Abstract

Background

The Affordable Care Act (ACA) included provisions to extend dependent healthcare coverage up to the age of 26 years in 2010. We examined the early impact of the ACA (prior to implementation of insurance exchanges in 2014) on insurance rates in young adults with cancer, a historically underinsured group.

Methods

Using National Cancer Institute Surveillance, Epidemiology and End Results (SEER) data for 18 cancer registries, we examined insurance rates pre-(January 2007–September 2010) vs. post-(October 2010–December 2012) dependent insurance provisions among young adults aged 18–29 years when diagnosed with cancer during 2007–2012. Using multivariate generalized mixed effect models, we conducted difference-in-differences analysis to examine changes in overall and Medicaid insurance after the ACA among young adults eligible (18–25 years) and ineligible (26–29 years) for policy changes.

Results

Among 39,632 young adult cancer survivors, we found an increase in overall insurance rates in 18–25 year-olds after the dependent provisions (83.5% pre vs. 85.4% post, p<0.01), but not among 26–29 year-olds (83.4% pre vs. 82.9% post, p=0.38). After adjusting for patient socio-demographics and cancer characteristics, we found 18–25 year-olds had a 3.1% increase in being insured relative to 26–29 year-olds (p<0.01); however, there were no significant changes in Medicaid enrollment (p=0.17).

Conclusions

Our findings identify an increase in insurance rates for young adults 18–25 relative to those 26–29 (1.9% vs. −0.5%) that were not due to increases in Medicaid enrollment, demonstrating a positive impact of the ACA dependent care provisions on insurance rates in this population.

Keywords: Affordable Care Act, SEER, policy, young adults, insurance

Improving the quality of cancer treatment and survivorship care for young adults diagnosed with cancer before 39 years of age has become a priority area in the United States because this age group has not experienced the survival gains enjoyed by other age groups over the past two decades.1–6 The Patient Protection and Affordable Care Act (ACA) has the potential to profoundly improve treatment and survivorship in this population, as many provisions were directly targeted at improving insurance rates in young adults, a historically underinsured group.7,8 Beginning in 2010, the ACA included provisions to extend dependent healthcare coverage up to the age of 26 years by allowing young adults to stay on their family’s insurance longer, eliminating limits on insurance coverage and prohibiting exclusion of preexisting conditions or termination of coverage.9 This provision was one of the earliest and most popular of the provisions,10 particularly because it extended coverage to a vulnerable and historically highly uninsured group of young adults, and was an easily implementable provision with clear eligibility guidelines.8,10,11 These new opportunities for extending insurance coverage under the dependent care provision are critical for young adult cancer survivors who confront significant post-diagnosis challenges, including increasing rates of uninsurance and underinsurance,12 and a lack of adequate medical support as they transition to adulthood with a chronic disease.13,14

In young adult cancer survivors, uninsurance and the costs of care are consistently associated with forgoing necessary medical care.13,14 In a 2010 study of Behavioral Risk Factor Surveillance System (BRFSS) data, young adult cancer survivors were 55% to 67% more likely than young adults without cancer to forgo medical care in the past year due to costs, pointing toward underinsurance in this population.15 Furthermore, uninsured survivors reported lower healthcare use, with more than two-thirds having no personal provider or routine medical care.13–15 While emerging research has identified a rapid increase in the proportion of young adults in the general population with dependent care coverage and an overall increase in insurance rates,16–21 no studies have specifically examined the impact of health policy-related changes in insurance coverage on young adult cancer survivors, – a group who requires consistent medical care access to appropriately manage survivorship care and late effects of treatment.15

The purpose of this study was to evaluate the early impact of recent health policy changes on insurance coverage among young adult cancer survivors eligible (aged 18–25) and ineligible (aged 26–29) for dependent insurance coverage changes. We chose individuals aged 26–29 as our comparison group rather than extending our analysis up to age 39 (i.e., the National Cancer Institute’s traditional age range for young adult cancer survivors),22 as these individuals were closest in age, stage of life and type of cancer diagnoses to those eligible for the policy; they also had similar pre-policy insurance rates.1,7,8 Using information on health insurance status from 18 population-based, cancer registries in the United States (US), we hypothesized that insurance rates would increase to a greater extent among eligible young adults relative to their older peers. Overall, these findings can help estimate additional insurance changes that may occur with the more expansive provisions from the ACA in 2014, including health insurance mandates and creation of health insurance exchanges.9

Methods

Data and Population

We used National Cancer Institute Surveillance, Epidemiology, and End Results (SEER) Program data, a large, population-based set of 18 geographically and socioeconomically diverse US cancer registries covering approximately 28% of the US population.23 In these 18 geographic regions, SEER collects demographic, clinical, treatment and survival information on all incident cancers (excluding non-melanoma skin cancer).24 Data are reported on an annual basis and released approximately two years after diagnosis (i.e., cases diagnosed up to December 2012 were released in Spring 2015; data accessed June 2015). For our study, we included all young adults 18–29 years of age when diagnosed with their first malignant (invasive and in situ) disease during 2007–2012 (n=39,698). Our final study population was 39,632, after excluding those diagnosed at autopsy or death (n=66) as these individuals would not have undergone treatment for their cancer and, therefore, would likely have unreliable information on health insurance.

