Abstract

The Medicare program insures >80% of patients with ESRD in the United States. An emphasis on reducing outpatient dialysis costs has motivated consolidation among dialysis providers, with two for-profit corporations now providing dialysis for >70% of patients. It is unknown whether industry consolidation has affected patients’ ability to choose among competing dialysis providers. We identified patients receiving in-center hemodialysis at the start of 2001 and 2011 from the national ESRD registry and ascertained dialysis facility ownership. For each hospital service area, we determined the maximum distance within which 90% of patients traveled to receive dialysis in 2001. We compared the numbers of competing dialysis providers within that same distance between 2001 and 2011. Additionally, we examined the Herfindahl–Hirschman Index, a metric of market concentration ranging from near zero (perfect competition) to one (monopoly) for each hospital service area. Between 2001 and 2011, the number of different uniquely owned competing providers decreased 8%. However, increased facility entry into markets to meet rising demand for care offset the effect of provider consolidation on the number of choices available to patients. The number of dialysis facilities in the United States increased by 54%, and patients experienced an average 10% increase in the number of competing proximate facilities from which they could choose to receive dialysis (P<0.001). Local markets were highly concentrated in both 2001 and 2011 (mean Herfindahl–Hirschman Index =0.46; SD=0.2 for both years), but overall market concentration did not materially change. In summary, a decade of consolidation in the United States dialysis industry did not (on average) limit patient choice or result in more concentrated local markets. However, because dialysis markets remained highly concentrated, it will be important to understand whether market competition affects prices paid by private insurers, access to dialysis care, quality of care, and associated health outcomes.

Keywords: dialysis, Economic Analysis, United States Renal Data System, patient choice, health policy, Choice Behavior, Humans, Insurance, Insurance Carriers, Kidney Failure, Chronic, Medicare, Outpatients, Ownership, peritoneal dialysis, Registries, renal dialysis, Renal Insufficiency, Chronic, United States

Introduction

The Medicare program provides health insurance for >80% of patients with ESRD receiving dialysis in the United States (1). Because the federal government is the primary payer for dialysis services, policies enacted by the Centers for Medicare and Medicaid Services (CMS) have a major influence on dialysis care. Between 1983 and 2011, Medicare reimbursement for the dialysis procedure remained virtually unchanged, leading to significant declines in reimbursement after adjusting for inflation (2). This created an emphasis on reducing costs of outpatient dialysis that likely contributed to more than a decade of national consolidation among dialysis providers, because large dialysis organizations (LDOs) have been able to deliver dialysis at a lower cost (owing in part to economies of scale) and negotiate favorable contracts with private insurers and suppliers (3–5). As a consequence of industry consolidation, two for-profit LDOs now provide dialysis for >70% of patients in the United States (6). Financial pressures associated with Medicare’s 2011 ESRD Prospective Payment System (PPS) and Quality Incentive Program (QIP) may promote additional consolidation in dialysis facility markets (7,8).

In other areas of health care, such as markets for physician services and hospital care, consolidation and decreased market competition have enabled providers to charge higher prices (9,10). In dialysis care, where prices for the majority of patients are fixed by Medicare, providers must find other ways to compete for patients. Consequently, rather than simply affecting the prices that facilities can charge private insurers, market competition in dialysis care may be more closely tied to the quality of care delivered or physician preferences (11–13).

Because most patients choose—or are assigned—to receive dialysis at facilities close to where they live (14), competition among dialysis providers occurs primarily at a local level. It is unknown whether national consolidation in the dialysis industry has translated into decreased market competition locally and fewer choices among competing providers available to individual patients. Growth in the number of dialysis facilities operating in the United States combined with targeted interventions by the Federal Trade Commission to prevent certain anticompetitive mergers and force divestitures (15–17) may have preserved local competition and patient choice. We used patient and dialysis facility data between 2001 and 2011 to examine whether industry consolidation reduced dialysis market competition at a local level and led to reductions in the number of competing dialysis providers from which patients could choose in the period before the 2011 PPS.

Materials and Methods

Data Sources and Collection

We selected all patients receiving in-center hemodialysis at the start of the year in 2-year intervals between 2001 and 2011 from the US Renal Data System database. Because of the many differences between home dialysis and in-center hemodialysis, we limited the scope of this analysis to markets for in-center hemodialysis. We linked patient zip codes to census–based Rural-Urban Commuting Area codes to determine population density (18) and the Dartmouth Atlas of Healthcare to identify the hospital service area (HSA) where patients lived and where dialysis facilities were located (19). We obtained detailed information on dialysis facility ownership from the CMS Dialysis Facility Compare. This resource includes 68 dialysis chains (organizations owning multiple facilities) in 2001 owning 2510 facilities and 90 dialysis chains in 2011 owning 4656 facilities. We excluded patients dialyzed at facilities affiliated with prisons, veterans affairs facilities, and military facilities, because patients receiving care at these facilities are less likely to have a choice in the facility where they receive dialysis.

Assessing the Effect of Consolidation on Individual Patient Choices

At the start of each calendar year, we identified the number of uniquely owned providers available for patients to choose to receive dialysis, where one uniquely owned provider could be an independently owned facility or a multifacility chain. Because facilities owned by the same organization are less likely to compete against one another, we assumed that all facilities owned by a single provider (or organization) represented one additional choice among competing providers. We estimated each patient’s location from the zip code centroids (which approximate the center point of a zip code) where they resided and identified dialysis facility locations at each point in time from their reported street addresses. In instances where we could not identify a facility location from the reported street address, we estimated its location from zip code centroids. We determined the distances between each patient’s residence, his or her dialysis facility, and all nearby dialysis facilities. When patients and dialysis facilities shared the same zip code, we assumed that the distance was zero. We tested our model’s sensitivity to this assumption.

