To the Editor

In recent years, genetic testing for heritable cancer syndromes has been shifting from singlegene analysis to multigene panels, typically using next-generation sequencing (NGS) technologies. As a correspondence in your October issue1 described, despite the increasing use of NGS in clinical practice, regulatory standards remain vague and payers have not adopted clear coding and reimbursement guidelines1. To help clarify the impact of these issues on the availability of testing, we review pricing and payer coverage of BRCA1/2 tests (providing determination of the entire nucleotide sequence for the BRCA1 and BRCA2 genes) and panels containing BRCA1/2 (‘panels’). We find that the number of BRCA1/2-only tests and panels has increased since June 2013, and average price has decreased. Even so, many payers consider panels investigational or experimental, although they have positive coverage policies for BRCA1/2 testing. Although 76% of payers have coverage policies about panels, none of these policies provides positive coverage. Of payers with policies on panels, most (77%) consider panels investigational or experimental, and the remainder limits coverage to those panels on which all the genes are considered medically necessary. The experience with BRCA1/2 may be instructive in understanding the evolution of testing and payer coverage toward multigene panels in other indications as well, particularly those with a substantial patient population eligible for testing.

For BRCA1/2 testing, the shift toward gene panels has primarily occurred because the US Supreme Court ruled in June 2013 that companies may not patent isolated genes, thus invalidating five patents held by Myriad Genetics (Salt Lake City, UT, USA) and clearing the way for other laboratories to offer tests with the BRCA1/2 genes2. Before June 2013, Myriad was the sole provider of BRCA1/2-only tests for clinical use, other than tests limited to single-site analysis, and there were no commercially available BRCA1/2 panels. The analysis of the BRCA1/2 testing landscape presented here is the first since the historic 2013 Supreme Court decision that allowed the entry of new testing providers. We identified commercially available and soon-to-be-available BRCA1/2-only tests and panels and collected data about the price and scope of testing for each. Because access to genetic tests is considerably influenced by insurance coverage3,4, we also reviewed publicly available coverage policies from private payers. Although past studies have demonstrated that most payers cover BRCA1/2 testing in indicated populations in accordance with National Comprehensive Cancer Network guidelines5–7, coverage policies have not been examined since the launch of new BRCA1/2-only tests and panels to assess whether and how policies have changed.

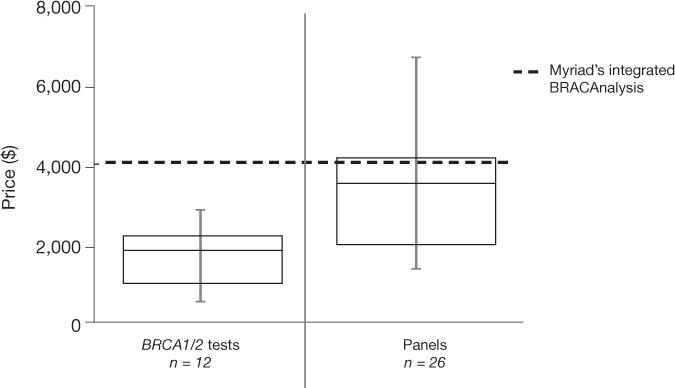

We identified laboratories offering BRCA1/2 tests and panels through test registries and gray literature (the US National Institutes of Health Genetic Testing Registry, http://www.ncbi.nlm.nih.gov/gtr/; Genetests. org, http://genetests.org; the Association for Molecular Pathology Test Directory, http://www.amptestdirectory.org/index.cfm; NextGxDx’s (Franklin, TN, USA) Genetic Testing Resource, https://www.nextgxdx. com/; and publisher GenomeWeb (New York), https://www.genomeweb.com/) and reviewed laboratory websites to code tests offered, list price and genes included (Supplementary Methods). There are 20 BRCA1/2-only tests and 36 panels now available or pending launch (as of 7/2014: Supplementary Table 1). The average price of BRCA1/2 testing has dropped, with all new BRCA1/2-only tests priced significantly below Myriad’s tests (mean price for new BRCA1/2-only tests is $1,711 versus $4,040 for Integrated BRACAnalysis, Myriad’s standard option, P < 0.01; Fig. 1). Panels are more expensive than new BRCA1/2-only tests on average (mean price $3,357), but 70% are less expensive than Integrated BRACAnalysis (Fig. 1). We were unable to access contract pricing or rebating between individual diagnostic providers and payers and therefore cannot comment on the actual cost of each test to payers. However, list prices are indicative of the overall trends in the marketplace.

