Abstract

Objective

To explore the relationship between commercial health care prices and Medicare spending/utilization across U.S. regions.

Data Sources

Claims from large employers and Medicare Parts A/B/D over 2007–2009.

Study Design

We compared prices paid by commercial health plans to Medicare spending and utilization, adjusted for beneficiary health and the cost of care, across 301 hospital referral regions.

Principal Findings

A 10 percent lower commercial price (around the average level) is associated with 3.0 percent higher Medicare spending per member per year, and 4.3 percent more specialist visits (p < .01).

Conclusions

Commercial health care prices are negatively associated with Medicare spending across regions. Providers may respond to low commercial prices by shifting service volume into Medicare. Further investigation is needed to establish causality.

Keywords: Geographic variation, health care spending, spillovers in health care, provider competition and health care prices, supplied-inducer demand

Health care spending varies markedly across the United States (Wennberg and Cooper 1996). Such variation raises important questions about the performance of the health care system and the design of public policy. Some areas may deliver good value, that is, high-quality care at low cost. Under current policy, Medicare payments to physicians and hospitals are adjusted for geographic differences in the cost of care, but not for geographic variation in value.

During the debate over health reform, the Secretary of Health and Human Services agreed to a congressional request to study whether Medicare should instead set payment rates based on the value of care across areas. The study was undertaken by a special committee of the Institute of Medicine (IOM). In its report (IOM 2013), the committee recommended against the adoption of a geographic “value index,” because such an approach would punish high-value providers in low-value areas (Newhouse and Garber 2013a,b).

The IOM's mandate reached beyond Medicare payment policy. In particular, the IOM was tasked with investigating variation in spending throughout the health care system, including commercial insurance, Medicaid, and the uninsured. The IOM was supported by a number of external research teams, including ours. This broader assessment of geographic variation in health care represents a significant contribution, because the existing evidence, while extensive, has focused largely on Medicare (Franzini, Mikhail, and Skinner 2010; Newhouse and Garber 2013a).

Nearly, 80 percent of U.S. health spending is outside of Medicare (Centers for Medicare and Medicaid Services 2014), and there may be important linkages across sectors of the overall system (Baker 1997; Yip 1998; Rice et al. 1999; Matlock et al. 2013; McWilliams, Landon, and Chernew 2013). For example, physicians with many Medicare patients tend to provide shorter office visits to their patients with commercial insurance (Glied and Zivin 2002).

Linkages between Medicare and commercial insurance could operate through payment levels. Reductions in Medicare payments have been met by concerns that providers will simply raise the prices they charge to the commercially insured; a recent review of the literature found some evidence of such “cost shifting,” albeit at a low rate (Frakt 2011). During the period studied by the IOM, Medicare did not implement significant payment reductions. However, information developed as part of the IOM study has created an opportunity to explore whether the price paid by commercial health plans in a particular region is related to spending and utilization in Medicare.

Specifically, the IOM measured the prices that commercial health plans paid for services and pharmaceuticals, and concluded that there is substantial geographic variation in the “markup” of price over cost, potentially due to differences across areas in competition levels among commercial plans and providers. One might hypothesize that lower commercial price markups cause providers to shift service volume and health care dollars out of the commercial sector and into Medicare (McGuire and Pauly 1991; McGuire 2000; Newhouse and Garber 2013a). This study investigates the association between commercial health care prices and Medicare spending and utilization.

Methods

We compared Medicare and commercial insurance spending across areas to a measure of the prices paid by commercial plans over the period 2007–2009. Data were obtained through our collaboration with the IOM; details on data construction are available in the main IOM report and its technical documentation (McKellar et al. 2012; IOM 2013; MaCurdy et al. 2013).

Following the Dartmouth Atlas of Health Care (Wennberg and Cooper 1996), geographic areas were defined by hospital referral regions (HRRs). HRRs represent regional health care markets for tertiary care and have been extensively studied in the literature. Of 306 HRRs in the United States, our analysis excluded five HRRs for which commercial spending and prices were unavailable due to confidentiality restrictions.

Our measure of Medicare spending included all inpatient, outpatient, and drug reimbursement (Parts A, B, and D) for fee-for-service beneficiaries. Total spending for commercial insurance was measured within the MarketScan claims database, a convenience sample of large employers. The MarketScan data included 113 million nonelderly person-years of commercial coverage (McKellar et al. 2012).