Patients living in different places may have different preferences and ability to travel a given distance for dialysis. For example, in a major metropolitan area, where transportation is cumbersome, patients may prefer to receive dialysis at facilities very close to home. In contrast, in a more rural area, patients may be more likely to have access to a car and more willing to travel farther to dialysis. To allow for geographic differences in patients’ willingness (or ability) to travel to dialysis, we identified for each HSA in 2001 the maximum distance within which 90% of patients living in that HSA traveled to receive dialysis. We selected a cutoff of 90% to include the majority of patients in an area while excluding nonrepresentative outliers. We defined this distance as the choice radius for that HSA and assigned this value to each patient according to the HSA where they lived.

We considered each competing (i.e., uniquely owned) facility within a given patient’s choice radius to represent a viable choice for that patient. To have a consistent reference for comparing dialysis facility choices in 2001 and future years, we used the choice radius identified for each HSA in 2001 to assess patients’ dialysis facility choices in both 2001 and future years. We examined the number of choices available to patients in each year during the study period, focusing on the difference in choices between 2001 and 2011.

Assessing Geographic Differences in Market Competition

We examined market competition at each point in time and changes in market competition over the decade before enactment of the PPS by calculating the Herfindahl–Hirschman Index (HHI) for each HSA. The HHI is a metric of market concentration commonly used in industrial organization economics and by regulatory agencies (20,21). The statistic is calculated by summing the squared market share of each provider and ranges in value from near zero to one. The HHI for a dialysis market area would asymptotically approach zero with increasing numbers of different competing dialysis facilities available from which patients could choose, whereas an HHI would be exactly one if there was a monopolist dialysis facility or organization. An HHI of 0.5 represents a duopoly, where there are two competing organizations (such as two LDOs) that serve the same number of patients in a given market. The HHI assumes that facilities owned by the same organization do not compete against each other.

Traditional methods of calculating the HHI rely on defining market boundaries. Describing competition in this way does not allow for consideration of patients who travel to dialysis facilities outside of their predefined market boundary (perhaps because they live near the border of the market). To avoid this limitation, we applied a three-step method for calculating competition that has been commonly used to measure market competition in health care settings, including a study of dialysis markets. Although HSAs remain the primary unit of measurement, this method produces an HHI that accounts for patients’ ability to receive dialysis outside of the HSA where they reside (10,14,22) (Calculating the Herfindahl–Hirschman Index [HHI] in Supplemental Appendix)

Characteristics of Patients Living in Less Competitive Areas

We selected patients with Medicare Parts A and B at the start of 2011 to investigate whether the number of choices available to patients in 2011 varied according to population density, patient demographic and socioeconomic characteristics, and comorbidities as determined by a modified Charlson Comorbidity Index (23) (Comorbidity Index in Supplemental Appendix). We used a 10% standardized difference between patients in the highest and lowest quartiles of facility choice and HHI in 2011 to identify meaningful differences in availability of dialysis facility choices among selected populations (24). We obtained patient comorbidities from the 6 months of Medicare claims before January 1, 2011.

This study was approved by the Internal Review Boards at Stanford University (17904) and Baylor College of Medicine (H-36408).

Results

Trends in National Dialysis Industry Consolidation

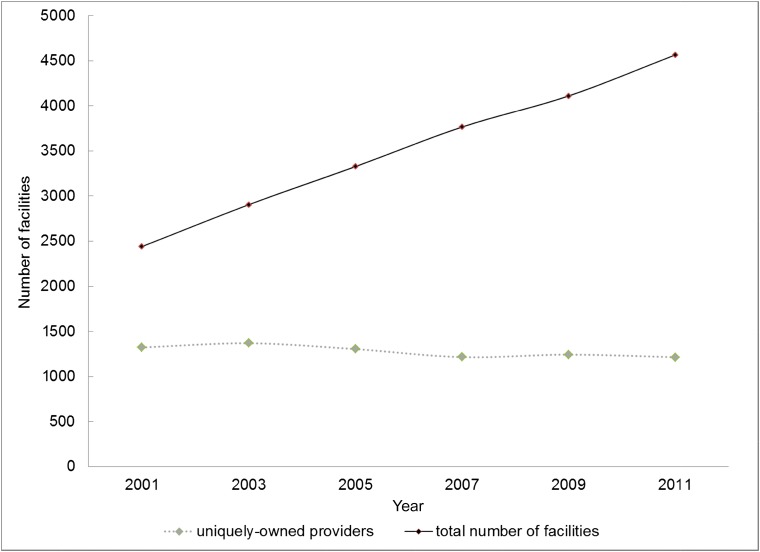

We identified 238,063 patients in the United States receiving in-center hemodialysis at eligible facilities on January 1, 2001. There were 3764 dialysis facilities and 1322 different uniquely owned dialysis providers. By January 1, 2011, the number of patients receiving in-center hemodialysis in the United States at eligible facilities increased by 45% to 346,057. The number of dialysis facilities increased by a similar magnitude of 54% to 5780, whereas the number of uniquely owned dialysis providers decreased by 8% to 1214 (Figure 1). This indicates that, although there was increased facility entry into markets to meet rising demand for dialysis care, multifacility dialysis chains were the majority of new entrants.

Figure 1.

The number of dialysis facilities in the United States increased over time while the number of uniquely owned providers remained virtually unchanged. Data include number of providers caring for patients receiving in-center hemodialysis at the start of every year measured at 2-year intervals.

Effect of Consolidation on Individual Patient Choices

On average, 90% of patients received dialysis at a facility within 18 miles (SD=14) of their reported residence in 2001. However, the choice radius distance varied by HSA. For 10% of HSAs (weighted by the number of patients living in each HSA), 90% of patients received dialysis at facilities <7 miles from their residence. The choice radii were 10, 13, 21, and 32 miles for the 25th, 50th, 75th, and 90th percentiles of HSA, respectively (Supplemental Figure 1).

