On 1 April 2013, the premiers of Canada's provincial and territorial governments, under the auspices of the Council of the Federation, achieved a breakthrough agreement to lower the price to be paid for 6 costly generic medicines (amlodipine, atorvastatin, omeprazole, rabeprazole, ramipril, and venlafaxine), pegging their reimbursement prices to 18% of the original innovator's price. These governments expect their new price ceiling to save up to $100 million, as these 6 drugs represent about 20% of publicly funded spending on generic drugs.1,2 The Council of the Federation made this decision on the advice of a subcommittee of provincial and territorial ministers of health (except the minister of health from Quebec) called the Health Care Innovation Working Group. Movements toward such price-fixing began largely in western Canada, especially in British Columbia and Saskatchewan, although Alberta Blue Cross has been coordinating the national effort, along with the ministers of health of Ontario and Yukon.3–7

Price ceilings have long been a common way of regulating drug prices in Canada,8 but they have never been as low as 18% of an "ex-factory" or supply-side price, and politicians have never made them national in scope. The Council's decision, therefore, represents an experiment of considerable importance in improving health system affordability and equitable access to essential medicines.

Canadian law mandates that new patented medicines be priced on the basis of comparisons with peer nations, but no such price mandate exists for generic drugs.9 However, previous international comparisons of generic drug prices using the same peer comparator countries and others have been carried out by academics10,11 and governments12–15 and have typically shown Canadian prices to be higher.16–18 After Ontario introduced generic price ceilings at 25% of the equivalent innovator product for public procurement and at 50% for private procurement in July 2010, Law et al.19 found that Ontarians continued to overpay for generic medicines relative to other countries. The same would be true of other Canadian provinces with price ceilings of 25% to 40% of the innovator product.1

We asked, therefore, whether the Council of the Federation's new price ceiling of 18%, the lowest yet, continues to leave Canadian generic medicines overpriced relative to generics in other countries. In the analysis described here, we found that they were.

We compared the Council's new reimbursement price ceilings on the above-mentioned 6 drugs20 to a convenience sample of prices publicly available in English for the same products from similarly wealthy countries with various market sizes and therefore differing bargaining power. We examined data provided by the following agencies: the UK National Health Service21 and Germany's Deutsches Institut für Medizinische Dokumentation und Information (the German Institute of Medical Documentation and Information, also known as DIMDI),22 both of which have pharmaceutical markets larger than Canada's; the US Department of Veterans Affairs Federal Supply Schedule Service,23 which caters mainly to Aboriginals and national security personnel and which has a market size comparable to that of Canada (about 23 million)24; and New Zealand's Pharmaceutical Management Agency (known as PHARMAC)25 and Sweden's Tandvårds-och läkemedelsförmånsverket (Dental and Pharmaceutical Benefits Agency),26 both of which have smaller markets, perhaps comparable to individual Canadian provinces. We applied methods similar to those of previous peer-reviewed studies on this topic,10,11 but whereas the previous studies used only 1 or 2 peer nations as comparators, we used this larger sample of 5 countries, which we believe strengthens the validity of our conclusions.

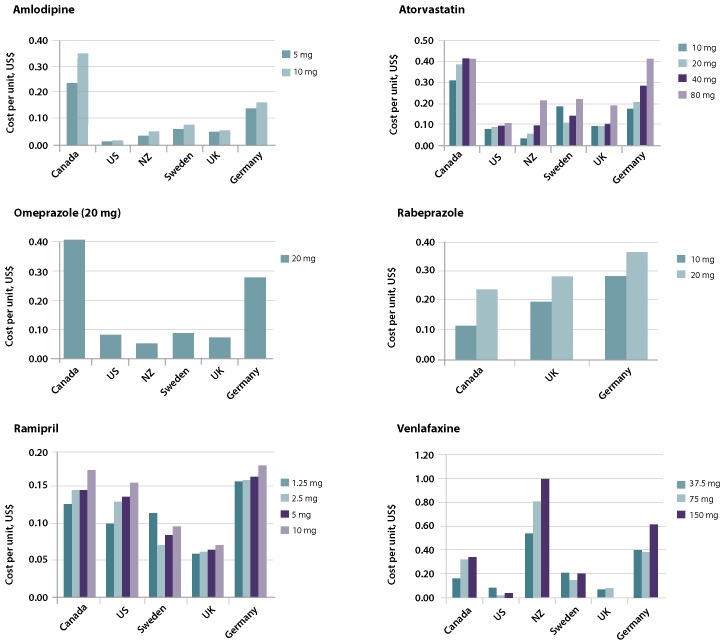

In absolute terms, the cost per unit of the 6 drugs targeted by the Council of the Federation's price ceiling remained markedly higher than costs in the other countries (Figure 1), and this difference remained even at the apparently low 18% level chosen by the Council, subject to only a few exceptions (rabeprazole and venlafaxine; see Figure 1).

