Abstract

Background

Models measuring the interactions between consumption of conventional cigarettes and electronic cigarettes (e-cigarettes) in the marketplace are becoming vital forecast tools as the popularity of e-cigarettes increases and policy on tobacco products changes. Behavioral economics, which involves the integration of psychology and consumer demand, can be used to measure individuals’ purchase behavior under different marketplace conditions. Our goal was to measure hypothetical conventional cigarette and e-cigarette purchasing among smokers with varying e-cigarette use patterns.

Methods

Daily cigarette smokers were recruited using Amazon Mechanical Turk, an online crowdsourcing tool. Participants were asked about their frequency of e-cigarette use and to complete hypothetical single and cross-commodity purchase tasks.

Results

Frequency of e-cigarette use differentially affected how individuals consumed both conventional and e- cigarettes in different hypothetical marketplace conditions. The present study demonstrates four main findings: 1) the demand for conventional cigarettes was the lowest in those with greater frequency of e-cigarette use, 2) the demand for e-cigarettes was the most in those with greater frequency of e-cigarette use, 3) when both products were available together, daily e-cigarette users purchased more e-cigarettes, but e-cigarettes served as a substitute for cigarettes in all groups regardless of frequency of use, and 4) the demand for conventional cigarette demand was lower in frequent e-cigarette users when e-cigarettes were concurrently available.

Conclusions

Together, these data suggest that price and marketplace conditions will impact purchasing behavior of conventional and e-cigarettes users heterogeneously. Therefore, frequency of use patterns should be considered when implementing novel policies and/or marketplace changes.

Keywords: E-cigarettes, Behavioral economics, demand, substitution, frequency of use, cigarettes

1. INTRODUCTION

In the present tobacco marketplace, the product landscape is shifting such that prices for conventional cigarettes are increasing at the same time that alternative nicotine delivery products, like electronic cigarettes (e-cigarettes), are becoming more prevalent (King et al., 2013; McMillen et al., 2015). In fact, based on the recent Population Assessment of Tobacco and Health (PATH) data, the prevalence of e-cigarette use was 5.5% of adults, which represents approximately 13.7 million people in the U.S. (Kasza et al., 2016). Moreover, frequent e-cigarette use (using 20 out of the past 30 days) was reportedly 1.5%, which would represent approximately 3.7 million Americans. Interestingly, adults who are most likely to use e-cigarettes are those who are current cigarette smokers, compared to former and never smokers (Caraballo et al., 2016; Delnevo et al., 2016). Consequently, most e-cigarette users are, to some degree, dual users who are faced with many choices in the marketplace.

When making purchasing choices in the tobacco marketplace, the extent to which (i.e., frequency) an individual uses conventional or e- cigarettes or both, can impact their demand for different products. For example, greater conventional cigarette valuation was demonstrated by those who smoke cigarettes more frequently (Mackillop et al., 2008; Murphy et al., 2011). A gap in our knowledge, however, is how different frequency of use patterns for e-cigarettes will influence consumer behavior in the marketplace under various conditions. Therefore, forecast tools to model interactions between individuals’ product use patterns, types of products (e.g., conventional cigarettes and e-cigarettes), and their prices, are needed to clarify their effects on consumer behavior on a greater scale.

Behavioral economics, which involves the integration of psychology and consumer demand, can measure hypothetical purchase behavior for a commodity under different market conditions (Hursh, 1984). The hypothetical purchase task, for example, can be implemented to examine the number of commodities (e.g., cigarettes or e-cigarettes) an individual may hypothetically purchase at increasing prices (Jacobs and Bickel, 1999). Consistent with consumer-demand theory, commodity consumption has been demonstrated to decline with greater prices, generating what is known as a demand curve (Hursh, 1984; Mackillop et al., 2008). A behavioral economic demand curve can yield two important parameters that describe an individuals’ valuation for cigarettes, 1) the intensity of the demand (i.e., Q0; total purchases at free price); and 2) the elasticity of demand (i.e., alpha; sensitivity to price) (Hursh, 1984; Hursh and Silberberg, 2008). Consequently, this procedure can be used to experimentally demonstrate decreases in consumption of conventional or e-cigarettes as a function of increasing price (Grace et al., 2015a; Huang et al., 2014; MacKillop et al., 2012).

Behavioral economic procedures can also assess the interaction of multiple commodities available concurrently. That is, as the price of commodity A increases, a concurrently available and constantly priced commodity B can act as a substitute (i.e., consumption increases), complement (i.e., consumption decreases), or not impact consumption of the other product (i.e., independence) (Bickel et al., 1995). The interaction that emerges between the two commodities is a product of the valuation of the alternative as defined by its magnitude and the relative prices of both commodities (Bickel et al., 1995). Therefore, in addition to empirical measurement of conventional and e-cigarettes alone, identifying how alternative nicotine products interact when available together can help to predict the way in which consumers, may substitute, complement, or alter purchasing independently as a function of the valuation and relative prices of the products in a variety of marketplace conditions.

Several reports have previously demonstrated that conventional and e-cigarettes interact. For example, a study conducted in New Zealand (N=210) reported that daily smokers substituted concurrently available e-cigarettes for conventional cigarettes when the price of cigarettes increased (Grace et al., 2015a). Moreover, purchasing patterns can differ based on the availability of alternative products. Previous studies have shown that consumption of conventional cigarettes is reduced when alternative commodities (i.e., e-cigarettes, de-nicotinized cigarettes, gum, and/or money) are available (Grace et al., 2015b; Johnson et al., 2004; Johnson and Bickel, 2003; Quisenberry et al., 2016). This second finding emphasizes an additionally relevant variable for predicting consumer behavior–marketplace availability of alternative products.

Examination of these interactions may help shed light on the impact of conventional cigarette taxation or bans, and or e-cigarette subsidies/vouchers. However, such price modifications will not impact the market homogeneously. That is, perhaps increasing cigarette price will cause some smokers to quit smoking entirely and others to increase consumption of alternatives more readily. Importantly, hypothetical purchases are correlated with purchases of laboratory-based real and potentially real cigarettes (Wilson et al., 2016).

Therefore, hypothetical purchases provide reasonable indications for how individuals may consume these products in the real world. Therefore, the present study examines how an individual will purchase both conventional cigarettes and e-cigarettes alone and in combination as a function of price and the frequency with which they currently use e-cigarettes. Based upon our earlier studies with conventional cigarettes, we hypothesized that the frequency of e-cigarette use would 1) reduce demand (lower intensity and raise elasticity) for conventional cigarettes, 2) increase demand for e-cigarettes, and 3) interact with conventional cigarettes whereby demand would decrease for cigarettes giving rise to increased substitution for e-cigarettes.

