To the Editor:

Next generation sequencing (NGS) technologies are increasingly being integrated into clinical practice.1,2 Proponents expect that the technology will continue to improve clinical care, and early reports suggest some clinical utility in oncology and the diagnosis of rare diseases.3,4,5 The industry, however, is in a considerable state of flux as new business models emerge, existing businesses begin to consolidate, and the industry reacts to an uncertain regulatory climate.6 Regulatory standards for test quality and reimbursement remain vague. For example more than two years ago the Food and Drug Administration (FDA) asserted its jurisdiction over laboratory developed tests (LDT), including some NGS technologies. In November 2013, FDA began regulating next generation genomic sequencing machines, granting marketing authorization for the first high-throughput next generation genomic sequencing platform (http://blogs.fda.gov/fdavoice/index.php/2013/11/gene-sequencing-devices-are-next-generation/). In the words of FDA Commissioner Hamburg and National Institutes of Health Director Collins, “This marketing authorization of a non-disease-specific platform will allow any lab to test any sequence for any purpose.”7 However, there are still many questions about how and if FDA will regulate NGS-based LDTs, such as what clinical validity standards they may need to meet. In July 2014, the FDA took significant steps to address these questions by releasing a draft framework for how the agency will regulate LDTs. These guidelines, however, will take upwards of two years to finalize, and five to ten years to implement. Moreover, it remains unclear whether and how they will address issues specific to clinical NGS.8

Meanwhile, the Centers for Medicare and Medicaid Services (CMS, Baltimore, MD, USA) have yet to adopt a clear coding and reimbursement structure for NGS in clinical practice, and Blue Cross Blue Shield has recently decided that whole exome and whole genome sequencing should be treated as experimental and not routinely reimbursed.9 Finally, while the recent Supreme Court ruling on Association for Molecular Pathology v. Myriad Genetics10 has begun to address uncertainty about intellectual property claims, it has also opened a new set of related lawsuits as well as a broader debate about proprietary genomic databases.11

Much has been written about these policy gaps, but it is important to understand how industry leaders are responding to the uncertainty and what implications it has for future policy development. In-depth interviews with leaders of 19 companies and laboratories involved in clinical NGS indicate that the industry is developing along the NGS pipeline partly in response to this policy uncertainty. The NGS pipeline consists of three phases. The pre-analytic phase includes sample collection, shipping, de-identification, and laboratory processing. The analytic phase entails sequencing, alignment, and base calling. The post-analytic and informatics phase, which is meant to interpret the significance of the data, includes variant calling, interpretation, report generation, delivery, and data storage and protection.

Interviewed industry leaders generally agree that the platform manufacture market—that is, the machines used in the analytic phase to physically determine sequence—is quite narrow. Several industry representatives mentioned that Illumina (San Diego) and Life Technologies (now part of Thermo Fisher Technologies, Waltham, MA, USA) lead this area. Although the possibility for additional breakthrough technologies remains, the price and quality of the current market leaders are substantial hurdles to overcome. In addition, the prospect of unpredictable new regulatory standards further accentuates the risk. Currently there is little clarity about which function(s) of the NGS process will constitute Class II or Class III medical devices by FDA standards. As the FDA contemplates this question, technology investors and developers are unsure about the extent to which new devices will require substantial additional time and investment to obtain pre-market approval from FDA.

In contrast, interviewees agree that there is considerable competition, and room for expansion in the post-analytic section of the pipeline. The need for bioinformatics software that can manage the data bottleneck created by large genomic sequence files, and parse these data into meaningful clinical reports, has led to a host of new enterprises.12 As one interviewee put it, “We don't have good enough, complete databases, so we have to be very creative [in] how we do interpretation”. The post-analytic segment of the NGS pipeline is open to new entrants at a comparatively low cost. Furthermore, there are few obvious regulatory hurdles. Regulation of these algorithms and software seem further off since jurisdiction over these components, as well as proficiency standards are completely unsettled.