Spending was adjusted for health status within HRRs based on age, sex, race, and claims in the prior year. For the latter, Hierarchical Condition Categories were used for Medicare, and Verisk DxCG risk scores for the commercially insured (Pope et al. 2004; Verisk Health 2013; Schone, Brown, and Goodell 2013). Spending was further adjusted for geographic differences in the cost of providing health care. Specifically, the Hospital Wage Index was used for the labor portion of inpatient claims (Centers for Medicare and Medicaid Services 2013a), while components of the Geographic Practice Cost Index were used for professional and outpatient claims (Centers for Medicare and Medicaid Services 2013b).

Hospital referral region-level spending was measured per member per year (PMPY). Spending reflects both utilization and prices, and commercial spending was decomposed into aggregate measures of each. For each HRR, aggregate utilization was calculated by weighting the utilization of each specific service and drug in the area by its average reimbursement at the national level within the MarketScan data (McKellar et al. 2014). Intuitively, this approach deals with differences across areas in the mix of individual services and drugs by standardizing them according to a proxy for resource use (Agency for Healthcare Quality and Research 2014). To make acute and chronic prescriptions comparable, drug claims for more than a 30-day supply were standardized into 30-day equivalents (McKellar et al. 2012). Given aggregate utilization within an HRR, the aggregate price for commercial health care was obtained by dividing spending by utilization. Because spending was adjusted for regional differences in costs, the commercial price measure reflects the markup of price over costs.

We performed separate regressions of commercial and Medicare spending on the commercial price index. In addition, we analyzed specific types of utilization (e.g., imaging encounters, as defined by days with a claim) among traditional (fee-for-service) Medicare beneficiaries, as well as total spending on an annualized basis among fee-for-service beneficiaries with specific conditions (e.g., over the year following an acute myocardial infarction or over the course of a 90-day episode of pneumonia) (MaCurdy et al. 2013). For each condition, commercial price was measured among patients with the condition (McKellar et al. 2012). Condition-specific spending was adjusted for beneficiary factors and area costs; utilization was adjusted for beneficiary factors.

Results

Table1 shows that spending on traditional Medicare beneficiaries, adjusted for beneficiary health and the local cost of care, averaged $11,403 PMPY throughout the United States over 2007–2009. Adjusted spending for commercial insurance was $4,100 per year. Results were similar when spending was weighted by number of beneficiaries within each HRR, as shown in the appendix.

Table 1.

Summary Statistics

| Variable | Mean | SD |

|---|---|---|

| Spending and commercial price | ||

| Adjusted Medicare spending | $11,403 | $1,028 |

| Adjusted commercial spending | $4,100 | $428 |

| Commercial health care price index | 1.03 | 0.13 |

| Medicare utilization | ||

| Inpatient admissions | 0.33 | 0.04 |

| Medical admissions | 0.24 | 0.03 |

| Surgical admissions | 0.10 | 0.01 |

| Inpatient days | 1.70 | 0.23 |

| Emergency department visits | 0.60 | 0.07 |

| Office visits | 7.01 | 0.81 |

| Specialist visits | 3.45 | 0.75 |

| Imaging services | 2.53 | 0.20 |

| Prescription drug fills | 25.82 | 1.75 |

| Adjusted Medicare spending by condition | ||

| Acute myocardial infarction | $65,484 | $5,272 |

| Breast cancer | $33,139 | $3,411 |

| Cataracts | $17,083 | $999 |

| Cholycystectomy | $67,681 | $4,906 |

| Chronic obstructive pulmonary disease | $26,941 | $2,410 |

| Congestive heart failure | $34,703 | $3,188 |

| Coronary heart disease | $23,157 | $1,768 |

| Depression | $22,972 | $2,777 |

| Diabetes | $19,249 | $1,932 |

| Lower back pain | $16,835 | $1,453 |

| Lung cancer | $71,947 | $7,400 |

| Pneumonia | $85,419 | $8,929 |

| Prostate cancer | $29,576 | $3,620 |

| Rheumatoid arthritis | $20,868 | $1,822 |

| Stroke | $59,154 | $5,696 |

Note Unit of observation is a hospital referral region (HRR). Includes 301 regions for which commercial price was available. Spending and utilization are measured per member per year (PMPY). Spending is adjusted for beneficiary health and the cost of providing care; utilization is adjusted for health status. Weighted statistics reported in appendix.