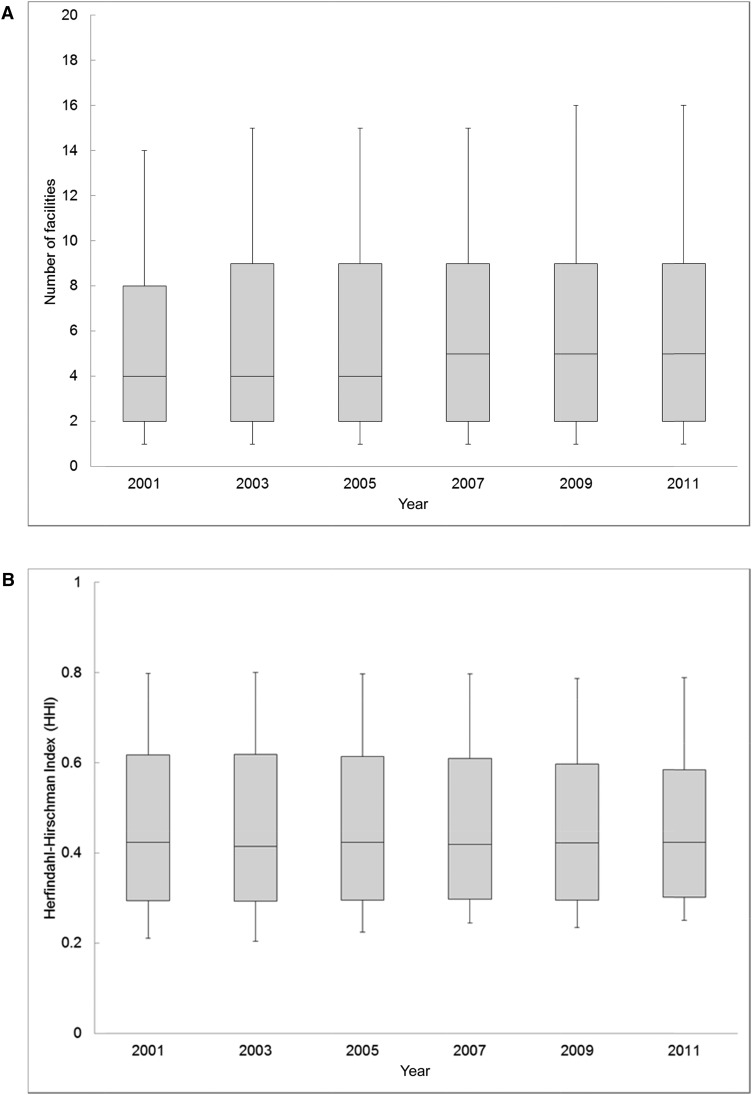

The number of dialysis facilities available to choose from within the area (choice radius) where 90% of patients residing in their HSA travel to receive dialysis increased during the follow-up period from an average of 12 (3–17 for the 25th to 75th percentiles) in 2001 to 17 (5–24 for the 25th to 75th percentiles) in 2011. However, many of these facilities were owned by the same organization. On average, in 2001, there were 6.9 competing dialysis providers from which patients could choose (2–8 for the 25th to 75th percentiles). In 2011, the number of competing dialysis providers increased by 10% to 7.6 (2–9 for the 25th to 75th percentiles; P value for difference in means <0.001). The increase in number of competing providers occurred gradually over the decade (Figure 2A). Results were not sensitive to the assumption that patients lived at the zip code centroid (Sensitivity Analysis in Supplemental Appendix).

Figure 2.

Despite wide geographic variation at any point in time, an index of market concentration was unchanged over time, while the number of choices available to patients increased slightly. (A) Number of dialysis facility choices. (B) Market concentration index. Increases in the number of competing providers from which patients could choose occurred gradually, whereas the distribution of an index of market concentration remained stable over the decade. Note that vertical bars indicate 10th and 90th percentiles. Boxes represents 25th and 75th percentiles. Middle bars represent median Herfindahl–Hirschman Indices (HHIs) and number of choices. Illustrated distributions are weighted by the number of patients in each hospital service area.

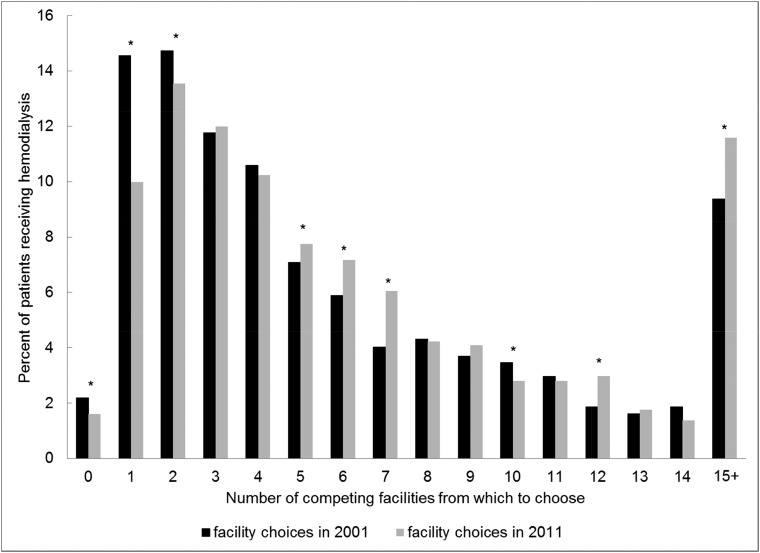

Between 2001 and 2011, there were statistically significant decreases in the proportions of patients with zero, one, and two competing providers from which to choose, indicating a reduction in the proportion of patients with highly limited options among competing providers (Figure 3).

Figure 3.

Number of competing dialysis facilities available for patients to choose from increased slightly between 2001 and 2011. The percentage of patients receiving hemodialysis with zero, one, or two choices among competing facilities decreased over the decade. *Instances where the proportions were significantly different between 2001 and 2011 at a P value of 0.05 using a test of equality of proportions. P values were as follows: P=0.03 for zero facilities, P=0.01 for five and 10 facilities, P=0.001 for 12 facilities, and P<0.001 for one, two, six, seven, and ≥15 facilities.

