Abstract

Objectives

The objectives of this study were threefold: (1) to empirically test the conceptual model proposed by the Lichtenberg Financial Decision Rating Scale (LFDRS); (2) to examine the psychometric properties of the LFDRS contextual factors in financial decision-making by investigating both the reliability and convergent validity of the subscales and total scale, and (3) extending previous work on the scale through the collection of normative data on financial decision-making.

Methods

A convenience sample of 200 independent function and community dwelling older adults underwent cognitive and financial management testing and were interviewed using the LFDRS. Confirmatory factor analysis, internal consistency measures, and hierarchical regression were used in a sample of 200 community-dwelling older adults, all of whom were making or had recently made a significant financial decision.

Results

Results confirmed the scale’s reliability and supported the conceptual model. Convergent validity analyses indicate that as hypothesized, cognition is a significant predictor of risk scores. Financial management scores, however, were not predictive of decision-making risk scores.

Conclusions

The psychometric properties of the LFDRS support the scale’s use as it was proposed in Lichtenberg et al., 2015.

Clinical Implications

The LFDRS instructions and scale are provided for clinicians to use in financial capacity assessments.

Keywords: Financial capacity, Cognitive impairment, financial decision-making

Introduction

In 2007, Moye and Marson noted that few working models of financial capacity were available. The following year, the APA/ABA’s (2008) Assessment of Older Adults with Diminished Capacity stated that unlike clinical judgment scales for the assessment of capacity for medical treatment, no such scales existed for financial capacity. As is often the case with gerontology, it can be difficult to translate scales that were developed to measure age-related changes—or even neurodegenerative disease-related changes—into clinical practice. Most financial capacity measures include a number of financial domains, such as bill paying, checkbook management, and cash transactions (see Marson, 2001), yet the legal standards for financial incapacity are strongly related to informed (financial) decision-making. The rating scale we present here was created to measure clinical judgment of capacity (i.e., capacity for a specific decision or transaction).

Financial capacity as applied to this paper is the capacity for financial transactions as applied to legal standards (i.e. a new rating scale that measures informed financial decision making for actual decisions/transactions). This paper will examine the empirical support for a conceptual model described by Lichtenberg, Stoltman, Ficker, Iris, and Mast (2015) and the reliability and validity of the measure’s rating scale. The financial decision-making scale examined is unique, in that it focuses on an actual financial decision(s) and/or transaction(s) and incorporates contextual variables specific to financial decision-making, and therefore goes beyond financial management skills, cognition, or rational decision-making by incorporating financial situational awareness (e.g., self-efficacy, financial strain), psychological vulnerability regarding finances, and susceptibility to undue influence and/or exploitation.

Literature Review

Applied Research in Financial Capacity and Decision-making

Examining how neurocognitive disorders impact aspects of financial competency has had the greatest impact on the field of financial capacity

In his review of conceptual frameworks for the assessment of financial capacity, Marson (2016) categorized his own approach as a clinical model for financial capacity. He argued that eight domains of financial capacity are necessary for independent functioning (e.g., basic monetary skills, checkbook management, bill payment, financial judgment). In Marson’s earlier (2001) clinical research with persons with dementia, he created the Financial Capacity Inventory (FCI) to measure financial capacity across these eight domains. His research provided supporting evidence that the impact of age-related dementia (e.g., Alzheimer’s disease) is one of the biggest challenges to intact financial capacity—most notably, FCI scores were strongly linked to the person’s stage of Alzheimer’s disease. For instance, in examining the eight domains of financial activity among study participants in the mild stage of Alzheimer’s, 53%, 47%, and 13% were rated as fully capable of, respectively, basic monetary skills, financial concepts, and financial judgment. In contrast, only 10%, 5%, and 0% of those in the moderate stage were rated as fully capable in the same domains. Fifty percent of those with mild stage Alzheimer’s disease were judged capable or marginally capable of financial judgment.

Sherod et al. (2009) extended Marson’s work by investigating the neurocognitive predictors of financial capacity domains across 85 healthy normal elders, 113 older adults with Mild Cognitive Impairment (MCI), and 43 with mild Alzheimer’s disease. Arithmetic ability was the single best predictor of FCI scores, accounting for 27% of the variance in healthy elders and 46% in those with mild Alzheimer’s disease. In terms of self-assessment by older adults, Okonkwo et al. (2009) found that even those in the early stages of cognitive decline were more likely to overestimate their cognitive skills than normal controls. Financial judgment, however, remained an area in which those with MCI were as accurate in assessing their abilities as normal controls. Sherod et al.’s findings demonstrate that impaired cognition, even as early as MCI, impacts financial capacity in certain domains and that neuropsychological tests are significantly related to these financial capacity domains. Taken together, these studies strongly suggest that financial capacity domains are highly related to cognitive functioning, and that declines are quite prevalent early in neurocognitive disorders.

Belbase and Sanzenbacher (2017) provide further support for a decline in financial capacity with the onset of dementia. Using data from a variety of sources, including the Health and Retirement Survey, they found that adults in their 70s and 80s are just as likely to be able to pay bills, manage debt, and maintain good credit as are people in their 50s and 60s. The authors did recognize, however, the impact of cognitive impairment on these financial abilities: 95% of older adults with no cognitive impairment could manage their finances well; in contrast, only 82% of those with MCI could do so, and a scant 20% of those with dementia. Based on these results, Belbase and Sanzenbacher argue that cognitive impairment can rapidly erode financial capacity.

Assessing independence in financial capacity domains, such as paying bills, managing debt, and using credit, differs from assessing whether an older adult meets the legal standards for capacity with regard to specific financial decisions or transactions—such as entering into a contract, independently managing one’s own finances, giving a gift, or creating a will—which are based on informed financial decision-making. Marson (2016) used non-case-based hypothetical vignettes to assess financial judgment/decision-making; this rendered their results limited for use in assessing legal issues related to financial capacity, since these involve specific real-life decisions made by the older adult. In addition, although Belbase and Sanzenbacher (2017) used actual financial capacity data, they were not able to assess financial decision-making.

