Abstract

Multinational corporations play a prominent role in shaping the environmental trajectory of the planet. The integration of environmental costs and benefits into corporate decision-making has enormous, but as yet unfulfilled, potential to promote sustainable development. To help steer business decisions toward better environmental outcomes, corporate reporting frameworks need to develop scientifically informed standards that consistently consider land use and land conversion, clean air (including greenhouse gas emissions), availability and quality of freshwater, degradation of coastal and marine habitats, and sustainable use of renewable resources such as soil, timber, and fisheries. Standardization by itself will not be enough—also required are advances in ecosystem modeling and in our understanding of critical ecological thresholds. With improving ecosystem science, the opportunity for realizing a major breakthrough in reporting corporate environmental impacts and dependencies has never been greater. Now is the time for ecologists to take advantage of an explosion of sustainability commitments from business leaders and expanding pressure for sustainable practices from shareholders, financial institutions, and consumers.

Keywords: corporate sustainability, ESG reporting, natural capital, ecosystem services, multinational corporations

The power of multinational corporations (MNCs) is evident in the massive scale of their revenues—roughly 40% of the world’s 100 largest economies are corporations as opposed to nations (1, 2), and the impacts of their operations on the environment can be profound (3, 4). As an iconic example, Walmart Stores, Inc. has annual sales that are higher than the gross domestic products (GDPs) of all but 25 nations, and its 2.1 million employees outnumber the populations of almost 100 nations (5). Given the scope of their influence on global commerce, human well-being, and the environment, the practices of MNCs have long been recognized as integral to global development outcomes (6). We focus on them here because of their enormous potential to impact the environment and because, thus far, larger companies have been shown to disclose more information (7), perhaps because they are more visible and face higher levels of stakeholder scrutiny (8). MNCs are also authoritative organizations that can direct extraordinary levels of research and development resources toward sustainability and then spread technological advances (9).

Several recent reports have documented widespread awareness among corporate management that environmental hazards are material for business (10–14). A 2013 survey of corporate representatives across 17 sectors found that over half anticipated that natural resource shortages will impact their core business in the next 3–5 years (15). As a result of these concerns, many high-profile chief executive officers (CEOs) are now publicly defining success in terms broader than rapid profit-taking (Table S1) and acknowledging the risks of environmental degradation to their bottom line. The most obvious manifestation of the environment as a priority is the issuance of corporate sustainability reports that communicate to stakeholders the company’s environmental performance (7). In addition to CEO leadership, corporate reporting is driven by a combination of investor demands, possibility of material risks due to interrupted supply chains, and emerging national policies on corporate disclosure of nonfinancial information (16–18).

Although the trend of expanding environmental disclosure is encouraging, the content and depth of corporate sustainability reports is varied. Companies are often accused of misrepresenting their environmental performance, or “greenwashing” (19). There is also enormous inconsistency of corporate environmental performance indicators (20). If the chaos of current disclosures continues, investors may lose interest in the possibility of distinguishing companies on the basis of environmental performance even though, in principle, they see the value of making such distinctions (21).

We hypothesize that the inclusion of ecosystem services in corporate environmental disclosures could lead to consistent, industry-wide reporting guidelines and vastly increase the information value of reports for companies and their stakeholders. In addition, with greater input from ecosystem scientists, companies would benefit by better understanding and anticipating environment-associated risks and opportunities.

In this paper, we discuss why now is a propitious time for scientists to engage corporations in improving the measurement of their environmental impacts and dependencies. Using the agricultural sector as an example, we suggest key environmental indicators as an illustration of how ecosystem science might inform industry-specific reporting frameworks. We also discuss the apparel industry as an example of how reporting transparency and collaboration can facilitate the development of common approaches to sustainability measurement. Finally, we recommend that, along with science-driven standardization of environmental reporting, there should also be a move toward policies that mandate corporate environmental disclosure.

Sustainability Reporting Is Now the Rule Rather than the Exception

Environmental sustainability is now commonly mentioned as a core component of successful business (Table S2), and today most corporations have sustainability officers (22, 23). Indeed, McKinsey Global Survey results from February 2014 indicate that 36% of CEOs (n = 2,632) view sustainability as one of their top three priorities, and 13% see it as their number one priority (24). In 2012, the majority of Standard & Poor's 500 (S&P 500) (53%) and Fortune 500 (57%) companies issued sustainability reports, up from just 19% and 20%, respectively, in 2010 (25). In addition, business schools are preparing students to understand and manage sustainability issues. Nineteen of the 20 highest ranked master of business administration (MBA) programs now offer courses and concentrations in environmental issues or social responsibility (Table S3).

At the same time that business leaders are embracing sustainability reporting, so too are environmental leaders. Notably, several prominent environmentalists have argued that the future of conservation and environmental stewardship depends on the values of nature becoming standard business practice—something that is good for both the environment and business (6, 26, 27). Almost all major conservation organizations are establishing corporate partnerships as part of their conservation toolbox (Table S4).

Another major impetus for environmentally friendly business is the formation of sustainable business coalitions. These coalitions convene companies to test environmental assessment tools, share best practices, and develop industry benchmarks (Table S5). For example, the World Business Council for Sustainable Development (WBCSD) compiles case studies of ecosystem service valuation techniques (28, 29) and provides guidance on available decision-making tools (30–32). Similarly, the Sustainability Consortium (TSC) convenes companies from diverse sectors with universities and nongovernmental organizations (NGOs) to develop scientific measures of product-specific environmental impacts. These consortiums represent businesses with global impact: the combined revenues of TSC members is over $2.4 trillion, and WBCSD members’ combined revenues are over $7 trillion. (33, 34).

The proliferation of professional service firms dedicated to quantifying and sometimes ranking companies in terms of their environmental performance is yet another reflection of the growing relevance of sustainability to business. For example, the investment company RobecoSAM (Sustainable Asset Management) conducts an annual sustainability assessment of more than 2,000 of the largest companies across the Dow Jones indices. The assessment’s results serve as the basis for listing on the Dow Jones Sustainability Indices (DJSI), which has become a source of prestige for companies with superior sustainability performance. The consulting firm Trucost offers data and management tools for companies to understand their natural capital dependencies. It also provides risk analyses to investors based on supply-chain information and potential environmental liabilities. TruCost was instrumental in Puma’s 2011 Environmental Profit and Loss (EP&L) Account, the first analysis to calculate net costs of a company’s environmental impacts throughout its entire supply chain (35).

The demand for professional analyses of sustainability performance and data are coming from asset owners and institutional investors. This trend is reflected in the large number of financial entities signing on to the United Nations' Principles for Responsible Investment (PRI), which commits signatories to incorporate environmental, social, and governance (ESG) data into investment analysis and decisions. The scope of PRI’s influence is significant: its signatories collectively manage over $34 trillion, roughly 15% of global investable assets (36). Within the United States, 10% ($2.7 trillion) of the assets under professional management are invested with social and environmental responsibility in mind (21). Long-term investments, such as those made by pension funds, insurance companies, and sovereign wealth funds lead the trend toward the adoption of ESG data into portfolios’ risk and return profiles (37, 38).

Unpacking the Business Case for the Environmental Reporting and Valuing Natural Capital

There is no denying that one motivation behind corporate sustainability is the desire to burnish a company’s image (39). Intangible assets such as management quality and reputation now account for 80% of the market value of an average US company, compared with only 17% in 1975 (40). In addition, firms with positive environmental profiles appear more attractive to high-quality prospective employees (41–43). They have also been found to retain a more satisfied and productive labor force (44–47).

