Abstract

Background

Spending on biologic drugs is a significant driver of drug expenditures for payers in private health plans. Biologic disease-modifying antirheumatic drugs (DMARDs) are some of the most effective and costly treatments in a physician's arsenal. Understanding the total annual expenditure, the average cost per prescription, and the impact of cost-sharing is important for drug benefit managers.

Objective

To assess drug utilization, expenditures, out-of-pocket (OOP) cost, and price trends of biologic DMARDs in patients with rheumatoid arthritis (RA) in a large managed care organization.

Methods

We conducted a retrospective database analysis of pharmacy claims data from January 2004 to December 2013 using the Optum Clinformatics Data Mart database, which covers 13.3 million lives. Pharmacy claims for 40,373 patients with RA were identified during the study period. In all, 9 biologic DMARDs approved for the treatment of RA, including infliximab, etanercept, adalimumab, certoizumab, golimumab, tocilizumab, anakinra, abatacept, and rituximab, and 1 nonbiologic oral, small molecule–targeted synthetic drug, tofacitinib, were included in this study. Descriptive statistics were used to analyze the total annual number of prescriptions, the total annual expenditures, the average annual cost per drug (a proxy of drug price), and the average OOP cost (copay plus deductible and coinsurance). All measurements were also stratified by study drugs and by insurance type.

Results

Of the 40,373 patients with RA included in the study, approximately 76% were female (mean age, 55 years at diagnosis). Approximately 77% of the patients were white, and almost 48% lived in the South or Midwest region of the United States. Approximately 62% of patients had a point of service insurance plan. Expenditures on biologic DMARDs increased from $166 million in 2004 to $243 million in 2013, and the number of prescriptions and refills increased from 59,960 in 2004 to 105,295 in 2013. Prescriptions for biologic DMARDs increased more than 20% per patient from 2004 to 2013. The average cost per prescription remained relatively unchanged, at approximately $2300 per prescription, but the OOP expenditures increased from $36 (2.5%) per prescription to $128 (7%) during the study period. The OOP expenditures increased the most in HMO plans and in plans categorized as other (284% and 388%, respectively).

Conclusions

Spending on biologic DMARDs has been primarily driven by an increase in prescribing rates, as the average amount reimbursed per prescription remained relatively unchanged over time, despite a regular annual increase to the average wholesale acquisition cost of 2% to 10%. The OOP burden for patients has increased, but this does not appear to have limited the use of biologic DMARDs. The entrance of new biologic and nonbiologic DMARDs into the market in the past few years is eroding the market share for several established drugs, and may lead to different results, warranting a study of new trends.

Keywords: biologic disease-modifying antirheumatic drugs, drug utilization, expenditures, out-of-pocket cost, price trends, rheumatoid arthritis

Rheumatoid arthritis (RA) is a chronic systemic inflammatory disease of unknown cause that primarily affects the peripheral joints in a symmetric pattern.1–4 RA's effect on other areas of the body, including the skin, heart, lungs, and eyes, can be substantial. The disease also causes joint destruction, and thus often leads to considerable morbidity and mortality.2 Daily living activities are impaired in most individuals with RA, and spontaneous clinical remission is uncommon (approximately 5%-10%).5 It is estimated that the annual incidence for RA is approximately 3 cases per 10,000 population.2

KEY POINTS

-

▸

Biologic DMARDs are the most effective, and costly, treatments for patients with RA.

-

▸

This retrospective database analysis of pharmacy claims data from 40,373 patients with RA calculated the current utilization, expenditures, and pricing trends for biologic DMARDs.

-

▸

Expenditures on biologic DMARDs increased from $166 million in 2004 to $243 million in 2013.

-

▸

Spending on biologic DMARDs was driven by higher prescribing rates, despite a regular annual increase in average wholesale acquisition cost of 2% to 10%.

-

▸

The average reimbursed amount per prescription was stable at approximately $2300, but out-of-pocket spending per prescription increased from $36 (2.5%) to $128 (7%) during the study.

-

▸

New biologic and nonbiologic DMARDs are eroding some market share for several established drugs.

-

▸

Creating a competitive market for treatments and the introduction of biosimilars will likely help control drug costs.

The prevalence rate of RA is approximately 1%; RA is 3 times more common in women, but this difference narrows as patients age.2 After 5 years of active disease, approximately 33% of patients are unable to work, and after 10 years, approximately 50% of patients experience substantial functional disability.6,7 Life expectancy in patients with RA is shortened by 5 to 10 years, although the mortality rate may be lower in those who respond to therapy.2,8 In the developed world, the prevalence of RA in adults is 0.5% to 1.0%.8 The incidence of RA globally is 5 to 50 per 100,000, and peaks between ages 35 and 50 years.9

The management of RA typically requires a 3-pronged therapy approach that includes (1) symptomatic drugs for pain (ie, nonsteroidal anti-inflammatory drugs, analgesics, and opioids); (2) disease-modifying antirheumatic drugs (DMARDs), which are divided into nonbiologic and biologic drugs; and (3) glucocorticoids for inflammation. Nonbiologic DMARDs, including methotrexate, sulfasalazine, leflunomide, and hydroxychloroquine, are older medications, with established safety profiles and a relatively low cost of between $30 and $900 monthly.10 Biologic DMARDs are generally newer, powerful medications that are capable of quickly decreasing disease activity in a relatively short time.11,12 The costs for biologic DMARDs range from $2000 to $5000 monthly.10

Biologic DMARDs are divided into several groups, based on which aspect of the immune system they target. There are 5 tumor necrosis factor (TNF)-alpha inhibitors, including infliximab, etanercept, adalimumab, certolizumab, and golimumab; 2 interleukin inhibitors, tocilizumab and anakinra; 1 T-cell activation inhibitor, abatacept; 1 CD-20 activity blocker, rituximab; and 1 oral nonbiologic Janus kinase inhibitor, tofacitinib.