There was substantial variation across HRRs in spending levels. For Medicare, the HRR at the 90th percentile spent 23 percent more on an adjusted basis than the HRR at the 10th percentile. The differential was 28 percent for commercial spending.1 Spending levels by region are shown in the appendix. Medicare and commercial spending were largely unrelated across HRRs (correlation coefficient of −0.09).

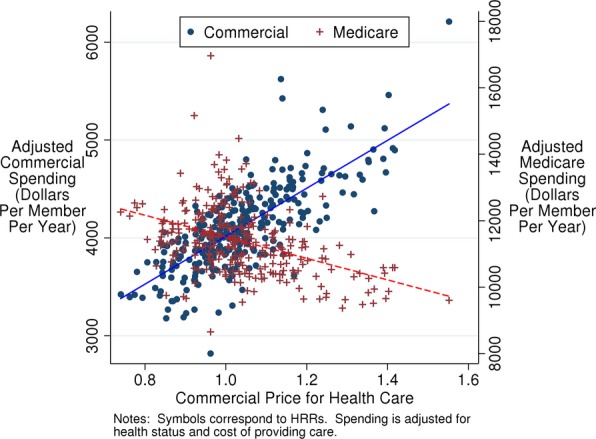

Commercial health care prices by region are shown in the appendix. Adjusted spending was systematically related to commercial prices across HRRs. As Figure1 shows, areas with lower commercial health care prices experienced lower spending on commercial insurance. Specifically, a value of the commercial price measure that is 10 percent lower (around its average level) was associated with 6.2 percent lower commercial spending PMPY (p < .01), as shown in Table2. By contrast, areas with low commercial prices saw higher Medicare spending, with a 10 percent lower price associated with 3.0 percent higher spending (p < .01). The regressions underlying these results are reported in the appendix.

Figure 1.

Relationship between Commercial Price of Health Care and Adjusted Spending on Commercially Insured and Medicare Beneficiaries

Table 2.

Predicted Percentage Difference in Outcome Associated with a 10% Lower Price for Commercial Health Care (around Its Average Level)

| Outcome | Percentage Change (95% confidence interval) |

|---|---|

| Aggregate spending | |

| Adjusted commercial spending | −6.2 (−6.9, −5.5) |

| Adjusted Medicare spending | 3.0 (2.4, 3.5) |

| Medicare utilization | |

| Inpatient admissions | 2.8 (1.9, 3.7) |

| Medical admissions | 3.4 (2.4, 4.5) |

| Surgical admissions | 1.3 (0.4, 2.2) |

| Inpatient days | 4.4 (3.4, 5.4) |

| Emergency department visits | 0.0 (−1.0, 1.0) |

| Office visits | 2.1 (0.9, 3.2) |

| Specialist visits | 4.3 (2.0, 6.6) |

| Imaging services | 3.4 (2.7, 4.0) |

| Prescription drug fills | −0.6 (−1.3, 0.2) |

| Adjusted Medicare spending by condition | |

| Acute myocardial infarction | 2.2 (1.6, 2.9) |

| Breast cancer | 2.9 (2.1, 3.7) |

| Cataracts | 1.1 (0.5, 1.6) |

| Cholycystectomy | 1.4 (0.7, 2.0) |

| Chronic obstructive pulmonary disease | 2.3 (1.7, 2.8) |

| Congestive heart failure | 3.1 (2.5, 3.7) |

| Coronary heart disease | 1.8 (1.3, 2.3) |

| Depression | 3.2 (2.5, 3.8) |

| Diabetes | 2.8 (2.2, 3.4) |

| Lower back pain | 2.4 (1.9, 3.0) |

| Lung cancer | 3.2 (2.3, 4.1) |

| Pneumonia | 2.9 (2.2, 3.6) |

| Prostate cancer | 3.4 (2.3, 4.4) |

| Rheumatoid arthritis | 1.4 (0.8, 2.1) |

| Stroke | 2.5 (1.8, 3.1) |

Note Predictions based on regression analyses. 95% confidence intervals based on heteroscedasticity-robust standard errors.

