Abstract

Introduction

The 2011 Maryland alcohol sales tax increase from 6% to 9% provided an opportunity to evaluate the impact on rates of alcohol-positive drivers involved in injury crashes.

Methods

Maryland police crash reports from 2001 to 2013 were analyzed using an interrupted time series design and a multivariable analysis employing generalized estimating equations models with a negative binomial distribution. Data were analyzed in 2014–2015.

Results

There was a significant gradual annual reduction of 6% in the population-based rate of all alcohol-positive drivers (p < 0.03), and a 12% reduction for drivers aged 15–20 years (p < 0.007), and 21–34 years (p < 0.001) following the alcohol sales tax increase. There were no significant changes in rates of alcohol-positive drivers aged 35–54 years (rate ratio, 0.98; 95% CI = 0.89, 1.09). Drivers aged ≥ 55 years had a significant immediate 10% increase in the rate of alcohol-positive drivers (rate ratio, 1.10; 95% CI = 1.04, 1.16) and a gradual increase of 4.8% per year after the intervention. Models using different denominators and controlling for multiple factors including a proxy for unmeasured factors found similar results overall.

Conclusions

The 2011 Maryland alcohol sales tax increase led to a significant reduction in the rate of all alcohol-positive drivers involved in injury crashes especially among drivers aged 15–34 years. This is the first study to examine the impact of alcohol sales taxes on crashes; previous research focused on excise tax. Increasing alcohol taxes is an important but often neglected intervention to reduce alcohol-impaired driving.

INTRODUCTION

In 2010, an estimated 22.6% of severely injured and 7.5% of all drivers involved in nonfatal crashes nationwide were alcohol-positive.1 These prevent-able crashes and resulting injuries place a significant burden on healthcare systems. Evidence suggests that increasing alcohol prices through taxes decreases demand for alcoholic beverages and consequently alcohol consumption, and is an effective measure to reduce alcohol-related harms such as alcohol-impaired driving.2–6 Alcohol taxation can mitigate the growing affordability of alcoholic beverages, which is especially relevant considering that the cost of a drink today in relation to per capita disposable income is 25% less than it was in 2000.7

Current research on the association between alcohol taxes and motor vehicle injuries has focused solely on the alcohol excise tax and predominantly used fatalities as the main outcome, which account for a minority of all motor vehicle injuries.3,8,9 Contrary to the alcohol excise tax (volume-based tax), the alcohol sales tax (value-based tax) is based on the retail price of the alcoholic beverage, affects all types of alcoholic beverages simultaneously, and is automatically adjusted for infiation and, therefore, does not erode with time. Distinctions between these two alcohol taxes may affect the consumer’s behaviors differently. Researchers found that alcohol excise tax, which is included in the shelf price, reduced alcohol consumption significantly more than alcohol sales tax, which is added only at the register.10 However, the effect of the alcohol sales tax on the price is larger at bars or restaurants (on premises) compared with liquor stores (off premises), which is unique to the alcohol sales tax. This larger monetary effect of the alcohol sales tax for on-premises purchase may contribute to reducing consumption before driving. A reduction in on-premises consumption has been associated with fewer alcohol-impaired fatal crashes.11 It is also plausible that drinkers may switch to a lower-cost alcohol instead of reducing their alcohol consumption following an increase in alcohol sales taxes.12

Effective July 1, 2011, Maryland increased the alcohol sales tax from 6% to 9% on all types of alcoholic beverages (MD. §11–104(g)), while maintaining the alcohol excise tax at the same level (MD. §5–105)). Using the average price per ounce of alcohol for beer from the alcohol brand research database,13 a beer costs approximately $1.16 (off premises), which corresponds to a tax of $0.07 prior to and $0.10 after the increase in alcohol sales tax. Based on a 3:1 ratio of on-premises to off-premises prices,14 the same beer may cost $3.48 on premises, for which the 6% tax is $0.21 and the 9% tax is $0.31; a $0.10 per drink increase on premises versus only $0.03 off premises. Although these prices are estimates, they illustrate that the monetary increase in tax will vary based on the type and brand of alcoholic beverages and on the location of the purchase.

The 2011 alcohol sales tax increase provided the unique opportunity to conduct the first evaluation of the effects of an alcohol sales tax increase on alcohol-positive driving that resulted in motor vehicle injuries across different age groups. The Guide to Community Preventive Services (Community Guide) previously identified this research gap by stating the need to better understand the effects of different alcohol taxation mechanism on health outcomes across various groups of the population.2

METHODS

Study Population

This interrupted time series study included drivers aged 15–95 years who were involved in a motor vehicle crash causing an injury as reported by the police in Maryland from 2001 to 2013. The study included 156 monthly data time points, with 127 months for the pre-intervention period (January 2001–July 2011) and 29 months after the intervention (August 2011–December 2013). A 1-month delay after the increase of the alcohol sales tax was included because people may have purchased alcohol in June in anticipation of the increase in alcohol sales tax or in preparation for the July 4th holiday. Data were analyzed in 2014–2015.