Because of the higher cost and risk profile for newer biologic and nonbiologic DMARDs, the current American College of Rheumatology (ACR) guidelines indicate that patients with early RA should start a treatment regimen of nonbiologic DMARD monotherapy, regardless of disease activity (low, moderate, high).12 In established RA, after nonresponse to conventional DMARD therapy, the ACR recommends either combination traditional DMARD therapy; a TNF inhibitor, with or without methotrexate; a non-TNF inhibitor biologic, with or without methotrexate; or tofacitinib, with or without methotrexate.12

The increased utilization of biologics has had a significant impact on healthcare payers, as a result of the high cost of these novel agents. Analyzing these costs is often difficult, because of the idiosyncrasies of insurance billing and the various drug formulations and routes of administration. Some biologic DMARDs are available as an injectable for at-home use and are reimbursed under drug benefit plans, whereas other biologics are administered via intravenous infusion only in a healthcare facility and are reimbursed under medical plans. To further complicate these analyses, several biologic DMARDs are available for both routes of administration.

Researchers have studied Medicare and Medicaid expenditures for RA per capita and per beneficiary. Doshi and colleagues studied the impact of Medicare Part D coverage, identifying significant increases in payments for infliximab, during a period when payments per patient with RA also increased.13 The Medicare Modernization Act of 2003 decreased the payments per patient, but infliximab still had a 4% increase in total expenditures.13 Patient payments for infliximab were slightly decreased once reimbursement was further reduced.11

Yazdany and colleagues compared patients who received Medicare's Low-Income Subsidy with those who did not, as well as the cost per beneficiary.14 The data showed that patients with the Low-Income Subsidy were more likely to receive biologics for at-home use than patients without the Low-Income Subsidy. As expected, the patients receiving the Low-Income Subsidy also had lower out-of-pocket (OOP) expenditures.14 In Medicare Part D, at least 1 biologic was covered in 97% of plans.14 Most plans (81%-100%) required some form of coinsurance rather than a predefined copayment, resulting in an annual OOP cost of $2712 to $2774 before catastrophic benefits take effect.15 Medicare Advantage plans covered more biologics than standard coinsurance, but had higher premiums compared with nonbiologic DMARDs, which relied on fixed copays of $5 to $10 monthly.15

The key drivers for higher expenditures on specialty drugs are increased utilization, approvals for expanded indications, and new biologics entering the market, all of which characterize the biologic DMARD market.16 Pharmacy benefit managers rely on various control mechanisms, such as benefit design modifications, step-edits, preauthorization, cost-sharing, and adherence counseling and patient education to control spending.16 The effects of cost-sharing and insurance plan generosity (ie, the percentage of pharmacy costs covered by the insurance plan) have been studied in relation to RA,17,18 and although healthcare spending is generally elastic, depending on the type of service, spending on specialty drugs, such as biologic DMARDs, is inelastic.17

There is a gap in the literature for a comprehensive analysis of payer and patient spending across all 10 currently approved biologic and nonbiologic DMARDs. The objective of this study is to assess drug utilization, expenditures, OOP cost, and pricing trends of biologic DMARDs in patients with RA in a large managed care organization. The results of this research could be significant to the healthcare system (insurance payers, Pharmacy & Therapeutics committee members, healthcare stakeholders, and pharmacy directors) to better understand the overall medication cost for payers and for patients with RA.

Methods

We conducted a retrospective cohort study using the Clinformatics Data Mart database (OptumInsight; Eden Prairie, MN) containing medical and pharmacy claims with linked enrollment information with data covering the period from 2004 to 2013. Data relating to approximately 13.3 million individuals with medical and pharmacy benefit coverage were available. An additional almost 8.7 million enrollees who had medical benefits only was also available for this study. The underlying information from the study database is geographically diverse across the United States and is fairly representative of the US population. Of the approximately 13.3 million individuals, information on race and ethnicity, as well as financial resources, was available for approximately 9 million (65%-70%) of the individuals.19 Although slightly smaller in terms of lives covered than other commercially available claims databases, the Clinformatics Data Mart database is nationally representative and has all the necessary data fields for this type of analysis.

Target Population and Sample Selection

There were 453,993 patients with an International Classification of Diseases, Ninth Revision, Clinical Modification (ICD-9-CM) diagnosis code for RA of 714.xx in this national privately insured population. A total of 192,287 patients were aged ≥18 years at diagnosis, with a confirmed diagnosis of RA and at least 3 claims for 714.xx in any billing position at least 45 days apart from each other.20

To be included in this study cohort, patients had to start taking at least 1 DMARD during that same period. A total of 129,005 patients met the inclusion criteria of RA diagnosis and at least 1 DMARD for this study. Only 45,923 patients with RA received at least 1 biologic DMARD. Patients were excluded if at any time during the study they had a diagnosis of another disease in which a biologic DMARD may be used as treatment, such as plaque psoriasis (ICD-9-CM 696.1x), psoriatic arthritis (696.0x), ankylosing spondylitis (720.0x), juvenile idiopathic arthritis (714.3x), Crohn's disease (555.xx), ulcerative colitis (556.xx), non-Hodgkin lymphoma (200.xx, 202.xx), or chronic lymphocytic leukemia (204.1x).20

Based on the inclusion and exclusion criteria, a total of 40,373 patients were identified for this study. The patients' pharmacy claims that were filed between 2004 and 2013 were extracted for this study.

Study Drugs and Costs

All biologics approved for self-injection were identified by their brand name and generic name within the pharmacy database (Table 1). All drugs requiring in-facility administration were identified by their Healthcare Common Procedure Coding System code. Costs associated with the administration of in-facility drugs were identified using Current Procedural Terminology codes. Drug name, prescription fill date, number of units, and the standard cost were collected and were linked to individual patient records.

Table 1.

List of Study Biologic and Nonbiologic DMARDs for the Treatment of Rheumatoid Arthritis

| Drug | Manufacturer | FDA approval date for RA | HCPCS code |

|---|---|---|---|

| Abatacept (Orencia) | Bristol-Myers Squibb | December 2005 | J1029 |

| Adalimumab (Humira) | AbbVie | December 2002 | J0135 |

| Anakinra (Kineret) | Sobi | November 2001 | J3490 |

| Certolizumab (Cimzia) | UCB | May 2009 | J0717 |

| Etanercept (Enbrel) | Amgen | November 1998 | J1438 |

| Golimumab (Simponi) | Janssen Biotech | April 2009 | J1602 |

| Infliximab (Remicade) | Janssen Biotech | November 1999 | J1745 |

| Rituximab (Rituxin) | Genentech | February 2006 | J9310 |

| Tocilizumab (Actemra) | Genentech | January 2010 | J3262 |

| Tofacitinib (Xeljanza) | Pfizer | November 2012 | NA |

Nonbiologic small-molecule DMARD.