Beyond reputation and workforce advantages, several prominent case studies and reports have argued that a failure to address environmental issues will undermine business performance. For example, the “Risky Business” report commissioned by Michael Bloomberg, Tom Steyer, and Hank Paulson incorporated the latest climate science from the Intergovernmental Panel on Climate Change (IPCC) and the US National Climate Assessment into quantified estimates of the effects of climate trends on the US economy (48). Other case studies note the importance of quantifying the value of environmental services such as biodiversity (49) and water (50) to business. As examples of the business case for prudent environmental management are mounting, corporations are realizing that they depend on nature and healthy functioning ecosystems to thrive (26).

Business is competitive, and it is important to know whether those companies that embrace sustainability fare better than those that neglect sustainability. There are some empirical studies that suggest a proactive approach to environmental issues enhances consumer loyalty and financial performance (51–53). In addition, several broader statistical metaanalyses (but not all) have found a general positive correlation between measures of corporate environmental and social responsibility and long-term financial performance (54–58). One of the challenges in linking financial performance to environmental performance is the fact that there is no simple metric of the latter, and different measures yield different results (20). In addition, there may exist a substantial time lag between “good behavior” and any detectable uptick in a company’s reputation (59).

Limitations of Existing Measurement and Reporting

A significant obstacle to the usefulness of environmental disclosure and sustainability assessments is the inconsistency of reporting methods. Dozens of assessment tools have been developed by NGOs and business coalitions, and they vary widely in their selection of indicators (18, 60). As a result, investors and sustainability rating agencies find it challenging to compare ESG data in reports (38).

To overcome the lack of consistency, a number of groups have promoted guidelines, but the guidelines have not quieted critics of current reporting standards (61). For instance, the Global Reporting Initiative (GRI) guidelines, which is one of the most widely used reporting frameworks (16), is questioned because its environmental scores are determined by level of disclosure, not by environmental performance (61). And, whereas the GRI provides some guidance on the incorporation of ecosystem services (62), it does not standardize the selection of performance indicators or methods of measurement. In general, sustainability reporting often presents detailed descriptions of processes, such as management and compliance, but neglects to disclose complete environmental impacts (20, 21). The result is a pattern of selective environmental disclosure whereby companies tend to report outcome metrics that make their performance look good (20, 21). The point of environmental disclosure should be to manage toward improved performance, but rarely is there a link between disclosure and actions that lead to observed improved performance (63, 64).

Even the many professional service firms whose job it is to analyze sustainability do not deliver full portraits of environmental value. For example, these firms may be hired by a company and then provide a one-off analysis tailored to its interests, rather than conducting an objective analysis of environmental linkages. Firms that provide sustainability ratings of many different companies often rely on proprietary data and confidential models to apply financial value to ecosystem attributes. As a result, investors tend to lack confidence in company sustainability scores (21).

In sum, corporations and their stakeholders lack critical knowledge about the environmental implications of company operations. Despite technological advances to supply chain management, methodological shortcomings of sustainability measurement and a dearth of decision-support tools hinder corporate analysis of environmental impacts and risks (65). According to a recent survey of corporate professionals (n = 700), the integration of sustainability into core business functions remains a considerable challenge (66).

Avenues for Ecosystem Science to Engage with Corporate Environmental Disclosure

There is immense opportunity to address weaknesses in MNCs’ environmental disclosure as the links between the environment and supply-chain disruption, commodity price spikes, and labor unrest grow more pronounced (23, 48). Corporate leaders sense that businesses now need to know more than ever before about their full supply-chain impacts and risks, ideally before their stakeholders (9, 13, 24–26). This desire for information would be well-served with support from ecosystem scientists and investment in expanded environmental data coverage.

The rapidly developing field of ecosystem service science has made it clear that, with the exception of climate regulation, access to ecosystem services is tightly linked to local and regional patterns of land and water use. The supply of these services is key to supply chains and risk management and in turn can be degraded or improved by corporate decisions. However, environmental disclosures rarely attend to these explicit links. For example:

-

•

few deal with implications for land conversion or changes in coastal and marine habitats;

-

•

few explicitly link business activities to material dependence on ecosystem services;

-

•

few deal with sustainable harvest or sustainable use of renewable resources like soil;

-

•

none of the existing reporting frameworks take into account cumulative impacts and in turn the possibility of thresholds or nonlinearity in ecosystem responses; and

-

•

few are geographically explicit—by which we mean that few adjust impacts or dependencies to the local context.

Failure to address these environmental feedbacks between corporate activities and ecosystem services is a missed opportunity.

Instead of rigid templates for reporting, standards should take the form of a targeted series of “questions” or “inquiries” about business practices and their links to the environment, and then simplified, consistent presentations of information to investors and consumers. The structured inquiry that is used to define each corporation’s actual environmental disclosures would examine the following dependencies and impacts: (i) land cover/land use conversion, (ii) air quality–greenhouse gas emissions and other airborne pollution, (iii) fresh water supply and quality, (iv) sustainable use of renewable resources (e.g., soil for agriculture) and sustainable harvest or use (e.g., of fish or timber), and (v) coastal and/or marine habitat degradation or conversion.

Companies with similar supply chains would track similar indicators. For example, some businesses may end up reporting primarily on water supplies, flood risk, and water quality. Coastal businesses may report on the status of local shoreline habitats that are key to property protection (67). Consumer goods companies that rely on biomaterials may report primarily on land conversion.

A significant missed opportunity that warrants scientific attention is the assessment of cumulative environmental impacts, for which any particular corporation’s impacts depend on what degradation has already occurred (68–70). Such analyses may require coordinated scientific efforts aimed at quantifying the total effects of business practices on local environmental assets (e.g., habitats, water, productive soil) throughout the value chain (e.g., siting and sourcing, production processes, plant operations). Companies could use cumulative impact assessments to weigh risks and tradeoffs, adjust operational strategies, and identify critical environmental metrics to monitor and report.

One major scientific challenge is addressing the possibility that cumulative impacts risk crossing an ecological threshold. Scientific understanding of and ability to predict thresholds is still in an early research stage. Thus, although there is consensus that once too much forest is cut, landslides and floods become likely, and once some threshold of habitat loss or degradation has been crossed, species will disappear, exactly where these thresholds exist is highly uncertain (71). This current uncertainty is not a reason to ignore thresholds. If scientists communicated threshold risks to business operations, companies might then be more likely to address cumulative impacts in their sustainability assessments.

To further complicate matters, risk estimates will need to be tailored to local geography and ecologies. For example, the withdrawal of 1 million L of water from an arid region will have a different risk than withdrawing the same amount of water from an area with ample flows of water. Similarly, trends in climate or development impacts are spatially heterogeneous.

One reason given for an absence of credible information in current reporting is that the data are too expensive and difficult to gather (72, 73). Indeed, every sustainability report cannot demand original scientific modeling to examine thresholds. Rather, the scientific community might generate and regularly update indices of ecosystem-collapse risks according to geography, much as the IPCC currently updates and revises its climate models and risks of negative impacts every 4 years. Similarly, inventory data on development activities such as power generation, infrastructure, and water withdrawals could improve consistency in life-cycle assessments and other strategic business-risk evaluations (65, 74). Several global efforts are working to increase the accessibility of environmental-change information, often based on cutting-edge satellite and remotely sensed data (75, 76). If these environmental intelligence platforms succeed, they could lower the cost of acquiring environmental data throughout the supply chain and make individualized and spatially explicit sustainability reporting routine. In the future, we might imagine standard corporate environmental disclosures to include a summary table that examines the environmental components we discussed in this section.

