Abstract

Livestock is considered central component in agricultural sector of Pakistan, provides employment to more than 8 million families. Meat and meat products holds pivotal significance in meeting dietary requirements serving as major protein source and provide essential vitamins and minerals. Globally, consumer demand is increasing for healthy, hygienic and safe meat and meat products due to growing population, income level and food choices. As, food choices are mainly influenced by region, religion and economic level. However, religion is one of the major factor to influence the food choices. In this context, halal foods a growing trend, trade estimated to cross USD $ 3 trillion and among this, meat sector contribute about US$ 600 billion. Halal meat and allied products is requirement from Muslims but it is also accepted by non-Muslims due to safe and hygienic nature, nutritious value and superior quality. Pakistan meat industry is vibrant and has seen rigorous developments during last decade as government also showed interest to boost livestock production and processing facilities to meet increasing local and global demand. The industry has potential to grow owing to its natural animal rearing capability, muslim majority country (96% of total population), improvisation of market and consumer preference towards halal meat. Current review debates Pakistan meat industry scenario, production trend, global trade as well as future potential with respect to modernization, processing, distribution and trade. The data presented here is useful for meat producers, processors and people involved in export of Pakistani meat and meat based products.

Keywords: livestock, pakistan meat industry, halal meat, consumer preference, healthy choices

Introduction

Livestock sector plays a critically vital role in the agricultural based economy of Pakistan. It is extremely labor-intensive and includes a large part of rural work force. Pakistan is a diversified, ethnic as well as Muslim majority country, housing a population estimated 195 million comprising of Muslims, Christians, Hindus and other minorities. The agriculture sector in Pakistan is backbone of economy, provides raw materials to run the different industries and helps in reducing poverty. This sector contributes approximately 19.8% in gross domestic product (GDP) and employer absorbing 42.3% of the country’s total labor force. Livestock contributes about 58.6% to agriculture value added and 11.6% to overall GDP during 2016 compared to 56.4% and 11.7% in corresponding last year. The gross value addition from livestock at constant price factor has elevated from Rs. 1247 billion in 2015 to Rs. 1292 billion in 2016, exhibiting a growth of 3.63%. As other segments and sub-sectors of agriculture are suffering from saturation and slight unproductivity. However, this sector is constantly registering at an optimistic real growth rate at the rate of 4%, annually. Livestock sector also yields an enormous range of by-products especially leather whose export, earned billions of dollars for Pakistan and the country listed as 3rd largest export after cotton and rice (GOP, 2015).

There are numerous factors involved in evolving the prospects of livestock and animal husbandry including large cattle populations, huge agricultural raw materials to be used as feed and fodder, and large scale meat slaughtering and processing plants (Younas and Yaqoob, 2005). In Pakistan, livestock population mainly comprises of cows, buffaloes, goats, sheep, poultry and camel. The quality livestock gene pool in Pakistan depending on reproduction, weight, milk and meat are Nili-Ravi & Kundi breeds of buffalos, Red Sindhi and Thari breeds of cows, Kajli, Thali, Kooka and Dumbi breeds of sheep and Kamori, Bari, and Teddy breeds of goats. Among these, Thari cow is especially well-known for rapid weight gain (Sarwar et al., 2002).

Meat consumption is the inclusion of meat and meat products in the diet, influenced by culture, economic status and religious norms. Among these, religion is considered as vital component and household income has positive correlation to meat consumption. This fact describes the higher per capita meat consumption by developed countries than that of developing ones. Also, culture, availability of meat and food choices affects the cuisine of people as evident from Israel and south American countries, consume relatively higher quantity of meat. The meat growth is also mainly influenced by income status and population growth, especially in countries with large middle classes like Asia, Latin America, and Middle East. However, developed countries data showed increasing meat demand but at a slower rate due to the fact they have already reached the saturartion level than that of developing world. It has been projected that global annual per capita meat consumption is expected to reach 35.3 kg retail weight equivalent (r.w.e.) by 2025 showing 1.3 kg r.w.e. increase compared to base period. However, this additional demand will be contributed mainly from poultry due to availability, cheaper price, shorter production time and convenient processing behavior (OECD-FAO agriculture outlook, 2016). Pakistan per capita meat consumption in 2000 was 11.7 kg that was increased to 13.8 and 14.7 kg in 2006 and 2009, respectively. Additionally, current per capita meat consumption has reached to 32 kg that is further expected to reach 47 kg by 2020 (Table 1). However, urbanization, economic growth, industrialization as well as eating pattern resulting increased per capita meat in the future years that will also generates higher demand for meat and allied products (Chartsbin, 2017). The dietary awareness to population has also played key role in shifting preferences to consume meat and its products. Pakistan having rich traditions and cultural festivities is also adding more demand for meat and meat products during whole year and this demand further rises significantly during festive season. To cope up this growing demand, government as well as meat industry are now concentrating to meet requirements by providing sufficient, healthy and quality produce, both fresh and processed products (GOP, 2016). Furthermore, consumer awareness is pushing meat industry and regulating agencies to keep an eye on quality of meat, safety assurance, animal health and welfare as well as precise traceability (Steinfeld et al., 2006).

Table 1. Per capita consumption of meat in Pakistan.

| Parameter | Per capita meat consumption (kg) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Year | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

| Meat consumed | 11.7 | 11.8 | 11.9 | 12.1 | 12.1 | 12.2 | 13.8 | 14.2 | 14.4 | 14.7 |

(FAO 2013), Current Worldwide annual meat consumption per capita (currently the per capita consumption is estimated around 32 kg/person/year and is expected to reach 40 kg by the end of 2020).

The market developments in this industry add towards different meat types as beef, mutton, poultry, camel, goat etc. However, poultry is the cheapest and preferred meat contributes in terms of production strategies, business set up and processing (Smil, 2014). Pakistan’s poultry industry particularly broiler dominates and Pakistan is the 11th largest poultry producer in the world with 1.02 billion broilers production, annually. This sector contributed 30% of total meat production, shown growth at the rate of 8-10% reflecting inherent potential of this sector (Bashir et al., 2015). Additionally, this meat sector is the most organized, contributed 1.4% in overall GDP during 2015-16 whereas, its contribution in agriculture and livestock value added products stands at 6.9 and 11.7%, correspondingly (Economic Survey of Pakistan, 2016).

