Abstract

Objectives

To determine if Medicare Shared Savings Program (MSSP) accountable care organizations (ACOs) are meeting public reporting requirements related to shared savings plans, to quantitate the composition of shared savings distribution plans, and to investigate whether early ACO success is associated with specific plan or ACO characteristics.

Study Design

Cross-sectional study.

Methods

ACO descriptive characteristics and distribution plan details were abstracted from official ACO websites for all 338 active MSSP ACOs launched through January 2014. Publicly available MSSP results from 2012 and 2013 start date ACOs were used to investigate associations with successful shared savings generation.

Results

Of current MSSP ACOs, 313 of 338 (93%) maintain a website, 284 of 338 (84%) provided at least a general statement about shared savings distributions, and 176 of 338 (52%) reported detailed allocation percentages to ACO participants. On average, ACOs reporting detailed allocations planned to give 63% (range = 0%–100%; SD = 26.3) to their primary care providers (PCPs), specialists, and/or hospitals, and 33% (range = 0%–100%; SD = 25.6) to infrastructure. ACOs including a hospital planned to give a larger average percentage to participating entities than those without (69% vs 58%; P = .01). ACOs planning to give >50% to their PCPs and specialists were more likely to have generated savings (P = .001), as were ACOs composed of >10 participating entities (P = .004).

Conclusions

Just over one-half of MSSP ACOs report detailed shared savings distribution plans online, and these plans vary widely. There appears to be no single shared savings distribution plan determinate of ACO success. Continued investigation of predictors for generating savings is needed to inform future shared savings models.

More than 440 Medicare accountable care organizations (ACOs) have been established nationwide since the Affordable Care Act was passed in 2010.1,2 Medicare ACOs in the Medicare Shared Savings Program (MSSP) and Pioneer ACO programs voluntarily contract with Medicare to be responsible for the health outcomes and expenditures of a defined patient population. ACOs aim to promote higher-quality care and to reduce the growth of healthcare costs through improved care coordination, care management programs, information technology, and other interventions,3–5 and when ACOs succeed in these goals, they may share in the cost savings with Medicare. These potential “shared savings” are 1 important driver for ACO formation.6

Early results are modest.7 Of MSSP ACOs that initiated operations in 2012 or 2013, 118 (54%) lowered expenditures compared with benchmark projections. In total, these ACOs generated $383 million in net savings for Medicare during their first performance year, with 52 ACOs earning shared savings payments of more than $315 million.8 ACOs (and ACO-like models) continue to form, including in the commercial insurance sector and in state-based Medicaid programs.9–11 Nevertheless, significant questions remain about the financial viability of the ACO model.12,13

Specific regulatory requirements governing the MSSP provide an opportunity to examine important questions about what ACOs plan to do with their shared savings (ie, their “shared savings distribution plans”). The MSSP requires ACOs to initially submit their shared savings plan in their application to the MSSP program, and later to publicly report their distribution plans on required ACO websites.14 Guidance suggests that MSSP ACOs should also describe the percentage of total shared savings that will be allocated to infrastructure, primary care providers (PCPs), specialists, and hospitals in the ACO. Importantly, Medicare ACOs have flexibility in how they use shared savings, as long as use is consistent with the ACO program mission15; shared savings payments to beneficiaries, however, are not permitted.

Whether and how ACOs are meeting these policy requirements is unknown but of significant interest to all stakeholders,16,17 and patients may be interested in whether savings benefit them directly (eg, via new care programs and interventions) or indirectly (eg, via incentives to clinicians and hospitals to improve care quality).18 Although savings distribution to ACO PCPs and specialists is considered a key component of ACO success, how much and on what basis ACOs will do so is unspecified and unknown.19 Finally, ACO leaders and policy makers may be interested in what ACOs are doing regarding shared savings, because savings distribution plans likely reflect ACO strategic planning and what ACOs believe will help to incentivize desired care patterns.20

The objective of this study was to begin describing the landscape of how MSSP ACOs publicly report and plan to use their shared savings. We also conducted a preliminary investigation on whether certain ACO organizational characteristics appear to be associated with certain intended uses of shared savings. Finally, using early results from the MSSP, we examined whether certain organizational characteristics or shared savings distribution plan design elements are associated with ACO financial success.

