Abstract

Using cross sectional data Psychological vulnerability was identified as a correlate of older adult’s being defrauded. We extend that research by examining fraud prevalence using longitudinal data from the Health and Retirement Study, and to identify the best predictors of fraud longitudinally across a 4-year time frame. Whereas reported fraud prevalence was 5.0% in a 5-year look-back period in 2008, it increased to 6.1% in 2012. The rate of new-incident fraud across only a 4-year look-back was 4.3%. Being younger-old, having a higher level of education, and having more depression significantly predicted the new cases of fraud reported in 2012. Psychological vulnerability was a potent longitudinal predictor of fraud, with the most vulnerable individuals being more than twice as likely to be defrauded. Results indicate that fraud victimization among older adults is rising, and that vulnerability variables, along with some demographic variables, predict new cases of fraud.

INTRODUCTION

The targeting of older adults for fraud is a major problem, about which researchers and policy makers agree. Yet data on incidence, prevalence, and the factors that make some older adults more vulnerable to fraud are scarce. In 2014, Stanford University’s Center on Fraud held a roundtable on the topic and published the proceedings in The True Impact of Fraud (2014). The experts who participated pointed out that fraud prevalence has commonly been measured by asking detailed questions about victimization and using complaint data, media reports, and self-report items about fraud. No matter which ways fraud is measured there are problems. Older adults with significant cognitive impairments typically do not participate and there is also concern that older adults may underreport cases of fraud no matter how the questions are asked. Lichtenberg, Stickney, and Paulson (2013), whose work in this area was the only study to use a nationally representative data set that used clinically relevant variables was cited in the proceedings. They examined cross-sectional and longitudinal predictors of fraud and found that high depression and low social needs-fulfillment were significant predictors. Fraud was also correlated with being younger-old and having more years of education and higher levels of depression. We extend this work by using a second wave of longitudinal data, which allows us not only to compute incidence of fraud, and also to compare prevalence rates between 2008 and 2012. More significantly, baseline demographic and psychological vulnerability factors were used with longitudinal data to test the ability to predict incident cases of fraud longitudinally.

Recent research has examined the rates and correlates of fraud susceptibility. Boyle et al. (2012) and Bryan, Boyle, and Bennett (2014) developed a five-item measure of fraud susceptibility for older adults that assesses how frequently older adults report feeling obligated to answer the phone, having trouble ending phone calls, or believing things that sound too good to be true. Boyle et al. examined 420 non-demented older adults from the Rush University Memory and Aging Project at baseline and 5-year follow-up. More rapid cognitive decline predicted increased scam susceptibility, as did poorer cognition overall, increased age, and lower education. Bryan et al. used 639 older adults, also from the Memory and Aging Project, to investigate what variables are correlated with scam susceptibility and found that increased age, lower income, lower cognition, lower well-being, and lower social support were all significantly related.

Three recent random-sample studies examined the variables that correlate more generally with reports of financial exploitation. For the most part, these studies gathered data on abuse of trust, coercion, and financial entitlement. Acierno et al. (2010) found that 5.2% of all respondents reported having experienced financial exploitation by a family member during the previous year; 60% of the mistreatment consisted of family members’ misappropriation of money. The authors also examined a number of demographic, psychological, and physical correlates of reported financial exploitation. Only two variables—deficits in the number of activities of daily living (ADLs) the subject could perform and nonuse of social services—were significantly related to financial exploitation

Laumann, Leitsch, and Waite (2008) found that 3.5% of their sample reported having been a victim of financial exploitation during the previous year. Younger adults (average age late 60s) were the most likely to report financial exploitation. African Americans were more likely than Non-Hispanic Whites to report financial exploitation, while Latinos were less likely to report having been victimized. Finally, participants with a romantic partner were less likely to report financial exploitation.

Beach, Schulz, Castle, and Rosen (2010) found that 3.5% of their sample reported having experienced financial exploitation during the six months prior to the interview, and almost 10% had experienced financial exploitation at some point since turning 60. The most common experience was signing documents the participant did not understand. The authors found that, directly related to theft and scams, 2.7% of their sample believed that someone had tampered with their money within the previous six months. In their sample, African Americans were more likely to report financial exploitation than were Caucasians. Risk for depression and having any ADL deficits were other correlates of financial exploitation.

Across studies of older-adult financial exploitation, physical and mental health impairments and being African American are consistent correlates. Experiencing disability and/or depression may also be related to increased loneliness and susceptibility to influence. However, because all of these studies were cross-sectional, it is difficult to draw longitudinal inferences; for instance, depression may have been a consequence of having been defrauded.

Psychological Vulnerability

Our conceptual framework, (see Lichtenberg, Stickney and Paulson, 2013 for more complete review) is based on previous findings with depression and its impacts and the impact of poor social need fulfillment in aging. Depression has long been known to predict disability and mortality (Blazer, 2003). In a similar fashion, the lack of social need fulfillment has been linked to disability and demoralization (Steverink and Lindenberg, 2006). The combination of clinically significant depressive symptomatology and poor social need fulfillment may improve our understanding of why clinically vulnerable older people are more susceptible to fraud than are others

We addressed the following research questions:

How does the prevalence of fraud in older adults in 2008 compare with its prevalence in 2012?

