723. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 12.Cabrera Escobar MA, Veerman JL, Tollman SM, Bertram MY, Hofman KJ. Evidence that a tax on sugar sweetened beverages reduces the obesity rate: a meta-analysis. BMC Public Health. 2013;13:1072. doi: 10.1186/1471-2458-13-1072. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 13.Sturm R, Powell LM, Chriqui JF, Chaloupka FJ. Soda taxes, soft drink consumption, and children’s body mass index. Health Aff (Millwood) 2010;29(5):1052–1058. doi: 10.1377/hlthaff.2009.0061. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 14.Wang YC, Coxson P, Shen YM, Goldman L, Bibbins-Domingo K. A penny-per-ounce tax on sugar-sweetened beverages would cut health and cost burdens of diabetes. Health Aff (Millwood) 2012;31(1):199–207. doi: 10.1377/hlthaff.2011.0410. [DOI] [PubMed] [Google Scholar]

- 15.Fletcher JM, Frisvold DE, Tefft N. The effects of soft drink taxes on child and adolescent consumption and weight outcomes. J Public Econ. 2010;94(11–12):967–974. [Google Scholar]

- 16.Ervin RB, Ogden CL. Consumption of added sugars among US adults, 2005–2010. NCHS Data Brief. 2013;(122):1–8. [PubMed] [Google Scholar]

- 17.Reedy J, Krebs-Smith SM. Dietary sources of energy, solid fats, and added sugars among children and adolescents in the United States. J Am Diet Assoc. 2010;110(10):1477–1484. doi: 10.1016/j.jada.2010.07.010. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18.Guthrie JF, Morton JF. Food sources of added sweeteners in the diets of Americans. J Am Diet Assoc. 2000;100(1):43–51. doi: 10.1016/S0002-8223(00)00018-3. [DOI] [PubMed] [Google Scholar]

- 19.Forshee RA. Innovative regulatory approaches to reduce sodium consumption: could a cap-and-trade system work? Nutr Rev. 2008;66(5):280–285. doi: 10.1111/j.1753-4887.2008.00033.x. [DOI] [PubMed] [Google Scholar]

- 20.Lewis KH, Rosenthal MB. Individual responsibility or a policy solution—cap and trade for the US diet? N Engl J Med. 2011;365(17):1561–1563. doi: 10.1056/NEJMp1105128. [DOI] [PubMed] [Google Scholar]

- 21.Burton E, Sanjour W. An Economic Analysis of the Control of Sulphur Oxides Air Pollution. Washington, DC: Dept of Health, Education, and Welfare; 1967. DHEW Program Analysis Report. [Google Scholar]

- 22.Conniff R. The political history of cap and trade. Smithsonian Magazine. August 2009. Available at: http://www.smithsonianmag.com/air/the-political-history-of-cap-and-trade-34711212. Accessed August 27, 2014. [Google Scholar]

- 23.Friday JE, Bowman SA. MyPyramid Equivalents Database for USDA Survey Food Codes, 1994–2002 Version 1.0. US Dept of Agriculture; 2006. Available at: http://www.ars.usda.gov/ba/bhnrc/fsrg. Accessed June 25, 2014. [Google Scholar]

- 24.Bowman SA, Friday JE, Moshfegh AJ. MyPyramid Equivalents Database, 2.0 for USDA Survey Foods, 2003–2004: Documentation and User Guide. US Dept of Agriculture; 2008. Available at: http://www.ars.usda.gov/SP2UserFiles/Place/12355000/pdf/mped/mped2_doc.pdf. Accessed June 25, 2014. [Google Scholar]

- 25.Annual Survey of Manufacturers. Washington, DC: US Census Bureau; 2011. [Google Scholar]

- 26.National Health and Nutrition Examination Survey, 1999–2012. Atlanta, GA: Centers for Disease Control and Prevention; 2012. [Google Scholar]

- 27.Eddy DM, Hollingworth W, Caro JJ, Tsevat J, McDonald KM, Wong JB. Model transparency and validation: a report of the ISPOR-SMDM Modeling Good Research Practices Task Force–7. Med Decis Making. 2012;32(5):733–743. doi: 10.1177/0272989X12454579. [DOI] [PubMed] [Google Scholar]

- 28.Grimm V, Berger U, DeAngelis DL, Polhill JG, Giske J, Railsback SF. The ODD protocol: a review and first update. Ecol Modell. 2010;221(23):2760–2768. [Google Scholar]

- 29.Ellerman AD, Buchner BK. The European Union emissions trading scheme: origins, allocation, and early results. Rev Environ Econ Policy. 2007;1(1):66–87. [Google Scholar]

- 30.Napolitano S, Schreifels J, Stevens G et al. The US acid rain program: key insights from the design, operation, and assessment of a cap-and-trade program. Electr J. 2007;20(7):47–58. [Google Scholar]

