Abstract

Objective

To forecast out‐of‐pocket health care spending among older adults. Long‐term forecasts allow policy makers to explore potential impacts of policy scenarios, but existing microsimulations do not incorporate details of supplemental insurance coverage and income effects on health care spending.

Data Sources

Dynamic microsimulation calibrated to survey and administrative data.

Study Design

We augment Urban Institute's Dynamic Simulation of Income Model (DYNASIM) with modules that incorporate demand responses and economic equilibria, with dynamics driven by exogenous technological change. A lengthy technical appendix provides details of the microsimulation model and economic assumptions for readers interested in applying these techniques.

Principal Findings

The model projects total out‐of‐pocket spending (point of care plus premiums) as a share of income for adults aged 65 and older. People with lower incomes and poor health fare worse, despite protections of Medicaid. Spending rises 40 percent from 2012 to 2035 (from 10 to 14 percent of income) for the median beneficiary, but it increases from 5 to 25 percent of income for low‐income beneficiaries and from 23 to 29 percent for the near poor who are in fair/poor health.

Conclusions

Despite Medicare coverage, near‐poor seniors will face out‐of‐pocket spending that would render them, in practical terms, underinsured.

Keywords: Health care costs, health insurance, Medicare beneficiaries, simulations

In spite of the recent spending slowdown, many analysts predict health care spending growth will rebound (Keehan et al. 2015). This presents a particular problem for those aged 65 and older, many of whom live on fixed incomes (Jacobson et al. 2015). Nearly all (95 percent) of these individuals are Medicare beneficiaries, but absent other subsidized insurance, they share costs through significant premiums, deductibles, and copayments. Medicare covers about 80 percent of spending, which is slightly less than a typical large employer‐sponsored plan (McArdle et al. 2012). Health expenses consume a three times greater share of household spending for Medicare beneficiaries compared to the general population (Cubanski et al. 2014). To reduce the financial risks of high out‐of‐pocket health spending, the vast majority of beneficiaries—86 percent in 2011 (MedPAC 2015)—supplement their Medicare coverage with employer‐provided, self‐purchased, or other public sources of coverage such as the Veterans Administration (VA).

Several factors imply that the burden of health care spending on the elderly will grow over time. First, income growth for the elderly lags that of younger populations. Second, supplemental coverage will likely erode as existing options become more expensive and subsidies deteriorate. From 1988 to 2013, the percentage of large employers offering retiree health coverage fell from 66 percent to 28 percent (McArdle, Neuman, and Huang 2014). Employers are also capping their contributions to retiree health plans, tightening eligibility requirements, and raising premiums and cost sharing (Fronstin and Adams 2012). Third, the Affordable Care Act (ACA) reduced benchmark payments for Medicare Advantage plans, pressuring Medicare Advantage plans—important sources of added coverage—to lower benefits and raise premiums.

This study applies a detailed dynamic microsimulation model to quantify how economy‐wide trends and policy changes will affect the health care spending burden of older adults. Policy researchers frequently use dynamic microsimulation models to make detailed projections for specific subgroups (Goldman et al. 2005; Smith and Favreault 2013; Congressional Budget Office 2015a,b; Gaudette et al. 2015). Our model simulates the health status, health insurance coverage, and health care spending of US residents aged 65 and older in each year. From this, we can compute detailed summaries of how health care spending growth will impact different subsets of this population. For example, in this study, we ask, “How does the burden of persistently high health care spending vary across the income distribution, and how will this change over time?”

The rest of this study proceeds as follows. First, we outline the main features of the microsimulation model: the characteristics of simulated individuals; the methods for updating those characteristics over time; and the operationalization of underlying economic assumptions about consumer choices, demand for care, and spending growth. We also describe the calibration of the model to the observed data. Then, we describe the projected health care spending and insurance coverage for various subpopulations under a realistic baseline spending growth scenario. Next, we explore the model's sensitivity to changes in key parameters. We conclude by discussing the limitations of our approach and suggesting future applications of and modifications to our microsimulation model.

Methods

Simulated Population, Outcomes of Interest, and Forecasting Horizon

We focus on individuals 65 years and older, almost all of whom are Medicare beneficiaries. Our primary outcome of interest is health care spending, which we compute as total out‐of‐pocket spending on premiums and point‐of‐care costs (e.g., coinsurance and copays) as a proportion of income. Our income measure is tailored to the financial situation of older adults and incorporates earned and unearned income, transfers, and annuitized housing wealth. Our outcomes of interest include (1) health care spending as a fraction of income, (2) the proportion of people with persistently high health care spending, and (3) the proportion of people with each type of supplemental coverage in each year. A person is categorized as having persistently high spending in a year if he or she devotes at least 20 percent of income to out‐of‐pocket health care spending in that year, the previous 2 years, and the subsequent 2 years (5 years total). We compute these outcomes in the whole simulated population and selected subpopulations defined by income and health status.

Results for the baseline scenario come from a single run of the simulation model projecting outcomes for the whole population of older adults in each year. Sensitivity results are from additional runs of the simulation model, each with one key parameter altered from the baseline model.