What is the incidence of new fraud cases across the 4-year period (2008–2012)?

What demographic, psychological, social, and functional predictors are related to the experience of fraud?

Does the combination of depression and low social-needs fulfillment (i.e., psychological vulnerability) predict fraud longitudinally?

METHODS

Sample Design and Procedures

Health and Retirement Survey (HRS)

The HRS, which began in 1992, is a national longitudinal study of the segment of the U.S. population that is at least 50 years old as well as their spouses and is based on core biennial telephone surveys of approximately 31,000 participants. The survey’s primary objective is to facilitate research on health, family, and economic variables during the transition from active employment to retirement. The HRS also collects supplemental data on participants using leave-behind questionnaires (LBQs). Participants chosen for this subset are asked to complete the LBQ in their homes and return it by mail. The 34-page survey consisted of 52 questions about various aspects of participants’ daily lives, such as health conditions and physical functioning; income, assets, and net worth; family structure; and psychosocial traits, states, and experiences. Our prevalence estimates used all data from 2008 (n=6,920) and 2012 (n=7,252).

One of the LBQ questions asked participants whether they had experienced fraud over the previous five years and the year in which any fraud occurred. In order to only include participants who had experienced fraud between the 2008 and 2012 surveys, we excluded individuals who reported fraud that occurred in 2007. Our final sample consisted of 4,661 respondents who had participated in both the regular 2008 HRS interview and the 2008 and 2012 LBQs and met the criteria described above.

Measures

HRS Measures

Measures obtained from the general HRS dataset in 2008 were age, gender, race, years of education, marital status (presently partnered vs. not partnered), depression, functional limitations, self-rated health (excellent, very good, good, fair, poor), total reported annual income, and cognition as measured by the Telephone Interview for Cognitive Status. In the 2008 LBQ, data were also gathered for the first time on three social needs (affection, behavioral confirmation, and status); financial exploitation (thefts and scams); and level of financial satisfaction.

Center for Epidemiologic Studies Depression Scale (CES-D)

Depressive symptoms were measured by the 8-item version of the CES-D (Radloff, 1977). Defining the time frame as the previous week, respondents were asked to respond yes/no as to whether (a) they were depressed, (b) everything felt like an effort, (c) their sleep was restless, (d) they were happy, (e) they were lonely, (f) they enjoyed life, (g) they felt sad, and (h) they could not “get going.”

Higher CES-D scores reflect more depressive symptoms, and a CES-D score ≥ 3 was used to indicate clinical depression (Steffick, 2000). The 8-item CES-D has similar symptom dimensions as the 20-item CES-D, and past research has demonstrated high internal consistency (α = .77) and validity as implemented in the HRS (Steffick, 2000; Wallace, 2000).

Functional Independence

Functional independence was rated by how many ADLs—bathing, eating, dressing, walking across a room, and getting in or out of bed—the respondent reported requiring assistance with. Scores ranged from 0 (complete assistance) to 5 (no assistance) for each item (range 0–15). Instrumental activities of daily living (IADLs)—using a telephone, taking medication, and handling money—were measured by assessing how many activities the respondent required assistance with. Scores ranged from 0 to 3 for each item (range 0–9).

Self-rated Health

Self-rated health was assessed with the question, “Would you say that your health is excellent, very good, good, fair, or poor?” Responses ranged from 1 (excellent) to 5 (poor), and lower scores reflected better self-rated health.

Cognitive Functioning

Cognitive functioning was measured by the modified Telephone Interview for Cognitive Status (TICS), which is included in the HRS data (Ofstedal, Fisher, & Herzog, 2005). This brief standardized test is based on the older TICS measure (Brandt, Spencer, & Folstein, 1988) and was developed for remote screening of cognitive disorders. Items address orientation, concentration, short-term memory, mathematical skills, praxis, and language, with a maximum score of 35 reflecting higher cognitive functioning. The TICS is generally sensitive to cognitive impairment (Brandt et al., 1988; Desmond, Tatemichi, & Hanzawa, 1994; Järvenpää et al., 2002; Welsh, Breitner, & Magruder-Habib, 1993); past work has also identified factors that reflect mental status and memory (Herzog & Wallace, 1997). The test has a Cronbach’s alpha of .69 and 1-month test-retest reliability of r = .90 (Desmond et al., 1994).

Financial Satisfaction

Financial satisfaction—the perception of how well one’s finances meet one’s needs—was measured in 2008 by one question: How satisfied are you with your finances? Participants responded on a 5-point scale that ranged from 1 (not at all satisfied) to 5 (completely satisfied), with lower scores reflecting lower satisfaction and higher scores reflected higher satisfaction.