Key Measures

Health Insurance

Beginning in 2007, SEER started releasing information on insurance status, defined as the primary insurance carrier or method of payment at the time of initial diagnosis or treatment (categorized by SEER as uninsured, Medicaid, insured-private insurance, insured-unknown, and unknown).25 Insurance status is obtained through medical record review by each SEER registry, with a re-abstraction analysis by the National Program of Cancer Registries finding that most insurance (92,8%) does not change between diagnosis and treatment.26,27 As we were specifically interested in the effect of the dependent insurance provision, which applied only to plans in the individual market (i.e., not including Medicaid coverage), we considered any insurance (i.e., having Medicaid, private insurance or insurance of unknown type; yes vs. no). and Medicaid coverage (yes vs. no) to evaluate how they both changed over time.11

Dependent Coverage Policy Implementation

Beginning in September 2010, the dependent insurance provision from the ACA was implemented throughout the US, extending dependent coverage for adult children up to age 26 for all individual and group policies.9 Therefore, we created two time indicators to evaluate insurance coverage at diagnosis or initial treatment: pre- (January 2007–September 2010) vs. post- (October 2010–December 2012) dependent coverage implementation.

Patient clinical and demographic information

SEER collects demographic and clinical information on cancer patients including race/ethnicity, marital status, sex, and stage of diagnosis, each of which may influence the relationship between policy implementation and insurance coverage. Specifically, for our study we categorized information on patient characteristics as follows: age (18–25 (eligible for dependent coverage policy) vs. 26–29 (ineligible for the policy)), sex (male vs. female), race/ethnicity (Non-Hispanic White, Non-Hispanic Black, Hispanic, Non-Hispanic Other/Unknown), married (yes vs. no), SEER registry at diagnosis, cancer site/type at diagnosis (from the SEER Adolescent and Young Adult site recode),28 and cancer stage (in situ, localized, regional, distant, unstaged/unknown).

