Abstract

Humans exhibit framing effects when making choices, appraising decisions involving losses differently from those involving gains. To directly test for the evolutionary origin of this bias, we examined decision-making in humans' closest living relatives: bonobos (Pan paniscus) and chimpanzees (Pan troglodytes). We presented the largest sample of non-humans to date (n = 40) with a simple task requiring minimal experience. Apes made choices between a ‘framed’ option that provided preferred food, and an alternative option that provided a constant amount of intermediately preferred food. In the gain condition, apes experienced a positive ‘gain’ event in which the framed option was initially presented as one piece of food but sometimes was augmented to two. In the loss condition, apes experienced a negative ‘loss' event in which they initially saw two pieces but sometimes received only one. Both conditions provided equal pay-offs, but apes chose the framed option more often in the positive ‘gain’ frame. Moreover, male apes were more susceptible to framing than were females. These results suggest that some human economic biases are shared through common descent with other apes and highlight the importance of comparative work in understanding the origins of individual differences in human choice.

Keywords: bonobo, chimpanzee, decision-making, economics, framing effect, cognition

1. Introduction

Humans exhibit a suite of biases not predicted by rational choice theory. One important example is the framing effect: the manner in which options are presented, or framed, can profoundly influence how we evaluate equivalent choices. When making decisions, we evaluate options relative to a reference point, and changes that appear to worsen the status quo (such as losses) are treated differently from changes that appear to improve it (such as gains) [1]. While well-known examples focus on framing's impact on decisions under risk [2], framing has broad influences on judgement and decision-making [3]. For example, people assess a hypothetical gamble as more favourable and are more willing to invest in it, when it is described positively in terms of likelihood of winning, compared with an identical gamble described negatively in terms of likelihood of losing [4]. That is, humans are sensitive to how decisions are presented and prefer situations where positive attributes are highlighted over identical choices that focus on negative attributes. However, the origin of the framing effect is unclear. One possibility is that this bias requires human-specific cultural experience with economic markets [5]. Alternatively, it may stem from psychological processes that are inherited through common descent with other apes and may even be widely shared across vertebrates.

There is some evidence that framing effects may not be unique to humans [6]. For example, capuchin monkeys (Cebus apella) prefer to trade a token with an experimenter who offered a smaller amount of food but sometimes augmented it (a gain) versus one who initially offered more but sometimes reduced it (a loss)—despite receiving equal pay-offs regardless [5]. Moreover, framing can influence non-human risk preferences: both capuchins and European starlings (Sturnus vulgaris) are more risk-seeking when attempting to avoid certain losses than when attempting to acquire gains [7,8]. However, unlike most human studies examining spontaneous responses to framing, these studies involved extensive training on task procedures or several sessions before individuals' preferences stabilized, and such experience may impact decision-making [9,10]. Furthermore, it is unknown whether humans share this bias with these more distantly related species due to homology, or evolutionary convergence.

The critical test of whether human framing is evolutionarily derived is to examine our closest phylogenetic relatives: chimpanzees (Pan troglodytes) and bonobos (Pan paniscus). The use of such phylogenetic inference is a powerful tool for comparative psychology [11]. In the current study, we presented apes with a simple, non-verbal task involving minimal prior experience that allowed us to test a much larger sample of individuals (n = 40) than previous comparative studies, in a manner more similar to human research. Apes made choices for a ‘framed’ option that always provided the same average amount of food, but was presented either positively (as a gain) or negatively (as a loss)—a situation sometimes referred to as attribute framing [4]. The framed option was pitted against an alternative choice that always provided a fixed amount of food. We predicted that both species would respond differently to perceived gains versus losses, preferring the framed option more in the gain condition—much like how humans judge options as more desirable when presented in terms of positive attributes compared with identical options framed in terms of negative attributes [4]. As bonobos are more risk-averse than chimpanzees [9–12], we further predicted that bonobos might exhibit relatively greater aversion to the loss frame.