Social Needs: Affection, Behavioral Confirmation, and Status

Nieboer, Lindenberg, Boomsma, & Van Bruggen (2005) developed a 15-item scale (Social Production Function-Independent Living) to measure levels of affection, behavioral confirmation, and status based on Ormel et al.’s social production functions theory (Ormel et al., 1999; Steverink & Lindenberg, 2006). We measured affection, behavioral confirmation, and status by identifying questions on the HRS 2008 LBQ that were comparable to questions on the SPF-IL 15-item scale, as described below.

Affection

SPF-IL: Do people help you if you have a problem? Pay attention to you? Really love you?

LBQ: Do you have people to turn to? People to talk to? People you feel close to?

For each participant, z-scores were calculated for responses to each of the three questions and totaled. This created a scale with scores ranging from −8.02 to 2.09, with higher scores reflecting greater fulfillment of Affection needs. Internal consistency for the affection items was (α =.84), compared to (α =.83) for the SPF-IL.

Behavioral Confirmation

SPF-IL: Do you feel useful to others? Is your role appreciated in a group? Do people find you reliable?

LBQ: Do you feel part of a group of friends? Do you receive adequate appreciation for providing help in your family? How well does the word “responsible” describe you?

The first and third questions were recoded so that higher scores would reflect greater fulfillment of Confirmation needs. The first question used a 3-point Likert scale, and the second and third questions used 5- and 4-point Likert scales, respectively. As above, z-scores for all item responses were totaled, creating a scale ranging from −8.04 to 2.37, with higher scores reflecting greater fulfillment of Confirmation needs. Internal consistency for the behavioral confirmation items was α =.70, which was similar to the SPF-IL (α =.75).

Social Status

SPF-IL: Are you influential? Known for accomplishments? Do better than others?

LBQ: Do you receive poorer service than others in restaurants or stores? Are you treated with less courtesy or respect than others? Do you have high standards and work toward them? Have you gotten the important things you want in life?

The second item used a 7-point Likert scale and the others used 6-point scales. As with the first and third Behavioral Confirmation items, the Status items were transformed so that their values fell evenly between 1 and 3 (with z-scores ranging from 13.10 to 3.18); higher scores reflect greater fulfillment of Status needs. Internal consistency for the status items was α =.50, compared to α =.58 for the SPF-IL. Therefore, although neither subscale that measured Status was in a range of desirable consistency, the LBQ’s alpha score for status-needs fulfillment is similar to that of the SPF-IL.

Financial Fraud Question

One question from the LBQ was used to gauge participants’ levels of financial exploitation from thefts and scams: Have you been the victim of financial fraud in the past five years (Yes, No)? This immediately followed the question, Have you been robbed or burglarized within the past five years (Yes, No)? We coded the Fraud scores as 0 (no fraud) or 1 (fraud victim). A higher score, therefore, was related to fraud victimization.

Statistical Methodology

We performed independent samples t-tests or chi-square tests of independence to evaluate bivariate relationships between fraud and predictor variables. A stepwise forward logistic regression was then performed to determine which variables of interest predicted frequency of fraud when combined together in a model. Predictor variables included age, gender, ethnic minority status (Caucasian- Non Caucasian), years of education, and marital status (partnered, non-partnered), 2008 scores for the CES-D, ADLs, IADLs, self-rated health, income, TICS, Financial Satisfaction, and the social-needs variables (Affection, Behavioral Confirmation, and Status). All analyses were completed using SPSS Version 22 (IBM, Armonk, NY).

RESULTS

Prevalence of Fraud 2008 vs. 2012

Among older adults, the overall reported prevalence of fraud across a 5-year look back increased significantly (χ2 = 7.85; p = .005) between 2008 and 2012: from 5.0% (347 out of 6,920) to 6.1% (442 out of 7,252). As mentioned in the Methods section, to evaluate the incidence and prediction of fraud cases over the previous four years between the surveys, we only included individuals who (a) had completed both the 2008 and 2012 surveys (excluded 2,544 individuals, including 843 who passed away between waves), and (b) if they reported fraud on the 2012 survey, it had to have occurred between 2008 and 2012 in order to exclude instances of fraud that occurred prior to the 2008 survey and ensure longitudinal prediction (excluded 47 individuals). After excluding ineligible cases, our final sample contained 4,661 participants. As can be seen in Table 1, the sample had a mean age of almost 68 years in 2008 and a mean educational level of almost 13 years. The majority of participants were Caucasian (84%), female (61%), and married (69%). Compared to the total of 7,252 respondents to the 2012 survey, our final sample’s demographics were not substantially different (mean age = 67.3 years, mean education = 12.8 years, 60% female, 83% Caucasian, 66% married). Fraud incidence in our sample was 4.3% (200 out of 4,661).

Table 1.