Sustainable or “Green” Labels as a Related Phenomenon

Improving the consistency and scientific credibility of annual corporate environmental disclosures could have a spillover effect and also improve the “green” labeling of consumer products. In particular, the same environmental indicators that inform corporate reports could ideally inform the labeling of products and in turn influence consumers.

There are several instances in which market pressure from consumers has created a business advantage to producing environmentally responsible products (77, 78). On the flip side, consumer boycotts of products perceived as socially irresponsible pose significant risks to corporate brands and earnings, particularly because online communities and social networks can rapidly organize brand boycotts (79, 80).

Just as an absence of standards and consistency haunt corporate sustainability reports, this lack of rigor undermines the power of consumer labeling. Consumers frequently report that they are skeptical and confused by company disclosures on sustainable product labels (84–86). Indeed, in 2010, 95% of “greener” products were found to have some form of greenwashing (disinformation that presents a sustainable image) (87).

There is some indication that the provision of credible information is key to motivating consumer action, with a number of recent studies suggesting that a growing consumer segment favors environmentally friendly products if provided with specific information on their impacts (81–83). In a recent survey, 63% of consumers agreed that they would make more sustainable purchases if they had a clearer understanding of what makes a product environmentally or socially responsible (88). Therefore, advancing these green or “sustainably produced” labels with more scientific information may be important to validating company performance and improving consumer response.

Case Studies: The Agricultural Sector and Apparel Industry

As outlined in Avenues for Ecosystem Science to Engage with Corporate Environmental Disclosure, five ecosystem attributes important for all MNCs to evaluate include land use, air quality, water supply and quality, use of renewable resources, and impact to coastal and/or marine habitats. The consistent consideration of these dimensions would strengthen the materiality assessments that many companies already undertake.

It is clear that no single sustainability report card will suit all sectors. An expansive analysis by the Governance and Accountability (G&A) Institute of 84 performance indicators across 1,246 organizations confirms that companies from separate sectors differ widely in their prioritization of environmental and performance issues (89). A sector-specific approach is consistent with recent academic recommendations on improving corporate disclosures (90) and with the production of industry-specific sustainability-reporting guidelines by the Sustainability Accounting Standards Board (SASB).

To illustrate how our proposed dimensions might be used, we discuss how ecosystem science can inform indicators for agricultural sustainability and the apparel sector. We select these case studies because they represent the second wave (after forest products and fisheries) of businesses self-organizing around sustainability metrics. The Walmart-initiated Sustainability Consortium (TSC) and McDonald’s pledge to use only “sustainable beef” are major ventures to advance sustainability in the agricultural sector, but the credibility of these commitments is uncertain and methods to accomplish their goals are still being developed (91, 92). The apparel industry provides an example of how companies are coordinating to share data and methods based on mutual interest in improving sustainability tools. In 2012, 49 companies self-organized the Sustainable Apparel Coalition (SAC)—representing over 30% of global market share in the industry—to develop a sustainability index suiting a wide variety of apparel and footwear products (93). The SAC is recognized as an exemplary model of collaboration for creating standardized industry-sustainability benchmarks (94).

Ecosystem Science Informing Agricultural Sustainability

Land use and land cover, water supply and quality, and soil maintenance represent the key dimensions of agricultural sustainability. Greenhouse-gas emissions are also an important outcome of different agricultural practices, but their impact is global and diffuse as opposed to local and immediate. New science is especially needed to establish relationships between specific agricultural practices and their impacts and dependencies on water supply, as well as their influence on soil stewardship as a renewable resource.

Quantity and Quality of Freshwater.

Global water consumption and water quality are strongly influenced by agricultural practices. The global water footprint from crop production is 7.4 trillion m3/y (95), not including 913 billion m3/y for grazing and 46 billion m3/y for livestock’s direct water footprint (96). Altogether, agricultural production accounts for 70% of water withdrawals (97). Agricultural water use in arid or water-scarce regions also contributes to desertification and other forms of soil degradation.

Data on agricultural water use are relatively easy to obtain because individual farmers understand how their management activities influence their water use. Spatial information on agricultural and other water uses might help farmers adjust their practices to more effectively conserve for irrigation. This information would also be useful for businesses and investors to advance their risk assessments of water scarcity and to distinguish between possible advances to water-use practices and precipitation trends outside their control.

Water pollution from nutrients, pesticides, or sediments has a clear, direct impact on freshwater systems and on human wellbeing. Inputs of nitrogen and phosphorous are likely the most significant and tractable factors in evaluating the effects of agriculture upon freshwater systems (98). There are several potential thresholds of interest with regard to water quality. Some pollutants will cause no adverse effect at sufficiently low concentrations, cross a threshold where an adverse effect is detectable, and cross another series of thresholds where conditions become lethal for various freshwater species or have human health impacts (99).

At the global and national level, we recommend focusing on identifying areas with relatively high nitrogen and phosphorous loading in streams. Some countries have excellent data on nutrient loading. For example, the Water Quality Portal from the National Water Quality Monitoring Council (NWQMC) includes extensive data for the United States, Canada, and Mexico and limited data for Cape Verde, Guatemala, Iraq, and Peru (100).

Renewable Resources: Soil.

Healthy soil is the foundation for farm productivity, but it is increasingly under threat. The global mean rate of soil loss is roughly ten times the rate at which soil is replenished (101). Several science efforts have sought to develop composite soil-quality indices that combine measurable soil properties into a metric of overall soil quality (102–108). But to be practical, a considerably simpler approach is needed that does not require so much elaborate data.

For the sake of discussion here, we target soil retention and soil organic carbon (SOC). The two are closely related because soil erosion is a major contributor to declines in SOC within agricultural fields (105–110). Soil erosion is the primary form of soil degradation (109), and it is a major driver of desertification of agricultural lands (111). SOC both reflects and controls primary productivity (109), which directly impacts agriculturally-oriented businesses. Furthermore, atmospheric carbon emissions due to soil erosion are significant; they are roughly equivalent to 16% of carbon emissions from fossil-fuel combustion and cement production, or 55% of carbon emissions from land-use change (110).

Remotely sensed reflectance within visible and near infrared (VNIR) bands can be used to estimate SOC, with 74–77% accuracy at coarse scales (112). At finer scales (at least in the US), we can also predict changes in organic matter under various agricultural management practices using the Soil Conditioning Index from the US Department of Agriculture Natural Resources Conservation Service (NRCS) (113).

As an indication of what could be done with these data, in 1998, the NRCS produced global maps based on water erosion (114), wind erosion (115), and desertification (116). These coarse datasets identify areas with potential for erosion or desertification risk, but, to actually predict erosion, local data on agricultural management practices are also required (117). Several studies have shown how to use remote sensing to detect tillage practices (118–120), which suggests that it may soon be possible to link information about where a crop was grown to the risk of crossing a soil-sustainability threshold. For businesses that source agricultural products—whether it be for food or biofuels or bioplastics—these maps of “soil risks” would reveal where part of their supply chain might be vulnerable to further degradation.

To put this information together, an agricultural company might track and report by region: water use, soil loss, soil organic carbon, and nutrient addition associated with its agricultural production. These measures could be indexed by the risk associated with the regions where the crops are grown. The risk adjustments would depend on ecosystem service models and threshold models, using the best available coarse data. Water and soil measurement would be the responsibility of the company or independent NGO auditors using methods suggested by scientists. In stark contrast to labels like “GMO-free” or “organically grown,” which are based on practices that may or may not be linked to desired outcomes, these metrics would directly assess environmental outcomes that impact both the environment and business.

