Abstract

Background

Given the growing legalization of recreational marijuana use and related increase in its prevalence in the United States, it is important to understand marijuana's appeal. We used a behavioral economic (BE) approach to examine whether the reinforcing properties of marijuana, including “demand” for marijuana, varied as a function of its perceived quality.

Methods

Using an innovative, Web-based marijuana purchase task (MPT), a sample of 683 young-adult recreational marijuana users made hypothetical purchases of marijuana across three qualities (low, mid and high grade) at nine escalating prices per joint, ranging from $0/free to $20.

Results

We used nonlinear mixed effects modeling to conduct demand curve analyses, which produced separate demand indices (e.g., Pmax, elasticity) for each grade of marijuana. Consistent with previous research, as the price of marijuana increased, marijuana users reduced their purchasing. Demand also was sensitive to quality, with users willing to pay more for higher quality/grade marijuana. In regression analyses, demand indices accounted for significant variance in typical marijuana use.

Conclusions

This study illustrates the value of applying BE theory to young adult marijuana use. It extends past research by examining how perceived quality affects demand for marijuana and provides support for the validity of a Web-based MPT to examine the appeal of marijuana. Our results have implications for policies to regulate marijuana use, including taxation based on the quality of different marijuana products.

Keywords: Marijuana, Behavioral economics, Purchase task, Demand curve, Reinforcement, Young adults

1. INTRODUCTION

In the U.S., marijuana is the most commonly used illicit drug, particularly among young adults. Large-scale national survey data suggest marijuana use peaks at ages 18 to 25 and rates of marijuana use among young adults have steadily increased over time (Johnston et al., 2014). Daily use of marijuana, which increases risk of dependence by 25%-50% (Hall and Pacula, 2003), is at its highest rate (5.9%) among college students since 1980 (Johnston et al., 2014). Thus, young adults are an important population of focus for marijuana research.

Over the past decade, momentum toward legalization of recreational marijuana in the U.S. has increased. At this writing (November 15, 2016), eight states (AK, CA, CO, MA, ME, NV, OR, WA) and DC have legalized recreational use of marijuana, and 28 states and DC permit medical use to varying degrees. Although controversy exists, some research indicates greater access to marijuana may lead to more use among those who may otherwise have lessened or discontinued use, such as young adults, thereby increasing risk for negative consequences, including dependence (Volkow et al., 2014).

Behavioral economic (BE) approaches posit that substance use is a behavior of choice and addictive substances are powerful reinforcers (Bickel et al., 1998, 2014). Simulated purchase tasks provide a well-controlled way to assess demand for or perceived value of substances, including marijuana. In such tasks, participants are allowed to “purchase” a substance as its price increases (e.g., Murphy and MacKillop, 2006; Yurasek et al., 2013). Results of these tasks generate demand curves, or the plot of amount purchased by price (Pearce, 1992). Purchase tasks provide several indices of demand: intensity of demand (level of purchase at the lowest price), Omax (peak expenditure), Pmax (price at Omax or point on curve where commodity moves from inelastic to elastic, breakpoint (first price at which purchasing is zero/suppressed) and elasticity of demand (price sensitivity or change in consumption as a function of change in price; Bickel et al., 2000).

To date, two studies have used purchase tasks to assess demand for marijuana (Aston et al., 2015; Collins et al. 2014). Collins et al. (2014) innovated use of a marijuana purchase task (MPT) in which young adult frequent marijuana users were asked how many average-sized joints of “high grade” marijuana they would purchase across a wide range of escalating prices ($0/joint to $160/joint). The sample was sensitive to the price of “high grade” marijuana (i.e., marijuana purchasing decreased as a function of price). In Aston et al.’s (2015) MPT, adult frequent marijuana users were asked how much “average quality” marijuana they would purchase across 22 escalating prices ($0 to $10/hit). Despite differences in sample demographics (e.g., age, ethnicity) and methods (e.g., price range, time frame, joints vs. hits, marijuana quality, statistical), both studies revealed significant associations between demand indices and marijuana use, supporting the construct validity of the MPT.

Perceived drug quality is usually defined as potency/strength and purity. For marijuana, quality may reflect presence/absence of seeds and stems, moistness, aroma, or “pressed” appearance (Sifaneck et al., 2007). Ethnographic research has revealed users will pay more for high quality marijuana, which they view as more potent (Sifanek et al., 2007). Only two studies (Cole at al., 2008; Goudie et al., 2007) have examined how perceived quality affects BE demand for marijuana. In both studies, polysubstance users were asked to purchase alcohol and illicit drugs, including marijuana. The researchers varied drug quality; Goudie and colleagues also varied participants’ disposable income for purchases. In the Goudie et al. study, there was no main effect of marijuana quality on purchasing. The purchase of poor and average quality marijuana was unaffected by disposable income; however, participants with more income purchased more good quality marijuana. Cole et al. found that marijuana users were price sensitive and quality affected purchasing, with more purchasing of good quality marijuana.

Given the dearth of research, the present study was designed to investigate the effects of perceived quality of marijuana on demand for marijuana as exemplified by purchasing behavior. Based on the law of demand and prior research (Aston et al., 2015; Collins et al., 2014), we predicted as the price of marijuana increased, purchasing would decrease. We also hypothesized perceived quality of marijuana would influence demand and demand would be greater for high grade (HG) vs. low grade (LG) or mid grade (MG) marijuana. Since marijuana use peaks during young adulthood, we focused on young adults. This study also is the first to use a Web-based MPT, a novel method enabling data collection from a large and varied sample, making it more representative, efficient, and cost-effective than traditional “in-person” methods. Thus, another aim was to determine the validity of a Web-based MPT, as indicated by the association between demand curve indices and typical marijuana use.