STUDY DATA AND METHODS

Study Sample

We examined the official ACO websites for all 338 active MSSP ACOs initiated in April and July 2012, January 2013, and January 2014. At the time of our study, 5 ACOs had been approved to participate, but were not included in the CMS database of active ACOs (these were not included in this analysis).21 Website addresses were found using information available on the CMS website,21 but because the CMS website did not include website addresses for the January 2014 start date, we located these on the Internet. Among 338 ACOs, 322 had an available official website for review; all 16 ACOs without a website locatable by routine search methods were in the January 2014 group. Pioneer ACOs were excluded from analysis.

Data Abstraction Strategy

We designed a data abstraction strategy based upon information expected from MSSP public disclosure requirements14 and our study objectives, such as key ACO descriptive characteristics and composition, public reporting, and proposed shared savings distribution plan features (eg, percentage of distribution to infrastructure). A data abstraction form covering these domains is not publicly available to our knowledge; therefore, we developed one to capture desired data. We piloted a draft form on a subset (n = 30) of ACOs from the July 2012 group, then met and revised the form into a final version (eAppendix Table, available at www.ajmc.com). This version was used to collect data on all MSSP ACOs from June 3 through July 23, 2014.

Some variables collected during data abstraction warrant explication. We hypothesized that organizational complexity might affect shared savings plan characteristics or ACO success, because larger, more complex organizations may complicate how an ACO forms and operates. As a proxy of complexity, we collected data on the number of individual entities (ie, clinicians, clinician group practices, hospital, and/or other participating providers) participating in each ACO. We refer to this as the number of “participating entities” in each ACO. To illustrate, by our definition, an integrated health system that forms an ACO within its existing organizational structure has 1 participating entity, whereas an ACO that forms from a private practitioner, a group practice, a multi-specialty group, and a hospital—all of whom were previously unaffiliated as defined by ACO rules—would have 4 participating entities. Our use of participating entity is generally consistent with the CMS regulatory definition of an ACO participant.15

We also hypothesized that ACO composition might affect shared savings plan characteristics or success. Although ACO regulations refer to ACO “providers,”15 we identified whether an ACO included hospitals, PCPs, and specialists from information provided on official ACO websites. Whether an individual or group practice in an ACO is primary care or specialty may not be evident by name alone; therefore, we independently confirmed these practices in all cases by reviewing their websites. Moreover, because an ACO composed of a single participating entity (such as an integrated health system) might include multiple clinician groups (such as PCPs, specialists, and hospitals) relevant for shared savings plan characteristics, we elucidated the composition of these ACOs in similar fashion.

We also believed it was important to assess whether involvement of an external stakeholder might affect shared savings distribution plans. We defined “external stakeholder involvement” as present when an external stakeholder investor or company representative (not apparently otherwise affiliated with an ACO participating entity) was present on the governing board, or when the distribution plan included distributions to investors/shareholders.

Analysis

Shared savings distribution plans were analyzed to determine if the composition of ACOs or the presence of external stakeholders were associated with differences in distribution plans. Once early MSSP financial performance results became available, we examined the 58 ACOs that generated savings to determine whether certain ACO characteristics or shared savings distribution plans were associated with success in generating shared savings.22

Study data were collected and managed using REDCap version 5,23 and statistical analysis was conducted using STATA version 11 (StataCorp, College Station, Texas). For comparisons of categorical variables, a χ2 test was used, and for comparisons of means, an unpaired t test was utilized.

RESULTS

General ACO Characteristics

We found that 313 (93%) of the MSSP ACOs have information regarding their composition publicly available on their website. Of these ACOs, 131 (42%) have more than 20 participating entities, while 42 (13%) are composed of only 1 (Table). More specifically, 140 (45%) included PCPs, specialists, and hospitals, 124 (40%) had PCPs and specialists, while 49 (16%) were composed entirely of primary care physicians. Those meeting our definition of involving external stakeholders numbered 67 (21%).

Table.

