Abstract

Although adverse socioeconomic conditions are correlated with worse child health and development, the effects of poverty-alleviation policies are less understood. We examined the associations of the Earned Income Tax Credit (EITC) on child development and used an instrumental variable approach to estimate the potential impacts of income. We used data from the US National Longitudinal Survey of Youth (n = 8,186) during 1986–2000 to examine effects on the Behavioral Problems Index (BPI) and Home Observation Measurement of the Environment inventory (HOME) scores. We conducted 2 analyses. In the first, we used multivariate linear regressions with child-level fixed effects to examine the association of EITC payment size with BPI and HOME scores; in the second, we used EITC payment size as an instrument to estimate the associations of income with BPI and HOME scores. In linear regression models, higher EITC payments were associated with improved short-term BPI scores (per $1,000, β = −0.57; P = 0.04). In instrumental variable analyses, higher income was associated with improved short-term BPI scores (per $1,000, β = −0.47; P = 0.01) and medium-term HOME scores (per $1,000, β = 0.64; P = 0.02). Our results suggest that both EITC benefits and higher income are associated with modest but meaningful improvements in child development. These findings provide valuable information for health researchers and policymakers for improving child health and development.

Keywords: child health, instrumental variables, poverty alleviation, socioeconomic determinants of health

Editor's note: An invited commentary on this article appears on page 785, and the authors’ response appears on page 790.

Poverty is highly correlated with worse child health and impaired development. Inadequate stimulation, maternal depression, and nutritional deficiencies affect brain development and result in poorer attention and cognitive outcomes in later life (1–3). The long-term effects of these factors on educational attainment and adult health are substantial contributors to intergenerational poverty and health disparities (3, 4).

However, little is known about how changes in economic policy affect child health and development. Researchers have identified characteristics of interventions that may equalize opportunities for low-income children, and an increasingly recognized component is economic assistance (5). Economic assistance is hypothesized to be particularly important for disadvantaged children, for whom financial support may bring about improved nutrition, household resources, and maternal health, as well as decreased stress levels (6). Unfortunately, much of the evidence is correlational, making the causal effect of income programs on health difficult to ascertain. In the present study, we build on prior work by exploiting changes in benefits from a poverty alleviation policy that are random with respect to individual characteristics; that is, individuals with the same characteristics will receive a different level of benefits depending on the year. The policy that we examined is the Earned Income Tax Credit (EITC), the largest poverty alleviation program in the United States. The program provides tax rebates to low-income families.

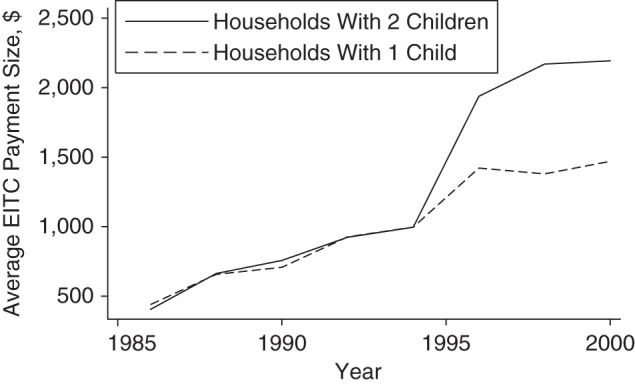

The EITC was initiated in 1975. It provided benefits to poor families contingent upon their employment, thereby incentivizing work while providing cash assistance. Benefits increase with increasing earned income until a plateau is reached, above which benefits are phased out. Individuals with no earned income are not eligible. In 2012, more than 27 million individuals received over $63 billion in tax credits (7, 8). The generosity of the program has changed over time, creating significant variation in the size of the benefits awarded to families: The inflation-adjusted maximum credit for a family with 2 children increased 5-fold from 1986 to 2000 (Web Figure 1, available at http://aje.oxfordjournals.org/) (9).

The EITC has brought millions of families out of poverty (10, 11). It has been shown to broaden insurance coverage among children, decrease the odds of being overweight among boys, increase the rate of prenatal care for pregnant mothers, and increase the birth weight of recipients' children (12–16). There has been only study in which child development was studied; the investigators found that larger benefits were associated with higher test scores among school-aged children, with greater improvements among disadvantaged children (17). However, systematic reviews of poverty-alleviation interventions in high-income countries found that the existing research on child and adult health effects was largely inconclusive (18, 19).

In the present study, we examined the impact of the EITC on child development using 2 conceptually distinct approaches. First, we used multivariate regressions with individual fixed effects. We used variations in the amount of the EITC, which stemmed from the expansion of the program over time, to estimate the association between the size of the tax credit and changes in 2 indicators of child development. Second, we used an instrumental variable approach to examine the causal effects of income itself on these 2 indicators, thereby overcoming the confounding present in prior studies in which the relationship between income and health was examined. We took 2 approaches to identification because it is important to understand both the effects of income from the EITC program specifically and those of income more generally when creating policies to improve child development.

METHODS

Study sample

We used data from the 1979 National Longitudinal Survey of Youth (NLSY) Child and Young Adult Study, a nationally representative cohort study with data collected annually from 1979 to 1994 and biennially thereafter. Our sample included female participants (n = 3,659) and their children (n = 8,186) for whom data were available in at least 2 consecutive years for at least 1 of the relevant health outcomes (Table 1). Female participants without children were excluded (n = 2,624). Children of male participants were not surveyed. To allow for similar densities of data across the study period (i.e., biennially), we only considered data collected in even years. We restricted our analyses to data from 1986–2000, during which there was the most variation in EITC payment size (Figure 1).

