Abstract

Background. The financial exploitation of older adults was recently recognized by the Centers for Disease Control and Prevention as a serious public health problem. Knowledge of the prevalence of elder financial exploitation is mostly limited to the category of financial abuse, which occurs in relationships involving an expectation of trust. Little is known about the other major category of elder financial exploitation—elder financial fraud and scams, which is perpetrated by strangers. A valid estimate of elder financial fraud–scam prevalence is necessary as a foundation for research and prevention efforts.

Objectives. To estimate the prevalence of elder financial fraud–scam victimization in the United States based on a systematic review and meta-analysis.

Search Methods. Multiple investigators independently screened titles and abstracts and reviewed relevant full-text records from PubMed, Medline, PsycINFO, Criminal Justice Abstracts, Social Work Abstracts, and AgeLine databases.

Selection Criteria. To maximize the validity and generalizability of prevalence estimation, we restricted eligibility to general population-based studies (English speaking, 1990 onward) using state- or national-level probability sampling and collecting data directly from older adults.

Data Collection and Analysis. Information on elder financial fraud–scam prevalence and study-level characteristics was extracted independently by 2 investigators. Meta-analysis of elder financial fraud–scam prevalence used generalized mixed models with individual studies as levels of a random classification factor.

Main Results. We included 12 studies involving a total of 41 711 individuals in the meta-analysis. Overall pooled elder financial fraud–scam prevalence (up to 5-year period) across studies was 5.6% (95% confidence interval [CI] = 4.0%, 7.8%), with a 1-year period prevalence of 5.4% (95% CI = 3.2%, 7.6%). Studies using a series of questions describing specific fraud–scam events to measure victimization found a significantly higher prevalence (7.1%; 95% CI = 4.8%, 9.4%) than studies using a single, general-question self-report assessment approach (3.6%; 95% CI = 1.8%, 5.4%).

Author’s Conclusions. Elder financial fraud and scams is a common problem, affecting approximately 1 of every 18 cognitively intact, community-dwelling older adults each year; it requires further attention from researchers, clinicians, and policymakers. Elder financial fraud–scam prevalence findings in this study likely underestimate the true population prevalence. We provide methodological recommendations to limit older adult participation and reporting bias in future population-based research.

Public Health Implications. Elder financial exploitation victimization is associated with mortality, hospitalization, and poor physical and mental health. Health care professionals working with older adults likely routinely encounter patients who are fraud–scam victims. Validation of instruments to screen for elder financial fraud and scams in clinical settings is an important area of future research. Without effective primary prevention strategies, the absolute scope of this problem will escalate with the growing population of older adults.

PLAIN-LANGUAGE SUMMARY

As the population ages, the financial exploitation of older adults is a growing issue that is associated with major consequences, such as shortened survival, hospitalization, and poor physical and mental health. Although previous prevalence research on elder financial exploitation has mostly focused on financial abuse that occurs in families and other types of trust relationships, little is known about financial fraud and scams perpetrated by strangers. This study sought to estimate a valid prevalence of elder financial fraud and scams using a meta-analysis strategy that pooled data from several existing studies. To enhance the generalizability of prevalence estimation, the meta-analysis only included large-scale studies that drew on state- or national-level random samples of older adults. Results indicate that 5.4% (approximately 1 of every 18) of cognitively intact older adults living in the community are victims of financial fraud or scams each year in the United States. Thus, elder financial fraud and scams is a common problem, affecting millions of older adults annually, which requires further attention from researchers, clinicians, and policymakers. Prevalence information from this study can be used as a rationale for further research and prevention efforts.

The issue of elder mistreatment has gained increasing attention by clinicians, policymakers, and researchers as a major issue affecting a rapidly aging population. The Centers for Disease Control and Prevention recently recognized and defined elder mistreatment as a serious public health problem requiring formal surveillance.1 The 2015 decennial White House Conference on Aging designated elder mistreatment as one of 4 top-priority issues affecting older adults.2 As a derivative of elder mistreatment, the financial exploitation of older adults is associated with increased risks of mortality and hospitalization, poor physical and mental health, and diminished quality of life.3–5 Age-associated vulnerability to financial exploitation is rooted in exposure to neurological, cognitive, functional, and psychosocial risks and is conceptualized as a potential clinical syndrome for screening.6

As a broad typology, the issue of elder financial exploitation can be divided into 2 major categories: elder financial abuse and elder financial fraud and scams (EFFS). Conceptually, these 2 major categories are distinguished by the presence or absence of the expectation of trust in the victim–perpetrator relationship (conceptual framework in Appendix A, available as a supplement to this article at http://www.ajph.org). Specifically, elder financial abuse occurs when an older adult’s resources are improperly or illegally used by a person in a relationship involving an expectation of trust, such as a family member, friend, home care aid, or someone else who is entrusted to protect the older adult’s interests or care.1 EFFS, on the other hand, is characterized by acts perpetrated by a stranger or someone else outside of a conventional or legally defined trust relationship. The Centers for Disease Control and Prevention recently defined EFFS as “Deception carried out for the purpose of achieving personal gain while causing injury to another party. An intentional distortion of truth initiated to convince another to part with something of value or to surrender a legal right.”1(p35) To date, our knowledge about the prevalence of elder financial exploitation is mostly limited to the category of elder financial abuse. Little is known about the other major category, EFFS.

