Abstract

Between 1968 and 2013, the poverty rate of young children age 0 to 5 years fell by nearly one third, in large part because of the role played by anti-poverty programs. However, young children in the U.S. still face a much higher rate of poverty than do older children in the U.S. They also continue to have a much higher poverty rate than do young children in other developed countries around the world. In this paper, we provide a detailed analysis of trends in poverty and the role of anti-poverty programs in addressing poverty among young children, using an improved measure of poverty, the Supplemental Poverty Measure. We examine changes over time and the current status, both for young children overall and for key subgroups (by child age, and by child race/ethnicity). Our findings can be summarized in three key points. First, poverty among all young children age 0–5 years has fallen since the beginning of our time series; but absent the safety net, today’s poverty rate among young children would be identical to or higher than it was in 1968. Second, the safety net plays an increasing role in reducing the poverty of young children, especially among Black non-Hispanic children, whose poverty rate would otherwise be 20.8 percentage points higher in 2013. Third, the composition of support has changed from virtually all cash transfers in 1968, to about one third each of cash, credit and in-kind transfers today.

1.0 Introduction

The child poverty rate in the United States is among the highest of developed nations in the world (Smeeding et al., 2016). In 2015, one in five children in the United States lived at or below the official poverty line (Proctor, Semega, & Kollar, 2016). With the more comprehensive Supplementary Poverty Measure (SPM), child poverty rates are lower, but children still have the highest poverty rates as compared to working-aged and elderly adults (Renwick & Fox, 2016). Moreover, young children’s SPM poverty rate is considerably higher than that of older children (20.9 percent, compared to 18.0 percent among 6–11 year olds and 16.0 percent among 12–17 year olds (Wimer, Nam, Waldfogel, & Fox, 2016) a pattern that is especially disconcerting given young children’s particular vulnerability to the effects of poverty (see e.g., Brooks-Gunn & Duncan, 1997; Duncan, Morris, & Rodrigues, 2011). While children of all ages may be affected directly and indirectly by poverty, young children are particularly at risk, because they are wholly dependent on their parents and caretakers for adequate subsistence and care. Moreover, early childhood (the period from birth through age five) is generally recognized as a “sensitive period”, during which children’s neurological development and subsequent cognitive and non-cognitive abilities are shaped by the accumulation of childhood experiences (Almond & Currie, 2011; Noble et al., 2015; Shonkoff et al., 2012).

Early childhood experiences in turn set the stage for later advantage or disadvantage. Economist James Heckman and others have documented that nearly half of income inequality in adulthood is due to factors that were set into place by age 18 (Cunha & Heckman, 2007; Heckman, 2006a, 2008b), and that the environment experienced in early childhood is a unique determinant of the skill formation critical to reducing the risk of poverty and improving human capital and health outcomes later in life (Heckman 2006, 2008a). Several recent studies have shown that children’s skills and ability measured at ages 6 to 8 predict nearly 12 percent of the variation in adult years of education (Mcleod & Kaiser, 2000), and up to 20 percent of the variation in adult wages (Cunha, Heckman, & Schennach, 2010; Currie & Thomas, 1999). A well-established body of interdisciplinary research has documented a number of consequences of early childhood poverty; these differ greatly in effect by the timing, intensity, duration, and type of scarcity (Brooks-Gunn & Duncan, 1997; Duncan, Yeung, Brooks-Gunn, & Smith, 1998; Hair, Hanson, Wolfe, & Pollak, 2015). Among these, the most salient short-term effects of income poverty include cognitive delays, lower educational attainment, and negative health effects. A number of studies have shown that children exposed to poverty at a young age have lower levels of academic achievement and lower test scores on standardized tests (Hair et al., 2015; Milligan & Stabile, 2011; Ratcliffe & McKernan, 2012; Smith, Brooks-Gunn, & Klebanov, 1997). Family income in early childhood also shows a strong relationship with children’s health status, which increases in magnitude and significance over time, likely as a result of the cumulative effects of negative health shocks (Aizer & Currie, 2014; Almond & Currie, 2011; Currie, 1993). Being born into an impoverished family has been associated with structural differences in the brain (Noble et al., 2015), and an increased exposure to environmental pollutants and toxins associated with disadvantage such as low birth weight, stunting, and decreased cognitive ability (Aizer & Currie, 2014; Currie & Walker, 2011; Schwartz, 1994; Schwartz, Angle, & Pitcher, 1986). As many of the deleterious effects of poverty are evident in children who experienced even just one year of poverty (Chaudry & Wimer, 2016), the early childhood period represents an important window for intervention.

Anti-poverty efforts that raise the incomes of families with young children are likely to yield large returns, because investments targeted at young children appear to be particularly productive, and more so for the less-advantaged (Cunha & Heckman, 2007; Hair et al., 2015; Heckman, 2006a, 2008a). In addition, numerous studies have shown that the earlier the anti-poverty intervention, the more sizable the positive effect to the well-being and human capital potential across the life course of a child (Brooks-Gunn & Duncan, 1997; Cunha & Heckman, 2007; Cunha et al., 2010; Dahl & Lochner, 2012; Duncan et al., 1998; Heckman, 2008a). Although the need for anti-poverty intervention in early childhood is clear, policymakers must decide the best “package” of anti-poverty interventions; i.e. that which has the most effective impact at the lowest relative cost.

Conventional economic theory suggests that policymakers should have a strong preference for supplying cash transfers (including tax credits that are consumed as cash) rather than in-kind transfers, as these offer the consumer the chance to spend the benefit in the way that best serves the needs of their family. However, the US government has long preferred in-kind transfers for their behavior-constraining features, as they are structured to ensure that a benefit is allocated fairly – especially for children -- and consumed optimally (Currie & Gahvari, 2007). For instance, nutritional programs such as SNAP and WIC give assurance that children are nourished, housing programs ensure basic housing, and Medicaid ensures a baseline level of access to healthcare. Although a number of causal studies have shown that in-kind transfer programs positively affect child well-being, in-kind benefits are not a substitute for cash. This point is vividly illustrated in the influential work of Edin and Shaefer (2015), who show that the need for cash is unique, and cannot be satisfied by food stamps (SNAP) or other in-kind benefits for families with unstable employment; without cash, the needs of the most destitute of families remain unmet. Yet, low-income families face a considerable disadvantage in accessing regular cash benefits, because in-kind and tax credit benefits are not fungible in the case of the former and come but once a year in the case of the latter.

1.1 The present paper

To date, there is relatively little evidence about the rates and trends in the risk of poverty among children age 0–5 in the United States or the role of the safety net in addressing such risk, and none to date that uses a comprehensive measure of poverty such as we use here. In this paper, we provide estimates of the historical trends in early childhood poverty as measured by the SPM disaggregated by age and race/ethnicity, followed by an analysis of the current and historical “package of benefits” available to families with young children. The paper thus provides critical evidence on the economic position of young children over time, and the resources that their families have at their disposal to meet their needs.

Unlike the official measure of poverty, the SPM uses a more comprehensive definition of resources, counting government transfers, cash and in-kind benefits, and tax credits toward the family budget. The SPM subtracts from this resource measure non-discretionary expenses, such as medical and child care expenditures, and income taxes. The family’s total resources are then compared to a poverty threshold that is adjusted to account for family size and resource sharing. As we detail in the data and methods section below, the SPM represents a distinct advantage over the official poverty measure.

We first partition young children in our sample by age into two distinct developmental periods: infancy / toddlerhood (0–2 years) and preschool age (3–5 years). The gradient of dependency that tapers off once children enter grade school shifts at around three years of age, when children achieve a number of developmental milestones. For instance, by the third year, children acquire a great deal of physical autonomy and begin to master the language skills needed to express their points of view (Waldfogel, 2006); both of these skills are essential to forming peer-relationships and for school preparation. Not only does this partition demarcate a shift in children’s physical, emotional, and cognitive development, but the family budget undergoes a substantial shift as well. At around the third year, parental spending transitions from one-time and persistent child-specific expenses -- such as car seats and strollers, and the costs associated with diapering, feeding, etc. -- to a period with expenses that are more regularly integrated into the family budget. While some large costs, such as diapering supplies and specialized gear, may decrease as a child transitions from one phase to the next, other costs increase over time, with the exception of the cost of childcare, which typically declines until the child reaches grade school (Lino, 2014). Infant and toddler childcare tends to be very expensive, because of the high staff-to-child ratios required. However, many infants and toddlers are cared for by a parent or relative, while preschoolers are more likely to go to daycare or preschool (Waldfogel, 2006). It is therefore not clear whether the risk of poverty is likely to be higher for infants/toddlers than it is for preschoolers or vice versa.

Second, we stratify our sample by race/ethnicity. Historically, racial/ethnic minorities have experienced higher rates of poverty than the white, non-Hispanic population as measured under the official poverty measure. Similar patterns have been observed under the Supplemental Poverty Measure as well (Haveman, Blank, Moffitt, Smeeding, & Wallace, 2014; Nolan et al., 2016b; Short, 2015). While safety net programs are not structured to benefit one race/ethnic group over another, the anti-poverty effects of these programs may differ by race/ethnicity. While several papers have found larger positive effects of safety net programs for minority children compared to non-Hispanic white children (see e.g. Hoynes, Schanzenbach, & Almond, 2016), the findings of other studies suggest that children of racial/ethnic minorities experienced larger negative effects of welfare reform as well, in the form of more frequent sanctioning, gaps in insurance coverage, and access to healthcare (Bitler, Gelbach, & Hoynes, 2005; Schram, Soss, Fording, & Houser, 2009; Wu, 2008). Although it is outside the scope of the present paper to explore the mechanisms behind this disparity, our stratification by a children’s race/ethnicity allows us to acknowledge and explore this known source of heterogeneity in our poverty rate estimations.

