Significance

A large part of all primary materials extracted globally accumulates in stocks of manufactured capital, including in buildings, infrastructure, machinery, and equipment. These in-use stocks of materials provide important services for society and the economy and drive long-term demand for materials and energy. Configuration and quantity of stocks determine future waste flows and recycling potential and are key to closing material loops and reducing waste and emissions in a circular economy. A better understanding of in-use material stocks and their dynamics is essential for sustainable development. We present a comprehensive estimate of global in-use material stocks and of related material flows, including a full assessment of uncertainties for the 20th century as we analyze changes in stock-flow relations.

Keywords: material flow accounting, socioeconomic metabolism, circular economy, carbon emission intensity, manufactured capital

Abstract

Human-made material stocks accumulating in buildings, infrastructure, and machinery play a crucial but underappreciated role in shaping the use of material and energy resources. Building, maintaining, and in particular operating in-use stocks of materials require raw materials and energy. Material stocks create long-term path-dependencies because of their longevity. Fostering a transition toward environmentally sustainable patterns of resource use requires a more complete understanding of stock-flow relations. Here we show that about half of all materials extracted globally by humans each year are used to build up or renew in-use stocks of materials. Based on a dynamic stock-flow model, we analyze stocks, inflows, and outflows of all materials and their relation to economic growth, energy use, and CO2 emissions from 1900 to 2010. Over this period, global material stocks increased 23-fold, reaching 792 Pg (±5%) in 2010. Despite efforts to improve recycling rates, continuous stock growth precludes closing material loops; recycling still only contributes 12% of inflows to stocks. Stocks are likely to continue to grow, driven by large infrastructure and building requirements in emerging economies. A convergence of material stocks at the level of industrial countries would lead to a fourfold increase in global stocks, and CO2 emissions exceeding climate change goals. Reducing expected future increases of material and energy demand and greenhouse gas emissions will require decoupling of services from the stocks and flows of materials through, for example, more intensive utilization of existing stocks, longer service lifetimes, and more efficient design.

The growing extraction of natural resources, and the waste and emissions resulting from their use, are directly or indirectly responsible for humanity approaching or even surpassing critical planetary boundaries (1). Both decoupling of resource use from economic development and absolute reductions in the use of certain materials and energy sources are imperative for sustainable development (2). The demand for materials and energy is to a large extent driven by constructing, maintaining, and operating in-use stocks of materials (hereafter “material stocks”), or what economists call manufactured capital (buildings, infrastructure, artifacts). These stocks transform material and energy flows into services, such as shelter or mobility (3, 4). The significance of long-lived stocks of infrastructure and buildings for determining and potentially reducing future material and energy use and greenhouse gas emissions is increasingly recognized (5, 6). This study investigates the dynamics of global stocks and flows of materials by using and expanding a material flow accounting (MFA) approach. MFA is used in industrial ecology to study the biophysical domain of society, comprising in-use stocks and the processes and flows that maintain and operate these stocks, from the extraction of primary materials to the disposal of waste and emissions (7, 8). MFA research has shown that during the 20th century global material consumption grew by an order of magnitude. It was estimated to range between 70 and 76 Pg/yr in 2010 (2, 9, 10). Primary materials are used for two main purposes (11). Currently around half of all materials extracted are used dissipatively and provide energy in a broad sense (Fig. 1A). This includes fossil energy carriers used for thermal energy conversion and also biomass, which are both used as fuel and constitute the primary energy source (and building-blocks) for the biological metabolism of humans and livestock. These materials are converted to carbon emissions and other waste and pollution soon after extraction. The other half of global resource extraction is used to build up more or less long-lived material stocks. This is the case for metals and nonmetallic minerals, and a minor fraction of biomass (e.g., timber) and fossil fuels used in in the chemical industry (e.g., for asphalt and plastics). These durable materials are extracted, processed, and used to construct and maintain buildings, transport and communication infrastructure, machinery, and consumer goods. The materials accumulate in socioeconomic systems and remain in use from several years up to decades and sometimes centuries.

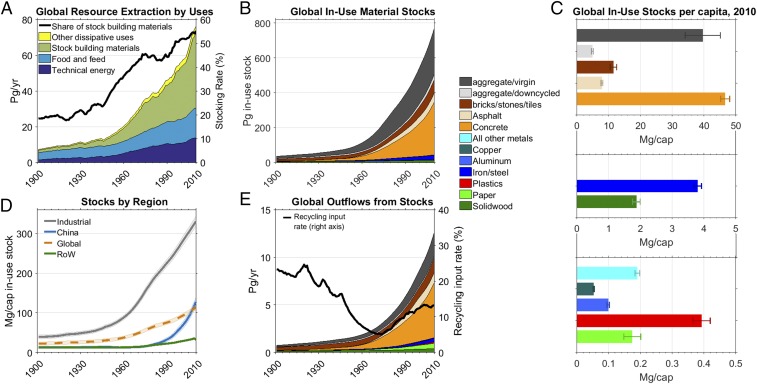

Fig. 1.

Development of global material stocks and flows from 1900 to 2010. (A) Annual global extraction of materials by use and share of stock-building materials in total extraction (right axis). (B) Development of global in-use stocks of materials by 12 main material groups. (C) Global material stocks in 2010 including uncertainty ranges (note that the scales in C differ by a factor of 10). (D) Development of total stock per capita in the group of industrial countries, China, and the rest of the world (RoW). (E) Global end-of-life outputs from discarded stocks and recycling input rate (i.e., share of recycled and down-cycled end-of-life outputs from stocks in total inputs to stocks). Note that B, C, and E share the same legend.