Our model is capable of forecasting 75 years into the future, as is done by Medicare and Social Security actuaries, but assumptions about underlying trends become less plausible for very long forecasting horizons. To strike a balance between useful results and plausible assumptions, we emphasize 20‐year projections. We provide some longer‐term forecasts for readers interested in comparing our results to those of other major forecasts such as the Office of the Actuary (OACT) at the Centers for Medicare and Medicaid Services (CMS).

Underlying Microsimulation Model

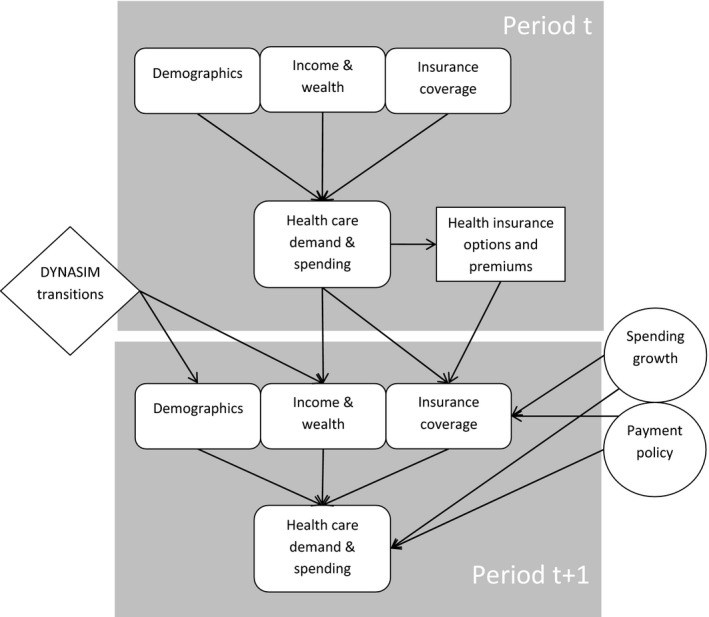

Our model rests on the platform of Urban Institute's DYNASIM model, which forecasts income and wealth of US residents (including those in US territories), including labor market behavior, wealth accumulation, demographic transitions (e.g., marriage and divorce), and mortality. It has been frequently used for Social Security projections (Uccello et al. 2003; Favreault et al. 2004; Favreault and Karamcheva 2011; Favreault and Steuerle 2012; Smith and Toder 2014; Commission on Retirement Security and Personal Savings 2016) and recently extended to project long‐term services and supports (Favreault, Gleckman, and Johnson 2015). We enhance DYNASIM by adding health status, health insurance, and health care use. Figure 1 depicts the logic flow of the model. In general, the procedure for creating and updating the simulated population is as follows:

Assign baseline values of health status, supplemental insurance coverage, expected spending, and other characteristics.

Compute premiums and cost sharing for each person in each possible coverage category for the next year.

Compute health, wealth, income, and other covariates for the next year.

Assign supplemental insurance coverage for the next year.

Compute spending for the next year based on updated traits and insurance coverage.

Repeat from Step 2.

Figure 1.

Spending Growth Framework

We briefly review each of these steps below; full details of each are contained in the online Appendix.

Personal Characteristics: Demographics, Health Status, and Insurance

In addition to basic demographic characteristics (age, sex, race, education, marital status, geographic region, household size, and employment status), we assign health status measures using models informed by the Survey of Income and Program Participation (SIPP) (United States Census Bureau 2015) and Health and Retirement Study (HRS) (Institute for Social Research 2015). These include counts of limitations on both activities of daily living and instrumental activities of daily living, indicators for receipt of home care and residence in a nursing home, count of chronic diseases, and self‐reported health status. Table 1 of the Appendix summarizes the key characteristics of each individual in the simulated population, and Step 1 of the Appendix describes the models that assign these characteristics to simulated individuals at baseline.

We also assign each individual to a category of supplemental insurance. Categories include employer‐paid Medicare Advantage, employer‐paid supplemental coverage, self‐paid Medicare Advantage, self‐paid supplemental coverage, Medicaid, and other public coverage (e.g., provided by the VA). Although some beneficiaries use more than one source of supplemental coverage, these mutually exclusive categories capture the broad patterns of coverage. They also allow us to estimate models for assigning coverage using Medicare Current Beneficiary Survey (MCBS) data; categories defined by a combination of coverage sources include too few observations for us to reliably estimate transition patterns with MCBS data. We also incorporate institutional features of Medicare and Medicaid programs, including means testing for Part D and Part B premiums, Medicare Advantage payment rules, and state‐specific eligibility for Medicaid. (Broadly consistent with CBO's [2015a] assumptions about long‐range Medicaid eligibility, we allow states to partially offset erosions in Medicaid eligibility due to income growth.)

