Abstract

Purpose

Financial concerns represent a major stressor for families of children with cancer but remain poorly understood among those with terminally ill children. We describe the financial hardship, work disruptions, income loss, and coping strategies of families who lost children to cancer.

Methods

Retrospective cross-sectional survey of 141 American and 89 Australian bereaved parents whose children died between 1990 and 1999 and 1996 to 2004, respectively, at three tertiary-care pediatric hospitals (two American, one Australian). Response rate: 63%.

Results

Thirty-four (24%) of 141 families from US centers and 34 (39%) of 88 families from the Australian center reported a great deal of financial hardship resulting from their children's illness. Work disruptions were substantial (84% in the United States, 88% in Australia). Australian families were more likely to report quitting a job (49% in Australia v 35% in the United States; P = .037). Sixty percent of families lost more than 10% of their annual income as a result of work disruptions. Australians were more likely to lose more than 40% of their income (34% in Australia v 19% in the United States; P = .035). Poor families experienced the greatest income loss. After accounting for income loss, 16% of American and 22% of Australian families dropped below the poverty line. Financial hardship was associated with poverty and income loss in all centers. Fundraising was the most common financial coping strategy (52% in the United States v 33% in Australia), followed by reduced spending.

Conclusion

In these US and Australian centers, significant household-level financial effects of a child's death as a result of cancer were observed, especially for poor families. Interventions aimed at reducing the effects of income loss may ease financial distress.

INTRODUCTION

Childhood cancer remains the leading nonaccidental cause of death for children in high-income countries.1 Financial concerns have been identified as a major stressor for families of children receiving cancer treatment across a wide range of health systems, benefit models, and economic climates.2–6 The financial burden on families whose children die has been less well elucidated.

Prior studies report that financial distress peaks shortly after diagnosis, when admissions are frequent, work disruptions common, and additional benefits have not kicked in.5,7 These studies helped identify vulnerable groups, such as those with long admissions and those treated far from home,6,8 and described the substantial income losses associated with out-of-pocket expenses and work disruptions, ranging from 20% to 50%.3,7,9 Data about parental employment are consistent across countries and suggest that as many as 77% of parents suffer some sort of work disruption in the first year after diagnosis.6 This includes 11% to 35% of parents who quit their jobs to care for their children,5,6,10 although this effect may be short-lived.10

A major limitation of this growing body of literature is that the economic consequences of the end-of-life period have been neglected. Only two studies included a small number of bereaved parents,8,10 and neither described their experiences in detail. To fully understand, and eventually alleviate, the financial impact of pediatric cancer, this may not be a trivial oversight. The end-of-life period brings more frequent hospitalizations11 and increased care-giving demands. Even when home care is possible, there exists variability in insurance coverage for comfort measures, home care assistance, and funeral expenses.8 All of these factors may add additional economic stresses to these already burdened families.

This study aims to describe bereaved parents' perceptions of the degree of economic hardship and work disruptions placed on the family by a child's illness and the economic coping strategies used to deal with such burdens in two US cancer centers and one Australian cancer center. We additionally explore child, family, socioeconomic, and care characteristics associated with financial hardship.

METHODS

Data for this analysis are from a retrospective cross-sectional survey of bereaved parents whose children were cared for at the Dana-Farber Cancer Institute/Children's Hospital Boston (DFCI/CHB), Children's Hospitals and Clinics of Minnesota (CHCM), and Royal Children's Hospital, Melbourne (RCH). Methods have been described previously.12–14 Briefly, physicians and parents of children who died as a result of cancer between 1990 and 1999 in the United States and between 1996 and 2004 in Australia were interviewed from 1997 to 2001 and 2004 to 2006, respectively. Eligibility criteria required that parents be English-speaking and residing in North America or Australia, the death occurred more than 1 year before data collection, and the child's physician allowed researchers to contact the family. Eligible families received a mailed invitation letter containing a postage-paid postcard: “opt-out” (DFCI/CHB), “opt-in” (CHC), or both (RCH), according to each site's institutional review board requests. The survey items we analyze here were identical across sites; the main difference was in mode of administration: in the United States, this was a phone-administered survey, whereas in Australia, the survey had two sections: a face-to-face interview followed by a paper-and-pencil self-report questionnaire. In both countries, one parent per family was interviewed, chosen by the family. The protocols were approved by the three corresponding institutional review boards.

Two hundred forty-four US families and 193 Australian families were identified as eligible, and 222 and 144, respectively, were reached. One hundred forty-one American and 89 Australian families completed the survey (overall response rate, 63%). No difference existed regarding child's age at death or diagnosis between responders and nonresponders. Interviews were conducted a median of 3.3 years (standard deviation = 2. 2 years) and 4.4 years (standard deviation = 2.1 years) after the child's death in the US and Australian centers, respectively.