Financial Decision-making in Older Normative and Clinical Samples

Financial decision making is emerging as a separate construct from cognition and from financial management skills

Hsu and Willis (2013) examined financial decision-making in their 10-year study of couples in the Health and Retirement Survey, and were able to assess real-world decision-making in areas such as how participants managed their retirement funds. Overall, those with declining cognition were no longer the primary financial respondent for their household. Even so, a surprisingly high number of cognitively impaired individuals continued in this role.

Financial decision-making may well be a construct that is related to, but separate from, cognition. Boyle and colleagues in the Rush University Memory and Aging Project (see Boyle et al., 2012; Boyle et al., 2013; and Han et al., 2015) examined financial decision-making and cognition longitudinally and found, in a sample of more than 400 older adults (Boyle et al., 2012) that even modest cognitive decline (i.e., outside the range of actual cognitive impairment) is related to a decline in financial decision-making ability. Further, they speculate that decision-making and cognition are related but independent constructs. In a subsequent study, Boyle et al. (2013) found that older persons without dementia—but with decision-making deficits—experienced a fourfold increase in mortality across a 4-year follow-up. Han et al. (2015) tested the discrepancy between cognition and decision-making in a sample of 689 older adults and found that in 13% of cases, decision-making scores were more than 1 z score below cognition; in 11% of cases, cognition scores were lower than decision-making scores.

One chief concern related to a decline in financial decision-making skills is whether this leads to increased vulnerability to financial exploitation. Declines in cognitive abilities and decision-making are linked to increased risk of financial exploitation. Boyle et al. (2012) found that reduced decision-making is related to increased susceptibility to scams, and Lichtenberg et al. (2016) assert that impaired decision-making abilities differentiate those who have in fact been victims of financial exploitation from those who have not.

Despite advances in our understanding of the relationships between financial capacity domains, cognition and financial decision-making, scant research has focused on what Marson (2016) terms “financial function in the real world”—a construct reinforced by a recent work group on Social Security and its representative payee system. The work group recommended that financial abilities, including financial decision-making, should be measured by real-world activity.

A New Model of Financial Decision-making

Lichtenberg et al. (2015) have proposed a new conceptual model to understand financial decision-making and for use in the assessment of financial capacity: the Lichtenberg Financial Decision-making Rating Scale (LFDRS). The conceptual frameworks used in creating the LFDRS were the Whole Person Dementia Assessment model (Mast, 2011) and the decision making model of Appelbaum and Grisso which elaborates on what Lichtenberg et al. term the intellectual factors involved in capacity assessment: choice, understanding, appreciation, and reasoning. The Whole Person Assessment model is described in some depth in Lichtenberg et al., (2015) and applies person-centered principles of deep respect for individuality and personhood to the standardized psychological assessment process. This includes focusing on actual decisions instead of hypothetical vignettes.

The LFDRS incorporates contextual variables (i.e., financial situational awareness, psychological vulnerability, susceptibility to undue influence and to financial exploitation) into Appelabum and Grisso’s (1988) decision-making model. These intellectual factors have been established as fundamental aspects of decisional abilities (ABA/APA, 2008). Although articulated originally for medical decision-making, the same intellectual factors apply to financial decisions. First, the older adult must be capable of clearly communicating his or her choice. Understanding is the ability to comprehend the nature of the proposed decision and provide some explanation or demonstrate awareness of its risks and benefits. Appreciation refers to the situation and its consequences, and often involves their impact on both the older adult and others. Appelbaum and Grisso (1988) contend that the most common causes of impairment in appreciation are due to lack of awareness of deficits and/or delusions or distortions. Reasoning includes the ability to compare options—for instance, treatment alternatives in the case of healthcare—and to provide a rationale for the decision or explain the communicated choice.

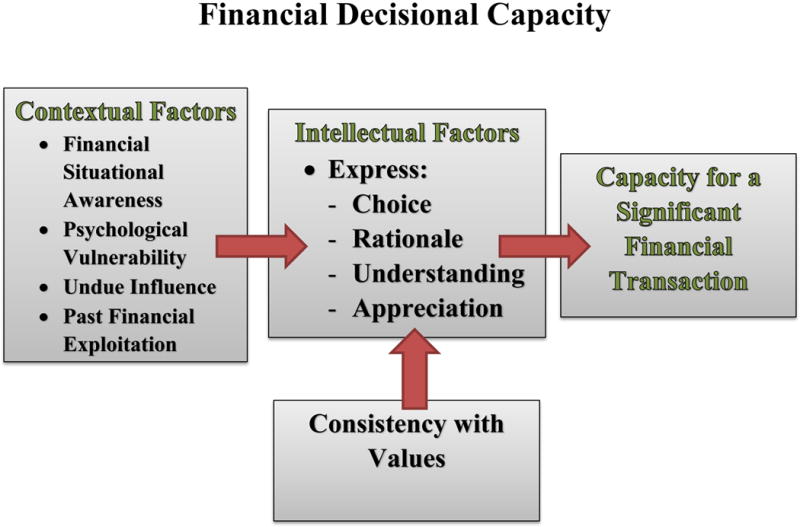

The scale developed is an attempt to quantify financial decision-making risk—that is, risk for meeting the legal standards for financial incapacity and risk for vulnerability to financial exploitation. As can be seen in Figure 1, the contextual factors for the LFDRS are Financial Situational Awareness (FSA); Psychological Vulnerability (PV), which includes loneliness and depression; susceptibility to Undue Influence (I); and to Financial Exploitation (FE). Contextual factors, as illustrated by the model, directly influence the intellectual factors associated with decisional abilities for a significant financial transaction or decision. The intellectual factors of the model map onto legal standards of incapacity, and we have demonstrated support for those items of the rating scale (see Lichtenberg et al.,2017). In this study, the aim is to use a community-based normative sample to investigate whether (a) the contextual factors in the financial decision-making model is supported by psychometric analysis and (b) the scale’s risk-scoring system demonstrates convergent validity. Participants were required to be in the process of making (or having recently made) a significant financial decision, and this precluded the use of a random sample. Our sample consisted of independent, community-dwelling older adults, one-half of whom were African American and the other half Non-Hispanic Whites. The purpose of the study was to investigate whether psychometric analysis supports the reliability, convergent validity, and conceptual model of financial decision-making. We had two hypotheses:

Confirmatory factor analysis will reveal four subscales from the contextual variables, with a minimum of six items in each subscale.