Figure 1.

Pricing for BRCA1/2-only and panel tests. Error bars represent the minimum and maximum values, the boxes show the 25th percentile to 75th percentile and the middle horizontal line shows median value. Two-gene test prices ranged from $500 to $2,895, with a mean price of $1,711 versus $4,040 for Myriad’s standard offering, Integrated BRACAnalysis. Pricing for panels including the BRCA1/2 genes ranged from $1,500 to $6,749 with a mean price of $3,357. Illumina’s TruGenome Predisposition Screen (BRCA gene analysis in a panel of 1,600 genes, $9,500) was excluded as an outlier.

To evaluate payer coverage of panels, we reviewed publicly available coverage policies from the largest private payers and coded coverage determinations and criteria used (as of May 2015; Supplementary Tables 2 and 3). Although payers with policies about BRCA1/2 testing universally cover two-gene testing in high-risk populations, none of the 17 payers reviewed explicitly covered panels that include BRCA1/2 (Table 1), and the majority considered all panels investigational or experimental. Three payers noted that panels may be considered medically necessary only if testing of all included genes are considered medically necessary, effectively excluding all currently available panels. Among payers who offer rationales for their policies on panels, most cite the lack of clinical utility and/or clinical validity (data not shown).

Table 1.

Payera coverage policies for gene panels including BRCA1/2

| Aspect of payer coverage | Percentage of policies satisfying criteria (number/total relevant policies) |

|---|---|

| Payers with any relevant coverage policies | 76 (13/17) |

| Panels considered medically necessary and covered | 0 (0/13) |

| Panels covered only if all individual components are medically necessary | 23 (3/13) |

| All panels considered investigational/experimental | 54 (7/13) |

| Specific panels considered investigational/experimental | 23 (3/14) |

| Payers with no relevant coverage policies | 24 (4/17) |

Payers include United Healthcare, Anthem, Aetna, Health Care Service Corporation (HCSC), Cigna, Humana, Health Net, Highmark, Independence Blue Cross, Blue Cross Blue Shield (BCBS) Michigan, CareFirst BCBS, BCBS Tennessee, BCBS Alabama, Blue Shield of California, BCBS Florida, Medical Mutual of Ohio and BCBS Massachusetts. These payers combined represent 158,974,237 covered lives.

Concerns about reimbursement issues may lead some physicians to avoid tests for which such issues are most common3. Because of the lack of coverage for panels, some laboratories may run full panels and bill payers only for the covered BRCA1 and BRCA2 genes; Washington University in St. Louis has had success obtaining reimbursement for their tumor panel using a similar approach8. However, one payer in our sample (Humana (Louisville, KY, USA); Supplementary Tables 2 and 3) specifically ruled out that option for BRCA1/2 testing. Additionally, if laboratories bill with the same method for BRCA1/2 testing and for panels, panels may not be covered for patients who have already had BRCA1/2 testing.

Understanding coverage policies is important, even though some panels are currently reimbursed despite the lack of positive coverage policies. We have found that payers are increasingly concerned about their inability to enforce their coverage policies and are thus implementing internal claims reviews and analytics to identify panels and deny related claims9. In the future, as the American Medical Association (Chicago) develops specific current procedural terminology codes for genetic panels, payers will be better able to enforce their coverage policies.

Thus, the increase in availability of panels allows physicians and patients to get more information for comparable prices, but it is not yet clear how and when panels should be used. Specific panels recently have been shown to identify more clinically actionable mutations than testing for BRCA1/2 tests alone, providing support for the clinical relevance of panel testing10–12. Even so, the clinical validity and clinical utility of many included genes require further research, and the optimal number and identity of genes to test have not been defined13. In addition to questions about clinical utility and payer coverage, panels also raise questions about how to interpret the results given that they return variants of unknown significance and also incidental findings10,12–15.

Furthermore, the services offered by each laboratory may differ, as well as the NGS technologies used to conduct the test. Oversight of NGS technologies, which are used for virtually all of the new tests, contains many gaps1. Our analysis did not include an evaluation of the analytic validity of new tests, and only limited studies exist on how newer laboratories compare to Myriad’s tests in that regard12. The supplementary services offered (follow-up as new results and variant classifications become available, assistance with reimbursement, patient education materials) may also differ between laboratories.