Data on motor vehicle crashes were obtained from the Maryland Automated Analysis Reporting System, which contains information on all police-reported crashes resulting in a tow away vehicle, nonfatal injury, or fatal injury. Police officers classify the injury severity of all individuals involved in a crash using a 5-point scale: fatal injury (K), incapacitating (A), non-incapacitating (B), possible (C), and no injury (O).15 Based on this variable, an injured (KABC)/non-injured dichotomous variable (O) was created. For alcohol-positive driver, the derived Maryland Automated Analysis Reporting System variable, which is based on a police officer’s perception of alcohol involvement or quantitative alcohol test results, was used. Driver’s records with drugs involvement ( < 1% of the study population) were excluded owing to unreliability.16

Measures

The effect of the alcohol sales tax on the rates of alcohol-positive drivers involved in motor vehicle crashes resulting in a fatal or nonfatal injuries was examined using three different denominators: per population of Maryland, per licensed drivers of Maryland, and per vehicle miles traveled (VMT) for Maryland. The separate effects of age in four subgroups (15–20, 21–34, 35–54, and ≥ 55 years) were also investigated. The injured person could have been a driver, occupant, or pedestrian. Drivers involved in a crash leading to property damage only (no injury) were excluded from the analysis.

Several independent variables were selected a priori and evaluated for inclusion in statistical analyses, including Maryland monthly numbers of unemployed individuals17 and the Maryland annual per-capita personal income.18 Three sources19–21 were used to determine whether the following traffic safety and alcohol control laws9,22 were changed in Maryland during the study period: administrative license revocation; illegal per se at blood alcohol concentration (BAC) ≥ 0.08 g/dL and ≥ 0.01g/dL for underage drivers; primary seat belt; mandatory helmet laws; mandatory ignition interlock for all convicted drivers; dram shop liability; keg registration; beverage service training; and bans on off-premises Sunday sales. The only change in those laws was in 2001, the legal BAC limit decreased in Maryland, but it was not included in the model, as it occurred early in the study period. The association between the 2008 Maryland general sales tax increase, from 5% to 6%, which affected alcoholic beverages, was also examined.23 For seasonality, yearly quarters were used.

Data on Maryland’s annual population estimates came from the U.S. Census Bureau,24 and the annual number of licensed drivers, including by age groups, and VMT from the Federal Highway Administration.25

Statistical Analysis

Because of the presence of temporal autocorrelation, generalized estimating equation models with a negative binomial distribution, a log link, and an initial autoregressive covariance structure were selected. Negative binomial rather than Poisson models were selected because crash data are often likely to be overdispersed, that is, the variance is likely greater than the mean.26 The autoregressive covariance structure assumes that the correlation declines across time, which is plausible with crashes.27

Variables were retained in the final multivariable model if they were significant at the p < 0.10 level using a manual backward stepwise approach, or if they had been identified as important predictors in the literature.8,9,28–32 An indicator variable for the 2011 alcohol tax increase and a continuous monthly variable for linear trend were included. For the linear trend, the researchers examined whether the slopes prior to and after the intervention differed significantly (p < 0.10) after the introduction of the alcohol sales tax increase.

In the results, both the immediate and gradual effects of the intervention are presented. The immediate effect is defined as the sudden change in the outcome in the month following the intervention.33 In the analysis, this level change (immediate effect) corresponds to the adjusted rate ratios (RRs), which can be interpreted as the rate of alcohol-positive drivers immediately after the implementation of the alcohol tax (August 2011) in comparison with before the introduction (July 2011). The gradual effect refers to the change in trend (slope) in the outcome following the intervention. The pre-intervention trend is the monthly change prior to the introduction of the tax, and the post-intervention trend follows the 2011 alcohol sales tax increase. This parameter allows the trend to differ before and after the intervention. If no significant change was detected, one continuous linear trend over time was assumed, which can be interpreted as the monthly change in the outcome of interest during the overall study period. The changes in level and trend enabled the authors to determine if the effect was immediate, gradual, or both.

In addition, analyses using a second model were conducted that included the log rate of alcohol-negative drivers per population, and per licensed drivers and per VMT, as a predictor variable along with the alcohol sales tax increase indicator variable and linear trends. These alcohol-negative crashes are used as a proxy to control for unmeasured external factors, such as the economy, improved car safety, and highway design.3,34

All analyses were conducted using SAS, version 9.3. This study received ethics approval from the University of Maryland, Baltimore IRB.