Descriptive Statistics for Variables of Interest based on 2008 Survey results

| Variable | Mean | SD | Interquartile Range |

|---|---|---|---|

| Age | 67.73 | 9.28 | 61–74 |

| Education (years) | 12.79 | 2.94 | 12–15 |

| CES-D | 1.25 | 1.86 | 0–2 |

| ADL | 0.20 | 0.65 | 0–0 |

| IADL | 0.06 | 0.31 | 0–0 |

| Self-rated Health | 2.76 | 1.05 | 2–3 |

| Annual Income | $12,912 | $34,478 | $0–$11,000 |

| TICS | 20.59 | 5.03 | 17–24 |

| Disease burden | 1.36 | 1.12 | 1–2 |

| Affection | 0.10 | 2.61 | −1.31–2.09 |

| Behavioral confirmation | 0.15 | 1.88 | −0.99–1.39 |

| Social Status | 0.11 | 2.47 | −1.24–2.02 |

| Race | |||

| Caucasian | 3879 | 83.9% | |

| Minority | 742 | 16.1% | |

| Sex | |||

| Male | 1807 | 38.8% | |

| Female | 2854 | 61.2% | |

| Marital Status | |||

| Married | 3192 | 68.5% | |

| Not married | 1467 | 31.5% | |

| Financial Satisfaction | |||

| Not at all satisfied | 273 | 5.9% | |

| Not very satisfied | 575 | 12.4% | |

| Somewhat satisfied | 1519 | 32.7% | |

| Very satisfied | 1272 | 27.4% | |

| Completely satisfied | 1002 | 21.6% | |

| Have you been the victim of financial fraud in the past 5 years? | |||

| Yes | 200 | 4.3% | |

| No | 4461 | 95.7% | |

Significant Predictors of Being a Victim of Fraud

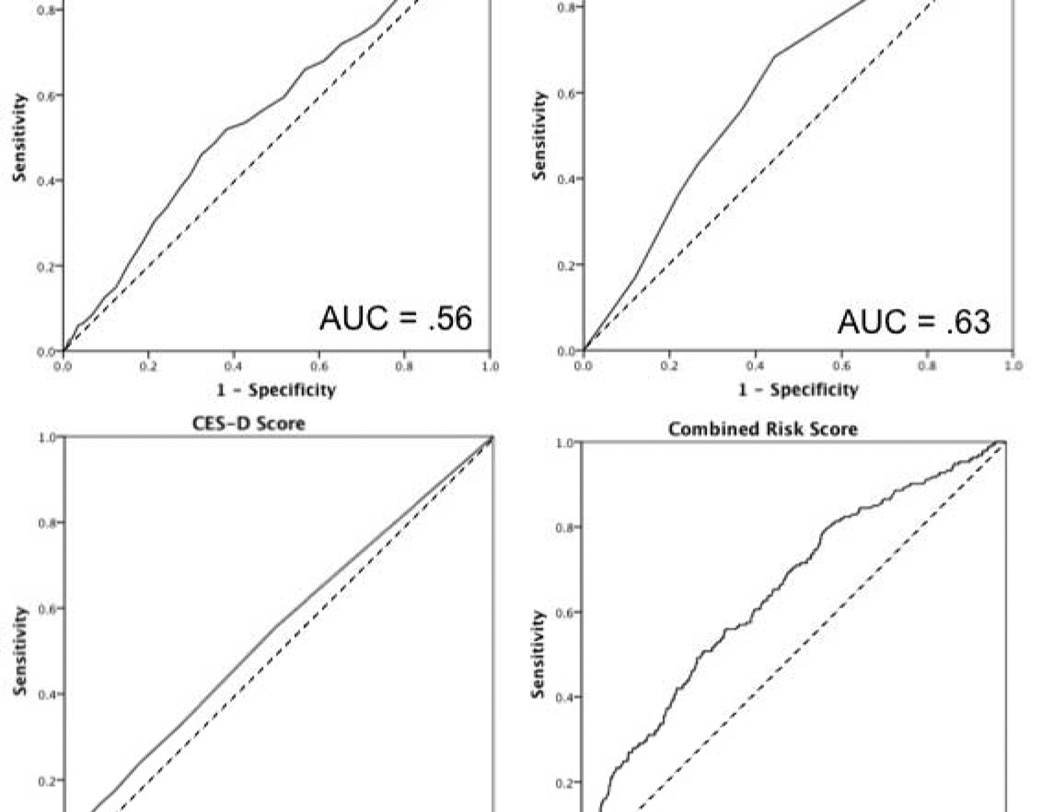

Being younger, more depressed and having more education significantly predicted fraud. Significant predictors of being a fraud victim can be found in Table 2 and 3. In Table 2, bivariate analyses using independent samples t-tests and chi square tests of independence compared those who reported fraud victimization and those who did not; decreased age, increased education, and increased depression were significantly related to being in the fraud victimization group. Results from a stepwise forward logistic regression are shown in Table 3. All variables from Table 2 were considered as predictors in the model; however, only younger age, higher education, and higher depression scores were significant predictors of fraud victimization. Figure 1 shows the Receiver Operating Characteristic curves for each of the three predictors, as well as the combined risk score calculated from the Beta weights of all three predictors. As shown, Education appears to be the strongest predictor, yielding an area under the curve (AUC) of .63. The combined predictive power of all three variables yielded only a modestly larger AUC of .65. An AUC of .65 corresponds to a Cohen’s d value of about 0.54, in the range of what is considered to be a “medium” effect size for discriminating between groups (Rice & Harris, 2005). Correlations between the predictors can be found in Table 4.