2. MATERIAL AND METHODS

2.1 Participants

Participants (N=385) who were U.S. registrants of Amazon Mechanical Turk, a crowd-sourcing service, accessed the Human Intelligence Test (HIT) titled “Hypothetical purchase research on cigarettes and e-cigarettes”. Participant eligibility requirements included being at least 18 years of age, smoke 10 or more cigarettes per day, and have at least a 90% approval rating from previous HITs. The participants who were eligible to accept the HIT implied consent when the participant indicated they understood the study description and accepted the HIT. No personally identifiable data were collected. All procedures in this study were reviewed and approved by Virginia Tech’s Institutional Review Board.

2.2 Procedure

Participants were first asked to provide some general demographic information (i.e., age, gender, income, race). Participants were asked to indicate all races that applied to them, including American Indian or Alaskan Native, Asian, Black or African American, Native Hawaiian or Other Pacific Islander, White/Caucasian, and/or Other.

Next, participants were asked to provide answers to several brief questionnaires including how many cigarettes they smoked per day, the Fagerstrom test for nicotine dependence (FTND) (Heatherton et al., 1991), perceived health risk of cigarettes (Hatsukami et al., 2016), whether or not they were trying to quit smoking cigarettes (or had immediate plans to do so), and how frequently they used e-cigarettes. The participants then completed a series of hypothetical purchase tasks based on the cigarette purchased task (Jacobs and Bickel, 1999; described in detail below). Participants also completed a series of other behavioral tasks as part of a larger unpublished study, the results of which did not influence the current data and are not reported here. 2.2.1 Frequency of E-cigarette Use Participants were asked to indicate their frequency of use of e-cigarettes from one of the following options: “More than 20 times per day”, “11–20 times per day”, “1–10 times per day”, “4–6 times a week”, “1–3 times week”, “1–3 times a month”, “Less than once a month”, I did not use e-cigarettes in the past six months, but I have in the past”, or “Never”. These choices were then combined to create “Daily”, “Weekly”, “Monthly”, Less than once in 6 months”, and “Never user” frequency groups for data analysis.

2.2.2 Hypothetical Purchase Tasks

2.2.2.1 Cigarettes alone

During this task, participants were asked to indicate how many single cigarettes they would purchase if they were available at incrementally increasing prices ($0, $0.12, $0.25, $0.50, $1). Participants were asked to assume they were purchasing cigarettes for their own consumption in a 24-hour period and that they did not have access to cigarettes outside of the present task. Participants were also instructed not to assume they could stock-pile or give away any of the hypothetical cigarettes they were purchasing.

2.2.2.2 E-cigarettes alone

Participants were asked to indicate how many disposable e-cigarettes they would purchase if they were available at incrementally increasing prices ($0, $3, $6, $12, $24). Participants were asked to assume they were purchasing e-cigarettes for their own consumption over a 24-hour period and that they did not have access to any other nicotine product outside of the present task. Again, participants were instructed not to assume they could stock-pile or give away any of the hypothetical e-cigarettes they were purchasing.

2.2.2.3 Cigarettes and E-cigarettes available concurrently

Participants completed a hypothetical cross-price purchase task. In this task participants were asked to input of the number of cigarettes and e-cigarettes they would hypothetically purchase when the two were concurrently available. In each trial the price of individual cigarettes increased ($0, 0.12, 0.25, 0.50, 1.00), while e-cigarette price ($7.73) remained fixed.

2.2.2.4 Price Determinations

The prices for both individual cigarettes and e-cigarettes were chosen to provide a range of prices surrounding approximate retail values. The fixed price of the disposable e-cigarettes fell in the middle of the price progression used in the e-cigarette alone condition and was the average of the prices for several commercially available disposable cigarettes.

2.3 Data Analysis

Prior to analysis, all purchase data was subjected to exclusion criteria described by Stein et al. (2015) to ensure systematic and valid data. Specifically, these criteria included violations of Trend in purchase progressions (i.e., increasing purchasing over successively increasing prices), Bounce purchase progressions (i.e., greater than 25% increase in consumption compared to initial consumption at the lowest price), and Non-consumption (i.e., zero purchases at any price). Additionally, hypothetical purchase of >200 cigarettes and/or 100 disposable e-cigarettes for use over a 24-hour period at any price was considered a violation of Overconsumption. Table 1 reports the number of participants excluded from each purchase task as a function of criterion type violation.

Table 1.

Number of participant datasets excluded from curve fitting utilizing Stein et al. (2015) criteria organized by frequency group and task type. Bold print in the Trend column indicates instance in which violation of both Trend and Bounce criteria occurred simultaneously. All violations were counted only once. Non-consumption was defined as zero purchasing at any price. Over-consumption was defined as >200 cigs and >100 disposable e-cigarettes at any price for use over a 24 hour period. *Indicates significant linear trend among frequency groups, p<0.0001.

| N before excl. | Trend | Bounce | Non-consumption | Over consumption | |

|---|---|---|---|---|---|

|

| |||||

| Cigs Alone | |||||

|

| |||||

| Daily | 81 | 2; 0 | 2 | 0 | 2 |

|

|

|||||

| Weekly | 80 | 1; 3 | 6 | 0 | 2 |

|

| |||||

| Monthly | 65 | 2; 2 | 1 | 0 | 1 |

|

|

|||||

| Less than once in 6 months | 49 | 4; 1 | 0 | 0 | 2 |

|

| |||||

| Never users | 110 | 1; 3 | 5 | 0 | 1 |

|

| |||||

|

| |||||

| E-cigs Alone | |||||

|

| |||||

|

| |||||

| Daily | 81 | 2; 0 | 0 | 3* | 2 |

|

|

|||||

| Weekly | 80 | 3; 2 | 0 | 4* | 3 |

|

| |||||

| Monthly | 65 | 3; 1 | 0 | 1* | 1 |

|

|

|||||

| Less than once in 6 months | 49 | 3; 0 | 0 | 7* | 1 |

|

| |||||

| Never users | 110 | 2; 2 | 0 | 20* | 2 |

|

| |||||

|

| |||||

| Cigs + e-cigs Available | |||||

|

|

|||||

| Daily | 81 | 4; 1 | 4 | 4 | 2 |

|

| |||||

| Weekly | 80 | 0; 3 | 3 | 0 | 2 |

|

|

|||||

| Monthly | 65 | 2; 1 | 2 | 2 | 0 |

|

| |||||

| Less than once in 6 months | 49 | 5; 0 | 2 | 0 | 0 |

|

|

|||||

| Never users | 110 | 8; 6 | 5 | 2 | 2 |

|

|

|||||

Purchase of (i.e., demand for) conventional or e-cigarettes with progressive increases in price was analyzed by fitting purchase data with the exponentiated behavioral economics demand model (Koffarnus et al., 2015). Individuals’ purchasing data from the cigarettes alone and cross-price (cigarettes + e-cigarettes available) tasks, were fit to this equation. Generated alphas and Q0’s were compared between frequency groups by using a non-parametric Kruskal Wallis test with Dunn’s multiple comparisons tests. Non-parametric analyses were used because of the excessive skew and kurtosis of alpha and Q0 measures here that could not be corrected by transformation (Leech and Onwuegbuzie, 2002; Onwuegbuzie and Daniel, 2002). Demand for e-cigarettes during the e-cigarettes alone task was assessed using only group demand curve fits. Group curve fits were necessary in this condition to accurately account for the Non-consumption in the groups that rarely/never used e-cigarettes. Between-group analyses of the group curves included a one-way ANOVA and Tukey multiple comparison’s post hocs.