RESULTS

From 2001 to 2013, a total of 794,729 drivers aged 15–95 years were involved in an injury crash. Approximately 6% of drivers involved in an injury-related crash were excluded because of either missing values for age or being outside the age range of 15–95 years (potential coding errors). Among drivers involved in crashes resulting in an injury, 54.7% suffered a nonfatal injury, 44.7% were not injured (occupant or pedestrians were injured), and 0.6% died from the crash. Most drivers were male (56.6%), and 36.7% were aged 35–54 years. According to police perception/BAC quantitative measurement, 4.29% of drivers in injury-related crashes (n=34,098) were classified as alcohol-positive.

On average, 218.6 alcohol-positive drivers were in an injury crash each month (SD=36.0) (Table 1). The monthly mean of alcohol-positive drivers differed by age group, with the highest mean found among drivers aged 21–34 years (mean, 97.3; SD = 15.5) and the lowest mean found among older drivers aged ≥ 55 years (mean, 19.1; SD = 4.5) (Table 1).

Table 1.

Counts and Monthly Means of Alcohol-Positive Drivers in Crashes Resulting in an Injury, Overall, Pre-, and Post-Intervention Periods, Maryland, 2001–2013

| Alcohol-positive driversa by age group | Overall (January 2001–December 2013)

|

Pre-intervention (January 2001 –July 2011)

|

Post-intervention (August 2011–December 2013)

|

|||

|---|---|---|---|---|---|---|

| n | Monthly M (SD) | n | Monthly M (SD) | n | Monthly M (SD) | |

| All | 34,098 | 218.58 (35.96) | 28,906 | 227.61 (32.91) | 5,192 | 179.03 (17.27) |

|

| ||||||

| 15–20 years | 3,886 | 24.91 (9.23) | 3,496 | 27.53 (8.07) | 390 | 13.44 (3.45) |

|

| ||||||

| 21–34 years | 15,183 | 97.33 (15.47) | 12,723 | 100.18 (14.88) | 2,460 | 84.83 (11.37) |

|

| ||||||

| 35–54 years | 12,055 | 77.28 (15.76) | 10,298 | 81.09 (14.46) | 1,757 | 60.59 (8.89) |

|

| ||||||

| ≥ 55 years | 2,974 | 19.06 (4.49) | 2,389 | 18.81 (4.41) | 585 | 20.17 (4.73) |

Driver’s alcohol status is a derived variable available in Maryland Automated Analysis Reporting System.

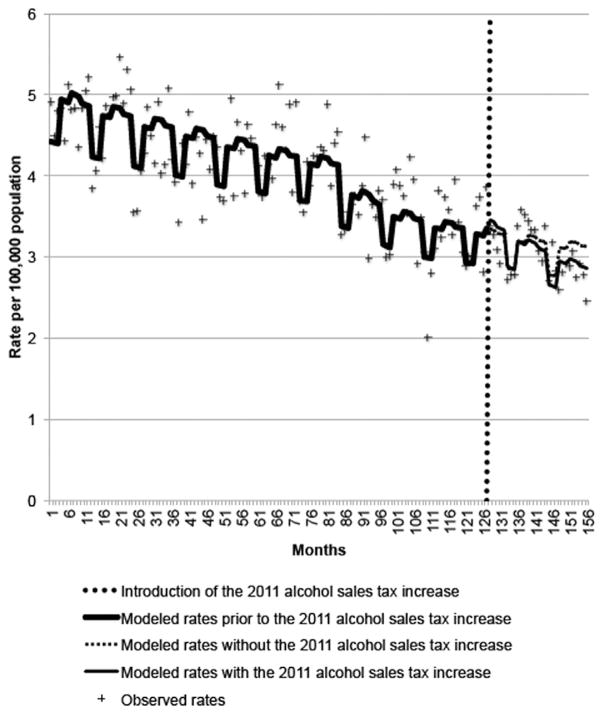

There was a significantly larger gradual reduction in the rate of alcohol-positive drivers after the 2011 alcohol sales tax increase for all drivers and those aged 15–20 and 21–34 years, in comparison with the months preceding its implementation. As illustrated in Figure 1 for all drivers, the modeled rates following the 2011 alcohol sales tax increase were lower in comparison to the expected rates without the intervention.

Figure 1.

Rate of all alcohol-positive drivers in injury-related crash per 100,000 population, Maryland, 2001–2013.

Based on the first statistical model, there was a significant 0.5% reduction in the monthly rate of alcohol-positive drivers per population of Maryland after the tax increase ([pre-trend − post-trend] × 100) (p = 0.03); or 6% in the annual rate (Table 2). There were also a 1% significant monthly reductions for the rates of both alcohol-positive drivers aged 15–20 years (p = 0.007) and those aged 21–34 years (p < 0.001) per population corresponding to each age group after the intervention, or a reduction of approximately 12% annually. Contrary to younger drivers, the population-based rate for alcohol-positive drivers aged ≥ 55 years showed a significant gradual increase of 0.4% per month compared with pre-intervention (p < 0.001), or a 4.8% increase annually.

