Abstract

Cocaine dependence and other forms of drug dependence are associated with steeper devaluation of future outcomes (delay discounting). Although studies in this domain have typically assessed choices between monetary gains (e.g., receive less money now versus receive more money after a delay), delay discounting is also applicable to decisions involving losses (e.g., small loss now versus larger delayed loss), with gains typically discounted more than losses (the “sign effect”). It is also known that drugs are discounted more than equivalently valued money. In the context of drug dependence, however, relatively little is known about the discounting of delayed monetary and drug losses and the presence of the sign effect. In this within-subject, laboratory study, delay discounting for gains and losses was assessed for cocaine and money outcomes in cocaine-dependent individuals (n=89). Both cocaine and monetary gains were discounted at significantly greater rates than cocaine and monetary losses, respectively (i.e., the sign effect). Cocaine gains were discounted significantly more than monetary gains, but cocaine and monetary losses were discounted similarly. Results suggest that cocaine is discounted by cocaine-dependent individuals in a systematic manner similar to other rewards. Because the sign effect was shown for both cocaine and money, delayed aversive outcomes may generally have greater impact than delayed rewards in shaping present behavior in this population.

Keywords: delay discounting, cocaine, sign effect, losses, drug dependence, behavioral economics

1. Introduction

Delay discounting refers to the devaluation of outcomes as a function of delay to their receipt. Delay discounting assessment typically involves repeated choices between receiving a smaller monetary reward now versus receiving a larger monetary reward after a delay. For example, an individual may show through a series of choices that receiving $500 now would be equally valuable to receiving $1000 after a 1-year delay. This person would be said to have discounted the $1000 reward by 50% of its value due to the year-long delay. However, rewards (i.e., “gains”) only constitute one valence of an outcome. Delay discounting is just as applicable to decisions regarding delayed punishments (e.g., losses). For example, the same person may show through a series of choices that losing $800 now would be subjectively equivalent to losing $1000 after a 1-year delay. This person would be said to have discounted the loss of $1000 by 20% of its value due to the year-long delay. Within the context of delay discounting, the “sign effect” refers to the finding that gains are discounted at higher rates than are the same magnitude of outcomes framed as losses. The sign effect is demonstrated by the individual in our examples above, in which a 1-year delay reduces the value of a $1000 gain by 50%, but reduces the value of a $1000 loss by only 20%.

Several studies have shown the sign effect in the discounting of delayed money (Baker, Johnson, & Bickel, 2003; Benzion, Rapoport, & Yagil, 1989; Johnson, Bickel, & Baker, 2007; Loewenstein, 1988; Shelley, 1993; Thaler, 1981). The sign effect has also been observed for the discounting of hypothetical delayed health outcomes, that is, when comparing the discounting of delayed health gains (choice between receiving a smaller duration of health improvement now versus a larger duration of health improvement later) to delayed health losses (choice between a smaller duration of diminished health now versus a larger duration of diminished health later; Baker et al., 2003; Chapman, 1996; Johnson et al., 2007; MacKeigan, Larson, Draugalis, Bootman, & Burns, 1993). Delay discounting has been widely associated with drug use disorders (Bickel & Johnson, 2003; MacKillop et al., 2011). While most studies showing the sign effect for money have been conducted in individuals whose drug use was not assessed, one study observed the sign effect for delayed money in both heavy smokers and never-smoking individuals (Baker et al., 2003). Another study assessing delayed monetary discounting showed the sign effect in light smokers (Johnson et al., 2007). Yet another study reported a sign effect for monetary delay discounting in smokers, but not in a group of detoxified heroin-dependent individuals (gains and losses were discounted to a similar extent; Cheng, Lu, Han, Gonzalez-Vallejo, & Sui, 2012). In addition to monetary and health outcomes, the sign effect has also been demonstrated for the discounting of delayed drugs of abuse, that is, when comparing the discounting of delayed drug gains (choice between receiving a smaller amount of drug now versus receiving a larger amount of drug later) to delayed drug losses (choice between losing a smaller amount of drug now versus losing a larger amount of drug later). The only studies reporting the sign effect for drug outcomes have assessed discounting of delayed cigarettes in heavy (Baker et al., 2003) and light smokers (Johnson et al., 2007).