These stocks are the material basis of wealth (3, 8). They provide services, such as shelter, mobility, and communication, and constitute the physical infrastructure for production and consumption (3, 4). Material stocks link basic services to flows of materials and energy and hence are a main determinant of material flows (4, 8). Large amounts of materials and energy are required in industry and construction to build, maintain, and refurbish stocks. Once they are in place, stocks require energy to provide services. Energy is needed to heat and light buildings, to operate railways and fuel cars, to run machinery, and power information and communication technologies. However, stocks not only affect demand for material and energy inputs, they also codetermine the amount of solid waste produced and the availability of materials for recycling in terms of quantity, quality, and time. Stock-flow dynamics and their role in shaping patterns of material and energy flows are thus key to understanding and changing resource flows and closing material loops. Circularity of resource flows in economic activities, contributing to improved resource efficiency and underpinning human well-being at much lower resource requirements, is at the core of sustainable resource-use strategies and policies instituted in Japan, China, and the European Union (12–14). Although current policy mechanisms mainly focus on products and specific industries, the importance of long-lived in-use stocks and the dynamics of material use in terms of their accumulation, maintenance, and use has not yet been adequately included in policy (11, 15, 16). Achieving absolute decoupling of resource use and emissions from economic development and a transition to sustainable resource use requires systemic knowledge about the interactions of in-use stocks and resource use at different spatial and temporal scales (4, 8, 17).

In recent years, scientific and policy interest in stocks has been growing, but studies conducted so far have been confined to specific elements, such as metals and other narrowly defined (groups of) substances or products (18–23). Comprehensive MFA-based analyses of the long-term development of material stocks accumulated in built infrastructure and durable goods, their composition and relation to demand for primary materials, and waste production are still rare (24–26) and have never been attempted at the global scale. Here we present a global estimate of the development and composition of total economy-wide material stocks, end-of-life wastes, and recycling flows by material types during the 20th century. Our estimates are fully consistent with the system boundaries and principles of economy-wide MFA (7). We expand the MFA approach by combining it with a mass-balanced top-down stock/flow model (SI Appendix, Fig. S1). By systematically linking all major stocks and flows of materials, we provide an important step toward a comprehensive understanding and modeling of the long-term dynamics of the global sociometabolic system (8, 27). We quantify the mass of all materials stored in buildings, infrastructure, and durable goods, distinguishing 11 types of stock-building materials from 1900 to 2010 (Dataset S1). We use Monte Carlo simulation to propagate errors for all parameters throughout the modeling. Uncertainties of results are shown as ±3 SD or 99.7% over 103 Monte Carlo simulations (SI Appendix). This research quantifies the development of stocks and also flow indicators, including material inputs to stocks and net additions to stocks, waste output, and recycled materials. We analyze stocks, inflows, and outflows and their relation to economic growth, energy use, and CO2 emissions, and discuss implications for future growth of stocks and emissions. We focus on global results, but for aggregate stocks also show results for industrial countries, China (a major driver of global resource use over the past two decades), and the rest of the world (SI Appendix, Table S3).

Results

Global Stock Growth in the 20th Century.

From 1900 to 2010, global material extraction grew 10-fold from 7 Pg/yr (1 Pg = 1015g = 1 Gt) to 78 Pg/yr in 2010 (SI Appendix). Separating dissipative uses from materials used to build up stocks, we find that the share of stock-building materials in total extraction rose from 18 to 55% (Fig. 1A). Deducting processing losses (e.g., tailings from metal production or CO2 from burning limestone), we calculate the actual amount of primary material inputs used to build up or renew in-use stocks of buildings, infrastructure, machinery, and durable goods. Primary inputs to stocks increased from 1 Pg/yr in 1900 to 36 Pg/yr in 2010. In the latter year, the largest of these primary material inflows (79% or 28.6 Pg/yr) was sand and gravel used in concrete and asphalt or in foundations and base course layers. Metals are often used in combination with construction minerals, for example in reinforced concrete. Primary materials amounted to 1.2 Pg/yr, more than biomass in the form of timber and paper as well as fossil fuels used as feedstock for plastics and bitumen, which amounted to 0.9 Pg/yr and 0.3 Pg/yr, respectively. A total of 4.8 Pg/yr of re- or down-cycled secondary materials added to the inflow of primary materials. The growth in the inflow of stock-building materials reflects a century of urbanization and industrialization in Europe, the United States, and other high-income countries. Buildings, transport and communication networks, supply and discharge systems, vehicle fleets, and industrial machinery were established, which constitute the material basis of modern society. In all world regions, in particular in the industrial countries, manufactured capital expanded greatly (3). Fig. 1B shows that material stocks grew from 35 Pg (± 18%) to 792 Pg (± 5%): that is, at an average annual growth rate of 2.9% between 1900 and 2010. Growth was fastest in the three decades after World War II at 4.0% per annum. This was the period of postwar economic boom. Large investment went into the reconstruction of war damage in Europe and Japan, and fast economic growth and urbanization in the industrial world were accompanied by the rapid expansion of material stocks. Nevertheless, most global stocks are comparatively young, which is because of the continuously high level of yearly inputs to stocks in the industrial world and more recent acceleration of stock growth in emerging economies. Globally, almost two-thirds of all materials used to build and renew material stocks between 1900 and 2010 were added to stocks since 1980. As a result, 82% of all in-use stocks are aged 30 y or younger (SI Appendix, Fig. S9).

