Abstract

We investigated the impact of the 2006 Massachusetts health care reform on insurance coverage and stability among minority and underserved women. We examined 36 months of insurance claims among 1,946 women who had abnormal cancer screening at six Community Health Centers pre-(2004–2005) and post-(2007–2008) insurance reform. We examined frequency of switches in insurance coverage as measures of longitudinal insurance instability. On the date of their abnormal cancer screening test, 36% of subjects were publicly insured and 31% were uninsured. Post-reform, the percent ever uninsured declined from 39% to 29% (p.001) and those consistently uninsured declined from 23% to 16%. To assess if insurance instability changed between the pre- and post-reform periods, we conducted Poisson regression models, adjusted for patient demographics and length of time in care. These revealed no significant differences from the pre- to post-reform period in annual rates of insurance switches, incident rate ratio 0.98 (95%-CI 0.88–1.09). Our analysis is limited by changes in the populations in the pre and post reform period and inability to capture care outside of the health system network. Insurance reform increased stability as measured by decreasing uninsured rates without increasing insurance switches.

Keywords: Health Reform, Insurance Coverage, Safety-Net Systems, Minority Health

There is consistent evidence that lacking health insurance is associated with decreased access to care, delays in receiving care, and subsequent negative health outcomes1–3. In many cases, lack of health insurance is a result of the fluid nature of insurance coverage. Throughout the course of a year insurance may be gained or lost due to changes in employment, eligibility status, financial status, or other reasons. We refer to these fluctuations in insurance coverage as insurance instability4,5. This phenomenon is documented among children6,7 demonstrating the insurance instability reduces use of preventive care8 and continuity of care for chronic medical conditions. The frequency and impact of insurance instability in adult populations is less well described but has the same potential negative impact.

The Patient Protection and Affordable Care Act9 aims to decrease the proportion of the population who are uninsured. These aims are to be achieved through Medicaid expansion, insurance market reforms, and the creation of subsidized insurance and health insurance exchanges. With expanded coverage options and more inclusive eligibility requirements, the expectation is that insurance coverage will not only increase but will become more stable. However, these positive effects may be undermined if an increase in the number of insurance options provides extra opportunity for insurance switching and thus instability5. A recent study estimated potentially large proportions of the adult population would experience switches in eligibility for Medicaid and non-Medicaid subsidized insurance (i.e., from an insurance exchange) within six months6,10, and anecdotes led to concern about increases in number of switches, or churning11, which might disrupt continuity of care. One way to understand how health reform may impact insurance instability nationally is to examine the impact of similar insurance policy changes in the Commonwealth of Massachusetts.

In 2006 Massachusetts implemented a broad health care reform measure. The reform included four main components: Medicaid expansion, introduction of a subsidized program for low income individuals called Commonwealth Care, an employer mandate, and an individual mandate. The law also required guaranteed issue, that is, insurers could not deny an applicant coverage on the basis of their health status (pre existing conditions) or other factors (age, gender, etc). Medicaid expansion was characterized by increasing the enrollment cap and expanding eligibility to long term unemployed individuals12. In October 2006, the Commonwealth Care Health Insurance Program was introduced as a subsidized plan intended to help low-income individuals up to 300% of the Federal Poverty Level (FPL). The employer mandate required employers with 11 or more employees to provide health insurance or a “fair share” contribution. The individual mandate required that individuals have insurance coverage by the end of 2007 with a penalty levied on state income tax returns for non-compliance13,14.

Utilizing an existing study of patients cared for within safety-net institutions before and after the Massachusetts health care reform, this study examines the impact of insurance reform on insurance instability within minority and low income populations. The main aims of the study were to 1) describe the frequency and types of insurance switches and rates of being uninsured among a vulnerable population seeking care within a safety-net setting and 2) to evaluate whether insurance instability decreased or increased after insurance reform.

Methods

Subjects and eligibility

This was a secondary analysis of the control arm of the Boston Patient Navigation Research Program (PNRP)15–17. This dataset was selected in order to examine an underserved population, representative of patients whose insurance coverage is likely impacted by insurance reform policy changes. The dataset included all women over 18 years of age with a breast or cervical cancer screening abnormality at one of six Community Health Centers within the greater Boston area, five of which are federally-qualified health centers. In the pre-reform period (2004–2005), the dataset included a randomly selected group of up to 100 women with screening abnormalities per health center; 434 were selected from a total of 878 subjects. The data set included all women with screening abnormalities during the post reform period (2007–2008). That data set did not include any subjects with abnormalities during the 2006 transition period of implementation of reform.