The Apparel Industry: A Model of Industry Collaboration

The apparel industry offers an example of how companies have collaborated on the development and implementation of industry-wide sustainability benchmarks. The Sustainable Apparel Coalition (SAC) has worked since 2010 to develop a self-assessment tool for companies, the Higg Index, which covers sustainability issues common to the apparel and footwear industries. The SAC effort convened over 100 members, including brands, retailers, manufacturers, service providers, and trade associations. The result is that now major retailers such as Target are already undertaking analyses with the Higg Index.

Whereas the Higg Index represents a success of industry collaboration, it does not go far enough in guiding companies' measurement of environmental impact and dependence. Instead of quantitative data, the Index reflects industry consensus around which sustainability issues are most important. It is a good starting point for more data-based indices.

Nike in particular has moved beyond the Higg Index for data-based environmental reporting at the product level. In particular, Nike’s Materials Sustainability Index (MSI) offers a compelling example of a science-based life-cycle analysis (LCA) approach (121, 122) to tracking environmental impacts throughout complex supply chains. The MSI is notable for its use in everyday business decisions about what materials are selected for Nike’s products. The MSI is intended to capture environmental impacts from “cradle-to-gate,” meaning raw materials to a finished textile or a product’s component part.

Nike published its MSI through a Creative Commons license to encourage information sharing (123). Today the MSI is the basis of a public digital app to inform the choices of any designer or manufacturer, and each type of impact in the MSI is based on publicly disclosed LCA studies and supplier-derived information (123, 124).

The development of the MSI reveals the complexity of life-cycle analyses. According to Nike, a typical sneaker incorporates 30 or more different materials, each with distinct procurement impacts. The company estimates that 60% of the life-cycle environmental impacts of sneakers come from these material choices (123). The process to create the MSI involved an assessment of 80,000 materials from 1,400 potential suppliers and an extensive review by Duke University researchers to verify its scientific foundations (123, 124).

The MSI is also notable for the ecosystem attributes it is missing. The index rates materials in terms of energy use and greenhouse gas emissions, water and land use intensity, and physical waste, but there are critical elements missing from these evaluations. There is no consideration of soil loss, minimal consideration of impacts on water quality, and no sense of where local context matters or possible thresholds exist. For example, land-use intensity represents how much land is required to produce each unit of product but does not capture whether that land use is in a region of conservation and biodiversity value. It is an open question as to whether Nike’s MSI represents the best we can reasonably create to index sustainability performance. However, because the data, algorithms, and assumptions for calculating MSI scores are available for anyone to examine and to improve, there is an opportunity for scientists to ask that question.

Improving Product Labels

Industry-wide sustainable apparel labels that allow one to compare products between different producers or brands will likely require several more years of collaboration, development, and uptake. In the meantime, several leading brands are offering their consumers ways to compare the sustainability of items within their collections.

For example, Puma recently released a product-level EP&L analysis to value and compare the impact of Puma products with their conventionally produced counterparts. Consumers can purchase biodegradable items from Puma’s InCycle collection, which were shown to reduce overall impact (in terms of greenhouse gas emissions, water, waste, air pollution, and land use) by roughly 30% (125).

Similarly, Levi’s offers apparel identified as less environmentally impactful. The company’s “Waste<Less” collection incorporates a minimum of 20% postconsumer recycled content in its materials, and it’s “Water<Less” jeans are advertised to use up to 96% less water in some styles (126, 127).

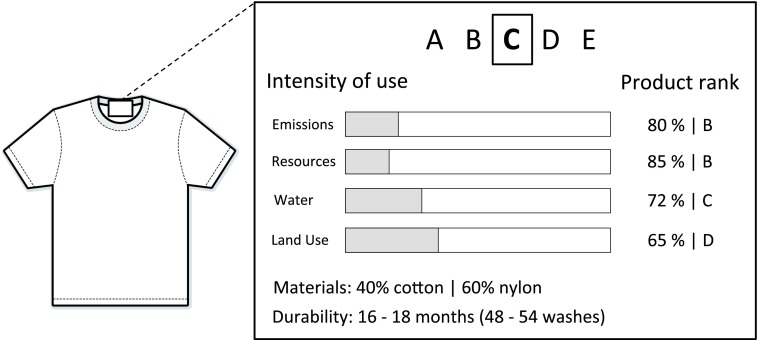

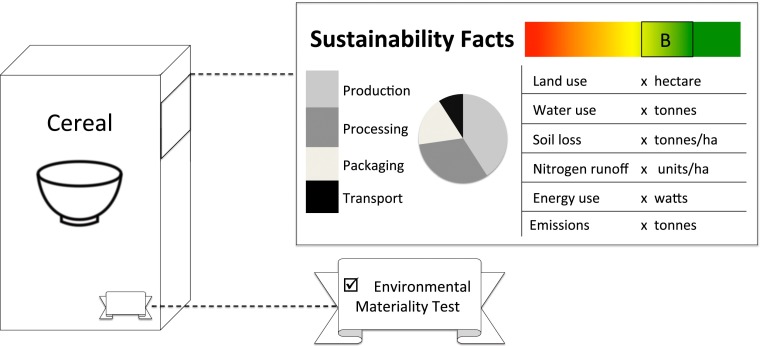

We can imagine labels in the future that incorporate key measures of production impact (e.g., land cover/land use conversion, greenhouse gas emissions, water use, sustainable use of renewable resources) that are decided on by industry-wide consortiums such as the SAC. For example, an item of clothing might be labeled with relative impacts on standard environmental indicators and be graded according to its performance and durability, as in Fig. 1. Labels for other consumer products might also present information on the absolute amount of resources being used, similar to a nutritional label display, or use a certification system that is based on this information, as shown in Fig. 2. Many models for advancing eco-labels will likely be proposed, and their adoption will require the collaborative effort of companies and the scientific community to agree upon industry standards that both capture critical environmental dimensions and are practical to report.

Fig. 1.

Sample apparel label presenting sustainability information. Labels might compare the environmental performance of the product with others in the industry. For example, this T-shirt has an average environmental performance (grade C) as determined by its rank across environmental indicators. Labels might also include the durability of a product, informing consumers of its typical lifespan, which could encourage purchasing of goods that lasted longer.

Fig. 2.

Sample cereal label showing environmental dimensions on which the sustainability score could be based and a breakdown of relative lifecycle impacts. A certification label indicating that this assessment has occurred could be displayed in addition to the “Sustainability Facts” label.

What Will Be Needed for Corporate Sustainability Reporting to Improve Global Sustainability?

Most environmentalists and sustainability scientists would agree that a sustainable planet hinges on improved corporate practices. However, methods to modify corporate behavior vary greatly. Our suggestion to deepen collaboration between ecosystem scientists and corporations is a departure from a well-trodden approach of vilifying their environmental misdeeds. Although public-opinion campaigns and boycotts against MNCs have been successful in changing the sourcing of some products, these episodic victories can require several years of continued pressure, and their lasting impacts are unpredictable.

Calls for a more sustainable capitalism are growing louder in the business community and among academics (128–132), suggesting that the time is ripe for collaboration. We argue that any approach to systemic change must address corporate environmental decision-making protocols. The mechanisms to achieve this change will include market-driven pressure from consumers as well as advances to ecosystem science describing businesses' material dependence on the environment. However, it is noteworthy that mandatory disclosure is likely necessary. When reporting is voluntary, there is too much opportunity for selective disclosure.

If natural capital degradation is treated as a true cost by these massive entities, we can imagine an economic system that rewards resource efficiencies and more effectively yields shared value for business and society. Such a system will likely require mandatory corporate disclosure of several ecosystem dimensions. Consensus on industry-specific environmental indicators, standardization of impact metrics, and strong incentives for MNCs to meet reporting requirements will be needed. Scientists, NGO organizations, and government entities can each contribute to creating these enabling conditions for companies to improve their practices. Indeed, scholars are calling for further coordination among these groups to advance big-brand sustainability and global environmental governance (92, 94).