Delay discounting has also been examined in the context of cocaine use. For example, cocaine-abusing or dependent individuals discount delayed monetary gains significantly greater than do matched controls (Coffey, Gudleski, Saladin, & Brady, 2003; Heil, Johnson, Higgins, & Bickel, 2006; Kirby & Petry, 2004). Moreover, delay discounting of cocaine gains has been examined in both humans (Bickel et al. 2011)) and nonhuman primates (Anderson & Woolverton, 2003; Woolverton, Myerson, & Green, 2007), showing delay to decrease cocaine value. However, the discounting of cocaine losses and the sign effect for cocaine discounting remain unevaluated. Determining how individuals respond to both future drug rewards as well as future drug losses is important for understanding decision-making within recovery (requiring the loss of future cocaine). Also, given that heroin-dependent individuals showed no sign effect in a recent study (Cheng et al., 2012), it would be valuable to know if the reported lack of sign effect for heroin generalizes to cocaine, given that both are more stigmatized than tobacco.

The present within-subjects study examined the sign effect in cocaine-dependent volunteers by assessing the discounting of delayed cocaine gains and delayed cocaine losses. Moreover, the study tested for the presence of the well-established sign effect for monetary outcomes, which is important for interpreting the meaningfulness of either the presence or absence of a cocaine sign effect. The examination of monetary delay discounting also allowed the study to test if the drug is discounted more steeply than an equivalently valued amount of money, another well-established finding that would confirm the validity of study results.

2. Methods

2.1. Participants

Volunteers participated in one of two previous studies assessing an operant delay-discounting procedure (Johnson, 2012) or a novel task examining delay discounting of hypothetical sexual rewards (Johnson & Bruner, 2012). Participants were 89 individuals aged 18–65 from the Baltimore/Washington, D.C. area who met DSM-IV criteria for cocaine dependence as assessed by a DSM checklist (updated for DSM-IV; Hudziak et al., 1993). Twenty-seven participants (30.3%) were female. Seventy-six participants were African American, 11 were Caucasian, 1 was Asian American, and 1 identified as biracial. No participants met criteria for current dependence on drugs other than cocaine (excluding nicotine). Participants had not received psychiatric treatment in the past six months. Other demographics are listed in Table 1. Volunteers were monetarily compensated for participation.

Table 1.

Demographic and drug use characteristics of participants.

| Demographic | Mean (SD) |

|---|---|

| Age (years) | 47.8 (8.1) |

| Education (years) | 12.5 (1.6) |

| Monthly income ($) | 738 (615) |

| Quick Test intelligence score a | 39.0 (4.4) |

| Cigarettes smoked per day | 7.9 (7.9) |

| Money spent on cocaine per week ($) | 186 (165) |

max=50; adult norms: M=41.4, SD=6.0 (Ammons & Ammons, 1962)

2.2. Procedure

A phone screen was conducted to collect demographic information and exclude individuals with a reported history of psychiatric disorders. Participants who initially qualified for the study were invited to participate in an in-person screening, where they provided informed consent, provided a urine sample to test for abused drugs, completed the Quick Test (verbal intelligence; Ammons & Ammons, 1962), and provided demographic and drug use history information. If participants qualified they were invited to immediately take part in the study. Cigarette smokers were given a 10-min smoking break every two hours (between tasks) during the screening and session to minimize the effects of nicotine withdrawal on outcome measures. Tasks were not completed until at least 20 min after smoking to avoid peak nicotine plasma concentrations (Benowitz, Porchet, Sheiner, & Jacob, 1988).

During the session, participants completed four delay-discounting tasks in a randomized order. Two of the discounting tasks assessed discounting of hypothetical delayed monetary gains and losses, and the other two tasks assessed discounting of hypothetical delayed cocaine gains and losses. Discounting tasks were administered using a PC in an isolated room, with a research assistant present to coordinate the tasks. Participants also completed other tasks not relevant to the current analyses. All procedures were approved by the Johns Hopkins Medicine Institutional Review Boards.

2.2.1. Monetary discounting task

The delay-discounting task used in the present study was based on that used in previous discounting studies (Baker et al., 2003; Heil et al., 2006; Heinz, Peters, Boden, & Bonn-Miller, 2013; Johnson & Bickel, 2002; Johnson et al., 2007; Johnson et al., 2010; Yi et al., 2008). During the task, participants made a series of choices between receiving a non-adjusting larger later outcome ($100) versus an adjusting smaller immediate outcome. The magnitude of the smaller immediate option was adjusted across trials until an indifference point was determined (i.e., the point at which a participant was indifferent between the smaller immediate option and the larger later option).