Figure 1.

Cost per unit (in 2013 US dollars) of 6 generic pharmaceuticals targeted by Canada's Council of the Federation, relative to 5 other nations. NZ = New Zealand; UK = United Kingdom; US = United States.

Table 1 displays the Canadian prices in April 2013 for each product (following the decision of the Council of the Federation) and the contemporaneous prices in each of the 5 comparator countries. As an aggregate assessment, these data show that across all medicines and strengths, Canadian prices exceeded those of the foreign comparators by a median price ratio of 2.13 (range 0.30–21.71). In other words, even after the Council's decision, Canadian prices for these generic medicines were more than double those of peer countries. More specifically, of the 69 pairwise comparisons for the generic medicines and countries studied, prices were cheaper in Canada for only 14 (20%).

Table 1.

Canada-to-foreign price ratio comparison (US dollars per unit)*

| Drug and dose, mg | Canada | United States | New Zealand | Sweden | United Kingdom | Germany | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Price | Price | Ratio | Price | Ratio | Price | Ratio | Price | Ratio | Price | Ratio | |

| Amlodipine | |||||||||||

| 5 | 0.238 | 0.012 | 20.67 | 0.032 | 7.52 | 0.057 | 4.18 | 0.053 | 4.46 | 0.142 | 1.68 |

| 10 | 0.353 | 0.016 | 21.71 | 0.050 | 7.12 | 0.074 | 4.79 | 0.058 | 6.06 | 0.158 | 2.23 |

| Atorvastatin | |||||||||||

| 10 | 0.309 | 0.078 | 3.97 | 0.033 | 9.24 | 0.187 | 1.65 | 0.072 | 4.27 | 0.174 | 1.77 |

| 20 | 0.386 | 0.088 | 4.39 | 0.055 | 6.98 | 0.111 | 3.49 | 0.093 | 4.15 | 0.208 | 1.85 |

| 40 | 0.415 | 0.097 | 4.28 | 0.097 | 4.27 | 0.144 | 2.87 | 0.105 | 3.95 | 0.285 | 1.45 |

| 80 | 0.415 | 0.106 | 3.90 | 0.215 | 1.93 | 0.221 | 1.87 | 0.190 | 2.18 | 0.414 | 1.00 |

| Omeprazole | |||||||||||

| 20 | 0.405 | 0.080 | 5.04 | 0.050 | 8.08 | 0.086 | 4.71 | 0.073 | 5.51 | 0.278 | 1.45 |

| Rabeprazole | |||||||||||

| 10 | 0.118 | NA | NA | NA | NA | NA | NA | 0.193 | 0.61 | 0.281 | 0.42 |

| 20 | 0.237 | NA | NA | NA | NA | NA | NA | 0.284 | 0.83 | 0.362 | 0.65 |

| Ramipril | |||||||||||

| 1.25 | 0.125 | 0.100 | 1.25 | NA | NA | 0.114 | 1.10 | 0.059 | 2.13 | 0.157 | 0.80 |

| 2.5 | 0.145 | 0.129 | 1.13 | NA | NA | 0.071 | 2.05 | 0.061 | 2.35 | 0.159 | 0.91 |

| 5 | 0.145 | 0.136 | 1.07 | NA | NA | 0.084 | 1.71 | 0.066 | 2.20 | 0.162 | 0.89 |

| 10 | 0.183 | 0.155 | 1.18 | NA | NA | 0.095 | 1.92 | 0.071 | 2.59 | 0.179 | 1.02 |

| Venlafaxine | |||||||||||

| 37.5 ER | 0.162 | 0.084 | 1.93 | 0.540 | 0.30 | 0.217 | 0.75 | 0.069 | 2.35 | 0.398 | 0.41 |

| 75 ER | 0.323 | 0.019 | 16.71 | 0.810 | 0.40 | 0.149 | 2.17 | 0.084 | 3.87 | 0.381 | 0.85 |

| 150 ER | 0.341 | 0.040 | 8.60 | 0.998 | 0.34 | 0.204 | 1.67 | NA | NA | 0.613 | 0.56 |

ER = extended-release, NA = not available or not applicable.