In the natural sciences, major advances to ecosystem modeling are urgently needed in the identification of thresholds and in data collection and management. Particularly important is the development of spatially explicit environmental data in accord with the fact that impacts and dependencies (for all but emissions) depend on local contexts and geographies. Social scientists will have a critical role in continuing their examination of corporate behavior and in identifying the most common motives for companies to prioritize the environment. NGOs will continue to be important auditors of company performance, and their assessments will likely improve with standard presentations of environmental information. Governments and stock exchanges can facilitate the material consideration of environmental issues by mandating integrated reports, which present shareholders with sustainability and financial information together.

Although many obstacles likely lay ahead, there are also compelling reasons to believe in the potential of concerted collaboration. Asset managers and financial institutions are interested in these data—and, if they were standardized, they could better guide investors. Consumers are also interested in these data, if they are credible and easy to interpret. The success of the dolphin-safe label in persuading customers to buy labeled tuna, in conjunction with strong legislative support for the definition of the label, demonstrates the potential for green labels to shape consumer decisions in a way that is relevant to environmental outcomes (133, 134). Label standards can also influence manufacturers to make improvements. For example, several businesses are shifting their seafood procurement in response to rating systems like the Monterey Bay Aquarium’s Seafood Watch and the Marine Stewardship Council’s certification (135, 136).

Ultimately, corporate environmental management is unlikely to improve unless models and measurement are grounded in scientific understanding of ecological systems. To meet this need, the scientific community should expand its focus on using environmental data and monitoring solely for its own research, and embrace the potential of applying new data and information to private-sector decision-making. There may be no better pathway to a sustainable future than the incorporation of natural capital accounting into corporate practices and reporting. Without such reporting, “short-termism”—which is reflected in the observation that, from 1975 to 2010, the average length of time a stock was held on the New York Stock Exchange (NYSE) declined from 6 years to less than 7 months (137)—will continue to drive business toward environmental abuse. The time is ripe to standardize corporate environmental sustainability disclosures with sound ecosystem service science.

Supplementary Material

Footnotes

The authors declare no conflict of interest.

This article is a PNAS Direct Submission.

This article contains supporting information online at www.pnas.org/lookup/suppl/doi:10.1073/pnas.1408120111/-/DCSupplemental.

References

- 1.Transnational Institute (TNI) 2014 State of Power 2014 (Transnational Institute Publications, Amsterdam, The Netherlands). Available at www.tni.org/briefing/state-power-2014. Accessed August 7, 2014.

- 2.Keys TS, Malnight TW, Stoklund CK. 2013 Corporate Clout 2013: Time for Responsible Capitalism (Strategy Dynamics Global Ltd, Princes Risborough, United Kingdom). Available at www.globaltrends.com/reports/?doc_id=500539&task=view_details. Accessed August 7, 2014.

- 3.Carbon Disclosure Project (CDP) Sector Insights: What is Driving Climate Change Action in the World’s Largest Entities? Carbon Disclosure Project; London: 2013. [Google Scholar]

- 4.TruCost . Natural Capital at Risk. Trucost Plc; London: 2013. [Google Scholar]

- 5.Rothkopf D. February 27, 2012 Inside Power, Inc.: Taking stock of big business vs. government, Foreign Policy. Available at www.foreignpolicy.com/articles/2012/02/27/inside_big_power_inc. Accessed April 29, 2014.

- 6.Brundtland GH. Report of the World Commission on Environment and Development, Our Common Future. United Nations; Oslo, Norway: 1987. [Google Scholar]

- 7.Fernandez-Feijoo B, Romero S, Ruiz S. Commitment to corporate social responsibility measured through global reporting initiative reporting: Factors affecting the behavior of companies. J Clean Prod. 2014 doi: 10.1016/j.jclepro.2014.06.034. [DOI] [Google Scholar]

- 8.Hahn R, Kuhnen M. Determinants of sustainability reporting: A review of results, trends, theory, and opportunities in an expanding field of research. J Clean Prod. 2013;59:5–21. [Google Scholar]

- 9.Patchell J, Hayter R. How big business can save the climate. Foreign Aff. 2013;92(5):17–22. [Google Scholar]

- 10.Bishop J, editor. The Economics of Ecosystems and Biodiversity in Business and Enterprise. Earthscan; London: 2012. [Google Scholar]

- 11.Environmental Leader (EL) LLC 2013 Insider knowledge: Lessons learned from corporate environmental sustainability and energy decision-makers, Environmental Leader. Available at www.environmentalleader.com/2013-insider-knowledge-report/. Accessed May 10, 2014.

- 12.Corporate EcoForum and The Nature Conservancy (TNC) 2012 The New Business Imperative: Valuing Natural Capital. Available at www.corporateecoforum.com/valuingnaturalcapital/. Accessed July 1, 2014.

- 13.Hanson C, Ranganathan J, Iceland C, Finisdore J. Guidelines for Identifying Business Risks and Opportunities Arising from Ecosystem Change. Version 2.0. World Resource Institute; Washington, DC: 2012. [Google Scholar]

- 14.Perera A, Putt Del Pino S, Oliveira B. 2013. Aligning Profit and Sustainability: Stories from the Industry (World Resources Institute, Washington, DC), Working paper.

- 15.Ernst & Young LLP (EY) and GreenBiz Group . Six Growing Trends in Corporate Sustainability. EY Publications; London: 2013. [Google Scholar]

- 16.KPMG International 2013 The KPMG Survey of Corporate Responsibility Reporting 2013. Available at www.kpmg.com/Global/en/IssuesAndInsights/ArticlesPublications/corporate-responsibility/Documents/corporate-responsibility-reporting-survey-2013-exec-summary.pdf. Accessed July 14, 2014.

- 17.Initiative for Responsible Investment 2014. Current Corporate Social Responsibility Disclosure Efforts by National Governments and Stock Exchanges (Hauser Center, Harvard, Cambridge, MA), Working Paper.

- 18.UNEP and Global Reporting Initiative GRI . Carrots and Sticks: Sustainability Reporting Policies Worldwide. GRI Publications; Amsterdam, The Netherlands: 2013. [Google Scholar]

- 19.Lyon TP, Maxwell JW. Greenwash: Corporate environmental disclosure under threat of audit. J Bus Econ Manag. 2011;20(1):3–41. [Google Scholar]

- 20.Delmas M, Etzion D, Nairn-Birch N. Triangulating environmental performance: what do corporate social responsibility ratings really capture? Acad Manage Perspect. 2013;27(3):255–267. [Google Scholar]

- 21.Delmas M, Blass VD. Measuring corporate environmental performance: The trade-offs of sustainability ratings. Bus Strategy Environ. 2010;19(4):245–260. [Google Scholar]

- 22.Gao J, Bansal P. Instrumental and integrative logics in business sustainability. J Bus Ethics. 2013;112:241–255. [Google Scholar]

- 23.Montiel I, Delgado-Ceballos J. Defining and measuring corporate sustainability: Are we there yet? Organ Environ. 2014;27(2):113–139. [Google Scholar]

- 24.McKinsey and Company . Global Survey Results: Sustainability’s Strategic Worth. McKinsey Publications; New York: 2014. [Google Scholar]

- 25.CorporateRegister.com . CR Perspectives 2013: Global CR Reporting Trends and Stakeholder Views. CorporateRegister.com Publications; London: 2013. [Google Scholar]

- 26.Tercek M, Adams JS. Nature’s Fortune: How Business and Society Thrive by Investing in Nature. Basic Books; New York: 2013. [Google Scholar]

- 27.Hawken P, Lovins A, Lovins LH. Natural Capitalism: Creating the Next Industrial Revolution. Hachette Book Group; New York: 1999. [Google Scholar]

- 28.WBCSD 2012 Biodiversity and Ecosystem Services Scaling up Business Solutions: Company Case Studies that Help Achieve Global Biodiversity Targets. Available at www.wbcsdpublications.org/viewReport.php?repID=335. Accessed July 23, 2014.