2. Material and methods

We tested 40 semi-free-ranging apes: 23 chimpanzees from Tchimpounga Chimpanzee Sanctuary in the Republic of Congo, and 17 bonobos from Lola ya Bonobo Sanctuary in the Democratic Republic of Congo (see the electronic supplementary material for details). Apes chose between a ‘framed’ option that provided preferred food (fruit), and an alternative option that provided intermediately preferred food (peanuts). In the gain condition, the framed option was always initially presented as one piece of food but was augmented to two after the ape's choice on half of trials. In the loss condition, the framed option was presented as two pieces but decreased to one on half of the trials (see electronic supplementary material and [12] for data).

Subjects completed five sessions (see electronic supplementary material, figure S1 for details). In the preference pre-test, we determined each individual's equivalence quantity—the number of peanuts they treated as equivalent to the average pay-off from the framed option (1.5 fruit pieces). We systematically adjusted the quantity until the ape chose between the two options equally; this amount was used as the alternative option in the main sessions. Apes then completed the gain and loss conditions (order counterbalanced). Each condition consisted of an initial exposure session of forced-choice trials (12 trials per option) to familiarize subjects with reward contingencies. In the test session, the following day, apes completed six additional exposure trials per option, followed by 12 test trials involving choices between the framed and alternative options. In all sessions, the ape and experimenter sat opposite each other at a sliding table. The experimenter baited the relevant options (side counterbalanced) and then pushed the table-top forward (looking straight ahead to avoid cuing); the ape indicated its choice by pointing.

3. Results

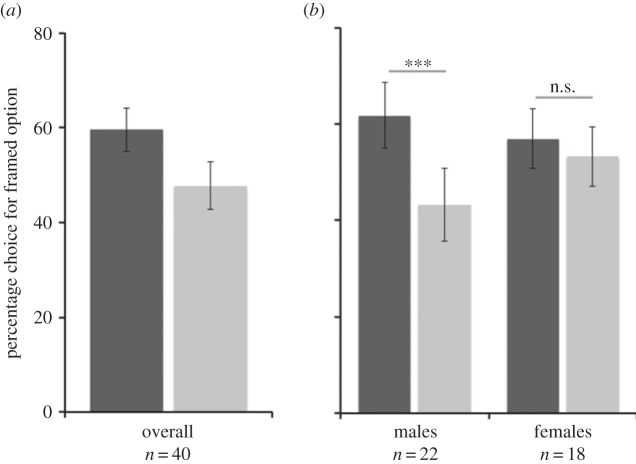

Apes chose the framed option significantly more in the gain condition (M = 59.6% ± s.e. = 4.6 of trials) than in the loss condition (47.7% ± 5.0 of trials) (Wilcoxon: N = 40, T+= 22, 10 ties, Z = −2.96, p < 0.005; see figure 1a and electronic supplementary material, table S1). We calculated a difference score (gain-frame − loss-frame choices) to index each individual's relative preference for the gain condition and found no difference between species (Mann–Whitney U = 192.5, Z = −0.08, p = 0.94, n.s.). However, males had a significantly higher score than females (males: M = 18.6 ± s.e. = 5.5; females: 3.7 ± 4.1; Mann–Whitney U = 119.0, Z = −2.18, p < 0.05; see figure 1b). Importantly, there was no difference between the sexes in their equivalence quantity, nor in pay-offs received from the framed option (see the electronic supplementary material).

Figure 1.

Responses to framing. (a) Percentage of choices for the framed option across conditions. (b) Responses by sex. Error bars depict standard error. ***p < 0.001. Dark grey bars denote gain frame and light grey bars denote loss frame.