For countries that have approved the same generic drug at more than one price (United States, Sweden, Germany), the price of the cheapest approved supplier was chosen, as this represents the price achievable in that country independent of other considerations (such as contracts given for racial affirmative action in the United States, for which a premium may be charged). As in other studies,10,11 foreign currency prices per unit were converted to US dollars per unit with the Bank of Canada 10-year currency converter27 for 1 April 2013, to allow calculation of the price ratio. Prices presented here have been rounded, but the ratios were calculated using exact prices (in US dollars). Comparisons were based on identical product strengths and formulations; tablets and capsules were considered interchangeable. All 6 generic drugs on the Council of the Federation's list are available internationally, with some lacunae. For rabeprazole, which remains under patent in much of the world, the only countries with a generic comparator were the United Kingdom and Germany. Likewise, some doses (e.g., amlodipine 2.5 mg) were not available to one or more foreign buyers and are therefore not included in this table.

Five of the 6 medicines in the Council's initiative were cheaper in some or all of the foreign countries we studied. This held true even in the few situations where Canadian generics companies supplied the product. For example, New Zealand purchases amlodipine and the United States purchases venlafaxine from Apotex, a Canadian generics firm, at substantially lower prices (86%–87% lower for amlodipine in New Zealand and 48%–94% lower for venlafaxine in the United States, depending on product strength) compared with the Council of the Federation's price for Canadian buyers.

The reality of our overall results is likely even grimmer than is reported here. The only Swedish and US data publicly available are the consumer prices, which typically include a profit margin or overhead for the end distributor; as such, those countries' reimbursement prices are somewhat lower than reported in Table 1. In a perfect like-for-like comparison, the actual margin relative to the Canadian formulary would be somewhat wider than reported here.

What accounts for Canada's excessive prices for generics relative to the foreign countries in this study? Given that our comparators were similarly developed countries facing similar health challenges and having larger, smaller, or roughly equivalent populations, it is not possible to ascribe our results simply to differences in market size, bargaining power, purchasing volumes, development status, or wealth. We propose that the price differences are better explained by the procurement strategies of the various countries.

The Council of the Federation's decision to set the maximum price ceiling for these post-patent medicines at 18% of the equivalent innovator's product, and not some higher or lower percentage, reflects a one-sizefits- all approach to health policy that is unlikely to suit all medicines optimally. This price ceiling was not the Council's original plan. Rather, the Council first proposed in August 2010 "to establish a provincialterritorial purchasing alliance to consolidate public sector procurement of common drugs."28 The Council decided that this purchasing alliance would "initiate a national competitive bidding process by Fall 2012 that would result in lower prices taking effect by April 1, 2013."28 However, the proposal to use competitive bidding— commonly called drug tendering—never came to fruition because the provinces failed to agree on an underlying alliance for bulk purchasing.29 So instead, the Council imposed the single, national price ceiling of 18%. The Council offered no rationale for that percentage and has not stated when, how, or even whether the percentage will be revised in the future as market conditions change.

The Canadian approach of setting a single price ceiling for multiple medicines is highly unusual. All other countries studied here have preferred competition or negotiation to varying extents. The most liberalized is New Zealand, where the public health system competitively tenders to procure each medicine from a single preferred vendor at the best price.10 In the United States, federal government programs (except Medicare) can procure a given medicine from multiple vendors, but each vendor negotiates its own governmentapproved maximum price that is tailored to its particular economic and political situation.23 Likewise, in Sweden, the public health system procures drugs from multiple vendors, with the difference that each vendor proposes a price that the government accepts or rejects, without negotiation.30 Similar to Canada, the United Kingdom and Germany set maximum price ceilings that bind all vendors, but with the very important difference that prices are revised at short intervals (e.g., quarterly or monthly) on the basis of negotiations with vendors and market trends.21,22

Thus, although the Council of the Federation's new 18% price ceiling saves some money compared with prices paid in the past, it is grossly deficient when one considers the opportunity costs that Canada sustains annually by refraining from adopting one of the alternative systems proven to be more effective in its peer countries, be it single-source tendering (as in New Zealand) or flexible price ceilings (as in Germany, Sweden, the United Kingdom, and the United States).