After assigning an insurance category, we assign a cost‐sharing parameter and a premium. The cost‐sharing parameter captures differences in generosity across the coverage types and allows for additional heterogeneity within each insurance type. As the populations enrolling in each insurance category change, the premiums change accordingly to cover their spending. Step 2 of the Appendix describes these premium computations, including details of the complex benchmark, bidding, and rebates of Medicare Advantage plans.

Each year, we update individuals' characteristics using a combination of deterministic (e.g., for age and program eligibility) and stochastic (e.g., for health status and coverage) models. The annual updates to each individual's health status characteristics use a Markov process estimated from HRS data, while updates to wealth and income combine the past year's spending with macroeconomic effects. These update procedures are described in Step 3 of the Appendix. Yearly updates to insurance coverage incorporate inertia, sensitivity to changing premiums, and varying preferences for coverage according to health status. These are detailed in Step 4 of the Appendix.

Health Care Spending

Spending on health care depends on health status, insurance coverage, income, and demographic characteristics. The relationship between spending and health status is determined by regression models fit to MCBS data, and the distribution of spending is further adjusted to account for the extreme skew of spending. People with more generous health insurance coverage demand more care according to a demand response parameter informed by the RAND health insurance experiment. Finally, income effects are governed by an income elasticity parameter that governs how people trade off spending on health care versus other types of goods and services. We also institute protections against very high levels of spending. For all but the most wealthy, we cap out‐of‐pocket spending on health care at 50 percent of income (a portion of which is financed from nonhousing wealth) and assume the rest is written off by providers or financed from outside of the household. Step 5 of the Appendix details these spending methods.

Economic Assumptions

Our basic approach, following Chernew and Newhouse (2012), is to assume the health insurance and health care sectors are in equilibrium in each period and that this equilibrium changes over time due to technological change, demographic trends, and exogenous forces such as decay in employer‐sponsored health insurance coverage. In terms of the equilibrium each period, we incorporate the two main economic features of health insurance: adverse selection and moral hazard. We allow for adverse selection among (but not within) coverage categories, and our demand response parameters use empirical estimates of moral hazard.

We emphasize demand‐side factors: consumer choices of insurance and health care are demand‐determined. On the supply side of both the insurance and health care sectors, we assume prices are set to approximate provider costs (i.e., zero profit). A single parameter captures spending growth pressure from sources such as advances in medical technology and payment and delivery system reforms (e.g., ACOs). Although we do not explicitly model effects of supply‐side policies, such effects would be captured in this underlying supply‐side growth parameter.

We refer to this as the “underlying” spending growth pressure because the rate of spending growth emerging from the model will be affected by equilibrium effects in the two modeled sectors. First, higher health care costs will dampen demand because of price and income effects. Second, higher health care costs will raise premiums and thus affect choice of health insurance. The incorporation of technology‐driven cost effects into sequential equilibrium in health care markets is a key contribution of our model.

Our baseline spending growth scenario matches the spending growth projected by OACT in their 2015 illustrative (most realistic) scenario (Shatto and Clemens 2015). We then explore the sensitivity of our results to alternative scenarios that change supply‐side pressure for spending growth, make different assumptions about employer dropping, modify the income elasticity of demand, and alter outside financing for health care expenses.

Calibration

Many of DYNASIM's core demographic and economic outcomes are calibrated to the intermediate assumptions of the 2014 Social Security Trustees Report (United States Congress, House 2014). Fertility, mortality, net immigration, participation in Social Security Disability Insurance, wages, wage dispersion, prices, and gross domestic product (GDP) all track the trustees' assumptions. DYNASIM's health spending projections start in 2008, enabling us to compare projections in historic years against data. For example, we compare our projected Medicaid receipt to data from the Medicaid Statistical Information System (MSIS) (Centers for Medicare and Medicaid Services 2015b). We similarly compare the projected distribution of Medicare spending to the Statistical Supplement (Centers for Medicare and Medicaid Services 2013, table 3.6) and the insurance distribution to published reports (Jacobson et al. 2016). We calibrate health status to historic data from the HRS, Medicare Current Beneficiary Survey (Centers for Medicare and Medicaid Services 2015a), National Long‐Term Care Survey, and National Health Interview Survey. We calibrate income and assets to Current Population Survey, HRS, and Survey of Consumer Finances. Within the larger DYNASIM model, birth, death, health, wealth, and work are all validated with historic data (Favreault, Smith, and Johnson 2015). Our baseline scenario calibrates the supply‐side spending growth parameter using the illustrative scenario from the 2015 Medicare Trustees Report (Board of Trustees 2015).

Simulation Scenarios

The value of microsimulation is as much in the sensitivity analyses as in the point estimates. We report several sensitivity analyses. First, we vary the supply‐side spending growth parameter by first assuming that the parameter is set such that spending growth reverts to its higher historic rate (GDP growth plus 2 percentage points) and second assuming that spending grows at the rate of GDP. Second, we assume the prevalence of employer‐sponsored coverage remains constant at 2015 levels. Third, we change income elasticity of demand from its baseline value of 0.2 (Newhouse 1993) to assume no income elasticity or increase it to 0.7 (Acemoglu, Finkelstein, and Notowidigdo 2013). Fourth, we increase the cap on out‐of‐pocket spending from 50 to 100 percent of income.