In terms of specific types of utilization, Table1 shows that Medicare beneficiaries averaged 0.33 inpatient admissions per year, 1.70 inpatient days, 0.60 emergency department visits, 7.01 office visits, 3.45 specialist visits, 2.53 imaging encounters, and 25.82 prescriptions filled per year. Table2 reports the predicted percentage difference in adjusted Medicare utilization associated with a 10 percent lower value of the commercial price index (around its average level). The adjusted number of inpatient admissions per year was predicted to be 2.8 percent higher (p < .01), while inpatient days were predicted to be 4.4 percent higher (p < .01). The adjusted number of specialist visits and imaging services per year were also substantially higher, 4.3 percent and 3.4 percent, respectively (p < .01 in both cases). There was a statistically significant association for all types of utilization, with the exceptions of emergency department visits and prescription fills.

For each of the specific conditions studied, total spending exceeded the average level of spending among the general population of Medicare beneficiaries. As Table1 shows, adjusted total spending ranged from $16,835 per year among Medicare beneficiaries with lower back pain to $85,419 on an annualized basis for a 90-day episode of pneumonia. Table2 shows the predicted difference in Medicare spending associated with a 10 percent lower price index for commercial health care. For all 15 conditions, total spending was predicted to be significantly higher, with differences ranging from +1.1 percent for beneficiaries with cataracts (p < .01) to +3.4 percent for beneficiaries with prostate cancer (p < .01).

As shown in the appendix, results were similar in analyses of the typically smaller number of HRRs for which data were available on commercial prices among patients with the various conditions. The appendix further shows that the results were generally similar when regression observations were weighted by the number of beneficiaries residing in each hospital referral region during the study period. Finally, the appendix shows that results were similar when spending, Medicare utilization, and commercial prices were measured in natural logarithms.

Discussion

Across HRRs in the United States, there is a significant positive association between commercial health care prices and per capita spending for the commercially insured, after adjusting for beneficiary health status and the local cost of providing care. Yet commercial prices are negatively associated with Medicare spending. The IOM's recent study of geographic variation in health care did not address the potential role of commercial prices in Medicare spending (IOM 2013).

A negative association between commercial health care prices and Medicare spending helps to explain the weak correlation that has been documented between commercial and Medicare spending across U.S. regions (Chernew et al. 2010; Baker, Bundorf, and Kessler 2014b). In the inpatient context, Medicare utilization tends to be higher in areas with lower price markups in the commercial sector (Baker, Bundorf, and Kessler 2014b). We contribute to this emerging evidence by showing that this pattern holds in the aggregate; for Medicare beneficiaries with a wide range of acute and chronic conditions; and for several types of utilization outside the hospital, including specialist visits and imaging services.

In assessing utilization, an ideal measure of commercial prices would have been specific to the type of utilization, as there is extensive geographic variation in commercial reimbursement to both hospitals and physicians (Medicare Payment Advisory Commission 2011; Baker, Bundorf, and Royalty 2013; Baker, Bundorf, and Kessler 2014b). However, the IOM study produced an aggregate price index. Use of this measure introduced measurement error into our analyses of utilization. In the MarketScan data, an aggregate price index for metro areas tends to be strongly positively correlated with the prices of specific services, for example, outpatient care (Dunn et al. 2013). Yet commercial price markups, above the costs of providing care, are weakly correlated for inpatient and outpatient care (Medicare Payment Advisory Commission 2011). Measurement error was likely to have been greatest for prescriptions, because our price measure accounts for regional differences in hospital and physician costs. In addition, MarketScan does not represent the universe of commercial claims. As a result of measurement error, the magnitude of the association between commercial price and Medicare utilization could have been understated.

One potential explanation for an inverse relationship between commercial health care prices and Medicare spending and utilization is that providers respond to low commercial reimbursements by shifting service volume into Medicare (McGuire and Pauly 1991; McGuire 2000).2 This interpretation is consistent with some existing evidence on the effects of changes in Medicare reimbursement. When physician fees for bypass surgery were reduced in the late 1980s, procedure volume increased in both the Medicare and commercial sectors (Yip 1998). Another study considered a wider range of procedures, and found substantial volume increases, particularly for orthopedic surgery (Rice et al. 1999). More recently, prospective payment of outpatient hospital services has been associated with more frequent surgeries at Florida hospitals among individuals with private fee-for-service insurance (He and Mellor 2012).