Although it is unclear whether older adults experience higher rates of fraud–scam victimization than other age groups, older adults represent a distinct demographic group differentiated by a unique set of age-associated fraud–scam vulnerabilities. The decision-making process necessary to actively avoid and resist fraud–scam activities requires complex, higher-order cognitive functions that decline disproportionately among older adults. For example, mild cognitive impairment is associated with poor financial decision-making,7 reduced financial literacy,8 and greater susceptibility to scams.9 Even among older adults without mild cognitive impairment or dementia, age-related changes in cognition are associated with poor decision-making and greater susceptibility to scams.10 Older adults are more likely to have financial resources than are their younger counterparts, and this, in combination with the higher prevalence of cognitive, functional, and health impairments, renders them uniquely susceptible to fraud and scams.6 Indeed, older adults are disproportionately targeted by fraud–scam attempts11 and encounter fraud–scam schemes that are specifically designed to exploit age-associated vulnerabilities.12

Given the unique set of age-associated fraud–scam vulnerabilities and tailored fraud–scam schemes affecting older adults, this subpopulation requires specialized research attention to inform targeted prevention strategies. Such specialization is now recognized by major government policymaking,13 law enforcement,14 and consumer protection15 entities.

Information on EFFS prevalence is needed as a foundation for research and to mobilize and inform efforts designed to prevent, respond to, and identify causes of EFFS. This information is currently fragmented across many disciplines and, in several cases, biased by information from unrepresentative convenience samples, complainant databases, or third-party reports.16 Prevalence estimates are wide-ranging, and the field does not have an accurate sense of the scope of the EFFS problem.17 Seeking to address this gap, we provide the first systematic review on the topic of EFFS and generate the most valid and reliable estimate of EFFS prevalence in the United States based on a meta-analysis of population-based studies.

METHODS

A primary concern in estimating the prevalence of a problem is external validity or generalizability to the broader population. To maximize the external validity of estimating the prevalence of EFFS in the United States, we restricted study eligibility to general population-based studies using probability sampling from state- or national-level frames and collecting data directly from older adults. We excluded studies that identified EFFS cases using convenience or clinical–agency samples, complainant databases, known victim lists, or third-party reporters to avoid prevalence bias introduced by such designs. We selected studies from 1990 onwards to reflect the emergence of the Internet era, which broadened the scope of fraud–scam activities. We restricted eligibility to quantitative, English-language studies, using a prevalence period of up to 5 years. Because an international literature of population-based EFFS studies is virtually nonexistent and EFFS prevalence is likely linked to country-specific legislation and policy and law enforcement practices, we focused on EFFS in the Unites States, where the vast majority of scholarship is available.

The outcome of EFFS is dynamic, not fixed, since the types of activities constituting this problem evolve over time and place in response to new regulations and laws, detection and enforcement tactics, technological advancements, consumer behaviors, finance and investment trends, public education and awareness, and other factors. Thus, a stable set of EFFS subtypes has not historically existed, and studies vary over time in regard to EFFS definitions and the specific types of fraud–scam activities considered. We included studies that assessed any type of financially related fraud–scam activity perpetrated by a stranger or other person standing outside of a conventional trust relationship. The literature on fraud and scams is mixed in regard to the inclusion11 or exclusion18 of identity theft and fraud as a subtype. To be comprehensive in this first systematic review of EFFS, we included studies covering identity theft and fraud; however, we conducted a disaggregated analysis to provide separate prevalence rates for studies that covered financial fraud and scams in general versus those that focused on identity theft and fraud.

Search Strategy

Two investigators (D. B. and C. S.) independently screened titles and abstracts for records that reported on the prevalence of EFFS victimization in the following interdisciplinary collection of databases: PubMed, Medline, PsycINFO, Criminal Justice Abstracts, Social Work Abstracts, and AgeLine. We searched databases with advanced search tools by combining keywords related to prevalence and incidence and to scam–fraud–financial exploitation. Full database search details, including search terms and number of records, are given in Appendix B (available as a supplement to this article at http://www.ajph.org). Full texts of relevant titles and abstracts were independently reviewed by 2 investigators (D. B. and C. S.). A list of excluded full-text-reviewed records appears in Appendix C with annotated exclusion justification. Two investigators (D. B. and C. S.) manually screened reference lists of retained records and relevant literature reviews related to the topic of fraud and scams, including a report published by the Financial Fraud Research Center listing all known original fraud–scam research studies.16 Only 1 relevant record in the search process was unavailable, and it was obtained by contacting the lead study organization.

