Abstract

We examined the role of affect (pleasant or unpleasant feelings) and decision frames (gains or losses) in risk taking in a 20-day stock investment simulation in which 101 participants rated their current feelings while making investment decisions. As predicted, affect attenuated the relationships between decision frames and risk taking. After experiencing losses, individuals made more risky choices, in keeping with the framing effect. However, this tendency decreased and/or disappeared when loss was simultaneously experienced with either pleasant or unpleasant feelings. Similarly, individuals’ tendency to avoid risk after experiencing gains disappeared or even reversed when they simultaneously experienced pleasant feelings.

One of the most commonly cited deviations from rational decision making is what is commonly referred to as the “framing effect”—that is, the tendency for people to avoid risk when a decision is framed in terms of potential gains—and to instead increase risk when a choice is framed in terms of potential losses (Kahneman & Tversky, 1979; Tversky & Kahneman, 1991, 1992). Widely accepted in the literature as a dominant descriptive theory of irrational choices (see Hastie and Dawes [2001] and Bazerman [2006] for reviews), the framing effect has been extensively applied to understanding firm-level risk choices and supported in various empirical settings (e.g., Audia, Locke, & Smith, 2000; Baum, Rowley, Shipilov, & Chuang, 2005; Chattopadhyay, Glick, & Huber, 2001; Fiegenbaum & Thomas, 1988; Greve, 1998; Jegers, 1991; Lant, Milliken, & Batra, 1992; Wiseman & Gomez-Mejia, 1998). Yet, despite its status, the framing effect is not robust at the individual level of analysis (Sitkin & Pablo, 1992; Wiseman & Catanach, 1997). For example, in a meta-analysis of 136 empirical studies Kühberger (1998) concluded that the framing effect was of only small to moderate size and that nearly a quarter of the effects examined (28%) were either nonsignificant or in the direction opposite to prediction.

A growing body of research suggests that human affect1 is an important individual-level factor that influences both risk perception and risk choice (cf. Rottenstreich & Hsee, 2001; Shiv, Loewenstein, Bechara, Damasio, & Damasio, 2005; Slovic, Finucane, Peters, & MacGregor, 2002). This literature suggests that deviations from the framing effect can be attributed to affective states. Yet past research has shown complex and inconsistent patterns of affective influence on risky choice (cf. Au, Chan, Wang, & Vertinsky, 2003; see Isen [2000] for a review), making it difficult to explain how and when such affective deviations may occur. For example, positive affect has promoted risk seeking in some studies (e.g., Au et al., 2003; Isen & Patrick, 1983) but risk aversion in others (e.g., Arkes, Herren, & Isen, 1988; Isen & Geva, 1987). Isen and her colleagues (e.g., Isen, Nygren, & Ashby, 1988; Nygren, Isen, Taylor, & Dulin, 1996) have suggested that one factor responsible for these inconsistent findings might be a decision’s situational context, which in turn influences how the decision is framed. Through a series of experimental studies, they found that people in a positive feeling state (compared with those in neutral affective states) were more risk averse only when a possible loss appeared real and salient. However, positive feelings led to greater risk seeking in other conditions (e.g., Isen et al., 1988). These findings suggest that framing effects and affective influences on risk taking are highly interrelated; perhaps one effect cannot be precisely understood without explicitly considering the other.

In this study, we contribute to research on decision making under risk and to prospect theory in particular (Tversky & Kahneman, 1991, 1992), by examining the relationships between framing, affect, and risk taking. In so doing, we explore both the mediating and the moderating mechanisms through which a broad range of affective states—both pleasant and unpleasant feelings—systematically create deviations from predicted framing effects. We also contribute to research on affect and decision making by demonstrating that the decision frames of gain and loss are important situational factors that shift the effects of pleasant and unpleasant feelings on risk taking into functionally opposite directions by magnifying certain types of affective influences while inhibiting others.

We provide support for our theory in an empirical setting that closely mimics actual decision making under risk. Subjects were recruited from investment clubs and made investment decisions that had significant financial consequences (payoffs ranged from $100 to $1,000). These payoffs were likely to trigger a wide range of pleasant and unpleasant feelings during decision making. This situation contrasts sharply with those in past studies in which student participants have often made choices with small or hypothetical payoffs (cf. Kühberger, 1998; Kühberger, Schulte-Mecklenbeck, & Perner, 2002), potentially inhibiting the role of affect. In this sense, we complement the findings of previous experimental studies that have emphasized internal validity (cf. Kühberger et al., 2002; Rottenstreich & Hsee, 2001; Shneideman, 2008). In addition, our longitudinal research design followed individuals over time, allowing us to examine dynamic, within-person relationships among frames, affect, and risk taking, thereby extending research findings that are predominantly based on a between-individual (cross-sectional) research design (Kühberger, 1998). Since real-life decisions under risk are seldom made in isolation from previous decisions, this research design also contributes to the predictive relevance of our study.

We begin our theory development by focusing on the cognitive processes underlying the framing effect, assuming that decision makers’ affective state is held constant at the neutral level. Then we develop specific hypotheses regarding how changes in individuals’ affective states may influence risk taking by affecting these cognitive processes or bypassing them entirely.

THEORETICAL BACKGROUND AND HYPOTHESES

Much research has been devoted to understanding how managers and employees make decisions when faced with uncertainty (see Hastie and Dawes [2001] for a review). A central finding in this long stream of research is the framing effect: individuals tend to avoid risks when experiencing gains or exceeding a reference point, and they seek risks when facing losses or performing below a reference point. The framing effect has been mainly understood from the perspective of prospect theory (cf. Kühberger, 1995). As in other cognitively based decision-making theories (e.g., subjective utility theory), in prospect theory it is assumed that risky choices result from two cognitive judgments: (1) a judgment about the utility (value) of a decision outcome, and (2) a judgment about the subjective probability of that outcome. To generate predictions consistent with the framing effect, prospect theory suggests that individuals frame decisions relative to a reference point, so that the marginal utility decreases as the decision outcome deviates from this reference point. (Kahneman & Tversky, 1979; Tversky & Kahneman, 1991, 1992). Prospect theory also explains that the utility is further weighted by the subjective probability assessments that overweight low-probability outcomes and underweight high-probability outcomes. Such weighting may overwhelm the framing effect when the probability of an outcome is very small. This feature reconciles the theory with “one-in-a-million” phenomena such as the purchase of negative expected–value lottery tickets or a greater fear of travel on airplanes than travel in cars.

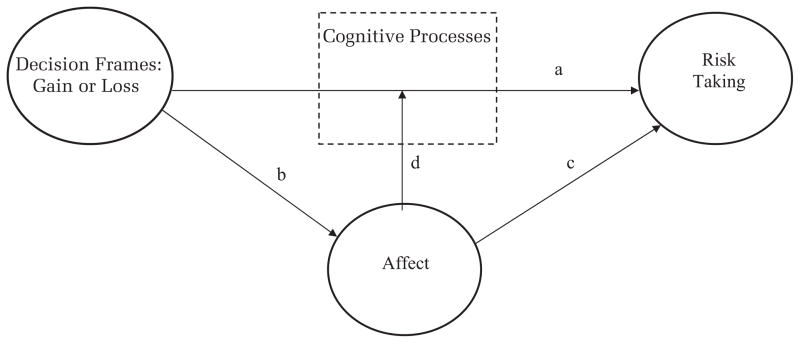

In general, scholars explain the framing effect using a consequentialist assumption that people make decisions after weighing the risks and payoffs associated with possible choices (Loewenstein, Weber, Hsee, & Welch, 2001). As illustrated in Figure 1, one’s wealth position relative to a reference point (i.e., perceived as a gain or a loss) is subject to cognitive processes (e.g., utility functions and probability weights), which in turn determine risk taking (arrow “a”). The implicit assumption here is that any factors unspecified in these relationships remain constant or do not influence risk taking. If there is a third variable, affect, that mediates (arrows “b” and “c”) or moderates (arrow “d”) the relationship between decision frames and risk taking, the framing effect may be suppressed or amplified.

FIGURE 1.

Cognitive and Affective Processes Underlying the Framing Effect

Prior to further discussing the possible mediating and moderating roles of affect, we propose the main predictions of the framing effect as baseline hypotheses2 while assuming that decision makers’ affective states are held constant at the neutral level:

-

Hypothesis 1a

Gain is negatively related to risk taking.