Neuropsychological test results and scores on the Managing Money subscale of the Independent Living Scale (Loeb, 1996) will be significantly but modestly correlated with the intellectual factors of the rating scale and the overall risk score from the rating scale. We hypothesize, in line with Han et al.(2015), that financial decision-making is a construct related to, but separate from, cognition, and will thus have a modest correlation with cognition and financial management skills (r < .30).

Figure 1. Conceptual Framework for the Lichtenberg Financial Decision-making Rating Scale.

Our proposed conceptual model of financial decisional capacity combines key contextual and intellectual factors that influence financial decision-making. As can be seen in the diagram below, the contextual factors are Financial Situational Awareness (FSA); Psychological Vulnerability (PV), which includes loneliness and depression; Susceptibility to Undue Influence (I), and to Financial Exploitation (FE). Contextual factors are viewed as having a direct impact on the intellectual factors associated with financial decisional capacity for a significant financial transaction (see diagram below).

Intellectual factors refer to the functional abilities required for financial decision-making capacity: the ability to (1) express a Choice (C); (2) communicate the Rationale (R) for the choice; (3) demonstrate an Understanding (U) of the choice; (4) demonstrate an Appreciation (A) of the relevant factors involved in the choice; and (5) ensure that the choice is consistent with one’s Values (V). In the decisional capacities framework, the intellectual factors—along with the contextual factors’ impact on them—determine financial capacity.

Methods

Procedures for Developing the Model and Scale

The LFDRS was created in order to offer ana alternative measure in financial capacity assessment; a measure of decision making based on actual financial decisions and/or transactions. More complete details for the development of the model and scale can be found in Lichtenberg et al. (2015). Briefly, while we began with the decisional abilities framework, we used the concept mapping method of brainstorming to expand the conceptual framework and finalize an initial set of items. Interrater reliability for overall ratings on the scale were presented in Lichtenberg et al.; at that time, the complete rating scale contained 77 items. After preliminary analyses (Lichtenberg et al., 2016), the scale was shortened to 68 items (56 items for all participants and 12 additional items with skip patterns).

Participant Recruitment Procedures

Two hundred community participants were recruited for the study. Inclusion criteria were being age 60 or older, living independently in the community, reporting the ability to be independent in independent activities of daily life and activities of daily life, being a native English speaker, and having the ability to do some basic word reading. After receiving approval from the Institutional Review Board, three methods were used to recruit participants. First, more than 100 participants were directly recruited from the Healthier Black Elders Participant Registry, which is part of the University of Michigan-Wayne State University NIA P30 Resource Center for Minority Aging Research. This required additional approval from the Healthier Black Elders Community Advisory Board (see Hall et al., 2016, for details on recruitment and retention of registry members). Second, the first author gave a number of presentations to groups of older adults across a wide variety of locations and settings (e.g. senior centers, churches, independent living center), and participants were recruited at these events. And third, a snowballing technique was used.

When older adults were approached to participate in the study, either by phone or in person, they were asked to participate in an interview and testing session that would last approximately 2 hours. Financial decisions were considered significant if they fell into one of the following categories: (a) investment planning (retirement, insurance, portfolio balancing); (b) estate planning (changes in a will or beneficiaries, allowing someone access to a bank/investment account); (c) major purchase (home, car, renovations, etc.); or (d) giving a gift.

Participants

Participant sociodemographic data can be found in Table 1. Two hundred independent, community-living adults ages 60 and older comprised the sample. Fifty-two percent were African American, and 74% were women. The significant financial decisions being made were predominantly major purchases/sales, as well as investment and estate planning.

Table 1.

Demographic Percentages and Cognitive Variables (N = 200)

| Demographics | Mean/SD or % |

|---|---|

| Female (n = 148) | 74.0% |

| Male (n = 52) | 26.0% |

| Age | 71.5 (7.4) |

| White Non-Hispanic | 48.0% |

| African American | 52.0% |

| Less than High School | 2.0% |

| High School Graduate | 15.5% |

| Some College | 33.0% |

| College Graduate | 49.5% |

| Types of Financial Decisions | |

| Major Purchase/Sale | 62.5% |

| Investment Planning | 16.0% |

| Estate Planning | 11.5% |

| Giving a Gift | 6.0% |

| Other (bankruptcy, lawsuit) | 4.0% |

| Cognition | |

| WRAT4 Reading | 57.4 (8.1) |

| MMSE | 28.5 (2.1) |

| Trails B (seconds) | 108.4 (56.3) |

| Stroop Color-Word | 30.1 (9.2) |

| RAVLT | 42.7 (9.7) |

| ILS Managing Money | 29.9 (4.1) |

Measures

Lichtenberg Financial Decision Rating Scale

Scores indicative of risk for decisional ability deficits are calculated for each item and for the total scale. Of the 68 total items, risk scores for 53 items are obtained directly from the older adult’s self-reported answers. These items include all of the contextual variables from the 4 subscales; Financial Situational Awareness, Psychological Vulnerability, Susceptibility to Undue Influence, and Susceptibility to Financial Exploitation. The Intellectual Factors subscale is a rating scale: both self-report and rater responses are utilized. In this subscale, older adults give a self-reported answer to each question and the rater marks the answer he or she believes to be most accurate. Risk scores are accentuated in cases in which there is a discrepancy between the older adult’s report and the rater’s report. Risk scores for the contextual variables and each subscale are then added. The risk score for the intellectual factors subscale follows a validated seven-item algorithm—or alternatively, a simple count of discrepancies between items is used (see Lichtenberg et al., in press). Each participant will have six scores: the five subscale risk scores and a total risk score.

Neuropsychological Measures

The neuropsychological measures described below were chosen because they cover broad areas of cognitive functioning,

Wide Range Achievement Test 4—Reading

The WRAT4 reading subtest has been found to be an excellent measure of quality (versus only quantity) of a person’s educational experience (Schneider & Lichtenberg, 2011). The test consists of 16 letters and 54 words that are read aloud (Wilkinson & Robinson, 2006). Higher scores are related to better reading abilities.

The Rey Auditory Verbal Learning Test

This 15-item word recall test (over five trials) measures immediate memory span and a learning curve, and reveals learning strategies (Lezak, 1983; Schmidt, 1996).