2. METHODS

2.1 Participants

Using a Web-based format, we administered the MPT to all interested members of a prominent nonprofit marijuana lobbying group. Of the 3,951 sent an e-mail invitation, 2,531 (64%) completed the study. Participants were assured anonymity and confidentiality. They provided informed consent prior to participation and had the opportunity to enter a raffle to win a $100 retail gift card. The University at Albany, SUNY Institutional Review Board approved the study.

The sample was restricted to young-adult (i.e., age 18-25) recreational marijuana users. Medical users and current non-users were excluded. We also omitted participants reporting >24 joints at any price point based on our judgment that users would be unable to smoke more than 6 joints/hour over an evening of about 4 hours. Indeed, most reported <10 joints in the MPT. Based on these criteria, the sample was reduced to 683 participants. The sample consisted of 683 young adult (M = 21.2 years, SD = 2.2) recreational marijuana users. They were mostly male (84%) and European-American (88%), with highest level of education some high school/high school diploma (19%), some college (56%), Associate’s (6%), Bachelor’s (16%), or advanced degree (3%).

2.2 Design and Procedure

2.2.1. Web-based simulated marijuana purchase task

In this within-subject design, each participant completed the MPT three times: for LG, MG, and HG marijuana, in that order. Due to attrition during the task, sample sizes were 683, 665, and 608 for LG, MG, and HG, respectively. Examples for each grade of marijuana were provided, including schwag (LG), schwan, mid, 50 (MG), and kindbud (HG).

Because the demand curve analysis of Collins et al. (2014) indicated demand for HG marijuana became elastic at less than $15 per joint (Pmax = 12.38), we used a narrower range of prices in this experiment, with a maximum price of $20/joint. Participants reported their use of marijuana for nine marijuana prices, ranging from $0 (free) to $20/joint. They were asked to imagine they had some free time one evening and [could] hang out at home and smoke marijuana. They also were told they could not save the joints for a later day and the marijuana would be smoked only by them and not shared. An average-sized joint was defined as approximately ½ gram, 5 bong hits, or 10 puffs. Participants were asked, How many averagesized joints of [LG/MG/HG marijuana] would you use if they were $––––? Price per joint was Free ($0), $2.50, $5.00, $7.50, $10, $12.50, $15, $17.50, and $20.

2.2.2. Demographics and Typical Marijuana Use

Prior to the MPT, participants answered demographic and background questions, including top three preferred smoking methods, frequency of use, and real-world purchasing behavior. Typical marijuana use was self-reported grams of marijuana/week in the past 3 months.

2.3. Data Analyses

To examine the “orderliness” of purchase task data, researchers have developed algorithms to identify nonsystematic demand data (e.g., Bruner and Johnson, 2014; Stein et al., 2015). We applied Stein et al.’s three quantitative criteria for identifying nonsystematic data: (1) trend (generally, consumption decreases as price increases), (2) bounce (no or few price increments involve a consumption increase), and (3) reversals from zero (consumption ceases at a certain price, then resumes at a higher price). All data met bounce and reversal criteria. Low percentages of data did not meet the trend criterion [12.6% LG (95% CI: 0.10-0.15); 4.8% MG (95% CI: 0.03-0.07); 6.3% HG (95% CI: 0.04-0.09)], with significantly more LG than MG or HG data failing to meet this criterion. Moreover, trend violations that involved no purchasing at any price were significantly lower for HG (5%; 95% CI: 0.01-0.18) compared with MG (78%; 95% CI: 0.60-0.91) or LG (94%; 95% CI: 0.87-0.98). Given its overall orderliness, we retained all participant data.

Conventional methods for analyzing BE demand curve data use linear models with log-transformed data (e.g., Murphy and MacKillop, 2006) or nonlinear models fit for each individual (e.g., Madden et al., 2007). To overcome methodological limitations, new approaches have emerged, including nonlinear mixed effects modeling (Yu et al., 2014), a modification of the Hursh et al.’s (1988) model. We analyzed the MPT data with nonlinear mixed effects modeling using the statistical software R [nlme package (Pinheiro and Bates, 2000]. Advantages of this approach are described elsewhere (Yu et al., 2014). Demand curve analysis generates simple average (i.e., observed) and derived values for intensity, Pmax and Omax. We report both values, where applicable. Simple average values reflect the sample mean of participants’ responses to the MPT; derived values are based on a fitted model (Murphy and MacKillop, 2006). Since derived values are more reliable and less sensitive to outliers, we based our interpretation more on derived values.

To examine the construct validity of the MPT for LG, MG, and HG marijuana, we explored the association between the demand curve indices and marijuana use. To generate the individual-level estimates of demand curve indices necessary for this analysis, we used the overparameterized model (i.e., individual model fitting; Pinheiro and Bates, 2000), which involved nonlinear modeling without log transformations. All demand indices and the marijuana use variable (grams/week) were screened for missing data, outliers (∣z∣ > 3.29), and normality. Based on examination of z-scores, small numbers of univariate outliers (1%-6%) were identified and recoded to one unit higher or lower than the next non-outlying value to reduce their impact (Tabachnick and Fidell, 2007). Following outlier treatment, distributions were screened for normality. Demand curve indices were positively skewed, which is common (e.g., MacKillop et al., 2010); therefore, some indices were square-root or log-transformed prior to analyses. Elasticity was transformed by taking the absolute value, common log-transforming, then multiplying by −1 to retain the variable’s original direction (MacKillop et al., 2010). Following outlier treatment, marijuana use was square-root transformed to improve its distribution. We conducted Pearson’s product-moment correlations and hierarchical regressions to explore the relationships between the demand indices and marijuana use.