The paper proceeds as follows. After describing our data and methodology for constructing the SPM measure of poverty, we document (a) the prevalence of poverty over time for young children, and how this varies by two key factors – child age, and child race/ethnicity; and (b) the effects of government policies and programs on young child poverty rates, and how these vary by child age and child race/ethnicity. Accordingly, we begin in the next section by describing the data and defining the measures of poverty we use. Then, in section 3.1, we present trends in poverty for young children as a whole and by age and race/ethnicity. In section 3.2, we analyze the role of the package of benefits available to families with young children. And in Section 4.0, we conclude by summarizing main findings and pointing out limitations and implications for further research.

2.0 Data and Methods

2.1 Data

Drawing on data constructed by Fox and colleagues (Fox, Wimer, Garfinkel, Kaushal, & Waldfogel, 2015), we use a sample of over 714,000 children age 0 to 5 years from the Census Bureau’s Current Population Survey Annual Social and Economic Supplement (CPS ASEC). The CPS ASEC is the source of official US poverty statistics and provides data going back historically to the 1960s.

We analyze poverty and the role of anti-poverty programs using the Supplemental Poverty Measure (SPM). Because the information required to produce the SPM exists only since 2009, we use the augmented historical data created by Fox et al. (2015), which used imputation techniques to create an SPM measure that can capture trends in a historically consistent manner. The data sources used for imputation and the accompanying imputation techniques are described in detail in the appendix of Fox et al. (2015).

Our analysis covers the time period from 1968 to 2013. To increase sample size and the accuracy of our estimates, we use 3-year moving averages for all our estimates; this is particularly important when we examine finer-grained age groups (i.e., children age 0 to 2 years and age 3 to 5 years) or sub-groups of children by race/ethnicity.

2.2 Measures

2.2.1 Measuring Poverty

We use the Supplemental Poverty Measure (SPM) as our measure of poverty. The SPM is better suited for this analysis than the official measure, because the SPM uses a more comprehensive definition of resources, including both cash and in-kind benefits (such as SNAP, WIC, and housing assistance), as well as tax credits (such as the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC)). Additionally, the SPM subtracts from family resources the value of income taxes and non-discretionary expenses (such as medical out of pocket expenditures, MOOP, and child care costs). Poverty is then determined by comparing resources with the SPM thresholds, which more accurately reflect family living standards than do official thresholds.

The official measure of poverty was conceived in 1963, and at the time, represented an important milestone in our nation’s War on Poverty, as it became the principal metric for measuring the need for and role of the social safety net. The official measure’s statistical shortcomings compelled the National Academy of Sciences to converge upon a set of recommendations for improving the measure of poverty (Citro and Michael, 1995), resulting in the SPM (Short, 2011). We use an iteration of the SPM, calculated historically, in the present paper.

The official measure was designed to compare the pre-tax market income of a family against a poverty threshold; if a family’s income falls below the threshold, they are considered to be in poverty. Poverty thresholds were set at three times the cost of a minimally adequate food diet, with adjustments for the size and composition of the family and the age of the householder, updated annually by the Consumer Price Index (CPI).

There are five major shortcomings of the official measure. First, its measure of resources does not account for in-kind benefits (such as food stamps) and tax credits (such as the Earned Income Tax Credit), which have become an increasingly important part of the safety net over time. Second, the official measure does not subtract from available income non-discretionary expenses such as medical out-of-pocket expenditures (MOOP), and child care and work expenses. Third, the official thresholds are based on 1960s family budgets, when food represented 1/3 of low-income family expenditures; food now represents only about 1/6 of family spending with housing representing the single largest item. Fourth, the official measure uses an outdated definition of the family, for example excluding from the family unit cohabiting partners who represent an increasing share of parents and likely do contribute to and benefit from the family budget (see e.g. Cherlin, 2010; Mclanahan, 2004). Fifth, official thresholds are not adjusted for geographical differences in the cost-of-living, which have become increasingly important over time as housing costs have grown to assume a larger share of family budgets (Nolan et al., 2016a).

In summary, the SPM improves on the official measure by more fully accounting for resources, expenses, and resource sharing, comparing household resources against poverty thresholds that are adjusted for modern standards of living as well as differences in costs of living across the US, and applying a broader definition of the household. For this reason, the SPM has been used to generate more accurate estimates of trends in poverty over time as well as estimates of current poverty today (Fox et al., 2015; Renwick & Fox, 2016; Wimer, Fox, Garfinkel, Kaushal, & Waldfogel, 2016). We detail our construction of the SPM below. For the most part, we follow Census procedures for the SPM but like Wimer et al. (2016), we differ from Census in using an “anchored” SPM measure, as detailed below.

2.2.2 Benefit measures

We define cash benefits as the total amount of welfare (TANF/AFDC), social security (SS), supplemental security income (SSI), and unemployment benefits. We define in-kind benefits as the total of food stamps (SNAP), housing subsidies, Low Income Home Energy Assistance Program (LIHEAP), and the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC).1 We define tax credit benefits as the total of Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC). We exclude short-term credits, such as Making Work Pay, and federal stimulus payments.

2.3 Poverty unit

Unlike the official poverty measure, in which the “poverty unit” is defined as the family (i.e. all individuals in the household related by blood, marriage, or adoption) -- the SPM broadens the definition of families to include unmarried partners (and their children/family members), unrelated children under age 15, and foster children under age 22 (when identifiable). We use the expanded definition in the CPS in all years. Full details of our methodological procedures can be found in Fox et al. (2015).

2.4 Threshold

The augmented CPS datasets that we use follow the Bureau of Labor Statistics’ SPM methodology in constructing poverty thresholds using a five-year average of the Consumer Expenditure Survey (CE) data on expenditures on food, clothing, shelter and utilities (FCSU) by consumer units with exactly two children (called the “reference unit”). Thresholds were adjusted by a three-parameter equivalence scale following BLS and Census procedures, and multiplied by 1.2 to account for additional basic needs. The equivalence scales were also used to set thresholds for all family configurations.

Furthermore, the SPM thresholds were adjusted for geographical differences in the cost of living using procedures outlined in (Nolan et al., 2016a).\. Geographic adjustment of thresholds is important in order to account for discrepancies in the costs faced by families in different parts of the country that affect the ability to “make ends meet.” The geographical adjustments use the best available data on median rents that is available in each year. For the geographical adjustment during the 1967–1984 period, this is based off of the Decennial Census; for the 1985–2008 period, Fair Market Rents (FMRs) measured by the U.S. Department of Housing and Urban Development (HUD) are used; for 2009–2014, the Census Bureau’s Public Use Research Files are used, which are based on American Community Survey data. A detailed description of the methods employed in our augmented dataset to construct geographically-adjusted thresholds can be found in (Nolan et al., 2016a). Finally, base thresholds vary by whether families are in one of three housing status groups: owners with a mortgage; owners without a mortgage; and renters, again following Census and BLS procedures. The shelter and utilities portion of the FCSU is estimated separately for each housing status group, and the geographic adjustment is applied to that portion of the threshold.

In contrast with the Census’ and BLS’ procedures, however, we use 2012 SPM thresholds carried back (and forward) adjusted only for inflation. This adjustment is based on the Consumer Price Index Research Series Using Current Methods (CPI-U-RS), the Census’ preferred price index for earnings and income statistics. We refer to this measure as an “anchored SPM,” since it is anchored, or fixed, in 2012 living standards in an analogous way to official statistics. The Census’ and BLS’ SPM uses a relative poverty threshold, which changes over time with underlying consumer expenditures on the basic bundle of goods in the FCSU basket. See (Wimer, Fox, et al., 2016)for a more extended discussion of the virtues of an anchored versus a relative threshold for analyzing trends over time. For the present study, we prefer the anchored measure over the relative measure because the relative threshold makes it more difficult to identify whether changes in poverty over time are the result of changes in income/resources or changes in underlying spending patterns, while the anchored threshold can provide for a much clearer identification of poverty trends stemming solely from changes in income/resources. Full details of our methodological procedures for the anchored threshold can be found in (Wimer, et al., 2016).

2.5 Resources

We briefly describe below how (Fox et al., 2015) calculate the value of various types of resources. Especially in the very early years of available CPS data, Fox et al. rely on imputation approaches to estimate resources that the CPS did not ask respondents about at the time. The imputation approach builds upon extensive previous work by a variety of researchers adapting the Census SPM to alternate datasets such as the American Community Survey, or to earlier years of the CPS when not all requisite data were available (Betson & Michael, 1993; Bohn, Danielson, Levin, Mattingly, & Wimer, 2013; Isaacs, Marks, Smeeding, & Thornton, 2010; Levitan et al., 2010; Wheaton, Giannarelli, & Martinez-schiferl, 2011). The near-cash and in-kind benefits added to the SPM resources are routinely measured by the CPS in recent years, including the receipt of the Supplemental Nutrition Assistance Program (SNAP); the National School Lunch Program (NSLP); the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC); Federal housing assistance programs; and the Low Income Home Energy Assistance Program (LIHEAP). Of the five in-kind benefits, only LIHEAP is measured in the CPS in all years that the program existed. For certain years, then, benefits for the remaining four programs must be imputed. For example, SNAP receipt and values in the CPS are not available prior to 1979. Thus, these must be imputed for all years between 1967 and 1978. A similar approach is used in the imputation of the NSLP (also prior to 1979), housing assistance (prior to 1975), and WIC (prior to 2000). Values of the NSLP are estimated in a similar manner to SNAP, whereas values of housing assistance are based on estimated household rental payments and the difference between estimated rental payments and the shelter component of the poverty threshold and values of WIC are estimated based on annual administrative data. A full description of these procedures can be found in the detailed technical appendix to Fox et al. (2015).

