Abstract

BACKGROUND AND OBJECTIVE:

Maternal smoking increases the risk for preterm birth, low birth weight, and sudden infant death syndrome, which are all causes of infant mortality. Our objective was to evaluate if changes in cigarette taxes and prices over time in the United States were associated with a decrease in infant mortality.

METHODS:

We compiled data for all states from 1999 to 2010. Time-series models were constructed by infant race for cigarette tax and price with infant mortality as the outcome, controlling for state per-capita income, educational attainment, time trend, and state random effects.

RESULTS:

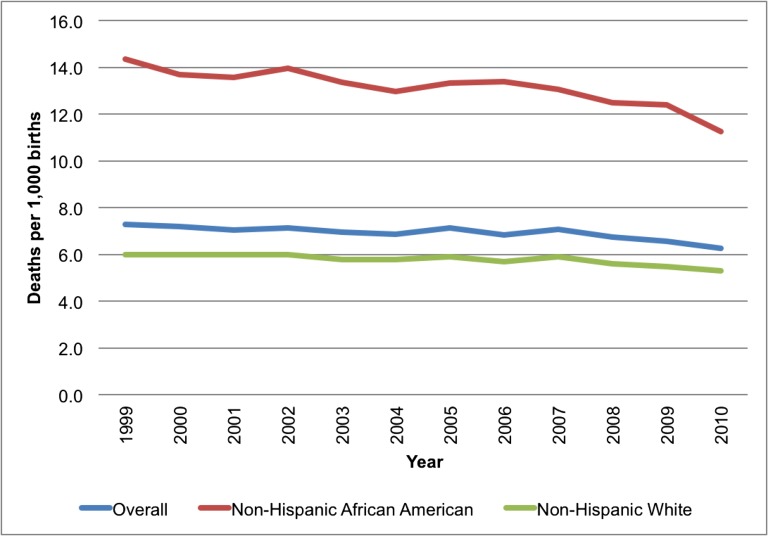

From 1999 through 2010, the mean overall state infant mortality rate in the United States decreased from 7.3 to 6.2 per 1000 live births, with decreases of 6.0 to 5.3 for non-Hispanic white and 14.3 to 11.3 for non-Hispanic African American infants (P < .001). Mean inflation-adjusted state and federal cigarette taxes increased from $0.84 to $2.37 per pack (P < .001). In multivariable regression models, we found that every $1 increase per pack in cigarette tax was associated with a change in infant deaths of −0.19 (95% confidence interval −0.33 to −0.05) per 1000 live births overall, including changes of −0.21 (−0.33 to −0.08) for non-Hispanic white infants and −0.46 (−0.90 to −0.01) for non-Hispanic African American infants. Models for cigarette price yielded similar findings.

CONCLUSIONS:

Increases in cigarette taxes and prices are associated with decreases in infant mortality rates, with stronger impact for African American infants. Federal and state policymakers may consider increases in cigarette taxes as a primary prevention strategy for infant mortality.

What’s Known on This Subject:

Cigarette use is common in pregnancy and associated with poor outcomes. Higher cigarette taxes are associated with lower rates of smoking in pregnancy and improvement in some birth outcomes; however, no US study has evaluated their impact on infant mortality.

What This Study Adds:

Increases in cigarette taxes are associated with decreases in infant mortality in the United States, with a stronger effect among non-Hispanic African American infants. Policymakers may consider cigarette tax increases as a primary prevention strategy for infant mortality.