Should the Council of the Federation continue to revise and/or add to the list of post-patent drugs with price ceilings, it could at a minimum introduce routine international price comparisons to ensure that Canada is not paying more than its peers, through comparisons such as this one or those carried out by the Patented Medicine Prices Review Board.12,14 Additionally, the Council could opt to consolidate the provinces' medicine needs and make bulk purchases through a tenderbased procurement process, which we and others think would be advantageous.18 These are just 2 of many promising policy alternatives that have been proposed over the years for introducing more competition into Canada's pricing of generics and/or for bringing Canada's generic prices down to a level that is more typical among its peers.17 Why the Council has decided against taking one of these or a similar approach at this time is unknown.

In a report commissioned by the Canadian Generic Pharmaceutical Association,31 Hollis and Grootendorst offered 3 principal arguments against tendering and other forms of competition. First, they argued that Canadian-style price ceilings already result in "generic drug reimbursement prices ... comparable to prices paid elsewhere." Second, they argued that tendering would make drug supplies dependent on a single supplier and would increase the risk of drug shortages if that supplier fails to meet demand. Third, they argued that lower prices for generics would make it unaffordable for generics companies to sue and overturn invalid patents that would otherwise force buyers into paying even higher prices because of an unusual Canadian law that "links" the innovator medicine's patent status to obtaining marketing approval for generics.32

None of these arguments is convincing. First, as we have shown here, prices for generics in Canada are not comparable to those in other countries, even at the Council's unprecedentedly low 18% price ceiling. Second, the dangers of drug shortages can be greatly mitigated by simply continuing to use multiple suppliers, as Germany, Sweden, the United Kingdom, and the United States do, and not single suppliers as New Zealand does (although we were unable to find credible, published reports of even New Zealand experiencing drug shortages). Finally, rather than pay generics companies elevated prices as bounty for suing and invalidating patents, it would be cheaper (basically, free) for Canada's Parliament to amend its unusual law, especially the controversial linkage between the innovator medicine's patent status and generic medicines' marketing approval. None of the other countries in this study have patent linkage laws, except the United States, where that system is better tailored and coexists with cheaper generics than is the case in Canada.33

The Council of the Federation plans to report in 2014 on the progress of its generic drug pricing scheme. That report doubtless will show that some money was saved, but our principal conclusion is that much more could be saved by following the example of peer countries and using competition or negotiation. Since a price ceiling applied categorically to entire groups of medicines, whether at 18% or another arbitrary level, is likely to be suboptimal, we recommend that the Council of the Federation return to its original but unfulfilled plan to "initiate a national competitive bidding process."28 This approach is more likely to restrain Canadian drug prices, and to avoid the politically difficult appearance of Canadian generics companies doing business at lower prices abroad than in Canada.

Footnotes

None declared.

No direct funding was received for this study. Jason Nickerson and Amir Attaran were personally salaried by their institutions during the period of writing, although no specific salary was set aside or given for the writing of this paper. Reed Beall's doctoral studies are funded by a Vanier doctoral fellowship from the Canadian Institutes of Health Research. No funding bodies had any role in the design of the study, the collection or analysis of the data, the decision to publish, or the preparation of the manuscript.

Contributor Information

Reed F Beall, Reed F. Beall, MA, is a PhD candidate in the Institute of Population Health at the University of Ottawa, Ottawa, Ontario..

Jason W Nickerson, Jason W. Nickerson, RRT, PhD, is a Clinical Investigator at the Bruyère Research Institute, Ottawa, Ontario..

Amir Attaran, Amir Attaran, DPhil, LLB, is Associate Professor and Canada Research Chair in Law, Population Health and Global Development Policy at the University of Ottawa, Ottawa, Ontario..

References

- 1. Council of the Federation , author. Provinces and territories seek significant cost savings for Canadians on generic drugs [news release] Ottawa (ON): Council of the Federation Secretariat; 2013. Available from: www.conseildelafederation.ca/en/latest-news/13-2013/122-territories-seek-significant-cost-savings-on-generic-drugs (accessed 2014 Aug 28). [Google Scholar]

- 2.Low Cost Alternative (LCA) and Reference Drug Program (RDP) data files. Victoria (BC): Government of British Columbia, Ministry of Health; 2013. Available from: www.health.gov.bc.ca/pharmacare/lca/lcabooklets.html (accessed 2014 Aug 28). [Google Scholar]

- 3.Lockwood C. IHS healthcare and pharma blog. Englewood (CO): IHS; 2013. Generic and branded prices in Canada: the provinces and territories band together in the cost-containment drive. Available from: http://healthcare.blogs.ihs.com/2013/03/14/generic-and-branded-prices-in-canada-the-provinces-and-territories-band-together-in-the-cost-containment-drive/ (accessed 2014 Aug 28). [Google Scholar]