Variable Definitions

Demographic covariates were validated18 and collected from clinical registration data and included race/ethnicity (White, African American, Hispanic, or other), primary spoken language (English or non-English), age (categorized by decades), and marital status. We also collected information on major health comorbidities using the Deyo system19 of classification of the Charlson Comorbidity Index20. The breast screening abnormalities included any screening imaging (mammography, ultrasound, magnetic resonance imaging) result with a Breast Imaging Reporting and Data System (BIRADS) designation of 0, 3, 4, or 5; or a suspicious lesion on clinical breast examination. Cervical screening abnormalities were based on Pap test reporting of atypical squamous cells of undetermined significance positive for human papillomavirus (ASCUS/HPV+), atypical glandular cells (AGC), low-grade or high-grade squamous intraepithelial lesion (LGSIL and HGSIL, respectively), and in situ carcinoma.

Data collection

All insurance data was manually abstracted from Community Health Center billing databases. This allowed us to identify insurance coverage based on who actually paid for the visit rather than patient reports or electronic medical records. For each subject we collected data within a three year window, 18 months before abnormal screening through 18 months after abnormal screening. During this timeframe we calculated for each subject the number of days in care, defined as the time between their first visit and last visit, between which we assumed continuous care. We collected data on the number of clinical visits during the days in care, and insurance coverage on specific dates, including the first visit, the date of the screening abnormalities (index event), the date of diagnostic resolution of the screening abnormality, and the last visit. When changes in insurance coverage were noted, we recorded the visit indicating the new insurance and the visit directly preceding. Visits for dental, mental health, vaccinations, substance abuse, and pharmacy care were excluded due to differing availability of these services across health centers, and use of secondary or alternate insurance coverage for these visits which did not constitute a switch in primary medical coverage. When subjects visited more than one health care department or provider on the same day and insurance coverage was different between the departments, we used coverage for primary care, urgent care or obstetric/gynecologic care over other subspecialty coverage. We did not differentiate between managed and non-managed care plans, or fee for service and capitation components. We were able to differentiate between managed care plans for Medicare, Medicaid and private insurance. When Title × funds for family planning were utilized, we did not consider this a change from prior insurance or lack of insurance.

Outcome variables

Our primary goal was to determine whether insurance instability increased after health insurance reform. We measured insurance status in several ways:

(1) Insurance status: Insurance coverage at the time of screening abnormality was analyzed as a categorical variable with mutually exclusive categories; private, public, uninsured. In the presence of dual or multiple insurance coverage, we assigned the principal insurance based on the following hierarchy of likely comprehensiveness of coverage: private insurance, Medicare, Medicaid, Commonwealth Care, and uninsured.

(2) Insurance history: To characterize subjects both by the extent of insurance stability and the comprehensiveness of coverage, we categorized the sample into the following five insurance history categories: 1) always privately insured, 2) always publicly insured, (including Medicaid and Commonwealth Care) 3) those with insurance switches but never becoming uninsured, 4) those with insurance switches including uninsured, and 5) always uninsured.

(3) Insurance switches: We defined an insurance switch as any change between any of the five principal insurance groups from one visit to the next: private insurance, Medicare, Medicaid, Commonwealth Care, and uninsured. We report both frequency and type of insurance switches observed and further rank the type of switch on a continuum of comprehensiveness of coverage from least to most favorable. We define unfavorable insurance switches as any switch from an insured to uninsured state.

Analysis

Breast and cervical subjects were pooled for analyses. For the first aim, to describe the type and frequency of insurance switches, we compared unadjusted proportions of insurance status and insurance history pre- and post-reform. We provided unadjusted rates of switches between each category of insurance, and unadjusted rates of our five combined categories for pre- and post-reform periods. For the second aim, in order to examine for differences in the rates of insurance switches in both the pre- and post-reform periods, adjusted for patient-level differences in the time period of care in the data, we specified a Poisson regression model with the number of insurance switches as the outcome measure. We estimated annual rate of switches, adjusted for patient age (as a continuous variable), race/ ethnicity (collapsing Asian and other due to small sample size), primary language (dichotomized as English or other), type of screening abnormality (breast or cervical), Community Health Center, and number of months observed in care. We did not adjust for marital status or for comorbidities due to the limited variability in our dataset. We anticipated that the number of switches post-reform may be higher, as the Massachusetts health reform intended to provide coverage to those without insurance and introduced a new subsidized health care option (Commonwealth Care), not previously available. To account for this additional option in calculating the switch rate, we performed sensitivity analyses where the number of switches was modified in two ways. In the first modification, we did not count switches between uninsured and Commonwealth Care as this option was not available in the pre-reform period. In the second version, we excluded the first post-reform insurance switch from an uninsured state to private insurance, Medicaid, or Commonwealth Care, as this initial switch represented the intended action of the insurance reform (i.e., to insure previously uninsured individuals); however, subsequent switches in insurance were included in the analyses.