Characteristics of Accountable Care Organizations in the Medicare Shared Savings Program

| Start date | Number of ACOs |

|---|---|

| April 2012 | 27 |

| July 2012 | 87 |

| January 2013 | 105 |

| January 2014 | 119 |

| Total number of active ACOsa | 338 |

| Number of ACOs with a website | 322 |

| Number of ACOs with organizational details on websiteb | 313 |

| Number of ACOs with shared savings distribution plan on website (includes “to be determined”)c | 285 |

| Number of ACOs with actual shared savings percentage allocations onlined | 176 |

| Number of participating entities in ACO | 313 reporting |

| 1 | 42 (13.4%) |

| 2–5 | 43 (13.7%) |

| 6–10 | 40 (12.8%) |

| 11–20 | 57 (18.2%) |

| 20 or more | 131 (41.9%) |

| Composition | 313 reporting |

| PCPs only | 49 (15.7%) |

| PCPs and specialists | 124 (39.6%) |

| PCPs, specialists, and hospital(s) | 140 (44.7%) |

| Academic medical centerse | 49/338 (14.5%) |

| External stakeholdersf | 313 reporting |

| Yes | 67 (21.4%) |

| No | 246 (78.6%) |

ACO indicates accountable care organization; PCP, primary care provider.

Only active ACOs, based on a public CMS database, were analyzed.

Only 313 of the active ACOs had a publicly available list of their participating members and governing board composition.

Of all ACOs, 285 stated how their savings would be distributed and either stated that their plan was “to be determined,” had general statements, or had a detailed plan with specific percentage allocations.

Of all ACOs, 176 have provided detailed plans with particular percentage distributions to various categories.

An ACO that included at least 1 Association of American Medical Colleges member institution was termed an academic medical center.

External stakeholders were determined by a distribution to an investor/shareholder or by an outside entity holding a seat on the governing board.

In rare instances, other types of clinicians were noted as being in the ACO. These included chiropractors, podiatrists, hospice, clinical laboratories, home care, pharmacies, dentists, physical therapists, optometrists, senior living centers, social services, and others. Among all ACOs, 49 (14%) included an academic medical center (AMC).

Public Reporting of Shared Savings Distribution Plans

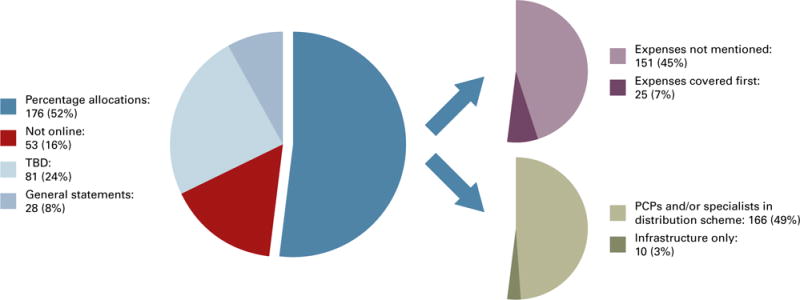

We found that 285 (84%) ACOs publicly reported their shared savings distribution plan in various levels of detail. Of these 285, 81 (28%) had “to be determined” (TBD) listed under their savings distribution plan, 28 (10%) had general statements regarding how distributions would be allocated (eg, “to incentivize physicians and build infrastructure”) but without specific percentages, and 176 (62%) had detailed plans with specific percentages of the savings allocated to distinct categories (Figure 1).

Figure 1. Online Reporting of Shared Savings Distribution Plans.

PCP indicates primary care provider; TBD, to be determined.

Of the 338 active accountable care organizations (ACOs), 285 had their shared savings distribution plan online. These plans either stated that their plan was “to be determined,” had general statements, or had a detailed plan with specific percentage allocations.

Of the 176 plans with percentage allocations online, 25 of them mentioned that any shared savings received would be used to cover ACO expenses before distributions would be given to participating entities and 151 plans did not mention if savings would be used to cover expenses.

Of the 176 plans with percentage allocations online, 166 included an allocation for PCPs and/or specialists in their distribution scheme and 10 planned to reinvest 100% of savings into ACO infrastructure.