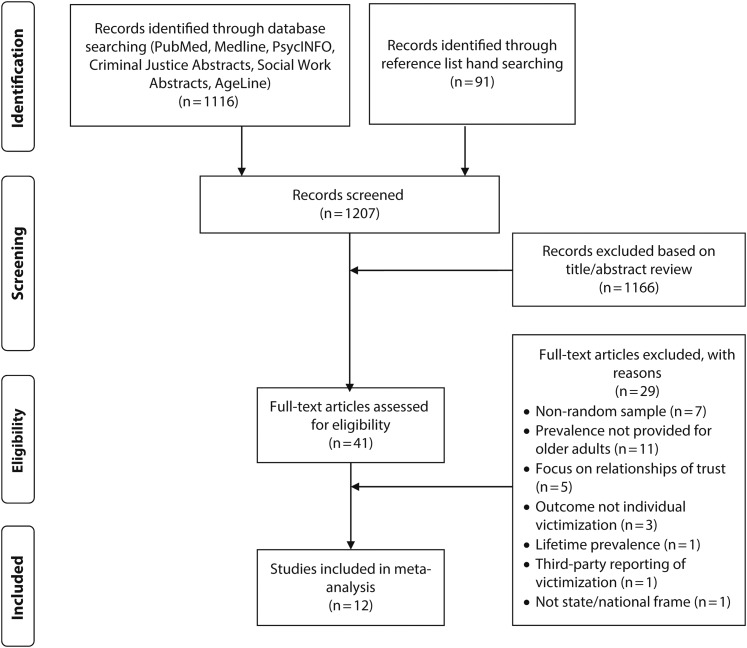

Our search strategy resulted in 12 records that satisfied inclusion–exclusion criteria. Figure 1 provides a flow diagram representing the overall search and exclusion process following Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) guidelines.

FIGURE 1—

Flow Diagram for Identifying Population-Based Studies Reporting the Prevalence of Elder Financial Fraud and Scams

Data Extraction

One investigator (D. B.) extracted information from each record on the following methodological specifications that represent overall study design or factors that may influence prevalence estimation: geographic area covered, older adult age cutoff, older adult sample size, study inclusion criteria, year and method of data collection, response rate, fraud–scam assessment approach, types of fraud and scams considered, and EFFS prevalence period. A second investigator (R. Z.) independently reviewed each study for the accuracy of extracted information. No discrepancies in data extraction were identified. Most studies were designed to examine fraud and scams among adults of all ages; thus, very few studies provided EFFS prevalence rates for older adult sociodemographic subgroups (e.g., gender, race/ethnicity).

Quality Assessment

To appraise study quality, we used a common evaluation-scoring framework developed by Loney et al.19 designed specifically to assess the rigor underlying the prevalence estimation of a health problem. We scored study quality assessment on a scale from 0 to 8 using items related to the following criteria: sampling strategy, sampling frame, sample size, outcome measurement, assessor bias, response rate and description of refusers, confidence intervals and subgroup analysis, and sample description. Higher scores indicated stronger quality of prevalence estimation. Quality assessment scoring was completed by 2 independent raters (D. B. and C. S.). No scoring discrepancies emerged. Appendix D provides quality assessment scoring details for each individual study, a quality scoring summary table for all studies, and graphical representations of item score variation across studies.

Bias Assessment

We evaluated study bias using a tool specifically designed by Hoy et al. to assess risk of bias in population-based prevalence studies.20 The tool consists of 10 items covering the following domains of bias, which are each rated as contributing to low or high study bias: selection, nonresponse, measurement, and analysis. Item 11 is an overall summary assessment of bias (low, moderate, high) based on the rater’s responses to the previous 10 items. Bias assessment ratings were completed by 2 independent raters (D. B. and C. S.). The raters independently agreed on 126 of 132 items (95.5%) across 12 studies. Agreement on the remaining 6 items was reached through consensus. Appendix E provides bias assessment rating details for each individual study and a bias rating summary table for all studies.

Data Analysis

We carried out a meta-analysis in generalized mixed models with a binomial error assumption, logistic link function, unstructured variance and covariance, and studies included as levels of a random classification factor. Random effects took into account heterogeneity among studies. Given the small number of studies, we estimated overall EFFS prevalence in a model including no additional variables. To examine whether specific study-level methodological characteristics had an effect on prevalence estimates, we examined 8 additional mixed models with each of the following methodological specifications included as an additional fixed classification factor: older adult age cutoff (< 65 vs ≥ 65 years), year of data collection (≤ 2005 vs > 2005), EFFS assessment approach (closed-ended and descriptive vs single self-report), number of EFFS subtypes considered (≤ 10 vs > 10), focus on identity fraud (no vs yes), prevalence period (1 year vs 5 years), and study quality assessment score (< 5 vs ≥ 5). Because significant effects (P < .05) are difficult to detect with a small number of studies, we also used Cohen’s d effect size statistic as a measure of the magnitude and importance of the difference in EFFS prevalence.

In this type of meta-analysis, it is clear that an assumption of studies as fixed (a single true prevalence rate for all studies) is inappropriate. True rates will vary by studies owing not just to sampling error but also to differences in sample composition (age, ethnicity, education), methods of assessment and study protocol, variable definitions, overall study quality, and numerous other factors. We used mixed models in which studies were assumed to be random (sampled from a population of studies). Rates were assumed to differ by studies. For the sake of completeness, we computed the Cochran Q statistic to examine heterogeneity across studies.

Publication bias is often examined using a funnel plot with 1 divided by the standard error, which is a measure of sample size plotted against prevalence rate. However, evidence suggests that when outcomes are proportions (especially small proportions), this standard type of funnel plot may show asymmetry, even when there is no publication bias.21 Thus, we examined a funnel plot of sample size versus prevalence rate. Appendix F presents the meta-analysis of observational studies in epidemiology (MOOSE) checklist. We conducted analyses using SAS version 9.3 (SAS Institute, Cary, NC).