Results

Of the initial 1,992 subjects from the control arm of the Patient Navigation Research Program, 46 (2.3%) were excluded due to restricted billing records or less than one month of care at the health center. Of the 1,946 women included in the analytic sample, 434 were from the pre-reform period (2004–2005) which included a random subset of all screening abnormalities and 1,512 were from the post-reform period (2007–2009) where all screening abnormalities were included. Table 1 presents subject characteristics by time period pre- and post-reform. The mean age of women with abnormal breast and cervical cancer screening was 52 years (± 11 years) and 28 years (± 9 years), respectively, consistent with recommendation for screening by age. The population was racially and ethnically diverse; 35% of women were white, 32% were black and 28% were Hispanic, 66% spoke English as their primary language, and 18% Spanish speaking. There were significant changes over time in race/ethnicity and primary language between the pre- and post-reform time periods; the proportion of white women increased from 32% to 36% and Hispanic women increased from 26% to 29%, while the proportion of Black women fell from 35% to 31% (P<.001). The overall rate of women without insurance in the sample dropped from 39% in the pre-reform period to 29% post-reform. At the time of abnormal breast cancer screening exam in the pre-reform period, 42% of subjects were uninsured, compared with 35% uninsured in the post-reform period (p = .009). Among women with cervical cancer screening abnormalities, the proportion uninsured (36 %) was reduced by half (18%) from the pre-reform to post-reform periods (p < .001). The populations we observed demonstrated stability in their use of the health centers. The mean number of months in care over a 36 month observation period was 24 months (standard deviation SD = 9.4) in the pre period and 25 months (SD 9.4) in the post period. This long term use of care at the health center allowed us to observe changes over time in insurance coverage. Subjects had few comorbidities; 74% had no comorbidities, and 19% had only 1 comorbidity on the Charlson index.

Table 1.

Population Characteristics of Women with Cancer Screening Abnormalities, Before and After Massachusetts Health Insurance Reform