Shared Savings Distribution Plans

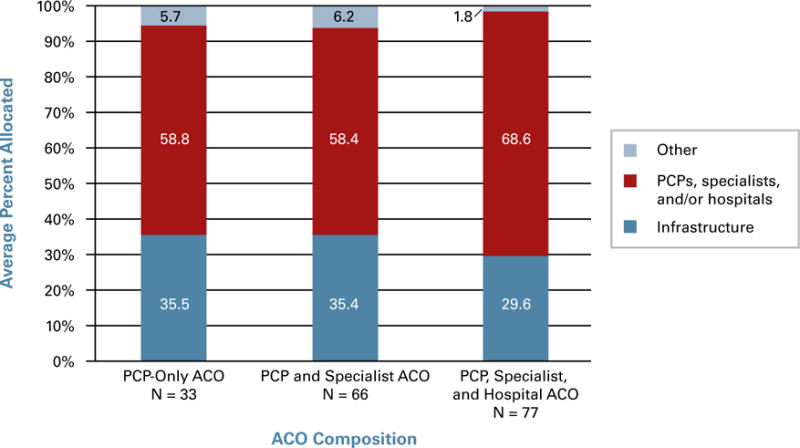

Among 176 MSSP ACOs with detailed plans available, 155 (88%) reported savings allotments for infrastructure (mean amount = 33%; range = 0%–100%; SD = 25.6; median = 25%); 166 (94%) reported savings allotments to their PCPs, specialists, and/or hospitals (mean amount = 63%; range = 0%–100%; SD = 26.3; median = 70%); and 29 (16%) reported savings apportionments for “other” reasons, such as investor allocations or payments to “strategic partners” or a “specialty advisory committee” (mean amount = 4%; range = 0%–50%; SD = 11.7; median = 0%) (Figure 2). Of note, 25 (14%) ACOs with detailed plans available reported planning to use shared savings to cover any expenses before apportioning savings to any participants (Figure 1).

Figure 2. Shared Savings Distribution Schemes.

ACO indicates accountable care organization; PCP, primary care provider.

PCPs were considered to be physicians who had a primary specialty designation of family medicine, internal medicine, or geriatric medicine. The percentages reported represent the average of the individual ACO percentage allocations for each category. The “other” category represents allocations given to investors/shareholders and non-ACO participants. ACOs including a hospital allocated a larger percentage of shared savings to PCPs, specialists, and/or hospitals within the ACO (P = .01).

In 166 cases, shared savings allocations were broken down into amounts for hospitals, PCPs, and specialists. Of the 77 ACOs including a hospital, 42 (55%) reported a specific percent designation to the hospital (mean amount = 9%; range = 0%–60%; SD = 15.0; median = 0%). Of the 166 ACOs reporting allocations to participating entities 137 (83%) designated a specific percent for clinicians, including PCPs and specialists (mean amount = 58%; range = 12.5%–100%; SD = 20.3; median = 59%). Of these 137, 95 (69%) reported specific allocations for PCPs (mean amount = 49%; range = 6.25%–100%; SD = 21.2; median = 50%) and specialists (mean amount = 11%; range = 0%–48%; SD = 12.5; median = 6%).

Finally, 46 plans (16% of plans with distribution plans online) explicitly referenced patients’ potential to benefit from shared savings. Furthermore, 16 (6%) referenced specific new programs that would be started to benefit patients and funded by shared savings. Examples included hiring case managers or launching educational sessions for patients.

Shared Savings Distribution Plans by ACO Type

Comparing the ACOs composed solely of PCPs to the ACOs with PCPs and specialists showed little difference in the distribution to each category (Figure 2). However, ACOs that included hospitals gave a larger average percentage to PCPs, specialists, and/or hospitals within the ACO compared with those without (69% vs 58%; P = .01).

Compared with all active ACOs, ACOs with external stakeholders had a higher percentage of plans that were TBD (55% vs 18%; P <.001) and a lower percentage of plans with specific percentage allocations listed (36% vs 62%; P <.001). In addition, compared with the 152 ACOs without external stakeholders, ACOs with external stakeholders planned to give a smaller average percentage to PCPs, specialists, and/or hospitals within the ACO (53% vs 65%; P = .04).

Shared Savings Distribution Plans and Financial Performance

No differences in the ability to generate savings were found between ACOs based on the inclusion of a hospital, AMC, or external stakeholder in the ACO.