Over the whole period, global material stocks grew 23-fold. They grew at a similar pace to global gross domestic product (GDP), which increased by a factor of 27, but much faster than global annual material extraction (factor of 10). Population only quadrupled and average per capita stocks surged from 22 Mg/cap (± 18%) in 1900 to 115 Mg/cap (± 5%) in 2010 (1 Mg = 106g = 1 t) (Fig. 1D). The differences are large between high-income industrial countries and the developing world. Average material stocks in industrial countries amounted to 335 Mg/cap (± 4%) in 2010, a value commensurate with the range of per capita stock estimates reported in the literature for specific industrial countries (25, 28). China has been catching up rapidly since the 1990s. Between 1990 and 2010 it increased its per capita stocks from 35 Mg/cap to 136 Mg/cap (± 8%): that is, to the level the industrial countries reached in the early 1970s. Average per capita stocks in the rest of the world are slowly on the rise as well but had reached only 38 Mg/cap (± 2%) in 2010, barely above the global average in 1900. Large growth in material stocks is expected for the second wave of urbanization in Asia, Africa, and Latin America (29). The composition of material stocks has also changed. Sand and gravel constitute a large but declining share of total stocks throughout the 20th century, from 47% in 1900 to 38% in 2010. In 1900 bricks and wood were dominant materials (44%), whereas in 2010 concrete, asphalt, and metals made up 50% of the total stock. The mass of metal accumulated in built structures and machinery increased from 0.6 to 4.1 Mg/cap, whereas biomass declined from 2.6 to 2.0 Mg/cap (Fig. 1C). Overall 25.6 Pg of iron, 0.7 Pg of copper, 0.4 Pg of aluminum, and 13.8 Pg of biomass were stored in in-use material stocks in 2010, of which two-thirds were located in industrial countries.

We compared our results with available estimates from studies that have quantified stocks of substances or single materials, including steel (23), aluminum (21), copper (30), carbon in timber and plastics (20), and concrete (6). As shown in SI Appendix, Figs. S5–S8, we find good agreement between levels and trends of material stocks despite considerable differences in the methods applied to estimate these stocks, corroborating the results from our comprehensive but less-detailed modeling approach. The uncertainty analysis reveals that despite uncertainty ranges of up to ±15–60% (3 SDs) for annual material inputs and recycling rates and ±15–30% for mean lifetimes, global stock uncertainty in 2010 was moderate at ±5%, but ranged from 6–15% for the 11 materials (Fig. 1C). This result shows that in our modeling approach, stochastic issues with specific data points are a relatively minor source of overall variation. Because of the tendency toward the mean (central limit theorem) in the resulting normal distributions, long lifetimes and detailed cohorts for each material smooth out large inflow variations. To check for systematic errors in the factor lifetime distributions, we also conducted a sensitivity analysis. We tested for –30% and +30% as well as +50% on the mean “best guess” lifetimes, yielding stock estimates −10% lower and +6% and +9% higher, respectively, than the mean estimate of 792 Pg in 2010. This finding suggests that lifetimes can have a substantial and nonlinear effect on overall uncertainty, but the error is still fairly small. Furthermore, we tested the influence of large-scale destructive events, such as World War II, and found little long-term impact on overall stock development. Economists have estimated that in World War II the value of destroyed physical capital ranged from 5 to 15% in European countries and from 25 to 30% in Japan and the Union of Soviet Socialist Republics (31). The assumption that 15% of existing physical stock of manufactured capital in the industrial group was destroyed by the end of the war results in a large waste flow (5 Pg). However, the impact on stock development remains small and in 2010 stocks in the industrial region were only 0.3% lower than without World War II stock destruction.

Waste, Recycling, and Closing the Loops.

Although the 20th century was a period of material accumulation, aging buildings, infrastructure, and durable products increasingly reached the end of their lifetimes and were discarded, resulting in growing end-of-life waste from stocks. We find that outflows from stocks increased from 0.8 Pg/yr in 1900 to 14.5 Pg/yr (± 7%) in 2010, half of which was concrete (Fig. 1E). The share of biomass was 7%; metals amounted to 5% and plastics to 1%. Not all outflows turned into waste, but a considerable fraction of the materials from discarded stocks was recycled into secondary material inputs, up from 0.3 Pg/yr in 1900 to 4.8 Pg/yr (± 25%) in 2010. The majority of the recycling flow comprises nonmetallic minerals (88% in 2010), which are mainly down-cycled as base materials for backfilling during new construction. Metals, biomass, and plastics together account for 12% of total end-of-life recycling. Because global stocks are growing, the contribution of recycling to closing material loops remained lower than the promising potential suggested by end-of-life recycling rates. For nonmetallic minerals we estimate that 37% of all end-of-life outflows from stocks are recycled, but because of the larger inputs into stocks this yields a recycling input rate (the share of recycled or down-cycled materials in the total inflow of primary and secondary materials into stocks) of only 11% (Fig. 1E). Metal recycling is relatively advanced and industry has taken significant steps in terms of scrap reuse and recycling (32). We find that 77% of end-of-life outputs of metals are recycled, but the share of secondary materials in total metal inputs to stock is only 27%. For biomass materials, the end-of-life recycling rate and the recycling input rate are similar at around 20%. We assume that with the onset of mass production and consumption, increasing abundance of primary raw materials and falling resource prices end-of-life recycling initially declined, until the rise of environmentalism in the 1970s drove recycling rates upward again (33, 34). Over time, aggregate recycling rates therefore follow a U-shaped trend. End-of-life recycling declined from 36% in 1900 to a trough in the 1970s of around 18% and then improved again, reaching 33% in 2010. We find that the aggregate recycling input rate (Fig. 1E) followed a similar trajectory, declining from 23% in 1900 to only 5% in 1970. Because of more and more stocks becoming obsolete, and increasingly effective recycling regulations and capacity in many countries, the recycling input rate recovered to 12% in 2010. However, as material stocks are growing and inputs to stocks exceed end-of-life outflows by a factor of 4, primary materials remain the main material input for building up and refurbishing in-use stocks, even if recycling rates are improving and more secondary resources become available.

