Abstract

Background

Past reports suggest that a near balance has been reached in the supply and demand for pharmacists in the US. Although data on the level of supply of pharmacists is available, there is no continuous and systematic tracking of the level of demand (unmet and latent) for pharmacists at state level. Unmet demand, an established construct in pharmacy workforce, is important to measure the number of vacancies and assess pharmacist shortage consistently over time. Latent demand or potential demand is a novel construct and has never been measured in pharmacy workforce. With the increase in supply, it is important to measure the potential demand that could be budgeted in pharmacies in the near future.

Objective

The objective of this study was to measure the unmet and latent demand for pharmacists and explore the association between latent demand and workload characteristics in community and hospital pharmacies in Wisconsin in 2011-12.

Methods

The study used a cross-sectional, descriptive survey design. A sample of community pharmacies (n=1,064) and hospital pharmacies (n=126) licensed in Wisconsin in 2011-12 was identified. Key informants (managers/owners) of sampled pharmacies were sent a one-page cover letter explaining the purpose of the study and requesting participation and a three page survey form. The main outcome measures of the study were total number of FTE pharmacist positions vacant, presence of adequate staff size, additional number of FTE pharmacist positions needed to attain adequate staff size, prescription volume, daily census, hospital size and number of hours prescription department is open. Descriptive statistics were calculated for all the pharmacies collectively, then separately for community and hospital pharmacies. Pharmacy setting, vacancies and workload characteristics of pharmacies with and without latent demand were compared using chi-squared test of independence and/or t-test. Sample weights were calculated and used in all the analyses to weigh the estimates to all pharmacies in Wisconsin.

Results

Overall response rate to the survey was 50.1%. Of the total number of FTE pharmacist positions budgeted in Wisconsin, 54.3 FTE positions (1.5%) were reported vacant in 2011-12. Approximately 28.2% of the community and hospital pharmacies reported the presence of latent demand. Latent demand was significantly associated with higher workload in community pharmacies and larger bed size in hospital pharmacies.

Conclusion

There appeared to be a balance between the supply and demand for pharmacists in Wisconsin in 2011-12. There is a potential for additional FTE positions (latent demand) to be budgeted in pharmacies to attain adequate pharmacist staff size. It is important to consistently track the level of unmet and latent demand for pharmacists in Wisconsin and combine this information with other workforce characteristics to guide the decision making of pharmacy workforce planners and pharmacy managers.

Keywords: Demand for pharmacists, Latent demand, Unmet demand, Adequate Staff Size, Community pharmacies, Hospital pharmacies

Introduction

Annual data about the trends in the supply of pharmacists (i.e. number of new pharmacy graduates) is available from pharmacy schools in the US.1 Another source of supply of pharmacists is the international pharmacy graduates achieving US licensure whose data can be obtained from National Association of board of Pharmacy.2,3 However, currently, there is no system in place to collect and assess the level of demand for pharmacists consistently over a period of time. Past surveys which measured the level of demand as pharmacist vacancies, have either been discontinued or have been limited to a specific pharmacy setting or didn't provide any state level information. 4–6 Another measure, the Aggregate Demand Index (ADI), is a national and regional level estimate of the demand for pharmacists, but it captures the perceptions of pharmacist employers on a scale of 1 to 5 with 1 being low demand and 5 being high demand. 7 It does not provide a numerical estimate of the level of demand i.e. number or rate of vacancies for pharmacists. With an exponential growth in the supply of pharmacists1,6,8,9 and concerns of an impending surplus of pharmacists10, it is important to be able to consistently measure the level of demand for pharmacists and report a numerical estimate for both national and state level. Some other state level surveys assessing pharmacist vacancies have been conducted but there is no consistent method to collect the level of demand in Wisconsin. 11,12 This study introduces a feasible and systematic way to collect data on level of demand for pharmacists in Wisconsin. The data collection methodology used in this study would be applicable and adaptable for other regions/states as well as at national level. This study defines the level of demand for pharmacists with two key components: unmet and latent demand.

Unmet demand, the first component, is the number of vacant budgeted positions in pharmacies. It provides an estimate of how many pharmacists are needed to fill vacant budgeted positions in pharmacies. Since these positions are budgeted, employers have funds available to hire pharmacists for the vacant positions. The supply of pharmacists plays a key role in filling these budgeted vacant positions. High levels of unmet demand across pharmacies may suggest that the supply of pharmacists is inadequate to fill the vacant positions.

The second component of level of demand for pharmacists, latent demand, projects a form of potential demand. In a goods/services market, latent demand is defined as the desire or potential of a buyer to purchase goods/services which goes unsatisfied. The goods/services are not purchased due to a lack of funds or resources or the unavailability of the goods/services in the market or the lack of information about availability of good /services. 13–15 Latent demand has been measured in the field of transportation and is defined as the potential ridership among people whose mobility is otherwise limited because of either poor access to transit service or unavailability of an automobile.16 Latent demand for transit services was represented as the potential number of people who would use transit services if new/improved services were available or they could obtain funds to buy an automobile.16

The concept of latent demand is novel and has never been measured in the field of healthcare and applied to the pharmacist workforce. The current study defines latent demand for pharmacists as the potential number of pharmacist positions that could be budgeted by the pharmacist employer if there was an adequate supply of pharmacists or if the employer could obtain funds to budget these positions.

It is important to apply the concept of latent demand to the pharmacy workforce for two reasons. First, a measure of latent demand suggests what the potential additional pharmacist demand could be if market parameters (i.e. supply of pharmacists and/or pharmacy capital) changed. Second, the presence of latent demand identifies pharmacies where pharmacist staffing may be inadequate and consequently, workload may be burdensome. There is enough evidence which suggests that inadequate staff size in a pharmacy is one of the factors responsible for elevated levels of stress and job dissatisfaction among the pharmacists. 17–21

Unmet and latent demand, together, provides a more complete picture of the demand for pharmacists and could be an important and useful piece of information for pharmacy workforce planners as well as pharmacy managers. The two components of demand work in synergy. Theoretically, with an increase in pharmacist supply and/or an increase in pharmacy capital, employers might be able to budget the additional positions reported currently as latent demand. This would in turn translate as a growth in the unmet demand. It is important to measure both unmet and latent demand for pharmacist as they go hand-in-hand. This is the first study known to the authors which measures the two components, unmet and latent demand, together, to obtain a composite picture of the level of demand in Wisconsin.

Objectives

Given the need to develop a systematic method for collecting information about the level of demand for pharmacists the purpose of this study was to measure state-wide estimates of the unmet and latent demand for pharmacists in community and hospital pharmacies in Wisconsin. In an attempt to validate the measurement of latent demand, the association between latent demand and various workload characteristics in community and hospital pharmacies was explored.

Methods

Design

A cross-sectional, descriptive survey design was used to collect data. A pharmacy site was used as the unit of analysis. All measures were assessed at the time of the survey and unless otherwise described, were self-reported by the pharmacy managers at each pharmacy site (i.e. key informants). The study was approved by the Institutional Review Board at the University of Wisconsin.