Table 1.

Sample Characteristics of the Study Population, National Longitudinal Survey of Youth, 1986–2000

| Characteristica | Mean (SD) | % |

|---|---|---|

| Mothers (n = 3,659) | ||

| Age, years | 30.6 (4.4) | |

| Educational at age 25 years | ||

| Less than high school | 31.6 | |

| High school | 43.0 | |

| More than high school | 25.4 | |

| Married | 54.2 | |

| No. of children in household | 2.5 (1.2) | |

| Pretax household income, $b | 15,110 (109,946) | |

| EITCc | ||

| No. ever eligible during 1986–2000 | 1,910 | |

| Payment size (if eligible), $ | 973.8 (899.5) | |

| Children (n = 8,186)d | ||

| Age, years | 6.5 (3.6) | |

| Female sex | 49.4 | |

| Race | ||

| Black | 36.0 | |

| Hispanic | 20.9 | |

| White or other | 43.1 | |

| Child development scorese | ||

| BPI | ||

| No. of children with ≥2 measures | 6,676 | |

| No. of observations per child | 2.6 | |

| Standardized score | 107.1 (14.9) | |

| HOME inventory | ||

| Number of children with ≥2 measures | 8,053 | |

| No. of observations per child | 3.1 | |

| Standardized score | 94.8 (16.3) | |

Abbreviations: BPI, Behavioral Problems Index; EITC, Earned Income Tax Credit; HOME, Home Observation Measurement of the Environment; SD, standard deviation.

a Summary statistics were calculated using imputed data for individuals with a pretax household income of less than $50,000.

b Includes spouse's income, if married. Inflation-adjusted to year 2000 dollars.

c EITC was imputed using Taxsim for Stata. Inflation-adjusted to year 2000 dollars.

d Children were included if they had at least 2 measures that allowed for the calculation of the primary outcomes (2- and 4-year differences).

e Higher values on the HOME inventory and lower BPI values denote a better outcome.

Figure 1.

Average Earned Income Tax Credit (EITC) payment by year and number of children in the household (n= 3,659 households), National Longitudinal Survey of Youth, 1986–2000. This figure demonstrates the variation in average EITC payment size among EITC-eligible participants in the study sample. Values are inflation-adjusted to year 2000 dollars.

Exposure

The size of the EITC payment for which a family was eligible served as the predictor variable in the multivariate regression and as the instrument in the instrumental variable analysis. We used self-reported household pretax income in conjunction with tax tables from the Internal Revenue Service to calculate posttax income using the package Taxsim for Stata, version 14 MP (StataCorp LP, College Station, Texas) (20). In prior studies, investigators found that more than 80% of families that were eligible actually received the credit during this study period (21). Because we were unable to identify recipients in our sample, we assumed that 100% of eligible households received their benefit, which is an intention-to-treat approach used in prior research that would bias our estimates toward zero (16, 17, 22–26).

It has also been shown in previous studies that there is “bunching” of income among EITC recipients at the exact level that maximizes the credit; this bunching has increased over time, suggesting that savvy families “self-select” into receipt of the maximum credit (10). This introduces possible confounding, because these individuals may be more educated or healthier. To reduce this selection bias, we used an individual's income and demographic characteristics from 2 years prior to impute her current EITC benefit (see Web Appendix).

Outcomes

The outcome variables included 2 indicators that captured aspects of development during different phases of childhood. The first was the Behavior Problems Index (BPI), a 28-item questionnaire that measures the degree to which a child exhibits problems in 6 domains: antisocial behavior, headstrongness, hyperactivity, immature dependency, peer conflict, and anxiousness/depression (27). This scale was based on one developed and validated by Peterson and Zill (28). Mothers of children 4–14 years of age answer these questions about each child's behavior in the past 3 months. Although the raw scores for the BPI ranges from 0 to 28, this score is normalized in the NLSY by sex and age based on a national sample to account for typical changes in the score as the children age (mean = 100; standard deviation, 15). The BPI can be used to predict a variety of child behaviors and has been used to validate other temperament scales (29).

The second outcome was the Home Observation Measurement of the Environment (HOME) inventory, which measures the quality of cognitive stimulation and environmental support in the home for children aged 0–14 years. This is a shortened version of the inventory developed and validated by Caldwell and Bradley (30). It involves objective items scored by the interviewer (e.g., whether the home is cluttered) and questions asked directly of the mother (e.g., how often the mother reads to the child). The number of items varies according to the age of the child (18–31 items), as does the percentage of questions that are objectively scored (30%–35%). Details have been published previously (27). The HOME inventory is normalized by age to allow for aging of the child and for comparability of the score across time (mean = 1,000; standard deviation, 150). For the purposes of the present study, we adjusted the scale to a mean of 100 and standard deviation of 15 for consistency with the BPI. Although the HOME inventory is not a measure of child development in itself, it has been used extensively as a predictor of child development and as an outcome influenced by socioeconomic status (31).

For both measures, we created outcome variables based on the difference between the child's current score and his score in 2 and 4 years. This enabled us to capture the short- and medium-term effects on child development of the EITC benefit and to control for baseline differences by examining changes over time. The average number of observations per child in this data set was 2.2 for the 2-year BPI variable, 1.9 for the 4-year BPI variable, 2.7 for the 2-year HOME inventory variable, and 2.4 for the 4-year HOME inventory variable. Children were only included in the analyses for the years in which they had an outcome recorded. There were no notable secular trends in these measures in this sample (Web Figure 2).