The computer varied the smaller immediate option amount according to a double-limit procedure developed by Richards, Zhang, Mitchell, and de Wit (1999). The computer randomly selected an amount for the smaller immediate option, in adjustment increments of 2% of the larger later amount, from within a range set by two outer limits. These limits adjusted so that the smaller immediate option converged upon an indifference point. An important aspect of the double limit procedure is that any single erroneous response will not result in the determination of an indifference point. If the most recent response was inconsistent with previous responses, then the appropriate limits were reset. When the difference between the upper and lower limits was equal to 2% of the larger later amount, the current smaller immediate amount was recorded as the indifference point. Once an indifference point was determined, the larger later option was delayed further and the adjustment procedure was repeated. Discounting was assessed at seven delays: 1 day, 1 week, 1 month, 6 months, 1 year, 5 years, and 25 years.

Discounting was also assessed for monetary losses (Baker et al., 2003; Johnson et al., 2007). The procedure was identical to that described above for monetary gains, but participants chose between losing a smaller immediate amount of money immediately or a larger amount of money after the delay. An example of a choice trial presented in this condition was: “Lose $50 now” versus “Wait 1 month and then lose $100.”

2.2.2. Cocaine discounting task

Prior to the task, participants were asked to report the number of cocaine units (crack rocks or vials of powdered cocaine, whichever form was most often used by the participant) they could obtain for $100. The research assistant asked the participant the following question:

How many nickels of [crack rocks/vials of powder cocaine] can you buy for $100, using the price that you normally pay for [crack/powder cocaine]? By nickel [crack rocks/vials of powder cocaine], we mean the amount of [crack/powder cocaine] you can normally buy for $5 in the Baltimore area. You might or might not be able to get nickel [crack rocks/vials of powder cocaine] for less than $5 depending on such factors as whether you buy it in large amounts at a time, or if you know somebody who can sell it to you at a good discount.

The research assistant assisted the participant in determining mathematically their response to the prompt, using a calculator as needed. This number was designated as the amount of cocaine subjectively equivalent to $100 for that individual participant. The participant then completed a task that assessed the delay discounting of that amount of cocaine.

The cocaine discounting task was modeled after the present monetary discounting task, as with previous tasks assessing cigarette discounting (Baker et al., 2003; Johnson et al., 2007) and cannabis discounting (Johnson et al., 2010). The cocaine gains task was identical to the monetary gains task, except participants were asked to make several hypothetical choices between a smaller adjusting amount of cocaine delivered immediately versus the amount of cocaine determined to be equivalent to $100 delivered after a delay. The magnitude of the smaller immediate option was adjusted across trials until an indifference point was determined using the same algorithm as for monetary discounting that is described above, with the exception that the smaller sooner amounts of cocaine were adjusted in increments of “nickel” crack rocks or “nickel” vials of powder cocaine. Discounting for cocaine losses was assessed with a task identical to the cocaine gains task, with the exception that participants chose between losing a smaller immediate amount of cocaine immediately and a larger amount of cocaine after a delay. As in the monetary discounting task, the delay to the larger outcome ranged from one day to 25 years.

2.3. Data analysis

Indifference points corresponding to each of the four sign-commodity conditions were calculated as a proportion of the larger later amount and fitted by the hyperbolic decay model (Mazur, 1987) using nonlinear regression (GraphPad Prism version 6.03 for Windows, GraphPad Software, La Jolla, CA):

| (1) |

In Equation 1, the indifference point is expressed as proportion of the larger later reward, D is the delay to the larger later amount, and k is a free parameter serving as the discounting rate. In the nonlinear regression, D was coded in the unit of days (i.e., 1, 7, 30, 182.5, 365, 1825, and 9125 days). Therefore, resulting k values carried the units of days−1 (Johnson & Bickel, 2002). Distributions of rates were non-normally distributed and were log10 transformed prior to analysis, which improved normality.

Repeated-measures analysis of variance (ANOVA), using Commodity (money, cocaine) and Sign (gains, losses) as within-subject factors, compared log k values across the four conditions (PASW Statistics for Windows, Version 18.0). Each log k value takes into account all 7 delays for a specific commodity and sign (i.e., money gains, cocaine gains, money losses, or cocaine losses). Log k values, therefore, describe the general steepness of discounting across all delays for each commodity and sign condition. Therefore, the ANOVA comparing conditions did not include Delay as a repeated measure. Paired t-tests were used to investigate differences in the event of a significant interaction between the two factors. Goodness-of-fit to Equation 1 was assessed with root mean squared error (RMSE). Although R2 is often used to index goodness-of-fit in discounting studies, this method is inappropriate because R2 values have been shown both empirically and by deductive logic to be confounded with discounting rate itself (Johnson & Bickel, 2008).