We used generalized linear mixed models to analyse choices on a trial-by-trial basis, accounting for within-subject repeated measures. We used the glmer function from the LME4 software package in R to fit binomial models with a logit link function using maximum likelihood and compared fit using likelihood ratio tests (see the electronic supplementary material for details). We first fitted a base model that included random subject intercepts to account for repeated trials, and three covariates: equivalence quantity (to account for variation in choices related to the value of each individual's alternative option), the average pay-off received from the framed option in that session (to account for variation in feedback), and trial number (to account for within-session preference changes). In the second model, we added condition to assess the importance of our framing manipulation. This further increased model fit compared with the base model (χ2 = 14.04, d.f. = 1, p < 0.001). In the third model, we added sex and a sex-by-condition interaction, to assess whether males and females differed in their framing susceptibility. This improved model fit (χ2 = 8.87, d.f. = 2, p < 0.05); while males and females did not differ in their overall propensity to choose the framed option, pairwise Tukey comparisons revealed that only males were significantly influenced by framing condition (see table 1 for model parameters). Finally, we added species and an interaction with condition to assess if chimpanzees and bonobos differed. However, this did not improve model fit compared with the third model (χ2 = 1.24, d.f. = 2, p = 0.54, n.s.). These results indicate that the species did not differ in susceptibility to framing, whereas male apes exhibited a more robust framing effect than female apes—even when accounting for other potential influences on their choices. Importantly, trial number did not impact choices (see table 1), ruling out within-session learning or changes in relative food preferences.

Table 1.

Factors influencing likelihood of choosing the framed option in the best-fit model. Trial number (1–12), equivalence quantity (or the value of the alternative option) and average session pay-offs were included as covariates across models. Significant p-values (p < 0.05) are italicized.

| factor | estimate | s.e. | Z | p |

|---|---|---|---|---|

| trial number | 0.008 | 0.022 | 0.356 | 0.72 |

| equivalence quantity | −0.196 | 0.147 | −1.335 | 0.18 |

| average session pay-off | 7.191 | 2.530 | 2.843 | <0.005 |

| condition (gain baseline) | −0.130 | 0.222 | −0.586 | 0.56 |

| sex (female baseline) | 0.330 | 0.573 | 0.576 | 0.56 |

| males: loss − gain | −1.074 | 0.229 | −4.690 | <0.001 |

| females: loss − gain | −0.130 | 0.222 | −0.586 | 0.99 |

4. Discussion

Chimpanzees and bonobos were more likely to choose the framed option when it was presented positively (as a gain) than when it was presented negatively (as a loss). That is, apes evaluated the gain option more positively than the loss option despite equivalent pay-offs, as do humans [4] (see also [5]). Indeed, although the framed option was initially presented as a larger amount in the loss condition, apes still chose it more in the gain condition. That both of humans' closest relatives exhibit human-like framing effects suggests that this bias is not a product of evolutionary convergence but of shared ancestry between humans, non-human apes and perhaps other species as well [5,7,8]. Importantly, apes exhibited this framing bias after no training and minimal experience—a set-up more similar to human research—and showed no changes in choices across trials. Together with comparative studies of the endowment effect [13,14], risk sensitivity [15] and ambiguity aversion [16,17], our work suggests that core features of human decision-making may reflect biological predispositions and that experience with monetary markets may not be necessary for components of human economic behaviour to emerge.

Although chimpanzees and bonobos exhibited differences in risk preferences in previous studies [18–21], we found no differences in their responses to framing. This aligns with previous work indicating that chimpanzees and bonobos may differ specifically in cognitive capacities relevant to their natural socioecology but show broad commonalities in cognition across many other contexts [22]. It is important to note that the current study focused on the apes' preference for an option framed positively (as a gain) versus negatively (as a loss)—or attribute framing—not how framing impacts their risk preferences (e.g. [8]). Thus, future research could address whether apes exhibit the ‘reflection’ effect, becoming more risk-seeking when attempting to avoid certain losses than when attempting to acquire gains.

Our study's large sample size allowed us to examine variation in non-human responses to framing—the first study to do so to our knowledge. In fact, we found that male apes showed a stronger response to framing than females. This difference remained even when accounting for potential differences in food preferences, framed option pay-offs or trial-by-trial shifts in strategy. Why might male and female apes differ in susceptibility to framing? In humans, there is mixed evidence for gender differences in framing responses [23,24]. However, men may respond more strongly to negative frames specifically when making decisions about resources [23]. Moreover, framing effects may be driven by affective responses to losses versus gains [25], and men show greater differentiation of these contexts in their patterns of arousal than do women [26]. As apes also exhibit emotional reactions to decision-making [21], future research could assess sex differences in their affective responses to framing. Importantly, gender differences in human decision-making may stem from diverse causes, including different market experiences, cultural norms of behaviour or differences in motivation [27]. The current results indicate that studies of larger populations of non-humans can help constrain these hypotheses, as animals lack many relevant human-specific experiences or explicit gender norms. That is, comparative work can provide unique insights into the origins of individual differences in human choice.