Sample

The sampling frame, a complete list of pharmacies licensed and located in Wisconsin, was purchased from the Wisconsin Department of Safety and Professional Services in January 2011. Pharmacies with an inactive license were eliminated from the list, leaving a total of 1,274 active pharmacies. Hospital pharmacies in Wisconsin were identified by cross referencing the name and address of licensed pharmacies with a list of hospitals in Wisconsin obtained from the American Hospital Association (AHA). In most cases, the pharmacy name contained in the sampling frame signified an outpatient hospital pharmacy and since, outpatient hospital pharmacies, if located in a separate location from the inpatient hospital pharmacy, have to be licensed separately in Wisconsin, these sites were not included. There were a total of 126 inpatient hospital pharmacies identified in the sampling frame. Community pharmacies were identified by comparing the list of active, licensed pharmacies to another list of community pharmacies, developed by a senior researcher and used in previous research.11 Community pharmacies were identified mainly by name recognition, looking up pharmacies on the internet, and confirming the type of pharmacy by phone. A total of 1,064 community pharmacies were identified. Thus, of the 1,274 active licensed pharmacies in Wisconsin in 2011, 93.4% of the pharmacies (1,190) were retained as the sample for the study. The licensed pharmacies that were not included in the sample (6.6%) represented practice settings such as veterinary pharmacies, outpatient hospital pharmacies, and long term care pharmacies.

Data Collection

The managing pharmacist listed for each pharmacy site in the sampling frame was identified as the key informant for that site. A one-page cover letter explaining the purpose of the study and requesting participation and a three page survey form consisting of one cover page and two pages of the survey instrument were used for collecting primary data. The questions in the survey instrument were adapted from a previously conducted study.11 The only questions included in the survey that had not been used previously and hence were not pre-tested were those related to the measurement of latent demand. Labor economic theory of demand guided the development of the data collection method and the demand survey.

Data collection occurred in three different phases. All the surveys were sent in a sequential manner to ascertain the feasibility of conducting this survey. It was not feasible to send out all the surveys at once due to limited resources and time. Therefore survey packets were mailed to key informants for one subset of community pharmacies in July 2011 and the other subset of community pharmacies in April 2012. The survey packets were mailed to hospital pharmacies in October 2011. To track the respondents, a unique pharmacy site identification number was written in pencil on the survey form and on the outside envelope. Key informants were instructed to fax the completed survey form back to the School of Pharmacy using a fax number provided on the title page and bottom of the last page of the survey form. Key informants were instructed that they could erase the identification number before returning the form. Three weeks after the first mailing, a second survey packet was sent to all of the key informants who had not responded to the first survey mailing. Key informants who didn't reply to two consecutive mailings were deemed to be non-respondents and were not contacted with further mailings.

Variables

Unmet demand

The level of unmet demand for pharmacists was reported by the key informants at the community and hospital pharmacies as the total number of budgeted FTE pharmacist positions vacant (FTEs vacant). One FTE was defined as a pharmacist working 40 hours per week.

Latent demand

Latent demand, as measured in this study, was a perception on the part of the key informant at community and hospital pharmacies. The survey instrument contained two questions that were used to measure latent demand. The first question asked key informants whether or not they thought that the number of FTE pharmacist positions budgeted (i.e. filled and vacant) at their pharmacy was sufficient to provide the level of care needed by their patient population. If not, the second question asked key informants to report the additional number of FTE pharmacist positions they thought were needed at their pharmacy to provide the level of care their patient population needed. The level of latent demand for pharmacists was defined as the number of additional unbudgeted FTE pharmacist positions the pharmacy needed to meet current demand for pharmacy goods and services.

Pharmacy staffing

Key informants at the community and hospital pharmacies reported the total number of pharmacist FTE positions filled at the site (FTEs filled). The authors calculated total FTE pharmacist positions budgeted (FTEs budgeted) as the sum of FTEs filled and FTEs vacant in a pharmacy. The authors calculated the vacancy rate for each pharmacy, which was defined as FTEs vacant divided by FTEs budgeted in a pharmacy. The key informants also were asked to report the actual number of licensed pharmacists (i.e. bodies) employed at the site.

Pharmacy Setting & Workload Characteristics

Community Pharmacies

The key informants at community pharmacies reported the type of pharmacy setting as one of five categories: independent, mass merchandiser, chain, super market pharmacy and other. Additionally, key informants at community settings were asked to report the number of prescriptions dispensed per weekday (prescription volume), the number of hours the prescription department is open per weekday and on the weekends. The authors calculated the number of prescriptions per FTE pharmacist for community pharmacies as the prescription volume divided by the pharmacist FTEs filled.

Hospital Pharmacies

The key informants at hospital pharmacies reported the type of hospital as one of four categories: for-profit hospital, non-profit hospital, government hospital and other. Key informants at hospital settings were asked to report the number of staffed beds, the number of beds occupied in the hospital per day (daily census), the number of hours the prescription department is open per weekday and on the weekends. The authors calculated daily census per FTE pharmacist for inpatient hospital pharmacies as the daily census divided by the FTE pharmacist positions filled. Hospital pharmacies were classified by the authors as small (less than 100 beds), medium (100-300 beds) and large (more than 300 beds) based on data provided by the key informants.22

Data analysis

The main objective of this study was to determine the level of unmet and latent demand in community and hospital pharmacies in Wisconsin. Responses from key informants were considered unusable if they did not provide information related to FTE pharmacist positions filled and budgeted FTE pharmacist positions vacant in the pharmacy. Responses from key informants who did not provide information about latent demand were considered usable, since this measure was not pre-tested.

To obtain state-wide estimates of the level of unmet and latent demand for pharmacists in community and hospital pharmacies, sample weights were calculated for useable responses. Two variables were used to determine sample weights: pharmacy setting (community and hospital) and rurality. Five levels of rurality were used based on RUCA codes. The number of licensed pharmacies in the population in each cell of a pharmacy type by rurality table was determined. Also, the number of useable responses was determined for each cell in the table. The sampling weight for a responding pharmacy in each cell was determined by calculating the ratio of the number of pharmacies in the population to the number of pharmacies providing useable responses.

Next, response rates were estimated overall and for community and hospital pharmacies separately. Characteristics of the pharmacies reported by the responding key informants were determined. Descriptive statistics were calculated for unmet and latent demand for all pharmacies collectively and then separately for community and hospital pharmacies. Characteristics of pharmacies with and without latent demand were compared, included setting, number of pharmacist vacancies, and workload. Comparisons of characteristics between pharmacies with and without latent demand were made using chi-squared test of independence for categorical variables and t-test for continuous variables. Sample weights were used in all the analyses to weigh the estimates to all pharmacies in Wisconsin. All analyses were conducted using StataCorp LP 2013.

The mail survey method has been criticized for nonresponse bias. If survey respondents differ substantially from non-respondents, the validity of the conclusions from the survey can be biased and the results cannot be generalized to the entire population.23 In this study, non-response bias was evaluated by comparing the respondents with the non-respondents on practice setting (community and hospital) and rurality of the pharmacy location. Information about the non-respondents was determined from data contained in the sampling frame. The rurality classification was determined using the five levels of rurality based on Rural-Urban Commuting Area (RUCA) codes. The chi-square test of independence was performed comparing the distribution of the respondents and non-respondents across rurality categories for community and hospital pharmacies. An a priori significance of 0.05 was chosen.