Table 2.

Results of t-Tests and Chi-Square Tests of Independence Comparing Variables of Interest between Respondents without and with a Reported History of Fraud between 2008 and 2012 Surveys

| Variable | No Fraud |

Fraud |

Cohen’s d or | ||||

|---|---|---|---|---|---|---|---|

| Mean | SD | Mean | SD | t or (χ2) | p | (Cramer’s V) | |

| Age (years) | 67.81 | 9.26 | 65.89 | 9.51 | 2.80 | .006 | 0.20 |

| Sex (% female) | 61.3% | 60.5% | (0.05) | .828 | (0.00) | ||

| Race (% minority) | 15.9% | 18.7% | (1.06) | .303 | (0.02) | ||

| Education (years) | 12.74 | 2.94 | 13.88 | 2.55 | −6.07 | < .001 | 0.41 |

| Marital Status (% partnered) | 68.5% | 68.5% | (0.00) | .997 | (0.00) | ||

| CES-D | 1.23 | 1.84 | 1.67 | 2.31 | −2.62 | .010 | 0.21 |

| ADL | 0.20 | 0.65 | 0.28 | 0.78 | −1.38 | .169 | 0.11 |

| IADL | 0.06 | 0.30 | 0.08 | 0.37 | −0.71 | .475 | 0.06 |

| Self-reported Health | 2.76 | 1.05 | 2.71 | 1.11 | 0.60 | .551 | 0.05 |

| Annual Income | $12,932 | $34,806 | $12,469 | $26,185 | 0.24 | .810 | 0.02 |

| TICS | 20.59 | 5.05 | 20.65 | 4.73 | −0.18 | .854 | 0.01 |

| Disease Burden | 1.37 | 1.12 | 1.24 | 1.12 | 1.63 | .104 | 0.12 |

| Financial Satisfaction | 3.47 | 1.13 | 3.40 | 1.16 | 0.81 | .422 | 0.06 |

| Affection | 0.09 | 2.62 | 0.39 | 2.43 | −1.71 | .089 | 0.12 |

| Confirmation | 0.16 | 1.87 | −0.02 | 2.05 | 1.19 | .236 | 0.09 |

| Status | 0.11 | 2.46 | 0.00 | 2.77 | 0.53 | .595 | 0.04 |

Table 3.

Results of stepwise logistic regression model predicting incidence of fraud between 2008 and 2012 surveys.

| Variables | β | SE | Wald χ2 | Exp(B) | p |

|---|---|---|---|---|---|

| 2008 Age | −0.02 | 0.01 | 6.87 | 0.98 | .010 |

| Education | 0.18 | 0.03 | 32.05 | 1.20 | < .001 |

| 2008 CES-D | 0.14 | 0.03 | 14.91 | 1.15 | < .001 |

| Constant | −4.24 | 0.76 | 30.85 | 0.01 | < .001 |

CES-D = Center for Epidemiologic Studies Depression Scale

Figure 1.

Receiver operating characteristic (ROC) curves for age, education, depression scores (as measured by the Center for Epidemiologic Studies Depression Scale), and the combination of the three variables for predicting incidence of fraud between 2008 and 2012. AUC = Area under the curve. Dotted lines represent a random chance, null-fitting model.

Table 4.

Pearson’s Correlation Matrix for Variables of Interest

| Age | Education | CES-D | ADL | IADL | Self-rated Health |

Annual Income |

TICS | Disease Burden | Affection | Behavioral Confirmation |

|

|---|---|---|---|---|---|---|---|---|---|---|---|

| Age | - | ||||||||||

| Education | −.09 | - | |||||||||

| CES-D | −.06 | −.19 | - | ||||||||

| ADL | .07 | −.14 | .33 | - | |||||||

| IADL | .05 | −.13 | .22 | .31 | - | ||||||

| Self-rated Health | .04 | −.31 | .40 | .36 | .18 | - | |||||

| Annual Income | −.30 | .20 | −.08 | −.09 | −.06 | −.15 | - | ||||

| TICS | .36 | .30 | −.23 | −.13 | −.16 | −.20 | −.06 | - | |||

| Disease Burden | .26 | −.13 | .17 | .20 | .14 | .42 | −.15 | .01 | - | ||

| Affection | .04 | .11 | −.23 | −.08 | −.04 | −.17 | .03 | .16 | −.05 | - | |

| Behavioral Confirmation | .08 | .14 | −.28 | −.13 | −.11 | −.24 | .04 | .19 | −.06 | .51 | - |

| Social Status | .14 | .09 | −.32 | −.16 | −.10 | −.26 | .01 | .18 | −.11 | .31 | .39 |