Another unresolved policy issue that is shaping the industry relates to payment and reimbursement for NGS tests. As investors and industry leaders look at reimbursement from health insurers and public payors, they observe that few standards exist, and those that do appear highly susceptible to change. Many of the companies that have traditionally built technology, reagents, or software for research are not prepared to navigate the clinical testing market where sources of reimbursement for their products is uncertain. As a result, whereas there are some signs that industry leaders are trying to develop or acquire capability in each part of the clinical NGS pipeline, and some NGS clinical diagnostic companies are emerging, a considerable part of the industry is currently manufacturing only one or a few of the components of NGS testing. Regulatory and reimbursement concerns are leading many companies to rely on existing clinical laboratories to incorporate their product into LDTs using NGS. These laboratories have established conduits to clinicians and payors, as well as the expertise to set and meet clinical laboratory standards. Partnering with them can reduce risk by allowing the laboratories to serve as a buffer between the technology companies and regulatory bodies, payors, and patients.

Our web-based analysis of 100 NGS companies confirms that technology companies are moving to serve the clinical arena, and supports the observations made in our industry interviews. (Supplementary Table) Of the 100 companies identified that were involved in NGS, 68 were producing one or more components for use in the clinical NGS pipeline (Supplementary Methods). Of these companies, nearly half (n=32) have documented Clinical Laboratory Improvement Amendments (CLIA) certification, indicating a commitment to standard clinical laboratory practices to ensure analytic validity of a medical test. Nearly two-thirds (n=44) are marketing to or working with clinicians, 17 list one or more clinical advisors, 21 are selling products including a clinical report, and 11 websites show companies working with insurers for reimbursement. Sixteen of these companies are providing some form of genomic data storage as service. Of those 16, three have publicly available privacy policies and/or state on their website that they are HIPAA compliant. This may become an issue as this area of the NGS pipeline expands.

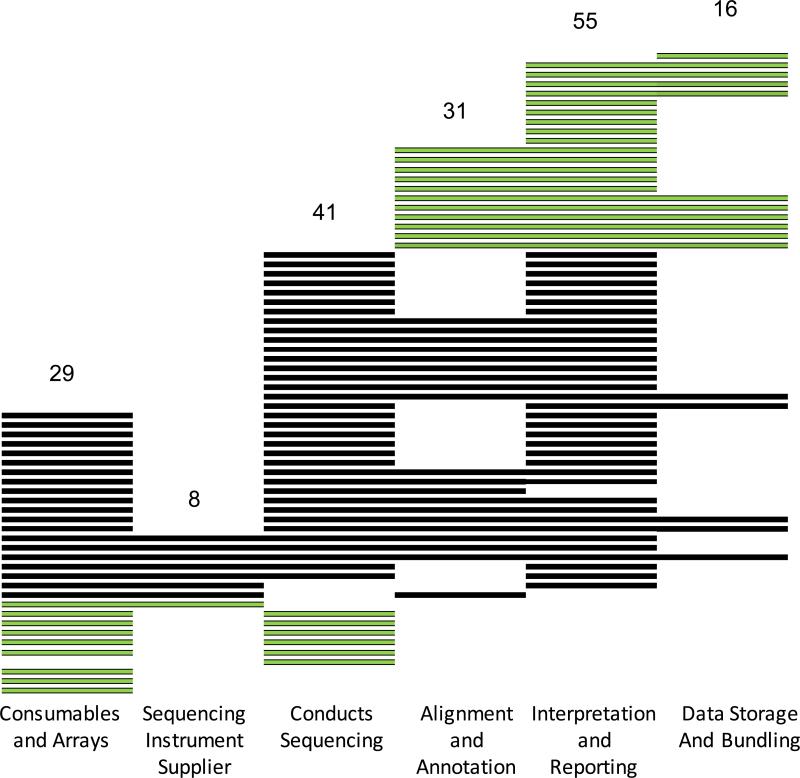

Figure 1 shows that there were a small number of companies (n=8) producing the sequencing technology, and smaller number selling products and services that cover the majority of the clinical NGS pipeline. Many of the newest companies were developing bioinformatic tools to identify and annotate variants from sequence data, and create clinical reports based on these interpreted variants. Twenty-one of these informatics companies had little or no connection to the pre-analytic and analytic processes used to obtain the sequence. Similarly there were ten companies manufacturing components needed to generate the sequence that do not transform the data into clinical information. This fragmentation of sequencing and analysis in nearly half of the companies we examined may make regulation of devices that only perform one function or the other difficult, since neither function on its own currently constitutes a medical test. Moreover it is unclear whether piecing together components crafted by different vendors would lead to a clinical genomic sequencing pipeline that delivers high quantity and quality clinical data.

Figure 1.