- 4.MacDonald K. Benefits Canada [website] Toronto (ON): Rogers Publishing Ltd.; 2013. Demystifying drug prices in Alberta. Available from: www.benefitscanada.com/benefits/health-benefits/demystifying-drug-prices-in-alberta-40886 (accessed 2014 Aug 28). [Google Scholar]

- 5.Progress report 2013: health care renewal in Canada. Toronto (ON): Health Council of Canada; 2013. Available from: www.healthcouncilcanada.ca/rpt_det.php?id=481 (accessed 2014 Aug 28). [Google Scholar]

- 6.Progress report 2012: health care renewal in Canada. Toronto (ON): Health Council of Canada; 2012. Available from: www.healthcouncilcanada.ca/rpt_det.php?id=377 (accessed 2014 Aug 28). [Google Scholar]

- 7.Progress report 2011: health care renewal in Canada. Toronto (ON): Health Council of Canada; 2011. Available from: http://healthcouncilcanada.ca/rpt_det.php?id=165 (accessed 2014 Aug 28). [Google Scholar]

- 8.Bell C, Griller D, Lawson J, Lovren D. Generic drug pricing and access in Canada: What are the implications? Toronto (ON): Health Council of Canada; 2010. Available from: www.healthcouncilcanada.ca/rpt_det.php?id=156 (accessed 2014 Aug 28). [Google Scholar]

- 9.Patented Medicines Regulations, SOR/94-688. 1994 Available from: http://laws-lois.justice.gc.ca/eng/regulations/SOR-94-688/page-1.html (accessed 2014 Aug 28). [Google Scholar]

- 10.Morgan S, Hanley G, McMahon M, Barer M. Influencing drug prices through formulary-based policies: lessons from New Zealand. Healthc Policy. 2007;3(1):e121–e140. [PMC free article] [PubMed] [Google Scholar]

- 11.Law M. Money left on the table: generic drug prices in Canada. Healthc Policy. 2013;8(3):17–25. [PMC free article] [PubMed] [Google Scholar]

- 12.Generic drugs in Canada: international price comparisons and potential cost savings. Ottawa (ON): Patented Medicine Prices Review Board; 2011. Available from: www.pmprb-cepmb.gc.ca/CMFiles/Publications/Analytical%20Studies/NPDUIS-GenericDrugs-IPCs-e-sept30.pdf (accessed 2014 Sep 30). [Google Scholar]

- 13.Drug system reforms. Example: 4 generic drugs in 5 other countries. Toronto (ON): Ontario Ministry of Health and Long-term Care; 2008. Available from: www.health.gov.on.ca/en/public/programs/drugreforms/genericdrugs_chart.aspx (accessed 2014 Aug 28). [Google Scholar]

- 14.Analytical snapshot: international generic price comparison, early 2011. Ottawa (ON): Patented Medicine Prices Review Board; 2013. Appendix C: Bilateral price comparison at drug level; pp. 13–14. Available from: www.pmprb-cepmb.gc.ca/CMFiles/NPDUIS/NPDUIS_International_Price_Comparison_Snapshot_2013-08-28_EN.pdf (accessed 2014 Sep 14). [Google Scholar]

- 15.PDCI Report Series. Ottawa (ON): Palmer D'Angelo Consulting Inc.; 2002. Generic drug prices: a Canada US comparison. Available from: www.pdci.on.ca/pdf/generic%20pricing%20study%20final%20report.pdf (accessed 2014 Aug 28). [Google Scholar]

- 16.Generic drugs in Canada: a policy paper. Toronto (ON): Canadian Treatment Action Council; 2007. Available from: www.ctac.ca/uploads/Position%20Papers/2007%20EN_PP%20Generic_Drugs_in_Canada_April_2007_FINAL.pdf (accessed 2014 Aug 28). [Google Scholar]

- 17.Benefiting from generic drug competition in Canada: the way forward. Gatineau (QC): Competition Bureau; 2008. Available from: www.competitionbureau.gc.ca/eic/site/cb-bc.nsf/eng/02753.html (accessed 2014 Aug 28). [PubMed] [Google Scholar]