| Pre Reform (n=434) | Post Reform (n=1512) | All Subjects (n=1946) | |

|---|---|---|---|

| N (%) | N (%) | N (%) | |

| Age*** | |||

| 18 – 25 | 127 (29) | 243 (16) | 370 (19) |

| 26 – 35 | 71 (16) | 209 (14) | 280 (14) |

| 36 – 45 | 78 (18) | 402 (27) | 480 (25) |

| 46 – 55 | 76 (18) | 334 (22) | 410 (21) |

| 56 + | 82 (19) | 324 (21) | 406 (21) |

| Race*** | |||

| White | 139 (32) | 551 (36) | 690 (35) |

| Black | 154 (35) | 462 (31) | 616 (32) |

| Hispanic | 111 (26) | 441 (29) | 552 (28) |

| Asian | 1 (<1) | 57 (4) | 58 (3) |

| Other | 29 (7) | 1 (<1) | 30 (2) |

| Primary Language*** | |||

| English | 291 (67) | 999 (66) | 1290 (66) |

| Spanish | 56 (13) | 294 (19) | 350 (18) |

| Vietnamese | 0 (0) | 28 (2) | 28 (1) |

| Albanian | 1 (<1) | 21 (1) | 22 (1) |

| Portuguese | 0 (0) | 21 (10) | 21 (1) |

| Other | 86(20) | 149 (2) | 235(12) |

| Health Insurance at the time of Abnormal Screening Exam*** | |||

| Private | 136 (31) | 517 (34) | 643 (33) |

| Public | 129 (30) | 574 (38) | 703 (36) |

| Uninsured | 169 (39) | 431 (29) | 600 (31) |

| Marital Status** | |||

| Married | 96 (22) | 441 (29) | 537 (28) |

| Number of Months in Care | |||

| Mean (SD) | 24 (9.4) | 25 (9.4) | 25 (9.5) |

| Median (25th,75thquartile) | 26 (17,32) | 28 (18,33) | 28 (18,33) |

| Number of Unique Days in Care | |||

| Mean (SD) | 17 (12) | 17 (12) | 17 (12) |

| Median(25th,75thquantile) | 15 (9,24) | 14 (9,22) | 14 (9,22) |

Chi square for differences

P < 0.05

P < 0.01

P < 0.001

Comparisons between the pre reform and post reform period for each variable

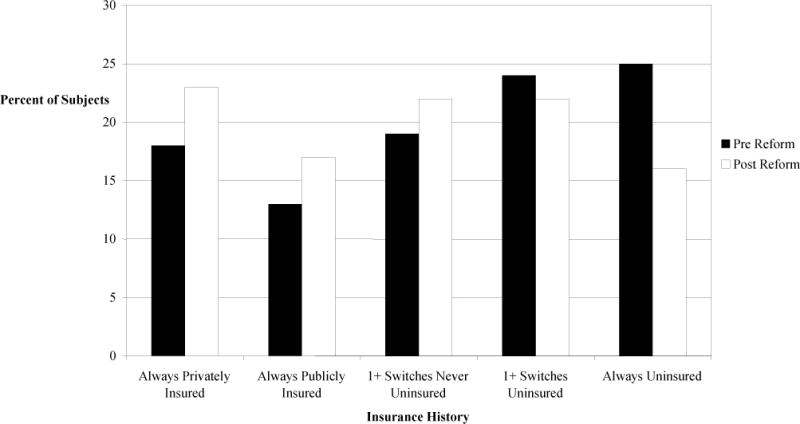

Our first aim was to describe the frequency and types of insurance switches before and after insurance reform. Figure 1 reports the unadjusted insurance histories over 36 months among the study groups before and after Massachusetts health care reform. In the pre-reform period 25% of women were consistently uninsured and an additional 24% were uninsured for at least part of the observation period. In the post-reform period, the percent of women consistently or at some point uninsured was reduced to 16% and 22%, respectively. The proportion of women consistently privately insured increased from 18% to 23% and the proportion with consistent public insurance increased from 13% to 17% from pre- to post-reform.

Figure 1.

Insurance History over 36 Months Among Two Groups of Women with Cancer Screening Abnormalities Before and After Massachusetts Health Insurance Reform

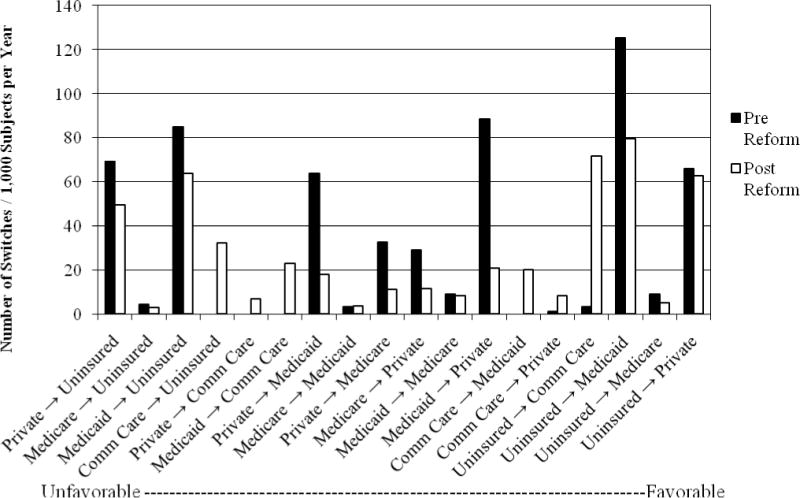

Figure 2 presents the frequency of switches in insurance coverage by insurance category pre- and post-reform, presented as rates per 1,000 subjects per year (full data in Appendix 1). Switches are presented on a continuum of comprehensiveness of coverage from least to most favorable. Overall, the most common patterns of switching in both the pre- and post-reform periods are switches to and from uninsured and Medicaid and back again, with switches between Medicaid and private insurance also common. The frequency of switches from Medicaid to private insurance seen in the pre-reform period was no longer as prevalent in the post-reform period. In the post-reform period, switches from an uninsured state to Commonwealth Care are common while switches from Commonwealth Care to uninsured are less common.