Supplementary Material

Acknowledgements

We thank Aidan Coleman for assistance with coding, and Laurie Santos for comments on the manuscript. We also thank Rebeca Atencia, Debby Cox, the animal caretakers at Tchimpounga and the Ministry of Scientific Research and Technological Innovation in Congo (permit: 009/MRS/DGRST/DMAST); and Claudine Andre, Dominique Morel, Fanny Mehl, Pierrot Mbonzo, the animal caretakers at Lola ya Bonobo and the Ministry of Research and the Ministry of Environment in D. R. Congo (permit: MIN.RS/SG/004/2009) for hosting our research.

Ethics statement

The non-invasive behavioural studies were approved by Duke University (IACUC no. A078–08–03) and adhered to host countries' laws.

Data accessibility

Data are available on Dryad (http://doi.org/10.5061/dryad.4h4r4).

Author contributions

C.K., A.G.R. and B.H. designed the experiment. C.K. performed the experiment. C.K. and A.G.R. analysed the data. C.K., A.G.R. and B.H. wrote the paper.

Funding statement

Support came from NSFGRFP DGE-1106401 to C.K., an L.S.B. Leakey Foundation grant to A.G.R., and a European Research Commission Advanced Grant Agreement 233297, NSF-BCS-08–27552–02 and NSF-BCS-10–25172 to B.H.

References

- 1.Kahneman D, Tversky A. 2000. Choices, values, and frames. Cambridge, UK: Cambridge University Press. [Google Scholar]

- 2.Kahneman D, Tversky A. 1979. Prospect theory: analysis of decision under risk. Econometrica 47, 263–291. ( 10.2307/1914185) [DOI] [Google Scholar]

- 3.Tversky A, Kahneman D. 1991. Loss aversion in riskless choice: a reference-dependent model. Q. J. Econ. 106, 1039–1061. ( 10.2307/2937956) [DOI] [Google Scholar]

- 4.Levin IP, Schneider SL, Gaeth GJ. 1998. All frames are not created equal: a typology and critical analysis of framing effects. Organ Behav. Hum. Decis. Process. 76, 149–188. ( 10.1006/obhd.1998.2804) [DOI] [PubMed] [Google Scholar]

- 5.Chen MK, Lakshminarayanan V, Santos LR. 2006. How basic are behavioral biases? Evidence from capuchin monkey trading behavior. J. Polit. Econ. 114, 517–537. ( 10.1086/503550) [DOI] [Google Scholar]

- 6.Santos LR, Rosati AG. 2015. The evolutionary roots of human decision making. Annu. Rev. Psychol. 66, 321–347. ( 10.1146/annurev-psych-010814-015310) [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.Marsh B, Kacelnik A. 2002. Framing effects and risky decisions in starlings. Proc. Natl Acad. Sci. USA 99, 3352–3355. ( 10.1073/pnas.042491999) [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8.Lakshminarayanan VR, Chen MK, Santos LR. 2011. The evolution of decision-making under risk: framing effects in monkey risk preferences. J. Exp. Soc. Psychol. 47, 689–693. ( 10.1016/j.jesp.2010.12.011) [DOI] [Google Scholar]

- 9.Hertwig R, Erev I. 2009. The description–experience gap in risky choice. Trends Cogn. Sci. 13, 517–523. ( 10.1016/j.tics.2009.09.004) [DOI] [PubMed] [Google Scholar]

- 10.Ludvig EA, Madan CR, Spetch ML. 2014. Extreme outcomes sway risky decisions from experience. J. Behav. Decis. Making 27, 146–156. ( 10.1002/bdm.1792) [DOI] [Google Scholar]

- 11.MacLean EL, et al. 2012. How does cognition evolve? Phylogenetic comparative psychology. Anim. Cogn. 15, 1–16. ( 10.1007/s10071-011-0433-2) [DOI] [PMC free article] [PubMed] [Google Scholar]