Covariates

Time-varying covariates included mother's marital status, number of children in the household, and number of hours worked in the past year. We controlled for household pretax income, which included the mother's self-reported income and that of her spouse if she was married. We included a third-degree polynomial of household pretax income (i.e., income, income-squared, etc.) to flexibly model income. In secondary analyses, we also adjusted for state-level annual unemployment and mean per capita personal income, which are available online publicly from the Bureau of Economic Analysis. We restricted analyses to individuals with a household income under $50,000 because individuals with higher incomes were unlikely to be an appropriate comparison group for EITC recipients. Income and EITC were inflation-adjusted and are presented in year 2000 US dollars.

Ethics approval

Ethics approval for the NLSY was provided by the institutional review boards of Ohio State University and the National Opinion Research Center at the University of Chicago. Approval was also obtained from the US Office of Management and Budget.

Data analysis

The NLSY suffers from a degree of nonresponse due to death, refusal to participate, and skipped questions. To address this, we conducted multiple imputation using chained equations to impute missing values (see Web Appendix).

Our analysis involved 2 separate strategies based on the hypothesis that EITC payment size affects posttax income, which then will influence child development. First, to determine the association between payment size and changes in child development, we used multivariate linear regressions. We included fixed effects for year to control for secular trends and fixed effects for each child to examine within-child variation. Including child-level fixed effects accounted for unobserved time-invariant maternal, child, and state-level characteristics. Because some mothers had several children in the sample, standard errors were clustered at the household level. An empirical model is provided in the Web Appendix.

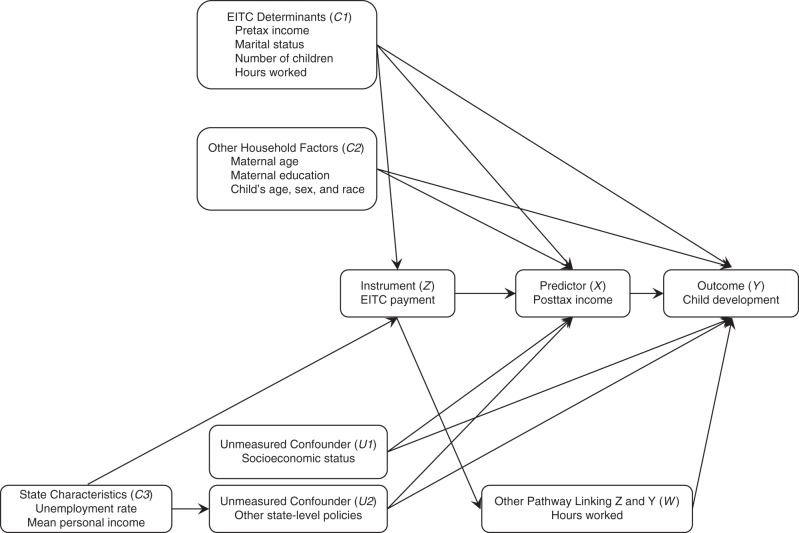

Our second analytical strategy involved an IV analysis in which we used the size of the EITC payment as the instrument for posttax income. IV methods are used in cases in which the relationship between the exposure (X) and outcome (Y) is confounded by unobserved factors (U1) and in which the exposure can not be randomized, as shown in the directed acyclic graph in Figure 2 (32). We hypothesized that the variation in EITC payment size over time—which is driven by exogenous policy changes—influenced health through its effect on income and that it was not subject to the same confounding by socioeconomic status. The use of EITC as an instrument for income has been implemented in prior studies (12, 17, 22, 23, 33, 34). For the IV assumptions to be valid, our models were adjusted for potential confounders that influence EITC payment size: pretax household income, marital status, number of dependents, and hours worked (C1). We also adjusted for state-level characteristics (C3) that may be common causes of both EITC generosity and for other state-level policies that influence income and child development (U2). As a sensitivity test, we also conducted IV analyses in which the primary predictor was the maximum federal tax benefit (rather than federal plus state) in order to break the link between state characteristics (C3) and policies (U2) and the instrument (Z). Of note, prior research has demonstrated no relationship between maximum EITC benefits and state minimum wage, welfare reform implementation, or other social benefits (35).

Figure 2.

Instrumental variable design. Instrumental variable methods are used in cases in which the relationship between the exposure (X) and the outcome (Y) is confounded by other unobserved factors (U) and in which the exposure cannot be randomized. They take advantage of the existence of a third variable—the instrument (Z)—which itself is quasi-random and which influences the outcome (Y) only through the exposure (X). EITC, Earned Income Tax Credit.

We used fixed-effects IV models that accounted for time-invariant mother- and child-level characteristics (C2) with standard errors clustered at the household level. These analyses were conducting using the xtivreg, fe command in Stata. Because the validity of multiple imputation in IV analyses has not been established (36), we conduct these regressions using unimputed data. To evaluate the endogeneity of income, we perform the Durbin-Wu-Hausman test, which produces a robust test statistic when standard errors are correlated (37). This test failed to reject the null that income was exogenous.

In each set of models, we included an interaction term between payment size and marital status to capture potential heterogeneous effects between these groups. As an alternative specification, we included analyses in which the predictor variable was modeled as the difference between current year's EITC and the EITC payment size from 2 years ago rather than the absolute value of the current year's EITC. These models were otherwise identical to those above, with both ordinary least squares and IV analyses. Although this exposure less directly captured the true exposure of interest—the amount of EITC payment received—it allowed for clearer identification of causal effects because the exposure was comprised entirely of the change in EITC benefits.

RESULTS

Sample characteristics

Approximately three-quarters of the sample had a high school education or less, and 54.2% were married (Table 1). The mean pretax household income was $15,110. In this sample, 1,910 women were eligible for the EITC at some point during the study period. The average age among children was 6.5 years, and the majority of participants were black or Hispanic.