A large number of small scale poultry rearing setups/sheds located all over the country to achieve self-sufficiently. However, most production at large scale poultry farms are widespread in Punjab and Northern areas. (Bashir et al., 2015). Red meat is among the most desired meat around the globe because its taste, flavor and juiciness creates a high demand in developing economies (Binnie et al., 2014). Pakistan being situated in the area with vast and variable atmosphere round the year, has extensive cattle and goat farming due to availability of pasture in northern areas and cholistan, natural animal rearing capability, meat producing breeds and favorable climatic conditions. Accordingly, beef production in country is increasing significantly due to demand that is at peak during festive seasons. However, the need for healthy animals, modern husbandry practices, feeding resource availability and proper feeding plan can boost this sector and Pakistan can earn capital by investing in this sector to meet the demand. Pakistan has potential to become a mainstream international participant in red meat industry and can significantly contribute towards the global halal red meat trade (Aghwan et al., 2016).

At this time, both government and private sector are focusing on long run policies and developing projects to satisfy consumer demand for safe and quality produce with improved nutritional value and also reduce wastage of by-products with minimize environmental pollution. Accordingly, Ministry of National Food Security and Research, Livestock and Dairy Development Board (LCCB) and Pakistan Dairy Development Company (PDDC) have been established to strengthen the livestock sectors especially with current focus on meat. These corporations are working platform for improvement in this sector by strengthening livestock production services, improving disease control practices, animal breeding and husbandry, management practices and quality meat production capacity in the country.

Recent Developments and Current Scenario of Pakistani Meat Industry

Consumer demand

The responsibility to produce high quality, sustainable and cost effective meat and allied meat products rests with producers, manufacturers, distributors and retailers to meet consumers demand. Meat is source of good quality animal protein and plays vital role in wellbeing of human (Troy et al., 2016). Worldwide the demand for meat and meat products depends on raw meat quality, popularity of special product and trends or traditions followed by the diverse nations. However, main aspect manipulating consumer liking for meat products is quality and safety (Henchion et al., 2014; Nam et al., 2010). Comparing to other protein sources like legumes and beans, meat is preferred by Pakistani consumer depending on cultural, religious and personal aspects. Pakistan being an Islamic country, with rich cultural and traditional festivities has more demand for meat especially during festival season. As this sector is developing in Pakistan, thus, consumer awareness is also pushing meat industry and regulating agencies to keep an eye on quality of meat, safety assurance, animal health and welfare as well as precise traceability (Steinfeld et al., 2006).

Pakistani peoples consume beef, mutton, poultry meat and some sea food, based solely on the concept of Halal. However, consumers inclined toward poultry meat mainly because it is cheap, easy to process, availability and variety of processed meat products. In Pakistan, meat production is still based on traditional management practices and is less productive. For the last few years, annual growth of meat production showed elevated trends. The meat production has risen to 3.873 million tons in 2016 compared to 3.696 and 3.531 in 2015 and 2014, respectively. Among exports, Pakistani mainly exports red meat that is annually growing by 30%. Despite this rapid growth, 96% of our exports are restricted to carcass with little or no value addition.

The role of animal-based foodstuffs especially meat in human consumption has changed over time and differs across geographies. Meat consumption tend to increase with urbanization, population growth and economic growth however, economic development, is increasingly concentrate in affluent societies leadings towards higher meat consumption (Mathijs, 2015). The factors influence the consumer preference for meat and meat products mainly depend are quality, freshness, texture, color, flavor, tenderness and juiciness of cooked meat products (Furnols and Guerrero, 2014). Currently, the demand of general population of Pakistan is shifting from fresh meat to frozen meat products or ready to eat foods due to changing life-style, socio-economic boost and nutritional awareness. Pakistani meat industry is growing, producing tons of different meat products such as ready to eat products (kababs, patties etc.) formed meat products (tender pops, sausages, nuggets, drumsticks etc.). The demand and purchase of processed meat products is comparatively higher in urban areas than rural mainly due to socio-economic status, fast and busy lifestyle opted, usage convenience and purchasing power of consumer (Vandendriessche, 2008). In this context, Garnier et al. (2003) stated four main attributes contributing directly to purchase of meat and meat products; taste, income, price and preference. However, clues and study factors for each country may vary that drives its market, affects consumer behavior and anticipation of consumer’s changing habits. Furthermore, the recent research and awareness about protein quality of animal based products than that of plant based proteins played a substantial role in changing the attitude and preferences for meat consumption.

Market trends and business opportunities

The Pakistan government is targeting to produce 3.8 million tons of meat in 2015-16 to meet the local and export demand. According to Ministry of National Food Security and Research, the target for beef meat was set to 2 million tons, 0. 686 million tons for mutton, whereas, meat for fish was 0.788 million tons during the same time. Furthermore, government is taking steps to increase livestock production, focusing not only on meat but also scaling up milk and eggs production. To meet this targeted scale, the government revolutionizing veterinary organizations and infrastructure, standardization of feed given to animals as well as develop trained manpower (Economic Survey of Pakistan, 2016). Considering this target, the government has announced a 4-year tax exemption on income for installation of halal meat production and processing facility before December 31, 2016. Moreover, to produce skilled manpower to cater needs of meat industry, academia and research organizations, Department of Meat Science and Technology, University of Veterinary and Animal Sciences, Lahore has started a master degree in Meat Science and Technology, first of its kind in Pakistan.

The market trends in meat industry contribute towards different meat types like beef, mutton, poultry, camel, goat etc. However, poultry being one of preferred meat contributes towards more emphasis on production strategies, business set up, production and processing (Smil, 2014). Pakistan’s poultry industry particularly broiler dominates the industry comprising 69.22% of total livestock in the country (Trade and markets division, 2016). Poultry meat production has shown a significant increase from 767 thousand tones in 2010 to 1074 thousand tons in 2015, recorded a substantial rise that is further mounting. In poultry, 10% increase been recorded for one day old chick’s production, increasing from 387.2 million in 2006 to 425.95 million during the year 2008. Whereas, the bird production has risen up from 477 million during 2006-07 to 518 million in the following year with an increase of 8.48%, reaching to ultimate production over the decade and producing 1177 million tons in 2016 (Economic Survey of Pakistan 2016). Thousands of small scale poultry farms located all over country, working independently with small-scale retailers to reach out market and consumer. Majority of poultry production at large scale farms are widespread all provinces of Pakistan. However, the major players are Khyber PakhtoonKhwa and Punjab that significant contribute a major share of chicken birds (Table 2). Poultry meat solely makes 28% of total meat production in Pakistan, exhibiting growth of 8% per year showing integral potential.