Parental Survey

The parental survey is a 390-item semistructured questionnaire. When possible, previously validated items were used; however, most items were developed de novo following accepted guidelines.15

This article focuses on the following survey items: (1) “How much of an economic or financial hardship was the cost of your child's illness for you and your family?” (2) “During your child's illness, did anyone in the family have to cut back on work, quit work, or forego overtime to provide personal care to your child?” (3) “Who was it and to what extent did they cut back?” (4) “About how much yearly income did your family lose by quitting or cutting back on work?” (5) “Did you or another person in the family have to get a job or take on an additional job to help pay for your child's medical care?” (6) “Did you or another person in the family have to forego making a big purchase like furniture or a car to help pay for your child's medical care?” (7) Did you or another person in the family have to sell personal property like a house or car, take out a loan or mortgage, or incur credit card debt to pay for your child's medical care?” (8) “Were there any fundraising efforts on your child's behalf?” In addition, sociodemographic information, child's diagnosis, duration of disease, and patterns of care during end of life were collected.

Statistical Methods

Analysis was conducted using SAS v.9.2 for Windows (SAS Institute, Cary, NC). Sociodemographics, disease characteristics, financial hardship, work disruptions, and financial coping strategies were characterized using descriptive statistics. Because main characteristics from the two US sites were comparable, data were pooled to increase power and clarity. Differences between US and Australian centers were tested using χ2 or Fisher's exact test for categorical variables and t test or Wilcoxon rank sum test for continuous variables.

Factors Associated With Financial Hardship

To explore factors associated with financial hardship we conducted univariate analysis by country. For US sites, we ran logistic regression models adjusting by site (and poverty level when warranted). For the Australian site, the smaller sample precluded adjusted analyses. We therefore used Fisher's exact test for categorical variables and t test or Wilcoxon rank sum test for continuous variables.

Main Dependent Variable

Degree of financial hardship, originally a four-category, ordinal item, was the main dependent variable. On the basis of the goal of the analysis and data distribution, we collapsed it into two categories: (1) no, a little, or moderate financial hardship, and (2) a great deal of financial hardship.

Independent Variables

The independent variables analyzed included sociodemographic factors, disease characteristics, time from child's death to interview, patterns of care, and economic factors (health insurance, poverty level, and income loss). Considerations about specific independent variables follow:

Distance from home to hospital.

This was reported in miles from home zip code to hospital zip code using www.imacination.com/distance (United States) and http://www.auinfo.com/(Australia).

Health insurance.

This was dichotomized as government insurance only (Medicaid in the United States, Medicare in Australia) versus other (including private insurance and government insurance plus private insurance).

Poverty level.

Annual household income was measured with a seven-category ordinal question: “Into which of the following categories did your annual family income for 1996 (Boston)/2000 (St. Paul)/2002 (Australia) fall?” Categories were (1) less than $15,000, (2) $15,000 to $24,999, (3) $25,000 to $34,999, (4) $35,000 to $49,999, (5) $50,000 to $74,999, (6) $75,000 to $99,999, and (7) more than $100,000. To allow for international comparison and following common practice,16 we derived the equivalized income. We calculated the midpoint for each category and conservatively set the highest category at $101,000 to limit its weight and then divided by the number of equivalent adults in the household using the Organisation for Economic Co-operation and Development modified scale,17 which assigns 1 for the first household member, 0.5 for each additional adult, and 0.3 per child. Equivalized household income was then categorized into three levels on the basis of how it compared with the corresponding national median equivalized income (NMEI) reported on the Organisation for Economic Co-operation and Development Web site.18 US NMEI for the mid 1990s was used for the DFCI/CHB data, and the US and Australian NMEI for early 2000 was used for the St Paul and Australian data, respectively. Poverty level was set at 50% of the NMEI, and two additional categories were created (income between 50% and 100% of NMEI and income above the NMEI).

Percent of annual income loss.

Annual income loss due to reductions in work was elicited through ordinal response categories: (1) less than $1,000, (2) $1,000 to $4,999, (3) $5,000 to $9,999, (4) $10,000-$19,999, (5) $20,000 to $29,999, (6) $30,000 to $49,999, (7) $50,000 or more. We calculated the midpoint for each loss category, setting the highest band at $51,000; we then divided by midpoint income to derive percent of income lost. Values greater than 100% were set to 100%, and values between 0% and 1% were set to 0%. The variable was collapsed into three levels: (1) ≤ 10%, (2) 10% to 39%, and (3) more than 40% of annual income loss. Cut points (10% and 40%19,20) correspond to levels of income consumed by health expenditures that are likely to lead households into poverty, aka catastrophic expenditures (income loss is assumed as a health expenditure).