Our model also yields estimates of global solid waste production from discarded stocks, an area for which data are notoriously poor. A recent study estimated the global waste flow, largely based on municipal waste statistics, to amount to 2.1 Pg/yr (35). This excludes organic waste, which is not covered in our study. We arrive at a much larger solid waste flow of 9.7 Pg/yr (± 14%) for 2010. The difference occurs because the estimate by Hoornweg et al. (35) only comprises a small fraction of the large mass flows of construction and demolition waste. Additionally, a considerable portion of our waste estimate may also be “hibernating” stocks (36). These involve abandoned infrastructure or buildings that are left in place and therefore do not appear in waste statistics. Overall, our calculations show that between 1900 and 2010 a total of 293 Pg of discarded stocks turned into solid waste, including 11 Pg of metals. These materials have been deposited in controlled or uncontrolled landfills or remain in place as unused structures, potentially polluting the environment, but they also constitute anthropogenic resource deposits for potential recovery in the future. Waste formation from stocks will continue to increase. The size and age distribution of global stocks (SI Appendix, Fig. S9) indicates that large material stocks currently in use may reach the end of their service lifetimes in coming decades. Assuming unchanged lifetime distributions, we estimate that by 2030 35% of the material stock in use in 2010 will be discarded, yielding 274 Pg of end-of-life outflows, about the same amount that accrued in the previous 110 y. These materials may become secondary resources and contribute to closing material loops, or they have to be disposed of. To ensure material outflows can be recycled and turned into valuable resources, it is vital to have better knowledge about where and when which types of material outflows from stocks become available (28).

Stock Productivity and Decoupling.

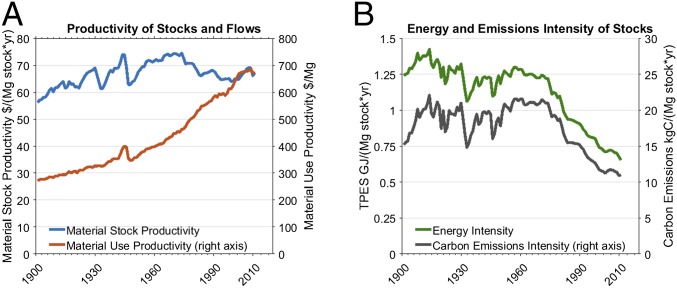

Previous studies (9, 37) of global material flows found a long-term trend of relative decoupling of global material use from economic development during the 20th century, where economic output grew faster than annual material consumption. This resulted in a considerable and continuous improvement in material use productivity (Fig. 2A). Our results enable us to go beyond this observation, which ignores the role of material stocks as a production factor, to analyze economic activity trends per unit of physical capital. Our results show no significant long-term improvement in material stock productivity (Fig. 2A). The added value produced per unit of stocked material fluctuated between $56/Mg in 1900 to a peak of $75/Mg in the early 1970s. Since then, global stock productivity has been declining, reaching $67/Mg in 2010. This decline hints toward a tight coupling of economic development and the growth of material stocks of manufactured capital. Infrastructure and capital goods are prerequisites to production and economic growth which, in turn, triggers private investments into housing, vehicles, and consumer goods. The lack of continuous improvements in average global stock productivity suggests that economic development, in particular in emerging economies, is likely to be connected to further stock growth. This finding shows that the question of whether stock growth drives economic growth or economic growth drives stock growth (and under which conditions) is complex, and poses challenges for designing policies that aim to decouple economic growth from stock growth.

Fig. 2.

Development of global stocks in relation to GDP, energy use, and CO2 emissions 1900–2010. (A) Global stock productivity (GDP/material stock) and material use productivity (GDP/annual material consumption, right axis). (B) Energy and carbon emission intensity of material stocks. Total primary energy supply (TPES) and CO2 emissions from fossil fuel use per megagram of material stock. Material use (domestic material consumption) is in megagrams (9), GDP in constant international dollars of 1990 (45), CO2 emissions in kilograms of C (46), and TPES in gigajoules (9).

Energy and Emission Intensity of Material Stocks.

