Abstract

Objectives. To evaluate the impact of the excise tax on sugar-sweetened beverage (SSB) consumption in Berkeley, California, which became the first US jurisdiction to implement such a tax ($0.01/oz) in March 2015.

Methods. We used a repeated cross-sectional design to examine changes in pre- to posttax beverage consumption in low-income neighborhoods in Berkeley versus in the comparison cities of Oakland and San Francisco, California. A beverage frequency questionnaire was interviewer administered to 990 participants before the tax and 1689 after the tax (approximately 8 months after the vote and 4 months after implementation) to examine relative changes in consumption.

Results. Consumption of SSBs decreased 21% in Berkeley and increased 4% in comparison cities (P = .046). Water consumption increased more in Berkeley (+63%) than in comparison cities (+19%; P < .01).

Conclusions. Berkeley’s excise tax reduced SSB consumption in low-income neighborhoods. Evaluating SSB taxes in other cities will improve understanding of their public health benefit and their generalizability.

Reducing sugar-sweetened beverage (SSB) consumption has become a public health priority because of strong evidence that SSBs increase risk of obesity, diabetes, heart disease, and dental caries.1,2 Because of the success of tobacco taxation3 and evidence from economic research,4,5 public health experts have called for excise taxes on SSBs to reduce consumption.6,7 Most US states have sales taxes on SSBs; however, they are typically too low to have a meaningful impact on consumption, are applicable to both SSBs and non-SSBs, and are added at the register—after a consumer has decided to purchase an SSB.8 Excise taxes, however, are expected to have greater saliency for consumers because they translate into higher shelf prices,9,10 which consumers see before deciding what to purchase.

From 2013 to 2014, more than a dozen states and several cities proposed SSB tax legislation.11 However, in November of 2014, Berkeley, California, became the first and only US jurisdiction to pass an SSB excise tax for public health purposes.12 Berkeley levied the $0.01-per-ounce tax on distribution of SSBs, including soda; energy, sports, and fruit-flavored drinks; sweetened water, coffee, and tea; and syrups used to make SSBs (non-SSBs such as diet soda are not taxed).13 We had previously found that, on average, 69% of the tax was passed through to higher retail prices of soda, and 47% was passed through to higher retail prices of SSBs overall.10 To date, the only other evidence on SSB excise taxes comes from outside the United States, in countrywide interventions without control groups.14,15

We sought to provide the first evaluation of an SSB excise tax in the United States by estimating the impacts of Berkeley’s SSB excise tax on SSB consumption, and used neighboring San Francisco and Oakland, California, as comparison cities to account for secular trends locally. In addition, we examined other perceived behavioral changes resulting from the tax, such as shifts in portion size and cross-border purchasing.

METHODS

We used a repeated cross-sectional design to examine pre- to posttax beverage consumption in Berkeley versus in Oakland and San Francisco, selected as comparison cities because of their proximity and mix of commercial and residential environments. San Francisco also considered an SSB tax in 2014 but failed to garner the 67% of votes required to pass.16

On November 4, 2014, the Berkeley SSB tax was voted into law. Implementation of tax collection from distributors began March 1, 2015. We collected pretax data in April through July 2014, before the elections and before major news coverage of the campaigns.17 We collected posttax data in April through August 2015.

Our sampling focused on low-income and minority populations, who are more likely to consume SSBs and suffer related health consequences.18,19 Thus, within Berkeley and San Francisco, we selected 2 large, low-income neighborhoods that yielded the highest combined proportion of African American and Hispanic residents according to 2010 census tract data.20 Using census tract characteristics in Berkeley and San Francisco, we then selected census tracts in Oakland that would provide the most similar percentages of Hispanic and African American residents. Within each neighborhood, we administered intercept surveys near the highest foot-traffic intersection. According to 2014 census estimates, average proportions of African American and Latino residents within the intersections’ census tracts were 25% and 28%, respectively, in Berkeley; 26% and 37% in Oakland; and 25% and 45% in San Francisco, compared with citywide percentages of 9% and 11% (Berkeley), 26% and 26% (Oakland), and 6% and 15% (San Francisco).21 Average household median incomes for these tracts versus the entire city were $59 000 versus $65 000 in Berkeley, $46 000 versus $53 000 in Oakland, and $52 000 versus $78 000 in San Francisco.21

Measures

We assessed beverage consumption via interviewer-administered intercept surveys with a beverage frequency questionnaire modified from the Behavioral Risk Factor Surveillance System 2011 SSB module.22 Participants were asked, “How often do you drink . . .?” for each beverage: “regular soda (not diet), like Coke or Sprite”; “energy drinks like Red Bull”; “sports drinks like Gatorade”; “fruit drinks like lemonade or fruit punch, not 100% juice”; “sweetened coffee or tea like Arizona iced tea or bottled Frappuccino”; as well as for “unsweetened water, bottled or tap.” Participants reported frequency as times per day, week, or month. We converted weekly and monthly intakes to daily intake by dividing by 7 and 30, respectively. To calculate total SSB frequency, we summed frequencies for soda, energy drinks, sports drinks, fruit drinks, and sweetened coffee or tea.