Analysis

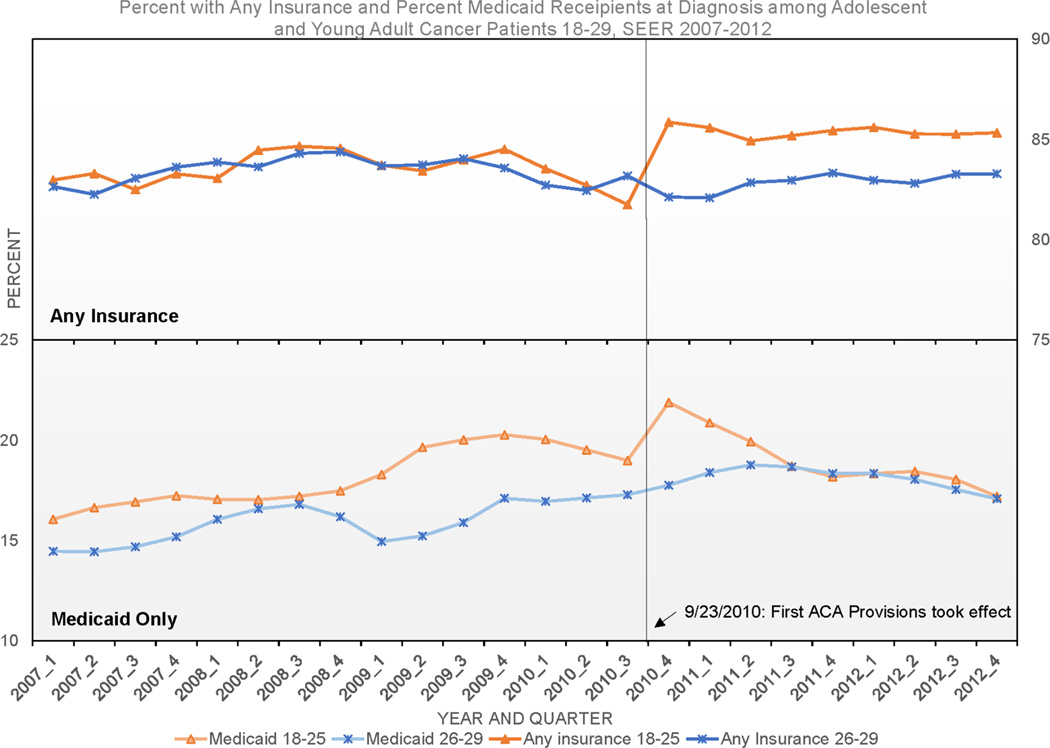

We used descriptive analyses to calculate average insurance rates (any insurance and Medicaid only) quarterly from 2007–2012 by age group (Figure 1). Chi-square analyses were used to examine differences in socio-demographic and cancer characteristics by age-group (Table 1), with post-hoc analyses of multi-category comparisons to confirm differences. We then calculated average overall insurance and Medicaid rates pre- vs. post dependent insurance provisions by age group using chi-square analyses (Table 2). Finally, we used multivariate generalized mixed effect models (logit) to conduct a difference-in-differences analysis,29 examining changes in insurance before vs. after the ACA dependent insurance provisions in young adults eligible and ineligible for policy changes (Table 2). Statistically, the association between policy implementation and outcomes is estimated by examining the interaction between the time (pre vs. post policy implementation) and age-group (age 18–25 vs. 26–29) indicator variables.29,30 Multivariate models included an indicator for time period, age group, a time period by age group interaction, sex, race/ethnicity, marital status, cancer site, and stage at diagnosis. We additionally included a random intercept for each cancer registry state to allow for differential initial levels of insurance across states.31 Separate models were run to examine the effect of dependent insurance provisions on overall and Medicaid insurance to ensure changes were related to dependent provisions and not other policies.9

Figure 1.

Smoothed quarterly insurance rates for young adults aged 18–25 and 269-29 at cancer diagnosis are shown from 2007 through 2012 according to data from the Surveillance, Epidemiology and End Results (SEER) Program. Insurance status defined as the primary insurance carrier or method of payment at the time of initial diagnosis or treatment (categorized by SEER as uninsured, Medicaid, insured-private insurance, insured-unknown, and unknown). Insurance status is obtained through medical record review by each SEER registry, was abstracted at time of diagnosis. The top panel displays the trend in the percentage of young adults with cancer with any type of insurance coverage at time of diagnosis (including private, Medicaid, insured-unknown primary payer). The bottom panel shows the trend in the percentage of young adults with cancer with Medicaid only.

Table 1.

Characteristics of Young Adult Cancer Patients Diagnosed During 2007–2012 by Age Group, SEER Program