Tobacco is the leading preventable cause of disease, disability, and death in the United States, accounting for one-fifth of all US deaths and an estimated $300 billion annually in national health care expenditures and lost worker productivity.1 Nevertheless, cigarette use, the most common form of tobacco used in the United States, remains widespread among all US populations, including pregnant women. In 2012, 24% of women of childbearing age and 15% of pregnant women smoked cigarettes.2 Rates of cigarette use in pregnancy have been reported to be higher among those with low education,3 those lacking access to health care before pregnancy,4 and those living in poverty.3 Cigarette use in pregnancy is associated with a myriad of complications for the infant, including low birth weight,1,5 premature birth,1,5,6 birth defects,1,5,7 and sudden infant death syndrome1,5,8: the leading causes of infant mortality.9

Given the consequences for mothers and infants of maternal cigarette use, reducing the proportion of women who smoke in pregnancy is a prominent public health goal. In 2014, a report from the US Surgeon General noted, “reducing the prevalence of smoking among pregnant women and women of reproductive age remains a critical component of public health efforts to improve maternal and child health.”1 Healthy People 2020 includes an objective to increase the proportion of pregnant women who abstained from smoking cigarettes to improve maternal and infant outcomes.10

Taxation of cigarettes is a public health tool used to reduce smoking at a population level.11 Results from several studies in the medical and economic literature demonstrated that increased cigarette prices and taxes led to reduced smoking rates among pregnant women,12,13 increased pregnancy quit rates,13 and increased smoke-free time in the postnatal period.13 Despite evidence that pregnant smokers change behavior in response to cigarette prices, data linking cigarette taxes and price directly to infant outcomes are evident in only a few studies that link increases in cigarette tax to higher birth weight and reduced deaths attributed to sudden infant death syndrome.8,14,15 In Canada, higher excise taxes on cigarettes have been correlated with subsequent decreases in infant mortality, but with substantially greater increases in taxes over time than have been applied in the United States.16

No study has evaluated the association of cigarette tax policies and overall infant mortality in the United States. Our study uses publicly available data to determine the association of cigarette tax and price with infant mortality in the United States. We hypothesized that increases in cigarette taxes and prices would decrease infant mortality at the state level.

Methods

Overall Analytic Approach

We based our analysis on a conceptual model of state and time factors that may be associated with both the outcome (infant mortality) and the key predictors of interest (cigarette tax and price per pack). As both cigarette use and infant mortality are associated with race,17 poverty,3 and educational attainment,3 we considered these variables as important potential confounders. As an analysis of de-identified, publicly available data, this study was considered exempt from human subjects review by the institutional review board of Vanderbilt University School of Medicine.

Covariates

Data for cigarette taxes and prices were obtained from The Tax Burden on Tobacco: Historical Compilation for the years 1999 to 2010.18 These data are compiled annually by survey of retailers and have been used in numerous analyses of tobacco tax.15,19,20 We used nongeneric pricing of a pack of cigarettes because available data indicate that nongeneric cigarettes are purchased by most smokers.21 State tax data were obtained for each state and the District of Columbia and were combined with federal cigarette tax to generate the total cigarette tax for each state. Data for educational attainment were obtained from an adaptation of the US Census Bureau Current Population Survey March supplement,22,23 defined as the proportion of adults within a state with a college degree. Data for state per-capita income were obtained from the US Department of Commerce24 and prepared by the Bureau of Business and Economic Research at the University of New Mexico.25 Data for tax, price, and per-capita income were adjusted to 2010 US$ by using the Consumer Price Index.26

Outcome

Infant mortality is defined as death before 1 year of age. Given racial disparities in infant mortality rates in the United States, we included data regarding overall state infant mortality and also specifically by race for non-Hispanic white (hereafter: white) and non-Hispanic African American (hereafter: African American) infants for each state. These data were obtained from the Centers for Disease Control and Prevention by using the Wide-Ranging Online Data for Epidemiologic Research system. For any race category with fewer than 10 deaths in a state in a given year, the Centers for Disease Control and Prevention suppresses the data.

Data Analysis

In the first phase of our analysis, we generated descriptive statistics and evaluated bivariate associations between our predictors and infant mortality. We determined if any of our data contained missing observations. Data for infant mortality were missing for <0.5% of state-year combinations for overall and white infant mortality rates; however, African American infant mortality data were missing for 25% of state-year combinations due to data being suppressed for <10 observations occurring in a given state-year combination.