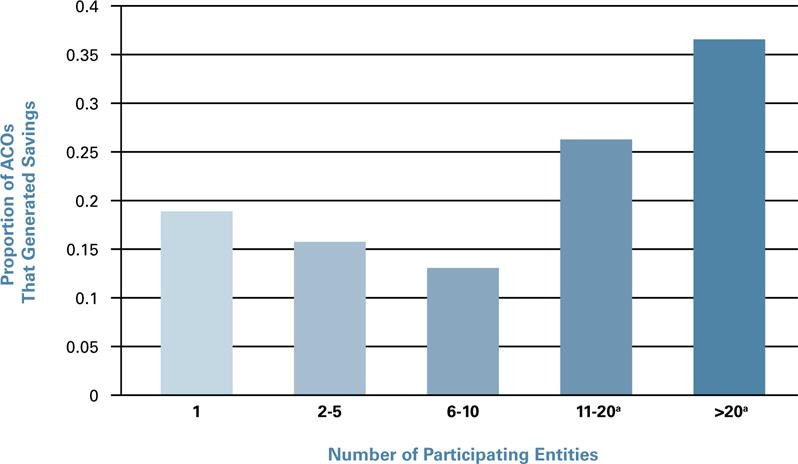

We also calculated the proportion of ACOs that generated savings based on numbers of participating entities within an ACO (Figure 3). ACOs with 6 to 10 participating entities were the least likely to have generated savings (13%), while ACOs with more than 20 participating entities were most likely to have generated savings (37%).

Figure 3. Proportion of MSSP ACOs That Generated Savings in Performance Year 1 by Number of Participating Entities.

ACO indicates accountable care organization; MSSP, Medicare Shared Savings Program.

aACOs with more than 10 participating entities were statistically more likely to have achieved shared savings (P =.004).

This graph reflects the 58 MSSP ACOs with a 2012 or 2013 start date that generated savings and were eligible to receive a shared savings payment. An ACO participant is “an individual or group of ACO providers/suppliers that is identified by a Medicare-enrolled tax ID number, that alone or together with 1 or more other ACO participants composes the ACO, and that is included on the list of ACO participants required to be submitted as part of the MSSP application.”15 The number of participating entities was determined from publicly available information on each ACO’s website.

No association was found between the percentage of shared savings allocated to PCPs, specialists, and/or hospitals within the ACO versus infrastructure and the ability to generate savings. However, we found that ACOs that planned to distribute greater than 50% of shared savings to PCPs and specialists were associated with a higher probability of generating savings compared with those that did not (39% vs 22%; P = .001). Similarly, we found that ACOs that planned to distribute greater than 60% of shared savings to PCPs were more likely to have generated savings compared with those that did not (53% vs 24%; P = .01).

DISCUSSION

Our study describes the landscape of MSSP ACO shared savings distribution plans with a focus on public reporting, plan details, and the association between ACO organizational or distribution plan characteristics and ACO early financial success in generating shared savings.

Most MSSP ACOs are meeting the basic public reporting guidelines related to their shared savings distribution plans, as set forth by CMS. Nearly 85% of all 338 ACOs included basic information about distribution plans; only about half, however, included planned percentage distributions to PCPs, specialists, and/or hospitals within the ACO. ACOs with external stakeholders were less likely than other ACOs to report such details.

There are several possible explanations for this finding. First, all of the ACOs without a website were in the January 2014 start date, and these ACOs might have created websites since the study was conducted mid-year, or the websites existed but were unable to be found with normal search functions. Second, since initial public reporting guidance was issued in 2012, CMS has issued updated guidance in September 2014 that explicitly clarifies that ACOs must adhere to the reporting format of CMS.14,24

From a broader perspective, reporting of discrete percentages (as opposed to not reporting them, or reporting TBD) may or may not be equivalent to transparency. The complexity, uncertainty, and dynamic nature of an ACO’s shared savings distribution plan pose challenges for static posting online. For example, an ACO may be unable to predict all operational costs or clinical program needs in advance of applying to CMS. For such an organization to post discrete percentages—when such percentages are almost certain to change—it could actually work against the ethical value of transparency. Because at present there is little evidence regarding how different ACO stakeholders (including their patients) perceive different ways of reporting shared savings, future research could investigate how (if at all) reporting affects perceptions, trust, and buy-in to the ACO.25

We found that MSSP ACOs vary widely in their infrastructure as well as in planned shared savings allocations toward their PCPs, specialists, and/or hospitals (Figure 2). Overall, these findings are consistent with the intent of CMS MSSP regulations, which give ACOs flexibility to determine distribution plans tailored to a particular ACO’s needs for meeting program goals.