Surveys also assessed age, race/ethnicity, gender, and educational attainment. Posttax surveys assessed awareness of the tax: “Thinking back to the election in November, from what you remember, did [city name] have a soda tax on the ballot?” Berkeley posttax surveys assessed cross-border purchasing—purchasing SSBs outside Berkeley to avoid tax-related costs—asking where residents primarily bought SSBs in 2014 and in the past month, and, if they switched cities, why. To understand if people perceived having made behavioral changes in response to any aspect of the tax, we asked, “As a result of the soda tax or its campaigns, did you make any changes to what you drink?” If they responded “yes,” we asked about changes in frequency (less often vs no change or more often) and size of consumed beverages (smaller vs no change or larger).

Surveys were approximately 3 to 10 minutes long and administered in English or Spanish on weekdays from 10:30 am to 5:30 pm. A small incentive (a water bottle or reusable bag worth < $1.00) was provided.

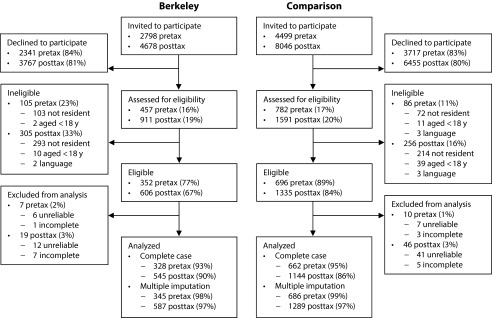

Eligible participants had to live in the city where the survey was conducted, be aged 18 years or older, and speak English or Spanish. Trained interviewers invited every passerby to participate. Figure 1 shows participant flow. Among those invited before the tax, 1239 (17%) individuals stopped to speak to an interviewer and were screened, of which 1048 (85%) were eligible. Among those invited after the tax, 2502 (20%) were interested and screened, of which 1941 (78%) were eligible. The proportion declining to participate was similar before and after the tax, but a smaller proportion of passersby were eligible after the tax. At both times, fewer residents were eligible in Berkeley than in comparison cities (Figure 1).

FIGURE 1—

Participant Flow During Pre- (2014) and Posttax (2015) Periods in Berkeley, CA, and Comparison Cities (Oakland and San Francisco, CA)

Note. Complete-case analysis of water consumption excluded those additionally missing data on water consumption and included 285 before the tax and 501 after the tax in Berkeley and 606 before the tax and 1045 after the tax in comparison cities.

After we excluded 66 participants who appeared to provide unreliable responses (e.g., because of difficulty hearing), 16 who left before completing beverage questions, 27 who were missing SSB consumption, and 201 who were additionally missing covariate data, the primary analytic sample for examining SSB consumption comprised 2679 (90% of those eligible): 328 in Berkeley and 662 in comparison cities before the tax, and 545 in Berkeley and 1144 in the comparison cities after the tax. Because 242 were also missing water consumption data, the analytic sample for examining water consumption included 2437 (82% of those eligible). In sensitivity analyses that used multiple imputation, the analytic sample included 2907 observations (97% of those eligible).

Statistical Analysis

Using a difference-in-differences approach, we estimated pre- to posttax changes in beverage consumption in Berkeley relative to that in comparison cities. For each beverage, we modeled frequency of beverage consumption by using separate generalized linear regression models with a γ distribution and a log link.23 The γ distribution accounted for the fact that beverage consumption cannot be negative and has a right-skewed distribution. The log link allowed us to directly model mean beverage consumption and obtain results that can be interpreted in terms of percent change in consumption. These models included an indicator for Berkeley, an indicator for posttax time period, and an interaction term for Berkeley and posttax time period. The indicator for Berkeley adjusted for pretax differences between Berkeley and the comparison cities. Because we used a log–link, the exponentiated coefficient for posttax period indicated the percent change in beverage consumption in the comparison cities (i.e., the ratio of post- to pretax consumption). The exponentiated interaction term for Berkeley and posttax period indicated how much more beverage consumption changed in Berkeley than in comparison cities (i.e., the ratio of post- to pretax consumption in Berkeley relative to that in comparison cities).