The EITC and child development

Higher values of the HOME inventory and lower BPI values denoted better outcomes. Larger EITC payments were associated with improved BPI scores at 2-year follow-up (per $1,000, β = −0.57; P = 0.04), although this result was somewhat attenuated (β = −0.34) when we controlled for state-level unemployment and mean income (Table 2). There was no association of EITC payment size with BPI scores at the 4-year follow-up or with HOME scores. The results of analyses using unimputed data were similar to these main results (Web Table 1), although there was also a statistically significant beneficial impact of EITC amount on 4-year difference in the HOME score. Including an interaction term between payment size and marital status showed that children of unmarried women were marginally significantly more likely to demonstrate improved BPI scores at the 2-year follow-up (per $1,000, β = −0.57; P = 0.09) and improved HOME scores at the 4-year follow-up (per $1,000, β = 0.87; P = 0.09) compared with children of married women (Web Table 2). There was no association with BPI scores at the 4-year follow-up or with HOME scores at the 2-year follow-up. In our alternative specification in which we modelled the predictor as the difference between the current year's EITC and the EITC payment size from 2 years prior, coefficients were in a similar direction and similar in magnitude for the BPI score but were no longer statistically significant (Web Table 3).

Table 2.

Effect of Earned Income Tax Credit Payment Size on Child Development, National Longitudinal Survey of Youth, 1986–2000

| Variable | BPIa |

HOMEa |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2-Year Difference |

4-Year Difference |

2-Year Difference |

4-Year Difference |

|||||||||

| No. | β | 95% CI | No. | β | 95% CI | No. | β | 95% CI | No. | β | 95% CI | |

| Base modelsb | ||||||||||||

| EITC amount per $1,000c | −0.57 | −1.14, −0.0034 | −0.29 | −1.22, 0.62 | 0.083 | −0.57, 0.74 | 0.59 | −0.26, 1.44 | ||||

| Married | 0.31 | −1.06, 1.68 | −0.28 | −2.32, 1.75 | −3.42 | −4.60, −2.23 | −5.53 | −7.09, −3.97 | ||||

| No. of hours worked | 0.0001 | −0.0007, 0.0005 | −0.0003 | −0.0011, 0.0004 | 0.0004 | −0.0001, 0.0010 | 0.0007 | 0.00, 0.0013 | ||||

| No. of dependent children | −0.49 | −1.36, 0.38 | −0.83 | −2.11, 0.45 | 1.35 | 0.66, 2.05 | 2.17 | 1.07, 3.27 | ||||

| Pretax household income per $1,000c,d | 0.0007 | −0.025, 0.026 | 0.0018 | −0.038, 0.042 | −0.0057 | −0.025, 0.014 | −0.0092 | −0.038, 0.020 | ||||

| Constant | 2.50 | 0.12, 4.89 | 3.17 | −0.23, 6.57 | −1.75 | −3.54, 0.047 | −3.01 | −5.71, −0.32 | ||||

| No. of child-years | 14,043 | 10,062 | 20,609 | 15,808 | ||||||||

| No. of children | 6,261 | 5,383 | 7,645 | 6,498 | ||||||||

| Models including state-level covariatesb | ||||||||||||

| EITC amount per $1,000c | −0.34 | −0.80, 0.13 | −0.25 | −0.97, 0.46 | −0.033 | −0.60, 0.53 | 0.052 | −0.65, 0.75 | ||||

| Married | 0.41 | −0.97, 1.79 | −0.31 | −2.36, 1.72 | −3.48 | −4.69, −2.26 | −5.59 | −7.12, −4.05 | ||||

| No. of hours worked | 0.00 | −0.0006, 0.0006 | −0.0003 | −0.0011, 0.0005 | 0.0004 | −0.0001, 0.0010 | 0.0007 | 0.00, 0.0014 | ||||

| No. of dependent children | −0.48 | −1.40, 0.43 | −0.80 | −2.09, 0.49 | 1.35 | 0.62, 2.07 | 2.10 | 1.00, 3.19 | ||||

| Pretax household income per $1,000c,d | 0.0018 | −0.023, 0.027 | 0.0027 | −0.036, 0.041 | −0.0021 | −0.022, 0.018 | −0.0077 | −0.037, 0.022 | ||||

| State unemployment | 0.075 | −0.40, 0.55 | 0.34 | −0.38, 1.06 | −0.021 | −0.041, 0.36 | 0.24 | −0.30, 0.79 | ||||

| State personal income per $1,000c | −0.077 | −0.44, 0.29 | −0.35 | −0.91, 0.20 | −0.082 | −0.40, 0.24 | 0.25 | −0.17, 0.67 | ||||

| Constant | 3.73 | −6.65, 14.10 | 8.99 | −6.50, 24.49 | 0.35 | −8.65, 9.34 | −10.66 | −22.79, 1.46 | ||||

| No. of child-years | 14,006 | 10,059 | 20,582 | 15,471 | ||||||||

| No. of children | 6,222 | 5,346 | 7,588 | 6,479 | ||||||||

Abbreviations: BPI, Behavioral Problems Index; CI, confidence interval; EITC, Earned Income Tax Credit; HOME, Home Observation Measurement of the Environment.

a Higher values on the HOME inventory and lower BPI values denote a better outcome.

b Analyses involve multivariate linear regression with fixed effects (i.e., dummy variables) for each child and year; time-invariant characteristics were therefore not included in these models. Standard errors were clustered at the household level. We utilized multiple imputation using chained equations to impute missing data.

c Values for income, EITC payment size, and state income were inflation-adjusted to year 2000 dollars.

d Coefficients for household income squared and cubed were zero and therefore omitted from this Table for display purposes only.