3. RESULTS

3.1. Marijuana Use and Real-World Purchasing Behavior

Participants began using marijuana around age 16 (M = 16.1, SD = 2.2; range: 8-23 years). Nearly all (95%) reported past month and 84% reported past week use of marijuana. Participants used marijuana frequently (M = 22.7 days/month, SD = 9.7; M = 5.2 days/week, SD = 2.2); 60% described themselves as regular or heavy smokers who used an average of 4.7 grams/week (SD = 3.7). Participants used a variety of methods, but their primary method was: bong (35%), smokeless vaporizer (22%), bowl (17%), joints (10%), blunts (10%), edibles (4%), or “spliffs” (marijuana and tobacco cigarettes; 2%).

Participants’ real world purchasing behavior reflected their use patterns. Over half (58%) purchased marijuana at least once/week, and most (83%) purchased >1/8 oz. Over half (60%) reported typically spending >$50 on a single marijuana purchase (range = $5 - $1300 USD). Nearly all reported being somewhat (25%) or very (68%) reliably able to find and purchase marijuana.

3.2. Web-Based Marijuana Purchase Task Demand Curves and Demand Indices by Marijuana Quality

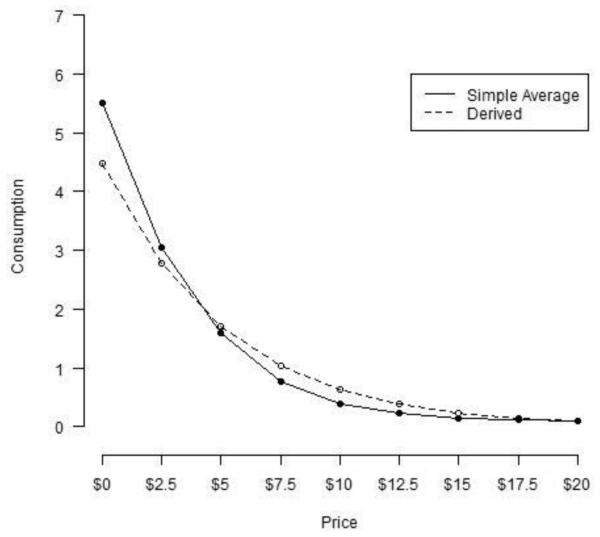

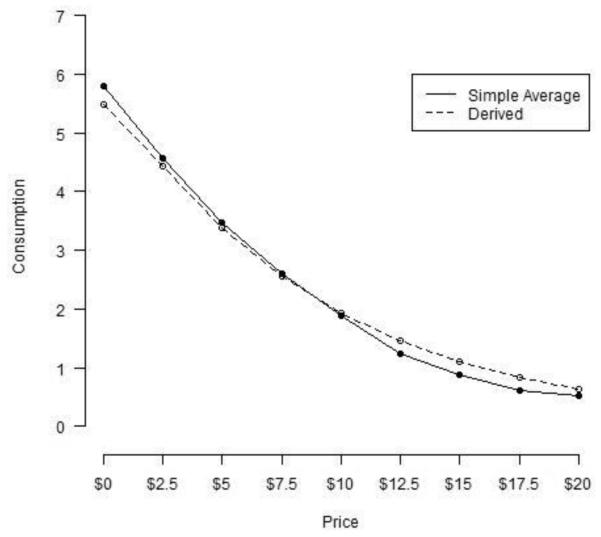

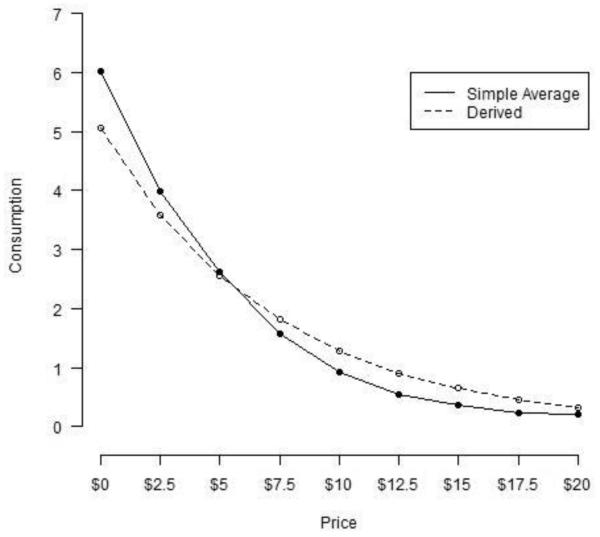

Figures 1 through 3 illustrate the marijuana consumption/demand curves generated by the Web-based MPT for LG, MG, and HG marijuana, respectively, in raw units, based on the nonlinear mixed effects model. The graphs show the number of marijuana joints (y-axis) participants would smoke one evening as a function of the price/joint (x-axis). Participants reported marijuana purchasing across 9 escalating prices, ranging from $0 (free) to $20 per joint. Data for each marijuana grade revealed negatively sloping curves, indicating regardless of marijuana quality, marijuana purchasing decreased as its price increased. However, the slopes and corresponding demand indices (see Table 1) varied by marijuana quality. As expected, price at peak expenditure (Pmax) for marijuana showed a systematic linear increase as quality improved. Intensity values (derived) were progressively higher as grade improved, suggesting if marijuana were free, purchasing would still vary by quality. Breakpoints also were progressively higher as grade improved, suggesting participants would spend more for higher quality marijuana. Notably, 35% and 16% of the sample had no breakpoints for HG and MG, respectively, suggesting even at the highest price ($20/joint), a substantial percentage of participants continued to purchase. For LG, 19% of the sample had no breakpoint (primarily due to no purchasing at any price) and the graph showed a steeper decline in purchasing following the price at which expenditure was maximized (Pmax; see Figure 1). Use of nonlinear mixed effects modeling does not provide individual-level data for demand indices, precluding statistical tests of the within-subject differences among marijuana grades for each demand metric. However, as shown in Table 1, the 95% confidence intervals for the demand indices by grade did not overlap for breakpoint, Omax observed and derived, Pmax observed and derived, intensity derived (MG vs. HG only) and elasticity, indicating the means significantly differed by grade/perceived quality. To directly test differences in demand indices by grade, separate oneway repeated measures (RM) ANOVAs were conducted using the individual-level demand curve data from the overparameterized model. For each demand index, there was a significant effect of marijuana grade. Three Bonferroni-adjusted pairwise comparisons were conducted to make post hoc comparisons among grades for each demand metric. All post hoc comparisons indicated significant differences by marijuana grade for each demand index (all ps <0.034). Thus, the overall pattern for the demand indices by grade indicated the reinforcing value of marijuana increased as its quality improved. Figure 4 illustrates the expenditure curves for the purchase of marijuana joints by marijuana grade, with average expenditure and price per joint in actual units.