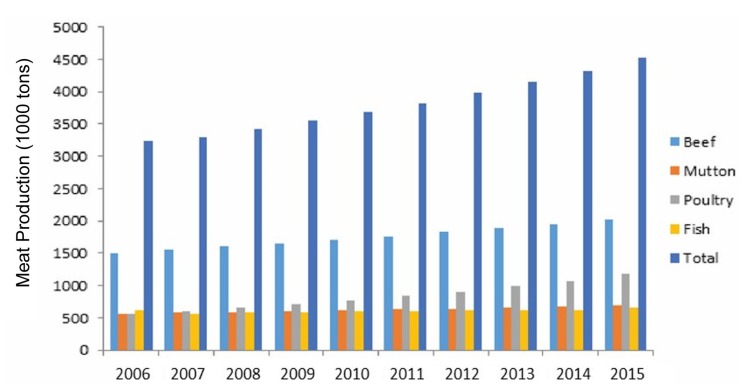

Table 2. Trend in meat production in Pakistan during the last decade.

| Meat type / Year | Meat production (1,000 tons) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | |

| Beef | 1498 | 1549 | 1601 | 1655 | 1711 | 1769 | 1829 | 1887 | 1951 | 2017 |

| Mutton | 566 | 578 | 590 | 603 | 616 | 629 | 643 | 657 | 671 | 686 |

| Poultry | 554 | 601 | 652 | 707 | 767 | 834 | 907 | 987 | 1074 | 1177 |

| Fish | 611 | 570 | 586 | 584 | 593 | 594 | 612 | 623 | 624 | 652 |

| Total | 3229 | 3298 | 3429 | 3549 | 3687 | 3826 | 3991 | 4154 | 4320 | 4532 |

Data obtained from Economic Survey of Pakistan 2016.

Fishery plays a critical role in national economy of Pakistan, considered as deliberate income source of coastal inhabitants. In addition to marine, inland fisheries (based in lakes, rivers, dams and ponds etc.) are also making significant throughout. Although, share of fisheries in country GDP is nominal but substantial for national growth through foreign export earnings. According to Pakistan Economic Survey (2016) total marine and inland fish produced an estimate of 501 million tons during 2015-16 whereas production of fish for the same period of 2014-15 was around 499 million tons. Moreover, 91.9 million tons of fish and allied products were exported to China, Thailand, Malaysia, Middle East, Sri Lanka, and Japan during 2015-16 generating a US $ 240.108 million for this sector.

Pakistan has capability to become international competitor in halal meat industry by contributing its red meat business as demand for beef is mounting. Pakistan being located in the region with vast and varying atmosphere during all the year, has an extensive scope of cattle and goat farming due to availability of resources like land, agriculture background pastures, Muslim majority population as well as intermediate zones of the country. In Pakistan, goat, buffalo, cattle and sheep population has been estimated as 45.74, 23.47, 24.11 and 15.03 million, respectively for year 2016, while a total number of 16,986,280 livestock animals were produced in Pakistan in 2015 (FAO, 2015). Moreover, different meat types including beef, mutton and poultry production increased from 1.711, 0.616 and 0.767 million tons in 2010-11 to 2.017, 0.686 and 1.177 million tons in 2015-16, correspondingly (Economic Survey of Pakistan, 2016). Goat production showed a rise from 66.6 million in 2014 up to 68.4 million in 2015 (Fig. 1). Similarly, buffalo meat production increased to 35.6 million in year 2015 from 34.6 million in 2014. Likewise, cattle production has also showed consistent increase year by year making up to 41.2 million in 2015 (Noor, 2015).

Fig. 1. Trends in meat production during the last decade in Pakistan. (Economic Survey of Pakistan 2015-16, FAO - Fisheries and Aquaculture Information and Statistics Branch).

The demand for meat products and ready to eat meat is showing a consistent increase during the last decade. This stagnant demand is pushing meat industry to produce more conventional meat product (Troy and Kerry, 2010). In Pakistan, people are opting to urban lifestyle, which makes processed products more popular than fresh due to factors like convenience, time constraint, and energy requirement. A large scale of meat industry is producing conventional convenience meat products like kababs, nuggets, samosas and patties etc. to meet consumer as well as restaurant/hotels demands. However, some new provision of this industry includes meat powder, soy based meat and flavored meat products. A number of professional private meat processing companies have entered in meat processing in addition with old brand like K&N with trade approval and compliance to high standards by independent third parties such as K&N’s, Sufi group, Seasons foods, Pk Livestock, Zenith, Syed traders, Abedin international, Euro Premium meat Peshawar, Meat one, Tazij meat, Anis associates, the organic meat company, ever fresh meat, Katco international, Snow king fresh & frozen foods Karachi, and Tata best food are few big players of meat processing, product development and meat export from Pakistan to world. Recently, Big birds, Fauji Meat Ltd., Al Shaheer Corporation with broader products and have entered and started their production of halal meat trade at local and international level to cope up the increasing demand.

Moreover, government of Pakistan has taken initiatives to promote establishment of meat processing plants and export facilities, hence introduced various projects such as Lahore meat processing complex, a flagship project of Punjab Agriculture & Meat Company (PAMCO) with growing demand of Halal meat products, it is important to abridge demand and supply gap through R&D initiatives for Halal meat supply system (Jalil et al., 2013). Lahore meat processing complex (PAMCO, 2014) is working with mechanical slaughtering lines for beef & mutton, meat processing facilities, value addition through allied products, supply to global Halal market, blood rendering plant, cooling system (Chilling & Blast Freezing) and compliance of standards at all tiers of value chain. Currently, 600 billion dollar halal meat is available in terms of quality animal based food products and processing under compliance regime of international quality standers can provide an opportunity for the Muslim country to be benefited from this opportunity (Farouk et al., 2012).

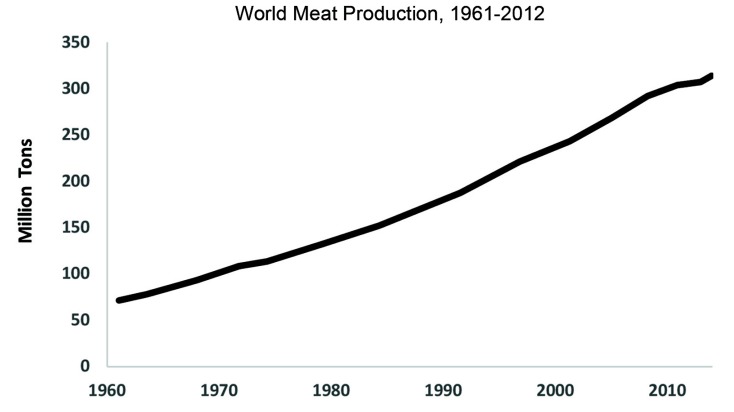

Global Meat Trade; Pakistani Prospective

Meat production growth is driven by increase in economic activity leading toward increased purchasing power tied with population growth (Elam, 2006). Estimated, current meat production is 320.7 million tons which is twice the amount produced in 1986 (Fig. 2). Global meat production and consumption have increased substantially during last 10 years. Worldwide meat production has trebled since 1960 and increased at the rate of 20% in past decade. Although there is rise in global meat production, however, consumption patterns are very uneven. The developed countries are consuming higher amounts, nearly double the quantity than that of underdeveloped countries (Petrovic et al., 2015). Developed countries accounted for 15% of world population but consume 37% of world meat production (Hussain et al., 2015).