RESULTS

Overall Characteristics

Table 1 presents the main sample characteristics for the US and Australian centers. Families were largely similar: predominantly married, non-Hispanic white, and small. American parents were on average more educated. Australian families lived farther away from the hospital. During the last month of life, children from US centers were more likely than their Australian counterparts to be admitted for 5 days or more.

Table 1.

Sample Characteristics

| Characteristic | US Centers (n = 141) |

Australian Center(n = 89) |

P * | ||

|---|---|---|---|---|---|

| No.† | % | No.† | % | ||

| Sociodemographic | |||||

| Child | |||||

| Age at death, years | NS‡ | ||||

| Mean | 10.3 | 9.3 | |||

| SD | 6.6 | 5.9 | |||

| Female sex | 66 | 47 | 40 | 45 | NS |

| Family | |||||

| Parental age at child's death, years | NS‡ | ||||

| Mean | 39 | 39.2 | |||

| SD | 8.2 | 8.0 | |||

| Married | 121 | 86 | 69/83 | 83 | NS |

| Non-Hispanic white | 131 | 93 | 79/84 | 94 | NS |

| Parent education college graduate or higher | 75 | 53 | 23/85 | 27 | < .01 |

| > 2 children at home at the time of child's illness | 25/140 | 18 | 10/87 | 11 | NS |

| Distance from home to hospital, miles | .01 | ||||

| Median | 20.3 | 33.8 | |||

| IQR | 12-41 | 15-112 | |||

| Disease and patterns of care | |||||

| Diagnosis (3 categories) | |||||

| Hematologic malignancy | 70 | 50 | 31 | 35 | |

| Solid tumor | 42 | 30 | 30 | 34 | NS |

| Brain tumor | 29 | 20 | 28 | 31 | |

| Duration of disease, days | NS§ | ||||

| Median | 589 | 665 | |||

| IQR | 302-1,285 | 302-1,369 | |||

| Parent followed by psychosocial clinician | 91/138 | 66 | 46/85 | 54 | NS |

| > 5 days admitted during last month of life | 72/140 | 51 | 32/87 | 37 | .03 |

| Economic variables | |||||

| Health insurance | |||||

| Government insurance only Medicaid (US) or Medicare (AUS) | 33 | 23 | 45/88 | 51 | < .01 |

| Poverty level∥ | |||||

| < 50% of NMEI | 25/138 | 18 | 17/78 | 22 | NS |

| 50%-100% of NMEI | 45/138 | 33 | 18/78 | 23 | |

| > 100% of NMEI | 68/138 | 49 | 43/78 | 55 | |

Abbreviations: NS, not significant (P > .05); SD, standard deviation; IQR, interquartile range; NMEI, national median equivalized income.

χ2 test.

Denominator is indicated when different from total sample.

t test.

Wilcoxon rank sum test.

Income was equivalized by dividing reported income by the Organisation for Economic Co-operation and Development (OECD) modified scale, an equivalence factor that accounts for number of equivalent adults in a house (1/0.5/0.3) and then collapsed into three categories according to their relationship to the respective NMEI as reported by OECD for the period the survey was conducted in (see Methods).

Not surprisingly, given universal health care coverage, Australian parents were more likely to have government insurance alone. No American families were uninsured. There were no differences in poverty level. After income was equivalized and categorized according to national income, both samples reflected their respective country distributions.18 All other characteristics were comparable across centers.

Financial Hardship

Although families from US and Australian centers experienced substantial financial hardship as a result of their children's illness, Australian households reported a significantly higher burden (Table 2). Specifically, 39% of Australian families versus 24% of American families reported a great deal of financial hardship (P = .02).

Table 2.

Degree of Financial Hardship and Work Disruptions Caused by Child's Illness and Financial Strategies to Cope With Burden Used by Parents of Children Who Died of Cancer in Three US and Australian Centers

| Variable | US Centers (n = 141) |

Australian Center(n = 88) |

P * | |||

|---|---|---|---|---|---|---|

| No.† | % | No.† | % | |||

| Degree of financial hardship | ||||||

| No, a little, or moderate | 107 | 76 | 54 | 61 | .02 | |

| A great deal | 34 | 24 | 34 | 39 | ||

| Work disruptions | ||||||

| Family member had to cut back work | 118 | 84 | 77 | 88 | NS | |

| None | 23 | 16 | 11/87 | 13 | ||

| Mother | 55 | 39 | 21/87 | 24 | ||

| Father | 19 | 14 | 20/87 | 23 | ||

| Other caregiver | 1 | 1 | 1/87 | 1 | ||

| More than one caregiver | 43 | 31 | 34/87 | 39 | ||

| Mother or father had to quit job | 50 | 35 | 43 | 49 | .04 | |

| Percent of annual income lost by work disruptions | ||||||

| ≤ 10% | 53/130 | 41 | 29/78 | 37 | .04 | |

| 10-40% | 52/130 | 40 | 22/78 | 28 | ||

| > 40% | 25/130 | 19 | 27/78 | 34 | ||

| Financial coping strategies | ||||||

| Transfers (fundraising efforts for child) | 73 | 52 | 29 | 33 | < .01 | |

| Reduced consumption (forego making a big purchase) | 44/140 | 31 | 22 | 25 | NS | |