Fig. 1.

Simple average (observed) and derived demand curves for low grade marijuana. For ease of interpretation, values are presented in raw units, with the x-axis showing price per joint ($) and the y-axis representing number of joints.

Fig. 3.

Simple average (observed) and derived demand curves for high grade marijuana. For ease of interpretation, values are presented in raw units, with the x-axis showing price per joint ($) and the y-axis representing number of joints.

Table 1.

Marijuana demand indices for low grade, mid grade, and high grade marijuana.

| Demand Indices |

Estimates (SE) [95% CI] |

||

|---|---|---|---|

|

Low grade marijuana (N = 683) |

Mid grade marijuana (N = 665) |

High grade marijuana (N = 608) |

|

| Breakpoint | 7.17 (.17) [6.84, 7.50] |

9.86 (.18) [9.51, 10.21] |

13.10 (.18) [12.75, 13.45] |

| Intensity of demand – observed |

5.51 (.19) [5.14, 5.88] |

6.02 (.19) [5.65, 6.39] |

5.80 (.20) [5.41, 6.19] |

| Intensity of demand - - derived |

4.56 (.18) [4.21, 4.91] |

5.06 (.18) [4.71, 5.41] |

5.85 (.19) [5.48, 6.22] |

| Omax – observed | 11.24 (.52) [10.22, 12.26] |

18.46 (.92) [16.66, 20.26] |

27.55 (1.10) [25.39, 29.71] |

| Omax – derived | 8.53 (.32) [7.90, 9.16] |

13.57 (.47) [12.65, 14.49] |

19.49 (.63) [18.26, 20.72] |

| Pmax – observed | 3.94 (.16) [3.63, 4.25] |

5.98 (.18) [5.63, 6.33] |

9.34 (.21) [8.93, 9.75] |

| Pmax – derived | 5.08 (.06) [4.96, 5.20] |

7.28 (.11) [7.06, 7.50] |

8.99 (.12) [8.75, 9.23] |

| Elasticity of demand | −1.97 (.03) [−1.91, −2.03] |

−1.37 (.02) [−1.33, −1.41] |

−1.11 (.02) [−1.07, −1.15] |

CI = confidence interval; SE = standard error. 95% CI was calculated as estimate ± 1.96 × SE.

Fig. 4.

Expenditure curves for purchase of marijuana joints by grade of marijuana (HG = high grade; MG = mid grade; LG = low grade). For ease of interpretation, values are presented in raw units, with the x-axis showing price per joint ($) and the y-axis representing average expenditure in dollars ($).

We computed R2 [1 - (SSreg/SStot)] to correspond with the common R2 interpretation in linear models (i.e., proportion of variability explained by the model). To evaluate model fit, we compared the sum of squares of residuals for the fitted model (SSfull) vs. the intercept only model (SSreduced). For LG and MG, we found a 72% reduction in SSfull vs. SSreduced; for HG, an 82% reduction was found. In all cases, the likelihood ratio test p value < 0.0001 indicated significant model improvement.

3.3. Associations between Demand Indices and Marijuana Use Variables

Correlations among the simple average (i.e., observed) demand indices and marijuana use for each grade are presented in Table 2. As found in previous studies, demand indices were mostly positively correlated. We also examined associations between demand indices and marijuana use (grams/week). For each grade, only intensity (purchasing at $0; r = 0.25 - 0.33, p < 0.001) and Omax (peak expenditure; r = 0.23 - 0.27, p ≤ 0.001) were related to typical weekly marijuana quantity.