Similarly, measures of after-tax income do not exist in the CPS prior to 1979, and even after 1979 are always estimated using a tax simulation program. The government created the EITC, however, in 1975 (albeit in a much smaller form than it exists today) and the CTC in 1997 to provide additional benefits to families with children. Income and payroll taxes have obviously existed for much longer. To estimate these after-tax income measures in years prior to 1979, we rely on Fox et al.’s use of the National Bureau of Economic Research’s TAXSIM model (Feenberg & Coutts, 1993). Full details on TAXSIM are in the technical appendix of Fox et al. (2015).

2.6 Non-discretionary expenses

The SPM also subtracts medical out-of-pocket expenses (MOOP) from income, as well as capped work and child care expenses. The CPS asks about MOOP and child care expenses directly only starting in 2009, meaning these must be imputed into the CPS for virtually the whole period. Work expenses (e.g., transportation costs) are never directly observed in the CPS and are currently estimated based on the Survey of Income and Program Participation (SIPP). We estimate historical work expenses back to 1997 using an extended time series provided to Fox et al. by the Census Bureau. For years prior to 1997, these are adjusted for inflation. Medical and child care expenses were imputed from the CE. Further details on the imputation of medical, work, and child care expenses are found in the technical appendix of (Fox et al., 2015).

2.7 Methods

Using the anchored SPM, we estimate poverty among young children overall, and then within key subgroups. Because the youngest children may be particularly vulnerable to poverty, we analyze children age 0–2 (infants and toddlers) separately from children age 3–5 (preschool-aged children). Due to longstanding racial/ethnic differences in the risk of poverty, we also examine subgroups defined by race/ethnicity, analyzing White non-Hispanic, Black non-Hispanic, and Hispanic children (sample sizes are too small to analyze other groups). In each of our analyses, we compare young child poverty estimates with and without the inclusion of taxes and transfers.

3.0 Results

3.1 Trends in poverty

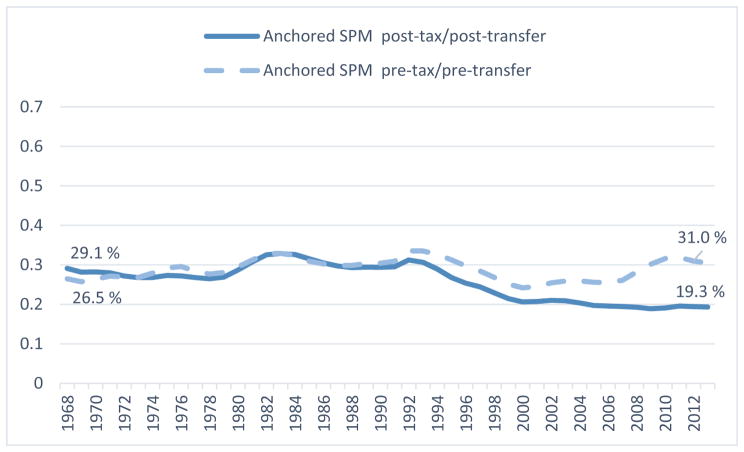

We begin by exploring trends in young child (age 0 to 5 years) poverty measured using the anchored SPM. Our results reveal a substantial decline in poverty among young children since 1968. As shown in Figure 1, the young child poverty rate falls from 29.1 percent in 1968 to 19.3 percent in 2013. Notably, this decline is only evident after taking government anti-poverty programs into account, which shows the growing importance of government programs in reducing poverty. Absent anti-poverty programs, the poverty rate among young children would be higher today than it was in 1968.

Figure 1.

Trends in Young Child Poverty from 1968–2013: Estimates using Anchored SPM

Note: 3-year moving averages of Anchored SPM Poverty with geographically-adjusted thresholds

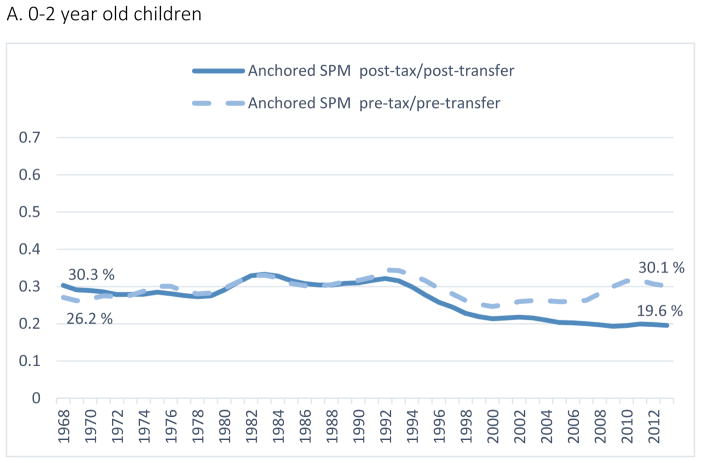

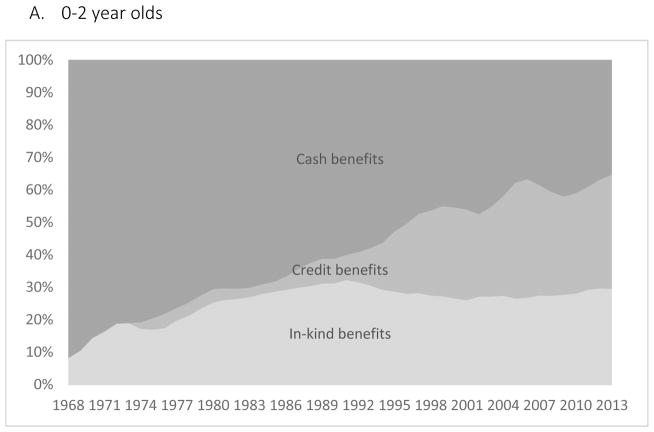

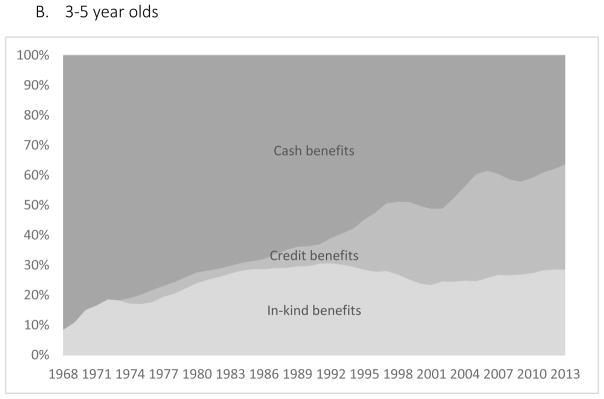

These overall patterns hold when we look separately at children age 0–2 and age 3–5 (Figure 2). The levels of poverty, overall trend, and role of anti-poverty programs are similar for both age groups. These findings make sense because anti-poverty policy and income supports are generally targeted at families with children of all ages, rather than at families with children within a particular age group. The similarities in poverty rates pre-tax and transfers suggest that the risk of poverty is roughly the same for infants/toddlers and preschoolers.

Figure 2.

Trends in Young Child Poverty, by Child Age

Note: 3-year moving averages of Anchored SPM Poverty with geographically-adjusted thresholds

Note: 3-year moving averages of Anchored SPM Poverty with geographically-adjusted thresholds