- 29.WBCSD 2013 Business Guide to Water Valuation: An Introduction to Concepts and Techniques. Available at www.wbcsd.org/Pages/EDocument/EDocumentDetails.aspx?ID=15801. Accessed July 23, 2014.

- 30.WBCSD 2011 Guide to Corporate Ecosystem Valuation: A Framework for Improving Corporate Decision-making. Available at www.wbcsd.org/work-program/ecosystems/cev.aspx. Accessed July 23, 2014.

- 31.WBCSD 2013 Eco4Biz: Ecosystem Services and Biodiversity Tools to Support Business Decision-Making. Available at www.wbcsd.org/eco4biz2013.aspx. Accessed July 23,2014.

- 32.WBCSD and IUCN 2014 Biodiversity for Business: A Guide to Using Knowledge Products Delivered Through IUCN. Available at www.wbcsdpublications.org/viewReport.php?repID=517. Accessed July 23, 2014.

- 33.State University and University of Arkansas 2013 About the Consortium. Available at www.sustainabilityconsortium.org/who-we-are/. Accessed April 10, 2014.

- 34.WBCSD 2014 Overview. Available at www.wbcsd.org/about/overview.aspx. Accessed August 13, 2014.

- 35.PUMA 2011 PUMA’s Environmental Profit and Loss Account for the year ended 31 December 2010. Herzogenaurach, GE: PUMAVision. Available at glasaaward.org/wp-content/uploads/2014/01/EPL080212final.pdf. Accessed August 6, 2014.

- 36.Principles for Responsible Investment (PRI) Association (2013) PRI Fact Sheet. Available at www.unpri.org/news/pri-fact-sheet/. Accessed March 29, 2014.

- 37.Business for Social Responsibility . Trends in ESG Integration in Investments. BSR Publications; San Francisco, CA: 2012. [Google Scholar]

- 38.Ernst & Young (EY) 2014 Tomorrow’s Investment Rules: Global Survey of Institutional Investors on Non-financial Performance. Available at www.ey.com/Publication/vwLUAssets/EY-Institutional-Investor-Survey/$File/EY-Institutional-Investor-Survey.pdf. Accessed March 29, 2014.

- 39.Costa Lourenco I, Callen JL, Castelo MC, Curto JD. The value relevance of reputation for sustainability leadership. J Bus Ethics. 2014;119:17–28. [Google Scholar]

- 40.Tomo O. 2013 Intangible Asset Market Value. Available at www.oceantomo.com/productsandservices/investments/intangible-market-value. Accessed March 30, 2014.

- 41.Brekke KA, Nyborg K. Attracting responsible employees: Green production as labor market screening. Resour Energy Econ. 2008;30:509–526. [Google Scholar]

- 42.Backhaus K, Stone BA, Heiner K. Exploring the relationship between corporate social performance and employer attractiveness. Bus Soc. 2002;41(3):292–318. [Google Scholar]

- 43.Greening DW, Turban DB. Corporate social performance as a competitive advantage in attracting a quality workforce. Bus Soc. 2000;39(3):254–280. [Google Scholar]

- 44.Dögl C, Holtbrügge D. Corporate environmental responsibility, employer reputation and employee commitment: An empirical study in developed and emerging economies. Int J Hum Resour Manage. 2014;25(12):1739–1762. [Google Scholar]

- 45.Delmas MA, Pekovic S. Environmental standards and labor productivity: Understanding the mechanisms that sustain sustainability. J Organ Behav. 2013;34:230–252. [Google Scholar]

- 46.De Roeck K, Delobbe N. Do environmental CSR initiatives serve organizations’ legitimacy in the oil industry? Exploring employees’ reactions through organizational identification theory. J Bus Ethics. 2012;110(4):397–412. [Google Scholar]

- 47.Edmans A. Does the stock market fully value intangibles? Employee satisfaction and equity prices. J Financ Econ. 2010;10(3):621–640. [Google Scholar]

- 48.Gordon K. The Risky Business Project 2014 Risky Business: The Economic Risks of Climate Change in the United States. Available at riskybusiness.org/uploads/files/RiskyBusiness_Report_WEB_7_22_14.pdf. Accessed August 8, 2014.

- 49.Bishop J, Kapila S, Hicks F, Mitchell P, Vorhies F. Building Biodiversity Business. Shell International Limited and the International Union for Conservation of Nature; London: 2008. [Google Scholar]

- 50.WBCSD 2012 Water Valuation: Building the Business Case. Available at www.wbcsd.org/Pages/EDocument/EDocumentDetails.aspx?ID=15099. Accessed July 23, 2014.

- 51.Kassinis G, Soteriou AC. Greening the service profit supply chain: The impact of environmental management practices. Prod Oper Manag. 2003;12(3):386–403. [Google Scholar]

- 52.Miles MP, Coving J. Environmental marketing: A source of reputational, competitive, and financial advantage. J Bus Ethics. 2000;23:299–311. [Google Scholar]

- 53.Sharma S, Vredenburg H. Proactive corporate environmental strategy and the development of competitively valuable organizational capabilities. Strateg Manage J. 1998;19:729–753. [Google Scholar]

- 54.Albertini E. Does environmental management improve financial performance? A meta-analytical review. Organ Environ. 2013;26(4):431–457. [Google Scholar]

- 55.Margolis JD, Elfenbein HA, Walsh JP. 2007. Does It Pay To Be Good? A Meta-Analysis and Redirection of Research on the Relationship Between Corporate Social and Financial Performance (Harvard Business School, Cambridge, MA), Working paper.

- 56.Orlitzky MO, Schmidt FL, Rynes SL. Corporate social and financial performance: A meta-analysis. Organ Stud. 2003;24:403–442. [Google Scholar]

- 57.Roman RM, Hayibor S, Agle BR. The relationship between social and financial performance: Repainting a portrait. Bus Soc. 1999;38:109–125. [Google Scholar]

- 58.Eccles RG, Ioannou I, Serafeim G. 2013. The Impact of a Corporate Culture of Sustainability on Corporate Behavior and Performance (Harvard Business School, Cambridge, MA), Working Paper 12-035.

- 59.Franks DM, et al. Conflict translates environmental and social risk into business costs. Proc Natl Acad Sci USA. 2014;111(21):7576–7581. doi: 10.1073/pnas.1405135111. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 60.Graafland J, Smid H. Drivers of Corporate Social Responsibility. In: Zoeteman K, editor. Sustainable Development Drivers: The Role of Leadership in Government, Business and NGO Performance. Edward Elgar Publishing Inc.; Northampton, MA: 2012. pp. 156–183. [Google Scholar]

- 61.Milne MJ, Gray R. W(h)ither Ecology? The triple bottom lines, the global reporting initiative, and corporate sustainability reporting. J Bus Ethics. 2013;118:13–29. [Google Scholar]

- 62.Global Reporting Initiative (GRI) 2011 Approach for Reporting on Ecosystem Services. Available at www.globalreporting.org/resourcelibrary/Approach-for-reporting-on-ecosystem-services.pdf. Accessed July 23, 2014.