Changes in an Index of Local Market Competition over Time

On January 1, 2001, the average HHI across all HSAs (weighted by the number of patients receiving dialysis in each HSA) was 0.46 (SD=0.2). On January 1, 2011, the average HHI was also 0.46 (SD=0.2). The average change in HHI between 2001 and 2011 was 0.002, which was not statistically significant (P=0.72). However, there was significant variability in HHI in both years, with the mean HHI per HSA ranging from 0.21–0.25 at the 10th percentile in 2001 and 2011 to 0.79 at the 90th percentile in 2001 and 2011 (Figure 2B). There was also significant variability in the change in HHI over time within HSAs; 50% of patients in 2001 lived in HSAs that became more concentrated over the decade, whereas 50% lived in HSAs that did not change or became less concentrated over the decade. The SD of the change in HHI was 0.15.

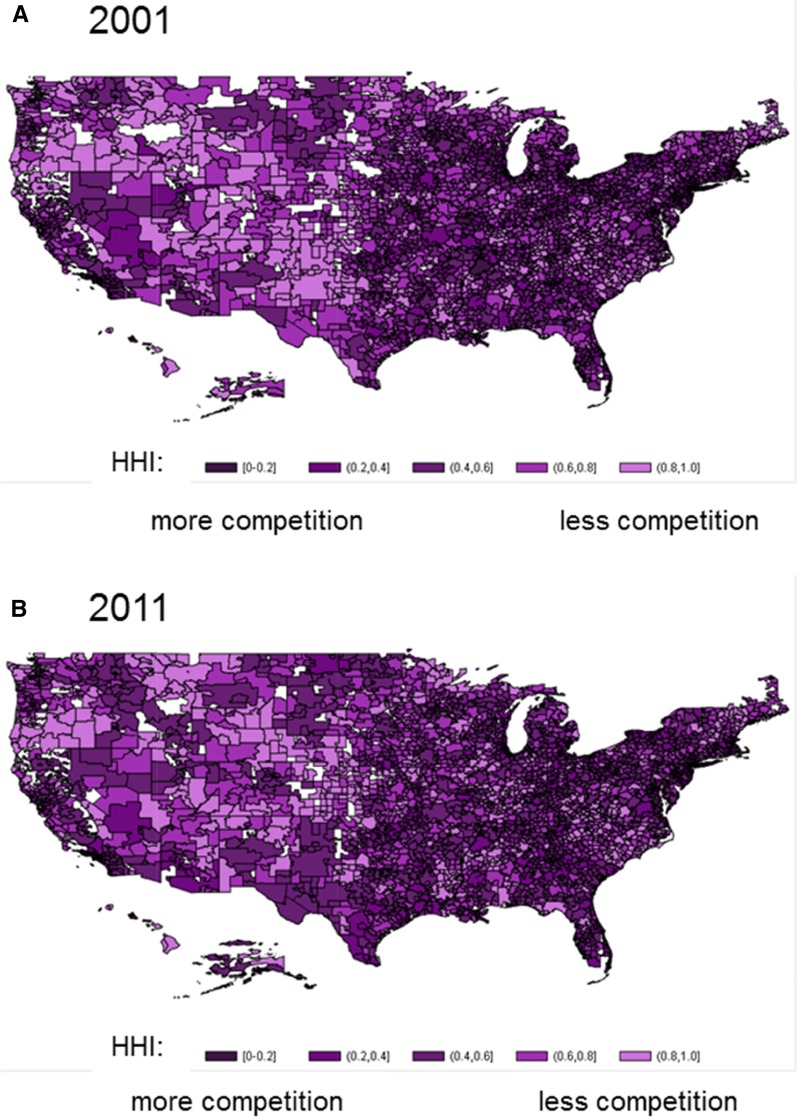

An examination of competition in each HSA (as measured by HHI) plotted across the United States in 2001 and 2010 illustrates geographic variation in market concentration, with the least concentrated areas in more densely populated regions of the country. There was no apparent geographic pattern in changes in market competition over time (Figure 4).

Figure 4.

Geographic variation in market concentration is present in the United States. (A) Market competition index in 2001. (B) Market competition index in 2011. Note that variation in Herfindahl–Hirschman Index (HHI) is illustrated after creating five categories of HHI in increments of 0.2 and plotting the category of HHI for each hospital service area. Map includes the HHI for each hospital service area. Areas in white are where there were no patients receiving hemodialysis. Markets were least concentrated in the North East Census Region, the southeastern portion of the South Census Region, parts of Texas, the East North Central Census Division (i.e., Great Lakes region), and the Pacific Census Division.

In additional analyses, we categorized markets according to whether they became more concentrated over the observation period and examined changes in the numbers of competing providers per HSA in these two groups. Patients receiving dialysis in 2001 lived in 1637 HSAs where markets became more concentrated (as indicated by an increase in the HHI from 2001 to 2011) compared with 1623 HSAs where they did not. In both types of markets, the share of HSAs with zero providers declined substantially by 10.5%–10.8% points. In markets that became more concentrated, there was an 8.4% point increase in the share of HSAs with only one provider, whereas markets that did not become more concentrated experienced a 7.5% point decrease in the share of HSAs with only one provider. Also, HSAs that did not become more concentrated had an 11.5% point increase in the number of markets with two competing providers between 2001 and 2011 compared with a 1.4% point increase among HSAs that consolidated (Table 1).

Table 1.