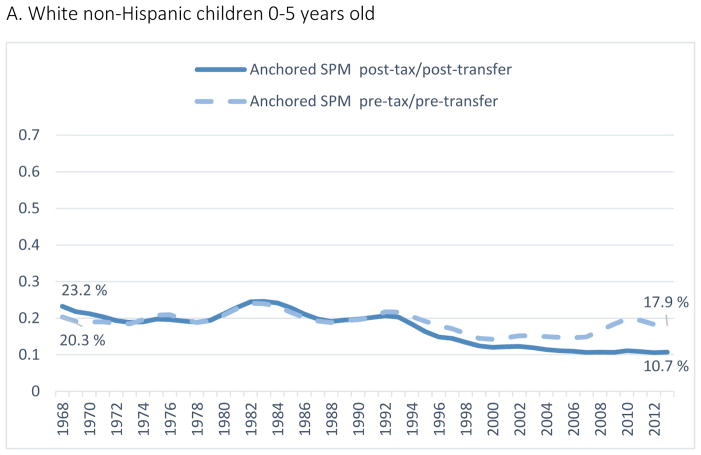

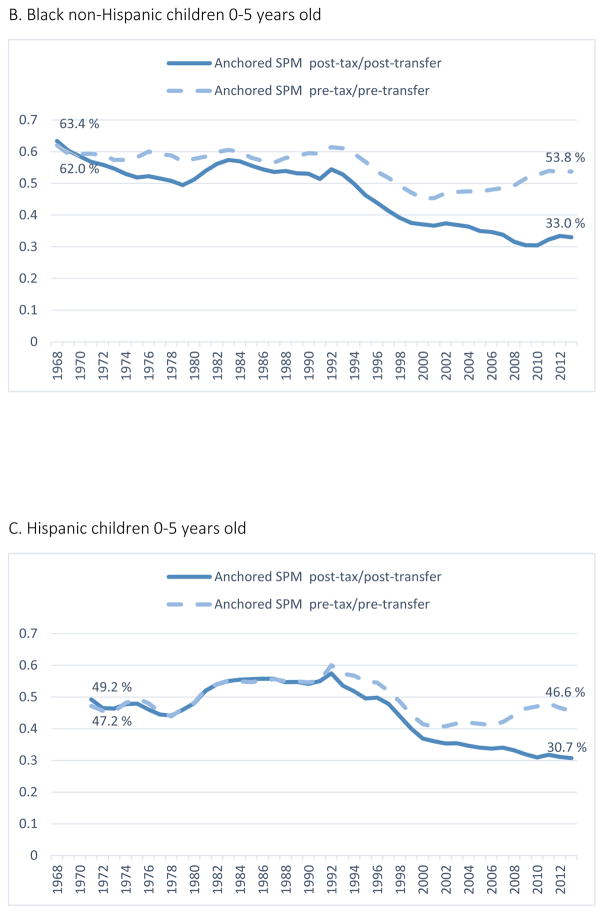

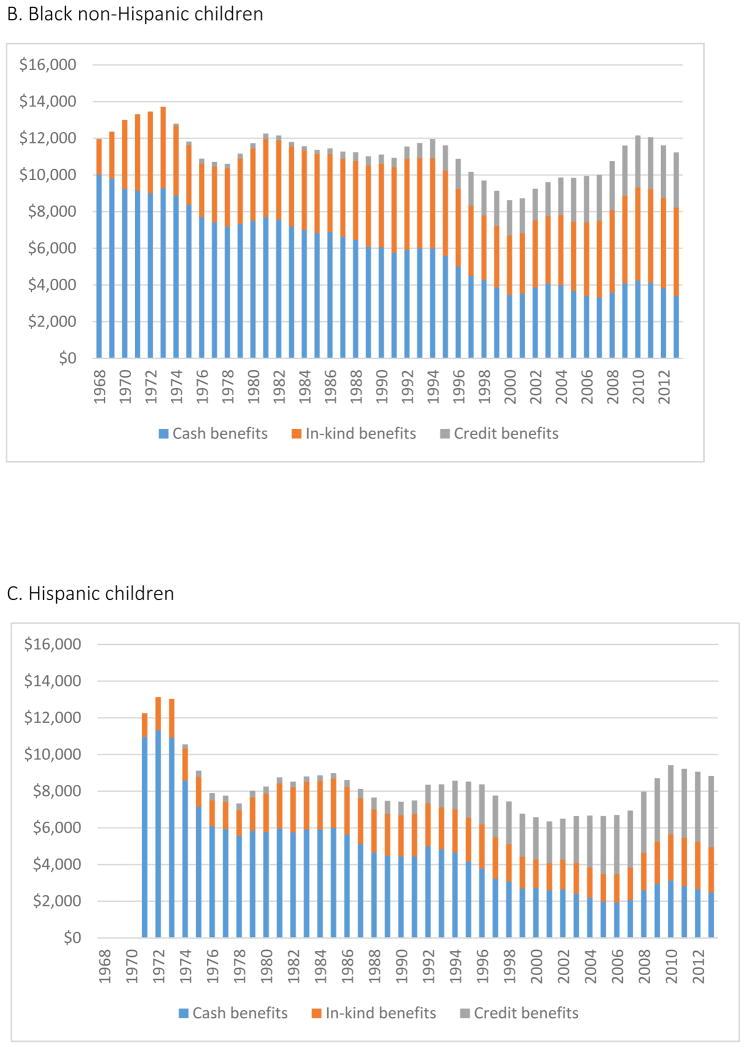

However, analyses by race/ethnicity reveal sharp differences (Figure 3). Overall, poverty among Black non-Hispanic and Hispanic young children is more than twice that among White non-Hispanic young children for the entire time series even after taking the safety net into account. But, when taking a closer look at specific trends in poverty by race/ethnicity, the story is quite different.

Figure 3.

Trends in young child poverty, by race/ethnicity

Note: 3-year moving averages of Anchored SPM Poverty with geographically-adjusted thresholds

Note: 3-year moving averages of Anchored SPM Poverty with geographically-adjusted thresholds

Note: 3-year moving averages of Anchored SPM Poverty with geographically-adjusted thresholds. This graph begins at 1971 because Hispanic children are only identifiable in the CPS ASEC from 1970 onward.

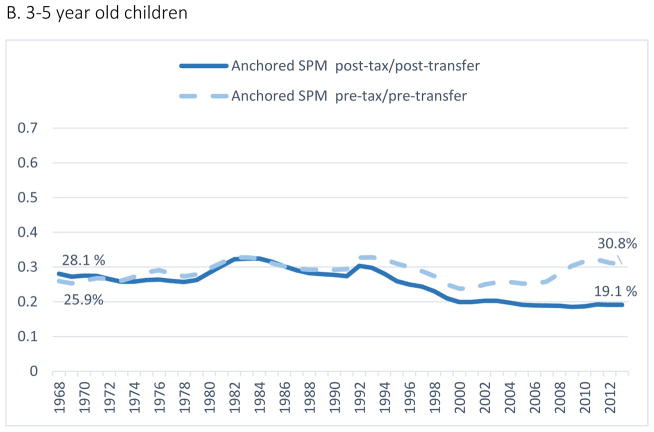

Panel A shows that poverty among White non-Hispanic young children has fallen by more than half since 1968, from 23.2 percent to 10.7 percent, after taking the safety net into account. Without the safety net, the poverty rate in 2013 would be 7.2 percentage points higher - as high as it was in 1968.

While poverty among Black non-Hispanic young children has also fallen by about half since 1968, levels have always been much higher and continue to be so (panel B). Over 60 percent of young Black non-Hispanic children were poor in 1968, and just over 30 percent are poor now – much higher rates but also a much starker decline in absolute terms than is observed for White non-Hispanic children. Anti-poverty programs play an important role for Black non-Hispanic children throughout the period, but more so over time, reducing poverty now by 20.8 percentage points -- from 53.8 percent to 33.0 percent in 2013. Notably, there is also an improvement in pre-tax and transfer poverty for Black non-Hispanic young children.

The trend for Hispanic young children (from 1971 onwards; Hispanic children not identified in CPS before that year) is shown in Panel C. Poverty falls for this group from 49.2 percent in 1971 to 30.7 percent in 2013, after taking the safety net into account. Prior to the early 1990s, there is little apparent impact of the safety net for Hispanic children, but this changes starting in the early 1990s, and by 2013, the safety net is reducing poverty for this group by 15.9 percentage points.

These results indicate that government programs play an important role in reducing poverty for both Black non-Hispanic young children and Hispanic young children – and particularly in recent years. While poverty rates regardless of race/ethnicity remain virtually flat for the entire time series absent the safety net, poverty rates for Black non-Hispanic young children and Hispanic young children greatly decline in the early 1990s, after taking the government programs into account.

3.2 The role of specific types of anti-poverty programs

We now turn our attention to specific types of anti-poverty programs to examine their roles in reducing poverty among young children. We consider three main types of anti-poverty programs: cash benefits, in-kind benefits, and tax credits. As described earlier, cash benefits include AFDC/TANF, state and local public assistance programs, Supplemental Security Income (SSI), Social Security Income, and Unemployment Insurance. In-kind benefits include SNAP, housing subsidies, energy assistance programs, and WIC2 . Finally, tax credits include the EITC and the CTC (temporary and near-universal initiatives such as Making Work Pay and the federal stimulus package during the recent recession are excluded).

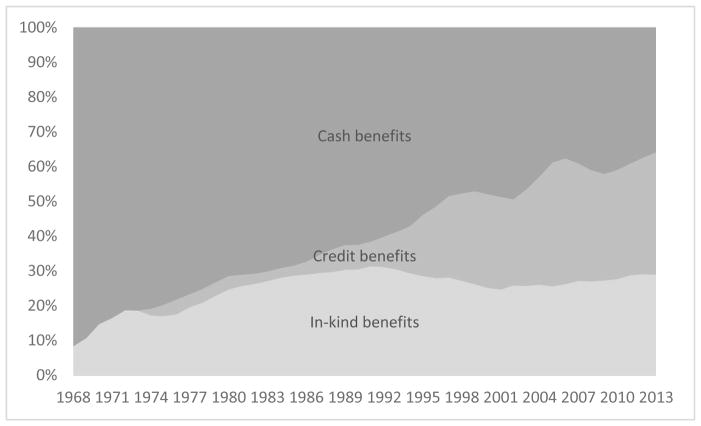

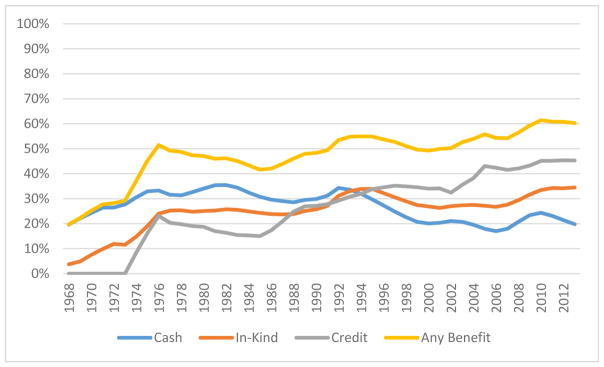

Nearly half of young children lived in families that received support from at least one of these programs in 1968, and this proportion has grown to two-thirds today (Appendix Table 1). The composition of this support has also changed dramatically, as shown in Figure 4. Among those receiving any assistance, over 90 percent of that assistance was in the form of cash in 1968. The relative contributions of in-kind benefits and especially tax credits have grown considerably over time, such that now each of these types of assistance contributes about one third of the overall benefit package, with cash assistance providing the other third. As a result, cash benefits make up a much smaller portion of the safety net for families with young children than they did in the past. When we examine children separately by child age (presented in Panels A and B of Figure 5), we see that these overall patterns are nearly identical.