Italicized values = p < .01

Depression and Low Social-needs Fulfillment

We then conducted analyses of the most psychologically vulnerable. These analyses may assist in determining risk for individuals based on single variables, as multivariate prediction models may have limited utility for clinical purposes. For those who had clinically significant symptoms of depression (CES-D score > 3), 5.7% went on to experience fraud compared to 3.9% for the rest of the sample. This increased risk was statistically significant (χ2 = 5.31, p = .021). For those who scored in the bottom 10% of social status (z-score < −3.10), 5.5% experienced fraud compared to 4.3% of the rest of the sample. This prevalence difference was not statistically significant (χ2 = 1.26, p = .262). However, fraud prevalence among those with clinically significant depression and the lowest 10% in social-needs fulfillment (8.7%) was more than twice as high compared to the rest of the sample (4.1%; χ2 = 7.85, p = .005). An additional logistic regression model provided further support for this interaction between depression and social status (Table 5); the interaction term for predicting future incidence of fraud was modestly significant (p = .069) when added to the model with education, age, CES-D scores, and status.

Table 5.

Results of logistic regression model predicting incidence of fraud between 2008 and 2012 surveys, including the interaction between depression and social status

| Variables | β | SE | Wald χ2 | Exp(B) | p |

|---|---|---|---|---|---|

| 2008 Age | −0.02 | 0.01 | 5.25 | 0.98 | .022 |

| Education | 0.18 | 0.03 | 32.73 | 1.20 | < .001 |

| 2008 CES-D | 0.12 | 0.04 | 7.56 | 1.12 | .006 |

| 2008 Status | 0.06 | 0.04 | 1.97 | 1.06 | .160 |

| CES-D x Status | −0.02 | 0.01 | 3.30 | 0.98 | .069 |

| Constant | −4.42 | 0.74 | 35.33 | 0.01 | < .001 |

CES-D = Center for Epidemiologic Studies Depression Scale

Individuals in the lowest 10% of Behavioral Confirmation, (z-score < −2.38) reported fraud at 7.4%, significantly higher compared to 4.1% of the rest of the sample (χ2 = 10.48, p = .001). Individuals in the bottom 10% of Behavioral Confirmation and with clinically significant depression were more than twice as likely to experience fraud (9.7%) compared to the rest of the sample (4.1%, χ2 = 11.76, p = .001). However, the interaction between depression and behavioral confirmation was not significant for predicting future fraud (p = .583) in a multivariate logistic regression model including education, age, CES-D scores, and behavioral confirmation.

DISCUSSION

This study was a direct extension of work by Lichtenberg et al. (2013), which examined fraud prediction with both longitudinal and cross-sectional data (social needs measures were only available cross-sectionally). We were able to measure both incidence and prevalence of fraud across a 4-year period and examine in depth the demographic, functional, psychological, and social predictors of new cases of fraud. The 5-year prevalence of older-adult fraud rose 5.0% to 6.1% in just 4 years. This finding is the first empirical support of the general perception that older adults are increasingly being targeted for fraud. This finding needs to be interpreted with the limitation that the samples were not independent, as about 65% of the 2012 survey participants also completed the 2008 survey. However, over 2,500 new participants were added to the sample at the 2012 wave. An additional limitation of this finding is that the survey does not include individuals with cognitive impairment substantial enough to impair their ability to complete a survey. Further, although the HRS attempts to be nationally representative, the sample is predominantly White (84%), female (61%), and married (69%). The incidence of new cases of fraud among individuals who completed both surveys was 4.3% when using a slightly shorter 4-year look back period.

Significant predictors of fraud include many of the variables that previous studies have found to be associated with financial exploitation of all types: being younger-old, more educated, and more depressed. In particular, higher education was the strongest predictor of fraud in our sample. Many of these variables are related to vulnerability. Many younger-old adults are uncertain about retirement income—and, sometimes, about being able to remain employed until retirement, even with a college education. These individuals may be primed to respond to higher-risk financial decisions or transactions. Those with depression are more likely to be socially isolated and lonely, and may be more susceptible to influence by socially skilled others. Any adult, of course, including young adults—whether vulnerable or not—can be a victim of fraud. Those who are vulnerable, however, are at significantly higher risk.

Specifically, we examined psychological vulnerability, as defined by having clinically significant symptoms of depression and being in the lowest 10% for social-needs fulfillment. This means that our sample was experiencing both high rates of depressive symptoms and low levels of social-needs fulfillment, especially Behavioral Confirmation. The psychologically vulnerable reported fraud at a rate that was 140% higher than the rest of the sample, which means that one out of every 10.3 persons in this group had experienced fraud, compared to one out of 24 for the rest of the sample. These results not only support our previous findings (Lichtenberg et al., 2013) that depressive symptoms and low social-needs fulfillment have an additive effect on fraud predictability, but will serve to remind elder-abuse specialists how broadly psychological vulnerability affects older adults’ lives across a variety of domains. Although social-needs fulfillment and behavioral confirmation were not significant predictors as continuous variables, our analyses indicated that individuals at the extreme ends of these measures were at a higher risk for fraud victimization.