We adjusted all models for gender, race/ethnicity (African American, Hispanic, White, and other), age category (< 30, 30–39, 40–49, 50–59, ≥ 60 years), education (< high school, high school or GED, some college, college degree, graduate school), language, and neighborhood. Because of sizeable percentages of zero values for beverage consumption, we used robust standard errors to ensure valid inferences.

In our primary analysis, we conducted a complete case analysis, excluding observations with missing outcome or covariate data. In sensitivity analyses, we used multiple imputation by chained equations to impute missing SSB consumption (n = 27 [1%]), water consumption (n = 267 [9%]), and covariates (n = 203 [7%]), generating 20 data sets and a sample size of 2907. The imputation model included gender, race/ethnicity, age, education, neighborhood, time, interviewer, and SSB and water consumption.

Numbers and percentages are presented for awareness of the tax and perceived behavioral changes among those who responded to these questions. We used logistic regression models to determine if awareness of SSB taxes differed significantly by city, adjusting for the same covariates used in models of beverage consumption. We conducted analyses in Stata/IC version 13.1 (StataCorp LP, College Station, TX).

RESULTS

Table 1 shows participant characteristics. Relative to comparison cities, Berkeley participants had higher educational attainment and were slightly older, less likely to be female and Hispanic, and more likely to be White. Posttax participants were older than pretax participants. In comparison cities, posttax participants were more likely than pretax participants to be female, to have a lower educational attainment, and to have done the survey in Spanish.

TABLE 1—

Characteristics of 2679 Participants During Pre- (2014) and Posttax (2015) Periods in Berkeley, CA, and Comparison Cities (Oakland and San Francisco, CA)

| Berkeley |

Comparison Cities |

P for Differencesa |

||||||

| Characteristic | Pretax (n = 328), Mean ±SD or % | Posttax (n = 545), Mean ±SD or % | Pb | Pretax (n = 662), Mean ±SD or % | Posttax (n = 1144), Mean ±SD or % | Pb | Pretax | Posttax |

| Age, y | 43 ±16 | 46 ±17 | .01 | 39 ±15 | 44 ±16 | < .001 | < .001 | .01 |

| Female | 46 | 53 | .10 | 54 | 60 | < .01 | .04 | < .01 |

| Race/ethnicity | ||||||||

| African American | 33 | 31 | .70 | 34 | 33 | .71 | .77 | .59 |

| Hispanic | 24 | 20 | .18 | 36 | 38 | .32 | < .001 | < .001 |

| White | 27 | 32 | .18 | 18 | 16 | .17 | < .01 | < .001 |

| Other | 16 | 17 | .74 | 13 | 14 | .56 | .28 | .03 |

| Survey in Spanish | 10 | 13 | .17 | 17 | 25 | < .01 | < .01 | < .001 |

| Highest education | ||||||||

| < high school | 6 | 10 | .07 | 12 | 20 | < .001 | .01 | < .001 |

| High school or GED | 22 | 19 | .29 | 30 | 24 | < .01 | < .01 | < .01 |

| Some college | 30 | 26 | .18 | 27 | 30 | .28 | .29 | .18 |

| College graduate | 25 | 27 | .39 | 21 | 19 | .29 | .18 | < .001 |

| Graduate school | 17 | 18 | .68 | 10 | 8 | .13 | < .01 | < .001 |

Note. GED = general equivalency diploma. Percentages were calculated by excluding those with missing data from the denominator.

Between Berkeley, California, and comparison cities.

For differences between pre- and posttax periods within cities.

