Abstract

Livestock is considered as one of the most important segments in agriculture since animal husbandry was practiced for centuries as a backyard system by rural families. Livestock plays as a powerful tool in rural development where meat industry contributes a dominant part. Meat and meat products become a vital component in the diet, which had been one of the main protein sources traditionally as well. The development in the livestock and meat industry of Sri Lanka basically depends upon religious, cultural, and economic factors. There is a growing demand for processed meat products in Sri Lankan urban culture and several large scale processors entered the business during the past few decades. The consumption of meat and meat products shows an upward trend in Sri Lanka during the last decade and is anticipated to increase further in future. The growth potential of the local meat industry is considerably high owing to the improvement of the market and consumer perception. The present status, trends, and future prospects for the Sri Lankan meat industry with respect to production, consumption, processing, marketing, and improvement are discussed in this review.

Keywords: meat industry, processed meat, Sri Lanka, livestock

Introduction

Livestock is considered a substantial part of many smallholder farming systems in tropical countries. Sri Lanka is an island in the Indian Ocean which can be considered as a multi-ethnic and multi-religious country. Out of the total population (20.3 million), 75% was Sinhalese followed by Tamils (15%), Muslims (9%), and others in 2012. In addition, total population is mainly comprised of Buddhists (70%) followed by Hindus (12.6%), Islam (9.7%), Catholic (6.2%), Christians (1.4%), and other in 2012 (Department of Census and Statistics, 2014b). The agriculture sector of Sri Lanka is basically comprised with 70% of crop smallholdings and the remaining has a mixture of crops and livestock and few merely available livestock. Economically, the livestock sector contributes almost 1.2% of Sri Lankan national GDP. The country had 16.6 million chicken, 1.1 million cattle, and 0.3 million buffaloes followed by swine (0.1 million), goats/sheeps (0.3 million), and ducks (0.01 million) in 2014 as the main livestock species (Department of Census and Statistics, 2014a).

Global meat consumption continues to grow at one of the highest rates compared to any other agricultural commodity due to increasing incomes, changing consumer preferences in many emerging economies, and lowering costs of meat production and meat prices (Devine, 2003). Meat industry still plays an important role in livestock sub-sector of Sri Lanka and chicken meat contributes about 70% to this sub-sector. The meat industry has the capability to self-sustain with chicken meat mainly due to the current purchasing levels of consumers (Silva et al., 2010). In addition, chicken meat is the most consumed animal protein source among Sri Lankan meat consumers and the other most preferred meat types are pork, mutton, and beef (Silva et al., 2010). Although all these meat types are available throughout the country from small retail shops to supermarket chains, certain religious and sociocultural views influence the promotion of consumption of these meat types in Sri Lanka since it is a multinational and multicultural country.

Poultry meat is the fastest growing component of meat demand in the globe as well as in Sri Lanka (Prabakaran, 2003). Moreover, poultry industry of Sri Lanka has developed from the level of backyard system into a commercial status over the past three decades. Throughout this period, poultry industry, in particular broiler sector has shown a prominent growth due to the active participation of private sector (Department of Census and Statistics, 2014a). Goat production is basically practiced as an extensive production system in the country, especially in the dry and intermediate zones as a traditional form of livestock production (Department of Census and Statistics, 2010). In addition, considerable numbers of goat farms are available which satisfy the demand of goat milk and mutton (Department of Census and Statistics, 2010). Furthermore, the swine industry is mainly concentrated in the coastal belt of Western and Northwestern provinces as extensive, semi-intensive and intensive management systems. Though there is a growing demand for pork and pork products, lack of market development and environmental issues are the major constraints in the particular sector (Department of Animal Production and Health, 2000). In addition, buffalo slaughtering has been totally banned in the country while cattle slaughtering is still legally done in several locations within the country. However, there was a huge campaign to force the government to ban cattle slaughtering in the country during the last decade and this has been growing steadily from last few years due to the influence from several religious organizations.