Figure 2. Frequency Of Switches in Insurance Coverage Among Two Groups of Women with Cancer Screening Abnormalities.

The frequency of switches in insurance coverage by insurance category pre and post Massachusetts health Insurance Reform presented as rates per 1,000 subjects per year.

Table 2 presents the analysis for the second aim of whether there are differences in rates of insurance switches between the pre and the post period. This table presents the comparison of adjusted rates of health insurance switches before and after health insurance reform in our groups. In the unadjusted analysis, the average annual rate of insurance switches pre-reform was 608 per 1000 (95% CI: 507–709), compared with 479 (95% CI: 440 – 518) after insurance reform. In the adjusted model, controlled for age, race/ethnicity, primary language, duration of time in care, and Community Health Center, there was no significant difference in the number of switches between the pre- and post-reform periods (adjusted incident rate ratio (aIRR) 0.98, 95% CI: 0.88 – 1.09). To account for additional opportunities for switches after insurance reform we performed two sensitivity analyses. In sensitivity analysis A, when switches between Commonwealth Care and uninsured are not included, there were significantly fewer switches in insurance in the post-reform period (aIRR 0.81, 95% CI: 0.72 – 0.90). In sensitivity analysis B, where the initial switch from uninsured to private insurance, Medicaid, or Commonwealth Care is excluded from the analysis, we showed no significant difference in the number of switches between the pre- and post-reform periods (aIRR 0.92, 95% CI: 0.83–1.02). In the model where we compared the adjusted number of insurance switches to an uninsured state, there was no difference pre- and post-reform (aIRR 1.12, 95% CI: 0.92 – 1.38).

Table 2.

| Model 1. Number of Insurance Switches: Incident Rate Ratios Comparing Post to Pre Reform Period | |

|---|---|

| aIRR* (95% CI) | |

| Base Model | 0.98 (.88 – 1.09) |

| Sensitivity A*: Excluding switches between Commonwealth Care and Uninsured | 0.81 (.72 – .90)** |

| Sensitivity B*: excluding first switch from Uninsured to Private, Medicaid, or Commonwealth Care | 0.92 (.83 – 1.02) |

| Model 2. Unfavorable Switches: Incident Rate Ratios Comparing Post to Pre Reform Period | |

| Adjusted* including only switches from Insured to Uninsured state | 1.12 (.92 – 1.38) |

aIRR – adjusted Incident Rate Ratios – adjustment for age (continuous variable), race/ethnicity, primary language, the number of months in care, Community Health Center.

Indicates significant difference p < 0.05

Discussion

Insurance coverage in Massachusetts after the 2006 health reform was characterized by a decrease in the percent of women uninsured and an increase in the percent of women consistently privately and publicly insured. Studying a cohort of women obtaining care in community health centers, a cohort most likely to be uninsured or underinsured, we identified no significant difference in insurance instability between the pre- and post-reform periods. Our findings suggest that the insurance reform had its intended effect of increasing the proportion of women with consistent health insurance and did not demonstrate that insurance coverage became more unstable, as defined by switches between different categories of insurance coverage. Of interest, our data shows very little transition from private insurers to the subsidized plans, indicating that employers did not drop their employee coverage21.

This study has the advantage of a dataset that captures longitudinal patient insurance histories based on billing claims among a diverse group of women seen at six community health centers, a group with high rates of public insurance and lack of insurance and for whom insurance reform was designed to benefit. This cohort was engaged in care and represents those actively receiving care for similar health conditions (namely abnormal cancer screening) over three years of visits to their community health center. This is in contrast to previous studies that rely upon cross sectional data or self-report of coverage and care8,21. By building the three year observation window around an episode of care requiring follow-up we optimized our ability to capture visits to the Community Health Center and their associated insurance coverage. Use of the Community Health Centers for care was longitudinally stable, with a mean of 25 months of utilization over the 36 months of observation and similar across the two time periods, despite an average of one switch in insurance every 2 years. Another advantage to our dataset is the population diversity, with nearly two-thirds of our population from racial and ethnic minority groups and one-third whose primary language was other than English.