Results for Baseline Scenario

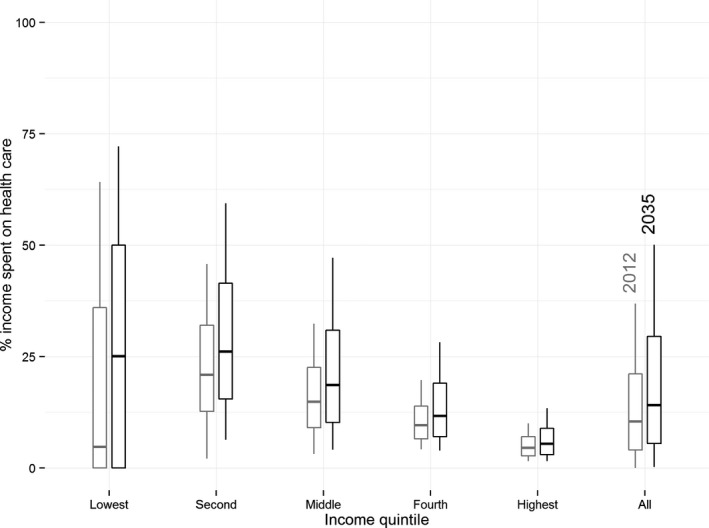

Under our baseline assumptions, the model projects an increasing burden of health care spending. Median out‐of‐pocket spending (point of care plus premiums) as a share of income rises from 10 percent in 2012 to 14 percent in 2035 (Figure 2). While the absolute increase is modest, the median older adult spends 40 percent or more on health care by 2035. Note that because we assume only point‐of‐care spending is subject to the cap, the total share of income devoted to out‐of‐pocket health care spending can exceed the cap. As a result of the cap, under our baseline assumption, 3–4 percent of spending is financed by sources such as charity care or medical bankruptcy.

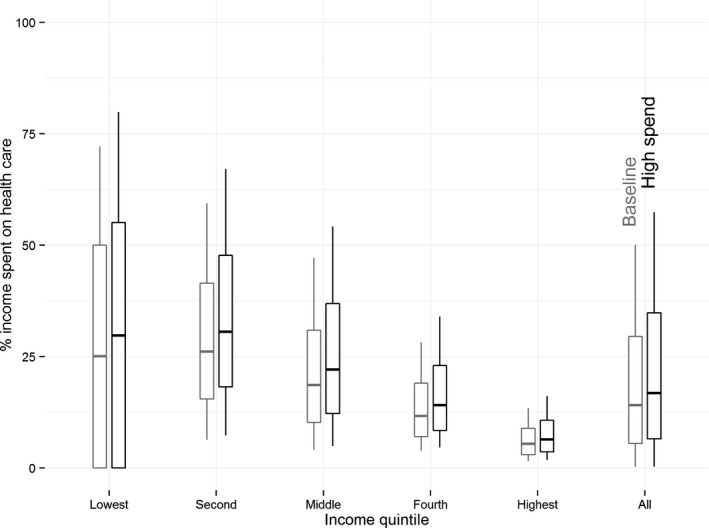

Figure 2.

Distribution of Health Care Spending

Note. Boxplots in each quintile of the income distribution and for the whole population. These results come from the baseline simulation scenario in simulation years 2012 (light) and 2035 (dark). The boxes extend from the 25th to 75th percentiles (with a bar at the median), and lines extend from the 10th to 90th percentiles.

Low‐income older adults are projected to devote a large and growing share of income to health care and coverage. In the lowest income quintile, a quarter of the population continues to pay nothing at all thanks to the protections of Medicaid, even as the median person's spending in this quintile grows from 5 percent of income to 25 percent and the 75th percentile of health spending grows from 36 percent to 50 percent of income (Figure 2). By contrast, among near‐poor seniors (in the 2nd income quintile), the lowest‐spending quarter of spending grows from 13 percent of income to 16 percent, the median grows from 21 to 26 percent, and the 75th percentile grows from 32 to 42 percent. Spending growth is particularly striking for people with low incomes who are also in fair or poor health. In the 2nd income quintile, median spending for those who are ill rises from 23 percent of income to 29 percent, and the 75th percentile grows from 34 to 46 percent. People in the upper income quintile pay considerably less as a share of income, a median of just 5 percent, which remains essentially steady through 2035.