Table 2.

Adjusted Analyses of Alcohol-Positive Drivers Involved in an Injury-Crash, Maryland, 2001–2013 (Model 1)

| Alcohol-positive drivers by age group | Rates and RRsa | 95% CI | p-value change of trend |

|---|---|---|---|

| All b | |||

| Pre-trendc | 0.998*** | 0.997, 0.999 | 0.03* |

| Post-trendd | 0.993*** | 0.988, 0.998 | |

| Immediate effect of alcohol tax | 1.007 | 0.910, 1.110 | — |

| 15–20 years e | |||

| Pre-trend | 0.993*** | 0.993, 0.994 | 0.007** |

| Post-trend | 0.983*** | 0.976, 0.991 | |

| Immediate effect of alcohol tax | 0.943 | 0.789, 1.128 | — |

| 21–34 years b | |||

| Pre-trend | 1.000 | 0.999, 1.001 | < 0.001*** |

| Post-trend | 0.990*** | 0.986, 0.994 | |

| Immediate effect of alcohol tax | 1.015 | 0.934, 1.103 | — |

| 35–54 years f | |||

| Linear trendg | 0.998*** | 0.997, 0.999 | 0.96 |

| Immediate effect of alcohol tax | 0.980 | 0.893, 1.087 | — |

| ≥ 55 years e | |||

| Pre-trend | 0.996*** | 0.996, 0.997 | < 0.001*** |

| Post-trend | 1.000 | 0.998, 1.002 | |

| Immediate effect of alcohol tax | 1.102*** | 1.043, 1.164 | — |

Note: Boldface indicates statistical significance (*p < 0.05, **p < 0.01, ***p < 0.001).

Statistical analysis based on generalized estimating equation models with autoregressive covariance matrix with log population as offset.

Model adjusted for quarters 1–4, unemployment, and sales tax 2008.

Pre-trend: from January 2001 to July 2011.

Post-trend: from August 2011 to December 2013.

Model adjusted for unemployment and quarters 1–4.

Model adjusted for quarters 1–4 unemployment, and sales tax 2008.

Linear trend assumes one continuous linear trend across study period as no significant difference between pre- and post-intervention trends was found. It can be interpreted as the monthly change in the outcome of interest during the overall study period.

RR, rate ratio.

The alcohol sales tax increase, however, did not have a significant immediate effect on reducing the rate of all alcohol-positive drivers (RR = 1.01, 95% CI = 0.91, 1.11) relative to the period before its implementation, after adjustment for covariables (Table 2). For drivers aged 15–20 years, there was a 6% but not statistically significant immediate decrease in the rate of alcohol-positive drivers following the 2011 alcohol sales tax increase (RR = 0.94, 95% CI = 0.79, 1.13). Changes were not significant for drivers aged 21–34 years (RR = 1.02, 95% CI = 0.93, 1.10) and 35–54 years (RR = 0.98, 95% CI = 0.89, 1.09). However, for drivers aged ≥ 55 years, there was a significant immediate 10% increase in the rate of alcohol-positive drivers (RR = 1.10, 95% CI = 1.04, 1.16) following the 2011 alcohol sales tax increase versus before its introduction.

A second model (Table 3) was used, which controlled for pre- and post-linear trends and used alcohol-negative drivers as a surrogate to control for unmeasured external factors.3,34 For drivers aged 15–20, 21–34, and 35–54 years, the findings from both models were comparable. For all alcohol-positive drivers, both models found a significant decrease following the 2011 alcohol sales tax. In Model 1, there was a significant gradual larger decline in the months following the 2011 alcohol sales tax (p=0.03). By contrast, results from Model 2 indicated a significant immediate reduction (p=0.05) but no significant gradual change (p=0.15). For alcohol-positive drivers aged ≥ 55 years, there was a significant immediate and gradual increase in Model 1, whereas in Model 2, there was no significant immediate change but a gradual increase in the rates after the 2011 alcohol sales tax.

Table 3.