At present, the private sector plays a major role in the meat industry in Sri Lanka. However, both government and private industries should have long run policies and investments to satisfy the growing consumer demand, improve nutritional status, and minimize environmental issues. Meanwhile, the Sri Lankan government has already considered the livestock industry as a specific sector for socio-economic development of the country and its expectation is to uplift the rural livestock sector benefiting farmer’s wellbeing and to ensure sustainable livestock development in future.

This review was aimed to discuss about the current status and trends in the Sri Lankan meat industry in the context of production, consumption, exports/imports, processing etc.

Present Status and Trends in Sri Lankan Meat Industry

Consumer demand for meat and meat products

Meat is an excellent source of proteins, and micronutrients such as vitamins, and minerals which are vital for the growth and development of human (Jung et al., 2015). Mainly, meat could be considered as one of the main sources of protein for Sri Lankan consumers, especially for children. Consumer behavior depends on several parameters such as economic, cultural, religious, social, personal, and marketing factors (Dietz et al., 1995). Consumer consideration on meat and meat products is mainly determined by safety guarantee, quality assurance and accurate information, as well as interest in animal welfare and convenience (Devine, 2003; Verbeke, 2005).

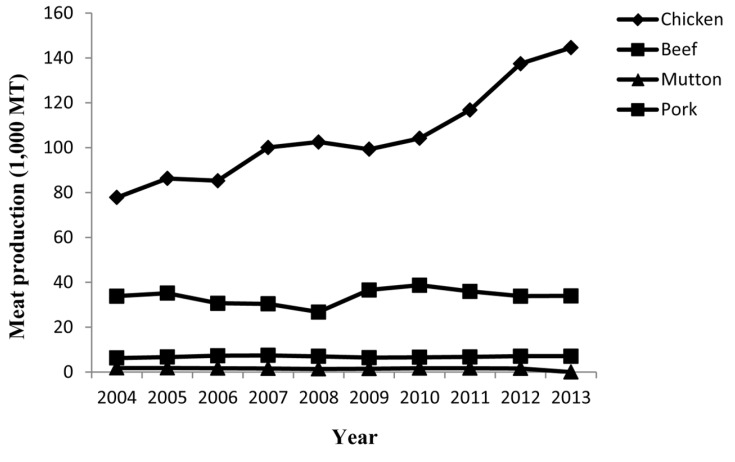

The per capita meat and meat product availability in Sri Lanka was 7.09 kg/year of chicken followed by beef (1.8 kg/year), pork (0.32 kg/year), and mutton (0.1 kg/year) in 2013 (Department of Animal Production and Health, 2014). As depicted in Table 1, per capita chicken meat availability has increased gradually compared to 10 years back while other meat types did not show a considerable growth. However, the total meat production in Sri Lanka has increased from 119,620 MT in 2004 to 185,490 MT in 2013 as shown in Fig. 1 where chicken meat production has mainly contributed to this increment (Department of Animal Production and Health, 2013).

Table 1. Per capita availability of meat in Sri Lanka during the last decade.

| Per capita availability of meat (kg) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

| Poultry | 4.00 | 4.39 | 4.29 | 4.98 | 5.01 | 4.85 | 4.86 | 5.57 | 6.80 | 7.09 |

| Beef | 1.45 | 1.49 | 1.38 | 1.27 | 1.31 | 1.34 | 1.61 | 1.71 | 1.72 | 1.80 |

| Mutton | 0.10 | 0.10 | 0.10 | 0.09 | 0.09 | 0.07 | 0.07 | 0.07 | 0.09 | 0.10 |

| Pork | 0.32 | 0.34 | 0.37 | 0.37 | 0.35 | 0.31 | 0.32 | 0.32 | 0.32 | 0.32 |

Department of Animal Production and Health, 2013.

Fig. 1. Trends in animal production during the last decade in Sri Lanka. Department of Animal Production and Health, 2013.