3. Results

Delay discounting data appeared reasonably orderly. Mean RMSE values were 0.14 (SD = 0.08) for cocaine gains, 0.18 (SD = 0.14) for cocaine losses, 0.18 (SD = 0.09) for monetary gains, and 0.18 (SD = 0.14) for monetary losses. These RMSE values are relatively low and comparable to published data (e.g., Kirby & Santiesteban [2003] for monetary gains discounting; Jarmolowicz, Bickel, & Gatchalian [2013] for monetary and non-monetary gains discounting).

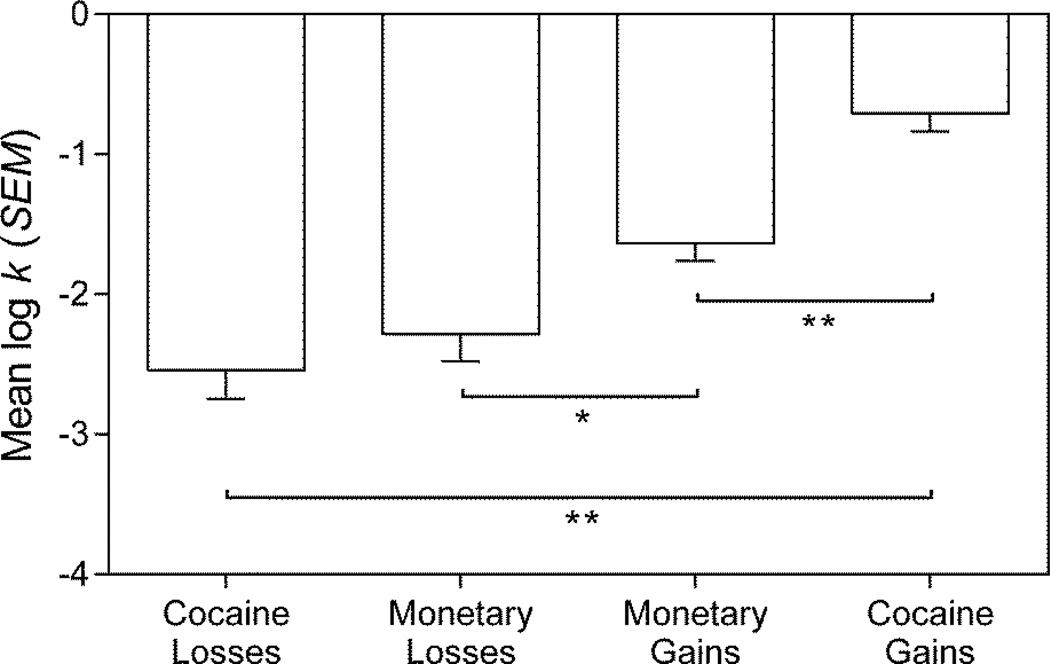

Figure 1 shows mean (SEM) log k for each of the four conditions. Lower log k values denote less discounting. Losses were discounted less than gains for both cocaine and monetary outcomes. The difference between gains and losses was larger for cocaine than for money. Between commodities, cocaine gains were discounted more than monetary gains. However, for losses, money and cocaine were discounted similarly. These effects are also reflected in the mean log k values. Mean log k for cocaine gains was −0.71 (SD = 1.22), and mean log k for cocaine losses was −2.54 (SD = 1.92). Mean log k for monetary gains was −1.63 (SD = 1.20), and mean log k for monetary losses was −2.28 (SD = 1.84).

Figure 1.

Mean (SEM) discounting rate (log k) for each of the four conditions. Lower log k values denote less discounting. Values of k carried the units of days−1. * p < .01; ** p < .0001

Statistical analysis supported the effects described above. Repeated-measures ANOVA showed a significant main effect of Sign, F(1, 88) = 45.35, p < .0001, ηp2 = .34, with lower log k values (less discounting) for losses than gains. There was also a significant main effect of Commodity, F(1, 88) = 9.97, p = .01, ηp2 = .07, with lower log k values for monetary outcomes than for cocaine outcomes. However, these main effects should be interpreted with caution because of the presence of a significant interaction between Sign and Commodity, F(1, 88) = 31.31, p < .0001, ηp2 = .18.