| Characteristics | Patients | |||

|---|---|---|---|---|

| Total % (n) |

Aged 18–25 Years % |

Aged 26–29 Years % |

p-value* | |

| No. of Patients | 39,632 | 21,299 | 18,333 | |

| Any Health Insurance | ||||

| Yes | 83.8% (33,195) | 84.2% | 83.2% | <0.01 |

| No | 16.2% (6,437) | 15.8% | 16.8% | |

| Medicaid Health Insurance | ||||

| Yes | 17.7% (7,013) | 18.5% | 16.8% | <0.01 |

| No | 82.3% (32,619) | 81.5% | 83.2% | |

| Time period | ||||

| Pre-ACA (2007–Sept. 2010) | 62.0% (21,299) | 37.9% | 38.2% | 0.45 |

| Post-ACA (Oct. 2010–2012) | 38.0% (15,069) | 62.2% | 61.8% | |

| Gender | ||||

| Female | 55.4% (21,963) | 52.5% | 58.8% | <0.01 |

| Male | 44.6% (17,669) | 47.5% | 41.2% | |

| Race/Ethnicity | ||||

| Non-Hispanic White | 58.9% (23,359) | 58.5% | 59.5% | <0.01 |

| Non-Hispanic Black | 9.1% (3,622) | 9.1% | 9.2% | |

| Hispanic | 21.6% (8,553) | 22.3% | 20.8% | |

| Non-Hispanic Other/Unknown | 10.3% (4,094) | 10.2% | 10.2% | |

| Marital Status | ||||

| Married | 23.9% (9,466) | 12.9% | 36.6% | <0.01 |

| Not Married | 76.1% (30,166) | 87.1% | 63.4% | |

| Cancer Registry | ||||

| Alaska | 0.2% (59) | 0.2% | 0.1% | <0.01 |

| California | 41.7% (16,542) | 42.9% | 40.4% | |

| Connecticut | 3.9% (1,560) | 4.1% | 3.7% | |

| Georgia | 10.4% (4,126) | 10.1% | 10.8% | |

| Hawaii | 1.7% (689) | 1.7% | 1.8% | |

| Iowa | 3.8% (1,515) | 3.8% | 3.9% | |

| Kentucky | 5.2% (2,051) | 4.6% | 5.9% | |

| Louisiana | 5.1% (2,011) | 4.9% | 5.3% | |

| Michigan | 4.4% (1,754) | 4.6% | 4.3% | |

| New Jersey | 10.4% (4,137) | 10.8% | 10.0% | |

| New Mexico | 2.3% (899) | 2.3% | 2.2% | |

| Utah | 4.4% (1,725) | 4.1% | 4.6% | |

| Washington | 6.5% (2,564) | 6.1% | 7.0% | |

| Cancer Site/ Type | ||||

| Leukemias | 5.9% (2,318) | 7.1% | 4.4% | <0.01 |

| Lymphomas | 15.0% (5,953) | 17.8% | 11.8% | |

| CNS/other intracranial/spinal neoplasms | 5.0% (1,984) | 5.6% | 4.3% | |

| Osseous/chondromatous neoplasms | 2.1% (814) | 2.8% | 1.1% | |

| Soft tissue Sarcomas | 4.5% (1,788) | 4.8% | 4.2% | |

| Germ cell/trophoblastic neoplasms | 14.4% (5,687) | 15.8% | 12.7% | |

| Melanoma/skin carcinomas | 9.7% (3,834) | 8.8% | 10.7% | |

| Other carcinomas | 33.3% (13,194) | 27.4% | 40.2% | |

| Unclassified neoplasms | 10.2% (4,060) | 9.8% | 10.7% | |

| Stage at Diagnosis | ||||

| In Situ | 7.3% (2,887) | 6.8% | 7.9% | <0.01 |

| Localized | 35.7% (14,717) | 33.4% | 41.5% | |

| Regional | 16.0% (6,324) | 15.3% | 16.8% | |

| Distant | 13.4% (5,327) | 14.7% | 11.9% | |

| Unstaged/Unknown | 26.2% (10,377) | 29.8% | 22.0% | |

Notes:

Percentages may not add to 100 due to rounding.

SEER=Surveillance, Epidemiology, and End Results Program

ACA=Patient Protection and Affordable Care Act

CNS=Central Nervous System

% (n)=Percent (Number of Patients)

p-values were computed for 18–25 vs. 26–29 year olds using Chi-squared tests

Table 2.

Changes in Overall and Medicaid Health Insurance Coverage among Young Adult Cancer Patients Before and After the Early Implementation of the ACA by Age-Group, SEER Program 2007–2012

| Type of Health Insurance Coverage |

Cancer Patients aged 18–25 | Cancer Patients aged 26–29 | Difference in Difference |

|||||

|---|---|---|---|---|---|---|---|---|

| Before % |

After % |

Difference | Before % |

After % |

Difference | Percent Points1 |

p-value2 | |

| Any health insurance | 83.5 | 85.4 | 1.9** | 83.4 | 82.9 | −0.5 | 3.1 | <0.01 |

| Medicaid Health Insurance | 18.2 | 19.0 | 0.8 | 15.9 | 18.1 | 2.2** | −1.3 | 0.17 |

Notes:

SEER=Surveillance, Epidemiology, and End Results Program

ACA=Patient Protection and Affordable Care Act

Before=January 2007 – September 2010

After=October 2010 – December 2012

Statistically significant with p-value of <0.01 from Chi-Squared tests

Represents the net change in each health insurance type for cancer patients aged 18–25 after the early implementation of the ACA; estimates are from generalized mixed effect models with random intercepts for each cancer registry state using the logit link function adjusting for time period, age group, time period*age group, sex, race/ethnicity, marital status, cancer site, and stage at diagnosis.

p-value of the interaction term for time period*age

As sensitivity analyses, we first re-ran our models excluding individuals with unknown insurance status or insurance of unknown type, as it is possible that some individuals with Medicaid may have been classified in this group. We then excluded individuals age 26 at diagnosis, as these individuals may have aged out of eligibility at the time of diagnosis or initial treatment. We then evaluated our models excluding those diagnosed in New Jersey, New Mexico and Utah, as these states implemented the dependent coverage expansion earlier than the September 2010 mandate,19 and those diagnosed in registries located in California, Connecticut, and Washington, as these states opted to expand Medicaid coverage to low-income adults before 2014, potentially influencing overall Medicaid coverage rates.32 Under both sensitivity analyses, our main findings remained unchanged. Analyses were conducted using SAS 9.3 (SAS Institute, Cary NC). This study was approved by the Institutional Review Board of the University of Texas Health Science Center at San Antonio.

Results

From 2007–2012, we identified 39,632 young adult cancer survivors diagnosed between the ages of 18–29 in the SEER registries (Table 1). Young adults 18–25 years of age were more likely to be male, of Hispanic race/ethnicity, unmarried and from the California, Georgia or New Jersey Registries compared to older cancer survivors 26–29 years of age (p<0.01 for all). Additionally, 18–25 year-olds were more likely to be diagnosed with lymphomas, leukemias and germ cell cancers than older survivors (p<0.01) and have a higher proportion of unstaged cancers.