Practically all of the technical energy, and consequently also fossil fuel-related CO2 emissions, are tightly linked to material stocks in one way or another. Energy is required in mining, manufacturing, and construction, indeed in all processes involved in building up and renewing the built environment and artifacts (6). Once stocks are in use, even larger amounts of energy are needed to heat, cool, and light buildings, keep transport moving, and power electrical appliances, among many other uses. Comparing stock size with the long-term development of energy use and CO2 emissions from fossil fuel use, we observe moderate decoupling (Fig. 2B). Primary energy use per unit of stock has declined by 53% since World War I to 0.7 GJ × Mg−1 × yr−1. Decoupling accelerated in the 1970s and since then primary energy inputs per unit of stock have declined at 1.6% per annum. The trajectory we find for CO2 emissions from fossil fuel consumption resembles that of primary energy use (Fig. 2B). The aggregate CO2 emission intensity of stocks began to improve in the 1970s and has declined by 48% since then. In 2010 an average of 11 kg C were emitted per megagram of material stock. Aggregate emission intensity can be separated into the amount of CO2 emitted because of building and renewing material stocks and the amount of CO2 emitted for the provision of services from stocks. Data on sectoral energy use from the International Energy Agency (38) indicate that in 2010 one-quarter of available final energy was used to manufacture stocks (industrial energy use) and three-quarters to provide services from stock (energy use in, for example, households, transport, service sectors). Assuming that this relation also roughly holds for fossil fuel-related CO2 emissions and adding CO2 emissions from cement production, we calculate an emission intensity for building and renewing stocks of 62 kg C per megagram of material inputs to stock and an average emission intensity of providing services from stocks of 8 kg C per megagram of in-use stock per year. This finding demonstrates that despite considerable efficiency gains, stocks and stock growth are important determinants of energy use and CO2 emissions.

Future Stock Development and Its Impact on Flows.

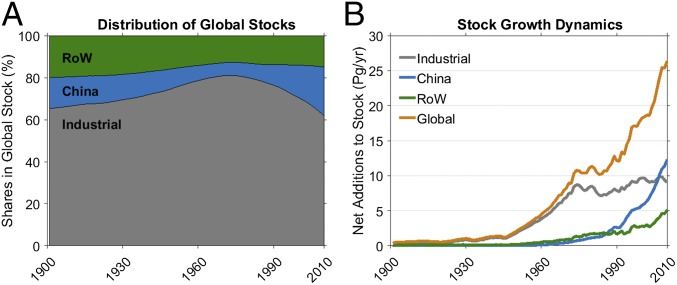

A major issue for sustainable development and for downsizing material and energy throughput is how the size of stocks will develop in the future. Chen and Graedel (3) have shown that the temporal evolution of a broad range of in-use stocks of manufactured capital in the United States follows a logistic function. Stocks rapidly accumulate and then saturate after a slow take-off and fast growth, often followed by another wave of capital accumulation of a new type of stock. A classic example is the expansion and saturation of transport networks, shifting from canals to railroads, roads, and airports. Such a trajectory has been projected for per capita in-use stocks of iron (23, 39, 40), as well as for aggregate material stocks in some countries (24, 25). Our global results show no sign of saturation yet; stocks continue to grow at high rates, including in wealthy and industrial countries where they have already reached a high level of 335 Mg/cap (± 4%) (Fig. 1D). However, in industrial countries inflows of stock-building materials have stabilized. In some countries they have even begun to decline in recent years (24, 25, 28). Our results indicate that net additions to stocks have ceased growing in the industrial group (Fig. 3B). If the decline in net additions to stock observed in the last years continues, this may eventually result in a saturation of stocks in the industrial world in coming decades (24, 26). This would increase the potential for closed loops and absolute reductions in primary material extraction.

Fig. 3.

Dynamics of stocks and flows in the industrial countries, China, and the rest of the world (RoW). (A) Distribution of global stocks across country groups. (B) Annual net additions to stock.

At the global scale, a stabilization of material stocks, and hence of primary material requirements to build up new stocks, still seems distant if past trends continue. Industrial countries currently possess about two-thirds of all material in-use stocks, and China is rapidly catching up. Since 1990 China’s share of global stocks has more than doubled from 10 to 22%, and its net additions to stock have surpassed those of the industrial countries (Fig. 3). Per capita stocks, however, are still only 41% of the level of industrial countries (Fig. 1B). The rest of the world was inhabited by 62% of the global population in 2010, but owned only 18% of global stocks. The average per capita stock is just 11% of the industrial level. If industrial countries and their level of stocks serve as a benchmark for other regions, this may put huge pressure on material and energy demand and contribute large additional CO2 emissions in coming decades (6). A simple scenario calculation (SI Appendix) illustrates this claim. Assuming a global convergence of per capita material stocks at the industrial level by 2050 and a world population of 9.7 billion implies a fourfold increase in global material stocks to 3,137 Pg. This number would require more than a doubling of global annual net additions to stock to 59 Pg/yr, up from 26 Pg/yr in 2010 (SI Appendix, Table S5). We further assume that historic trends of improvements in emission intensity will continue and lead to a reduction in the emission intensity of building and renewing stocks and of stock use by 52% by 2050 (SI Appendix). A fourfold increase in global stocks would then still result in cumulative carbon emissions of 542 Pg C between 2010 and 2050 (SI Appendix, Fig. S4B). Of these emissions, 72% result from providing services from stocks; the remainder is from building up (18%) and renewing stocks (10%). This amount exceeds the remaining emission budget to stay within 2 °C with a 50% or higher chance, which ranges from 234 to 417 Pg C (41). Even in the highly unlikely case that full decarbonization of the energy system could be achieved by 2050, cumulative C emissions would still amount to 303 Pg C. This finding underlines that a convergence of material stocks at the high level of industrial countries is not compatible with the global climate change mitigation target agreed in Paris in 2015.