In exploration of the simple effects contributing to this interaction, paired t-tests showed a significant sign effect (i.e., log k for losses < log k for gains) for each commodity when analyzed individually (cocaine: t[88] = 7.87, p < .0001; money: t[88] = 2.93, p < .01). When examining each sign individually, log k values for monetary gains were significantly lower than log k values for cocaine, t(88) = 6.99, p < .0001. However, there was no significant difference between log k values for monetary and cocaine losses (p = .25). These mixed results in terms of commodity differences (or lack thereof) for each sign accounts for the significant interaction in the ANOVA.

4. Discussion

We systematically examined the sign effect (greater discounting of gains compared to losses) for cocaine and monetary outcomes among cocaine-dependent individuals. Three major conclusions were drawn from the results. First, cocaine gains were discounted more than cocaine losses. Second, monetary gains were discounted more than monetary losses. Third, cocaine was discounted more than money for gains, but similarly for losses. Each conclusion will be discussed with regard to theoretical and clinical implications.

The first finding was that cocaine gains were discounted more than cocaine losses. In other words, cocaine-dependent individuals showed a relative preference for losing a smaller amount of cocaine now rather than losing a larger amount of cocaine after a delay. In contrast, the same participants showed a relative preference for accepting a smaller amount of cocaine reward now rather than receiving a larger cocaine amount after a delay. These findings are consistent with previous reports examining the sign effect in the discounting of a drug. In particular, heavy cigarette smokers discounted delayed cigarette gains to a greater degree than cigarette losses (Baker et al., 2003) and light smokers showed the same effect (Johnson et al., 2007). These studies and the present study suggest that future losses of a drug are weighed heavily by dependent participants. Subjectively overweighting drug loss may be one behavioral mechanism dissuading the addicted individual from quitting their drug of choice, seeking treatment, or successfully remaining abstinent during or after a course of treatment.

A second finding was that monetary gains were discounted more steeply than monetary losses. This finding is consistent with studies showing the sign effect for monetary consequences in populations not selected for drug dependence and in cigarette smokers (Baker et al., 2003; Benzion et al., 1989; Cheng et al., 2012; Johnson et al., 2007; Loewenstein, 1988; Shelley, 1993; Thaler, 1981), suggesting that cocaine-dependent individuals do not differ from these other populations with respect to this behavioral process. Moreover, the observation of the sign effect for both cocaine and money in the present study suggests the sign effect is a general pattern in this population, and not an effect isolated to one type of commodity. These results suggest that delayed aversive outcomes may generally have greater impact than delayed rewards in shaping present behavior in cocaine-dependent individuals. A sign effect for money in a cocaine-dependent sample differs, however, with findings of a recent study in heroin-dependent individuals (Cheng et al., 2012). One possibility is that heroin-dependent individuals differ along this dimension from other marginalized groups of drug users such as cocaine-dependent individuals. Although the heroin study was conducted in China and the present study was conducted in the United States, cultural or currency differences do not likely account for these divergent findings because Cheng et al. did show a sign effect for money in cigarette smokers (a comparison group).

Finally, we observed that cocaine was discounted more than money for gains, but not for losses. Cocaine and money losses were discounted similarly. The difference between commodities for gains is consistent with several studies reporting drugs to be discounted more than money (Baker et al., 2003; Bickel, Odum, & Madden, 1999; Coffey et al., 2003; Estle, Green, Myerson, & Holt, 2007; Johnson et al., 2007; Johnson et al., 2010; Madden, Petry, Badger, & Bickel, 1997; Odum & Baumann, 2007; Odum & Rainaud, 2003; Petry, 2001). However, studies have demonstrated that this pattern is not a special property of drugs, but is rather a difference between money and consumable rewards (Estle et al., 2007; Odum & Baumann, 2007; Odum, Baumann, & Rimington, 2006; Odum & Rainaud, 2003). Regardless, observing this frequently reported effect validates other findings from the study. On the other hand, the finding that money was discounted at a similar rate compared to cocaine for losses differs from the few previous studies comparing drug gains and losses. That is, both heavy and light smokers were shown to discount cigarette losses more than monetary losses (Baker et al., 2003; Johnson et al., 2007). If future research confirms the present results comparing losses between cocaine and money, then this finding may represent a difference in decision making between cigarette smokers and cocaine-dependent populations.