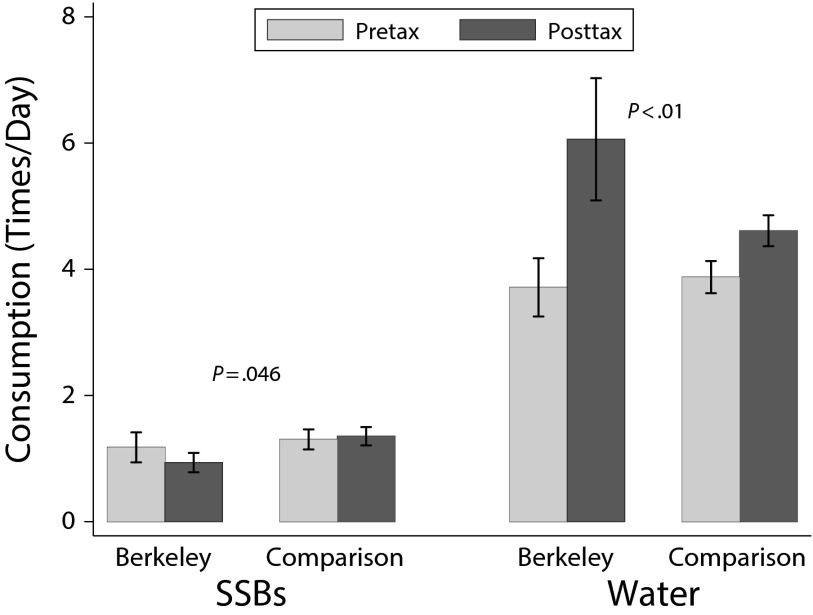

Table 2 compares change in consumption in Berkeley to change in the comparison cities. After passage of Berkeley’s SSB tax, adjusted consumption of SSBs decreased in Berkeley (–21%) and increased in the comparison cities (+4%); Figure 2; P = .046). Specifically, adjusted consumption of regular soda decreased by 26% in Berkeley and increased by 10% in the comparison cities (P = .05), and adjusted consumption of sports drinks decreased by 36% in Berkeley and increased by 21% in the comparison communities (P = .02). In addition, as illustrated in Figure 2, water consumption increased more in Berkeley (+63%) than in comparison cities (+19%; P < .01). For other specific beverages, differences between Berkeley and comparison cities were not significant.

TABLE 2—

Beverage Consumption and Pre- to Posttax Change (%) in Consumption in Berkeley, CA, Versus Comparison Cities (Oakland and San Francisco, CA) Among 2679 Participants

| Berkeley, CA (n = 873) |

Comparison Cities (n = 1806) |

||||||||

| Consumption (Times/Day) | Unadjusted Pretax, Mean ±SD | Unadjusted Posttax,a Mean ±SD | Unadjusted Absolute Difference | Adjustedb Percent Changec | Unadjusted Pretax, Mean ±SD | Unadjusted Posttax,a Mean ±SD | Unadjusted Absolute Difference | Adjustedb Percent Changec | Ratio of Post- to Pretax Consumption in Berkeley Relative to Comparison Cities (n = 2679), Bb (95% CI) |

| SSBs | 1.25 ±2.25 | 0.97 ±1.66 | −0.28 | −21 | 1.29 ±1.76 | 1.26 ±2.09 | −0.03 | +4 | 0.76 (0.58, 0.995) |

| Regular soda | 0.47 ±1.40 | 0.34 ±0.86 | −0.13 | −26 | 0.44 ±0.79 | 0.47 ±1.11 | +0.03 | +10 | 0.67 (0.45, 1.00) |

| Sports drinks | 0.18 ±0.49 | 0.12 ±0.42 | −0.06 | −36 | 0.18 ±0.45 | 0.17 ±0.56 | −0.01 | +21 | 0.53 (0.31, 0.91) |

| Energy drinks | 0.09 ±0.51 | 0.05 ±0.24 | −0.04 | −29 | 0.07 ±0.28 | 0.07 ±0.32 | 0.00 | −14 | 0.83 (0.38, 1.82) |

| Fruit drinks | 0.28 ±0.57 | 0.26 ±0.65 | −0.03 | −13 | 0.39 ±0.79 | 0.34 ±0.81 | −0.06 | −12 | 0.99 (0.69, 1.44) |

| Sweetened coffee or tea | 0.23 ±0.57 | 0.21 ±0.61 | −0.02 | −13 | 0.21 ±0.56 | 0.21 ±0.59 | 0.00 | +22 | 0.71 (0.44, 1.15) |

| Waterd | 3.50 ±3.24 | 5.84 ±10.38 | +2.33 | +63 | 3.98 ±3.12 | 4.69 ±3.53 | +0.70 | +19 | 1.37 (1.14, 1.64) |

Note. CI = confidence interval; SSB = sugar-sweetened beverage.

Posttax data were collected approximately 12 months after pretax data collection, 8 months after elections, and 4 months after implementation of the tax.

Adjusted for gender, age, education, race/ethnicity, language, and neighborhood in which the survey was conducted. Generalized linear models were used with a γ distribution, log link, and robust standard errors.

From adjusted within-city ratio of post- to pretax consumption.

Sample sizes for water included 2437—786 in Berkeley and 1651 in comparison cities.