Fig. 2. World meat production trend from 1961-2011 (FAO, 2016).

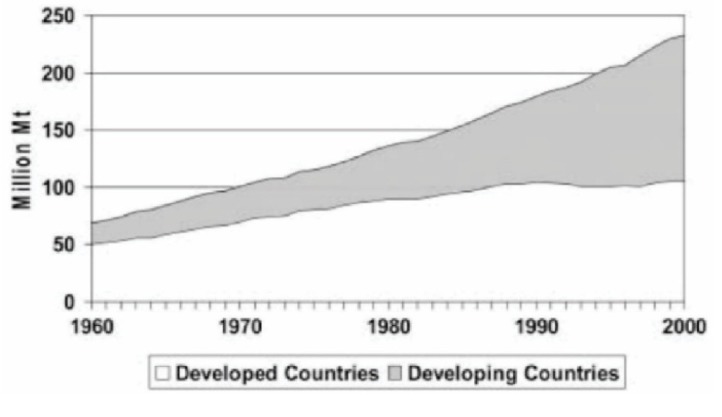

The large increase in demand for animal based foods since 1960 has been largely met by worldwide growth in poultry. This growth pattern can be expected to continue because of the inherent efficiency in feed conversion and the lower production costs associated with intensive poultry production (Chang, 2007). The production of poultry meat has increased from 9 million tons in 1960, to 26 in 1980, and 68 million tons in 2000, thereby overtaking the production of beef. Globally, beef production is expanding at the rate of 1% per year. This is expected to continue as population and available income grows in the emerging economies. However, majority of meat production has been taking place in countries such as China and Brazil (Bruinsma, 2003). Because of these two countries, meat production in the developing countries went from 50 million tons in 1980 to 180 million tons in 2000. If we exclude the production of these two countries, it rose from 27 million tons to only 50 million tons over the same period (Fig. 3).

Fig. 3. Comparison of meat production in developed and developing countries.

Global meat production expected to reach 320.7 million tons in 2016, an increase of 0.3% over 2015. In recent years’ low rates of growth has been observed compared to previous years: in 2014, 2013 and 2010, meat production rose by 1.06, 1.4, and 2.68%, respectively. There are various factors that contribute to the lower rises in meat production. The factors that have been driving the rapid growth of meat demand in the past are considerably weak mainly due to slower population growth rate (in developed countries) compared with the past is an important factor. Majority of the meat consumer disproportionately concentrated in the developed countries where consumption of meat is fairly high and their dietary pattern are changing because of nutrition and food safety reasons such as preference of fish (Bruinsma, 2003; Speedy 2003).

Rising food prices are forcing consumers to purchase cheaper meat cuts such as poultry. From the 1990-2005, consumption of chicken was almost same in both developed and developing countries. Therefore, the prospects for poultry industry is good. It is estimated that production and consumption of chicken in developing countries will increase by 3.5% per annum till 2030. In next 10 years, poultry meat production will grow at around 2.3% per annum to around 135 million tons that will bring it to top of this sector (Steinfeld et al., 2006).

Now-a-days meat is generally evaluated based on three parameters, quality, safety and nutritional status. At the moment, Pakistan’s share in meat global market is insignificant 2.9% despite the fact, country has potential to produce and export halal meat products. Though, Pakistani exporters are now determined to make up for lost opportunities, business and time. In last six years during 2004-09, Pakistani red meat export market has showed rise by an average of 68.6% per year, and commencing high base by exporting 0.0462 million tons of red meat in 2016. Although Pakistan has extraordinary natural capabilities with variety of cattle and sheep breeds, pastures, and suitable environment for livestock country is still facing massive infrastructure limitations that restrict the ability of Pakistani professionals engaged in marketing meat locally or globally. Pakistan meat industry needs to build such facilities to cure meat products, maintain shelf life before being exported to efficiently compete with competitors in meat export as, Australia, Brazil or even India (Noor, 2015).

Globally, halal beef export is the leading commodity and Pakistan has potential capacity & resources to become a major player in this domain. Naturally, the country has numerous positive that can boost the country export. Firstly, a traditionally agricultural country with resources for rearing of meat animals. Secondly, geographical location and proximity to meat exporters & importers like China, Middle East, Russia, Iran and Central Asian countries. Lastly, Pakistani beef quality and surety of being Halal is far greater than the leading meat exporter in the world. Instead of all this, Pakistan is still lagging behind to get his share global halal industry. Even per capita consumption increase, consumer awareness, acceptance for Pakistani Halal meat, Pakistan still have a long way to get its share (Table 3).

Table 3. Trend in meat export of Pakistan for last decade.

| Pakistani export of meat ($ Million/year) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Year | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

| Total | 47.64 | 60.2 | 74.4 | 137.5 | 108.5 | 123.6 | 129.2 | 177.5 | 145.6 | 144.8 |

Data obtained from Economic survey of Pakistan.

In Pakistan, per capita use of meat is around 32 kg as compared to developed world, where per capita meat consumption reached to 93 kg as lead by Australia followed by USA. Accordingly, during the last few years, modern slaughter houses and processing facilities are established in Pakistan. These plants are mainly located across Lahore and Karachi, having capacity to produce processed meat products. Currently, Pakistan meat industry is producing variety of meat products including traditional and western style like kabab, kofta, fillings for samosas, mince products, nuggets, burger patties, sausages, and tender pops etc (Noor, 2015). Moreover, given the increased concern of food safety and a shift to modern meat processing methods, the meat product businesses are experiencing further integration (Kristensen et al., 2014). Furthermore, the size of slaughter houses and meat processing companies has also been raising leading intensification and more variety of meat products. The slaughtering and meat processing technologies for poultry and livestock has seen momentous changes. The conventional techniques of “one knife to kill”, one blade to remove hair/skin and one weighing balance to trade meat” has disappeared significantly in large-scale productions, shifting to mechanized slaughter houses, refined cuts according to consumer demand, chilled-chain distribution and regulated selling of meat and meat products (Troy et al., 2016).