We also found several notable associations between ACO characteristics and distribution plans. First, ACOs that included a hospital planned to allocate a larger percentage of shared savings to PCPs, specialists, and/or hospitals within the ACO compared with ACOs without hospitals. This may be because hospitals have fewer infrastructure needs initially compared with nonhospital ACOs, but determining the exact reasons for this association requires further in-depth study.26–28 Second, ACOs involving external investors or organizations planned to give a smaller percentage of shared savings to the ACO’s PCPs, specialists, and/or hospitals. This could be for several reasons: some savings might need to be distributed to the investors, leaving a lesser share available for participating entities; or alternatively, ACOs with external investors may have other financial arrangements in lieu of shared savings.29

We found few associations between ACO organizational or distribution plan characteristics and ACO early financial success. In terms of organizational characteristics, our most notable finding was that ACOs with over 20 participating entities were most likely to have generated savings (Figure 3). Although not statistically significant (perhaps due to the low number of ACOs examined), there appeared to be a U-shaped relationship, whereby ACOs with 6 to 10 participating entities were least likely to have generated savings. The reasons for this may be complex. For ACOs with fewer participating entities, greater control over care delivery may make it easier to implement new programs and care patterns necessary for success. For larger ACOs, ACO participating entity number could be a proxy for ACO size (in terms of patient number or diversity) or for operational complexity in functioning in an aligned manner. This finding merits further in-depth investigation.

In terms of other ACO characteristics, we found that ACOs distributing the majority of their savings to PCPs and specialists were more likely to have generated savings in their first operational year. No association existed between the generation of savings and amounts allocated to specialists, but ACOs distributing over 60% of savings to PCPs were more likely to have generated savings.

While these findings are not necessarily causal, intuitively, a greater potential monetary reward for individual clinicians, if well advertised to the participating provider community, could help incentivize behavior change and generate buy-in to the overall goals of the ACO. It is possible that specific distribution thresholds may play a factor in altered perceptions of individual providers. For example, individual clinicians may not change their behavior in response to a 10% or 30% distribution, but once the allocation rises above a certain threshold, they may be more willing to change their behavior. While robust relationships have yet to be established, preliminary data suggest that in order to generate savings, ACOs should consider allocating significant percentages of savings to providers, specifically PCPs.

Limitations

Our study had limitations. First, all data were based upon publicly available information at the time of our study. Data were not verified with the 338 ACOs examined, and shared savings plan characteristics may change over time. Second, as our results show, only 176 (52%) of the 338 ACOs publicly reported specific percentage distributions to PCPs, specialists, and/or hospitals within the ACO. Distribution plans without this detail may differ, limiting our ability to make generalizable or detailed claims about how ACOs are using shared savings. This, as well as heterogeneity in data reporting, also prevented us from conducting regression analyses; as more data emerge, these could be considered in the future.

CONCLUSIONS

By examining publicly reported shared savings distribution plans of MSSP ACOs, we have described for the first time the landscape of how MSSP ACOs report and plan to use their shared savings. Most ACOs are meeting CMS reporting guidelines, but many are not reporting detailed characteristics of their planned shared savings allocations. Allocations of those that do report, vary widely. We found that ACOs that planned to distribute a majority of their savings to providers were more likely to have generated savings, as were ACOs with larger (>10) numbers of participating entities. However, no 1 common path yet exists for ACOs in terms of shared savings uses. Our findings, while preliminary, generate important hypotheses for future research. As ACOs evolve, it will be critical to continue examining how different stakeholders perceive shared savings distribution plan reporting and whether certain distribution plan characteristics may be associated with ACO success or failure.

Supplementary Material

Take-Away Points.

Analysis of publicly reported organizational characteristics, shared savings distribution plans, and early financial success of accountable care organizations (ACOs) in the Medicare Shared Savings Program (MSSP) demonstrated that:

-

■

Most ACOs are meeting their public reporting requirements related to shared savings distribution plans.

-

■

ACOs vary widely in how they plan to distribute shared savings.

-

■

In a preliminary investigation using early MSSP ACO results, ACOs that planned to allocate the majority of shared savings to their primary care providers and specialists or were composed of more individual participating entities (ie, clinicians, clinician group practices, hospital, and/or other participating providers) were more likely to have generated savings.