Trailmaking Test

The Trailmaking Test has two parts (Reitan & Wolfson, 1985). In part A, older adults are timed as they connect circles in order by number; this is a test of basic visuomotor attention. A mental flexibility component is added in part B, in which the older adult connects the circles in order, but this time while alternating between number and letter. Trailmaking scores for part B were used in this study, because this test is well known to measure executive functioning. Raw scores were used in the analyses. Lower scores indicate better cognitive performance.

The Stroop Color-Word Test

This is a test of disinhibition and mental flexibility (Golden, 1978). Words (consisting of colors; red, blue, green) on a page are read as quickly as possible for the first part; colors of XXX markings are named on the second part, and then words printed in colored ink are presented on the third part. One the first part the older adult reads as many words aloud as they can in 45 seconds. In the second part they state the color of the XXX markings aloud as fast as they can for 45 seconds. On the third part and the individual must ignore the printed word and name the color of the ink. The examiner provides corrections and the total score is the number of items correctly stated in 45 seconds. Higher scores indicate better cognitive performance.

Mini Mental State Exam (MMSE)

The MMSE (Folstein, Folstein, & McHugh, 1975), which assesses general cognitive ability, contains items that evaluate orientation, memory, concentration, and language and visual skills. The measure is well established and used frequently with older adults, as it can be given in many settings and requires only 5–10 minutes to administer. Higher scores (greater than or equal to 24) on the 30 items indicate better cognitive functioning.

The Independent Living Scales (ILS) and the Managing Money Subscale

The ILS (Loeb, 1996) is a 68-item measure of (a) ability to perform instrumental activities of daily living, (b) memory and orientation, (c) ability to manage matters related to home and transportation, (d) health and safety knowledge, (e), social adjustment, and (f) financial management. The Managing Money subscale assesses knowledge of both broad concepts, such as insurance and Social Security, and specific skills, such as counting change, calculating a bill, and completing a check or money order. Higher scores are associated with better financial management skills.

Methodological Approach

Our general approach to the analyses was to use factor analysis. The first step of the analyses presented here was to determine whether sets of items had formed unidimensional constructs, according to the conceptual map.

Unidimensionality was examined by merged exploratory factor analysis (EFA) and confirmatory factor analysis (CFA; Asparouhov & Muthén, 2009) with polychoric correlations using MPlus (Muthén & Muthén, 2011). The CFA of the unidimensional model and evaluation of the comparative fit index (CFI) were performed in the context of invariance testing and model fit (Bentler, 1990; Cook, Kallen, & Amtmann, 2009; Meade, Johnson, & Bradley, 2008). Eigenvalues and the ratios of the first to the second eigenvalue were derived. Ideally, the ratios should be greater than 4, but we report on ratios greater than 3. Model fit statistics were evaluated—specifically, the CFI and the root mean square error of approximation (RMSEA; Bentler, 1990). The following cut-offs for good model fit for categorical outcomes are recommended: RMSEA < 0.06, CFI > 0.95. Adequate fit is observed if the RMSEA is at least 0.1 and the CFI is > 0.9. Item loadings on the estimated factors were examined; ideally, values > 0.30 are desired. The analysis was performed iteratively, starting with a full set of items in a domain followed by excluding nonfitting items from the set in several consecutive runs. Classical reliability analysis (using SPSS) was also performed with the same goal.

The following rules were employed to derive the final items:

Items with no variation and one item of a pair of overlapping items were excluded.

Items with loadings < 0.10 on the unidimensional factor were excluded.

Items with loadings between 0.10 and < 0.20 on the unidimensional factor and substantially higher loadings on the second factor in two-factor EFA/CFA were excluded.

In subsequent iterations, items with higher loadings on the second factor in the two-factor solution were excluded until a satisfactory model fit statistic and eigenvalue ratio were reached.

Evaluation of Reliability and Information

Reliability can be evaluated by decomposing the scale score into the sum of the item scores and identifying the contribution of the common term or communality. McDonald’s Omega Total (ωt; McDonald, 1999) is a reliability estimate based on the proportion of total common variance explained.

The convergent validity of the subscales and Long Form were examined by Pearson correlations in order to examine the relationship between cognitive test scores and the scale, as well as between financial management skills and the scale. Hierarchical regression analyses were conducted to determine whether cognitive and financial management tests contributed to the prediction of risk scores above and beyond the demographic variables.

Results

The data set included 200 cases: 74% females, 52% African-American, and 48% Non-Hispanic White. The mean age was 71.5 (SD = 7.4), ranging from 60 to 93; the mean education was 15 years (SD = 2.6), ranging from 9 to 24. Only 8% of cases revealed rater concerns about the participant’s financial decision-making capacity. This low level of concerns about decision-making capacity is consistent with a normative sample. As a result of the small percentage, Intellectual Factor subscale items were only used in convergent validity analyses, since the lack of variance precluded use in CFA. In our previous work, however (Lichtenberg et al., in press) the Intellectual Factor subscale was found to be reliable and valid.

Item recoding and exclusion

To facilitate analysis, items with cell frequencies < 10 were recoded. For most items, the frequency counts for “Inaccurate” and “Don’t know” were low, and therefore these responses were combined with responses in the closest response category, going in the direction of less financial incapacity.

Several items were excluded from the analysis at the beginning. There was no variation in responses for the following items: “Who manages your money day to day?”; “How often do you talk with or visit others on a regular basis?”; “Have you had any conflicts with anyone about the way you spend money?”; and “Has anyone recently told you to stop getting financial advice from someone?”

Item selection

The items selected by CFA supported the conceptual model of contextual variables and are presented in Tables 2–4. Seven items were included in the Financial Situational (FSA) item set, eight in the Psychological Vulnerability (PV) set, and six in the Susceptibility set (Susceptibility to Undue Influence and Susceptibility to Financial Exploitation were combined into one factor, which is labeled FE hereafter).

Table 2.