- 31.Basu S, Seligman H, Bhattacharya J. Nutritional policy changes in the supplemental nutrition assistance program: a microsimulation and cost-effectiveness analysis. Med Decis Making. 2013;33(7):937–948. doi: 10.1177/0272989X13493971. [DOI] [PubMed] [Google Scholar]

- 32.Basu S, Vellakkal S, Agrawal S, Stuckler D, Popkin B, Ebrahim S. Averting obesity and type 2 diabetes in India through sugar-sweetened beverage taxation: an economic–epidemiologic modeling study. PLoS Med. 2014;11(1):e1001582. doi: 10.1371/journal.pmed.1001582. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 33.Hall KD, Guo J, Dore M, Chow CC. The progressive increase of food waste in America and its environmental impact. PLoS ONE. 2009;4(11):e7940. doi: 10.1371/journal.pone.0007940. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 34.Hall KD, Sacks G, Chandramohan D et al. Quantification of the effect of energy imbalance on bodyweight. Lancet. 2011;378(9793):826–837. doi: 10.1016/S0140-6736(11)60812-X. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 35.Hall KD, Butte NF, Swinburn BA, Chow CC. Dynamics of childhood growth and obesity: development and validation of a quantitative mathematical model. Lancet Diabetes Endocrinol. 2013;1(2):97–105. doi: 10.1016/s2213-8587(13)70051-2. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 36.Livesey G, Taylor R, Livesey H, Liu S. Is there a dose–response relation of dietary glycemic load to risk of type 2 diabetes? Meta-analysis of prospective cohort studies. Am J Clin Nutr. 2013;97(3):584–596. doi: 10.3945/ajcn.112.041467. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 37.Willett W, Manson J, Liu S. Glycemic index, glycemic load, and risk of type 2 diabetes. Am J Clin Nutr. 2002;76(1):274S–280S. doi: 10.1093/ajcn/76/1.274S. [DOI] [PubMed] [Google Scholar]

- 38.Writing Group for the SEARCH for Diabetes in Youth Study Group. Dabelea D, Bell RA et al. Incidence of diabetes in youth in the United States. JAMA. 2007;297(24):2716–2724. doi: 10.1001/jama.297.24.2716. [DOI] [PubMed] [Google Scholar]

- 39.Incidence of Diagnosed Diabetes per 1,000 Population Aged 18–79 Years, 1980–2011. Atlanta: Centers for Disease Control and Prevention; 2013. [Google Scholar]

- 40.Bureau of Labor Statistics. Consumer Price Index. 2013. Available at: http://www.bls.gov/cpi. Accessed September 26, 2013.

- 41.Cawley J, Meyerhoefer C. The medical care costs of obesity: an instrumental variables approach. J Health Econ. 2012;31(1):219230. doi: 10.1016/j.jhealeco.2011.10.003. [DOI] [PubMed] [Google Scholar]

- 42.Institute of Medicine. Accelerating Progress in Obesity Prevention: Solving the Weight of the Nation. Washington, DC: National Academies Press; 2012. [Google Scholar]

- 43.Waters E, de Silva Sanigorski A, Hall BJ et al. Interventions for preventing obesity in children (review) Cochrane Collab. 2012;12:1–212. doi: 10.1002/14651858.CD001871.pub3. [DOI] [PubMed] [Google Scholar]

- 44.Smith T, Lin B-H, Lee J-Y. Taxing Caloric Sweetened Beverages: Potential Effects on Beverage Consumption, Calorie Intake, and Obesity. Washington, DC: US Dept of Agriculture; 2010. [Google Scholar]

- 45.Briggs AD, Mytton OT, Kehlbacher A, Tiffin R, Rayner M, Scarborough P. Overall and income specific effect on prevalence of overweight and obesity of 20% sugar sweetened drink tax in UK: econometric and comparative risk assessment modelling study. BMJ. 2013;347:f6189. doi: 10.1136/bmj.f6189. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 46.Shankar P, Ahuja S, Sriram K. Non-nutritive sweeteners: review and update. Nutrition. 2013;29(11–12):1293–1299. doi: 10.1016/j.nut.2013.03.024. [DOI] [PubMed] [Google Scholar]

- 47.Fitch C, Keim KS. Position of the Academy of Nutrition and Dietetics: use of nutritive and nonnutritive sweeteners. J Acad Nutr Diet. 2012;112(5):739–758. doi: 10.1016/j.jand.2012.03.009. [DOI] [PubMed] [Google Scholar]

- 48.Artificial Sweeteners and Cancer. Bethesda, MD: National Cancer Institute; 2009. [Google Scholar]

- 49.Suez J, Korem T, Zeevi D et al. Artificial sweeteners induce glucose intolerance by altering the gut microbiota. Nature. doi: 10.1038/nature13793. 2014;Epub ahead of print. [DOI] [PubMed] [Google Scholar]