- 12.Krupenye C, Rosati AG, Hare B. 2015. Data from: Bonobos and chimpanzees exhibit human-like framing effects. Dryad Digital Repository. ( 10.5061/dryad.4h4r4) [DOI] [PMC free article] [PubMed] [Google Scholar]

- 13.Brosnan SF, Jones OD, Lambeth SP, Mareno MC, Richardson AS, Schapir SJ. 2007. Endowment effects in chimpanzees. Curr. Biol. 17, 1704–1707. ( 10.1016/j.cub.2007.08.059) [DOI] [PubMed] [Google Scholar]

- 14.Lakshminaryanan V, Chen MK, Santos LR. 2008. Endowment effect in capuchin monkeys. Phil. Trans. R. Soc. B 363, 3837–3844. ( 10.1098/rstb.2008.0149) [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.Kacelnik A, Bateson M. 1996. Risky theories: the effects of variance on foraging decisions. Am. Zool. 36, 402–434. [Google Scholar]

- 16.Hayden BY, Heilbronner SR, Platt ML. 2010. Ambiguity aversion in rhesus macaques. Front. Neurosci. 4, 166 ( 10.3389/fnins.2010.00166) [DOI] [PMC free article] [PubMed] [Google Scholar]

- 17.Rosati AG, Hare B. 2011. Chimpanzees and bonobos distinguish between risk and ambiguity. Biol. Lett. 7, 15–18. ( 10.1098/rsbl.2010.0927) [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18.Haun DB, Nawroth C, Call J. 2011. Great apes’ risk-taking strategies in a decision making task. PLoS ONE 6, e28801 ( 10.1371/journal.pone.0028801) [DOI] [PMC free article] [PubMed] [Google Scholar]

- 19.Heilbronner SR, Rosati AG, Stevens JR, Hare B, Hauser MD. 2008. A fruit in the hand or two in the bush? Divergent risk preferences in chimpanzees and bonobos. Biol. Lett. 4, 246–249. ( 10.1098/rsbl.2008.0081) [DOI] [PMC free article] [PubMed] [Google Scholar]

- 20.Rosati AG, Hare B. 2012. Decision making across social contexts: competition increases preferences for risk in chimpanzees and bonobos. Anim. Behav. 84, 869–879. ( 10.1016/j.anbehav.2012.07.010) [DOI] [Google Scholar]

- 21.Rosati AG, Hare B. 2013. Chimpanzees and bonobos exhibit emotional responses to decision outcomes. PLoS ONE 8, e63058 ( 10.1371/journal.pone.0063058) [DOI] [PMC free article] [PubMed] [Google Scholar]

- 22.Herrmann E, Hare B, Call J, Tomasello M. 2010. Differences in the cognitive skills of bonobos and chimpanzees. PLoS ONE 5, e12438 ( 10.1371/journal.pone.0012438) [DOI] [PMC free article] [PubMed] [Google Scholar]

- 23.Huang Y, Wang L. 2010. Sex differences in framing effects across task domain. Pers. Indiv. Differ. 48, 649–653. ( 10.1016/j.paid.2010.01.005) [DOI] [Google Scholar]

- 24.Fagley NS, Miller PM. 1997. Framing effects and arenas of choice: your money or your life? Organ Behav. Hum. Decis. Process. 3, 355–373. ( 10.1006/obhd.1997.2725) [DOI] [Google Scholar]

- 25.De Martino B, Kumaran D, Seymour B, Dolan RJ. 2006. Frames, biases, and rational decision-making in the human brain. Science 313, 684–687. ( 10.1126/science.1128356) [DOI] [PMC free article] [PubMed] [Google Scholar]

- 26.Sarlo M, Lotto L, Palomba D, Scozzari S, Rumiati R. 2013. Framing the ultimatum game: gender differences and autonomic responses. Int. J. Psychol. 48, 263–271. ( 10.1080/00207594.2012.656127) [DOI] [PubMed] [Google Scholar]

- 27.Croson R, Gneezy U. 2009. Gender differences in preferences. J. Econ. Lit. 47, 448–474. ( 10.1257/jel.47.2.448) [DOI] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Data Availability Statement

Data are available on Dryad (http://doi.org/10.5061/dryad.4h4r4).