Sri Lanka has a multi-ethnic and multi-religious society and diverse cultural traditions. Therefore, studies performed in other countries could not be directly related to Sri Lankan context due to the specific nature of social, economic and cultural background of the country. In general, religious beliefs have a strong influence on meat consumption pattern of a particular nation (Delener, 1994; Pettinger et al., 2004) and this is in well agreement with that of Sri Lanka where religious beliefs causes a suppression of the consumption of beef and pork.

However, consumption of chicken is not considerably affected by ethno-religious beliefs compared to that of pork and beef in Sri Lanka. Moreover, chicken meat is considered as a healthy meat type by majority of consumers. Per capita availability of chicken in Sri Lanka is anticipated to increase in tandem with the projected growth in per capita income level which is expected to reach US$ 4,000 by 2016 (www.thepoultrysite.com). Meanwhile, as expected by large poultry producers, the per capita poultry consumption in Sri Lanka is to increase to 8 kg within the next five years in line with the increase in purchasing power of the citizens. According to a study carried out in the Southern province of Sri Lanka, Silva et al. (2010) stated that chicken meat was more popular among females than males. This might be attributed to the fact that females are more health concern than males (Almas, 1999). Indigenous breeds of chickens has a meaningful contribution to poultry meat production and consumption in developing countries (NAFRI, 2005). Similarly, Sri Lankans prefer indigenous chicken meat over exotic meat due to its high nutritive value and better flavor (Weerahewa, 2004).

Current meat consumption habits are slowly changing from fresh and frozen meat towards processed meat products. It could be attributed to the nutritional awareness and changing socio-economic status of the people.

Sri Lankan processed meat industry produces a variety of meat products under three main categories; comminuted meat products (sausage, luncheon meats, and hot dogs), cured meat products (bacon and ham), and formed meat products (nuggets, meat fingers, drumsticks etc). In addition, most of the meat processing factories now prepare marinated meat products which have become popular among the consumers during the past decade. However, purchasing and consumption of processed meat are comparatively lower in rural market than in urban areas in the country. This consumption and purchasing pattern could be explained by the availability and price of meat, or regional/cultural differences. On the other hand, consumption of processed meat and its purchasing power is higher among educated consumers than others mainly due to their high income and their awareness on nutritional quality of these products. Putnam and Gerrior (1997) has also stated that price, income, taste, and preference as the key variables affecting the meat purchasing and consumption patterns. Hence, it is important to identify those clues which impact on the purchasing patterns of meat and meat products in order to anticipate the changes in the purchasing behavior of consumers.

Meat production

Chicken meat, particularly broiler chicken meat dominates the meat industry in Sri Lanka. Broiler chicken meat production has increased rapidly duing the last couple of years with the higher demand for chicken meat compared to other meat types. There are many small-scale retailers who sell chicken meat independently throughout the country. Meanwhile, number of large scale local manufacturers produce whole chicken meat and meat products. Chicken meat industry mainly prevails in the North Western, Western, and Central provinces. In this regards, majority of chicken farms are situated in the North Western region and almost half of them are categorized as large scale farms (Department of Census and Statistics, 2013). According to Department of Census and Statistics (2013), there are approximately 16,000 chicken farms in Sri Lanka of which 88% are considered as small in size (below 1000 chickens).

In general, demand for chicken meat is considerably high during the festival seasons − April and December − in the country. A very high demand for chicken meat and eggs has been observed within the country since the latter part of the year 2009. This might be attributed to several factors including cessation of civil war in the country which consequently made people returning in to normal day-to-day life style and improved tourism sector. Due to the post war situation, the chicken production was also increased. Currently, chicken meat production shows an upward trend while per capita availability is also increased consequently.