Next, we developed time-series multivariable regression models, accounting for repeated observations across years, at the state level. Regression models were stratified by race, with each controlling for inflation-adjusted mean per-capita income, educational attainment, and state random effects.27 State random effects were used to control for factors that may change over time across states (eg, cultural beliefs about smoking). We tested effect modification of time × price and time × tax, neither of which was significant; therefore, they were not included in our models. We then evaluated if there was a 1-year lagged association between cigarette tax and price changes and infant mortality changes; nonlagged models were superior to lagged models, so we present nonlagged models and include the lagged models in Supplemental Table 3. All analyses were conducted by using Stata version 13.1 (Stata Corp, College Station, TX).

Results

From 1999 through 2010, the mean state infant mortality rate decreased for all study groups: for infants overall from 7.3 to 6.2 per 1000 births; for African American infants from 14.3 to 11.3 per 1000 births; for white infants from 6.0 to 5.3 per 1000 births. Over the same period, mean inflation adjusted state per-capita income and college graduation rates increased (Table 1).

TABLE 1.

Mean Cigarette Taxes and Prices per Pack, Per-Capita Income, Overall Infant Mortality Rate, Non-Hispanic African American Infant Mortality Rate, and Non-Hispanic White Infant Mortality Rate: United States, 1999–2010

| 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Mean cigarette tax per pack, 2010 US$a | 0.84 | 0.96 | 0.93 | 1.06 | 1.25 | 1.30 | 1.38 | 1.42 | 1.48 | 1.55 | 2.28 | 2.37 |

| Mean cigarette price per pack, 2010 US$ | 4.05 | 4.20 | 4.43 | 4.80 | 4.87 | 4.83 | 4.87 | 4.78 | 4.92 | 4.93 | 5.97 | 6.19 |

| Mean per-capita income, 2010 US$ | 35 632 | 36 832 | 36 815 | 37 134 | 37 392 | 37 831 | 38 665 | 39 300 | 40 675 | 40 937 | 38 971 | 39 468 |

| Mean college graduation rate, % | 16.1 | 16.3 | 16.4 | 17.2 | 17.4 | 17.5 | 18.0 | 17.9 | 17.9 | 18.1 | 18.2 | 18.5 |

| Mean overall infant mortality rate, per 1000 births | 7.3 | 7.2 | 7.0 | 7.1 | 6.9 | 6.9 | 7.1 | 6.8 | 7.1 | 6.7 | 6.6 | 6.2 |

| Mean Non-Hispanic African American infant mortality rate, per 1000 births | 14.3 | 13.7 | 13.6 | 14.0 | 13.3 | 13.0 | 13.3 | 13.4 | 13.1 | 12.5 | 12.4 | 11.3 |

| Mean Non-Hispanic White Infant Mortality Rate (per 1000 births) | 6.0 | 6.0 | 6.0 | 6.0 | 5.8 | 5.8 | 5.9 | 5.7 | 5.9 | 5.6 | 5.5 | 5.3 |

All dollars adjusted to 2010 US$.

Includes state and federal cigarette tax.

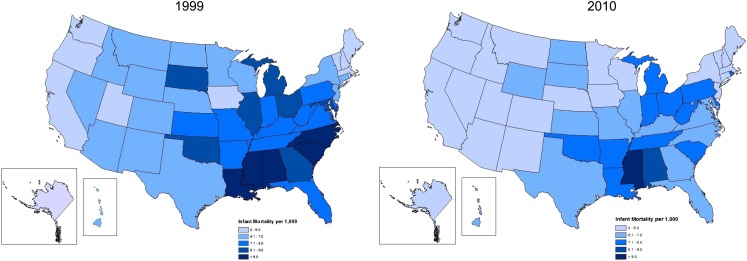

Throughout the study period, the African American infant mortality rate remained more than twice as high as the white infant mortality rate overall (Fig 1). In 2010, the infant mortality rates varied substantially by state, with Alaska having the lowest rate of 3.6 and Mississippi having the highest at 9.6 (Fig 2).