This scenario calls for rigorous decoupling of in-use stocks from material and energy throughput and service provision (4). Making services from material stocks more energy efficient and increasing the reuse and recycling of discarded stocks is one strategy. However, stock decoupling also requires a reduction, or at least stabilization, in the size of material stocks without reducing the services provided by stocks. More intensive use of stocks, extensions of service lifetimes, material substitutions, and light weighting can contribute to this goal (4, 42). Such decoupling of stocks from services and wealth would have a large impact on the global socioeconomic metabolism. Let us assume that the level of quantitative stock development the industrial world had achieved by the 1970s, after two decades of postwar growth and massive increases in wealth and quality of life, is sufficient to provide wealth. Taking into account technological improvement and efficiency gains this amount of material stock should provide more and better services today than in 1970. Global convergence at the 1970 level of industrial per capita stock of 132 Mg/cap by 2050 would result in a comparatively moderate expansion of global stocks by 61% to 1,274 Pg and a reduction in net additions to stock from 26 Pg/yr currently to an average of just 12 Pg/yr (SI Appendix, Table S5). It would, however, also imply a considerable reduction in the mass of material stocks in the industrial world: that is, a shrinking of infrastructure and buildings, with the side effect of making large amounts of material available for recycling. Such a contraction and convergence scenario would induce cumulative carbon emissions of 302 Pg C if historic improvements in emissions intensities were to continue and 188 Pg C if full decarbonization could be achieved by 2050 (SI Appendix, Fig. S4B). In contrast to the catch-up scenario outlined above, such a contraction and convergence pathway could be compatible with 2 °C climate goals and contribute to dematerialization.

Conclusions

The 20th century has often been characterized by the emergence of a throwaway society (43). Paradoxically, it would be better described as a century of massive stockpiling. A considerable proportion of all primary materials used globally has accumulated in growing material stocks in the built environment in cities and rural areas. These link flows of materials and energy to the provision of services used by the economy and by households. In-use stock of materials has now reached 792 Pg (± 5%) and is growing in unison with GDP. Saturation, or significant decoupling of stock growth from economic development, is not in sight. Rather, growth is likely to continue, as differences in stock size between industrial and emerging economies are large, and development needs in the global South and climate change mitigation and adaptation will require revamping existing spatial structures and developing new infrastructures and settlements (6, 29, 41, 44). A global convergence to the current level of in-use stocks in industrial countries, however, would drive a massive increase in material and energy demand and greenhouse gas emissions, and undermine sustainable development and climate goals.

The sociometabolic macroperspective on stock-flow relations we provide here shows that the global economy is still far from steady state or a circular economy (11). This would essentially require a stabilization of material stocks (and a shrinking in some regions) to reduce yearly throughput. However, as long as inputs to stocks are growing and inflows to stocks are a multiple of outflows, significant improvements in closing material loops cannot be achieved, even if end-of-life recycling rates were to improve drastically. Current research and political strategies concerned with circular economy focus on closing loops at the industry or product level (14). Our results underpin the need to take the dynamics of stocks of buildings and infrastructure into account. This is where a large and still growing part of all extracted materials accumulate and after retirement eventually become available as secondary resources. With their long service lifetimes, stocks shape the dynamics of technological change and contribute to lock-in and path-dependency with respect to material-, energy-, and carbon-intensive technologies and settlement patterns. The stocks constitute a long legacy in driving material and energy flows and corresponding wastes and emissions. Our research indicates that decoupling global resource use from economic development, as called for in a recent United Nations Environment Program report (2), foremost requires decoupling of services from stocks and stocks from flows. This can be achieved through, for example, more intensive use of existing stocks, longer service lifetimes, and more efficient design. To reach a steady state of the physical economy, material stocks clearly deserve more attention in socioeconomic metabolism and sustainability research. To develop strategies toward a circular economy and reductions of material and energy use, improved knowledge about stock-flow dynamics, the role of stocks in connecting human well-being and resource use, and the spatial patterns of stock distribution is required.

Materials and Methods

The Material Input Stock and Output model is a top-down, input-driven, and mass-balanced dynamic stock model (22, 25, 30). It covers material inputs, stock accumulation, end-of-life outflows, and recycling for the time period 1900–2010. Drawing on a comprehensive global MFA database (9, 10) and additional sources (SI Appendix), annual global material use of steel, aluminum, copper, an aggregate of other metals and industrial minerals, concrete, asphalt, bricks, primary and down-cycled aggregates, paper, solid-wood products, and plastics were estimated. The annual gross additions to stock of each material group were handled as explicit cohorts and tracked throughout the entire time period, similar to a population or vintage-stock model. We covered all in-use manufactured capital, such as buildings, infrastructure, machinery, and durable goods with a lifetime longer than 1 y. Normal distributed lifetime functions were used to estimate stock dynamics and annual end-of-life outputs from stocks. Based on an extensive literature review, model parameters for lifetimes and recycling rates for all material/stock types were compiled (SI Appendix). A detailed description of the model, the data used and assumptions, the uncertainty analysis and the calculated scenarios, as well as numerical results are provided in SI Appendix.