Table 2.

Correlations among demand indices and marijuana use by marijuana grade.

| Marijuana grade |

Variable | 1 | 2 | 3 | 4 | 5 | 6 |

|---|---|---|---|---|---|---|---|

| Low Mid High |

1. Breakpoint | -- | -- | -- | -- | -- | -- |

| 2. Intensity of demand (observed) |

.09† .08† .07 |

-- | -- | -- | -- | -- | |

| 3. Omax (observed) | .65*** .59*** .48*** |

.46*** .45*** .55*** |

-- | -- | -- | -- | |

| 4. Pmax (observed) | .75*** .71*** .58*** |

−.17 −.23*** −.43*** |

.54*** .43*** .17** |

-- | -- | -- | |

| 5. Elasticity of demand | .37*** .69*** .60*** |

.03 −.13** −.36*** |

.06 .38*** .18*** |

.07 .66*** .69*** |

-- | -- | |

| 6. Grams/week of marijuana | .01 −.03 .01 |

.30*** .33*** .25*** |

.23*** .27*** .25*** |

−.05 −.07 −.05 |

−.05 −.07 .06 |

-- |

Simple average (i.e., observed) values for Intensity of demand, Omax, and Pmax from the overparameterized model were used. For low grade marijuana, Omax was square-root transformed and Pmax was common log-transformed. For mid grade marijuana, Omax was square-root transformed. For high grade marijuana, Omax was square-root transformed and Intensity of demand was common log-transformed. For each grade of marijuana, the absolute value of Elasticity of demand was common log-transformed, then the result was multiplied by −1 to retain the variable’s original direction. Due to skew, grams per week of marijuana was square-root transformed. All significance tests are two-tailed.

p < .10.

p < .05.

p < .01.

p < .001.

Next, we conducted separate hierarchical regression analyses for each marijuana grade to examine whether the demand indices were associated with the dependent variable of typical marijuana use (grams/week), after controlling for demographic variables. Demographic variables were entered simultaneously in Step 1 and the five demand indices were entered simultaneously in Step 2. In these analyses, we used only simple average (i.e., observed), not derived values, of demand indices (cf., MacKillop and Murphy, 2007). As shown in Table 3, each step accounted for significant portions of the variance in typical marijuana use. Participant sex was unrelated to marijuana use; however, older participants, European Americans, those with less education, and those who began smoking at a younger age used more marijuana than their counterparts.

Table 3.

Prediction of marijuana use by demand Indices for low, mid, and high grade marijuana from a marijuana purchase task.

| Grams/week of marijuana | ||||||

|---|---|---|---|---|---|---|

| Low grade marijuana |

Mid grade marijuana |

High grade marijuana |

||||

| Predictor | Δ R2 | ß | Δ R2 | ß | Δ R2 | ß |

| Step 1: Demographic Variables |

.06*** |

.05*** |

.05** |

|||

| Sexa | −.03 | .01 | .01 | |||

| Age (years) | .15** | .15** | .13* | |||

| Ethnicityb | .11* | .10* | .13* | |||

| Level of educationc | −.15** | −.16** | .08 | |||

| Age at first use of marijuana (years) |

−.10* | −.09† | −.14** | |||

| Step 2: Demand Indices | .11*** | .14*** | .11*** | |||

| Breakpoint | −.08 | −.20** | −.24** | |||

| Intensity of demand | .19** | .19*** | .26** | |||

| Omax | .24** | .31*** | .18* | |||

| Pmax | −.07 | −.01 | .01 | |||

| Elasticity of demand | −.04 | −.03 | .25*** | |||

| Adjusted R2 | .14 | .18 | .14 | |||

Notes. Simple average (i.e., observed) values for Intensity of demand, Omax, and Pmax from the overparameterized model were used in analyses. Regression coefficients represent results from each step prior to entry of subsequent step. For low grade marijuana, Omax was square-root transformed and Pmax was common log-transformed. For mid grade marijuana, Omax was square-root transformed. For high grade marijuana, Omax was square-root transformed and Intensity of demand was common log-transformed. For each grade of marijuana, the absolute value of Elasticity of demand was common log-transformed, then the result was multiplied by −1 to retain the variable’s original direction. All significance tests are two-tailed.

Sex was coded 1 = male, 0 = female.

Ethnicity was coded 1 = European American, 0 = non-European American/minority.

Level of education was coded 1 = some high school, 2 = finished high school, 3 = Associate’s degree, 4 = some college, 5 = Bachelor’s degree, 6 = some graduate training, and 7 =advanced degree.

p < .10.

p < .05.

p < .01.

p < .001.

For LG, more marijuana use was related to higher intensity, or more purchasing when marijuana was $0/free, and higher maximum expenditures (Omax). Other demand indices were unrelated to marijuana use. Likewise for MG, higher intensity and Omax values were associated with greater marijuana use. Surprisingly, breakpoint was negatively related to marijuana use for MG, suggesting heavier users were willing to pay less per joint. Demand indices for HG were most consistently related to marijuana use. Along with the associations already described for MG, those who used more marijuana showed less price sensitivity (elasticity) to HG. Entire equations accounted for 14%-18% of the variance in marijuana use.

4. DISCUSSION

Using a novel Web-based MPT, we found regardless of marijuana quality, users were sensitive to price changes such that as the price increased, marijuana purchasing decreased. Graphs of marijuana use as a function of price (in raw units) showed decelerating curves typically found when analyzing hypothetical purchase data for substances (e.g., Bickel et al., 2000), including marijuana (Aston et al., 2015; Collins et al., 2014).