LFDRS Data Set, Selection from Financial Situation Awareness (FSA) Items: Eigenvalues from the Exploratory Factor Analysis (EFA); Factor Loadings from the Unidimensional Confirmatory Factor Analysis (CFA; Mplus); and Classical Reliability Analysis Results (SPSS)

| Item Name | Item description | Eigenvalues | Ratio of First/Second | Loading on One-factor CFA | Corrected Item-Total Correlation |

|---|---|---|---|---|---|

| FSA_WORRY | How worried are you about having enough money to pay for things? | 3.758 | 3.79 | 0.844 | 0.623 |

| FSA_SATISFIED | Overall, how satisfied are you with your finances? | 0.991 | 0.846 | 0.624 | |

| FSA_MANAGE$ | How satisfied are you with this money management arrangement? | 0.805 | 0.668 | 0.404 | |

| FSA_CONFIDENT | How confident are you in making big financial decisions? | 0.572 | 0.638 | 0.484 | |

| FSA_WORRY | How often do you worry about financial decisions you’ve recently made? | 0.411 | 0.584 | 0.391 | |

| FSA_EXCEED | How often do your expenses exceed your regular monthly income? | 0.246 | 0.745 | 0.489 | |

| FSA_ADVICE | Change in finances since you’ve gotten older in terms of seeking advice? | 0.217 | 0.450 | 0.312 |

CFA Model Fit:

| CFI | 0.981 | ||

| RMSEA | 0.062 | ||

| Reliability coefficient alpha | 0.75 | McDonald’s omega total | 0.857 |

| Standardized alpha | 0.75 |

Table 4.

LFDRS Data Set, Selection from Susceptibility (S) Items: Eigenvalues from the Exploratory Factor Analysis (EFA); Factor Loadings from the Unidimensional Confirmatory Factor Analysis (CFA; Mplus); and Classical Reliability Analysis Results (SPSS)

| Item Name | Item description | Eigenvalues | Ratio of First/Second | Loading on One-factor CFA | Corrected Item-Total Correlation |

|---|---|---|---|---|---|

| S_STRAINED | Has a relationship with a family member/friend become strained due to finances as you have grown older? | 3.579 | 4.39 | 0.896 | 0.564 |

| S_SPEND | How often has a person talked you into a decision to spend money? | 0.816 | 0.449 | 0.267 | |

| S_TAKE$ | Did anyone ever tell you that someone else you know wants to take your money? | 0.666 | 0.813 | 0.366 | |

| S_CONFLICT | Have you had any conflicts with anyone about the way you spend money? | 0.455 | 0.749 | 0.463 | |

| S_PERMISSION | Has anyone used or taken your money without your permission? | 0.372 | 0.667 | 0.449 | |

| S_LIKELY | How likely is it that anyone now wants to take or use your money without your permission? | 0.112 | 0.760 | 0.421 |

CFA Model Fit:

| CFI | <1.000 | ||

| RMSEA | <0.001 | ||

| Reliability coefficient alpha | 0.66 | McDonald’s omega total | 0.865 |

| Standardized alpha | 0.70 |

Exploratory factor analyses

Examining the ratio of the first to the second eigenvalue, two of the item sets reached the criterion of approximately 4 or above: Susceptibility (4.4, Table 4) and Financial Situational Awareness (3.8, Table 2). The eigenvalue ratio for Psychological Vulnerability was 3.1 (Table 3).

Table 3.

LFDRS Data Set, Selection from Psychological Vulnerability (PV) Items: Eigenvalues from the Exploratory Factor Analysis (EFA); Factor Loadings from the Unidimensional Confirmatory Factor Analysis (CFA; Mplus); and Classical Reliability Analysis Results (SPSS)

| Item Name | Item description | Eigenvalues | Ratio of First/Second | Loading on One-factor CFA | Corrected Item-Total Correlation |

|---|---|---|---|---|---|

| PV_WISH | How often do you wish that you had someone to talk to about finances? | 3.964 | 3.10 | 0.652 | 0.474 |

| PV_ANXIOUS | How often do you feel anxious about financial decisions? | 1.277 | 0.836 | 0.623 | |

| PV_DOWN | How often do you feel downhearted? | 0.874 | 0.777 | 0.529 | |

| PV_COG$ | Has memory or thinking skills [getting worse in past year] interfered with your everyday financial activities? | 0.690 | 0.843 | 0.388 | |

| PV_DR_COG | Has a physician or other healthcare professional evaluated your memory? | 0.608 | 0.809 | 0.296 | |

| PV_RESPECT | When making financial decisions or transactions, how often are you treated with less courtesy or respect? | 0.350 | 0.612 | 0.423 | |

| PV_FEARFUL | How fearful are you that someone will take away your financial freedom? | 0.184 | 0.316 | 0.178 | |

| PV_LONELY | How often do you feel relieved when talking about finances because you were lonely? | 0.054 | 0.619 | 0.389 |

CFA Model Fit:

| CFI | 0.919 | ||

| RMSEA | 0.098 | ||

| Reliability coefficient alpha | 0.71 | McDonald’s omega total | 0.853 |

| Standardized alpha | 0.72 |

Confirmatory factor analyses

Model fit statistics for the CFA model were adequate to excellent across domains. The CFI was 0.981 for SA, 0.919 for PV, and 0.999 for FE. Respective RMSEAs were 0.062, 0.098, and 0.001 (see Tables 2–4).

Reliability

Coefficient alpha internal consistency estimates were as follows: 0.75 (unstandardized and standardized) for the SA scale; 0.71 unstandardized and 0.72 standardized for the PV scale; and 0.66 unstandardized and 0.70 standardized for the FE scale. Combined scale estimates were 0.84 for both unstandardized and standardized alpha. McDonald’s omegas were 0.86 for SA, 0.85 for PV, and 0.87 for FE. These analyses taken together support Hypothesis 1 which supported the conceptual model of financial decision-making abilities having contextual subscales.