Supplementary Material

Acknowledgments

We thank Karin Hosking at Commonwealth Scientific and Industrial Research Organization for editing the manuscript. This work was supported by the Austrian Science Fund (FWF) (Project MISO P27590) and by the Environment Research and Technology Development Fund (Contract 1-1402) of the Ministry of the Environment, Japan.

Footnotes

The authors declare no conflict of interest.

This article is a PNAS Direct Submission.

This article contains supporting information online at www.pnas.org/lookup/suppl/doi:10.1073/pnas.1613773114/-/DCSupplemental.

References

- 1.Steffen W, et al. Sustainability. Planetary boundaries: Guiding human development on a changing planet. Science. 2015;347(6223):1259855. doi: 10.1126/science.1259855. [DOI] [PubMed] [Google Scholar]

- 2.UNEP . Global Material Flows and Resource Productivity. Assessment Report for the UNEP International Resource Panel. United Nations Environment Programme; Paris: 2016. [Google Scholar]

- 3.Chen W-Q, Graedel TE. In-use product stocks link manufactured capital to natural capital. Proc Natl Acad Sci USA. 2015;112(20):6265–6270. doi: 10.1073/pnas.1406866112. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 4.Pauliuk S, Müller DB. The role of in-use stocks in the social metabolism and in climate change mitigation. Glob Environ Change. 2014;24:132–142. [Google Scholar]

- 5.Liu G, Bangs CE, Müller DB. Stock dynamics and emission pathways of the global aluminium cycle. Nat Clim Chang. 2012;3(4):338–342. [Google Scholar]

- 6.Müller DB, et al. Carbon emissions of infrastructure development. Environ Sci Technol. 2013;47(20):11739–11746. doi: 10.1021/es402618m. [DOI] [PubMed] [Google Scholar]

- 7.Fischer-Kowalski M, et al. Methodology and indicators of economy-wide material flow accounting: State of the art and reliability across sources. J Ind Ecol. 2011;15(6):855–876. [Google Scholar]

- 8.Weisz H, Suh S, Graedel TE. Industrial ecology: The role of manufactured capital in sustainability. Proc Natl Acad Sci USA. 2015;112(20):6260–6264. doi: 10.1073/pnas.1506532112. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 9.Krausmann F, et al. Growth in global materials use, GDP and population during the 20th century. Ecol Econ. 2009;68(10):2696–2705. [Google Scholar]

- 10.Schaffartzik A, et al. The global metabolic transition: Regional patterns and trends of global material flows, 1950-2010. Glob Environ Change. 2014;26:87–97. doi: 10.1016/j.gloenvcha.2014.03.013. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 11.Haas W, Krausmann F, Wiedenhofer D, Heinz M. How circular is the global economy? An assessment of material flows, waste production, and recycling in the European Union and the world in 2005. J Ind Ecol. 2015;19(5):765–777. [Google Scholar]

- 12.Mathews JA, Tan H. Circular economy: Lessons from China. Nature. 2016;531(7595):440–442. doi: 10.1038/531440a. [DOI] [PubMed] [Google Scholar]

- 13.Moriguchi Y. Recent developments in material cycle policies. J Ind Ecol. 2009;13(1):8–10. [Google Scholar]

- 14.Stahel WR. The circular economy. Nature. 2016;531(7595):435–438. doi: 10.1038/531435a. [DOI] [PubMed] [Google Scholar]

- 15.OECD . Material Resources, Productivity and the Environment. OECD; Paris: 2015. [Google Scholar]

- 16.Wiedenhofer D, Steinberger JK, Eisenmenger N, Haas W. Maintenance and expansion: Modeling material stocks and flows for residential buildings and transportation networks in the EU25. J Ind Ecol. 2015;19(4):538–551. doi: 10.1111/jiec.12216. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 17.O’Neill DW. What should be held steady in a steady-state economy?: Interpreting Daly’s definition at the national level. J Ind Ecol. 2015;19(4):552–563. [Google Scholar]

- 18.Chen W-Q, Graedel TE. Anthropogenic cycles of the elements: A critical review. Environ Sci Technol. 2012;46(16):8574–8586. doi: 10.1021/es3010333. [DOI] [PubMed] [Google Scholar]

- 19.Graedel TE, Cao J. Metal spectra as indicators of development. Proc Natl Acad Sci USA. 2010;107(49):20905–20910. doi: 10.1073/pnas.1011019107. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 20.Lauk C, Haberl H, Erb K-H, Gingrich S, Krausmann F. Global socioeconomic carbon stocks in long-lived products 1900–2008. Environ Res Lett. 2012;7(3):34023. [Google Scholar]

- 21.Liu G, Müller DB. Centennial evolution of aluminum in-use stocks on our aluminized planet. Environ Sci Technol. 2013;47(9):4882–4888. doi: 10.1021/es305108p. [DOI] [PubMed] [Google Scholar]

- 22.Müller E, Hilty LM, Widmer R, Schluep M, Faulstich M. Modeling metal stocks and flows: A review of dynamic material flow analysis methods. Environ Sci Technol. 2014;48(4):2102–2113. doi: 10.1021/es403506a. [DOI] [PubMed] [Google Scholar]