Swine farming could be categorized as one of the major livestock sectors next to the poultry and dairy sectors in Sri Lanka. It is mainly concentrated in the coastal region known as pig belt, including Colombo, Gampaha, Kalutara, and Puttalam districts. According to Department of Census and Statistics (2013), there are around 6,000 farmers and 10,000 farms in the swine sector of the country by 2013. At present, swine farming is considered as a highly profitable livestock sector due to simple management and feeding practices involved and less disease occurrence. In 2013, the total pig population was 81,000 and the pork production was 7,040 MT and mainly Large White, Landrace, and Duroc breeds are reared in small- (60%), medium- (25%), and large-scale (15%) farms (Department of Census and Statistics, 2013). In addition, a total of 0.16 MT pork had been imported to the country in 2013. Data obtained during the last decade showed an increase in pork production throughout that period. Swine farming has a potential to be improved further with new interventions in the management and feeding practices. On the other hand, product quality standards and marketing aspects of pork products could be advanced in order to expand this sub-sector in livestock sector.

Extensive goat farming is concentrated mainly in dry and intermediate zones of the country while semi-intensive and intensive systems are practiced in the coconut triangle, hill country and in urban areas of the country. Goat and sheep population in 2013 is recorded as 331,000 and 9,000, respectively (Department of Census and Statistics, 2013). Local breeds, Saanan, Jamnapari, and Kottukachchiya are the commonly available goat breeds in Sri Lanka reared over 64,000 farms (Department of Animal Production and Health, 2011). However, a total of 338.36 MT of mutton had been imported to the country during 2013 and it showed an upward trend (Department of Animal Production and Health, 2013). However, the total mutton production in the same year was considerably lower than previous years. Even though a considerably lower attention is paid for mutton production, many people demand mutton during festival seasons in the country. Therefore, development in mutton production should be taken into consideration in order to reduce the imports and to be self-sustained in future.

Beef production seems to be stagnant throughout the last decade. There is a strong objection for cattle slaughtering from several ethnic groups in the country. The slow growth rate of beef production could be attributed to aforementioned objection. As depicted in the Table 2, cattle slaughtering has been reduced over the last decade from 207,000 in 2004 to 170,000 in 2013 (Department of Census and Statistics, 2013). Moreover, buffalo meat is not popular among Sri Lankans and buffalo slaughtering has been completely banned in the country.

Table 2. Trends in animal slaughtering during the last decade.

| Amount of slaughtered animals ('000 numbers) |

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

| Cattle | 207 | 215 | 188 | 186 | 164 | 168 | 204 | 162 | 174 | 170 |

| Goat & Sheep | 72 | 75 | 68 | 64 | 58 | 63 | 68 | 63 | 73 | 65 |

| Swine | 29 | 30 | 31 | 32 | 21 | 22 | 20 | 25 | 30 | 30 |

Department of Census and Statistics, 2013.

Export and import

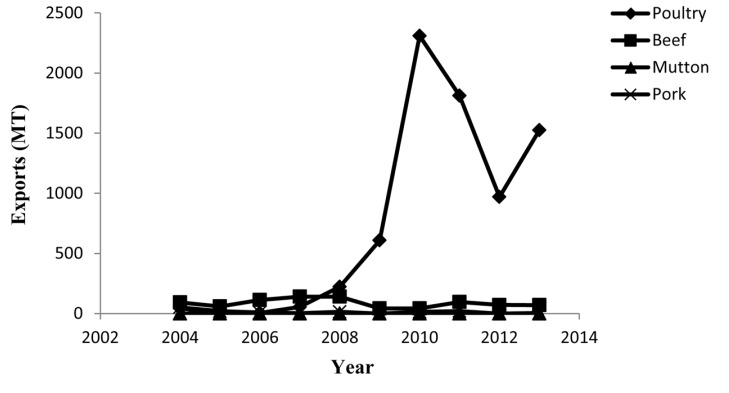

In terms of exportation of meat from Sri Lanka, poultry accounts the highest quantity (1524 MT) in 2013, followed by beef (70.5 MT), pork (5.05 MT), and mutton (3.84 MT), respectively (Department of Animal Production and Health, 2013). In addition, there is a contribution from edible offals, preserved meat, pig fat, and poultry fat to export quantity. Bulk of the chicken meat and meat products are exported to Maldives, UAE, Azerbaijan, Armenia, Iraq, Angola, Oman, Kuwait, Doha Qatar, Ghana, and India (Department of Animal Production and Health, 2012). The exports of chicken meat and meat products shows an upward trend during the last decade (Fig. 2) and anticipates an continuous increase in the future as well.