The mounting demand for fresh meat and quality meat products is driving the industry towards innovative technologies and methods to cater the demand. Presently, large-scale industries have initiated to accept modern research and apply improved technologies such as automated lines for slaughtering, blood collection with vacuum, scalding equipment, rapid cooling systems, grading methods, chilled storage, distribution at refrigerated temperatures, implication of HACCP, food safety and traceability mechanism as well as investing in research and development to innovate new products for local desires and according to western trends for global sale (Kristensen et al., 2014).

Halal Meat; Worldwide Scenario

Food is the essential requirement to sustain human life. Although human population has spread over the earth and its nutrient needs have been provided by nature through plants and animal resources distributed over the globe but food habits vary among regions, religions and tribes. Among these, religion is the most powerful factor influencing the dietary patterns/habits for consuming food. Halal is an Arabic term meaning “permitted” or lawful, while Haram means “not permitted.” Food consumed by Muslims must meet the Islamic dietary code called Halal. Globally, demand for halal foods is mounting mainly due to increasing Muslims populations as well as safety and hygiene nature of the food products (Querashi et al., 2015). Halal meat is getting popularity and acceptance around the globe due to factors like quality, hygienic nature, slaughtering that facilitates maximum bleeding and processing system resulting overall improved quality meat and meat based products.

The Muslims population is estimated between 1.6-1.8 billion (23% of total population) and growing, forecasted to represent 27% of the world population by 2030. However, two major factors to boost growth of halal foods are increasing economic development and disposable income of Muslims (Lever and Miele, 2012). Halal meat is among the fastest growing segments of halal food sector in global food trade. The beef trade grew at the rate of 10.4% to reach over $30 billion during the time span of 2001-09 as reported by Food and Agriculture Organization (FAO). However, this increase in halal beef exports to Middle East and South Asia grew by above 18.2% reporting a higher demand in the region. Halal as mainly mandatory and concerns the Muslims. However, with rising health issues and complications, it is now being accepted and promoted among non-Muslim mainly due to hygiene, cleanliness and the food quality (Mathew, 2014). Research showed halal slaughtering technique provides animals more care in terms of stress, bleeding resultantly gives more protection to consumers from diseases compared to other commercial methods. This disease preventing and hygienic properties of halal meat is playing major role in getting acceptance. Moreover, urbanization and increase in per capita income coupled with mounting population also elevated demand of Halal meat and meat products in EU states. The Muslims rank 2nd largest population in the world after Christians as well as Islam is the fastest growing religion around the globe in 2015, which is anticipated to play a major share in world’s consumer spending. The religious compulsion of only Halal food, drink and medicine consumption by Muslims has also encouraged the demand and generated a market for Halal meat and meat products. Moreover, leading western retail outlets and restaurant chains like Walmart, Tesco, McDonald’s, KFC and Nestle have also started Halal food production thereby the demand is rising.

Globally, major meat supplier are non-Muslims countries such as Australia, Brazil, Canada, USA, Argentine, New Zealand and France. Among these, France and Brazil are considered largest halal chicken suppliers, whereas USA and Australia are leading halal beef exporters. Interesting to this, recently India has emerged as top competitive players for halal meat through specializing industry aspects. NZ exported red meat as well as halal beef products with worth NZ $425 million during the year 2011. Additionally, NZ also exported 0.153 million tons of halal certified sheep meat and beef during the same time frame. Adding to this, 90% NZ sheep and beef slaughter premises are halal certified (Farouk, 2013). Brazil is exporting approximately 1 million frozen Halal chickens per year to around 100 different countries, contributing to 0.3 million tons of Halal beef produce to Saudi Arabia, Gulf countries, Egypt and Iran. While, France export share is 0.75 million tons of Halal frozen chickens per year to Saudi Arabia, Kuwait, United Arab Emirates and Yemen. Accordingly, the meat export increased to $ 4.6 billion in 2014 from $ 1.1 billion in 2009 by India showing 318% increase in this short time span. Additionally, Asian countries like Malaysia, Turkey and Thailand have also jumped up in this growing business. Considering meat exports, Pakistan ranked 19th position however, raw beef carcass is the major export item and Pakistan can earn more if further processed meat products are formulated and prepared. Pakistan’s meat industry is reached to $ 244 million in Year 2015 from $ 14 million in Year 2003 showing overall growth of 27%. Although this increase showing potential but still this increase is minimal considering Pakistan potential and available resources than that of competing countries (Noor, 2015).

Pakistan as a Halal Meat Hub

Pakistani Halal meat industry is getting ground in international market and now the government as well as private sector is focusing on measures to produce, process and export Halal meat and meat based products by adopting halal certification and other quality assurance systems being implemented in the world to meet the demand. The strength of Pakistan meat industry is, 100% Halal production of meat and processed products from a Muslim country, with a market of over 195 million consumers inside Pakistan and a vast network of direct access to major Halal meat importing countries like Afghanistan, Central Asia and Middle East, captivating the grand total export of 470 million. Halal meat export of Pakistan has been increased to 243.5 million dollar during the year 2014-15, exhibiting increase in comparison to US$ 229.9 million in 2014. Pakistan has exported Halal mutton contributing to US $ 58.9 million and US $ 133.5 million in terms of Halal beef export in 2013-14 to various countries (Table 4).

Table 4. Export trend of Halal meat and preparations from Pakistan in last five years.

| Export of Halal meat and preparations (1,000 US dollar) | ||

|---|---|---|

| Year | Value | Change (%) |

| 2010-11 | 132,804 | +36.8 |

| 2011-12 | 173,818 | +30.9 |

| 2012-13 | 210,881 | +21.3 |

| 2013-14 | 229,924 | +9.0 |

| 2014-15 | 243,529 | +5.9 |

Source: Trade Development Authority of Pakistan.