In conclusion, we found that BRCA1/2 test options have increased and prices have decreased. Nearly all payers have positive coverage policies for BRCA1/2-only testing, but despite the increasing availability of panels, private insurers do not currently formally cover these panels. In their coverage documents, payers cited limited data regarding clinical validity and clinical utility as justification for not covering panels, and routine use of panels has not yet been recommended in guidelines5. The comparative effectiveness and cost effectiveness of panels versus single-gene tests have also not been established. Future research on these issues will help define the appropriate use of panels and likely lead to changes in payer coverage policies regarding panels. These issues will accelerate in importance as test panels for other genes and conditions enter clinical care.

Supplementary Material

Acknowledgments

This study was partially funded by a National Human Genome Research Institute grant to K.A.P. (R01HG007063), a National Cancer Institute grant to the University of California at San Francisco (UCSF), Helen Diller Family Comprehensive Cancer Center (5P30CA082013-15) and the UCSF Mount Zion Health Fund. E.C. received Summer Research Fellowship funds from the Albert Einstein College of Medicine in support of this study.

Footnotes

Note: Any Supplementary Information and Source Data files are available in the online version of the paper (doi:10.1038/nbt.3322).

COMPETING FINANCIAL INTERESTS

The authors declare competing financial interests: details are available in the online version of the paper (doi:10.1038/nbt.3322).

References

- 1.Curnutte MA, Frumovitz KL, Bollinger JM, McGuire AL, Kaufman DJ. Nat Biotechnol. 2014;32:980–982. doi: 10.1038/nbt.3030. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 2.Ratner M. Nat Biotechnol. 2013;31:663–665. doi: 10.1038/nbt0813-663. [DOI] [PubMed] [Google Scholar]

- 3.Weldon CB, Trosman JR, Gradishar WJ, Benson AB, III, Schink JC. J Oncol Pract. 2012;8:e24–31. doi: 10.1200/JOP.2011.000448. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 4.Trosman JR, Van Bebber SL, Phillips KA. J Oncol Pract. 2011;7:18s–24s. doi: 10.1200/JOP.2011.000300. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Daly M, et al. NCCN Clinical Practice Guidelines in Oncology (NCCN Guidelines) Genetic/Familial High-Risk Assessment: Breast and Ovarian (version 2.2105) 2015 http://www.nccn.org/professionals/physician_gls/pdf/genetics_screening.pdf. Accessed July 19, 2015.

- 6.Graf MD, Needham DF, Teed N, Brown T. Per Med. 2013;10:235–243. doi: 10.2217/pme.13.9. [DOI] [PubMed] [Google Scholar]

- 7.Wang G, Beattie MS, Ponce NA, Phillips KA. Genet Med. 2011;13:1045–1050. doi: 10.1097/GIM.0b013e31822a8113. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8.Heger M. Official Discusses Wash U’s Successful Strategy in Developing a Reimbursable NGS Cancer Test. 2014 http://www.genomeweb.com/sequencing/official-discusses-wash-us-successful-strategy-devel-oping-reimbursable-ngs-cance. Accessed June 30, 2014.

- 9.Trosman JR, Weldon CB, Kelley RK, Phillips KA. J Natl Compr Canc Netw. 2015;13:311–318. doi: 10.6004/jnccn.2015.0043. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 10.Kurian AW, et al. J Clin Oncol. 2014;32:2001–2009. doi: 10.1200/JCO.2013.53.6607. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 11.Domchek SM, Bradbury A, Garber JE, Offit K, Robson ME. J Clin Oncol. 2013;31:1267–1270. doi: 10.1200/JCO.2012.46.9403. [DOI] [PubMed] [Google Scholar]

- 12.Kurian AW, Kingham KE, Ford JM. Curr Opin Obstet Gynecol. 2015;27:23–33. doi: 10.1097/GCO.0000000000000141. [DOI] [PubMed] [Google Scholar]

- 13.Turnbull C, Rahman N. Annu Rev Genomics Hum Genet. 2008;9:321–345. doi: 10.1146/annurev.genom.9.081307.164339. [DOI] [PubMed] [Google Scholar]

- 14.Couch FJ, Nathanson KL, Offit K. Science (New York, NY) 2014;343:1466–1470. doi: 10.1126/science.1251827. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.Hiraki S, Rinella ES, Schnabel F, Oratz R, Ostrer H. J Genet Couns. 2014;23:604–617. doi: 10.1007/s10897-014-9695-6. [DOI] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.