DMARD indicates disease-modifying antirheumatic drug; HCPCS, Healthcare Common Procedure Coding System; NA, not applicable; RA, rheumatoid arthritis.

To account for the differences in pricing across health plans and provider contracts, OptumInsight applies standard pricing algorithms to the claims data in Clinformatics Data Mart. These algorithms are designed to create standard prices that reflect allowed payments across all provider services. In this way, relative pricing within a therapeutic category and generic indicator is determined by Clinformatics Data Mart information, whereas general pricing levels by therapeutic category and generic indicator are determined by observed payments. To create a standardized cost, the resulting average payment schedule is applied to each pharmacy service based on the National Drug Code listed and the metric quantity for the prescription. All costs are adjusted to 2013 US dollars.

Measures and Definitions

The total number of prescriptions was based on the sum of the prescription fills for all biologic DMARDs and each biologic within each year. The total annual expenditure is based on the sum of the standard cost for each prescription fill within each year. The average cost was based on the total annual expenditure divided by the total number of prescription fills for each drug within each year. The OOP costs represent the sum of the patient's copay, deductible, and coinsurance, if any. The percentage of patient share was calculated by dividing the OOP expenditure by the standard cost. The year-over-year changes were calculated starting with a drug's first full year on the market, then moving forward using the formula (T2 – T1)/T1, where T represents the value of a measure at a given time point. The data were also stratified by insurance plan type of exclusive provider organization (EPO), PPO, HMO, point of service (POS), fee for service (FFS), and other uncategorized plans. The study protocol was approved by the University of Cincinnati Institutional Research Board.

Results

Of the 40,373 study patients, 30,740 (76.14%) were female, and the mean age was 55 years (standard deviation, 12.9; Table 2). The patients were predominantly white (76.83%), resided in the Southern and Midwestern states (27.44% and 20.44%, respectively), and primarily (62.28%) had POS insurance coverage plans. The majority (52.78%) of patients had less than a bachelor's degree.

Table 2.

Characteristics of Patients with Rheumatoid Arthritis, 2004–2013

| Metric variable | Patients (N = 40,373) |

|---|---|

| Age, mean, yrs (SD) | 55 (12.9) |

| Age-group, % | |

| 18–24 yrs | 1.91 |

| 25–34 yrs | 5.56 |

| 35–44 yrs | 12.59 |

| 45–54 yrs | 24.19 |

| 55–64 yrs | 32.46 |

| ≥65 yrs | 23.28 |

| Sex, % | |

| Female | 76.14 |

| Male | 23.86 |

| Race, % | |

| White | 76.83 |

| Asian | 2.23 |

| Black | 7.68 |

| Hispanic | 8.86 |

| Unknown | 4.40 |

| CMS geography, % | |

| ME, MA, RI, CT, NH, VT | 2.73 |

| NY, NJ, PR, VI | 4.68 |

| PA, DE, MD, DC, VA, WV | 5.34 |

| KY, TN, NC, SC, GA, AL, MS, FL | 27.44 |

| MN, WI, MI, IN, IL, OH | 20.44 |

| NM, OK, AR, LA, TX | 17.55 |

| NE, IA, MO, KS | 6.19 |

| MT, ND, SD, WY, CO, UT | 5.73 |

| CA, NV, AZ, HI, GU | 7.81 |

| WA, OR, ID, AK | 2.06 |

| Insurance type, % | |

| EPO | 11.91 |

| HMO | 15.77 |

| FFS | 1.84 |

| OTH | 0.22 |

| POS | 62.28 |

| PPO | 7.98 |

| Education level, % | |

| Bachelor's degree or higher | 16.59 |

| High school diploma | 29.46 |

| Less than 12th grade | 0.66 |

| Less than a bachelor's degree | 52.78 |

| Unknown | 0.51 |

CMS indicates Centers for Medicare & Medicaid Services; EPO, exclusive provider organization; FFS, fee for service; OTH, other plan; POS, point of service; SD, standard deviation.

The prevalence of biologic DMARD use among patients with RA increased from 16% in 2004, with 7.6 biologic DMARD prescription fills per patient to 39% in 2013, with 9.6 prescription fills per patient (Table 3).

Table 3.

Trend of Biologic DMARD Use in Patients with RA, 2004–2013

| Year | Biologic DMARDs refills, N | Reimbursement amount, $ | Patients receiving a biologic DMARD, N | Patients with RA, N | Patients with RA receiving a biologic DMARD, % | Average biologic DMARD prescription fills per patient, N |

|---|---|---|---|---|---|---|

| 2004 | 59,960 | 166,817,302 | 9709 | 40,340 | 24.1 | 7.6 |

| 2005 | 68,763 | 202,565,153 | 11,574 | 45,822 | 25.3 | 7.3 |

| 2006 | 71,706 | 213,342,534 | 12,353 | 44,832 | 27.6 | 7.4 |

| 2007 | 81,858 | 228,900,255 | 13,140 | 47,563 | 27.6 | 7.8 |

| 2008 | 91,822 | 245,026,318 | 14,127 | 48,037 | 29.4 | 8.1 |

| 2009 | 92,444 | 238,222,067 | 14,064 | 46,875 | 30.0 | 8.2 |

| 2010 | 96,011 | 241,086,264 | 14,006 | 45,241 | 31.0 | 8.8 |

| 2011 | 102,417 | 251,319,669 | 14,502 | 44,031 | 32.9 | 8.9 |

| 2012 | 105,576 | 255,885,971 | 14,577 | 41,250 | 35.3 | 9.3 |

| 2013 | 105,295 | 242,683,714 | 14,284 | 37,089 | 38.5 | 9.6 |

DMARD indicates disease-modifying antirheumatic drug; RA, rheumatoid arthritis.