FIGURE 1.

State mean overall, non-Hispanic African American, and non-Hispanic white infant mortality rates: United States, 1999–2010.

FIGURE 2.

Variation in infant mortality rates across states and over time: United States, 1999 and 2010.

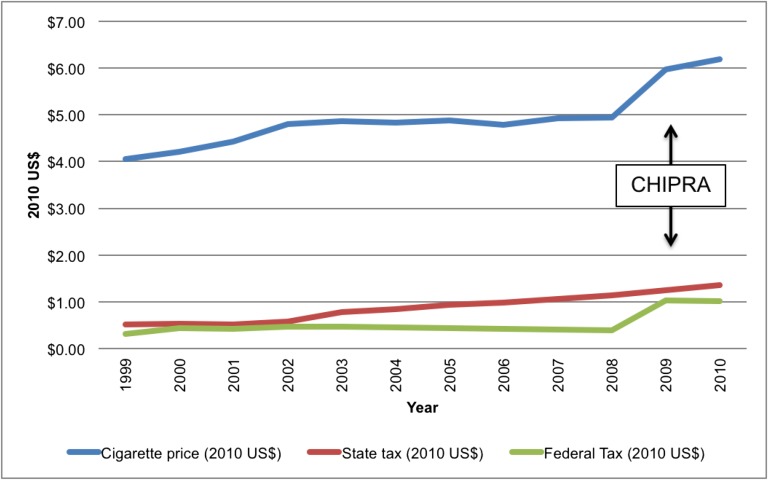

During the study period, the state mean inflation-adjusted cigarette tax (state + federal) increased from $0.84 to $2.37 expressed in 2010 US$ (Table 1; Fig 3). There was substantial state-to-state variation in cigarette taxes in all study years; in 2010, South Carolina had the lowest state cigarette tax ($0.07 per pack), whereas Rhode Island had the highest ($3.46 per pack) (Supplemental Fig 4A). Mean state cigarette prices increased as taxes increased (Table 1; Fig 3), with similar state-to-state variation (Supplemental Fig 4B).

FIGURE 3.

Mean inflation-adjusted cigarette state tax, federal tax, and price: United States, 1999–2010. All data expressed in 2010 US$, per pack of cigarettes. Note: Children’s Health Insurance Program Reauthorization Act (CHIPRA; 2009) increased federal tobacco tax from $0.39 to $1.01 per pack.

After adjusting for year, educational attainment, mean inflation-adjusted per-capita income, and state random effects, we found that every $1 increase in cigarette tax per pack (expressed in 2010 US$) was associated with a change in infant mortality rate of −0.19 (95% confidence interval [CI] −0.33 to −0.05) in the population overall. For African American infants, a $1 increase in cigarette tax per pack was associated with a change in the infant mortality rate of −0.46 (95% CI −0.90 to −0.01), whereas for white infants the change in infant mortality was −0.21 (95% CI −0.33 to −0.08) (Table 2).

TABLE 2.

Time-Series Linear Regression Analysis of Cigarette Tax, Cigarette Price, and Other State-Level Factors Associated With Infant Mortality: United States, 1999–2010

| Population Overall | Non-Hispanic African American | Non-Hispanic White | ||||

|---|---|---|---|---|---|---|

| Infant Deaths per 1000 Live Births (95% CI) | Infant Deaths per 1000 Live Births (95% CI) | Infant Deaths per 1000 Live Births (95% CI) | ||||

| Unadjusted | Adjusteda | Unadjusted | Adjusteda | Unadjusted | Adjusteda | |

| Cigarette tax increase, per dollar per pack | −0.41 (−0.49 to −0.32) | −0.19 (−0.33 to −0.05) | −1.17 (−1.45 to −0.88) | −0.46 (−0.90 to −0.01) | −0.36 (−0.44 to −0.28) | −0.21 (−0.33 to −0.08) |

| Cigarette price increase, per dollar per pack | −0.34 (−0.40 to −0.27) | −0.19 (−0.30 to −0.09) | −0.90 (−1.13 to −0.68) | −0.35 (−0.68 to −0.01) | −0.30 (−0.37 to −0.24) | −0.20 (−0.29 to −0.11) |

Models adjusted for year, educational attainment, mean inflation-adjusted per-capita income, and state random effects.