FIGURE 2—

Adjusted Mean Consumption of Sugar-Sweetened Beverages (SSBs) and Water Before and After the Tax in Berkeley, CA, and Comparison Cities (Oakland and San Francisco, CA)

Note. Adjusted means and 95% confidence intervals were obtained by using the margins command in Stata/IC version 13.1 (StataCorp LP, College Station, TX) after running generalized linear models adjusting for neighborhood, gender, age, education, race/ethnicity, and language. P values shown are for the difference between Berkeley and comparison cities in change in consumption and come from the generalized linear models.

In a sensitivity analysis, after we imputed covariates and outcomes, coefficients indicating change in consumption in Berkeley relative to in the comparison cities remained the same for SSBs and soda, and the coefficient for soda was significant (P = .04). Results for water and sports drinks were similar with imputed data, but the coefficient for sports drinks was not significant (P = .10),

When asked if a soda tax had been on their city’s ballot, 68% in Berkeley, 56% in San Francisco, and 28% in Oakland replied yes (Ps for differences < .05).

Table A (available as a supplement to the online version of this article at http://www.ajph.org) presents perceived behavioral changes in Berkeley related to the tax. Only 18 respondents (5% of those who reported buying SSBs in Berkeley before the tax) reported switching SSB purchases to another city after the tax. Of these, 6 respondents (2%) reported switching because of the tax or prices. In addition, of the 124 (22%) who reported changing drinking habits because of the tax, 101 (82%) reported drinking SSBs less frequently and 48 (40%) reported drinking smaller sizes because of the tax.

DISCUSSION

This study provides the first evidence on the impact of an SSB excise tax on beverage consumption in the United States. In low-income neighborhoods in Berkeley, SSB consumption declined by 21% over a 1-year period from before the tax to after the tax, and increased by 4% in the comparison neighborhoods over the same period, a statistically significant difference. Regular soda and sports drink consumption similarly showed greater decreases whereas water consumption demonstrated a greater increase in Berkeley versus comparison cities.

Although Berkeley is the first US jurisdiction to pass an SSB excise tax, other countries have implemented such taxes. Mexico’s 1-peso-per-liter SSB excise tax (equivalent to a 10% price increase) resulted in a 12% reduction in purchases of taxed SSBs 1 year later.14 France saw a 6.7% decline in demand for regular cola in the first 2 years after an 11 euro-cent per 1.5-liter SSB excise tax15 (corresponding to a 6% price increase24). Although the SSB excise taxes in Mexico and France appear to have reduced SSB consumption, because they were implemented nationwide, evaluations did not include concurrent comparison groups to account for secular trends. A major strength of our study is inclusion of comparison cities.

Excise taxes are hypothesized to reduce consumption by raising prices. In a longitudinal study of 71 stores, we examined how retail prices changed in Berkeley versus in the comparison cities before and after the tax (i.e., pass-through).10 We had found that, on average, 69% of Berkeley’s SSB tax was passed through to higher soda prices, and 47% was passed through to prices of SSBs overall.10 Pass-through varied considerably by retailer type and beverage. These analyses were not weighted by sales, and because soda is the largest contributor of SSB calories in the United States,19 47% may be a conservative estimate. However, a 47% pass-through is equivalent to about an 8% price increase.25 Powell et al. recently reviewed price elasticity of demand estimates for SSBs—the percent change in demand for SSBs resulting from a 1% increase in price.5 They reported an average price elasticity for SSBs of −1.2 (range = −0.71 to −3.87).

On the basis of these estimates,5 and the early SSB price increases of 8% in Berkeley,10 Berkeley’s SSB tax would be predicted to reduce consumption by approximately 10% (range = 6% to 31%). The 21% reduction in SSB consumption that we saw in low-income Berkeley neighborhoods represents a price elasticity of −2.6, and the relative reduction we saw of 25% (relative to comparison neighborhoods) would represent a price elasticity of −3.1. In Mexico and France, in which pass-through rates were higher,24,26 reductions in purchases of SSBs following an SSB tax14,15 were approximately consistent with the average price elasticity of −1.2.5 The greater reduction in Berkeley could reflect greater price sensitivity in the San Francisco Bay Area or, specifically, among lower-income populations. In Mexico, households of low-socioeconomic status were most responsive to the tax, reducing purchases by 17% (compared with 12% overall).14 Few studies have examined differential responsiveness to food taxes by socioeconomic status, and results have been mixed.27,28

The magnitude of our results may also reflect an early reaction to the tax that could rebound and settle closer to a 10% reduction in consumption; however, Mexico’s reduction in SSB purchases increased over the year following the tax.14 Alternatively, stronger than expected results in Berkeley could be attributable to greater overall health consciousness. Ongoing evaluation in Berkeley and studies in other cities proposing SSB taxes will be critical to sort out long-term impact.