Pacula and Lundberg (2014) stress the importance of studying regular or heavy users when examining demand for marijuana. Using such a sample, we demonstrated demand was influenced by marijuana quality, with both the shape of the demand curves and corresponding indices varying predictably as a function of quality. Overall, results suggested the perceived value of marijuana increased as its quality improved. For example, maximum expenditures (Pmax) for marijuana showed a systematic linear increase as the grade of marijuana improved from low to high. For each demand metric, RM ANOVAs and post hoc comparisons confirmed significant differences by grade. Indeed, all demand indices showed predictable variation by grade of marijuana. Even our analyses of nonsystematic data were consistent with greater demand for HG vs. MG or LG. For example, significantly fewer (5%) trend violations for HG involved no purchasing at any price, compared with MG (78%) and LG (94%). Our results also were consistent with those of Cole and colleagues (2008) who demonstrated users were price sensitive and purchasing for good quality marijuana was higher than for poor or average quality marijuana.

For each marijuana grade, demand indices were related to marijuana use, above and beyond the effects of relevant covariates. Thus, the present study provides support for the construct validity of the MPT, as well as its validity for each grade of marijuana. The negative relation between breakpoint and marijuana use is counterintuitive and inconsistent with the results for the other indices. In previous purchase task studies, breakpoint has been either unrelated or positively related to substance use (e.g., Collins et al., 2014; Murphy and MacKillop, 2006; Murphy et al., 2011). Like other demand indices, breakpoint reflects price sensitivity, so it is unclear why participants who use more marijuana would be willing to pay less per joint. Perhaps heavier users are more knowledgeable about the price of marijuana and thus unwilling to pay as much for better quality marijuana than would lighter users. Interestingly, the most consistent pattern between demand indices and marijuana use was found for HG marijuana, reflecting the sensitivity of the MPT to drug price and quality.

Both Collins et al. (2014) and the present study involved young adults and the hypothetical purchasing of HG marijuana. Demand indices in the present study were consistently lower than those in our prior work, likely due to differences in the samples (marijuana advocates vs. college/community) or methods (Web vs. not; $0 to $20/joint vs. $0 to $160/joint). In the present study, after controlling for demographic variables, elasticity for LG and MG marijuana were unrelated to use; however, the positive association between elasticity for HG marijuana and use indicated participants who used more marijuana found HG marijuana more reinforcing. Since BE theory suggests those who use more marijuana should demonstrate less price sensitivity, these results make sense conceptually.

An examination of how marijuana demand changes as a function of price and quality has policy implications for regulating marijuana, particularly in places where recreational marijuana use is legal (Collins et al., 2016). Our research, and that of others, suggests if marijuana were legalized for recreational use and the price fell, use would increase. By extension, the long-term effects of lower prices could lead to greater numbers of dependent users (Becker et al., 1991). It is worth noting that along with price and quality, other factors such as legal risk and perceived harm influence demand for marijuana (Pacula and Lundberg, 2014). Our findings also highlight the value of conceptualizing LG, MG, and HG marijuana as “a different good” (Olmstead et al., 2015, p. 64), because price sensitivity and other aspects of demand were affected by perceived quality. Policy responses to drug abuse and problems often aim to increase the price of the drug (cf. Olmstead et al., 2015). Our study suggests pricing and tax policies should target grades of marijuana differently in order to offset greater demand for high quality marijuana among users.

To our knowledge, the present study is novel in its use of a Web-based purchase task, an efficient and cost-effective method of recruiting large samples. Our sample of 600+ participants was much larger than samples typically reported for in-person purchasing experiments, which have been constrained by laboratory methods. Our study suggests the promise of a Web-based approach for conducting simulated purchase studies. A focus on demand for marijuana among young adults is important given the rapidly changing policy climate in the U.S. Since marijuana use peaks during young adulthood, young adults may be more vulnerable than other age groups to the effects of liberalization of marijuana laws. Increased access to marijuana may escalate use among those who may otherwise have lessened or discontinued use, thereby increasing their risk for negative consequences, including dependence (Volkow et al., 2014).

Despite its strengths, the present study has limitations. First, although we demonstrated unique associations between demand and marijuana use, as with all purchasing studies, the results of our hypothetical purchase task may not reflect real world behavior. Even so, our findings are consistent with prior research on hypothetical demand for marijuana (Aston et al., 2015; Cole et al., 2008; Collins et al., 2014), and other substances (e.g., Murphy and MacKillop, 2006). Moreover, our participants likely had direct experience with marijuana of varying quality. Second, future research should strive for more demographically diverse samples. Given the nature of our sample, our findings may not generalize to the broader population of young adult marijuana users. Although we used a national sample, we did not collect data on state of residence, so could not examine whether demand varied based on state policy/legal access to marijuana. Third, order of presentation of marijuana quality was not counterbalanced, so participants’ hypothetical purchasing of lower quality marijuana may have influenced their purchasing of higher quality marijuana, prompting consistent responding. Since we used sequential presentation of price, participants’ responses to lower prices may have served as reference points, influencing their responses to higher prices. Amlung and MacKillop (2012) compared results for random vs. sequential presentation of prices in an alcohol purchase task and found that while random presentation reduced response consistency, responses were generally consistent regardless of presentation method. Another methodological limitation concerns how best to quantify amount of marijuana purchased/used. We asked participants to make purchases of “average-sized joints” of marijuana, defined as about ½ gram. Aston and colleagues (2015) have argued that number of hits may be the optimal unit for MPTs. However, users typically purchase marijuana in grams or ounces. Future research should explore weight as a unit of purchase. For methodological reasons, participants were instructed that any marijuana purchased would be smoked only by them and not shared; however, these instructions are inconsistent with the highly social nature of young adult marijuana use (e.g., Bonn-Miller and Zvolensky, 2009) and may have affected demand for marijuana. Collins et al. (2014) demonstrated that marijuana demand indices were more strongly related to real-time than retrospective data on marijuana use. The present data were limited to retrospective reports of typical marijuana use, which may have impacted the results. Nevertheless, the current study provides further empirical support for the application of BE principles to examine demand for marijuana. Responses from 600+ young adult users to a Web-based MPT demonstrated sensitivity to the price of marijuana, with decreased purchasing as price increased. Marijuana quality affected demand, with demand increasing as quality increased; users were willing to pay more for better quality marijuana. Given its changing legal status, our findings have important implications for pricing, taxation and other policies for regulating marijuana use. Differential quality-based policies could lessen demand for marijuana, and ultimately, use.