Table 5 contains correlations of cognitive, demographic, and financial management variables, along with the LFDRS. Gender and race were (r=.14, p<.05) significantly correlated with the total risk score for the rating scale, but cognitive and financial management measures were (Trails B: r=.30; p<.05; ILS: r=−.21; p<.05). The Intellectual factors subscale in the rating scale showed significant correlations with both cognition and ILS money management at around r=.30; consistent with the second hypothesis that the measures would be modestly, but significantly related. Overall, the Financial Situational Awareness and Psychological Vulnerability subscales were chiefly unrelated to demographic and financial management variables. In sum, the LFDRS demonstrated adequate convergent validity and supported Hypothesis 2. Table 6 summarizes the hierarchical analyses that examined whether cognition and/or money management contributed to predicting significant LFDRS Full Scale risk score variance after controlling for demographic variables, including quality of education (WRAT4 Reading). Gender (with men having lower risk) and Trailmaking B scores were significant predictors of LFDRS Full Scale risk scores. Overall, 12.2% of the variance was predicted, and Trailmaking B accounted for 7.4% of unique variance above and beyond demographic variables. The Managing Money subscale of the ILS was not a significant predictor of LFDRS risk scores in the regression analysis due to its overlap with cognition which proved to be the strongest predictor.

Table 5.

Correlation Matrix between Risk Scores for BLINDED subscales, Total Score, and Demographic and Cognitive Variables

| Financial Situational Awareness | Psycho-social Vulner. | Intellectual Factor | Financial Exploit Undue Influence | SUM TOTAL FULL SCALE | |

|---|---|---|---|---|---|

| Age | −.01 | −.04 | .13 | −.01 | .02 |

| Education | −.09 | −.20** | −.13 | .01 | −.12 |

| Gender | .01 | −.10 | −.11 | −.17* | −.14* |

| Race | .10 | .09 | .09 | .14* | .14* |

| WRAT4 Reading | −.09 | −.18** | −.16* | .01 | −.14+ |

| MMSE | −.10 | −.04 | −.33*** | −.06 | −.18* |

| Trails B | .18 | .22** | .34*** | .16* | .30*** |

| Stroop C-W | −.15* | −.18** | −.25*** | −.07 | −.21** |

| RAVLT | −.06 | −.07 | −.22** | −.11 | −.17* |

| ILS Money Management | −.05 | −.08 | −.30*** | −.19** | −.21** |

p = .06,

p ≤ .05,

p≤ .01,

p ≤ .001

Gender (1=female, 2=male), Race (1=Non-Hispanic White, 2=African-American)

Table 6.

Hierarchical Regression for BLINDED TOTAL Risk Score as the Dependent Variable (DV)

| β | t | R2 | ΔR2 | F Change | F | |

|---|---|---|---|---|---|---|

| Step 1 | .023 | .044 | 2.13 | 2.13 | ||

| Age | .07 | .98 | ||||

| Gender | −.11 | −1.47 | ||||

| Race | .09 | 1.10 | ||||

| WRAT4 Reading | −.10 | −1.29 | ||||

|

| ||||||

| Step 2 | .089 | .074 | 7.59 | 4.05*** | ||

| Age | −.07 | −.85 | ||||

| Gender | −.14* | −1.94* | ||||

| Race | .01 | .01 | ||||

| WRAT4 Reading | .06 | .64 | ||||

| Trails B | .30** | 3.10** | ||||

| Stroop C-W | −.08 | −.89 | ||||

|

| ||||||

| Step 3 | .088 | .004 | .842 | 3.59*** | ||

| Age | −.08 | −.92 | ||||

| Gender | −.14 | −1.86+ | ||||

| Race | −.01 | −.13 | ||||

| WRAT4 Reading | .08 | .89 | ||||

| Trails B | .27** | 2.71** | ||||

| Stroop C-W | −.08 | −.93 | ||||

| ILS $ Management | −.08 | −.92 | ||||

p ≤ .06,

p ≤ .05,

p≤ .01,

p ≤ .001

Discussion

Use of normative data is important when evaluating psychological scales, for three main reasons. First, the underlying conceptual framework can be tested. Second, understanding how a scale’s scoring system is related to pertinent variables allows for analysis of convergent validity. And third, establishment of a normative data set enables evaluation of an individual’s score relative to group norms in order to determine cut-offs for impairment scores. In this study, we were able to examine the first and second reasons empirically. A new conceptual model was proposed and supported through rigorous psychometric testing, and the Lichtenberg Financial Decision-making Rating Scale (LFDRS) are provided for use in real-world clinical assessment of financial decision-making and financial capacity. The model extends beyond the impact of cognitive variables on decision-making and demonstrates how financial awareness, psychological vulnerability, and susceptibility are related to decision-making abilities. This scale follows the principles laid out by the Whole Person Assessment model (Mast, 2011), in which person-centered principles are applied to standardized assessments with older adults. Above all, person-centered principles convey deep respect for the individual and his or her breadth of experiences, preferences, and desires, regardless of cognitive abilities. Further, person-centered principles are rooted in real-world situations, decisions, or preferences, since those are most relevant to the individual. Finally, person-centered principles fully explore the person’s perspective on the matter at hand—in this case, an older adult’s significant financial decision or transaction. To our knowledge, the LFDRS—a financial decision-making scale grounded in an actual decision or transaction the older adult is making—is the first of its kind, and represents a dramatically different approach to the assessment of financial decision-making capacity/incapacity (see Marson, 2016, for a review of other models/scales). While we were not able to directly assess how effectively scores on the Full Scale measure risk for incapacity or exploitation, in a previous study (Lichtenberg et al., 2017) we examined the validity of the Intellectual Factors subscale, which contains the items most relevant to the legal standards for financial capacity/incapacity.

Confirmatory factor analysis results support the hypothesized model of contextual factors, as represented empirically by the contextual subscales. Specifically, support was found for a Financial Situational Awareness subscale, a Psychological Vulnerability subscale, and a Susceptibility (to either Undue Influence or Financial Exploitation) subscale. Items in the Financial Situational Awareness subscale are related to financial strain, financial satisfaction, financial self-efficacy, and stability of financial management approaches. Financial strain and financial satisfaction have long been important constructs for understanding aging and well-being and aging and health. The Financial Situational Awareness subscale was not related to education or other demographic variables, but was related to an executive functioning measure.

Items in the Psychological Vulnerability subscale assess anxiety, depression, social status, loneliness, and fearfulness as they relate to financial decisions and one’s financial situation. Unlike other scales—such as items from traditional depression or anxiety inventories—the items for this subscale were specifically related to finances. Lichtenberg et al. (2013) found that in a random normative sample, psychological vulnerability was the strongest correlate to self-reported experience of fraud; in addition, psychological vulnerability scores correlated with education, quality of education, and executive functioning scores.