RESULTS

We included 12 studies involving a total of 41 711 individuals in the current meta-analysis (Table 1).11,22–32 The mean sample size was 3456 (SD = 4380; median = 1125; range = 210–12 024). In all studies, participants were community dwelling, with those living in institutional settings excluded. Ten studies were limited to cognitively intact older adults, and 2 studies included older adults with a range of cognitive functioning. Across studies, data collection occurred between 1991 and 2014, with most studies (n = 10) collecting data after 2000. Ten studies collected data on a national scale and 2 studies represented state-level coverage. Minimum age cutoffs for older adults included 50 (n = 2), 55 (n = 1), 60 (n = 1), and 65 (n = 8) years. Nine studies used a 1-year prevalence period and 3 studies used a 5-year prevalence period. Eight studies used a closed-ended, descriptive EFFS assessment–measurement approach examining multiple specific EFFS activities, and 4 studies used a single self-report question assessment–measurement approach. Response rates across studies ranged from 14.0% to 68.2% (mean = 47.3%; SD = 20.2%). Quality assessment ratings ranged from 3 to 5.5 (mean = 4.6; SD = 0.8). Overall bias risk ratings included moderate (n = 7) and high (n = 5).

TABLE 1—

Population-Based Studies Using Random Samples and Reporting on Prevalence of Elder Financial Fraud and Scam (EFFS): United States, 1991–2016

| Reference | Geographic Area (Study Name) | Older Adult Age (Sample Size) | Inclusion Criteria | Data Collection Type and Year (Response Rate) | EFFS Measurementa | Overall EFFS Prevalence Period (Rate) | Study Qualityb (Risk of Bias)c |

| Lichtenberg et al., 201622 | United States (Health and Retirement Study [HRS]) | ≥ 50 y (n = 7 252) |

Participated in both the regular 2008 HRS interview and the 2008–2012 Leave Behind HRS Questionnaire | Telephone interview and self-administered questionnaire in 2008–2012 (response rate not provided) | Single general self-report question | 5-y (6.1%) |

4.5 (high) |

| Harrell, 201523 | United States (National Crime Victimization Survey Identity Theft Supplement) | ≥ 65 y (n = 11 464) |

Age ≥ 16 y, English speaking, community dwelling, cognitively intact | Computer-assisted interviews in person or by telephone in 2014 (66.1%) | Several closed-ended questions describing 3 different identity fraud types | 1-y (5.8%) |

5.5 (moderate) |

| Holtfreter et al., 201411 | Florida and Arizona | ≥ 60 y (n = 2 000) |

Age ≥ 60 y, with land-line phone, English or Spanish speaking, community household, cognitively intact | Computer-assisted telephone interviews in 2011 (48.4%) | Several closed-ended questions describing 10 different EFFS types | 1-y (13.6%) |

5.5 (moderate) |

| Lichtenberg et al., 201324 | United States (HRS) | ≥ 50 y (n = 4 440) |

Participated in both the regular 2002 HRS interview and the 2008 Leave Behind HRS Questionnaire | Self-administered questionnaire in 2008 (response rate not provided) | Single general self-report question | 5-y (4.5%) |

4.5 (high) |

| Anderson, 201325 | United States | ≥ 65 y (n = 992) |

Age ≥ 18 y, English or Spanish speaking, land-line or mobile phone, residential household, cognitively intactd | Computer-assisted telephone interviews in 2011 (14%) | Several closed-ended questions describing 17 specific or general fraud–scam types | 1-y (7.0%) |

5.5 (moderate) |

| Harrell and Langton, 201326 | United States (National Crime Victimization Survey Identity Theft Supplement) | ≥ 65 y (n = 12 024) |

Age ≥ 16 y, English speaking, community dwelling, cognitively intact | Computer-assisted interviews in person or by telephone in 2012 (68.2%) | Several closed-ended questions describing 3 different identity fraud types | 1-y (5.0%) |

5.5 (moderate) |

| Anderson, 200727 | United States | ≥ 65 y (n = 677) |

Age ≥ 18 y, English or Spanish speaking, community dwelling, cognitively intactd | Computer-assisted telephone interviews in 2005 (23%) | Several closed-ended questions describing 16 specific or general fraud–scam events | 1-y (8.3%) |

5 (moderate) |

| Holtfreter et al., 200628 | Florida | ≥ 65 y (n = 430) |

Age ≥ 18 y, English speaking (other languages unknown), community dwelling, cognitively intactd | Telephone interviews in 2004–2005 (44%) | Single general self-report question | 1-y (1.8%) |

3 (high) |

| Anderson, 200429 | United States | ≥ 65 y (n = 505) |

Age ≥ 18 y, English speaking, land-line phone, community dwelling, cognitively intactd | Telephone interviews in 2003 (response rate not provided) | Several closed-ended questions describing 12 specific or general fraud–scam events | 1-y (4.7%) |

4 (moderate) |

| Federal Trade Commission, 200330 | United States | ≥ 55 y (n = 1 258)e |

Age ≥ 18 y, English speaking (other languages unknown), residential dwelling, cognitively intactd | Computer-assisted telephone interviews in 2003 (response rate not provided) | Several closed-ended questions describing 3 different identity fraud types | 5-y (9.0%) |

4 (high) |

| AARP, 199931 | United States | ≥ 65 y (n = 459) |

Age ≥ 18 y, land-line phone, residential dwelling, cognitively intactd |

Computer-assisted telephone interviews in 1998 (48.9%) | Single general self-report question | 1-y (2.0%) |

4 (high) |

| Titus et al., 199532 | United States | ≥ 65 y (n = 210) |

Age ≥ 18 y, land-line phone, residential dwelling, cognitively intactd |

Computer-assisted telephone interviews in 1991 (66.1%) | Several closed-ended questions describing 21 specific events and 1 general fraud–scam event | 1-y (5.7%) |

4 (moderate) |

Note. Study quality assessment relates to the rigor of studies in estimating the prevalence of EFFS. Some studies were designed with a broader focus on all adults and therefore may attain a higher quality score in relation to estimating fraud–scam prevalence for the broader adult population.