Income and child development

The first stage of the IV analysis showed that EITC payment size and the 2-year difference in payment size were predictive of posttax household income (Table 3, Web Table 4). The coefficient for EITC payment size in the first stage—$1,784—was consistent with the direct effect of the EITC on income and its effect on increased labor market earnings. The F statistic for the first stage was well above the standard cutoff of 10 for each model, which indicated that payment size is a strong instrument for posttax income (Table 4).

Table 3.

Effect of Earned Income Tax Credit Payment Size on Posttax Household Income From the First Stage of Instrumental Variable Analysis, National Longitudinal Survey of Youth, 1986–2000

| Variable | Base Modela |

Model With State-level Covariatesa |

||||

|---|---|---|---|---|---|---|

| No. | β | 95% CI | No. | β | 95% CI | |

| EITC amount per $1,000b | 1,784 | 1,673, 1,895 | 1,782 | 1,672, 1,893 | ||

| Married | −65.58 | −343.8, 212.7 | −65.99 | −347.6, 215.6 | ||

| No. of hours worked | −0.11 | −0.22, 0.0057 | −0.11 | −0.22, 0.0055 | ||

| No. of dependent children | 43.84 | −86.88, 174.6 | 43.82 | −87.08, 174.7 | ||

| Pretax household incomeb,c | 1.04 | 1.00, 1.08 | 1.04 | 1.00, 1.08 | ||

| Constant | −1,482 | −1,843, −1,122 | −1,137 | −3,321, 1,046 | ||

| No. of child-years | 12,072 | 12,072 | ||||

| No. of children | 5,216 | 5,216 | ||||

Abbreviations: CI, confidence interval; EITC, Earned Income Tax Credit.

a Analyses involved multivariate linear regression with fixed effects for each child and year; time-invariant characteristics were therefore not included in this model. Unimputed data were used for this instrumental variables analysis. Standard errors were clustered at the household level.

b Values for income, EITC payment size, and state income were inflation-adjusted to year 2000 dollars.

c Coefficients for household income squared and cubed were zero and therefore omitted from this Table for display purposes only.

Table 4.

Effect of Income on Child Development Using Earned Income Tax Credit as an Instrument, National Longitudinal Survey of Youth, 1986–2000

| Variable | BPIa |

HOMEa |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2-Year Difference |

4-Year Difference |

2-Year Difference |

4-Year Difference |

|||||||||

| No. | β | 95% CI | No. | β | 95% CI | No. | β | 95% CI | No. | β | 95% CI | |

| Base modelsb | ||||||||||||

| Posttax household income per $1,000c | −0.47 | −0.84, −0.096 | −0.44 | −0.96, 0.091 | 0.22 | −0.21, 0.65 | 0.64 | 0.12, 1.16 | ||||

| Married | −0.18 | −2.39, 2.03 | −1.60 | −4.77, 1.57 | −2.28 | −4.18, −0.37 | −4.89 | −7.20, −2.59 | ||||

| No. of hours worked | 0.0002 | −0.0007, 0.0011 | −0.0002 | −0.0014, 0.0009 | 0.0008 | −0.0001, 0.0016 | 0.0006 | −0.0004, 0.0016 | ||||

| No. of dependent children | −0.065 | −1.15, 1.02 | −0.36 | −1.93, 1.22 | 1.73 | 0.81, 2.66 | 2.59 | 1.23, 3.95 | ||||

| Pretax household incomec,d | 0.0006 | 0.0001, 0.0012 | 0.0003 | −0.0004, 0.0010 | −0.0004 | −0.0010, 0.0002 | −0.0009 | −0.0015, −0.0002 | ||||

| F statistic | 941 | 670 | 976 | 825 | ||||||||

| No. of child-years | 6,359 | 4,000 | 9,615 | 7,012 | ||||||||

| No. of children | 2,327 | 1,665 | 3,130 | 2,518 | ||||||||

| Models including state-level covariatesb | ||||||||||||

| Posttax household income per $1,000c | −0.46 | −0.84, −0.091 | −0.41 | −0.94, 0.00011 | 0.22 | −0.21, 0.65 | 0.65 | 0.13, 1.17 | ||||

| Married | −0.19 | −2.40, 2.02 | −1.65 | −4.82, 1.51 | −2.27 | −4.19, −0.35 | −4.86 | −7.16, −2.56 | ||||

| No. of hours worked | 0.0002 | −0.0007, 0.0011 | −0.0003 | −0.0014, 0.0009 | 0.0008 | −0.0001, 0.0016 | 0.0006 | −0.0004, 0.0016 | ||||

| No. of dependent children | −0.071 | −1.16, 1.02 | −0.40 | −1.98, 1.17 | 1.73 | 0.81, 2.66 | 2.61 | 1.25, 3.96 | ||||

| Pretax household incomec,d | 0.0006 | 0.094, 0.0012 | 0.0003 | −0.0004, 0.0010 | −0.0004 | −0.0010, 0.0002 | −0.0009 | −0.0015, −0.0002 | ||||

| State unemployment | 0.23 | −0.45, 0.90 | 0.62 | −0.39, 1.63 | −0.033 | −0.58, 0.52 | 0.36 | −0.35, 1.07 | ||||

| State personal income per $1,000c | 0.023 | −0.51, 0.55 | −0.26 | −1.07, 0.0006 | 0.018 | −0.43, 0.47 | 0.19 | −0.36, 0.74 | ||||

| F statistic | 944 | 672 | 976 | 824 | ||||||||

| No. of child-years | 6,359 | 4,000 | 4,000 | 9,615 | 7,012 | |||||||

| No. of children | 2,327 | 1,665 | 1,665 | 3,130 | 2,518 | |||||||

Abbreviations: BPI, Behavioral Problems Index; CI, confidence interval; EITC, Earned Income Tax Credit; HOME, Home Observation Measurement of the Environment.