- 63.Cho C, Guidry RP, Hageman AM, Patten DM. Do actions speak louder than words? An empirical investigation of corporate environmental reputation. Account Organ Soc. 2012;37:14–25. [Google Scholar]

- 64.Clarkson PM, Overell MB, Chapple L. Environmental reporting and its relation to corporate environmental performance. Abacus. 2011;47(1):27–60. [Google Scholar]

- 65.O’Rourke D. The science of sustainable supply chains. Science. 2014;344(6188):1124–1127. doi: 10.1126/science.1248526. [DOI] [PubMed] [Google Scholar]

- 66.Business for Social Responsibility (BSR) and Globescan . State of Sustainable Business Survey 2013. BSR Publications; San Francisco, CA: 2013. [Google Scholar]

- 67.Arkema KK, et al. Coastal habitats shield people and property from sea-level rise and storms. Nat Clim Chang. 2013;3:913–918. [Google Scholar]

- 68.Hobday AJ, et al. Ecological risk assessment for the effects of fishing. Fish Res. 2011;108:372–384. [Google Scholar]

- 69.Samhouri JF, Levin PS, Ainsworth CH. Identifying thresholds for ecosystem-based management. PLoS ONE. 2010;5(1):e8907. doi: 10.1371/journal.pone.0008907. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 70.Samhouri JF, Levin PS. Linking land- and sea-based activities to risk in coastal ecosystems. Biol Conserv. 2011;145:118–129. [Google Scholar]

- 71.Suding KN, Hobbs RJ. Threshold models in restoration and conservation: A developing framework. Trends Ecol Evol. 2009;24(5):271–279. doi: 10.1016/j.tree.2008.11.012. [DOI] [PubMed] [Google Scholar]

- 72.Kashmanian RM, Moore JR. Building greater sustainability in supply chains. Environ Qual Manage. 2014;23(4):13–37. [Google Scholar]

- 73.Mervis J. The information highway gets physical. Science. 2014;344(6188):1104–1107. doi: 10.1126/science.344.6188.1104. [DOI] [PubMed] [Google Scholar]

- 74.O’Shea T, Golden JS, Olander L. Sustainability and earth resources: Life cycle assessment modeling. Bus Strategy Environ. 2013;22:429–441. [Google Scholar]

- 75.Metzger MJ, et al. Environmental stratification as the basis for national, European and global ecological monitoring. Ecol Indic. 2013;33:26–35. [Google Scholar]

- 76.Scholes RJ, et al. Building a global observing system for biodiversity. Curr Opin Enviro Sustain. 2012;4:139–146. [Google Scholar]

- 77.Sarkis J, Zhu Q, Lai K. An organizational theoretical review of green supply chain management literature. Int J Prod Econ. 2011;130(1):1–15. [Google Scholar]

- 78.Yalabik B, Fairchild R. Customer, regulatory, and competitive pressure as drivers of environmental innovation. Int J Prod Econ. 2011;131:519–527. [Google Scholar]

- 79.McGriff JA. A conceptual topic in marketing management: the emerging need for protecting and managing brand equity: The case of online consumer brand boycotts. Int Manage Rev. 2012;8(1):49–54. [Google Scholar]

- 80.Braunsberger K, Buckler B. What motivates consumer to participate in boycotts: Lessons from the ongoing Canadian seafood boycott. J Bus Res. 2011;64:96–102. [Google Scholar]

- 81.Michaud C, Llerena D. Green consumer behaviour: An experimental analysis of willingness to pay for remanufactured products. Bus Strategy Environ. 2011;20:408–420. [Google Scholar]

- 82.Kemmerly JD, Macfarlane V. The elements of a consumer-based initiative in contributing to positive environmental change: Monterey Bay Aquarium’s Seafood Watch program. Zoo Biol. 2009;28(5):398–411. doi: 10.1002/zoo.20193. [DOI] [PubMed] [Google Scholar]

- 83.Rokka J, Uusitalo L. Preference for green packaging in consumer product choices: Do consumers care? Int J Consum Stud. 2008;32:516–525. [Google Scholar]

- 84.Finisterra AM, Reis R. Factors affecting skepticism toward green advertising. J Advert. 2012;41(4):147–155. [Google Scholar]

- 85.D’Souza C, Taghian M, Lamb P. An empirical study on the influence of environmental labels on consumers. Corp Commun. 2006;11(2):162–173. [Google Scholar]

- 86.Chan YS, Chang CH. Greenwash and green trust: The mediation effects of green consumer confusion and green perceived risk. J Bus Ethics. 2013;114:489–500. [Google Scholar]

- 87.TerraChoice . The Sins of Greenwashing: Home and Family Edition. Underwriters Laboratories; Northbrook, IL: 2010. [Google Scholar]

- 88.Bemporad R, Hebard A, Bressler D. Re-thinking Consumption: Consumers and the Future of Sustainability. BBMG, GlobeScan, and SustainAbility; New York: 2012. [Google Scholar]

- 89.Governance & Accountability (G&A) Institute 2014 Sustainability: What Matters? Available at www.ga-institute.com/sustainability-what-matters.html Accessed August 8, 2014.

- 90.Lydenberg S, Rogers J, Wood D. From Transparency to Performance: Industry -Based Sustainability Reporting on Key Issues. Hauser Center for Nonprofit Organizations at Harvard University; Cambridge, MA: 2010. [Google Scholar]

- 91. Liebelson D (March 20, 2014) McDonald’s definition of “Sustainable”: Brought to you by the beef industry, Mother Jones. Available at www.motherjones.com/blue-marble/2014/03/mcdonalds-sustainable-beef. Accessed August 8, 2014.

- 92.Dauvergne P, Lister J. Big brand sustainability: Governance prospects and environmental limits. Glob Environ Change. 2012;22:36–45. [Google Scholar]

- 93.Kester C, Ledyard D. The Sustainable Apparel Coalition: A Case Study of A Successful Industry Collaboration. Center for Responsible Business, University of California; Berkeley: 2012. [Google Scholar]

- 94.Nidmulo R, Ellison J, Whalen J, Billman E. The Collaboration Imperative. Harv Bus Rev. 2014;92(4):77–84. [PubMed] [Google Scholar]

- 95.Hoekstra AY. The hidden water resource use behind meat and dairy. Anim Front. 2012;2(2):3–8. [Google Scholar]

- 96.Hoekstra AY, Mekonnen MM. The water footprint of humanity. Proc Natl Acad Sci USA. 2012;109(9):3232–3237. doi: 10.1073/pnas.1109936109. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 97. UN Food and Agriculture Organization (2013) FAO Statistical Yearbook 2013. Available at www.fao.org/docrep/018/i3107e/i3107e.PDF. Accessed April 30, 2014.

- 98.Carpenter SR, et al. Nonpoint pollution of surface waters with phosphorus and nitrogen. Ecol Appl. 1998;8(3):559–568. [Google Scholar]

- 99.Rouse JD, Bishop CA, Struger J. Nitrogen pollution: An assessment of its threat to amphibian survival. Environ Health Perspect. 1999;107(10):799–803. doi: 10.1289/ehp.99107799. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 100. National Water Quality Monitoring Council (NWQMC) Water Quality Portal. Available at www.waterqualitydata.us/. Accessed April 30, 2014.