-

Hypothesis 1b

Loss is positively related to risk taking.

Research suggests that risk perceptions and associated choices may be influenced by affect experienced at the moment of decision making (e.g., Isen, 2000; Loewenstein et al., 2001; Raghunathan & Pham, 1999; Rottenstreich & Hsee, 2001; Shiv et al., 2005; Slovic et al., 2002). For example, Shiv and colleagues (2005) recently found that in an experimental investment setting in which expected gains were greater than expected losses, brain-damaged patients who could not process affective information achieved better investment performance than control group patients. The control patients, who could process affect normally, consistently avoided risk after either a gain or a loss. This study provided strong evidence that affect influences risk taking, although it did not investigate how risk taking changed with the nature and degree of affect.

The literature suggests two possible mechanisms—mediation and moderation—through which affect may influence risk taking. We explore both these mechanisms, and to this end, we focus on a fundamental dimension of core affect, pleasant and unpleasant feelings (Barrett, 2006a, 2006b; Russell, 2003; Russell & Barrett, 1999), as our unit of analysis to understand decision makers’ affective experiences. Past studies on affective structure (e.g., Barrett & Russell, 1998; Russell & Carroll, 1999; Watson, Wiese, Vaidya, & Tellegen, 1999) have suggested that pleasant and unpleasant feelings as well as their cognitive and behavioral consequences are neither independent of each other (e.g., Barrett & Russell, 1998), nor complete bipolar opposites (e.g., Erber & Erber, 1994; Forgas, 1991; Raghunathan & Pham, 1999). Therefore, we treated them as negatively correlated but distinctive entities in both our theory development and empirical investigation.

The Mediating Role of Affect in the Framing Effect

Core affect is characterized as the constant stream of transient alterations in an organism’s neurophysiological state that represents its immediate relationship to the flow of changing events (Barrett, 2006a; Russell, 2003; Russell & Barrett, 1999). Pleasant and unpleasant feelings, as the most basic dimension of core affect, summarize how well/badly, positively/negatively, or appetitively/aversively one is doing in relation to his or her current environment. Thus, any change in the environment that is meaningful to one’s goal or well-being is likely to induce pleasant and/or unpleasant feelings, a positive change for pleasantness and a negative change for unpleasantness (Frijda, 1986; Lazarus, 1991; Ortony, Clore, & Collins, 1988).

Because individual wealth is a fundamental element of one’s personal environment, changes in one’s wealth position, framed as gains or losses, are likely to induce a range of pleasant or unpleasant feelings (arrow “b” in Figure 1). In particular, gain may be positively related to pleasant feeling and negatively related to unpleasant feeling, whereas loss is likely to increase unpleasant feeling and decrease pleasant feeling. This view is consistent with many anecdotal accounts telling how investors often experience strong feelings while engaging in their day-to-day investment activities (e.g., Babin & Donovan, 2000; Lo, 2002). Once induced, those pleasant and unpleasant feelings are likely to influence decision makers’ choices in several distinctive ways (cf. Loewenstein et al., 2001; Seo, Barrett, & Bartunek, 2004).

An accumulating body of research suggests that affect can directly influence individuals’ choices by bypassing and/or overpowering cognitive processes entirely (e.g., Berridge & Winkielman, 2003; Gray, 1999; LeDoux, 1996; Shah, Friedman, & Kruglanski, 2002). For example, Winkielman, Zajonc, and Schwarz (1997) produced affectively charged responses in liking ratings and drinking behavior through exposure to a stimulus presented for 1/250 of a second, an interval so short that there is no conscious recognition of the stimulus. Likewise, it is possible that affect may bypass cognitive assessment of risk and directly influence risk choices (arrow “c” in Figure 1) and thus mediate the effect of decision frames on risk taking. If this bypassing occurs, the approach or avoidance orientations inherent in the hedonic quality of affect (cf. Gray, 1999; Raghunathan & Pham, 1999; Shah et al., 2002) may cause decision makers experiencing pleasant feelings to ”approach” risky choices and pursue greater risk, whereas decision makers experiencing unpleasant feelings may ”avoid” risky choices and take less risk (cf. Bargh & Chartrand, 1999; Cacioppo, Gardner, & Berntson, 1999; Frijda, 1986; Peters & Slovic, 2000). Supporting these arguments, Au and his colleagues (Au et al., 2003) found in two foreign exchange trading experiments that traders experiencing pleasant feelings placed larger bets, but those with unpleasant feelings made more conservative choices.

Accordingly, we hypothesize that pleasant and unpleasant feelings mediate the relationships between decision frames and risk taking. Moreover, this mediation may work in a direction that is functionally opposite to the hypothesized negative relationship between gains and risk taking (Hypothesis 1a) because a gain will lead to more pleasant feeling and/or less unpleasant feeling, both of which will increase risk taking. Similarly, pleasant and unpleasant feelings are likely to mediate the hypothesized positive relationship between loss and risk taking (Hypothesis 1b) because an increased loss will lead to more unpleasant and/or less pleasant feelings, both of which will decrease risk taking:

-

Hypothesis 2a

Gain has a positive indirect relationship with risk taking through the mechanism of pleasant feelings: gain is positively related to pleasant feelings, and pleasant feelings are positively related to risk taking.

-

Hypothesis 2b

Gain has a positive indirect relationship with risk taking through the mechanism of unpleasant feelings: gain is negatively related to unpleasant feelings, and unpleasant feelings are negatively related to risk taking.

-

Hypothesis 2c

Loss has a negative indirect relationship with risk taking through the mechanism of unpleasant feelings: loss is positively related to unpleasant feelings, and unpleasant feelings are negatively related to risk taking.

-

Hypothesis 2d

Loss has a positive indirect relationship with risk taking through the mechanism of pleasant feelings: loss is negatively related to pleasant feelings, and pleasant feelings are positively related to risk taking.

The Moderating Role of Affect in the Framing Effect

A considerable body of literature suggests that affective states influence cognitive processes involved in decision making under risk (arrow “d” in Figure 1), including memory (e.g., Erber, 1991; LeDoux, 1993; Meyer, Gayle, Meeham, & Harman, 1990) and judgments (e.g., Johnson & Tversky, 1983; Meyer, Gaschke, Braverman, & Evans, 1992; see Forgas [1995] and Schwarz and Clore [2003] for reviews). In pioneering work, Isen and her colleagues (e.g., Isen & Geva, 1987; Isen & Patrick, 1983; Isen et al., 1988) and later others (e.g., Finucane, Alhakami, Slovic, & Johnson, 2000; Loewenstein et al., 2001; Rottenstreich & Hsee, 2000; Slovic et al., 2002) have suggested that affect experienced at the moment of decision making might influence cognitive processes associated with risk choices in two ways. First, affect may influence subjective probability judgments (e.g., Finucane et al., 2000; Loewenstein et al., 2001; Rottenstreich & Hsee, 2000; Slovic et al., 2002). Scholars have found a general effect known as mood congruence judgment (e.g., Meyer et al., 1992), whereby individuals in pleasant affective states tend to perceive positive events or outcomes as more likely (cf. Rottenstreich & Hsee, 2001; Wegener & Petty, 1996), whereas those in unpleasant affective states assign greater likelihood to negative events or outcomes (e.g., Johnson & Tversky, 1983). These effects may occur because pleasant and unpleasant feelings involve encoding and retrieving positive and negative memories from the brain that indirectly influence one’s judgment of the likelihood of positive or negative events (cf. Erber, 1991; Le-Doux, 1993; Meyer, Gayle, Meeham, & Harman, 1990). In addition, pleasant and unpleasant feelings convey evaluative information regarding whether a situation is safe or problematic, which may directly influence judgments of the probability of positive or negative events (Schwarz, 1990; Schwarz & Clore, 1983; 1988). Second, pleasant and unpleasant feelings may influence the utility judgments associated with possible outcomes (e.g., Damasio, 1994; Finucane et al., 2000; Isen et al., 1988; Seo et al., 2004). For example, scholars have found two general effects of pleasant and unpleasant feelings rooted in the two distinctive motivational impetuses of seeking pleasure and avoiding displeasure (Wegener & Petty, 1996). The mood maintenance effect is a tendency to maintain current pleasant feelings by avoiding situations that may take away those pleasant feelings (e.g., Forgas, 1995; Isen, 2000). Formally, such behavior implies increased utility associated with avoiding possible losses, and all else being equal, greater risk aversion (Isen et al., 1988; Nygren et al., 1996). The mood repair effect is a tendency to behave in ways that change current unpleasant feelings toward more positive ones by actively seeking situations likely to bring about more pleasant feelings (Forgas, 1991, 1995; Morris & Reilly, 1987). This implies increased utility of gains, and greater risk taking (Forgas, 1991; Raghunathan & Pham, 1999).