We acknowledge that the process of demand exhibits a total of five different “facets”: alpha, Q0, Pmax, Omax, and breakpoint (Bickel et al., 2000). However, demand can be separated into two factors, “persistence” (i.e., sensitivity to price composed predominantly of alpha, Pmax, Omax, and breakpoint) and “amplitude”, (i.e., composed predominantly of Q0 and (lesser so) Omax), suggesting significant overlap between these facet measures (Mackillop et al., 2009; O’Connor et al., 2016). In all instances of demand of the present study, alpha was significantly correlated with Pmax, Omax, and breakpoint. Moreover, Q0 was correlated with Omax in the majority of demand instances. Therefore, we opted to omit discussion and analyses of Pmax, Omax, and breakpoint to retain parsimony among the results and interpretations.

Group e-cigarette substitution curves were fit using the cross-price elasticity of demand equation by (Hursh and Roma, 2013). The I term (i.e., interaction), b term (sensitivity to price), and Qalone (consumption of fixed-price e-cigarettes while price of cigarettes go to infinity) were all generated from the equation and differences between group fit terms were analyzed using a one-way ANOVA. Two 2-way ANOVAs (between frequency group, within prices) and subsequent Tukey’s multiple comparison’s post hocs were also performed on the cigarette + e-cigarette task purchase data to assess differences in purchasing and substitution at each price-point between frequency groups.

We used a modified version of the Pearson chi squared test (Cochran-Armitage test for trend) to assess differences in the demographic variables exclusion criteria types between frequency groups. The Cochran-Armitage test can be used to test for a linear trend of more than two nominal variables when input in a logical order (e.g., daily–never users). All statistical analyses were performed using Graphpad Prism 7a for Mac OS X (GraphPad Software, La Jolla California USA).

3. RESULTS

Demographic variables of the participants in each of the frequency groups are presented in Table 2. Frequency groups did not differ significantly in any demographic variables, number of reported cigarettes smoked per day, Fagerstrom score, or perceived health risk of cigarettes. All participants were also asked a “yes” or “no” question about whether they were trying to quit smoking cigarettes or had immediate plans to do so. The percent of participants quitting cigarettes in each group increased with increases in frequency of e-cigarette use. The chi-square test for trend revealed a significant trend in percent of participants quitting smoking conventional cigarettes by frequency group, X2 (1, N = 369) = 31.32, p<0.0001; d = 0.61.

Table 2.

Demographic information, self-reported cigarette use, and risk perception. FTND abbreviation indicates Fagerstrom test for nicotine dependence (Heatherton et al., 1991). *Percentage of participants reporting currently quitting or having immediately planning to do so demonstrated a significant linear trend between frequency of use groups, p<0.0001.

| Frequency Group | N | Age (SEM) | % Male | % Caucasian | Income (SEM) | Cigs/day (SEM) | FTND | Perceived Risk (SEM) | % Quitting* |

|---|---|---|---|---|---|---|---|---|---|

| Daily | 81 | 33 (1.0) | 55.6 | 81.50 | 40.3k (3.2) | 18.3 (2.1) | 4.4 | 61.1 (2.2) | 81.50 |

| Weekly | 80 | 33 (1.2) | 58.8 | 53.80 | 43.8k (3.3) | 17.9 (0.9) | 4.8 | 63.2 (1.7) | 62.50 |

| Monthly | 65 | 32 (1.0) | 49.2 | 81.50 | 43.8k (4.6) | 16.4 (0.8) | 4.7 | 63.6 (1.9) | 50.70 |

| Less than once in 6 months | 49 | 35 (1.6) | 44.9 | 85.70 | 46.9k (5.0) | 16.5 (0.7) | 4.6 | 62.4 (2.3) | 32.70 |

| Never users | 110 | 35 (1.0) | 57.3 | 80.00 | 5.2k (5.3) | 17.2 (0.6) | 4.7 | 59.0 (1.8) | 44.50 |

3.1 Cigarettes alone

Table 1 reports the total number of participant datasets removed from analyses for cigarettes alone due to violation of Trend, Bounce, or Over-consumption criteria. Chi-square for trend analyses revealed no significant trends in the exclusions between frequency groups.

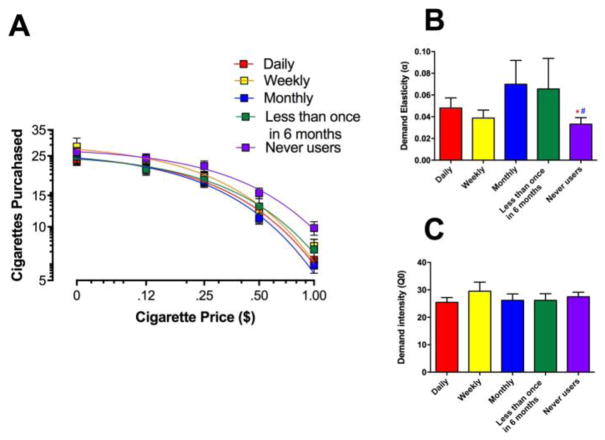

With the remaining datasets, Figure 1A depicts the fitted group demand curves for cigarettes between the frequency groups when cigarettes were available alone at increasing prices. The group curves fit well (R2 ranged between 0.90 – 0.994) and elasticity increases with increasing e-cigarette frequency. When alpha and Q0 values were generated from individual curves, mean (SEM) R2 curve fits were also reasonable: Daily, 0.836 (0.011); Weekly, 0.845 (0.014); Monthly, 0.863 (0.013); Less than once in 6 months, 0.838 (0.017); and Never users, 0.827 (0.010). A Kruskal-Wallis test revealed significant differences between the alpha values, H (4,339) = 15.87, p = 0.0032, d = 0.38 (See Figure 1B). Dunn’s multiple comparison post-hoc tests indicated that daily and monthly e-cigarette users had significantly higher alpha values for cigarettes than never e-cigarette users, p<0.05. No significant difference was present between frequency groups for intensity of demand (Q0, Figure 1C).

Figure 1.

Cigarette purchases by frequency of e-cigarette use group when cigarettes were available alone. Panel A illustrates the group curve fits. Panel B represents the demand elasticities for individual curve fits for each frequency group. Panel C is the demand intensities derived from individual curve fits in each group. In B and C, bar columns represent group means (SEM). *p<0.5 difference from Daily group. #p<0.05 difference from Monthly group.

3.2 E-cigarettes alone

Table 1 reports the total number of participant datasets to violate criteria. A significant trend emerged in Zero-consumption between frequency of e-cigarette use groups (X2 (1, N = 385) = 16.2, p<0.0001, d = 0.42). Specifically, zero consumption of e-cigarettes occurred more often in the less frequent e-cigarette users when e-cigarettes were available alone.