a Higher values on the HOME inventory and lower BPI values denote a better outcome.

b Instrumental variable analyses using with fixed effects for each child and year; time-invariant characteristics were therefore not included in this model. These analyses were conducted using unimputed data, resulting in smaller sample sizes. EITC payment size is used as instrument for posttax household income. Standard errors are clustered at household level.

c Values for income, EITC payment size, and state income were inflation-adjusted to year 2000 dollars.

d Coefficients on household income squared and cubed were zero and therefore omitted from this Table for display purposes only.

In IV models (Table 4), higher income predicted improved BPI scores at the 2-year follow-up (per $1,000, β = −0.47; P = 0.01) and improved HOME scores at the 4-year follow-up (per $1,000, β = 0.64; P = 0.02). This result was robust to the inclusion of state-level unemployment and mean income as covariates, as well as to the use of federal EITC benefit size rather than total (federal plus state) benefit size as an instrument (Web Table 5). There was no association with BPI scores at the 4-year follow-up or with HOME scores at the 2-year follow-up. When using the 2-year difference in EITC payment size as the instrument, higher income was marginally significantly associated with improvement in BPI scores at the 2-year follow-up (per $1,000, β = −0.49; P = 0.06) and the 4-year follow-up (per $1,000, β = −0.59; P = 0.08) but not with HOME scores (Web Table 6).

DISCUSSION

In the present study, we examined the effects of the EITC on child development among children of qualifying families. Our results suggest that there were positive effects on children's behavioral problems in the sample overall. The effect magnitudes were 2%–5% of a standard deviation for every $1,000. Prior research has shown that BPI and HOME scores worsen by roughly 3% of a standard deviation for every additional year that a child's family is in poverty (38), which is similar in magnitude to our findings and those from a prior study of the association of the EITC with children's test scores (17). Although these associations were modest, it is possible that persistent increases in income might bring about greater cumulative changes in child development (39); our analyses, however, were of relatively short-term impacts. In previous studies, investigators have demonstrated that early-life socioeconomic conditions have long-lasting effects on later-life health and productivity (3, 40). Thus, even seemingly small effect sizes may bring about meaningful long-term population-level impacts.

The results from our IV analyses suggest that increased income is associated with improved BPI and HOME scores. When using an alternative specification with 2-year differences in EITC payment size as the instrument, BPI score improvements remained marginally statistically significant and were of a similar magnitude and direction. These results are consistent with those from studies on poverty alleviation, in which researchers found that boosting income improved health, especially among younger children (39, 41). The economic boost may lead to an increased ability to purchase material resources or to improved parental mental health. Decreased parental stress and depression are associated with decreased behavioral problems in children (42), perhaps because of heightened parental responsiveness and warmth (43). Given that the EITC has been associated with improved mental and physical health among female recipients (44), this may represent a mechanism through which larger benefits lead to decreased child behavioral problems. Furthermore, children's home environments improve with increased maternal self-esteem and a stronger locus of control (45), both of which may be higher with the increased labor participation brought about by the EITC (46). Although our results suggest that associations with BPI effects are more pronounced in the short term, HOME effects are more prominent in the medium term, perhaps because this measure captures lasting investments in household resources. It has been shown in previous studies that poverty later in childhood is associated with lower HOME scores compared with early poverty (47), although to our knowledge there have been no studies of the persistence of the effects of poverty alleviation on HOME scores. Future research should examine how poverty alleviation interventions over the life course affect child development.

Our study contributes to the literature on the differential impacts of the EITC for married and unmarried women, which has been mixed. For example, investigators have found larger increases in birth weight for unmarried women (14, 15) but larger effects on fertility among married women (48). We found that child development scores are marginally significantly improved among children of unmarried women relative to married women, which suggests that the added income from EITC payments is particularly important for these more vulnerable households. Because these results were not significant at the 5% level, they should be tested in future research.

There are several limitations to the present study. EITC increases employment in single-headed households (46), which may then affect health through pathways other than income (Figure 2, pathway W). Although our models did attempt to address this through statistical control for number of hours worked, this still weakens the validity of EITC as an instrument for posttax income. Also, the Durbin-Wu-Hausman test failed to reject the null; this suggests that income may not be endogenous in this sample, although the literature supports a strong conceptual basis for the endogeneity of income (49), specifically for child development outcomes (50). IV analyses are also subject to residual confounding; for example, changes over time may not be truly exogenous. We have endeavored to address these in our use of fixed-effects models and by conducting several sensitivity tests. Nevertheless, the results of the IV analysis should be interpreted with caution. Another limitation involves possible measurement error due to self-report of income and measurement error due to the use of the Taxsim algorithm to impute benefits. Also, although we examined short- and medium-term changes, future studies should revisit these children later in life to determine the longer-term effects of poverty alleviation. Additionally, our IV results are limited by the “local average treatment effect,” in that they apply primarily to individuals similar to those in our study sample and only to income boosts brought about by EITC changes (51). Another threat to generalizability is that this study included children of NLSY female participants only; children in single-parent male-headed households are not represented and should be examined in future work.