See Appendix G for detailed information regarding specific types of EFFS assessed in each study.

Range = 0–8. See Appendix D for a full description of scoring details on each study.

See Appendix E for a full description of rating details on each study.

We assumed that older adults with cognitive impairment were excluded since there was no indication of methods to include.

Exact sample size of older adults was not provided in the study. Number provided is an estimate based on US population statistics in year closest to the study.

Appendix G outlines types of scam–fraud activities covered across each study. The number of fraud and scams considered across studies ranged from 3 to 22 (mean = 10.8; SD = 7.3). Among studies using the closed-ended and descriptive EFFS assessment–measurement approach, the following categories of fraud and scams were covered: investment (n = 4), products and services (n = 5), employment (n = 5), prize and grant (n = 5), charity (n = 2), and identity (n = 5).

Prevalence

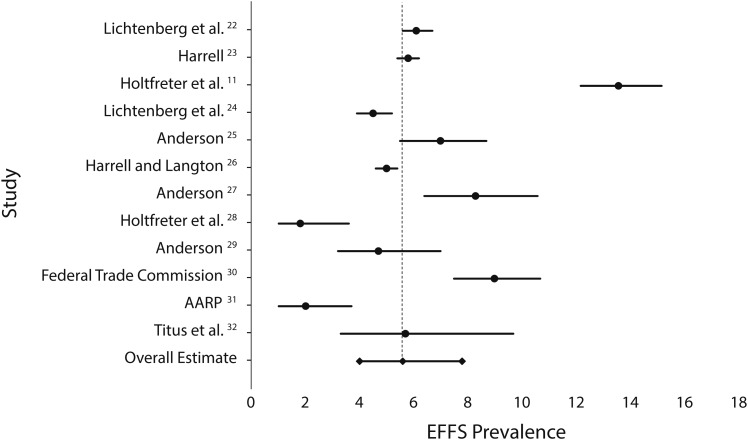

A Cochran Q statistic of 1567.6 (P < .001) indicated the presence of between-study heterogeneity. Meta-analytic pooling of EFFS prevalence estimates across the 12 studies yielded an overall EFFS prevalence (1- to 5-year period) of 5.6% (95% confidence interval [CI] = 4.0%, 7.8%) and a 1-year EFFS prevalence of 5.4% (95% CI = 3.2%, 7.6%). Figure 2 shows EFFS prevalence across individual studies in relation to the overall meta-analyzed prevalence.

FIGURE 2—

Prevalence of Elder Financial Fraud and Scam (EFFS) Across Studies, With 95% Confidence Intervals: United States, 1994–2016

Note. The dotted line refers to the meta-analyzed EFFS summary prevalence (5.6%; 95% confidence interval = 4.0%, 7.8%).

Table 2 presents results on the effects of study-level methodological characteristics on EFFS prevalence. EFFS assessment–measurement type produced a statistically significant difference in prevalence characterized by a large effect size (d = 1.6). Specifically, studies using the closed-ended and descriptive questions approach found a significantly higher prevalence rate (7.1%; 95% CI = 4.8%, 9.4%) than studies using the single self-report question approach (3.6%; 95% CI = 1.8%, 5.4%). Although not significant, the difference in EFFS prevalence based on study quality assessment score carried a large effect size (d = 1.1); studies scoring 5 or more reported a higher prevalence (7.5%; 95% CI = 4.1%, 10.8%) than those scoring below 5 (4.5%; 95% CI = 2.6%, 6.4%). The difference in EFFS prevalence based on older adult age cutoff was also characterized by a large effect size (d = 1.0), although not statistically significant; studies using an older-age cutoff of younger than 65 years reported a higher prevalence (7.7%; 95% CI = 3.8%, 11.6%) than studies applying an age cutoff of 65 years or older (4.8%; 95% CI = 2.9%, 6.7%). The difference in EFFS prevalence based on a 1-year versus 5-year period was not significant and carried a small effect size.

TABLE 2—

Elder Financial Fraud and Scam (EFFS) Prevalence, by Study-Level Methodological Characteristic: United States, 1994–2016

| Characteristic | EFFS Prevalence, % (95% CI) | Difference in Prevalence, Percentage Points | Effect Size (d) |

| Year of data collection | 1.8 | 0.7 | |

| 2005 or earlier | 4.7 (2.3, 7.1) | ||

| After 2005 | 6.5 (3.5, 9.5) | ||

| EFFS assessment approach | 3.5 | 1.6 | |

| Single, self-report question | 3.6 (1.8, 5.4) | ||

| Multiple closed-ended and descriptive questions | 7.1 (4.8, 9.4) | ||

| No. of EFFS subtypes considered | 1.3 | 0.4 | |

| ≤ 10 | 7.7 (4.5, 10.9) | ||

| > 10 | 6.4 (3.5, 9.3) | ||

| Focus on identity theft and fraud | 1.0 | 0.3 | |

| No | 5.4 (3.2, 7.6) | ||

| Yes | 6.4 (2.1, 10.7) | ||

| Prevalence period, y | 0.9 | 0.3 | |

| 1 | 5.4 (3.2, 7.6) | ||

| 5 | 6.3 (2.0, 10.5) | ||

| Study quality assessment score | 2.9 | 1.1 | |

| < 5 | 4.5 (2.6, 6.4) | ||

| ≥ 5 | 7.5 (4.1, 10.8) | ||

| Older adult age cutoff, y | 2.9 | 1.0 | |

| < 65 | 7.7 (3.8, 11.6) | ||

| ≥ 65 | 4.8 (2.9, 6.7) |

Note. CI = confidence Interval. Prevalence estimates were generated from generalized mixed models, with studies included as levels of a random classification factor and methodological specifications included as a fixed classification factor.