Number of uniquely owned facilities per hospital service area and change in number of uniquely owned facilities per hospital service area stratified by consolidation

| No. of Uniquely Owned Facilities per HSA | HSAs That Consolidated,a % of HSAs | HSAs That Did Not Consolidate,a % of HSAs | All HSAs Combined,% of HSAs | ||||||

|---|---|---|---|---|---|---|---|---|---|

| 2001 | 2011 | Difference | 2001 | 2011 | Difference | 2001 | 2011 | Difference | |

| 0 | 43.7 | 33.0 | −10.8 | 43.8 | 33.3 | −10.5 | 43.8 | 33.1 | −10.6 |

| 1 | 38.1 | 46.5 | 8.4 | 41.9 | 34.4 | −7.5 | 40.0 | 40.5 | 0.5 |

| 2 | 11.4 | 12.8 | 1.4 | 9.6 | 21.1 | 11.5 | 10.5 | 17.0 | 6.4 |

| 3 | 2.6 | 3.4 | 0.7 | 2.8 | 5.9 | 3.1 | 2.7 | 4.6 | 1.9 |

| 4 | 1.4 | 1.4 | 0.0 | 0.9 | 2.0 | 1.1 | 1.2 | 1.7 | 0.6 |

| 5 | 0.7 | 0.7 | 0.0 | 0.4 | 1.3 | 0.9 | 0.6 | 1.0 | 0.5 |

| 6 | 0.5 | 0.6 | 0.1 | 0.3 | 0.7 | 0.4 | 0.4 | 0.6 | 0.3 |

| 7 | 0.1 | 0.3 | 0.2 | 0.1 | 0.5 | 0.4 | 0.1 | 0.4 | 0.3 |

| 8 | 0.2 | 0.3 | 0.1 | 0.2 | 0.1 | −0.1 | 0.2 | 0.2 | 0.0 |

| >8 | 1.2 | 1.0 | −0.2 | 0.1 | 0.8 | 0.6 | 0.6 | 0.9 | 0.2 |

| Sum | 100 | 100 | 100 | 100 | 100 | 100 | |||

Note that the table includes all HSAs where patients live in each year. HSAs where patients live but where no dialysis facilities exist have zero uniquely owned facilities in that HSA. Data are not weighted according to the number of patients who live in each HSA. HSA, hospital service area.

Consolidation is defined as a hospital service area where the Herfindahl–Hirschman Index increased between 2001 and 2011; 50% of patients lived in HSAs that consolidated.

Characteristics of Patients Living in Less Competitive Areas

Table 2 illustrates differences in populations according to the level of market competition and facility choices. Whites, Native Americans, patients with primary Medicare coverage, and those living in less densely populated areas had fewer choices among competing dialysis providers in 2011. Blacks, Asians, and patients living in areas with less education had more choices among competing dialysis providers. Patient comorbidities and age did not vary by facility choice or level of HHI.

Table 2.

Patient and geographic characteristics stratified by dialysis facility choices and Herfindahl–Hirschman Index in 2011

| Patient and Geographic Characteristics | Quartile of Facility Choices | Quartile of Concentration Index | ||||||

|---|---|---|---|---|---|---|---|---|

| More Competitive | Less Competitive | More Competitive | Less Competitive | |||||

| First | Second | Third | Fourth | First | Second | Third | Fourth | |

| Mean no. of facility choices or HHI | 19.2 | 7.2 | 3.9 | 1.5 | 0.24 | 0.36 | 0.50 | 0.75 |

| Patient demographic and health characteristics | ||||||||

| Age, mean | 60.8 | 61.4 | 62.1 | 62.1 | 61.1 | 61.1 | 62.1 | 62.1 |

| Women, % | 44.6 | 44.5 | 44.9 | 45.6 | 44.5 | 44.7 | 45.3 | 45.2 |

| White, %a,b | 47.4 | 50.0 | 59.8 | 59.4 | 45.7 | 51.2 | 61.3 | 61.1 |

| Black, %a,b | 44.8 | 43.7 | 33.9 | 33.2 | 46.2 | 43.2 | 30.7 | 32.7 |

| Native American, %a,b | 0.4 | 0.8 | 1.3 | 3.2 | 0.4 | 1.2 | 1.4 | 3.0 |

| Asian, %a,b | 6.5 | 5.0 | 4.7 | 4.0 | 6.9 | 4.0 | 6.2 | 2.9 |

| Reported Hispanic, % | 6.7 | 6.3 | 6.5 | 6.2 | 7.0 | 6.2 | 6.6 | 5.9 |

| Comorbidity score, mean | 3.2 | 3.1 | 3.1 | 3.0 | 3.2 | 3.1 | 3.1 | 3.0 |

| Health insurance types, % | ||||||||

| Medicaid eligible | 37.6 | 36.6 | 36.5 | 38.7 | 37.6 | 36.5 | 36.8 | 38.3 |

| Medicare as primary insurera,b | 62.7 | 69.5 | 71.9 | 77.6 | 64.1 | 68.1 | 72.5 | 78.0 |

| Private group insurance | 4.5 | 5.1 | 5.1 | 5.0 | 4.6 | 5.2 | 5.2 | 4.8 |

| Geographic characteristics | ||||||||

| Rural/small town, %a,b | 2.5 | 3.8 | 8.4 | 20.7 | 1.1 | 2.5 | 9.9 | 23.2 |

| Metropolitan, %a,b | 95.3 | 92.1 | 82.0 | 56.2 | 98.3 | 94.9 | 79.6 | 50.5 |

| No high school education, % of HSAa | 22.7 | 18.0 | 17.4 | 17.8 | 21.1 | 19.0 | 17.8 | 17.5 |

| Poverty, % of HSA | 19.4 | 18.8 | 17.2 | 18.0 | 19.6 | 18.5 | 16.9 | 17.8 |

Note that standardized difference quantifies the difference in means between comparison groups as a share of the pooled SD for the two groups. HHI, Herfindahl–Hirschman Index; HSA, hospital service area.

Signifies >10% standardized difference in a comparison of the 1st and 4th quartiles of facility choices.

Signifies >10% standardized difference in a comparison of the 1st and 4th quartiles of HHI.

Discussion

Significance of Study Findings

Our analysis confirms that the United States dialysis industry experienced considerable consolidation at the national level in the decade before enactment of Medicare’s ESRD PPS (The Bundle) in 2011; the number of competing dialysis providers declined by 8%, despite a 54% increase in the number of dialysis facilities. Despite consolidation at a national level over the decade, patients generally had more choices among competing facilities in 2011 than 2001, whereas an index of market consolidation (HHI) remained unchanged. These findings suggest that, rather than limiting patients’ choice among competing providers, national dialysis industry consolidation in the decade before the PPS primarily served to maintain the high local market shares of dialysis chains in the setting of a growing hemodialysis population and increasing numbers of dialysis facilities.