Overall Insurance Changes after Dependent Insurance Provisions

In the first quarter of 2007, 83.0% of 18–25 year-olds had insurance (Medicaid or Private) compared to 82.7% of those 26–29 years of age at diagnosis (Figure 1). While overall insurance rates fluctuated until the dependent insurance provision took effect in September 2010, 26–29 year-olds had similar insurance rates compared to those 18–25 years of age. However, once the policy change was implemented, overall insurance rates in 18–25 year-olds gradually increased and remained higher than those 26–29 years of age for the two years after policy implementation. Overall, 83.5% of 18–25 year-olds were insured prior to the policy change compared to 85.4% after the policy implementation (p<0.01) (Table 2). However, among 26–29 year-olds, 83.4% were insured prior to the policy implementation, with insurance rates decreasing (non-significantly) after the policy to 82.9% (p=0.38). In multivariate analyses adjusting for patient socio-demographics and cancer characteristics, we found 18–25 year-olds had a 3.1% increase in being insured relative to 26–29 year-olds (p<0.01, Table 2).

Medicaid Coverage

In the first quarter of 2007, 18–25 year-olds had slightly higher Medicaid coverage compared to those 26–29 years of age (16.1% vs. 14.5%). While Medicaid rates also fluctuated over time, with 18–25 year-olds having slightly higher enrollment rates, within a year after policy implementation, Medicaid rates were almost identical between the two groups (Figure 1). Overall, 18.2% of 18–25 year-olds had Medicaid prior to the policy change compared to 19.0% after the policy implementation (p=0.12) (Table 2). Among 26–29 year-olds, 15.9% had Medicaid prior to the policy implementation, which increased to 18.1% after the policy (p<0.01). However, in multivariate analyses adjusting for patient socio-demographics and cancer characteristics, we found no significant differences in Medicaid rates before and after policy changes in 18–25 relative to 26–29 year-olds (p=0.17, Table 2).

Discussion

In our population-based study of young adult cancer survivors diagnosed between 2007 and 2012, we identified increases in overall insurance rates after 2010 among 18–25 year-olds, but not among 26–29 year-olds. In addition, we observed no significant changes in Medicaid insurance rates between these two age-groups, indicating that overall changes in insurance rates were likely due to the dependent insurance provisions rather than changes to other public insurance programs. Overall, our findings demonstrate a positive impact of the ACA dependent care provisions on insurance rates in this population.

Several prior studies have examined the impact of the dependent care provisions on insurance coverage in the overall young adult population (i.e., those with and without a history of cancer). Overall, studies have demonstrated an increase in insurance rates among young adults during the time the dependent care provisions took effect.16–18 Specifically, using nationally representative data on health insurance from the 2005–2010 National Health Interview Survey, Sommers et al. found that in the year post-policy implementation, insurance coverage increased by 4.7% more among 19–25 year-olds (68.1% to 73.6%) than among 26–34 year-olds (0.8% increase); however, they found no significant differences in public insurance coverage (i.e., Medicaid) between the two age-groups.17 Another study by Cantor et al. examined 2005–2011 Current Population Survey data, finding that insurance rates among younger adults 19–25 years of age increased between 4.3 and 8.7 percentage points more (62.5% to 65.1% from 2009 to 2010) than an older comparison group, 27–30 years of age (70.6% to 70.1% from 2009 to 2010).16 Finally, Wallace and Sommers found a 6.6% net change in insurance coverage among 19–25 year-olds (68.0% to 70.9%) relative to 26–34 year-olds (77.8% to 71.4%) after the dependent policy change among a representative sample from the Behavioral Risk Factor Surveillance System.18 While our findings are consistent with these findings among the general young adult population, the overall 3.1% net change in insurance rates between our two young adult cancer survivor age-groups was less than the differences observed in these earlier studies. This may have been partly due to the ability for low income individuals to enroll on Medicaid due to their cancer diagnosis33,34 as reflected by the higher levels of Medicaid insurance rates in our young cancer survivor population (16–19%) relative to the general young adult population (11–17%).16,17 Further, our study includes an additional year of data post-policy compared to two of the studies, which may have resulted in regression to pre-policy rates (i.e., regression to the mean). Regardless, we estimate that more than 408 young adults (i.e., 3.1% of young adults diagnosed post-policy) in our study gained access to insurance under the dependent care provision and an additional 248 uninsured young adults in our study would have been eligible to gain access to insurance if the policy was enacted prior to 2010. While relatively small, our study demonstrates a positive impact of dependent care policies on overall insurance rates in young adult cancer survivors-a group who will require life-long medical care access for survivorship care.1,3,15