Figure 4.

Trends in cash, in-kind, and credit benefits as a proportion of all benefits for 0–5 year olds from 1968–2013

Notes: Cash benefits include AFDC/TANF, public assistance programs, Supplemental Security Income, Social Security Income, Unemployment Insurance. In-kind benefits include Food Stamp/SNAP, housing subsidies, and WIC. Credit benefits include EITC and CTC.

Figure 5.

Trends in cash, in-kind, and credit benefits as a proportion of all benefits by child age group from 1968–2013

Notes: Cash benefits include AFDC/TANF, public assistance programs, Supplemental Security Income, Social Security Income, Unemployment Insurance. In-kind benefits include Food Stamp/SNAP, housing subsidies, and WIC. Credit benefits include EITC and CTC.

Notes: Cash benefits include AFDC/TANF, public assistance programs, Supplemental Security Income, Social Security Income, Unemployment Insurance. In-kind benefits include Food Stamp/SNAP, housing subsidies, and WIC. Credit benefits include EITC and CTC.

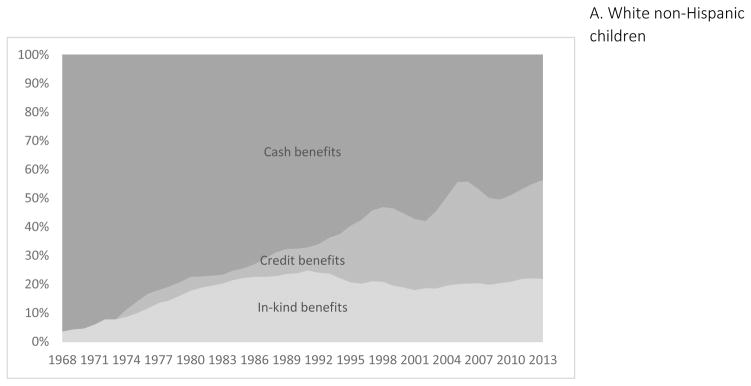

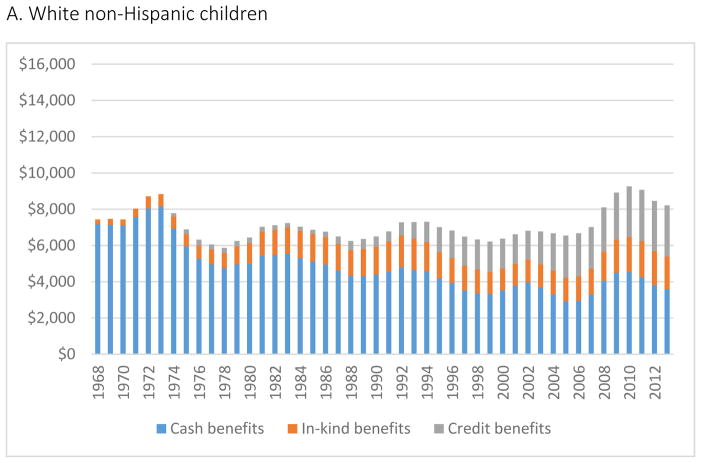

Figure 6 shows the composition of support by child race/ethnicity. The pattern for White non-Hispanic children is similar to that seen for young children overall, with cash benefits declining as a share of the support package from over 90 percent in 1968 to about 45 percent in 2013, with tax credits and in-kind benefits contributing the other 35 percent and 20 percent respectively. Black non-Hispanic children, in contrast, were already receiving a notable share (about 20%) of their support in the form of in-kind benefits in 1968 and this share rises to about 40 percent in 2013, with cash benefits and tax credits each contributing about 30 percent of the whole. The pattern for Hispanic children (from 1971 onwards) reveals the particularly sharp growth of tax credits for this group, with tax credits now contributing about 40 percent of the total support package for this group, while cash assistance and in-kind benefits each contribute about 30 percent.

Figure 6.

Trends in cash, in-kind, and credit benefits as a proportion of all benefits for 0–5 year olds from 1968–2013, by race/ethnicity

Notes: Cash benefits include AFDC/TANF, public assistance programs, Supplemental Security Income, Social Security Income, Unemployment Insurance. In-kind benefits include Food Stamp/SNAP, housing subsidies, and WIC. Credit benefits include EITC and CTC

Notes: Cash benefits include AFDC/TANF, public assistance programs, Supplemental Security Income, Social Security Income, Unemployment Insurance. In-kind benefits include Food Stamp/SNAP, housing subsidies, and WIC. Credit benefits include EITC and CTC

Notes: Cash benefits include AFDC/TANF, public assistance programs, Supplemental Security Income, Social Security Income, Unemployment Insurance. In-kind benefits include Food Stamp/SNAP, housing subsidies, and WIC. Credit benefits include EITC and CTC. This graph begins at 1971 because Hispanic children are only identifiable in the CPS ASEC from 1970 onward.

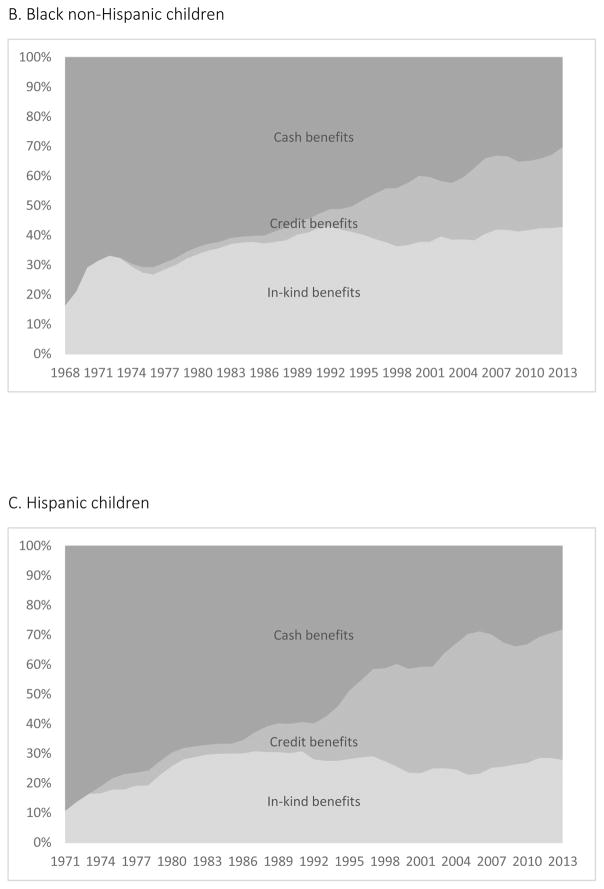

The general shift toward more assistance provided through in-kind benefits and tax credits, rather than cash assistance, is confirmed in Figure 7, which displays the average amount of assistance received from each type of program (among those receiving any such assistance). The average value of assistance for families with young children ages 0–5 has held roughly constant at about $8,000 to $10,000 total for all children ages 0–5 in the SPM unit (in constant 2013 dollars) from 1968 to 2013. However, the composition has shifted to relatively more dollars from in-kind programs and tax credits, and relatively fewer in the form of cash.

Figure 7.

Trends in the average value of benefits for 0–5 year olds receiving benefits from 1968–2013

Notes: Cash benefits include AFDC/TANF, public assistance programs, Supplemental Security Income, Social Security Income, Unemployment Insurance. In-kind benefits include Food Stamp/SNAP, housing subsidies, and WIC. Credit benefits include EITC and CTC. All years adjusted to 2013 constant dollars.