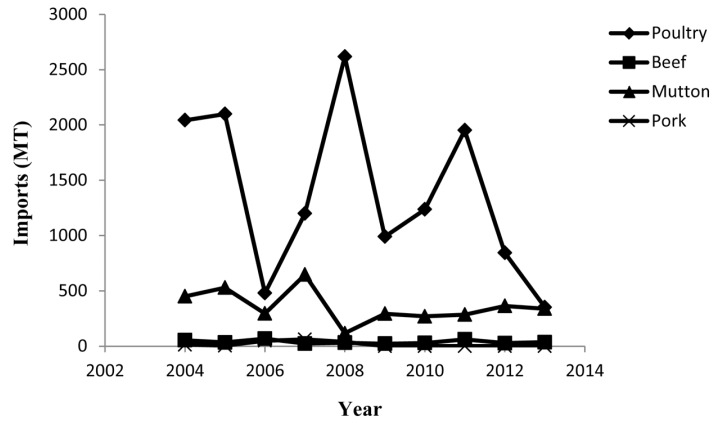

Fig. 2. Exporting trend of meat and meat products during the last decade in Sri Lanka. Department of Animal Production and Health, 2013.

However, there is still a prominent gap between the production and demand for meat in Sri Lanka. This led to importation of meat to Sri Lanka from high producing countries over the years. The highest import was poultry meat followed by mutton, beef, and pork during last ten years. A large increase in poultry meat volume of 1599.67 MT was observed during 2011-2013 period. Moreover, bulk of imported chicken consisted of chicken meat products such as mechanically deboned meat (MDM), which is used for the preparation of value added products. A remarkable increase in poultry import in volume of 1481.02 MT was observed during the last 10 years (Department of Animal Production and Health, 2013). Specifically, import of meat and meat products has been increased in 2010 compared with the previous years due to the improved life styles during post-war situation. Altogether, importation would assist to balance the market gaps and to support the reduced prices.

Since the country has a surplus of maize and paddy production, excess of maize would be used for the production of poultry as the government convinced. However, expanded breeder and broiler farms would be supported to supply the demand in domestic market and per capita chicken consumption is then expected to rise to 8.5 kg/year from the current consumption of 6.5 kg/year. The prevalent problem regarding the livestock sector is that raw material cost is high and it creates a barrier to the competition between producers. However, the existing poultry market is expanding and becoming saturated disregarding these circumstances.

Meanwhile, there was a shortage of whole chicken meat in the market during certain periods, since some of the major producers sold chicken in parts with the expectation of having a bigger profit than selling it as whole. Sri Lankan chicken price is primarily influenced by two major factors; the price of poultry feed and price of chicks.

No prominent changes in the exports or imports of other meat types were observed during the last few years. Both private and government sectors supported the improvement of the chicken meat industry, thus it has shown a tremendous development with an upward trend in exports during the last decade. Similarly, there is a potential to reduce the gap between production of and demand for other popular meat types in the country. Nevertheless, there is a potential for meat production in the country to meet the domestic demand and consequently increase the export of chicken meat and gradually decrease the imports of chicken meat. Furthermore, meat is free from growth promoters and other residues and diseases, and this leads the Sri Lankan meat industry to enter into international market.

Fig. 3. Imports of meat and meat products to Sri Lanka during the last decade. Department of Animal Production and Health, 2013.