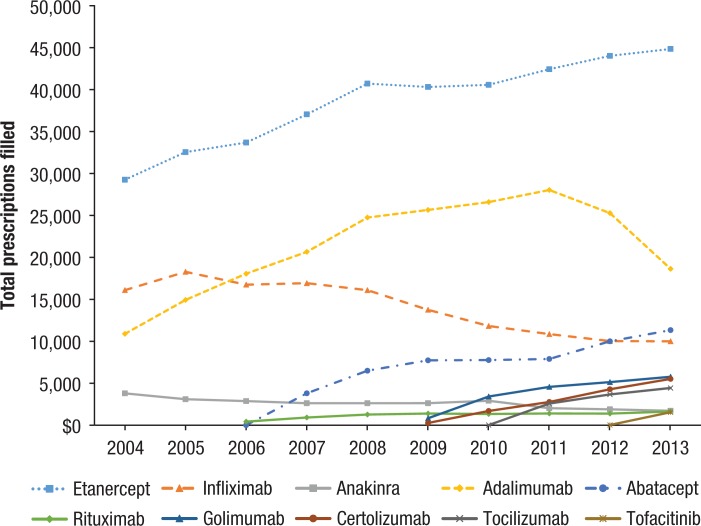

Etanercept, infliximab, and adalimumab—3 of the earliest biologics approved for the treatment of RA—were by far the most frequently prescribed therapies in this class of treatments (44%, 16%, and 24%, respectively), accounting for 84% of the prescriptions overall (Figure 1).

Figure 1.

Annual Number of Biologic DMARD Prescriptions per Drug

All drugs have seen a net increase in the total number of prescriptions filled since 2004. With other new biologic DMARDs launched in the market, infliximab has seen a downward trend since 2005, as did adalimumab starting in 2011.

The relatively newer drugs golimumab, certolizumab, tocilizumab, and tofacitinib have shown consistent year-over-year growth since their first full year on the market (certolizumab, 225%; tocilizumab, 72%; and golimumab, 69%). When stratified by insurance plan type, the expenditures followed the pattern of patient plan distribution, with 62% of expenditures incurred by POS plans, 16% by HMO plans, 12% by EPO plans, 8% by PPO plans, and <2% by FFS plans.

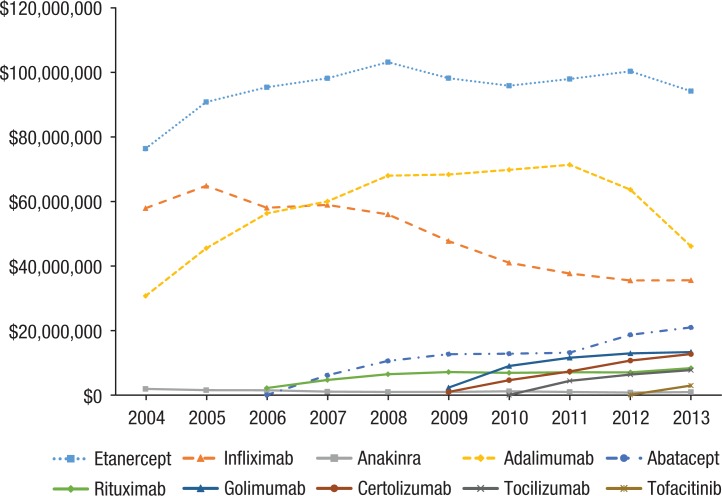

Aggregate spending on biologic DMARDs increased 45% from $166 million in 2004 to $242 million in 2013 (Figure 2). The most costly biologic DMARDs annually included etanercept (approximately $100 million), adalimumab (approximately $60 million), and infliximab (approximately $50 million–$60 million). Newer biologics, such as certolizumab and tocilizumab, also had strong growth in expenditures. The growth of tofacitinib was unable to be calculated, because it was only on the market for 1 full year.

Figure 2.

Annual Aggregate Spending on Biologic DMARDs per Drug

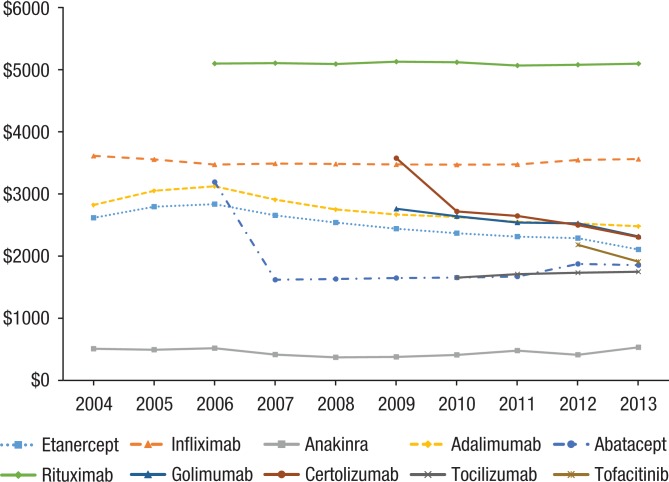

The average reimbursement amount for each biologic has fluctuated over time, with an increase in average cost each year until 2006 (Figure 3). Since 2006, the average cost per prescription has remained relatively unchanged, but costly. The cost for rituximab has been approximately $5000 per prescription fill, and stands out as significantly higher than other approved biologic DMARDs. It's notable that rituximab was initially approved as a chemotherapy agent used to treat cancers of the white blood system (ie, leukemia and lymphomas). Its price may be competitive against other chemotherapy agents, but not against biologic DMARDs.

Figure 3.

Annual Average Cost per Prescription Fill (Price) per Drug

Other costly biologics include infliximab, at approximately $3800 per fill; adalimumab, at approximately $3000 per fill; etanercept, at approximately $2700 per fill; and certolizumab, at approximately $2600 per fill. In addition, the costs of abatacept and certolizumab had a noticeable decrease between their market entry year and their first full year on the market.

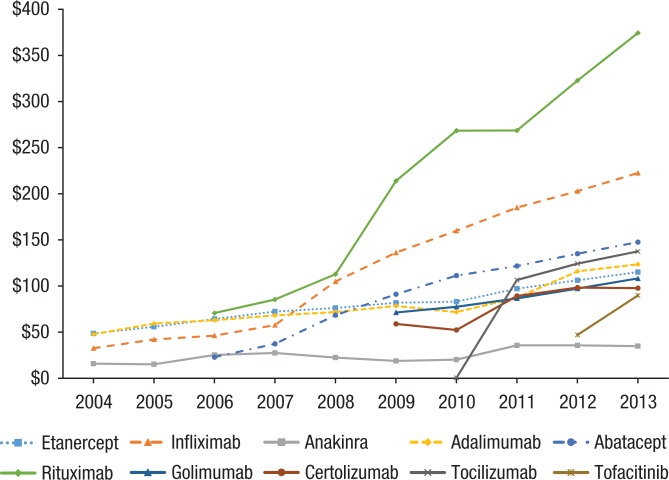

The direct OOP costs and the percentage of cost-sharing increased by more than 10% annually for all biologic DMARDs (Figure 4). By 2013, the average OOP cost per prescription was $145, ranging from $34 for anakinra to $222 for infliximab (Table 4). Rituximab had the highest (30%) annual increase in OOP expenditure, followed by abatacept (28%), certolizumab (27%), and infliximab (25%).