In analyses of changes in cigarette prices, the outcomes were similar. With every $1 increase in cigarette price per pack, there was a change in infant mortality rates of −0.19 (95% CI −0.30 to −0.09) overall, −0.35 (95% CI −0.68 to −0.01) for African American infants, and −0.20 (95% CI −0.29 to −0.11) for white infants (Table 2).

Discussion

We found that higher cigarette taxes and prices in the United States were associated with lower rates of infant mortality, even after accounting for potential confounding factors, such as education and income. Although consumers make purchase decisions based on price, we found that changes in cigarette tax and price had very similar impact on infant mortality. Increases in cigarette taxes are the primary mechanism available to policymakers to increase cigarette price, to achieve improvements in population health. Given our findings and more than 3.93 million births annually in the United States,28 a $1 increase in cigarette tax nationwide would be expected to result in 750 fewer infant deaths per year, or a 3.2% reduction in infant mortality.

Increases in cigarette taxes are known to decrease smoking in pregnancy and improve fetal outcomes in US studies.8,14,15,20,29,30 Although a study of Canadian excise taxes on cigarettes indicated that higher taxes were associated with a lower infant mortality rate at the provincial level,16 many Canadian provinces increased their excise taxes substantially more than most states implemented during our study period, which limits the direct comparability of our findings to those from Canada. To our knowledge, our study is the first to investigate the direct association between cigarette taxes and infant mortality in the United States and to include a focus on disparities in mortality for children of different races, a continuing major policy concern.

Overwhelming evidence indicates that tobacco control policies have been effective in limiting tobacco consumption11,31 and preventing death from their use.11,32 Cigarette taxes with subsequent increases in cigarette price prevent smoking initiation, decrease consumption, and encourage cessation.33 The impact of tobacco taxes on behavioral smoking changes is most significant among younger individuals and populations with lower socioeconomic status,34 which makes smoking cessation especially relevant among pregnant women. Sensitivity to cigarette tax and price also differs across racial/ethnic groups, with non-Hispanic African American and Hispanic smokers more likely to reduce smoking with increase in cigarette price.35 Our findings are consistent with this previous literature, in that the effect sizes for changes in cigarette taxes and prices on infant mortality for African American infants are larger than for white infants.

Importantly, in an investigation of the differential effects of cigarette taxes on white versus black pregnant women, Hawkins and Baum20 failed to find a difference in smoking cessation rates when analyses were stratified by education. Our findings of a differential improvement in infant mortality for African American infants, when controlling for education, diverge from those of Hawkins and Baum,20 although limitations in our aggregate state-level data prevented us from modeling outcomes by using the same approach. The interplay of race and education in infant mortality, with respect to the impact of cigarette taxation, merits further investigation.

State and Federal Proposals

Analogous to the association between taxes and infant mortality, we found a strong association between increases in cigarette prices and infant mortality. In states in which increases in cigarette taxes may be politically untenable, state legislatures are turning to novel means to increase cigarette prices. For example, this year the Tennessee General Assembly passed a bill to increase the retail price of cigarettes, creating a mandatory increase in profit margin, without increasing the state’s cigarette tax.36 Our findings suggest that an increase in cigarette price, regardless of the rationale, will improve infant outcomes. Increases in federal cigarette tax have also been proposed. In President Obama’s fiscal year 2016 budget, a $0.94 cigarette tax increase was proposed to cover the costs of preschool for all 4-year-olds, improvements in Head Start, and home visitation.37 Importantly, nurse home visitation has been shown to be effective in preventing maternal and infant mortality among some populations.38