Acknowledgments

Source of Funding: Dr DeCamp’s work on this manuscript was funded by grant 1K08HS023684 from the Agency for Healthcare Research and Quality.

Footnotes

Author Disclosures: Dr Berkowitz is the executive director for Johns Hopkins Medicine Alliance for Patients, LLC, the Johns Hopkins Medicine accountable care organization. The authors report no relationship or financial interest with any entity that would pose a conflict of interest with the subject matter of this article.

Authorship Information: Concept and design (JS, MD, SAB); acquisition of data (JS); analysis and interpretation of data (JS, MD, SAB); drafting of the manuscript (JS, MD); critical revision of the manuscript for important intellectual content (JS, SAB); statistical analysis (JS); and supervision (SAB).

References

- 1.Program news and announcements. CMS; website. http://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/sharedsavingspro-gram/News.html. Published December 22, 2014. Accessed January 27, 2015. [Google Scholar]

- 2.Berkowitz SA, Miller ED. Accountable care at academic medical centers–lessons from Johns Hopkins. N Engl J Med. 2011;364(7):e12. doi: 10.1056/NEJMp1100076. [DOI] [PubMed] [Google Scholar]

- 3.Fisher ES, Shortell SM, Kreindler SA, Van Citters AD, Larson BK. A framework for evaluating the formation, implementation, and performance of accountable care organizations. Health Aff (Millwood) 2012;31(11):2368–2378. doi: 10.1377/hlthaff.2012.0544. [DOI] [PubMed] [Google Scholar]

- 4.Colla CH, Wennberg DE, Meara E, et al. Spending differences associated with the Medicare Physician Group Practice Demonstration. JAMA. 2012;308(10):1015–1023. doi: 10.1001/2012.jama.10812. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 5.Shortell SM, Casalino LP. Implementing qualifications criteria and technical assistance for accountable care organizations. JAMA. 2010;303(17):1747–1748. doi: 10.1001/jama.2010.575. [DOI] [PubMed] [Google Scholar]

- 6.Siddiqui M, Berkowitz SA. Shared savings models for ACOs-incentivizing primary care physicians. J Gen Intern Med. 2014;29(6):832–834. doi: 10.1007/s11606-013-2733-5. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 7.Toussaint J, Milstein A, Shortell S. How the Pioneer ACO Model needs to change: lessons from its best-performing ACO. JAMA. 2013;310(13):1341–1342. doi: 10.1001/jama.2013.279149. [DOI] [PubMed] [Google Scholar]

- 8.Medicare ACOs continue to succeed in improving care, lowering cost growth. CMS; website. http://www.cms.gov/Newsroom/MediaReleaseDatabase/Fact-sheets/2014-Fact-sheets-items/2014–11–10.html. Published Published November 7, 2014. Accessed January 21, 2015. [Google Scholar]

- 9.Petersen M, Gardner P, Tu T, Muhlestein D. Growth and dispersion of accountable care organizations: June 2014 update. Salt Lake City, UT: Leavitt Partners; 2014. [Google Scholar]

- 10.McGinnis T. Advancing accountable care organizations in Medicaid. Commonwealth Fund; website. http://www.commonwealthfund.org/publications/blog/2012/aug/advancing-accountable-care-organizations-in-medicaid. Published August 15, 2012. Accessed October 1, 2014. [Google Scholar]

- 11.Tallia AF, Howard J. An academic health center sees both challenges and enabling forces as it creates an accountable care organization. Health Aff (Millwood) 2012;31(11):2388–2394. doi: 10.1377/hlthaff.2012.0155. [DOI] [PubMed] [Google Scholar]

- 12.Moore K, Coddington D. The work ahead: activities and costs to develop an accountable care organization. American Heart Association; website. www.aha.org/content/11/aco-white-paper-cost-dev-aco.pdf. Published April 2011. Accessed August 1, 2014. [Google Scholar]

- 13.Berkowitz SA, Pahira JJ. Accountable care organization readiness and academic medical centers. Acad Med. 2014;89(9):1210–1215. doi: 10.1097/ACM.0000000000000365. [DOI] [PubMed] [Google Scholar]