Results

Response Rate

Of the 1,190 survey packets mailed to the key informants, 15 survey packets were returned as non-deliverable from pharmacies that were closed. Therefore, there were a total of 1,175 pharmacies [1,049 community pharmacies and 126 hospital pharmacies] that were considered valid pharmacies in the sample.

Of the 1,175 valid pharmacies, 597 key informants at each pharmacy (527 community pharmacies and 70 hospital pharmacies) responded to the survey. The responses from key informants at 8 pharmacies (five community pharmacies and three hospital pharmacies) were considered unusable. Therefore, there were a total of 589 usable responses for a response rate of 50.1% (589/1,175). There were a total of 522 usable responses representing community pharmacies (49.8% response rate) and 67 usable responses representing hospital pharmacies (53.2% response rate). Tables showing the un-weighted results for the study are in Appendix A to F.

Tables 1 and 2 show the weighted characteristics of community and hospital pharmacies reported by key informants. Over one-half of community pharmacies had 2.0 or fewer FTE pharmacist positions budgeted. Conversely, nearly one-half of hospital pharmacies had more than 5.0 FTE pharmacist positions budgeted. Key informants reported the FTE pharmacist positions filled and number of licensed pharmacists employed at the community and hospital pharmacies in Wisconsin. The weighted number of total FTE pharmacist positions filled in community and hospital pharmacies in Wisconsin was 3,683.3 FTE (FTEs filled) and a weighted total of 4,254 licensed pharmacists were employed to fill these FTE positions.

Table 1. Characteristics of Responding Community Pharmacies Weighted Across Wisconsin.

| Characteristic | Community Pharmacies (n=1,049) |

|---|---|

| Setting [n, (%)] | |

| Independently-owned | 246 (23.5) |

| Mass merchandiser | 121 (11.5) |

| Chain | 507 (48.3) |

| Supermarket | 76 (7.3) |

| Other | 99 (9.4) |

| Pharmacist Staffing Characteristics | |

| Total FTE pharmacist positions budgeted per pharmacy [mean (std. dev.)] | 2.33 (1.3) |

| FTE pharmacist positions budgeted per pharmacy [n (%)]: | |

| 0.01-1.00 FTE pharmacist position | 131 (12.5) |

| 1.01-2.00 FTE pharmacist positions | 452 (43.1) |

| 2.01-3.00 FTE pharmacist positions | 314 (29.9) |

| 3.01-4.00 FTE pharmacist positions | 84 (8.0) |

| 4.01-5.00 FTE pharmacist positions | 33 (3.2) |

| 5.01 or more FTE pharmacist positions | 35 (3.3) |

| Workload Characteristics | |

| Prescription volume per weekday [mean (std. dev.)] | 245 (201.8) |

| Hours prescription department open per weekday [mean (std. dev.)] | 11.68 (13.4) |

Note: Independently-owned included pharmacies owned by a pharmacist usually with less than 4 settings under one owner. Mass Merchandiser included pharmacies located in large warehouse stores or merchandisers e.g. Target, Wal-Mart, etc. Chain was defined as a corporate ownership including four or more outlets e.g. Walgreens, CVS. Supermarket represented pharmacies located within a supermarket. Other includes pharmacies located in clinics and pharmacies affiliated with a health system.

Note: FTE is Full-time Equivalent. One FTE is equal to working 40 hours per week for 52 weeks per year.

Table 2. Characteristics of Responding Hospital Pharmacies Weighted Across Wisconsin.

| Characteristic | Hospital Pharmacies (n=126) |

|---|---|

| Setting [n (%)] | |

| For-profit | 9 (7.1) |

| Non-profit | 108 (85.8) |

| Government or other | 9 (7.1) |

| Pharmacist Staffing Characteristics | |

| Total FTE pharmacist positions budgeted per pharmacy [mean (std. dev.)] | 10.3 (17.2) |

| FTE pharmacist positions budgeted per pharmacy [n (%)]: | |

| 0.01-1.00 FTE pharmacist position | 6 (4.8) |

| 1.01-2.00 FTE pharmacist positions | 18 (14.3) |

| 2.01-3.00 FTE pharmacist positions | 13 (10.3) |

| 3.01-4.00 FTE pharmacist positions | 15 (11.9) |

| 4.01-5.00 FTE pharmacist positions | 13 (10.3) |

| 5.01-10.00 FTE pharmacist positions | 32 (25.4) |

| 10.01-20.00 FTE pharmacist positions | 13 (10.3) |

| 20.01 or more FTE pharmacist positions | 16 (12.7) |

| Workload Characteristics | |

| Hospital Size [n (%)]a: | |

| Small (<100 beds) | 79 (68.7) |

| Medium (100-299 beds) | 23 (20.0) |

| Large(≥300 beds) | 13 (11.3) |

| Daily census [mean (std. dev.)]a | 77.9 (114.5) |

| Hours prescription department open per weekday [mean (std. dev.)]a | 15.6 (6.4) |

Note: FTE is Full-time Equivalent. One FTE is equal to working 40 hours per week for 52 weeks per year.

The sample size for these variables was 115 due to missing responses.

A total of 5.1% (60/1175) of all community and hospital pharmacies in Wisconsin had at least one pharmacist vacancy (Table 3). A greater proportion of hospital pharmacies (18.3% i.e. 37 out of 126) had a pharmacist vacancy relative to community pharmacies (3.5% i.e. 23 out of 1049). The weighted number of total FTE pharmacist positions vacant in community and hospital pharmacies in Wisconsin was 54.3 FTEs (FTEs vacant). This number of FTEs vacant represents a total number of 69 vacant positions with 37 positions reported by key informants in community and 32 positions reported by key informants in hospital pharmacies. A higher proportion of vacant FTE pharmacist positions were for one-half FTE or less in community pharmacies compared to hospital pharmacies. Of all the budgeted FTE pharmacist positions vacant in community pharmacies, 26.4% were reported by independent settings. Of all the budgeted FTE pharmacist positions vacant in hospital pharmacies, 45.7% were reported by large hospital pharmacies.

Table 3. Characteristics of Vacant Pharmacist Positions in Community and Hospital Pharmacies (with a Pharmacist Vacancy) Weighted Across Wisconsin.

| Characteristic | Overall (n=60) | Community Pharmacies (n=37) | Hospital Pharmacies (n=23) |

|---|---|---|---|

| Total number of FTE pharmacist positions vacant | 54.3 | 25.7 | 28.7 |

| Mean FTE pharmacist positions vacant per pharmacy [mean (std. dev.)] | 0.9 (0.6) | 0.7 (0.4) | 1.2 (0.6) |

| Distribution of FTE pharmacist positions vacant per pharmacy [n (%)]: | |||

| 0.01-0.50 vacant FTE pharmacist positions | 23 (38.3) | 21 (56.8) | 2 (8.7) |

| 0.51-1.00 vacant FTE pharmacist positions | 28 (46.7) | 14 (37.8) | 14 (60.9) |

| 1.01 or more vacant FTE pharmacist positions | 9 (15.0) | 2 (5.4) | 7 (30.4) |

| Vacancy rate a [mean (std. dev)] | 19.8 (15.2) | 24.9 (15.2) | 11.5 (11.6) |

Note:

Vacancy Rate = Total FTE pharmacist positions vacant / Total FTE pharmacist positions budgeted.