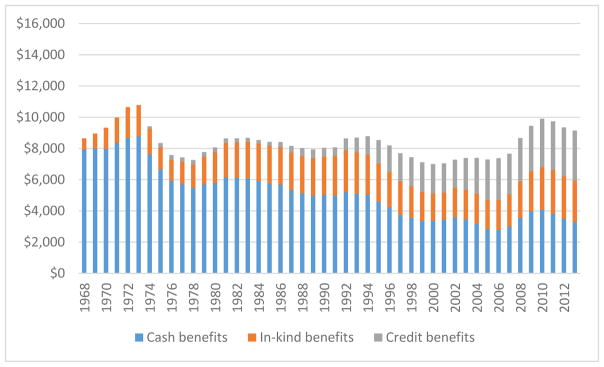

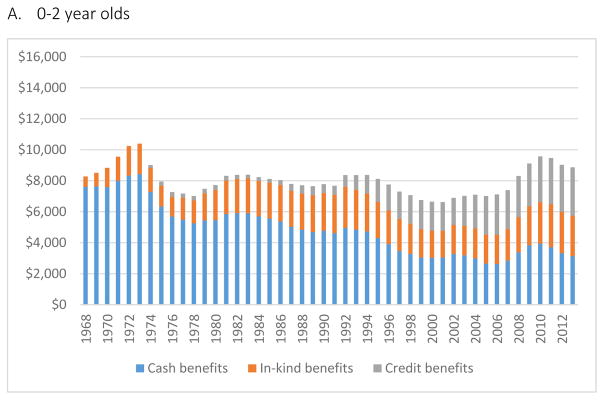

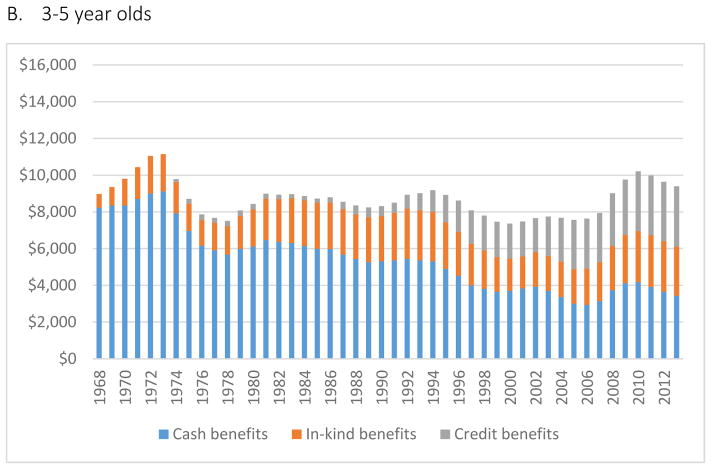

Figure 8 indicates that these patterns are similar by age group, although preschoolers (ages 3–5) tend to receive slightly higher average amounts than do infants/toddlers. With regard to differences by race/ethnicity, Figure 9 indicates that both levels and trends in average benefit amounts differ considerably. White non-Hispanic young children have historically received lower amounts on average, presumably because they have had higher pre-tax and transfer incomes, and their average benefit amounts have held roughly constant over time. Black non-Hispanic young children, in contrast, have historically received larger average amounts, with some decline over time, while Hispanic young children received relatively high benefit amounts at the start of the time period but not in more recent years.

Figure 8.

Trends in the average value of benefits for 0–5 year olds receiving benefits by child age from 1968–2013

Notes: Cash benefits include AFDC/TANF, public assistance programs, Supplemental Security Income, Social Security Income, Unemployment Insurance. In-kind benefits include Food Stamp/SNAP, housing subsidies, and WIC. Credit benefits include EITC and CTC. All years adjusted to 2013 constant dollars.

Notes: Cash benefits include AFDC/TANF, public assistance programs, Supplemental Security Income, Social Security Income, Unemployment Insurance. In-kind benefits include Food Stamp/SNAP, housing subsidies, and WIC. Credit benefits include EITC and CTC. All years adjusted to 2013 constant dollars.

Figure 9.

Trends in the average value of benefits for 0–5 year olds receiving benefits from 1968–2013, by race/ethnicity

Notes: Cash benefits include AFDC/TANF, public assistance programs, Supplemental Security Income, Social Security Income, Unemployment Insurance. In-kind benefits include Food Stamp/SNAP, housing subsidies, and WIC. Credit benefits include EITC and CTC. All years adjusted to 2013 constant dollars.

Notes: Cash benefits include AFDC/TANF, public assistance programs, Supplemental Security Income, Social Security Income, Unemployment Insurance. In-kind benefits include Food Stamp/SNAP, housing subsidies, and WIC. Credit benefits include EITC and CTC. All years adjusted to 2013 constant dollars.

Notes: Cash benefits include AFDC/TANF, public assistance programs, Supplemental Security Income, Social Security Income, Unemployment Insurance. In-kind benefits include Food Stamp/SNAP, housing subsidies, and WIC. Credit benefits include EITC and CTC. All years adjusted to 2013 constant dollars. This graph begins at 1971 because Hispanic children are only identifiable in the CPS ASEC from 1970 onward.

The large, persistent black/white gap in benefit levels is parallel to the racial gap in labor market earnings; as benefit calculations are often based in part on pre-tax/pre-transfer market income, on average, it is no surprise that families with lower market earnings receive higher benefits.3 Economists estimate that the black/white gap in earnings has remained large and stagnant over our time series among men, yet among women, the gap has notably widened (see e.g. Altonji & Blank, 1999). This overall pattern is consistent with our finding from Figure 9 that the average benefit levels among Black non-Hispanic children have remained nearly 50 percent higher than that of White non-Hispanic children. This point is emphasized in Figure 3, where the pre-tax/pre-transfer poverty rates of Black non-Hispanic children are consistently 30 to 40 percentage points higher than that of White non-Hispanic children. As the racial gap in post-tax/post-transfer poverty has decreased by half in the same period, higher benefit levels appear especially important in closing the racial gap in poverty. That the same gap in benefit levels is not evident between Hispanic and White non-Hispanic children may be because only documented Hispanic immigrants – who likely have higher market incomes than those who are undocumented -- are generally eligible for benefits.

4.0 Conclusion and discussion

In this paper, we provide estimates of historical trends in poverty for young children ages 0 to 5, using an improved measure of poverty, the anchored Supplemental Poverty Measure. Three main findings emerge.

First, we find that poverty among all young children age 0–5 has declined since 1968, with the sharpest decline beginning in the early 1990s. However, this decline only occurs when taking government anti-poverty programs into account. Absent these programs, today’s poverty rate among young children would be identical to or higher than it was in 1968. This result echoes the findings of previous literature where the same pattern was detected among all children (Fox et al., 2015; Short, 2016) and among young children (Wimer, et al., 2016). Second, trends in poverty among young children differ greatly by race/ethnicity. Although post-tax / post-transfer poverty rates among all children have all fallen since the beginning of the time series, the poverty rates of Black non-Hispanic and Hispanic children today are three times that of White non-Hispanic children, a trend that has persisted since the early 1990’s (Eggebeen & Lichter, 1991; Garrett, Ng’andu, & Ferron, 1994; Seccombe, 2000). Anti-poverty programs play an increasingly significant role in reducing poverty for all three groups, especially among Black non-Hispanic children, reducing poverty in 2013 by 20.8 percentage points. It wasn’t until the early 1990s that these programs had a substantial effect among White non-Hispanic and Hispanic children, a trend noted in at least one earlier study (Lichter, Qian, & Crowley, 2005). The convergence of poverty rates between non-Hispanic White children and racial/ethnic minorities has emerged in previous research as well. Notably, similar patterns were detected using the Supplemental Poverty Measure in two previous studies (Nolan et al., 2016b;Short, 2015). Third, the fraction of young children living in families that receive support from government anti-poverty programs has gradually grown, while the composition of this support has changed; in-kind and tax credit benefits have grown considerably while cash benefits have decreased over time. In 1968, over 90 percent of benefits were in the form of cash; today, benefits are composed of about one-third in cash, the remainder split evenly between tax credits and in-kind transfers.

That benefits have shifted away from cash transfers to in-kind and tax credit transfers is the unsurprising product of a litany of policy preferences for conditional transfers. As a result, cash benefits have become increasingly difficult to access among families with children lowest on the income distribution. Historically, the largest cash benefit program aimed at families with children was Aid to Dependent Children (ADC) (which became AFDC in 1962 and TANF after the 1996 reform), which was conceived to help widowed women care for their young children, and eventually expanded to include families whose breadwinners were unemployed. It wasn’t until the late 1980s and early 1990s that employment requirements were enforced, and under the 1996 Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA), time limits for receipt were set and states were given the autonomy to create and enforce more rigorous work requirements, re-allocate expenditures, and restrict benefit receipt to their liking. These changes caused caseloads to plummet to historical lows, as many of those who were eligible under AFDC were no longer so under TANF, or were diverted or “pushed off” the rolls (Ziliak, 2015). Although much of the analysis on AFDC/TANF found that it was successful in lifting families out of poverty prior to 2000, post-2000 trends show that TANF has become less responsive to economic need and increasingly unavailable to many families at the bottom of the income distribution (Ziliak 2015; Moffit & Scholz 2010; Edin & Shaefer, 2015). TANF now fills a smaller percentage of the poverty gap than AFDC did (Moffit & Scholz, 2010), and has been less responsive to business cycles than other safety-net programs that favor the working poor (Bitler & Hoynes 2010). Since the mid-1980’s, expansions in other cash benefit programs either targeted families with higher earnings (such as Unemployment Insurance), or favored the elderly or disabled without children (such as Social Security and SSI), with sharp declines in those programs aimed at families with children – especially those with low incomes (Ben-Shalom, Moffitt, & Scholz, 2011; Moffit & Scholz, 2010; Scholz, Moffitt, & Cowan, 2009; Ziliak, 2004).

After PRWORA, the Earned Income Tax Credit (EITC) quickly grew to become one of the largest anti-poverty programs (in terms of expenditures and participation), and today is widely lauded for its anti-poverty effectiveness. The refund amounts received by recipients are large relative to cash welfare benefits and studies have shown positive effects on well-being and poverty alleviation (Dahl & Lochner, 2012; Gundersen & Ziliak, 2004). However, the EITC does not reach many of the neediest families because eligibility hinges on the child’s parent both working and filing tax returns, and increasingly, the largest stipends are received by the working poor and those above the poverty line (Ben-Shalom, Moffitt, & Scholz, 2011; Moffitt, 2013).

SNAP and WIC have remained a critical pillar of support for low-income families, especially those experiencing extreme poverty (Hoynes et al., 2016; Moffitt, 2013; Shaefer & Edin, 2013). Both programs appear to have positive effects on child health and well-being (Almond, Hoynes, & Schanzenbach, 2011; Hoynes, Page, & Stevens, 2009), and on the long-run economic sufficiency for women (Hoynes et al., 2016). Although SNAP (and WIC) reach more low-income families than TANF, SNAP (and WIC) cannot contribute to the bottom line of the family budget in many domains, as they are not legally transferrable to cash. Overall, it is clear that while cash transfers have declined both in proportion to credit and in-kind transfers and in absolute amount since 1968, post-tax/post-transfer poverty has declined dramatically for young children in the same period. As the sum of all three types of benefits has remained somewhat stable, what was lost in the decline of cash benefits is accounted for by increasing credit benefits. However, whether the change in the composition of benefits has altered the effectiveness of the safety net is outside the scope of the present paper, representing an important avenue for future research.