Taken together, these effects suggest that affect may moderate the relationship between framing and risk taking. However, the mood congruence effect on subjective probability may be functionally opposite to the mood maintenance and mood repair effects on utility judgments. For example, pleasant feeling can positively influence subjective probability of possible gains and thus foster risk seeking through the mood congruence effect. Yet these same pleasant feelings may simultaneously promote risk aversion by increasing the negative utility of losses through the mood maintenance effect. Therefore, different risk behaviors may arise depending on whether mood congruence or mood maintenance/repair is more dominant in a given situation (cf. Au et al., 2003; Isen, 2000).

Isen and her colleagues (e.g., Isen & Geva, 1987; Isen & Patrick, 1983; Isen et al., 1988; Nygren et al., 1996) have provided important theoretical insights regarding how the decision frame of gain or loss is likely to shift the relative positions of the opposing effects. In a series of experimental studies, they found that risk aversion dominated both when individuals experienced positive, as opposed to neutral, feelings, and when possible losses were real and salient. In contrast, risk taking became dominant when possible losses were not salient. These results suggest that decision frames may determine when we might expect mood congruence or mood maintenance/repair to dominate by making future gains or losses appear more or less salient to decision makers.

In particular, the mood congruence effect is likely to be dominant when individuals’ current decision frame of gain or loss matches the valence of their current feelings, which may happen when pleasant feelings are experienced after gains or, alternatively, when unpleasant feelings are experienced after losses. To explain, individuals who experience a gain may also perceive future gains as more likely because the possibility is more accessible in memory. Moreover, they may simultaneously view future losses as unlikely because these are perceived as less relevant future events. When such individuals also experience pleasant feelings, the mood congruence effect may strengthen the salience of the future gains, but the mood maintenance effect should be minimized because future losses appear remote. Conversely, the mood maintenance/repair effect should dominate when the current decision frame mismatches the valence of the current feelings. This would happen when pleasant feelings are experienced after losses or, alternatively, when unpleasant feelings are experienced after gains, for reasons external to the gains or losses. For example, a gain and unpleasant feelings should prompt individuals to experience (1) a weakened mood congruence effect because future losses are seen as less likely because of their recent experience of gain and (2) a strengthened mood repair effect because future gains are more salient and thus more attractive.

Below we consider four permutations—pleasant feeling amidst gains, pleasant feeling amidst losses, unpleasant feelings amidst losses, and unpleasant feelings amidst gains—more systematically and summarize each with a testable hypothesis.3

Pleasant feelings in the midst of gains

When pleasant feelings are experienced in the midst of gains, the mood congruence effect leads individuals to estimate that a future gain is more likely. The experienced gain makes the prospect of future gains more salient, magnifying the effect. In contrast, although the mood maintenance effect may increase the utility associated with losses, currently experienced gain makes potential losses seem less salient. This minimizes the mood maintenance effect on the utility of losses. As a result, mainly owing to enhanced probability estimates for future gains, pleasant feelings experienced following recent gains moderate (attenuate) the usual risk-aversion framing effects of gains and lead to greater risk taking. Thus, we hypothesize:

-

Hypothesis 3a

Pleasant feelings attenuate the negative relationship between gain and risk taking.

Pleasant feelings in the midst of losses

When pleasant feelings are experienced following recent losses, future losses become salient, which in turn may prompt individuals to avoid such salient negative events and subsequently increase the utility associated with losses (i.e., a mood maintenance effect). Since a current loss position makes potential gains seem less salient in the future, however, the individuals’ tendency to perceive future gains more likely is diminished (a mood congruence effect), as is the related risk-seeking tendency. As a result, pleasant feelings experienced within a loss frame may moderate (attenuate) the typical risk-taking orientation prompted by losses in such a way that individuals become more risk averse. Thus, we predict:

-

Hypothesis 3b

Pleasant feelings attenuate the positive relationship between loss and risk taking.

Unpleasant feeling in the midst of losses

Similarly, when individuals experience both unpleasant feelings and large losses, the salience of the current negative events (the losses) amplifies the mood congruence effect and accordingly increases the effect of unpleasant feeling on the subjective probability of losses. The recent loss also makes future gains seem less salient, which in turn weakens the mood repair effect and decreases the utility of pursuing nonsalient future gains. As a result, mainly by magnifying probability estimates for losses, unpleasant feeling experienced following a recent loss may moderate (attenuate) the usual risk-seeking effect of loss and prompt individuals to become more risk averse. Thus, our next hypothesis is:

-

Hypothesis 3c

Unpleasant feelings attenuate the positive relationship between loss and risk taking.

Unpleasant feelings in the midst of gains

When individuals have unpleasant feelings following a recent gain, the prospects of future gains become more salient and real. This prominence amplifies the mood repair effect and increases the utility of pursuing such salient and positive future events. Moreover, the recent experience of gains makes future losses seem less salient. The mood congruence effect is depressed, as individuals are less likely to focus on nonsalient negative events and their probabilities. As a result, unpleasant feelings experienced in the midst of gains may moderate (attenuate) the usual tendency for individuals to become risk averse following gains and instead prompt them to become risk seeking. Therefore, we hypothesize:

-

Hypothesis 3d

Unpleasant feelings attenuate the negative relationship between gain and risk taking.

METHODS

To explore the role of framing and affect in risk taking, as part of a larger data collection (e.g., Seo & Barrett, 2007; Seo & Ilies, 2009), we developed and ran an internet-based stock investment simulation combined with an experience sampling procedure (e.g., Barrett, 1998; Barrett & Barrett, 2001; Feldman, 1995). Experience sampling procedures, in which thoughts and feelings are measured at the time they are being experienced, minimize the memory biases that are typically observed when using retrospective self-report measures (e.g., Barrett, 1997).

The stock investment simulation consisted of 20 investment sessions, 1 session for each day over 20 consecutive business days. Each day, participants logged onto the stock investment simulation website and viewed market and stock information pertaining to 12 anonymous stocks, checked their current investment performance (which also determined their monetary reward after the simulation), and finally, made investment decisions about which and how many shares of stocks to buy or sell for the day. All information was updated daily after the public market closed, and one set of decisions was allowed each day. Importantly, just before making investment decisions, participants reported their current affect.

Each participant was rewarded at the end of the simulation conditional on full participation. Rewards were distributed as a function of performance relative to the local stock index (expressed as the difference in percentage between an individual’s current stock portfolio value and its initial value), and ranged from $100 to $1,000 ($100, less than 3 percent; $150, between 2.99 and 1 percent; $200, between 99 and .99 percent; $250, between 1 and 2.99 percent; $300, between 3 and 4.99 percent; $350, between 5 and 6.99 percent; $400, 7 percent and above; $500, above 7 percent, and third place among the participants; $750, above 7 percent, and second place; and $1,000, above 7 percent, and first place). The local stock market index was a function solely of the performance of the 12 stocks in the national markets; hence, subjects had no influence on local prices.

Sample

We recruited 118 private stock investors for the stock investment simulation from six investment clubs4 located in the New England area. Their ages ranged from 18 to 74 years (mean = 24.7, s.d. = 13.2). As is typical in most investment clubs, the majority of them were male (86 of 118, or 80%). Their investment experience was 4.3 years on average (s.d. = 7.4), ranging from 0 to 50 years. A total of 108 participants (91.5%) completed the simulation task and generated 2,059 daily observations. Seven participants (totaling 126 daily observations) were dropped because of noncompliance with instructions; a further 57 daily observations were eliminated because of reported interruptions during the simulation; and 6 cases were eliminated because of data transmission errors. In all, we analyzed 1,870 daily observations stemming from 101 participants.

Procedures

For 20 consecutive business days (four weeks), participants logged onto a website once between 6:00 p.m. and 9:00 a.m. the next morning. Upon logging in (each using a unique code name and password), they were reminded that they should avoid interruption as much as possible while participating in the simulation. They were also reminded that the task was strictly individual based and that thus they must not discuss it with or get advice from any other person during the entire period of the simulation. They were then asked to describe their current day, including the amount of time they had spent to catch up on the stock market and their initial prediction of the day’s national stock market condition.