Adjusted Analyses of Alcohol-Positive Drivers Involved in an Injury-Crash, Maryland, 2001–2013 (Model 2)

| Alcohol-positive drivers by age group | Rates and RRsa | 95% CI | p-value change of trend |

|---|---|---|---|

| All | |||

| Linear trendb | 0.999*** | 0.998, 0.999 | 0.153 |

| Alcohol-negative drivers | 1.00**** | 1.000, 1.000 | — |

| Immediate effect of alcohol tax | 0.938** | 0.880, 1.000 | — |

| 15–20 years | |||

| Pre-trendc | 0.998** | 0.997, 0.999 | < 0.001**** |

| Post-trendd | 0.989**** | 0.984, 0.995 | |

| Alcohol-negative drivers | 2.113**** | 1.668, 2.677 | — |

| Immediate effect of alcohol tax | 0.969 | 0.850, 1.123 | — |

| 21–34 years | |||

| Pre-trend | 0.999* | 0.999–1.000 | < 0.001**** |

| Post-trend | 0.993**** | 0.990, 0.996 | |

| Alcohol-negative drivers | 1.618**** | 1.320, 1.983 | — |

| Immediate effect of alcohol tax | 0.979 | 0.850, 1.123 | — |

| 35–54 years | |||

| Linear trend | 0.999**** | 0.998, 0.999 | 0.707 |

| Alcohol-negative drivers | 1.95**** | 1.531, 2.484 | — |

| Immediate effect of alcohol tax | 0.965 | 0.876, 1.062 | — |

| ≥ 55 years | |||

| Pre-trend | 0.998**** | 0.997, 0.999 | < 0.01*** |

| Post-trend | 1.004**** | 1.001, 1.008 | |

| Alcohol-negative drivers | 1.761**** | 1.328, 2.335 | — |

| Immediate effect of alcohol tax | 1.049 | 0.941, 1.168 | — |

Note: Boldface indicates statistical significance (*p < 0.10, **p < 0.05, ***p < 0.01, ****p < 0.001).

Statistical analysis based on generalized estimating equation models with autoregressive covariance matrix with log population as offset. Model adjusted for the variables included in the table.

Linear trend assumes one trend across study period as no significant difference between pre- and post-intervention trends was found.

Pre-trend: from January 2001 to July 2011.

Post-trend: from August 2011 to December 2013.

RR, rate ratio.

Overall, similar findings were obtained using either VMT or licensed drivers as denominators compared to those estimated per population. Results from additional sensitivity analyses remained unchanged if all drivers involved in an injury crash were included, including the 6.2% with ages unknown or outside the study range of 15–95 years.

DISCUSSION

The 2011 alcohol sales tax increase in Maryland led to a significant decline in the rate of alcohol-positive drivers aged 15–95 years involved in injury-related motor vehicle crashes after adjustment for other variables. Similar findings were obtained independent of the multiple denominators used. Examination of the effects of the 2011 alcohol sales tax increase on drivers by age revealed a significantly larger gradual decline among drivers aged 15–20 and 21–34 years in the months following the 2011 alcohol sales tax increase compared with the pre-intervention period but not among drivers aged 35–54 and ≥ 55 years.

There is strong evidence that increasing alcohol prices through taxation reduces alcohol consumption and traffic fatalities,3,8,9 although some findings were inconclusive.31,35 Except for a few studies,3,36 researchers have restricted analyses to the national effects of the aggregate federal and state beer excise taxes, or average state annual beer tax on traffic fatalities. There is sparse information on the immediate and long-term effects of alcohol tax increases on motor vehicle injuries in a specific state and no study has focused on alcohol sales taxes.

Consistent with previous literature,3,37 younger drivers were more sensitive to the alcohol tax increase than older drivers. Studies have not previously assessed the effects on older drivers aged ≥ 55 years. The rate of alcohol-positive drivers aged ≥ 55 years actually increased during the post-intervention period compared with pre-intervention, which illustrates the importance of considering the heterogeneity of a population when developing and evaluating alcohol control policies.38 Although drivers aged ≥ 55 years are not the primary target for most prevention programs, interventions are relevant considering that among this age group approximately 60%–67% of the impaired drivers have a BAC ≥ 0.15 g/dL.39 This finding is alarming, considering that at this BAC, drivers are 22 times more likely to be involved in a crash compared with drivers with negative BAC.40

Perhaps, the 3% alcohol sales tax increase (from 6% to 9%) was an insufficient price increase for drivers aged 35–54 and ≥ 55 years to change their behavior. These age groups are likely to have a higher disposable income than young drivers, especially considering the SES of Mary-land, which was second nationwide in 2013 for median household income.41 It is plausible that a similar level of increase in excise tax may have a different impact, depending on the socioeconomic level of its population. Also, despite the 3% increase in alcohol sales tax, the Maryland alcohol excise tax is low and has not been adjusted for infiation for more than 40 years. The last alcohol excise tax per gallon increase was in 1957 for distilled spirits and 1973 for beer and wine,42 amounting to less than 1 cent per beer.