The impact of instability of insurance coverage has been previously documented in the pediatric literature, showing a negative impact of insurance gaps on utilization of preventive services and access to care22,23, in conditions such as asthma7, and found that gaps in childhood coverage correlated with parental insurance gaps24. A 2008 systematic review only identified 14 studies examining the impact of gaining and losing health insurance in adults. Half of these studies addressed utilization, identifying increased use of preventive and primary care with the gain of insurance8. Seven studies examined health outcomes, all finding that continuously insured patients reported better physical functioning and overall health, or decreased mortality in the setting of an acute illness25–31. Other research has demonstrated that gaps in insurance coverage are linked to a lack of continuity in prescription refills32.

Statewide estimates indicate that after insurance reform in 2011 only 1.9% of the Massachusetts population was uninsured33. This is in contrast to our study population which found 29% of women with abnormal cancer screenings remained uninsured. This rate is significantly reduced from the pre-reform rate of 43%; however it demonstrates the ongoing role that safety-net institutions play in providing care to the proportion that remained uninsured. We do not have information on immigration status to know what proportion of the uninsured are unable to be covered with current insurance reform policies. Our study supports previous findings that indicate a positive impact of the Massachusetts health care reform on increasing rates of the population who become and remain insured. Studies of self-report surveys by Long demonstrated a significant increase in the percentage of residents insured at a given point in time and a significant decrease in the percentage ever uninsured comparing 2007 to 2006 data21. Using a difference in differences approach, other researchers found increased rates of insurance coverage over time in Massachusetts that were not seen in other states, indicating that secular trends do not account for this increase34. Our findings also show demographic shifts in the populations with abnormal screening by race and ethnicity of patients at the health centers, although we cannot determine if this is due to new enrollees, or patients with coverage moving their care.

There are several limitations to our study. A limitation of this study is the inability to identify the length of gaps in coverage. Our data are limited to visits to the health care center and as such we are unable to assess gaps or changes in coverage that occur between visits. Receiving health insurance coverage increases health care utilization35. It may be that our dataset underestimates episodes without insurance coverage because patients are less likely to access care when they are uninsured. However, this limitation is present in both the pre- and post-reform groups, which reduces the potential for bias in our comparisons. The Health Centers were able to accept all Medicaid managed care and most Commonwealth managed care plans during the time of study, and the average time in care for both the pre and post group remained similar, making differential loss of patients due to insurance loss between the two time periods less likely. Our dataset may also underestimate the extent of insurance instability in several ways. We do not report changes within private insurers or across Medicaid plans. This may underestimate the amount of instability, although we expect more disruptions in continuity of care are accounted for by switches across the large categories of insurance. We have documented insurance changes among a patient population that maintained stability in primary care even during lack of insurance coverage; this may not generalize to those without established primary care. At least one previous study found that diabetic patients seen at Federally Qualified Health Centers were less likely to receive comprehensive diabetic preventive care services when they had discontinuous insurance coverage than those with continuous coverage36, suggesting that stable primary care alone may not mitigate the gaps in care during gaps in insurance coverage. Our dataset is also limited by the inability to observe care outside of the health system network. The populations observed in the pre and post period differ, and while our models adjust for the demographic differences, they may differ in other unmeasured ways, especially in income volatility.

This study has several important implications as we embark on insurance reform nationwide. Massachusetts Health Insurance Reform effectively provided insurance coverage to a large percentage of the uninsured population who seek care within Community Health Centers. In vulnerable populations, defined by living in urban areas seeking care at Community Health Centers, switches in insurance coverage are common, and switches from coverage to becoming uninsured are common. Insurance reform reduced the prevalence of being or becoming uninsured without evidence of an increase in the instability of insurance. These data provide important findings regarding the impact of insurance reform to increase insurance coverage without increasing the likelihood of insurance switches or instability in insurance coverage. It will be important to replicate these analyses across other states as national reform is implemented and compare the impact of state decisions regarding Medicaid expansion, and the presence of state based versus the national exchange on insurance coverage patterns.

Supplementary Material

Acknowledgments

Funding sources: National Institute on Minority Health and Health Disparities RC1MD004582, National Cancer Institute U01CA116892, and the American Cancer Society – Harry and Elsa Jiler Clinical Research Professorship

References

- 1.Kasper JD, Giovannini TA, Hoffman C. Gaining and losing health insurance: strengthening the evidence for effects on access to care and health outcomes. Med Care Res Rev. 2000 Sep;57(3):298–318. doi: 10.1177/107755870005700302. discussion 319–25. [DOI] [PubMed] [Google Scholar]