In our study, we examined the effects of the EITC—the largest US poverty-alleviation program—on development outcomes among children of recipient families. Our results suggest that this program leads to improved development and health, with potentially greater benefits for children of unmarried mothers. These findings have implications for child health researchers and policymakers, providing valuable information to target health disparities among children of vulnerable families.

Supplementary Material

ACKNOWLEDGMENTS

Author affiliations: Department of Medicine, School of Medicine, Stanford University, Palo Alto, California (Rita Hamad, David H. Rehkopf).

R.H. is supported by a KL2 Mentored Career Development Award of the Stanford Clinical and Translational Science Award to The Stanford Center for Clinical and Translational Research and Education (Spectrum) (grant NIH KL2 TR 001083). D.H.R. is supported by a grant from the National Institute of Aging (grant NIA K01AG047280).

Conflict of interest: none declared.

REFERENCES

- 1.Galler JR, Bryce CP, Zichlin ML et al. Infant malnutrition is associated with persisting attention deficits in middle adulthood. J Nutr. 2012;1424:788–794. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 2.Najman JM, Hayatbakhsh MR, Heron MA et al. The impact of episodic and chronic poverty on child cognitive development . J Pediatr. 2009;1542:284–289.e1. [DOI] [PubMed] [Google Scholar]

- 3.Walker SP, Wachs TD, Grantham-McGregor S et al. Inequality in early childhood: risk and protective factors for early child development. Lancet. 2011;3789799:1325–1338. [DOI] [PubMed] [Google Scholar]

- 4.Halfon N. Socioeconomic influences on child health: building new ladders of social opportunity. JAMA. 2014;3119:915–917. [DOI] [PubMed] [Google Scholar]

- 5.Engle PL, Black MM, Behrman JR et al. Strategies to avoid the loss of developmental potential in more than 200 million children in the developing world. Lancet. 2007;3699557:229–242. [DOI] [PubMed] [Google Scholar]

- 6.Dawson G, Ashman SB, Carver LJ. The role of early experience in shaping behavioral and brain development and its implications for social policy. Dev Psychopathol. 2000;124:695–712. [DOI] [PubMed] [Google Scholar]

- 7.Flores QT. Tax credits for working families: earned income tax credit. National Conference of State Legislatures; http://www.ncsl.org/research/labor-and-employment/earned-income-tax-credits-for-working-families.aspx Updated February 1, 2015. Accessed February 21, 2014. [Google Scholar]

- 8.Scott C. The Earned Income Tax Credit (EITC): Changes for 2012 and 2013. Washington, DC: Congressional Research Service; 2013. [Google Scholar]

- 9.Committee on Ways and Means. Green Book. Washington, DC: U.S. House of Representatives; 2004. [Google Scholar]

- 10.Chetty R, Friedman JN, Saez E. Using differences in knowledge across neighborhoods to uncover the impacts of the EITC on earnings. Working Paper 18232 Cambridge, MA: National Bureau of Economic Research; 2012. [Google Scholar]

- 11.Dahl M, DeLeire T, Schwabish J. Stepping Stone or Dead End? The Effect of the EITC on Earnings Growth. Bonn, Germany: Institute for the Study of Labor; 2009. [Google Scholar]

- 12.Rehkopf DH, Strully KW, Dow WH. The impact of poverty reduction policy on child and adolescent overweight: a quasi-experimental analysis of the earned income tax credit [abstract] Am J Epidemiol. 2011;173(suppl):S238. [Google Scholar]

- 13.Baughman RA. The effects of state EITC expansion on children's health (Paper 168). Durham, NH: The Carsey School of Public Policy at the Scholars’ Repository, University of New Hampshire; 2012. [Google Scholar]

- 14.Strully KW, Rehkopf DH, Xuan Z. Effects of prenatal poverty on infant health: state earned income tax credits and birth weight. Am Sociol Rev. 2010;754:534–562. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.Baker K. Do Cash Transfer Programs Improve Infant Health: Evidence from the 1993 Expansion of the Earned Income Tax Credit. Notre Dame, IN: University of Notre Dame; 2008. [Google Scholar]

- 16.Hoynes HW, Miller DL, Simon D. Income, the earned income tax credit, and infant health. Am Econ J Econ Policy. 2015;71:172–211. [Google Scholar]

- 17.Dahl GB, Lochner L. The impact of family income on child achievement: evidence from the earned income tax credit. Am Econ Rev. 2012;1025:1927–1956. [Google Scholar]

- 18.Lucas PJ, McIntosh K, Petticrew M et al. Financial benefits for child health and well-being in low income or socially disadvantaged families in developed world countries. Cochrane Database Syst Rev. 2008;2:CD006358. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 19.Pega F, Carter K, Blakely T et al. In-work tax credits for families and their impact on health status in adults. Cochrane Database Syst Rev. 2013;8:CD009963. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 20.Feenberg D, Coutts E. An introduction to the TAXSIM model. J Policy Anal Manage. 1993;121:189–194. [Google Scholar]

- 21.Scholz JK. The earned income tax credit: participation, compliance, and antipoverty effectiveness. Natl Tax J. 1994;471:63–87. [Google Scholar]

- 22.Schmeiser MD. Expanding wallets and waistlines: the impact of family income on the BMI of women and men eligible for the Earned Income Tax Credit. Health Econ. 2009;1811:1277–1294. [DOI] [PubMed] [Google Scholar]