Figure 4.

Average Out-of-Pocket Expenditure per Prescription, by Year and Drug

Table 4.

Patient Out-of-Pocket Expenditures and Cost-Sharing Percentage for Patients with RA, 2004–2013

| OOP cost/cost-sharing percentage | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|

| By biologic/nonbiologic DMARD, $ (%) | ||||||||||

| Etanercept | 48 (2.2) | 55 (2.4) | 63 (2.7) | 71 (3.2) | 75 (3.8) | 81 (4.2) | 82 (3.9) | 96 (4.5) | 105 (4.8) | 114 (5.5) |

| Infliximab | 32 (0.9) | 41 (1.4) | 45 (2.2) | 57 (2.3) | 10 (3.6) | 135 (4.6) | 159 (5.3) | 184 (5.9) | 202 (6.1) | 222 (6.6) |

| Anakinra | 15 (4.9) | 14 (5.7) | 24 (7.4) | 26 (11.6) | 22 (12.2) | 18 (11.5) | 19 (10.7) | 35 (15.5) | 35 (14.8) | 34 (14.2) |

| Adalimumab | 47 (1.9) | 58 (2.3) | 62 (2.5) | 67 (2.8) | 71 (3.3) | 78 (3.6) | 71 (3.0) | 86 (3.8) | 115 (5.0) | 123 (5.3) |

| Abatacept | — | — | 22 (11.6) | 36 (2.4) | 68 (4.4) | 90 (5.6) | 110 (6.9) | 121 (7.4) | 134 (7.7) | 147 (8.2) |

| Rituximab | — | — | 70 (1.5) | 85 (1.8) | 11 (2.4) | 213 (4.2) | 268 (5.3) | 268 (5.5) | 322 (6.5) | 374 (7.5) |

| Golimumab | — | — | — | — | — | 70 (2.9) | 77 (3.1) | 86 (3.5) | 96. (4.0) | 107 (4.6) |

| Certolizumab | — | — | — | — | — | 58 (2.2) | 51 (2.1) | 88 (3.6) | 97 (4.1) | 97 (4.4) |

| Tocilizumab | — | — | — | — | — | — | — | 106 (7.4) | 123 (8.1) | 137 (8.9) |

| Tofacitinib | — | — | — | — | — | — | — | — | 46 (2.1) | 89 (4.7) |

| By insurance plan type, $ (%) | ||||||||||

| EPO | 37 (1.4) | 47 (2.2) | 48 (2.2) | 50 (2.3) | 68 (2.9) | 66 (3.3) | 70 (3.5) | 78 (3.7) | 83 (3.8) | 93 (4.2) |

| PPO | 52 (2.5) | 51 (2.1) | 59 (2.8) | 62 (3.3) | 69 (5.9) | 77 (5.9) | 78 (3.4) | 89 (3.9) | 107 (4.6) | 117 (5.4) |

| POS | 63 (2.6) | 79 (4.0) | 97 (8.1) | 96 (8.5) | 102 (7.3) | 104 (7.0) | 102 (7.2) | 104 (7.4) | 110 (6.5) | 121 (7.1) |

| FFS | 39 (1.9) | 49 (2.2) | 58 (2.5) | 65 (2.9) | 82 (3.7) | 97 (4.3) | 95 (4.4) | 114 (5.1) | 131 (5.8) | 141 (6.4) |

| HMO | 39 (1.8) | 49 (2.1) | 48 (2.2) | 67 (3.0) | 81 (3.6) | 91 (4.0) | 104 (4.9) | 125 (5.8) | 138 (6.2) | 151 (6.7) |

| Other | 37 (1.5) | 42 (1.9) | 76 (3.2) | 82 (3.6) | 125 (5.6) | 109 (4.7) | 109 (5.3) | 152 (6.9) | 170 (7.2) | 180 (8.0) |

DMARD indicates disease-modifying antirheumatic drug; EPO, exclusive provider organization; FFS, fee for service; OOP, out-of-pocket; POS, point of service; RA, rheumatoid arthritis.