The initial screen reported the daily stock market information, including daily changes and five-day trends of three major national stock market indexes (e.g., the Dow Jones Industrial Average, the NAS-DAQ composite index, and the S&P 500 index), and of the local market index, the composite index of the 12 anonymous stocks selected for this study.5 The next page contained information for these 12 stocks. Participants saw generic individual stock names (e.g., stock A, B, and C) as well as the current price (normalized to $100.00 on day 1), daily price change (%), average price change for the past five days, beta coefficient (measuring a stock’s volatility in relation to the market), one-year stock performance (the percent change in stock price over the trailing 52 weeks), the price-earnings ratio (a ratio of stock price to its trailing 12-month earnings per share), and company size (sales volume). Then participants saw a report that summarized their current investment performance and expected reward. In addition, they saw their current cash balance, the total value of their current stock portfolio, the number and average performance of the participants in the simulation, and the performance of the best performer in the simulation.

On the next page, participants rated the various feelings that together comprised their current affective state (core affective feelings of pleasantness and activation). Moving to the next page, they reported their subjective beliefs, aspirations, and goals for various aspects of the investment simulation.

On the subsequent page, participants made their own investment decisions on which stocks to sell and which to buy for the day. Each participant was initially given hypothetical cash of $10,000 and allowed to invest all or a part of it in any of the 12 stocks in the local market with no transaction costs and as long as the cash balance did not go below zero. All mathematical calculations required for investment decision making were automatically and instantly performed by the simulation. For reference, the current national and local market and stock information that participants had seen in the previous pages also became available on a separate web page.

Before logging out, participants saw their investment summary in a table and explained the reasons behind their investment decisions for that day. Then they reported whether, when, and how long any type of interruptions had occurred during the tasks for the day. This process was repeated daily for 20 business days.

Measurement

Dependent variable: Risk taking

Risk-taking was measured in two ways. First, we measured the weighted averaged beta coefficient in a subject’s stock portfolio. The beta coefficient of each stock, which participants saw every day during the simulation period, was a measure of the volatility of the stock price in relation to the stock market (cf. Bodie, Kane, & Marcus, 2001).6 This is a well known parameter of a stock’s potential risk. Second, we measured the degree of diversification in individuals’ portfolios. Diversification is a well-known financial strategy for avoiding risk (cf. Bodie et al., 2001). As our measure of diversification, we used Herfindahl’s index, the sum of the squares of the weighted share of portfolio stocks (0 < index < 1). A lower score on the index indicates less risk taking, and a higher score indicates greater risk taking.

In addition, we created a compound measure of risk taking as a product of the degree of diversification and the weighted averaged beta coefficient.7 The weighted averaged beta coefficient reflects the level of volatility of the portfolio relative to the national market, and the degree of diversification dampens the effects of price changes of individual stocks relative to the local market. Thus, more diversified portfolios contain less risk, even if they have the same average beta. Since rewards were distributed according to performance relative to the local market, riskier portfolios contained a few high-beta stocks, whereas a risk-free portfolio would be fully diversified over the 12 stocks. This latter case, in which the diversification score was zero, was without risk, as it mimicked the local market index, which in turn determined rewards. The compound measure captured this intuition and hence was our preferred measure of risk. Moreover, it was superior to an additive measure that would have assigned a certain degree of risk to a perfectly diversified portfolio because of the positive value of its averaged beta coefficient.

Gain and loss

In the simulation, performance relative to the local market determined final rewards and was prominently reported daily to each participant. Thus, we expected this to be the primary reference point around which individuals framed their decisions. Performance was measured as the difference between an individual’s return (Vt) relative to its initial position (V1) and the market index return (mktt) relative to its initial position (mkt1), per Equation 1:

| (1) |

Given the expected differences between risk taking in the realms of gains and losses, we measured the variable gain (the maximum of performancet and 0) and the variable loss by taking the absolute value of the negative scores of performance and setting all other (nonnegative) scores at 0 (the minimum of performancet and 0).

It was important to ensure that our measures of gain and loss corresponded to the frames that participants used for their decisions. In particular, although a performance level below the local market return (a positive loss score) incurred a reduction of monetary reward from the initial endowment of $200, it is possible that participants perceived it as a small gain rather than a loss.

To assess this possibility, we examined two sets of findings, both of which suggested that our measures of gains and losses represented the decision frames adopted by most participants. First, gain scores significantly and positively predicted pleasant feelings such as satisfaction (β = .20, p < .001) and excitement (β = .18, p < .001), whereas loss scores significantly and negatively predicted unpleasant feelings such as disappointment (β = .17, p < .001) and irritation (β = .13, p < .001). This finding suggests that our measures of gain and loss were, on average, perceived as positive and negative events. Most importantly, loss scores would be unlikely to predict unpleasant feelings if the majority of the participants perceived them as small gains. Second, we asked the participants to indicate the degree to which they perceived their current performance as either positive progress (0 = “neutral,” 1 = “slightly good,” 2 = “notably good,” 3 = “very good”) or negative progress (0 = “neutral,” 1 = “slightly bad,” 2 = “notably bad,” 3 = “very bad”) toward their current goal (a reference point). When participants performed above the local market return, in keeping with our measure of gain, most of them perceived their current performance as positive progress toward their goal (positive = 67%, neutral = 23%, negative = 10%, n = 716). In contrast, when participants performed below the local market return, in keeping with our measure of loss, the majority perceived their current performance as negative progress towards their goal (negative = 76%, neutral = 16%, positive = 7%, n = 1,062). This pattern would not have been observed if the goal (reference point) of the majority of participants was far below the local market return. This might have indicated that their current performance below the local market return (losses) could be perceived as positive progresses.

Affect

Although we focus on basic feelings of pleasure or displeasure, core affect simultaneously consists of another fundamental dimension, called “activation” or “arousal,” which refers to the degree to which an individual is feeling a sense of energy or mobilization (Barrett, 2006a, 2006b). Together, the pleasantness dimension and the activation dimension map out a broad range of affective experiences into a two-dimensional circular space, commonly called the affective circumplex. For example, an individual who is feeling excited is feeling pleasantness and activation, whereas a calm individual is experiencing pleasantness and deactivation. To examine the effect of the pleasantness dimension on risk taking independent of the activation dimension, we measured and controlled for the activation dimension.

Drawing on conceptual and empirical examination of the core affective structure by Barrett and Russell (1998), we selected 16 items, all rated on a scale ranging from 0, “not at all,” to 4, “extremely so,” that captured both the pleasantness and activation dimensions of the affective circumplex and measured the four anchors of these two dimensions, so that the measures of one dimension were relatively neutral in the other dimension (by sampling items that are neutral in the other dimension and/or selecting equal numbers of items rated high and low on the other dimension). In particular, we first measured the two anchors of the pleasantness dimensions: pleasant and unpleasant feelings. Pleasant feeling was the average score of four items (“happy,” “satisfied,” “enthusiastic,” and “relaxed”) that are positively valenced and at the same time centered on neutral activation (α = .82). Unpleasant feeling was similarly computed by averaging the scores of four items (“sad,” “disappointed,” “depressed,” and “irritated”) that are negatively valenced and centered on neutral activation (α = .83). Next, we measured the two anchors of the activation dimension, activated and deactivated feelings. We assessed activated feeling by averaging the scores of four items (“aroused,” “surprised,” “interested,” and “nervous”) that are high in activation and neutral in pleasantness (α = .61), and deactivated feeling by averaging the scores of four items (“quiet,” “still,” “calm,” and “tired”) that are low in activation and neutral in pleasantness (α = .64).8

Other controls

Although performance relative to the local market was the most obvious frame of reference provided to each participant in each session, several other features of the stock investment simulation suggested that participants might have used alternative frames of reference. To explore the robustness of the results, we explicitly measured and controlled for these alternative frames.

First, given that an individual’s entire performance history was also reported, we considered two possible alternative reference points: immediate performance and its three-day moving average. Immediate performance was measured as the difference between an individual’s current performance (performancet) and his or her performance at the previous round (performancet − 1) for each period t. Immediate gain was measured by taking the positive scores of immediate performance and holding all other (nonpositive) scores constant at 0 (i.e., the maximum between immediate performance and 0), and immediate loss was measured by taking the absolute value of the negative scores of immediate performance and setting all other (nonnegative) scores at 0 (i.e., the minimum between immediate performance and 0). Average three-day gain was the three-period moving average of immediate gain. Average three-day loss was the three-period moving average of immediate loss.