Unlike some studies evaluating alcohol excise taxes that found sudden decreases in fatal alcohol-related crashes,3 a gradual reduction was observed in the rates as indicated by a change in slope, with no immediate effect in most analyses. This could be due to the lack of visibility of the alcohol sales tax (added at the register) compared with excise tax (included in the advertised shelf price), as mentioned in previous research.10 Consumers may have taken a certain time to notice the net increase in price and change their behaviors related to the purchase of alcohol, leading to the observed gradual effect of the sales tax rather than a sudden drop seen with the excise taxes.

This study is the first to examine the effect of an alcohol sales tax change on all motor vehicle injuries and across various age groups. Despite variations in the point estimates, the overall findings remained consistent regardless of denominators used.

Limitations

Although several covariables were assessed to control for economic factors, changes in laws, and seasonality, there still may be omitted/unmeasured confounders (e.g., interventions implemented at the county levels). However, the second model using alcohol-negative drivers as a surrogate to control for unmeasured external factors3,34 found similar results. Injury severity and alcohol involvement, which are based partly on police officers’ perceptions, may have been misclassified, but to the researchers’ knowledge, no systematic changes in laws or practices occurred during the study period.

CONCLUSIONS

Overall, the results of this study suggest that the 2011 Maryland alcohol sales tax increase led to a significantly larger decline in the rate of alcohol-positive drivers implicated in fatal or nonfatal motor vehicle injuries in comparison to before its implementation. The effect of the tax varied across age groups; young drivers appeared to be alcohol price–sensitive. These results are consistent with recent findings that the Maryland tax increase also reduced per-capita alcohol consumption and sexually transmitted diseases.4,5 Increasing alcohol taxes in combination with other alcohol-control policies is an effective means of reducing drunk driving and may contribute in maximizing the public health gain across different age groups.

Acknowledgments

This study was supported by Public Health Law Research Dissertation Grant, Robert Wood Johnson Foundation Public Health Law Research Program and NIH National Institute on Alcohol Abuse and Alcoholism grant R01AA018313. We thank the staff at the National Study Center for Trauma and Emergency Medical Systems at the University of Maryland Baltimore for their help throughout the study, and Dr. Sania Amr for her feedback.

No financial disclosures were reported by the authors of this paper.

References

- 1.Miller TR, Gibson R, Zaloshnja E, et al. Underreporting of driver alcohol involvement in United States police and hospital records: capture-recapture estimates. Ann Adv Automot Med. 2012;56:87–96. [PMC free article] [PubMed] [Google Scholar]

- 2.Elder RW, Lawrence B, Ferguson A, et al. The effectiveness of tax policy interventions for reducing excessive alcohol consumption and related harms. Am J Prev Med. 2010;38(2):217–229. doi: 10.1016/j.amepre.2009.11.005. http://dx.doi.org/10.1016/j.amepre.2009.11.005. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3.Wagenaar AC, Livingston MD, Staras SS. Effects of a 2009 Illinois alcohol tax increase on fatal motor vehicle crashes. Am J Public Health. 2015;105(9):1880–1885. doi: 10.2105/AJPH.2014.302428. http://dx.doi.org/10.2105/AJPH.2014.302428. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 4.Staras SAS, Livingston MD, Wagenaar AC. Maryland alcohol sales tax and sexually transmitted infections. A natural experiment. Am J Prev Med. 2016;50(3):e73–e80. doi: 10.1016/j.amepre.2015.09.025. http://dx.doi.org/10.1016/j.amepre.2015.09.025. [DOI] [PubMed] [Google Scholar]

- 5.Esser MB, Waters H, Smart M, Jernigan DH. Impact of Maryland’s 2011 alcohol sales tax increase on alcoholic beverage sales. Am J Drug Alcohol Abuse. 2016;42(4):404–411. doi: 10.3109/00952990.2016.1150485. http://dx.doi.org/10.3109/00952990.2016.1150485. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 6.Fell JC, Beirness DJ, Voas RB, et al. Can progress in reducing alcohol-impaired driving fatalities be resumed? Results of a workshop sponsored by the transportation research board alcohol, other drugs, and transportation committee (ANB50) Traffic Inj Prev. 2016;17(8):771–781. doi: 10.1080/15389588.2016.1157592. http://dx.doi.org/10.1080/15389588.2016.1157592. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.Kerr WC, Patterson D, Greenfield TK, et al. U.S. alcohol affordability and real tax rates, 1950–2011. Am J Prev Med. 2013;44(5):459–464. doi: 10.1016/j.amepre.2013.01.007. http://dx.doi.org/10.1016/j.amepre.2013.01.007. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8.Chaloupka FJ, Saffer H, Grossman M. Alcohol-control policies and motor-vehicle fatalities. J Legal Stud. 1993;22(1):161–186. http://dx.doi.org/10.1086/468161. [Google Scholar]