Meat processing

Three large scale and ten medium scale poultry processing establishments and seven further processing plants were in operation during 2010 in the country. Estimated chicken meat production showed an increase of 5% in 2010 (104,160 MT) over that in 2009 (99,280 MT). Total amount of value added meat products manufactured by further processing plants was 8,083.45 MT in 2010; an increase of 12% over the 2009 volume of 7,235.04 MT. Out of this production in 2010, a major portion (85%) consisted of chicken meat based value added products (Department of Census and Statistics, 2010).

Majority of Sri Lankans prefers to consume meat as a spicy curry compared to being consumed as processed meat products such as sausages, meat balls, hams, bacons, cold meats, drumsticks etc. Therefore, comparatively low amount of meat is processed in Sri Lanka whereas the majority of meat is sold in fresh or frozen form in the domestic market. Sri Lankan meat processing industry has a developing trend to supply domestic consumer demand with the entry of large scale producers. They have established quality assurance systems for processed meat production with Sri Lankan Standards (SLS), ISO and HACCP standards and serve those products to both local and international markets including India, UAE, and Maldives. Therefore, Sri Lanka has a potential to expand the meat exports, especially poultry meat through establishing modern abattoirs and processing plants with quality control systems. Fortunately, private corporate sector is very much interested and involved in poultry feed manufacture, poultry breeder farm and hatchery management, large-scale commercial poultry production, and poultry processing.

Opportunities & Constraints

Sri Lankan meat industry, including poultry, swine, cattle, sheep and goat has a potential to be developed due to several reasons, such as improving market balance, technical leadership for livestock development, and declining raw materials costs.

The government and private sectors contribute equally in the context of technical leadership on many aspects of livestock development including research, extension, animal health management, and breeding services in Sri Lanka. The principal state organization functioning in livestock development is Department of Animal Production and Health (DAPH) under the Ministry of Livestock Development. The development programs are conducted under the support of nine Provincial Departments of Animal Production and Health (PDAPH) and veterinary offices located in the nine provinces. Moreover, the National Livestock Development Board plays a major role in maintaining nucleus herds of livestock species and supplying improved livestock to interested farmers. Similarly, the private corporate sector involvement is active in the supply of veterinary pharmaceuticals and vaccines and in the supply of machinery and equipment, mainly for the poultry industry. Two multinational companies are also engaged in integrated operations in the poultry sector. Swine population has also been frequently upgraded through artificial breeding programmes by PDAPH.

In addition, price structure and market facilities are satisfactory for the meat industry in Sri Lanka especially for poultry products. Access to the international market seems to be easy, since Sri Lanka already has a market network in the Middle East, Asian, and Europe countries.

Dietary guidelines sometimes advise to substitute red meat with chicken due to health concerns regarding red meat. Therefore, the market for Sri Lankan lean meat could be further improved as a result of the international consumption trend.

However, the development in the meat industry has somewhat suppressed due to environment-related problems. As a result, several swine farms have already been closed to avoid the occurrence of crisis between producers and the public. Therefore, a special attention should be paid towards the improvement of farm standards, selecting appropriate locations, and educating farmers on waste management before it comes to a serious issue. State organizations have taken some initiatives to support livestock farmers, majority being swine farmers to alleviate environmental problems. Moreover, vaccination programmes have been implemented against certain diseases in the relevant provinces to manage swine population healthy and to prevent transmission of diseases to humans.

Procurement of animal feeds has become a major constraint for animal production in Sri Lankan context. Bran and polish from rice-the major crop cultivated in Sri Lanka-are available as animal feed ingredients. The main crop responsible to satisfy the availability of feed resources is coconut which provides a large amount of copra and oilcakes (coconut poonac) to manufacture animal feeds. Hence, rice bran and oilcakes together contributes to the feed industry in the country. However, there is a severe shortage of high protein feedstuffs within the country. Therefore, high protein feed ingredients such as fish meal, meat meal, and soybean meal are imported into the country for compound feed manufacture.