Another recent study concluded that the average cost of hospital stays among Medicare beneficiaries is lower in areas with greater hospital competition, while length of stay does not differ (Henke et al. 2013). Competition influences the price of health care and may also affect efficiency in delivery (Robinson and Luft 1985; Dranove and Satterthwaite 2000; Gaynor and Vogt 2000, 2006; Bloom et al. 2010, 2014; Chandra et al. 2013; McKellar et al. 2014). Our finding of a negative association between commercial prices and inpatient days in Medicare operates primarily through number of admissions, rather than length of stay.

An alternative explanation for a relationship between commercial health care prices and Medicare spending and utilization is that the capacity of local health care systems for treating commercial beneficiaries is influenced by utilization within Medicare. Providers with excess capacity may be more willing to negotiate with commercial plans (Ho 2009). Under this explanation, low Medicare utilization would result in low commercial prices, and thus a positive association, contrary to our finding.

Nevertheless, an inverse relationship must be interpreted cautiously, and it does not necessarily imply that low commercial prices cause high Medicare spending. A causal interpretation would be reinforced if supported by evidence of a stronger association among providers with higher powered incentives or better opportunities for shifting service volume between the commercial and Medicare sectors. Hospital ownership of physician practices could facilitate such behavior; commercial prices for inpatient care are significantly higher in areas in which physicians are highly integrated with hospitals (Baker, Bundorf, and Kessler 2014a).

It is important to place our findings in the context of our understanding of geographic variation in U.S. health care. The IOM study concluded, “After accounting for differences in age, sex, and health status, geographic variation is not further explained by other beneficiary demographic factors, insurance plan factors, or market-level characteristics. In fact, after controlling for all factors measurable within the data used for this analysis, a large amount of variation remains unexplained.” Another prominent study focused exclusively on Medicare and reached a similar conclusion (Zuckerman et al. 2010). Both analyses considered the supply side of health care markets, for example, physicians per capita. However, the price paid for health care in the commercial sector was not addressed.

Our study demonstrates that price markups for commercial care are negatively associated with Medicare spending and utilization across U.S. regions. The nature, causes, and consequences of this relationship warrant further investigation.

Acknowledgments

Joint Acknowledgment/Disclosure Statement: This research was supported by the Leonard D. Schaeffer Center for Health Policy and Economics at the University of Southern California. It follows from work conducted by Precision Health Economics, Acumen, LLC, and Harvard University under contract to the National Academy of Sciences. Dr. Goldman is a partner at Precision Health Economics and a member of the Institute of Medicine; Dr. Lakdawalla is a partner at Precision Health Economics; Dr. Romley and Ms. Axeen served as paid consultants to Precision Health Economics. Dr. Bhattacharya served as a consultant to Acumen, LLC. Dr. Chernew is a member of the Institute of Medicine and served as principal investigator for Harvard University's contract with the National Academy of Sciences to examine geographic variation in the commercial sector. Drs. Bhattacharya and Chernew have prior consulting relationships with Precision Health Economics. No other disclosures.

Disclosures: None.

Disclaimers: None.

Footnotes

The IOM reported larger differentials in unadjusted spending, specifically, 42 percent for Medicare and 36 percent for commercial insurance.

Medicare spending and utilization should have similar relationships with commercial prices, because geographic variation in Medicare spending is driven by utilization differences within Medicare, rather than differences in Medicare payment across areas (Chernew et al. 2010; Gottlieb et al. 2010; Philipson et al. 2010; IOM 2013; Newhouse and Garber 2013a).

Supporting Information

Additional supporting information may be found in the online version of this article:

Appendix SA1: Author Matrix.

Figure S1: Commercial Spending (Dollars per Member per Year).

Figure S2: Adjusted Medicare Spending (Dollars per Member per Year).

Figure S3: Price Index for Commercial Health Care.

Table S1: Regression Results Underlying Table2.

Table S2: Weighted Summary Statistics.

Table S3: Predicted Percentage Difference in Outcome Associated with a Ten Percent Lower Price for Commercial Health Care (Around Its Average Level), Based on Weighted Regressions.

Table S4: Predicted Percentage Difference in Outcome Associated with a Ten Percent Lower Price for Commercial Health Care (Around Its Average Level), Log–Log Specification.

Table S5: Predicted Percentage Difference in Outcome Associated with a Ten Percent Lower Price for Commercial Health Care (Around Its Average Level), Using Condition-Specific Price Indices.