Examination of Publication Bias

The funnel plot of sample size versus prevalence rate (Appendix H) showed no clustering of studies in the lower right of the funnel, indicating a lack of publication of smaller or nonsignificant studies. We do not believe publication bias has led to inflated estimates of prevalence because, unlike evaluations of drugs or interventions where positive findings may be favored, there should be little incentive by researchers or reviewers to favor studies with higher estimates. Additionally, studies in our sample from non–peer-reviewed sources had, on average, greater quality assessment scores (4.8) than did studies from peer-reviewed sources (4.3).

DISCUSSION

This study conducted a systematic review and meta-analysis to estimate the prevalence of EFFS in the United States. To generate the most generalizable EFFS prevalence estimate possible, we restricted the meta-analysis to population-based studies using state- or national-level probability sampling.

This study found an overall 1- to 5-year EFFS prevalence of 5.6% and a 1-year EFFS prevalence of 5.4% among community-dwelling and (predominantly) cognitively intact older adults. Thus, approximately 1 of every 18 cognitively intact older adults living in the community experiences financial fraud or scam each year. Within the context of the broader issue of elder financial exploitation, a 1-year EFFS prevalence of 5.4% is similar to, but slightly higher than, the estimated 1-year prevalence of elder financial abuse that occurs in relationships of trust.33 A recent review of population-based elder mistreatment studies found a 1-year elder financial abuse prevalence of 4.5% among community-dwelling, cognitively intact older adults in the United States.34 Combining these 2 major categories of elder financial exploitation, we can crudely estimate that between 5.4% (complete overlap of EFFS and financial abuse victims) and 9.9% (no overlap of EFFS and financial abuse victims) of community-dwelling, cognitively intact older adults experience some form of financial exploitation each year.

Guided by information from the risk of bias assessment, we found a prevalence of EFFS in this meta-analysis that likely underestimates true population prevalence for several reasons. First, the studies predominantly excluded particularly vulnerable older adult subpopulations, such as those living with cognitive impairment or in long-term care settings. Second, several studies reported low response rates. The nonresponse group in EFFS research is likely disproportionately represented by victims who have become cautious of participating in a process involving the provision of personal information. Finally, EFFS victims tend to underreport their victimization.17

Methodological Recommendations

Several methodological procedures can be implemented to enhance the quality of future EFFS research and address the various forms of participation and reporting bias described here. This meta-analysis found that studies characterized by greater overall methodological quality detected higher rates of EFFS victimization. Specifically, studies that used an EFFS assessment–measurement approach with multiple closed-ended questions describing specific fraud–scam events identified victims at a higher rate than did studies that employed a single general self-report question. The closed-ended and descriptive assessment method is meant to improve identification of EFFS victimization by reducing a respondent’s confusion about what constitutes “fraud–scam” and cueing–activating memory recall.17 Research and industry experts have recently created a fraud–scam taxonomy intended to guide the development of prevalence study surveys that capture a comprehensive array of specific fraud–scam types and to move the field toward greater measurement standardization.18 The principles underlying this taxonomy recognize, however, that prevalence surveys must also incorporate some flexibility and open-endedness to capture fluctuations in specific fraud–scam popularity over time and the emergence of new fraud–scam types. Other ways to address underreporting among EFFS victims include the following: priming for honesty at the beginning of the survey, designing fraud–scam questions with forgiving wording, and contextualizing survey questions with content that reduces social stigma attached to EFFS victimization.17

To limit the extent of nonresponse among EFFS victims, it may be necessary to implement face-to-face interviewing or leave-behind, self-administered surveys that provide an opportunity to meet the researcher and engender credibility. Recruitment scripts and survey items should be designed with input from older adults, known EFFS victims, and other key stakeholders to ensure linguistic appropriateness. Finally, future EFFS research should include use of close proxy respondents to represent older adults with cognitive impairment or other physical or mental conditions that limit direct participation.

Limitations

The main limitation of this meta-analysis is the small sample size of population-based studies reporting EFFS prevalence. Without a large sample, the scope of analytic techniques and detection of significant effects is limited. However, we integrated a measure of effect size to identify factors warranting further attention in research. Although it is possible that some studies in this meta-analysis contained overlapping participants, we believe the risk is low given the national scope of most sampling frames and the small number of studies. Many studies constituting this meta-analysis were designed for adults of all ages without a specific focus on older adults. A comprehensive, methodologically rigorous national-level prevalence study focusing on older adults is required to help understand EFFS within different older adult subgroups. Further scholarship is necessary to distinguish boundaries between identity theft and financial fraud and scams.