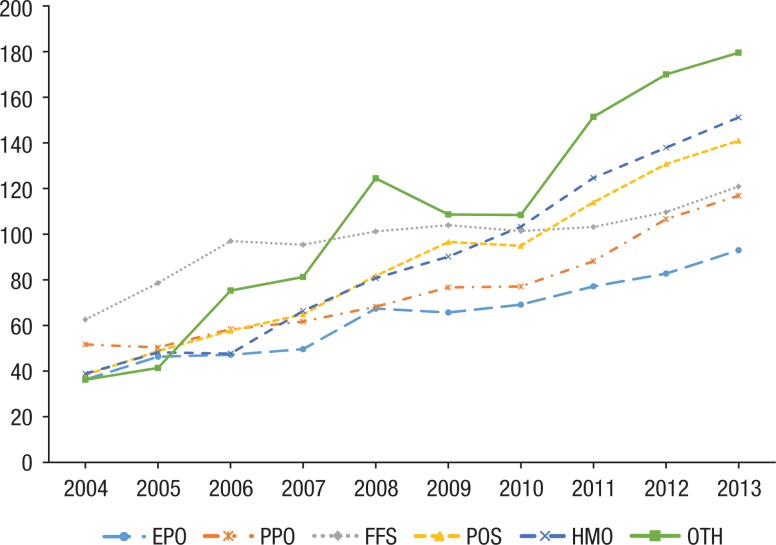

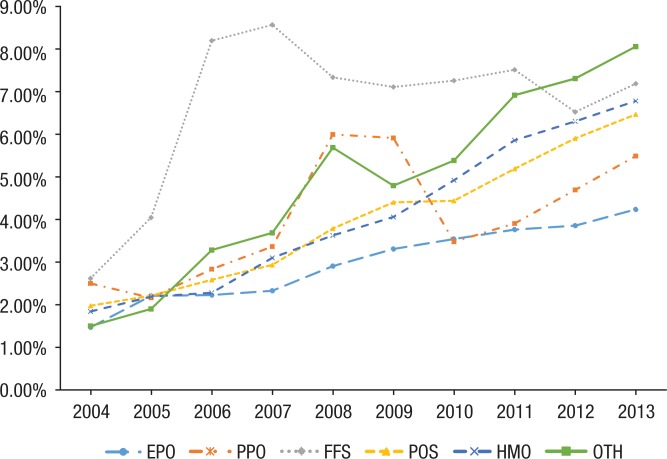

The average OOP expenditure within each plan showed the same pattern of steady increases from 2004 to 2013 (Figure 5). HMO plans and uncategorized plans showed the largest increase in OOP spending, for example, the OOP expenditure for a patient with an HMO plan increased 288% from $39 to $151 per fill; OOP spending for plans in the “other” category increased 388% from $36 to $180 per fill. FFS plans showed the lowest increase (92%) from 2004 to 2013. EPO and PPO plans consistently had the lowest OOP spending and percentage of cost-sharing (Figure 6).

Figure 5.

Average Out-of-Pocket Expenditure, by Insurance Plan Type

Figure 6.

Average Patient Cost-Sharing, by Insurance Plan Type

Discussion

The identified cohort in our study matched the descriptions of similar cohorts from other studies of biologic DMARD costs, in being predominantly female, older, and Caucasian.3,21–26 The data in Table 3 show an annual increase in the percentage of patients who were prescribed a biologic, demonstrating physicians' increased confidence in prescribing these new medications.

It is possible that other factors, such as easier dosing regimens, autoinject syringes for at-home use, oral agents, and direct-to-patient marketing, have contributed to increased utilization of biologic DMARDs. Strong competition from multiple competing therapies may have kept prices in check and relatively similar, with the exception of rituximab, whose price is based off of competing chemotherapy agents, which are generally more expensive than DMARDs. Multiple treatment options targeting several sites have clinical and economic benefits for patients.

However, a recent study reported that more than 50% of patients with RA who were prescribed their first biologic DMARD (88.7% TNF inhibitors) did not fill the prescription via a pharmacy or receive the drug in an outpatient or inpatient setting within 30 days of the index prescription. By 180 days postindex, more than 40% of patients had not yet filled or received a prescription for a biologic DMARD.27

There are clear favorites in physicians' prescribing patterns for older drugs (ie, etanercept, infliximab, and adalimumab) that have documented safety profiles. These drugs were also the first to be approved as first-line therapy options for the treatment of RA, and most insurance plans require that patients use at least 2 anti-TNF drugs before moving to a different class of biologic. This leads to the higher utilization and expenditures seen with anti-TNF drugs compared with the newer biologic DMARDs. We did not expect to see the decreases in prescriptions and in spending for these 3 drugs (ie, etanercept, infliximab, and adalimumab) in 2012 and 2013.

There have been 6 biologics approved since 2005 for RA, 4 of which were approved since 2009, which could be eating into the market share of the older RA drugs. There has been a considerable amount of research about switching drugs among biologic DMARDs in recent years. Research suggests that a high proportion of patients who do not respond to their initial anti-TNF therapy are unlikely to have a meaningful response to a second anti-TNF drug,28 or that dosing for a second anti-TNF drug may need to be increased.29 Although anti-TNF treatment cycling is common and may be required by some drug benefit plans, this may lead to increased risk for patients who are exposed to therapies without the possibility for a meaningful benefit.

It is possible that with 6 additional treatment options, physicians are more comfortable switching a patient's treatment to another biologic DMARD faster if a patient is not responding as quickly or as completely as they would like, especially with treat-to-target paradigms; however, these older drugs are still leaders in the industry, because they are approved for multiple indications. It is possible that although the RA market share is going down, these agents are gaining ground in other indications, where there may not be as many approved treatment options, as has happened in the treatment for psoriasis, with the approval of secukinumab and apremilast.

Two drugs are outliers in general. Rituximab, the first US Food and Drug Administration (FDA)-approved CD-20 inhibitor, was first developed for lymphoma and leukemia. As such, it was priced in relation to other chemotherapy agents. The cost per prescription is extremely high by comparison, and the number of annual prescriptions was initially relatively low. It is possible that rituximab was approved by the FDA only for patients with moderate-to-severe RA, because there are lower-cost options with easier routes of administration. Anakinra, 1 of only 2 interleukin-1 receptor antagonists, is another outlier drug, with an extremely low cost per prescription but relatively low utilization, indicating a lack of faith in the drug by physicians. This claim is backed up by Amgen's sale of anakinra to Sobi in 2013, although Sobi has invested in the clinical development of the drug for the treatment of other conditions.30

Stratification by insurance plan type clearly demonstrates the drug benefit design of the plan with respect to biologics. EPO and PPO plans, which have more expensive premiums than other plan types, offered the lowest OOP costs and the lowest increase in patient cost-sharing. HMOs, which have lower premiums, ended up with the highest OOP costs and the highest amount of cost-sharing. This puts a disproportionate burden on patients who may not be able to afford the higher premiums of plans with better drug benefits.

A recent study of patients covered under the Medicare Advantage plan and Prescription Drug Plan has shown that higher OOP costs affect a patient's decision to initiate treatment with a biologic DMARD or if the patient would continue to use a biologic DMARD.31 An examination of the OOP expenditures of biologic DMARDs exposes several trends. Patients are being asked to participate in greater cost-sharing year after year, as is evidenced by the increase in average OOP spending, while the average cost of biologic DMARDs decreases. This is in line with a payer's interest to control costs by controlling access to specialty and top-tier drugs. On the surface, these data support the idea that specialty and top-tier drug pricing is very inelastic to demand.

Drug manufacturers, however, have engaged in a series of initiatives through rebates, patient access programs, and other reimbursement schemes to deflect and absorb a patient's direct financial burden and to increase access to biologic DMARDs, thereby invoking a moral hazard. Payers have attempted not to honor rebates or coupons, but little data are available to support that this tactic is effective at controlling cost.