References

- Agency for Healthcare Quality and Research. 2014. . “ Introduction to Resource Use/Efficiency Measures ” [accessed on August 25, 2014]. Available at http://www.ahrq.gov/professionals/quality-patient-safety/quality-resources/tools/perfmeasguide/perfmeaspt3.html.

- Baker LC. The Effect of HMOs on Fee-for-Service Health Care Expenditures: Evidence from Medicare. Journal of Health Economics. 1997;16(4):453–81. doi: 10.1016/s0167-6296(96)00535-8. [DOI] [PubMed] [Google Scholar]

- Baker LC, Bundorf MK. Kessler DP. Vertical Integration: Hospital Ownership of Physician Practices is Associated with Higher Prices and Spending. Health Affairs. 2014a;33(5):756–63. doi: 10.1377/hlthaff.2013.1279. [DOI] [PubMed] [Google Scholar]

- Baker LC, Bundorf MK. Kessler DP. Why Are Medicare and Commercial Insurance Spending Weakly Correlated? Am J Manag Care. 2014b;20(1):e8–14. [PubMed] [Google Scholar]

- Baker L, Bundorf MK. Royalty A. Private Insurers’ Payments for Routine Physician Office Visits Vary Substantially across the United States. Health Affairs. 2013;32(9):1583–90. doi: 10.1377/hlthaff.2013.0309. [DOI] [PubMed] [Google Scholar]

- Bloom N, Propper C, Seiler S. Van Reenen J. 2010. Cambridge, MA National Bureau of Economic Research, and The Impact of Competition on Management Quality: Evidence from Public Hospitals. National Bureau of Economic Research Working Paper.

- Bloom N, Lemos R, Sadun R, Scur D. Van Reenen J. 2014. Cambridge, MA National Bureau of Economic Research, and The New Empirical Economics of Management. National Bureau of Economic Research Working Paper.

- Centers for Medicare and Medicaid Services. 2014. . “ National Health Expenditure Data ” [accessed on September 7]. Available at http://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-Trends-and-Reports/NationalHealthExpendData/index.html?redirect=/nationalhealthexpenddata/

- Centers for Medicare and Medicaid Services. 2013a. . “ Acute Inpatient Prospective Payment System Wage Index ” [accessed on August 25, 2013]. Available at http://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/AcuteInpatientPPS/wageindex.html.

- Centers for Medicare and Medicaid Services. 2013b. . “ National Physician Fee Schedule and Relative Value Files ” [accessed on August 25, 2013]. Available at http://www.cms.gov/apps/physician-fee-schedule/documentation.aspx.

- Chandra A, Finkelstein A, Sacarny A. Syverson C. 2013. Cambridge, MA National Bureau of Economic Research, and Healthcare Exceptionalism? Productivity and Allocation in the U.S. Healthcare Sector. National Bureau of Economic Research Working Paper.

- Chernew ME, Sabik LM, Chandra A, Gibson TB. Newhouse JP. Geographic Correlation between Large-Firm Commercial Spending and Medicare Spending. American Journal of Management Care. 2010;16(2):131–8. [PMC free article] [PubMed] [Google Scholar]

- Dranove D. Satterthwaite M. The Industrial Organization of Health Care Markets. Handbook of Health Economics. 2000;1:1093–139. [Google Scholar]

- Dunn A, Liebman E, Pack S. Shapiro AH. Medical Care Price Indexes for Patients with Employer-Provided Insurance: Nationally Representative Estimates from MarketScan Data. Health Services Research. 2013;48(3):1173–90. doi: 10.1111/1475-6773.12008. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Frakt AB. How Much Do Hospitals Cost Shift? A Review of the Evidence. Milbank Quarterly. 2011;89(1):90–130. doi: 10.1111/j.1468-0009.2011.00621.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Franzini L, Mikhail OI. Skinner JS. McAllen and El Paso Revisited: Medicare Variations Not Always Reflected in the Under-Sixty-Five Population. Health Affairs (Millwood) 2010;29(12):2302–9. doi: 10.1377/hlthaff.2010.0492. [DOI] [PubMed] [Google Scholar]

- Gaynor M. Vogt WB. Antitrust and Competition in Health Care Markets. In: Culyer AJ, Newhouse JP, editors; Handbook of Health Economics. Amsterdam: Elsevier Science; 2000. pp. 1405–87. [Google Scholar]