The fact that we find few detectable differences in the patterns of poverty by child age indicates that families are uniformly benefiting from the safety net in this highly sensitive developmental period. With the mounting evidence on the primacy of investment during early childhood, a smaller role for the safety net for families with infants/toddlers would have been disconcerting. That families appear to be accessing the safety net equitably in both early childhood stages is a promising finding. Although we are unable to estimate the distribution of benefits among children within an SPM unit or the consumption of benefits of children relative to adults, the fact that young children increasingly have access to these benefits suggests an improvement in well-being, at least in terms of poverty.

The present study does have some limitations. First, we do not take into account any potential behavioral responses to the safety-net programs in estimating the effects of policies and programs. For example, families with young children might respond in different ways that we observe in the data if some policies and programs did not exist. Second, the estimates of poverty presented here do not adjust for the underreporting of income and benefits. It is well know that the underreporting of benefits is a problem in survey data including the CPS (Meyer et al., 2009) so that correcting for the underreporting may provide a different picture of poverty among young children.

In spite of these limitations, our results clearly indicate that government programs and policies are on the whole effective at reducing poverty among young children, and more so over time. In-kind and tax credit policies and programs have played a particularly important role since the early 1990s. However, the young child poverty rate remains high, particularly for Black non-Hispanic and Hispanic children, both in contrast to that for older children and to that seen in other countries. As a country, we still have much to do to improve poverty among young children. However as indicated by our findings, we are heading in the right direction.

Appendix

Figure A1.

Rate of benefit receipt among children 0–5 years old

Footnotes

School lunches are excluded from this category for the present study, as Census valuation procedures for school lunch mean that a large number of children who are not actually in the School Lunch Program receive a positive monetary value of the subsidy nevertheless. This is because children in schools where large percentages of students receive free or reduced school lunch do derive some economic benefit from the larger subsidies going to other children, but there is no consistent monetary value currently available over time that can be used to distinguish children actually enrolled in the program and those simply deriving a monetary benefit from the program though not enrolled.

As detailed in footnote 1, school lunches are excluded from this category for the present study

Although this is true on average for means-tested safety net programs, it is not the rule. There is some variation in eligibility and benefit levels across safety net programs, and as we described above, some programs benefit impoverished families with higher earnings over those with lower earnings, such as Unemployment Insurance.

Contributor Information

Jessica Pac, Columbia University School of Social Work, 1255 Amsterdam Avenue, New York, NY 10027.

JaeHyun Nam, Columbia University School of Social Work.

Jane Waldfogel, Columbia University School of Social Work.

Christopher Wimer, Center on Poverty and Social Policy, Columbia University School of Social Work.

References

- Aizer A, Currie J. The intergenerational transmission of inequality: Maternal disadvantage and health at birth. 2014;344(6186) doi: 10.1126/science.1251872. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Almond D, Currie J. Human Capital Development before. Age Five. 2011;4B(11):1315–1486. [Google Scholar]

- Almond D, Hoynes HW, Schanzenbach DW. Inside the War on Poverty: The Impact of Food Stamps on Birth Outcomes. The Review of Economics and Statistics. 2011;93(2):387–403. [Google Scholar]

- Altonji JG, Blank RM. Chapter 48 Race and gender in the labor market. Handbook of Labor Economics. 1999;3 PART(3):3143–3259. http://doi.org/10.1016/S1573-4463(99)30039-0. [Google Scholar]

- Ben-Shalom Y, Moffitt RA, Scholz JK. An Assessment of the Effectiveness of Anti-Poverty Programs in the United States. 2011. [Google Scholar]

- Ben-Shalom Y, Moffitt R, Scholz J. An assessment of the effectiveness of anti-poverty programs in the United States. NBER Working Paper Series. 2011 http://doi.org/10.3386/w17042.

- Betson D, Michael R. A recommendation for the construction of equivalences scales. Unpublished memorandum prepared for the Panel on Poverty and Family Assistance Committee on National Statistics National Research Council Department of Economics University of Notre Dame. 1993 Retrieved from http://www.nd.edu/~dbetson/research/documents/MichaelBetsonMemo.pdf.

- Bitler M, Gelbach J, Hoynes H. Welfare Reform and Health. Journal of Human Resources. 2005;40(2):309–334. http://doi.org/10.3368/jhr.XL.2.309. [Google Scholar]

- Bitler MP, Hoynes HW. The state of the social safety net in the post-welfare reform era. Brookings Papers on Economic Activity. 2010;2010(2):71–127. http://doi.org/10.1353/eca.2010.0013. [Google Scholar]

- Bohn S, Danielson C, Levin M, Mattingly M, Wimer C. The California Poverty Measure: A New Look at the Social Safety Net In collaboration with the Stanford Center on Poverty and Inequality. 2013 Oct; Retrieved from http://www.ppic.org/main/home.asp.

- Brooks-Gunn J, Duncan GJ. The Effects of Poverty on Children. 1997;7(2):88–112. http://doi.org/10.2307/1602387. [PubMed] [Google Scholar]

- Chaudry A, Wimer C. Poverty is Not Just an Indicator: The Relationship Between Income, Poverty, and Child Well-Being. Academic Pediatrics. 2016;16(3):S23–S29. doi: 10.1016/j.acap.2015.12.010. http://doi.org/10.1016/j.acap.2015.12.010. [DOI] [PubMed] [Google Scholar]

- Cherlin AJ. Demographic trends in the United States: A review of research in the 2000s. Journal of Marriage and Family. 2010;72(3):403–419. doi: 10.1111/j.1741-3737.2010.00710.x. http://doi.org/10.1111/j.1741-3737.2010.00710.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Cunha F, Heckman J. The technology of skill formation. American Economic Review. 2007;97(2):31–47. http://doi.org/10.1257/aer.97.2.31. [Google Scholar]

- Cunha F, Heckman J, Schennach S. Estimating the Technology of Cognitive and Noncognitive Skill Formation. Econometrica. 2010;78(3):883–931. doi: 10.3982/ECTA6551. http://doi.org/10.3982/ECTA6551. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Currie J. Healthy, wealthy and wise. NBER Working Paper 13987. 1993;6(5):25–27. http://doi.org/10.1126/science.128.3322.443. [Google Scholar]

- Currie J, Gahvari F. TRANSFERS IN CASH AND IN KIND: THEORY MEETS THE DATA. NBER Working Paper Series. 2007;1 (Working Paper 13557). http://doi.org/10.1017/CBO9781107415324.004. [Google Scholar]

- Currie J, Thomas D. Early Test Scores, Socioeconomic Status and Future Outcomes. National Bureau of Economic Research Working Paper Series. 1999 http://doi.org/10.3386/w6943.

- Currie J, Walker R. Traffic Congest and Infant Health: Evidence from E-ZPass. American Economic Journal: Applied Economics. 2011;3(1):65–90. [Google Scholar]

- Dahl GB, Lochner L. The impact of family income on child achievement: Evidence from the earned income tax credit. The American Economic Review. 2012;102(5):1927–1956. http://doi.org/10.2307/41724610. [Google Scholar]

- Duncan GJ, Yeung WJ, Brooks-Gunn J, Smith JR. How Much Does Childhood Poverty Affect the Life Chances of Children? 1998;63(3):406–423. [Google Scholar]

- Eggebeen DJ, Lichter DT. Race, Family Structure, and Changing Poverty Among American Children. American Sociological Review. 1991;56(6):801–817. http://doi.org/10.2307/2096257. [Google Scholar]

- Feenberg D, Coutts E. An Introduction to the TAXSIM Model. Journal of Policy Analysis and Management. 1993;12(1):189–194. [Google Scholar]

- Fox L, Wimer C, Garfinkel I, Kaushal N, Waldfogel J. Waging War on Poverty: Poverty Trends Using a Historical Supplemental Poverty Measure. Journal of Policy Analysis and Management. 2015;34(3):567–592. doi: 10.1002/pam.21833. http://doi.org/10.1002/pam. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Garrett P, Ng’andu N, Ferron J. Poverty experience of young children and the quality of their home environments. Child Development. 1994;65(2):331–345. [PubMed] [Google Scholar]

- Gundersen C, Ziliak JP. Poverty and macroeconomic performance across space, race, and family structure. Demography. 2004;41(1):61–86. doi: 10.1353/dem.2004.0004. http://doi.org/10.1353/dem.2004.0004. [DOI] [PubMed] [Google Scholar]

- Hair NL, Hanson JL, Wolfe BL, Pollak SD. Association of Child Poverty, Brain Development, and Academic Achievement. JAMA Pediatrics. 2015;53706(9):1–8. doi: 10.1001/jamapediatrics.2015.1475. http://doi.org/10.1001/jamapediatrics.2015.1475. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Haveman R, Blank R, Moffitt R, Smeeding T, Wallace G. The War on Poverty: 50 Years Later. Journal of Policy Analysis and Management. 2014;34(5):593–638. doi: 10.1002/pam.21846. (2014). http://doi.org/10.1002/pam.21846. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Heckman JJ. Investing in Disadvantaged Children. Social Sciences. 2006a;312(June):2005–2007. doi: 10.1126/science.1128898. http://doi.org/10.1016/j.adolescence.2005.09.001. [DOI] [PubMed] [Google Scholar]

- Heckman JJ. Skill Formation and the Economics of Investing in Disadvantaged Children. Social Sciences. 2006b;312(June):2005–2007. doi: 10.1126/science.1128898. http://doi.org/10.1016/j.adolescence.2005.09.001. [DOI] [PubMed] [Google Scholar]

- Heckman JJ. Role of income and family influence on child outcomes. Annals of the New York Academy of Sciences. 2008a;1136:307–323. doi: 10.1196/annals.1425.031. http://doi.org/10.1196/annals.1425.031. [DOI] [PubMed] [Google Scholar]

- Heckman JJ. Schools, Skills, and Synapses. Economic Inquiry. 2008b;141(4):520–529. doi: 10.1111/j.1465-7295.2008.00163.x. http://doi.org/10.1016/j.surg.2006.10.010.Use. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Hoynes HW, Page ME, Stevens AH. Is a WIC Start a Better Start? Evaluating WIC’s Impact on Infant Health Using Program Introduction. National Bureau of Economic Research Inc, NBER Working Paper. 2009 http://doi.org/10.3386/w15589.