Currently, about 14 Pakistani companies are successfully exporting halal meat in international markets. Among them, the leading ones are PK Livestock Company, Quick Food Industries, Anis Associates, Al-Shaheer Corporation and The Organic Meat Company, Lahore Meat Company, and Everfresh Meat known with Shafi Group. PK Livestock is considered leading meat exporter in Pakistan having mechanized abattoir facility. They have also started to offer processed meat items of chicken, meat and beef in the local market also. Similarly, MőnSalwa by Quick Food Industries Ltd., PK Food, K&Ns as well as Organic Meat Company are among the key players of this sectors. Additionally, Fauji Meat Limited and Big Birds have entered in to the market and in the coming days will add value in sense of halal meat and meat products to the local and export demands. Approximately, 80% of Pakistan’s Halal meat production is exported to the Bahrain, Kuwait, Oman, Qatar, Gulf countries and Middle East, in which Saudi Arabia and the United Arab Emirates (UAE) serves as main destinations. Pakistan is on track to get momentum in Vietnam, Iran and Thailand as well. Pakistan has far more potential to wide its range of exports to various other markets such as Asia-Pacific region, North-Africa and the Far East. Halal market is pacing up globally, in regions like Europe, Australia and North America, due to increasing Muslim population as well as food safety and quality concerns. Pakistan has still a huge demand for Halal meat and meat products export included value added chicken products from a number of nations of European Union predominantly Spain, France, Canada as well as from Saudi Arabia and other Gulf countries (KCCI, 2016).

Pros and Cons

Livestock is an integral part of agriculture and holds inimitable position in national agenda of economic development in Pakistan. The livestock division is trying to ensure consumers demands of foods of animal origin such as milk, meat and eggs. The major problems for meat include water addition in whole carcass, supply of non-branded meat as well as antibiotic residues. However, Punjab food Authority with the help of livestock department and other stakeholders have working hard to improve the situation to tackle issue and is trying to ensure safe supply of animal origin food products especially milk and meat. Pakistan meat industry, including cattle, buffalo, goat, sheep and poultry has potential for sustainable meat supply depending on production capacity, availability of processing technologies, cold supply chain management, research and development as well as to meet changing business trends. Handling such a perishable produce in market, it is predictable that novel and innovative technologies need to be developed and applied in meat processing sector to enhance quality characteristics, extend shelf-life and storage stability. The major requirement of meat industry is consistent and high quality meat production in order to maintain and expand business. Consistent rising demand of consumer for quality meat with safety assurance has challenged meat processors, food process engineers and researchers to develop new and improved techniques for sustainable production of meat and meat products, though minimizing environmental impact.

Recently, government of Pakistan has announced a huge budget “Kissan Package worth Rs 341 billion” for agriculture, including livestock and meat industry, which is bringing improvement in this sector. Furthermore, the research and planning in context of livestock development, animal genetics and breeding services, health management and extension services is carried out under principal state organization “Ministry of National Food Security and Research”, which is further regulating organizations like Livestock and Dairy Development Board (LDDB) and Pakistan Agricultural Research Council (PARC), further taking initiatives to take meat industry to a new level, by implementing international standards for safety and quality as well as marketing the produce to global businesses. Similarly, involvement of corporate is important step and active in supplying services for animal welfare, veterinary pharmaceuticals, vaccines and processing equipment. Additionally, Pakistani government is taking a number of initiatives to expand fisheries sector and enhancing its production focusing on reinforcement and improving older techniques as well as introducing innovative solutions, development of further value addition of fish and fish products that is increasing per capita fish availability and consumption and leveling up the socio-economic conditions of the fishermen’s community in Pakistan (Economic Survey of Pakistan, 2016).

A number of private meat processing plants have been established for value addition of fresh meat to produce meat products. In addition, price range, access to market and market facilities are reasonable for meat industry. Access to global market also seems quite feasible due to geographical location of Pakistan, provides better access towards Asian, Middle East and European countries.

The major constraints of meat industry in Pakistan is lack of modern abattoirs and processing units. Major meat sold in local market is still sold in open market as well as slaughter houses lack proper sanitation system and untrained staff practicing animals slaughtering on floor producing unhygienic condition hence causing serious health hazard. Additionally, old slaughter houses have improper provision for discharge of blood and waste water. Moreover, waste blood mostly coagulates in the drainage system and causes off-odor and various environmental threats (Aghwan et al., 2016). This system can be rectified by allowing only the restricted slaughtering as well as big meat processing plants such as Al shaheer, Big birds and Fauji Meat that have state of the art meat processing facilities will set some examples for better meat processing facilities in future.

Another weakness of the Pakistani meat industry is lack of proper supply chain system, if consumer is to choose with their money they must be capable to identify what they are opting for (Jalil et al., 2014). There are many loopholes in meat supply chain as transparency, hygienic and chilled transportation, proper meat inspection and governmental legislation for price fixing of meat and meat products. Also, animal welfare is integral part of meat industry, including proper system for animal care, availability of proper feed resources, reproduction efficiency, breeding techniques and protection from diseases, bleeding methods must be properly monitored (Rahman et al., 2008). Proper vaccination programs and disease prevention systems should be implemented to reduce losses to maximum.

Furthermore, the meat industry was not taken care seriously in past as it was considered a sub-segment of dairy industry. However, this sector is now developing rapidly and has seen rigorous development in the past decade in meat production and processing aspects by reducing wide-spread breeding of inferior animals, developing livestock breeding farms, feeding patterns for animal production, developing meat grading system, cold supply chain management, training of butchers and allied stakeholders and especially implementing international food safety and quality management systems can boost the demand for Pakistani produce. Therefore, proper legislation and implementation needs to be introduced to both small and large scale production system in the country (Aghwan et al., 2016).

Pakistan has the 2nd largest buffalo herd, 8th largest cattle herd, 4th largest goat herd and 9th largest sheep herd in the world. However, Pakistan’s animal population is very scattered mainly present in South Punjab, Sindh and KPK which makes animals procurement for abattoir expensive as well as longer transportation also decrease the meat quality. However, developing better lairage facilities can cope with this problem and can help to provide a good quality meat availability. Considering challenges, perhaps the biggest challenge is regulatory requirements as meat importing nations have strict health codes for safety of meat and meat products including the animals as well as food traceability especially for deceased animals. Therefore, there is a dire need to establish a food traceability systems for different animals to better produce safe, healthy and quality meat and meat products.

Considering the situation, Punjab government has established Lahore meat processing complex (LMPC) under the umbrella of Punjab agriculture and meat company (PAMCO) having mechanical slaughtering lines for beef and mutton, hygienic processing facilities, blood rendering plant, waste water treatment plant, cooling system as well as value addition through meat and meat based products developments. Additionally, PAMCO is ISO, HACCP and Halal certified organization for LMPC to ensure safe, nutritious and hygienic meat to locals as well as to cater the global demands. LMPC was established with an objective to become Pakistan as an international player in the domain of meat production and processing.