Fig. 2.

Simple average (observed) and derived demand curves for mid grade marijuana. For ease of interpretation, values are presented in raw units, with the x-axis showing price per joint ($) and the y-axis representing number of joints.

Highlights.

Used Web-based purchase task to examine demand for marijuana in young adult users.

Marijuana users were sensitive to both price and quality of marijuana.

Demand indices (e.g., Omax) accounted for significant variance in typical use.

Taxation and other policies to regulate use should incorporate marijuana quality.

Acknowledgement

The authors wish to thank the research participants. We also thank the anonymous reviewers for their insightful feedback and contributions to improving the manuscript.

Role of funding source

This research was supported in part by National Institute on Drug Abuse grants R01 DA027606 and R34 DA035358 awarded to R. Lorraine Collins. The funding source had no role in the study design, analysis or interpretation of the data, manuscript preparation, or the decision to submit the manuscript for publication.

Footnotes

Contributors

Drs. Collins, Vincent, Earleywine, and De Leo helped design the Web-based experiment. Drs. Earleywine and De Leo collected the data. Ms. Liu, Drs. Yu and Vincent conducted the statistical analyses. Dr. Vincent wrote the first draft of the manuscript and Dr. Collins provided a comprehensive editing of the manuscript. All authors have reviewed drafts of the manuscript and approved the final version.

Conflict of interest

The authors declare that they have no financial conflict of interest. Dr. Earleywine works for organizations devoted to altering marijuana policy.

Publisher's Disclaimer: This is a PDF file of an unedited manuscript that has been accepted for publication. As a service to our customers we are providing this early version of the manuscript. The manuscript will undergo copyediting, typesetting, and review of the resulting proof before it is published in its final citable form. Please note that during the production process errors may be discovered which could affect the content, and all legal disclaimers that apply to the journal pertain.

REFERENCES

- Amlung M, MacKillop J. Consistency of self-reported alcohol consumption on randomized and sequential alcohol purchase tasks. Front. Psychiatr. 2012;3:1–6. doi: 10.3389/fpsyt.2012.00065. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Aston ER, Metrik J, MacKillop J. Further validation of a marijuana purchase task. Drug Alcohol Depend. 2015;152:32–38. doi: 10.1016/j.drugalcdep.2015.04.025. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Becker GS, Grossman M, Murphy KM. Rational addiction and the effect of price on consumption. Am. Econ. Rev. 1991;81:237–241. [Google Scholar]

- Bickel WK, Johnson MW, Koffarnus MN, MacKillop J, Murphy JG. The behavioral economics of substance use disorders: reinforcement pathologies and their repair. Annu. Rev. Clin. Psychol. 2014;10:641. doi: 10.1146/annurev-clinpsy-032813-153724. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Bickel WK, Madden GJ, Petry NM. The price of change: the behavioral economics of drug consumption. Behav. Ther. 1998;29:545–565. [Google Scholar]

- Bickel WK, Marsch LA, Carroll ME. Deconstructing relative reinforcing efficacy and situating the measures of pharmacological reinforcement with behavioral economics: a theoretical proposal. Psychopharmacol. (Berl.) 2000;153:44–56. doi: 10.1007/s002130000589. [DOI] [PubMed] [Google Scholar]

- Bonn-Miller MO, Zvolensky MJ. An evaluation of the nature of marijuana use and its motives among young adult active users. Am. J. Addict. 2009;18:409–416. doi: 10.3109/10550490903077705. [DOI] [PubMed] [Google Scholar]

- Bruner NR, Johnson MW. Demand curves for hypothetical cocaine in cocaine-dependent individuals. Psychopharmacol. (Berl.) 2009;231:889–897. doi: 10.1007/s00213-013-3312-5. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Cole JC, Goudie AJ, Field M, Loverseed A, Charlton S, Sumnall HR. The effects of perceived quality on the behavioural economics of alcohol, amphetamine, cannabis, cocaine, and ecstasy purchases. Drug Alcohol Depend. 2008;94:183–190. doi: 10.1016/j.drugalcdep.2007.11.014. [DOI] [PubMed] [Google Scholar]