- Hoynes HW, Schanzenbach DW, Almond D. Long Run Impacts of Childhood Access to the Safety Net. w18535. 2016;(4):903–934. http://doi.org/10.3386/w18535.

- Isaacs JB, Marks JY, Smeeding TM, Thornton KA. Wisconsin Poverty Report: Technical Appendix for 2009. 2010 Retrieved from http://www.irp.wisc.edu/research/WisconsinPoverty/pdfs/WIPovTechnicalAppendix_Sept2010.pdf.

- Levitan M, D’Onofrio C, Koolwal G, Krampner J, Scheer D, Seidel T, Virgin V. Using the American Community Survey to Create a National Academy of Sciences–Style Poverty Measure: Work by the New York City Center for Economic Opportunity. Journal of Policy Analysis and Management. 2010;29(2):373–400. http://doi.org/10.1002/pam. [Google Scholar]

- Lichter DT, Qian Z, Crowley ML. Child poverty among racial minorities and immigrants: Explaining trends and differentials. Social Science Quarterly. 2005;86(SPEC. ISS):1037–1059. http://doi.org/10.1111/j.0038-4941.2005.00335.x. [Google Scholar]

- Lino M. Expenditures on Children by Families, 2013. U.S. Department of Agriculture, Center for Nutrition Policy and Promotion; 2014. Retrieved from http://www.cnpp.usda.gov/familyeconomicsandnutritionreview.htm%5Cnhttp://search.ebscohost.com/login.aspx?direct=true&db=ecn&AN=0616896&site=ehost-live. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Mclanahan S. DIVERGING DESTINIES: HOW CHILDREN ARE FARING UNDER THE SECOND DEMOGRAPHIC TRANSITION. Demography. 2004;41(4):607–627. doi: 10.1353/dem.2004.0033. http://doi.org/10.1353/dem.2004.0033. [DOI] [PubMed] [Google Scholar]

- Mcleod JD, Kaiser K. Childhood Emotional and Behavioral Problems and Educational Attainment. 2000;9:636–658. [Google Scholar]

- Milligan K, Stabile M. Do Child Tax Benefits Affect the Wellbeing of Children? Evidence from Canadian Child Benefit Expansions. American Economic Journal: Economic Policy. 2011;3(August):175–205. Retrieved from http://www.aeaweb.org/articles.php?doi=10.1257/pol.3.3.175. [Google Scholar]

- Moffit R, Scholz JK. Trends in the Level and Distribution of Income Support. In: Jeffrey E, Brown R, editors. Tax Policy and the Economy, Volume 24. Chicago, IL: University of Chicago Press; 2010. pp. 111–152. Retrieved from http://www.nber.org/books/brow09-1. [Google Scholar]

- Moffitt R. The Great Recession and the Social Safety Net. The ANNALS of the American Academy of Political and Social Science. 2013;650(1):143–166. doi: 10.1177/0002716213499532. http://doi.org/10.1177/0002716213499532. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Noble KG, Houston SM, Brito NH, Bartsch H, Kan E, Kuperman JM, … Sowell ER. Family income, parental education and brain structure in children and adolescents. Nature Neuroscience. 2015;18(5):773–778. doi: 10.1038/nn.3983. http://doi.org/10.1038/nn.3983. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Nolan L, Garfinkel I, Kaushal N, Nam J, Waldfogel J, Wimer C. A new method for measuring historical poverty trends: Incorporating geographic differences in the cost of living using the Supplemental Poverty Measure. Journal of Economic and Social Measurement. 2016a;41(3):237–264. http://doi.org/10.3233/JEM-160433. [Google Scholar]

- Nolan L, Garfinkel I, Kaushal N, Nam J, Waldfogel J, Wimer C. Trends in Child Poverty by Race/Ethnicity: New Evidence Using a Historical Supplemental Poverty Measure. Journal of Applied Research on Children 2016b [Google Scholar]

- Proctor BD, Semega JL, Kollar MA. Income and poverty in the United States: 2015 Current Population Reports. Current Population Reports. 2016. [Google Scholar]

- Ratcliffe C, McKernan S-M. Child Poverty and Its Lasting Consequence. Low-Income Working Families. Paper 21. Urban Institute. 2012 Sep; Retrieved from http://antioch.idm.oclc.org/login?url=http://search.ebscohost.com/login.aspx?direct=true&db=eric&AN=ED544342&site=ehost-live&scope=site.

- Renwick T, Fox L. The Supplemental Poverty Measure: 2015 Current Population Reports. 2016. Sep, [Google Scholar]

- Schram SF, Soss J, Fording RC, Houser L. Deciding to Discipline: Race, Choice, and Punishment at the Frontlines of Welfare Reform. American Sociological Review. 2009;74(3):398–422. http://doi.org/10.1177/000312240907400304. [Google Scholar]

- Schwartz J. Low-Level Lead Exposure and Children’s IQ: A Metaanalysis and Search for a Threshold. Environmental Research. 1994 doi: 10.1006/enrs.1994.1020. http://doi.org/10.1006/enrs.1994.1020. [DOI] [PubMed]

- Schwartz J, Angle C, Pitcher H. Relationship between childhood blood lead levels and stature. Pediatrics. 1986;77(3):281–8. Retrieved from http://www.ncbi.nlm.nih.gov/pubmed/3951909. [PubMed] [Google Scholar]

- Seccombe K. Families in poverty in the 1990s: Trends, causes, consequences, and lessons learned. Journal of Marriage and Family. 2000;62(4):1094–1113. http://doi.org/10.1111/j.1741-3737.2000.01094.x. [Google Scholar]

- Shaefer HL, Edin K. Rising Extreme Poverty in the United States and the Response of Federal Means-Tested Transfer Programs. Social Service Review. 2013;87(2):250–268. http://doi.org/10.1086/671012. [Google Scholar]

- Shonkoff JP, Garner aS, Siegel BS, Dobbins MI, Earls MF, Garner aS, … Wood DL. The Lifelong Effects of Early Childhood Adversity and Toxic Stress. Pediatrics. 2012;129(1):e232–e246. doi: 10.1542/peds.2011-2663. http://doi.org/10.1542/peds.2011-2663. [DOI] [PubMed] [Google Scholar]

- Short K. The Supplemental Poverty Measure: 2014. 2015. [Google Scholar]

- Short K. Child Poverty: Definition and Measurement. Academic Pediatrics. 2016;16(3):S46–S51. doi: 10.1016/j.acap.2015.11.005. http://doi.org/10.1016/j.acap.2015.11.005. [DOI] [PubMed] [Google Scholar]

- Smeeding T, Thévenot C, Cooper K, Stewart K, Walker R, … Fund CD OECD. Addressing Child Poverty: How Does the United States Compare With Other Nations? Academic Pediatrics. 2016;16(3):S67–S75. doi: 10.1016/j.acap.2016.01.011. http://doi.org/10.1016/j.acap.2016.01.011. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Smith J, Brooks-Gunn J, Klebanov P. In: Consequences of Growing Up Poor for Young Children; in Consequences of Growing Up Poor. Duncan GJ, Brooks-gunn J, editors. New York: Russell Sage; 1997. [Google Scholar]

- Waldfogel J. What Children Need. First Harvard University Press; 2006. [Google Scholar]

- Wheaton L, Giannarelli L, Martinez-schiferl M. How Do States ’ Safety Net Policies Affect Poverty? Poverty & Public Policy. 2011 Sep;3 http://doi.org/10.2202/1944-2858.1212. [Google Scholar]

- Wimer C, Fox L, Garfinkel I, Kaushal N, Waldfogel J. Progress on Poverty? New Estimates of Historical Trends Using an Anchored Supplemental Poverty Measure. Demography. 2016;53(4):1207–1218. doi: 10.1007/s13524-016-0485-7. http://doi.org/10.1007/s13524-016-0485-7. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Wimer C, Nam J, Waldfogel J, Fox L. Trends in Child Poverty Using an Improved Measure of Poverty. Academic Pediatrics. 2016;16(3):S60–S66. doi: 10.1016/j.acap.2016.01.007. http://doi.org/10.1016/j.acap.2016.01.007. [DOI] [PubMed] [Google Scholar]

- Wu CF. Severity, timing, and duration of welfare sanctions and the economic well-being of TANF families with children. Children and Youth Services Review. 2008;30(1):26–44. http://doi.org/10.1016/j.childyouth.2007.06.009. [Google Scholar]

- Ziliak JP. TEMPORARY ASSISTANCE FOR NEEDY FAMILIES. NBER WORKING PAPER SERIES. 2015. (Vol. NBER Worki) [Google Scholar]