The greater-than-predicted reduction in consumption in Berkeley could also reflect effects of the campaign surrounding the tax, which may have shifted social norms29 and thus reduced consumption. Whereas dozens of jurisdictions failed to pass SSB taxes, the Berkeley protax campaign—“Berkeley vs. Big Soda”—achieved success, which has been attributed to early and diverse coalition building, reflected in the campaign having prominently featured community representatives and endorsements from a wide range of supporters.17 Campaign messages focused not only on health harms of SSBs, but also on inappropriate behavior by the SSB industry.17 Campaign exposure, knowledge that the tax passed by a high margin (76%) of votes,13 or awareness of widespread support for the tax may have altered social norms, but we did not assess social norms. Future research on SSB-related policies should study potential mediating effects of perceived norms.

In SSB tax debates, it has been argued that cross-border shopping would undermine the tax’s effectiveness.30 However, we found that very few—only 2%—of Berkeley residents who reported having bought SSBs primarily in Berkeley before the tax reported that they switched to buying SSBs elsewhere as a result of the tax or prices. Also, a greater proportion of Berkeley residents reported having reduced how frequently they consume SSBs, rather than reducing SSB portion size. Going forward, it will be important to monitor consumers’ changes in behavior in response to SSB taxes and the beverage industry’s responses to consumer demand (e.g., reformulation, altering can or bottle size, and promotion), to fully understand the potential public health impacts of SSB taxes.

Limitations

Although our results suggest that SSB taxes can significantly reduce SSB consumption, Berkeley is a single city of relatively high socioeconomic status,21 and results may not generalize to other cities. Although intercept surveys allowed us to focus on low-income neighborhoods, the use of repeated cross-sections reduced power and limited analytic options. Also, it is probable that our samples were not independent, so our analysis likely overestimated standard errors for pre- versus posttax change (and hence understated statistical significance). Although our beverage questions asked about frequency, not size, of SSBs, multiple studies have shown that adding portion-size questions have little impact on nutrient correlations between food frequency questionnaires and gold standards.31 We did not assess a comprehensive list of non-SSBs, including diet soda, so it was not possible to examine beverage substitution beyond water.

It is possible that factors unrelated to the taxes affected consumption; however, we are unaware of concurrent interventions in Berkeley during this time period, and the increase in SSB consumption in comparison cities suggests that external factors may have encouraged higher consumption in the Bay Area. The region experienced higher-than-average temperatures in the relevant months of 2015 compared with 2014.32 Although we adjusted for differences in participant characteristics between cities and time points in our models, with any nonrandomized design, there is the possibility of unmeasured and residual confounding.

We did not collect measures of self-reported height, weight, or desire to lose or maintain weight, which may have been associated with magnitude of change in SSB consumption in response to the tax. Also, self-reported behaviors are vulnerable to social desirability bias; this was partially addressed by including comparison cities, but SSB sales data could provide complementary objective evidence. Our posttax sample sizes were larger than pretax sample sizes, but samples were larger by a similar proportion across all cities, minimizing potential for differential impact by city.

Lastly, we collected posttax consumption data less than 6 months after implementation, reflecting short-term impacts of the tax. Because Berkeley’s SSB tax ordinance does not specify adjusting the tax to account for inflation, price effects on consumption may decrease somewhat over time. Currently, model SSB tax legislation includes adjustment based on the Consumer Price Index.33

Public Health Implications

An SSB excise tax is one of the few public health interventions expected to reduce health disparities, save more money than it costs, and generate substantial revenues for public health programs.25,34 Already, Berkeley city council has allocated $1.5 million to fund programs to reduce SSB consumption and address obesity for the 2016–2017 fiscal year.35 In addition, a recent modeling study found that a national SSB tax resulting in a reduction in consumption on par with what we observed would result in lower child and adult body mass index (defined as weight in kilograms divided by the square of height in meters) and avert 101 000 disability-adjusted life-years over a decade.25 Although the present study provides short-term results, it is the first evaluation of an SSB excise tax implemented in the United States and provides evidence that a $0.01 per ounce city-level SSB tax reduced SSB consumption in vulnerable neighborhoods in Berkeley. If impacts in Berkeley persist, and evidence from other cities passing SSB taxes corroborate our findings, widespread adoption of SSB excise taxes could have considerable fiscal and public health benefits.