Second, participants may have had different aspiration levels regarding their performance in this stock investment simulation, and these aspiration levels could be used as alternative frames of reference for their investment decisions. To control for this possibility, every day we asked participants to report to which performance level, as measured by performance relative to the local market, they aspired. Participants could choose one of these percentages: −5, −4, −3, −2, −1, 0, 1, 3, 5, 10, 20, or 30. We first computed performance-to-aspiration by subtracting the reported aspiration level from the current performance level. Then, we measured gain-to-aspiration by taking the positive scores of performance-to-aspiration and holding all other (nonpositive) scores constant at 0, and loss-to-aspiration by taking the absolute value of the negative scores of performance-to-aspiration and holding all other (nonnegative) scores constant at 0.

Third, cash rewards to the top performers were strongly and positively skewed. Hence, some individuals may have evaluated their performance with reference to the performance of the top performer. The measure relative to best performer measures the absolute value of the difference between a participant’s performance and the top performer’s performance. Since there was only one top performer in any given period, all except the top performer experienced negative performance relative to this potential reference point.9

In addition, as discussed below, we statistically controlled for individual-level differences (e.g., gender, age, skills, personalities, etc.) and for any period-related effects (e.g., weather, stock market movements, political events, increased learning and comfort with the simulation itself, etc.).

Analysis

We used a fixed effects (within-subject) regression methodology to predict risk-taking levels as a function of individuals’ decision frames and affective states. The fixed effects methodology is appropriate when there is heterogeneity associated with a decision maker that remains constant over the period of analysis (Griliches & Mairesse, 1998). This approach allowed us to control for any individual-specific (fixed) effects that might be related to risk-taking propensity, so all of the results reported reflect within-individual variation.

We estimated the following model:

where yit is the risk taking of individual i in period t; Zit is a matrix that contains measures for individual i at period t of performance (broken up into gain and loss), affective state (broken up into positive and negative components) and, depending on specification, their interactions; dt is a period dummy (20 periods, the first omitted); γi is an individual effect, that is, any individual characteristic, such as risk preference, that is fixed over the 20 periods; and ηt is an idiosyncratic error term assumed to be uncorrelated with the other variables. If this error term was correlated with the covariates, then the coefficients of interest in the vector β would be biased. Including the fixed effects parameter γi may mitigate such problems. For example, if an individual was predisposed to experiencing positive affect by underlying personality traits and similarly predisposed to risk-taking behavior, then a regression without fixed effects would incorrectly attribute risk taking to affective state as opposed to underlying traits. Use of a fixed effects methodology removes this possibility. Similarly, by including a series of period dummies (dt), we avoided possible biases stemming from factors related to a specific day (round) during the simulation period.

RESULTS

Table 1 presents the means and standard deviations of each variable and the within-person correlations among them. For most of the variables, there was substantial within-person variation (between 47 and 63 percent), which suggests that the data supported a fixed effects model. We present the fixed effects regression results in Table 2.10 All models include period dummies (i.e., indicator variables for 19 periods, the first omitted).

TABLE 1.

Means, Standard Deviations, Variance Proportions, and Correlationsa

| Variables | Mean | s.d. | Percent Variance

|

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Within | Between | ||||||||||||||||

| 1. Risk taking | 0.09 | 1.37 | 42% | 58% | |||||||||||||

| 2. Gain | 0.94 | 2.02 | 47 | 53 | −.10 | ||||||||||||

| 3. Loss | 1.41 | 2.19 | 47 | 53 | .08 | −.46 | |||||||||||

| 4. Pleasantness | 1.13 | 0.84 | 50 | 50 | −.01 | .23 | −.34 | ||||||||||

| 5. Unpleasantness | 0.79 | 0.80 | 44 | 56 | .02 | −.18 | .23 | −.48 | |||||||||

| 6. Activation | 0.97 | 0.71 | 56 | 44 | −.02 | .15 | −.16 | .40 | .09 | ||||||||

| 7. Deactivation | 1.14 | 0.72 | 53 | 47 | .02 | −.04 | −.05 | .11 | .25 | .00 | |||||||

| 8. Relative to best | 8.73 | 5.93 | 30 | 70 | .04 | .06 | .32 | −.26 | .13 | −.15 | −.16 | ||||||

| 9. Gain to aspiration | 0.18 | 0.68 | 44 | 56 | −.14 | .50 | −.16 | .07 | −.03 | .05 | −.04 | .19 | |||||

| 10. Loss to aspiration | 3.99 | 5.03 | 55 | 45 | .10 | −.42 | .42 | −.03 | .13 | −.02 | .05 | −.15 | −.47 | ||||

| 11. Immediate gain | 0.43 | 0.92 | 23 | 77 | .00 | .29 | −.17 | .39 | −.29 | .19 | −.07 | −.03 | .08 | −.13 | |||

| 12. Immediate loss | 0.45 | 0.82 | 26 | 74 | .08 | −.22 | .42 | −.35 | .33 | −.09 | −.04 | .14 | −.09 | .24 | −.40 | ||

| 13. Average three-day gain | 0.25 | 0.53 | 29 | 71 | −.07 | .49 | −.29 | .27 | −.24 | .15 | −.06 | .02 | .21 | −.29 | .41 | −.28 | |

| 14. Average three-day loss | 0.25 | 0.50 | 30 | 70 | .06 | −.25 | .57 | −.36 | .28 | −.14 | −.05 | .28 | −.10 | .25 | −.24 | .48 | −.38 |

n = 1,870 (101 participants, 20 rounds). Means, standard deviations, and correlations were computed for each individual in all rounds and then averaged for averaged within-individual correlations. Correlation coefficients that are equal to or larger than .05 are significant at a .05 level.

TABLE 2.

Results of Fixed Effects Regression Analysesa

| Variables | Model 2a: Pleasantness | Model 2b: Unpleasantness | Model 2c | Model 2d | Model 2e | Model 2f | Model 2g: Mean Beta | Model 2h: Diversification Index |

|---|---|---|---|---|---|---|---|---|

|

| ||||||||

| Risk-Taking: Mean Beta × Diversification Index | ||||||||

| Gain | 0.06*** (5.79) | −0.03** (−2.96) | −0.003 (−1.34) | −0.003 (−1.49) | −0.02*** (−3.57) | −0.11** (−2.80) | −0.04*** (−4.93) | |

| Loss | −0.05*** (−5.47) | 0.07*** (6.86) | 0.02*** (10.40) | 0.02*** (10.60) | 0.03*** (9.50) | 0.27*** (9.49) | 0.03*** (5.92) | |

| Pleasantness | −0.004 (−0.82) | 0.002 (0.42) | 0.003 (0.46) | 0.08 (1.46) | 0.003 (0.31) | |||

| Unpleasantness | 0.001 (0.22) | −0.01 (−1.13) | 0.004 (0.67) | 0.05 (0.83) | −0.003 (−0.29) | |||

| Gain × pleasantness | 0.01*** (3.76) | 0.03 (1.49) | 0.01*** (3.80) | |||||

| Loss × pleasantness | −0.01** (−3.09) | −0.08*** (−4.04) | −0.01 (−1.76) | |||||

| Loss × unpleasantness | −0.01*** (−3.57) | −0.07*** (−4.44) | 0.002 (0.77) | |||||

| Gain × unpleasantness | 0.001 (0.73) | 0.01 (0.77) | 0.002 (0.60) | |||||

| R2 | .08*** | .06*** | .09*** | .02 | .09*** | .11*** | .09*** | .15*** |

T-statistics are in parentheses. R2 reflects within-subject explained variance only. R2 significance estimates were based on F-statistics. The constant term was estimated but not reported. All regressions controlled for investment round. n = 1,870 (101 participants, 20 rounds).

p < .01

p < .001

Prior to testing our hypotheses, we examined the relationships between decision frames and affective states by regressing pleasant and unpleasant feelings on the degrees of gain and loss. As reported in models 2a and 2b in Table 2, the degree of gain was significantly and positively related to pleasant feeling, whereas the degree of loss was significantly and negatively related to pleasant feeling. Similarly, the degree of loss was positively and significantly related to unpleasant feeling, and the degree of gain was significantly and negatively related to unpleasant feeling. These results generally supported our earlier argument that experience of gain or loss is an important antecedent of decision makers’ affective states. Gain and loss together explained 8 and 6 percent of the within-person variances in pleasant and unpleasant feelings, respectively.