| Borrowing (take out mortgage, credit, loan, other) | 29 | 21 | 19 | 22 | NS | |

| Income diversification (family member got a job or took another job) | 9 | 6 | 2 | 2 | NS‡ | |

| Disposal of assets (sell property) | 8 | 6 | 5 | 6 | NS | |

| No. of strategies used | ||||||

| 0 | 49 | 35 | 36 | 41 | ||

| 1 | 46 | 33 | 30 | 35 | NS | |

| ≥ 2 | 45 | 32 | 21 | 24 | ||

Abbreviation: NS, not significant (P > .05).

χ2 test.

Denominator is indicated when different from total sample.

Fisher's exact test.

As expected, all parents reported substantial work disruptions. Eighty-four percent of American and 88% of Australian families reported that at least one family member had to cut back on work to care for the child; 32% and 38% needed two or more caregivers to cut back. Approximately half of parents consumed their work benefits. The types of work cut-back most frequently reported were reduction in work hours (52% US and 58% Australian families) and quitting a job, which was more likely among Australian parents (49% v 35% in the United States; P = .04).

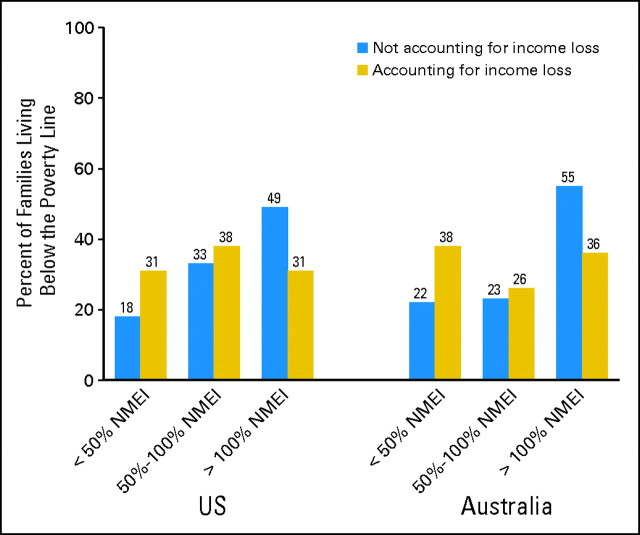

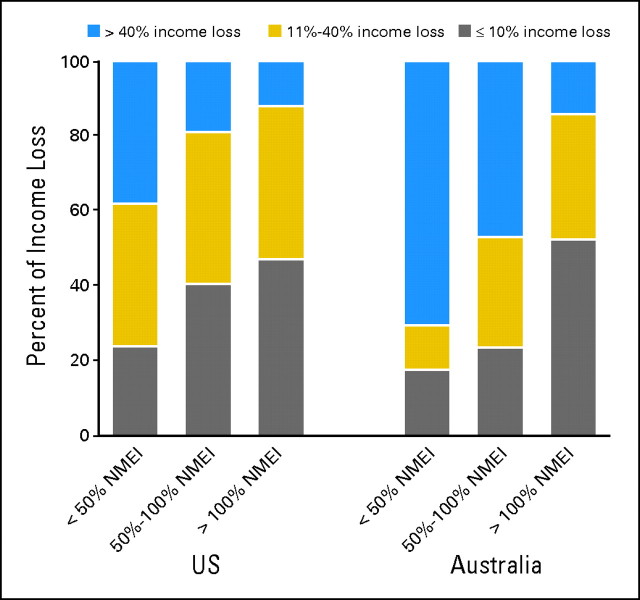

Income loss was substantial for all families, but especially for those from the Australian center. Approximately 60% of all families reported losing more than 10% of their annual income as a result of work disruptions. Compared with families from the US centers, Australian families were more likely to lose more than 40% of their income (34% v 19% in the United States; P = .04) and tended to lose a higher percentage within this bracket (median income loss for households who lost > 40% was 81% [interquartile range, 64% to 100%] in Australia and 59% [interquartile range, 50% to 94%] in the United States; P = .02). This income loss was enough to shift 36% of US and 43% of Australian families to a lower income category (Fig 1). Sixteen percent and 22% of families (US and Australia, respectively) moved from above to below the poverty line. People from the lowest income categories tended to experience the greatest income loss (Fig 2), and this was more significant for Australian families.

Fig 1.