- 9.Chang K, Wu C, Ying Y. The effectiveness of alcohol control policies on alcohol-related traffic fatalities in the United States. Accid Anal Prev. 2012;45:406–415. doi: 10.1016/j.aap.2011.08.008. http://dx.doi.org/10.1016/j.aap.2011.08.008. [DOI] [PubMed] [Google Scholar]

- 10.Chetty R, Looney A, Kroft K. Salience and taxation: theory and evidence. Am Econ Rev. 2009;99(4):1145–1177. http://dx.doi.org/10.1257/aer.99.4.1145. [Google Scholar]

- 11.Cotti C, Dunn RA, Tefft N. Alcohol-impaired motor vehicle crash risk and the location of alcohol purchase. Soc Sci Med. 2014;108:201–209. doi: 10.1016/j.socscimed.2014.03.003. http://dx.doi.org/10.1016/j.socscimed.2014.03.003. [DOI] [PubMed] [Google Scholar]

- 12.Gruenewald PJ, Ponicki WR, Holder HD, Romelsjö A. Alcohol prices, beverage quality, and the demand for alcohol: quality substitutions and price elasticities. Alcohol Clin Exp Res. 2006;30(1):96–105. doi: 10.1111/j.1530-0277.2006.00011.x. http://dx.doi.org/10.1111/j.1530-0277.2006.00011.x. [DOI] [PubMed] [Google Scholar]

- 13.Siegel M, Jernigan D. [Accessed May 15, 2016];Database of brand-specific alcohol and prices alcohol content. www.youthalcoholbrands.com/about-this-project.html.

- 14.Xuan Z, Chaloupka FJ, Blanchette JG, et al. The relationship between alcohol taxes and binge drinking: evaluating new tax measures incorporating multiple tax and beverage types. Addiction. 2015;110(3):441–450. doi: 10.1111/add.12818. http://dx.doi.org/10.1111/add.12818. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 15.Burch C, Cook L, Dischinger P. A comparison of KABCO and AIS injury severity metrics using CODES linked data. Traffic Inj Prev. 2014;15(6):627–630. doi: 10.1080/15389588.2013.854348. http://dx.doi.org/10.1080/15389588.2013.854348. [DOI] [PubMed] [Google Scholar]

- 16.Berning A, Smither DD. Understanding the Limitations of Drug Test Information, Reporting, and Testing Practices in Fatal Crashes. DOT HS 812 072. Washington, DC: U.S. Department of Transportation, National Highway Traffic Safety Administration; 2014. [Google Scholar]

- 17.U.S Bureau of Labor Statistics. [Accessed January 7, 2015];Local area unemployment statistics. http://data.bls.gov/cgi-bin/dsrv. Updated 2014.

- 18.U.S. Department of Commerce. [Accessed May 4, 2016];Regional economic accounts: state personal income accounts. http://www.bea.gov/regional/downloadzip.cfm. Updated March 24, 2016.

- 19.National Institute of Alcohol Abuse and Alcoholism. [Accessed March 5, 2015];Alcohol policy information system. https://alcoholpolicy.niaaa.nih.gov.

- 20.Insurance Institute for Highway Safety. [Accessed November 6, 2014];Safety belt laws. www.iihs.org/iihs/topics/laws/safetybeltuse?topicName=safety-belts. Updated 2014.

- 21.National Highway Traffic Safety Administration. Digest of Impaired Driving and Selected Beverage Control Laws. 28. Washington, DC: U.S. Department of Transportation, National Highway Traffic Safety Administration; 2013. [Google Scholar]

- 22.Villaveces A, Cummings P, Koepsell TD, Rivara FP, Lumley T, Moffat J. Association of alcohol-related laws with deaths due to motor vehicle and motorcycle crashes in the United States, 1980–1997. Am J Epidemiol. 2003;157(2):131–140. doi: 10.1093/aje/kwf186. http://dx.doi.org/10.1093/aje/kwf186. [DOI] [PubMed] [Google Scholar]

- 23.Tax Foundation. [Accessed November 13, 2014];State sales, gasoline, cigarette, and alcohol tax rates by state, 2000–2014. http://taxfoundation.org/article/state-sales-gasoline-cigarette-and-alcohol-tax-rates. Updated 2014.

- 24.U.S. Census Bureau. [Accessed January 7, 2015];State and county quickfacts. http://quickfacts.census.gov/qfd/states/24/24001.html. Updated 2014.

- 25.U.S Department of Transportation Federal Highway Administration. [Accessed November 13, 2014];Highway statistics series. www.fhwa.dot.gov/policyinformation/statistics.cfm. Updated 2013.