- Gaynor M. Vogt W. How Has Hospital Consolidation Affected the Price and Quality of Hospital Care? Princeton, NJ: Robert Wood Johnson Foundation; 2006. [PubMed] [Google Scholar]

- Glied S. Zivin JG. How Do Doctors Behave When Some (But Not All) of their Patients Are in Managed Care? Journal of Health Economics. 2002;21(2):337–53. doi: 10.1016/s0167-6296(01)00131-x. [DOI] [PubMed] [Google Scholar]

- Gottlieb DJ, Zhou W, Song Y, Andrews KG, Skinner JS. Sutherland JM. Prices Don't Drive Regional Medicare Spending Variations. Health Affairs. 2010;29(3):537–43. doi: 10.1377/hlthaff.2009.0609. [DOI] [PMC free article] [PubMed] [Google Scholar]

- He D. Mellor JM. Hospital Volume Responses to Medicare's Outpatient Prospective Payment System: Evidence from Florida. Journal of Health Economics. 2012;31(5):730–43. doi: 10.1016/j.jhealeco.2012.06.001. [DOI] [PubMed] [Google Scholar]

- Henke RM, Maeda JL, Marder WD, Friedman BS. Wong HS. Medicare and Commercial Inpatient Resource Use: Impact of Hospital Competition. American Journal of Management Care. 2013;19(6):e238–48. [PubMed] [Google Scholar]

- Ho K. Insurer-Provider Networks in the Medical Care Market. American Economic Review. 2009;99(1):393–430. doi: 10.1257/aer.99.1.393. [DOI] [PubMed] [Google Scholar]

- IOM. Variation in Health Care Spending: Target Decision Making, Not Geography. Washington, DC: National Academies Press; 2013. [PubMed] [Google Scholar]

- MaCurdy T, Bhattacharya J, Perlroth D, Shafrin J, Au-Yeung A, Bashour H, Chicklis C, Cronen K, Lipton B, Saneinejad S, Shrestha E. Ziidi S. 2013. “ Geographic Variation in Spending, Utilization and Quality: Medicare and Medicaid Beneficiaries ” [accessed on August 25, 2013]. Available at http://iom.edu/Reports/2013/Variation-in-Health-Care-Spending-Target-Decision-Making-Not-Geography/~/media/Files/Report%20Files/2013/Geographic-Variation2/Subcontractor-Reports/Updated%20Acumen%20Report.pdf.

- Matlock DD, Groeneveld PW, Sidney S, Shetterly S, Goodrich G, Glenn K, Xu S, Yang L, Farmer SA, Reynolds K, Cassidy-Bushrow AE, Lieu T, Boudreau D M, Greenlee RT, Tom J, Vupputuri S, Adams KF, Smith DH, Gunter MJ, Go AS. Magid DJ. Geographic Variation in Cardiovascular Procedure Use among Medicare Fee-for-Service vs. Medicare Advantage Beneficiaries. Journal of the American Medical Association. 2013;310(2):155–62. doi: 10.1001/jama.2013.7837. [DOI] [PMC free article] [PubMed] [Google Scholar]

- McGuire TG. Physician Agency. In: Newhouse JP, editor; Culyer AJ, editor. Handbook of Health Economics. Amsterdam: Elsevier; 2000. pp. 462–536. [Google Scholar]

- McGuire TG. Pauly MV. Physician Response to Fee Changes with Multiple Payers. Journal of Health Economics. 1991;10(4):385–410. doi: 10.1016/0167-6296(91)90022-f. [DOI] [PubMed] [Google Scholar]

- McKellar M, Landrum MB, Gibson T, Landon B, Naimer S. Chernew M. Geographic Variation in Health Care Spending, Utilization, and Quality among the Privately Insured. 2012. “ ” [accessed on August 25, 2013]. Available at http://www.iom.edu/Reports/2013/~/media/Files/Report%20Files/2013/Geographic-Variation/Sub-Contractor/Harvard-University.pdf. [Google Scholar]

- McKellar MR, Naimer S, Landrum MB, Gibson TB, Chandra A. Chernew M. Insurer Market Structure and Variation in Commercial Health Care Spending. Health Services Research. 2014;49(3):878–92. doi: 10.1111/1475-6773.12131. [DOI] [PMC free article] [PubMed] [Google Scholar]