- 14.Medicare Shared Savings Program public reporting guidance, version 2. CMS; website. http://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/sharedsavingsprogram/Downloads/ACO-Public-Reporting-Guidance.pdf. Updated September 16, 2014. Accessed January 28, 2015. [Google Scholar]

- 15.CMS, HHS. Medicare program: Medicare Shared Savings Program: accountable care organizations. final rule. Fed Regist. 2011;212(76):67,802–67,990. [PubMed] [Google Scholar]

- 16.DeCamp M, Sugarman J, Berkowitz S. Shared savings in accountable care organizations: how to determine fair distributions. JAMA. 2014;311(10):1011–1012. doi: 10.1001/jama.2014.498. [DOI] [PubMed] [Google Scholar]

- 17.Dupree JM, Patel K, Singer SJ, et al. Attention to surgeons and surgical care is largely missing from early Medicare accountable care organizations. Health Aff (Millwood) 2014;33(6):972–979. doi: 10.1377/hlthaff.2013.1300. [DOI] [PubMed] [Google Scholar]

- 18.McWilliams JM, Landon BE, Chernew ME, Zaslavsky AM. Changes in patients’ experiences in Medicare accountable care organizations. N Engl J Med. 2014;371(18):1715–1724. doi: 10.1056/NEJMsa1406552. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 19.Engelberg Center for Health Care Reform, The Dartmouth Institute. ACO toolkit. Washington, DC: The Brookings Institution; 2011. [Google Scholar]

- 20.Shortell SM, Wu FM, Lewis VA, Colla CH, Fisher ES. A taxonomy of accountable care organizations for policy and practice. Health Serv Res. 2014;49(6):1883–1899. doi: 10.1111/1475-6773.12234. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 21.Medicare Shared Savings Program accountable care organizations. CMS; website. https://data.cms.gov/ACO/Medicare-Shared-Savings-Program-Accountable-Care-O/ay8x-m5k6Published 2014. Accessed July 7, 2014. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 22.Medicare Shared Savings Program accountable care organizations performance, year 1 results. CMS; website. https://data.cms.gov/ACO/Medicare-Shared-Savings-Program-Accountable-Care-O/yuq5–65xt. Published 2014. Accessed January 21, 2015. [Google Scholar]

- 23.Harris P, Taylor R, Thielke R, Payne J, Gonzalez N, Conde J. Research electronic data capture (REDCap) – a metadata-driven methodology and workflow process for providing translational research informatics support. J Biomed Inform. 2009;42(2):377–381. doi: 10.1016/j.jbi.2008.08.010. [DOI] [PMC free article] [PubMed] [Google Scholar]

- 24.Shared Savings Program public reporting guidance, version 2. CMS; website. http://www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/sharedsavingsprogram/Downloads/ACO-Public-Reporting-Guidance.pdf. Published September 16, 2014. Accessed July 23, 2015. [Google Scholar]

- 25.McWilliams JM, Chernew ME, Dalton JB, Landon BE. Outpatient care patterns and organizational accountability in Medicare. JAMA Intern Med. 2014;174(6):938–945. doi: 10.1001/jamainternmed.2014.1073. [DOI] [PubMed] [Google Scholar]

- 26.Lee TH, Casalino LP, Fisher ES, Wilensky GR. Creating accountable care organizations. N Engl J Med. 2010;363(15):e23. doi: 10.1056/NEJMp1009040. [DOI] [PubMed] [Google Scholar]

- 27.Epstein AM, Jha AK, Orav EJ, et al. Analysis of early accountable care organizations defines patient, structural, cost, and quality-of-care characteristics. Health Aff (Millwood) 2014;33(1):95–102. doi: 10.1377/hlthaff.2013.1063. [DOI] [PubMed] [Google Scholar]

- 28.Camargo R, Camargo T, Deslich S, Paul DP, 3rd, Coustasse A. Accountable care organizations: financial advantages of larger hospital organizations. Health Care Manag (Frederick) 2014;33(2):110–116. doi: 10.1097/HCM.0000000000000004. [DOI] [PubMed] [Google Scholar]

- 29.Manos D. CHS is partnered with third of new Shared Savings ACOs. Healthcare IT News website. http://www.healthcareitnews.com/news/chs-partnered-third-new-shared-savings-acos. Published July 10, 2012. Accessed November 2, 2014.

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.