Limitations

As a study of state-level policy changes in cigarette taxes and prices, our data were not compiled at the individual level; therefore, we were not able to incorporate potentially important individual-level variables (eg, infant gender, gestational age, mother’s smoking status during pregnancy) in our analyses. For our analysis, we chose the perspective of state and federal policymakers that is typically informed by aggregate rather than individual-level data. Importantly, other recent studies using individual-level data found that increases in cigarette tax decrease cigarette smoking in pregnancy30 and improve infant outcomes,15 and these individual-level findings serve as the conceptual grounding for our work. A further limitation is that even though we attempted to control for important confounders, including education, income, and state random effects, residual confounding remains a possibility. In addition, each data source has its own potential limitations. For example, within-state variation in cigarette price may not be captured in surveys conducted for The Tax Burden on Tobacco: Historical Compilation.18 Next, given that our study was at the state level, increases in city cigarette taxes would not be captured. The extent to which within-state variation may have influenced our findings is not known and likely merits further investigation as a source of potential approaches to reducing infant mortality. Further, although our empirical analysis provides a robust assessment of the association between tobacco taxes and infant mortality over several years, the magnitude of the association will not necessarily remain the same in the future, or for tax increases larger than those that have been implemented to date. Thus it is possible that the impact of a $1 per pack tax increase might be slightly smaller or larger than what we have estimated. The important point is the qualitative conclusion that results from our quantitative analysis, which is not likely subject to variation due to small changes in price responses; increases in cigarette taxes will be expected to decrease infant mortality. The current study design precludes us from measuring potential unintended negative effects that increases in tobacco taxes may have during pregnancy (eg, for women who continue to purchase tobacco at higher prices, they will have less disposable income to purchase other goods and services, possibly including some necessities). Similarly, we are not able to assess additional benefits that women who quit smoking will derive (eg, they will have more disposable income available to purchase other goods and services).

Conclusions

We find a strong association between higher cigarette taxes and decreases in infant mortality, with implications for a potential reduction of 750 infant deaths per year nationwide, or an average of 2 infant deaths averted per day, for every $1 in tax increase per pack. In the context of published literature demonstrating that cigarette taxes decrease prenatal smoking and improve fetal outcomes at the individual level, our findings provide further evidence that this important tobacco control policy has merit to improve maternal and infant health at the population level. Further, our findings imply that higher cigarette taxes can play an important role in closing the infant mortality disparity gap between African American and white infants in the United States. As policymakers consider future steps to improve infant mortality and reduce disparities, increases in cigarette taxes represent an increasingly evidence-based approach.

Acknowledgments

The authors acknowledge Angela Tune, Ann Boonn, MPH, and Carrie Fry, MEd, for their assistance in preparation of this manuscript.

Glossary

- CI

confidence interval

Footnotes

Dr Patrick conceptualized the study, conducted the analysis, and drafted the initial manuscript; Drs Davis, Warner, and Pordes were involved in the analytic plan and interpretation of the results, and revised the manuscript; and all authors approved the final manuscript as submitted and agree to be accountable for all aspects of the work.

FINANCIAL DISCLOSURE: The authors have indicated they have no financial relationships relevant to this article to disclose.

FUNDING: Supported by the National Institute on Drug Abuse through award 1K23DA038720-01 (Dr Patrick). Funded by the National Institutes of Health (NIH).

POTENTIAL CONFLICT OF INTEREST: The authors have indicated they have no potential conflicts of interest to disclose.