- 101.Eswaran H, Lal R, Reich PF. Land Degradation: An Overview. Responses to Land Degradation. In: Bridges EM, et al., editors. Proceedings of the 2nd International Conference on Land Degradation and Desertification. Oxford Univ Press; New Delhi: 2001. [Google Scholar]

- 102.Montgomery DR. Soil erosion and agricultural sustainability. Proc Natl Acad Sci USA. 2007;104(33):13268–13272. doi: 10.1073/pnas.0611508104. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 103.Aziz M, Ashraf T, Mahmood T, Islam KR. Crop rotation impact on soil quality. Pak J Bot. 2011;4(2):949–960. [Google Scholar]

- 104.Jackson LE, Calderon FJ, Steenwerth K, Scow KM, Rolston DE. Responses of soil microbial processes and community structure to tillage events and implications for soil quality. Geoderma. 2003;114(4):305–317. [Google Scholar]

- 105.Jokela W, Posner J, Hedtcke J, Baiser T, Read H. Midwest cropping system effects on soil properties and on a soil quality index. Agron J. 2011;103(5):1552–1562. [Google Scholar]

- 106.Karlen DL, et al. Crop rotation effects on soil quality at three northern corn/soybean belt locations. Agron J. 2006;98(3):484–495. [Google Scholar]

- 107.Seybold CA, Herrick JE. Aggregate stability kit for soil quality assessments. Catena. 2001;44(1):37–45. [Google Scholar]

- 108.Trasar-Cepeda C, Leirós MC, Gil-Sotres F. Hydrolytic enzyme activities in agriculture and forest soils: Some implications for their use as indicators of soil quality. Soil Biol Biochem. 2008;40(9):2146–2155. [Google Scholar]

- 109.Gregorich EG, Greer KJ, Anderson DW, Liang BC. Carbon distribution and losses: Erosion and deposition effects. Soil Tillage Res. 1998;47(4):291–302. [Google Scholar]

- 110.Lal R. Soil erosion and the global carbon budget. Environ Int. 2003;29(4):437–450. doi: 10.1016/S0160-4120(02)00192-7. [DOI] [PubMed] [Google Scholar]

- 111.Dregne HE. Desertification of arid lands. In: El-Baz F, Hassan MHA, editors. Physics of Desertification. Martinus Nijhoff, Dordrecht; The Netherlands: 1986. [Google Scholar]

- 112.Chen F, et al. Field-scale mapping of surface spill organic carbon using remotely sensed imagery. Soil Sci Soc Am J. 2000;64:746–753. [Google Scholar]

- 113.USDA-NRCS 2002 Guide to Using the Soil Conditioning Index. Available at ftp://ftp-fc.sc.egov.usda.gov/SQI/web/SCIguide.pdf. Accessed April 28, 2014.

- 114.USDA-NRCS 2003 Vulnerability to Water Erosion Map. Available at www.nrcs.usda.gov/wps/portal/nrcs/detail/soils/use/maps/?cid=nrcs142p2_054006. Accessed April 30, 2014.

- 115.USDA-NRCS 2003 Vulnerability to Wind Erosion Map. Available at www.nrcs.usda.gov/wps/portal/nrcs/detail/soils/use/maps/?cid=nrcs142p2_054007. Accessed April 30, 2014.

- 116.USDA-NRCS 2003 Global Desertification Vulnerability Map. Available at www.nrcs.usda.gov/wps/portal/nrcs/detail/soils/use/maps/?cid=nrcs142p2_054003. Accessed April 30, 2014.

- 117.USDA Economic Research Service 2013 Agricultural Productivity in the U.S. Available at www.ers.usda.gov/data-products/agricultural-productivity-in-the-us.aspx#.U2EnT-ZdW9U. Accessed April 30, 2014.

- 118.Serbin G, Daughtry C, Hunt ER, Brown DJ, McCarthy GW. Effect of soil spectral properties on remote sensing of crop residue cover. Agron J. 2009;73(5):1545–1558. [Google Scholar]

- 119.Daughtry C, Serbin G, Reeves JB, III, Doraiswamy PC, Hunt ER., Jr Spectral reflectance of wheat residue during decomposition and remotely sensed estimate of residue cover. Remote Sens. 2010;2(2):416–431. [Google Scholar]

- 120.Aguilar J, Evans R, Vigil M, Daughtry C. Spectral estimates of crop residue cover and density for standing and flat wheat stubble. Agron J. 2012;104(2):271–279. [Google Scholar]

- 121.European Environment Agency 1997. Life Cycle Assesment: A Guide to Approaches, Experiences and Information Sources (European Environment Agency, Copenhagen), Environmental Issues Series No. 6.

- 122.Hellweg S, Milà i Canals L. Emerging approaches, challenges and opportunities in life cycle assessment. Science. 2014;344(6188):1109–1113. doi: 10.1126/science.1248361. [DOI] [PubMed] [Google Scholar]

- 123.Nike, Inc. 2012 Nike Materials Sustainability Index. SAC Release. Available at www.apparelcoalition.org/storage/Nike_MSI_2012_0724b.pdf. Accessed April 28, 2014.

- 124.NikeResponsibility.com Material Choice and Impact. Available at www.nikeresponsibility.com/infographics/materials/index.html. Accessed April 30, 2014.

- 125. Puma (2012) New PUMA Shoe and T-Shirt Impact the Environment by a Third Less than Conventional Products. Puma Press Release. Available at www.trucost.com/news-2012/156/new-puma-shoe-and-t-shirt-impact-the-environment-by-a-third-less-than-conventional-products. Accessed April 30, 2014.

- 126.Levi Strauss & Co 2014 Sustainability. Available at www.levistrauss.com/sustainability/enduring-brands/levis-less-platform/. Accessed April 30, 2014.

- 127.Levi Strauss & Co 2014 Water<Less. Available at store.levi.com/waterless/index.html. Accessed April 30, 2014.

- 128. Barton D (March 2011) Capitalism for the long term. Harvard Business Review. Available at https://hbr.org/2011/03/capitalism-for-the-long-term. Accessed April 30, 2014.

- 129.Dunning JH. Making Globalization Good: The Moral Challenges of Global Capitalism. Oxford Univ Press; Oxford: 2003. [Google Scholar]

- 130. Generation Investment Management LLP (2012) Sustainable Capitalism. Available at www.generationim.com/media/pdf-generation-sustainable-capitalism-v1.pdf. Accessed April 30, 2014.

- 131. Barton D, Wiseman M (January 2014) Focusing capital on the long-term. Harvard Business Review. Available at https://hbr.org/2014/01/focusing-capital-on-the-long-term. Accessed April 30, 2014.

- 132.Hart SL, Prahalad CK. New Age of Sustainable Capitalism: Business Models to Drive Growth and Social Change. Pearson Education, Inc.; Upper Saddle River, NJ: 2013. [Google Scholar]

- 133.Ramach J. Dolphin-safe tuna labeling: Are the dolphins finally safe? Virginia Environ Law J. 1996;15:743–784. [Google Scholar]

- 134.Teisl MF, Roe B, Hicks RL. Can eco-labels tune a market? Evidence from dolphin-safe labeling. J Environ Econ Manage. 2002;43(3):339–359. [Google Scholar]

- 135. Compass Group North America (May 14, 2009) Compass Group Announces Results of Landmark Policy to Purchase Sustainable Seafood. Available at compass-usa.com/pages/News-Release-Viewer.aspx?ReleaseID=60. Accessed April 30, 2013.

- 136.Gutiérrez NL, et al. Eco-label conveys reliable information on fish stock health to seafood consumers. PLoS ONE. 2012;7(8):e43765. doi: 10.1371/journal.pone.0043765. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 137. Oxford Martin Commission for Future Generations (2013) Now for the Long Term (Oxford Martin School Publications, Oxford)

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.