All the percentage values are column percentages.

Approximately 3.7% of the responding key informants did not answer the questions related to latent demand. Excluding those with missing response, the presence of latent demand was reported by 28.2% (319/1,130) of key informants (Table 4). A total of 393 additional pharmacist FTEs were reported as additional FTEs needed across the community and hospital pharmacies. This number represents about 9.5% (i.e. 393/3,737.6) of the FTE pharmacist positions budgeted in community and hospital pharmacies in Wisconsin in 2011-12. The total number of FTE pharmacist positions budgeted in community and hospital pharmacies, 3,737.6, was the sum of FTEs filled (i.e. 3,683.3) and FTEs vacant (i.e. 54.3). Over one-half of the key informants at community pharmacies reported a need of 0.5 or less additional FTEs.

Table 4. Characteristics of Latent Demand for Pharmacists in Community and Hospital Pharmacies (with Latent Demand) Weighted Across Wisconsin.

| Characteristic | Overall (n=319) | Community Pharmacies (n=274) | Hospital Pharmacies (n=45) |

|---|---|---|---|

| Total number of additional FTE pharmacist positions needed (n) | 392.6 | 316.4 | 76.2 |

| Mean number of additional FTE pharmacist positions needed per pharmacy [mean (std. dev.)] | 1.19 (1.0) | 1.11 (1.0) | 1.66 (1.2) |

| Distribution of additional FTE pharmacist positions needed per pharmacy [n (%)]: | |||

| 0.01-0.50 FTE pharmacist positions | 152 (47.6) | 142 (51.8) | 10 (22.2) |

| 0.51-1.00 FTE pharmacist positions | 74 (23.2) | 63 (23.0) | 11 (24.4) |

| 1.01-2.00 FTE pharmacist positions | 44 (13.8) | 27 (9.9) | 17 (37.8) |

| 2.01 or more FTE pharmacist positions | 49 (15.4) | 42 (15.3) | 7 (15.6) |

Note:

All the percentage values are column percentages.

Table 5 shows the characteristics of community pharmacies for which responding key informants reported the presence or absence of latent demand. For the community pharmacies that had the presence of latent demand, workload was significantly higher compared to community pharmacies that did not have latent demand. Pharmacies with latent demand filled 60 more prescriptions per weekday than those without latent demand.

Table 5. Characteristics of Community Pharmacies with and without Latent Demand Weighted Across Wisconsin.

| Characteristic | Pharmacies With Latent Demand (N= 274) | Pharmacies Without Latent Demand (N= 733) | p value |

|---|---|---|---|

| Settings [n (%)] | 0.00*a | ||

| Independently-owned | 29 (10.6) | 207 (28.2) | |

| Mass merchandiser | 43 (15.7) | 76 (10.4) | |

| Chain | 169 (61.7) | 315 (43.0) | |

| Supermarket | 19 (6.9) | 54 (7.4) | |

| Other | 14 (5.1) | 81 (11.1) | |

| Vacancies | |||

| Have a pharmacist position vacant [n (%)] | 19 (6.9) | 15 (2.05) | 0.00*a |

| Mean pharmacist FTEs vacant [Mean (std. dev.)] | 0.05 (0.2) | 0.01 (0.1) | 0.07b |

| Workload characteristics [Mean (std. dev.)] | |||

| Prescription volume per weekday | 289.5 (281.9)c | 229.0 (163.4)d | 0.02*b |

| Prescriptions per FTE pharmacist per weekday | 121.9 (51.0)c | 103.4 (50.8)d | 0.00*b |

| Hours prescription department open per weekday | 14.3 (25.8)e | 10.7 (2.7)f | 0.12b |

| Hours prescription department open on the weekend (Saturday and Sunday) | 7.2 (5.2)e | 4.9 (4.2)f | 0.00*b |

Significant at 5% level.

p-value for Chi-test for independence and t-test, respectively.

The sample sizes for these variables were 258, 692, 272 & 729 respectively due to missing responses.

Note: Independently-owned included small chains with up to 10 settings under one owner. Mass Merchandiser included Target, Wal-Mart, etc. Chain included Walgreens, CVS. Supermarket represented pharmacies located within a supermarket. Other includes pharmacies located in clinics and pharmacies affiliated with a health system.

Table 6 shows the characteristics of hospital pharmacies which reported the presence and absence of latent demand. Hospital bed size was a significant characteristic associated with the presence of latent demand. More than half of the hospitals with the presence of latent demand were medium and large sized hospitals. Approximately 70% of the hospitals without a latent demand were small sized.

Table 6. Characteristics of Hospital Pharmacies with and without Latent Demand Weighted Across Wisconsin.

| Characteristic | Pharmacies With Latent Demand (N= 45) | Pharmacies Without Latent Demand (N= 77) | p value |

|---|---|---|---|

| Settings [n (%)] | 0.34a | ||

| For-profit hospital | 2 (4.4) | 7 (9.1) | |

| Non-profit hospital | 38 (84.5) | 66 (85.7) | |

| Government and other hospital | 5 (11.1) | 4 (5.2) | |

| Vacancies | |||

| Have a pharmacist position vacant [n (%)] | 7 (15.6) | 20 (26.0) | 0.18a |

| Mean FTE pharmacist positions vacant [Mean (std. dev.)] | 0.15 (0.4) | 0.26 (0.1) | 0.41b |

| Workload characteristics | |||

| Hospital Size [n(%)]: | 0.03*a | ||

| Small (<100 beds) | 21 (52.5)c | 54 (75.0)d | |

| Medium (100-300 beds) | 13 (32.5)c | 11 (14.3)d | |

| Large(>300 beds) | 6 (15.0)c | 7 (9.1)d | |

| Mean daily census (std. dev.) | 85.32 (87.6)c | 77.22 (130.0)d | 0.79b |

| Mean daily census per FTE pharmacist (std. dev.) | 12.25 (11.8)c | 14.69 (9.3)d | 0.42b |

| Mean hours prescription department open per weekday (std. dev.) | 16.90 (6.8) | 14.75 (6.1) | 0.22b |

| Mean hours prescription department open on the weekend (Saturday and Sunday) (std. dev.) | 14.48 (9.5) | 12.95 (8.2) | 0.52b |

Significant at 5% level.

p-value for Chi-test for independence and t-test respectively.

The sample sizes for these variables were 40 and 72 respectively due to missing responses.

Significant non-response bias was observed for community and hospital pharmacies (Appendix). A larger proportion of community and hospital pharmacies located in small rural areas responded to the survey and a smaller proportion of pharmacies located in urban core areas responded to the survey.