Overall, our study has several implications that may influence overall treatment and health outcomes in young adult cancer survivors. First, prior studies have consistently demonstrated that having health insurance is associated with earlier stage at diagnosis, increased enrollment on clinical trials and utilization of medical care, shorter times to treatment initiation and lower mortality.7,14,35,36 As a result, there is potential for significant improvements in cancer outcomes and reduced barriers to care, including earlier stage at diagnosis, improved guideline-concordant treatment and better survival as a result of these policies.37,38 Future studies should evaluate how increased access to insurance in these young adult cancer survivors may drive improved short and longer-term outcomes. Second, despite the high rates of insurance we identify in our study, prior research has identified decreasing rates of insurance as cancer patients progress from active treatment to survivorship.12 This may result from an number of factors, including the loss of eligibility to enroll in public programs once treatment is complete,33 job changes, marriage, and aging off a parent’s insurance policy.39 For public programs specifically, eligibility for the Medicaid Medically Needy Program33 or the Breast and Cervical Cancer Program34, and therefore eligibility for Medicaid more broadly, will most likely end upon treatment completion and varies by state of residence. Future research will be needed to examine how the dependent insurance provisions can combine with public programs (i.e., Medicaid cancer provisions) or expanded insurance options under the ACA healthcare exchanges to ensure survivors remain consistently insured after diagnosis. Finally, at the time the dependent care provisions were enacted, states had vastly different eligibility criteria for both enrollment on dependent insurance coverage as well as public insurance programs.19–21 While our population-based assessment of policy-changes demonstrated an overall positive effect of dependent provisions on insurance, future studies should examine how uptake and enrollment on insurance by young adult cancer survivors varies by geography and local or state policies.

We do, however, acknowledge certain limitations of our study. First, we were unable to distinguish the exact type of private insurance coverage that some survivors were enrolled on. However, when we excluded those with unknown insurance types in our sensitivity analyses, we still observed a similar relationship between the policy and higher insurance rates. Additionally, information on insurance coverage reported to the cancer registries includes only a point-in-time assessment of insurance at the time of diagnosis or initial treatment. Insurance coverage can change over time and eligibility for certain public programs, including Medicaid, can be dependent on active treatment for cancer. Future studies should continue to monitor and evaluate how the ACA expands access to insurance after treatment have been completed. Additionally, we recognize that employment rates vary considerably by age among young adults (54% of 18–25 year olds employed versus 73% of 26–29 year olds in 2010)40 and may influence whether individuals need to on enroll insurance under the policy. Future studies may examine the relationship between employment and insurance enrollment under the dependent insurance provision. We additionally recognize that dependent coverage expansions occurred earlier in some states included in our analysis.19 However, the expansion was not all encompassing, had residency restrictions and excluded those who were married or had children.19 Further, some states had expanded Medicaid options before 2014, potentially influencing overall Medicaid coverage rates.32 Again, excluding states with earlier adoption of these policies did not change our primary findings. Finally, we are cognizant that the insurance eligibility policies are not uniform across political entities, including counties and states. We did account for these varying policies by including a county- and state-level random intercept to account for differences in policies across political entities and again found virtually no change between the policy and insurance gains. Overall, this research serves as a starting point to understand how new provisions from the ACA can improve insurance rates in a vulnerable population of young adult cancer survivors

In conclusion, we found a larger increase in insurance rates for young adults 18–25 years of age relative to those 26–29 years of age, demonstrating a positive impact of the ACA dependent care provisions on insurance rates in this population. As individuals comply with health insurance mandates and enroll on new insurance options through health insurance exchanges with the more expansive provisions from the ACA in 2014, future research should continue to monitor changes in insurance rates and how improved insurance coverage influences diagnosis, treatment, and outcomes in young adult cancer patients.

Acknowledgments

Funding: Dr. Parsons and Schmidt received support from a National Cancer Institute Cancer Prevention and Control Career Development Award [K07CA175063] and the UTHSCSA School of Medicine Clinical Investigator Kickstart Award. Dr. Bang was partly supported by the National Center for Advancing Translational Sciences, National Institutes of Health, through grant number UL1 TR 000002.

Footnotes

Author Contributions: Helen M. Parsons: Conceptualization, methodology, validation, formal analysis, investigation, resources, data curation, writing – original draft, visualization, supervision, project administration, and funding acquisition. Susanne Schmidt: Conceptualization, methodology, validation, formal analysis, writing – original draft, writing – review and editing, and visualization. Laura L. Tenner: Conceptualization, methodology, and writing – review and editing. Heejung Bang: Software, validation, formal analysis, and writing – review and editing. Theresa H.M. Keegan: Conceptualization, writing – review and editing, visualization, and funding acquisition.

No conflict of interest/disclosures.

References

- 1.Adolescent and Young Adult Oncology Progress Review Group. Closing the gap: research and care imperatives for adolescents and young adults with cancer. Bethesda, MD: National Institutes of Health; 2006. [Google Scholar]

- 2.A snapshot of adolescent and young adult cancers. [Accessed March 1, 2014];Cancer Snapshots. 2014 http://www.cancer.gov/researchandfunding/snapshots/adolescent-young-adult.