Public Health Implications

Our findings suggest that EFFS is a common problem in the United States that affects millions of older adults each year. Financial fraud victimization is associated with serious physical and mental health consequences, including major depression, generalized anxiety disorder, lower subjective health ratings, and increased functional somatic complaints.5 A majority of fraud–scam victims report resulting anger, stress, regret, betrayal, embarrassment, sadness, helplessness, and shame.35 Related to EFFS, elder financial abuse is associated with premature mortality and greater hospitalization.3,4 EFFS victims suffer both direct and indirect financial costs at a stage in life when it is particularly difficult to recover losses and when financial savings are necessary to manage age-associated health issues. Further, EFFS is an issue that affects vulnerable older adult subpopulations, including those with cognitive, functional, and health impairments.6 Barring the development of effective primary EFFS prevention, the number of cases of EFFS will nearly double over the next 2 to 3 decades in accordance with older adult population growth.

Prevalence findings from this study suggest that health care professionals who work with older adults are likely to encounter patients who are victimized by EFFS on a routine basis. Primary EFFS prevention in health care settings is critical. Although clinicians may not see this in their purview, they are ideally situated to detect victimization in annual wellness visits or when older people present for intercurrent medical problems. Validation of instruments to screen for EFFS in hurried clinical settings represents an important area for future research. Although not empirically derived, suspicious signs for EFFS victimization may include nonadherence with medications, failure to follow up on ordered tests, or nonpayment for physician services, particularly if these behaviors deviate from known historical patterns.

Conclusions

Perhaps the greatest constraint in the nascent EFFS field is a lack of basic knowledge regarding the extent or scope of the problem.17 Without an accurate sense of EFFS prevalence, it is difficult to mobilize and coordinate efforts toward resource allocation, policy development, prevention, and response. The current study sought to address this knowledge gap and provide a foundation for further research on this emerging topic.

ACKNOWLEDGMENTS

This work was supported by funding from a Social Sciences and Humanities Research Council of Canada Institutional Grant (fund no. 500544).

HUMAN PARTICIPANT PROTECTION

Institutional review board approval was not necessary because data were obtained from secondary sources.

REFERENCES

- 1.Hall JE, Karch DL, Crosby AE. Elder Abuse Surveillance: Uniform Definitions and Recommended Core Data Elements for Use in Elder Abuse Surveillance, Version 1.0. Atlanta, GA: National Center for Injury Prevention and Control, Centers for Disease Control and Prevention; 2016. [Google Scholar]

- 2.2015 White House Conference On Aging: Final Report. Washington, DC: White House Conference on Aging; 2015. [Google Scholar]

- 3.Burnett J, Jackson SL, Sinha AK et al. Five-year all-cause mortality rates across five types of substantiated elder abuse occurring in the community. J Elder Abuse Negl. 2016;28(2):59–75. doi: 10.1080/08946566.2016.1142920. [DOI] [PubMed] [Google Scholar]

- 4.Dong X, Simon MA. Elder abuse as a risk factor for hospitalization in older persons. JAMA Intern Med. 2013;173(10):911–917. doi: 10.1001/jamainternmed.2013.238. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Ganzini L, McFarland BH, Cutler D. Prevalence of mental disorders after catastrophic financial loss. J Nerv Ment Dis. 1990;178(11):680–685. doi: 10.1097/00005053-199011000-00002. [DOI] [PubMed] [Google Scholar]

- 6.Lachs MS, Han SD. Age-associated financial vulnerability: an emerging public health issue. Ann Intern Med. 2015;163(11):877–878. doi: 10.7326/M15-0882. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.Han SD, Boyle PA, James BD, Yu L, Bennett DA. Mild cognitive impairment is associated with poorer decision-making in community-based older persons. J Am Geriatr Soc. 2015;63(4):676–683. doi: 10.1111/jgs.13346. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 8.Han SD, Boyle PA, James BD, Yu L, Bennett DA. Poorer financial and health literacy among community-dwelling older adults with mild cognitive impairment. J Aging Health. 2015;27(6):1105–1117. doi: 10.1177/0898264315577780. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 9.Han SD, Boyle PA, James BD, Yu L, Bennett DA. Mild cognitive impairment and susceptibility to scams in old age. J Alzheimers Dis. 2016;49(3):845–851. doi: 10.3233/JAD-150442. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 10.Boyle PA, Yu L, Wilson RS, Gamble K, Buchman AS, Bennett DA. Poor decision making is a consequence of cognitive decline among older persons without Alzheimer’s disease or mild cognitive impairment. PLoS One. 2012;7(8):e43647. doi: 10.1371/journal.pone.0043647. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 11.Holtfreter K, Reisig MD, Mears DP, Wolfe SE. Financial exploitation of the elderly in a consumer context. 2014. Available at: https://www.ncjrs.gov/pdffiles1/nij/grants/245388.pdf. Accessed May 2016.

- 12.DeLiema M, Yon Y, Wilber KH. Tricks of the trade: motivating sales agents to con older adults. Gerontologist. 2016;56(2):335–344. doi: 10.1093/geront/gnu039. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 13.US Senate Special Committee on Aging. Fighting fraud: US Senate Aging Committee identifies top 10 scams targeting our nation’s seniors. Available at: https://www.aging.senate.gov/imo/media/doc/217925%20Fraud%20Book%20Final.pdf. Accessed September 2016.

- 14.Federal Bureau of Investigation. Scams and safety—seniors. Available at: https://www.fbi.gov/scams-and-safety/common-fraud-schemes/seniors. Accessed September 2016.