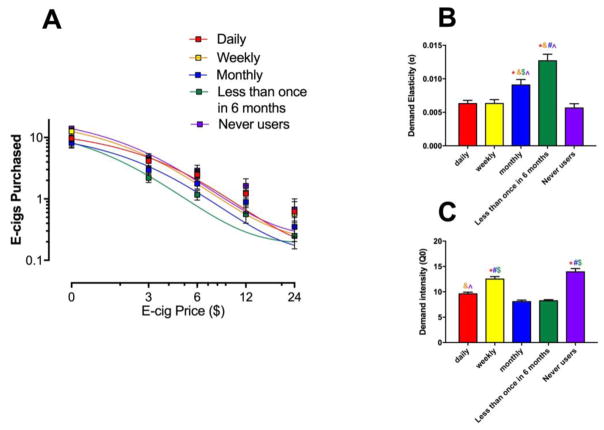

To compare differences between the frequency groups demand parameters, group fit curves were used in order to best account for these systematic differences in e-cigarette non-consumption. All data was included except for instances of Bounce and Over-consumption violations (Figure 2A). One-way ANOVA analyses of the group curve alpha (Figure 2B) and Q0s (Figure 2C) between frequency groups reported significant results F(4,366) = 14.85, p<0.0001, d = 3.80 and F(4,366) = 27.02, p < 0.0001, d = 2.67, respectively. Tukey post hoc comparisons indicated significant differences of alpha values between all groups with the exception of daily and weekly; daily and never users; and weekly and never users (p<0.05). Moreover, Tukey post hoc comparisons of Q0 indicated significant differences between between all groups with the exception of daily and monthly; daily and less than once in 6 months, weekly and never users; and monthly and less than onces in 6 months (p<0.05).

Figure 2.

E-cigarette purchases by frequency of e-cigarette use group when e-cigarettes were available alone. Panel A illustrates the group curve fits. Panel B and C represent the demand elasticities and demand intensities derived from the group fits when Bounce and Overconsumption violations were excluded. In B and C, the bar columns represent group means (SEM). *p<0.05 difference from Daily group. &p<0.05 difference from Weekly group. #p<0.05 difference from Monthly group. $p<0.05 difference from Less than once in 6 months group.

3.3 Cross-Price Purchasing of Cigarettes and E-cigarettes Together

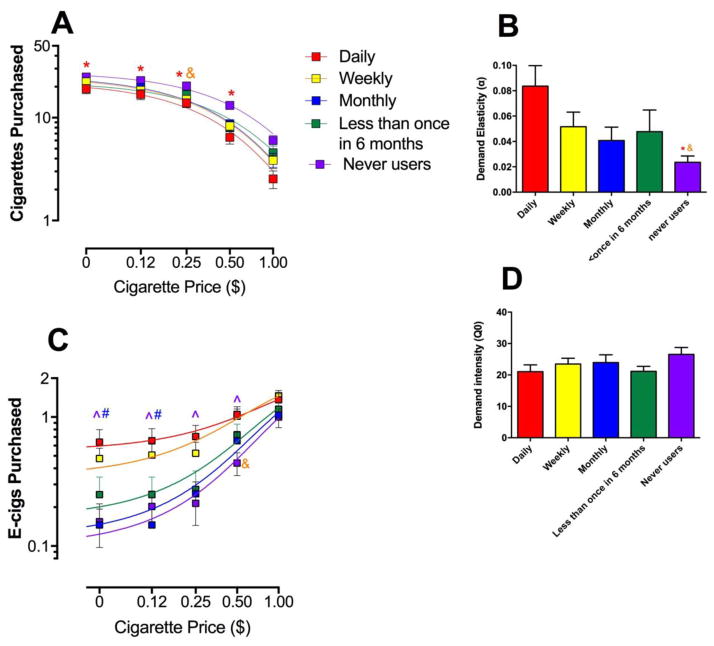

As shown in Table 1, no differences in violations of any type were observed between frequency groups as determined by chi-square tests. Overall, cigarette demand decreased with increasing cigarette price in all frequency groups shown by group curves (R2 values between 0.914–0.991) in Figure 3A. Individual curves were also fit to compare alpha (Figure 3B) and Q0 (Figure 3D) values between frequency groups. The mean R2 (±SEM) for individual curve fits were: Daily, 0.76 (0.016), Weekly, 0.83 (0.016), Monthly, 0.82 (0.019), Less than once in 6 months, 0.77 (0.013), Never users, 0.82 (0.012). A single individual curve fit from the Less than once in 6 months frequency group was excluded due to an ambiguous fit. A Kruskal-Wallis test reported a significant difference between alpha values of frequency groups (H (4,319) = 20.43, p = 0.0004, d = 0.46), but no significant difference in Q0’s. Dunn’s multiple comparison’s post-hoc tests revealed significantly more elasticity of the demand curve (i.e., higher alpha) in the daily and monthly e-cigarette users compared to never users (p<0.05).

Figure 3.

Concurrent cigarette and e-cigarette demand and substitution. Panel A represents group curve fits of cigarette purchases. Panel B and D represent the demand elasticities and intensities derived from individual curve fits for each frequency group. Panel C illustrates the substitution of e-cigarette purchases when cigarette price increased. All symbols and bars represent group means (SEM). *p<0.05 difference from Daily group. &p<0.05 difference from Weekly group. $p<0.05 difference from Less than once in 6 months group. ^p<0.05 difference from Never users.

We also examined differences in cigarette purchasing between frequency groups at each price-point. A 2-way ANOVA (between group, within price) found significant main effects of frequency group F(4,321) = 3.684, p = 0.0060, ηp2 = 0.077, and price F(4,1284) = 253.3, p<0.0001, ηp2 = 0.44. Tukey’s multiple comparisons post-hoc analyses revealed that significantly (p<0.05) more cigarettes were purchased by the Never users group compared to the Daily users group at all prices, except for $1, and compared to the Weekly users group when cigarettes were $0.25 (see Figure 3A).

The concurrent substitution of e-cigarette purchasing was compared between frequency groups. Non-linear substitution curves were fit using Hursh and Roma’s (2013) cross-price elasticity of demand equation. Group curve fits ranged between R2 = 0.969–0.996. The calculated I-term (i.e., interaction) was negative for all groups demonstrating a reciprocal relationship between cigarettes and e-cigarettes; that is, substitution. The group fit I-term (±SEM) calculated for each group was: Daily, −0.55 (0.17); Weekly, -0.77 (0.18); Monthly, −1.2 (0.18); Less than once in 6 months, −1.03 (0.15); Never users, −1.83 (0.80). However, no significant differences emerged between frequency groups I term, b term, or Qalone.