- 23.Larrimore J. Does a higher income have positive health effects? Using the earned income tax credit to explore the income-health gradient. Milbank Q. 2011;894:694–727. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 24.Arno PS, Sohler N, Viola D et al. Bringing health and social policy together: the case of the earned income tax credit. J Public Health Policy. 2009;302:198–207. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 25.O'Hara A. Tax variable imputation in the current population survey. Presented at the IRS Research Conference, Washington, DC, June 14–15, 2006. [Google Scholar]

- 26.Eissa N, Hoynes HW. Taxes and the labor market participation of married couples: the earned income tax credit. J Public Econ. 2004;88(9-10):1931–1958. [Google Scholar]

- 27.Baker P, Kech C, Mott F et al. NLSY Child Handbook—Revised Edition. A Guide to the 1986–1990 National Longitudinal Survey of Youth—Child Data. Columbus, OH: Ohio State University; 1993. [Google Scholar]

- 28.Peterson JL, Zill N. Marital disruption, parent-child relationships, and behavior problems in children. J Marriage Fam. 1986;482:295–307. [Google Scholar]

- 29.Baydar N. Reliability and validity of temperament scales of the NLSY child assessments. J Appl Dev Psychol. 1995;163:339–370. [Google Scholar]

- 30.Caldwell BM, Bradley RH. Home Observation for Measurement of the Environment. Little Rock, AR: University of Arkansas at Little Rock; 1984. [Google Scholar]

- 31.Mott FL. The utility of the HOME-SF scale for child development research in a large national longitudinal survey: the National Longitudinal Survey of Youth 1979 cohort. Parenting. 2004;4(2-3):259–270. [Google Scholar]

- 32.Glymour MM. Natural experiments and instrumental variable analyses in social epidemiology. In: Oakes JM, Kaufman JS, eds. Methods in Social Epidemiology. San Francisco, CA: Wiley & Sons, Inc.; 2006:429–460. [Google Scholar]

- 33.Hamad R, Rehkopf DH. Poverty, pregnancy, and birth outcomes: a study of the Earned Income Tax Credit. Paediatr Perinat Epidemiol. 2015;295:444–452. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 34.Kenkel DS, Schmeiser MD, Urban C. Is smoking inferior? Evidence from variation in the earned income tax credit. J Hum Resour. 2014;494:1094–1120. [Google Scholar]

- 35.Leigh A. Who benefits from the earned income tax credit? Incidence among recipients, coworkers and firms. BE J Econ Anal Policy. 2010;101:Article 45. [Google Scholar]

- 36.Palmer TM, Lawlor DA, Harbord RM et al. Using multiple genetic variants as instrumental variables for modifiable risk factors. Stat Methods Med Res. 2012;213:223–242. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 37.Davidson R, MacKinnon JG. Section 8.7. Durbin-Wu-Hausman Tests. Econometric Theory and Methods. New York, NY: Oxford University Press; 2004:338–341. [Google Scholar]

- 38.Dubow EF, Ippolito MF. Effects of poverty and quality of the home environment on changes in the academic and behavioral adjustment of elementary school-age children. J Clin Child Psychol. 1994;234:401–412. [Google Scholar]

- 39.Blau D. The effect of income on child development. Rev Econ Stat. 1999;812:261–276. [Google Scholar]

- 40.Painter RC, Roseboom TJ, Bleker OP. Prenatal exposure to the Dutch famine and disease in later life: an overview. Reprod Toxicol. 2005;203:345–352. [DOI] [PubMed] [Google Scholar]

- 41.Duncan GJ, Morris PA, Rodrigues C. Does money really matter? Estimating impacts of family income on young children's achievement with data from random-assignment experiments. Dev Psychol. 2011;475:1263–1279. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 42.Bates JE, Bayles K, Bennett DS et al. Origins of externalizing behavior problems at eight years of age. In: Rubin KH, Pepler DJ, eds. The Development and Treatment of Childhood Aggression. Hillsdale, NJ: Lawrence Erlbaum Associates, Inc.; 2013:93–120. [Google Scholar]

- 43.Bates JE, Maslin CA, Frankel KA. Attachment security, mother-child interaction, and temperament as predictors of behavior-problem ratings at age three years. Monogr Soc Res Child Dev. 1985;50(1-2):167–193. [PubMed] [Google Scholar]

- 44.Evans WN, Garthwaite CL. Giving mom a break: the impact of higher EITC payments on maternal health. Am Econ J. 2014;62:258–290. [Google Scholar]

- 45.Menaghan EG, Parcel TL. Determining children's home environments: the impact of maternal characteristics and current occupational and family conditions. J Marriage Fam. 1991;532:417–431. [Google Scholar]

- 46.Hotz VJ, Scholz JK. Examining the effect of the earned income tax credit on the labor market participation of families on welfare. Working Paper 11968 Cambridge, MA: National Bureau of Economic Research; 2006. [Google Scholar]

- 47.Miller JE, Davis D. Poverty history, marital history, and quality of children's home environments. J Marriage Fam. 1997;594:996–1007. [Google Scholar]

- 48.Baughman R, Dickert-Conlin S. Did expanding the EITC promote motherhood? Am Econ Rev. 2003;932:247–251. [Google Scholar]

- 49.Kawachi I, Adler NE, Dow WH. Money, schooling, and health: mechanisms and causal evidence. Ann N Y Acad Sci. 2010;1186:56–68. [DOI] [PubMed] [Google Scholar]

- 50.Cooper K, Stewart K. Does Money Affect Children's Outcomes?: A Systematic Review. York, United Kingdom: Joseph Rowntree Foundation; 2013. [Google Scholar]

- 51.Imbens GW. Better LATE than nothing: some comments on Deaton (2009) and Heckman and Urzua (2009). J Econ Lit. 2010;482:399–423. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.