Although market competition did not seem to change, on average, between 2001 and 2011, dialysis markets remained highly concentrated throughout this period. On the basis of their experience, the Federal Trade Commission and Department of Justice consider markets with an HHI>0.25 to be highly concentrated, where even small changes in market concentration due to mergers raise significant competitive concerns (25). We found that, in 2001, >85% of patients lived in places where the HHI was ≥0.25, suggesting that many of the areas that became more concentrated over the study period may have been at risk for cost and quality consequences associated with decreased competition. Nearly one half of the HSAs in the United States where markets became more concentrated over the decade had only one uniquely owned provider in 2011.

We also found that choices among competing dialysis providers available to patients and market concentration varied geographically and with population density. Patients living in metropolitan areas had many more competing dialysis facilities from which to choose, even after accounting for a reduced willingness (or ability) to travel longer distances to dialysis. Similarly, less densely populated regions in the country tended to have more highly concentrated markets. Any effect that changes in market competition over the period may have had on the cost, quality, or access to care provided would likely be most prominent in less densely populated areas with more concentrated markets.

Interestingly, patient populations traditionally considered to be disadvantaged (through race, ethnicity, or socioeconomic status) did not face more limited choices in dialysis facilities in 2011. Considering well described racial, ethnic, and socioeconomic disparities in other areas of kidney disease care, it will be important to determine whether the proximity of competing dialysis facilities actually translates into available choices for disadvantaged patient populations. It will also be important to determine whether these populations have begun to experience more limited choices among competing providers since the enactment of the 2011 dialysis payment bundle. Blacks require, on average, higher doses of erythropoietin stimulating agents and other injectable medications (26,27), creating a financial incentive (before the 2011 PPS) to open or acquire facilities in areas with large black populations. Now that injectable medications are included in the dialysis payment bundle, these incentives are no longer present.

Public surveys suggest that people value having a choice in health plans, physicians, and hospitals (28–30). It is unknown whether patients receiving dialysis place a meaningful premium on choice and if so, what facility attributes they value most, and it is also unknown whether they are primarily concerned with having a provider close to where they live; >40% of patients receive dialysis at the facility closest to their homes, and another 25%–30% receive dialysis at the second and third closest facilities (14). We found that the median distance traveled to dialysis decreased 8% from 4.5 to 4.2 miles from 2001 to 2011. In many instances, patients may be assigned to a facility by their physician or a social worker, or choices may be limited due to available days (some facilities may be open only 3 days per week) or number of dialysis stations that are adequately staffed at nearby facilities. Surveys and qualitative analyses may help to answer some of these questions.

Our two analytic approaches yielded slightly discrepant results. There was an increase of 10%—on average—in the number of competing dialysis facilities available within their choice radius, whereas market concentration—as measured by the HHI—did not seem to change over the study period. The high value that patients place on receiving dialysis close to home can explain this discrepancy. Although facilities opening to meet the demand of new or growing dialysis populations may have fallen into existing patients’ choice radius, patients in existing markets may not have received dialysis at these new facilities. Many of these new facilities may be more accurately described to be serving different markets, whereas existing markets became geographically smaller over time. It is likely that our calculated HHI remained unchanged over the observation period, because it accounted for patients’ decisions to reduce the distance traveled to dialysis, or possibly, it could be due to a growing preference or necessity to avoid traveling longer distances to dialysis. Decreasing facility sizes over time may have also contributed to the observed discrepancy; on average, facilities provided care for 4% fewer patients in 2011 compared with 2001.

Potential Health Consequences from Highly Concentrated Dialysis Markets

One of the most widely studied areas of market competition in health care is in the hospital sector, which experienced significant consolidation during the 1990s and has recently begun a new wave of merger activity (31). Although controversy still exists, evidence suggests that consolidation in hospital markets in the 1990s led to substantial increases in prices paid by private insurers but that more competition had no effect or perhaps, a slightly negative effect on the quality of care delivered (32). More recent evidence from selected health care markets where governments fix prices, thereby forcing providers to compete on quality, suggests that more competition leads to higher quality care and better health outcomes (9,33).

Findings from competition in hospital markets can inform how we think about competition in dialysis. Notably, because Medicare is the primary payer for ESRD services, creating a predominantly fixed price environment, the link between market competition and quality of care may be stronger. Studies in the 1980s and 1990s found evidence of both reduced amenities offered and limited access to care among sicker patients in dialysis markets that were less competitive (12,13). In contrast, more recent analyses found that patients receiving dialysis in more competitive markets were hospitalized more frequently and less likely to use peritoneal dialysis (34). It is not clear to what extent patients, physicians, hospital case managers, or other agents drive choices among competing providers. Recent efforts by the CMS to inform patients about differences in dialysis facility quality through its Five Star Rating System may encourage facilities to compete on the achievement of quality metrics included in the system.

Although patients receiving dialysis did not, on average, experience additional limitations in the number of competing dialysis providers from which they could choose in the decade before enactment of the PPS, we found that local markets for dialysis care were highly concentrated throughout the period. Patients received dialysis in markets that were close to twofold more concentrated than the average hospital market, where the average HHI is only slightly above 0.25 (35). Additionally, changes in market concentration over time varied across HSAs. Several large acquisitions occurred during the period of analysis (36–38), contributing to increased market concentration in some areas (Supplemental Table 1). Meanwhile, entry of competitors into new markets led to declining market concentration in other areas.

National consolidation in the dialysis industry has continued since 2011, likely maintaining highly concentrated markets. When the Federal Trade Commission and Department of Justice review a proposed health care merger, they claim to consider its potential effects on cost and quality of care (25,39). In practice, however, it is unclear to what degree quality considerations enter into these deliberations (40). It is noteworthy that dialysis markets, where costs are predominantly fixed by Medicare reimbursement policy, have been permitted to become so highly concentrated.