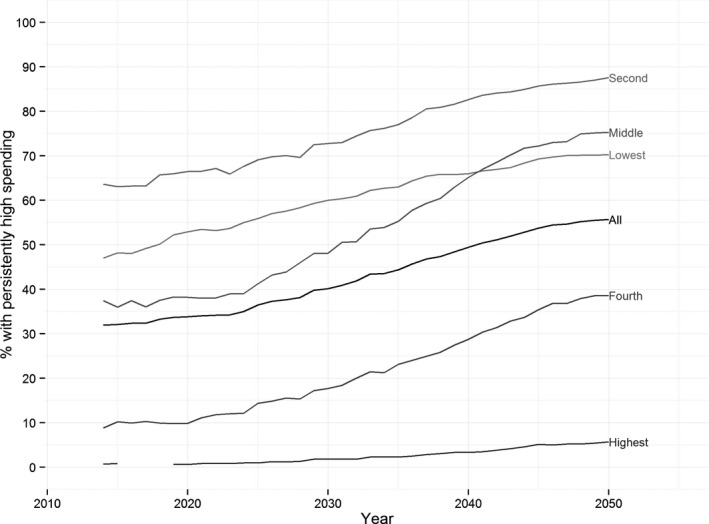

Persistent high spending can be problematic for older households. In 2014, 32 percent of older adults have persistently high spending (by our definition above); this grows to 44 percent by 2035 (Figure 3). People in the 2nd income quintile fare the worst because they have neither the safety net protections of the lowest income quintile nor the financial resources of the higher income groups. Over time, the proportion of people with persistently high spending in the middle income quintile also surpasses the proportion in the lowest income quintile.

Figure 3.

Time Trends in Persistently High Health Care Spending

Note. The lines show the percentage of people in the simulated population who spend at least 20 percent of per capita income on health care (in the index year ± 2 years) in each year of the simulation. Results are shown separately for each income quintile and for the whole population. These results come from the baseline simulation scenario.

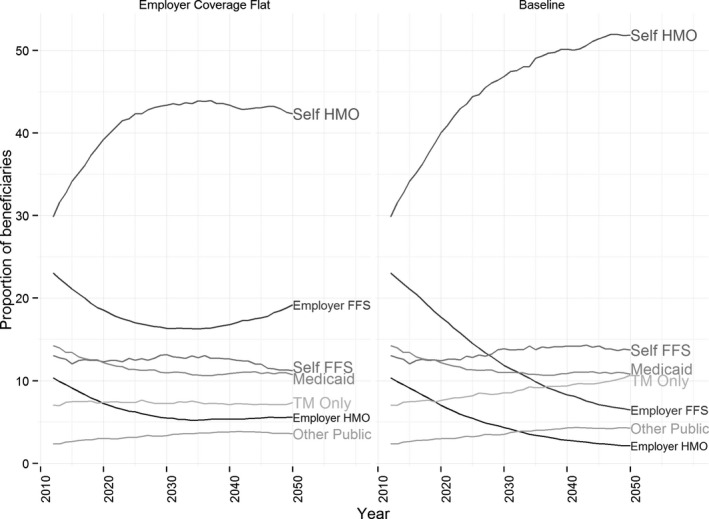

In 2011, approximately 15 percent of older adults qualified for Medicaid or other public subsidies. These seniors pay very little for health care. By 2035, the percent with Medicaid and other subsidized care falls to 11 percent (Figure 4), because existing rules do not index all Medicaid eligibility parameters to inflation. Indexed parameters grow with prices, which rise slower than wages and Social Security benefits, thus reducing the fraction of eligible seniors.

Figure 4.

Trends in Supplemental Insurance Coverage

Note. The lines show the percentage of people in the simulated population who are enrolled in each coverage type in each year of the simulation. Results are shown for the whole population in the baseline scenario (right panel) and in the flat employer dropping scenario (left panel). Abbreviations: HMO = Managed Care (e.g., Medicare Advantage); FFS = Fee for Service (e.g., Medigap), TM = Traditional Medicare.

Sensitivity Analyses

The underlying supply‐side pressure on spending growth has major effects on the distribution of spending. Higher underlying spending growth pressure drives the median share of income devoted to health in 2035 from 14 percent (baseline assumptions) to 17 percent, a more than 20 percent increase (Figure 5). Among those in the middle quintile of income, the median share of income devoted to health care in 2035 goes from 19 percent (baseline) to 22 percent with faster growth. When we assume a lower spending growth pressure (equal to GDP growth), we project the median health spending to be 12 percent of income in 2035, a 14 percent reduction compared to the baseline scenario. The impact of changing assumptions is more pronounced at the top of the spending distribution. The 75th and 90th percentiles of health care spending in the whole population in 2035 increase from 30 percent and 50 percent of income, respectively, in the baseline scenario to 35 percent and 57 percent with faster growth.

Figure 5.

Distribution of Health Care Spending under Different Growth Scenarios

Note. Boxplots show the distribution of health care spending (as a fraction of income) in the simulated population in 2035. Results are shown separately for each quintile of the income distribution and for the whole population. These results come from the baseline simulation scenario (light) and the high spending growth scenario (dark). The boxes extend from the 25th to 75th percentiles (with a bar at the median), and lines extend from the 10th to 90th percentiles.