Change in distribution of poverty level after accounting for income loss. After accounting for income loss, the proportion of families living below the poverty line increased significantly (P < .01 for centers in both countries). To account for income loss, we subtracted midpoint loss from midpoint income; this income after loss was equivalized as per the Organization for Economic Co-operation and Development scale and collapsed into the three poverty level categories. Poverty level was classified as less than 50% of the corresponding national median equivalized income (NMEI), between 50% and 100% of NMEI, and greater than NMEI (see Methods). US, United States.

Fig 2.

Annual income loss resulting from work disruptions and poverty level. Proportion is shown of parents in each poverty level and country (where cancer centers were located) who lost 10% or less, between 11% and 40%, and more than 40% of their annual income owing to work disruptions caused by their children's illness. Households living below the poverty line were more likely to lose more than 40% of their annual income (Cochran-Armitage test for trends, P = .01 for United States [US] and P < .001 for Australia). Poverty level was classified as less than 50% of the corresponding national median equivalized income (NMEI), between 50% and 100% of NMEI, and greater than NMEI (see Methods).

Use of Financial Coping Strategies

Fundraising was the most commonly reported coping strategy, used in 52% of US families and 33% of Australian families (P < .01; Table 2). Poor families from the US centers fundraised more than richer families (68% v 40%), whereas those from the Australian center fundraised less (24% v 37%; not tested due to small sample).

Other reversible financial coping strategies such as reduced consumption and borrowing were used less frequently but at similar rates in both countries. Only a few families coped by taking an additional job (6% in the United States and 2% in Australia), and in most cases this occurred in households in which one parent had quit his or her job. Disposal of assets, an irreversible coping strategy, was used sparingly in both countries. Thirty-two percent and 24% of parents in the US and Australian centers, respectively, required more than one coping strategy to pay for their children's health care.

Factors Associated With Financial Hardship

In Table 3, we present results of the univariate analysis of factors associated with financial hardship in the US and Australian sites. Type of cancer and patterns of care (duration of disease and length of admission in last month of life) were not associated with financial hardship. After adjusting by site and poverty level, younger American parents were more likely to report financial hardship as were those with lower education. As expected, poverty level and income loss were strongly associated with financial hardship in all sites.

Table 3.

Factors Associated With Degree of Financial Hardship in US and Australian Centers: Univariate Analysis

| Variable | Degree of Financial Hardship |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| US Centers (n = 141) |

Australian Center (n = 88) |

|||||||||

| No/A Little/Moderate(n = 107) |

A Great Deal(n = 34) |

P * | No/A little/Moderate(n = 54) |

A Great Deal(n = 34) |

P † | |||||

| No. | % | No. | % | No. | % | No. | % | |||

| Sociodemographic | ||||||||||

| Parental age at child's death, years | .02‡ | NS§ | ||||||||

| Mean | 40.3 | 36.0 | 39.1 | 39.2 | ||||||

| SD | 7.7 | 6.1 | 7.9 | 8.3 | ||||||

| Time elapsed since child's death, years | NS | NS§ | ||||||||

| Mean | 3.8 | 3.6 | 4.4 | 4.4 | ||||||

| SD | 2.2 | 2.1 | 2.1 | 2.3 | ||||||

| Marital status | ||||||||||

| Married | 79 | 21 | NS | 62 | 38 | NS | ||||

| Not married | 60 | 40 | 57 | 43 | ||||||

| Parent education | ||||||||||

| College graduate or higher | 87 | 13 | .04‡ | 70 | 30 | NS | ||||

| Less than college graduate | 64 | 36 | 58 | 42 | ||||||

| Family size at the time of child's illness | ||||||||||

| > 2 children at home | 72 | 28 | NS | 70 | 30 | NS | ||||

| ≤ 2 children at home | 77 | 23 | 61 | 39 | ||||||

| Distance∥ (home to hospital), miles | NS | NS¶ | ||||||||

| Median | 20 | 31 | 33 | 35 | ||||||

| IQR | 12-40 | 12-55 | 15-96 | 16-132 | ||||||

| Economic | ||||||||||

| Type of health insurance | ||||||||||

| Had government insurance only (Medicaid in US, Medicare in Australia) | 61 | 39 | NS‡ | 62 | 38 | NS | ||||

| Had other or additional sources of insurance | 81 | 19 | 60 | 40 | ||||||

| Poverty level# | ||||||||||

| < 50% of NMEI | 60 | 40 | .01 | 41 | 59 | .05 | ||||

| 50%-100% NMEI | 67 | 33 | 50 | 50 | ||||||

| > 100% of NMEI | 87 | 13 | 72 | 28 | ||||||

| Percent of annual income loss resulting from work disruption | ||||||||||

| > 40% | 48 | 52 | < .01 | 26 | 74 | < .01 | ||||

| 10%-40% | 73 | 27 | 73 | 27 | ||||||

| ≤ 10% | 91 | 9 | 86 | 14 | ||||||

Abbreviations: NS, not significant (P > .05); SD, standard deviation; IQR, interquartile range; NMEI, national median equivalized income; MN, Minnesota; BOS, Boston; OECD, Economic Co-operation and Development.