Differences in e-cigarette purchasing between groups were demonstrated when comparing purchasing at each price point. A 2-way ANOVA reported significant main effects of frequency group F(4,312) = 5.207, p = 0.0005, ηp2 = 0.13 and price F(4,1248) = 103.2, p< 0.0001, ηp2 = 0.29 emerged. Tukey’s multiple comparison’s post-hoc analyses revealed significant differences in e-cigarette purchases between daily and never users at all prices except for $1, daily and monthly users at $0 and $0.12, and weekly and never users at $0.50, p<0.05 (Figure 3C).

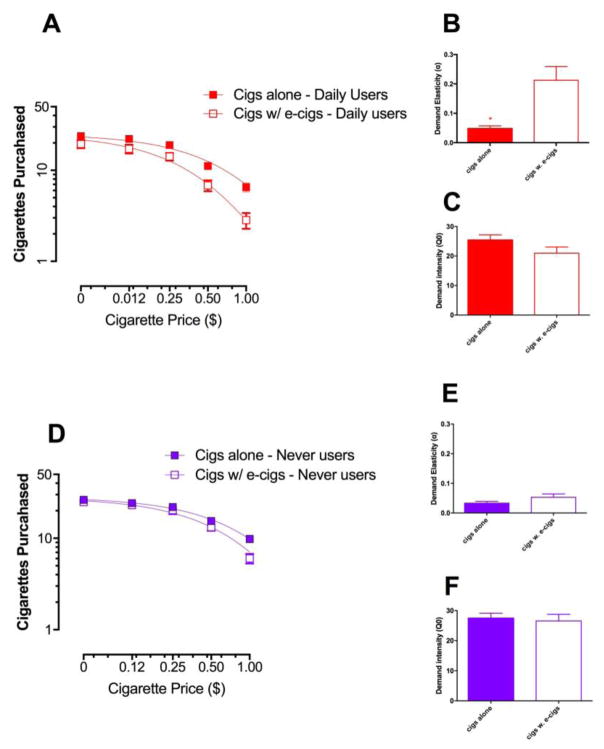

3.3.1 Commodity availability

Finally, differences were apparent in purchasing demand for cigarettes based on the commodities available at the time between daily and never e-cigarette users. Figure 4A illustrates the group demand curves for the daily users group comparing their cigarette purchasing between task type (i.e., cigarettes alone vs. cigarettes + e-cigarettes; R2=0.94 and 0.92). When individual curves (mean R2 (±SEM) for cigarettes alone, 0.84 (0.01); cigs + e-cigs, 0.76 (0.019)) were fit, alpha levels were compared using a paired t-test (Figure 4B). A significant effect emerged (t(63) = 3.83, p = 0.0003, d = 0.55) in which demand elasticity was greater for the daily users when e-cigarettes were available concurrently. Demand intensities (Q0; Figure 4C) were not significantly different between task types. Group (R2= 0.98 and 0.97) and individual curves (cigarettes alone R2 = 0.83 (0.010); cigs + e-cigs R2 = 0.80 (0.012) were fit for both task types in the never e-cig user frequency group (Figure 4D). When individual curve fit alphas and Q0’s were compared, no significant differences were present (Figures 4E&F).

Figure 4.

Cigarette purchases by frequency groups based on the availability of the e-cigarette alternative. Panel A represents the group curve fits of daily e-cigarette users demand for conventional cigarettes during two different market conditions. Panels B and C represent the demand elasticities and intensities derived from individual curve fits for each condition type (i.e., cigarettes alone or cigarettes + e-cigarettes). Panel D represents the group curve fits for the never e-cigarette users for conventional cigarettes during both marketplace conditions. Panels E & F illustrate the elasticities and intensities derived from individual curve fits. *p<0.05.

4. DISCUSSION

Frequency of use of e-cigarettes differentially affected how individuals consumed both conventional cigarettes and e-cigarettes in response to different hypothetical marketplace conditions, regardless of similar conventional cigarette use patterns in the real world. The following key findings from the present study revealed that in general: 1) the demand for conventional cigarettes alone decreased with greater frequency of e-cigarette use, 2) the demand for e-cigarettes alone increased with greater frequency of e-cigarette use, 3) when both products were available together, never users of e-cigarettes defended consumption of conventional cigarettes while e-cigarette users purchased more e-cigarettes, but e-cigarettes served as a substitute for cigarettes in all groups regardless of frequency of use, and 4) the demand for conventional cigarettes decreased in frequent e-cigarette users when e-cigarettes were concurrently available.

We note that across the e-cigarette frequency groups, participants reported similar cigarette daily intake, dependence, and perception of health risk, however, more frequent e-cigarette users tended to report intention to quit smoking cigarettes. These findings are consistent with the demonstration that smokers who use e-cigarettes were significantly more likely to report intention to quit smoking compared to non-e-cigarette users (Rutten et al., 2015). However, we observed no significant differences in demand parameters in any task between participants who reported intentions to quit compared to those who did not. Also, intention to quit did not significantly contribute to the difference in e-cigarette substitution between frequency groups when included as a co-variate. The following provides further discussion of each of the first key findings.

First, consumer demand economics predicts; as the price of commodity A increases, total consumption of that commodity will decline non-linearly (Hursh, 1984). Many reports have demonstrated this sensitivity to increasing prices in cigarettes (e.g., Bickel et al., 2016; Bickel and Madden, 1999; Johnson and Bickel, 2003; Mackillop et al., 2008), supporting that increasing the excise tax on cigarettes will reduce cigarette consumption on a larger scale (Chaloupka and Warner, 2000; Lewit and Coate, 1982). Grace et al. (2015a) examined the effects on cigarette demand before and after a 10% increase on tobacco excise tax in New Zealand. The authors demonstrated that daily smokers’ demand for cigarettes was significantly reduced after the initiation of the tax, suggesting that price increases and tax implementation reduce cigarette demand. Similarly, the present study found that when cigarettes were available alone, demand for cigarettes declined non-linearly for all groups. However, demand elasticity was higher in those who used e-cigarettes daily, suggesting individual differences in demand as a function of e-cigarette use patterns. Moreover, although naturalistic cigarette use and cigarette dependence is associated with higher demand intensity and lower elasticity in cigarette smokers (Mackillop et al., 2008; Murphy et al., 2011), the frequency of e-cigarette use groups in the present sample did not differ on FTND score or cigarettes smoked per day therefore suggesting that frequency of e-cigarette use manipulates cigarette valuation independently.