Testing main effects

To test Hypotheses 1a and 1b, we regressed the single product measure of risk taking to performance relative to the market index in the form of gains and losses in model 2c. To obtain a baseline, so as to better interpret the within-person variance explained by model 2c, we first estimated a model that included only the 19 period dummies (the first is omitted) and found that they explained 2 percent of the within-person variance in risk-taking behavior. As reported in model 2c in Table 2, we found support for Hypothesis 1a; participants who experienced more losses took greater risk in the simulation. However, gain did not significantly relate to risk taking, and thus Hypothesis 1b was not supported. These frames explained approximately 7 percent of the within-person variance in risk taking.

Testing mediation effects

To test the four mediation effects predicted by Hypotheses 2a, 2b, 2c, and 2d, we first estimated the individual path coefficients that comprised the mediated effects in several regression models. As discussed above (regarding models 2a and 2b), all four path coefficients linking gain and loss decision frames to affect were significant in the hypothesized directions. However, as shown in model 2d, reporting regressions of risk taking on pleasant and unpleasant feelings, neither of these was significantly related to risk taking. These results remained nonsignificant when both independent and mediating variables were simultaneously entered into the equation (model 2e), failing to meet a necessary condition for mediation (Shrout & Bolger, 2002).

Using the path coefficients estimated above, we formally tested the mediation hypotheses with the Sobel (1982) test, which estimates the product of the path coefficients comprising a given mediated effect (e.g., “b” × “c” in Figure 1) and thus allowed us to directly examine whether pleasant and unpleasant feelings significantly mediated the influence of gain and loss on risk taking. The results suggest that none of the hypothesized mediated effects were significant. Therefore, none of the mediation hypotheses were supported.

Testing moderation effects

In model 2f, we report our findings regarding the moderating effect of emotions on risk taking. The interactions between gain/loss frames and pleasant/unpleasant feelings were added. We included four separate interactions as predicted by Hypotheses 3a, 3b, 3c and 3d.

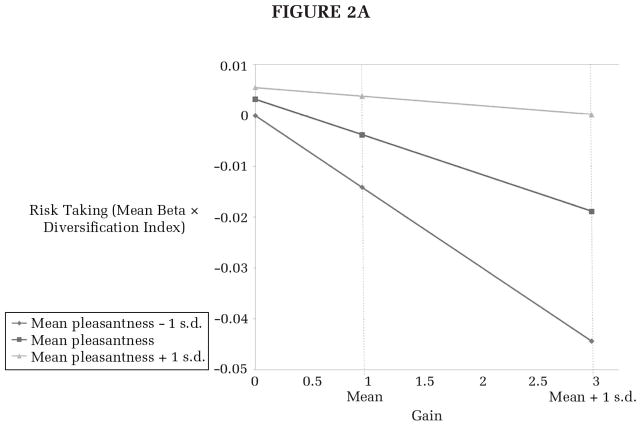

First, in keeping with Hypothesis 3a, pleasant feelings negatively and significantly attenuated the relationship between gain and risk taking; the tendency to avoid risk after a gain was weaker for those experiencing more pleasant feelings. To get a sense of the nature of this interaction effect, we plotted this relationship in Figure 2a.11 As shown in the figure, the framing effect of gain was strong when participants experienced a neutral level of pleasantness (one standard deviation below the mean). However, as individuals had more pleasant feelings, their propensity for risk taking increased. When individuals were feeling very pleasant (i.e., one or two standard deviations above the mean), the typical risk-aversion framing effect of gain was generally eliminated or reversed.

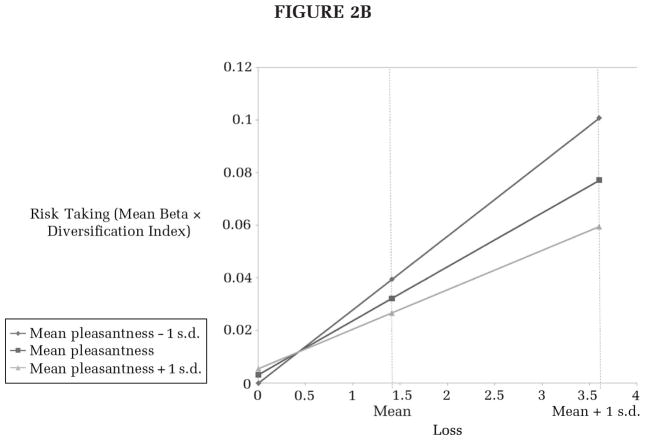

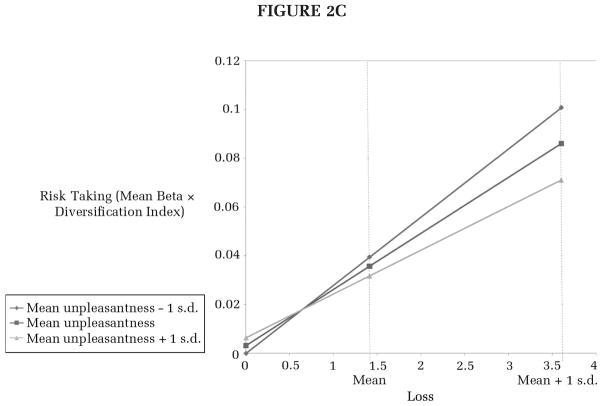

FIGURE 2.

FIGURE 2A. Moderation Effect of Pleasantness on the Relationship between Gain and Risk Taking

FIGURE 2B. Moderation Effect of Pleasantness on the Relationship between Loss and Risk Taking

FIGURE 2C. Moderation Effect of Unpleasantness on the Relationship between Loss and Risk Taking

Second, and supporting Hypothesis 3b, pleasant feelings significantly interacted with degree of loss and attenuated the relationship between loss and risk seeking. As individuals experienced more pleasant feelings despite losses, their propensity to make riskier choices diminished. Figure 2b illustrates the pattern of this interaction. For individuals feeling a neutral level of pleasantness (one standard deviation below the mean), a clear framing effect was observed (top line). However, this effect diminished as they experienced a greater degree of pleasantness. For individuals who experienced strong (one standard deviation above the mean) pleasant feelings (bottom line), the loss effect on risk seeking was substantially weakened.

In support of Hypothesis 3c, unpleasant feelings significantly attenuated the relationship between loss and risk taking. This result suggests that the propensity for taking greater risk after experiencing a loss was weaker when individuals experienced more unpleasant feelings. Figure 2c shows the pattern of this interaction effect in more detail. For individuals feeling neutral (one standard deviation below the mean), risk taking increased as losses increased (top line). However, this effect became weaker as subjects experienced more unpleasant feelings.

Finally, and contrary to Hypothesis 3d, we did not find a significant interaction between unpleasantness and gain in influencing risk taking. Thus, Hypothesis 3d was not supported.

We note that once we controlled for interactions between affect and gain/loss frames, the data supported Hypothesis 1a—that is, holding affective experience constant at the mean level, risk taking decreased following gains. This indicates that the lack of results in model 1c (the nonsignificant gain coefficient) was observed because we had not controlled for the affect of individuals who were also experiencing a gain. In addition, these interactions explained 9 percent of the within-person variance in risk taking, as opposed to the 7 percent that was explained by the framing effects alone.12

In models 2g and 2h in Table 2, we explored the sensitivity of our results to our choice of risk measure. In particular, we examined the effects of the independent variables on the beta index and the diversification index separately. In general, our findings mostly replicated those of model 2f, with two exceptions. First, the moderation effects of affect on the loss and risk-seeking relationship (Hypotheses 3b and 3c) did not predict the level of diversification. Thus, this affective influence following loss occurred mainly through the selection of less volatile stocks, rather than through increased diversification of a stock portfolio. Second, the moderation effect of pleasant feeling on the gain and risk aversion relationship (Hypothesis 3a) did not predict the averaged beta; this effect occurred mainly through diversifying a stock portfolio.