It is important to note that although we have identified several longitudinal risk factors, fraud victimization is still a relatively low base rate event and is difficult to predict. Those with the highest psychological vulnerability still only experienced fraud at a rate of about 9% in our sample, and our predictors in the logistic regression model were able to generate only a modest AUC of .65, corresponding to a medium effect size. However, financial exploitation is a potentially catastrophic event for older adults, and it is important to identify any and all risk factors to protect the most vulnerable individuals. One strength of our study is that fraud victimization was studied longitudinally using a large dataset drawn from individuals living in the community. This is one of a few studies comparing those who have experienced financial fraud to those who have not. In choosing to examine fraud risk in this way, we inescapably face the methodological challenge of predicting a low-frequency event. For this reason, these results should be interpreted cautiously, and in combination with results from studies using purpose-collected samples of fraud victims.

Currently, groups such as the United States Department of State Division of Consumer Protection and Federal Bureau of Investigations spearhead public campaigns to raise awareness of financial fraud against older adults. In combination with other studies, these findings may be employed to tailor these primary interventions to older adults who are at the elevated fraud risk, as well as to their families. Similar strategies have been employed to tailor messages involving other low-frequency but devastating events, such as recognizing signs of a stroke, reducing swimming-related fatalities involving children, and prevention of motorcycle-related traffic accidents.

As participants in the Stanford roundtable on fraud (2014) emphasized, significant questions regarding measurement continue to spark debate. For instance, self-report surveys, such as the measures used in this study, exclude those with significant cognitive impairment—a group that is susceptible to all types of financial exploitation. The Federal Trade Commission does not ask any general questions about fraud, asking instead about specific types of interactions that can be categorized as fraud (e.g., drive-by home-repair scams and Internet or mail fraud). Also, what constitutes fraud can sometimes be in the eye of the beholder: What seems like fraud to one individual may look like financial confusion or poor decision making to another. Nevertheless, results across time and studies are beginning to document the important impact vulnerability can have on older adults as potential victims of fraud, and the data provided by the HRS substudy is not to be dismissed.

Tips for Clinicians

Clinical Gerontologists are being called upon to become more aware of and proactive about detecting financial exploitation; of which fraud is one form of financial exploitation. Does the older adult have the right to make a bad choice or do they need protection? In clinical cases, especially where affective, social need and cognitive factors are involved, determining the older adult’s capacity for a specific financial decision becomes the cornerstone assessment. Many cases of fraud involve significant financial decisions or transactions, and yet traditionally there have been no scales focused on the specific decision in question. We have created a set of person-centered instruments (Lichtenberg et al., 2015) that allow a professional who works with older adults (e.g., financial planners, elder law attorneys, bankers) to evaluate whether the person has intact decisional abilities, including the ability to communicate choice and to understand, appreciate, and express their rationale for a financial decision. These scales have the potential to aid clinicians of all types who work with older adults. We offer a subset of questions from our scale that may be helpful to clinicians when working with their clients. The following questions can help alert clinicians to the potential vulnerability to financial exploitation in their clients:

-

❖

How often do your expenses exceed your monthly income?

-

❖

How confident are you about making big financial decisions?

-

❖

How worried are you about having enough money to pay for things?

-

❖

How anxious are you about your finances?

-

❖

Do you have a confidante whom you can talk to about things including finances?

The current study provides some compelling evidence that psychological issues are a key element in many cases of older adult fraud. Psychological vulnerability predicted new cases of fraud and provided further support for our cross sectional findings in 2013. Psychological vulnerability continues to be an under-emphasized aspect of financial fraud and fraud susceptibility.

Acknowledgments

Funding for this project was provided in part by the following grants:

National Institute of Justice MU-CX-0001

National Institutes of Health P30 AG015281

Michigan Center for Urban African American Aging Research

Retirement Research Foundation

American House Foundation

Robert and Martha Sachs

Contributor Information

Dr Peter Alexander Lichtenberg, Email: p.lichtenberg@wayne.edu, Wayne State University, Institute of Gerontology, 87 E. Ferry Street, Detroit, 48202, United States.

Michael A. Sugarman, Wayne State University, Institute of Gerontology and department of Psychology, Detroit, MI

Daniel Paulson, University of Central Florida, Psychology.

Lisa J Ficker, Wayne State University, Institute of Gerontology and department of Psychology, Detroit, MI.

Annalise Rahman-Filipiak, Wayne State University, Institute of Gerontology and department of Psychology, Detroit, MI.