Discussion

The results of this study suggest low unmet demand for pharmacists in community and hospital pharmacies in 2011-2012. This is in agreement with the ADI value (3.36) in Wisconsin in 2011 7, which suggests that the supply of pharmacists was close to meeting the demand for pharmacists. The low vacancy rate of 2.2% (i.e. 28.7/ 1,304.5 or FTEs vacant/FTEs budgeted) reported across all Wisconsin hospital pharmacies are also consistent with national estimates of vacancy rates (2.4%) reported by the American Society of Health–System Pharmacists (ASHP) survey in 2011. However, for community pharmacies, there is no recent, national or regional information to which the unmet demand results of this study could be compared.

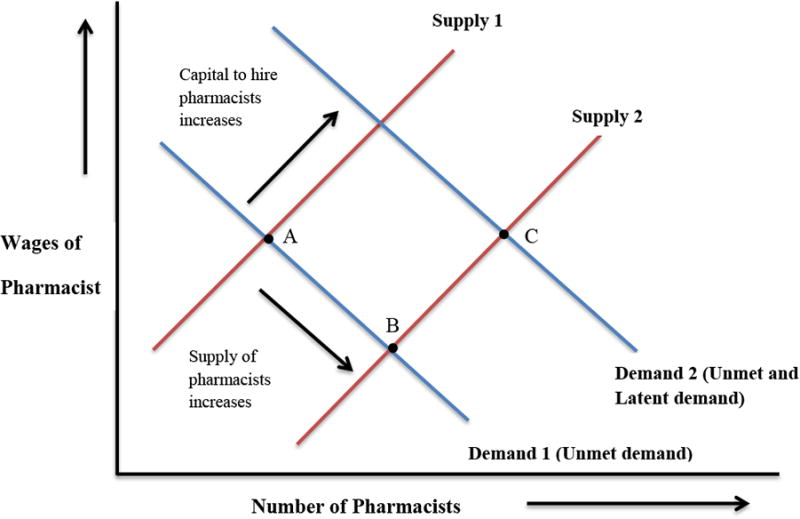

Even though there is low unmet demand for pharmacists in Wisconsin, the results of this study suggest a possibility of potential (latent) demand for pharmacists across both practice settings (additional 400 FTE pharmacists approximately). According to the concept of latent demand, pharmacies may not be hiring these pharmacists either because there are not enough pharmacists (i.e. pharmacist supply) available to be hired or the resources (i.e. capital) to hire them. Figure below is the diagrammatic representation of how the level of demand for pharmacists would change with increase in the supply for pharmacists and/or capital to hire them. The supply for pharmacists continues to expand in the US, 1,6,8,9 which is represented in the Figure as the supply curve shifting from Supply1 to Supply2 and level of demand increasing from A to B. Along with the increase in the supply, if there is an increase in the capital resources (i.e. as the US economy recovers 24), pharmacies would be in a position to budget additional latent demand positions. The latent demand positions, once budgeted, would add to unmet demand for pharmacists and shift the demand curve in Figure from Demand 1 to Demand 2 (B to C). Tracking latent demand for pharmacists over time is important to measure the changes in the level of unmet demand for pharmacists and understand the potential demand for pharmacists in specific areas and/or throughout the state.

Figure.

Diagrammatic Representation of the Impact of Increase in Supply of Pharmacists and/or Capital to Hire Pharmacists on the Level of Demand for Pharmacists in Pharmacy Labor Market.

The presence of latent demand has important implications for pharmacists working at a pharmacy with latent demand. The results of this study suggest that the workload was greater in pharmacies with latent demand since the pharmacies were understaffed in terms of pharmacists. Community pharmacies with latent demand typically had characteristics reflective of higher workload for pharmacists suggesting these pharmacies may need to fill additional pharmacist FTE positions. Since the workload was measured using the estimate of prescription volume per weekday, majority of the workload in the community pharmacies with latent demand would comprise of traditional pharmacist roles such as dispensing. For hospital pharmacies, the presence of latent demand was associated only with hospital bed size. One explanation for this finding is that pharmacy departments in bigger hospitals provide more, and more diverse, services to the hospital.5 Thus, hospital bed size may be acting as a proxy for workload in this study. Future research associating the presence of latent demand with workload could refine the workload measure in the hospital setting. Associating workload characteristics with a report of the presence of latent demand provided some evidence of the validity of the presence of latent demand reported by key informants.

One caveat to the implications about latent demand is the manner in which the authors measured latent demand. The measure asked key informants to report the number of additional pharmacist positions that were “needed” by the pharmacy to meet the “needs” of their patient population. Pharmacists could have interpreted the author's use of the word need as reflecting normative need.25 Normative needs typically are viewed as being ideal needs which is independent of economic factors (e.g. market prices, budget constraints)25. Thus, if key informants were thinking about normative need, one would expect that all key informants would not factor the economic constraints and report having latent demand at their pharmacy. Interestingly, this study found that only one-quarter of key informants reported the presence of latent demand. Also, majority of the pharmacies with latent demand reported only a small (e.g., 0.5 or less FTE) level of latent demand which supports the fact that key informants were considerate of the economic factors such as budget constraints and market prices when interpreting the latent demand questions. Future surveys could avoid the possibility of key informants interpreting the measure of latent demand as normative need if a refined measure of latent demand is used. The wordings of the latent demand measure could be changed to reflect on “the current level of demand for services from the pharmacy and the current wage rates (i.e. prices) for pharmacists”, and report “how many additional pharmacists would/could you hire”.

The labor economic theory, guiding this study, proposes that the labor markets are dynamic in nature. For example, in times of a pharmacist surplus, wage rates tend to decrease. There are several implications for pharmacist workforce planning related to the dynamic nature of labor markets. First, valid measures of vacancies and latent demand are needed to better understand these important demand concepts for the pharmacist labor market. Second, consistent tracking of the number and location (i.e. rural and urban) of vacancies as well as the level of latent demand over time is important to better understand how the labor market for pharmacists changes from one time period to the next, or how the labor market changes across regions of the state. The measurement of demand concepts at single points in time are not useful for workforce planning because they do not consider the dynamic nature of labor markets.

A systematic assessment of vacancies and latent demand also could include an assessment of various macro and micro economic characteristics of the pharmacy labor market to better understand the dynamics of the labor market. For example, characteristics of the labor market such as the supply of pharmacists, the size of the pharmacist workforce (i.e. employed pharmacists) and wage rates could be tracked along with vacancies and latent demand. These data could be used to provide context and explanation for changes in vacancy rates or to evaluate how policies/programs designed to impact the labor market (i.e. creation of a new pharmacy school or enrollment expansion/retraction in existing schools) impact the labor market. In terms of microeconomic factors, data describing characteristics of pharmacist positons (i.e. job titles or job descriptions) that are vacant or that represent latent demand could be collected to better understand the pharmacist skills that are missing at pharmacy settings. Additionally, information about how the work settings are being impacted by vacant and latent demand positions could be collected. Examples of information include pharmacist workload levels, quality of work life, and time spent in various patient care activities. This information would provide a more complete understanding of where and how shortages or surpluses of pharmacists are impacting practice and patient care.