- 23.Pauliuk S, Wang T, Müller DB. Steel all over the world: Estimating in-use stocks of iron for 200 countries. Resour Conserv Recy. 2013;71:22–30. [Google Scholar]

- 24.Fishman T, Schandl H, Tanikawa H. Stochastic analysis and forecasts of the patterns of speed, acceleration, and levels of material stock accumulation in society. Environ Sci Technol. 2016;50(7):3729–3737. doi: 10.1021/acs.est.5b05790. [DOI] [PubMed] [Google Scholar]

- 25.Fishman T, Schandl H, Tanikawa H, Walker P, Krausmann F. Accounting for the material stock of nations. J Ind Ecol. 2014;18(3):407–420. doi: 10.1111/jiec.12114. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 26.Tanikawa H, Fishman T, Okuoka K, Sugimoto K. The weight of society over time and space: A comprehensive account of the construction material stock of Japan, 1945–2010. J Ind Ecol. 2015;19(5):778–791. [Google Scholar]

- 27.Pauliuk S, Hertwich EG. Socioeconomic metabolism as paradigm for studying the biophysical basis of human societies. Ecol Econ. 2015;119:83–93. [Google Scholar]

- 28.Schiller G, Müller F, Ortlepp R. Mapping the anthropogenic stock in Germany: Metabolic evidence for a circular economy. Resour Conserv Recy. 2016 doi: 10.1016/j.resconrec.2016.08.007. [DOI] [Google Scholar]

- 29.Seto KC, Güneralp B, Hutyra LR. Global forecasts of urban expansion to 2030 and direct impacts on biodiversity and carbon pools. Proc Natl Acad Sci USA. 2012;109(40):16083–16088. doi: 10.1073/pnas.1211658109. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 30.Glöser S, Soulier M, Tercero Espinoza LA. Dynamic analysis of global copper flows. Global stocks, postconsumer material flows, recycling indicators, and uncertainty evaluation. Environ Sci Technol. 2013;47(12):6564–6572. doi: 10.1021/es400069b. [DOI] [PubMed] [Google Scholar]

- 31.Harrison M. The Economics of World War II: Six Great Powers in International Comparison. Cambridge Univ Press; Cambridge, UK: 2000. [Google Scholar]

- 32.Graedel TE, et al. What do we know about metal recycling rates? J Ind Ecol. 2011;15(3):355–366. [Google Scholar]

- 33.Oldenziel R, Weber H. Introduction: Reconsidering recycling. Contemp Eur Hist. 2013;22(3):347–370. [Google Scholar]

- 34.Zimring CA. Cash for Your Trash: Scrap Recycling in America. Rutgers Univ Press; New Brunswick, NJ: 2009. [Google Scholar]

- 35.Hoornweg D, Bhada-Tata P, Kennedy C. Environment: Waste production must peak this century. Nature. 2013;502(7473):615–617. doi: 10.1038/502615a. [DOI] [PubMed] [Google Scholar]

- 36.Daigo I, Iwata K, Ohkata I, Goto Y. Macroscopic evidence for the hibernating behavior of materials Stock. Environ Sci Technol. 2015;49(14):8691–8696. doi: 10.1021/acs.est.5b01164. [DOI] [PubMed] [Google Scholar]

- 37.UNEP . Decoupling Natural Resource Use and Environmental Impacts from Economic Growth. United Nations Environmment Programme; Nairobi: 2011. [Google Scholar]

- 38.IEA . World Energy Statistics and Balances 2015. International Energy Agency; Paris: 2015. [Google Scholar]

- 39.Müller DB, Wang T, Duval B. Patterns of iron use in societal evolution. Environ Sci Technol. 2011;45(1):182–188. doi: 10.1021/es102273t. [DOI] [PubMed] [Google Scholar]

- 40.Müller DB, Wang T, Duval B, Graedel TE. Exploring the engine of anthropogenic iron cycles. Proc Natl Acad Sci USA. 2006;103(44):16111–16116. doi: 10.1073/pnas.0603375103. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 41.IPCC . In: Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. Edenhofer O, et al., editors. Cambridge Univ Press; Cambridge, UK: 2014. [Google Scholar]

- 42.Allwood JM, Cullen JM, Milford RL. Options for achieving a 50% cut in industrial carbon emissions by 2050. Environ Sci Technol. 2010;44(6):1888–1894. doi: 10.1021/es902909k. [DOI] [PubMed] [Google Scholar]

- 43.Strasser S. Waste and Want: A Social History of Trash. Holt; New York: 2000. [Google Scholar]

- 44.Hertwich EG, et al. Integrated life-cycle assessment of electricity-supply scenarios confirms global environmental benefit of low-carbon technologies. Proc Natl Acad Sci USA. 2015;112(20):6277–6282. doi: 10.1073/pnas.1312753111. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 45.Maddison A. 2013 The Maddison-Project, 2013 version. Available at: www.ggdc.net/maddison/maddison-project/home.htm. Accessed December 15, 2015.

- 46.Boden TA, Marland G, Andres RJ. Global, Regional, and National Fossil-Fuel CO2 Emissions. Carbon Dioxide Information Analysis Center, Oak Ridge National Laboratory, US Department of Energy; Oak Ridge, TN: 2016. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.