The impact that biosimilar generics in the RA market will have on reducing costs is unclear. The Biologics Price Competition and Innovation (BPCI) Act, which was passed under the Affordable Care Act, lays out a regulatory pathway for generic biologics. The BPCI provisions for biosimilars allow for 2 distinct categories—biosimilars and interchangeable biologic drugs.32 It is unlikely that any drug will immediately achieve status as an interchangeable biologic drug.33,34

Any new biosimilar drug will likely have market penetration similar to that of a novel drug. This will be unlike the impact that generic small-molecule drugs had on brand-name reference drugs, which saw 70% to 80% decreases in costs over time.34–36 Although it is assumed that there will be some cost-savings, biosimilars are likely to be closer to 20% to 30% of the reference drug.36

This is particularly relevant for the new biosimilar approvals, including infliximab, with the April 2016 approval of infliximab-dyyb (Inflectra; Celltrion), a biosimilar to Remicade37; the August 2016 approval of etanercept-szzs (Erelzi; Novartis), a biosimilar to Enbrel38; and the September 2016 approval of adalimumab-atto (Amjevita; Amgen), a biosimilar to Humira.39

Limitations

This study used a large single-payer data set and may not represent the subscriber characteristics of other payers.

Only the cost of biologic DMARDs was included for the intravenously administered medications. The costs associated with the administration and monitoring of the infusion were not included, nor were costs for teaching patients about self-injectables.

Data for tofacitinib were limited, and a detailed analysis was not possible with the current data set, because the drug was only on the market for 1 full year at the time of this analysis.

Furthermore, these current study data were only available from 2004 through 2013, which limits the observation of this study to the more recent market share changes. For example, recently, the utilization of adalumimub was reported to increase in the RA treatment marketplace, and etanercept may lose some market share because of switching patients with RA to adalimumab, as well as from switching patients with psoriasis to apremilast or secukinumab.

Conclusion

Spending on biologic DMARDs has been primarily driven by an increase in prescribing rates, because the cost per prescription remained relatively unchanged over time. The OOP burden for patients has increased, but this does not appear to have limited the use of biologic DMARDs. The entrance of new biologics may be eroding some market share for established drugs through faster rates of treatment switching. Attempts at cost control via cost-sharing have either been ineffective or circumvented. Patients and physicians have a wide array of treatment options with varying treatment targets, and creating a competitive market might help control costs. The introduction of biosimilars will be critical to continued cost control, but the effects of biosimilars are unlikely to be as dramatic as the effects that small-molecule generic drugs have had in their respective markets.

Acknowledgments

The opinions and conclusions expressed in this manuscript are solely those of the authors.

Author Disclosure Statement

Mr Atzinger reported no conflicts of interest. Dr Guo has received research grant or unrestricted grant funding from CMS MedTAPP & Ohio Department of Jobs and Family Services (Medicaid Agency), Ortho-McNeil Janssen Scientific Affairs, Eli-Lilly, Novartis, and Roche-Genentech.

Contributor Information

Christopher B. Atzinger, Graduate student, College of Pharmacy, University of Cincinnati, OH, and Associate Director, Pharmerit International, Bethesda, MD.

Jeff J. Guo, Professor, Pharmacoepidemiology & Pharmacoeconomics, College of Pharmacy, University of Cincinnati..

References

- 1. Centers for Disease Control and Prevention. Rheumatoid arthritis (RA). Updated July 22, 2016. www.cdc.gov/arthritis/basics/rheumatoid.htm. Accessed June 15, 2016.

- 2. Smith HR, Brown A. Rheumatoid arthritis. Medscape. Updated February 2013. http://emedicine.medscape.com/article/331715-overview. Accessed April 4, 2013.

- 3. Filipovic I, Walker D, Forster F, Curry AS. Quantifying the economic burden of productivity loss in rheumatoid arthritis. Rheumatology (Oxford). 2011; 50: 1083–1090. [DOI] [PubMed] [Google Scholar]

- 4. Scott DL, Wolfe F, Huizinga TW. Rheumatoid arthritis. Lancet. 2010; 376: 1094–1108. [DOI] [PubMed] [Google Scholar]

- 5. Shammas RM, Ranganath VK, Paulus HE. Remission in rheumatoid arthritis. Curr Rheumatol Rep. 2010; 12: 355–362. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6. Felts W, Yelin E. The economic impact of the rheumatic diseases in the United States. J Rheumatol. 1989; 16: 867–884. [PubMed] [Google Scholar]

- 7. Seymour HE, Worsley A, Smith JM, Thomas SH. Anti-TNF agents for rheumatoid arthritis. Br J Clin Pharmacol. 2001; 51: 201–208. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8. Kvien TK. Epidemiology and burden of illness of rheumatoid arthritis. Pharmacoeconomics. 2004; 22 (2 suppl 1): 1–12. [DOI] [PubMed] [Google Scholar]

- 9. Alamanos Y, Voulgari PV, Drosos AA. Incidence and prevalence of rheumatoid arthritis, based on the 1987 American College of Rheumatology criteria: a systematic review. Semin Arthritis Rheum. 2006; 36: 182–188. [DOI] [PubMed] [Google Scholar]

- 10. Truven Health Analytics. Micromedex Solutions web applications access. www.micromedexsolutions.com. Accessed June 15, 2016.

- 11. Keystone EC, Smolen J, van Riel P. Developing an effective treatment algorithm for rheumatoid arthritis. Rheumatology (Oxford). 2012; 51 (suppl 5): v48–v54. [DOI] [PubMed] [Google Scholar]

- 12. Singh JA, Saag KG, Bridges SL, Jr, et al. 2015. American College of Rheumatology guideline for the treatment of rheumatoid arthritis. Arthritis Rheumatol. 2016; 68: 1–26. [DOI] [PubMed] [Google Scholar]