Varying the income elasticity from 0.7 (i.e., significant dampening of demand from income effects) to 0 (i.e., no dampening of demand) shifts median spending in 2035 from 13 to 15 percent of income and spending at the 90th percentile from 47 to 52 percent of income. The reason income effects are modest is that most additional Medicare costs are borne by the under‐65 population via taxes (or debt, which is ultimately tax financed; McGuire 2014) rather than by beneficiaries themselves.

In results not shown, altered rates of employers dropping coverage have modest effects on out‐of‐pocket spending, despite major impacts on the form of supplemental insurance. Dropping may not affect “grandfathered” employees, and other former employees buy coverage on their own when employers drop coverage. The cost of this coverage is modest (a median premium of 5 percent of median income in 2035 in our baseline scenario) because it covers only what Medicare does not. Although lower‐income seniors may be more sensitive to premiums, most (89 and 75 percent in the first and second income quintiles, respectively) already lack access to employer coverage.

The main effect of raising the cap on out‐of‐pocket spending is at the top of the spending distribution, as that is where the cap matters. In 2012, the 90th percentile of spending is 37 percent of income in both the baseline and higher cap scenario. But by 2035, the 90th percentile of spending grows to 50 percent of income in the baseline scenario and 54 percent in the higher cap scenario. For the median older adult, there is essentially no difference between the two scenarios.

Discussion

Using a microsimulation model with supply‐side spending growth pressure calibrated to the realistic forecasts of OACT, we project detailed health spending and insurance coverage outcomes for older adults. By dynamically updating the whole population over a forecasting horizon of 20 years, we assess the changing burden of health care spending growth on seniors in different parts of the population. We find that the most vulnerable seniors are the near poor who do not qualify for Medicaid and do not enroll in sufficiently generous supplemental coverage to protect them from the risk of devoting very large proportions of income to health care. We also find that middle‐income seniors are projected to have the largest growth in persistently high spending. As employers stop offering new retirees supplemental coverage, we project dramatic growth in self‐purchased Medicare Advantage plans.

Our simulation results for health care spending in 2035 are comparable to those from similar models. For example, our projections of the progressivity of lifetime Medicare benefits and taxes closely mirror those of analysts from the Congressional Budget Office (Niu 2016). Similarly, our projections of the age gradient for average Medicare benefits are similar to those projected by FEM (Gaudette et al. 2015). Our model has several important advantages over these alternative models, including detailed information about a very broad range of income sources over the life course, more explicit inclusion of demand responses to spending growth, an interaction with a detailed model of long‐term services and supports, and better ability to assess how spending growth affects specific subpopulations of seniors, such as the near poor.

Through this application of a complex microsimulation model, we demonstrate the power of this technique to provide detailed projections, with an emphasis on distributional consequences. Other simulation techniques are not as well equipped to forecast the upper quantiles of spending, the persistence of individual spending over time, and these outcomes stratified by income, health status, or any other number of individual characteristics.

Microsimulation's major limitations are the complexity of the modeling (see, for example, our lengthy and detailed technical appendix) and the reliance on numerous assumptions. Our simulation uses a set of relatively simple models to generate complex, dynamic, nonlinear, and heterogeneous behavior and outcomes. However, these simple models contain parameters about which there is uncertainty regarding the “correct” values. In sensitivity analyses, we find our results qualitatively robust to variation around a few key parameters.

Future methodological work should seek to make the underlying modules of the simulation more robust, flexible, and realistic. In one ongoing project, for example, we are expanding the module for updating supplemental insurance coverage. Of particular interest is the ability of different modeling methods to represent consumer behavior and therefore changes in enrollment. This will allow a user to use the model to study how benefit design changes, such as the proposal to unify the deductible for Parts A and B, will impact enrollment and spending.

The most important policy conclusion of our work is that affordability concerns, often discussed in the context of the commercially insured population, also apply to the Medicare population. In our simulation, more than half of seniors in the bottom two income quintiles spend at least 25 percent of income on health care by 2035, while the fraction with burdensome spending is vanishingly small for the highest income quintile. Moreover, an increasing fraction of older adults (almost half) persistently spend over 20 percent of their income on health care. This is well above some thresholds for catastrophic spending (Xu et al. 2003; Cunningham 2015; Schoen et al. 2015). Finally, even aggressive assumptions about elasticities do not suggest large aggregate demand‐side effects, demonstrating the limits to approaches that aim to constrain health care spending growth by adjusting levers expected to affect demand. Policy makers and care providers should prepare for a growing number of underinsured older adults and consider how the Medicare program may respond (Zuckerman, Shang, and Waidman 2010). In these policy deliberations, microsimulations such as ours may provide an important testing ground for projecting the effects of proposed policy changes.

Supporting information

Appendix SA1: Author Matrix.

Appendix SA2: Technical Appendix.

Acknowledgments

Joint Acknowledgment/Disclosure Statement: This work was supported by funding from the National Institutes of Health National Institute on Aging (Grant No. R01 AG034417‐01). The authors thank Todd Caldis and Liming Cai of the Centers for Medicare and Medicaid Services, Paul Fronstin of the Employee Benefits Research Institute, Joseph Newhouse of Harvard University, and Robert Reischauer and Stephen Zuckerman of the Urban Institute for their input on the development of the simulation and direction of the project. The authors also thank Jeannie Biniek of Harvard University for helpful comments on the draft. Paul Johnson assisted with programming of DYNASIM's Medicaid module. Karen Smith and Douglas Murray have made innumerable contributions to DYNASIM. No other disclosures.