Items in the Susceptibility subscale explore conflicts with others about spending and other financial decisions and perceived financial victimization by others. These items are akin to several of the items in the Older Adult Financial Exploitation Measure (Conrad, Iris, Ridings, Langley, & Wilber, 2011). Susceptibility items were modestly related to race and gender—with women being more susceptible than males—and were also related to executive functioning.

Although excluded from the factor analyses, we were able to examine correlations between the Intellectual Factors/Current Decisions subscale and demographic, cognitive, and money management measures. The Current Decisions subscale was the only subscale significantly related to financial management (r = .−30; p < .01), and was also related to measures of memory and executive functioning, as well as to the MMSE general score.

Results of the factor analyses and correlations support much broader use of the scale than solely in clinical assessments. Lachs and Han (2015) propose an age-associated financial vulnerability phenomenon. This underscores the idea that any cognitive, emotional, social, or physical vulnerability or stressor carries with it the risk of a decline in financial management and decision-making skills. The LFDRS, whether the total scale or simply a subscale or two, can be incorporated across health and social service settings. Clinicians of all types now have a scale that will allow them to screen for psychological vulnerability, financial strain, and susceptibility to influence/exploitation. Understanding financial decision-making and its relationship to a number of outcomes, including financial exploitation, is becoming a topic of major research interest in the world of aging and Alzheimer’s disease. The LFDRS offers three self-report subscales that are empirically supported by factor analyses. Measures of financial decision-making self-efficacy, psychological vulnerability regarding finances, and susceptibility to influence—which have not previously been used in longitudinal studies on aging and health or neurocognitive health—can now be easily incorporated into research. The LFDRS thus offers clinicians and researchers alike a novel way to assess capacity for financial decision-making.

The major use of the LFDRS will be as part of a clinical (and often with legal issues involved) assessment of financial capacity. Although on the surface it may appear that many older adult clients being assessed do not have a specific financial decision they are dealing with, that typically isn’t the case. In cases where older adults ability to manage money (e.g. conservatorship) the financial decision is whether or not the older adult wants complete control of their monies. The desire to control one’s own financial decisions/transactions is often the basic decision in disputes about wills, contracts, investments etc. Thus the clinician should probe the older adult around the core financial decision making issue(s) at hand; typically whether the older adult retains autonomous control of his or her finances. The LFDRS then helps to elucidate whether this basic decision about financial control or financial decisions/transactions in question are informed decisions or whether they lack aspects of decisional abilities.

One limitation of the study is that we assessed only one sample, and therefore replication of our results across other samples will be needed. This was a normative sample, so the Long Form’s risk-scoring system in relation to cases of financial incapacity could not be assessed. In addition, because of limitations in sample size, factor analysis could not be conducted separately for different subgroups (e.g., more educated versus less educated), and thus we could not determine whether there are differences between subgroups of older adults. Despite these limitations, the emergence of an empirically reliable and valid scale that supports a new conceptual model will significantly advance our understanding of real-world financial decision-making—and, crucially, how to measure it.

Supplementary Material

Acknowledgments

National Institute of Justice MU-CX-0001,The opinions, findings, and conclusions or recommendations expressed in this publication are those of the authors and do not necessarily reflect those of the Department of Justice.

National Institutes of Health P30 AG015281, Michigan Center for Urban African American Aging Research; American House Foundation; Retirement Research Foundation

Michigan Alzheimer’s Center Core grant #P30AG053760.

Martha and Bob Sachs

Contributor Information

Peter A. Lichtenberg, Director, Institute of Gerontology & Merrill Palmer Skillman Institute, Professor of Psychology, Wayne State University, 87 East Ferry Street, Detroit, MI 48202.

Katja Ocepek-Welikson, Research Division, Hebrew Home at Riverdale; RiverSpring Health, New York, New York.

Lisa J. Ficker, Research Associate, Institute of Gerontology, 87 East Ferry Street, Wayne State University, Detroit, MI 48202

Evan Gross, Graduate Research Assistant, Institute of Gerontology & Department of Psychology, Institute of Gerontology, 87 East Ferry Street, Detroit, MI 48202.

Analise Rahman-Filipiak, Post-doctoral Fellow, University of Michigan Health System, Neuropsychology Section, 2101 Commonwealth Blvd. Suite C, Ann Arbor, MI 48105

Jeanne A. Teresi, Columbia University Stroud Center at New York State Psychiatric Institute, Research Division, Hebrew Home at Riverdale; RiverSpring Health, Weill Cornell Medical Center, Department of Geriatrics and Palliative Medicine.

References

- American Bar Association Commission on Law and Aging and American Psychological Association. Assessment of older adults with diminished capacity: A handbook for psychologists. Washington, DC: American Bar Association; 2008. [Google Scholar]

- Appelbaum PS, Grisso T. Assessing patients’ capacities to consent to treatment. New England Journal of Medicine. 1988;319:1635–1638. doi: 10.1056/NEJM198812223192504. [DOI] [PubMed] [Google Scholar]

- Asparouhov T, Muthén B. Exploratory structural equation modeling. Structural Equation Modeling. 2009;16:397–438. [Google Scholar]

- Belbase AB, Sanzenbacher GT. Cognitive aging and the capacity to manage money. Center for Retirement Research at Boston College. 2017;17(1):1–7. http://crr.bc.edu/wp-content/uploads/2017/01/IB_17-1.pdf. [Google Scholar]

- Bentler PM. Comparative fit indexes in structural models. Psychological Bulletin. 1990;107(2):238–246. doi: 10.1037/0033-2909.107.2.238. [DOI] [PubMed] [Google Scholar]

- Boyle PA, Wilson RS, Yu LY, Buchman AS, Bennett DA. Poor decision making is a consequence of cognitive decline among older persons without Alzheimer’s disease or mild cognitive impairment. PLOS One. 2012;7(8):1–5. doi: 10.1371/journal.pone.0043647. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Boyle PA, Wilson RS, Yu LY, Buchman AS, Bennett DA. Poor decision making is associated with an increased risk of mortality among community-dwelling older persons without dementia. Neuroepidemiology. 2013;40(4):247–252. doi: 10.1159/000342781. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Conrad KJ, Iris M, Ridings JW, Langley K, Wilber KH. Self-report measure of financial exploitation of older adults. Gerontologist. 2010;50:758–773. doi: 10.1080/08946566.2011.584045. [DOI] [PubMed] [Google Scholar]