Second, greater frequency of e-cigarette use increased demand for e-cigarettes. That is, the demand intensity for e-cigarettes was significantly higher and elasticity significantly lower in those who used e-cigarettes more frequently, with the exception of the never users (implications discussed below). Interestingly, demand for e-cigarettes across frequency groups was between 2.5–12.5 times lower compared to the conventional cigarette demand elasticities. These findings are consistent with others who have found that e-cigarettes are more sensitive to increases in price (Huang et al., 2014; Stoklosa et al., 2016). Importantly however, we note that the never users did not follow the linear pattern of decreased demand for e-cigarettes. That is, in contrast to our hypotheses, never users reported greater demand for e-cigarettes when they were available alone. We asked all participants to hypothetically purchase e-cigarettes in a close economy situation (i.e., they would not have access to alternative sources of nicotine outside of the current purchases for 24 hours). Without previous experience with e-cigarettes, purchasing the precise amount of e-cigarettes likely to be consumed in one day would be challenging for a naïve e-cigarette user. Although future research will need to better understand this phenomenon, the results suggest that in a marketplace in which cigarettes are no longer available, regular smokers who do not have prior experience with e-cigarettes will likely over-purchase initially.

Third, when cigarettes and e-cigarettes were available concurrently, never users defended consumption of cigarettes (i.e., higher alpha) compared to the more frequent users and substitution of e-cigarettes for conventional cigarettes was present in a frequency of use-dependent fashion. Although all groups substituted e-cigarettes at the highest cigarette prices, frequent e-cigarette users purchased more e-cigarettes at lower cigarette prices and substituted earlier. These data are consistent with other demonstrations that alternative products (i.e., dissolvables, Snus, lozenges, cigarillos, dip, nicotine gum, de-nicotinized cigarettes), including e-cigarettes, are substitutes for conventional cigarettes (Grace et al., 2015b; Johnson et al., 2004; Johnson and Bickel, 2003; O’Connor et al., 2014; Quisenberry et al., 2016; Stoklosa et al., 2016) in smoker populations. However frequency of e-cigarette use patterns were either not reported or current e-cigarette users were excluded from these samples. Therefore, the present study’s findings expand upon this data and highlight the importance of assessing individual factors (e.g., frequency of use patterns) .

Fourth and finally, even while conventional cigarettes were consistently available, the availability of the alternative in the marketplace altered demand for cigarettes differentially across frequency groups. That is, when conventional cigarettes were available alone, both daily and never e-cigarette users purchased cigarettes similarly. Because both groups are comprised of daily smokers, within this closed economy, similar cigarette demand was predicted. However, when e-cigarettes were concurrently available, daily e-cigarette users significantly reduced their intensity and increased demand elasticity for conventional cigarettes, compared to never e-cigarette users. This reduction provides an additional way to measure the valuation of e-cigarettes among our users. Johnson et al.(Johnson et al., 2004) found that the availability of denicotinized cigarettes significantly reduced consumption of cigarettes, whereas concurrently available nicotine gum did not, suggesting that perhaps nicotine gum was a less influential alternative. Therefore, valuation of the alternatives may be inferred by the extent of demand change when 2 or more are available concurrently.

As an initial evaluation of the effects of frequency of e-cigarette use on conventional and e-cigarette consumption within multiple hypothetical marketplace scenarios, the present study was not without limitations. During these tasks only disposable e-cigarettes were made available (in contrast to higher generation devices) and no additional information was provided to the participants regarding the brand/type of disposable e-cigarette, nicotine strength, and/or how disposable e-cigarettes generally compare to conventional cigarettes. Although potentially a limitation, this methodology allowed for a better representation of how all frequency groups, particularly naïve users, may alter their behavior in different price conditions given only their previous experience. Disposable e-cigarettes are more accessible to all types of smokers in that they are available in the same marketplace as their cigarettes (convenience stores and gas stations) and disposable e-cigarette do not require large upfront costs for tank-based devices. Therefore, comparing the purchase behavior for only conventional cigarettes and disposable e-cigarettes allowed for measurement of consumption of two relatively equivalent products by all groups. Moreover, because the instructions were worded to indicate that the participant should assume he/she would not have access to any other form of tobacco or nicotine other than that purchased in the task, we anticipate the frequent users of e-cigarettes could better titrate their purchasing of disposable e-cigarettes, given their experience, even if they primarily use 2nd and 3rd generation e-cigarettes. Finally, we acknowledge that omitting the information about e-cigarette nicotine strength may have led to varied assumptions about the product and likely produced challenges for naïve users. However, these methods still led to orderly results and, interestingly, a demonstration that never users may initially adopt these products by overconsuming them before learning to titrate to their nicotine needs.

Although not explicitly measured, we note that other characteristics of the e-cigarette itself such as flavor may alter purchasing. In fact, interest in e-cigarettes significantly varies by flavor (Shiffman et al., 2015) and flavors are important to users who reported trying to quit (Farsalinos et al., 2013). Therefore, considerations for other aspects of e-cigarette use such as flavors, system personalization, or social reinforcement should be considered in future studies examining e-cigarette value. Moreover, because e-cigarettes and cigarettes are consumed differentially (i.e., periodic puffing compared to rapid bouts of smoking), future demand analyses should consider demand tasks aimed to examine the intensity and elasticity of single puffs, while accounting for their frequency and/or their volume.

Nonetheless, the findings from the present study are important because hypothetical purchase task data can be used as a predictive tool for consumer behavior. The data suggests that product purchasing will not change homogeneously in the presence of rapid shift in the tobacco marketplace. For example, when conventional cigarettes were available alone, the significant increases in elasticity demonstrated by frequent e-cigarette users may implicate that a subset of daily smokers are more likely to decrease use significantly leading to the potential for quitting entirely in the face of increasing cigarette tax. In contrast, if cigarettes were banned and no other alternative were available, smokers would use e-cigarettes to some extent yet naïve e-cigarettes users would not sustain use with increasing price points. Moreover, when available together, frequent e-cigarette users will substitute e-cigarettes more readily, suggesting a potential for them to discontinue conventional cigarette use altogether. While we acknowledge that these implications are currently speculation, the empirical evidence from the present study provide support for examining patterns of frequency of use to make better predictions and target subsets of the smoker population prior to implementing novel policies and/or market changes.

Table 3.

Demand parameters alpha and Q0 for each frequency group by task type. Reported values are average group values (±SEM). Values for cigarettes alone and cigarettes + e-cigarettes available are derived from individual demand curve fits. Values for e-cigarettes alone are derived from group curve fits.

| Alpha (±SEM) | Q0(±SEM) | |

|---|---|---|

|

| ||

| Cigs Alone | ||

|

| ||

| Daily | 0.048 (0.0093) ^ | 25.44 (1.76) |

|

|

||

| Weekly | 0.039 (0.0074) | 29.51 (3.30) |

|

| ||

| Monthly | 0.070 (0.022)^ | 26.17 (2.36) |

|

|

||

| Less than once in 6 months | 0.066 (0.028) | 26.19 (2.44) |

|

| ||

| Never users | 0.033 (0.0060)*# | 27.47 (1.67) |

|

| ||

|

| ||

| E-cigs Alone | ||

|

|

||

| Daily | 0.0063 (0.00048)#$ | 9.61 (0.33)&^ |

|

| ||

| Weekly | 0.0063 (0.00058)#$ | 12.53 (0.48)*#$ |

|

|

||

| Monthly | 0.0091 (0.00081)*&$^ | 8.08 (0.31)&^ |

|

| ||

| Less than once in 6 months | 0.013 (0.00097)*&#^ | 8.23 (0.23)&^ |

|

|

||

| Never users | 0.0056 (0.00064)#$ | 13.94 (0.66)*#$ |

|

| ||

| Cigs + e-cigs Available | ||

|

|

||

| Daily | 0.084 (0.016)^ | 21.07 (2.16) |

|

| ||

| Weekly | 0.052 (0.012)^ | 23.47 (1.84) |

|

|

||

| Monthly | 0.041 (0.011) | 23.96 (2.46) |

|

| ||

| Less than once in 6 months | 0.048 (0.017) | 21.16 (1.60) |

|

|

||

| Never users | 0.024 (0.005)*& | 22.18 (2.20) |

|

|

||

p<0.05 difference from Daily group.

p<0.05 difference from Weekly group.

p<0.05 difference from Monthly group.

p<0.05 difference from Less than once in 6 months group.

p<0.05 difference from the Never users group.