Testing activated and deactivated feelings

We examined whether our results would change if we explicitly took into account the activation dimension of core affect. In an unreported regression model, we included measures of activated and deactivated feelings as well as measures of their interactions with gain and loss frames. Including these measures had no effect on our results regarding the effects of pleasant and unpleasant feelings on risk taking. However, the results were, in and of themselves, interesting. First, including the activation and deactivation measures increased the explanatory power of the model by an amount similar to that explained by the valence measures (2%). Second, although activated and deactivated feelings had no direct effects, we found that risk taking increased for deactivated individuals who were performing poorly. Unlike pleasant and unpleasant feelings, which generally attenuated the framing effect, deactivated feeling magnified the framing effect of loss toward a greater degree of risk taking.

Testing alternative reference points

Individuals might evaluate performance using alternative frames of reference, and moreover, the choice of frames might depend on an individual’s affective state (cf. Seo et al., 2004). If this situation existed, it would lead us to conflate the impact of affective state with the impact of alternative frames. In an unreported analysis, we conducted several robustness checks of our results.13 We explored four alternative frames described in the measurement section: performance on the previous day, performance of a three-day moving average, performance relative to one’s aspiration level, and performance relative to the best performer. Alternative gain and loss frames were computed on the basis of each alternative reference point. The influence of the alternative reference points and their interactions with pleasant/unpleasant feelings were entered simultaneously with the default reference point and its interactions.

The main findings in model 2g in Table 2 were robust both statistically and qualitatively to considering each of the four alternative reference points, and further, there was little evidence that these alternative frames influenced decision making.14

In these robustness checks, we also developed and tested a series of models that allowed individuals to switch between the default reference point (the local market return) and one of the four alternative reference points. We hypothesized that the switch was related to affective states.15 We found that the switching models did not fit the data well. Our failure to find robust effects for any of the alternative frames suggests that these frames were not generally relevant to decision makers in this simulation.

DISCUSSION

The findings of this study first contribute to the literature on risk taking and the framing effect in particular (Tversky & Kahneman, 1991, 1992), in which the role of affect has received relatively little attention (cf. Rottenstreich & Hsee, 2001; Shiv et al., 2005; Slovic et al., 2002). We found that affective experiences at the moment of decision making led participants to behave in ways that sometimes were inconsistent with framing effects and generally mitigated them. In particular, we found that when individuals who experienced large gains also had pleasant feelings, they were not risk averse but instead were risk seeking. Conversely, when individuals simultaneously experienced pleasant feelings and large losses, they became less risk seeking, and when such individuals were feeling particularly pleasant, the framing effect of loss was mostly eliminated. Moreover, when individuals experienced a loss and felt unpleasant, they became less risk seeking.

These results suggest that the framing effect can be more completely understood only when decision makers’ affective states are explicitly taken into account. Indeed, we found that the framing effect only partially explained risk-taking behavior; when we did not take decision makers’ affective experiences into account, only those participants who experienced losses made riskier choices. This finding is consistent with the findings of Kühberger’s (1998) meta-analysis, in which the framing effect was not robust across empirical settings. Only after accounting for the interactions between decision frames and decision makers’ affective experiences did we find general support for the predictions of prospect theory. In particular, when decision makers’ affective experiences and their interactions with decision frames were held constant at the mean level, greater gains led to decreased risk, whereas greater losses led to increased risk.

Moreover, our results offer important theoretical implications for prospect theory (Kahneman & Tver-sky, 1979), in which the framing effect is mainly understood as a function of two cognitive properties: the subjective utilities and probabilities of decision outcomes. In particular, our finding that strong feelings generally attenuate the framing effect in the realms of both gains and losses suggests several possible mechanisms through which decision makers’ affective states may shift the utility and probability functions. Specifically, in the realm of gains, pleasant feelings may reduce risk aversion by increasing the subjective probabilities of future gains (through a mood congruence effect). In the realm of losses, unpleasant feelings may reduce risk seeking by increasing the subjective probabilities of future losses (again through to a mood congruence effect). Alternatively, pleasant feelings may increase the subjective utilities of further losses (through a mood maintenance effect) and thus diminish the risk-seeking tendency. These findings are consistent with those of several previous studies showing that affect changes risk taking by shifting the probability and utility functions (e.g., Isen et al., 1988; Rottenstreich & Hsee, 2001). Future research is needed to examine precisely how such shifts occur as a function of changes in pleasant and unpleasant feelings in the realms of gains and losses.

Second, the results of this study contribute to the literature on affect and risk taking. Scholars have discussed whether affective experiences influence risk taking directly or indirectly, via decision makers’ cognitive processes (cf. Forgas, 1995; Loewenstein et al., 2001; Seo et al., 2004). Contrary to some recent findings (e.g., Au et al., 2003; Shiv et al., 2005), this study failed to show a direct influence of decision makers’ affective states on risk taking. Instead, our findings indicate that affect influences risk taking mostly via its effect on cognitive processes, and more importantly, that affect (in this case, pleasant and unpleasant feelings) interacts with situational contexts (in this case, gains and losses) in a complex manner.

In particular, our findings support Isen and her colleagues’ (e.g., Isen & Geva, 1987; Isen, Nygren, & Ashby, 1988; Isen & Patrick, 1983) argument that the same pleasant feelings can influence the cognitive components underlying risky choice (e.g., probability or utility judgments) in functionally opposite directions toward risk, as evidenced by our results that pleasant feelings led to increased risk taking in the realm of gains but decreased risk taking in the realm of losses. Our results further extend this theoretical argument by suggesting that decision frames (gain or loss) may provide important situational contexts that determine which of the two conflicting affective influences dominates. For example, by providing a context in which potential losses appear less salient than potential gains to decision makers, experiencing a gain may magnify the influence of pleasant feelings on their probability estimates of future gains but simultaneously inhibit their influence on the utility estimates of potential losses. Consequently, pleasant feelings may promote risk-seeking propensity following gains. In contrast, pleasant feelings may foster a risk-averse tendency after an individual experiences a loss, because the decision frame of loss can make potential losses appear more salient to decision makers and thus magnify the effect of pleasant feelings on the utility estimates of potential losses.

Also as an extension to existing research, which has mainly focused on the effects of pleasant feelings on risk taking, we simultaneously examined the effects of unpleasant feelings on risk taking under varying conditions of gains and losses. However, compared to the effects of pleasant feelings, the effects of unpleasant feelings were less apparent (only the interaction with loss was supported) and weaker in magnitude. One possible explanation is that individuals may have a more differentiated understanding of unpleasant feelings (cf. Fredrickson, 2001, 2003). Moreover, this may show more complex patterns in how those differentiated negative feelings (e.g., anger versus sadness or anxiety) impact risk taking. For example, anxiety may promote risk aversion, whereas anger or sadness may foster risk taking (Lerner & Keltner, 2001; Raghunathan & Pham, 1999). Since the present study examined the effect of overall unpleasant affect on risk taking, such complex patterns may have been washed out. Future research is needed to determine whether this weaker support came from the nature of the unpleasant feelings or from the strong main effect of loss on risk taking.

Finally, we found that the activation dimension in core affect had as powerful an impact on risk taking as did the effects of the pleasant/unpleasant dimension. In particular, our results suggest that individuals experiencing deactivated feelings (absence of energy) and simultaneously experiencing losses tend to increase risk. Yet little past research has addressed the role of the activation dimension in risk taking (Cropanzano, Weiss, Hale, & Reb, 2003). This limitation makes interpretation of our results challenging. Perhaps, just as unpleasant feelings motivate “repairing” the unpleasantness of one’s current feelings (mood repair effect), deactivated feelings may motivate repairing low energy by seeking more stimulation, such as taking risks. This tendency may increase when individuals experience greater losses, which may signal that their current situation is problematic and thus requires them to have more energy to cope with it. Clearly, more research is needed to explore the role of activation in risk taking.

Practical Implications

Our results directly speak to managers and employees making decisions in organizations and facing uncertainty. Per framing effect predictions, as soon as decision makers perceive their current performance going over or under a certain reference point, they pursue lesser or greater degrees of risk. Our results suggest that through an interaction with decision frames, affective experiences generally mitigate these biases. Thus, assuming that decision frames will elicit suboptimal outcomes, a broad range of pleasant and unpleasant feelings may improve performance by correcting cognitive biases that affect risk taking. This argument is consistent with recent findings that affective experiences (intensity) are functional for decision-making performance (e.g., Seo & Barrett, 2007). In particular, our findings suggest that the corrective influences of affective experiences are stronger for pleasant feelings than for unpleasant feelings in both gain and loss conditions. Interpreted broadly, our study suggests that managerial practices that foster a broad range of affective experiences at work, particularly pleasant feelings, may improve performance. Implementation of such practices requires reexamining and unlearning the dominant beliefs, norms, and languages in organizations that discourage experiencing and expressing feelings and emotions (Ashforth & Humphrey, 1995).