References

- 1.National Center for Chronic Disease Prevention and Health Promotion (US) Office on Smoking and Health. The Health Consequences of Smoking—50 Years of Progress: A Report of the Surgeon General. Atlanta, GA: Centers for Disease Control and Prevention (US); 2014. Available at: www.ncbi.nlm.nih.gov/books/NBK179276/. Accessed April 1, 2015 [PubMed]

- 2.Substance Abuse and Mental Health Services Administration, Office of Applied Studies Results From the 2012 National Survey on Drug Use and Health: Summary of National Findings. Rockville, MD: Substance Abuse and Mental Health Services Administration; 2013 [Google Scholar]

- 3.Page RL, Padilla YC, Hamilton ER. Psychosocial factors associated with patterns of smoking surrounding pregnancy in fragile families. Matern Child Health J. 2012;16(1):249–257 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 4.Adams KE, Melvin CL, Raskind-Hood CL Sociodemographic, insurance, and risk profiles of maternal smokers post the 1990s: how can we reach them? Nicotine Tob Res 2008;10(7):1121–1129 [DOI] [PubMed]

- 5.Centers for Disease Control and Prevention Tobacco use and pregnancy. 2015. Available at: www.cdc.gov/reproductivehealth/maternalinfanthealth/tobaccousepregnancy/index.htm. Accessed June 8, 2015

- 6.Shah NR, Bracken MB. A systematic review and meta-analysis of prospective studies on the association between maternal cigarette smoking and preterm delivery. Am J Obstet Gynecol. 2000;182(2):465–472 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.Hackshaw A, Rodeck C, Boniface S. Maternal smoking in pregnancy and birth defects: a systematic review based on 173 687 malformed cases and 11.7 million controls. Hum Reprod Update. 2011;17(5):589–604 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8.Markowitz S. The Effectiveness of Cigarette Regulations in Reducing Cases of Sudden Infant Death Syndrome. Cambridge, MA: National Bureau of Economic Research; 2006 [DOI] [PubMed] [Google Scholar]

- 9.Centers for Disease Control and Prevention Infant mortality. 2015. Available at: www.cdc.gov/reproductivehealth/maternalinfanthealth/infantmortality.htm. Accessed June 8, 2015

- 10.US Department of Health and Human Services, Office of Disease Prevention and Health Promotion Maternal, infant, and child health. Available at: https://www.healthypeople.gov/2020/topics-objectives/topic/maternal-infant-and-child-health/objectives. Accessed June 8, 2015

- 11.Chaloupka FJ, Straif K, Leon ME; Working Group, International Agency for Research on Cancer . Effectiveness of tax and price policies in tobacco control. Tob Control. 2011;20(3):235–238 [DOI] [PubMed] [Google Scholar]

- 12.Ringel JS, Evans WN. Cigarette taxes and smoking during pregnancy. Am J Public Health. 2001;91(11):1851–1856 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 13.Colman G, Grossman M, Joyce T. The effect of cigarette excise taxes on smoking before, during and after pregnancy. J Health Econ. 2003;22(6):1053–1072 [DOI] [PubMed] [Google Scholar]

- 14.Evans WN, Ringel JS. Can Higher Cigarette Taxes Improve Birth Outcomes. Cambridge, MA: National Bureau of Economic Research; 1997 [Google Scholar]

- 15.Hawkins SS, Baum CF, Oken E, Gillman MW. Associations of tobacco control policies with birth outcomes. JAMA Pediatr. 2014;168(11):e142365. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 16.Sen A, Pierard E Estimating the effects of cigarette taxes on birth outcomes. Can Public Policy 2011;37(2):257–276 [DOI] [PubMed]

- 17.Jamal A, Agaku IT, O’Connor E, King BA, Kenemer JB, Neff L. Current cigarette smoking among adults—United States, 2005-2013. MMWR Morb Mortal Wkly Rep. 2014;63(47):1108–1112 [PMC free article] [PubMed] [Google Scholar]

- 18.The Tax Burden on Tobacco Historical Compilation. Arlington, VA: Orzechowski and Walker; 2013 [Google Scholar]

- 19.Ahmad S, Billimek J. Limiting youth access to tobacco: comparing the long-term health impacts of increasing cigarette excise taxes and raising the legal smoking age to 21 in the United States. Health Policy. 2007;80(3):378–391 [DOI] [PubMed] [Google Scholar]