HIGHLIGHTS.

Behavioral economics may be used to predict demand among dual users

Price and marketplace conditions do not affect frequency groups homogeneously

Frequent e-cigarette users showed lower cigarette demand

Frequent e-cigarette users showed higher e-cigarette demand

Frequent e-cigarette users showed greater e-cigarette substitution from cigarettes

Acknowledgments

ROLE OF FUNDING SOURCE This research was support by NIH grants U19CA157345, P01CA138389, P01CA200512, Virginia Tech Carilion Research Institute (VTCRI), and a small grant from the International Tobacco Control (ITC). The funding agencies had no additional role in study design, data collection, analysis and interpretation of the data, nor in the preparation and submission of the report, including the decision to submit.

Footnotes

CONTRIBUTORS

SES performed the study, data analyses, and wrote the first draft of the manuscript. KMC contributed conceptual feedback on the study and manuscript drafts. WKB conceived the study design, facilitated data analysis strategies, and edited manuscript drafts. All authors contributed to and approved the final manuscript.

CONFLICT OF INTERESTS

KMC has received grant funding from the Pfizer, Inc, to study the impact of a hospital-based tobacco cessation intervention, and has received funding as an expert witness in litigation filed against the tobacco industry. SES and WKB report no competing interests.

Publisher's Disclaimer: This is a PDF file of an unedited manuscript that has been accepted for publication. As a service to our customers we are providing this early version of the manuscript. The manuscript will undergo copyediting, typesetting, and review of the resulting proof before it is published in its final citable form. Please note that during the production process errors may be discovered which could affect the content, and all legal disclaimers that apply to the journal pertain.

References

- Bickel WK, DeGrandpre RJ, Higgins ST. The behavioral economics of concurrent drug reinforcers : A review and reanalysis of drug self - administration research. Psychopharmacology (Berl) 1995;118:250–259. doi: 10.1007/BF02245952. [DOI] [PubMed] [Google Scholar]

- Bickel WK, Madden GJ. A comparison of measures of relative reinforcing efficacy and behavioral economics: Cigarettes and money in smokers. Behav Pharmacol. 1999;10:627–637. doi: 10.1097/00008877-199911000-00009. [DOI] [PubMed] [Google Scholar]

- Bickel WK, Marsch LA, Carroll ME. Deconstructing relative reinforcing efficacy and situating the measures of pharmacological reinforcement with behavioral economics: A theoretical proposal. Psychopharmacology (Berl) 2000;153:44–56. doi: 10.1007/s002130000589. [DOI] [PubMed] [Google Scholar]

- Bickel WK, Moody LN, Snider SE, Mellis AM, Stein JS, Quisenberry AQ. The behavioral economics of tobacco products: Innovations in laboratory methods to inform regulatory science. In: Hanoch Y, Rice T, Barnes A, editors. Behavioral Economics and Health Behaviors: Key Concepts and Current Research. 2016. [Google Scholar]

- Caraballo RS, Jamal A, Nguyen KH, Kuiper NM, Arrazola RA. Electronic nicotine delivery system use among U.S. adults, 2014. Am J Prev Med. 2016;50:226–229. doi: 10.1016/j.amepre.2015.09.013. [DOI] [PubMed] [Google Scholar]

- Chaloupka FJ, Warner KE. Chapter 29 The economics of smoking. Handb Heal Econ. 2000;1:1539–1627. doi: 10.1016/S1574-0064(00)80042-6. [DOI] [Google Scholar]

- Delnevo CD, Giovenco DP, Steinberg MB, Villanti AC, Pearson JL, Niaura RS, Abrams DB. patterns of electronic cigarette use among adults in the United States. Nicotine Tob Res. 2016;18:715– 719. doi: 10.1093/ntr/ntv237. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Farsalinos K, Romagna G, Tsiapras D, Kyrzopoulos S, Spyrou A, Voudris V. Impact of flavour variability on electronic cigarette use experience: An internet survey. Int J Environ Res Public Health. 2013;10:7272–7282. doi: 10.3390/ijerph10127272. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Grace RC, Kivell BM, Laugesen M. Assessing the temporal stability of a cigarette purchase task after an excise tax increase for factory-made and roll-your-own smokers. Nicotine Tob Res. 2015a;17:1393–6. doi: 10.1093/ntr/ntv025. [DOI] [PubMed] [Google Scholar]

- Grace RC, Kivell BM, Laugesen M. Estimating cross-price elasticity of e-cigarettes using a simulated demand procedure. Nicotine Tob Res. 2015b;17:592–8. doi: 10.1093/ntr/ntu268. [DOI] [PubMed] [Google Scholar]

- Hatsukami DK, Vogel RI, Severson HH, Jensen JA, O’Connor RJ. Perceived health risks of snus and medicinal nicotine products. Nicotine Tob Res. 2016;18:794–800. doi: 10.1093/ntr/ntv200. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Heatherton TF, Kozlowski LT, Frecker RC, Fagerstrom KO. The Fagerstrom Test for Nicotine Dependence: A revision of the Fagerstrom Tolerance Questionnaire. Br J Addict. 1991;86:1119–1127. doi: 10.1111/j.1360-0443.1991.tb01879.x. [DOI] [PubMed] [Google Scholar]

- Huang J, Tauras J, Chaloupka FJ. The impact of price and tobacco control policies on the demand for electronic nicotine delivery systems. Tob Control. 2014;23(Suppl 3):iii41–7. doi: 10.1136/tobaccocontrol-2013-051515. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Hursh S. BEHAVIORAL ECONOMICS. J Exp Anal Behav. 1984;42:435–452. doi: 10.1901/jeab.1984.42-435. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Hursh S, Silberberg A. Economic demand and essential value. Psychol Rev. 2008;115:186–198. doi: 10.1037/0033-295X.115.1.186. [DOI] [PubMed] [Google Scholar]

- Hursh SR, Roma PG. Behavioral economics and empirical public policy. J Exp Anal Behav. 2013;99:98–124. doi: 10.1002/jeab.7. [DOI] [PubMed] [Google Scholar]