Limitations

As with all research, this study has limitations. Key informants of pharmacies in rural areas were more likely to respond to the survey compared to key informants of pharmacies located in urban areas. One implication of this result is that the weighted estimates of the number of pharmacist vacancies and latent demand in this study are biased. Unfortunately the authors do not know the direction and level of the potential bias. Past evidence suggests that compared to urban areas, populations in rural areas display higher demand for health care services 26 and pharmacies in rural areas have difficulty in finding/retaining pharmacists 26–30. Based on these results, pharmacies in rural areas could have higher unmet and latent demand relative to their urban-located counterparts. Future efforts to generate response should focus on improving response rates from key informants for pharmacies located in urban areas.

A second limitation of this study is that all of the data were not collected during the same calendar year. Data collection was conducted in an incremental fashion purposely in order to assess the feasibility of the data collection process used. It was not feasible to send out 1,190 survey packets at once due to limited resources and time. Therefore they were sent out in batches. Given that the demand for pharmacists could have changed while data were being collected, the results for the demand for pharmacists could be over or under-estimated. In the future, all data should be collected at the same time.

A third limitation is that the study only focused on the hospital and community pharmacies in the sampling frame. These two settings, however, accounted for 93.4% of pharmacies listed in the sampling frame. Further, the included settings employ 87% of pharmacists in Wisconsin. The remaining pharmacy settings were excluded from the study sample primarily due to lack of familiarity with characteristics of the practice and the setting. It is unknown whether and to what degree the exclusion of these other practice settings influenced the estimates of unmet and latent demand. Lastly, the results of this survey are applicable to the state of Wisconsin, but the systematic methodology to collect demand data could be utilized by other states as well.

Conclusion

Overall, of the total number of FTE pharmacist positions budgeted in community and hospital pharmacies in Wisconsin, 54.3 FTE positions (1.5%) were reported vacant in 2011-12. It appears that a near balance has been struck in the supply and demand for pharmacists in Wisconsin. Based on the reports of latent demand and workload, there could be a possibility of potential demand for pharmacists in Wisconsin. As the latent demand positions are budgeted, there could be an increase in the unmet demand for pharmacists in the near future. Latent demand is a novel concept but possibly a valid measure to detect the potential unbudgeted and unfilled pharmacist positions. It is important to track these two components of demand for pharmacists together, to improve pharmacist workforce planning as well as explore pharmacist workload characteristics. This study shows that a relatively simple and systematic assessment of pharmacist demand at the state level is feasible and useful.

Appendices.

Appendix A

Un-weighted Characteristics of Responding Community Pharmacies Across Wisconsin.

| Characteristic | Community Pharmacies (n=522) |

|---|---|

| Setting [n, (%)] | |

| Independently-owned | 132 (25.3) |

| Mass merchandiser | 59 (11.3) |

| Chain | 246 (47.1) |

| Supermarket | 37 (7.1) |

| Other | 48 (9.2) |

| Pharmacist Staffing Characteristics | |

| Total FTE pharmacist positions budgeted per pharmacy [mean (std. dev.)] | 2.31 (1.3) |

| FTE pharmacist positions budgeted per pharmacy [n (%)]: | |

| 0.01-1.00 FTE pharmacist position | 66 (12.6) |

| 1.01-2.00 FTE pharmacist positions | 226 (43.3) |

| 2.01-3.00 FTE pharmacist positions | 155 (29.7) |

| 3.01-4.00 FTE pharmacist positions | 43 (8.2) |

| 4.01-5.00 FTE pharmacist positions | 16 (3.1) |

| 5.01 or more FTE pharmacist positions | 16 (3.1) |

| Workload Characteristics | |

| Prescription volume per weekday [mean (std. dev.)] | 244.66 (201.40) |

| Hours prescription department open per weekday [mean (std. dev.)] | 11.52 (12.76) |

Note: Independently-owned included pharmacies owned by a pharmacist usually with less than 4 settings under one owner. Mass Merchandiser included pharmacies located in large warehouse stores or merchandisers e.g. Target, Wal-Mart, etc. Chain was defined as a corporate ownership including four or more outlets e.g. Walgreens, CVS. Supermarket represented pharmacies located within a supermarket. Other includes pharmacies located in clinics and pharmacies affiliated with a health system

Note: FTE is Full-time Equivalent. One FTE is equal to working 40 hours per week for 52 weeks per year.

Appendix B

Un-weighted Characteristics of Responding Hospital Pharmacies Across Wisconsin.

| Characteristic | Hospital Pharmacies (n=67) |

|---|---|

| Setting [n (%)] | |

| For-profit | 4 (6.0) |

| Non-profit | 58 (86.6) |

| Government or other | 5 (7.4) |

| Pharmacist Staffing Characteristics | |

| Total FTE pharmacist positions budgeted per pharmacy [mean (std. dev.)] | 9.06 (15.9) |

| FTE pharmacist positions budgeted per pharmacy [n (%)]: | |

| 0.01-1.00 FTE pharmacist position | 4 (5.97) |

| 1.01-2.00 FTE pharmacist positions | 11 (16.42) |

| 2.01-3.00 FTE pharmacist positions | 8 (11.94) |

| 3.01-4.00 FTE pharmacist positions | 9 (13.43) |

| 4.01-5.00 FTE pharmacist positions | 6 (8.96) |

| 5.01-10.00 FTE pharmacist positions | 16 (23.88) |

| 10.01-20.00 FTE pharmacist positions | 7 (10.45) |

| 20.01 or more FTE pharmacist positions | 6 (8.96) |

| Workload Characteristics | |

| Hospital Size [n (%)]a: | |

| Small (<100 beds) | 45 (73.8) |

| Medium (100-299 beds) | 10 (16.4) |

| Large(≥300 beds) | 6 (9.8) |

| Daily census [mean (std. dev.)]a | 68.34 (109.0) |

| Hours prescription department open per weekday [mean (std. dev.)]a | 14.68 (6.2) |

Note: FTE is Full-time Equivalent. One FTE is equal to working 40 hours per week for 52 weeks per year.

The sample size for these variables was 61 due to missing responses.

Appendix C

Un-weighted Characteristics of Vacant Pharmacist Positions in Community and Hospital Pharmacies (with a Pharmacist Vacancy) Across Wisconsin.

| Characteristic | Overall (n=32) | Community Pharmacies (n=20) | Hospital Pharmacies (n=12) |

|---|---|---|---|

| Total number of FTE pharmacist positions vacant | 27.1 | 13.2 | 13.9 |

| Mean FTE pharmacist positions vacant per pharmacy [mean (std. dev.)] | 0.9 (0.6) | 0.7 (0.4) | 1.2 (0.6) |

| Distribution of FTE pharmacist positions vacant per pharmacy [n (%)]: | |||

| 0.01-0.50 vacant FTE pharmacist positions | 14 (43.8) | 12 (60.00) | 2 (16.67) |

| 0.51 -1.00 vacant FTE pharmacist positions | 14 (43.8) | 7 (35.00) | 7 (58.33) |

| 1.01 or more vacant FTE pharmacist positions | 4 (12.4) | 1 (5.00) | 3 (25.00) |

| Vacancy rate a [mean (std. dev)] | 19.9 (14.8) | 24.46 (14.91) | 12.32 (11.49) |

Note:

Vacancy Rate = Total FTE pharmacist positions vacant / Total FTE pharmacist positions budgeted

All the percentage values are column percentages.