- 18.Law MR, Kratzer J. The road to competitive generic drug prices in Canada. CMAJ. 2013;185(13):1141–1144. doi: 10.1503/cmaj.121367. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 19.Law M, Ystma A, Morgan S. The short-term impact of Ontario's generic pricing reforms. PLoS One. 2011;6(7):e23030–e23030. doi: 10.1371/journal.pone.0023030. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 20.Drugs funded by Ontario Drug Benefit (ODB) program. Toronto (ON): Ontario Ministry of Health and Long-term Care; 2013. Available from: www.health.gov.on.ca/en/pro/programs/drugs/odbf_mn.aspx (accessed 2014 Aug 28). [Google Scholar]

- 21.Electronic drug tariff. London (UK): Department of Health, National Health Service England and Wales; 2014. NHS Business Services Authority, NHS Prescription Services. Available from: www.ppa.org.uk/ppa/edt_intro.htm (accessed 2014 Oct 2). [Google Scholar]

- 22. Downloadcenter Arzneimittel-Festbeträge [Download Center for Fixed Drug Price Amounts] [website]. Deutsches Institut für Medizinische Dokumentation und Information [German Institute of Medical Documentation and Information]; 2013. Available from: www.dimdi.de/dynamic/de/amg/festbetraege-zuzahlung/festbetraege/downloadcenter/ (accessed 2014 Aug 28).

- 23.Pharmaceutical prices [website] Washington (DC): US Department of Veterans Affairs, Pharmacy Benefits Management Services; 2013. Available from: www.pbm.va.gov/PharmaceuticalPrices.asp (accessed 2014 Aug 28). [Google Scholar]

- 24.Profile of veterans: 2011. Data from the American Community Survey. Washington (DC): US Department of Veterans Affairs, National Center for Veterans Analysis and Statistics; 2013. Available from: www.va.gov/vetdata/docs/SpecialReports/Profile_of_Veterans_2011.pdf (accessed 2014 Sep 30). [Google Scholar]

- 25.Pharmaceutical schedule [website] Wellington (New Zealand): PHARMAC Pharmaceutical Management Agency; 2013. 2013–2014. Available from: www.pharmac.health.nz/tools-resources/pharmaceutical-schedule (accessed 2014 Aug 28). [Google Scholar]

- 26.Läkemedel [Welcome to the TLV] [website] Stockholm (Sweden): Tandvårds-Och Läkemedelsförmånsverket [Dental and Pharmaceutical Benefits Agency]; Available from: www.tlv.se/beslut/sok/lakemedel/ (accessed 2014 Aug 28). [Google Scholar]

- 27.10-year currency converter. Ottawa (ON): Bank of Canada; Available from: www.bankofcanada.ca/rates/exchange/10-year-converter/ (accessed 2014 Aug 28). [Google Scholar]

- 28.From innovation to action: the first report of the Health Care Innovation Working Group. Ottawa (ON): Council of the Federation Secretariat; 2012. Council of the Federation. Available from: www.conseildelafederation.ca/en/featured-publications/75-council-of-thefederation-to-meet-in-victoria (accessed 2014 Aug 28). [Google Scholar]

- 29.Lunn S. Provinces reach deal to save on 6 generic drugs: Premiers say agreement will cut costs by $100M on common drugs. CBC News. 2013 Jan 18; Available from: www.cbc.ca/news/politics/provinces-reach-deal-to-save-on-6-generic-drugs-1.1331370 (accessed 2014 Aug 28). [Google Scholar]

- 30.The Swedish pharmaceutical reimbursement system—a brief overview. Solna (Sweden): Pharmaceutical Benefits Board; 2007. Available from: www.tlv.se/Upload/English/ENG-swe-pharma-reimbursement-system.pdf (accessed 2014 Aug 28). [Google Scholar]

- 31.Hollis A, Grootendorst P. Tendering generic drugs: What are the risks? Toronto (ON): Canadian Generic Pharmaceutical Association; 2012. Available from: www.canadiangenerics.ca/en/advocacy/docs/10.24.12%20Tendering%20Generic%20Drugs%20-%20What%20Are%20the%20Risks_FINAL.pdf (accessed 2014 Aug 28). [Google Scholar]

- 32.Patented Medicines (Notice of Compliance) Regulations, SOR/93-133, 1993 [amended 2011 Mar 25] Available from: http://laws-lois.justice.gc.ca/PDF/SOR-93-133.pdf (accessed 2014 Aug 28).

- 33.Hore E. A comparison of United States and Canadian laws as they affect generic pharmaceutical market entry. Food Drug Law J. 2000;55(3):373–388. [PubMed] [Google Scholar]