- 20.Hawkins SS, Baum CF. Impact of state cigarette taxes on disparities in maternal smoking during pregnancy. Am J Public Health. 2014;104(8):1464–1470 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 21.Hyland A, Bauer JE, Li Q, et al. Higher cigarette prices influence cigarette purchase patterns. Tob Control. 2005;14(2):86–92 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 22.Frank M. Inequality and growth in the United States: evidence from a new state-level panel of income inequality measures. Econ Inq. 2009;47(1):55–68 [Google Scholar]

- 23.Frank MUS. State-level income inequality data. 2014. Available at: www.shsu.edu/eco_mwf/inequality.html. Accessed October 1, 2014

- 24.US Bureau of Economic Analysis State personal income news release archive. 2014. Available at: www.bea.gov/newsreleases/relsarchivespi.htm. Accessed January 12, 2015

- 25.Bureau of Business & Economic Research Per capita personal income by state, 1990 to 2012. 2013. Available at: https://bber.unm.edu/econ/us-pci.htm. Accessed January 12, 2015

- 26.US Bureau of Labor Statistics Consumer price index. 2014. Available at: www.bls.gov/cpi/. Accessed July 15, 2014

- 27.Patrick SW, Choi H, Davis MM. Increase in federal match associated with significant gains in coverage for children through Medicaid and CHIP. Health Aff (Millwood). 2012;31(8):1796–1802 [DOI] [PubMed] [Google Scholar]

- 28.Centers for Disease Control and Prevention Infant health. 2015. Available at: www.cdc.gov/nchs/fastats/infant-health.htm. Accessed July 15, 2015

- 29.Been JV, Nurmatov UB, Cox B, Nawrot TS, van Schayck CP, Sheikh A. Effect of smoke-free legislation on perinatal and child health: a systematic review and meta-analysis. Lancet. 2014;383(9928):1549–1560 [DOI] [PubMed] [Google Scholar]

- 30.Adams EK, Markowitz S, Kannan V, Dietz PM, Tong VT, Malarcher AM. Reducing prenatal smoking: the role of state policies. Am J Prev Med. 2012;43(1):34–40 [DOI] [PubMed] [Google Scholar]

- 31.Warner KE, Sexton DW, Gillespie BW, Levy DT, Chaloupka FJ. Impact of tobacco control on adult per capita cigarette consumption in the United States. Am J Public Health. 2014;104(1):83–89 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 32.Holford TR, Meza R, Warner KE, et al. Tobacco control and the reduction in smoking-related premature deaths in the United States, 1964-2012. JAMA. 2014;311(2):164–171 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 33.Chaloupka FJ, Yurekli A, Fong GT. Tobacco taxes as a tobacco control strategy. Tob Control. 2012;21(2):172–180 [DOI] [PubMed] [Google Scholar]

- 34.Townsend J, Roderick P, Cooper J. Cigarette smoking by socioeconomic group, sex, and age: effects of price, income, and health publicity. BMJ. 1994;309(6959):923–927 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 35.Centers for Disease Control and Prevention (CDC) . Response to increases in cigarette prices by race/ethnicity, income, and age groups—United States, 1976-1993. MMWR Morb Mortal Wkly Rep. 1998;47(29):605–609 [PubMed] [Google Scholar]

- 36.HB 0225: Tobacco, Tobacco Products: Redefines “cost of doing business by the retailer” for purposes of violations under the “Unfair Retailer's Cigarette Sales Law.” Marsh, trans. TCA Title 47, Chapter 25, Part 3 2015. ed2015

- 37.Obama B. Budget of the United States Government, Fiscal Year 2016. Washington, DC: Office of Management and Budget; 2015 [Google Scholar]

- 38.Olds DL, Kitzman H, Knudtson MD, Anson E, Smith JA, Cole R. Effect of home visiting by nurses on maternal and child mortality: results of a 2-decade follow-up of a randomized clinical trial. JAMA Pediatr. 2014;168(9):800–806 [DOI] [PMC free article] [PubMed] [Google Scholar]