Despite this potentially functional role of affect in decision making, however, our results also suggest that extremely intense pleasant or unpleasant feelings may overcorrect and reverse the framing effect. Moreover, our finding indicates that feeling an absence of physical energy (deactivation) may magnify the framing effect of loss toward a greater degree of risk taking. Therefore, this study informs decision makers to be aware of such possible affective biases in making their decisions in those situations or to avoid such situations entirely.

Limitations and Future Research Directions

Our study has several limitations. First, we did not directly examine the underlying mechanisms leading to the results of this study—how decision makers’ affective states may shift their subjective utility and probability functions in particular. We only inferred such mechanisms from our theoretical development. Thus, for example, we cannot eliminate the possibility that the nonadditive weighting of probability judgments may have systematically affected our results, nor can we take into account the effect of choices with extremely high or low outcome probabilities, which may have even overwhelmed the framing effect itself (Tversky & Kahneman, 1991). Future studies explicitly examining the role of decision makers’ subjective utilities and probabilities together with their affective states may not only reveal the underlying mechanisms through which decision makers’ decision frames and affective states interact with each other in influencing risk taking, but also enable more precise examination of such effects by controlling for the possible nonadditive weighting of subjective probabilities.

Second, our simulation is more generalizable to real-world settings, in particular to investment markets, than the simulations generally used in prior research. However, this virtue is not costless, as it comes at the expense of internal validity. For example, our measure of risk taking is a combination (product) of two major indicators, averaged beta and a diversification index. Individuals working in finance and investment frequently use these indicators. The strength of this measure is that it does not rely on participants’ risk perceptions, but is based on concrete decision outcomes objectively observable in a complex and naturally occurring setting. As a result, the practical significance of our measure of risk itself is likely to be high, in the sense that the patterns of decision outcomes (risk taking) found here are also likely to be observed in similar, natural settings. However, the flip side is that, unlike in most other experimental studies, in which risk is assessed by survey items or a forced choice between two hypothetical risky options, our measure is subject to other factors besides individuals’ perceptions of risk, and thus our models explain only relatively small percentages of its variance (7 percent was explained by the framing effects, and 2 percent by their interactions with affect). For example, some individuals may purchase high-beta stocks simply because these stocks have been rising, ignoring their beta components. In addition, our correlational research design generally makes it difficult to determine the causal relationships between the key variables. Future research is needed to increase the internal validity of these measures, perhaps through the use of both objective and subjective measures of risk.

Third, the remuneration structure for the participants in this study was designed to prevent them from incurring losses. The worst performer still got paid $100 (incurring a $100 loss from the initial baseline reward of $200). In addition, the expected gains for participants in this simulation (between $0 and $800 in cash remuneration) were much greater than the expected losses (between $0 and $100). This imbalance between possible gains and losses in the remuneration structure may have biased the results. In particular, participants may have been more sensitive to rewards and less sensitive to possible losses, and thus have taken more risk than they would have taken if the remuneration structure had been more balanced. Moreover, the lack of real and serious losses in this study might have undermined both the psychological realism and the replicability of these results to other decision-making settings in which actual and serious losses can occur. In principle, additional experimental research might need to examine the key hypotheses of this study in a setting in which a balanced range of both actual gains and losses is possible. However, since it may raise an ethical issue if experiments result in financial losses for participants, field studies are probably necessary to determine the importance of this limitation.

Fourth, as is typical in most investment clubs, participants were predominantly male (80%) and young. In addition, the participants were not randomly selected but instead drawn voluntarily from six clubs, which violated the assumption of independence among the respondents. The gender and age imbalance and the nonrandomness in the sample may have constrained the applicability of study results to the general population. Additional examination using a more gender-balanced, age-balanced, and/or randomized sample would be of value.

Fifth, we did not find direct effects of pleasant and unpleasant feelings on risk taking, in contrast to some previous studies of financial decision making (e.g., Au et al., 2003; Shiv et al., 2005). One possible explanation for this discrepancy is that, unlike other studies using a between-individual research design, we used a longitudinal panel data approach. Our results were obtained from the within-individual relationships between affect and risk taking. If the direct influence of affect on risk taking operates through other individual-level factors, a relationship would disappear when those individual factors are taken into account, as we did here. In keeping with this line of reasoning, in unreported regression analyses in which we ignored individual factors, we found that positive affect was associated with greater risk taking, though we found no relationship between negative affect and risk taking. When we analyzed each round separately, we found a similar association between positive affect and risk taking in 3 of the 20 rounds. These results suggest that taking into account individual effects is important. Nevertheless, more research is needed to determine the precise causes of this discrepancy.

Finally, this is among the relatively small number of investigations to adopt an event-contingent experience sampling procedure in the study of emotion (e.g., Barrett, 1998; Barrett & Barrett, 2001; Feldman, 1995). That is, participants’ affective states were measured at the moment they were being experienced during a meaningful event or task. This procedure was enabled by recent advances in internet technology that allowed many critical features such as online measurement, dynamic session and identity control, and instant and dynamic data transfer, transformation, and presentation to both investigators and participants. None of these would have been possible using a traditional pen-and-paper method (cf. Shneideman, 2008). We hope this methodological advance stimulates future studies that apply this method to investigation of affective experience and its effects on decision making under risk.

Conclusion

This study provides strong evidence that both affective experiences and decision frames are important factors influencing decision making under risk in an ambiguous, real-life setting. In particular, we found that in the realms of gains and losses, pleasant feelings can completely eliminate the framing effect, whose operation is a central tenet of many theories, including prospect theory. Moreover, we also found that unpleasant feelings can attenuate framing effects in the realms of gains. However, we found no direct influence of affective experience on risk taking. Thus, our results suggest that decision makers’ feelings influence risky choices by interacting with situational factors, the decision frames of gain or loss in particular. Surprisingly, we found that when such interactions happen, feelings generally negate cognitive biases associated with the framing effect.

Acknowledgments

This research was supported by a National Science Foundation (NSF DRMS #0215509, to Lisa Feldman Barrett) and a Boston College Dissertation Research Grant (to Myeong-Gu Seo). We give our thanks to Jason Colquitt, Cindy Stevens, Ken Smith, Debra Shapiro, Subra Tangirala, Gilad Chen, Jeffrey Furman, Gerard Hoberg, Zur Shapira, and the anonymous reviewers for their helpful comments and feedback on this article.

Biographies

Myeong-Gu Seo (mseo@rhsmith.umd.edu) is an assistant professor in the R. H. Smith School of Business at the University of Maryland. He received his Ph.D. in organization studies from Boston College. His research focuses on emotion in organizations, organizational change and development, and institutional change.

Brent Goldfarb (bgoldfarb@rhsmith.umd.edu) is an associate professor of entrepreneurship and strategy at the Robert H. Smith School of Business at the University of Maryland. He studies how decision making under uncertainty affects markets, particularly in new industries. He has also focused on how the production and exchange of technology differ from those of more traditional economic goods, and the implications of these differences for firms and policy.

Lisa Feldman Barrett (barretli@bc.edu) is currently a professor of psychology and the director of the Interdisciplinary Affective Science Laboratory at Boston College, as well as an assistant in research at Harvard Medical School at Massachusetts General Hospital. Her major research focus addresses the nature of emotion from social-psychological, psychophysiological, cognitive science, and neuroscience perspectives.

Footnotes

We use “affect” as a broad and general term referring both to various affective states, including mood, which is a prolonged and diffused affective state associated with no particular object, and to discrete emotions, such as anger and fear, which are intense prototypical affective experiences directed toward certain objects (cf. Forgas, 1995; Russell, 2003).

We do not attempt to reconcile our theory to predict behavior regarding very low probability events. This allows us to rely on prospect theory to generate the unambiguous predictions in Hypotheses 1a and 1b. It also sets a boundary condition on our theoretical interpretation. For example, if one assumed that some subjects thought that gains and losses were very low probability events, equivalent, say, to winning the lottery, then the predictions of Hypotheses 1a and 1b would be reversed (Tversky & Kahneman, 1991). We believe this boundary condition is reasonable given the context of our study, and perhaps generally reasonable in many real-world risk-taking situations.