Disclosures: None.

Disclaimer: None.

References

- Acemoglu, D. , Finkelstein A., and Notowidigdo M. J.. 2013. “Income and Health Spending: Evidence from Oil Price Shocks.” Review of Economics and Statistics 95 (4): 1079–95. [Google Scholar]

- Board of Trustees . 2015. 2015 Annual Report of the Board of Trustees of the Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds. Washington, DC: Federal Hospital Insurance and Federal Supplementary Medical Insurance Trust Funds. [Google Scholar]

- Centers for Medicare and Medicaid Services . 2013. Medicare and Medicaid Statistical Supplement. Washington, DC: CMS Office of Enterprise Data and Analytics. [Google Scholar]

- Centers for Medicare and Medicaid Services . 2015a. “Medicare Current Beneficiary Survey (MCBS) “[accessed on October 23, 2015]. Available at https://www.cms.gov/Research-Statistics-Data-and-Systems/Research/MCBS/index.html?redirect=/mcbs

- Centers for Medicare and Medicaid Services . 2015b. “MSIS Medicaid Statistical Information System” [accessed on October 23, 2015]. Available at http://www.medicaid.gov/Medicaid-CHIP-Program-Information/By-Topics/Data-and-Systems/MSIS/Medicaid-Statistical-Information-System.html

- Chernew, M. , and Newhouse J. P.. 2012. “Health Care Spending Growth” In Handbook of Health Economics, edited by Pauly T., McGuire T. G., and Barros P., pp. 1–43. Oxford, UK: North Holland. [Google Scholar]

- Commission on Retirement Security and Personal Savings . 2016. Securing our Financial Future: Report of the Commission on Retirement Security and Personal Savings. Washington, DC: Bipartisan Policy Center. [Google Scholar]

- Congressional Budget Office . 2015a. The 2015 Long‐Term Budget Outlook. Washington, DC: Congress of the United States. [Google Scholar]

- Congressional Budget Office . 2015b. Social Security Policy Options. Washington, DC: Congress of the United States. [Google Scholar]

- Cubanski, J. , Swoope C., Damico A., and Neuman T.. 2014. “Health Care on a Budget: The Financial Burden of Health Spending by Medicare Households.” Issue Brief Menlo Park, CA: Henry J. Kaiser Family Foundation. [Google Scholar]

- Cunningham, P. J. 2015. “The Share of People with High Medical Costs Increased Prior to Implementation of the Affordable Care Act.” Health Affairs 34 (1): 117–24. [DOI] [PubMed] [Google Scholar]

- Favreault, M. M. , Gleckman H., and Johnson R. W.. 2015. “Financing Long‐Term Services And Supports: Options Reflect Trade‐Offs for Older Americans and Federal Spending.” Health Affairs 34 (12): 2181–91. [DOI] [PubMed] [Google Scholar]

- Favreault, M. , and Karamcheva N.. 2011. How Would the President's Fiscal Commission's Social Security Proposals Affect Future Beneficiaries? Washington, DC: Urban Institute. [Google Scholar]

- Favreault, M. M. , Smith K. E., and Johnson R. W.. 2015. The Dynamic Simulation of Income Model (DYNASIM): An Overview. Washington, DC: Urban Institute. [Google Scholar]

- Favreault, M. M. , and Steuerle C. E.. 2012. Measuring Social Security Proposals by More Than Solvency: Impacts on Poverty, Progressivity, Horizontal Equity, and Work Incentives. Boston, MA: Center for Retirement Research at Boston College. [Google Scholar]

- Favreault, M. , Goldwyn J., Smith K., Thompson L., Uccello C., and Zedlewski S.. 2004. Reform Model Two of the President's Commission to Strengthen Social Security: Distributional Outcomes Under Different Economic and Behavioral Assumptions, Boston, MA: Center for Retirement Research at Boston College. [Google Scholar]

- Fronstin, P. , and Adams N.. 2012. “Employment‐Based Retiree Health Benefits: Trends in Access and Coverage, 1997–2010.” EBRI Issue Brief Washington, DC: Employee Benefit Research Institute. [PubMed] [Google Scholar]

- Gaudette, E. , Tysinger B., Cassil A., and Goldman D.. 2015. Health and Health Care of Medicare Beneficiaries in 2030. Los Angeles and Washington: USC Leonard D. Schaeffer Center for Health Policy and Economics and Center for Health Policy at Brookings. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Goldman, D. P. , Shang B., Bhattacharya J., Garber A. M., Hurd M., Joyce G. F., Lakdawalla D. N., Panis C., and Shekelle P. G.. 2005. “Consequences of Health Trends and Medical Innovation for the Future Elderly.” Health Affairs 24 (Suppl 2): W5R5–17. [DOI] [PMC free article] [PubMed] [Google Scholar]