Future Potential and Strategies

According to estimations, the demand for meat and meat products will further increase in developed and developing countries but developing countries will see a robust growth as the developed countries already reached at saturation level mainly due to increasing population, per capita income growth, urbanization and nutritional shifts. There is a need for consumer awareness about meat consumption to improve nutritional status through diet by including particular food item (Zhou et al., 2012). In Pakistan, per capita consumption is also estimated to rise in coming years and to cater demand, interventions and improvements are required such as animal production facilities, developing cutting edge research technologies, improving efficiency of livestock, enhancing local abattoirs facilities and infrastructure, staff training and cold supply chain management, stimulating quality and safety by implementing GMP, GAP, HACCP, ISO standards, new and improved packaging techniques, proper distribution system as well as inspection and grading system to meat global markets.

In addition, the Kissan package also aid farmers against the unprecedented climate behavior and diseases spread going forward. The future plans including inter-provincial coordination for livestock sector development with ultimately help from private stakeholder will help to promote value addition of livestock, controlling trans-boundary animal diseases (zoonotic diseases) for trade and economic importance and exploring new markets for export of beef, mutton and poultry meat. Additionally, the four-year exemption on income tax policy for installation of halal meat production unit registered before December 31, 2016 has also encouraged the industrialist to get benefit and this will surely help Pakistan halal meat industry to flourish in a better way.

The Organization of Islamic Countries (OIC) ranked Pakistan only after Malaysia on the Halal Food Indicator(HFI) category mainly due to its potential required for halal food operations in the global Islamic economy report published in 2015/16. Furthermore, global Islamic Economy Indicator (GIEI) ranking placed Pakistan at 5th position indicating country possess well organized halal sectors in various categories like Finance, pharmaceuticals and cosmetics. These findings reported halal industry in Pakistan can grow drastically in coming time owing to its competitive advantage like Muslim population, cheap labor, resourceful agriculture based country. Furthermore, Pakistan Halal Authority (PHA) bill has been passed by National Assembly of Pakistan in 2015 to set up halal authority to overall monitor the imports, exports as well as local production of different food products that will ultimately increase the creditability of the country in the world.

Conclusion

Pakistan meat industry is influenced by religious believes and consumer choices that impact the demand of meat and meat products. As, Pakistan majority population consist of Muslims (96%) thereby, production of halal meat and meat products is prerequisite. Moreover, the demand of halal meat is increasing due to its escalating popularity and acceptance halal as a brand, therefore, Pakistan is a potential player in this context to enhance export of quality halal meat and its products. As, meat is essential component of Pakistani diet therefore, meat industry needs improvisation on each stage of meat production and processing to meet local demands. Pakistan being an agricultural and Muslim majority country, has potential to rear livestock herds for better meat quality to meet ever increasing demands of halal meat. However, adopting innovative technologies for animal breeding, proper animal’s welfare and feeding system, mechanized slaughtering, processing and improved packaging could improve the safety and quality of resulting meat. Moreover, the provision of supply chain system as well as strictly following the safety and quality legislation in this sector could yield fruitful outcomes for increasing meat production and processing to make Pakistan as hub for halal meat and meat products.

References

- 1.Aghwan Z. A., Bello A. U., Abubakar A. A., Imlan J. C., Sazili A. Q. Efficient halal bleeding, animal handling, and welfare: A holistic approach for meat quality. Meat Sci. 2016;121:420–428. doi: 10.1016/j.meatsci.2016.06.028. [DOI] [PubMed] [Google Scholar]

- 2.Alahakoon A. U., Jo C., Jayasena D. An overview of meat industry in Sri Lanka: A comprehensive review. Korean J. Food Sci. An. 2016;36:137–144. doi: 10.5851/kosfa.2016.36.2.137. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 3.Bashir A., Ahmad F., Mehmood I., Qasim M., Abbas M., Hassan S. Economics of red meat production in Punjab. Pak. J. Agric. Res. 2015;28:85–95. [Google Scholar]

- 4.Binnie M. A., Barlow K., Johnson V., Harrison V. Red meats: Time for a paradigm shift in dietary advice. Meat Sci. 2014;98:445–451. doi: 10.1016/j.meatsci.2014.06.024. [DOI] [PubMed] [Google Scholar]

- 5.Bruinsma J. World agriculture: Towards 2015/2030. An FAO perspective. Earthscan Publications Ltd; London, UK: 2003. [Google Scholar]

- 6.Chang H. S. Overview of the world broiler industry: Implications for the Philippines. Asian J. Agri. Dev. 2007;4:67–82. [Google Scholar]

- 7.ChartsBin statistics collector team. Current Worldwide Annual Meat Consumption per capita. chartsbin.com; 2013. [Accessed Feb. 17, 2017]. Available from: http://chartsbin.com/view/12730 . [Google Scholar]

- 8.Economic Survey of Pakistan. Ministry of National Food Security and Research. Government of Pakistan; Islamabad, Pakistan: 2014. [Google Scholar]

- 9.Economic Survey of Pakistan. Ministry of National Food Security and Research. Government of Pakistan; Islamabad, Pakistan: 2015. [Google Scholar]

- 10.Economic Survey of Pakistan. Ministry of National Food Security and Research. Government of Pakistan; Islamabad, Pakistan: 2016. [Google Scholar]

- 11.Elam T. E. Projections of global meat production through 2050. Center for Global Food Issues; 2006. [Google Scholar]

- 12.Farouk M. M. Advances in the industrial production of halal and kosher red meat. Meat Sci. 2013;95:805–820. doi: 10.1016/j.meatsci.2013.04.028. [DOI] [PubMed] [Google Scholar]

- 13.Farouk M. M., Pufpaff K. M., Amir M. Industrial halal meat production and animal welfare: A review. Meat Sci. 2016;120:60–70. doi: 10.1016/j.meatsci.2016.04.023. [DOI] [PubMed] [Google Scholar]

- 14.Furnols F. M., Guerrero L. Consumer preference, behavior and perception about meat and meat products: An overview. Meat Sci. 2014;98:361–371. doi: 10.1016/j.meatsci.2014.06.025. [DOI] [PubMed] [Google Scholar]

- 15.Garnier J. P., Klont R., Plastow G. The potential impact of current animal research on the meat industry and consumer attitudes towards meat. Meat Sci. 2003;63:79–88. doi: 10.1016/S0309-1740(02)00059-1. [DOI] [PubMed] [Google Scholar]

- 16.GOP, Government of Pakistan. Milk and meat statistics of Pakistan. Ministry of Food, Agriculture and Livestock; Islamabad, Pakistan: 2012. [Google Scholar]

- 17.GOP, Government of Pakistan Milk and meat statistics of Pakistan. Ministry of Food, Agriculture and Livestock; Islamabad, Pakistan: 2015. [Google Scholar]