ACKNOWLEDGMENTS

This research was supported by The Global Obesity Prevention Center, Johns Hopkins University; the Eunice Kennedy Shriver National Institute of Child Health and Human Development and the Office of the Director (award U54HD070725), National Institutes of Health; Community Health Equity and Promotion Branch, San Francisco Department of Public Health; and a University of California Office of the President Multi-Campus Research Initiative grant (PI, Elissa Epel). J. Falbe’s work was additionally supported by a postdoctoral fellowship from the American Heart Association (grant 14POST20140055).

HUMAN PARTICIPANT PROTECTION

This study was deemed exempt by UC Berkeley’s institutional review board because it involved only anonymous survey data; thus, review was not needed.

Footnotes

See also Galea and Vaughan, p. 1730.

REFERENCES

- 1.Malik VS, Popkin BM, Bray GA, Despres JP, Hu FB. Sugar-sweetened beverages, obesity, type 2 diabetes mellitus, and cardiovascular disease risk. Circulation. 2010;121(11):1356–1364. doi: 10.1161/CIRCULATIONAHA.109.876185. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 2.Hu FB. Resolved: there is sufficient scientific evidence that decreasing sugar-sweetened beverage consumption will reduce the prevalence of obesity and obesity-related diseases. Obes Rev. 2013;14(8):606–619. doi: 10.1111/obr.12040. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3.Jha P, Chaloupka FJ, Moore J . Tobacco addiction. In: Jamison DT, Breman JG, Measham AR, editors. Disease Control Priorities in Developing Countries. Washington, DC: World Bank; 2006. [PubMed] [Google Scholar]

- 4.Andreyeva T, Long MW, Brownell KD. The impact of food prices on consumption: a systematic review of research on the price elasticity of demand for food. Am J Public Health. 2010;100(2):216–222. doi: 10.2105/AJPH.2008.151415. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Powell LM, Chriqui JF, Khan T, Wada R, Chaloupka FJ. Assessing the potential effectiveness of food and beverage taxes and subsidies for improving public health: a systematic review of prices, demand and body weight outcomes. Obes Rev. 2013;14(2):110–128. doi: 10.1111/obr.12002. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6.Brownell KD, Farley T, Willett WC et al. The public health and economic benefits of taxing sugar-sweetened beverages. N Engl J Med. 2009;361(16):1599–1605. doi: 10.1056/NEJMhpr0905723. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.Institute of Medicine. Accelerating Progress in Obesity Prevention: Solving the Weight of the Nation. Washington, DC: The National Academies Press; 2012. [Google Scholar]

- 8.Chriqui JF, Chaloupka FJ, Powell LM, Eidson SS. A typology of beverage taxation: multiple approaches for obesity prevention and obesity prevention-related revenue generation. J Public Health Policy. 2013;34(3):403–423. doi: 10.1057/jphp.2013.17. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 9.Brownell KD, Frieden TR. Ounces of prevention—the public policy case for taxes on sugared beverages. N Engl J Med. 2009;360(18):1805–1808. doi: 10.1056/NEJMp0902392. [DOI] [PubMed] [Google Scholar]

- 10.Falbe J, Rojas N, Grummon AH, Madsen KA. Higher retail prices of sugar-sweetened beverages 3 months after implementation of an excise tax in Berkeley, California. Am J Public Health. 2015;105(11):2194–2201. doi: 10.2105/AJPH.2015.302881. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 11.Rudd Center for Food Policy and Obesity. Legislative database. 2015. Available at: http://www.uconnruddcenter.org/legislation-database. Accessed June 13, 2015.

- 12. Alameda County. Registrar of voters: November 4, 2014—general election results. 2015. Available at: http://www.acgov.org/rov/elections/20141104. Accessed July 1, 2015.

- 13.The City of Berkeley. Election information: 2014 ballot measures. 2014. Available at: https://www.cityofberkeley.info/Clerk/Elections/Election__2014_Ballot_Measure_Page.aspx. Accessed July 28, 2016.

- 14.Colchero MA, Popkin BM, Rivera JA, Ng SW. Beverage purchases from stores in Mexico under the excise tax on sugar sweetened beverages: observational study. BMJ. 2016;352:h6704. doi: 10.1136/bmj.h6704. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15. Food taxes and their impact on competitiveness in the agri-food sector. Rotterdam, The Netherlands: European Competitiveness and Sustainable Industrial Policy Consortium; 2014.