One limitation of the study is that hypothetical outcomes were utilized. However, several studies have shown similar results with real and hypothetical delay discounting rewards (Baker et al., 2003; Bickel, Pitcock, Yi, & Angtuaco, 2009; Johnson & Bickel 2002; Johnson et al., 2007; Lawyer, Schoepflin, Green, & Jenks, 2011; Madden, Begotka, Raiff, & Kastern, 2003; Madden et al., 2004; c.f., Hinvest & Anderson, 2010; Paloyelis, Asherson, Mehta, Faraone, & Kuntsi, 2010). However, the possibility remains that the validity of hypothetical outcomes does not extend to the discounting of drug outcomes or monetary losses. Another limitation of the present study is that the sign effect was only examined for a single magnitude ($100 or its cocaine equivalent). Results could differ at other magnitudes.

In conclusion, the present study observed that the sign effect, a commonly reported finding in delay discounting research, extends to cocaine-dependent individuals, both in terms of their discounting of delayed cocaine and monetary outcomes. The results suggest that delayed aversive outcomes may generally have greater impact than delayed rewards in shaping present behavior in cocaine-dependent individuals. Relative preference between drug and monetary gains and losses should be taken into account when considering choices made by cocaine-dependent individuals, particularly in the context of decisions to seek treatment and achieve and maintain abstinence from cocaine.

References

- Ammons RB, Ammons CH. The Quick Test (QT): Provisional manual. Psychological Reports. 1962;11:111–161. [Google Scholar]

- Anderson KG, Woolverton WL. Effects of dose and infusion delay on cocaine self-administration choice in rhesus monkeys. Psychopharmacology (Berl) 2003;167:424–430. doi: 10.1007/s00213-003-1435-9. [DOI] [PubMed] [Google Scholar]

- Baker F, Johnson MW, Bickel WK. Delay discounting in current and never-before cigarette smokers: similarities and differences across commodity, sign, and magnitude. Journal of Abnormal Psychology. 2003;112:382–392. doi: 10.1037/0021-843x.112.3.382. [DOI] [PubMed] [Google Scholar]

- Benowitz NL, Porchet H, Sheiner L, Jacob P., 3rd Nicotine absorption and cardiovascular effects with smokeless tobacco use: comparison with cigarettes and nicotine gum. Clinical Pharmacology and Therapeutics. 1988;44:23–28. doi: 10.1038/clpt.1988.107. [DOI] [PubMed] [Google Scholar]

- Benzion U, Rapoport A, Yagil J. Discount rates inferred from decisions: An experimental study. Management Science. 1989;35:270–284. [Google Scholar]

- Bickel WK, Johnson MW. Delay discounting: A fundamental behavioral process of drug dependence. In: Loewenstein G, Read D, Baumeister RF, editors. Time and Decision. New York, NY: Russell Sage Foundation; 2003. pp. 419–440. [Google Scholar]

- Bickel WK, Landes RD, Christensen DR, Jackson L, Jones BA, Kurth-Nelson Z, Redish AD. Single- and cross-commodity discounting among cocaine addicts: the commodity and its temporal location determine discounting rate. Psychopharmacology (Berl) 2011;217:177–187. doi: 10.1007/s00213-011-2272-x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Bickel WK, Odum AL, Madden GJ. Impulsivity and cigarette smoking: delay discounting in current, never, and ex-smokers. Psychopharmacology (Berl) 1999;146:447–454. doi: 10.1007/pl00005490. [DOI] [PubMed] [Google Scholar]

- Bickel WK, Pitcock JA, Yi R, Angtuaco EJC. Congruence of BOLD response across intertemporal choice conditions: fictive and real money gains and losses. Journal of Neuroscience. 2009;29:8839–8846. doi: 10.1523/JNEUROSCI.5319-08.2009. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Chapman GB. Temporal discounting and utility for health and money. Journal of Experimental Psychology: Learning, Memory, and Cognition. 1996;22:771–791. doi: 10.1037//0278-7393.22.3.771. [DOI] [PubMed] [Google Scholar]

- Cheng J, Lu Y, Han X, Gonzalez-Vallejo C, Sui N. Temporal discounting in heroin-dependent patients: no sign effect, weaker magnitude effect, and the relationship with inhibitory control. Experimental and Clinical Psychopharmacology. 2012;20:400–409. doi: 10.1037/a0029657. [DOI] [PubMed] [Google Scholar]