Given the likelihood that financial pressures related to Medicare’s PPS and QIP will continue to promote highly concentrated dialysis markets and our finding that approximately one half of the local dialysis markets became more highly concentrated between 2001 and 2011, any association between competition in dialysis markets and patient health may become increasingly important.

Limitations and Conclusions

Our study has several limitations. First, we assume that dialysis facilities owned by the same organization do not compete against one another. This may not be entirely true, particularly when managers at individual facilities within a single organization are able to see quality-related data from neighboring facilities. Second, although we attempted to account for differences in the amount of time that it takes (and ability) to travel to dialysis across regions by making the choice radius specific to a patient’s HSA, our analysis of patient choice did not account for differences in travel preferences within HSAs or changes in travel preferences that may have occurred over the 10-year follow-up period. Patient allocation among competing dialysis facilities could be the result of patient choices, physician referrals, or choices made by health care plans. We did not attempt to disentangle these different ways in which dialysis facilities may compete for patients. In some instances, markets for dialysis may be smaller than HSAs. Our analyses used patients’ residential zip codes rather than their actual addresses, which may have led to some misclassification in distances to facilities that were defined by actual street addresses. Third, using the data available to us, we were not able to determine when treating nephrologists had joint venture relationships with providers or served as a medical directors and how these factors may have influenced patient disposition to alternative facilities.

In summary, a decade of national consolidation in the United States dialysis industry did not (on average) limit patient choice or result in more concentrated local markets. However, because many dialysis markets have remained highly concentrated, it will be important to understand how dialysis facilities compete and whether market competition affects prices paid by private insurers, access to dialysis care, the quality of care provided, and associated health outcomes.

Disclosures

G.M.C. serves on the board of directors at Satellite Healthcare (San Jose, CA).

Supplementary Material

Acknowledgments

The authors thank Maria Montez-Rath for her assistance in assembling the cohorts.

This work was supported by grants 1K23DK101693-01 (to K.F.E.) and DK085446 (to G.M.C.) from the National Institutes for Diabetes and Digestive and Kidney Diseases (NIDDK). W.C.W. receives research and salary support through the endowed Gordon A. Cain Chair in Nephrology at Baylor College of Medicine. J.B. thanks the National Institute on Aging for support for his work on this paper (grant R37 150127-5054662-0002).

This work was conducted under a data use agreement between W.C.W. and the NIDDK. An NIDDK officer reviewed the manuscript and approved it for submission. The data reported here have been supplied by the US Renal Data System. The interpretation and reporting of these data are the responsibility of the author(s) and in no way should be seen as an official policy or interpretation of the US Government.

Footnotes

Published online ahead of print. Publication date available at www.cjasn.org.

This article contains supplemental material online at http://cjasn.asnjournals.org/lookup/suppl/doi:10.2215/CJN.06340616/-/DCSupplemental.

References

- 1.USRDS: Annual Data Report: Atlas of Chronic Kidney Disease and End-Stage Renal Disease in the United States, Bethesda, MD, National Institutes of Health, National Institute of Diabetes and Digestive and Kidney Diseases, 2013 [Google Scholar]

- 2.Department of Health and Human Services, Center for Medicare and Medicaid Services: Medicare Programs; End-Stage Renal Disease Prospective Payment System; Town Hall Meeting on End-Stage Renal Disease Prospective Payment System; Proposed Rule and Notice, Washington, DC, Department of Health and Human Services, 2009, pp 49922–50102 [Google Scholar]

- 3.Sullivan JD: The end-stage renal disease industry and exit strategies for nephrologists. Health Care Manag (Frederick) 25: 356–361, 2006 [DOI] [PubMed] [Google Scholar]

- 4.Himmelfarb J, Berns A, Szczech L, Wesson D: Cost, quality, and value: The changing political economy of dialysis care. J Am Soc Nephrol 18: 2021–2027, 2007 [DOI] [PubMed] [Google Scholar]

- 5.Hirth RA, Held PJ, Orzol SM, Dor A: Practice patterns, case mix, medicare payment policy, and dialysis facility costs. Health Serv Res 33: 1567–1592, 1999 [PMC free article] [PubMed] [Google Scholar]

- 6.Medicare Payment and Advisory Commission. Report to Congress: Medicare Payment Policy, Washington, DC, Medicare Payment and Advisory Commission, March 2015 [Google Scholar]

- 7.Johnson DS, Meyer KB, Johnson HK: The 2011 ESRD prospective payment system and the survival of an endangered species: The perspective of a not-for-profit medium-sized dialysis organization. Am J Kidney Dis 57: 553–555, 2011 [DOI] [PubMed] [Google Scholar]

- 8.Sedor JR, Watnick S, Patel UD, Cheung A, Harmon W, Himmelfarb J, Hostetter TH, Inrig JK, Mehrotra R, Robinson E, Smedberg PC, Shaffer RN; American Society of Nephrology ESRD Task Force: ASN End-Stage Renal Disease Task Force: Perspective on prospective payments for renal dialysis facilities. J Am Soc Nephrol 21: 1235–1237, 2010 [DOI] [PubMed] [Google Scholar]

- 9.Gaynor M, Town R: The Impact of Hospital Consolidation: Update, Princeton, NJ, The Robert Wood Johnson Foundation, 2012

- 10.Baker LC, Bundorf MK, Royalty AB, Levin Z: Physician practice competition and prices paid by private insurers for office visits. JAMA 312: 1653–1662, 2014 [DOI] [PubMed] [Google Scholar]

- 11.Farley DO: Competition under fixed prices: Effects on patient selection and service strategies by hemodialysis providers. Med Care Res Rev 53: 330–349, 1996 [DOI] [PubMed] [Google Scholar]

- 12.Hirth RA, Chernew ME, Orzol SM: Ownership, competition, and the adoption of new technologies and cost-saving practices in a fixed-price environment. Inquiry 37: 282–294, 2000 [PubMed] [Google Scholar]

- 13.Held PJ, Pauly MV: Competition and efficiency in the end stage renal disease program. J Health Econ 2: 95–118, 1983 [DOI] [PubMed] [Google Scholar]