References

- Acierno R, Hernandez MA, Amstadter AB, Resnick HS…, Kilpatrick DG. Prevalence and correlates of emotional, physical, sexual and financial abuse and potential neglect in the United States: The National Elder Mistreatment Study. American Journal of Public Health. 2010;100:292–297. doi: 10.2105/AJPH.2009.163089. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Beach SR, Schulz R, Castle NG, Rosen J. Financial exploitation and psychological mistreatment among older adults: Differences between African Americans and Non-African Americans in a population based survey. The Gerontologist. 2010;50:744–757. doi: 10.1093/geront/gnq053. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Boyle PA, Yu L, Wilson RS, Gamble K, Buchman AS, Bennett DA. Poor decision making is a consequence of cognitive decline among older persons without Alzheimer’s disease or mild cognitive impairment. PloS One. 2012;7(8):e43647. doi: 10.1371/journal.pone.0043647. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Brandt J, Spencer M, Folstein M. The Telephone Interview for Cognitive Status. Neuropsychiatry, Neuropsychology, and Behavioral Neurology. 1988;1:111–117. [Google Scholar]

- Desmond DW, Tatemichi TK, Hanzawa L. The Telephone Interview for Cognitive Status (TICS): Reliability and validity in a stroke sample. International Journal of Geriatric Psychiatry. 1994;9:803–807. [Google Scholar]

- Herzog AR, Wallace RB. Measures of cognitive functioning in the AHEAD Study. Journals of Gerontology. Series B, Psychological Sciences and Social Sciences. 1997;52B(Special Issue):37–48. doi: 10.1093/geronb/52b.special_issue.37. [DOI] [PubMed] [Google Scholar]

- Järvenpää T, Rinne JO, Räihä I, Koskenvuo M, Löppönen M, Kaprio J. Characteristics of two telephone screens for cognitive impairment. Dementia and Geriatric Cognitive Disorders. 2002;13:149–155. doi: 10.1159/000048646. [DOI] [PubMed] [Google Scholar]

- Laumann EO, Leitsch SA, Waite LJ. Elder mistreatment in the United States: Prevalence estimates from a nationally representative sample. Journal of Gerontology: Social Sciences. 2008;63B:S248–S254. doi: 10.1093/geronb/63.4.s248. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Lichtenberg PA, Stickney L, Paulson D. Is psychological vulnerability related to the experience of fraud in older adults? Clinical Gerontologist. 2013;36:132–146. doi: 10.1080/07317115.2012.749323. PMCID: PMC3755896. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Anonymous P, Stoltman J, Ficker L, Iris M, Mast B. A person-centered approach to financial capacity assessment: Preliminary development of a new rating scale. Clinical Gerontologist. 2014;38:49–67. doi: 10.1080/07317115.2014.970318. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Nieboer A, Lindenberg S, Boomsma A, Van Bruggen AC. Dimensions of well-being and their measurement: The SPF-IL Scale. Social Indicators Research. 2005;73:313–353. [Google Scholar]

- Ofstedal MB, Fisher GG, Herzog AR. Documentation of cognitive functioning measures in the Health and Retirement Study. Ann Arbor: University of Michigan; 2005. [Google Scholar]

- Ormel J, Lindenberg A, Steverink N, Verbrugge LM. Subjective well-being and social production functions. Social Indicators Research. 1999;46:61–90. [Google Scholar]

- Radloff LS. The CES-D Scale: A self-report depression scale for research in the general population. Applied Psychological Measurement. 1977;1:385–401. [Google Scholar]

- Rice M, Harris GT. Comparing effect sizes in follow-up studies: ROC Area, Cohen’s d, and r. Law and Human Behavior. 2005;29:615–620. doi: 10.1007/s10979-005-6832-7. [DOI] [PubMed] [Google Scholar]

- Stanford Center on Longevity, & Financial Fraud Research Center, editor. Conference proceedings: The True Impact of Fraud—A Roundtable of Experts; FINRA Investor Education Foundation; Washington, D.C. 2014. [Google Scholar]

- Steffick DE. HRS Documentation Report DR-005. Ann Arbor: Survey Research Center at the University of Michigan Institute for Social Research; 2000. Documentation of affective functioning measures in the health and retirement study. [Google Scholar]

- Steverink N, Lindenberg S. Which social needs are important for subjective well-being? What happens to them with aging? Psychology and Aging. 2006;12:281–290. doi: 10.1037/0882-7974.21.2.281. [DOI] [PubMed] [Google Scholar]

- Wallace R, Herzog AR, Ofstedal MB, Steffick D, Fonda S, Langa K. Documentation of affective functioning measures in the Health and Retirement Study. Ann Arbor, MI: Survey Research Center, University of Michigan; 2000. [Google Scholar]

- Welsh KA, Breitner JCS, Magruder-Habib KM. Detection of dementia in the elderly using telephone screening of cognitive status. Neuropsychiatry, Neuropsychology, and Behavioral Neurology. 1993;6:103–110. [Google Scholar]