- 3.Bleyer A. The adolescent and young adult gap in cancer care and outcome. Curr Probl Pediatr Adolesc Health Care. 2005;35(5):182–217. doi: 10.1016/j.cppeds.2005.02.001. [DOI] [PubMed] [Google Scholar]

- 4.Bleyer A, Barr R. Cancer in young adults 20 to 39 years of age: overview. Semin Oncol. 2009;36(3):194–206. doi: 10.1053/j.seminoncol.2009.03.003. [DOI] [PubMed] [Google Scholar]

- 5.Bleyer WA. Cancer in older adolescents and young adults: epidemiology, diagnosis, treatment, survival, and importance of clinical trials. Med Pediatr Oncol. 2002;38(1):1–10. doi: 10.1002/mpo.1257. [DOI] [PubMed] [Google Scholar]

- 6.Bleyer WA. Latest estimates of survival rates of the 24 most common cancers in adolescent and young adult americans. Journal of Adolescent and Young Adult Oncology. 2011;1:37–42. doi: 10.1089/jayao.2010.0005. [DOI] [PubMed] [Google Scholar]

- 7.Bleyer A, Ulrich C, Martin S. Young adults, cancer, health insurance, socioeconomic status, and the Patient Protection and Affordable Care Act. Cancer. 2012;118(24):6018–6021. doi: 10.1002/cncr.27685. [DOI] [PubMed] [Google Scholar]

- 8.Adams SH, Newacheck PW, Park MJ, Brindis CD, Irwin CE., Jr Health insurance across vulnerable ages: patterns and disparities from adolescence to the early 30s. Pediatrics. 2007;119(5):e1033–e1039. doi: 10.1542/peds.2006-1730. [DOI] [PubMed] [Google Scholar]

- 9.Kaiser Family Foundation. Health Reform Implementation Timeline. [January 10, 2014]; http://kff.org/interactive/implementation-timeline/ [Google Scholar]

- 10.Goldman TR, editor. Progress Report: The Affordable Care Act's Extended Dependent Coverage Provision. [Accessed January 5, 2016];Health Affairs. 2013 Dec 16; http://healthaffairs.org/blog/2013/12/16/progress-report-the-affordable-care-acts-extended-dependent-coverage-provision/ [Google Scholar]

- 11.United States Department of Labor. Young Adults and the Affordable Care Act: Protecting young adults and eliminating burdens on businesses and families. [Accessed October 12, 2015];2015 http://www.dol.gov/ebsa/faqs/faq-dependentcoverage.html.

- 12.Parsons HM, Schmidt S, Harlan LC, Kent Young and Uninsured: Insurance Patterns of Recently Diagnosed Adolescent and Young Adult Cancer Survivors in the AYA HOPE Study. Cancer. 2014;120(15):2352–2360. doi: 10.1002/cncr.28685. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 13.Keegan TH, Lichtensztajn DY, Kato I, et al. Unmet adolescent and young adult cancer survivors information and service needs: a population-based cancer registry study. J Cancer Surviv. 2012 doi: 10.1007/s11764-012-0219-9. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 14.Keegan TH, Tao L, DeRouen M, et al. Medical care in adolescents and young adult cancer survivors: what are the biggest access-related barriers? J Cancer Surviv. 2014 Jan 10; doi: 10.1007/s11764-013-0332-4. (Epub) [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.Kirchhoff AC, Lyles CR, Fluchel M, Wright J, Leisenring W. Limitations in health care access and utilization among long-term survivors of adolescent and young adult cancer. Cancer. 2012 doi: 10.1002/cncr.27537. [DOI] [PubMed] [Google Scholar]

- 16.Cantor JC, Monheit AC, DeLia D, Lloyd K. Early impact of the Affordable Care Act on health insurance coverage of young adults. Health Serv Res. 2012;47(5):1773–1790. doi: 10.1111/j.1475-6773.2012.01458.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 17.Sommers BD, Buchmueller T, Decker SL, Carey C, Kronick R. The Affordable Care Act has led to significant gains in health insurance and access to care for young adults. Health Aff (Millwood) 2013;32(1):165–174. doi: 10.1377/hlthaff.2012.0552. [DOI] [PubMed] [Google Scholar]

- 18.Wallace J, Sommers BD. Effect of dependent coverage expansion of the Affordable Care Act on health and access to care for young adults. JAMA Pediatr. 2015;169(5):495–497. doi: 10.1001/jamapediatrics.2014.3574. [DOI] [PubMed] [Google Scholar]

- 19.Monheit AC, Cantor JC, DeLia D, Belloff D. How have state policies to expand dependent coverage affected the health insurance status of young adults? Health Serv Res. 2011;46(1 Pt 2):251–267. doi: 10.1111/j.1475-6773.2010.01200.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 20.Nicholson JL, Collins SR. Young, uninsured, and seeking change: health coverage of young adults and their views on health reform. Findings from the Commonwealth fund Survey of Young Adults (2009) Issue Brief (Commonw Fund) 2009;73:1–22. [PubMed] [Google Scholar]

- 21.Nicholson JL, Collins SR, Mahato B, Gould E, Schoen C, Rustgi SD. Rite of passage? Why young adults become uninsured and how new policies can help. Washington, D.C.: The Commonwealth Fund; 2009. [PubMed] [Google Scholar]

- 22.National Cancer Institute. Adolescents and Young Adults with Cancer. [Accessed January 18, 2016];2016 http://www.cancer.gov/types/aya.