- Collins RL, Vincent PC, Earleywine M, Liu L, Yu J, De Leo JA. The Effects Of Perceived Quality On Demand For Marijuana: Policy Implications Of A Web-Based Behavioral Economic Experiment With Young-Adult Marijuana Users. Presented March, 2016 at Marijuana and Cannabinoids: A Neuroscience Research Summit; Bethesda, MD. 2016. [Google Scholar]

- Collins RL, Vincent PC, Yu J, Liu L, Epstein LH. A behavioral economic approach to assessing demand for marijuana. Exp. Clin. Psychopharmacol. 2014;22:211–221. doi: 10.1037/a0035318. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Goudie AJ, Sumnall HR, Field M, Clayton H, Cole JC. The effects of price and perceived quality on the behavioural economics of alcohol, amphetamine, cannabis, cocaine, and ecstasy purchases. Drug Alcohol Depend. 2007;89:107–115. doi: 10.1016/j.drugalcdep.2006.11.021. [DOI] [PubMed] [Google Scholar]

- Hall W, Pacula RL. Cannabis Use And Dependence: Public Health And Public Policy. Cambridge University Press; 2003. [Google Scholar]

- Hursh SR, Raslear TG, Shurtleff D, Bauman R, Simmons L. A cost-benefit analysis of demand for food. J. Exp. Anal. Behav. 1988;50:419–40. doi: 10.1901/jeab.1988.50-419. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Johnston LD, O'Malley PM, Bachman JG, Schulenberg JE. Volume II: College Students And Adults Ages 19-50. Institute For Social Research; Ann Arbor, MI: 2014. Monitoring The Future: National Survey Results On Drug Use, 1975-2010. [Google Scholar]

- MacKillop J, Miranda R, Monti PM, Ray LA, Murphy JG, Rohsenow DJ, McGeary JE, Swift RM. Alcohol demand, delayed reward discounting, and craving in relation to drinking and alcohol use disorders. J. Abnorm. Psychol. 2010;119:106–114. doi: 10.1037/a0017513. [DOI] [PMC free article] [PubMed] [Google Scholar]

- MacKillop J, Murphy JG. A behavioral economic measure of demand for alcohol predicts brief intervention outcomes. Drug Alcohol Depend. 2007;89:227–233. doi: 10.1016/j.drugalcdep.2007.01.002. [DOI] [PubMed] [Google Scholar]

- Madden GJ, Smethells JR, Ewan EE, Hursh SR. Tests of behavioral-economic assessments of relative reinforcer efficacy: economic substitutes. J. Exp. Anal. Behav. 2007;87:219–240. doi: 10.1901/jeab.2007.80-06. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Murphy JG, MacKillop J. Relative reinforcing efficacy of alcohol among college student drinkers. Exp. Clin. Psychopharmacol. 2006;14:219–227. doi: 10.1037/1064-1297.14.2.219. [DOI] [PubMed] [Google Scholar]

- Murphy JG, MacKillop J, Tidey JW, Brazil LA, Colby SM. Validity of a demand curve measure of nicotine reinforcement with adolescent smokers. Drug Alcohol Depend. 2011;113:207–214. doi: 10.1016/j.drugalcdep.2010.08.004. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Olmstead TA, Alessi SM, Kline B, Pacula RL, Petry NM. The price elasticity of demand for heroin: matched longitudinal and experimental evidence. J. Health Econ. 2015;41:59–71. doi: 10.1016/j.jhealeco.2015.01.008. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Pacula RL, Lundberg R. Why changes in price matter when thinking about marijuana policy: a review of the literature on the elasticity of demand. Public Health Rev. 2014;35:1–18. doi: 10.1007/BF03391701. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Pearce DW. The MIT Dictionary Of Modern Economics. fourth edition MIT Press; Cambridge, MA: 1992. [Google Scholar]

- Pinheiro JC, Bates DM. Mixed-Effects Models In S And S-PLUS. Springer; New York: 2000. [Google Scholar]

- Sifaneck SJ, Ream GL, Johnson BD, Dunlap E. Retail marijuana purchases in designer and commercial markets in New York City: sales units, weights, and prices per gram. Drug Alcohol Depend. 2007;90:S40–S51. doi: 10.1016/j.drugalcdep.2006.09.013. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Stein JS, Koffarnus MN, Snider SE, Quisenberry AJ, Bickel WK. Identification and management of nonsystematic purchase task data: toward best practice. Exp. Clin. Psychopharmacol. 2015;23:377–386. doi: 10.1037/pha0000020. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Tabachnick BG, Fidell LS. Using Multivariate Statistics. Fifth Edition Allyn and Bacon; Boston, MA: 2007. [Google Scholar]

- Volkow ND, Baler RD, Compton WM, Weiss SR. Adverse health effects of marijuana use. N. Engl. J. Med. 2014;370:2219–2227. doi: 10.1056/NEJMra1402309. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Yu J, Liu L, Collins RL, Vincent PC, Epstein LH. Analytical problems and suggestions in the analysis of behavioral economic demand curves. Mult. Behav. Res. 2014;49:178–192. doi: 10.1080/00273171.2013.862491. [DOI] [PubMed] [Google Scholar]

- Yurasek AM, Murphy JG, Dennhardt A, Skidmore JR, Buscemi J, McCausland C, Martens MP. Drinking motives mediate the relationship between reinforcing efficacy and alcohol consumption and problems. J. Stud. Alcohol Drug. 2011;72:991–999. doi: 10.15288/jsad.2011.72.991. [DOI] [PubMed] [Google Scholar]