- McWilliams JM, Landon BE. Chernew ME. Changes in Health Care Spending and Quality for Medicare Beneficiaries Associated with a Commercial ACO Contract. Journal of the American Medical Association. 2013;310(8):829–36. doi: 10.1001/jama.2013.276302. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Medicare Payment Advisory Commission. Report to the Congress: Medicare and the Health Care Delivery System. Washington, DC: MedPAC; 2011. [Google Scholar]

- Newhouse JP. Garber AM. Geographic Variation in Health Care Spending in the United States: Insights from an Institute of Medicine Report. Journal of the American Medical Association. 2013a;310(12):1227–8. doi: 10.1001/jama.2013.278139. [DOI] [PubMed] [Google Scholar]

- Newhouse JP. Garber AM. Geographic Variation in Medicare Services. New England Journal of Medicine. 2013b;368(16):1465–8. doi: 10.1056/NEJMp1302981. [DOI] [PubMed] [Google Scholar]

- Philipson TJ, Seabury SA, Lockwood LM, Goldman DP, Lakdawalla DN. Cutler DM. Geographic Variation in Health Care: The Role of Private Markets. Brookings Papers on Economic Activity. 2010;41(Spring):325–61. [Google Scholar]

- Pope GC, Kautter J, Ellis RP, Ash AS, Ayanian JZ, Lezzoni LI, Ingber MJ, Levy JM. Robst J. Risk Adjustment of Medicare Capitation Payments Using the CMS-HCC Model. Health Care Financ Review. 2004;25(4):119–41. [PMC free article] [PubMed] [Google Scholar]

- Rice T, Stearns SC, Pathman DE, DesHarnais S, Brasure M. Tai-Seale M. A Tale of Two Bounties: The Impact of Competing Fees on Physician Behavior. Journal of Health Politics, Policy and Law. 1999;24(6):1307–30. doi: 10.1215/03616878-24-6-1307. [DOI] [PubMed] [Google Scholar]

- Robinson JC. Luft HS. The Impact of Hospital Market Structure on Patient Volume, Average Length of Stay, and the Cost of Care. Journal of Health Economics. 1985;4(4):333–56. doi: 10.1016/0167-6296(85)90012-8. [DOI] [PubMed] [Google Scholar]

- Schone E, Brown R. Goodell S. Risk Adjustment: What Is the Current State of the Art and How Can It Be Improved? Princeton, NJ: Robert Wood Johnson Foundation; 2013. [Google Scholar]

- Verisk Health. 2013. . “ DxCG Risk Analytics ” [accessed on August 25, 2013]. Available at http://www.veriskhealth.com/answers/population-answers/dxcg-risk-analytics.

- Wennberg DE. Cooper MM. Dartmouth Atlas of Health Care. Chicago, IL: American Hospital Publishing Inc; 1996. [PubMed] [Google Scholar]

- Yip WC. Physician Response to Medicare Fee Reductions: Changes in the Volume of Coronary Artery Bypass Graft (CABG) Surgeries in the Medicare and Private Sectors. Journal of Health Economics. 1998;17(6):675–99. doi: 10.1016/s0167-6296(98)00024-1. [DOI] [PubMed] [Google Scholar]

- Zuckerman S, Waidmann T, Berenson R. Hadley J. Clarifying Sources of Geographic Differences in Medicare Spending. New England Journal of Medicine. 2010;363:54–62. doi: 10.1056/NEJMsa0909253. [DOI] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Appendix SA1: Author Matrix.

Figure S1: Commercial Spending (Dollars per Member per Year).

Figure S2: Adjusted Medicare Spending (Dollars per Member per Year).

Figure S3: Price Index for Commercial Health Care.

Table S1: Regression Results Underlying Table2.

Table S2: Weighted Summary Statistics.

Table S3: Predicted Percentage Difference in Outcome Associated with a Ten Percent Lower Price for Commercial Health Care (Around Its Average Level), Based on Weighted Regressions.

Table S4: Predicted Percentage Difference in Outcome Associated with a Ten Percent Lower Price for Commercial Health Care (Around Its Average Level), Log–Log Specification.

Table S5: Predicted Percentage Difference in Outcome Associated with a Ten Percent Lower Price for Commercial Health Care (Around Its Average Level), Using Condition-Specific Price Indices.