- 2.Sudano JJ, Jr, Baker DW. Intermittent lack of health insurance coverage and use of preventive services. Am J Public Health. 2003 Jan;93(1):130–7. doi: 10.2105/ajph.93.1.130. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3.Weissman JS, Witzburg R, Linov P, et al. Termination from Medicaid: how does it affect access, continuity of care, and willingness to purchase insurance? J Health Care Poor Underserved. 1999 Feb;10(1):122–37. doi: 10.1353/hpu.2010.0764. [DOI] [PubMed] [Google Scholar]

- 4.Ginde AA, Lowe RA, Wiler JL. Health insurance status change and emergency department use among US adults. Arch Intern Med. 2012 Apr 23;172(8):642–7. doi: 10.1001/archinternmed.2012.34. [DOI] [PubMed] [Google Scholar]

- 5.Sommers BD. Loss of health insurance among non-elderly adults in Medicaid. J Gen Intern Med. 2009 Jan;24(1):1–7. doi: 10.1007/s11606-008-0792-9. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6.Sommers BD. From Medicaid to uninsured: drop-out among children in public insurance programs. Health Serv Res. 2005 Feb;40(1):59–78. doi: 10.1111/j.1475-6773.2005.00342.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.Halterman JS, Montes G, Shone LP, et al. The impact of health insurance gaps on access to care among children with asthma in the United States. Ambul Pediatr. 2008 Jan-Feb;8(1):43–9. doi: 10.1016/j.ambp.2007.10.005. [DOI] [PubMed] [Google Scholar]

- 8.Freeman JD, Kadiyala S, Bell JF, et al. The causal effect of health insurance on utilization and outcomes in adults: a systematic review of US studies. Med Care. 2008 Oct;46(10):1023–32. doi: 10.1097/MLR.0b013e318185c913. [DOI] [PubMed] [Google Scholar]

- 9.The Patient Protection and Affordable Care Act. Public Law. 2010 Mar 23;:111–48. [Google Scholar]

- 10.Ellwood M, Lewis K. On and Off Medicaid: enrollment patterns for California and Florida in 1995. Washington, DC: Urban Institute; 1999. [Google Scholar]

- 11.Saunders MR, Alexander GC. Turning and churning: loss of health insurance among adults in Medicaid. J Gen Intern Med. 2009 Jan;24(1):133–4. doi: 10.1007/s11606-008-0861-0. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 12.McDonough JE, Rosman B, Butt M, et al. Massachusetts health reform implementation: major progress and future challenges. Health Aff (Millwood) 2008 Jul-Aug;27(4):w285–97. doi: 10.1377/hlthaff.27.4.w285. [DOI] [PubMed] [Google Scholar]

- 13.MassHealth Essential. Mass Resources. 2012 http://www.massresources.org/masshealth-essential.html. Accessed June 5, 2012.

- 14.McDonough JE, Rosman B, Phelps F, et al. The third wave of Massachusetts health care access reform. Health Aff (Millwood) 2006 Nov-Dec;25(6):w420–31. doi: 10.1377/hlthaff.25.w420. [DOI] [PubMed] [Google Scholar]

- 15.Patient Navigation Research Program (PNRP) Center to Reduce Cancer Health Disparities. 2011 Jan; http://crchd.cancer.gov/pnp/pnrp-index.html. Accessed June 5, 2012.

- 16.Battaglia TA, Santana MC, Bak S, et al. Predictors of timely follow-up after abnormal cancer screening among women seeking care at urban community health centers. Cancer. 2010 Feb 15;116(4):913–21. doi: 10.1002/cncr.24851. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 17.Freund KM, Battaglia TA, Calhoun E, et al. National Cancer Institute Patient Navigation Research Program: methods, protocol, and measures. Cancer. 2008 Dec 15;113(12):3391–9. doi: 10.1002/cncr.23960. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18.Laiteerapong N, Sherman BJ, Kim K, et al. Validation of Racial Categorization in a Hospital Administrative Database. J Gen Intern Med. 2005;20(Suppl 1):130. [Google Scholar]

- 19.Deyo RA, Cherkin DC, Ciol MA. Adapting a clinical comorbidity index for use with ICD-9-CM administrative databases. J Clin Epidem. 1992 Jun;45(6):613–9. doi: 10.1016/0895-4356(92)90133-8. [DOI] [PubMed] [Google Scholar]