P values correspond to results from logistic regression adjusted by US site (MN-BOS).

Fisher's exact test.

Results from logistic regression adjusted by US site and poverty level.

Student's t test.

Distance was calculated as miles from home zip code to hospital zip code using www.imacination.com.

Wilcoxon rank sum test.

Income was equivalized by dividing reported income by the OECD and then collapsed into three categories according to their relationship to the respective NMEI as reported by OECD for the period the survey was conducted in (see Methods).

DISCUSSION

This study describes the financial impact of childhood death from cancer and the financial coping mechanisms used by families who received care at one Australian and two US sites. Unlike prior reports,2,3,5–7,9 this study focuses on the population of families whose children died. Our results underscore that the cost of losing a child to cancer exceeds emotional grief. Families from all centers experienced a significant degree of financial hardship, work disruption, and associated income losses. Not surprisingly, hardship was unequally distributed: poor families and those with high income losses endured the heaviest burden. The study also suggests that many families cope with this distress by using relatively healthy mechanisms such as fundraising.

In this sample of bereaved parents, work disruptions were more prevalent than reported in unselected families affected by pediatric cancer.5,6,10 They were also more than threefold higher than the 24% reported by families of children with special health care needs (CSHCN) in the 2005 to 2006 US National Survey of CSHCN.21 Work disruptions caused an income loss that reached catastrophic levels (≥ 40%20) in 20% to 30% of households and were enough to push 16% of American and 22% of Australian families into poverty. Families from Australia were worse off: they were more likely to quit a job and consequently lose higher proportions of income and they fundraised less. This may partly explain why this group reported a greater degree of hardship. Whether this greater impact reflects differences in the culture of care or in working conditions cannot be answered with our data and deserves further study.

That the poor bear the greatest income losses likely reflects less flexible working conditions.22 Although both countries have legislation that protects employees from losing their jobs or benefits when taking caregiver's leave (1993 US Family Medical Leave Act and 1996 Australian Workplace Relations Act), these provisions are quite restrictive (with regard to type and duration of employment) and provide little protection against the acute financial strain of childhood cancer and death. Specifically, the Australian Workplace Relations Act mandates a minimum of 2 weeks of paid and 2 weeks of unpaid leave and the US Family Medical Leave Act mandates 12 weeks of unpaid leave. Interestingly, recent studies have shown that some health and social programs do provide financial relief to low-income families of CSHCN, suggesting promising intervention paths.21,23

Regarding financial coping mechanisms in this population, many families were able to draw on relatively healthy economic coping strategies (ie, strategies that typically maintain household resources). Fundraising, the most commonly used strategy, is one without downstream economic consequences. Other types of fund transfers (eg, family or friend's loans) were not explored. Reduced spending, the second most common strategy, is reversible and tends to preserve families' wealth.24 Noteworthy, nearly a third of families needed to borrow or dispose of assets, strategies that have long-term negative effects and may hinder economic recovery. At the same time, many families were able to absorb an annual income loss of more than 10% without experiencing a great deal of financial hardship, suggesting the existence of benefits and coping mechanisms not captured in this study and another interesting avenue for further research.

Study findings suggest that interventions aimed at preventing or ameliorating income loss may improve this important source of family distress. We propose three types of potential interventions: (1) promotion of healthy financial coping mechanisms, (2) adequate provision of available resources to families, and (3) policy making (improving working conditions and subsidies). However, to design such interventions, a deeper understanding of the underlying phenomena is needed. Specifically, we need to further delineate periods of financial vulnerability for families of children with cancer, families' economic recovery patterns, financial coping strategies including the role of culture and social networks, short- and long-term consequences of work disruptions and coping mechanisms, and access to governmental support and its determinants.

The study has a number of limitations. Its cross-sectional nature does not enable distinguishing variations in economic burden along the disease trajectory; however, comparison of our results with prior studies suggests that end of life may add additional hardship. Parental reports are subject to recall bias. However, the lack of association between time since death and hardship suggests that the risk of recall bias, if any, is small. By transforming income and income loss into continuous variables and containing the weight of extreme observations, we may have overestimated the proportion of poor families and underestimated income loss. These misclassifications are, however, independent of hardship status and should affect all variable levels equally and, if anything, lead to an underestimation of the true association.25 Out-of-pocket expenses, which are relatively fixed costs and often place more strain on lower income families,26 were not measured. Again, this would result in an underestimation of the effect of income loss. Our sample did not include any uninsured families, so we cannot comment on their experience. Finally, we report data from three tertiary-care pediatric sites and as such do not necessarily represent the minority of pediatric oncology patients who receive their care outside highly specialized centers.