- 15.Consumer Financial Protection Bureau. Money smart for older adults: prevent financial exploitation. June 2013. Available at: http://files.consumerfinance.gov/f/201306_cfpb_msoa-participant-guide.pdf. Accessed September 2016.

- 16.Deevy M, Lucich S, Beals M. Scams, schemes, & swindles: a review of consumer financial fraud research. 2013. Available at: http://www.ncpc.org/resources/files/pdf/fraud/Scams-Schemes-Swindles.pdf. Accessed May 2016.

- 17.Deevy M, Beals M. The scope of the problem: an overview of fraud prevalence measurement. 2013. Available at: http://longevity3.stanford.edu/the-scope-of-the-problem-an-overview-of-fraud-prevalence-measurement. Accessed May 2016.

- 18.Beals M, DeLiema M, Deevy M. Framework for a taxonomy of fraud. July 2015. Available at: http://162.144.124.243/∼longevl0/wp-content/uploads/2016/03/Full-Taxonomy-report.pdf. Accessed January 25, 2017.

- 19.Loney PL, Chambers LW, Bennett KJ, Roberts JG, Stratford PW. Critical appraisal of the health research literature prevalence or incidence of a health problem. Chronic Dis Can. 1998;19(4):170–176. [PubMed] [Google Scholar]

- 20.Hoy D, Brooks P, Woolf A et al. Assessing risk of bias in prevalence studies: modification of an existing tool and evidence of interrater agreement. J Clin Epidemiol. 2012;65(9):934–939. doi: 10.1016/j.jclinepi.2011.11.014. [DOI] [PubMed] [Google Scholar]

- 21.Hunter J, Saratzisb A, Sutton AJ, Boucher RH, Sayers RD, Bown MJ. In meta-analyses of proportion studies, funnel plots were found to be an inaccurate method of assessing publication bias. J Clin Epidemiol. 2014;67(8):897–903. doi: 10.1016/j.jclinepi.2014.03.003. [DOI] [PubMed] [Google Scholar]

- 22.Lichtenberg PA, Sugarman MA, Paulson D, Ficker LJ, Rahman-Filipiak A. Psychological and functional vulnerability predicts fraud cases in older adults: results of a longitudinal study. Clin Gerontol. 2016;39(1):48–63. doi: 10.1080/07317115.2015.1101632. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 23.Harrell E. Victims of identity theft, 2014. September 2015. Available at: http://www.bjs.gov/index.cfm?ty=pbdetail&iid=5408. Accessed May 15, 2016.

- 24.Lichtenberg PA, Stickney L, Paulson D. Is psychological vulnerability related to the experience of fraud in older adults? Clin Gerontol. 2013;36(2):132–146. doi: 10.1080/07317115.2012.749323. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 25.Anderson KB. Consumer fraud in the United States, 2011: the third FTC survey. April 2013. Available at: https://www.ftc.gov/sites/default/files/documents/reports/consumer-fraud-united-states-2011-third-ftc-survey/130419fraudsurvey_0.pdf. Accessed May 15, 2016.

- 26.Harrell E, Langton L. Victims of identity theft, 2012. December 2013. Available at: http://www.bjs.gov/content/pub/pdf/vit12.pdf. Accessed May 15, 2016.

- 27.Anderson KB. Consumer fraud in the United States: the second FTC survey. October 2007. Available at: https://www.ftc.gov/sites/default/files/documents/reports/consumer-fraud-united-states-second-federal-trade-commission-survey-staff-report-federal-trade/fraud.pdf. Accessed May 15, 2016.

- 28.Holtfreter K, Reisig MD, Blomberg TG. Consumer fraud victimization in Florida: an empirical study. St Thomas Law Rev. 2006;18(3):761–789. [Google Scholar]

- 29.Anderson KB. Consumer fraud in the United States: an FTC survey. August 2004. Available at: https://www.ftc.gov/sites/default/files/documents/reports/consumer-fraud-united-states-ftc-survey/040805confraudrpt.pdf. Accessed May 15, 2016.

- 30.Federal Trade Commission. Identity theft survey report. September 2003. Available at: https://www.ftc.gov/sites/default/files/documents/reports/federal-trade-commission-identity-theft-program/synovatereport.pdf. Accessed May 15, 2016.

- 31.AARP. Consumer behavior, experiences and attitudes: a comparison by age groups. March 1999. Available at: http://assets.aarp.org/rgcenter/consume/d16907_behavior.pdf. Accessed May 15, 2016.

- 32.Titus RM, Heinzelmann F, Boyle JM. Victimization of persons by fraud. Crime Delinq. 1995;41(1):54–72. [Google Scholar]

- 33.Acierno R, Hernandez MA, Amstadter AB et al. Prevalence and correlates of emotional, physical, sexual, and financial abuse and potential neglect in the United States: The National Elder Mistreatment Study. Am J Public Health. 2010;100(2):292–297. doi: 10.2105/AJPH.2009.163089. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 34.Pillemer K, Burnes D, Riffin C, Lachs MS. Elder abuse: global situation, risk factors and prevention strategies. Gerontologist. 2016;56(suppl 2):S194–S205. doi: 10.1093/geront/gnw004. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 35.FINRA Investor Education Foundation. Non-traditional costs of financial fraud: report of survey findings. March 2016. Available at: http://www.finrafoundation.org/web/groups/sai/@sai/documents/sai_original_content/p602454.pdf. Accessed February 2, 2017.