Sixty-eight companies were identified as producing hardware, software, reagents and services for use in the clinical NGS pipeline. Each horizontal row represents one company, categorized in the columns by the products and services the company offers. Thirty-one light colored companies are either involved in sequencing only (10) or annotation and interpretation only (21).

There is general optimism about the future use of NGS in health care. Many interviewed industry representatives predict that all clinical laboratories will convert to NGS for all genetic testing within the next few years: “I think, in the next two or three years, 80–90% of the current testing labs can convert over into next generation sequencing. Once that is there, and the price point is coming down, then, basically, everyone will convert over” (Interview 4). In the words of another industry leader, “It's happening. It's the right thing for medicine. It's the right thing for patients. It's ultimately the right thing for the health care system from a purely economic basis. We just have to figure out how it should roll out over the course of the next couple of years” (Interview 16).

As the technology continues to evolve, our interviews suggest that many companies are paying close attention to how FDA is asserting its role in the regulation of LDTs and NGS technologies. Some worry that, since reimbursement standards for NGS are lacking, large payors may unexpectedly create benchmarks that leave their product out in the cold. Interviewees differ in their views about the proper role of specific regulatory agencies like FDA and CMS. Several subjects said that some policies and standards are needed to guide clinical NGS, but felt that at this point, regulatory bodies should remain vigilant and act slowly in order to accommodate the evolving nature of the industry. They cautioned against setting standards that could quickly become outdated. From the perspective of those interviewed, premature regulation could stifle innovation of an industry that is still developing the products that will set the gold standard for clinical NGS. The unresolved regulatory issues, however, may also be hindering the adoption and improvement of clinical NGS. Smaller clinical laboratories may be reluctant to invest in expensive new technology before they know it will meet new standards. Since FDA has signaled its interest in oversight of clinical sequencing, the development of expensive landmark improvements in clinical sequencing technology may be delayed until clear benchmarks are established. We agree with industry leaders that in the short term overly eager regulation would hinder the development of clinical NGS, especially as the playing field continues to settle. In the long term, however, the NGS industry would benefit from standards that ensure the quality of data production, processing, and analysis, as well as clearer guidelines for reimbursement. These measures would create clarity for further business development and lend credibility to a very promising segment of the biotechnology industry.

Supplementary Material

ACKNOWLEDGEMENTS

This work was funded by National Human Genome Research Institute grant RO1-HG006460.

Footnotes

COMPETING FINANCIAL INTERESTS

References

- 1.Crawford JM, Aspinali MG. Personalized Medicine. 2012;9:265–286. doi: 10.2217/pme.12.23. [DOI] [PubMed] [Google Scholar]

- 2.Gingsburg GS. JAMA. 2013;309:1463–1464. doi: 10.1001/jama.2013.1465. [DOI] [PubMed] [Google Scholar]

- 3.Katsanis S, Katsanis N. Nature Review Genetics. 2013;14:415–426. doi: 10.1038/nrg3493. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 4.Yang Y, et al. New England Journal of Medicine. 2013;369:1502–1511. doi: 10.1056/NEJMoa1306555. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Jacob HJ. New England Journal of Medicine. 2013;369:1557–1558. doi: 10.1056/NEJMe1310846. [DOI] [PubMed] [Google Scholar]

- 6.Walcoff SD, Pfeifer JD. Personalized Medicine. 2012;9:295–308. doi: 10.2217/pme.12.13. [DOI] [PubMed] [Google Scholar]

- 7.Collins FS, Hamburg MA. First FDA authorization of next-generation sequencer. New England Journal of Medicine. 2013;369:2369–2371. doi: 10.1056/NEJMp1314561. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8.U.S. Food and Drug Administration 2014 available at http://www.fda.gov/downloads/MedicalDevices/ProductsandMedicalProcedures/InVitroDiagnostics/UCM407409.pdf.

- 9.BlueCross BlueShield of North Carolina, Corporate Medical Policy, Whole Exome Sequencing (2013).

- 10.Association for Molecular Pathology et al. v. Myriad Genetics, Inc.; 2013. 133 S. Ct. 2107. [Google Scholar]

- 11.Evans B. Genetics in Medicine. 2014 [Google Scholar]

- 12.Moorthie S, Hall A, Wright CF. Genetics in Medicine. 2013;15:165–171. doi: 10.1038/gim.2012.116. [DOI] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.