Our study highlights yet again the vulnerability of poor families and suggests that existing health care, social, and work policies at these three sites were not sufficient to prevent the household-level financial effects of a child's death from cancer. We hypothesize that interventions and policies aimed at preventing or ameliorating income loss owing to work disruptions may ease financial distress. However, a better understanding of the magnitude and length of economic hardship is needed to adequately address this highly significant problem.

Acknowledgment

We thank the families for sharing their stories; Caron Moore, RN, MSW, and Jan Watterson-Schaeffer, BA, from Children's Hospital and Clinics St Paul, and Naomi E. Clarke, MBBS, BMedSc, from the Royal Children's Hospital, Melbourne, for their contribution to data collection; Kun Chen, PhD, and Bridget Neville, MPH, from the Center for Outcomes and Policy Research, Dana-Farber Cancer Institute, Boston, MA, and Fernando Rubinstein, MD, MSc, from the Institute of Clinical Effectiveness and Health Policy Research, Buenos Aires, Argentina, for their suggestions and comments regarding statistical and economic analysis; and Peter Saunders, PhD, BSc, FASSA, from the Social Policy Research Centre, University of New South Wales, Australia, for his suggestions regarding analysis and report of economic variables.

Footnotes

J.A.H. was supported by a National Health and Medical Research Council (NHMRC) Health Professional Fellowship and is the recipient of an NHMRC Palliative Care Grant. J.W. was the recipient of a Gloria Spivak Merit Award. Authors' work was independent of funders.

Authors' disclosures of potential conflicts of interest and author contributions are found at the end of this article.

AUTHORS' DISCLOSURES OF POTENTIAL CONFLICTS OF INTEREST

The author(s) indicated no potential conflicts of interest.

AUTHOR CONTRIBUTIONS

Conception and design: Veronica Dussel, Kira Bona, Joanne M. Hilden, Jane C. Weeks, Joanne Wolfe

Provision of study materials or patients: John A. Heath, Joanne M. Hilden, Joanne Wolfe

Collection and assembly of data: John A. Heath, Joanne M. Hilden, Joanne Wolfe

Data analysis and interpretation: Veronica Dussel, Kira Bona, Joanne Wolfe

Manuscript writing: Veronica Dussel, Kira Bona, Joanne Wolfe

Final approval of manuscript: Veronica Dussel, Kira Bona, John A. Heath, Joanne M. Hilden, Jane C. Weeks, Joanne Wolfe

REFERENCES

- 1.Kellie SJ, Howard SC. Global child health priorities: What role for paediatric oncologists? Eur J Cancer. 2008;44:2388–2396. doi: 10.1016/j.ejca.2008.07.022. [DOI] [PubMed] [Google Scholar]

- 2.Lansky SB, Black JL, Cairns NU. Childhood cancer: Medical costs. Cancer. 1983;52:762–766. doi: 10.1002/1097-0142(19830815)52:4<762::aid-cncr2820520434>3.0.co;2-v. [DOI] [PubMed] [Google Scholar]

- 3.Lansky SB, Cairns NU, Clark GM, et al. Childhood cancer: Nonmedical costs of the illness. Cancer. 1979;43:403–408. doi: 10.1002/1097-0142(197901)43:1<403::aid-cncr2820430157>3.0.co;2-l. [DOI] [PubMed] [Google Scholar]

- 4.Patterson JM, Holm KE, Gurney JG. The impact of childhood cancer on the family: A qualitative analysis of strains, resources, and coping behaviors. Psychooncology. 2004;13:390–407. doi: 10.1002/pon.761. [DOI] [PubMed] [Google Scholar]

- 5.Eiser C, Upton P. Costs of caring for a child with cancer: A questionnaire survey. Child Care Health Dev. 2007;33:455–459. doi: 10.1111/j.1365-2214.2006.00710.x. [DOI] [PubMed] [Google Scholar]

- 6.Heath JA, Lintuuran RM, Rigguto G, et al. Childhood cancer: Its impact and financial costs for Australian families. Pediatr Hematol Oncol. 2006;23:439–448. doi: 10.1080/08880010600692526. [DOI] [PubMed] [Google Scholar]

- 7.Bloom BS, Knorr RS, Evans AE. The epidemiology of disease expenses. The costs of caring for children with cancer. JAMA. 1985;253:2393–2397. [PubMed] [Google Scholar]

- 8.Dockerty JD, Skegg DC, Williams SM. Economic effects of childhood cancer on families. J Paediatr Child Health. 2003;39:254–258. doi: 10.1046/j.1440-1754.2003.00138.x. [DOI] [PubMed] [Google Scholar]