Appendix D

Un-weighted Characteristics of Latent Demand for Pharmacists in Community and Hospital Pharmacies (with Latent Demand) Across Wisconsin.

| Characteristic | Overall (n=157) | Community Pharmacies (n=134) | Hospital Pharmacies (n=23) |

|---|---|---|---|

| Total number of additional FTE pharmacist positions needed (n) | 185 | 149.4 | 35.6 |

| Mean number of additional FTE pharmacist positions needed per pharmacy [mean (std. dev.)] | 1.18 (1.0) | 1.12 (1.0) | 1.55 (1.2) |

| Distribution of additional FTE pharmacist positions needed per pharmacy [n (%)]: | |||

| 0.01-0.50 FTE pharmacist positions | 75 (47.8) | 69 (51.49) | 6 (26.09) |

| 0.51-1.00 FTE pharmacist positions | 37 (23.6) | 31 (23.13) | 6 (26.09) |

| 1.01-2.00 FTE pharmacist positions | 21 (13.4) | 13 (9.70) | 8 (34.78) |

| 2.01 or more FTE pharmacist positions | 24 (15.3) | 21 (15.67) | 3 (13.04) |

Note:

All the percentage values are column percentages.

Appendix E

Un-weighted Characteristics of Community Pharmacies with and without Latent Demand Across Wisconsin.

| Characteristic | Pharmacies With Latent Demand (N= 154) | Pharmacies Without Latent Demand (N= 368) | p value |

|---|---|---|---|

| Settings [n (%)] | 0.00*a | ||

| Independently-owned | 21 (13.6) | 111 (30.2) | |

| Mass merchandiser | 22 (14.3) | 37 (10.1) | |

| Chain | 91 (59.1) | 155 (42.1) | |

| Supermarket | 11 (7.1) | 26 (7.1) | |

| Other | 9 (5.8) | 39 (10.6) | |

| Vacancies | |||

| Have a pharmacist position vacant [n (%)] | 8 (5.2) | 12 (3.3) | 0.00*a |

| Mean pharmacist FTEs vacant [Mean (std. dev.)] | 0.05 (0.2) | 0.02 (0.1) | 0.03*b |

| Workload characteristics [Mean (std. dev.)] | |||

| Prescription volume per weekday | 283.0 (271.6)c | 228.9 (162.0)d | 0.01*b |

| Prescriptions per FTE pharmacist per weekday | 120.6 (50.6)c | 104.4 (51.4)d | 0.00*b |

| Hours prescription department open per weekday | 13.6 (23.1)e | 10.7 (2.7)f | 0.01*b |

| Hours prescription department open on the weekend (Saturday and Sunday) | 6.7 (5.0)e | 4.8 (4.1)f | 0.00*b |

Significant at 5% level.

p-value for Chi-test for independence and t-test, respectively.

The sample sizes for these variables were 143, 348, 152 and 366 respectively due to missing responses.

Note: Independently-owned included small chains with up to 10 settings under one owner. Mass Merchandiser included Target, Wal-Mart, etc. Chain included Walgreens, CVS. Supermarket represented pharmacies located within a supermarket. Other includes pharmacies located in clinics and pharmacies affiliated with a health system.

Appendix F

Un-weighted Characteristics of Hospital Pharmacies with and without Latent Demand Across Wisconsin.

| Characteristic | Pharmacies With Latent Demand (N= 368) | Pharmacies Without Latent Demand (N= 42) | p value |

|---|---|---|---|

| Settings [n (%)] | 0.42a | ||

| For-profit hospital | 1 (4.4) | 3 (7.1) | |

| Non-profit hospital | 19 (82.6) | 37 (88.1) | |

| Government and other hospital | 3 (13.0) | 2 (4.8) | |

| Vacancies | |||

| Have a pharmacist position vacant [n (%)] | 3 (15.6) | 8 (19.0) | 0.54a |

| Mean FTE pharmacist positions vacant [Mean (std. dev.)] | 0.13 (0.3) | 0.23 (0.6) | 0.44b |

| Workload characteristics | |||

| Hospital Size [n(%)]: | 0.23a | ||

| Small (<100 beds) | 12 (46.7)c | 31 (79.5)d | |

| Medium (100-300 beds) | 6 (28.9)c | 5 (12.8)d | |

| Large(>300 beds) | 2 (24.4)c | 3 (9.4)d | |

| Mean daily census (std. dev.) | 76.0 (85.0)c | 67.05 (122.3)d | 0.77b |

| Mean daily census per FTE pharmacist (std. dev.) | 13.10 (11.9)c | 15.82 (9.7)d | 0.35b |

| Mean hours prescription department open per weekday (std. dev.) | 16.17 (6.8) | 13.86 (5.8) | 0.15b |

| Mean hours prescription department open on the weekend (Saturday and Sunday) (std. dev.) | 14.48 (9.5) | 11.67 (8.0) | 0.45b |

Significant at 5% level.

p-value for Chi-test for independence and t-test respectively.

The sample sizes for these variables were 20 and 39 respectively due to missing responses.

Appendix G

Characteristics of Respondents and Non-respondents by RUCA category for Community Pharmacies and Hospital Pharmacies.

| Community Pharmacies | Respondents | Non-Respondents |

| N= 522 | N=527 | |

| RUCA Categories | N (%) | N (%) |

| Urban | ||

| Urban Core | 275 (52.7)* | 339 (64.3)* |

| Other Urban | 38 (7.3) | 44 (8.4) |

| Rural | ||

| Large Rural | 61 (11.7) | 59 (11.2) |

| Small Rural | 93 (17.8)* | 45 (8.5)* |

| Isolated | 55 (10.5) | 40 (7.6) |

| *p-value < 0.00, Chi-square test of independence, 4 d.f. | ||

| Hospital Pharmacies | Respondents | Non-Respondents |

| N= 67 | N= 59 | |

| RUCA Categories | N (%) | N (%) |

| Urban | ||

| Urban Core | 25 (37.3)* | 32(54.2)* |

| Other Urban | 2(3.0) | 2(3.4) |

| Rural | ||

| Large Rural | 15 (22.4) | 15 (25.4) |

| Small Rural | 16 (23.9)* | 2(3.4)* |

| Isolated | 9(13.4) | 8(13.6) |

p-value < 0.00, Chi-square test of independence, 4 d.f.