- 18.GOP, Government of Pakistan. Milk and meat statistics of Pakistan. Ministry of Food, Agriculture and Livestock; Islamabad, Pakistan: 2016. [Google Scholar]

- 19.Henchion M., McCarthy M., Resconi V., Troy D. Meat consumption: Trends and quality matters. Meat Sci. 2014;98:561–568. doi: 10.1016/j.meatsci.2014.06.007. [DOI] [PubMed] [Google Scholar]

- 20.Hussain J., Rabbani I., Aslam S., Ahmad H. A. An overview of poultry industry in Pakistan. World's Poult. Sci. J. 2015;71:689–700. doi: 10.1017/S0043933915002366. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 21.Jalil H., Hussain S., Siddiqi A. F. An empirical study of meat supply chain and prices pattern in Lahore (Pakistan): A case study. J. Sup. Chain Man. Sys. 2013;2:1–10. [Google Scholar]

- 22.Karachi Chamber of commerce and industry (KCCI) Halal meat sector; time to make most of the edge. 2016. Info-analysis report. Research and Development wing, Karachi Chamber of Commerce and Industry; Pakistan: 2016. [Google Scholar]

- 23.Kristensen L., Stoier S., Wurtz J., Hinrichsen L. Trends in meat science and technology: The future looks bright, but the journey will be long. Meat Sci. 2014;98:322–329. doi: 10.1016/j.meatsci.2014.06.023. [DOI] [PubMed] [Google Scholar]

- 24.Lever J., Miele M. The growth of halal meat markets in Europe: An exploration of the supply side theory of religion. J. Rural Stud. 2012;28:528–537. doi: 10.1016/j.jrurstud.2012.06.004. [DOI] [Google Scholar]

- 25.Mathew V. N. Acceptance on Halal food among non-Muslim consumers. Procedia-Soc. Behav. Sci. 2014;121:262–271. doi: 10.1016/j.sbspro.2014.01.1127. [DOI] [Google Scholar]

- 26.Mathijs E. Exploring future patterns of meat consumption. Meat Sci. 2015;109:112–116. doi: 10.1016/j.meatsci.2015.05.007. [DOI] [PubMed] [Google Scholar]

- 27.Nam K. C., Jo C., Lee M. Meat products and consumption culture in the East. Meat Sci. 2010;86:95–102. doi: 10.1016/j.meatsci.2010.04.026. [DOI] [PubMed] [Google Scholar]

- 28.Nierenberg D. Global meat production and consumption continue to rise. Worldwatch Institute; 2011. [Accessed on April 26, 2017]. [Google Scholar]

- 29.Noor A. M. Demand grows for Pakistani Halal meat. Pak. Food J. 2015;4:1–3. [Google Scholar]

- 30.OECD-FAO Agriculture outlook. [Accessed April 26, 2017];Meat consumption (indicator) 2016 doi: 10.1787/agr_outlook-2016-en. [DOI]

- 31.Petrovic Z., Djordjevic V., Milicevic D., Nastasijevic I., Parunovic N. Meat production and consumption: Environmental consequences. Procedia Food Sci. 2015;5:235–238. doi: 10.1016/j.profoo.2015.09.041. [DOI] [Google Scholar]

- 32.Qureshi S. S., Jamal M., Qureshi M. S., Rauf M., Syed B. H., Zulfiqar M., Chand N. A review of Halal food with special reference to meat and its trade potential. J. Anim. Plant Sci. 2012;22:79–83. [Google Scholar]

- 33.Rahman A., Duncan A., Miller D., Clemens J., Frutos P., Gordon I., Rehman A., Baig A., Ali F., Wright I. Livestock feed resources, production and management in the agro-pastoral system of the Hindu Kush-Karakoram-Himalayan region of Pakistan: The effect of accessibility. Agri. Systems. 2008;96:26–36. doi: 10.1016/j.agsy.2007.05.003. [DOI] [Google Scholar]

- 34.Sarwar M., Khan M. A., Iqbal Z. Status paper feed resources for livestock in Pakistan. Int. J. Agric. Biol. 2002;4:186–192. [Google Scholar]

- 35.Smil V. Eating meat: Constants and changes. Global Food Sec. 2014;3:67–71. doi: 10.1016/j.gfs.2014.06.001. [DOI] [Google Scholar]

- 36.Speedy A. W. Global production and consumption of animal source foods. J. Nutr. 2003;133:4048S–4053S. doi: 10.1093/jn/133.11.4048S. [DOI] [PubMed] [Google Scholar]

- 37.Steinfeld H., Wassenaar T., Jutzi S. Livestock production systems in developing countries: Status, drivers. Trends. Rev. Sci. Tech. 2006;25:505–516. doi: 10.20506/rst.25.2.1677. [DOI] [PubMed] [Google Scholar]

- 38.Tilman D., Balzer C., Hill J., Befort B. L. Global food demand and the sustainable intensification of agriculture. Proceedings of National Academy of Sci. 2011;108:20260–20264. doi: 10.1073/pnas.1116437108. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 39.Trade and Markets Division. Food outlook: Biannual report on global food markets. Food and Agriculture organization (FAO); 2013. [Google Scholar]

- 40.Troy D. J., Kerry J. P. Consumer perception and the role of science in the meat industry. Meat Sci. 2010;86:214–226. doi: 10.1016/j.meatsci.2010.05.009. [DOI] [PubMed] [Google Scholar]

- 41.Troy D. J., Ojha K. S., Kerry J. P., Tiwari B. K. Sustainable and consumer-friendly emerging technologies for application within the meat industry: An overview. Meat Sci. 2016;120:2–9. doi: 10.1016/j.meatsci.2016.04.002. [DOI] [PubMed] [Google Scholar]

- 42.Vandendriessche F. Meat products in the past, today and in the future. Meat Sci. 2008;78:104–113. doi: 10.1016/j.meatsci.2007.10.003. [DOI] [PubMed] [Google Scholar]

- 43.Younas M., Yaqoob M. Feed resources of livestock in the Punjab, Pakistan. [Retrieved April 26, 2017];Livestock Res. Rural Develop. 2005 17(2) from http://www.lrrd.org/lrrd17/2/youn17018.htm . [Google Scholar]

- 44.Zhou G., Zhang W., Xu X. China's meat industry revolution: Challenges and opportunities for the future. Meat Sci. 2012;92:188–196. doi: 10.1016/j.meatsci.2012.04.016. [DOI] [PubMed] [Google Scholar]