- 13. Doshi JA, Li P, Puig A. Impact of the Medicare Modernization Act of 2003 on utilization and spending for Medicare Part B-covered biologics in rheumatoid arthritis. Arthritis Care Res (Hoboken). 2010; 62: 354–361. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 14. Yazdany J, Tonner C, Schmajuk G. Use and spending for biologic disease-modifying antirheumatic drugs for rheumatoid arthritis among US Medicare beneficiaries. Arthritis Care Res (Hoboken). 2015; 67: 1210–1218. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15. Yazdany J, Dudley RA, Chen R, et al. Coverage for high-cost specialty drugs for rheumatoid arthritis in Medicare Part D. Arthritis Rheumatol. 2015; 67: 1474–1480. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 16. Patel BN, Audet PR. A review of approaches for the management of specialty pharmaceuticals in the United States. Pharmacoeconomics. 2014; 32: 1105–1114. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 17. Goldman DP, Joyce GF, Lawless G, et al. Benefit design and specialty drug use. Health Aff (Millwood). 2006; 25: 1319–1331. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 18. Karaca-Mandic P, Joyce GF, Goldman DP, Laouri M. Cost sharing, family health care burden, and the use of specialty drugs for rheumatoid arthritis. Health Serv Res. 2010; 45 (5 pt 1):1227–1250. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 19. Optum. Clinformatics Data Mart User Manual. Vol 5.0.1. Eden Prairie, MN: Optum; 2014. www.optum.ca/life-sciences/differentiate-products/marketing-analytics/clinformatics-data-mart.html. Accessed June 15, 2016. [Google Scholar]

- 20. Chung CP, Rohan P, Krishnaswami S, McPheeters ML. A systematic review of validated methods for identifying patients with rheumatoid arthritis using administrative or claims data. Vaccine. 2013; 31 (suppl 10): K41–K61. [DOI] [PubMed] [Google Scholar]

- 21. Birnbaum HG, Pike C, Banerjee R, et al. Changes in utilization and costs for patients with rheumatoid arthritis, 1997 to 2006. Pharmacoeconomics. 2012; 30: 323–336. [DOI] [PubMed] [Google Scholar]

- 22. Bonafede MM, Fox KM, Johnson BH, et al. Factors associated with the initiation of disease-modifying antirheumatic drugs in newly diagnosed rheumatoid arthritis: a retrospective claims database study. Clin Ther. 2012; 34: 457–467. [DOI] [PubMed] [Google Scholar]

- 23. Bonafede MM, Gandra SR, Watson C, et al. Cost per treated patient for etanercept, adalimumab, and infliximab across adult indications: a claims analysis. Adv Ther. 2012; 29: 234–248. [DOI] [PubMed] [Google Scholar]

- 24. Borah BJ, Huang X, Zarotsky V, Globe D. Trends in RA patients' adherence to subcutaneous anti-TNF therapies and costs. Curr Med Res Opin. 2009; 25: 1365–1377. [DOI] [PubMed] [Google Scholar]

- 25. Carter CT, Changolkar AK, Scott McKenzie R. Adalimumab, etanercept, and infliximab utilization patterns and drug costs among rheumatoid arthritis patients. J Med Econ. 2012; 15: 332–339. [DOI] [PubMed] [Google Scholar]

- 26. Cheng LI, Rascati KL. Impact of Medicare Part D for Medicare-age adults with arthritis: prescription use, prescription expenditures, and medical spending from 2005 to 2008. Arthritis Care Res (Hoboken). 2012; 64: 1423–1429. [DOI] [PubMed] [Google Scholar]

- 27. Harnett J, Wiederkehr D, Gerber R, et al. Primary nonadherence, associated clinical outcomes, and health care resource use among patients with rheumatoid arthritis prescribed treatment with injectable biologic disease-modifying antirheumatic drugs. J Manag Care Spec Pharm. 2016; 22: 209–218. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 28. Gottenberg JE, Brocq O, Perdriger A, et al. Non-TNF-targeted biologic vs a second anti-TNF drug to treat rheumatoid arthritis in patients with insufficient response to a first anti-TNF drug: a randomized clinical trial. JAMA. 2016; 316: 1172–1180. [DOI] [PubMed] [Google Scholar]

- 29. Greenberg JD, Reed G, Decktor D, et al; for the CORRONA Investigators. A comparative effectiveness study of adalimumab, etanercept and infliximab in biologically naive and switched rheumatoid arthritis patients: results from the US CORRONA registry. Ann Rheum Dis. 2012; 71: 1134–1142. [DOI] [PubMed] [Google Scholar]

- 30. Sobi acquires full rights for Kineret and additional clinical data for Kepivance from Amgen. Press release; September 9, 2013. Updated July 27, 2011. www.sobi.com/en/Investors--Media/News/RSS/?RSS=http://publish.ne.cision.com/Release/GetDetailInLegacyFormat/80F2BE0AF59DCBB0. Accessed January 13, 2017.

- 31. Hopson S, Saverno K, Liu LZ, et al. Impact of out-of-pocket costs on prescription fills among new initiators of biologic therapies for rheumatoid arthritis. J Manag Care Spec Pharm. 2016; 22: 122–130. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 32. Biologics Price Competition and Innovation Act of 2009, Pub L No. 111–148, Title VII, Subtitle A, 124 Stat 804–821.

- 33. Falit BP, Singh SC, Brennan TA. Biosimilar competition in the United States: statutory incentives, payers, and pharmacy benefit managers. Health Aff (Millwood). 2015; 34: 294–301. [DOI] [PubMed] [Google Scholar]

- 34. Grabowski HG, Guha R, Salgado M. Regulatory and cost barriers are likely to limit biosimilar development and expected savings in the near future. Health Aff (Millwood). 2014; 33: 1048–1057. [DOI] [PubMed] [Google Scholar]

- 35. Kelton CM, Chang LV, Guo JJ, et al. Firm- and drug-specific patterns of generic drug payments by US Medicaid programs: 1991–2008. Appl Health Econ Health Policy. 2014; 12: 165–177. [DOI] [PubMed] [Google Scholar]

- 36. Singh SC, Bagnato KM. The economic implications of biosimilars. Am J Manag Care. 2015; 21 (16 suppl): s331–s340. [PubMed] [Google Scholar]

- 37. US Food and Drug Administration. FDA approves Inflectra, a biosimilar to Remicade. Press release; April 5, 2016. www.fda.gov/NewsEvents/Newsroom/PressAnnouncements/ucm494227.htm. Accessed January 16, 2017.

- 38. US Food and Drug Administration. FDA approves Erelzi, a biosimilar to Enbrel. Press release; August 30, 2016. www.fda.gov/newsevents/newsroom/pressannouncements/ucm518639.htm. Accessed January 16, 2017.

- 39. US Food and Drug Administration. FDA approves Amjevita, a biosimilar to Humira. Press release; September 23, 2016. www.fda.gov/newsevents/newsroom/pressannouncements/ucm522243.htm. Accessed January 16, 2017.