Note: All percentages are column percentages

Footnotes

Previous presentations: In part at the American Pharmacists Association Annual Meeting and Exposition, March 9-12th, 2012, New Orleans, LA, in part at the Midwestern Social and Administrative Pharmacy Conference, August 8-10th, 2012, Madison, WI and in part at American Pharmacists Association Annual Meeting and Exposition, March 27-30th, 2015, San Diego, CA

References

- 1.Taylor DA, Patton JM. The Pharmacy Student Population: Applications Received 2009-10, Degrees Conferred 2009-10, Fall 2010 Enrollments. Am J Pharm Educ. 2011;75(10) doi: 10.5688/ajpe7510S3. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 2.Knapp KK, Cultice JM. New pharmacist supply projections: lower separation rates and increased graduates boost supply estimates. J Am Pharm Assoc JAPhA. 2006;47(4):463–470. doi: 10.1331/JAPhA.2007.07003. [DOI] [PubMed] [Google Scholar]

- 3.National Association of Boards of Pharmacy (NABP) Accesssed at: https://www.nabp.net/

- 4.NACDS January 2006 Chain Pharmacy Employment Survey Results. Alexandria, VA: National Association of Chain Drug Stores; 2006. National Association of Chain Drug Stores Foundation. [Google Scholar]

- 5.Pedersen CA, Schneider PJ, Scheckelhoff DJ. ASHP national survey of pharmacy practice in hospital settings: dispensing and administration-2011. Am J Health Syst Pharm. 2012;69(9):768. doi: 10.2146/ajhp110735. [DOI] [PubMed] [Google Scholar]

- 6.Midwest Pharmacy Workforce Research Consortium and others. Final Report of the 2009 National Sample Survey of the Pharmacist Workforce to Determine Contemporary Demographic and Practice Characteristics. 2010 [Google Scholar]

- 7.Pharmacy Manpower Project. Aggregate demand index. http://www.pharmacymanpower.com.

- 8.Knapp DA, Knapp DE. Attributes of Colleges and Schools of Pharmacy in the United States. Am J Pharm Educ. 2009;73(5):1–6. doi: 10.5688/aj730596. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 9.Pharmacists : Occupational Outlook Handbook. U.S. Bureau of Labor Statistics; [Accessed October 23, 2014]. http://www.bls.gov/ooh/healthcare/pharmacists.htm. [Google Scholar]

- 10.Brown DL. A Looming Joblessness Crisis for New Pharmacy Graduates and the Implications It Holds for the Academy. Am J Pharm Educ. 2013;77(5) doi: 10.5688/ajpe77590. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 11.Gadkari AS, Mott DA, Kreling DH, Bonnarens JK. Characteristics of unmet demand for pharmacists: A survey of rural community pharmacies in Wisconsin. J Am Pharm Assoc. 2008;48(5):598–609. doi: 10.1331/JAPhA.2008.07039. [DOI] [PubMed] [Google Scholar]

- 12.Schommer JC, Gaither C, Hadsall RS, Larson TA, Schondelmeyer SW, Uden DL. Minneapolis: University of Minnesota College of Pharmacy; 2012. Changes in the Pharmacist and Technician Workforce in Licensed Minnesota Pharmacies between 2002 and 2012. Accessed at : http://www.mpha.org/?page=12_comp_labor_survey. [Google Scholar]

- 13.Latent Demand [Def. no. 1] Camb Dict. http://dictionary.cambridge.org/us/dictionary/business-english/latent-demand.

- 14.Latent Demand [Def. no. 1] Blacks Law Dict Free Online. (2nd) http://thelawdictionary.org/latent-demand/

- 15.Latent Demand [Def. no. 1] Buisness Dict. http://www.businessdictionary.com/definition/latent-demand.html.

- 16.Anderson RB, Hoel LA. Estimating latent demand and cost for statewide transit service. [Accessed October 27, 2014];1974 Available at: http://trid.trb.org.ezproxy.library.wisc.edu/view.aspx?id=38767.

- 17.McCann L, Hughes CM, Adair CG, Cardwell C. Assessing job satisfaction and stress among pharmacists in Northern Ireland. Pharm World Sci. 2009;31(2):188–194. doi: 10.1007/s11096-008-9277-5. [DOI] [PubMed] [Google Scholar]

- 18.Cox ER, Fitzpatrick V. Pharmacists' job satisfaction and perceived utilization of skills. Am J Health Syst Pharm. 1999;56(17):1733–1737. doi: 10.1093/ajhp/56.17.1733. [DOI] [PubMed] [Google Scholar]

- 19.Reilley S, Grasha AF, Schafer J. Workload, error detection, and experienced stress in a simulated pharmacy verification task. Percept Mot Skills. 2002;95(1):27–46. doi: 10.2466/pms.2002.95.1.27. [DOI] [PubMed] [Google Scholar]

- 20.Dw R. Barriers to providing cognitive services. Am Pharm. 1993;NS33(12):54–58. doi: 10.1016/s0160-3450(15)30574-2. [DOI] [PubMed] [Google Scholar]

- 21.Chui MA, Look KA, Mott DA. The association of subjective workload dimensions on quality of care and pharmacist quality of work life. Res Soc Adm Pharm. 2014;10(2):328–340. doi: 10.1016/j.sapharm.2013.05.007. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 22.Gupta SR, Wojtynek JE, Walton SM, et al. Association between hospital size and pharmacy department productivity. Am J Health Syst Pharm. 2007;64(9):937–944. doi: 10.2146/ajhp060228. [DOI] [PubMed] [Google Scholar]

- 23.Armstrong JS, Overton TS. Estimating Nonresponse Bias in Mail Surveys. J Mark Res. 1977;14(3):396–402. doi: 10.2307/3150783. [DOI] [Google Scholar]

- 24.Knapp KK, Shah BM, Barnett MJ. The Pharmacist Aggregate Demand Index to Explain Changing Pharmacist Demand Over a Ten-Year Period. [Accessed April 26, 2015];Am J Pharm Educ. 2010 74(10) doi: 10.5688/aj7410189. http://www.ncbi.nlm.nih.gov/pmc/articles/PMC3058450/ [DOI] [PMC free article] [PubMed] [Google Scholar]

- 25.Jeffers JR, Bognanno MF, Bartlett JC. On the demand versus need for medical services and the concept of “shortage”. Am J Public Health. 1971;61(1):46–63. doi: 10.2105/ajph.61.1.46. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 26.Schur CL, Franco SJ. Access to health care. In: Ricketts TC III, editor. Rural Health in the United States. III. Vol. 1999. Oxford University Press; New York: [Accessed October 23, 2014]. pp. 25–37. http://books.google.com.ezproxy.library.wisc.edu/books?hl=en&lr=&id=kEErphxU1m4C&oi=fnd&pg=PA25&dq=Schur,+C.,+%26+Franc0.+(1999).+Access+to+healthcare&ots=t0BEdhnbqe&sig=pdZO4mwwR3mWz-CNn21PwvQFyhc. [Google Scholar]

- 27.Glaeser EL, Mare DC. Cities and Skills. National Bureau of Economic Research; 1994. [Accessed October 23, 2014]. http://www.nber.org.ezproxy.library.wisc.edu/papers/w4728. [Google Scholar]

- 28.Gabe T, Colby K, Bell KP. Creative Occupations, County-Level Earnings and the US Rural-Urban Wage Gap. Can J Reg Sci. 2007;30(3):393–410. [Google Scholar]

- 29.Straub LA, Straub SA. Consumer and Provider Evaluation of Rural Pharmacy Services. J Rural Health. 1999;15(4):403–412. doi: 10.1111/j.1748-0361.1999.tb00763.x. [DOI] [PubMed] [Google Scholar]

- 30.Stratton TP. The Economic Realities of Rural Pharmacy Practice. J Rural Health. 2001;17(2):77–81. doi: 10.1111/j.1748-0361.2001.tb00261.x. [DOI] [PubMed] [Google Scholar]