- 14.Lee DKK, Chertow GM, Zenios SA: Reexploring differences among for-profit and nonprofit dialysis providers. Health Serv Res 45: 633–646, 2010 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.Federal Trade Commission: FTC Requires Fresenius Medical Care AG to Sell 60 Dialysis Clinics Around the Country as a Condition of Acquiring Liberty Dialysis Holdings, Inc. FTC File No 111-0070, Washington, DC, Federal Trade Commission, 2012 Available online at: https://www.ftc.gov/news-events/press-releases/2012/02/ftc-requires-fresenius-medical-care-ag-sell-60-dialysis-clinics. Accessed on December 28, 2015

- 16.Federal Trade Commission: FTC Accepts Settlement to Remedy DaVita’s Acquisition of Rival Outpatient Dialysis Clinic Provider Gambro. FTC File No: 051-0051, Washington, DC, Federal Trade Commission, 2005 Available at: https://www.ftc.gov/news-events/press-releases/2005/10/ftc-accepts-settlement-remedy-davitas-acquisition-rival. Accessed on December 28, 2015

- 17.Federal Trade Commission: Maintaining Competition, FTC Allows Fresenius $3.5 Billion Deal to Buy Rival Dialysis Provider Renal Care Group, Washington, DC, Federal Trade Commission, 2006 Available at: https://www.ftc.gov/news-events/press-releases/2006/03/maintaining-competition-ftc-allows-fresenius-35-billion-deal-buy. Accessed on December 28, 2015

- 18.WWAMI: Rural-Urban Commuting Area Codes (RUCA), Washington, DC, WWAMI Rural Health Research Center, 2005 [Google Scholar]

- 19.The Dartmouth Institute for Health Policy and Clinical Practice: Selected Hospital and Physician Capacity Measures. Lebanon, NH, The Trustees of Dartmouth College, 2006 [Google Scholar]

- 20.Church J, Ware R: Industrial Organization: A Strategic Approach, Madison, WI, Irwin McGraw-Hill, 2000 [Google Scholar]

- 21.Federal Trade Commission: Horizontal Merger Investigation Data: Fiscal Years 1996–2011, Washington, DC, Federal Trade Commission, 2013, p 34 [Google Scholar]

- 22.Kessler DP, McClellan MB: Is hospital competition socially wasteful? Q J Econ 115: 577–615, 2000 [Google Scholar]

- 23.Hemmelgarn BR, Manns BJ, Quan H, Ghali WA: Adapting the Charlson Comorbidity index for use in patients with ESRD. Am J Kidney Dis 42: 125–132, 2003 [DOI] [PubMed] [Google Scholar]

- 24.Austin PC: Balance diagnostics for comparing the distribution of baseline covariates between treatment groups in propensity-score matched samples. Stat Med 28: 3083–3107, 2009 [DOI] [PMC free article] [PubMed] [Google Scholar]

- 25.US Department of Justice and the Federal Trade Commission: Horizontal Merger Guidelines, Washington, DC, US Department of Justice and Fair Trade Commission, 2010 [Google Scholar]

- 26.Lacson E Jr., Rogus J, Teng M, Lazarus JM, Hakim RM: The association of race with erythropoietin dose in patients on long-term hemodialysis. Am J Kidney Dis 52: 1104–1114, 2008 [DOI] [PubMed] [Google Scholar]

- 27.United States Government Accountability Office: End-Stage Renal Disease: CMS Should Monitor Access to and Quality of Dialysis Care Promptly after Implementation of New Bundled Payment System, Washington, DC, GAO, 2010, p 72 [Google Scholar]

- 28.Gawande AA, Blendon R, Brodie M, Benson JM, Levitt L, Hugick L: Does dissatisfaction with health plans stem from having no choices? Health Aff (Millwood) 17: 184–194, 1998 [DOI] [PubMed] [Google Scholar]

- 29.Lambrew JM:Choice in Health Care: What Do People Really Want. Issue Brief, New York, The Commonwealth Fund, 2005 [PubMed] [Google Scholar]

- 30.Employee Benefit Research Institute: Health Confidence Survey: Choice in Health Care, Washington, DC, Employee Benefit Research Institute, 2002 [Google Scholar]

- 31.Dafny L: Hospital industry consolidation--still more to come? N Engl J Med 370: 198–199, 2014 [DOI] [PubMed] [Google Scholar]

- 32.Town RJ, Vogt W: How Has Hospital Consolidation Affected the Price and Quality of Hospital Care? Research Synthesis Report, Princeton, NJ, Robert Wood Johnson Foundation, 2006 [PubMed] [Google Scholar]

- 33.Gaynor M: What Do We Know about Competition and Quality in Health Care Markets? NBER Working Paper Series, Cambridge, MA, National Bureau of Economic Research, 2006

- 34.Wang V, Lee S-YD, Patel UD, Maciejewski ML, Ricketts TC: Longitudinal analysis of market factors associated with provision of peritoneal dialysis services. Med Care Res Rev 68: 537–558, 2011 [DOI] [PubMed] [Google Scholar]

- 35.US Department of Health and Human Services: Health System Measurement Project: Concentration in the Hospital Market, Washington, DC, US Department of Health and Human Services, 2013 [Google Scholar]

- 36.Businesswire: Renal Care Group to Acquire National Nephrology Associates in Transaction Valued at $345 Million, New York, NY, Business Wire, 2004

- 37.PR Newswire: DaVita to Acquire Gambro Healthcare, a Renal Dialysis Services Company, New York, NY, PR Newswire, 2004

- 38.Businesswire: Fresenius Medical Care to Acquire Renal Care Group, Inc., New York, NY, Business Wire, 2004

- 39.Ramirez E: Antitrust enforcement in health care--controlling costs, improving quality. N Engl J Med 371: 2245–2247, 2014 [DOI] [PubMed] [Google Scholar]

- 40.Sage WM, Hyman DA, Greenberg W: Why competition law matters to health care quality. Health Aff (Millwood) 22: 31–44, 2003 [DOI] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.