- Jacobs E, Bickel W. Modeling drug consumption in the clinic using simulation procedures: Demand for heroin and cigarettes in opioid-dependent outpatients. Exp Clin Psychopharmacol. 1999;7:412–426. doi: 10.1037//1064-1297.7.4.412. [DOI] [PubMed] [Google Scholar]

- Johnson MW, Bickel WK. The behavioral economics of cigarette smoking: The concurrent presence of a substitute and an independent reinforcer. Behav Pharmacol. 2003;14:137–144. doi: 10.1097/00008877-200303000-00005. [DOI] [PubMed] [Google Scholar]

- Johnson MW, Bickel WK, Kirshenbaum AP. Substitutes for tobacco smoking: A behavioral economic analysis of nicotine gum, denicotinized cigarettes, and nicotine-containing cigarettes. Drug Alcohol Depend. 2004;74:253–264. doi: 10.1016/j.drugalcdep.2003.12.012. [DOI] [PubMed] [Google Scholar]

- Kasza K, Ambrose B, Conway K, Taylor K, Cummings K, Goniewicz M, Sharma E, Pearson J, Bansal-Travers M, Travers M, Kwan J, Tworek C, Cheng Y, Yang L, Pharris-Ciurej N, van Bemmel D, Green V, Kaufman A, Borek N, Backinger C, Comptom W, Hyland A. Adult tobacco use in the United States in 2013/14: Findings from the Population Assessment of Tobacco and Health (PATH) Study, Wave 1. Society for Research on Nicotine and Tobabacoo; Chicago, IL: 2016. [Google Scholar]

- King BA, Alam S, Promoff G, Arrazola R, Dube SR. Awareness and ever-use of electronic cigarettes among U.S. adults, 2010–2011. Nicotine Tob Res. 2013;15:1623–7. doi: 10.1093/ntr/ntt013. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Koffarnus MN, Franck CT, Stein JS, Bickel WK. A modified exponential behavioral economic demand model to better describe consumption data. Exp Clin Psychopharmacol. 2015 doi: 10.1037/pha0000045. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Leech NL, Onwuegbuzie AJ. A Call for Greater Use of Nonparametric Statistics. Annual Meeting of the Mid-South Educational Research Association; 2002. pp. 3–24. [Google Scholar]

- Lewit EM, Coate D. The potential for using excise taxes to reduce smoking. J Health Econ. 1982;1:121–145. doi: 10.1016/0167-6296(82)90011-X. [DOI] [PubMed] [Google Scholar]

- MacKillop J, Few LR, Murphy JG, Wier LM, Acker J, Murphy C, Stojek M, Carrigan M, Chaloupka F. High-resolution behavioral economic analysis of cigarette demand to inform tax policy. Addiction. 2012;107:2191–200. doi: 10.1111/j.1360-0443.2012.03991.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Mackillop J, Murphy JG, Ray LA, Eisenberg DTA, Lisman SA, Lum JK, Wilson DS. Further validation of a cigarette purchase task for assessing the relative reinforcing efficacy of nicotine in college smokers. Exp Clin Psychopharmacol. 2008;16:57–65. doi: 10.1037/1064-1297.16.1.57. [DOI] [PubMed] [Google Scholar]

- Mackillop J, Murphy JG, Tidey JW, Kahler CW, Ray LA, Bickel WK. Latent structure of facets of alcohol reinforcement from a behavioral economic demand curve. Psychopharmacology (Berl) 2009;203:33–40. doi: 10.1007/s00213-008-1367-5. [DOI] [PMC free article] [PubMed] [Google Scholar]

- McMillen RC, Gottlieb MA, Shaefer RMW, Winickoff JP, Klein JD. Trends in electronic cigarette use among U.S. adults: Use is increasing in both smokers and nonsmokers. Nicotine Tob Res. 2015;17:1195–1202. doi: 10.1093/ntr/ntu213. [DOI] [PubMed] [Google Scholar]

- Murphy JG, MacKillop J, Tidey JW, Brazil LA, Colby SM. Validity of a demand curve measure of nicotine reinforcement with adolescent smokers. Drug Alcohol Depend. 2011;113:207–14. doi: 10.1016/j.drugalcdep.2010.08.004. [DOI] [PMC free article] [PubMed] [Google Scholar]

- O’Connor RJ, Heckman BW, Adkison SE, Rees VW, Hatsukami DK, Bickel WK, Cummings KM. Persistence and amplitude of cigarette demand in relation to quit intentions and attempts. Psychopharmacology (Berl) 2016;233:2365–2371. doi: 10.1007/s00213-016-4286-x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- O’Connor RJ, June KM, Bansal-Travers M, Rousu MC, Thrasher JF, Hyland A, Cummings KM. Estimating demand for alternatives to cigarettes with online purchase tasks. Am J Health Behav. 2014;38:103–13. doi: 10.5993/AJHB.38.1.11. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Onwuegbuzie AJ, Daniel LG. Uses and misuses of the correlation coefficient. Res Sch. 2002;9:73–90. [Google Scholar]

- Quisenberry AJ, Koffarnus MN, Hatz LE, Epstein LH, Bickel WK. The experimental tobacco marketplace I: Substitutability as a function of the price of conventional cigarettes. Nicotine Tob Res. 2016;18:1642–1648. doi: 10.1093/ntr/ntv230. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Rutten LJF, Blake KD, Agunwamba AA, Grana RA, Wilson PM, Ebbert JO, Okamoto J, Leischow SJ. Use of e-cigarettes among current smokers: Associations among reasons for use, quit intentions, and current tobacco use. Nicotine Tob Res. 2015;17:1228–1234. doi: 10.1093/ntr/ntv003. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Shiffman S, Sembower MA, Pillitteri JL, Gerlach KK, Gitchell JG. The impact of flavor descriptors on nonsmoking teens’ and adult smokers’ interest in electronic cigarettes. Nicotine Tob Res. 2015;17:1255–1262. doi: 10.1093/ntr/ntu333. [DOI] [PubMed] [Google Scholar]

- Stein JS, Koffarnus MN, Snider SE, Quisenberry AJ, Bickel WK. Identification and management of nonsystematic purchase task data: Toward best practice. Exp Clin Psychopharmacol. 2015;23:377–86. doi: 10.1037/pha0000020. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Stoklosa M, Drope J, Chaloupka FJ. Prices and e-cigarette demand: Evidence from the European Union. Nicotine Tob Res. 2016:ntw109. doi: 10.1093/ntr/ntw109. [DOI] [PubMed] [Google Scholar]

- Wilson AG, Franck CT, Koffarnus MN, Bickel WK. Behavioral economics of cigarette purchase tasks: Within-subject comparison of real, potentially real, and hypothetical cigarettes. Nicotine Tob Res. 2016;18:524–530. doi: 10.1093/ntr/ntv154. [DOI] [PMC free article] [PubMed] [Google Scholar]