- Cook KF, Kallen MA, Amtmann D. Having a fit: Impact of number of items and distribution of data on traditional criteria for assessing IRT’s unidimensionality assumption. Quality of Life Research. 2009;18:447–460. doi: 10.1007/s11136-009-9464-4. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Folstein MF, Folstein SE, McHugh “Mini mental state”. A practical method for grading the cognitive state of patients for the clinician. Journal of Psychiatric Research. 1975;12:189–198. doi: 10.1016/0022-3956(75)90026-6. [DOI] [PubMed] [Google Scholar]

- Golden JC. Stroop Color and Word Test. Chicago IL: Stoelting Co.; 1978. [Google Scholar]

- Hall LN, Ficker LJ, Chadiha LA, Green CR, Jackson JS, Lichtenberg PA. Promoting retention: African American older adults in a research volunteer registry. Gerontology & GeriatricMedicine. 2016;2:1–9. doi: 10.1177/2333721416677469. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Han SD, Boyle PA, James BD, Yu LY, Barnes LL, Bennett DA. Discrepancies between cognition and decision making in older adults. Aging—Clinical and Experimental Research. 2015;28:99–108. doi: 10.1007/s40520-015-0375-7. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Hsu JW, Willis R. Dementia risk and financial decision making by older households: The impact of information. Journal of Human Capitol, University of Chicago. 2013;17:340–37. doi: 10.2139/ssrn.2339225. http://www.journals.uchicago.edu/doi/pdfplus/10.1086/674105. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Lachs MS, Han SD. Age-associated financial vulnerability: An emerging public health issue. Annals of Internal Medicine. 2015;163:877–878. doi: 10.7326/M15-0882. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Lezak MD. Neuropsychological assessment. 2nd. New York: Oxford University Press; 1983. [Google Scholar]

- Lichtenberg PA, Ficker L, Rahman-Filipiak A, Tatro R, Farrell C, Speir JJ, Jackman JD. The Lichtenberg Financial Decision Screening Scale: A new tool for assessing financial decision making and preventing financial exploitation. Journal of Elder Abuse and Neglect. 2016;28:134–151. doi: 10.1080/08946566.2016.1168333. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Lichtenberg PA, Stickney L, Paulson D. Is psychological vulnerability related to the experience of fraud in older adults? Clinical Gerontologist. 2013;36:132–146. doi: 10.1080/07317115.2012.749323. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Lichtenberg PA, Stoltman J, Ficker LJ, Iris M, Mast BT. A person-centered approach to financial capacity assessment: Preliminary development of a new rating scale. Clinical Gerontologist. 2015;38:49–67. doi: 10.1080/07317115.2014.970318JGP.0b013e318157cb00. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Lichtenberg PA, Teresi JA, Ocepek-Welikson K, Eimick J. Reliability and validity of the Lichtenberg Financial Decision Screening Scale. Innovation in Aging. doi: 10.1093/geroni/igx003. In press. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Loeb . Independent Living Scales. NCS Pearson; San Antonio, Texas: 1996. [Google Scholar]

- Marson DC. Loss of financial competency in dementia: Conceptual and empirical approaches. Aging, Neuropsychology, and Cognition. 2001;8:164–181. [Google Scholar]

- Marson D. Conceptual models and guidelines for clinical assessment of financial capacity. Archives of Clinical Neuropsychology. 2016;31(6):541–553. doi: 10.1093/arclin/acw052. https://doi.org/10.1093/arclin/acw052. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Mast BT. Whole person dementia assessment. Baltimore, MD: Health Professions Press Inc; 2011. [Google Scholar]

- McDonald RP. Test theory: A unified treatment. Mahwah, NJ: L. Erlbaum Associates; 1999. [Google Scholar]

- Meade AW, Johnson EC, Bradley PW. Power and sensitivity of alternative fit indices in tests of measurement invariance. Journal of Applied Psychology. 2008;93:568–592. doi: 10.1037/0021-9010.93.3.568. [DOI] [PubMed] [Google Scholar]

- Moye J, Marson DC. Assessment of decision-making capacity in older adults: An emerging area of practice and research. Journals of Gerontology: Series B, Psychological Sciences and Social Sciences. 2007;62B:P3–P11. doi: 10.1093/geronb/62.1.p3. [DOI] [PubMed] [Google Scholar]

- Muthén LK, Muthén BO. M-PLUS Users Guide. 6th. Los Angeles: Muthén and Muthén; 2011. pp. 1998–2011. [Google Scholar]

- Okonkwo O, Griffith HR, Vance DE, Marson DC, Ball KK, Wadley VG. Awareness of functional difficulties in mild cognitive impairment: A multidomain assessment approach. Journal of the American Geriatrics Society. 2009;57:978–984. doi: 10.1111/j.1532-5415.2009.02261.x. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Reitan RM, Wolfson D. The Halstead-Reitan Neuropsychological Test Battery. Tucson, AZ: Neuropsychology Press; 1985. [Google Scholar]

- Sherod MG, Griffith HR, Copeland J, Belue K, Krzywanski S, Zamrini EY, Marson DC. Neurocognitive predictors of financial capacity across the dementia spectrum: Normal aging, mild cognitive impairment, and Alzheimer’s disease. Journal of the International Neuropsychological Society. 2009;15:258–67. doi: 10.1017/S1355617709090365. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Schmidt M. Rey Auditory Verbal Learning Test: A Handbook. Torrance, CA: Western Psychological Services; 1996. [Google Scholar]

- Schneider BT, Lichtenberg PA. Influence of reading ability on neuropsychological performance in African American elders. Archives of Clinical Neuropsychology. 2011;26:624–631. doi: 10.1093/arclin/acr062. doi.org/10.1093/arclin/acr062. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Wilkinson GS, Robinson GJ. Wide Range Achievement Test-IV: Professional Manual. Lutz, FL: Psychological Assessment Resources; 2006. [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.