- Institute for Social Research . 2015. “About the Health and Retirement Study” [accessed on December 28, 2015]. Available at http://hrsonline.isr.umich.edu/

- Jacobson, G. , Swoope C., Neuman P., and Smith K.. 2015. Income and Assets of Medicare Beneficiaries, 2014–2030. Washington, DC: Henry J. Kaiser Family Foundation. [Google Scholar]

- Jacobson, G. , Casillas G., Damico A., Neuman T., and Gold M.. 2016. “Medicare Advantage 2016 Spotlight: Enrollment Martket Update.” Issue Brief Washginton, DC: Henry J. Kaiser Family Foundation. [Google Scholar]

- Keehan, S. P. , Cuckler G. A., Sisko A. M., Madison A. J., Smith S. D., Stone D. A., Poisal J. A., Wolfe C. J., and Lizonitz J. M.. 2015. “National Health Expenditure Projections, 2014–24: Spending Growth Faster Than Recent Trends.” Health Affairs 34 (8): 1407–17. [DOI] [PubMed] [Google Scholar]

- McArdle, F. , Neuman T., and Huang J.. 2014. Retiree Health Benefits at the Crossroads. Menlo Park, CA: Henry J. Kaiser Family Foundation. [Google Scholar]

- McArdle, F. , Stark I., Levinson Z., and Neuman T.. 2012. “How Does the Benefit Value of Medicare Compare to the Benefit Value of Typical Large Employer Plans? A 2012 Update.” Issue Brief Menlo Park, CA: The Henry J. Kaiser Family Foundation. [Google Scholar]

- McGuire, T. G. 2014. “A Note on Income Effects and Health Care Cost Growth in Medicare.” Forum for Health Economics & Policy 17 (1): 1–12. [DOI] [PMC free article] [PubMed] [Google Scholar]

- MedPAC . 2015. “Health Care Spending and the Medicare Program.” Data Book Washington, DC: Medicare Payment Advisory Commission. [Google Scholar]

- Newhouse, J. P. , and Insurance Experiment Group . 1993. Free for All? Lessons from the Health Insurance Experiment. Cambridge, MA: Harvard University Press. [Google Scholar]

- Niu, X. 2016. “Distribution of Medicare Taxes and Spending by Lifetime Household Earnings.” Conference of the American Socity of Health Economists Philadelphia: Congressional Budget Office. [Google Scholar]

- Schoen, C. , Buttorff C., Andersen M., and Davis K.. 2015. “Policy Options to Expand Medicare's Low‐Income Provisions to Improve Access and Affordability.” Health Affairs 34 (12): 2086–94. [DOI] [PubMed] [Google Scholar]

- Shatto, J. D. , and Clemens M. K.. 2015. Projected Medicare Expenditures Under an Illustrative Alternative Scenario With Alternative Payment Updates to Medicare Providers. Baltimore, MD: Centers for Medicare & Medicaid Services. [Google Scholar]

- Smith, K. E. , and Favreault M.. 2013. A Primer on Modeling Income in the Near Term, Version 7 (MINT7). Washington, DC: The Urban Institute. [Google Scholar]

- Smith, K. E. , and Toder E.. 2014. Adding Employer Contributions to Health Insurance to Social Security's Earnings and Tax Base. Chestnut Hill, MA: Center for Retirement Research at Boston College. [Google Scholar]

- Uccello, C. , Favreault M., Smith K. E., and Thompson L.. 2003. Simulating the Distributional Consequences of Personal Accounts: Sensitivity to Annuitization Options. Chestnut Hill, MA: Center for Retirement Research at Boston College. [Google Scholar]

- United States Census Bureau . 2015. “SIPP Introduction and History” [accessed on December 28, 2015]. Available at http://www.census.gov/programs-surveys/sipp/about/sipp-introduction-history.html

- United States Congress, House . 2014. “The 2014 Annual Report of the Board of Trustees of the Federal Old‐Age and Survivors Insurance and Federal Disability Insurance Trust Funds.” Communication from The Board of Trustees. 113th Congress, 2nd session. House Document 113–139. Washington, DC: US Government Publishing Office. [Google Scholar]

- Xu, K. , Evans D. B., Kawabata K., Zeramdini R., Klavus J., and Murray C. J. L.. 2003. “Household Catastrophic Health Expenditure: A Multicountry Analysis.” Lancet 362 (9378): 111–17. [DOI] [PubMed] [Google Scholar]

- Zuckerman, S. , Shang B., and Waidman T.. 2010. “Reforming Beneficiary Cost Sharing to Improve Medicare Performance.” Inquiry 47: 215–25. [DOI] [PubMed] [Google Scholar]

Associated Data

This section collects any data citations, data availability statements, or supplementary materials included in this article.

Supplementary Materials

Appendix SA1: Author Matrix.

Appendix SA2: Technical Appendix.