Another weakness of the Sri Lankan meat industry is the poor condition of the majority of abattoirs. There is a lack of slaughter facilities to produce meat under hygienic conditions. In many abattoirs, floor slaughtering is practiced for large animals with poor hygienic conditions and most of these places are overcrowded. As there are authorized and unauthorized places for animal slaughtering, meat inspection has become impractical. In addition, the one of the major issues is the environmental pollution and offensive odor due to inappropriate drainage facility and utilization of animal byproducts which give a negative image to general public. The main meat recipe of Sri Lankan people is cooking it as a curry together with different spices, thus most of pathogens could be destroyed during cooking. However, the international market totally depends on the quality and hygienic products. Therefore, establishing abattoirs and meat processing plants with integrated technology for slaughtering and dressing of animals, carcass deboning, packing, chilled and frozen storages, byproduct utilization, and effluent treatment are required to compete for global market.

There are several other reasons for the lethargic nature of the meat industry in Sri Lanka. Nowadays, a lot of people have misbeliefs on meat consumption, which give a negative feedback for the meat industry all over the world. The main argument against meat consumption is that it leads to several health problems. Consumption of pork and beef is mainly regulated by the ethno-religious beliefs among the Sri Lankans whereas chicken meat consumption becomes considerably higher due to less religious barriers. Since Sri Lanka has a multi-ethnic and multireligious society with a diverse culture, the development of the meat industry is challenged by the consumption patterns of different ethnic groups.

Furthermore, there is an immense need for proper marketing practices and transport systems for the meat industry in Sri Lanka especially in the rural areas. The meat production and distribution in the rural areas should be modernized to avoid lack of coordination between the producer and the consumer and thereby consumers could purchase good quality meat at a reasonable price. Furthermore, transportation and storage of meat should be done under proper conditions to improve the keeping quality of meat and to improve the consumer acceptance. Since meat is a perishable product, cold chain is an essential part in the storage and during transportation until it reaches to the consumer. However, cold chain infrastructures are not satisfactory at rural level. On the other hand, overcrowding of food animals during transport results lesser meat quality. Therefore, a proper transportation system should be introduced to both small and large scale producers throughout the country.

Future Prospects

According to the global assessments, the demand for livestock products will increase for the next decades due to population growth, income growth, and urbanization. In the Sri Lankan context, per capita meat consumption is expected to rise with higher per capita incomes, specifically the chicken meat consumption. To satisfy the requirement of good quality and hygienic meat for the consumers, there should be a proper management practice of meat animals. On the other hand, each and every step of meat production and processing should ensure the food safety. Therefore, SLS, HACCP, ISO standards have to be maintained thoroughly in the meat industry at every scale of meat production which would support to build a positive image among meat consumers.

Since there are some myths among many people on meat consumption, it is important to improve consumer awareness towards the nutritional benefits of meat consumption and possible health risks. Even though the main meat recipe for Sri Lankan is the spicy curry, the majority of urban people prefers to eat processed meat due to the convenience, variety etc. Hence, value addition is the key factor for the prosperity of the meat industry. The awareness regarding the processed meats and their nutritional benefits should be improved. Moreover, new packaging methods used for meat should also be promoted among small scale producers, since majority of them are selling their fresh meat without packaging in small retail shops. For safe delivery of meat and various value added meat products to the consumer, packaging is of the most extreme importance at each production stage including processing, storage, transport, distribution and marketing.

Conclusion

Generally, Sri Lankan meat consumption pattern is highly affected by the ethno-religious beliefs which basically impact on the type of meat consumed. A few people have strong concerns about misbeliefs on health issues due to meat consumption. In general, many Sri Lankan people consider meat as an essential food componenet in their diet. From meat production, marketing system, packaging, transport, to storage sectors every segment need to be improved in order to achieve a success in the meat industry. Modernization of respective sections in meat industry would be important. Meat processing which is currently under little attention should be promoted to ensure the prosperity in the meat industry. It is essential to diversify the meat and meat product market of Sri Lanka to match with the diverse preferences for meat types.