- 16.San Francisco Department of Elections. November 4, 2014 official election results. 2014. Available at: http://www.sfelections.org/results/20141104. Accessed June 17, 2015.

- 17.Somji A, Nixon L, Mejia P, Azizi M, Arbatman L, Dorfman L. Soda tax debates in Berkeley and San Francisco: an analysis of social media, campaign materials and news coverage. Berkeley, CA: Berkeley Media Studies Group; 2016.

- 18.Ogden CL, Carroll MD, Kit BK, Flegal KM. Prevalence of childhood and adult obesity in the United States, 2011–2012. JAMA. 2014;311(8):806–814. doi: 10.1001/jama.2014.732. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 19.Han E, Powell LM. Consumption patterns of sugar-sweetened beverages in the United States. J Acad Nutr Diet. 2013;113(1):43–53. doi: 10.1016/j.jand.2012.09.016. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 20.US Census Bureau. 2006–2010 5-year American Community Survey. 2010. Available at: http://factfinder.census.gov. Accessed February 8, 2014.

- 21.US Census Bureau. 2010–2014 5-year American Community Survey. 2014. Available at: http://factfinder.census.gov. Accessed April 18, 2016.

- 22.Park S, Pan L, Sherry B, Blanck HM. Consumption of sugar-sweetened beverages among US adults in 6 states: Behavioral Risk Factor Surveillance System, 2011. Prev Chronic Dis. 2014;11:E65. doi: 10.5888/pcd11.130304. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 23.McCullagh P, Nelder JA. Generalized Linear Models. 2nd ed. London, England: Chapman and Hall; 1989. [Google Scholar]

- 24.Berardi N, Sevestre P, Tepaut M, Vigneron A. The impact of a “soda tax” on prices: evidence from French micro data. Paris, France: Banque de France; 2012. Working paper no. 415.

- 25.Long MW, Gortmaker SL, Ward ZJ et al. Cost effectiveness of a sugar-sweetened beverage excise tax in the U.S. Am J Prev Med. 2015;49(1):112–123. doi: 10.1016/j.amepre.2015.03.004. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 26.Colchero MA, Salgado JC, Unar-Munguia M, Molina M, Ng S, Rivera-Dommarco JA. Changes in prices after an excise tax to sweetened sugar beverages was implemented in Mexico: evidence from urban areas. PLoS One. 2015;10(12) doi: 10.1371/journal.pone.0144408. e0144408. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 27.Smed S, Jensen JD, Denver S. Socio-economic characteristics and the effect of taxation as a health policy instrument. Food Policy. 2007;32(5–6):624–639. [Google Scholar]

- 28.Finkelstein EA, Zhen C, Nonnemaker J, Todd JE. Impact of targeted beverage taxes on higher- and lower-income households. Arch Intern Med. 2010;170(22):2028–2034. doi: 10.1001/archinternmed.2010.449. [DOI] [PubMed] [Google Scholar]

- 29.Mytton OT, Eyles H, Ogilvie D. Evaluating the health impacts of food and beverage taxes. Curr Obes Rep. 2014;3(4):432–439. doi: 10.1007/s13679-014-0123-x. [DOI] [PubMed] [Google Scholar]

- 30.Watts RA, Heiss S, Moser M, Kolodinsky J, Johnson RK. Tobacco taxes vs soda taxes: a case study of a framing debate in Vermont. Health Behav Policy Rev. 2014;1(3):191–196. [Google Scholar]

- 31.Willett WC. Nutritional Epidemiology. New York, NY: Oxford University Press; 2013. [Google Scholar]

- 32.California Department of Water Resources. Climate data and information for California. 2015. Available at: http://www.water.ca.gov/floodmgmt/hafoo/csc/climate_data. Accessed December 3, 2015.

- 33.National Policy and Legal Analysis Network to Prevent Childhood Obesity. ChangeLab Solutions. Model sugar-sweetened beverage tax legislation. 2014. Available at: http://www.changelabsolutions.org/publications/ssb-model-tax-legislation. Accessed January 3, 2016.

- 34.Gortmaker SL, Long MW, Resch SC et al. Cost effectiveness of childhood obesity interventions: evidence and methods for CHOICES. Am J Prev Med. 2015;49(1):102–111. doi: 10.1016/j.amepre.2015.03.032. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 35.Lynn J. The Daily Californian. City council votes to allocate “soda tax” revenue to school district, city organizations. January 20, 2016. Available at: http://www.dailycal.org/2016/01/20/city-council-votes-allocate-soda-tax-revenue-school-district-city-organizations. Accessed July 28, 2016. [Google Scholar]