- Coffey SF, Gudleski GD, Saladin ME, Brady KT. Impulsivity and rapid discounting of delayed hypothetical rewards in cocaine-dependent individuals. Experimental and Clinical Psychopharmacology. 2003;11:18–25. doi: 10.1037//1064-1297.11.1.18. [DOI] [PubMed] [Google Scholar]

- Estle SJ, Green L, Myerson J, Holt DD. Discounting of monetary and directly consumable rewards. Psychological Science. 2007;18:58–63. doi: 10.1111/j.1467-9280.2007.01849.x. [DOI] [PubMed] [Google Scholar]

- Heil SH, Johnson MW, Higgins ST, Bickel WK. Delay discounting in currently using and currently abstinent cocaine-dependent outpatients and non-drug-using matched controls. Addictive Behaviors. 2006;31:1290–1294. doi: 10.1016/j.addbeh.2005.09.005. [DOI] [PubMed] [Google Scholar]

- Heinz AJ, Peters EN, Boden MT, Bonn-Miller MO. A comprehensive examination of delay discounting in a clinical sample of Cannabis-dependent military veterans making a self-guided quit attempt. Experimental and Clinical Psychopharmacology. 2013;21:55–65. doi: 10.1037/a0031192. [DOI] [PubMed] [Google Scholar]

- Hinvest NS, Anderson IM. The effects of real versus hypothetical reward on delay and probability discounting. The Quarterly Journal of Experimental Psychology. 2010;63:1072–1084. doi: 10.1080/17470210903276350. [DOI] [PubMed] [Google Scholar]

- Hudziak JJ, Helzer JE, Wetzel MW, Kessel KB, Janca A, Przybeck T. The use of the DSM-III-R Checklist for initial diagnostic assessments. Comprehensive Psychiatry. 1993;34:375–383. doi: 10.1016/0010-440x(93)90061-8. [DOI] [PubMed] [Google Scholar]

- Jarmolowicz DP, Bickel WK, Gatchalian KM. Alcohol-dependent individuals discount sex at higher rates than controls. Drug and Alcohol Dependence. 2013;131:320–323. doi: 10.1016/j.drugalcdep.2012.12.014. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Johnson MW. An efficient operant choice procedure for assessing delay discounting in humans: initial validation in cocaine-dependent and control individuals. Experimental and Clinical Psychopharmacology. 2012;20:191–204. doi: 10.1037/a0027088. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Johnson MW, Bickel WK. Within-subject comparison of real and hypothetical money rewards in delay discounting. Journal of the Experimental Analysis of Behavior. 2002;77:129–146. doi: 10.1901/jeab.2002.77-129. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Johnson MW, Bickel WK. An algorithm for identifying nonsystematic delay-discounting data. Experimental and Clinical Psychopharmacology. 2008;16:264–274. doi: 10.1037/1064-1297.16.3.264. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Johnson MW, Bickel WK, Baker F. Moderate drug use and delay discounting: a comparison of heavy, light, and never smokers. Experimental and Clinical Psychopharmacology. 2007;15:187–194. doi: 10.1037/1064-1297.15.2.187. [DOI] [PubMed] [Google Scholar]

- Johnson MW, Bickel WK, Baker F, Moore BA, Badger GJ, Budney AJ. Delay discounting in current and former marijuana-dependent individuals. Experimental and Clinical Psychopharmacology. 2010;18:99–107. doi: 10.1037/a0018333. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Johnson MW, Bruner NR. The Sexual Discounting Task: HIV risk behavior and the discounting of delayed sexual rewards in cocaine dependence. Drug and Alcohol Dependence. 2012;123:15–21. doi: 10.1016/j.drugalcdep.2011.09.032. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Kirby KN, Petry NM. Heroin and cocaine abusers have higher discount rates for delayed rewards than alcoholics or non-drug-using controls. Addiction. 2004;99:461–471. doi: 10.1111/j.1360-0443.2003.00669.x. [DOI] [PubMed] [Google Scholar]

- Kirby KN, Santiesteban M. Concave utility, transaction costs, and risk in measuring discounting of delayed rewards. Journal of Experimental Psychology: Learning, Memory, and Cognition. 2003;29:66–79. [PubMed] [Google Scholar]

- Lawyer SR, Schoepflin F, Green R, Jenks C. Discounting of hypothetical and potentially real outcomes in nicotine-dependent and nondependent samples. Experimental and Clinical Psychopharmacology. 2011;19:263–274. doi: 10.1037/a0024141. [DOI] [PubMed] [Google Scholar]

- Loewenstein GF. Frames of mind in intertemporal choice. Management Science. 1988;34:200–214. [Google Scholar]