- 23.National Cancer Institute. Surveillance, Epidemiology and End Results Program. [Accessed October 12, 2015];2015 http://seer.cancer.gov/about/overview.html.

- 24.National Cancer Institute. SEER Program: About the Registries. [Accessed October 12, 2015];2015 http://seer.cancer.gov/registries/

- 25.National Cancer Institute. SEER Insurance Recode. [Accessed October 12, 2015];2015 http://seer.cancer.gov/seerstat/variables/seer/insurance-recode/

- 26.Verrill C, editor. Assessing the reliability and validity of primary payer informatio in central cancer registry data. [Accessed January 19, 2016];2010 https://www.naaccr.org/LinkClick.aspx?fileticket=AtR4s7_3i34%3D&tabid=230&mid=679. [Google Scholar]

- 27.National Cancer Institute. SEER Training Modules: Abstracting the Medical Records. [Accessed Oct. 20, 2015];2015 http://training.seer.cancer.gov/abstracting/intro/ [Google Scholar]

- 28.National Cancer Institute. AYA Site Recode. [Accessed October 15, 2015];2015 http://seer.cancer.gov/ayarecode/

- 29.Dimick JB, Ryan AM. Methods for evaluating changes in health care policy: the difference-in-differences approach. JAMA. 2014;312(22):2401–2402. doi: 10.1001/jama.2014.16153. [DOI] [PubMed] [Google Scholar]

- 30.Fitzmaurice GM, Laird NM, Ware JH. Applied Longitudinal Analysis. New Jersey: John Wiley & Sons; 2012. [Google Scholar]

- 31.Singer JD, Willett JB. Applied Longitudinal Data Analysis. New York, NY: Oxford University Press; 2003. [Google Scholar]

- 32.Golberstein E, Gonzales G, Sommers BD. California's Early ACA Expansion Increased Coverage And Reduced Out-Of-Pocket Spending For The State's Low-Income Population. Health Aff (Millwood) 2015;34(10):1688–1694. doi: 10.1377/hlthaff.2015.0290. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 33.Kaiser Family Foundation. Medicaid and the Uninsured: The Medicaid Medically Needy Program. [Accessed Oct 28, 2015];2012 https://kaiserfamilyfoundation.files.wordpress.com/2013/01/4096.pdf. [Google Scholar]

- 34.Services TDoSH. Medicaid for Breast and Cervical Cancer (MBCC) Information. [Accessed Oct 22, 2015];2015 https://www.dshs.state.tx.us/bcccs/treatment.shtm. [Google Scholar]

- 35.Rosenberg AR, Kroon L, Chen L, Li CI, Jones B. Insurance status and risk of cancer mortality among adolescents and young adults. Cancer. 2015;121(8):1279–1286. doi: 10.1002/cncr.29187. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 36.Parsons HM, Harlan LC, Seibel NL, Stevens JL, Keegan TH. Clinical trial participation and time to treatment among adolescents and young adults with cancer: does age at diagnosis or insurance make a difference? J Clin Oncol. 2011;29(30):4045–4053. doi: 10.1200/JCO.2011.36.2954. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 37.Robbins AS, Han X, Ward EM, Simard EP, Zheng Z, Jemal A. Association Between the Affordable Care Act Dependent Coverage Expansion and Cervical Cancer Stage and Treatment in Young Women. Jama. 2015;314(20):2189–2191. doi: 10.1001/jama.2015.10546. [DOI] [PubMed] [Google Scholar]

- 38.Aizer AA, Falit B, Mendu ML, et al. Cancer-specific outcomes among young adults without health insurance. J Clin Oncol. 2014;32(19):2025–2030. doi: 10.1200/JCO.2013.54.2555. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 39.Dahlen HM. Labor Market and Health Insurance Impacts Because of "Aging Out" of the Young Adult Provision of the Patient Protection and Affordable Care Act. Am J Public Health. 2015:e1–e11. [Google Scholar]

- 40.Statistics BoL. Employment status of the civilian noninstitutional population by age, sex and race. [Accessed January 15, 2016];2010 http://www.bls.gov/cps/aa2010/cpsaat3.pdf.