Acknowledgments

This work was partially supported by Golden Seed Project, Ministry of Agriculture, Food and Rural Affairs Korea and Institute of Green Bio Science and Technology, Seoul National University.

References

- 1.Almas R. Food trust, ethics and safety in risk society. Sociol. Res. Online. 1999;4:282–291. [Google Scholar]

- 2.Delener N. Religious contrasts in consumer decision behavior patterns: their dimensions and marketing implications. Eur. J. Marketing. 1994;28:36–53. [Google Scholar]

- 3.Department of Animal Production and Health. Administration Report. Department of Animal Production and Health; Gatambe, Sri Lanka: 2000. [Google Scholar]

- 4.Department of Animal Production and Health. Administration Report. Department of Animal Production and Health; Gatambe, Sri Lanka: 2011. [Google Scholar]

- 5.Department of Animal Production and Health. Administration Report. Department of Animal Production and Health; Gatambe, Sri Lanka: 2012. [Google Scholar]

- 6.Department of Census and Statistics. Livestock and Poultry Statistics. Ministry of Finance and Planning; Colombo Sri Lanka: 2010. [Google Scholar]

- 7.Department of Census and Statistics. Livestock and Poultry Statistics. Ministry of Finance and Planning; Colombo Sri Lanka: 2014a. [Google Scholar]

- 8.Department of Census and Statistics. Quick stats. 2014b Retrieved 16 January 2016 from: http://www.statistics.gov.lk/PopHouSat/CPH2012Visualization/htdocs/index.php .

- 9.Devine R. Meat consumption trends in the world and the European Union. Prod. Anim. 2003;16:325–327. [Google Scholar]

- 10.Dietz T., Frisch A. S., Kalof L., Stern P. C., Guagnano G. A. Values and vegetarianism: An exploratory analysis. Rural Sociol. 1995;60:533–542. [Google Scholar]

- 11.Jung S., Bae Y. S., Yong H. I., Lee H. J., Seo D. W., Park H. B., Lee J. H., Jo C. Proximate composition and L-carnitine and betaine contents in meat from Korean indigenous chicken. Asian-Aust. J. Anim. Sci. 2015;28:1760–1766. doi: 10.5713/ajas.15.0250. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 12.NAFRI. Indigenous chicken and rural livelihoods in LAO PDR. NAFRI Report. 2005

- 13.Pettinger C., Holdsworth M., Gerber M. Psychosocial influences on food choice in Southern France and Central England. Appetite. 2004;42:307–316. doi: 10.1016/j.appet.2004.01.004. [DOI] [PubMed] [Google Scholar]

- 14.Prabakaran R. Good practices in planning and management of integrated commercial poultry production in South Asia. Food and Agriculture Organization of the United Nations; Rome: 2003. [Google Scholar]

- 15.Putnam J., Gerrior S. Americans consuming more grains and vegetables, less saturated fat. Food Rev. 1997;20:2–12. [Google Scholar]

- 16.Silva P. H. G. J. D., Atapattu N. S. B. M., Sandika A. L. A study of the socio-cultural parameters associated with meat purchasing and consumption pattern: A case of southern province, Sri Lanka. J. Agr. Sci. 2010;5:71–79. [Google Scholar]

- 17.The poultry site news desk. Good times ahead for Sri Lankan poultry sector. Retrieved 10 June 2015 from: http://www.thepoultrysite.com/poultrynews/31631/good-times-ahead-for-srilankan-poultry-sector/

- 18.Verbeke W. Consumer acceptance of functional foods: Socio-demographic, cognitive and attitudinal determinants. Food Qual. Pref. 2005;16:45–57. [Google Scholar]

- 19.Weerahewa J. Current and potential market supply and demand, marketing opportunities, and consumer preferences for indigenous animal products. 2004 Retrieved 12 October 2015 from: http://www.fangrasia.org/admin/admin_content/files/17432.pdf .

- 20.Williams P. G. Nutritional composition of red meat. Nutr. Diet. 2007;64:113–119. [Google Scholar]