- 9.Bodkin CM, Pigott TJ, Mann JR. Financial burden of childhood cancer. B Med J (Clin Res Ed) 1982;284:1542–1544. doi: 10.1136/bmj.284.6328.1542. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 10.Limburg H, Shaw AK, McBride ML. Impact of childhood cancer on parental employment and sources of income: A Canadian pilot study. Pediatr Blood Cancer. 2008;51:93–98. doi: 10.1002/pbc.21448. [DOI] [PubMed] [Google Scholar]

- 11.Feudtner C, Silveira MJ, Christakis DA. Where do children with complex chronic conditions die? Patterns in Washington State, 1980-1998. Pediatrics. 2002;109:656–660. doi: 10.1542/peds.109.4.656. [DOI] [PubMed] [Google Scholar]

- 12.Wolfe J, Grier HE, Klar N, et al. Symptoms and suffering at the end of life in children with cancer. N Engl J Med. 2000;342:326–333. doi: 10.1056/NEJM200002033420506. [DOI] [PubMed] [Google Scholar]

- 13.Mack JW, Joffe S, Hilden JM, et al. Parents' views of cancer-directed therapy for children with no realistic chance for cure. J Clin Oncol. 2008;26:4759–4764. doi: 10.1200/JCO.2007.15.6059. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 14.Heath JA, Clarke NE, Donath SM, et al. Symptoms and suffering at the end of life in children with cancer: An Australian perspective. Med J Aust. 2010;192:71–75. doi: 10.5694/j.1326-5377.2010.tb03420.x. [DOI] [PubMed] [Google Scholar]

- 15.Streiner DL, Norman GR. New York, NY: Oxford Medical Publications; 1995. Health Measurement Scales: A Practical Guide to Their Development and Use (ed 2) [Google Scholar]

- 16.Smeeding T. Globalization, Inequality and the Rich Countries of the G-20: Evidence from the Luxembourg Income Study (LIS) Luxembourg Income Study (LIS) Working Paper Series, No. 320, July 2002. http://www.lisproject.org/

- 17.Organisation for Economic Co-operation and Development (OECD); Directorate of Employment, Labour and Social Affairs. What are equivalence scales? OECD Project on Income Distribution and Poverty. http://www.oecd.org/LongAbstract/0,3425,en_2649_33933_35411112_1_1_1_1,00.html.

- 18.Organisation for Economic Co-operation and Development (OECD) OECD: Stat Extracts— Income distribution. http://stats.oecd.org.

- 19.McIntyre D, Thiede M, Dahlgren G, et al. What are the economic consequences for households of illness and of paying for health care in low- and middle-income country contexts? Soc Sci Med. 2006;62:858–865. doi: 10.1016/j.socscimed.2005.07.001. [DOI] [PubMed] [Google Scholar]

- 20.Xu K, Evans DB, Kawabata K, et al. Household catastrophic health expenditure: A multicountry analysis. Lancet. 2003;362:111–117. doi: 10.1016/S0140-6736(03)13861-5. [DOI] [PubMed] [Google Scholar]

- 21.Okumura MJ, Van Cleave J, Gnanasekaran S, et al. Understanding factors associated with work loss for families caring for CSHCN. Pediatrics. 2009;124:S392–S398. doi: 10.1542/peds.2009-1255J. [DOI] [PubMed] [Google Scholar]

- 22.Clemans-Cope L, Perry CD, Kenney GM, et al. Access to and use of paid sick leave among low-income families with children. Pediatrics. 2008;122:e480–e486. doi: 10.1542/peds.2007-3294. [DOI] [PubMed] [Google Scholar]

- 23.Parish SL, Shattuck PT, Rose RA. Financial burden of raising CSHCN: Association with State Policy Choices. Pediatrics. 2009;124:S435–S442. doi: 10.1542/peds.2009-1255P. [DOI] [PubMed] [Google Scholar]

- 24.Sauerborn R, Adams A, Hien M. Household strategies to cope with the economic costs of illness. Soc Sci Med. 1996;43:291–301. doi: 10.1016/0277-9536(95)00375-4. [DOI] [PubMed] [Google Scholar]

- 25.Rothman KJ, Greenland S. Precision and Validity in Epidemiologic Studies. In: Rothman KJ, Greenland S, editors. Modern epidemiology. ed 2. Philadelphia, PA: Lippincott-Raven; 1998. pp. 113–134. [Google Scholar]

- 26.Galbraith AA, Wong ST, Kim SE, et al. Out-of-pocket financial burden for low-income families with children: Socioeconomic disparities and effects of insurance. Health Serv Res. 2005;40:1722–1736. doi: 10.1111/j.1475-6773.2004.00421.x. [DOI] [PMC free article] [PubMed] [Google Scholar]