- MacKeigan LD, Larson LN, Draugalis JR, Bootman JL, Burns LR. Time preference for health gains versus health losses. Pharmacoeconomics. 1993;3:374–386. doi: 10.2165/00019053-199303050-00005. [DOI] [PubMed] [Google Scholar]

- MacKillop J, Amlung MT, Few LR, Ray LA, Sweet LH, Munafo MR. Delayed reward discounting and addictive behavior: a meta-analysis. Psychopharmacology (Berl) 2011;216:305–321. doi: 10.1007/s00213-011-2229-0. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Madden GJ, Begotka AM, Raiff BR, Kastern LL. Delay discounting of real and hypothetical rewards. Experimental and Clinical Psychopharmacology. 2003;11:139–145. doi: 10.1037/1064-1297.11.2.139. [DOI] [PubMed] [Google Scholar]

- Madden GJ, Petry NM, Badger GJ, Bickel WK. Impulsive and self-control choices in opioid-dependent patients and non-drug-using control participants: drug and monetary rewards. Experimental and Clinical Psychopharmacology. 1997;5:256–262. doi: 10.1037//1064-1297.5.3.256. [DOI] [PubMed] [Google Scholar]

- Madden GJ, Raiff BR, Lagorio CH, Begotka AM, Mueller AM, Hehli DJ, Wegener AA. Delay discounting of potentially real and hypothetical rewards: II. Between- and within-subject comparisons. Experimental and Clinical Psychopharmacology. 2004;12:251–261. doi: 10.1037/1064-1297.12.4.251. [DOI] [PubMed] [Google Scholar]

- Mazur JE. An adjusting procedure for studying delayed reinforcement. In: Commons ML, Mazur JE, Nevin JH, Rachlin H, editors. Quantitative analyses of behavior: Vol. 5. The effect of delay and of intervening events on reinforcement value. New Jersey: Erlbaum; 1987. pp. 55–73. [Google Scholar]

- Odum AL, Baumann AAL. Cigarette smokers show steeper discounting of both food and cigarettes than money. Drug and Alcohol Dependence. 2007;91:293–296. doi: 10.1016/j.drugalcdep.2007.07.004. [DOI] [PubMed] [Google Scholar]

- Odum AL, Baumann AAL, Rimington DD. Discounting of delayed hypothetical money and food: effects of amount. Behavioural Processes. 2006;73:278–284. doi: 10.1016/j.beproc.2006.06.008. [DOI] [PubMed] [Google Scholar]

- Odum AL, Rainaud CP. Discounting of delayed hypothetical money, alcohol, and food. Behavioural Processes. 2003;64:305–313. doi: 10.1016/s0376-6357(03)00145-1. [DOI] [PubMed] [Google Scholar]

- Paloyelis Y, Asherson P, Mehta MA, Faraone SV, Kuntsi J. DAT1 and COMT effects on delay discounting and trait impulsivity in male adolescents with attention deficit/hyperactivity disorder and healthy controls. Neuropsychopharmacology. 2010;35:2414–2426. doi: 10.1038/npp.2010.124. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Petry NM. Delay discounting of money and alcohol in actively using alcoholics, currently abstinent alcoholics, and controls. Psychopharmacology (Berl) 2001;154:243–250. doi: 10.1007/s002130000638. [DOI] [PubMed] [Google Scholar]

- Richards JB, Zhang L, Mitchell SH, de Wit H. Delay or probability discounting in a model of impulsive behavior: effect of alcohol. Journal of the Experimental Analysis of Behavior. 1999;71:121–143. doi: 10.1901/jeab.1999.71-121. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Shelley MK. Outcome signs, question frames, and discount rates. Management Science. 1993;39:805–815. [Google Scholar]

- Thaler R. Some empirical evidence on dynamic inconsistency. Economics Letters. 1981;8:201–207. [Google Scholar]

- Woolverton WL, Myerson J, Green L. Delay discounting of cocaine by rhesus monkeys. Experimental and Clinical Psychopharmacology. 2007;15:238–244. doi: 10.1037/1064-1297.15.3.238. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Yi R, Johnson MW, Giordano LA, Landes RD, Badger GJ, Bickel WK. The effects of reduced cigarette smoking on discounting future rewards: an initial evaluation. Psychological Record. 2008;58:163–174. doi: 10.1007/bf03395609. [DOI] [PMC free article] [PubMed] [Google Scholar]