- 26.Lord D, Mannering F. The statistical analysis of crash-frequency data: a review and assessment of methodological alternatives. Transport RES A-Pol. 2010;44(5):291–305. http://dx.doi.org/10.1016/j.tra.2010.02.001. [Google Scholar]

- 27.Kincaid C. Guidelines for selecting the covariance structure in mixed model analysis; Philadelphia, PA. Paper presented at: Thirtieth Annual SAS Users Group International Conference; 2005 April. [Google Scholar]

- 28.Chaloupka FJ, Laixuthai A. Do youths substitute alcohol and marijuana? Some econometric evidence. Eastern Econ J. 1997;23(3):253–276. http://dx.doi.org/10.3386/w4662. [Google Scholar]

- 29.Mast BD, Benson BL, Rasmussen DW. Beer taxation and alcohol-related traffic fatalities. Southern Econ J. 1999;66(2):214–249. http://dx.doi.org/10.2307/1061141. [Google Scholar]

- 30.Morrisey MA, Grabowski DC. Gas prices, beer taxes and GDL programmes: effects on auto fatalities among young adults in the U. S. Appl Econ. 2011;43(25):3645–3654. http://dx.doi.org/10.1080/00036841003670796. [Google Scholar]

- 31.Young DJ, Likens TW. Alcohol regulation and auto fatalities. Int Rev Law Econ. 2000;20(1):107–126. http://dx.doi.org/10.1016/S0144-8188(00)00023-5. [Google Scholar]

- 32.Young DJ, Bielinska-Kwapisz A. Alcohol prices, consumption, and traffic fatalities. Southern Econ J. 2006;72(3):690–703. http://dx.doi.org/10.2307/20111841. [Google Scholar]

- 33.Wagner AK, Soumerai SB, Zhang F, Ross-Degnan D. Segmented regression analysis of interrupted time series studies in medication use research. J Clin Pharm Ther. 2002;27(4):299–309. doi: 10.1046/j.1365-2710.2002.00430.x. http://dx.doi.org/10.1046/j.1365-2710.2002.00430.x. [DOI] [PubMed] [Google Scholar]

- 34.Fell JC, Langston EA, Tippetts AS. Evaluation of four state impaired driving enforcement demonstration programs: Georgia, Tennessee, Pennsylvania and Louisiana. Annu Proc Assoc Adv Automot Med. 2005;49:311–326. [PMC free article] [PubMed] [Google Scholar]

- 35.Whetten-Goldstein K, Sloan FA, Stout E, Liang L. Civil liability, criminal law, and other policies and alcohol-related motor vehicle fatalities in the United States: 1984–1995. Accid Anal Prev. 2000;32(6):723–733. doi: 10.1016/s0001-4575(99)00122-0. http://dx.doi.org/10.1016/S0001-4575(99)001-22-0. [DOI] [PubMed] [Google Scholar]

- 36.Kisely SR, Pais J, White A, et al. Effect of the increase in "alcohol pops" tax on alcohol-related harms in young people: a controlled interrupted time series. Med J Aust. 2011;195(11):690–693. doi: 10.5694/mja10.10865. http://dx.doi.org/10.5694/mja10.10865. [DOI] [PubMed] [Google Scholar]

- 37.Saffer H, Grossman M. Drinking age laws and highway mortality rates: cause and effect. Econ Inq. 1987;25(3):403–417. http://dx.doi.org/10.1111/j.1465-7295.1987.tb00749.x. [Google Scholar]

- 38.Meier PS, Purshouse R, Brennan A. Policy options for alcohol price regulation: the importance of modelling population heterogeneity. Addiction. 2010;105(3):383–393. doi: 10.1111/j.1360-0443.2009.02721.x. http://dx.doi.org/10.1111/j.1360-0443.2009.02721.x. [DOI] [PubMed] [Google Scholar]

- 39.National Highway Traffic Safety Administration. [Accessed August 3, 2013];Prevalence of high BAC in alcohol-impaired driving fatal crashes. http://www-nrd.nhtsa.dot.gov/Pubs/811654.pdf. Updated 2012.

- 40.Blomberg RD, Peck RC, Moskowitz H, Burns M, Fiorentino D. The Long Beach/Fort Lauderdale relative risk study. J Safety Res. 2009;40(4):285–292. doi: 10.1016/j.jsr.2009.07.002. http://dx.doi.org/10.1016/j.jsr.2009.07.002. [DOI] [PubMed] [Google Scholar]

- 41.U.S Department of Commerce. [Accessed December 11, 2014];Household income: 2013. www.census.gov/content/dam/Census/library/publications/2014/acs/acsbr13-02.pdf. Updated 2014.

- 42.Comptroller of Maryland. [Accessed August 1, 2014];Consumer FAQs about alcoholic beverages. http://taxes.marylandtaxes.com/Business_Taxes/Taxpayer_Assistance/Business_Tax_FAQs/Alcohol_and_Tobacco_Tax/Consumer_FAQs_about_Alcoholic_Beverages.shtml. Updated 2013.