- 20.Charlson ME, Pompei P, Ales KL, et al. A new method of classifying prognostic comorbidity in longitudinal studies: development and validation. J Chronic Dis. 1987;40(5):373–83. doi: 10.1016/0021-9681(87)90171-8. [DOI] [PubMed] [Google Scholar]

- 21.Long SK. On the road to universal coverage: impacts of reform in massachusetts at one year. Health Aff (Millwood) 2008 Jul-Aug;27(4):w270–84. doi: 10.1377/hlthaff.27.4.w270. [DOI] [PubMed] [Google Scholar]

- 22.Federico SG, Steiner JF, Beaty B, et al. Disruptions in insurance coverage: patterns and relationship to health care access, unmet need, and utilization before enrollment in the State Children’s Health Insurance Program. Pediatrics. 2007 Oct;120(4):e1009–16. doi: 10.1542/peds.2006-3094. [DOI] [PubMed] [Google Scholar]

- 23.Satchell M, Pati S. Insurance gaps among vulnerable children in the United States, 1999–2001. Pediatrics. 2005 Nov;116(5):1155–61. doi: 10.1542/peds.2004-2403. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 24.DeVoe JE, Tillotson CJ, Wallace LS, et al. Parent and child usual source of care and children’s receipt of health care services. Ann Fam Med. 2011 Nov-Dec;9(6):504–13. doi: 10.1370/afm.1300. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 25.Baker DW, Sudano JJ, Albert JM, et al. Lack of health insurance and decline in overall health in late middle age. New Engl J Med. 2001 Oct 11;345(15):1106–12. doi: 10.1056/NEJMsa002887. [DOI] [PubMed] [Google Scholar]

- 26.Baker DW, Sudano JJ, Albert JM, et al. Loss of health insurance and the risk for a decline in self-reported health and physical functioning. Med Care. 2002 Nov;40(11):1126–31. doi: 10.1097/00005650-200211000-00013. [DOI] [PubMed] [Google Scholar]

- 27.Braveman P, Schaaf VM, Egerter S, et al. Insurance-related differences in the risk of ruptured appendix. New Engl J Med. 1994 Aug 18;331(7):444–9. doi: 10.1056/NEJM199408183310706. [DOI] [PubMed] [Google Scholar]

- 28.Doyle JJ. Health Insurance, Treatment, and Outcomes: Using Auto Accidents as Health Shocks. Rev Econ Stat. 2005;87:256–70. [Google Scholar]

- 29.Goldman DR, Bhattacharya J, McCaffrey DF, et al. Effect on insurance on mortality in an HIV-positive population in care. J Am Stat Assoc. 2001;96(455):883–94. [Google Scholar]

- 30.Hadley J, Waidmann T. Health insurance and health at age 65: implications for medical care spending on new Medicare beneficiaries. Health Serv Res. 2006 Apr;41(2):429–51. doi: 10.1111/j.1475-6773.2005.00491.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 31.Quesnel-Vallée A. Is it really worse to have public health insurance than to have no insurance at all? Health insurance and adult health in the United States. J Health Soc Behavior. 2004;45(4):376–92. doi: 10.1177/002214650404500402. [DOI] [PubMed] [Google Scholar]

- 32.Gai Y, Gu NY. Association between insurance gaps and continued antihypertension medication usage in a US national representative population. Am J Hypertens. 2009;22(12):1276–80. doi: 10.1038/ajh.2009.188. [DOI] [PubMed] [Google Scholar]

- 33.Health Reform in Massachusetts: Expanding Access to Health Insurance Coverage, Assessing the Results. 2011 Apr; http://bluecrossmafoundation.org/health-reform/~/media/d0dda3d667be49d58539821f74c723c7.pdf. Accessed June 8, 2012.

- 34.Kolstad JT, Kowalski AE. The impact of health care reform on hospital and preventive care: evidence from Massachusetts. J Public Econ. 2012 Dec 1;96(11–12):909–29. doi: 10.1016/j.jpubeco.2012.07.003. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 35.Baicker K, Finkelstein A. The effects of Medicaid coverage–learning from the Oregon experiment. New Engl J Med. 2011 Aug 25;365(8):683–5. doi: 10.1056/NEJMp1108222. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 36.Gold R, DeVoe J, Shah A, et al. Insurance continuity and receipt of diabetes preventive care in a network of federally qualified health centers. Med Care. 2009 Apr;47(4):431–9. doi: 10.1097/mlr.0b013e318190ccac. [DOI] [PMC free article] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.